US ECONOMICS

GDP

Doc. BEA. April 29, 2020. Gross Domestic Product, 1st Quarter 2020 (Advance Estimate)

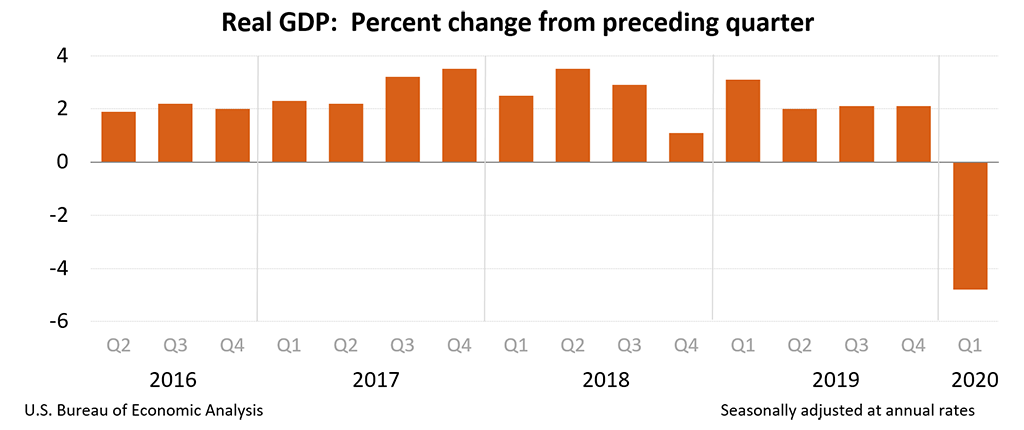

Real gross domestic product (GDP) decreased at an annual rate of 4.8 percent in the first quarter of 2020 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2019, real GDP increased 2.1 percent.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency (see "Source Data for the Advance Estimate" on page 2). The "second" estimate for the first quarter, based on more complete data, will be released on May 28, 2020.

Coronavirus (COVID-19) Impact on the Advance First-Quarter 2020 GDP Estimate

The decline in first quarter GDP was, in part, due to the response to the spread of COVID-19, as governments issued "stay-at-home" orders in March. This led to rapid changes in demand, as businesses and schools switched to remote work or canceled operations, and consumers canceled, restricted, or redirected their spending. The full economic effects of the COVID-19 pandemic cannot be quantified in the GDP estimate for the first quarter of 2020 because the impacts are generally embedded in source data and cannot be separately identified.

The decrease in real GDP in the first quarter reflected negative contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and private inventory investment that were partly offset by positive contributions from residential fixed investment, federal government spending, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased (table 2).

The decrease in PCE reflected decreases in services, led by health care, and goods, led by motor vehicles and parts. The decrease in nonresidential fixed investment primarily reflected a decrease in equipment, led by transportation equipment. The decrease in exports primarily reflected a decrease in services, led by travel.

Current‑dollar GDP decreased 3.5 percent, or $191.2 billion, in the first quarter to a level of $21.54 trillion. In the fourth quarter, GDP increased 3.5 percent, or $186.6 billion (tables 1 and 3).

The price index for gross domestic purchases increased 1.6 percent in the first quarter, compared with an increase of 1.4 percent in the fourth quarter (table 4). The PCE price index increased 1.3 percent, compared with an increase of 1.4 percent. Excluding food and energy prices, the PCE price index increased 1.8 percent, compared with an increase of 1.3 percent.

Personal Income and Outlays

Current-dollar personal income increased $95.2 billion in the first quarter, compared with an increase of $144.1 billion in the fourth quarter. The deceleration was more than accounted for by a deceleration in compensation that was partly offset by an acceleration in personal current transfer receipts (table 8).

Disposable personal income increased $76.7 billion, or 1.9 percent, in the first quarter, compared with an increase of $123.7 billion, or 3.0 percent, in the fourth quarter. Real disposable personal income increased 0.5 percent, compared with an increase of 1.6 percent.

Personal outlays decreased $253.5 billion, after increasing $118.8 billion. The decrease was mainly accounted for by a decrease in PCE.

Personal saving was $1.60 trillion in the first quarter, compared with $1.27 trillion in the fourth quarter. The personal saving rate—personal saving as a percentage of disposable personal income—was 9.6 percent in the first quarter, compared with 7.6 percent in the fourth quarter.

FULL DOCUMENT: https://www.bea.gov/system/files/2020-04/gdp1q20_adv_0.pdf

DoC. BEA. April 29, 2020. Statement from U.S. Secretary of Commerce Wilbur Ross on Q1 2020 GDP Advance Estimate

Today, the Department of Commerce’s Bureau of Economic Analysis (BEA) released the advance estimate for gross domestic product (GDP) for the first quarter of 2020, finding that real gross domestic product contracted at an annual rate of 4.8 percent.

U.S. Secretary of Commerce Wilbur Ross issued the following statement in response:

"Today’s GDP numbers are weak, but in line with expectations as a result of the COVID-19-driven disruptions to daily lives at home and around the globe that have rocked global markets and supply chains. We continue to have the most resilient economy in the world, driven by innovative and hardworking Americans who have shown that they are willing to make the needed sacrifices to defeat this invisible enemy.

The President has taken bold action to leverage the expertise and resources of the entire Nation in this fight. Congress has confronted the seriousness of this challenge with trillions of dollars in relief funding for those impacted by the virus, establishing a firm footing for a swift and strong American comeback. When this chapter ends, America will be both stronger and healthier than ever because of the President’s decisive and timely actions."

THE WHITE HOUSE. Council of Economic Advisers. April 29, 2020. ECONOMY & JOBS. An In-Depth Look at COVID-19’s Early Effects on Consumer Spending and GDP

Today, the Bureau of Economic Analysis (BEA) released its advance estimate of U.S. GDP for the first quarter of 2020. BEA estimates that real GDP contracted 4.8 percent at an annual rate in the first quarter of 2020, the first decline in six years. In comparison, real GDP expanded 2.5 percent annually over the first three years of the Trump Administration.

This release confirms that COVID-19’s unprecedented adverse shock to the economy brought an end to the longest economic expansion in U.S. history. Consumer spending declined sharply, contributing -5.3 percentage points to the first quarter’s contraction. This rapid shift in consumer spending shows that Americans are dramatically curtailing expenditures as the Nation responds to COVID-19. But just as consumers cutting back drove the first quarter’s GDP decline, they will also contribute to the economic recovery—showing the importance of policies that support American workers and businesses.

This drop in GDP serves as an early indicator of the costs of the American and global economies shutting down in response to COVID-19. To put a 4.8 percent contraction in perspective, the figure below plots quarters with negative annual GDP declines since the series began in 1947.

Falling consumer spending has major effects on overall GDP growth, as it accounts for roughly 68 percent of GDP. The sharp decline in consumer spending was driven by suppressed spending on services and durable goods, with a partial offset from positive spending on nondurable goods. The service sector alone contributed -5.0 percentage points to overall real GDP growth, with particularly sharp annualized declines in household spending on healthcare services (-18.0 percent), transportation (-29.2 percent), recreation (-31.9 percent), and food services and accommodations (-29.7 percent).

Consumers also sharply curtailed spending on durable goods, which contributed -1.2 percentage points to overall GDP growth. Annualized declines in household spending on motor vehicles and parts (-33.2 percent) and furnishings and household equipment (-6.4 percent) were particularly steep. The declines in both services and durable goods spending were partially offset by growth in spending on nondurable goods, which was entirely driven by the largest ever quarterly surge in consumer spending on at-home food and beverages (25.1 percent). Given COVID-19’s risks, it is not surprising that these spending patterns were observed.

Despite the major challenges posed by COVID-19, the United States is in a strong position to recover as the public health threat recedes. Prior to COVID-19’s spread, GDP and job growth were exceeding pre-2016 election expectations, the strong job market was pulling Americans off the labor market’s sidelines, measures of business and consumer optimism were at or near historic highs, and wages were rising—especially for lower-income Americans. Furthermore, among G7 countries, the United States had the strongest real GDP growth from the fourth quarter of 2016 to the fourth quarter of 2019. Over that period, the U.S. rate of growth was more than a full percentage point above the other G7 countries’ average.

While a sharp decline in household spending takes a toll on the economy, consumers can also respond to positive economic changes as they respond to public health risks. Last year, when consumer confidence reached a 20-year high, elevated consumer spending accounted for roughly 80 percent of real GDP growth. The potential for and necessity of a strong rebound is one reason why the Trump Administration has worked with Congress to keep people attached to their work, and enacted financial supports for those who lost their jobs or were temporarily furloughed.

COVID-19 has also led to a whole-of-government response to bridge the current gap between a historically strong economy and the coming economic recovery. Federal policies that support workers and job creators should help limit negative effects on the economy in the second quarter as States restart their economies and let their residents return safely to work.

INTEREST RATE

FED. April 29, 2020. Federal Reserve issues FOMC statement

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.

The coronavirus outbreak is causing tremendous human and economic hardship across the United States and around the world. The virus and the measures taken to protect public health are inducing sharp declines in economic activity and a surge in job losses. Weaker demand and significantly lower oil prices are holding down consumer price inflation. The disruptions to economic activity here and abroad have significantly affected financial conditions and have impaired the flow of credit to U.S. households and businesses.

The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. The Committee expects to maintain this target range until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.

The Committee will continue to monitor the implications of incoming information for the economic outlook, including information related to public health, as well as global developments and muted inflation pressures, and will use its tools and act as appropriate to support the economy. In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

To support the flow of credit to households and businesses, the Federal Reserve will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will closely monitor market conditions and is prepared to adjust its plans as appropriate.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Patrick Harker; Robert S. Kaplan; Neel Kashkari; Loretta J. Mester; and Randal K. Quarles.

Implementation Note issued April 29, 2020. Decisions Regarding Monetary Policy Implementation

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on April 29, 2020:

- The Board of Governors of the Federal Reserve System voted unanimously to maintain the interest rate paid on required and excess reserve balances at 0.10 percent, effective April 30, 2020.

- As part of its policy decision, the Federal Open Market Committee voted to authorize and direct the Open Market Desk at the Federal Reserve Bank of New York, until instructed otherwise, to execute transactions in the System Open Market Account in accordance with the following domestic policy directive:

"Effective April 30, 2020, the Federal Open Market Committee directs the Desk to:

- Undertake open market operations as necessary to maintain the federal funds rate in a target range of 0 to 1/4 percent.

- Increase the System Open Market Account holdings of Treasury securities, agency mortgage-backed securities (MBS), and agency commercial mortgage-backed securities (CMBS) in the amounts needed to support the smooth functioning of markets for these securities.

- Conduct term and overnight repurchase agreement operations to support effective policy implementation and the smooth functioning of short-term U.S. dollar funding markets.

- Conduct overnight reverse repurchase agreement operations at an offering rate of 0.00 percent and with a per-counterparty limit of $30 billion per day; the per-counterparty limit can be temporarily increased at the discretion of the Chair.

- Roll over at auction all principal payments from the Federal Reserve's holdings of Treasury securities and reinvest all principal payments from the Federal Reserve's holdings of agency debt and agency MBS in agency MBS and all principal payments from holdings of agency CMBS in agency CMBS.

- Engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve's agency MBS transactions."

- In a related action, the Board of Governors of the Federal Reserve System voted unanimously to approve the establishment of the primary credit rate at the existing level of 0.25 percent.

CORONAVIRUS

BRAZIL

U.S. Department of State. 04/29/2020. Secretary Pompeo’s Call with Brazilian Foreign Minister Araujo

The below is attributable to Spokesperson Morgan Ortagus:

Secretary of State Michael R. Pompeo spoke by phone today with Brazilian Foreign Minister Ernesto Araujo. Secretary Pompeo and Foreign Minister Araujo discussed the importance of a coordinated response to combat the COVID-19 pandemic through increased production of medical supplies in the Americas and enhanced cooperation on therapy and vaccine development. The two discussed ways to intensify the economic and security partnerships between our two countries, including progress towards shared goals such as increased trade and digital security. Secretary Pompeo and Minister Araujo agreed to continue advancing the Democratic Transition Framework for Venezuela to ensure a secure, prosperous, and democratic hemisphere.

THE WHITE HOUSE. April 28, 2020. HEALTHCARE. Remarks by President Trump in Meeting with Governor DeSantis of Florida

THE PRESIDENT: Well, thank you very much. We’re with the Governor of Florida, Ron DeSantis, who’s done a spectacular job in Florida. He enjoys very high popularity, and that’s for a reason. The reason is he’s doing a good job.

And he came up. We talked about many things, including he’s going to be opening up large portions and, ultimately, pretty quickly, because he’s got great numbers — all of Florida. And I thought Ron would maybe — we’re together, we’re in the White House. This was a — sort of, a little bit of an unplanned meeting, and then we said, “Well, let’s bring in the press. Let’s talk to them if you’d like.” And we had some boards made up.

GOVERNOR DESANTIS: Yeah.

THE PRESIDENT: And Ron has a few things to say. So, Ron DeSantis, please.

GOVERNOR DESANTIS: Well, thank you, Mr. President. I think what we’re going to talk about is, kind of, our plan for nursing homes, our most vulnerable, what we did from the beginning, and then some of the innovations in testing. And that was really, kind of, state conceived and executed, but with great federal support. And it’s made a difference.

Our nursing home population — obviously very vulnerable in the state of Florida — so we knew by the time this all started, that that was the most vulnerable part in Florida. So we immediately suspended visitation. We had all staff required to be screened for temperature. They had to be asked a series of questions about contacts they may have had. And then we did require the wearing of PPE, such as masks.

But we also wanted to be offensive about it, so we deployed over 120 of these ambulatory assessment teams to long-term care facilities. That was over 3,800 facilities. And we were working on a needs assessment, trying to figure out where they were deficient so we could try to get ahead of this.

And then we also deployed rapid emergency support teams; we call them “RES teams.” These are to facilities where you’re training people on infectious controls and helping to augment their clinical mission. So that’s the Florida Department of Health going out, the Florida Agency for Health Care Administration going out and doing it.

So what happened was: There were times when some of the facilities didn’t follow the regulations, they’d let a sick worker go in, and you would see an outbreak. Most of them did a great job. But what we started to see is there were people that would follow all of this, but you could have a staff member that was just simply asymptomatic and then it would spread amongst the staff. And when you’re working with nursing care patients, you have to be in contact with them. That’s just the reality.

So we said, “All right, how do we get ahead and try to identify outbreaks amongst asymptomatic and try to limit it so it doesn’t affect more of the residents?” So we created — and then you — your support of allowing the National Guard with the funding —

THE PRESIDENT: Right.

GOVERNOR DESANTIS: Well, we have 50 mobile teams — we call them “strike teams” — that they go prospectively into different nursing facilities and they will test. Sometimes they’ll test everyone; sometimes they’ll test a sample just to see if there’s any prevalence of the virus. So they’ve already done over 6,000 of those tests. And I think that it’s been able to limit some outbreaks.

And then, because we’re saying you got to wear PPE, because we’re making these directives, we had to step up to the plate, and obviously, federal support on some of the materials. But we have put out, just to our nursing facilities, almost 7 million masks to the nursing facilities in Florida; almost a million gloves; half a million face shields; 160,000 gowns. And so that is a huge thing. That helps reduce the transmission.

THE PRESIDENT: Give me that, Ron. Let me have that. I’ll hold it.

GOVERNOR DESANTIS: Yeah. And then the result has been —

THE PRESIDENT: I’ll be an easel. (Laughs.)

GOVERNOR DESANTIS: — you know, if you look at the fatalities per 100,000, for Florida, we’ve been able to keep the rate low. We still have cases. We’re still going to have cases. But this is going to continue to be an issue that we’re going to have to be attuned to. We’re constantly looking for ways of how we can innovate. But, you know, our fatality per 100,000, fortunately, I think is much lower than most people would have predicted just a couple months ago. So thank you for your support on that.

And then I think the other area that we’ve really worked well with the White House and the administration on is with testing. This was a big deal when we were first starting. I’ve showed the President — most states were able to do the drive-through testing. We had one of the most successful sites with the Florida National Guard down in Broward County, which is one of our initial hotspots. And they’re putting through 750 a day for quite a while. The demand is now lower, but they were able to do the traditional drive-through testing.

But we also have done other things. So we wanted to learn more about COVID-19 very early on, and so the state partnered with the University of Florida to do both clinical testing and research testing in The Villages retirement community. We got 125,000 seniors in Central Florida. And so, as you know, they all do their golf carts, so it’s not actually car drive-through testing, it’s golf cart drive-up testing. But they loved it.

And we did 1,200 asymptomatic seniors in The Villages to try to see the prevalence of the virus amongst people not showing symptoms. The result of that was pretty astounding: Zero tested positive out of 1,200 asymptomatic seniors.

So, partnering with our academic institutions — I know Dr. Birx talks about using all the resources you have. We’re doing that in Florida, and I think that that’s been very successful.

One of the things we also noticed, though, is not everyone has access to a drive-through test site. Maybe you don’t own a car. Maybe it’s just too far away. So we worked with different groups, like the Urban League in Broward County, to go into communities that may be underserved and do this walk-up testing concept. So you actually have people who are in the neighbor- — they can just walk up, get tested. We have everything set out.

And so we’ve done though in Southern Florida, Central Florida. We did one at a housing project in Jacksonville. And so we’re going to continue with this concept. This is a way, as you go get back to business, you can put this almost anywhere. You can put it in a business district and then have people have access to this. So we think that that’s very important.

And then, of course, our National Guard strike teams at the long-term care facilities have just been very, very important. So the support of the Guard — the support of all the supplies, whenever we needed them to get down, it’s really made a difference.

Going forward, we’ve already done contracts. Dr. Birx laid out how there’s all this lab capacity. So we already have contracts to double our capacity in 24-, 48-hour-type timeframe. And then we’re going to turn our state labs into high-throughput labs as well. So that’s going to take a month or so, but we’re really looking forward to that.

I will say this, though: We have seven drive-through sites around the state of Florida that we operate. Our ability to test exceeds the current demand. And we don’t have restrictive criteria. It started off more restrictive. If you have coronavirus symptoms, test. If you’re a healthcare worker, first responder, come test. If you have no symptoms at all but just think you may have been exposed, come and test.

And so we have seen more of those latter start to come, but the overall numbers of people who are seeking testing is not currently beyond our capacity. So we’re going to have a lot more capacity going forward, but we still, right now, are able to meet the current demand.

THE PRESIDENT: So you actually have more testing than you have demand.

GOVERNOR DESANTIS: Right now. Yep.

THE PRESIDENT: It’s a fantastic thing.

Any questions for Ron?

Q So your safer-at-home order expires on Thursday?

GOVERNOR DESANTIS: So, my — you know, I did an essential business order, so we kept a lot of things going safely. And I think there’s — I know the people conflate all these around the country, but, you know, I kept construction going. I accelerated road projects in Florida, because we — the traffic was down. So we’re going I-4 in Orlando. We’re doing bridges in Tampa. So we had a lot of things going.

So that’s through April 30th. I worked with the White House on, kind of, going to phase one. I’m going to make an announcement tomorrow. But I think, for Florida, going from where we are now to phase one is not a very big leap. I think that, you know, it will be able to be a small step for us. But we’re going to approach it in a very measured, thoughtful, and data-driven way, and I think that that’s — that’s what most of the folks throughout the state are looking for.

Q So you won’t be doing what they did in Georgia?

THE PRESIDENT: Ron saw the — hey, Jon, Ron saw the empty roads. And he was telling me before — it was fascinating. He saw the empty roads all over Florida from doing this, where they’re staying at home. And he said, “This is a great time to build roads. This is a great time to fix bridges.” They were fixing bridges down there where normally there’d be a traffic nightmare. And they’re fixing bridges and there’s hardly any traffic. Very smart.

GOVERNOR DESANTIS: Yeah. So they — we’ve been able to accelerate key projects by as much as two months. And so, when — as people get back into the swing of things — and this is going to be a gradual process — you’re going to end up having reduced congestion, probably more than we’ve ever done in such a short period of time. So I think it was taking advantage of an opportunity.

Q So do more tests than demand, is that the norm in this country, do you think?

THE PRESIDENT: It’s true in other places. It’s definitely true with Ron. It seems to be true where the governors have done the proper job using us and utilizing the services that we provide. But it is also true in certain other locations.

GOVERNOR DESANTIS: One thing I would say, just so people don’t get the misimpression: You know, we have seven sites in major areas in our state. We have more capacity than we get.

These walk-up sites, though, have gone into areas that were underserved. You do have demand there. And so, I think what — so we definitely have enough supplies and everything, but I think the key is going to be finding pockets that maybe we’re not testing as much. I mean, obviously, we’ve got testing everywhere in Miami because they have the most cases. We have testing in other parts.

So I think this walk-up site is going to give us some confidence that we’re going into places that may have been overlooked and giving people easy access.

I also just recently got rid — or suspended any regulations that would prevent licensed pharmacists from administering tests. So CVS and Walmart, you’re hopefully — and I think they’re interested in doing this — or Walgreens — you could actually maybe go in there and the licensed pharmacist will be able to test you.

THE PRESIDENT: Pharmacies.

GOVERNOR DESANTIS: That’s going to be very convenient for an awful lot of people.

Q Mr. President, overall, South Korea has done five times more tests than the U.S. per capita. Why is that?

THE PRESIDENT: I don’t think that’s true.

Q That is true. You said this morning that —

THE PRESIDENT: I don’t — I don’t think it’s true.

Q The White House said the U.S. passes South Korea on virus testing.

THE PRESIDENT: I don’t think it’s true. Who are you with?

Q Yahoo News. And it’s not true per capita.

THE PRESIDENT: Do you want to respond to that? Do you — if you have the numbers.

DR. BIRX: (Inaudible) sure I have the numbers. So, remember, early on, we pushed tests to the outbreak areas, just like he described. His primary outbreak was in Miami-Dade and Broward County and Palm Beach, so they pushed tests into that region. We did the same thing in the United States.

So if you look at every single state that had an outbreak, their testing is greater than anywhere in the world. They’re in the 4 per — you know, 42 per thousand range, rather than —

Q Your point is taken about individual areas. But overall, we’ve had 14 times more infections than South Korea. So are we doing something wrong? And why is that? They have a very dense population.

DR. BIRX: Yeah, our epidemic looks much more like the European epidemic. So, right now, we’re tracking very close to the countries in Europe, and we’re testing at their rate of their concentrated epidemics and where they’re occurring in the metros. I think it really shows the susceptibility of our major cities in the same way they were susceptible in Europe.

And so we’ve been very focused on that. That’s not to say that we’re not supporting rural states.

Q But South Korea also has dense major cities, though. They do.

DR. BIRX: We’re very much supporting the rural states and very much supporting their testing. There’s no — there’s no state right now in the United States that’s tested really less than 1 percent, which is pretty remarkable when they don’t really have significant cases.

But we’ve been really working with states to do sentinel surveillance and also to reach out to our Native American populations, as well as our inner city.

So I think now that we’ve expanded testing dramatically and CDC has altered the criteria for testing, I think you’ll see, as governors have unlocked more and more potential in their laboratories, we know that we have more laboratory capacity. And you hear the governors talk about we have capacity and now we have to match things, you know, the resources that you need — the swabs and the extraction media — with the capacity. And I think governors are well aware of how to expand testing now.

And so we’re in that partnership. That’s what was announced yesterday. We want testing linked to critical contact tracing, but we also want testing as he described. The Governor described a really important insight. He went where the virus could cause the most damage to human beings, and so he went into the nursing homes to really proactively test. And that’s really in our —

THE PRESIDENT: And that’s true also throughout the country.

DR. BIRX: Yes. And that’s true in our — that’s why it’s in the blueprint. And I think some of the press didn’t hear how much we were emphasizing the asymptomatic testing. We believe that’s a critical part of this.

So you can’t approach this like you just traditionally approached flu, and you have to be more innovative. And we’ve been in, really, a strong partnership with the governors. And I think that’s why the blueprint was so important, because it talked about symptomatic testing and asymptomatic testing to protect the most vulnerable individuals.

And you can see what it did with the nursing home fatality rates. I mean, it’s remarkable.

GOVERNOR DESANTIS: Well, especially with the asymptomatic — in a nursing home situation, if that starts getting out, man, that is a perfect environment for this virus to just start spreading. I mean, it can spread like wildfire very quickly.

Q But, Governor, you didn’t shut your state until April 1st.

GOVERNOR DESANTIS: So that’s why — that’s why you’re trying to do all this stuff. So —

Q Why did you wait? And are you worried people died because of that?

Q Governor DeSantis, it sounds like that you are planning to announce tomorrow that you’re likely to go to the President’s phase one (inaudible).

GOVERNOR DESANTIS: So, we’re going to make an announcement tomorrow. You know, I created a task force, and I have all kinds of folks. We have all — some of the great health systems. We have great docs. We’ve got business folks. I’ve got elected officials. They’ve submitted a report to me. I’m going to be reviewing that.

Today, obviously we’ve been thinking about what we’re going to need to do. And so we’ll announce it tomorrow, about the next step forward for Florida. But I’ll just wait to announce it then.

Q Governor, you still have flights coming from Latin America to Miami. And we see an increase of cases in Latin America and South America. Aren’t you worried to see those planes (inaudible)?

GOVERNOR DESANTIS: Oh, I’ve been worried about that the whole time. I mean, I think that Brazil and some of those places, which have a lot of interaction with Miami, you’re going to probably see the epidemic increase there as their season changes. And so we could potentially have — we could be way on the other side doing well in Florida, and then you could just have people kind of come in.

So one of the things I’ve mentioned to the President is — you know, you have this Abbott Labs test. If you have some of these international flights, maybe some of these airliners should — it should be on them to check before they’re getting on and coming to this country so that we’re able to keep it.

I mean, you’ve seen what happened with the China flight restrictions. That kept a lot of people from seeding the West Coast more. And so if we’re in a situation you could potentially have from hotspots coming in, I think we — we’re technologically more advanced where there should be something like that.

So I’ve been advocating for that. I’ve talked with some other governors about it. But for Florida, clearly, that’s going to be an issue.

If you look at —

THE PRESIDENT: And that’ll be cutting off Brazil? I mean, are you going to (inaudible) Brazil?

GOVERNOR DESANTIS: Well, not necessarily cut them off, but it’s just — if you’re going to fly to Miami, then the airlines should give you the Abbott test and then put you on the plane. But —

THE PRESIDENT: Would you ever want to ban certain countries?

GOVERNOR DESANTIS: If they’re — if they were seeding the United States, I think you should ban them.

THE PRESIDENT: Yeah. You’ll let us know.

GOVERNOR DESANTIS: For sure.

THE PRESIDENT: You’ll be watching and you’ll let us know.

GOVERNOR DESANTIS: But I would say, in the United States — or in Florida, excuse me — in spite of all the international travel — I mean, we have so many people that go to Orlando, Miami, and all that. If you look at our outbreak, not a lot of it is tied to that. It’s mostly tied to New York City travel into the three Southern Florida, because the Orlando situation is worlds different than Palm Beach and Broward and Miami-Dade, but yet they have as much international travel as anybody. And yet, as of this morning, I think Orlando had 50 people hospitalized in that whole area for COVID-19. I mean, people were predicting there were going to be hundreds of thousands hospitalized in Florida by this time. So — so they’ve had a really modest outbreak.

Southeast Florida — I mean, still, by some of these other standards, not as bad as other parts of the country. But that was really more of a domestic seeding, I think, than international.

THE PRESIDENT: Well, we’re going to be in touch on that. Go ahead, please.

Q So, why not then require that people take tests before they take international flights? And why not even require that people wear masks on planes?

THE PRESIDENT: So we’re looking at that, and we’re probably going to be doing that. Brazil has pretty much of an outbreak, as you know. They also went a different way than other countries in South America. If you look at the chart, you’ll see what happened, unfortunately, to Brazil. So we’re looking at it very closely, and we’re in coordination with other governors also, but in particular with Ron. We’ll make that decision pretty soon.

Q So what about all flights — all international flights?

THE PRESIDENT: Well, we’re looking at that. That’s a very big thing to do. You know, again, I did it —

DR. BIRX: So let me just —

THE PRESIDENT: — with China. I did it with Europe. That’s a very big thing to do. It’s certainly a very big thing to do to Florida, because you have so much business from South America. So we’ll be — we’ll be looking at that.

DR. BIRX: So, to our Yahoo gentleman, I just want to make it clear that South Korea’s testing was 11 per — per 100,000, and we’re at 17 per 100,000. So —

THE PRESIDENT: Right. Are you going to apologize, Yahoo? That’s why you’re Yahoo and nobody knows who the hell you are.

Q If that’s correct — based on —

THE PRESIDENT: Go ahead. Let’s go, Jeff. Go ahead.

Q — the numbers I’ve seen, that’s not —

THE PRESIDENT: That’s why nobody knows who you are, including me.

Go ahead.

Q Mr. President —

DR. BIRX: Just check it again.

THE PRESIDENT: You ought to get your facts right before you make a statement like that.

Q But we have had — we have had 14 times the infection they have.

THE PRESIDENT: Okay, well, your facts are wrong.

Let’s go.

Q Just to clarify what you were just talking about, you’re looking at cutting off more international travel from Latin America?

THE PRESIDENT: No, we’re looking — we’re talking to the governor, we’re talking with others also that have a lot of business coming in from South America, Latin America. And we’ll make a determination. We’re also setting up a system where we do some testing, and we’re working with the airlines on that.

Q Tests or taking temperature?

THE PRESIDENT: Testing on the plane. Getting on the planes.

Q Temperature checks, sir, or virus tests?

THE PRESIDENT: It’ll be both.

Q And, Governor DeSantis, you did face quite a bit of criticism for not closing your state as soon as some did. There was a lot of —

GOVERNOR DESANTIS: Yeah, and look at — what have the results been? You look at some of the most draconian orders that have been issued in some of these states and compare Florida in terms of our hospitalizations per 100,000, in terms of our fatalities per 100,000.

I mean, you go from D.C., Maryland, New Jersey, New York, Connecticut, Massachusetts, Michigan, Indiana, Ohio, Illinois — you name it — Florida has done better. And I’m not criticizing those states, but everyone in the media was saying Florida was going to be like New York or Italy, and that has not happened because we understood we have a big diverse state. We understood the outbreak was not uniform throughout the state. And we had a tailored and measured approach that not only helped our numbers be way below what anyone predicted, but also did less damage to our state going forward.

I had construction going on — the road projects. But we did it in a safe way, and we did it, I think, in a way that is probably more sustainable over the long term.

So I think people could go back and look at all the criticism and then look now, and nobody predicted that Florida would — we have challenges. This is not an easy situation. We’ve had people in the hospital, but I’m now in a situation where I have less than 500 people, at a state of 22 million, on ventilators as of last night. And I have 6,500 ventilators that are sitting idle, unused through the state of Florida.

Q So my question — my question is, I mean, you faced that criticism, you have these numbers that you’re sharing. Are you concerned at all about another outbreak coming this summer or this fall and not being ready for it?

GOVERNOR DESANTIS: So, of course. That’s why the whole thing we’re doing is — this is a novel virus. It’s unpredictable. But we’re in a situation now where we have so many more tools to be able to detect.

And one of the things that I was talking to Dr. Birx about: Our Florida Department of Health — we have a fully integrated health system with the counties — we have been doing contact tracing from the very beginning.

Now, sure, once the outbreak gets to a certain point, the mitigation is really what you do. The contact tracing is not going to be able to stop, like what was going on in New York City. But in Florida, we had such an uneven outbreak, and we were doing contact tracing throughout this whole time in parts of the state that the outbreak wasn’t as severe. They limited the spread and did it very effectively. And so that’s going to be a huge part of what we’re doing going forward. And we think that — we think that that can be successful.

And we’re going to have so many opportunities with sentinel surveillance. We’re offensive with the nursing homes. Nothing is going to change on the nursing home testing. This is — until this virus goes away, this is the population that is most at risk. In Florida, we have — close to 85 percent of the fatalities have been age 65 or older. And most of them have some comorbidities. And so these are types of facilities that are the most at risk, so nothing is going to change on that.

We’re going to continue protecting elderly. And we messaged that very early, about the risk, about how they should stay home. I wasn’t going to arrest an elderly if they, you know, left their house. But we told them, limit contacts because you’re more at risk, and they listened.

That’s why you go to a place like The Villages — there were articles written saying, “Oh, The Villages is going to crash and burn,” and all this other stuff. They have like a 2 percent — 2.5 percent infection rate. We tested 1,200 asymptomatic, and none were — none were found to have the virus. And so this is — this message of understanding the risks are different for different parts of our communities and age and health, and continue doing —

So I think what you’ll see is, however we move forward — and I’ll announce that soon — you’re going to see even more attention paid to the vulnerable. And I think that that’s what we need to be doing.

THE PRESIDENT: And, you know, Ron — Ron said one thing that was very interesting: You talk about ventilators. And ventilators were going to be a disaster in Florida. A disaster. “There’s not enough.” And we sent them thousands of ventilators.

But in the meantime, you have thousands of ventilators that aren’t used, and we’ll be able to send them probably to other countries. You’ll build up your stockpile, but we’ll be able — because other countries: Italy, France, numerous — Spain is very much — we’re sending to Sprain. I spoke today to Nigeria. They want — they’ll do anything for ventilators. We’re going to send at least 200 ventilators to Nigeria; probably more than that.

So — but ventilators was going to be a big problem, and now we have really — I mean, through an incredible amount of work by the federal government, we have a big, big beautiful overcapacity.

And it’s the same thing with testing. The only problem is the press doesn’t give credit for that because, you know, no matter what test you do, they’ll say, “Oh, you should have done this. You should have tested 325 million people 37 times.” No, the testing is going very well.

But this is a good example of a partnership between the federal government and a state government. Ron has been great. And some of your friends, some of the other governors, have done a good job. And some haven’t done a very good job, I’ll be honest with you. Some have not.

GOVERNOR DESANTIS: But one of the things, I think — you know, Jared — he had a team of going about — like, figuring out where the ventilators would be needed. So when everyone was talking about 40,000 ventilators in New York, I’m in contact with Jared about Florida, about New York. And he was saying, “Whoa, they’re not going to need that.” And I was like, “Look, I actually — I agree with your numbers. I don’t think we need any ventilators in Florida right now. Maybe things will change.”

So they were ready at a moment’s notice to get the ventilators wherever they need. We never got — I think we may have just gotten 100 at the beginning from FEMA, but we never got like an emergency shipment because we didn’t need it. But they were absolutely ready, willing, and able to do that once the data suggested they needed to.

THE PRESIDENT: They were on call. A lot of people expected it. When we read reports from the papers, I’d call Ron and say, “Ron, I think we’re going to need maybe thousands,” based on what some phony news organization was saying. And more and more — you know, number one, it was well handled. But we were ready to move, and we still are. We have more than 10,000. Jared, what do we have? Ten thousand? More than 10,000 in the stockpile.

MR. KUSHNER: More than 10,000. And it’s growing every day. We’re getting a lot more in than we’re sending out.

THE PRESIDENT: And what we’ll be able to do is help other countries, which is a good thing. Not only allies; countries that need help. We’re talking about a lot of countries that need help.

Jennifer?

Q Mr. President, on the food supply chain —

THE PRESIDENT: Yeah.

Q — is there anything your administration is doing or might be doing in the future to make sure that there is enough meat supplies? And should we —

THE PRESIDENT: Yeah, we’re working with Tyson.

Q Should we ban exports of pork to other countries?

THE PRESIDENT: We are. We’re going to sign an executive order today, I believe, and that’ll solve any liability problems where they had certain liability problems, and we’ll be in very good shape. We’re working with Tyson, which is one of the big companies in that world. And we always work with the farmers. There’s plenty of supply. There’s plenty of — as you know, there’s plenty of supply. It’s distribution, and we will probably have that today solved. It was a very unique circumstance because of liability.

Yeah, Jon.

Q Mr. President, can you clarify what your intelligence advisors were telling you back in January and February? Were you warned about what was happening with coronavirus and the threat to this country? Should there have been stronger warnings?

THE PRESIDENT: Well, no. I think —

Q What were you hearing every day in your —

THE PRESIDENT: Yeah, yeah. Well, I think probably a lot more to the Democrats, because a month later, Nancy Pelosi was saying, “Let’s dance in the streets of Chinatown.” You go back and you take a look at — even professionals, like Anthony, were saying this is no problem. This is late in February: “This is no problem. This is going to blow — this is going to blow over.” And they’re professionals, and they’re good professionals.

Most people thought this was going to blow over. And if you can go — we did, I think, on January — toward the end of January, we did a ban with China. That was a very — I think you just said, a little while ago, that was a very important step. And then ultimately, we did a ban on Europe. That was very early in the process.

Because if you take the ban and you look at it, I was badly criticized by Sleepy Joe Biden, by others. I was criticized horribly for — I mean, he called — he said all sorts of things. We won’t even say it. And then he apologized because — two weeks ago, he put out a statement that I was right. We did a ban —

Q So you were —

THE PRESIDENT: Jon, as you know, we did a ban. And many people — Democrats, professionals, probably Republicans — said that this would never happen, there’d be nothing; no big problem. You saw that, I think, better than anybody, Deborah. This was after the ban. So, obviously, I took it very serious. I’m not going be banning China from coming in if I didn’t take it seriously. And I did that early.

Q But — so were you getting warnings in your presidential daily brief about —

THE PRESIDENT: Well, I’d have to check. I would have to check. I want to look as to the exact dates of warnings.

But I can tell you this: When I did the ban on China, almost everybody was against me, including Republicans. They thought it was far too harsh, that it wasn’t necessary. Professionals, Republicans, and Democrats — almost everybody disagreed. And that was done very early. And that was a big state- — because I think we saved — whether it was luck, talent, or something else, we saved many thousands of lives. And Anthony said that, and you were saying that, and a lot of people said it. It was a very — I think you’d have a much different situation right now if we didn’t do the ban.

Q On that, you know, 40- —

THE PRESIDENT: We also did a ban, as you know, earlier. We did a ban on Europe sometime after, but still relatively early.

Q Now, after the ban on travel from China, 40,000 people came into the United States. Those were American citizens largely. In hindsight, looking back, should there have been steps made to quarantine those people that were coming back or to test them? Or —

GOVERNOR DESANTIS: Well, there were. We — in Florida, we had hundreds of people that were under investigation by our health department. There were — they were asked to quarantine for 14 days anyone that was coming back from China. The Wuhan area in Hubei province, they were having to self-isolate before they could even get to Florida, because that’s what you guys did.

THE PRESIDENT: Right.

GOVERNOR DESANTIS: But we had all — hundreds of people under investigation during this time. And actually, none of them ended up testing positive, the ones that developed symptoms. I don’t think — a lot of them didn’t develop symptoms. But that was actually being done in Florida, and we were very much viewing it as a China — a China deal, of course. I think it was, you know — New York eventually brought it to Florida. But that was being done in the state level.

THE PRESIDENT: And the people we let back, Jon, as you know, they were American citizens. What are you going to do? “You can’t come back into your country”? You know, we had — it wasn’t like we were thrilled either. I said, “Well, we have these people coming back, all American citizens,” meaning just about all American citizens. There’s not much you can do about that.

Now, we did do testing and individual —

Q In hindsight, would you have —

THE PRESIDENT: Well, in hindsight, the states did testing. I know Ron was doing a lot of testing, and the individuals states were doing in cooperation with the federal government. But originally, it was, “Oh, 40,000 people came in.” What they don’t say — what the news doesn’t say is they happen to be American citizens. How do you keep American citizens — you say they’re coming in from China, they want to come back to their country. There is a tremendous problem in China; they want to come back. Are we supposed to say to an American citizen, “You can’t come back into your country”? And we did do testing, and individual states did testing or were supposed to have.

Yeah, anybody else? Yes.

Q (Inaudible) more details on the executive order regarding the meat supply. So it seems like the issue right now is that with the processing plants closed down, there are all these animals but they can’t be processed into meat to hit American supermarket shelves.

THE PRESIDENT: Yeah. We’re handling it. Probably today we’ll have that — that — it’s a roadblock. It’s sort of a legal roadblock more than anything else. We’ll have that done today. You can speak to the chief in a little if you’d like. Okay? They’ll give you a specific. I don’t know if you’d like that because there won’t be any cameras running, but if you’d like to get a real answer, you can speak to the chief.

Q And also, JetBlue today was the first airline to mandate that passengers wear masks on planes. Is that something that you are considering rolling out for all flights?

THE PRESIDENT: Who did? Who did?

Q JetBlue.

THE PRESIDENT: Yeah. It sounds like a good idea. To me, it sounds like a very good idea.

Q Governor, you have hundreds of thousands of tourists and visitors coming from Canada each year, spending months in your state.

GOVERNOR DESANTIS: Not right now we don’t, but normally we do.

Q No, exactly. Have you been able to evaluate how much your — the economy of your state is losing from the borders being closed? And when do you think — what’s your feeling about things going back to something normal as for the visitors coming from Canada?

GOVERNOR DESANTIS: So I think that a lot of this is confidence and building confidence with the public that the next step is going to be done thoughtfully, it’s going to be done in a measured way, and it’s going to be done with an eye to making sure that we’re not pretending that this virus just doesn’t exist. I mean, we — we have to make safety a priority.

I will say, though, that I do think there is a path to do that. If you look at Florida’s outbreak, just think of all the people that were in Florida — January, February, all — I mean, Disney was going all the way to mid-March.

We didn’t have outbreaks tied to a lot of that stuff for whatever reason. Maybe it’s because most of our activities are outdoors and I think it’s probably not as an efficient vector when you’re outside in the sun, as compared to close contact indoors. But — and all these different people in these industries, part of my task force — and this is not going to happen overnight — but they’re all thinking about innovative ways to be able to do — do different things and do it safely.

And we’ve seen that even on the basic level of — if you go to — like, drive by Home Depot now, they’ll be six feet apart, waiting to go in the store, and then they’re doing it. So people are adapting and they’re innovating. So I think that that will happen. I don’t think it’s going to happen overnight. I think we’re going to have to be measured and thoughtful, but I think that as people see that — that different things can happen safely — I think the confidence factor will go up.

But clearly, financially, it’s — it’s an issue for Florida because any time people come, they end up paying tax on that. I mean, you look at just the theme parks and the amount of — of the tax that they contribute to the state. Now, fortunately, we had billions of dollars in reserve, but even with that, you are facing a hit. There is just no doubt about it.

THE PRESIDENT: I think the fourth quarter is going to be really strong, and I think next year is going to be a tremendous year. That’s what’s building. That’s my opinion. Third quarter is a transition quarter. Second quarter is what it is, but the — I mean, we’re — we’re in this period where let’s see what the numbers are. Third quarter is transition. I think fourth quarter is going to be incredibly strong. I think next year is going to be an unbelievably strong year.

Kevin and Larry, would you like to say something about that?

MR. HASSETT: Why don’t you start with the CBO numbers?

MR. KUDLOW: Yeah, I mean, I’ll just say — look, we know we’re in a deep contraction with rising unemployment. It’s a lot of hardships, a lot of difficulty. The President’s rescue package, which really totals $9 trillion between the Treasury and the Fed, has helped to cushion that blow. So that’s point number one. We’ll take the hit. It’s very bad, very difficult. We’re doing what we can.

As the Governor said, as confidence returns, with safety features and data-driven, people are anxious to go back to work. And it’s interesting to me, the Congressional Budget Office, as well as Wall Street Journal’s survey of economists, both predicting very significant pick-ups in growth in the second half of the year — almost 20 percent growth increases. So that’s a good sign.

And the President has commissioned us to study middle-class tax relief, middle-class regulatory relief, infrastructure developments, insurance liability protections for small businesses. And again, middle class — I think people are anxious to go to work. There’s going to be a lot of pent-up demand.

And so, I am optimistic about the future. This current situation — as my great friend and colleague, Kevin, has said — right in here, it is going to be the worst we’ve seen probably. But nonetheless, that will be temporary. I believe it passes. And that’s what some of these surveys are telling us.

THE PRESIDENT: And, Larry, I wanted a payroll tax cut.

MR. KUDLOW: Yes, you did.

THE PRESIDENT: I thought that would’ve been the best thing, but the Democrats did not want to give it to us, so we went a different way, which is fine. But I wanted a payroll tax cut, so we’ll —

MR. KUDLOW: Both of — both of us — both of us agreed with you, as I recall.

THE PRESIDENT: Yeah, no, I think they should’ve done a payroll tax cut. The Democrats did not want a payroll tax cut and I think that’s a mistake.

Q Mr. President, Congress comes back next week. Let me try to ferret out the elephant in the room here, potentially, if there is an elephant in the room: What about the idea of aid to states? And, Governor, what do you think of this idea from Capitol Hill and Washington sending money to individual states who may be suffering severely through lost revenues and picking up a lot of the tab here?

THE PRESIDENT: I think there’s a big difference with a state that lost money because of COVID and a state that’s been run very badly for 25 years. There’s a big difference, in my opinion. And, you know, we’d have to talk about things like payroll tax cuts. We’d have to talk about things like sanctuary cities, as an example.

I think sanctuary cities are something — it has to be brought up, where people that are criminals are protected — they’re protected from prosecution. I think that has to be done. I think it’s one of the problems that the states have. I don’t even think they know they have a problem, but they have a big problem with it — the sanctuary city situation. We’d have to talk about a lot of different things. But we’re certainly open to talking, but it would really have to be COVID-related, not related for mismanagement over a long time — over a long period of time.

Q And you’re willing to make that distinction — that much of a distinction?

THE PRESIDENT: Well, it’s a very —

Q I can only imagine what some governors would say.

THE PRESIDENT: — very simple distinction to make. Yeah. We’re not looking to do a bailout for a state that’s been — it’s unfair to — it’s unfair to many of the states, most of the states that have done such a good job. Okay?

Anything else? Thank you very much.

Q Do you have any message —

THE PRESIDENT: Go ahead, Jeff.

Q Just to follow up with something that you mentioned yesterday, sir, in the last —

THE PRESIDENT: Say it?

Q A follow-up to a question from yesterday.

THE PRESIDENT: Yeah.

Q You spoke about having a sense of what’s going on with Kim Jong Un. Can you say whether or not he’s in control of his country?

THE PRESIDENT: I just don’t want to comment on it, okay? I don’t want to comment on it. I just wish him well. I don’t want to comment on it.

Q I just want to ask you: I’m sure you saw that Congress was supposed to come back next week. Steny Hoyer has just announced that the House will not come back, given that D.C. has a stay- — still has a stay-at-home order. Is that a good move, a wise move, or a bad move? What — what do you make of that?

THE PRESIDENT: The Democrats, they don’t want to come back. They don’t want to come back. I think they should be back here, but they don’t. They’re enjoying their vacation and they shouldn’t be. This is a time —

Q You think they’re enjoying their vacation?

THE PRESIDENT: Yeah, I think they are. I think they are.

Q You think this is a vacation?

THE PRESIDENT: If you look at Nancy Pelosi eating ice cream on late-night television — yeah, I think they probably are. They’re having a good time. I think they should be back. I think they should all come back and we should work on this together.

Thank you very much, everybody.

U.S. Department of State. 04/29/2020. Secretary Michael R. Pompeo With Steve Doocy, Ainsley Earhardt, and Brian Kilmeade of Fox and Friends. Michael R. Pompeo, Secretary of State

QUESTION: They’re telling us to mind our own business; that’s what China is telling us. Let’s bring in Mike Pompeo, Secretary of State. Good morning to you.

SECRETARY POMPEO: Ainsley, it’s great to be with you this morning.

QUESTION: Can you believe that? They’re telling us to mind our own business, that we’re lying through our teeth. Meanwhile we have almost 60,000 people dead, so many people out of work, and they’re telling us to mind our own business. How are we going to – how are we going to fire back? What are we going to do to hold them accountable?

SECRETARY POMPEO: So Ainsley, this very much is our own business. I was talking with some friends back in Kansas – I’m sure Steve knows some of them – they’ve been impacted by this in ways that are going to fundamentally change their lives over the course of the next several months. They’re trying to figure their way out of this. What the Chinese Communist Party did here, in not preventing the spread of this around the world, they are responsible for. America needs to hold them accountable. I’ve been heartened to see Australia, other countries joining this, demanding an investigation, because while we know this started in Wuhan, China, we don’t yet know from where it started.

And in spite of our best efforts to get experts on the ground, they continue to try and hide and obfuscate. That’s wrong, it continues to pose a threat to the world, and we all need to get to the bottom of what actually happened here, not only for the current instant but to make sure something like this doesn’t happen again. There are still many labs operating inside of China today, and the world needs to know that we’re not going to see a repeat of this in the days and weeks and months ahead.

QUESTION: Well, if it did come from the wet markets it will come again because they are back. I’ve seen the video. You know more than I’ll ever know. They are back, so they haven’t learned their lesson. Either that or it came from the Wuhan laboratory and they’re lying again. Here’s what China said when the criticism starts coming out of America where we are to them: “We advise American politicians to reflect on their own problems and try their best to control the epidemic as soon as possible, instead of continuing to play tricks to deflect blame.” Can you read between the lines for us?

SECRETARY POMPEO: Yeah, they know that this happened in their country. This is classic communist disinformation. This is what communists do. The Chinese people were harmed by this too. The Chinese Communist Party – we know there were journalists that were kicked out. We know that there were doctors that tried to tell this story, and instead they were pushed aside, covered up, taken out of the news. Those are the kind of things that communist institutions do. We all know them from the Soviet days. We know the kinds of things that communist parties do to try and manage information inside of their own country and around the world.

And so we see these efforts – I saw a foreign ministry official this morning on TV trying to change this narrative. We know that this virus started in Wuhan, China. We now have – the Chinese Communist party now has a responsibility to tell the world how this pandemic got out of China and all across the world, causing such global economic devastation.

QUESTION: Yeah, I mean, if we would have known earlier, things could be a lot different. There’s a story in the New York Post that apparently Dr. Fauci’s National Institute of Allergy and Infectious Diseases shelled out a total of $7.4 million to the Wuhan Institute of Virology lab, which has become the center of theories about the origin of COVID. And also, Mr. Secretary, I understand that apparently Democratic senators have written a letter to you – they want to see some cables, any or all cables that the State Department might have regarding this as well. What can you tell us about what’s going on behind the scenes at that federal level?

SECRETARY POMPEO: So I can’t – I don’t know the details of the NIH grants. I do know a bit about the cables. We’ll do our best to respond to those two senators. Look, the United States, for a long time and continuing today, tries to help countries around the world who are conducting research on highly contagious pathogens. We do this not only in China, but we try to bring our expertise from our National Institutes of Health, from our CDC, to precisely prevent something like this. That’s the reason that we spend American taxpayer dollars is to protect American people from labs that aren’t up to standard. I can tell you there are – were real concerns about the labs inside of China, and I have to say I’m still concerned that the Chinese Communist Party is not telling us about all of what’s taking place in all of the labs, in fact each of the labs, all across China today.

QUESTION: Yeah, pretty scary. What’s happening in North Korea? What’s the latest there? Any sightings of Kim Jong-un?

SECRETARY POMPEO: Ainsley, not much to add to what the President said yesterday. We haven’t seen him. We don’t have any information to report today. We’re watching it closely, keeping track of what’s going on, not only around Chairman Kim himself but more broadly inside of North Korea. They also have the risk of COVID there and there is a real risk that there will be a famine, a food shortage inside of North Korea too. We’re watching each of those things closely, as they have a real impact on our mission set, which is to ultimately denuclearize North Korea.

QUESTION: And your administration knows better than any other administration in the past or present what these people are like face to face, because you know your counterparts better, because you’ve had all these meetings since then. But let’s move over to Iran. Iran’s flat on its back, right, economically with the coronavirus, the humiliation of having Soleimani killed, and then shooting down a passenger jet, but yet you say they’re still up to their unsavory acts. They shot a satellite into sky they say is so terrible it’s just a – basically a – it’s a traveling webcam up there, so the embarrassment of that. But you say they’re still up to some – up to no good. In what way?

SECRETARY POMPEO: They’re trying to put disinformation out as well, Brian. They’re telling the world that they’re broke and they need relief from American sanctions, they need humanitarian assistance. But we’ve offered humanitarian assistance, and the ayatollah and the kleptocrats, the theocrats that lead the Iranian regime today are still out spending money on things that don’t benefit the Iranian people, things like the military missile launch in violation of UN Security Council Resolution 2231, and they’re continuing to fund Lebanese Hizballah and the Iraqi Shia, all the things that take money out of the mouths of the people inside of Iran.

So no one should be fooled about this regime. If they truly cared about their people, they’d behave in a way that is fundamentally different. It’s what we’ve been trying to get them to do for our three years in office, and I’m convinced we’re on the right path to deny them their resources – the regime the resources to threaten America. That’s been President Trump’s goal, to deny them a nuclear weapon. We’re determined to do that.

QUESTION: All right. Mr. Secretary, the United States has really mobilized in producing masks and ventilators as well as figuring out the testing situation. The President has made it very clear that he’s talked to other countries about how we did it, but at the same time other countries reached out to the United States and said, “Hey, if you’ve got some spare ventilators, we can use them over here.” Obviously some countries are downplaying the impact of COVID in their nations, but who is reaching out for help to the United States?

SECRETARY POMPEO: Steve, a lot of countries are asking us for assistance and a lot of countries have received assistance. We’ve, of course, done the right thing. We’ve made sure we had the resources for our own people, but as the American greatness – as American power and American commercial prosperity continues to grow, we’re building out – we’re getting not only ventilators but all of the equipment that the world will need. The United States will be an enormous force for good in countries in South America, in countries in Africa, all across the world, helping them solve this problem for themselves, which in turn, if we get it right – we can reduce the risk of COVID in their countries – will reduce the risk that it comes back to our country either this fall or again next year.

QUESTION: Yeah, which countries that experienced this before our country did – which ones are you watching to see how they reopen their businesses and they get back to work?

SECRETARY POMPEO: We’re watching a number of countries. We’re watching how Singapore handles it, although they’ve had a resurgence in cases in their country as well. South Korea, too, had some success at the front end and now they’re trying to maintain that. We’re watching each of them to see how not only they’re doing it inside of their own country, but these are countries that often buy products from American companies – we want to make sure that they get their markets back open, and that American products and American jobs return here in our country as well.

QUESTION: For the longest time, the State Department would dance on the edges of what – should we be tight with China, not tight with China? They make things so cheap and they make things also that are cheap, and a lot of times they break and – ineffective. But for the first time in all of our lifetime, the world has been poisoned by this country, and there’s only one way to point – is to China. As Secretary of State, do you have a unique opportunity to unite the world and open up their eyes to the type of regime this is, and is there a plan in place with the nine months or four and a half years you have left to neutralize this superpower?

SECRETARY POMPEO: Brian, you’ve hit it square on the head. I think President Trump said it clearly himself as well. The threat, the risk, the danger, and now the harm that the Chinese Communist Party has imposed not only on the United States but all around the world. We not only have an opportunity, we have an obligation to get this right, to unite the freedom-loving nations, likeminded countries around the world, to make sure that it is not a communist regime that controls our infrastructure. We’ve talked about this with you all with Huawei, our telecommunications infrastructure. We know what this needs to look like and the United States has an obligation to get this right. We’ll do this to make sure that we keep the American people safe and get our economy back on its feet, and continue to make America the most prosperous, wonderful, great nation in the history of civilization.

QUESTION: Mr. Secretary, I think before this COVID crisis struck, I think the conventional wisdom was that the President was going to be able to broker a trade deal with China maybe just five minutes before the election, or whatever. It would just be one of those things that he would be able to say, look, I was able to do a deal with China. Right now, the politics are very complicated, and given the fact that China has done what they have done, not being forthcoming with this epidemic, it probably doesn’t look too good for a deal, does it?

SECRETARY POMPEO: So, Steve, look, we’ve got – this is the conundrum. We’ve got the phase one trade deal. China continues to make promises and says they’ll live up to it. I hope that they do. We have every expectation today that they will. It’s certainly what they had agreed to. But we’ve watched China now break repeated promises. They say they’re transparent, they say they want to be open, they say they want to join the community of nations, and then we watched them in this crisis behave in ways that are just the opposite of that. I hope we can find a way to have commercial relationships with them where it makes sense for America and American businesses, but President Trump has, from the beginning, said we need fair and reciprocal trade with China, and that’s what he’s going to continue to demand.

QUESTION: Mr. Secretary, thanks for joining us this morning.

SECRETARY POMPEO: Ainsley, thank you, ma’am.

U.S. Department of State. 04/29/2020. Opening Remarks at the Global Cooperation and Training Framework Group

Robert A. Destro, Assistant SecretaryBureau of Democracy, Human Rights, and Labor

Virtual Global Cooperation and Training Framework Workshop on Countering COVID-19 Disinformation

Minister Tang, Deputy Minister Hsu, Representative Izumi, and distinguished guests. Ni Hao (hello). I would also like to recognize the Global Engagement Center Principal Deputy Coordinator Daniel Kimmage and AIT Director Brent Christensen.

I am speaking to you tonight from my home in Arlington, Virginia. On behalf of the U.S. Government and the Department of State, I am honored to open the virtual Global Cooperation and Training Framework workshop on countering COVID-19 disinformation. I only wish I could be in Taipei with my Taiwan friends to congratulate you in person for the spectacular work you are doing fighting COVID-19 and the disinformation that is spreading like the disease itself.

It is no secret that Taiwan is leading the Indo-Pacific region in its handling of COVID-19. You are serving as an inspiration for the world, and we are grateful for your leadership. All of us are learning from the Taiwan Model – a fact that underscores that democracies have the clear upper hand over authoritarian regimes when it comes to fighting this virus.

The lessons from Taiwan’s success in keeping COVID-19 transmissions and deaths to a minimum are pretty clear. We have learned that transparency matters. We have learned that access to accurate information matters. We have learned that government accountability matters. We have learned that the truth matters. And, most importantly, we have learned that access to the truth makes it possible for us to defend ourselves, our families, our economies, and our communities.

Not surprisingly, these truths about human nature contrast deeply with the approach taken by the People’s Republic of China and other authoritarian governments in responding to COVID-19. While the PRC restricted the flow of news and information, silencing those who attempted to share life-saving data and facts, and resorting to outright lies and ongoing coverups, Taiwan was holding daily press conferences to give its people the most up-to-date information on the virus. I understand your health minister, Shih-Chung Chen, has become something of a rock star in Taiwan for those bravura performances that demonstrated true government accountability. Good for you! We are grateful for your leadership.

The contrast with the PRC’s actions could not be more profound. PRC officials have been actively engaged in a disinformation campaign designed to sow confusion about the origins and impact of COVID-19 in China. We in the United States have been the target of some of this disinformation. Taiwan too has been a target, and I have no doubt that those attacks have felt all too familiar given the PRC’s long history of disinformation campaigns, especially during your elections.

Over the years, Taiwan has developed an impressive array of methods to combat disinformation coming from across the Taiwan Strait. It has deployed a variety of rapid-response mechanisms, ranging from fact-checking to effective crisis communications, as Health Minister Chen has done so ably. Perhaps most importantly, Taiwan has a longstanding and very successful record of helping its own people to recognize and fight back against disinformation. This includes robust media literacy which I know you now incorporate into your public-school curriculum. I am impressed with how you fought PRC disinformation while holding successful elections earlier this year. Later this morning we will learn just how this toolkit can be deployed effectively, not only here in Taiwan but around the world.

If the rest of the world would follow the Taiwan Model — including the transparency and timely communications needed to fight disinformation — all of us would be better positioned in the fight against the COVID-19 pandemic, which is by no means over, and to work together to repair the damage to our communities and businesses.

I would like to close by thanking the Taiwan government and the American Institute in Taiwan for putting this critically important workshop together. By exchanging ideas and working together, we can demonstrate to the world what we have always known and practiced: that transparency and democracy are key to creating lasting solutions that will ensure we are properly prepared to face the next global health crisis. And I look forward to working further with Taiwan through our U.S.-Taiwan Consultations on Democratic Governance in the Indo-Pacific Region. Through these consultations we can together show the world the significant benefits of an inclusive and accountable approach to governance.

Thank you. Have a great day. Next time, I hope to see you in Taiwan!

_________________

ORGANISMS

CORONAVIRUS

IMF. 04/29/2020. COVID-19 PANDEMIC AND THE CARIBBEAN: NAVIGATING UNCHARTED WATERS

- Krishna Srinivasan, currently a Deputy Director in the IMF's Western Hemisphere Department.

- Sònia Muñoz, Division Chief of Caribbean I Division and mission chief of the regional consultation for the Eastern Caribbean Currency Union at the IMF's Western Hemisphere Department

- Varapat Chensavasdijai, Deputy Division Chief of Caribbean I Division in the IMF’s Western Hemisphere Department and mission chief for Trinidad and Tobago.

As the COVID-19 pandemic continues to spread across the globe—bringing severe human and economic costs—the Caribbean is no exception. With over 1,000 confirmed cases, many countries have taken strong containment measures, such as border closures and lockdowns, to “flatten the curve”.

But the “sudden stop” in tourism is sharply slowing economic activity in the Caribbean, and growth in the region is projected to contract by 6.2 percent in 2020. This would be the deepest recession in more than half a century.

There are also possible spillovers to the financial system. For instance, lost output from firms and the high fiscal costs associated with managing local outbreaks— given deficiencies in the region’s public health systems—can potentially worsen the pandemic’s financial impact.

Further, the upcoming hurricane season poses additional risks to these already budget-strapped economies. To sustain the economy during the crisis and contribute to a faster recovery, countries will need to allocate resources to vulnerable groups affected by the pandemic.

Collapse of tourism

The Caribbean economies are being hit hard by the collapse of the tourism sector, which accounts for 50 to 90 percent of GDP and employment in some countries.