CUBA

CNN. POLÍTICA. 8 Junio, 2023. Cuba niega que China esté instalando una base de espionaje en la isla, tras reportes de inteligencia de EE.UU. de que sí autorizó la construcción. Por Natasha Bertrand. Patrick Oppmann colaboró con este reporte.

(CNN) -- El vicecanciller de Cuba, Carlos Fernández de Cossio, negó este jueves que China esté instalando una base de espionaje en Cuba, luego de que información de inteligencia de Estados Unidos indicara que la isla había accedido a la construcción.

En una conferencia de prensa en La Habana este jueves, Fernández de Cossio calificó los informes sobre la base de espionaje como “totalmente falsos” y “calumnias”.

Previamente, dos fuentes familiarizadas con la inteligencia le dijeron a CNN que Cuba había accedido a permitir que China construyera una instalación de espionaje en la isla que podría permitir a los chinos espiar las comunicaciones electrónicas en todo el sudeste de EE.UU.

Estados Unidos se enteró del plan en las últimas semanas, dijo una fuente, y no está claro si China ya comenzó a construir la instalación de vigilancia.

No sería la primera vez que China intenta espiar las comunicaciones electrónicas de Estados Unidos, lo que se conoce como inteligencia de señales. Un presunto globo espía chino que transitó por Estados Unidos en febrero era capaz de recopilar señales de inteligencia y se cree que las transmitió a Beijing casi en tiempo real, según dijeron fuentes a CNN en aquel momento.

En ese caso, Estados Unidos tomó medidas para proteger lugares sensibles y censurar las señales de inteligencia antes de derribar el globo. Pero no está claro qué puede hacer Estados Unidos para impedir la construcción de una instalación de espionaje china en Cuba.

The Wall Street Journal fue el primero en informar de los nuevos datos de inteligencia sobre la instalación. CNN se puso en contacto con las embajadas de China y Cuba en Washington para obtener comentarios.

La fuente familiarizada con la inteligencia estadounidense señaló que, si bien una base de espionaje en Cuba sería preocupante, China ya ha establecido puntos de apoyo dentro de EE.UU., concretamente, comisarías secretas que la administración Biden comenzó a desmantelar.

Estados Unidos también lleva a cabo misiones de espionaje cerca de China, utilizando aviones de reconocimiento que realizan habitualmente escuchas electrónicas. Uno de esos aviones estadounidenses fue interceptado recientemente por un caza chino, en lo que Estados Unidos describió como una maniobra peligrosa y poco profesional.

Pero la revelación sobre el posible puesto de avanzada chino en Cuba se produce cuando las relaciones entre Estados Unidos y China han alcanzado un punto bajo, tras el incidente del globo espía y varias maniobras agresivas de aviones y barcos chinos contra activos estadounidenses en el Mar de China Meridional.

EE.UU. ha intentado mejorar las relaciones y el mes pasado envió a Beijing al director de la CIA, Bill Burns, para mantener conversaciones con funcionarios chinos. También se espera que el secretario de Estado, Antony Blinken, visite China en las próximas semanas.

Pero la semana pasada, el jefe de Defensa chino rechazó una solicitud de reunión del secretario de Defensa estadounidense, Lloyd Austin, y advirtió a Estados Unidos de que dejara de operar cerca de las aguas y el espacio aéreo chinos.

"La mejor manera de evitar que esto ocurra es que los buques y aviones militares no se acerquen a nuestras aguas y espacio aéreo", declaró la semana pasada en Singapur el ministro de Defensa chino, Li Shangfu, en referencia a los recientes acercamientos entre aviones y barcos chinos y estadounidenses. "Cuiden sus propias aguas territoriales y su espacio aéreo, entonces no habrá problemas".

La administración Biden ha hecho poco por intentar mejorar las relaciones con Cuba y solo ha reanudado conversaciones bilaterales limitadas sobre asuntos como la migración. Tras los esfuerzos de acercamiento bajo la administración Obama, las relaciones cayeron en picada debido a la enfermedad llamada "síndrome de La Habana" que afectó a los diplomáticos estadounidenses destinados en la capital cubana y a la decisión de la administración Trump —durante los últimos días de ese gobierno— de volver a incluir a Cuba en la lista de Estados patrocinadores del terrorismo.

CNN. 8 junio, 2023. El Pentágono descarta que China y Cuba llegaran a un acuerdo para espiar a EE.UU. Por Juan Carlos López, Sergio Sacristán

Fuentes de inteligencia le dijeron a CNN que Cuba habría llegado a un acuerdo con China para que, a cambio de asistencia económica, La Habana permitiera a Beijing la instalación de equipos de vigilancia electrónica desde la isla. El Pentágono y el viceministro de Relaciones Exteriores de Cuba negaron dicha afirmación.

INFOBAE. AMÉRICA LATINA. 8 Jun, 2023. China planea construir un centro de espionaje en Cuba para seguir las actividades de Estados Unidos. El régimen de Beijing acordó pagar a La Habana miles de millones de dólares por la instalación de la base a tan sólo 160 kilómetros de la Florida

Los regímenes de China y Cuba llegaron a un acuerdo para que Beijing establezca una sede de espionaje electrónico en la isla, como parte de un nuevo desafío geopolítico de ambas dictaduras contra el gobierno de Estados Unidos.

De acuerdo a una publicación del periódico estadounidense The Wall Street Journal (WSJ), funcionarios del gobierno norteamericano familiarizados con inteligencia altamente clasificada, le revelaron al medio los detalles sobre la instalación de esta base de espionaje en Cuba.

Una base de espionaje en Cuba, aproximadamente a 160 kilómetros del estado de la Florida, permitiría a los servicios de inteligencia chinos captar comunicaciones electrónicas en todo el sureste de los EEUU, donde se encuentran muchas bases militares, y monitorear el tráfico de barcos estadounidenses, publicó el prestigioso medio.

Lo funcionarios le dijeron al WSJ dijeron que China acordó pagar varios miles de millones de dólares a Cuba para permitirle construir la estación de espionaje, y que los dos países habían llegado a un acuerdo en principio.

La noticia encendió las alarmas dentro del gobierno del presidente Joe Biden debido a la proximidad territorial de Cuba a los Estados Unidos.

Washington considera a Beijing como su rival económico y militar más importante. Una base china con capacidades militares y de inteligencia avanzadas tan cerca de su territorio, significa una nueva amenaza sin precedentes.

“Aunque no puedo hablar sobre este informe específico, somos muy conscientes de los esfuerzos de la República Popular China para invertir en infraestructura en todo el mundo que puede tener fines militares, incluso en este hemisferio, y hemos hablado muchas veces sobre ellos”, dijo a WSJ John Kirby, portavoz del Consejo de Seguridad Nacional de los EEUU.

“Lo monitoreamos de cerca, tomamos medidas para contrarrestarlo y confiamos en que podemos cumplir con todos nuestros compromisos de seguridad en casa, en la región y en todo el mundo”, agregó.

Antecedentes de la Guerra Fría

Funcionarios estadounidenses dijeron que la base permitiría a China realizar señales de inteligencia, conocidas en el mundo del espionaje como sigint, que podrían incluir el monitoreo de una variedad de comunicaciones, incluidos correos electrónicos, llamadas telefónicas y transmisiones satelitales.

Estados Unidos ha intervenido antes para evitar que las potencias extranjeras extiendan su influencia en el hemisferio occidental, sobre todo durante la crisis de los misiles cubanos de 1962.

En ese entonces el gobierno de Estados Unidos y la Unión Soviética estuvieron al borde de una guerra nuclear después de que los soviéticos desplegaran misiles en Cuba, lo que provocó una cuarentena de la isla por parte de la Armada de Estados Unidos.

Los soviéticos retrocedieron y retiraron los misiles. Unos meses más tarde, EEUU retiró silenciosamente los misiles balísticos de alcance intermedio de Turquía de los que se habían quejado los soviéticos.

La inteligencia sobre la nueva base se produce en medio de los esfuerzos de la administración Biden para mejorar las relaciones entre Estados Unidos y China después de meses de acritud que siguieron al vuelo de un globo espía chino sobre Estados Unidos a principios de este año.

Se espera que el secretario de Estado, Antony Blinken, viaje a Beijing a fines de este julio y que posiblemente se reúna con el líder chino, Xi Jinping.

Una instalación de espionaje en Cuba dejaría en claro que “China está preparada para hacer lo mismo en el patio trasero de Estados Unidos”, dijo a WSJ Craig Singleton, miembro principal de la Fundación para la Defensa de las Democracias, un grupo de expertos en seguridad nacional en Washington.

“El establecimiento de esta instalación señala una nueva fase de escalada en la estrategia de defensa más amplia de China. Es un poco un cambio de juego”, dijo Singleton. “La selección de Cuba también es intencionalmente provocativa”.

La única base militar extranjera declarada de China está en Yibuti, en el Cuerno de África. Se ha embarcado en una campaña mundial de desarrollo portuario en lugares como Camboya y los Emiratos Árabes Unidos. Los funcionarios estadounidenses dicen que el esfuerzo tiene como objetivo crear una red de puertos militares y bases de inteligencia para proyectar el poder chino en todo el mundo.

Biden ha intentado acercarse a La Habana, revirtiendo algunas políticas del gobierno de Trump al flexibilizar las restricciones a los viajes entre Cuba y EEUU, así como restablecer el programa de reunificación familiar.

También ha ampliado los servicios consulares para permitir que más cubanos visiten los EEUU y ha restablecido a algunos miembros del personal diplomático que fueron retirados después de una serie de misteriosos incidentes de salud que afectaron al personal estadounidense en La Habana.

THE GUARDIAN. Reuters in Washington. Thu 8 Jun 2023. China reportedly reaches secret deal with Cuba to host spy base on island. Facility would allow Beijing to gather electronic communications from US but Cuba dismisses report as ‘unfounded’

China has reached a secret deal with Cuba to establish an electronic eavesdropping facility on the island roughly 100 miles (160km) from Florida, the Wall Street Journal has reported, but the US and Cuban governments cast strong doubt on the report.

Such a spy installation would allow Beijing to gather electronic communications from the south-eastern United States, which houses many US military bases, as well as to monitor ship traffic, the newspaper reported.

The US Central Command headquarters is based in Tampa. Fort Liberty, formerly Fort Bragg, the largest US military base, is based in North Carolina.

The countries have reached an agreement in principle, the officials said, with China to pay Cuba “several billion dollars” to allow the eavesdropping station, according to the Journal.

“We have seen the report. It’s not accurate,” John Kirby, spokesperson for the White House national security council, told Reuters. But he did not specify what he thought was incorrect.

He said the United States has had “real concerns” about China’s relationship with Cuba and was closely monitoring it.

Brig Gen Patrick Ryder, a US defense department spokesperson, said: “We are not aware of China and Cuba developing a new type of spy station.”

In Havana, the Cuban vice-foreign minister, Carlos Fernández de Cossio, dismissed the report as “totally mendacious and unfounded”, calling it a US. fabrication meant to justify Washington’s decades-old economic embargo against the island. He said Cuba rejects all foreign military presence in Latin America and the Caribbean.

A spokesperson for the Chinese embassy in Washington said: “We are not aware of the case and as a result we can’t give a comment right now.” The Cuban embassy did not respond to a request for comment.

The reported deal comes as Washington and Beijing are taking tentative steps to soothe tensions that spiked after a suspected Chinese high-altitude spy balloon crossed the United States before the US military shot it down off the east coast in February.

It could also raise questions about a trip to China that US officials say the secretary of state, Antony Blinken, is planning in coming weeks. Washington’s top diplomat had earlier scrapped a visit over the spy balloon incident.

The Biden administration has pushed to boost engagement with China even as ties have deteriorated over disputes ranging from military activity in the South China Sea and near Taiwan, Beijing’s human rights record and technology competition.

Senator Bob Menendez, Democratic chairman of the Senate foreign relations committee and a Cuba hawk, said that if the report were true, it would be “a direct assault upon the United States”.

“So I hope the administration will think about how they’ll react, if it’s true,” he told reporters on Capitol Hill.

A former US intelligence official with knowledge of signals intelligence collection told Reuters that a Chinese listening post in Cuba would be a “big deal”.

However, the US has a long history of spying on China in its neighborhood. It is widely reported to have used Taiwan as a listening post for the mainland and regularly flies spy planes in the South China Sea.

The head of Taiwan’s national security bureau told the island’s parliament in April that Taiwan was conducting real-time encrypted intelligence sharing with Five Eyes partners, which includes the US.

An infusion of cash would probably be welcomed in Cuba, where the economy is sputtering with inflation, fuel shortages, plunging farm production and a cash crunch that drag on output and continue to fan discontent in the communist-run island nation.

Relations between Washington and Havana remain tense. The Biden administration last year partially rolled back some Trump-era restrictions on remittances and travel to the island, but Cuban officials called the steps insufficient.

The intelligence on the plans for a Cuba station was gathered in recent weeks and was convincing, the Journal reported. The officials said it would allow China to conduct signals intelligence, including emails, phone calls and satellite transmission.

The Cuban missile crisis in 1962 began after Moscow began placing Soviet nuclear weapons on the island. It backed down and removed the missiles, but it is widely regarded as the moment when the United States and the Soviet Union came closest to a nuclear confrontation.

The Soviets installed a spy base on the island at Lourdes, just south of Havana, in the mid-1960s, with parabolic antennas aimed at Cuba’s northern neighbor. The Russian president, Vladimir Putin, closed the facility in the early 2000s.

ARGENTINA

PR. Jueves 08 de junio de 2023. Gabriela Cerruti: “Seguimos en una senda de ordenamiento de la economía”

La portavoz de la Presidencia, Gabriela Cerruti, informó esta tarde en conferencia a la prensa acreditada en Casa Rosada, que se está llevando adelante un canje de deuda para los vencimientos en el segundo semestre, que es “mirado con mucha expectativa por todo el Gobierno y también por el Fondo Monetario Internacional (FMI)”.

“Se está llevando a cabo un canje de deuda muy importante, que comprometía todo el segundo semestre, lo cual es mirado con mucha expectativa por todo el Gobierno y también por el Fondo Monetario Internacional (FMI)”, sostuvo y adelantó que dicha operatoria, la tercera del año en pesos, “se realizó exitosamente, con lo cual despeja mucho el segundo semestre”.

“Este era uno de los puntos que se estaba aguardando a ver cómo finalizaba para poder avanzar en los nuevos acuerdos y las negociaciones que se están llevando adelante”, agregó en relación a la situación monetaria del país y para evidenciar que el cronograma que se plantearon el Gobierno y el FMI se está cumpliendo.

Por otra parte, Cerruti aportó los últimos datos de crecimiento industrial: “En el primer trimestre, la industria creció 2.6. En abril, creció 1.7 interanual y 1.2 respecto al mes previo, esto implica, por ejemplo, que el 72.5 por ciento de la capacidad instalada automotriz está ocupada”, precisó.

Además, la Portavoz actualizó los últimos números que hacen a la actualidad de las y los trabajadores en relación al empleo formal y afirmó que “estamos en la mejor racha en los últimos catorce años, llevamos 32 meses consecutivos de crecimiento del empleo formal, y el empleo industrial lleva subas de 20 meses consecutivos, el mejor número desde 2009”.

En relación al pago del impuesto a las ganancias sobre el aguinaldo Cerruti detalló que “hay 502 mil beneficiados, ya que se aumentó el piso y no van a pagar quienes cobren hasta 880.000 pesos”. Y agregó que “1.200.000 personas accederán a un crédito con tasa fija a dos años, para seguir implementando la actividad entre los monotributistas”.

En relación con las cifras de consumo, la funcionaria afirmó que “indican que, en marzo, el índice de ventas totales a precios constantes de los supermercados, subió 3.8 interanual”. Y tras brindar estos índices económicos, finalizó: “Seguimos en una senda de ordenamiento de la economía y de crecimiento que nos está haciendo sentar bases muy sólidas para seguir adelante con el proyecto de este Gobierno”.

PR. Jueves 08 de junio de 2023. Alberto Fernández en la primera exportación de Whirlpool: “Forma parte del objetivo de industrializar a la Argentina"

El presidente Alberto Fernández participó de la primera exportación a Brasil de los lavarropas que produce la nueva planta de la empresa de electrodomésticos Whirlpool, en el Parque Industrial de Pilar.

"Todo esto empezó en un tiempo muy difícil, cuando la pandemia nos prohibía muchas cosas. Esperábamos una recuperación muy lenta, pero no pasó eso porque hubo decisión", explicó el mandatario y agregó que "el proyecto Whirlpool es casi perfecto, cada uno hizo su parte, y esto forma parte de un objetivo: industrializar a la Argentina".

El presidente, que en octubre de 2022 participó de la inauguración de esta nueva fábrica, sostuvo que “el Estado es muy importante para igualar allí donde las desigualdades aparecen y también para ayudar a quienes ponen su patrimonio en la Argentina para producir, dar trabajo y hacer crecer al país".

Por su parte, el presidente de Whirlpool, Juan Carlos Puente, detalló que "para ser más competitivos tuvimos que hacer una inversión de más de 52 millones de dólares en esta planta, un paso clave en la industrialización para tener una plataforma de manufactura integrada en Argentina", y destacó que "desde junio estamos haciendo un segundo turno para duplicar la fabricación que tenemos y exportar el 70 por ciento, principalmente a Brasil".

En la planta de Pilar, la más moderna de la firma en el mundo, en la actualidad se fabrican cocinas y lavarropas de carga frontal y superior, con una capacidad instalada de producción de más de 300 mil unidades al año, de las cuales 200 mil son para exportar a la región.

El mandatario estuvo acompañado por el ministro de Relaciones Exteriores, Comercio Internacional y Culto, Santiago Cafiero; el secretario general de la Presidencia, Julio Vitobello: el embajador de la Argentina en Brasil, Daniel Scioli; el CEO de Whirlpool para Argentina, Uruguay y Paraguay, Martín Castro y la gerenta de Marketing de la empresa, María Laura Perosio.

MRREECIyC. Información para la Prensa N°: 279/23. Viernes 9 junio 2023. Treinta empresas argentinas de biotecnología participaron de Misión Comercial en Estados Unidos en la principal feria del sector

Una delegación de 30 empresas argentinas de biotecnología participaron de una importante Misión Comercial en Boston, Estados Unidos, organizada por la Cancillería argentina, en colaboración con la Cámara Argentina de Biotecnología (CAB), CAB-Startups, y el Consejo Federal de Inversiones (CFI), en el marco de la feria Biotechnology Industry Organization (BIO 2023).

El objetivo de la misión consistió en promocionar las capacidades productivas de la biotecnología argentina, fundadas en un ecosistema científico y tecnológico construido a lo largo de décadas, así como explorar las oportunidades de negocios e inversiones en el mercado estadounidense, tanto en materia de financiamiento como de vinculación con contrapartes locales y posibilidades de colaboración, intercambio de información y emprendimientos conjuntos.

El subsecretario de Promoción del Comercio e Inversiones de la Cancillería Argentina, Guillermo Merediz, destacó la importancia del sector de la Economía del Conocimiento como uno de los principales complejos exportadores nacionales, así como el rol de la Cancillería en la apertura de nuevas oportunidades comerciales en todo el mundo: "La economía del conocimiento es actualmente el tercer complejo exportador de Argentina, que se ha desarrollado y expandido de la mano de un fuerte proceso de inversión pública y políticas de incentivo al sector científico-tecnológico. Desde la Cancillería trabajamos intensamente con el fin de impulsar su crecimiento y posicionamiento en los mercados internacionales, promoviendo la destacada oferta de la biotecnología argentina, fortaleciendo lazos con inversores, instituciones y empresas del exterior, siendo el socio ideal del sector privado al momento de internacionalizarse".

Formaron también parte de la delegación argentina el Presidente de la Agencia Nacional de Promoción de la Investigación, el Desarrollo Tecnológico y la Innovación (Agencia I+D+i), Fernando Peirano. junto a autoridades y empresas biotecnológicas de las provincias de Buenos Aires, Chubut, Córdoba, Salta, Santa Fe, Tucumán y la Ciudad Autónoma de Buenos Aires.

En adición al tradicional pabellón coordinado por la Agencia Argentina de Inversiones y Comercio Internacional, la Cancillería argentina organizó una intensa agenda de reuniones de negocios con delegaciones extranjeras y visitas a laboratorios, aceleradoras e instituciones científicas y académicas de referencia del ecosistema biotecnológico local, incluyendo el Massachusetts Biotechnology Council, el Bayer Research and Innovation Center, LabCentral, la empresa Johnson & Johnson, la feria BIO EUROPE, el Hub de Boston de la aceleradora de emprendimientos German Accelerator, el Massachusetts Institute of Technology (MIT) y el Blavatnik Biomedical Accelerator de la Universidad de Harvard.

La organización, por primera vez, de estas actividades contribuye a agregar valor a la presencia de las empresas argentinas en la feria BIO y a potenciar sus vínculos con delegaciones y empresas de distintos países del mundo, incluyendo a Alemania, Brasil, España, Estados Unidos, Francia, Italia, y México.

La Cancillería argentina organizó en el marco de la feria BIO un evento titulado “Argentina Global Innovation Hub”, que cuenta con presentaciones de la Agencia I+D+i, el CFI y la CAB tendientes a mostrar la oferta tecnológica exportable del sector argentino de biotecnología y su distribución geográfica a lo largo del territorio nacional a inversores extranjeros, fondos de inversión, funcionarios públicos, cámaras de comercio y grandes empresas internacionales.

"Para nosotros esta es la feria más importante del sector biotecnológico, ya que nos permite tener presencia ante 16.000 especialistas de diversas industrias y países del mundo para conectar nuestras compañías y generar nuevos negocios exportadores, y también para conectar a nuestra cámara con otros pares a nivel internacional", indicó Sergio Drucaroff, coordinador ejecutivo de la Cámara Argentina de Biotecnología, y agregó: "Valoramos todo el apoyo que brindaron la Cancillería y la AAICI para promover los contactos y las vinculaciones con contrapartes internacionales, para hacer visibles las oportunidades en biotecnología de origen argentino, siendo nuestro país uno de los 10 más importantes del mundo en esta disciplina".

BIO es el evento global más importante de la industria farmacéutica. Se desarrolla anualmente desde 1993 en distintas ciudades de Estados Unidos y ofrece oportunidades estratégicas de reunión y comercialización con las principales empresas internacionales, PyMEs, Startups y universidades. Argentina participa desde 2006. Durante el evento se desarrollan conferencias y sesiones de promoción y capacitación vinculadas a diversas áreas de la biotecnología.

En Argentina, el sector biotecnológico cuenta con más de 200 empresas, lo que ubica al país entre los primeros 20 en el mundo. El sector genera 2.100 millones de USD en productos exclusivamente biotecnológicos, y brinda empleo a 27.000 personas. La inversión en I+D supera los 90 millones de USD, alcanzando el 7% en el sector de Salud, y creando más de 1.100 empleos sólo en I+D. El 56% de las firmas fueron creadas en los últimos 15 años, y el dinámico ecosistema emprendedor local registra inversiones del orden de los 1.100 millones de USD anuales.

Las exportaciones anuales alcanzan los 430 millones de USD anuales y representan cerca del 20% de las ventas, proporción que alcanza en 45% en Salud Humana. Los principales destinos de las exportaciones argentinas son Brasil, Estados Unidos, Uruguay, Paraguay, China, Países Bajos, Bolivia, Colombia y Chile.

Las empresas argentinas participantes fueron: APOLO BIOTECH, ARDAN PHARMA, ARGENOMICS S.A., BIOCERES S.A., BIOGÉNESIS, BAGÓ S.A., BIOPROFARMA BAGÓ S.A., CARPE SCHEIDER & CIA S.A., EXOMAS S.A., FUTURE BIOME S.A., GADOR S.A., GISENS BIOTECH S.A., INSTITUTO BIOLÓGICO CONTEMPORÁNEO S.A., KECLON S.A., KRESKO RNATECH S.A.U., LABORATORIO ELEA PHOENIX S.A., LABORATORIOS RICHMOND SACIF, LATINABA S.R.L., LIFE SOLUCIONES INTEGRALES SOCIEDAD POR ACCIONES SIMPLIFICADA, LOCI LABS, MABXIENCE S.A.U., PROINPHARMA BIOMED S.A., ROMIKIN S.A., SINERGIUM BIOTECH S.A, STAMM VEGH S.A.U., TAXON BIOINFORMATICS SOLUTIONS S.A., UNTECH S.A.S., UOVOTEK S.A., WIENER LABORATORIOS S.A.I.C.

MEconomía. jueves 08 de junio de 2023. Alivio fiscal: Sergio Massa anunció mejoras en el monotributo que benefician a casi 5 millones de trabajadores

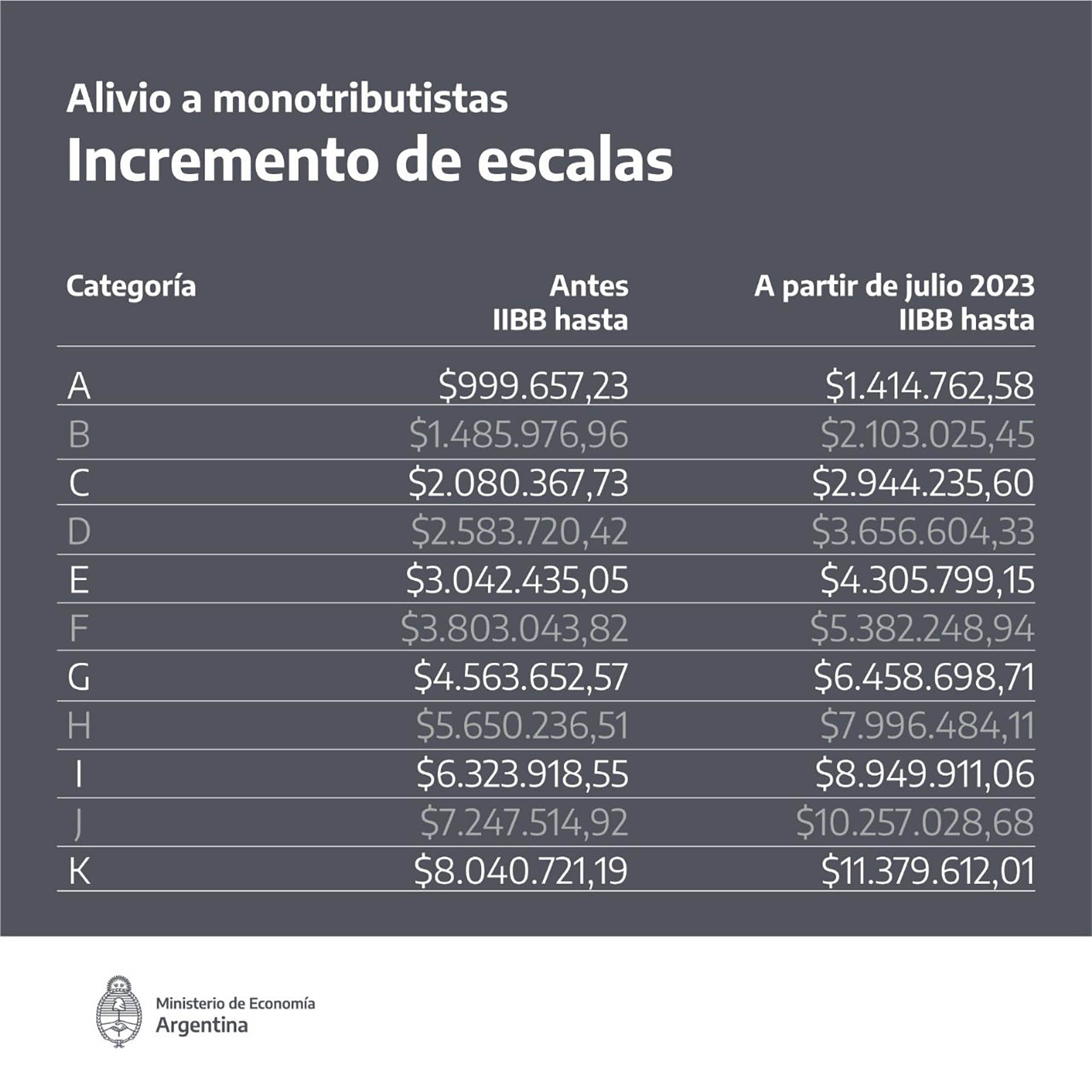

En el marco de la Expo Escobar 2023, el ministro de Economía, Sergio Massa, anunció este jueves un incremento en las escalas del monotributo que generan un alivio fiscal en 4.781.614 de trabajadores y trabajadoras de todo el país.

De esta manera, el titular del Palacio de Hacienda destacó las últimas medidas anunciadas para recomponer el poder adquisitivo, fomentar el consumo y la actividad económica. “La primera tiene que ver con que los trabajadores paguen menos impuesto a las Ganancias en sus aguinaldos, porque eso vuelve al consumo. Además, porque alivia la situación que entendemos genera la pelea contra la inflación”.

En esta línea, Massa explicó que la decisión de incrementar 41% la base imponible para todos los monotributistas a través de la modificación de las escalas del tributo generará un alivio fiscal para casi 5 millones de trabajadores y trabajadoras del país.

Asimismo, el Ministro anunció una ampliación del financiamiento otorgado a través del Programa Crédito Argentino a través de la cual 1.240.000 monotributistas van a poder acceder a créditos a tasa fija, con 40 puntos porcentuales de subsidio de tasa del Estado Nacional, sin requisito bancario, "para que muchos de esos talentosos que están acá y que necesitan su equipo lo puedan comprar con garantía del Estado a través del Fogar”. “Creemos que al talento y la innovación, el Estado les tiene que poner puentes de incentivo para crecer”, agregó.

A partir de las modificaciones que comenzarán a regir en el mes de julio en el monotributo, los ingresos brutos de la categoría A pasarán de $ 999.657,23 a $ 1.414.762,58; en la B de $ 1.485.976,96 a $ 2.103.025,45; en la C de $ 2.080.367,73 a $ 2.944.235,60; en la D de $ 2.583.720,42 a $ 3.656.604,33; en la E de $ 3.042.435,05 a $ 4.305.799,15; en la F de $ 3.803.043,82 a $ 5.382.248,94; en la G de $ 4.563.652,57 a $ 6.458.698,71; y en la H de $ 5.650.236,51 a $ 7.996.484,11.

En esta línea, la categoría I subirá de $ 6.323.918,55 a $ 8.949.911,06; la J de $ 7.247.514,92 a $ 10.257.028,68; y la K de $ 8.040.721,19 a $ 11.379.612,01.

En la actualidad, existen 4.781.614 de monotributistas, de los cuales 2.894.352 pertenecen a la categoría A; 642.137 a la B; 359.565 a la C; 350.964 a la D; 180.989 a la E; 185.074 a la F; 107.562 a la G; 49.608 a la H; 7.471 a la I; 2.575 a la J; y 1.317 a la K.

En tanto, del total general de 4.781.614 monotributistas, 1.671.515 son de la provincia de Buenos Aires (34,957%); 779.760 de CABA (16,307%); 486.560 de Córdoba (10,176%); 448.191 de Santa Fe (9,373%); 175.606 de Mendoza (3,673%); 172.864 de Entre Ríos (3,615%); 117.091 de Tucumán (2,449%); 106.232 de Misiones (2,222%); 91.623 de Salta (1,916%); 88.597 de Corrientes (1,853%); 82.657 de Chaco (1,729%); 69.668 de Río Negro (1,457%); 61.972 de Santiago del Estero (1,296%); 60.450 de Neuquén (1,264%); 58.993 de San Juan (1,234%); 55.833 de Chubut (1,168%); 42.078 de Jujuy (0,880%); 41.614 de La Pampa (0,870%); 40.277 de Formosa (0,842%); 31.487 de San Luis (0,659%); 29.406 de Catamarca (0,615%); 29.102 de La Rioja (0,609%); 26.562 de Santa Cruz (0,555%); y 13.475 de Tierra del Fuego (0,282%).

En el anuncio, estuvieron presentes el secretario de Industria y Desarrollo Productivo, José Ignacio de Mendiguren; su par de Economía del Conocimiento, Juan Manuel Cheppi; el titular de Administración Federal de Ingresos Públicos, Carlos Castagneto; el intendente de Escobar, Ariel Sujarchuk; y el presidente de la Asociación del Fútbol Argentino, Claudio Tapia.

PÁGINA 12. 9 de junio de 2023. La medida impacta en 5 millones de contribuyentes. Suben un 41 por ciento las escalas del monotributo. El ministro de Economía, Sergio Massa, anunció que las escalas del monotributo aumentan un 41 por ciento y que se amplía la línea Crédito Argentino.

El ministro de Economía, Sergio Massa, anunció este jueves medidas dirigidas al sector de monotributistas. Comunicó que las escalas aumentarán un 41 por ciento, lo cual tiene impacto sobre 5 millones de contribuyentes, junto a una ampliación de la línea Crédito Argentino, destinada a 1,2 millones de monotributistas.

La novedad aparece apenas después de que el Gobierno informara que la primera cuota del sueldo anual complementario (SAC) queda exenta del impuesto a las Ganancias para los salarios brutos de hasta 880 mil pesos, lo cual equivale a 10 veces el Salario Mínimo Vital y Móvil (SMVM).

Se trata de dos decisiones en favor del bolsillo de los sectores medios, castigados por la dinámica inflacionaria. Se inscriben dentro del limitado herramental de política fiscal expansiva que tiene el Gobierno, agobiado por la presión de tratar de cumplir con la austeridad fiscal que propone el FMI y la necesidad de fortalecer el pedido de una entrega anticipada de fondos de parte del organismo que permita aliviar el frente externo.

Nuevas escalas

A partir del 1 de julio, suben un 41,5 por ciento las escalas de facturación de las categorías del monotributo. Sin embargo, la cuota mensual se mantiene sin cambios. Dicho porcentaje resulta de la acumulación de los incrementos que definió el índice de movilidad jubilatoria, del 17,04 por ciento en marzo y 20,92 por ciento en junio.

El aumento en las escalas se produce en julio precisamente porque es el mes donde los monotributistas deben recategorizarse, dado que estas instancias se producen cada seis meses. Para evaluar si corresponde una recategorización se debe tener en cuenta la actividad de los últimos 12 meses respecto a la facturación o alguno de los otros parámetros utilizados, como la superficie afectada, los alquileres devengados anualmente o el consumo de energía eléctrica.

Si los parámetros analizados superan o son inferiores a los de la categoría vigente corresponde realizar la recategorización. Y el importe correspondiente a la nueva categoría se abonará al mes siguiente a la recategorización.

Desde el mes que viene, los límites de ingresos brutos anuales de cada categoría quedan de la siguiente manera: la Categoría A pasa de 999.657 a 1.414.762 pesos; la Categoría B pasa de 1.485.976 a 2.103.025 pesos; la Categoría C pasa de 2.080.367 pesos a 2.944.235 pesos; la Categoría D pasa de 2.583.720 pesos a 3.656.604 pesos; la Categoría E pasa de 3.042.435 a 4.305.799 pesos; la Categoría F pasa de 3.803.043 a 5.382.248 pesos; la Categoría G pasa de 4.563.652 a 6.458.698 pesos; la Categoría H pasa de 5.650.236 a 7.996.484 pesos; la Categoría I pasa de 6.323.918 a 8.949.911 pesos; la Categoría J pasa de 7.247.514 a 10.257.028 pesos y la Categoría K pasa de 8.040.721 a 11.379.612 pesos anuales.

El motor

"Tomamos decisiones para mejorar el tercer motor de la economía, el consumo. Por eso subimos un 41 por ciento la base imponible, para facilitar a todos los monotributistas de la Argentina, más de cinco millones, su situación formal frente a la Administración Federal de Ingresos Públicos (AFIP)", precisó Massa al participar de la inauguración de la tercera edición de Expo Escobar, en esa localidad bonaerense.

El funcionario también resaltó la decisión a partir de la cual "los trabajadores paguen menos impuestos a las Ganancias en sus aguinaldos porque eso vuelve al consumo, pero además alivia la situación que entendemos genera la pelea contra la inflación".

Por otro lado, Massa dio a conocer que "1.240.000 monotributistas van a poder acceder a créditos a tasa fija 43 por ciento subsidiada por el Estado nacional sin requisito bancario, para capital de trabajo. Estamos dando crédito a la industria y a la pyme a tasa subsidiada porque entendemos que de alguna manera el Estado tiene que sostener los niveles de inversión y actividad".

INFOBAE. ECONOMÍA. 8 Jun, 2023. Cómo serán las nuevas escalas del Monotributo 2023 a partir de julio. El ministro de Economía, Sergio Massa, anunció el aumento de los topes máximos de ingresos brutos anuales de cada escala. ¿Cómo queda cada categoría?

El ministro de Economía, Sergio Massa, anunció este jueves un incremento de las escalas del monotributo del orden del 41,5% para todas las categorías. El aumento implica un mayor margen de facturación para los casi cinco millones de trabajadores que están encuadrado dentro del régimen simplificado.

Para el ajuste en este caso se utiliza el índice de movilidad jubilatoria (17,04 en marzo y 20,92% en junio), que da un resultado acumulado del 41,5%.

El aumento en las escalas se produce en julio precisamente porque es el mes donde los monotributistas deben recategorizarse, dado que los períodos de recategorización se producen cada seis meses.

De esta manera, a partir de las modificaciones que comenzarán a regir en el mes de julio, los ingresos brutos de la categoría A pasarán de $ 999.657,23 a $ 1.414.762,58; en la B de $ 1.485.976,96 a $ 2.103.025,45; en la C de $ 2.080.367,73 a $ 2.944.235,60; en la D de $ 2.583.720,42 a $ 3.656.604,33; en la E de $ 3.042.435,05 a $ 4.305.799,15; en la F de $ 3.803.043,82 a $ 5.382.248,94; en la G de $ 4.563.652,57 a $ 6.458.698,71; y en la H de $ 5.650.236,51 a $ 7.996.484,11.

En esta línea, la categoría I subirá de $ 6.323.918,55 a $ 8.949.911,06; la J de $ 7.247.514,92 a $ 10.257.028,68; y la K de $ 8.040.721,19 a $ 11.379.612,01.

En tanto, la cuota mensual -- los importes a pagar por el impuesto integrado y por los aportes a la obra social y al sistema jubilatorio-- se mantienen sin cambios, para las distintas categorías.

Con este nuevo aumento en los topes de facturación, los límites de ingresos brutos anuales de cada categoría quedan de la siguiente manera:

- Categoría A: pasa de $ 999.657 a $ 1.414.762

- Categoría B: pasa de $ 1.485.976 a $ 2.103.025

- Categoría C: pasa de $ 1.557.443 a $ 2.944.235

- Categoría D: pasa de $ 2.583.720 a $ 3.656.604

- Categoría E: pasa de $ 3.042.435 a $ 4.305.799

- Categoría F: pasa de $ 3.803.043 a $ 5.382.248

- Categoría G: pasa de $ 4.563.652 a $ 6.458.698

- Categoría H: pasa de $ 5.650.236 a $ 7.996.484

- Categoría I: pasa de $ 6.323.918 a $ 8.949.911

- Categoría J: pasa de $ 7.247.514 a $ 10.257.028

- Categoría K: pasa de $ 8.040.721 a $ 11.379.612

En la actualidad, existen 4.781.614 de monotributistas, de los cuales 2.894.352 pertenecen a la categoría A; 642.137 a la B; 359.565 a la C; 350.964 a la D; 180.989 a la E; 185.074 a la F; 107.562 a la G; 49.608 a la H; 7.471 a la I; 2.575 a la J; y 1.317 a la K, detallaron fuentes del Ministerio de Economía.

¿Tengo que recategorizarme en el monotributo?

En julio regirá el período para la recategorización obligatoria de todos los contribuyentes. Es el trámite por el cual cada monotributista debe observar la facturación de los 12 meses previos y, en caso de ser necesario, reubicarse en la tabla de las categorías acorde a los ingresos.

Para evaluar si corresponde una recategorización se debe tener en cuenta la actividad de los últimos 12 meses respecto a la facturación o alguno de los otros parámetros utilizados para el encasillamiento como la superficie afectada, los alquileres devengados anualmente o el consumo de energía eléctrica.

Si los parámetros analizados superan o son inferiores a los de la categoría vigente corresponde realizar la recategorización. Y el importe correspondiente a la nueva categoría se abonará al mes siguiente a la recategorización.

Por otro lado, si transcurrieron menos de 6 meses de la inscripción en el monotributo no corresponde hacer la recategorización. En tanto, aquellos monotributistas que mantengan la misma categoría no deberán efectuar ninguna acción.

VIDEO: https://www.youtube.com/watch?v=oUItF4OM2Dc&ab_channel=T%C3%A9lam

Ámbito. Economía. Monotributistas. 8 de junio 2023. Crédito para monotributistas: cómo son las nuevas tasas que anunció Massa. El ministro de Economía anunció esta tarde nuevas medidas que apuntan a mejorar el consumo. Monotributo: Massa anunció cambios en las escalas y beneficios para el sector

El ministro de Economía Sergio Massa anunció este jueves a la tarde nuevas medidas que apuntan a mejorar el consumo, entre ellas la baja del impuesto a las Ganancias para los aguinaldos, suba de escalas para el monotributo y una nueva línea de crédito a tasa subsidiada.

"Hoy vamos a agregar un capítulo más al Programa de Crédito Argentino. Hasta acá con $1 millón en crédito, dimos crédito a la industria y a la PyME a tasa subsidiada, porque entendemos que el Estado tiene que sostener la inversión", inició Sergio Massa durante su discurso en la apertura de la Expo Escobar 2023.

En ese sentido, el ministro de Economía añadió: "Ahora damos un paso más, 1,2 millones monotributistas van a poder acceder a un créditos a tasa fija del 43% subsidiada por el Estado nacional sin requisito bancario para capital de trabajo. Para que muchos talentos puedan comprar sus equipos sin requisito bancario con garantía del Estado y del FOGAR, porque creemos que al talento y a la innovación el Estado tiene que tenderle puentes de incentivo para crecer".

Durante el anuncio, Massa estuvo acompañado del intendente de ese municipio, Ariel Sujarchuk, el secretario de Producción José Ignacio de Mendiguren y el presidente de la Asociación del Fútbol Argentino (AFA) Claudio "Chiqui" Tapia.

El plan de créditos será a dos años con tasas diferenciadas del 43% para monotributistas, que será financiado por el Fondo de Garantías Argentino (FOGAR) y tiene como objetivo mejorar el financiamiento de microemprendimientos.

El programa de crédito, se ideó en conjunto con la Secretaría de Producción, que encabeza De Mendiguren, con el objetivo de mantener el consumo y apuntalar la inversión en la producción para tratar de sostener la actividad económica.

PARAGUAY

PR. Jueves - 8 / Junio / 2023. Inicia oficialmente el proceso de transición presidencial

En la fecha se inició oficialmente el proceso de transición para el traspaso de mando previsto para el próximo 15 de agosto, anunciaron el presidente de la República, Mario Abdo Benítez y el electo, Santiago Peña. Durante el encuentro realizado en el Palacete Villa Rosalba, ambos mandatarios y sus equipos técnicos, iniciaron el proceso para una transición armónica y ordenada. Santiago Peña informó que a invitación del presidente Mario Abdo, acompañará al Jefe de Estado a la cumbre del Mercosur a realizarse en Puerto Iguazú (Argentina) el próximo 04 de Julio.

Al tiempo de agradecer al presidente Peña por su presencia, el presidente Abdo Benítez dijo que este gesto robustece el espíritu democrático y demuestra un compromiso con la Nación. Igualmente, el presidente Peña agradeció este encuentro que marca un inicio a una etapa importante para la salud política y económica del país.

“Hoy ya de manera oficial inicia el proceso y la construcción de un cronograma de trabajo, para que podamos tener una transición ordenada, donde el equipo del Gobierno entrante tenga toda la información necesaria para ir construyendo las políticas públicas y la planificación, en lo que respecta a su gestión después del 15 de agosto”, expresó el presidente Mario Abdo Benítez.

Por su parte, el mandatario electo, Santiago Peña dijo: “quiero agradecer públicamente al presidente de la República Mario Abdo Benítez, por recibirnos, por abrirnos la puerta, por iniciar este proceso de transición que es tan importante para la salud política y económica del Paraguay, para todos los paraguayos”, significó.

ROBUSTECE ESPÍRITU DEMOCRÁTICO

El titular del Ejecutivo, Abdo Benítez, sostuvo que la presencia del presidente electo robustece el espíritu democrático y constituye un compromiso con la Nación.

“Agradezco a presidente electo Santiago Peña por su presencia aquí, que robustece el espíritu democrático de la Nación paraguaya, demuestra un compromiso con nuestra Nación por sobre las coyunturas políticas momentáneas y coyunturales. Esta reunión es una muestra de un compromiso con la profundización de nuestra democracia, del fortalecimiento de nuestras instituciones y la capacidad de reencuentro que tenemos que construir los paraguayos, para trazar un destino común para nuestra Nación, en beneficio de nuestros pueblos”, acotó

Detalló que durante el encuentro conversaron sobre “las diferentes áreas, transmitió sus experiencias respecto a este mismo proceso y se puso a disposición para compartir todo lo necesario para que el Paraguay pueda seguir por el sendero del desarrollo, de prosperidad y de progreso”, manifestó el presidente Abdo Benítez

PROCESO CLAVE PARA LA SALUD PÚBLICA Y ECONÓMICA

Por su parte, el presidente electo aseguró que hoy es un día muy importante para la República del Paraguay y en ese sentido, agradeció a mandatario Abdo Benítez por la apertura e iniciar un proceso clave para la salud política y económica del Paraguay.

“Hoy es un día muy importante para la República del Paraguay. En este día soleado, en esta mañana, quiero agradecer públicamente al presidente de la República Mario Abdo Benítez, por recibirnos, por abrirnos la puerta, por iniciar este proceso de transición que es tan importante para la salud política, la salud económica del Paraguay y para todos los paraguayos”, refirió el presidente electo, Santiago Peña.

OBJETIVO COMÚN

Sostuvo que el objetivo del Gobierno entrante como saliente es la apertura de un camino que beneficie al pueblo paraguayo.

“Se han dado los pasos correctos, el acto de proclamación hace 8 días, el decreto que fue el inicio y hoy esta reunión que abre la puerta para un camino que va llevar probablemente los próximos 70 días, hasta el 15 de agosto, que tiene que llevar adelante tanto el gobierno saliente como el entrante, para que esto sea en beneficio de todos los paraguayos. Ese es nuestro gran objetivo, eso es lo que nos ha unido con el presidente Mario Abdo”, resaltó el mandatario electo.

Por otro lado, admitió que en los últimos tiempos tuvieron unas internas duras que son propias del proceso electoral que por momentos generó preocupación, pero que concluyó durante las elecciones del 30 de abril pasado.

“Quiero destacar, a los dos nos envuelve un ánimo de cordialidad, hemos dejado atrás las diferencias políticas que son normales en el ejercicio de la política, de la democracia y hoy lo que nos pide y lo que espera el pueblo paraguayo es que podamos trabajar en beneficio de ellos”, aseguró el presidente electo Santiago Peña.

PROCESO TRANQUILO Y ARMÓNICO

En ese sentido, sostuvo que tanto él como el presidente Abdo tienen la gran responsabilidad de promover la paz y la tranquilidad por el bien de todos los paraguayos.

“Quiero nuevamente agradecerle presidente este gesto y poner todo de mí también para que estos próximos 60 días y un poco más los podamos llevar de manera tranquila, armónica en beneficio de todos los paraguayos”, exteriorizó el mandatario Santiago Peña.

CON EL PRESIDENTE ABDO PARTICIPARÁ DE CUMBRE DEL MERCOSUR

Por otro lado, el presidente de la República electo, Santiago Peña confirmó que a invitación del presidente Mario Abdo, lo acompañará a la cumbre del Mercosur que se realizará en Puerto Iguazú, Argentina, el próximo 04 de Julio.

“El 4 de julio el presidente va participar en la cumbre del MERCOSUR y me invitó para participar en este evento tan importante, que es una vitrina para el Paraguay. Es nuestro espacio, nuestra unión aduanera y comercial más importante. Asi que yo le he manifestado también mi gratitud por el ofrecimiento y ya le confirmé que voy a estar acompañándole el 4 de julio”, informó.

Puntualizó que será “la oportunidad de poder trasmitir a nuestros socios comerciales más importantes, pero al mundo que el Paraguay. ha vivido un proceso político electoral que ha dado todas las garantías y que estamos comprometidos a proyectar una imagen seria, responsable, de un país que está convencido que tiene un destino de grandeza y ese destino de grandeza depende de las decisiones y acciones que tomemos cada uno de ustedes. Asi que les agradezco nuevamente presidente, muchas gracias por esta apertura y el compromiso de trabajar y estar comunicando eventualmente las próximas decisiones”, remarcó el presidente electo Santiago Peña.

MRREE. 06/08/23. Paraguay y España dialogan sobre acuerdo Mercosur - Unión Europea

El viceministro de Relaciones Económicas e Integración, embajador Enrique Franco Maciel, participó de una reunión con la secretaria de Estado de Comercio de España, Xiana Méndez Bértolo, y el ministro de Industria y Comercio, Ing. Luis Alberto Castiglioni.

El diálogo tuvo lugar a iniciativa de la parte española, y en la ocasión se analizaron las relaciones económicas y comerciales con España y con la Unión Europea, así como el estado de situación del acuerdo birregional con el Mercosur, teniendo en cuenta que España asumirá la Presidencia del Consejo de la Unión Europea en el segundo semestre del presente año.

Ambas partes se refirieron a las realidades y desafíos que representa el acuerdo birregional y expresaron la disposición de avanzar hacia su pronta conclusión y puesta en vigencia.

También participaron del encuentro el viceministro de Comercio, Pedro Mancuello, así como directores del Ministerio de Relaciones Exteriores y funcionarios de las respectivas representaciones diplomáticas de ambos países.

Asunción, 8 de junio de 2023

MRREE. 06/08/23. Se realizó la XXIV Reunión Ordinaria del Grupo de Cooperación Internacional (GCI) del MERCOSUR

Una delegación de Paraguay participó de la XXIV Reunión Ordinaria del Grupo de Cooperación Internacional (GCI) del MERCOSUR. Esta se llevó a cabo el lunes 5 de junio del presente año vía teleconferencia.

El encuentro estuvo coordinado por la Presidencia Pro Témpore Argentina (PPTA) y contó con la presencia de las delegaciones de los Estados miembros y de la Unidad Técnica de Cooperación Internacional (UTCI) de la Secretaría del MERCOSUR (SM).

La cooperación internacional en el MERCOSUR ha sido concebida, desde los inicios del bloque, como una herramienta que permite fortalecer las capacidades de cada uno de los Estados Partes y contribuye a la profundización del proceso de integración regional.

Bajo esta premisa se han ejecutado múltiples proyectos de cooperación con el apoyo de distintos organismos internacionales y otros socios cooperantes.

Para el desarrollo de programas y proyectos de cooperación, los Estados Partes identifican y actualizan distintas áreas temáticas consideradas como prioritarias, como son: salud, educación, medio ambiente, igualdad de género, comercio intrarregional, integración productiva, entre otros.

En la reunión, las delegaciones abordaron temas referentes al posicionamiento y relacionamiento del MERCOSUR en materia de cooperación y la vinculación del bloque con nuevos socios cooperantes.

Entre los temas más relevantes tratados en esta XXIV RO, y a modo de dinamizar la cooperación del MERCOSUR, se analizó un posible acercamiento del Grupo de Cooperación Internacional (GCI) con el Fondo de Convergencia del MERCOSUR (FOCEM).

Asimismo, se realizó el seguimiento de la cartera de proyectos en ejecución de los Sub Grupos de Trabajo (SGT).

También se actualizaron los estados de las iniciativas en el marco de acuerdos de cooperación recientemente renovados con la Organización Internacional para las Migraciones (OIM) y el Programa de las Naciones Unidas para el Medio Ambiente (PNUMA).

Finalmente, se analizó la posibilidad de renovación de un Memorándum de Entendimiento de Cooperación con la Organización Panamericana de la Salud (OPS/OMS).

La delegación paraguaya estuvo representada por la directora de Cooperación Internacional, ministra Martha Medina Zorrilla; la jefa del Departamento de Cooperación Multilateral, segunda secretaria Guadalupe Jara; y la segunda secretaria Belén Ávalos.

Asunción, 8 de junio de 2023

MRREE. 06/08/23. Jefes de seguridad interna de Paraguay y Brasil acuerdan fortalecer lucha contra la delincuencia organizada

El lunes 5 de junio del corriente año tuvo lugar la visita oficial al Brasil del ministro del Interior de la República del Paraguay, embajador Federico González, para tratar temas de la agenda bilateral en materia de seguridad, invitado por su homólogo, el ministro de Justicia y Seguridad Pública (MJSP) brasileño, Flavio Dino.

En la ocasión, el ministro González puso énfasis en que, a pesar del periodo de transición política que se vive actualmente en nuestro país, el encuentro entre los ministros encargados de la seguridad interna del Paraguay y del Brasil constituye una muestra clara de la voluntad de ambos gobiernos de continuar firmes y de no bajar la guardia en el combate a la delincuencia organizada transnacional.

Ambos ministros coincidieron en la importancia de intensificar los operativos conjuntos enmarcados en los comandos bipartito y tripartito y, sobre este último, acordaron realizar los trámites internos necesarios para la actualización de su marco normativo, que data de 1996, lo cual dotará de más y mejores herramientas a las fuerzas de seguridad de los tres países: Argentina, Brasil y Paraguay, atendiendo a la evolución de las organizaciones criminales.

Asimismo, concordaron en proseguir con la ejecución de operativos conjuntos bajo la modalidad “espejo” en la zona de frontera: Basalto (Py) y Ágata (Br), debido a los resultados auspiciosos que se han venido obteniendo al atacar las finanzas de la delincuencia organizada transnacional.

El ministro González estuvo acompañado por el embajador paraguayo en el Brasil, Juan Ángel Delgadillo, y otras autoridades del Ministerio del Interior.

Por su parte, la delegación brasileña estuvo integrada por el secretario nacional de Seguridad Pública del MJSP, Tadeu Alencar; el director general de la Policía Federal (PF), delegado Andrei Passos Rodrigues; y el asesor especial internacional del MJSP, ministro Paulo Gustavo Iansen de Sant´Ana.

Asunción, 8 de junio de 2023

MRREE. 06/08/23. Embajador en Brasil se reunió con senadora federal para repasar los proyectos de infraestructura y conectividad

El embajador de la República del Paraguay ante la República Federativa del Brasil, Juan Ángel Delgadillo, realizó una visita de trabajo a la senadora federal por el Estado de Mato Grosso del Sur, Soraya Vieira Thronicke.

Durante el encuentro, ambas autoridades repasaron varios temas de la agenda bilateral con especial énfasis en lo que se refiere a infraestructura física y conectividad, la culminación de los accesos al “Puente de la Integración” y el avance de obras del “Puente Carmelo Peralta-Puerto Murtinho”.

De igual manera, conversaron acerca del proceso para la incorporación al ordenamiento jurídico brasileño del “Acuerdo para la Construcción del Puente San Lázaro – Puerto Murtinho”.

Asimismo, destacaron las acciones coordinadas entre ambos países para fortalecer la cooperación en la lucha contra el narcotráfico y el crimen organizado transnacional.

Finalmente, resaltaron las buenas relaciones que unen al Paraguay y el Brasil y la importancia de que los parlamentarios trabajen en forma coordinada para seguir fortaleciendo el desarrollo de ambos países.

Asunción, 8 de junio de 2023

MHacienda. Viernes, 09 de Junio de 2023. DESTACA SATISFACTORIO DESEMPEÑO DEL PROGRAMA. Directorio del FMI aprueba la primera revisión en el marco del acuerdo PCI

El Directorio Ejecutivo del Fondo Monetario Internacional (FMI) concluyó la primera revisión en el marco del Instrumento de Coordinación de Políticas (PCI) para Paraguay y aprobó la evaluación del personal técnico que se realizó a fines del mes de marzo, de acuerdo al comunicado difundido por el organismo internacional.

Cabe resaltar que este acuerdo del PCI respalda las políticas macroeconómicas y las reformas estructurales de Paraguay, con el objetivo de garantizar la estabilidad macroeconómica y fiscal, fomentar el crecimiento económico y reforzar la protección e inclusión social.

El FMI destaca en el comunicado que “el desempeño del programa es satisfactorio y se han alcanzado casi todas las metas fijadas para diciembre de 2022”. Asimismo, menciona que la economía de Paraguay ha demostrado una resiliencia notable durante un período de cuatro años en el que se han producido varios shocks adversos.

En cuanto a la evolución de las finanzas públicas, el FMI menciona que la situación fiscal siguió mejorando en 2022 merced a la consolidación del ingreso y la limitación del gasto, y el déficit fiscal se ha reducido hasta 3% del PIB.

Finalmente, se destaca que la economía ha sido resiliente a los recientes shocks externos y sus respuestas de política han sido eficaces y adecuadas. Para que esta capacidad de respuesta a los shocks perdure, es necesario que Paraguay continúe recomponiendo las cuentas fiscales y siga adelante con las reformas estructurales importantes.

Más detalles sobre el comunicado emitido por el FMI puede verse en el siguiente enlace: https://lc.cx/lmn1it

URUGUAY

PR. En Paysandú. 08/06/2023. Gobierno anunció inversión de 4.000 millones de dólares para planta de hidrógeno verde y energías renovables

El presidente Lacalle Pou informó sobre la construcción de una planta de hidrógeno verde en Paysandú, para el cual se invertirán 2.000 millones de dólares. Las obras ocuparán a 1.500 personas y en su momento de mayor productividad alcanzará los 3.200 puestos de trabajo. La edificación comenzará en 2023 y una vez culminada, trabajarán unos 300 operarios. Otros 2.000 millones se invertirán en proyectos de energías renovables

Acompañaron al mandatario, el secretario de la Presidencia, Álvaro Delgado; el ministro de Industria, Energía y Minería, Omar Paganini; el subsecretario de la cartera, Walter Verri; el ministro de Defensa Nacional, Javier García; el titular de Ancap, Alejandro Stipanicic y el intendente departamental, Nicolas Olivera, entre otras autoridades nacionales y locales.

“En esa transformación energética que está viviendo el mundo, Uruguay ha hecho los deberes”, reflexionó Lacalle Pou.

Puntualizó que la construcción, que se iniciará en 2023, será el producto de un proceso en el que el Gobierno recibió propuestas de más de 50 empresas.

El mandatario explicó además que se concretarán otras obras en Paysandú. Entre ellas se refirió a las inversiones en la planta de tratamiento de efluentes que en breve se concretará.

Por otra parte, explicó que está culminando el proceso para la construcción de un hotel con una inversión que rondará los 25 millones de dólares.

Por su parte, Paganini explicó que la propuesta forma parte de un proceso que involucrará una planta que instalará Alcoholes del Uruguay (ALUR) en asociación con Ancap para producir hidrógeno verde y con ese elemento elaborar gasolina sintética, que no requiere uso de petróleo. Dijo que esta planta implicará unos 2.000 millones de dólares de inversión, pero además para la energía renovable serán otros 2.000 millones de dólares.

“Esto es energía renovable que se transforma en hidrógeno, que se combina con anhídrido carbónico que sale de ALUR y con eso se hacen estos nuevos combustibles, que reemplazan exactamente a la gasolina actual”, aseveró.

El secretario de Estado dijo que esta gasolina verde saldrá por el río Uruguay y se destinará a la exportación, por los importantes volúmenes que generará.

En tanto, Stipanicic subrayó que será el primer proyecto en el país que se dedicará a la producción de electrocombustible o combustible sintético. “Pone a Uruguay a la vanguardia de los países en este tipo de producción”, indicó.

El presidente de Ancap indicó que la planta se situará a 7 kilómetros de la capital departamental hacía el norte y que las obras durarán 30 meses.

“Se trata de una muestra de confianza muy grande en el país y una apuesta muy grande al prestigio que ha generado Ancap en ámbitos internacionales en lo que hace a la transición energética”, puntualizó.

Agregó que la planta tendrá un área de influencia cercana a los 180 kilómetros en redes de alta tensión y granjas de generación eólica y fotovoltaica

Afirmó que se trata de una obra “realmente significativa” que demuestra que el trabajo que desarrolla el Poder Ejecutivo junto a las empresas públicas, empieza a generar sus frutos.

MRREE. Comunicado de prensa N.° 32-23. 06/06/2023. Uruguay integra la lista de países elegibles del Programa de Autorización Electrónica de Viaje de Canadá. Uruguay integra la lista de países elegibles del Programa de Autorización Electrónica de Viaje de Canadá

El Ministerio de Inmigración, Refugiados y Ciudadanía de Canadá comunicó que había seleccionado a Uruguay para integrar la lista de países elegibles del Programa de Autorización Electrónica de Viaje (eTA).

Se trata de un proceso simplificado en línea, de exención de visado a los viajes aéreos que se realizan a Canadá, dentro de cuyos requisitos figuran: que el ciudadano uruguayo solicitante del eTA haya sido titular de una visa canadiense en los últimos 10 años o que, actualmente, sea titular de un visado válido de no inmigrante de los Estados Unidos.

Esta medida unilateral adoptada por el gobierno canadiense de otorgar tal facilidad a los ciudadanos uruguayos se corresponde con la excelente relación existente entre nuestros países, así como al firme propósito compartido de fortalecer y profundizar la misma, en este caso particular a nivel migratorio.

MEF. Gestión de deuda. 07/06/2023. Fitch Ratings subió la calificación crediticia de Uruguay a “BBB”, con perspectiva Estable. La agencia Fitch Ratings anunció hoy que subió la calificación soberana de Uruguay de “BBB-” a “BBB”, manteniendo la perspectiva Estable.

De acuerdo a la agencia, la decisión de mejora de la calificación crediticia estuvo basada en el sólido desempeño fiscal del país que permitió absorber el shock de la pandemia del Covid -19, sumado al historial de cumplimiento del marco fiscal, que ha mejorado su credibilidad, aumentado la resiliencia a los shocks económicos y reducido el riesgo de un potencial aumento en el stock de la deuda pública. Según Fitch, la reciente aprobación de la reforma previsional, que mejora la sostenibilidad financiera del sistema de pensiones, también indica el compromiso por una política fiscal más prudente y coherente con el alto estándar de gobernabilidad del país.

La nota de BBB es la más alta otorgada por Fitch a Uruguay, desde que la agencia comenzó a calificar al país en enero de 1995. Por otro lado, la última mejora en la calificación de esta Agencia se había producido hace más de diez años (marzo de 2013), cuando Uruguay recuperó la calificación crediticia de grado inversor de Fitch de “BBB-”.

La decisión adoptada por Fitch Ratings se suma a otras mejoras adoptadas, desde fin de 2021, por las cinco calificadoras que evalúan a Uruguay. En diciembre de 2021, Fitch había mejorado previamente la perspectiva de la deuda uruguaya “BBB-”, desde Negativa a Estable; en octubre de 2022, la agencia japonesa R&I subió la nota a “BBB+”, con perspectiva Estable; en noviembre del 2022 DBRS Morningstar elevó la nota a “BBB” con perspectiva Estable; en abril de 2023, la calificadora Standard & Poor´s subió la nota a “BBB+”, con perspectiva Estable; y en mayo de este año, Moody´s Investors Service había mejorado la perspectiva a Positiva, manteniendo la calificación en “Baa2” (equivalente a “BBB”).

URUGUAY XXI. 07/06/2023. La finlandesa UPM inauguró su segunda planta en Uruguay. La compañía concretó la mayor inversión productiva en la historia de Uruguay con su planta Paso de los Toros

La compañía finlandesa UPM inauguró su segunda planta de producción de celulosa -Paso de los Toros- en la localidad de Centenario, del departamento de Durazno. Esta nueva sede supuso una inversión de US$ 3.470 millones.

Con la presencia de cientos de invitados entre autoridades uruguayas, empresarios y medios de comunicación, el presidente del directorio de UPM, Henrik Ehrnrooth calificó a Uruguay como un país confiable para hacer negocios.

El presidente de Uruguay, Luis Lacalle Pou, celebró la inauguración y repasó varios hitos en la historia del país que, precisó, condujeron a la concreción de la inversión histórica de UPM: la intervención de distintos gobiernos para impulsar la cadena forestal, la ley de puertos y el tratado de protección de inversiones con Finlandia, entre otros.

“Eso que nos parece obvio a nosotros, en el mundo genera confianza. Podrá haber cambios de gobierno, pero en Uruguay hay una Constitución, leyes y contratos que siempre se van a respetar. Uruguay tiene una trayectoria y una tendencia de ser acompañado por empresas exitosas”, afirmó el mandatario.

UPM Paso de los Toros es la mayor inversión productiva en la historia de Uruguay

El ministro de Industria uruguayo, Omar Paganini, destacó la visión histórica que mantuvieron los gobiernos uruguayos y el sector privado, encargados de impulsar la llegada de inversiones internacionales a un territorio apto para el cultivo de eucaliptus.

En ese sentido, destacó las condiciones institucionales como la democracia plena, el respeto a los compromisos y contratos asumidos, así como la estabilidad política y social. Consideró que estos aspectos que ostenta Uruguay fueron claves a la hora de captar la mayor inversión productiva en el país.

Paganini remarcó la importancia de la cadena forestal-industrial uruguaya, que es ejemplo por su sostenibilidad y cuidado del ambiente con certificación internacional, tecnología de última generación e inserción internacional.

La nueva planta de UPM producirá 2,1 millones de toneladas de celulosa por año a través del consumo de 7 millones de metros cúbicos de madera. La obra posiciona a Uruguay entre los principales exportadores globales de celulosa de mercado.

Está diseñada para enviar su producción por ferrocarril hasta la terminal especializada de UPM en el puerto de Montevideo, que posteriormente será cargada en buques transoceánicos con destino a Europa y Asia.

El emprendimiento genera 7.000 empleos directos y 10.000 indirectos a través de los puestos en la cadena de valor (más de 20.000 uruguayos participaron de la construcción) y 600 medianas y pequeñas empresas. Redistribuirá US$ 290 millones en salario neto anual, generará un impacto de 3,4% en el producto bruto interno (PBI) con el crecimiento de las operaciones. Además, le permitirá al país alcanzar los US$ 1.900 millones en exportaciones de sus productos por año.

MONTEVIDEO PORTAL. ENTRE ORIENTALES. 08.06.2023. Hay “posibilidad cierta” de que Lacalle viaje a China “antes de fin de año”, dijo Bustillo. El Gobierno buscará firmar nuevos acuerdos con el gigante asiático, pero el TLC quedó relegado por la disposición de Brasil a participar.

El ministro de Relaciones Exteriores, Francisco Bustillo, dijo este miércoles en el Parlamento que existe una “posibilidad cierta” de que el presidente Luis Lacalle Pou “concurra antes de fin de año” a China.

La Cancillería trabaja para concretar la firma de algunos acuerdos durante el viaje, aunque el anunciado Tratado de Libre Comercio (TLC) quedará relegado a las negociaciones que emprendan China y Brasil.

“Estamos trabajando de cara a una eventual visita del presidente. Esperamos poder concretarla antes de fin de año; no tenemos fecha aún, pero estamos trabajando en tal sentido”, dijo más adelante el canciller en su comparecencia ante la Comisión de Asuntos Internacionales de la Cámara de Senadores.

“En las distintas conversaciones me hicieron saber que en la visita del presidente Lula, una semana antes, diez días antes, había manifestado que, respecto a las conversaciones y negociaciones que venían avanzando con Uruguay, también a Brasil eventualmente le podría interesar en el futuro acompañar esas negociaciones y avanzar como Mercosur”, dijo Bustillo sobre la posibilidad de un TLC con China, que ahora aparece como lejana pese a haber sido como una prioridad por el Gobierno.

El canciller dijo más adelante que Uruguay está “en condiciones de avanzar ya mismo” con el TLC, pero el Gobierno tendrá “la delicadeza de esperar los siguientes pasos ante la eventualidad de que Brasil se disponga a sumarse, tal como lo manifestó”.

Montevideo Portal

MERCOSUL

El País (Uruguai) – "Este gobierno avanzó y llegó hasta donde no se había llegado antes", dijo Lacalle Pou sobre el TLC con China

"A la vista está que el Mercosur no tiene intención de avanzar, por lo menos con China", dijo el mandatario y recalcó su intención de una apertura comercial para el país.

08/06/2023, 16:13

"Esto no es nuevo para Uruguay, simplemente que este gobierno avanzó y llegó hasta donde no se había llegado antes, que fue un estudio de factibilidad en conjunto", dijo el presidente Luis Lacalle Pou este jueves sobre la búsqueda de un Tratado de Libre Comercio ( TLC ) con China que, al menos hasta el momento, está detenida.

En rueda de prensa en Paysandú, Lacalle Pou recordó que hace poco tiempo dijo a un medio extranjero que no le "cabe la menor duda que tanto Brasil como Argentina seguramente hayan incidido" en que China no se apreste a firmar el acuerdo solo con Uruguay y prefiera hacerlo con el Mercosur en su conjunto. "Las cartas están sobre la mesa, ya lo han dicho, y en el juego diplomático a veces estas presiones surten efecto", agregó.

De todos modos, recalcó: "Nosotros vamos a seguir yendo, porque a la vista está que el Mercosur no tiene intención de avanzar, por lo menos con China. Con la Unión Europea sí, pero con China no". "Y nosotros lo dijimos al principio, hay que abrir el Uruguay y lo que nos está faltando es apertura de mercados en igualdad de condiciones", agregó.

"Seguramente China haya tenido conversaciones con los otros países, y este es el resultado hasta el momento, pero el partido termina a los 90 minutos", sentenció.

El País (Uruguai) – Bustillo, el "ni sí ni no" de China a un TLC y la esperanza de que Lula lidere un acuerdo con el Mercosur

El canciller actualizó el estado de las negociaciones con China por un acuerdo de libre y comercio e insistió en sus críticas al bloque regional.

08/06/2023, 16:06

El canciller Francisco Bustillo ratificó este miércoles que Uruguay seguirá en una "búsqueda incesante" de cumplir su objetivo de firmar un tratado de libre comercio (TLC) con China. También, la disposición de avanzar ya mismo en ese sentido, aunque, marcó que el país tendrá la "delicadeza" de esperar los eventuales pasos que dé Brasil al respecto.

El próximo paso natural sería comenzar las negociaciones por ese acuerdo. Algo que, admitió, de forma realista no resulta sencillo y dependerá de una serie de acontecimientos internacionales en el futuro cercano. No solo dependerá de los éxitos o fracasos que pueda tener el presidente Luiz Inácio Lula Da Siva en su política exterior, en donde el brasileño "ha tenido alguna cosa cuestionable", sino también del liderazgo que pueda exhibir Lula en favor del tratado con los chinos, agregó.

"Este gobierno avanzó y llegó hasta donde no se había llegado antes", dijo Lacalle Pou sobre el TLC con China

Al respecto, Bustillo transmitió en el Parlamento los comentarios que recibió en su reciente visita a China. "Básicamente, lo que nos trasladaron no fue un sí o un no a un TLC", dijo. Lo que hizo China fue informar que "había tomado nota" de las expresiones efectuadas por el presidente de Brasil, Luiz Inácio Lula Da Silva, cuando se reunió en Montevideo con Luis Lacalle Pou, sostuvo. En líneas generales, lo que dijo Lula fue que a su país le interesaría avanzar en un acuerdo entre todo el Mercosur y China.

Los chinos le dijeron a Bustillo que Lula les había expresado lo mismo en una visita que, antes de esa reunión, el brasileño había realizado a Pekín. Lula, dijo Bustillo, generó allí una gran expectativa. "Expectativa que compartimos, porque nuestra primera opción en cualquier negociación es avanzar junto a nuestros vecinos", afirmó.

"El problema es que el Mercosur no avanza", agregó Bustillo en otro tramo de su exposición. "No avanza con ningún acuerdo de los tantos que están planteados", lamentó. En materia de inserción internacional, el Mercosur deja mucho que desear".

Bustillo dijo que nunca durante la tramitación supo del chat en el que advertían a Ache sobre la peligrosidad de Marset

La presencia de Bustillo en la Comisión de Asuntos Internacionales del Senado respondió a una convocatoria planteada por el Frente Amplio ante los anuncios de que China había desistido de la posibilidad de avanzar en ese acuerdo de manera bilateral, si no que prefería hacerlo con todo el Mercosur. Palabras más, palabras menos, el mensaje de los chinos fue que "están estudiando la situación" y que les interesa un acuerdo con Uruguay. Pero, apuntó, "desearían" avanzar junto al resto de los países del Mercosur.

"Lo hemos intentado todos. Ustedes, nosotros", les dijo el canciller a los legisladores frenteamplistas. "Todos hemos intentado dar pasos en favor de ese TLC". El objetivo del gobierno, dijo, es "entregar el testigo más cerca de la meta de lo que lo heredamos".

Bustillo señaló que en su reciente visita a China quedó planteada la posibilidad de que el presidente Luis Lacalle Pou concurra a ese país antes de fin de año. Allí, adelantó, se estarían firmando una serie de acuerdos. Entre ellos el plan OBOR. Heredado del gobierno de Tabaré Vázquez, se trata de la Iniciativa de la Franja y la Ruta, la estrategia de desarrollo de infraestructura global y cooperación internacional impulsada desde 2013 por el gigante asiático.

Bustillo sostuvo que la relación con China va más allá de un TLC y agregó que le objetivo es llevarla al plano de una "asociación estratégica integral".

El Observador (Uruguai) – Bustillo: la "tristísima realidad" del Mercosur y la política de Lula que tuvo "alguna cosa cuestionable"

El canciller supeditó sus expectativas de que el Mercosur avance con la Unión Europea a "si creemos en Lula", y llamó a un "acuerdo nacional" para replantearse el bloque regional

09 de junio de 2023 a las 05:00

El canciller Francisco Bustillo pintó un panorama poco optimista en materia de inserción internacional durante su extensa comparecencia este miércoles ante la comisión de Asuntos Internacionales del Senado. El titular del Ministerio de Relaciones Exteriores refirió a sus casi nulas expectativas de concretar el Tratado de Libre Comercio (TLC) con China y de que se firme el acuerdo del Mercosur con la Unión Europea, al tiempo que describió la influencia que la gestión del brasileño Lula Da Silva pueda tener en diversas tratativas.

Bustillo comenzó diciendo que el reciente mensaje desde China "no fue un sí o un no a un TLC, sino que nos hicieron saber que habían tomado nota de lo expresado por el presidente Lula en ocasión de la visita al presidente Lacalle Pou, respecto a que también a Brasil le podría interesar, una vez culminadas las negociaciones con la Unión Europea, avanzar en un acuerdo Mercosur-China".

Su exjefe de Gabinete y negociador jefe en dichas conversaciones, Fernando López Fabregat, arremetió contra la premisa de que "fue en vano lo realizado y que tal vez se dañó la relación con los vecinos". El actual embajador ante Alemania sostuvo que "lo hecho enriquece al Uruguay y a su recurso humano negociador", y aseguró que la administración estuvo "más que a la altura de los acontecimientos para enfrentar una conversación realmente sofisticada con una contraparte china con la que existen notorias asimetrías".

El canciller Bustillo adelantó en tanto que esperan concretar "antes de fin de año" una visita del presidente Luis Lacalle Pou al mandatario chino Xi Jinping. Ante una consulta del senador frentista José Carlos Mahía, respecto a cómo continuarían las tratativas, respondió en "forma realista" que "no es algo sencillo".

"Va a depender mucho de los próximos acontecimientos internacionales, (...) no solo de los éxitos o no del propio presidente Lula que, en materia de política internacional, ha tenido alguna cosa cuestionable, y también va a depender mucho del liderazgo que pueda exhibir él en favor, en este caso, de un eventual acuerdo con China", declaró ante los senadores.

El mandatario brasileño fue cuestionado en las últimas semanas –por el propio Lacalle Pou y por el chileno Gabriel Boric– por conminar a la Venezuela de Nicolás Maduro a contrarrestar con su propio relato la "narrativa construida" sobre el país carbeño, mientras que días atrás había atribuido a Ucrania el mismo nivel de responsabilidad que Rusia en el conflicto sobre la Europa oriental.

Bustillo reiteró que "la expectativa hoy está en torno a los próximos pasos que dé Brasil", en especial por el "prestigio que ha logrado o ha dejado de lograr".

El canciller insistió en que los socios del Mercosur "no quieren nada de nada y esa es la tristísima realidad". "Pero no solo con Uruguay, no quieren nada con nadie, en un caso por imperio de Argentina, en otro caso por Brasil y en otro por Paraguay".

Ante la consulta del senador Mario Bergara sobre la expectativa de que "mueva Brasil" para concretar la firma del acuerdo entre el Mercosur y la Unión Europea –sobre la que avanzó la anterior administración pero que frustró el lobby europeo–, Francisco Bustillo afirmó que "eso depende de si creemos en Lula o no".

"Lula nos manifestó que efectivamente estaba la voluntad de Brasil de avanzar primero con la Unión Europea y luego con China. (...) Y además, es lo que le manifestó también a China. ¿Creemos en Lula? Si creemos en Lula, entonces, la expectativa la tenemos", comentó el canciller uruguayo.

En esta línea, y pese a que la presidencia de España en el Consejo de la Unión Europea abría una ventana de expectativa, Bustillo admitió que si tiene que "pasar raya", diría: "No soy optimista, por lo menos en el corto plazo, y quizás mediano, de que se vaya a suscribir el acuerdo". El canciller relató que el alto representante de la Unión para Asuntos Exteriores, Josep Borrell, trasladó su "desazón" por "no lograr culminar el acuerdo", al tiempo que concluyó: "Lo que se respira de parte de los distintos países (europeos) es que es muy difícil que se logre".

Hoy también "hay países europeos que no están a favor del acuerdo" y "esa es la triste realidad", cerró.

"Acuerdo nacional" sobre el Mercosur

Fiel a la línea defendida por las últimas administraciones, llamó a modernizar el Mercosur. "Creo que está llegando el momento de que haya un acuerdo nacional –o lo que fuera– para considerar nuestra posición respecto de esta imposibilidad de avanzar, ya no con Acuerdo del Transpacífico o con China, sino en cualquier materia en lo que refiere a inserción internacional", declaró y opinó que "estamos siendo rehenes de otros actores que no han mostrado el más mínimo interés en avanzar con nadie".

"En algún momento todos vamos a tener que poner las barbas en remojo y pensar seriamente qué hacemos", lamentó. Bustillo repasó que los problemas en Argentina "se reflejan en la sustitución de importaciones de los años setenta", mientras que "Brasil ha sido históricamente proteccionista, con un mercado propio" que "no necesita de nadie", y Paraguay "a duras penas" ha llegado a un "mercado cautivo al que le exporta casi el 70 % de la producción".

"No tienen las necesidades del Uruguay; esa es la triste realidad. Algún día tendremos que encarar este tema y decir: 'Señores, ¿qué vamos a hacer con el Mercosur?'. No estoy planteando que nos tengamos que ir; quizás podamos cambiar el estatus del Mercosur. En fin, caben todas las posibilidades; no me va a corresponder a mí porque además son decisiones que me trascienden, pero creo que algún día va a haber que encarar seriamente qué se hace con este Mercosur", concluyó.

AMÉRICA DO SUL

El País (Uruguai) – Alarma en Argentina por acuerdo para puerto chino en Tierra del Fuego

La medida tiene un fuerte carácter político y estratégico; la inversión sería de US$ 1.250 millones.

09/06/2023, 04:00

Mariano De Vedia, La Nación/GDA

Pocos días después del viaje de Sergio Massa y Máximo Kirchner a Shanghai, el gobernador de Tierra del Fuego, Gustavo Melella, dictó un decreto por el cual autoriza la construcción de un puerto multipropósito por parte de una empresa china, mediante una inversión de 1.250 millones de dólares.

La medida tiene un fuerte carácter político y estratégico, pese a que el puerto, que dependerá de la provincia, solo podrá funcionar como un polo agroquímico. No tiene, por ahora, una autorización de la Subsecretaría de Puertos, Vías Navegables y Marina Mercante.