US ECONOMICS

WESTERN HEMISPHERE

U.S. Department of State. 01/08/2020. Senior State Department Official On State Department 2019 Successes in the Western Hemisphere Region. Washington, D.C. Press Correspondents’ Room

MODERATOR: So this is connected to sort of a series of bureau retrospectives on 2019, looking forward to 2020. So of course you all have talked to before, and he’s going to start with a statement and then take some of your questions. This is all on background, attribution to a senior State Department official.

Sir, whenever you’re ready, go ahead.

SENIOR STATE DEPARTMENT OFFICIAL: Okay, good. Well, happy – again, Happy New Year to all and good afternoon. A pleasure to be here today and talk about the Western Hemisphere Bureau and to discuss what is a region, I think, increasingly of critical importance to the administration.

And 2019 was a historic period of cooperation throughout the Western Hemisphere.

Just some of the accomplishments: The U.S., Mexico, and Canada signed the USMCA. This treaty achieved the administration’s key goals of modernizing and rebalancing the North American trade agreement. Once in force, the Agreement will result in more balanced, reciprocal trade with Mexico and Canada. It will support high-paying jobs for Americans. It will grow the North American economy and it will ensure our region remains the world’s economic powerhouse.

We also in the region saw a major success for democracy in Bolivia. Then President Morales ignored the will of his people expressed in a referendum and had his Supreme Court declare the constitutional term limits unconstitutional. This is always interesting to me how people can do that. He had – he’d – in order to win in the first round, he had to win by at least 10 percent in the elections. When he failed to do that, he tried to alter the vote count and got caught at it. Popular protests forced his resignation and his own party is now working with the interim government to organize new elections that are scheduled for May 3rd. So we’re seeing Bolivia get back on the democratic path.

VENEZUELA. On September 23rd, the U.S. joined 15 countries to invoke the Rio Treaty for collective action against the undemocratic actions of the Maduro dictatorship. This was the first time the Rio Treaty had been used since 9/11, since 2000, and it was the first time since the 1960s that it had been used to deal with a circumstance in the hemisphere. And this for us is a big deal. The Rio Treaty was designed to be the sort of Chapter 7 authority of the Inter-American system, and when you don’t use it for 50 or 60 years it means you’ve taken a powerful tool off the table. And so we’re pleased to see that it’s back and able to be used in the – as part of the Inter-American system.

We’re also pleased to see the voices of the Venezuelan people continue to be highlighted by the democratically-elected National Assembly. Just a few days ago it reelected President Guaido, overcoming the regime’s desperate efforts to buy off votes, physically bar Deputies from entering the premises of the National Assembly, and other measures.

Maduro remains in power only because of the support he receives from Cuba and Russia. The United States will cut off Cuba’s remaining sources of revenue in response to its intervention in Venezuela. We’ve already eliminated visits to Cuba via passenger and recreational vehicles. We suspended U.S. air carriers’ authority to operate scheduled air service between the U.S. and all Cuban airports other than Havana. This will further restrict the Cuban regime from using resources to support its repression of the people of Cuba. Countries in the region have also taken action regarding the Cuban Government’s program which traffics thousands of Cuban doctors around the world in order to enrich the regime. Brazil insisted on paying the doctors directly at a fair wage. The Cuban regime in response withdrew the doctors from Brazil. Doctors have also now left Ecuador and Bolivia.

MEXICO. INMIGRATION. The U.S. has been faced with an uncontrolled mass migration, as we all have seen. During 2019 we negotiated the June 7 Joint Declaration with Mexico enlisting Mexican Government support in reducing the number of irregular migrants arriving at the U.S. southern border. This has reduced arrivals by 62 percent from four hundred and – 4,600 per day in May down to less than 1,500 per day in October. So really steep decline. The State Department also supported the creation and expansion of the Migrant Protection Protocols in Mexico with the Department of Homeland Security, and negotiated signing of Asylum Cooperation Agreements with Guatemala, Honduras, and El Salvador, along with other arrangements to bolster border security, combat migrant smuggling, promote information sharing, and expand H-2 visa access to the United States. This all promises to thwart human smugglers and to channel migration back into safe, orderly, and legal avenues.

As a result of aggressive counternarcotic efforts under President Trump and President Duque of Colombia, Colombia made early progress in rolling back a record-high coca cultivation and cocaine production levels. This – data has indicated the first decrease for the first time since 2012.

Our renewed engagement with Caribbean countries following President Trump’s meeting last March in – with the Bahamas, Haiti, St. Lucia, Jamaica and the Dominican Republic at Mar-a-Lago. We’ve established the U.S.-Caribbean Resilience Partnership through which 10 federal agencies share expertise and information to our Caribbean partners during natural disasters. We drew on this framework in response to Hurricane Dorian in the Bahamas last September.

And finally, the United States launched the Growth in the Americas, America Crece initiative, a partnership with Latin American and Caribbean countries to attract private sector investment to create high-quality and secure infrastructure of all types, including energy, airports, ports, roads, telecom, and digital networks. Building prosperity in the region is key to our interests in building a stable neighborhood with stable democratic partners.

And in 2020, we will continue to seek a secure, democratic, and prosperous hemisphere so all people can build a future in their own countries and communities.

So with that, I thank you, and would look forward to questions.

MODERATOR: Yeah. We’ll take some questions. Who’s first? Matt? Carol?

QUESTION: Is the State Department – is the United States anticipating any sort of response in Venezuela to what’s happened in the last couple days with blocking the opposition and Juan Guaido from entering the National Assembly? What kind of range of things might you be considering doing?

SENIOR STATE DEPARTMENT OFFICIAL: That we would do to Venezuela, or something that they —

QUESTION: No, the U.S. response.

SENIOR STATE DEPARTMENT OFFICIAL: Well, I think you’ve seen a steady increase in the pressure on the Maduro regime in response to a whole range of anti-democratic actions, the last couple days just being the latest of them. And so we – I mentioned in the intro the Rio Treaty invocation, that’s kicking in, which is multilateral travel restrictions so that it’s not just that the people who are behind these things don’t get to come to the United States; they’re now going to be banned from traveling to most of the big countries in the region. We’ve steadily increased, and I think you will see more sanctions on both individuals and institutions. We’ve been trying to cut off their sources of revenue with, I think, significant success.

So not – I wouldn’t say that we have something specifically linked to the events of the other day, although there are people who have engaged in corrupt activity that may have gotten themselves on the radar screen for the first time.

QUESTION: In the last couple days, they’ve done —

SENIOR STATE DEPARTMENT OFFICIAL: So I mean, when you see people taking money from people that are already under sanction in the United States for criminal activity. So – but I don’t want to make it sound like we only are going to be doing something in response to their efforts to block people entering the National Assembly building. That’s just – it’s part of a piece.

Our whole policy is designed – I mean, this is what’s been going on in Venezuela, is a year ago when I got back in this business, everybody was saying if you don’t get Maduro out in a month, the opposition will fall apart. Because that had been the history of the situation in Venezuela.

And Maduro works overtime to try to divide and split and conquer the opposition parties. And he’s tried everything in his playbook this last year. He tries to come up with a sort of mini negotiation, picks off a couple of the small parties, and says okay, we’ll have the little negotiation, and we – maybe we’ll give better prison conditions to some of your members if you agree with us on this and that. In the past, that kind of activity has resulted in big splits in the opposition. It didn’t. They’ve tried holding out the prospect of maybe having an opposition person on the electoral tribunal. The opposition people have said no, we want a genuinely free and fair election, not just a little piece of a bad election.

And so basically what’s been going on is Maduro has been trying every one of those tricks, and he’s been shut down on every one of them because of opposition unity. So I think that’s been the real news this year. So what you’re seeing now, we’re going to keep increasing the pressure. The opposition is increasing the pressure by remaining unified. And what we’re hoping is that people around him will look and conclude, say, look, he’s got no way out of this. He can’t get the sanctions lifted, he can’t get the opposition to fragment, he can’t get any – the only way out is a free and fair election organized by a transitional government that’s widely acceptable. That’s what we’re trying to drive his side to that conclusion. And in my view, the events of the last day show that we’re actually making a lot of progress on this. Because he was forced to, in the end, resort to just naked repression of trying to bar people from entering the building. And even that didn’t work, because they went and met elsewhere and carried out the election. So it’s real.

QUESTION: Just to be sure I understand, are you saying you are considering placing sanctions on some of the 15 deputies who voted against Guaido because they accepted bribes?

SENIOR STATE DEPARTMENT OFFICIAL: I want to say – no, we don’t put sanctions on people for the way they vote.

QUESTION: But if they accepted bribes?

SENIOR STATE DEPARTMENT OFFICIAL: The people who work with and – I think you’ve seen this in the past, with some of the people who’ve been sanctioned – that if you collaborate with, give aid and comfort to, aid and abet, and – or profit from the anti-democratic behavior of the regime, you could be subjected to sanctions. That doesn’t mean we’ll necessarily sanction anybody on that basis, but you are asking if something could happen, and the answer is yes, of course.

MODERATOR: Thanks. Shaun?

QUESTION: Can I follow up on your statement on Bolivia? You mentioned the May 3rd election that coming up.

SENIOR STATE DEPARTMENT OFFICIAL: Yeah.

QUESTION: How confident are you that it’s going to be free and fair? Are you concerned at all about either Morales personally or his allies playing some sort of role in that? And added to that, what’s your view on Mexico giving him asylum? Is that something that the United States has had discussions with Mexico on? Do you think that’s something you’re okay with? Is that something that – would you like him to be tried, as some of the current Bolivian authorities are seeking?

SENIOR STATE DEPARTMENT OFFICIAL: Well, I think we were – first, we were happy that he had a place to go so that he could go away and not further the strife inside the country. And that actually worked; it ended the strife. On the elections, his own party, the MAS party, has been working with the interim government to pass a new election law. I mean, I think it passed unanimously. So it’s – this is not a one party trying to impose a system on the other. It’s a genuine – I mean, the MAS party has, like, a two-thirds majority in the Assembly, so anything that gets done there is going to require their agreement, and so far so good. They’ve scheduled the elections now for May 2nd. We have a USAID team – I think they’re there now or – are they there today?

STAFF: Yeah – I think it’s May 3rd.

SENIOR STATE DEPARTMENT OFFICIAL: Okay. So they’re there to – precisely to work with the interim government on what do they need to do to get the election machinery back in good shape so that they can have a free and fair election with international observation and all. So we’re pretty confident that that is going to work.

What we are concerned about is when Morales, who’s now in Argentina, starts making threats of going and stirring up violence in the country, and, obviously, we don’t want to see that, and I don’t think the neighboring countries want to see it either. But I think it’s also telling. He claimed he was going to have a meeting in Buenos Aires to select the candidate for the MAS party to run in the new elections, and very few people showed up. And the leadership of the party back in Bolivia said publicly that the MAS nominee would be picked in Bolivia, not in Buenos Aires, which was kind of a – saying to him, “You don’t have the juice anymore,” that we’re going to – so that, to me, is a promising thing, is that the socialists – or Movement Towards Socialism party – is thinking ahead and thinking about the future. How do they name a good candidate and compete in the elections rather than trying to go back and deal with the legacy that he left by messing with the last election?

MODERATOR: Thank you.

SENIOR STATE DEPARTMENT OFFICIAL: So that’s why we feel pretty positive about the whole equation.

QUESTION: Sure.

MODERATOR: Next. Yeah, Lara.

QUESTION: This may be a very broadly addressed question, but at the end of last year, we saw all sorts of unrest in many different countries across the continent, and I – understanding completely that every country had its own specific situation, I’m just wondering if you think the moment has passed. Obviously, it has not in Venezuela, but that’s always been the issue there. Do you feel like things have kind of calmed down for the moment or do you feel like they are still brimming and we should be on high alert for another rash of unrest?

SENIOR STATE DEPARTMENT OFFICIAL: Again, I will quote you back to yourself. Yes, each country is different. And things are calmed down for the moment, I think, in most of the countries, but the – some of the issues are still there. Each government has been handling it differently.

The ones that I think have been successful have – like in Ecuador, they figured out – I mean, there the underlying issue was that they are faced with austerity measures because they’re trying to dig out of the hole that they were left by the previous government. And they put those on hold, they engaged with the groups that had actual concerns about those kinds of issues, not with the violent groups. So they did – I think they managed to effectively separate the people who had legitimate concerns about the price of gasoline and that kind of thing versus the ones who were just trying to create violence against the government. And they were able to reach some kind of an accord with them and go back and renegotiate with the international financial institutions. Now, that doesn’t mean they’re completely out of the woods. They’re still having to impose austerities because of the fiscal situation, but at least they’ve managed to, I think, work it politically and in an intelligent way.

You’ve seen in Colombia, the government also has done outreach to peaceful protestors. In Chile, they’re trying to do much the same. The issues and the dynamic and the groups involved are all different, but I think what is in common is that the – the successful way of dealing with these are: don’t give in to the violent protestors, but do listen seriously and try to negotiate with people who have legitimate grievances that they want to petition their government about. So we’ll see. I wouldn’t say that that – problem solved because the underlying problems are still there in each case, but the process that they’re using to deal with it seems to be working for the – at least for the time being.

QUESTION: Thanks.

MODERATOR: Michele.

QUESTION: Just to follow up on that news, to expand a little bit more on Chile and how they’re handling it. And then second of all, what’s your concern about Iran’s influence in the Western Hemisphere? Have you seen an uptick in that as —

SENIOR STATE DEPARTMENT OFFICIAL: Well, I mean, Chile, I think you can see what they’re doing as well as I can. They’re trying – I mean, one of the things that they agreed to do was make some changes in the constitution. I don’t think that the unrest was driven by sort of abstract unhappiness with the constitution, but you look and say, okay, this constitution was written by the Pinochet military dictatorship, so there was, I think, sort of an emotional reaction against it, and we’ll see if that bleeds off. But that wasn’t the underlying cause of the protests, so we’ll see how they do in dealing with those, but it does get at something that had bothered people for a while and they seem to have come to an accord on that.

On the Iranians, they continue to play around. I’m not sure I would say there’s been an uptick in there. I think it’s probably steady state would be my own assessment of how – they’re not constructive actors, though.

MODERATOR: Yeah, Rich.

QUESTION: Thanks. What’s your sense of – this might be more of a law enforcement question, but the trajectory of violence in Mexico – in a weird way, it almost seems as – after El Chapo’s extradition to the U.S. – that cartel violence got even worse there. It just —

SENIOR STATE DEPARTMENT OFFICIAL: Yeah.

QUESTION: Just your sense of the state of play and where things might be headed.

SENIOR STATE DEPARTMENT OFFICIAL: I’m not a law enforcement expert, but I sort of remember back when – D.C., in the ‘80s or something, when we had a lot of drug violence and so on, and part of that was due to having – the Federal Government having taken out the chief drug dealers. And then what happens is you get the – there are spoils to divide up and people start fighting with each other, and I think there’s some of that going on in Mexico. But the real problem is just the degree of influence and power and of ability to intimidate and corrupt people that the transnational criminal organizations have achieved there. And it’s really concerning. I mean, we have said that to our colleagues in Mexico and, obviously, they’re concerned about it too. I think you saw the attorney general was down there recently and is trying to work with Mexico, and is sort of the point person for us in what can we do to further downgrade – or degrade the abilities of the drug cartels to inflict this kind of damage on Mexico.

But the other half of it is Mexico needs to strengthen its own institutions, and I think they’re working on that. And obviously, we’ve been working with them now for a number of years. But there’s a – there’s not a direct equation, though, in my view, between success and – the metric isn’t lack of violence. You can have lack of violence because the cartels have completely taken over and have an agreement amongst themselves and now are running everything. So that would not be a success. But neither is mass blood shed a sign of – that you’re succeeding either.

So I mean, what we’re looking at is are we able to strengthen Mexican law enforcement institutions and so on so they can’t be corrupted and that they’re able to deal with these things in an effective and rights-respecting way. Are the cartels being degraded in terms of their power? Are their sources of revenue being cut off or diminished – because that’s where their power comes from is money. Are their leadership being broken up? Now, yeah, when you break them up, sometimes it sets off fights amongst their henchmen, but they’re not as effective in taking over and controlling territory or in being able to influence decisions by governmental authorities. So it’s a big mix.

But it is an issue of big concern. I mean, I don’t want to minimize that – the degree of presence and influence that those transnational criminal organizations have in Mexico is really concerning, and we’re just looking for any way we can to help the Mexicans bring it under control.

QUESTION: How’s the institution building going? What’s your assessment of that process?

SENIOR STATE DEPARTMENT OFFICIAL: They’ve passed good legislation on a lot of things over the last few years. They’ve created this new federal prosecutor’s office, but here again, you get the long-term, short-term thing. The old prosecutor’s office tended to – every time there was a change in – of the attorney general or a change in administrations, all of the investigators and everything would get removed and replaced, so you didn’t have continuity to follow cases.

This new system is supposed to address that, but it means you’re starting over again, so there’s a lag time there. They’ve also moved from a civil law type, paper-based system more to a accusatorial system, more akin to what we have. Again, I think our law enforcement people think in the end that’s going to be much more effective, but the transition between the two systems – there’s a learning curve for people and so on.

But the – you can look at it and see the Mexicans really have been trying on these things. But you have the problem of plata o plomo – that if you’re the chief of police in a small town and a drug dealer come to you and say, “Okay, you can retire in a year with $2 million, or I can kill you and your wife and children tomorrow.” Which is your choice going to be? That’s the kind of influence you want to cut off.

QUESTION: I’d go with plata.

QUESTION: You would – the plata?

MODERATOR: Matt?

QUESTION: I had a question.

QUESTION: Yeah. Well, first of all, it’s good to hear you – someone in this administration extol the virtues of the deep state like you did just then. (Inaudible.)

But secondly, it seems like every week or so, there’s a new rumor – or it’s rather the same rumor – because it circulates and it comes out of Havana that you guys are shutting down the embassy, that you’re going to break all relations – like, not even have an intersection, this kind of thing.

SENIOR STATE DEPARTMENT OFFICIAL: Yeah.

QUESTION: And the Cubans – several Cuban officials are promoting this idea.

SENIOR STATE DEPARTMENT OFFICIAL: Yeah, I know.

QUESTION: What the hell is going on? Is this – is there any contemplation of even further draw down of the already skeletal staff there?

SENIOR STATE DEPARTMENT OFFICIAL: Yeah, it’s pretty skeletal right now. I would just say – I mean, as I mentioned, as long as the Cubans keep doing what they’re doing, especially in Venezuela – I mean, we’ve had problems with what they do in Cuba forever, but they’re back – intervening in another country now. We’ve been pretty clear with them that the pressure on them is going to continue to rise. And we haven’t ruled in or out any specific – I mentioned some of the measures we’ve already taken; there will be more.

QUESTION: Right, I know. But yeah, but —

SENIOR STATE DEPARTMENT OFFICIAL: But —

QUESTION: — those are sanctions related. I’m talking about —

SENIOR STATE DEPARTMENT OFFICIAL: But I don’t know why they’ve seized – the question is why have they seized on this one particular possible —

QUESTION: But is their contemplation of breaking up all —

SENIOR STATE DEPARTMENT OFFICIAL: I’m just saying that I don’t know why the Cubans have – or promoting —

QUESTION: Okay. So there is a —

SENIOR STATE DEPARTMENT OFFICIAL: — I don’t think you’re hearing it from anybody here. You’re hearing it from the Cubans.

QUESTION: No. Every time I get it from our Havana group, I ask here and I’m told —

SENIOR STATE DEPARTMENT OFFICIAL: So maybe they should be careful – they should be careful what they wish for maybe, but —

QUESTION: Okay.

SENIOR STATE DEPARTMENT OFFICIAL: They’re – I gave up trying to explain them a long time ago. (Laughter.)

MODERATOR: All right. One last question. Jennifer?

QUESTION: Can you tell us where the administration’s position is on TPS for Venezuelans now that we’re coming up on year of this crisis there?

SENIOR STATE DEPARTMENT OFFICIAL: Yeah. I think the factual situation is that very few people are being sent back to Venezuela simply because it’s physically impossible. So the question of whether you need TPS doesn’t really arise. I mean, I think they’ve managed to send a few convicted criminals back, but it’s not – there are no direct flights or anything anymore, so it’s just not a – it’s not a big issue.

I know some people have really gotten into it as sort of a – this would signal how bad things are in Venezuela, but nobody’s being returned anyway, so it’s just not a – or very few.

QUESTION: And in the end, it’s a DHS call, right?

QUESTION: Yeah, but the State Department has a say in it.

MODERATOR: Okay.

QUESTION: Thank you.

QUESTION: Thanks.

SENIOR STATE DEPARTMENT OFFICIAL: Okay. Thank you. Again, Happy New Year.

QUESTION: Happy New Year.

VENEZUELA

U.S. Department of State. 01/09/2020. Free and Fair Presidential and Parliamentary Elections in Venezuela

A broadly acceptable, negotiated transitional government must be responsible for overseeing elections. Independent electoral authorities run and administer an election. In the Venezuelan context, this includes:

- A new, balanced, and independent National Electoral Commission (CNE) – selected through the National Assembly — as constitutionally mandated – must spearhead the electoral process. This CNE should be named by the National Assembly as soon as possible in accordance with the constitution, in order to allow sufficient time to prepare for elections.

- A newly constituted, fair and independent supreme court, the TSJ, is a critical safeguard to ensure the principles of justice and protect the integrity of the election and the sanctity of each vote.

Elections must be open to all parties and candidates. In the Venezuelan context, this includes:

- Reinstatement of all powers and authorities of the National Assembly – Venezuela’s legitimate, constitutional parliamentary authority.

- Remove all restrictions on individuals and political parties to allow their free participation in presidential and parliamentary elections. This includes protections for those who have fled the country fearing for their safety and security, and the release of all those arbitrarily detained, including political prisoners.

Unrestricted media/telecommunications/internet access to independent news sources and equitable airtime must be available for all candidates, parties, and the electorate. The former Maduro regime must not be allowed to dictate the content of independent media actors. This includes allowing the exercise of the rights of peaceful assembly and freedom of expression without repression, reprisal, or politically motivated disruptions of service.

Independent electoral observation, free of undue restrictions, comprised of domestic and international experts.

The United States and its partners issuing this statement intend to:

- Urge all Venezuelan authorities to adhere to the above criteria;

- Facilitate the process for Venezuelan citizens anywhere in the world to exercise their rights by voting in a free and fair presidential election from abroad;

- Provide technical support and/or funding, as appropriate, to assist the voter registration process; and

- Provide a team of highly regarded independent electoral observers to begin work with the new CNE as soon as it is appointed.

U.S. Department of State. 01/09/2020. Supporting the Venezuelan People. Michael R. Pompeo, Secretary of State

Venezuela’s political crisis has led to the flight of more than 4.8 million people, the collapse of a once prosperous country’s educational, economic, industrial, and healthcare systems, and the abuse of human rights and fundamental freedoms. A swift negotiated transition to democracy is the most effective and sustainable route to peace and prosperity in Venezuela. Negotiations could open the path out of the crisis through a transitional government that will organize free and fair elections.

Venezuela faces a crossroads in 2020. Presidential and National Assembly elections at the end of 2020 should help shape the country’s future for years to come, including shepherding the difficult work of rebuilding institutions and infrastructure eviscerated by a brutal regime. 2020 presents the opportunity to provide the Venezuelan people with what they have been demanding for years: genuinely free and fair Presidential and National Assembly elections to choose their leadership and begin the long process of renewal.

The international community plays a pivotal role in supporting the Venezuelan people. The measures outlined in the fact sheet here: https://www.state.gov/free-and-fair-presidential-and-parliamentary-elections-in-venezuela/ – which are consistent with Venezuela’s own constitution – can help end Venezuela’s political crisis; any other process that deviates from or distorts these measures may not be viewed as legitimate or credible.

ECONOMY

FED. January 09, 2020. Speech. U.S. Economic Outlook and Monetary Policy. Vice Chair Richard H. Clarida. At the C. Peter McColough Series on International Economics, Council on Foreign Relations, New York, New York

Thank you for the opportunity to join you bright and early on this January 2020 Thursday morning. As some of you may know, I am a longtime member of the Council on Foreign Relations and have attended and participated in many such events over the past 20 years, although I will point out that in my previous visits to the dais, I was in the somewhat less demanding position of asking the questions rather than answering them. I am really looking forward to this conversation, but I would like first to share with you some thoughts about the outlook for the U.S. economy and monetary policy.1

The U.S. economy begins the year 2020 in a good place. The unemployment rate is at a 50-year low, inflation is close to our 2 percent objective, gross domestic product growth is solid, and the Federal Open Market Committee's (FOMC) baseline outlook is for a continuation of this performance in 2020.2 At present, personal consumption expenditures (PCE) price inflation is running somewhat below our 2 percent objective, but we project that, under appropriate monetary policy, inflation will rise gradually to our symmetric 2 percent objective. Although the unemployment rate is at a 50-year low, wages are rising broadly in line with productivity growth and underlying inflation. We are not seeing any evidence to date that a strong labor market is putting excessive cost-push pressure on price inflation.

Committee projections for the U.S. economy are similar to our projections at this time one year ago, but over the course of 2019, the FOMC shifted the stance of U.S. monetary policy to offset some significant global growth headwinds and global disinflationary pressures. In 2019, sluggish growth abroad and global developments weighed on investment, exports, and manufacturing in the United States, although there are some indications that headwinds to global growth may be beginning to abate. U.S. inflation remains muted. Over the 12 months through November, PCE inflation was running at 1.5 percent, and core PCE inflation, which excludes volatile food and energy prices and is a better measure of underlying inflation, was running at 1.6 percent. Moreover, inflation expectations, those measured by both surveys and market prices, have moved lower and reside at the low end of a range I consider consistent with our price-stability mandate.

The shift in the stance of monetary policy that we undertook in 2019 was, I believe, well timed and has been providing support to the economy and helping to keep the U.S. outlook on track. I believe that monetary policy is in a good place and should continue to support sustained growth, a strong labor market, and inflation running close to our symmetric 2 percent objective. As long as incoming information about the economy remains broadly consistent with this outlook, the current stance of monetary policy likely will remain appropriate.

Looking ahead, monetary policy is not on a preset course. The Committee will proceed on a meeting-by-meeting basis and will be monitoring the effects of our recent policy actions along with other information bearing on the outlook as we assess the appropriate path of the target range for the federal funds rate. Of course, if developments emerge that, in the future, trigger a material reassessment of our outlook, we will respond accordingly.

In January 2019, my FOMC colleagues and I affirmed that we aim to operate with an ample level of bank reserves in the U.S. financial system.3 And in October, we announced and began to implement a program to address pressures in repurchase agreement (repo) markets that became evident in September.4 To that end, we have been purchasing Treasury bills and conducting both overnight and term repurchase operations, and these efforts were successful in relieving pressures in the repo markets over the year-end. As we enter 2020, let me emphasize that we stand ready to adjust the details of this program as appropriate and in line with our goal, which is to keep the federal funds rate in the target range desired by the FOMC. As the minutes of the December FOMC meeting suggest, it may be appropriate to gradually transition away from active repo operations this year as Treasury bill purchases supply a larger base of reserves, though some repo might be needed at least through April, when tax payments will sharply reduce reserve levels.

Finally, allow me to offer a few words about the FOMC review of the strategy, tools, and communication practices that we commenced in February 2019. This review—with public engagement unprecedented in scope for us—is the first of its kind for the Federal Reserve. Through 14 Fed Listens events, including an academic conference in Chicago, we have been hearing a range of perspectives not only from academic experts, but also from representatives of consumer, labor, community, business, and other groups. We are drawing on these insights as we assess how best to achieve and maintain maximum employment and price stability. In July, we began discussing topics associated with the review at regularly scheduled FOMC meetings. We will continue reporting on our discussions in the minutes of FOMC meetings and will share our conclusions with the public when we conclude the review later this year.5

Thank you very much for your time and attention. I look forward to the conversation and the question-and-answer session to follow.

Notes

- These remarks represent my own views, which do not necessarily represent those of the Federal Reserve Board or the Federal Open Market Committee. I am grateful to Brian Doyle of the Federal Reserve Board staff for his assistance in preparing this text. Return to text

- The most recent Summary of Economic Projections is an addendum to the minutes of the December 2019 FOMC meeting. See Board of Governors of the Federal Reserve System (2020), "Minutes of the Federal Open Market Committee, December 10–11, 2019," press release, January 3.

- See the Statement Regarding Monetary Policy Implementation and Balance Sheet Normalization, which is available on the Board's website at https://www.federalreserve.gov/newsevents/pressreleases/monetary20190130c.htm. Also see the Balance Sheet Normalization Principles and Plans, available on the Board's website at https://www.federalreserve.gov/newsevents/pressreleases/monetary20190320c.htm.

- See the Statement Regarding Monetary Policy Implementation, which can be found on the Board's website at https://www.federalreserve.gov/newsevents/pressreleases/monetary20191011a.htm.

- Information about the review and the events associated with it is available on the Board's website at https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications.htm.

FULL DOCUMENT: https://www.federalreserve.gov/newsevents/speech/files/clarida20200109a.pdf

GDP

DoC. BEA. JANUARY 9, 2020. Gross Domestic Product by Industry, Third Quarter 2019

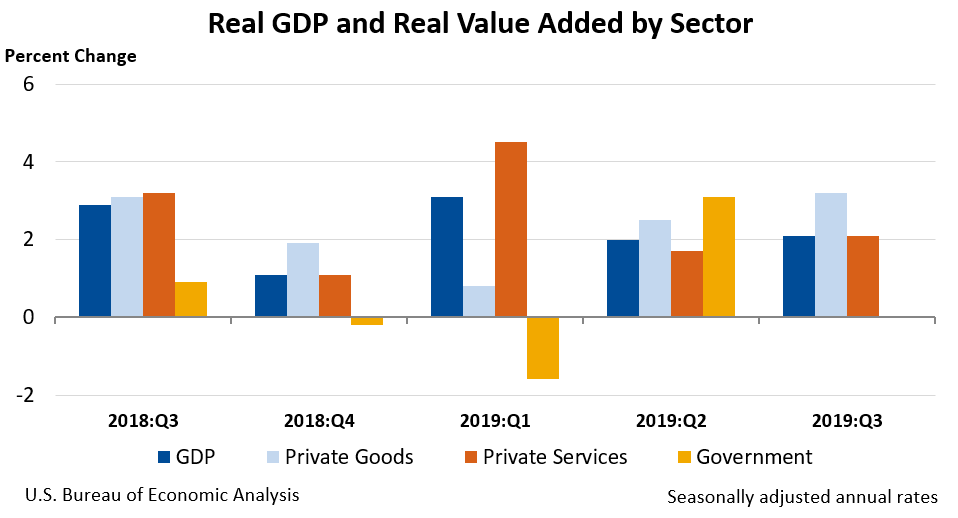

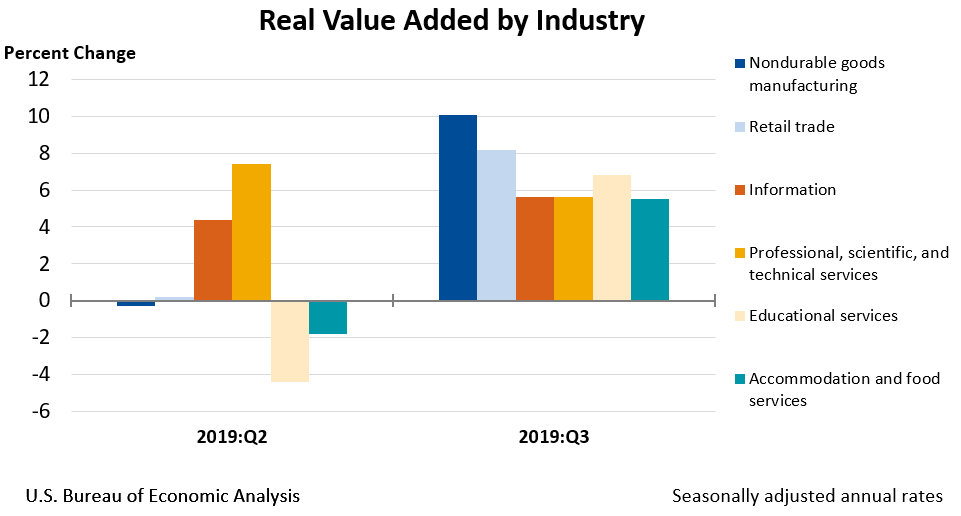

Nondurable goods manufacturing; retail trade; and professional, scientific, and technical services were the leading contributors to the increase in U.S. economic growth in the third quarter of 2019, according to gross domestic product (GDP) by industry statistics released by the Bureau of Economic Analysis. Both private services- and goods-producing industries contributed to the increase; the government sector increased slightly. Overall, 17 of 22 industry groups contributed to the 2.1 percent increase in real GDP in the third quarter.

- For the nondurable goods manufacturing industry group, real value added—a measure of an industry’s contribution to GDP—increased 10.1 percent in the third quarter, after decreasing 0.3 percent in the second quarter. The third-quarter growth primarily reflected increases in petroleum and coal products and chemical products manufacturing.

- Retail trade increased 8.2 percent, after increasing 0.2 percent. The third-quarter growth primarily reflected an increase in other retail, which includes nonstore retailers, gasoline stations, and food and beverage stores.

- Professional, scientific, and technical services increased 5.6 percent, after increasing 7.4 percent. The third-quarter growth primarily reflected an increase in miscellaneous professional, scientific, and technical services, which includes consulting as well as accounting and tax preparation services.

Other highlights

- Real GDP accelerated slightly to 2.1 percent in the third quarter, up from 2.0 percent in the second quarter. The acceleration primarily reflected upturns in wholesale trade and nondurable goods manufacturing, and an acceleration in retail trade.

- Information services increased 5.6 percent, after increasing 4.4 percent. The third-quarter growth primarily reflected increases in publishing as well as in broadcasting and telecommunications.

- Accommodation and food services increased 5.5 percent, after decreasing 1.8 percent, primarily reflecting increases in food services and drinking places.

Gross output by industry

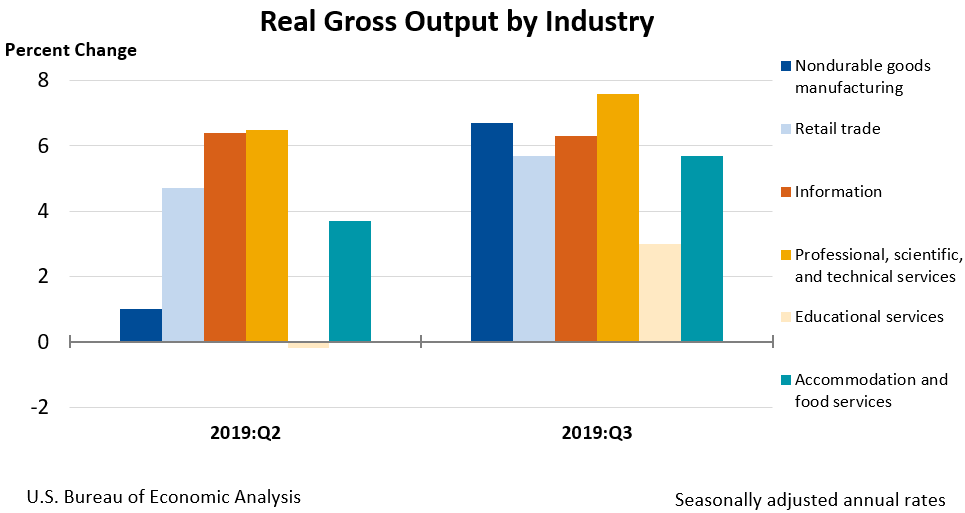

Real gross output—principally a measure of an industry’s sales or receipts, which includes sales to final users in the economy (GDP) and sales to other industries (intermediate inputs)—increased 2.5 percent in the third quarter. This reflected increases of 3.1 percent for the private services-producing sector, 1.6 percent for the private goods-producing sector, and 1.2 percent for the government sector. Overall, 16 of 22 industry groups contributed to the increase in real gross output.

- Real gross output for nondurable goods manufacturing increased 6.7 percent in the third quarter, after increasing 1.0 percent in the second quarter, primarily reflecting chemical products.

- Information increased 6.3 percent, after increasing 6.4 percent, primarily reflecting increases in data processing, internet publishing, and other information services.

- Educational services increased 3.0 percent, after decreasing 0.2 percent.

FULL DOCUMENT: https://www.bea.gov/system/files/2020-01/gdpind319.pdf

CANADA

U.S. Department of State. 01/09/2020. United States and Canada Finalize Action Plan on Critical Minerals Cooperation

Deputy Assistant Secretary of State for Western Hemisphere Affairs Cynthia Kierscht and Associate Deputy Minister of Natural Resources Canada Shawn Tupper finalized the U.S.-Canada Critical Minerals Action Plan in December 2019. This achieves a goal set by President Trump and Prime Minister Trudeau in June 2019. Cooperation under the Action Plan includes securing the supply of critical minerals for strategic industries and defense; improving information sharing on critical mineral resources; engaging with the private sector; and working together in multilateral fora and with third countries. The Action Plan outlines a range of joint activities, such as research and development cooperation, supply chain modeling, and increased support for industry. The comprehensive, whole-of-government approach outlined in the Action Plan will strengthen the U.S.-Canada supply chain for critical minerals, which are essential to U.S. and Canadian security and future prosperity.

________________

ORGANISMS

GLOBAL ECONOMY

THE WORLD BANK GROUP. JANUARY 8, 2020. January 2020 Global Economic Prospects: Slow growth, policy challenges

STORY HIGHLIGHTS

- The world economy is poised for a modest rebound this year, but outlook is fragile.

- Emerging, developing economy growth to accelerate in 2020 as some emerging economies recover from periods of stress.

- Rise in debt, slowdown in productivity pose challenges for policymakers.

Hanging over this lethargic recovery are two other trends that raise questions about the course of economic growth: the unprecedented runup in debt worldwide, and the prolonged deceleration of productivity growth, which needs to pick up to bolster standards of living and poverty eradication.

Global growth is set to rise by 2.5% this year, a small uptick from 2.4% in 2019, as trade and investment gradually recover, the World Bank’s semi-annual Global Economic Prospects forecasts. Advanced economies are expected to slow as a group to 1.4% from 1.6%, mainly reflecting lingering weakness in manufacturing.

Emerging market and developing economies will see growth accelerate to 4.1% from 3.5% last year. However, the pickup is anticipated to come largely from a small number of large emerging economies shaking off economic doldrums or stabilizing after recession or turbulence. For many other economies, growth is on track to decelerate as exports and investment remain weak.

A worrying aspect of the sluggish growth trend is that even if the recovery in emerging and developing economy growth takes place as expected, per capita growth will remain below long-term averages and will advance at a pace too slow to meet poverty eradication goals. Income growth would in fact be slowest in Sub-Saharan Africa – the region where 56 percent of the world’s poor live.

Per capita income growth lags behind long-term averages. © World Bank Group

And even this modest rally could be disrupted by any number of threats. Trade disputes could re-escalate. A sharper-than-expected growth slowdown in major economies such as China, the United States, or the Euro Area would similarly reverberate widely. A resurgence of financial stress in large emerging markets, as was experienced in Argentina and Turkey in 2018, an escalation of geopolitical tensions, or a series of extreme weather events could all have adverse effects on economic activity around the world.

Debt Wave

One feature overshadowing the outlook is the largest, fastest, and most broad-based wave of debt accumulation among emerging and developing economies in the last 50 years. Total debt among these economies climbed to about 170% of GDP in 2018 from 115% of GDP in 2010. Debt has also surged among low-income countries after a sharp drop over 2000-2010.

The current wave of debt differs from previous ones in that there has been an increase in the share of non-resident holdings of EMDE government debt, foreign currency-denominated private EMDE debt, and, for low-income countries, borrowing from financial markets and non-Paris Club bilateral creditors, raising concerns about debt transparency and debt collateralization.

In emerging and developing economies over the last decade, growth has slowed while debt has increased. © World Bank Group

Public borrowing can be beneficial and spur economic development, if used to finance growth- enhancing investments, such as in infrastructure, health care, and education. Debt accumulation can also be appropriate in economic downturns as a way to stabilize economic activity.

However, the three previous waves of debt accumulation have ended badly – sovereign defaults in the early 1980s; financial crises in the late 1990s; the need for major debt relief in the 2000s; and the global financial crisis in 2008-2009. And while currently low interest rates mitigate some of the risks, high debt carries significant risks. It can leave countries to vulnerable to external shocks; it can limit the ability of governments to counter downturns with fiscal stimulus; and it can dampen longer-term growth by crowding out productivity-enhancing private investment.

This means that governments need to take steps to minimize risks associated with debt buildups. Sound debt management and debt transparency can keep a lid on borrowing costs, enhance debt sustainability, and reduce fiscal risks. Strong regulatory and supervisory regimes, good corporate governance, and common international standards can help contain risks, ensure that debt is used productively, and identify vulnerabilities early.

Productivity Slowdown

Yet another aspect of the disappointing pace of global growth is the broad-based slowdown in productivity growth over the last ten years. Growth in productivity – output per worker – is essential to raising living standards and achieving development goals.

An extensive look at productivity trends in this edition of Global Economic Prospects focuses on how the productivity slowdown has affected emerging and developing economies. Average output per worker in emerging and developing economies is less than one-fifth that of a worker in an advanced economy, and in low-income economies that figure drops to 2%.

Since the global financial crisis, there has been a broad-based slowdown in productivity in emerging and developing economies. © World Bank Group

Among emerging and developing economies, which have a history of productivity growth surges and setbacks, the slowdown from 6.6% in 2007 to a trough of 3.2% in 2015 has been the steepest, longest, and broadest on record. The slowdown is due to weaker investment and efficiency gains, dwindling gains from the reallocation of resources to more productive sectors, and slowing improvements in the key drivers of productivity, such as education and institutional quality.

How to rekindle productivity growth? The outlook for productivity remains challenging. Therefore, efforts are needed to stimulate private and public investment; upgrade workforce skills to boost firm productivity; help resources find the most productive sectors; reinvigorate technology adoption and innovation; and promote a growth-friendly macroeconomic and institutional environment.

Two other issues merit consideration in this edition of the outlook: adverse consequences of price controls and inflation prospects in LICs.

While price controls are sometimes considered a useful tool to smooth price fluctuations for good and services such as energy and food, they can also dampen investment and growth, worsen poverty outcomes, and lead to heavier fiscal burdens. Replacing them with expanded and targeted social safety nets alongside the encouragement of competition and an effective regulatory environment, can be beneficial both to poverty eradication and to growth.

And while inflation has declined sharply among low-income countries over the last 25 years, keeping it low and stable cannot be taken for granted. Low inflation is associated with more stable output and employment, higher investment, and falling poverty rates. However, rising debt levels and fiscal pressures could put some economies at risk of disruptions that could send prices sharply higher. Strengthening central bank independence, making the monetary authority’s objectives clear, and cementing central bank credibility are essential to keep prices anchored.

While the global economic outlook for 2020 envisions a fragile upward path that could be upended, there is high degree of uncertainty around the forecast given unpredictability around trade and other policies. If policy-makers manage to mitigate tensions and clarify unsettled issues in a number of areas – they could prove the forecast wrong by sending growth higher than anticipated.

FULL DOCUMENT: file:///C:/Users/gonzaga.coelho/Downloads/9781464814693.pdf

BIRD. PORTAL G1. 08/01/2020. Banco Mundial prevê avanço do PIB do Brasil de 2% neste ano e 2,5% em 2021. Instituição piorou a estimativa para o desempenho da economia neste ano, mas melhorou a projeção para 2021.

O Banco Mundial atualizou nesta quarta-feira (8) as previsões de crescimento para a economia brasileira e mundial. Em 2020, a instituição estima que o Produto Interno Bruto (PIB) do Brasil deve avançar 2%. Para 2021, a projeção é de alta de 2,5%.

A previsão para 2020 é menor do que a divulgada no último relatório publicado em junho. Mas a estimativa para o próximo ano melhorou. Na leitura passada, o Banco Mundial projetava crescimento de 2,5% em 2020 e 2,3% para 2021.

"No Brasil, a confiança mais forte dos investidores, juntamente com o afrouxamento gradual das condições de empréstimos e do mercado de trabalho, deverá sustentar uma aceleração do crescimento para 2%", informou a instituição em relatório.

Para 2019, a instituição avalia que o PIB brasileiro deve ter crescido 1,1%, 0,4 ponto percentual mais baixo do que o apurado em junho.

/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2020/C/H/4zkACOSQqdkxKidJHB5g/0bqvk-as-previs-es-do-banco-mundial-1-.png)

As projeções do Banco Mundial estão próximas das observadas no relatório Focus, elaborado pelo Banco Central com base na projeção de analistas das instituições financeiras. Para 2019, a estimativa é de alta do PIB de 1,17%. Em 2020 e 2021, as projeções são de 2,3% e 2,5%, respectivamente.

Desempenho da economia mundial

O Banco Mundial ainda estima que a economia global deve crescer ligeiramente menos neste e no próximo ano em relação ao que era esperado no relatório de junho.

A previsão é que o PIB mundial avance 2,5% em 2020 e 2,6% em 2021. Em relação a junho, houve uma redução de 0,2 ponto percentual nas leituras para os dois anos.

Para 2019, o Banco Mundial estima que o PIB global tenha avançado 2,4%.

/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2020/a/w/mTBZKkTAuNACuYBKBByA/qdbsi-proje-es-para-o-pib-de-2020.png)

No relatório divulgado nesta quarta, a instituição alertou para riscos envolvendo a guerra comercial, uma desaceleração econômica mais forte do que o esperado nas economias avançadas e uma eventual turbulência financeira nos mercados emergentes. Todos esses risco podem piorar o desempenho da economia mundial.

"Predominam os riscos descendentes para as perspectivas globais que, caso se concretizem, poderiam desacelerar substancialmente o crescimento", escreveu o Banco Mundial.

"Estes riscos incluem nova escalada das tensões comerciais e incerteza da política comercial, uma desaceleração mais forte do que o esperado nas principais economias e turbulência financeira nas economias de mercados emergentes e em desenvolvimento", completou a instituição.

________________

ECONOMIA BRASILEIRA / BRAZIL ECONOMICS

INFLAÇÃO

FGV. IBRE. 09/01/20. Índices Gerais de Preços. IPC-S Capitais. Inflação pelo IPC-S recua em quatro de sete capitais pesquisadas

O IPC-S de 07 de janeiro de 2020 registrou variação de 0,57%, ficando 0,20 ponto percentual (p.p.) abaixo da taxa divulgada na última apuração. Quatro das sete capitais pesquisadas registraram decréscimo em suas taxas de variação.

A tabela a seguir, apresenta as variações percentuais dos municípios das sete capitais componentes do índice, nesta e nas apurações anteriores.

DOCUMENTO: https://portalibre.fgv.br/navegacao-superior/noticias/inflacao-pelo-ipc-s-recua-em-quatro-de-sete-capitais-pesquisadas.htm

BACEN. 09 Janeiro 2020. Apresentação do Presidente Roberto Campos Neto na coletiva sobre Agenda BC, na coletiva de imprensa.

DOCUMENTO: https://www.bcb.gov.br/conteudo/home-ptbr/TextosApresentacoes/ppt_balanco_agenda_bc_2019.pdf

VÍDEO: https://www.youtube.com/watch?v=Jzunf4VZLuU&feature=youtu.be

BACEN. REUTERS. 9 DE JANEIRO DE 2020. Em crise EUA-Irã, foco do BC é possível impacto sobre inflação, diz Campos Neto

Por Marcela Ayres

BRASÍLIA (Reuters) - Na recente crise entre Estados Unidos e Irã, para o Banco Central o importante é avaliar como os eventos podem afetar o canal de transmissão para a inflação no Brasil, afirmou nesta quinta-feira o presidente da autarquia, Roberto Campos Neto.

“Importante é olhar o impacto do conflito nas variáveis macroeconômicas e como nós entendemos que as variáveis macroeconômicas influenciam nossas projeções”, afirmou ele, em coletiva de imprensa.

Campos Neto exemplificou que o petróleo havia subido no primeiro dia do “conflito recente do Irã”, mas que já estava sendo cotado abaixo do patamar de antes do ataque de drone dos EUA que matou o poderoso general iraniano Qassem Soleimani em Bagdá no dia 3 de janeiro.

“A única coisa que podemos mencionar é que depende dos impactos que vão ter. Temos dois elementos que tiveram volatilidade grande: petróleo e carne. Para o BC o importante é como isso afeta canal de transmissão”, afirmou ele.

O BC cortou os juros básicos em 0,50 ponto em sua última reunião do Comitê de Política Monetária (Copom), de dezembro, à mínima histórica de 4,5%. O próxima encontro do colegiado ocorre em 4 e 5 de fevereiro.

Na mais recente pesquisa Focus, feita pelo BC junto a uma centena de economistas, a expectativa é de mais um corte na Selic no próximo mês, mas de 0,25 ponto.

Em sua fala inicial, Campos Neto afirmou que o BC vê a inflação ancorada no médio e longo prazo.

Já em relação ao cenário externo, o presidente do BC disse que há “princípio de consenso” sobre estabilização e início de melhora da expectativa de crescimento global.

AGENDA BC#

Durante a coletiva, Campos Neto expôs as metas do BC para a primeira metade do ano, frisando acreditar numa aprovação, ainda nos três primeiros meses de 2020, do projeto de autonomia formal da instituição e do projeto que moderniza o arcabouço legal ligado ao câmbio.

Particularmente sobre a autonomia, Campos Neto afirmou que há “ambiente legislativo propício” para análise da matéria, citando também o apoio do presidente da Câmara dos Deputados, Rodrigo Maia (DEM-RJ).

Questionado sobre qual proposta contava com o apoio do BC, uma vez que há textos diferentes tramitando no Senado e na Câmara, ele afirmou que endossa a proposta da Câmara, que incorporou o projeto de autoria do Executivo sobre a autonomia.

Para além de refletir a visão do BC sobre como deve ser sua autonomia formal, o projeto relatado pelo deputado Celso Maldaner (MDB-SC) é mais extenso e complexo, contando também com alterações adicionais ao tema da autonomia, como a criação dos depósitos voluntários remunerados.

Sobre eventual mandato duplo estabelecido para o BC, contemplando também uma meta para crescimento econômico —proposta que não consta dos dois projetos em tramitação no Congresso—, Campos Neto disse ser contra a medida, reiterando que “a melhor forma de (o BC) contribuir com crescimento no médio e longo prazo é através do controle de inflação”.

Também para o primeiro trimestre, o BC previu em apresentação um novo benchmark para gestão de reservas. Questionado sobre o assunto, o diretor de Política Monetária do BC, Bruno Serra, afirmou que essa revisão foi feita algumas vezes nos últimos anos, mas destacou que o BC não divulga o benchmark adotado.

Dentre as várias ações listadas para o segundo trimestre pelo BC, estão medidas voltadas a um Sistema Nacional de Garantias, além de iniciativas para modernização de instrumentos financeiros, como notas comerciais, LIGs e fundos imobiliários.

A apresentação de Campos Neto também mencionou uma Lei das Infraestruturas do Mercado Financeiro para o período de abril a junho, bem como a regulamentação do arranjo do sistema de pagamentos instantâneos e normativos do sistema de open banking.

Com reportagem adicional de Gabriel Ponte

INDÚSTRIA

IBGE. 09/01/2020. Produção industrial cai 1,2% em novembro

Em novembro de 2019, na série com ajuste sazonal, o setor industrial teve queda de 1,2% em relação a outubro. Houve redução na produção das quatro grandes categorias econômicas e em 16 das 26 atividades pesquisadas nessa comparação. A queda de 1,2% elimina parte da expansão de 2,2% acumulada no período agosto-outubro de 2019. Com esses resultados, o setor industrial se encontra 17,1% abaixo do nível recorde alcançado em maio de 2011.

| Período | Produção industrial |

|---|---|

| Novembro / Outubro 2019 | -1,2% |

| Novembro 2019 / Novembro 2018 | -1,7% |

| Acumulado em 2019 | -1,1% |

| Acumulado em 12 meses | -1,3% |

| Média móvel trimestral | -0,1% |

No confronto com novembro de 2018, o total da indústria recuou 1,7%, interrompendo dois meses de resultados positivos consecutivos: setembro (1,1%) e outubro (1,1%). Assim, o setor industrial acumula queda de 1,1% no ano.

O indicador acumulado em 12 meses recuou 1,3% em novembro de 2019, repetindo os resultados de setembro e de outubro.

Com a perda de ritmo da atividade industrial em novembro, o índice de média móvel trimestral mostrou taxa negativa (-0,1%) e interrompeu a trajetória ascendente iniciada em julho de 2019.

| Indicadores da Produção Industrial por Grandes Categorias Econômicas Brasil - Novembro de 2019 | ||||

|---|---|---|---|---|

| Grandes Categorias Econômicas | Variação (%) | |||

| Novembro 2019/ Outubro 2019* | Novembro 2019/ Novembro 2018 | Acumulado Janeiro-Novembro | Acumulado nos Últimos 12 Meses | |

| Bens de Capital | -1,3 | -3,1 | 0,2 | -0,2 |

| Bens Intermediários | -1,5 | -2,8 | -2,2 | -2,3 |

| Bens de Consumo | -1,3 | 1,0 | 1,1 | 0,7 |

| Duráveis | -2,4 | 0,7 | 2,0 | 0,9 |

| Semiduráveis e não Duráveis | -0,5 | 1,1 | 0,8 | 0,6 |

| Indústria Geral | -1,2 | -1,7 | -1,1 | -1,3 |

| Fonte: IBGE, Diretoria de Pesquisas, Coordenação de Indústria *Série com ajuste sazonal | ||||

No recuo de 1,2% da atividade industrial na passagem de outubro para novembro de 2019, entre as atividades, as principais influências negativas foram registradas por produtos alimentícios (-3,3%), veículos automotores, reboques e carrocerias (-4,4%) e indústrias extrativas (-1,7%), com a primeira eliminando grande parte da expansão verificada no mês anterior (3,6%); a segunda intensificando a perda de 0,4% assinalada em outubro de 2019; e a última acumulando recuo de 4,6% em três meses consecutivos de queda na produção. Outras contribuições negativas relevantes vieram de outros produtos químicos (-1,5%), de máquinas e equipamentos (-1,6%), de manutenção, reparação e instalação de máquinas e equipamentos (-5,7%), de celulose, papel e produtos de papel (-1,8%), de produtos de minerais não-metálicos (-1,8%) e de metalurgia (-1,1%).

Com exceção da metalurgia, que mostrou a sexta taxa negativa consecutiva e acumulou perda de 8,0% nesse período, as demais haviam apontado crescimento em outubro último: 1,1%, 1,8%, 1,1%, 2,6% e 2,3%, respectivamente. Por outro lado, entre os dez ramos que ampliaram a produção nesse mês, os desempenhos de maior importância para a média global foram registrados por coque, produtos derivados do petróleo e biocombustíveis (1,6%), impressão e reprodução de gravações (24,0%) e produtos de borracha e de material plástico (2,5%). Com os resultados desse mês, o primeiro setor recuperou parte da perda de 3,2% acumulada no período setembro-outubro de 2019; o segundo mostrou expansão de 42,5% em dois meses consecutivos de crescimento na produção, após registrar recuo de 27,0% em setembro de 2019; e o último eliminou a queda de 0,5% verificada no mês anterior.

Entre as grandes categorias econômicas, ainda na comparação com o mês imediatamente anterior, bens de consumo duráveis, ao recuar 2,4%, mostrou a queda mais acentuada em novembro de 2019, influenciada, em grande parte, pela menor produção de automóveis. Vale ressaltar que esse resultado eliminou parte do ganho de 3,9% acumulado no período setembro-outubro de 2019. Os segmentos de bens intermediários (-1,5%), de bens de capital (-1,3%) e de bens de consumo semi e não-duráveis (-0,5%) também assinalaram taxas negativas nesse mês, com o primeiro interrompendo três meses consecutivos de crescimento na produção, período em que registrou expansão de 1,8%; o segundo voltando a recuar, após avançar 0,4% no mês anterior; e o último eliminando parte do ganho de 1,8% acumulado nos meses de setembro e outubro de 2019.

A evolução do índice de média móvel trimestral para o total da indústria mostrou variação negativa de 0,1% no trimestre encerrado em novembro de 2019 frente ao nível do mês anterior, interrompendo, dessa forma, a trajetória ascendente iniciada em julho de 2019. Entre as grandes categorias econômicas, considerando esse índice, bens de capital (-0,4%) e bens intermediários (-0,4%) assinalaram os resultados negativos em novembro de 2019, com o primeiro permanecendo com o comportamento predominantemente negativo iniciado em julho de 2019 e acumulando nesse período redução de 1,1%; e o segundo interrompendo a trajetória ascendente iniciada em junho de 2019. Por outro lado, os segmentos de bens de consumo duráveis (0,5%) e de bens de consumo semi e não-duráveis (0,4%) registraram os avanços em novembro de 2019, com ambos permanecendo com a trajetória ascendente iniciada em agosto de 2019.

Na comparação com igual mês do ano anterior, o setor industrial assinalou queda de 1,7% em novembro de 2019, com resultados negativos em duas das quatro grandes categorias econômicas, 18 dos 26 ramos, 43 dos 79 grupos e 53,8% dos 805 produtos pesquisados. Vale citar que novembro de 2019 (20 dias) teve o mesmo número de dias úteis do que igual mês do ano anterior (20). Entre as atividades, indústrias extrativas (-8,9%) e metalurgia (-8,4%) exerceram as maiores influências negativas na formação da média da indústria, pressionadas, em grande medida, pela menor fabricação dos itens minérios de ferro, na primeira; e bobinas a quente e a frio de aços ao carbono não revestidos, barras de aços ao carbono, bobinas ou chapas de aços inoxidáveis e zincadas, artefatos e peças diversas de ferro fundido, ouro em formas brutas, fio-máquina de aços ao carbono e lingotes, blocos, tarugos ou placas de aços ao carbono, na segunda.

Houve ainda contribuições negativas assinaladas pelos ramos de veículos automotores, reboques e carrocerias (-2,3%), de celulose, papel e produtos de papel (-5,5%), de outros produtos químicos (-3,5%), de produtos alimentícios (-1,2%), de manutenção, reparação e instalação de máquinas e equipamentos (-12,0%) e de perfumaria, sabões, produtos de limpeza e de higiene pessoal (-6,8%). Por outro lado, ainda na comparação com novembro de 2018, entre as oito atividades que apontaram expansão na produção, as principais influências no total da indústria foram registradas por coque, produtos derivados do petróleo e biocombustíveis (5,4%) e bebidas (6,7%). Outros impactos positivos importantes foram assinalados pelos ramos de impressão e reprodução de gravações (21,0%), de produtos diversos (12,5%) e de máquinas e equipamentos (2,0%).

Ainda no confronto com igual mês do ano anterior, bens de capital (-3,1%) e bens intermediários (-2,8%) assinalaram, em novembro de 2019, os recuos entre as grandes categorias econômicas. Por outro lado, os segmentos de bens de consumo semi e não-duráveis (1,1%) e de bens de consumo duráveis (0,7%) marcaram os resultados positivos nesse mês.

No acumulado do ano para o período janeiro a novembro de 2019, frente a igual período do ano anterior, o setor industrial mostrou redução de 1,1%, com resultados negativos em 1 das 4 grandes categorias econômicas, 16 dos 26 ramos, 41 dos 79 grupos e 54,9% dos 805 produtos pesquisados. Entre as atividades, indústrias extrativas (-9,5%) exerceu a maior influência negativa na formação da média da indústria, pressionada, em grande medida, pelos itens minérios de ferro. Vale destacar também as contribuições negativas assinaladas pelos ramos de celulose, papel e produtos de papel (-3,9%), de manutenção, reparação e instalação de máquinas e equipamentos (-9,1%), de metalurgia (-2,2%), de outros equipamentos de transporte (-9,3%), de produtos de madeira (-5,7%), de produtos de borracha e de material plástico (-1,8%) e de produtos farmoquímicos e farmacêuticos (-2,4%). Por outro lado, entre as nove atividades que apontaram ampliação na produção, as principais influências no total da indústria foram registradas por veículos automotores, reboques e carrocerias (2,4%), produtos alimentícios (1,4%), produtos de metal (5,1%), bebidas (3,9%) e coque, produtos derivados do petróleo e biocombustíveis (1,0%).

Entre as grandes categorias econômicas, o perfil dos resultados para os onze meses de 2019 mostrou menor dinamismo para bens intermediários (-2,2%), pressionado, sobretudo, pela redução verificada em indústrias extrativas (-9,5%), explicada, principalmente, pelos efeitos do rompimento de uma barragem de rejeitos de mineração na região de Brumadinho (MG) ocorrido em janeiro de 2019. Por outro lado, o setor produtor de bens de consumo duráveis (2,0%) assinalou a expansão mais acentuada, impulsionado, em grande parte, pela maior fabricação de eletrodomésticos da “linha branca” (11,9%).

Indústria nacional. Produção industrial cai 1,2% em novembro após três altas seguidas. Com queda de 4,4%, setor de veículos puxou o resultado da indústria para baixo

A produção industrial no Brasil recuou 1,2% em novembro em comparação a outubro, quebrando a sequência de altas dos três meses anteriores. É o pior novembro desde 2015, quando a indústria caiu 1,9%, de acordo com a Pesquisa Industrial Mensal, divulgada hoje (09/01) pelo IBGE. De janeiro a novembro, o índice acumulou queda de 1,1%; em 12 meses, recuou 1,3%.

“A queda verificada em novembro eliminou uma parte importante do crescimento atingido nos meses anteriores, sendo que 16 categorias, dentre as 26 avaliadas, tiveram queda”, ressalta o gerente da pesquisa, André Macedo.

Uma das principais influências negativas foi o segmento de veículos automotores, reboques e carrocerias (-4,4%). “Mas é comum que a produção de automóveis seja elevada nos meses de setembro e outubro e reduza no final do ano, por conta férias coletivas”, explica Macedo.

Produção industrial (mês/mês anterior)

Clique e arraste para zoom

Fonte: IBGE - Pesquisa Industrial Mensal - Produção Física

Outra produção que teve forte influência na queda foi a de produtos alimentícios (-3,3%), eliminando quase toda a expansão verificada no mês anterior (3,6%). “O crescimento vinha sendo alavancado pelo aumento nas exportações de carne e da produção de açúcar. A carne continua em expansão, mas o açúcar tem uma volatilidade maior, tanto por conta de condições climáticas quanto em função da demanda por etanol, que também é produto da cana-de-açúcar”, destaca o gerente da pesquisa.

A indústria extrativa também teve queda expressiva (-1,7%), acumulando recuo de 4,6% em três meses consecutivos. E outras contribuições negativas relevantes vieram de outros produtos químicos (-1,5%), de máquinas e equipamentos (-1,6%), de manutenção, reparação e instalação de máquinas e equipamentos (-5,7%), de celulose, papel e produtos de papel (-1,8%), de produtos de minerais não-metálicos (-1,8%) e de metalurgia (-1,1%).

Entre as grandes categorias econômicas, a de bens de consumo duráveis foi a que teve o recuo mais acentuado, de 2,4%, puxado principalmente pela menor produção de automóveis. Perdeu assim parte do ganho de 3,9% acumulado no período setembro-outubro de 2019, mas cresceu 0,7% frente a igual período do ano anterior e acumulou ganho de 2% de janeiro a novembro.

Já os bens de consumo semi e não duráveis, apesar da queda de 0,5% em relação a outubro, avançou 1,1% em relação a novembro de 2018, acumulando alta de 0,8% no ano. O desempenho foi explicado, em grande parte, pela expansão observada no grupamento de alimentos e bebidas elaborados para consumo doméstico (1,9%), impulsionado, principalmente, pela maior fabricação de sucos concentrados de laranja, cervejas, chope, carnes e miudezas de aves congeladas, refrigerantes e pães.

Apesar de todas as quatro grandes categorias terem assinalado resultado negativos em novembro, apenas a de bens intermediários teve desempenho negativo no acumulado do ano até novembro (-2,2%). O segmento teve queda de 1,5% em relação ao mês anterior e de 2,8% em relação a novembro de 2018, refletindo, especialmente, a queda verificada no setor extrativo.

E a categoria de bens de capital teve o recuo mais elevado na comparação de novembro de 2019 com o mesmo período do ano anterior (-3,1%). Teve grande influência nesse resultado a queda observada no grupamento para equipamentos de transporte (-4,8%), pressionado, principalmente, pela menor fabricação de caminhão-trator para reboques e semirreboques, embarcações para transporte de pessoas ou cargas (inclusive petroleiros e plataformas), caminhões e reboques e semirreboques (inclusive para uso agrícola). Em relação ao mês anterior, a queda foi de 1,3%. Contudo, no acumulado dos 11 meses do ano, o setor ficou com taxa positiva (0,2%).

DOCUMENTO: https://agenciadenoticias.ibge.gov.br/agencia-sala-de-imprensa/2013-agencia-de-noticias/releases/26582-producao-industrial-cai-1-2-em-novembro

EMPREGO

LINKEDIN. PORTAL G1. Levantamento do LinkedIn mostra 15 profissões em alta para 2020. Estudo mostra que gestor de redes sociais ocupa a primeira posição do ranking, seguido pelo engenheiro de cibersegurança e o representante de vendas.

A rede social profissional LinkedIn divulgou um levantamento com as 15 profissões em alta para este ano de 2020. Chamado de “Profissões Emergentes”, o levantamento mostra que o gestor de redes sociais ocupa a primeira posição do ranking, seguido pelo engenheiro de cibersegurança e o representante de vendas.

O estudo é feito a partir de informações do LinkedIn e destaca as profissões que estão experimentando um grande crescimento e o que isso significa para a força de trabalho.

As profissões ligadas aos setores de tecnologia da informação e internet foram as que mais apareceram lista, com 13 de 15 cargos relacionados a algum deles.

Dentre as profissões estão cargos como o engenheiro de cibersegurança e cientista de dados, que têm sido contratados também pelo segmento financeiro e bancário, como grande movimento das fintechs e bancos digitais. O próprio setor financeiro em si aparece em duas profissões: investidor day trader e consultor de investimentos.

Além disso, um dos destaques é a profissão de motorista. Ao observar os três setores da economia que mais devem demandá-los no próximo ano, constata-se que, entre eles, estão as empresas ligadas a internet e a serviços e facilidades ao cliente, como os aplicativos de transporte de passageiros e os de compras e entregas. O segmento de logística também aparece na segunda posição no índice de contratações.

“Ao pensar a carreira no médio e no longo prazo - seja para permanecer em uma posição ou mudar - devemos mapear os riscos para assumir as responsabilidades do caminho que vamos seguir. Neste processo, a análise das informações disponíveis se torna essencial para tomar a decisão certa”, defende Milton Beck, diretor geral do LinkedIn para a América Latina. “Esperamos que essa lista seja um norte para as pessoas que estejam nessa transição ou ainda, no início da carreira”, complementa.

O relatório foi feito com base em dados de usuários do LinkedIn com perfis públicos que tenham ocupado uma ou mais posições em tempo integral no Brasil nos últimos cinco anos. A partir de uma análise minuciosa, identifica-se o grupo de profissões que mais se movimentaram no período e aplica-se, a cada uma delas, uma fórmula que inclui o número de contratações e a taxa de crescimento anual entre 2015 e 2019 para mapear as que tiveram maior expansão.

Esta é a primeira vez que a lista é segmentada por país. Além do ranking das posições emergentes no Brasil, a pesquisa também elenca as habilidades mais requisitadas e os setores que mais contratam cada uma delas. Confira abaixo a lista completa do ranking:

1. Gestor de mídias sociais

Cinco conhecimentos primordiais: Marketing digital; redes sociais; Adobe Photoshop; Adobe Illustrator; e marketing.

Três segmentos que mais buscam a profissão: Publicidade e marketing; mídia online; e internet.

2. Engenheiro de cibersegurança

Cinco conhecimentos primordiais: Docker Products; Ansible; DevOps; Amazon Web Services, AWS; e Kubernetes.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; software de computadores; serviços financeiros.

3. Representante de vendas

Cinco conhecimentos primordiais: Outbound Marketing; inbound marketing; pré-venda; vendas internas; e prospecção.

Três segmentos que mais buscam a profissão: Softwares de computadores; tecnologia da Informação e serviços; e internet.

4. Especialista em sucesso do cliente

Cinco conhecimentos primordiais: Inbound marketing; auxiliar no sucesso do cliente; relações com o cliente; marketing digital; e experiência do cliente.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; software de computadores; e internet.

5. Cientista de dados

Cinco conhecimentos primordiais: Machine Learning; ciência de dados; linguagem Python; linguagem R; e ciência de dados.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; bancos; e softwares de computadores.

6. Engenheiro de dados

Cinco conhecimentos primordiais: Apache Spark; Apache Hadoop; grandes bancos de dados; Apache Hive; e a linguagem de programação Python.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; bancos; e serviços financeiros.

7. Especialista em Inteligência Artificial

Cinco conhecimentos primordiais: Machine learning; deep learning; linguagem de programação Python; ciência de dados; Inteligência Artificial (IA).

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; softwares de computadores; e instituições de ensino superior.

8. Desenvolvedor em JavaScript

Cinco conhecimentos primordiais: React.js; Node.js; AngularJS; Git; e MongoDB.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; softwares de computadores; e internet.

9. Investidor Day Trader

Cinco conhecimentos primordiais: Bolsa de valores; Technical Analysis; investimentos; mercado de capitais; e o investimento de curto prazo Trading.

Três segmentos que mais buscam a profissão: Serviços financeiros; mercado de capitais; e gestoras de fundos de investimentos.

10. Motorista

Cinco conhecimentos primordiais: Serviço ao cliente; Microsoft Word; liderança; Microsoft Excel; e vendas.

Três segmentos que mais buscam a profissão: Internet; transportes terrestres e ferroviários; e serviços e facilidades ao cliente.

11. Consultor de investimentos

Cinco conhecimentos primordiais: Investimentos; mercado de capitais; mercado financeiro; renda fixa; e análise financeira.

Três segmentos que mais buscam a profissão: Serviços financeiros; mercado de capitais; e bancos.

12. Assistente de mídias sociais

Cinco conhecimentos primordiais: Redes sociais; marketing digital; Adobe Photoshop; Instagram; e publicidade.

Três segmentos que mais buscam a profissão: Publicidade e marketing; internet; Tecnologia da Informação e serviços.

13. Desenvolvedor de plataforma Salesforce

Cinco conhecimentos primordiais: Desenvolvimento de Salesforce.com; linguagem de programação Apex; recursos do Salesforce.com; administração de Salesforce.com; e Visualforce.

Três segmentos que mais buscam a profissão: Softwares de computadores; Tecnologia da Informação e serviços; e consultoria em gestão.

14. Recrutador especialista em Tecnologia da Informação

Cinco conhecimentos primordiais: Recrutamento em TI; recrutamento; entrevista; pesquisa de executivos; e técnicas de recrutamento.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; recrutamento e seleção; e Recursos Humanos.

15. Coach de metodologia Agile

Cinco conhecimentos primordiais: Kanban; metodologia Agile; Scrum; gestão de projetos em Agile; e agilidade para os negócios.

Três segmentos que mais buscam a profissão: Tecnologia da Informação e serviços; softwares de computadores; e internet.

________________

LGCJ.: