BRASIL - EUA

US CONGRESS. REUTERS. 3 DE JUNHO DE 2020. CORREÇÃO-Comitê da Câmara dos EUA diz que se opõe a qualquer acordo comercial entre EUA-Brasil

WASHINGTON (Reuters) - O Comitê de Assuntos Tributários (“Ways and Means”) da Câmara dos Deputados dos Estados Unidos disse nesta quarta-feira que se opôs ao plano do governo Trump de expandir os laços econômicos com o Brasil, dado seu histórico no que diz respeito aos direitos humanos e ao meio ambiente durante o governo de Jair Bolsonaro.

O presidente do comitê, Richard Neal, e seus colegas democratas no Comitê afirmaram, por meio de uma carta ao representante comercial dos EUA, Robert Lighthizer, que o governo Bolsonaro vem mostrando “uma total desconsideração pelos direitos humanos básicos”.

“Nós nos opomos fortemente a buscar qualquer tipo de acordo comercial com o governo Bolsonaro no Brasil. O aprimoramento do relacionamento econômico entre os EUA e o Brasil, neste momento, iria minar os esforços dos defensores dos direitos humanos, trabalhistas e ambientais brasileiros para promover o estado de direito e proteger e preservar comunidades marginalizadas”, escreveram eles.

No mês passado, autoridades comerciais dos EUA e do Brasil concordaram em acelerar as negociações com o objetivo de concluir um acordo em torno das regras comerciais e da transparência neste ano, incluindo uma simplificação do comércio e “boas práticas regulatórias”.

Mas os democratas no comitê disseram que o governo Bolsonaro não tem credibilidde de que estaria preparado para adotar novas normas para os direitos dos trabalhadores e proteções ao meio ambiente estabelecidos no acordo comercial EUA-México-Canadá, dado seu próprio histórico ruim em torno dos direitos humanos e de outras questões importantes.

O deputado Kevin Brady, o republicano mais graduado no comitê, disse a repórteres que desconhecia a carta.

Em vez de buscar um acordo comercial com o Brasil, os deputados democratas disseram que Lighthizer deveria intensificar a aplicação das leis dos Estados Unidos e levantar considerações sobre práticas comerciais desleais do Brasil com o governo brasileiro.

O presidente dos EUA, Donald Trump, tem desenvolvido um relacionamento próximo a Bolsonaro. Na semana passada, a Casa Branca disse que tinha fornecido ao Brasil 2 milhões de doses de hidroxicloroquina para uso contra o coronavírus, apesar das advertências médicas sobre os riscos associados ao medicamento para tratamento da malária.

Por Andrea Shalal e David Lawder

US HOUSE OF REPRESENTATIVES. WAYS AND MEANS COMMITTEE. Jun 3, 2020. WAYS AND MEANS DEMOCRATS STRONGLY OPPOSE EXPANDING ECONOMIC RELATIONS WITH PRESIDENT BOLSONARO’S BRAZIL

WASHINGTON, DC – Today, House Ways and Means Committee Chairman Richard E. Neal (D-MA) and Committee Democrats expressed their opposition to the Trump Administration’s intent to pursue an expanded economic partnership with Brazil under the leadership of President Jair Bolsonaro. In a letter to Ambassador Robert Lighthizer, the lawmakers detailed the litany of reasons why it is inappropriate for the Administration to engage in economic partnership discussions of any scope with the Bolsonaro government in Brazil, which has dismantled years of civil, human, environmental, and labor rights progress in the nation since 2018.

“Through reprehensible rhetoric and actions, the Bolsonaro government in Brazil has demonstrated its complete disregard for basic human rights, the need to protect the Amazon rainforest, the rights and dignity of workers, and a record of anticompetitive economic practices. In addition to being worthy of condemnation in their own right, these positions and actions demonstrate that Brazil under Bolsonaro could not credibly be prepared to assume the new standards for worker rights and environmental protections established in the U.S.-Mexico-Canada Agreement,” wrote Ways & Means Democrats.

“We strongly oppose pursuing any type of trade agreement with the Bolsonaro government in Brazil. Enhancing the U.S.-Brazilian economic relationship at this time would undermine the efforts of Brazilian human, labor, and environmental rights advocates to advance the rule of law and protect and preserve marginalized communities,” concluded the lawmakers. “Instead, we urge you to aggressively address these issues by using U.S. enforcement tools and by raising them with your Brazilian counterparts through other, more appropriate, channels.”

In addition to Chairman Neal, Trade Subcommittee Chairman Earl Blumenauer (D-OR), along with Representatives John Lewis (D-GA), Lloyd Doggett (D-TX), Mike Thompson (D-CA) , John B. Larson (D-CT), Ron Kind (D-WI), Bill Pascrell, Jr. (D-NJ), Danny K. Davis (D-IL), Linda T. Sánchez (D-CA), Brian Higgins (D-NY), Terri A. Sewell (D-AL), Suzan K. DelBene (D-WA), Judy Chu (D-CA), Gwen Moore (D-WI), Daniel T. Kildee (D-MI), Brendan Boyle (D-PA), Donald S. Beyer, Jr. (D-VA), Dwight Evans (D-PA), Bradley S. Schneider (D-IL), Thomas R. Suozzi (D-NY), Jimmy Panetta (D-CA), Jimmy Gomez (D-CA), and Steven Horsford (D-NV) signed on to the letter.

FULL DOCUMENT: https://waysandmeans.house.gov/sites/democrats.waysandmeans.house.gov/files/documents/20200603_WM%20Dem%20Ltr%20to%20Amb%20Lighthizer%20re%20Brazil.pdf

________________

US ECONOMICS

INTERNATIONAL TRADE

DoC. BEA. US CENSUS. U.S. Census Bureau. 06/04/2020. U.S. International Trade in Goods and Services

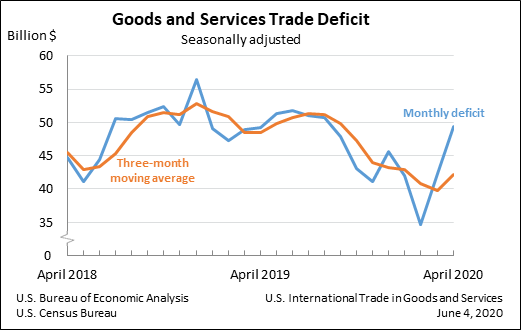

The nation's international trade deficit in goods and services increased to $49.4 billion in April from $42.3 billion in March (revised), as exports decreased more than imports.

- April 2020: 49.4° $ billion

- March 2020 (r): 42.3° $ billion

(*) The 90% confidence interval includes zero. The Census Bureau does not have sufficient statistical evidence to conclude that the actual change is different from zero.

(°) Statistical significance is not applicable or not measurable for these surveys. The Manufacturers’ Shipments, Inventories and Orders estimates are not based on a probability sample, so we can neither measure the sampling error of these estimates nor compute confidence intervals.

(r) Revised.

All estimates are seasonally adjusted except for the Rental Vacancy Rate, Home Ownership Rate, Quarterly Financial Report for Retail Trade, and Quarterly Services Survey. None of the estimates are adjusted for price changes.

DoC. BEA. JUNE 4, 2020. U.S. International Trade in Goods and Services, April 2020

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $49.4 billion in April, up $7.1 billion from $42.3 billion in March, revised.

| Deficit: | $49.4 Billion | +16.7%° |

| Exports: | $151.3 Billion | -20.5%° |

| Imports: | $200.7 Billion | -13.7%° |

Next release: July 2, 2020

(°) Statistical significance is not applicable or not measurable. Data adjusted for seasonality but not price changes

Source: U.S. Census Bureau, U.S. Bureau of Economic Analysis; U.S. International Trade in Goods and Services, June 4, 2020

| ||

Coronavirus (COVID-19) Impact on April 2020 International Trade in Goods and Services

The declines in exports and imports that continued in April were, in part, due to the impact of COVID-19, as many businesses were operating at limited capacity or ceased operations completely, and the movement of travelers across borders was restricted. The full economic effects of the COVID-19 pandemic cannot be quantified in the trade statistics for April because the impacts are generally embedded in source data and cannot be separately identified. The Census Bureau and the Bureau of Economic Analysis have monitored data quality and determined estimates in this release meet publication standards. For more information on the impact of COVID-19 on the statistics, see the frequently asked questions on goods from the Census Bureau and on services from BEA.

Exports, Imports, and Balance (exhibit 1)

April exports were $151.3 billion, $38.9 billion less than March exports. April imports were $200.7 billion, $31.8 billion less than March imports.

The April increase in the goods and services deficit reflected an increase in the goods deficit of $5.8 billion to $71.8 billion and a decrease in the services surplus of $1.3 billion to $22.4 billion.

Year-to-date, the goods and services deficit decreased $26.0 billion, or 13.4 percent, from the same period in 2019. Exports decreased $79.8 billion or 9.5 percent. Imports decreased $105.8 billion or 10.2 percent.

Three-Month Moving Averages (exhibit 2)

The average goods and services deficit increased $2.5 billion to $42.1 billion for the three months ending in April.

Average exports decreased $19.7 billion to $184.4 billion in April.

Average imports decreased $17.3 billion to $226.5 billion in April.

Year-over-year, the average goods and services deficit decreased $6.3 billion from the three months ending in April 2019.

Average exports decreased $26.7 billion from April 2019.

Average imports decreased $33.0 billion from April 2019.

Exports (exhibits 3, 6, and 7)

Exports of goods decreased $32.2 billion to $95.5 billion in April.

Exports of goods on a Census basis decreased $32.0 billion.

Capital goods decreased $10.1 billion.

Civilian aircraft engines decreased $2.2 billion.

Civilian aircraft decreased $2.1 billion.

Other industrial machinery decreased $1.0 billion.

Industrial supplies and materials decreased $9.1 billion.

Crude oil decreased $2.0 billion.

Fuel oil decreased $1.7 billion.

Other petroleum products decreased $1.1 billion.

Automotive vehicles, parts, and engines decreased $7.4 billion.

Automotive parts and accessories decreased $2.6 billion.

Passenger cars decreased $2.4 billion.

Trucks, buses, and special purpose vehicles decreased $1.2 billion.

Net balance of payments adjustments decreased $0.2 billion.

Exports of services decreased $6.7 billion to $55.8 billion in April.

Travel decreased $3.4 billion.

Transport decreased $2.3 billion.

Imports (exhibits 4, 6, and 8)

Imports of goods decreased $26.4 billion to $167.4 billion in April.

Imports of goods on a Census basis decreased $26.2 billion.

Automotive vehicles, parts, and engines decreased $14.6 billion.

Passenger cars decreased $6.9 billion.

Automotive parts and accessories decreased $4.1 billion.

Trucks, buses, and special purpose vehicles decreased $2.3 billion.

Capital goods decreased $5.8 billion.

Semiconductors decreased $1.4 billion.

Electric apparatus decreased $0.8 billion.

Civilian aircraft decreased $0.7 billion.

Civilian aircraft engines decreased $0.7 billion.

Consumer goods decreased $3.1 billion.

Pharmaceutical preparations decreased $1.2 billion.

Cotton apparel and household goods decreased $1.1 billion.

Net balance of payments adjustments decreased $0.2 billion.

Imports of services decreased $5.4 billion to $33.3 billion in April.

Travel decreased $2.9 billion.

Transport decreased $2.0 billion.

Real Goods in 2012 Dollars – Census Basis (exhibit 11)

The real goods deficit increased $4.1 billion to $80.0 billion in April.

Real exports of goods decreased $29.2 billion to $113.8 billion.

Real imports of goods decreased $25.1 billion to $193.8 billion.

Revisions

Exports and imports of goods and services for all months through March 2020 shown in this release reflect the incorporation of annual revisions to the goods and services series. See the “Notice” in this release for a description of the revisions.

Revisions to March exports

Exports of goods were revised down $0.4 billion.

Exports of services were revised up $2.8 billion.

Revisions to March imports

Imports of goods were revised up less than $0.1 billion.

Imports of services were revised up $0.3 billion.

Goods by Selected Countries and Areas: Monthly – Census Basis (exhibit 19)

The April figures show surpluses, in billions of dollars, with South and Central America ($2.9), OPEC ($1.4), Brazil ($0.8), Saudi Arabia ($0.3), and Hong Kong (less than $0.1). Deficits were recorded, in billions of dollars, with China ($26.0), European Union ($14.3), Germany ($4.0), Japan ($3.6), Mexico ($3.3), South Korea ($2.3), Taiwan ($2.2), Italy ($2.0), India ($1.9), France ($1.4), Singapore ($1.1), Canada ($0.4), and United Kingdom ($0.4).

The deficit with China increased $9.0 billion to $26.0 billion in April. Exports increased $2.1 billion to $9.3 billion and imports increased $11.0 billion to $35.2 billion.

The surplus with South and Central America decreased $2.1 billion to $2.9 billion in April. Exports decreased $4.3 billion to $8.7 billion and imports decreased $2.2 billion to $5.8 billion.

The deficit with Mexico decreased $5.6 billion to $3.3 billion in April. Exports decreased $7.0 billion to $12.4 billion and imports decreased $12.6 billion to $15.8 billion.

FULL DOCUMENT: https://www.bea.gov/sites/default/files/2020-06/trad0420_0.pdf

CORONAVIRUS

U.S. Department of State. 06/04/2020. Fulfilling the President’s Generous Commitment to Provide Critical Medical Supplies Across the Globe. Michael R. Pompeo, Secretary of State

The United States has been the largest contributor to global health security and humanitarian assistance for more than a half century, saving lives all over the planet. In the face of the COVID-19 pandemic, we have truly mobilized as a nation to combat the virus, both at home and abroad, committing more than $11 billion for the international COVID-19 response.

Today, the United States is announcing more than $194 million in new assistance, including nearly $180 million to support the purchase of ventilators. In addition, the United States is providing more than $14 million in new humanitarian assistance to support refugees, vulnerable migrants, and host communities affected by the COVID-19 pandemic.

Consistent with our values, the American people are not just delivering ventilators, but ensuring proper training, equipment, and support measures are in place for countries to both receive and effectively use the ventilators to save lives. Our talented teams are working with Ministries of Health and in-country partners to create distribution plans at the facility level that consider factors such as the availability of electricity—ensuring these state-of-the-art machines will provide relief for people who critically need it.

In addition to direct shipments, we continue to encourage our partner countries to increase their domestic production of ventilators, face masks, and other Personal Protective Equipment. In Israel, a U.S.-supported hospital has partnered with the private sector to invent a high-flow respirator – importantly, the open source designs can be downloaded for free for assembly anywhere in the world. In Colombia, a graduate of the U.S.-sponsored Academy for Women Entrepreneurs converted her business to make face masks and other protective gear available to her community. In Egypt, a U.S.-funded startup has pivoted to produce face shields for local medical workers.

Once again, in each corner of the globe, American innovation and private enterprise is leading the way.

U.S. Department of State. 06/04/2020. Secretary Pompeo’s Call with United Arab Emirates Crown Prince Sheikh Mohammed bin Zayed Al Nahyan

The below is attributable to Spokesperson Morgan Ortagus:

Secretary of State Michael R. Pompeo spoke today with Crown Prince Sheikh Mohammed bin Zayed Al Nahyan of the United Arab Emirates. The Secretary and the Crown Prince discussed regional and bilateral issues of concern, including agreeing on the need for a ceasefire in Libya and return to UN-led political negotiations. The Secretary also thanked the Crown Prince for his strong partnership with the United States in combatting the global COVID-19 pandemic.

CHINA

U.S. Department of State. 06/04/2020. New Nasdaq Restrictions Affecting Listing of Chinese Companies. Michael R. Pompeo, Secretary of State

The Trump Administration is committed to ensuring that all American businesses and investors can operate on a level playing field with the rest of the world. As part of this ongoing effort, I applaud Nasdaq for requiring auditing firms to ensure all listed companies comply with international reporting and inspection standards.

Nasdaq’s announcement is particularly important given a pattern of fraudulent accounting practices in China-based companies. To protect American investors and U.S. national security, President Trump moved to stop the investment of U.S. federal employee retirement funds into Chinese companies. The President also instructed the Presidential Working Group on Financial Markets to study the differing practices of Chinese companies listed on the U.S. financial markets.

American investors should not be subjected to hidden and undue risks associated with companies that do not abide by the same rules as U.S. firms. Nasdaq’s action should serve as a model for other exchanges in the United States, and around the world.

U.S. Department of State. 06/04/2020. Remarks at International Women of Courage Honorary Awards Ceremony: Tiananmen Mothers.

- Stephen Biegun, Deputy Secretary of State.

- Ambassador Kelley E. Currie, Ambassador-at-Large for Global Women's IssuesOffice of Global Women’s Issues

- Harry S. Truman Building, Washington, DC

AMBASSADOR-AT-LARGE KELLEY CURRIE: Today is a solemn day in China. Thirty-one years ago, at this very hour, troops of the People’s Liberation Army began to clear peaceful protests from Tiananmen Square, using machine guns and tanks, massacring unknown numbers.

Mr. Deputy Secretary, it is an honor to be with you today. It is my pleasure to introduce Ms. Tong Yi who joins virtually from California. Ms. Tong was one of the leading students in the Tiananmen protests of 1989.

DEPUTY SECRETARY STEPHEN BIEGUN: Thank you, Ambassador Currie. I’m honored to join you, Tong Yi, even if only virtually, as we recognize the Tiananmen Mothers on this important day, that around the world has come to symbolize the power of the human spirit against tyranny.

Thirty-one years ago, the Chinese Communist Party massacred hundreds in Tiananmen Square. Those lost are remembered every year not only by the international community but by their families every day, who keep alive the memory of their loved ones. For the families, the fate of their sons, daughters, sisters, brothers, mothers, fathers have never been acknowledged by the Chinese Communist Party and their final resting place remains unknown.

These families have demonstrated immeasurable courage in the face of tragedy and loss, and have, at great cost to their own lives, continued to advocate for holding those responsible accountable.

On this year’s anniversary, I am honored, on behalf of the Department of State, to recognize the courageous mothers of these victims, known as “The Tiananmen Mothers,” who have dedicated their lives to unmasking the CCP and seeking justice for the fallen. What began as one mother who is now 83 years old and essentially under house arrest by the CCP, seeking the truth about her son, grew to a collective appeal to hundreds of mothers still seeking answers.

These Mothers have stood up against the CCP for more than three decades to bring the truth to light. And despite efforts by the Chinese government to silence their voices, they have only grown louder, joined by a growing chorus from around the world.

Today, it is my great honor to present the Tiananmen Mothers this honorary International Women of Courage award on behalf of all the Tiananmen Mothers. Their courage to stand for what is right, what is decent, what is just, is a testament to us all. Ambassador Currie and I are honored to recognize their decades-long efforts to seek justice through their grief. Thank you, Tong Yi, for receiving this award on their behalf, and I hope you will say a few words.

TONG YI: Thank you, Deputy Secretary Biegun and Ambassador Currie.

I am honored and humbled that you have asked me to receive this special award on behalf of the Tiananmen Mothers. Many others, constrained by their presence inside China, would be more qualified than I.

I was a protester at Tiananmen in 1989 and a witness to the massacre. I also did my best, during the early 1990s, to help family members of some of the victims to get in touch with Professor Ding Zilin and the Tiananmen Mothers. This work involved helping people to overcome fear. It was a justified fear, because the government was still viewing the dead and wounded not as victims but as criminals.

Around this very hour thirty-one years ago, I was standing with crowds of Beijing people near Fuxingmen, about two miles west of Tiananmen Square. We could hear machine-gun fire approaching from locations that were still farther west. In an effort to block the approach, citizens where I was had placed articulated buses across the road and set them ablaze. Shortly after midnight, the army’s frontline troops arrived and began removing the burning buses. The tanks arrived and soldiers fired at random into the angry crowds. Two people a few feet away from me fell. Passing motorists stopped, picked them up, and rushed to hospitals. I have never known what happened to those two who fell.

But the fate of a certain 17-year old named Jiang Jielian is well-known. About an hour earlier, to the west along that same avenue of death, Jiang said to a classmate, “I think I’ve been hit.” Then he collapsed and never stood again. He was the son of Ding Zilin, and the main reason why the good professor, at great risk to herself, began speaking out and organizing others who had lost family members in the massacre. This was the birth of the Tiananmen Mothers, a group that eventually came to number several hundred. From then until now, year after year, and in the face of unrelenting government surveillance and harassment, The Tiananmen Mothers have called for the right to mourn their dead publicly and to receive and distribute humanitarian aid. They have called for ending persecution of victims’ families, for releasing all people imprisoned for reasons related to the 1989 protests, and, not least, for a full public accounting for the massacre.

The Chinese Communist Party and its government have never responded to their demands. With the ascension to power of Xi Jinping, the repression of the Mothers has become even worse than before.

As time passes, their numbers have dwindled. Prof. Ding’s husband died in 2015. In a handwritten letter to me dated January 30, 2018, she wrote that she plans simply to stay home for her remaining years. She is known in her apartment building as the only one who has “special protection” twenty-four hours a day. Her letter also contains these lines:

“Thank you for thinking of me. You remind me that I have a duty to let people who care about me know that I am still alive.”

“I no longer expect, in the years that are left to me, to attain justice for the lost souls of Tiananmen. I did my best, but did not make it.”

“My only hope is to live in dignity and to die with dignity. Two years ago, I did everything I could to help my husband depart in dignity. From now on, my fate is in the hands of Heaven.”

The CCP is hoping that The Tiananmen Mothers will gradually die off and be forgotten. But is that possible? I doubt it. Today, on the 31st anniversary of the massacre, this special award helps to continue and to strengthen memory—both of the lost souls of 1989 and of the cause of freedom and democracy for which they gave their lives.

DEPUTY SECRETARY STEPHEN BIEGUN: Thank you, Tong Yi, for joining us today.

________________

ORGANISMS

GLOBAL ECONOMY

IMF. REUTERS. 4 DE JUNHO DE 2020. Chefe do FMI diz que alguns países podem precisar de reestruturação da dívida, não apenas congelamento

WASHINGTON (Reuters) - Alguns dos países mais pobres do mundo e economias de mercados emergentes podem precisar reestruturar sua dívida no futuro, disse a chefe do Fundo Monetário Internacional na quarta-feira, acrescentando que simplesmente congelar os pagamentos da dívida pode não ser suficiente.

A diretora-gerente do FMI, Kristalina Georgieva, disse que alguns países emergentes que adotaram políticas de dívida prudentes e sustentáveis estavam enfrentando a crise do coronavírus melhor do que outros, mas um pequeno universo de países com altos encargos provavelmente precisará de ajuda daqui para frente.

Ela disse que o Fundo desembolsou cerca de 260 bilhões de dólares do seu poder de empréstimo de 1 trilhão de dólares até agora, com financiamento emergencial concedido a 63 dos 103 países que pediram ajuda desde o início de março.

Reportagem de Andrea Shalal

IMF. June 4, 2020. IMF Press Briefing

MR. RICE: Good morning everyone. And welcome to this Press Briefing on behalf of the IMF. I'm Gerry Rice of the Communications Department. And as usual, our briefing this morning will be embargoed until 10:30 a.m., that's Washington Time.

First thing to say is, I hope everyone is managing to stay safe and well. The second thing I want to say is thank you so much for joining us today. Thank you so much to those of you who sent your questions in advance, given our virtual format. It really helps.

We have had a lot of questions. I'm going to try and get to as many as I can, including those that I see are coming in online as we speak.

In the past several press briefings I've been using them to update you on IMF action in response to the crisis. So, I'll do a little bit of that today. Things are moving very quickly. I hope it's helpful to keep you up to speed. And then I'll turn to your questions.

So, since the last time I briefed you here, a couple of weeks ago. As I say, there has been further action and progress in terms IMF support for our membership. I think the last time we spoke, we were closing in on 60 countries that we were supporting with our emergency financing, that number, as of yesterday is actually 66 countries, totaling about 23.5 billion in emergency financing. So, that's 66 countries in 10 weeks or so, and we are expecting another 20 countries to be considered very soon.

As our Managing Director, Kristalina Georgieva, said yesterday, we have a trillion dollars in financial capacity, here at the Fund to help our membership. And as this crisis continues to unfold, we have already deployed about $250 billion. This is across all IMF lending facilities.

So just to recall, we've doubled access to our emergency facilities, enabling us to provide about 100 billion in financing. We expect to triple our concessional credit to low-income countries. We have provided immediate debt relief to 27 of our poorest member countries. In addition, we've established a new Short-Term Liquidity Line to further strengthen the global financial safety net, and of course, we've been leveraging our lending toolkit as I mentioned.

And here I might note, in particular, that just last week, our Executive Board recognized the very strong policy fundamentals in Peru and Chile, and approved their requests for the IMF's Flexible Credit Line, created to protect economies with sound policies and institutions against external shocks. So that was 24 billion for Chile, and about 11 billion for Peru.

This supplements Flexible Credit Lines already for Colombia and Mexico for a total of $107 billion for these Flexible Credit Lines with which we are supporting our membership. You know, as I mentioned the last time, our emergency financing is provided in upfront, outright disbursements, very quickly getting financial support to member countries, and without the traditional IMF conditionality.

That said, of course we are maintaining our commitment to address governance, and corruption vulnerabilities as they apply. We continue to promote transparency and accountability, and ensure that those resources are used for their intended purpose. As Kristalina Georgieva likes to say, we are urging countries to spend what is needed, but to keep the receipts.

I'd also like to give you just a very quick update on the Debt Suspension Initiative. I know that's of great interest to many of you. Just recalling this was an initiative called for my Kristalina Georgieva, and David Malpass of The World Bank sometime ago, then endorsed by the G20. So, about 73 low-income countries are eligible, and this would, potentially, mean 12 billion in debt relief for those countries.

So far 35 countries have made formal requests, so that's just about half of those countries eligible, and we are expecting further interest.

Yesterday the G7 Finance Ministers met, and issued a statement stressing on the Debt Suspension Initiative, the importance of private sector involvement in the initiative, the importance of transparency, and the G7's continued strong support and commitment to this Debt Suspension Initiative.

So, you know, with that, let me conclude just with a few event announcements. You may have seen Kristalina Georgieva quite active in recent days. I can tell you that next Tuesday, she will be speaking at the U.S. Chamber of Commerce, and that will be open, it will be live-webcast, and you can watch it there.

And let me remind of a very important upcoming event on the calendar. I know you watch out for this. On June 24th, Gita Gopinath, our Economic Counsellor, will be releasing our World Economic Outlook Update with our fresh forecast for the global economy.

And on the following day, June 25th, our Financial Counsellor, Tobias Adrian, will be releasing the Global Financial Stability Report update on that, on financial market developments, and so on.

So, thank you for your patience in allowing me to give you that update on what's happening here at the IMF. With that, let turn to your questions, there are quite a number, and I'll try and get through them.

I want to start with Africa today. Simon Ateba, of Today News Africa, has a question, it's quite a long question from Simon, I'm going to just paraphrase it a bit: but he's talking about the Chair of the African Union, Cyril Ramaphosa of South Africa, told leaders that Africa is still in great need of COVID testing equipment facilities, PPE, and so on. So Simon is asking, in that context, "Can you tell us about the IMF's financial assistance to Sub-Saharan Africa, and how substantial has that assistance been?"

Thank you for that question, Simon. What I can tell you is that to help Sub-Saharan Africa address this crisis, the IMF is providing emergency financing assistance, on what I characterize as an unprecedented scale.

So what does that mean? As of June 3rd, yesterday, between 35 and 40 Sub-Saharan African countries have made a request for emergency assistance from the IMF, and 27 countries so far have received financing from the Fund. They have received it, for a total of about USD10 billion.

Again, already disbursed, and without IMF traditional conditionality. More is planned in the coming weeks, so this 10 billion number that I just gave, this is actually about 10 times more than what we have been disbursing to the region on average, on an annual basis our average disbursement in the past has been about 1 billion per year, and already halfway through this year we have disbursed 10 billion, with more to come. So that gives some perspective on what we're doing.

Additionally, 19 Sub-Saharan Africa countries have received debt relief under our Catastrophe Containment and Relief Trust which provides debt relief on IMF payment obligations from countries. And that's been 27 countries as I said, totally, 19 for Sub-Saharan Africa, and that's been for a total of 204 million. More broadly, we are exploring ways to deploy our Special Drawing Rights, to support low-income and small economies, including those in Sub-Saharan Africa.

And together, as I just mentioned, with The World Bank, that we are supporting this Debt Service Suspension Initiative from which many Sub-Saharan African countries can benefit. And of course we are urging other development partners to do more, certainly more needs to be done by all of Africa's partners, complementing the efforts of African countries themselves. And as I said, I mean, in a nutshell, the IMF for its part is making an unprecedented effort in Sub-Saharan Africa.

I'm staying with Africa for a question on Sudan from Matthew Lee, up there in New York, Inner City Press. Thank you, Matthew. "On Sudan," Matthew asks, "What's the status? It's reported that Sudan is seeking its first IMF program since 2014, agreeing the non-financial initiative in June talks and persuading the U.S. to drop its long-standing listing of Sudan as a state sponsor of terrorism, are key planks of the transitional government's plan."

So, again, Matthew is essentially asking what's the status, to which I can tell you that of course we all know Sudan faces very significant economic challenges, compounded by past sanctions, external arrears, and unsustainable external debt, the legacy, the terrible legacy of conflict, and more recently the pandemic.

So, as such, I can confirm for Matthew, the Sudanese authorities have requested a Staff-Monitored Program from the IMF to help build a track record of policy implementation, to support progress toward debt relief for Sudan. An IMF negotiation mission, a virtual mission, of course these days, is expected by be completed by around the fourth week of June, and successful negotiations would indeed lead to the approval of the Staff-Monitored Program for Sudan.

For those of you who don't follow the IMF so closely, the Staff-Monitor Program is not financing at this stage, but it's a way for Sudan to show a track record of good policy implementation, and by showing such a track record, it can help Sudan toward clearing its arrears to the IMF, which in turn, and this is the key, can unlock financing from other sources as well.

So, that's the status with Sudan. There are many, many questions on Lebanon. I'm turning to the Middle East. Emma Graham, CNBC; Lin Noueihed, Bloomberg; Odette Ayoub, Addiyar; and once again, Matthew Lee, all asking questions about Lebanon, what's the status of IMF negotiations. “The Prime Minister has said he thought talks with the IMF would be wrapped up within a month. Again, can we confirm? We know central banks numbers and government numbers are different, what's the IMF's view? What's the IMF's view on corruption? In Lebanon it's said that the IMF is asking to decrease government expenditures, will these costs of reforms fall on the poorest?"

Those are the questions. Let me try and take them. On the status of discussions, I would characterize them as I did last time here, as constructive. They’ve been focused on a better understanding of the government's reform plan and its implications. We all recognize the challenges facing Lebanon are difficult, they're complex, and they will require the right diagnostic and the right set of comprehensive reforms, and of course implementation is key. This needs to be underpinned strong government ownership of its economic program, and support for across the political spectrum and civil society.

There was a question about the timeline. I don't have a timeline for the conclusion of the discussions. We do expect them to be rather lengthy due to the complexity of the issues that I just mentioned.

On the difference in numbers question, between central banks' numbers, government numbers: we have had several rounds of technical meetings with senior officials in Lebanon, to better understand the estimated losses stemming from the assumed public debt restructuring, exchange rate depreciation and other factors, as presented in the government's plan, and these discussions, as I said have helped us improve our understanding of many specific technical issues.

Having said this, the preliminary view from Fund's staff, is that the estimated losses presented in the reform plan, are broadly in the right order of magnitude, given the assumptions presented. Nevertheless, further technical work will be needed ahead to refine these estimates, particularly as specific reforms are implemented.

On the question of corruption, of course this is an issue the IMF is addressing in many countries. In the context of Lebanon, there is significant scope to strengthen the transparency and accountability of economic policies, and public sector entities. And this will be critical, in our view, to restore confidence, and ensure that loss-making sectors are reformed and help strengthen overall economic performance in the year ahead.

Finally, the question about reforms falling on the poor: we are discussing with the authorities how they can implement their economic reform plan in a way, and I want to be clear on this. In a way to ensure that the burden of adjustment does not fall on the poor and middle class, while the proposed fiscal adjustment strategy is successfully implemented.

I am staying in the Middle East, and turning to Egypt. Doa'a Abdel Moneam from Ahram Online, and Samar ELsyaed of Al Mal asking a couple of questions on Egypt. Thank you. "When will the IMF's Executive Board announce its decision regarding the standby arrangement loan for Egypt?"

So, reminder, our Executive Board has already approved emergency financing for Egypt less than a month ago, several weeks ago, 2.7 billion, to help Egypt and with the pandemic that was a Rapid Financing Instrument. On the Stand-by Arrangement, which is what the question is about, I can tell you that an IMF mission, led by Uma Ramakrishnan, our Mission Chief, is currently in discussion with the Egypt authorities. And again, that's virtual, that's how we're doing it these days.

On the modalities of that Stand-by Arrangement, land, size, reviews, et cetera, they’ll have to be considered in the light of the ongoing crisis, its impact on the economy, and I would expect the team to communicate at the end of the mission, as we usually do at the IMF.

If the team, the Staff team reaches an agreement, they will present the authority's request for the standby arrangement to our Executive Board for discussion and final decision. This is our process at the IMF, those of you who watch us, you know how this works. We have discussions with the authorities, we have a Staff-level agreement, and then the ultimate discussion and decision lies with our Executive Board. That's always the case.

So, the amount of the SBA, the Stand-By Arrangement, is not predetermined, depends on various factors, and our Board will make the final decision.

The second question on Egypt is, "When will the IMF revise its forecast in light of the crisis?"

So, we did revise our projections for Egypt in the World Economic Outlook in April. And as I mentioned at the top of this meeting, we will have the WEO Update with Gita Gopinath and her team on June 24th.

Turning to South Asia, India, and our friend, Lalit Jha; normally with us in the room, but asking online. Thank you, Lalit. "What's the IMF's assessment of the Indian economy? PM Modi this week has announced a series of steps of strengthen the Indian economy, are they enough to put it on track?"

So, again, in the April World Economic Outlook, growth for India was project at 4.2 percent and 1.9 percent, that's for fiscal year 2019-

2020 and fiscal year 2020-2021, with the former matching the national accounts data outturn released last week. There will be an update, again, in the World Economic Outlook, coming, on June 24th. Like most other countries in the world, given the sharp slowdown in global and domestic demand from the pandemic, and the national lockdown policies, we are expecting that there will be an impact on the Indian economy, and the near-term outlook, again, like many other countries, is clouded by these uncertainties related to the impact of COVID-19.

In terms of India’s response, we would characterize it as a strong response by the authorities to the crisis. India’s economic relief package has included fiscal stimulus, monetary easing, and liquidity regulatory measures for the financial sector and for borrowers, and provides much needed support to businesses and agriculture, and it expands support to vulnerable households. Given the crisis, the priority is -- continues to be swift implementation of this response effort to the crisis, in particular, although, medium-term fiscal consolidation remains important. Further fiscal stimulus can be deployed as needed to support the poor and given the sharp slowdown in domestic and global activity, there may be scope for additional monetary easing, as well, to support growth and financial stability, so, all of this building on the recent government measures, the easing, the liquidity, the financial sector measures, that I mentioned, taken by the authorities as part of their strong response to the crisis in India.

On Pakistan, what’s the status of the Extended Fund Facility, which is another of our instruments that we used, that we use to support our membership? And, again, before talking about that, let me just mention, as I did in a previous case, that, a number of weeks ago, the IMF already provided emergency financing to Pakistan in the context of the COVID-19 crisis, and that was in the amount of about $1.4 billion, approved by our Board in April, and on the Extended Fund Facility, which was already in place with Pakistan, I can tell you that technical discussions with the authorities continue. They remain fluid with a view to bringing that second review of that program, that Extended Fund Facility, to a positive conclusion, as soon as possible. We’re working with the authorities, constructively, to ensure that that can be brought to a positive conclusion, as soon as possible, while taking into account the new conditions that we’re facing in Pakistan, and to ensure the program delivers on its objectives.

I’m turning to Europe. There are many questions on Ukraine, from Julia Ustymovych, from The Page, in Ukraine, and I’m seeing one popping up from Yaroslav Dovgopol, from UKRINFORM, and they’re basically asking about what’s the status of the discussions with the IMF? The Prime Minister indicated that the IMF will approve $5 billion, at a Board meeting. Can we give the status of that? There’s also a question -- this is from Julia, as well. Some media have said that the text of the memorandum between the Fund and Ukrainian government has been released. Can you comment on that? And there’s another question, online, about the -- again, about the calendar and the status.

So, since the last couple of weeks ago, when I was here, we talked about Ukraine. A couple of developments. On May 21st, IMF staff and the Ukrainian authorities, indeed, reached this staff-level agreement on a new 18-month Stand-by Arrangement with a requested access of around $5 billion. Kristalina Georgieva also had a conversation with President Zelensky, just last week. We communicated about that. She congratulated him on the completion of the prior actions for this IMF-supported program. I can tell you they also discussed, of course, the impact of the crisis on the Ukrainian people and the economy, and how the IMF can help. The agreement on the standby arrangement is, again, subject to discussion and approval by our Executive Board, as in all cases, and that Board discussion is expected on June 9th. So, I am giving you a date, there.

On the question about the leak of the memorandum and so on, you know, we never comment on leaked documents, but what I can tell you is that the IMF is a transparent institution, as many of you know, from looking even just at our website, and based on our transparency policy, we will be releasing, in full, the staff report, as we always do, on the agreement with Ukraine and all the accompanying documents and details, and we will do that soon after the Board meeting, and assuming the Board’s approval. Again, this is par for the course. This is what we do. We publish our agreements with countries, so that you can see them, the world can see them.

I’m staying on Europe, with a question from Jose De Haro, elEconomista, in Spain. Thank you. Jose has two questions. What is the IMF’s view on the Spanish government’s decision to undo labor reform, and what’s the IMF’s view on the newly approved minimum income scheme for the poor?

On the labor issue, I would say that past labor market reforms have underpinned Spain’s job rich recovery from the global financial crisis, and that has helped create greater flexibility, boost competitiveness, and it helped reduce unemployment, but, of course, now, we have the crisis, and to support recovery from the COVID crisis. Once the containment measures are lifted, it remains critical that labor market institutions continue to provide sufficient flexibility and take into account firm specific needs. Thus, you know, any future reforms should build on past achievements and continue to address structural weaknesses in the Spanish labor market, that are intensifying inequality and that hinder labor productivity growth. What does this mean?

In particular, it means making the labor market more inclusive, which will require lowering the precariousness of work contracts. Moreover, it will be important that active labor market policies boost the acquisition of new skills for people, such as those needed for the digitalization of the economy. One more thing, the dialogue with social partners is very important for future successful reforms.

On the question about the minimum income scheme, the Spanish government’s resolute measures to support people’s incomes during the current crisis are greatly welcome, as far as the IMF is concerned. Ensuring sufficient support for the most vulnerable households is particularly crucial. Beyond the immediate needs of this crisis, of course, a careful review will be needed of how to effectively integrate the existing different levels of income support and embed them in a medium-term budgetary plan, but, again, the introduction of Targeted National Minimum Income Program is an important contribution to enhance the social safety net in Spain, and particularly at this time.

One last question on Europe, just coming in. The European Central Bank, today, said they would spend an extra 600 billion Euros on emergency bond purchases. Does the IMF have a view?

What I can say is this is news just breaking, of course, this morning. The IMF staff welcomes the ECB’s decision to provide further liquidity support, by increasing the size and duration of its Pandemic Emergency Purchase Program, and its commitment to maintain a strong accommodative stance, until the ECB’s medium-term inflation objective is met.

I’m turning to Latin America, and questions on Argentina. Natalia Donato, Infobae, and Liliana Franco, Ambito Financiero, asking until when do you see Argentina has time to close the deal with bondholders on its debt restructuring, and what would happen if there was no agreement?

I won’t speculate on the outcome of the ongoing discussions between Argentina and the creditors, but, as we have said, recently, and I would point you to the technical note issued by IMF staff, just a couple of days ago, quite detailed, but, as we have said, recently, we are encouraged by the willingness of all parties to continue to engage and find a consensus. We are hopeful that an agreement can be reached, that will restore debt sustainability with high probability in Argentina and pave the way for strong and inclusive economic growth. On the timing, I don’t have anything on the timing issue.

Liliana Franco’s question is, yesterday, Kristalina Georgieva said that the aim is to restructure the debt, Argentina’s debt, in a way that it can be paid. Will you include this criteria when the negotiations on a new IMF program begins?

So, you know, I don’t have any updates, at this stage, on the negotiations regarding a new program between Argentina and the IMF. As I’ve said here before, we have a very active and constructive dialogue with the Argentine authorities, and we are looking to be as supportive of Argentina and the Argentine people as we can, but, at this stage, we have not started -- I want to be clear. We have not started discussions on a Fund-supported -- a new Fund-supported program for Argentina. As always, that will be the prerogative of the Argentine authorities.

I am taking some questions on Ecuador, from Evelyn Tapia, and Monica Orozco, of El Comercio, and hello to Wilmer Torres, of Primicias. How is the process for a new agreement with the Fund going, in Ecuador? What steps have been taken? Can you give us the status, the amount, and so on, and will the Fund deliver more resources through the emergency financing for Ecuador?

So, Ecuador, like most other countries, has been hit by COVID-19. It’s also been hit by the sharp oil and fallen oil prices. Indeed, I mean, it’s one of the worst outbreaks of COVID-19 in Latin America, the collapse in global demand, and so on. In the context of the Ecuadorian authorities’ response to the virus, we have already provided $643 million in immediate and, again, virtually unconditional support to help Ecuador address the effects of the health crisis and its impact.

Now, in parallel to that emergency financing, so, you’re seeing this familiar story in a number of countries, there’s the emergency financing, and, in parallel, there’s complimentary support via other IMF mechanisms. So, in parallel to the emergency financing, we continue to work with the authorities on a successor program to the previous Extended Fund Facility, and, you know, that will be aimed at broader economic objectives to bolster economics, Ecuador’s economic performance, strengthen the foundations of Ecuador’s dollarization, which has contributed to the stability of the Ecuadorian economy, and is greatly valued by the people of Ecuador, as well as, you know, help deliver broad-based benefits for all Ecuadorians, especially the most vulnerable parts of the population. So, that’s where we stand.

A question is could we deliver even more emergency financing? Ecuador could request additional emergency financing next month, under the IMF’s Rapid Financing Instrument, that could be anywhere around U.S. $250 million, if the effect of recent economic shocks persist. However, and, again, let me be clear, the Ecuadorian authorities have indicated their interest in negotiating a comprehensive IMF-supported program, and are working with IMF staff in pursuing that objective. So, that’s where we stand. There’s one other question on Ecuador, and I want to take it because it’s important be -- the question is can you confirm that the IMF Mission Chief held meetings with political party leaders in Ecuador, and what’s the reason for this meeting?

So, let me just step back here, again, for those of you who don’t follow the Fund so closely. Similar to the engagement we have with all member countries, including in the context of our regular surveillance, our Article IV missions, and program discussions, IMF staff engage with a broad spectrum of stakeholders, so, including leaders across the political spectrum, civil society, trade unions, academics, think tanks, and the private sector. This is what we do in all countries, across a broad spectrum. So, this is also what has been happening in Ecuador, and there’s nothing more or less to it. This is what we do, in all countries, and that’s been the case in Ecuador, as well. These discussions are important. They help enrich our understanding. We’re a listening institution, and, so, they help inform our assessment of the economy by talking to this broad group of stakeholders, and, again, not just in the case of Ecuador, in all countries. I hope that’s clear.

I’m going to take the last question. It’s from Xinhua, in China. It’s from Maoling Xiong, and it’s not a question on China, actually. It’s a question on, more broadly, on trade, and asking, according to a recent report, some 156 export controls on medical supplies and medicines have been executed by 85 governments, just since the beginning of this year. What’s the IMF’s reaction?

Look, broadly, as I’ve said here before, we’ve said we believe we are all better off in a world where trade and investment flows freely, and supply chains adjust with the needs of the global economy. Today, more than ever, the global economy would benefit from a more open, stable, transparent, rules-based trade system. On the particular questions, we have, in fact, raised our concerns over supply disruptions from the use of export restrictions and other actions that limit trade of key medical supplies and food. In particular, and in the context of this crisis, we’ve raised this concern, and you might recall that, in the global financial crisis 10 years ago, global leaders, in fact, jointly committed to refrain for a year from new import, export, and investment restrictions. This was very helpful. I think it helped the world to recover from the global financial crisis, and we think a similarly bold step is needed today. As I said, the Fund, and I believe the WTO, others are calling on governments to refrain from imposing or intensifying export and other trade restrictions, and to work to promptly remove those put in place since the start of the year, particularly in the area of medical supplies, equipment, and food.

So, on that note, let me leave it there. Let me thank you, again, for your very cooperative approach working with us in these virtual days, enabling us to have this regular press briefing, and provide you with information about what the IMF is doing in the midst of the crisis. Thank you for your attention, and I’ll see you again in a couple of weeks. Stay safe, everyone.

AGRICULTURE

FAO. 04 June 2020. FAO Food Price Index falls to 17-month low. First forecasts for 2020/21 point to new records ahead for global cereal production, utilization, stocks and trade

Rome - Global commodity food prices fell for the fourth consecutive month in May, as supplies appear strong and demand weakens due to economic contractions triggered by the COVID-19 pandemic, the Food and Agriculture Organization of the United Nations reported today.

The FAO Food Price Index, which tracks international prices of the most commonly-traded food commodities, averaged 162.5 points in May, 1.9 percent below the previous month and marking its lowest reading since December 2018.

The FAO Dairy Price Index declined 7.3 percent from April, led by steep drops in the quotations for butter and cheese due to seasonal supply factors and lower import demand, and averaged 19.6 percent below its level one year ago. Quotations for milk powders declined only moderately, as low prices and renewed economic activity in China fueled strong buying interests.

The FAO Sugar Price Index bucked the trend, rising 7.4 percent from the previous month and undoing half of its April decline due to a rebound in international crude oil prices as well as lower-than-expected harvests in India and Thailand, respectively the world's second-largest sugar producer and second-largest exporter.

The FAO Cereal Price Index declined 1.0 percent from April. International rice prices edged up slightly, buoyed by rising Japonica and Basmati quotations, while wheat export prices fell, amid expectations of ample global supplies. Coarse grain prices fell further, with U.S. maize prices now almost 16 percent below their level of May 2019.

The FAO Vegetable Oil Price Index fell 2.8 percent to a 10-month low. While quotations for rapeseed and sunflower oil prices increased, those for palm oil fell for the fourth consecutive month, reflecting subdued global import demand and higher-than-expected production and inventory levels in major exporting countries.

The FAO Meat Price Index declined by 0.8 percent in May, averaging 3.6 percent below its May 2019 value. Bovine meat quotations increased while those for poultry and pig meats continued to fall, reflecting high export availabilities in major producing countries, despite an increase in import demand in East Asia following the relaxation of COVID-19 social distancing measures.

Records ahead for global cereal output and trade

Global cereal production is on track to reach a new record level of 2 780 million tonnes, 2.6 percent higher than 2019/2020, according to FAO's Cereal Supply and Demand Brief, also released today.

FAO's first forecasts for the 2020/21 season, based on conditions of crops already in the ground, planting expectations for those still to be sown and assuming normal weather for the remainder of the season, point to a comfortable global supply-demand situation for cereals.

Maize accounts for 90 percent of the predicted output increase of all cereals, with an expected expansion of 64.5 million tonnes - to a total of 1 207 million tonnes - boosted by anticipated record harvests in North America and Ukraine and near-record harvests in South America. Rice production is seen reaching an all-time high of 508.7 million tonnes, up 1.6 percent from 2019, boosted by expected recoveries in China, Southeast Asia and South Asia as well as the United States of America. Wheat output, by contrast, is forecast to decline from the solid level of 2019, as likely drops in the European Union, Ukraine and the U.S. more than offset expected increases in Australia and the Russian Federation.

World cereal utilization in the year ahead is also forecast to reach an all-time high, rising 1.6 percent to 2 732 million tonnes, as feed, food and industrial uses are all expected to expand. Maize is the primary driver, as its use for livestock feeding in China and for ethanol production in the U.S. are both foreseen increasing. Rice utilization in 2020/21 is forecast to expand by 1.6 percent, underpinned by ample supplies, with global per capita food intake rising 0.6 percent in the year to 53.9 kilograms.

Reflecting the new production and consumption forecasts, FAO now expects world cereal inventories by the end of national marketing seasons in 2021 to reach a new record of 927 million tonnes, a 4.5 percent increase from their already high opening levels. That would drive the global cereal stock-to-use ratio to 32.9 percent, a comfortably higher level than the 21.2 percent low registered in 2007/08. China is expected to hold 47 percent of global cereal stocks.

FAO expects world cereal trade in 2020/21 to rise by 2.2 percent to 433 million tonnes, setting a new record, with expansions expected for all major cereals, led by a 6.2 percent anticipated increase in the global trade in rice.

FULL DOCUMENT: http://www.fao.org/worldfoodsituation/foodpricesindex/en/

_________________

ECONOMIA BRASILEIRA / BRAZIL ECONOMICS

PROMOÇÃO COMERCIAL

CNI. 03/06/2020. MPEs têm a oportunidade de participar de rodadas virtuais para exportação de bebidas e alimentos. Na 1ª edição online no Brasil, evento terá a participação de compradores dos Estados Unidos, Canadá, Índia, Emirados Árabes, entre outros países

O Banco Interamericano de Desenvolvimento (BID) juntamente com o Serviço Brasileiro de Apoio às Micro e Pequenas Empresas (Sebrae), a Confederação Nacional da Indústria (CNI) e a Agência Brasileira de Promoção de Exportações e Investimentos (Apex-Brasil) vão realizar, entre os dias 22 e 26 de junho, uma rodada internacional de negócios do setor de alimentos e bebidas, envolvendo micro, pequenas e médias empresas. Fornecedores brasileiros poderão se conectar com compradores de toda a América Latina, além dos Estados Unidos, Índia, Emirados Árabes e Canadá. Essa é a 1ª vez que o evento acontecerá no modelo virtual em função da pandemia do coronavírus, que afeta o Brasil e diversas outras nações do mundo.

As instituições brasileiras que atuam na organização do evento fazem parte do Plano Nacional da Cultura Exportadora (PNCE). O Sebrae, a CNI e a Apex-Brasil são responsáveis por conduzir as ações voltadas às empresas do setor de alimentos e bebidas. Independentemente do porte, todos os segmentos terão uma grande oportunidade de expandir suas atividades e buscar novos negócios fora do país.

“Para a Apex-Brasil, as rodadas virtuais fazem parte de um conjunto de ações de suporte às empresas brasileiras para incrementar a geração de negócios internacionais e tornar a nossa indústria mais competitiva, com mais efetividade e menores riscos”, avalia a Gerente de Competitividade da Apex-Brasil, Deborah Rossoni.

“A internacionalização aumenta a competitividade das empresas, com a ampliação de mercados e diversificação da demanda o que se transforma em mais uma alternativa para se conseguir ultrapassar este momento desafiador que vivemos”, afirma Carlos Abijaodi, diretor de Desenvolvimento Industrial da CNI. A CNI coordena nacionalmente a Rede Brasileira de Centros Internacionais de Negócios (Rede CIN), presente nas 27 unidades da federação com foco no atendimento às empresas para assegurar uma atuação competitiva no mercado internacional.

A rodada virtual internacional, chamada de Business Connection Brazil: food & beverage, é um dos desdobramentos da Connectamericas.com. A plataforma de negócios gratuita criada pelo BID para apoiar mais de 300 mil empresários cadastrados na realização de mais e melhores negociações internacionais. O evento será o primeiro que acontece virtualmente no Brasil. “Será uma semana inteira de atividades online e vamos dar todo o suporte para que as empresas tenham agendas de negócios bem-sucedidas”, comenta o diretor técnico do Sebrae, Bruno Quick.

Fabrizio Opertti, Gerente do Setor de Integração e Comércio do BID, ao qual pertence a ConnectAmericas, assegura: “Este evento só é possível graças a uma aliança histórica entre as mais reconhecidas instituições de apoio empresarial do Brasil, agora reforçada com a participação do BID, cujo propósito comum é apoiar as MPMEs neste momento de crise sanitária e econômica global. No BID, temos muito orgulho de fazer parte deste esforço por meio do nosso apoio contínuo ao Plano Nacional da Cultura Exportadora (PNCE) para que, depois da rodada, as empresas possam seguir fazendo negócios na ConnectAmericas.com.

A ConnectAmericas, segundo a analista do Sebrae, realiza anualmente várias rodadas de forma presencial, mas em função da pandemia, estão fazendo tudo de forma virtual em 2020. A plataforma foi criada pelo BID para fomentar o comércio exterior e investimentos internacionais nos países da América Latina e Caribe. As empresas que queiram participar do evento este ano podem se inscrever entre os dias 1 e 19 de junho, gratuitamente, na plataforma e no site bcbrazil.com. Em uma segunda etapa haverá um processo de seleção dessas empresas, de acordo com uma avaliação da sua capacidade de exportação e o grau de correspondência com as demandas dos compradores.

As micro, pequenas e médias empresas têm um papel muito importante nas exportações brasileiras de forma diversificada. Juntas representam 70% do número de empresas exportadoras segundo estudo do Sebrae de 2019, principalmente do setor da indústria. De acordo com o Sebrae, mais de 40% das empresas exportadoras brasileiras são micro e pequenas. Elas foram responsáveis por vendas externas no montante de US$1,2 bilhões em 2018.

CORONAVÍRUS

CNI. MDefesa. 04/06/2020. Empresas podem encontrar fornecedores de EPIs em cadastro do Ministério da Defesa. Denominado Covid-19: Produtos ao Alcance de Todos, o cadastro visa facilitar e agilizar o processo de aquisição de materiais. Os itens com maior número de fornecedores são os EPIs

Para ajudar empresas a cumprir as exigências sanitárias impostas pelo governo para o funcionamento de lojas, escritórios e indústrias no Distrito Federal, e colaborar com o controle da pandemia da Covid-19, está disponível no site do Ministério da Defesa um cadastro de empresas que fornecem produtos e equipamentos que auxiliam no combate ao coronavírus. Denominado Covid-19: Produtos ao Alcance de Todos, o cadastro visa facilitar e agilizar o processo de aquisição de materiais.

As empresas cadastradas são indústrias ou fornecedores que têm equipamentos disponíveis para comercialização, permitindo que os setores retomem atividades seguindo as exigências dos governos locais, como a aferição de temperatura de todos que entrarem no local, distribuição de álcool em gel e uso de máscaras obrigatório.

Apenas no Distrito Federal estão cadastradas 32 empresas, de várias regiões administrativas, que oferecem produtos como máscaras, aparelhos, camas, produtos químicos, desinfetantes, entre outros. Os itens com maior número de fornecedores são os equipamentos de proteção individual (EPI), onde se enquadram máscaras, aventais, luvas e toucas, por exemplo.

Um produto muito procurado por empresários é o teste rápido de covid-19. Na lista do Ministério da Defesa não constam fornecedores desse item na capital federal, mas há em Minas Gerais, no Paraná, no Rio de Janeiro, em Santa Catarina e em São Paulo. No cadastro há também empresas que vendem termômetros, produto essencial para a reabertura de estabelecimentos. Para encontrar os fornecedores de um produto específico é preciso ir na aba listagem de produtos, e fazer o filtro pelo item procurado.

O cadastro do Ministério da Defesa vai ajudar os fornecedores que precisam vender esses equipamentos e os empresários que precisam cumprir a legislação.

Ministério da Defesa cadastra fornecedores para Operação COVID-19

Com o objetivo de fortalecer as ações do governo federal na Operação COVID-19, o Ministério da Defesa (MD) está cadastrando as empresas que atuam no setor de Defesa. A meta na ação denominada “COVID-19, Produtos ao Alcance de Todos” é identificar as empresas que podem fornecer equipamentos para auxiliar no combate ao vírus.

Em paralelo, o Ministério está disponibilizando as informações sobre as empresas para órgãos públicos. A lista, com os nomes das empresas, locais onde atuam e os equipamentos que podem fornecer, será enviada ao Ministério da Saúde, às Forças Armadas, ao Conselho Nacional de Secretarias Municipais de Saúde (CONASEMS) e ao Conselho Nacional de Secretários de Saúde (CONASS).

CADASTRO: https://www.defesa.gov.br/noticias/67558-ministerio-da-defesa-reforca-acoes-da-operacao-covid-19.

FGV. 04/06/2020. Impactos da COVID-19. O agronegócio e o meio-ambiente na pandemia

Uma das primeiras impressões que surgem quando se trata do tema meio-ambiente relacionado à Covid-19 é a centralidade que as questões sobre a água ganham no debate. Não só em função das recomendações da Organização Mundial da Saúde, que aconselha a constante higienização das mãos, produtos e alimentos como um dos meios de evitar a disseminação da doença. Mas em função de um protagonismo da água na dessedentação e manutenção de processos produtivos, como o agronegócio. Quem fala sobre o assunto é a pesquisadora Bianca Medeiros, da FGV Direito Rio.

VÍDEO: https://www.youtube.com/watch?v=QZ5OfWvx-9k&feature=youtu.be

POUPANÇA

BACEN. 04 Junho 2020. BC divulga o Relatório de Poupança de maio de 2020.

DOCUMENTO: https://www.bcb.gov.br/detalhenoticia/17092/nota

BACEN. REUTERS. 4 DE JUNHO DE 2020. Captação mensal da poupança renova recorde histórico em maio, a R$37,201 bi

BRASÍLIA (Reuters) - A caderneta de poupança registrou entrada líquida de 37,201 bilhões de reais em maio, renovando recorde histórico para qualquer mês na série histórica do Banco Central iniciada em 1995.

Em abril, o ingresso líquido de recursos havia sido de 30,459 bilhões de reais, maior marca até então.

Segundo dados divulgados pelo Banco Central nesta quinta-feira, os depósitos superaram os saques em 30,301 bilhões de reais no Sistema Brasileiro de Poupança e Empréstimo (SBPE), enquanto na poupança rural houve entrada de 6,9 bilhões de reais em maio.

Nos cinco primeiros meses do ano, a captação da poupança ficou positiva em 63,9 bilhões de reais, ante saída de 16,997 bilhões de reais em igual período de 2018.

Por Marcela Ayres

MERCADO DE IMÓVEIS

ABECIP. REUTERS. 4 DE JUNHO DE 2020. Financiamento imobiliário no Brasil sobe 22,6% em abril, mesmo com pandemia

SÃO PAULO (Reuters) - O crédito imobiliário com recursos das poupança somou 6,7 bilhões de reais em abril, alta de 22,6% ante mesmo mês de 2019, e recuo de 0,4% na base sequencial, informou nesta quinta-feira a Abecip, que representa as financiadoras do setor.

“O volume financiado (...) foi próximo ao dos dois meses anteriores, indicando assim, até então, ausência ou pequeno impacto da crise do novo coronavírus sobre o crédito imobiliário”, afirmou a Abecip.

No acumulado do ano até abril, os empréstimos destinados à aquisição e construção de imóveis avançaram 27,9% ano a ano, para 26,95 bilhões de reais.

De acordo com a entidade, em abril a modalidade de compra e construção movimentou 23,6 mil imóveis, resultado 7,8% inferior ao de março e 15,7% maior do que no mesmo mês de 2019.

De janeiro a abril de 2020, foram financiadas 102,72 mil unidades, volume 22,2% maior do que em igual período de 2019.

Por Aluísio Alves

BANCOS

BACEN. 04 Junho 2020. BC divulga o Relatório de Economia Bancária de 2019

O Banco Central (BC) divulgou nesta quinta-feira (04/06) o Relatório de Economia Bancária de 2019. Publicado anualmente, o relatório faz uma ampla avaliação do mercado de crédito brasileiro e analisa de forma abrangente as condições de funcionamento do Sistema Financeiro Nacional.

Nesta edição, foram atualizadas as estatísticas de decomposição do custo do crédito e do spread bancário para 2019, que mostraram a continuidade da trajetória de redução do custo de captação e da inadimplência.

Sobre o nível de concentração e competição no sistema financeiro, o relatório aponta que houve uma redução do grau de concentração em 2019 em virtude, principalmente, da redução da fatia de mercado ocupada pelos bancos públicos.

O relatório também apresenta informações sobre as expectativas para o mercado de crédito para 2020 oriundas da Pesquisa Trimestral de Condições de Crédito (PTC), bem como um conjunto de textos abordando diversas temáticas como: microcrédito, mudanças no cheque especial e uma simulação de seus impactos, a portabilidade no crédito imobiliário, sensibilidade da demanda de crédito à taxa de juros em determinadas modalidades de crédito livre, comportamento de bancos e cooperativas após a captura de novos clientes, além de uma avaliação de longo prazo de uma ação de educação financeira em escolas de nível médio, o perfil dos cidadãos com endividamento de risco, uma avaliação dos modelos de negócios de Fintechs e cooperativas, e a atuação do BC na prevenção da lavagem de dinheiro e financiamento ao terrorismo.

APRESENTAÇÕES: https://www.bcb.gov.br/conteudo/home-ptbr/TextosApresentacoes/REB%202019-2020%20v9.pdf

BACEN. REUTERS. 4 DE JUNHO DE 2020. Com aposta em modalidades de crédito mais caras, bancos elevam rentabilidade pelo 3º ano, diz BC

Por Marcela Ayres

BRASÍLIA (Reuters) - A rentabilidade dos bancos no Brasil seguiu trajetória ascendente em 2019, seu terceiro ano consecutivo de aumento, apoiada pelo aumento de operações que são mais caras para pessoas físicas, como cheque especial, cartão de crédito e empréstimo não consignado, mostraram dados do Banco Central divulgados nesta quinta-feira.

Para este ano, contudo, o BC afirma que dados já apontam para uma queda da rentabilidade com um aumento nas provisões para fazer frente à esperada elevação da inadimplência.

Conforme o Relatório de Economia Bancária do BC, o Retorno sobre o Patrimônio Líquido (ROE) do sistema bancário alcançou 16,5% em dezembro de 2019, ante 14,8% no mesmo mês de 2018.

Enquanto o ROE dos bancos privados fechou o ano em 17,2% (+1,1 ponto), o dos bancos públicos ficou em 15,6% (+2,8 pontos) e dos estrangeiros em 16,4% (+2 pontos).

A elevação foi contra prognóstico traçado pelo próprio BC, que havia estimado, após o ROE do sistema ter atingido 15,8% no primeiro semestre do ano passado, que a tendência à frente era de arrefecimento em função do esgotamento da redução das despesas de provisão e da expectativa de retração dos ganhos de eficiência operacional.

No documento, o BC apontou que a melhora na rentabilidade veio sobretudo com a retomada do crédito e alteração da composição da carteira priorizada pelos bancos, além do aumento das rendas de serviços.

Segundo o BC, os grandes bancos deram foco ao relacionamento com clientes pessoas físicas e pequenas e médias empresas, mirando produtos e segmentos com spreads mais elevados nos dois casos.

“As operações de cheque especial, cartão de crédito e empréstimo não consignado geraram cerca de 42% da margem de crédito líquida do total da carteira PF (pessoa física)”, disse o BC.

“Em contrapartida, essas modalidades corresponderam a aproximadamente 10% do estoque total da carteira PF, o que indica elevado nível de rentabilidade dessas operações”, acrescentou.

Sobre a receita com serviços, o BC apontou que houve alta de 7,5% sobre 2018, com destaque para receitas advindas do mercado de capitais (+70,1%), na esteira do aumento das comissões de colocação de títulos e rendas de corretagem.

Na comparação internacional, a rentabilidade dos bancos no Brasil em 2019 ganhou com folga da observada em países como Turquia (12,7%), China (12,3%), Alemanha (5,1%), Itália (3,9%), Estados Unidos (3,5%) e Índia (1,0%).

Por outro lado, perdeu do ROE verificado no sistema bancário de países como Argentina (53,2%), México (20,6%) e Rússia (19,5%).

“Para 2020, espera-se maior pressão sobre a rentabilidade do sistema, com possibilidade de redução no volume de serviços prestados e de aumento de risco diante do cenário de incertezas e dos potenciais impactos da pandemia de Covid-19 na economia”, avaliou o BC.

Em coletiva de imprensa, o diretor de Política Econômica do BC, Fabio Kanczuk, afirmou que os processos que têm feito os bancos elevarem sua rentabilidade nos últimos anos decorrem de ganhos de produtividade, por exemplo ligados ao aumento do crédito concedido enquanto há redução do número de agências, digitalização de sistemas e implementação de programas de demissão voluntária.

“Isso gera mais rentabilidade e é ótimo. A gente não deve comemorar que a rentabilidade do banco caiu”, afirmou ele. “Objetivo do regulador é aumentar a competição, o que importa é a competição, não é algo positivo para o BC que os bancos percam dinheiro, não é esse o ponto.”

Os dados do Relatório de Economia Bancária, contudo, mostram que em 2019 houve aumento das despesas administrativas acima da inflação, que ocasionou desaceleração da melhora de eficiência operacional.

Segundo Kanczuk, dados na ponta mostram queda “importante” da rentabilidade bancária este ano por conta dos efeitos da crise com o surto de Covid-19, e que isso decorre do aumento das provisões pela expectativa de inadimplência mais alta.

PEQUENA QUEDA NA CONCENTRAÇÃO

O BC também divulgou nesta quinta-feira que a concentração bancária no Brasil caiu levemente em 2019, com as cinco maiores instituições — Banco do Brasil, Itaú, Bradesco, Caixa Econômica Federal e Santander — detendo 81,0% dos ativos totais do segmento bancário comercial, contra 81,2% em 2018.

No relatório, o BC mostrou ainda que esse grupo passou a responder por 83,7% das operações de crédito no segmento, sobre 84,8% no ano anterior. Em relação aos depósitos totais, houve queda para 83,4% do total, sobre 83,8% em 2018.

O diretor de Organização do Sistema Financeiro do BC, João Manoel de Mello, avaliou que o sistema é “moderadamente” concentrado no Brasil.

“O relevante, o que importa para determinação da taxa de juros e acesso ao crédito, em última instância para o bem estar social dos tomadores de crédito, é o grau de competição. É perfeitamente possível você ter sistema bancário razoavelmente, digamos, concentrado e muito competitivo”, disse ele.

Mello defendeu ainda que há expectativa de aumento de competição no país porque o BC segue com seu cronograma de projetos para tanto, independentemente da pandemia, o que abarca a implementação do ecossistema de pagamentos instantâneos brasileiro, batizado de PIX, e do open banking, para compartilhamento consentido de dados e serviços entre os bancos.

BACEN. REUTERS. 4 DE JUNHO DE 2020. BC eleva perspectiva para estoque de crédito em 2020 a +7,6%, contra +4,8%

(Reuters) - O Banco Central elevou sua projeção para o saldo de crédito bancário em 2020 a um aumento de 7,6% em 2020, ante patamar de 4,8% calculado no Relatório Trimestral de Inflação de março, refletindo a ampliação do volume de empréstimos por conta dos impactos da pandemia de coronavírus.

Em apresentação nesta quinta-feira, o diretor de Política Econômica do BC, Fabio Kanczuk, destacou que essa aceleração repercute tanto a busca por recursos por parte de empresas em face à redução dos fluxos de caixa, como efeitos das medidas que abrangeram o mercado de crédito para mitigar danos econômicos causados pelo surto de Covid-19.

O BC agora prevê que o estoque de crédito com recursos livres irá subir 10,6% em 2020. O saldo de crédito com recursos direcionados, por sua vez, deve aumentar 3,5%.

Por Marcela Ayres

BACEN. REUTERS. 4 DE JUNHO DE 2020. BC está vigilante com efeitos anticoncorrenciais ligados a maquininhas e auxílio emergencial, diz diretor

BRASÍLIA (Reuters) - O diretor de Organização do Sistema Financeiro do Banco Central, João Manoel de Mello, afirmou nesta quinta-feira que o BC está extremamente vigilante quanto a possíveis efeitos anticoncorrenciais relacionados à bandeira de cartões Elo e ao auxílio emergencial.

Caixa Econômica Federal e Elo definiram que Cielo, GetNet e Rede serão as empresas de maquininhas de cartão que poderão aceitar o pagamento de compras por meio do Caixa Tem, aplicativo do auxílio emergencial pago pelo governo de 600 reais.

“É importante lembrar que nós estamos num momento de pandemia e isolamento social, algumas medidas são tomadas inclusive para evitar aglomerações e por isso a urgência de colocar meio de pagamento para distribuição do benefício que evite aglomerações”, afirmou ele.

“Dito isso, estamos extremamente vigilantes e o mais rapidamente esse arranjo de pagamento dará acesso o mais simétrico possível a todos os credenciadores de estabelecimentos comerciais”, acrescentou.

Mello disse ainda que o BC já agiu em relação ao tema ao editar a circular 4020 que toma previdências exigindo a simetria competitiva no caso.

“Enquanto ela não vier, (a circular) estabelece limites de preços nos três elos da cadeia”, afirmou.