CANADA ECONOMICS

NAFTA

Innovation, Science and Economic Development Canada. April 13, 2018. Minister Bains to meet with representatives of the automotive industry

Ottawa, Ontario — The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development, will meet with automotive industry representatives in Toronto to discuss the cars of the future.

Minister Bains will be available for interviews following the meeting.

FULL DOCUMENT AND SCHEDULE: https://www.canada.ca/en/innovation-science-economic-development/news/2018/04/minister-bains-to-meet-with-representatives-of-the-automotive-industry.html

The Globe and Mail. 13 Apr 2018. NAFTA talks lag despite concession by U.S. on auto-content rules

GREG KEENAN, TORONTO

ADRIAN MORROW, WASHINGTON

The United States knocked its auto-content proposal down to 75 per cent from its previous demand that vehicles made in the region contain 85 per cent North American content in order to qualify for duty-free status, sources with knowledge of the talks said.

The three NAFTA countries are far from reaching a full deal to overhaul the pact – despite the Trump administration further softening a key demand on content rules in the crucial auto sector.

The United States knocked its auto-content proposal down to 75 per cent from its previous demand that vehicles made in the region contain 85 per cent North American content in order to qualify for duty-free status, sources with knowledge of the talks said – a concession that could make tougher auto rules easier for Canada, Mexico and the industry to swallow.

The climb-down in the Unites States’ demand brings the content requirement close to the existing level of such content: Although the existing rule is that a North American vehicle must have 62.5 per cent content from one of the three NAFTA countries to be shipped duty-free, many current cars and trucks have between 70 per cent and 75 per cent North American content.

Three sources said the United States has also batted around the idea of obliging auto companies to use at least 70 per cent North American steel in some or all auto parts.

But gulfs remain at the bargaining table on every major issue after several days of quiet but intensive talks in Washington this week. And some key areas, including the United States’ demand for tougher Buy American procurement rules and an end to supply management in Canada’s dairy industry, weren’t even discussed at all, according to a schedule of the negotiations obtained by The Globe and Mail.

U.S. President Donald Trump also publicly backed off the U.S. deadline for a NAFTA deal by mid-April – then surprised his own administration by abruptly announcing he wanted to look into rejoining the Trans-Pacific Partnership, an 12-nation trade pact he pulled out of on his first full day in office in 2017. The remaining 11 nations, including Canada, signed a revised deal earlier this year.

The pessimism at the NAFTA table is an abrupt shift from just a few days ago, when the United States was pushing hard for a deal Mr. Trump could announce at the Summit of the Americas in Peru this week. Even Canadian and Mexican officials signalled that things were moving along at a fast clip.

However, Mr. Trump has cancelled his trip to the summit. U.S. Trade Representative Robert Lighthizer has also opted not to attend the summit, dashing hopes for a meeting between himself, Foreign Affairs Minister Chrystia Freeland and Mexican Economy Minister Ildefonso Guajardo to push NAFTA talks forward.

The lack of progress on a deal comes as Canada and Mexico face the prospect of new steel and aluminium tariffs May 1: The Trump administration announced its exemptions of the two countries from the duties – 25 per cent on steel and 10 per cent on aluminium – will expire at the start of next month without a new NAFTA deal.

The U.S. President insisted on Thursday that any report he wanted a fast deal was “fake news” – even though his own point man on the file, Mr. Lighthizer, announced in early March that he wanted an agreement within six weeks. The President said he was happy to leave NAFTA in flux because this would discourage companies from moving to Mexico.

“There’s no timeline,” Mr. Trump said at a trade meeting with governors and members of Congress at the White House. “We can negotiate forever … It could be three or four weeks. It could be two months. It could be five months. I don’t care.”

During a closed-door portion of the meeting, Mr. Trump announced that he had ordered Mr. Lighthizer to look at how the U.S. could get back into TPP. The directive, revealed by Nebraska Senator Ben Sasse, appeared to catch even Mr. Trump’s own administration by surprise: His nominee for secretary of state, Mike Pompeo, told a legislative committee later in the day that the order was “news to me.”

While these head-spinning developments were taking place at the White House, teams of NAFTA negotiators continued working feverishly around Washington for a deal.

The key negotiating table on automotive rules of origin met on Thursday for the second of three consecutive days of talks.

The U.S. is still trying to convince Mexico to agree to new rules that would tie automotive content to wages. Under Mr. Lighthizer’s proposal, auto companies would have to source some parts from factories where workers make at least US$15 an hour, a provision that would incentivize the use of auto parts from the U.S. instead of Mexico.

Two sources with knowledge of the talks said negotiations are now focused on sorting out which parts would have to be made in factories with a wage standard and which would not. One source said the U.S. now wants the wage threshold to be US$16 an hour. Another source said the threshold would vary depending on the part, and would be pegged to the average North American wage for that part.

As auto talks ground on, the three sides are even further apart on other contentious matters.

Two people with knowledge of the talks said there has been no agreement on procurement, where the U.S. wants a Buy American rule that would restrict how much government contracting Canadian and Mexican firms could bid on; a sunset clause, in which the U.S. wants to automatically terminate NAFTA in five years unless all three countries agree to extend it; Chapter 19 dispute resolution, which the U.S. wants to abolish; or Canada’s protectionist supply management system for milk, eggs and dairy, which Washington wants to open up to foreign competition.

The schedule viewed by The Globe did not list procurement, agriculture or dispute resolution among the negotiating tables meeting this week.

REUTERS. APRIL 13, 2018. U.S. lowers NAFTA regional auto content demand: Mexico auto lobby

MEXICO CITY (Reuters) - U.S. trade negotiators have reduced their demand for regional auto content under a reworked NAFTA trade deal to 75 percent from the 85 percent they had sought, Eduardo Solis, the head of Mexico’s automotive industry association, said on Friday.

Eduardo Solis, President of the Mexican Automotive Industry Association (AMIA), speaks during an interview with Reuters in Mexico City, Mexico May 22, 2017. REUTERS/Carlos Jasso/File Photo

Asked whether reports were true that Washington had scaled back its demand to 75 percent, Solis said: “Yes.”

Reporting by Anthony Esposito; Editing by Dave Graham

BLOOMBERG. BUSINESSWEEK. 13 April 2018. These Are Five Sticking Points to a New Nafta Deal

By Josh Wingrove

The clock is running on Nafta negotiations. Though trade among the U.S., Canada and Mexico has tripled since the North American Free Trade Agreement took effect in 1994, U.S. President Donald Trump blames the accord for a loss of U.S. manufacturing jobs and for trade deficits. Talks to update Nafta effectively began last August with a pair of objectives -- modernizing an aging agreement for new economies and rewriting it to appease Trump. With time running out to get a deal in time for this U.S. Congress to pass it, these are the major sticking points.

1. The Tariff-Free Auto

For Trump, Nafta is mostly about cars. Mexico has emerged as an auto-making powerhouse within Nafta, sending on average $4.3 billion of parts and $2.6 billion of finished vehicles each month to the U.S. over the last five years. Under current Nafta rules, at least 62.5 percent of a car needs to be sourced from the three countries in order for it to be traded tariff-free. U.S. negotiators are said to want to raise that to 75 percent (down from their initial proposal of 85 percent), though the details aren’t yet clear. The U.S. also wants to expand the “tracing list” of car parts whose origin is actually tracked. Canada and Mexico have warned that the U.S. proposals are too much, too fast, and that companies would simply abandon using Nafta -- and pay U.S. tariffs, which are relatively low -- rather than contort their supply chains.

2. Mexico’s Fruit and Canada’s Milk

The U.S. seeks the phase-out of Canada’s protectionist system of quotas and tariffs for dairy and poultry, known as supply management, which is something of a sacred cow. Its demise is seen as a political non-starter for Canada. The U.S. also wants to lower the bar for mounting a trade challenge against Mexico for exports of fruits to the U.S. There’s been virtually no movement on either. It’s not clear if the U.S. backed down, as some analysts believe happened.

3. The Airing of Grievances

Two of Nafta’s provisions for settling fights are under fire. One sets up panels to review complaints that a country is flooding another’s market with an under-priced product, a practice known as dumping. The stakes over these so-called Chapter 19 panels (after the section of Nafta that created them) are high. Canadian Prime Minister Justin Trudeau says the panels are “essential.” The U.S. wants them gone. U.S. negotiators are also targeting investor-state dispute settlement panels, which deal with disagreements between a company and a government. The U.S. wants to make that system optional, hinting they’d drop out altogether. The U.S. business community opposes such a step. Canada and Mexico have said they’d strike a side deal if necessary to keep the panels.

4. The Sharing of Work

U.S. administrations have long advanced so-called Buy American policies to shield public-works projects from foreign bidders. Such policies can result in other countries retaliating by blocking U.S. corporations, such as General Electric Co., from winning foreign business. The U.S. wants to cap the combined value of contracts available to Canadian and Mexican bidders at whatever the value is of contracts those countries award to U.S. companies. Such a formula could benefit the U.S., since its economy and population dwarf those of its neighbors. The sides are in a standoff here.

5. The Five-Year Itch

The U.S. wants to add a clause specifying that Nafta expire in five years unless the three countries agree to extend it. Businesses warn that such a move would would kneecap long-term investment by adding too much uncertainty into the mix. Negotiators settle on some kind of non-binding periodic review. After all, Nafta already has an exit clause: any country can quit on six months’ notice.

The Reference Shelf

BLOOMBERG. BUSINESSWEEK. 13 April 2018. These Are Five Sticking Points to a New Nafta Deal

By Josh Wingrove

The clock is running on Nafta negotiations. Though trade among the U.S., Canada and Mexico has tripled since the North American Free Trade Agreement took effect in 1994, U.S. President Donald Trump blames the accord for a loss of U.S. manufacturing jobs and for trade deficits. Talks to update Nafta effectively began last August with a pair of objectives -- modernizing an aging agreement for new economies and rewriting it to appease Trump. With time running out to get a deal in time for this U.S. Congress to pass it, these are the major sticking points.

1. The Tariff-Free Auto

For Trump, Nafta is mostly about cars. Mexico has emerged as an auto-making powerhouse within Nafta, sending on average $4.3 billion of parts and $2.6 billion of finished vehicles each month to the U.S. over the last five years. Under current Nafta rules, at least 62.5 percent of a car needs to be sourced from the three countries in order for it to be traded tariff-free. U.S. negotiators are said to want to raise that to 75 percent (down from their initial proposal of 85 percent), though the details aren’t yet clear. The U.S. also wants to expand the “tracing list” of car parts whose origin is actually tracked. Canada and Mexico have warned that the U.S. proposals are too much, too fast, and that companies would simply abandon using Nafta -- and pay U.S. tariffs, which are relatively low -- rather than contort their supply chains.

2. Mexico’s Fruit and Canada’s Milk

The U.S. seeks the phase-out of Canada’s protectionist system of quotas and tariffs for dairy and poultry, known as supply management, which is something of a sacred cow. Its demise is seen as a political non-starter for Canada. The U.S. also wants to lower the bar for mounting a trade challenge against Mexico for exports of fruits to the U.S. There’s been virtually no movement on either. It’s not clear if the U.S. backed down, as some analysts believe happened.

3. The Airing of Grievances

Two of Nafta’s provisions for settling fights are under fire. One sets up panels to review complaints that a country is flooding another’s market with an under-priced product, a practice known as dumping. The stakes over these so-called Chapter 19 panels (after the section of Nafta that created them) are high. Canadian Prime Minister Justin Trudeau says the panels are “essential.” The U.S. wants them gone. U.S. negotiators are also targeting investor-state dispute settlement panels, which deal with disagreements between a company and a government. The U.S. wants to make that system optional, hinting they’d drop out altogether. The U.S. business community opposes such a step. Canada and Mexico have said they’d strike a side deal if necessary to keep the panels.

4. The Sharing of Work

U.S. administrations have long advanced so-called Buy American policies to shield public-works projects from foreign bidders. Such policies can result in other countries retaliating by blocking U.S. corporations, such as General Electric Co., from winning foreign business. The U.S. wants to cap the combined value of contracts available to Canadian and Mexican bidders at whatever the value is of contracts those countries award to U.S. companies. Such a formula could benefit the U.S., since its economy and population dwarf those of its neighbors. The sides are in a standoff here.

5. The Five-Year Itch

The U.S. wants to add a clause specifying that Nafta expire in five years unless the three countries agree to extend it. Businesses warn that such a move would would kneecap long-term investment by adding too much uncertainty into the mix. Negotiators settle on some kind of non-binding periodic review. After all, Nafta already has an exit clause: any country can quit on six months’ notice.

The Reference Shelf

- QuickTake explainers on what a trade war looks like, what might happen to Mexico without Nafta, and why milk is a U.S.-Canada issue.

- Among Nafta’s gifts to Mexico: more obesity.

- Nafta’s biggest challenge may come after a deal is reached, Shannon O’Neil writes in Bloomberg View.

TPP

THE GLOBE AND MAIL. REUTERS. APRIL 13, 2018. Trump says U.S. will only rejoin Pacific trade pact under ‘substantially better’ terms

WASHINGTON/TOKYO - U.S. President Donald Trump said the United States would only join the Trans Pacific Partnership, a multinational trade deal his administration walked away from last year, if it offered “substantially better” terms than those provided under previous negotiations.

His comments, made on Twitter late Thursday, came only hours after he had unexpectedly indicated the United States might rejoin the landmark pact, and amid heightened volatility in financial markets as Washington locked horns with China in a bitter trade dispute.

Trump had told Republican senators earlier in the day that he had asked United States Trade Representative Robert Lighthizer and White House economic adviser Larry Kudlow to re-open negotiations.

In his Twitter post, which came during Asian trading hours, Trump said the United States would “only join TPP if the deal were substantially better than the deal offered to Pres. Obama. We already have BILATERAL deals with six of the eleven nations in TPP, and are working to make a deal with the biggest of those nations, Japan, who has hit us hard on trade for years!”

Policymakers in the Asia-Pacific region on Friday responded to the possibility of the U.S. rejoining the trade deal with scepticism.

“If it’s true, I would welcome it,” Japanese Finance Minister Taro Aso told reporters after a cabinet meeting on Friday and before Trump’s tweet. Aso added that the facts needed to be verified.

Trump “is a person who could change temperamentally, so he may say something different the next day”, Aso said.

Australian Prime Minister Malcolm Turnbull, commenting after Trump’s tweet, said it would be “great” to have the U.S. back in the pact though doubted it would happen.

“We’re certainly not counting on it,” Turnbull told reporters in Adelaide in South Australia.

The TPP, which now comprises 11 nations, was designed to cut trade barriers in some of the fastest-growing economies of the Asia-Pacific region and to counter China’s rising economic and diplomatic clout.

Trump, who opposed multilateral trade pacts in his election campaign in 2016 and criticised the TPP as a “horrible deal”, pulled the U.S. out of the pact in early 2017. He argued bilateral deals offered better terms for U.S. businesses and workers, and signalled an intention to raise trade barriers.

But Trump is struggling to get support from other countries for his recent threat to impose import tariffs on China and the U.S. farm lobby is arguing that retaliation by China would hit American agricultural exports.

Trade experts believe Trump is probably trying to placate his political base in the wake of criticism over the U.S.-China China tariff standoff.

“Well I think you have to take it seriously but I think there is an enormous chance that this is simply posturing or a tactical decision taken to placate concerned governors and senators from agricultural states that could be affected by China imposing tariffs,” said Charles Finny, a Wellington-based trade consultant and a former New Zealand government trade negotiator.

“I think it’s very important for people to realise, particularly given this most recent tweet, if there is a negotiation it will not be an easy one. It will take a long time and also there is huge risk around ratification.”

NEW PROCESS

Even before Trump’s official withdrawal last year, U.S. participation in the pact was seen as increasingly unlikely due to opposition in the U.S. Congress.

The United States entered TPP negotiations in 2008. In 2016, then President Barack Obama’s administration abandoned attempts to push the pact through Congress.

The other 11 countries forged ahead with their own agreement without U.S. participation, and in the process eliminated chapters on investment, government procurement and intellectual property that were key planks of Washington’s demands.

New Zealand Prime Minister Jacinda Ardern, noting the progress made by the 11 countries after Trump abandoned the deal, also flagged challenges to the Untied States rejoining the pact.

“If the United States, it turns out, do genuinely wish to rejoin, that triggers a whole new process,” she told reporters in Auckland.

“There would be another process and so, at this stage we are talking hypotheticals.”

The 11-member pact includes Mexico and Canada, which are in the process of re-negotiating the terms of the North American Free Trade Agreement with the United States.

A Canadian government official said on Thursday there had not been any formal outreach from the United States about the pact.

Japanese Prime Minister Shinzo Abe will meet Trump next week. Japan, a close U.S. ally, is a member of the TPP.

REUTERS. APRIL 13, 2018. Trump says would only join TPP if deal were substantially better than offered to Obama

(Reuters) - President Donald Trump said late on Thursday he would only consider joining the landmark Trans-Pacific Partnership trade agreement if it were a “substantially better” deal than the one offered to President Barack Obama.

“We already have bilateral deals with six of the eleven nations in TPP, and are working to make a deal with the biggest of those nations, Japan, who has hit us hard on trade for years!” he wrote on Twitter.

Reporting by Brendan O'Brien; Editing by Eric Meijer

BLOOMBERG. 13 April 2018. TPP Nations Welcome Trump's Interest, Don't Want Renegotiation

By Justin Sink and Margaret Talev

Members of an 11-nation Asia-Pacific trade pact said Friday they opposed any renegotiation of the deal to accommodate the U.S. should it decide to rejoin at a later date.

Ministers from Japan, Australia and Malaysia welcomed President Donald Trump directing officials to explore returning to the Trans-Pacific Partnership, a pact he withdrew from shortly after coming to office. But they also cautioned against making any significant changes.

"We welcome the U.S. coming back to the table but I don’t see any wholesale appetite for any material re-negotiation of the TPP-11,” Australia Trade Minister Steven Ciobo said Friday.

Toshimitsu Motegi, Japan’s minister in charge of TPP, also said it would be difficult to change the deal, calling it a "balanced one, like fine glassware." Malaysia’s International Trade and Industry Minister Mustapa Mohamed echoed these remarks, saying that renegotiation would "alter the balance of benefits for parties.”

Trump Tweet

In a Twitter post on Thursday night, Trump said the U.S. "would only join TPP if the deal were substantially better than the deal offered to Pres. Obama. We already have BILATERAL deals with six of the eleven nations in TPP, and are working to make a deal with the biggest of those nations, Japan, who has hit us hard on trade for years!"

In remarks on Thursday he also expressed optimism about a deal with China, a week after escalating tensions with his threat to impose tariffs on an additional $100 billion in Chinese products. He said the two countries ultimately may end up levying no new tariffs on each other.

“Now we’re really negotiating and I think they’re going to treat us really fairly,” Trump said during a White House meeting with Republican governors and lawmakers from farm states. “I think they want to.”

U.S. Commerce Secretary Wilbur Ross later said the administration needs to see concrete actions from China to reach a deal.

The remarks were another conciliatory signal from the administration following tit-for-tat tariffs proposals from the world’s largest two economies that rattled markets. Trump also indicated that talks are progressing toward successful renegotiation of the North American Free Trade Agreement.

The S&P 500 Index closed up 0.8 percent and the Dow Jones Industrial Average added almost 300 points, or 1.2 percent, as investors assessed the changing trade dynamics. Asian stocks climbed as equities in Japan and Australia advanced.

Trump withdrew the U.S. from the accord during his first week in office. The pact, which was conceived as a counterweight to China’s rising economic power in the region, had been negotiated under the Obama administration but never approved by Congress.

Senator Ben Sasse, Nebraska Republican who participated in a meeting with Trump on Thursday where he spoke about rejoining the deal, said: "He multiple times reaffirmed the point that TPP might be easier to join now."

The news drew a rebuke from opponents of the multilateral trade pact. AFL-CIO President Richard Trumka, head of the main trade union group, said on Twitter that TPP “was killed because it failed America’s workers and it should remain dead.”

Democrat Senator Sherrod Brown, said he was “very open to a new TPP” as long as it had strong labor rights protections and currency provisions. “You’d need a whole renegotiation.”

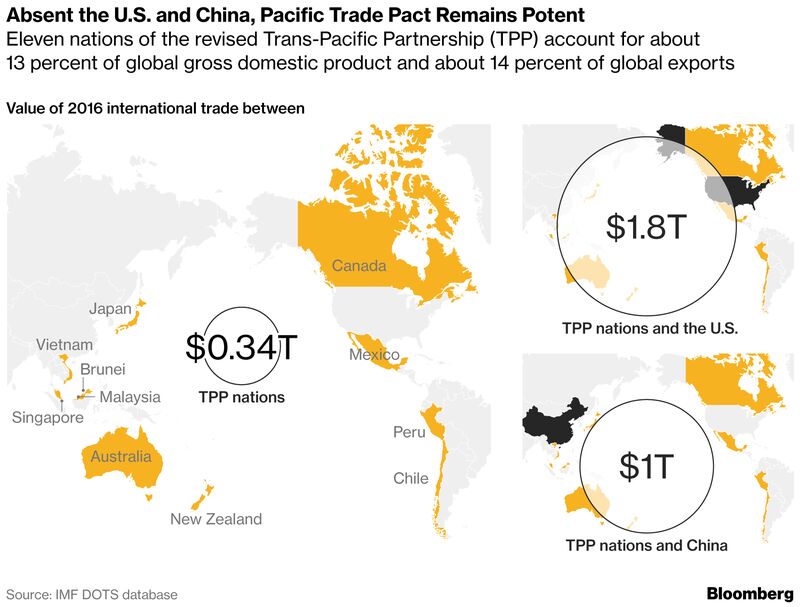

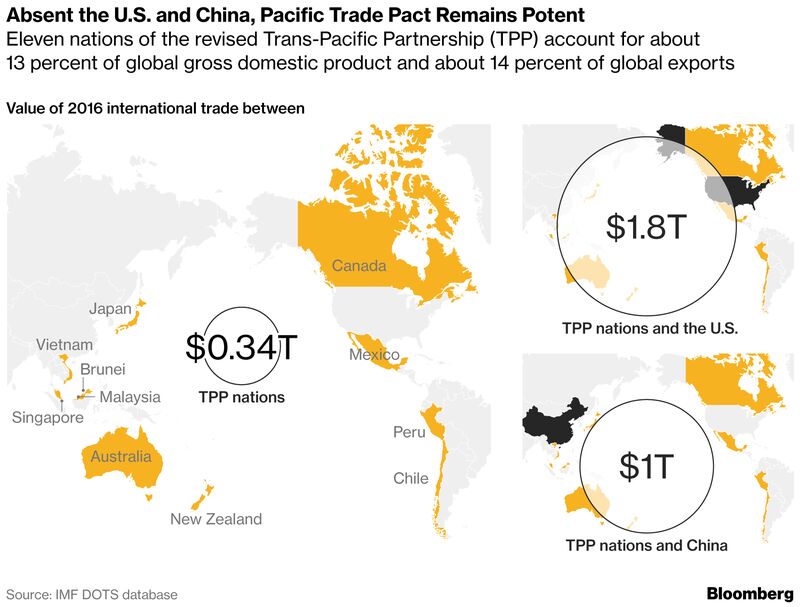

The 11 remaining nations represent 13 percent of global output and include Japan and Canada. They finalized a revised version of the trade pact last month, renaming it the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or CPTPP.

One of the White House officials said that while the president prefers negotiating bilateral trade deals, a multilateral deal with the TPP countries would counter Chinese competition and would be faster than negotiating one-on-one with each of the 11 other nations.

— With assistance by Debra Mao, Steven T. Dennis, Connor Cislo, Toru Fujioka, Isabel Reynolds, and Ben Bartenstein

BLOOMBERG. 13 April 2018. TPP Nations Welcome Trump's Interest, Don't Want Renegotiation

By Justin Sink and Margaret Talev

- Trump ordered officials to take another look at a TPP deal

- President said trade deal ‘easier to join now,’ Sasse says

Members of an 11-nation Asia-Pacific trade pact said Friday they opposed any renegotiation of the deal to accommodate the U.S. should it decide to rejoin at a later date.

Ministers from Japan, Australia and Malaysia welcomed President Donald Trump directing officials to explore returning to the Trans-Pacific Partnership, a pact he withdrew from shortly after coming to office. But they also cautioned against making any significant changes.

"We welcome the U.S. coming back to the table but I don’t see any wholesale appetite for any material re-negotiation of the TPP-11,” Australia Trade Minister Steven Ciobo said Friday.

Toshimitsu Motegi, Japan’s minister in charge of TPP, also said it would be difficult to change the deal, calling it a "balanced one, like fine glassware." Malaysia’s International Trade and Industry Minister Mustapa Mohamed echoed these remarks, saying that renegotiation would "alter the balance of benefits for parties.”

Trump Tweet

In a Twitter post on Thursday night, Trump said the U.S. "would only join TPP if the deal were substantially better than the deal offered to Pres. Obama. We already have BILATERAL deals with six of the eleven nations in TPP, and are working to make a deal with the biggest of those nations, Japan, who has hit us hard on trade for years!"

In remarks on Thursday he also expressed optimism about a deal with China, a week after escalating tensions with his threat to impose tariffs on an additional $100 billion in Chinese products. He said the two countries ultimately may end up levying no new tariffs on each other.

“Now we’re really negotiating and I think they’re going to treat us really fairly,” Trump said during a White House meeting with Republican governors and lawmakers from farm states. “I think they want to.”

U.S. Commerce Secretary Wilbur Ross later said the administration needs to see concrete actions from China to reach a deal.

The remarks were another conciliatory signal from the administration following tit-for-tat tariffs proposals from the world’s largest two economies that rattled markets. Trump also indicated that talks are progressing toward successful renegotiation of the North American Free Trade Agreement.

The S&P 500 Index closed up 0.8 percent and the Dow Jones Industrial Average added almost 300 points, or 1.2 percent, as investors assessed the changing trade dynamics. Asian stocks climbed as equities in Japan and Australia advanced.

Trump withdrew the U.S. from the accord during his first week in office. The pact, which was conceived as a counterweight to China’s rising economic power in the region, had been negotiated under the Obama administration but never approved by Congress.

Senator Ben Sasse, Nebraska Republican who participated in a meeting with Trump on Thursday where he spoke about rejoining the deal, said: "He multiple times reaffirmed the point that TPP might be easier to join now."

The news drew a rebuke from opponents of the multilateral trade pact. AFL-CIO President Richard Trumka, head of the main trade union group, said on Twitter that TPP “was killed because it failed America’s workers and it should remain dead.”

Democrat Senator Sherrod Brown, said he was “very open to a new TPP” as long as it had strong labor rights protections and currency provisions. “You’d need a whole renegotiation.”

The 11 remaining nations represent 13 percent of global output and include Japan and Canada. They finalized a revised version of the trade pact last month, renaming it the Comprehensive and Progressive Agreement for Trans-Pacific Partnership or CPTPP.

One of the White House officials said that while the president prefers negotiating bilateral trade deals, a multilateral deal with the TPP countries would counter Chinese competition and would be faster than negotiating one-on-one with each of the 11 other nations.

— With assistance by Debra Mao, Steven T. Dennis, Connor Cislo, Toru Fujioka, Isabel Reynolds, and Ben Bartenstein

US - CHINA

REUTERS. APRIL 13, 2018. U.S. trade war fears ripple through China's 'workshop of the world'

James Pomfret

DONGGUAN, China (Reuters) - Allan Chau, the general manager of a Chinese factory making precision metal parts for U.S. customers, is still calling it a “proposed” trade war, but that hasn’t stopped him from planning for the worst.

Unlike last year, when U.S. President Donald Trump sounded protectionist warnings that were largely dismissed as bluster, Chau and other factory bosses across China say the risks from this trade spat are now far more tangible.

As a result they warn of a possible wave of small factory closures, a shift of some production away from China, and the use of questionable practices to dodge increased tariffs.

“Before, we didn’t think we’re affected because we’re doing little metallic parts,” said Chau at his three-storey beige-colored-plant in Dongguan. “(Now), everybody is talking about this proposed war.”

The city of Dongguan is one of the main export hubs in southern China’s Pearl River Delta. The region has been dubbed the “workshop of the world” and accounts for around a quarter of China’s exports.

As hundreds of computer-controlled lathes hummed around him, fashioning slender aluminum, steel and brass rods into intricate parts, Chau pointed out a car valve, the size of a thumb - used in car braking systems assembled in U.S. plants - as an example of a product caught up in the storm.

Of the 1,500 or so metal parts made in Chau’s plant, including needles for espresso machines to puncture coffee capsules, he says around 200 could be hit by the proposed U.S. tariffs that stand to affect $50 billion worth of Chinese goods.

“If they’re going to propose 25 percent tax on those things, we have a lot of counter-measures we’ve got to do to keep ourselves alive,” said Chau, whose company, Tien Po International, has run factories in China for more than 30 years.

Chau says he’s now considering building a warehouse in Malaysia, Vietnam or Thailand, where he could ship his goods for re-export, or he talks of setting up a small factory in a Southeast Asian country to avoid the increased tariffs altogether.

EXACERBATE THE PAIN

China’s reliance on exports as an economic driver has declined over the past decade, with total exports as a percentage of Gross Domestic Product dropping to 18 percent in 2017 from 35 percent in 2006, according to research by Credit Suisse.

But at a more micro level, at the heart of China’s vast industrial supply chains, the tariffs stand to exacerbate the pain of already struggling plants.

Many have already been buffeted by an appreciating currency, soaring wage costs, and labor shortages as a younger generation shuns a life on the factory floor.

The Trump threat has been a further sideswipe for many exporters and soured sentiment, even as the full implications are unclear.

“The U.S. is a huge market and some of the companies, especially those less competitive, may be washed out,” said Danny He, the founder of Alpha Lighting, a small LED maker in Dongguan with 100 workers.

In interviews with six other Chinese manufacturers of LED lighting products, another affected sector, four expect some closures of Chinese factories, particularly those making more generic products like bulbs and LED panels.

Places like Dongguan, with large clusters of grittier industrial plants, are especially vulnerable.

Dongguan’s economic growth of 8.1 percent last year while robust, doesn’t fully reflect its long struggle to upgrade rusting factories and catch up with the likes of neighboring technology powerhouse Shenzhen.

“If you are those without special technology or products, you will die,” said Rose Qiu, a director with Zhejiang Fonda Technology, another LED maker.

Jacky Patel, the president of OM Lighting, an exporter of Chinese lighting products to several U.S. states including Florida, said the tariffs would be passed onto U.S. consumers.

“The customer will have to pay 30 to 35 percent more.”

“They won’t be happy but we have no other choice. We just have to go with the flow.”

All six LED makers interviewed by Reuters also said they would pass on any extra costs to U.S. customers.

“We are considering moving our core market out of the U.S., said James Chou, the boss of Poly Dragon, who has run an LED factory in Dongguan for the past 17 years.

“I worry even more about the global economy going into a recession under a trade war.”

Chinese manufacturers talk of being stuck in limbo.

“Over in the U.S. right now they don’t dare make new orders ... So everyone is just monitoring things and no one knows what will happen next,” said Chau from the precision metal parts factory.

GREY AREAS

Under a so-called harmonized system of tariffs - Chinese products are now coded specifically so that the same product would face higher U.S. tariffs if used in a higher-tech sector like nuclear energy, rather than a more generic category like household electronics.

“There’s still a gray area,” said one manufacturer who declined to be named, adding that there was scope for some factories to fudge such codes to avoid tariffs.

He said some U.S. customers were also proposing components be shipped to Mexico to blur the country of origin. Such a practice could technically be illegal.

More broadly, should the retaliatory trade moves escalate, and the U.S. slap tariffs on more mainstream goods like household appliances, consumer electronics or toys, the repercussions would be substantially higher.

Ye Xiaqing, with the China Household Electrical Appliance Association, told Reuters that so far, only 5 percent of household appliance exports to the U.S. were affected by the proposed increase in tariffs.

“If they impose tax on the household appliances, they’re going to raise the price and that will affect the citizens of the U.S. at the end,” said Chau, the Dongguan factory owner.

“Donald Trump doesn’t want to do that. He’s already pissed off enough people there.”

Reporting by James Pomfret in Dongguan, Additional reporting by Wyman Ma and Tina Ge in Hong Kong, Michael Martina in Beijing; Editing by Martin Howell

REUTERS. APRIL 13, 2018. Trade war backfire: Steel tariff shrapnel hits U.S. farmers

Tom Polansek, P.J. Huffstutter

KANE COUNTY, Ill. (Reuters) - Lucas Strom, who runs a century-old family farm in rural Illinois, canceled an order to buy a new $71,000 grain storage bin last month - after the seller raised the price 5 percent in a day.

The reason: steel prices jumped right after U.S. President Donald Trump announced tariffs.

Throughout U.S. farm country, where Trump has enjoyed strong support, tariffs on steel and aluminum imports are boosting costs for equipment and infrastructure and causing some farmers and agricultural firms to scrap purchases and expansion plans, according to Reuters’ interviews with farmers, manufacturers, construction firms and food shippers.

The impact of rising steel prices on agriculture illustrates the unintended and unpredictable consequences of aggressive protectionism in a global economy. And the blow comes as farmers fear a more direct hit from retaliatory tariffs threatened by China on crops such as sorghum and soybeans, the most valuable U.S. agricultural export.

A&P Grain Systems in Maple Park, Illinois - the seller of the storage bin Strom wanted to buy with a neighboring farmer - raised its price two days after Trump announced aluminum and steel tariffs on March 1 to protect U.S. producers of the metals. Strom and his neighbor backed out.

“Would that price destroy us? No,” Strom said. “But these days, you have to be smart about your expenses.”

The metals tariffs also hitting makers and sellers of farm equipment, from smaller firms like A&P Grain to global giants such as Deere & Co (DE.N) and Caterpillar Inc (CAT.N). Such firms are struggling with whether and how to pass along their higher raw materials costs to farmers who are already reeling from low commodity prices amid a global grains glut.

The world’s two largest economies have threatened each other with tariffs on tens of billions of dollars of goods recent weeks.

Trump imposed tariffs of 25 percent on steel and 10 percent on aluminum in a move mainly aimed at curbing imports from China. He has since temporarily excluded the European Union and six other allies from the duties and given them until May 1 to negotiate permanent exemptions.

A&P Grain President Dave Altepeter said the steel used in their bins is made in the United States, but domestic steel prices also have soared because of the tariffs.

U.S. steel mills typically adjust their prices once a year, normally in the first quarter, Altepeter said. But this year, those prices have jumped four times, he said.

The price of steel used in A&P’s grain bins has jumped about 20 percent since January 1.

“Any time there’s any type of negative talk that affects the steel mill, they’ve raised the price,” said Altepeter.

Last year, about 95,000 tons of steel was shipped to the agriculture industry, compared to the 14 million tons for the U.S. auto industry, according to the American Iron and Steel Institute, an industry group.

Other factors had been driving up steel prices before the recent trade disputes, including an improving global economy and accelerating manufacturing and construction, particularly in the U.S.

The White House referred questions from Reuters to the U.S. Department of Agriculture, which did not respond to a request for comment. Trump and Agriculture Secretary Sonny Perdue have vowed the U.S. government will protect farmers from China’s tariffs, but not explained how.

U.S. farmers can ill-afford any loss of sales. Farm income has dropped by more than half since 2013, following years of massive harvests that have depressed prices for staples such as corn and soybeans.

U.S. competitors Brazil, Argentina and Russia have all raised grain output in recent years, eating into the U.S. share of global markets. Mexico imported ten times more corn from Brazil last year and is set to buy even more in 2018 on worries that renegotiations of the NAFTA trade pact could disrupt their U.S. supplies.

Strom said he has also pushed back plans to build a new metal storage building to house his planter and the combine head he uses for harvesting corn and soybeans. Other farmers, food producers and beer makers have scrambled to finalize deals for steel-based equipment before prices climb more.

CONSTRUCTION POSTPONED

In Riverton, Illinois, farmer Allen Entwistle said he postponed construction of a new $800,000 storage system for grain after AGCO Corp’s (AGCO.N) GSI unit increased prices by 15 percent.

Entwistle, who voted for Trump, will instead store corn in bags on the ground.

“President Trump keeps telling us he’s going to get a better deal,” Entwistle said. “When are we gonna make it better?”

AGCO said Trump’s tariffs will raise its costs and make price hikes to customers unavoidable.

“As the entire grain storage industry has weathered increased steel prices, AGCO and GSI are constantly looking for new ways to maximize efficiency and minimize the impact to customers,” said spokeswoman Kelli Cook.

Other companies, including Deere and Caterpillar, are also facing pain from rising steel prices, which account for about 10 percent of equipment manufacturers’ direct costs.

Deere CEO Samuel Allen told Reuters last month the company will have to absorb the price increase and cut costs elsewhere. China’s threatened tariffs on U.S. crops could hurt the company even more by undermining demand from farmers, he said.

“This has a huge effect on livelihood of the farmer right now, and at the same time it has a huge impact on manufacturers,” said Dennis Slater, president at the Association of Equipment Manufacturers, an industry group.

U.S. net farm income is forecast to drop to $59.5 billion in 2018 dollars, down from $64.9 billion in 2017, an 8.3 percent decline, according to the USDA.

TARIFF ‘DOOM-AND-GLOOM’

In Sheffield, Iowa, Sukup Manufacturing has seen steel prices soar 40 percent since November, said Brent Hansen, the company’s commercial accounts manager.

The maker of grain bins and pre-manufactured steel buildings has encouraged customers to buy quickly before prices jump more. But some have already postponed projects, Hansen said.

“That’s obviously a big price increase for an industry that’s a little bit doom-and-gloom over tariffs,” Hansen said.

Sukup used to give customers up to two months to consider its bids for projects. Now, it allows just a week in some cases because of volatile steel prices, Hansen said.

Prices have jumped by 25 percent for thermal insulated panels that keep food cold – which can use either steel, aluminum or both, said Glenn Todd, owner of Todd Construction Services. The company has built food processing and storage facilities for Bumble Bee Seafoods and poultry company Foster Farms.

Richard Adkins, director of sales at Discovery Designs Refrigeration in Mukwonago, Wisconsin, thought his company wouldn’t have to worry about Trump’s tariffs. Most of the metal they use to design industrial refrigeration systems comes from Canada and Mexico, he said, and the president has exempted both countries from the levies.

It didn’t matter. Price-hike notices from vendors landed in Adkins’ mailbox days after Trump announced the duties.

Deere & Co

150.89

DE.NNEW YORK STOCK EXCHANGE

+0.63(+0.42%)

DE.N

DE.NCAT.NAGCO.N

“There’s this knee-jerk reaction,” Adkins said. “We’re quoting prices for projects that won’t be awarded for another six or eight months, and no one wants to be hung out to dry.”

Reporting by Tom Polansek in Chicago and PJ Huffstutter in Kane County. Additional reporting by Rajesh Kumar Singh in Chicago.; Editing by David Gaffen, Simon Webb and Brian Thevenot

ECONOMY

REUTERS. BANK OF CANADA. APRIL 13, 2018. Bank of Canada to go slow and steady with two more rate hikes in 2018: poll

Leah Schnurr

OTTAWA (Reuters) - The Bank of Canada is likely to raise interest rates twice more this year as the economy regains momentum in the current quarter but will hold them steady at its April 18 meeting, according to a Reuters poll of economists.

Risks posed by highly indebted consumers and an uncertain future around Canada’s trade arrangements with the United States, its largest export market, are expected to restrain the central bank from tightening policy more quickly.

After growing strongly last year, the economy got off to a disappointing start in 2018. The first quarter’s performance is forecast to be further reined in by weak trade and a housing market coming off the boil.

Economists as a group trimmed their first-quarter growth forecast to 1.8 percent from 2.0 percent in the previous poll. But the survey concluded that slowdown will be temporary, with expectations for the second quarter bumped up to 2.4 percent from 2.0 percent.

Along with a tightening labor market and rising inflation, that should prompt the bank to resume raising interest rates, with a 25-basis-point increase in the third quarter and another in the fourth quarter.

“The growth fears you’re seeing right now in the market generally probably aren’t going to last,” said Benjamin Reitzes, senior economist at BMO Capital Markets, who sees the Bank of Canada next raising rates in July.

Canada’s central bank has hiked rates three times since July 2017, while the U.S. Federal Reserve raised its benchmark rate last month and is due to raise rates twice more this year. The Bank of Canada has said it will be cautious in considering future moves.

“It would be reasonable for the Bank to continue to raise rates slowly but surely. Going in July is not particularly aggressive, given their prior move would have been in January,” Reitzes said.

Twenty-seven of 29 economists said rates would remain on hold at 1.25 percent at its April 18 policy decision.

Like other central banks, the BoC is trying to lift rates off historically low levels imposed as a response to the global financial crisis a decade ago, but without snuffing out economic growth that has been supported by rock-bottom rates.

Fourteen poll respondents who answered an additional question said the bigger risk to the economy would be if the central bank raised rates too quickly. Just three said tightening policy too slowly was a bigger risk.

There are also a number of uncertainties likely to prompt policymakers to take their time, including the uncertain fate of the North American Free Trade Agreement (NAFTA) and how highly indebted Canadian households would handle higher rates.

In March, the BoC held rates steady, saying trade policy was an “important and growing source of uncertainty,” but February’s inflation rate was a three-year high of 2.4 percent, above the central bank’s 2 percent target.

Still, Canada’s trade-sensitive dollar is set to advance over the coming year as prospects improve for a revamped NAFTA trade deal.

Higher borrowing costs, along with recent tighter mortgage regulations, have already weighed on home sales and prices. The Bank has said it could take several months to see how consumers react to rate hikes already in place.

“What really is dictating the more gradual pace is the high household debt loads that make consumers that much more sensitive to rate hikes,” said Brittany Baumann, macro strategist at TD Securities, who expects just one more rate hike this year.

Canadian household debt as a share of income remained near a record high in the fourth quarter.

Still, analysts do not see much impact on housing starts for now, with ground breaking on new homes expected to average 204,000 units in 2018, in line with levels considered to be consistent with demographic demand.

Reporting by Leah Schnurr; Polling by Kailash Bathija in Bengaluru; Editing by Ross Finley and Bernadette Baum

BOMBARDIER

The Globe and Mail. REUTERS. 13 Apr 2018. Bombardier to bid on New Jersey rail contract, sources say

ALLISON LAMPERT, MONTREAL

Bombardier Inc. will bid on an impending New Jersey Transit rail car contract, two sources familiar with the matter said, as the Canadian plane and train maker seeks to boost its North American business after losing ground in the region to rivals.

NJ Transit, the largest statewide public transportation system in the United States, has previously said it will order 113 multilevel passenger cars to modernize its aging fleet, which has been criticized for overcrowding and delays. The agency is also considering an estimated 900 more railcars as options, according to the industry sources who spoke on condition of anonymity because the tendering process is private.

Proposals are expected in June, according to the agency’s website. The deal is expected to range from around US$500-million into the billions of dollars, depending on how many, if any, options are exercised, one of the sources said.

Bombardier declined to comment. NJ Transit did not respond to a request for comment.

Despite a healthy US$34-billion global backlog, Bombardier Transportation is under pressure to improve performance in North America following delays to orders in Ontario and recent losses to other rail makers in Canada and the United States.

The company, which lost a Montreal rail deal worth more than $1-billion to France’s Alstom SA, had to drop out of a 2017 competition held by New York’s Metropolitan Transportation Authority that was later won by Japan’s Kawasaki Heavy Industries. But Bombardier is seen to have an advantage in the NJ procurement, one of the sources said, because it has already made 429 multilevel vehicles over the years for the agency, a longstanding client.

BOMBARDIER (BBD.B) CLOSE: $3.65, DOWN 3¢

The Globe and Mail. 13 Apr 2018. South Africa’s Guptas elude EDC efforts to recover Bombardier jet. Bombardier: Guptas have long history of fighting court battles

GEOFFREY YORK

Despite a court order, Canada’s export agency has been unable to recover a US$52-million Bombardier jet from South Africa’s Gupta brothers, who have allegedly hidden the plane and could be using it for criminal activities.

The Guptas, the long-time business partners of ex-president Jacob Zuma’s family, are now fugitives from justice and subject to arrest warrants on corruption charges. But instead of complying with the court order to ground the Bombardier plane, they are gearing up for a potentially lengthy court battle against the federal Crown corporation, Export Development Canada (EDC).

While they seek leave to appeal the court order, the Guptas continue to control the Bombardier jet and have allegedly switched off the tracking device to make it impossible for the plane to be located. The plane has been flown between Dubai, India and Russia in recent months and EDC says it has no idea where the plane is located.

To support Bombardier Inc.’s jet sale, EDC provided US$41-million in financing in 2015 to the Guptas, who controlled a sprawling business empire. The agency says the Guptas have defaulted on the loan.

It is worried about its financial and reputational risks if the Guptas keep flying the Canadian-made and federally financed luxury jet.

In a court ruling in Johannesburg on March 19, a judge said there was a “pungent possibility” that the Guptas switched off the tracking device on the airplane so that the jet could be used for unlawful activities.

The judge ordered the plane to be returned to a Johannesburg airport and placed in safekeeping under EDC’s custody. She also ordered South Africa’s civil aviation authority to cancel the plane’s registration, preventing it from being legally flown.

But the aviation authority says it cannot act until the appeal process has finished. “We are ready, willing and able to deregister the aircraft with immediate effect,” said Kabelo Ledwaba, a spokesman for the authority. “However, we need to follow the right legal processes.”

There is a “general principle” that court rulings are automatically suspended until the completion of the appeal process, he told The Globe and Mail on Thursday.

An EDC spokesman, Phil Taylor, said the agency is contesting the Guptas’ right to appeal the court order. It has asked the court to confirm that the Guptas are “required to return the aircraft now or be held in contempt of court,” he told The Globe on Thursday.

He said he expects the appeal application to be heard in “a matter of days” so that the situation can be quickly remedied.

The Guptas, however, have a long history of fighting court battles for years, exhausting every legal avenue before giving in.

In its court application earlier this year, EDC said it urgently needed to “decouple” from the Guptas because of the risks to its reputation. “There is a very real concern that the aircraft may be used to escape justice or for some other unlawful means,” it said.

The agency’s critics, however, have argued that EDC failed to do a proper duediligence review of the Guptas when it gave them the loan in 2015, at a time when there were already widespread reports of their involvement in corruption cases and other wrongdoing.

In their application to appeal the court order, the Guptas argue that EDC must have known of the allegations of illegal activity by the brothers because the allegations “had enjoyed widespread and frequent coverage in the South African and Canadian media” at the time of the loan in 2015.

Moreover, an investigation by a South African ombudsman’s office in 2016 had produced “serious allegations of wrongdoing” against the Guptas, yet EDC was “content to continue with their contractual association” with the Guptas, the application says.

BUDGET

Department of Finance Canada. April 12, 2018. Minister Morneau at Public Policy Forum: Building a Strong Middle Class for a More Competitive Canada

Toronto, Ontario – Canada's long-term economic success rests on a strong and growing middle class. That means making sure that all Canadians—including Canada's talented, ambitious and hard-working women—have an opportunity to work, and to earn a good living from that work.

Finance Minister Bill Morneau spoke today at the Public Policy Forum's Canada Growth Summit 3: Going the Distance, on the importance of equality and shared growth as a way to strengthen and grow the middle class, and ensure Canada's competitiveness long-term.

In a free-ranging question-and-answer session, the Minister touched on measures in Budget 2018 aimed at delivering greater opportunities for Canadian women, including greater support for women entrepreneurs and new benefits designed to make it easier for women to return to work. These measures—along with the historic investments in science and innovation in Budget 2018—will continue to deliver real change for Canadians, and position Canada as a leader in an increasingly competitive world.

The conversation also included a discussion of other factors that make Canada an attractive place to invest, create jobs and do business including openness to international trade; a workforce that is diverse, innovative, highly skilled and well-educated; a wealth of natural resources; low energy costs; liveable cities; and a stable, well-regulated financial system, among others.

The Minister reiterated his commitment to making business competitiveness a top priority for the Government of Canada. In the coming weeks and months, the Minister will meet with Canadians—particularly business leaders—to hear their perspectives on the current business environment, and to discuss opportunities and challenges related to global trade. This outreach is in addition to an ongoing review of Canada's competitive environment by Department of Finance Canada officials.

Quote

"Our country is poised for success because we let evidence guide our decisions—and the evidence shows that Canada is a great place to invest and do business. Our Government's focus on shared middle class growth—which includes equal opportunities for women—has led to the creation of over 600,000 jobs since November 2015. Working with the business community, we will build on this success and make sure Canada remains competitive in the economy of tomorrow."

- Bill Morneau, Minister of Finance

Quick Facts

- Over the last 40 years, the rising number of women in the workforce has accounted for about a third of Canada's real gross domestic product per capita growth.

- Even though Canadian women are among the best educated in the world, they are less likely to participate in the labour market than men, and more likely to work part-time. And, despite their high level of educational attainment, Canadian women working full-time earn, on average, just 88 cents for every dollar men working full-time earn.

- Consumer confidence rose 4.5% in March 2018 and remains 19.1% above its average since 2010.

- Business investment started to pick up in 2017, growing at about 2% in 2017 after declining in the previous two years.

- According to the Bank of Canada's Business Outlook Survey, business investment intentions sit near their highest point since the recovery from the Great Recession.

FULL DOCUMENT: https://www.fin.gc.ca/n18/18-024-eng.asp

________________

LGCJ.: