CANADA ECONOMICS

BUDGET

Department of Finance Canada. March 1, 2018. Minister Morneau Brings Budget 2018 Call to Action on Gender Equality to Toronto

Toronto, Ontario – The Government of Canada is building on its successful long-term plan that focuses on people and the things that matter most to them, leading to a stronger economy and more opportunities for the middle class and those working hard to join it. With a strong and growing economy in place, now is the right time to make progress that truly reflects the diversity of our country, where all Canadians can contribute to, and share in, Canada's prosperity.

Canada's strong fiscal fundamentals—anchored by a low and consistently declining debt-to-GDP (gross domestic product) ratio—mean that the Government has the confidence to make the investments that will strengthen and grow the middle class, and lay a more solid foundation for our children's future.

Finance Minister Bill Morneau today spoke to the Canadian Club in Toronto at a Facebook Live event on how Budget 2018 advances the Government's plan for middle class progress with new investments to promote gender equality and create new opportunities for Canadians.

Through Budget 2018, the federal government is leading by example in promoting gender equality by proposing:

- A legislated "equal-pay-for-equal-work" regime in federally regulated sectors to the benefit of approximately 1.2 million employees.

- To provide Canadians with more information on the pay practices of employers in the federally regulated sector, helping to shine a light on employers who lead in equitable pay practices, while holding employers accountable for wage gaps.

- To support the advancement of women in senior positions by publicly recognizing corporations that are committed to promoting women to senior management and board positions.

- A new Gender Results Framework to support equal opportunity for all Canadians, backed by new investments to achieve equality in the workforce and at home.

- A new Women Entrepreneurship Strategy to encourage greater participation by women in the economy, and help more women-owned companies grow into world-class businesses.

Quote

"Providing Canadians with the opportunity to realize their full potential isn't just the right thing to do. It's the smart thing to do for our economy. Simply put, equality between Canadian women and men will lead to greater prosperity and a better quality of life—not just for women and their families, but for all Canadians. And with equality of opportunity as a guiding principle, Budget 2018 proposes a comprehensive range of measures to ensure every Canadian has an equal and fair chance at success."

- Bill Morneau, Minister of Finance

Quick Facts

Budget 2018 supports Toronto by proposing:

- Budget Plan: https://www.budget.gc.ca/2018/docs/plan/toc-tdm-en.html

- To increase the amount of loans provided by the Rental Construction Financing Initiative from $2.5 billion to $3.75 billion over the next three years. This new funding is intended to support projects that address the needs of modest- and middle-income households struggling in expensive housing markets like the Greater Toronto Area. In total, this measure alone is expected to spur the construction of more than 14,000 new rental units across Canada.

- Renewed funding of $1.2 million over three years, starting in 2019–20, in support of the Gairdner Foundation. Based in Toronto, the Gairdner Foundation recognizes and rewards scientific excellence through the Canada Gairdner Awards, which are among the most prestigious biomedical prizes worldwide. This new funding would support the Foundation's activities, including Canadian and international outreach efforts to expand its reach and diversity.

FULL DOCUMENT: https://www.fin.gc.ca/n18/18-010-eng.asp

Employment and Social Development Canada. March 1, 2018. Budget 2018: Equality and growth for the middle class in Sudbury

Sudbury, Ontario - The Government of Canada is building on its successful long-term plan that focuses on people and on the things that matter most to Canadians.

Providing all Canadians with opportunities to participate fully in the economy is not only the right thing to do, it is the smart thing to do—leading to stronger growth for the middle class and those working hard to join it.

Now is the right time to build an economy that truly reflects the diversity of our country, where all Canadians can contribute to—and share in—Canada’s prosperity.

Today, the Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development was in Quebec to highlight Budget 2018, Equality + Growth: A Strong Middle Class, the Government’s people-centred plan to strengthen the middle class and support economic growth.

Speaking at an event at Science North, Minister Duclos discussed how the Government is making new investments through Budget 2018 that ensure every Canadian has an equal chance at success.

Through Budget 2018, the Government will:

- Make significant progress towards equality, by supporting equal parenting, addressing the gender wage gap, taking action against gender-based violence and introducing a new Women Entrepreneurship Strategy.

- Put more money in the pockets of those who need it the most, by improving access to the Canada Child Benefit and introducing the new Canada Workers Benefit (a strengthened version of the Working Income Tax Benefit).

- Support science and innovation, by renewing the Government’s commitment to the next generation of research and researchers, providing record investments for researchers and equipment and reforming business innovation programs to make it easier for Canadian businesses to get the information and support they need to succeed at home and abroad.

- Advance reconciliation with Indigenous people, by investing to close the gap between the living conditions of Indigenous and non-Indigenous people, ensuring First Nations children are safe within their communities, and supporting the recognition of rights and self-determination.

- By building on the Government’s plans to invest in the middle-class, Budget 2018 takes additional significant steps to ensure everyone has the opportunity to fully participate in the Canadian economy, leading to economic growth that works for all.

Quotes

“It’s time to build an economy that truly reflects the values we share as Canadians. Together, we can create an economy that works for all of us and a country where differences are recognized not as a barrier to success, but as a source of strength, and where we all have the same opportunity to succeed.”

– The Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development

The Globe and Mail. 1 Mar 2018. There’s a smorgasbord of offerings to women in the new budget, but they’re not much more than a nice token. Budget’s wage-gap fix little more than a token.

LINDA NAZARETH, Senior fellow for economics and population change at the Macdonald-Laurier Institute

Please, at least let’s start by using the right numbers. Of course there is a pay gap between men and women in Canada, but let’s not make it worse than it is. When you play with the statistics on male-female earnings, you lose your credibility and then who knows what else some of us are going to question.

Case in point: In the 2018 budget speech, Finance Minister Bill Morneau earnestly said that women make just 69 cents for every dollar earned by men on an annual basis. It is a shocker of a statistic, the same one that sometimes has people asserting that it is as if women start working for free at 2:40 in the afternoon while men keep getting paid all day. Trouble is, it simply is not true.

Comparing the earnings of men and women on an annual basis is a red herring given that women tend to work fewer hours than men. According to a 2017 study by Statistics Canada, when you look at hourly earnings of men and women, you see that women earn 87 cents for every dollar that men earn. That is still a gap and that’s not okay, but it is a lot less than the one Mr. Morneau is talking about.

Next, let’s look at why that gap exists and whether any of the policies put forth in the federal budget are likely to make a dent in it.

The reasons for the pay gap between men and women are not particularly new. Women tend to be clustered in fields that traditionally pay less than the ones that men choose and in occupations that pay less as well. They are also a lot more likely than men to take “breaks” from work (a really poor word to express what happens when you are home with small children), which does not help their longterm earnings power either. And there is straight-out pay discrimination, which is some portion of that 13 cents, although it is hard to know just how much.

And so we have a smorgasbord of offerings to women in this budget. Female entrepreneurs will have $1.4-billion earmarked for them through the Business Development Bank, along with another $250-million through Export Development Canada. Given that these sums are relatively small and will be doled out over a series of years, they are not much more than a token, but a welcome one anyway. The same is true for a promise to support women entering the trades and the $85-million allocated to investigate sexual-harassment claims in the work force.

The one child-care measure in the budget is a “use-it-or-lose-it” parental-leave program that can be used by men or women. That presumably will allow women to return to work earlier if they want while knowing that their partners are home on their own “break,” taking care of their children. It is really not meaningful enough to change the hours worked by women very significantly, however.

Despite the hype, the measures directed at women in this budget are pretty scant and that is actually okay. After all, according to that same Statistics Canada study, that 13-cent gap between men and women has narrowed already from 23 cents in 1977 and 18 cents in 1994. Maybe it is because over that period, women have tired of waiting for help from the government and have gotten themselves loads more education and degrees, realizing that that is the best path to earning more. A just-published study from Georgetown University in Washington comes to the grim conclusion that for women to equal men’s pay, they need one full degree more their male counterparts. Depressing as that is, in both the United States and Canada, women seem to be getting on with it and making that happen.

Looking at the budget through economist-eyes shows that the thing that most threatens the economic health of women is the same thing that threatens men: There is red ink as far as the eye can see. With deficits merrily forecast for years to come, the government figures that Canadian public debt payments will grow by 37 per cent between the last fiscal year and 2022-23. That is a burden that is going to fall on millennial men and women and on Generation Z and Generation Alpha as well.

Celebrating women is nice, but really, the best way to say some things is with money and on that, this budget does not make the grade.

The Globe and Mail. 1 Mar 2018. Morneau credits ‘crowdsourcing’ for simpler small-business tax plan

BILL CURRY

Finance Minister Bill Morneau attends in a postbudget discussion at the Economic Club of Canada in Ottawa on Wednesday. He said at the event that he and his officials made a serious effort to understand and respond to criticism generated by his original small-business tax proposals.

After enduring months of condemnation from angry doctors, accountants and other smallbusiness owners, Bill Morneau’s latest small-business tax plan has successfully quieted some of his loudest critics. This week’s federal budget revealed a significant change to the Finance Minister’s controversial plan to change the tax rules for passive investment income held inside an incorporated small business.

While far from effusive, the Canadian Federation of Independent Business concluded that the government’s plans were now “less bad,” and expressed appreciation for the change. From the right, the Canadian Taxpayers Federation called the changes “much improved,” while the leftleaning Canadians for Tax Fairness praised the minister for following through on restricting a tax practice that primarily benefits high-income Canadians.

Speaking at an Economic Club of Canada breakfast in Ottawa on the morning after the budget, Mr. Morneau said he and his officials made a serious effort to understand and respond to the criticism generated by the original proposals. “What I was saying to my team this morning is crowdsourcing seems to work,” he said on Wednesday. “We listened to a lot of people.”

The Liberal government’s third budget was primarily focused on improving employment opportunities for women and boosting funding for scientific research. The document spread relatively small amounts of new funding across a wide range of areas. It projects an $18.1-billion deficit in 2018-19 with no timeline for returning to a balanced budget.

For the first-term politician, the small-business tax furor was Mr. Morneau’s first exposure to being at the centre of a prolonged controversy. The issue dogged him on Parliament Hill and at town halls across the country.

It overlapped in the fall with questions about his personal finances, particularly his decision not to place his considerable personal assets in a blind trust to avoid potential conflicts of interests. The minister ultimately sold off his shares in his former company, Morneau Shepell, but he is still the subject of a continuing investigation by the federal ethics commissioner over whether he was in a conflict when he introduced pension reform legislation while still holding shares in Morneau Shepell, which is in the pension-management business.

The minister’s original July proposals for incorporated small businesses included changes to the treatment of dividends and capital gains – which were later abandoned – and changes to the sharing of business income with family members, which went ahead this year. Yet, the most controversial change was a proposal to restrict the use of a small-business corporation as a vehicle for making passive investments – such as investing in stocks – that are unrelated to the business.

The government’s rationale is that high-income Canadians shouldn’t be able to use a corporation as a way of paying less tax on investment income than if they held those investments as an individual. The original proposals were widely viewed as excessively complex. The new approach announced in the budget is winning praise for being a simpler approach, even though it is still fairly complicated.

While the federal corporatetax rate is 15 per cent on business income, a lower rate applies on up to $500,000 annually for smaller businesses. The federal small-business tax rate was reduced from 10.5 per cent to 10 per cent this year and will be 9 per cent in 2019.

Under the new rules announced this week, that $500,000 threshold would be gradually reduced for incorporated small businesses with more than $50,000 in investment income. For context, that amount of income represents a 5-per-cent return on $1-million in assets or a 2-per-cent return on $2.5-million in assets. “If they’re saving millions and millions of dollars in passive investment … then clearly you’re not necessarily needing that small-business tax rate,” Mr. Morneau said.

Allan Lanthier, a former chair of the Canadian Tax Foundation who has been a persistent critic of the minister’s small-business tax plans, said very few private corporations will be affected by the latest plan and even those that are will still be entitled to the 15per-cent corporate-tax rate. “This represents a complete retreat by the government, but a welcome one,” he said. “The government put the entire business community through months of uncertainty for a proposal that never should have been tabled, and has now been withdrawn.”

The Globe and Mail. 1 Mar 2018. Basic science makes historic gains in research-friendly budget. Ottawa commits $3.8-billion spread over the next five years for a range of programs

IVAN SEMENIUK, SCIENCE REPORTER

Going into this year’s budget process Finance Minister Bill Morneau said he was already convinced of the need to boost support for Canadian scientists but that he had to think about “how we can have the biggest impact.”

The nod to science was spurred by last year’s landmark review of publicly funded research in Canada led by former University of Toronto president David Naylor. The review identified structural problems in the federal research funding system and pointed out a growing shortfall in how much money Ottawa allocates toward science relative to other countries. Over the past several months, scientists have rallied around the Naylor report and called on the government to act on its recommendations.

Now, Mr. Morneau has partly answered that call with a research-intense budget that commits approximately $3.8-billion spread over the next five years for a range of science programs. A portion of this will be aimed at stepping up support for the three granting councils that distribute money for physical and life sciences, social sciences and health science researchers at Canadian universities and institutions. All told, by 2023, scientists can count on about $446million more annually from the councils, including direct money for grants, research chairs and a new program to support interdisciplinary science and international collaboration.

“I think the Naylor panel did the country a great service by articulating how important investment in science and research is, and this budget reflects that,” said Paul Davidson, president of Universities Canada, which advocates for academic research.

In actual dollars, the increase remains a far cry from the $1.3billion a year that the Naylor report said is needed to bring Canada’s research machine up to global standards. Anyone hoping for a bolder, more transformational move from Mr. Morneau was bound to come away disappointed. But the budget provides a 25-per-cent increase in the category of basic research, which is technically Ottawa’s biggest ever and enough for Mr. Morneau to claim a historic investment in research that is “on brand” for a government that wants to be seen as pro-science.

“There are gaps, but they’ve listened carefully and I have a high degree of confidence that in the years ahead we can talk to them about what else would help,” Dr. Naylor said.

The budget will also go down as a win for Science Minister Kirsty Duncan, who commissioned the Naylor report in 2016 and who faced some ire from researchers when last year’s budget kept basic research in a holding pattern until after the report’s release. This year, in addition to an increase, there is the five-year arc of a longer term commitment from Ottawa that lays the foundations for more researcher input into science priorities and more emphasis on supporting early-career researchers who have anxiously been looking for signs that they have a viable future.

“My message to them and all scientists: We’ve gone big so that you can go even bigger,” Ms. Duncan said on Wednesday.

The budget also signals a departure from several previous years’ worth of big-ticket programs for a limited number of senior scientists by establishing an additional 250 Canada Research Chairs for early-career researchers by 2021.

“My sense is that the time when we were seeing the trend in research chairs looking like a lot of old white guys – I think that time is over. And that’s a really helpful message for young Canadians,” said Jeremy Kerr, an ecologist at the University of Ottawa and co-author last year of a survey that revealed the dire funding stress many young researchers are facing across Canada.

The influence of the Naylor report can be seen in other ways, including a move to stabilize funding for the Canada Foundation for Innovation. Launched in 1997, the organization plays a crucial role as the principal underwriter of large-scale research facilities and equipment. But until now, it has operated on sporadic chunks of cash doled out by successive governments every so often. With a newly annualized budget projected to reach $462million by 2023, the CFI will finally be able to make long-term plans and dovetail its allocations with international research efforts and trends.

Another change that is likely to be consequential in the long term is a call for “a new approach” to so-called third-party research organizations. These include institutes and research centres that in the past have been favoured in an ad hoc way by successive governments sold on the need to support research specialties such as quantum computing or drug discovery, among others. Mirroring another recommendation from the Naylor report, the budget calls for a competitive process that could eventually trim back the number of boutique research entities that draw on Canada’s science budget through their own dedicated funding streams.

Outside of the Naylor report, more than $600-million of the new science funding will be directed toward beefing up the government’s own laboratories and bringing together federal scientific activities across departments. The budget doesn’t specify exactly how this will be accomplished, but it likely reveals how Ms. Duncan will be spending her time this year.

The internal science funding also encompasses what the budget document calls a “reimagined” National Research Council, an agency previously seen as sorely in need of new direction. Whereas the Harper government pointed the NRC toward short-term commercial objectives, the new vision will draw on $180-million over the next five years to enable the NRC’s own scientists to make some high-risk research bets of the kind that the agency was known for in its heyday and that anticipate business sector activities by several years.

The Globe and Mail. 1 Mar 2018. Budget proposes allowing credit unions to use ‘generic bank terms’

JAMES BRADSHAW, BANKING REPORTER

In late June last year, the Office of the Superintendent of Financial Institutions (OSFI) promised to get tough on firms that aren’t federally regulated as banks, such as credit unions and financial technology startups, for using terms such as ‘bank,’ ‘banker’ or ‘banking.’

Credit unions appear to have won relief from regulations that would have banned them from using terms such as “banking” to describe their business.

The federal budget released on Tuesday proposed rewriting the Bank Act to give provincially regulated financial institutions like credit unions “flexibility to use generic bank terms,” overriding new rules proposed by Canada’s banking regulator.

In late June last year, the Office of the Superintendent of Financial Institutions (OSFI) promised to get tough on firms that aren’t federally regulated as banks, such as credit unions and financial technology startups, for using terms such as “bank,” “banker” or “banking.” The use of such terms is restricted under the Bank

Act, and OSFI said it wanted “to provide clarity” as the financial sector evolves.

Yet those terms have been treated as commonplace language for years by nonbank financial institutions, which take deposits, make loans and transfer money, but seek to set themselves apart from big banks. Credit unions cried foul at the new rules, and the Canadian Credit Union Association (CCUA) warned it would cost members up to $80-million over two years to scrub the terms from signage, websites and documents. At the time, CCUA chief executive Martha Durdin called OSFI’s crackdown “a clash of regulation versus common sense.”

In July, Finance Minister Bill Morneau agreed to revisit the issue, and the federal government now seems poised to roll back OSFI’s effort at tighter enforcement.

“We are obviously pleased with Minister Morneau’s announcement,” Ms. Durdin said in a statement.

Details of proposed changes are not yet clear, but “once the Bank Act is revised OSFI will communicate its compliance expectations,” an OSFI spokesperson said.

The proposed flexibility to use banking terminology extends only to “prudentially regulated deposit-taking institutions,” which could mean unregulated financial technology, or “fintech,” firms will still be restricted from using the words to describe their activities.

The Globe and Mail. 1 Mar 2018. Budget media provisions disappointing, industry says

SUSAN KRASHINSKY, ROBERTSON MEDIA AND MARKETING REPORTER

Measures in the federal budget to support journalism in underserved communities are a disappointment, some industry representatives say.

“It doesn’t really address the current problem that we have,” John Hinds, president and chief executive officer of industry group News Media Canada, said of Tuesday’s budget, which pledged $10-million a year over five years to support local media.

The funds, which will be handed out by one or more independent, non-governmental organizations, are far less than some had proposed. News Media Canada had asked the government to provide $350-million to a revamped Canadian Periodical Fund and to open up eligibility for that fund to more publications.

“This is most disappointing, and somewhat insulting when you consider all the time we’ve wasted making appearances in front of commissions they’ve set up,” Postmedia Network Canada Corp. CEO Paul Godfrey said. “Continuing to ignore us means more job cuts, more closures and more anguish.”

Approximately 16,500 jobs in the media sector have been eliminated since 2008, according to the Canadian Media Guild. Nearly half of those are in print media; 36 per cent are in broadcasting and 17 per cent are in digital and other forms of media. In the past 10 years, 238 local news outlets have closed their doors, according to Ryerson University professor April Lindgren, who runs the Local News Research Project. Of those, 212 were newspapers that were either closed entirely or closed due to mergers. The remaining 26 closings were TV, radio and digital outlets.

“If the $50-million is going to be used just as a direct subsidy to reduce operating costs, it may keep a few local operations alive for a while but they will go under once the funding comes to an end,” Prof. Lindgren said.

The budget’s second measure for the media industry was greeted with more optimism: The government announced that it would explore the idea of granting charitable status to news outlets, which would allow them to fund their journalism through tax-deductible donations.

“To me, it’s pretty clear that there would be individuals, there would be foundations, who potentially would say, ‘We like that,’ ” said Phillip Crawley, publisher of The Globe and Mail. “The industry at large, as we all look around and see what’s happening in other parts of the world, that’s one of the examples where we say, why can’t that happen in Canada?”

Non-profit newsroom ProPublica reported US$28.3-million in revenue in 2017. In 2016, already in the midst of a global expansion, British news outlet The Guardian created a non-profit arm in the United States, theguardian.org, which attracted early support from philanthropic organizations including the Skoll Foundation and the Conrad N. Hilton Foundation.

“It’s the one aspect that we’re very pleased about,” Mr. Hinds said. “Canadians want and value civic journalism and local stories. Being charitable gives it that extra push. It also allows existing owners to transition properties without shutting them down.”

That could include allowing community groups or civic foundations to take over the operations of a local newspaper that is no longer profitable, he said.

However, Mr. Godfrey cast doubt on how much support would come from donations.

“There are so many charities around,” he said. “Who would you rather give to, SickKids Hospital or Postmedia and Torstar?”

The government has not responded to a proposal from groups including News Media Canada, that advertising by Canadian companies on foreignowned websites should no longer be tax deductible. Under Article 19 of the Income Tax Act, advertising expenses directed to foreign publications or television stations are not deductible, providing an incentive to advertise with Canadian entities. Some have argued that the same rule should apply online; currently, companies can deduct online advertising expenses whether or not the website is Canadian.

NAFTA

REUTERS. MARCH 1, 2018. Talks on NAFTA autos impasse to be scheduled between rounds-sources

David Ljunggren, Anthony Esposito

MEXICO CITY (Reuters) - U.S., Mexico and Canada plan to schedule extra discussions on trade rules for auto production in North America if no progress is made on the issue in the current round of NAFTA negotiations, two people familiar with the matter said.

The proposed talks, at the level of technical subject experts, would take place in March before the next formal NAFTA session, which is due to be held in Washington in late March or early April.

Agreeing on new rules of origin for autos has been a major sticking point in the effort to rework the North American Free Trade Agreement, which U.S. President Donald Trump has threatened to ditch if it is not recast to his liking.

Talks on the issue during the seventh round in Mexico City were suspended this week when the U.S. negotiator overseeing auto rules of origin, Jason Bernstein, unexpectedly returned to Washington for consultations with industry.

Two people familiar with the negotiations said they expected so-called “inter-sessional” talks to be held if Bernstein did not return and no further progress was made. Officials say Bernstein is unlikely to fly back to Mexico City.

The plan would be to arrange the inter-sessional talks as quickly as the three sides can agree on a date, one of the two sources said.

Officials have made little progress on the most contentious files since the talks started last August and the negotiations look set to drag on beyond the end date, which is tentatively scheduled for early April.

Under NAFTA, 62.5 percent of the net cost of a passenger car or light truck must originate in the NAFTA region to avoid tariffs. Trump wants the threshold raised to 85 percent and is also seeking to ensure half the total content is U.S.-made.

The auto industry has opposed Trump’s demands on higher content, arguing it will disrupt supply chains and raise costs. Mexican officials say the issue must largely be resolved between the White House and U.S.-based industry bosses.

Negotiators have struggled to advance on the auto proposal since it was submitted in October, but automakers are evaluating ideas put forward by Canada last month to include newer technology in the calculation of a vehicle’s value.

The current round of negotiations is set to end on Monday, when Mexican Economy Minster Ildefonso Guajardo, U.S. Trade Representative Robert Lighthizer and Canadian Foreign Minister Chrystia Freeland are scheduled to meet in the Mexican capital.

Separately, a private-sector official familiar with the talks said that negotiators from the three sides had now completed talks on good regulatory practices.

Additional reporting by Dave Graham and Lesley Wroughton in Mexico City; editing by Jonathan Oatis

BLOOMBERG. 1 March 2018. Nafta Negotiators Agree to Regulatory Best Practices, Source Says

By Eric Martin

- Chapter represents fourth finished in process; about 26 remain

- Issue is first finalized in latest talks in Mexico City

A U.S. Customs and Border Protection inspects a truck entering from Mexico at the Otay Mesa Cargo Port of Entry in San Diego. Photographer: David Maung/Bloomberg

Negotiators from the U.S., Canada and Mexico finished work on regulatory best practices for Nafta, the first official “chapter” completed in the latest talks in Mexico City, according to a person with knowledge of the process.

The three nations had agreed to some similar measures on regulatory coherence as part of the Trans-Pacific Partnership, but the rules approved for the North American Free Trade Agreement go deeper, according to the person, who asked not to be identified before a public announcement and wouldn’t elaborate on the chapter’s specifics. U.S. President Donald Trump withdrew from that Pacific Rim pact a year ago, days after taking office.

In its negotiating objectives released in July, a month before Nafta talks began, the U.S. Trade Representative’s office said that in regulatory best practices it would seek to ensure transparency and accountability in the development of regulations; provide meaningful opportunities for public comment; and promote impact assessments to ensure that regulations avoid unnecessary redundancies.

With the regulatory best practices chapter, on top of work on anti-corruption measures, rules for small- and medium-size businesses and for competition now done, it’s taken six months to complete four of the roughly 30 chapters likely to form the updated deal. Still, negotiators don’t see this as a negative: Important strides have been made on the remaining chapters and a deal could come together quickly once the most contentious issues are worked out.

Mexico and Canada began negotiating with the U.S. in August at the initiative of Trump, who’s repeatedly said the Nafta accord led U.S. companies to fire workers and move factories to Mexico -- a “horrible deal” for the U.S. Trump has promised to negotiate a better deal for America or withdraw.

At the outset of the talks last year, optimistic assessments held that a deal could get done by the end of 2017. Officials later pushed that goal back to March -- a deadline that now looks almost impossible. The U.S. has complained that progress on its demands is too slow, and Trump has threatened to exit the pact.

The most contentious issues in the talks have included a proposal to require more auto manufacturing in the U.S., seasonal barriers to agriculture trade, access to U.S. procurement deals, dispute resolution mechanisms, and a clause that would terminate the deal after five years unless the nations agree to continue it.

Some Nafta chapters involve a less controversial modernization of the 24-year-old deal, building off work from previously negotiated agreements like the TPP. Kenneth Smith Ramos, Mexico’s chief Nafta technical negotiator, identified regulatory practices as one of these areas that the nation wanted to advance in this latest round of talks. The others were telecommunications; digital trade; technical barriers to trade; and measures to protect humans, animals, and plants from diseases, pests, or contaminants.

The media office of the USTR declined to comment. The press offices of the Mexican Economy Ministry and the press office of Canada’s Foreign Ministry didn’t immediately respond to a request for comment.

REUTERS. FEBRUARY 28, 2018. Amid NAFTA talks, Mexico airs concerns over U.S. steel tariffs

Dave Graham, Lesley Wroughton

MEXICO CITY (Reuters) - Mexico’s economy minister met with top U.S. trade officials on Wednesday midway through the latest push to renegotiate the NAFTA trade deal, as concerns about steel added to trade tensions between the two countries.

Economy Minister Ildefonso Guajardo met U.S. Commerce Secretary Wilbur Ross and U.S. Trade Representative Robert Lighthizer during a hastily arranged visit to Washington as U.S., Mexican and Canadian officials held a seventh round of negotiations to rework the North American Free Trade Agreement.

In a statement, Mexico’s economy ministry said Guajardo had discussed possible U.S. steel import tariffs with Ross, as well as bilateral agreements over tomatoes and sugar, which have been renegotiated periodically.

Guajardo also met with Lighthizer to discuss the agenda of the ministerial meeting on March 5 at the conclusion of the latest NAFTA talks in Mexico City, his ministry said.

U.S. President Donald Trump is considering imposing steel and aluminum tariffs on imports from China and elsewhere following a probe looking at whether imports of the metals threatened U.S. national security.

Among the options before Trump is a tariff of at least 24 percent on steel products from all countries. However, Trump could decide to exempt some countries from any measures, including its NAFTA trading partners and has indicated he might exempt Canada.

A Mexican official said the Ross meeting would address Mexican concerns over trade in steel and tomatoes, noting that Mexico would retaliate against steel tariffs.

Ross has said he would not be surprised to see countries challenge any steel tariffs at the World Trade Organization.

There are concerns that stiff U.S. tariffs could raise global steel prices, which would impact Mexico. While Mexico is a large steel importer, it also exported approximately 4.5 million tonnes in 2016.

‘HARD TO ACHIEVE’

Meanwhile in Mexico City, negotiators discussed the broad outlines of so-called rules of origin, which would have a big impact on the automotive industry.

Talks were hampered by the absence of the chief U.S. negotiator, Jason Bernstein, who was unexpectedly called to Washington on Tuesday for consultations and is unlikely to return to Mexico.

The possible delay in tackling the matter underlines the slow progress of the talks, which are supposed to wrap up by early April, but look set to drag on for longer.

The current round of talks will also focus on closing chapters related to digital trade, telecommunications, technical barriers to trade, good regulatory practices, and sanitary and phytosanitary measures, according to an official with knowledge of the talks.

Steve Verheul, Canada’s chief negotiator in the NAFTA talks, reported some advances in Mexico City.

“We’re making reasonably good progress so far,” he told journalists without elaborating.

NAFTA talks have crawled along for the past six months, and Trump has threatened to walk away from the $1.2 trillion treaty unless major changes are made to benefit American interests.

Additional reporting by Sharay Angulo and David Ljunggren in Mexico City; Editing by Cynthia Osterman, Susan Thomas and Lisa Shumaker

BLOOMBERG. 1 March 2018. Trump Expected to Announce Stiff Steel, Aluminum Tariffs

By Joe Deaux, Andrew Mayeda and Toluse Olorunnipa

- President to announce decision on Thursday, people say

- Tariffs could antagonize China and hurt relations with allies

Trump Is Said to Likely Impose Stiff Steel, Aluminum Tariffs

President Donald Trump is set to announce steep tariffs on steel and aluminum imports Thursday, people familiar with the matter said, in what would be one of his toughest actions yet to implement a hawkish trade agenda that risks antagonizing friends and foes alike.

Trump told aides he wants to announce tariffs of 25 percent on steel and 10 percent on aluminum from all countries, according to two people who asked not to be identified because the deliberations aren’t public. One person said the details of the decision may still change, and it’s possible some countries may be granted exemptions.

"Our Steel and Aluminum industries (and many others) have been decimated by decades of unfair trade and bad policy with countries from around the world,” Trump said in a Twitter posting Thursday. “We must not let our country, companies and workers be taken advantage of any longer. We want free, fair and SMART TRADE!"

A White House official said on Thursday that there will be an announcement on trade later in the day.

Then president has been considering a range of options to curb imports of steel and aluminum, after the Commerce Department concluded shipments of the two metals hurt U.S. national security. Leading up to the decision, the president told confidantes he was leaning toward a 24 percent tariff on steel, the harshest of the alternatives given to him by Commerce.

The U.S. move may provoke retaliation from China, the world’s biggest steel and aluminum producer, at a time when President Xi Jinping’s top economic adviser, Liu He, has been dispatched the U.S. in attempt defuse tensions. China has already launched a probe into U.S. imports of sorghum, and is studying whether to restrict shipments of U.S. soybeans -- targets that could hurt Trump’s support in some politically important farming states.

Asian steel stocks declined. Nippon Steel & Sumitomo Metal Corp. and JFE Holdings Inc. slumped in Tokyo while Baoshan Iron & Steel Co. fell in Shanghai, Hesteel Co. retreated in Shenzhen and BlueScope Steel Ltd. dropped in Sydney. U.S. producers from Alcoa Corp. to AK Steel Holding Corp. rose before the start of regular trading in New York, while aluminum avoided an industrial-metals selloff in London.

“Trade measures on specific sectors or countries usually don’t have a major impact on overall global trade,” said Chua Hak Bin, a senior economist at Maybank Kim Eng Research in Singapore. “The danger is if affected countries, like China, Korea and Mexico in this case, choose to retaliate with even stronger countermeasures, but we think any retaliation will likely be calibrated and measured as no country wants this to spiral into a major trade war.”

While China accounts for just a fraction of U.S. imports of the metals, it’s accused of flooding the global market and dragging down prices.

“The United States has over-used trade remedies and it will impact employment in the U.S. and the interests of U.S. consumers,” Chinese Foreign Ministry spokeswoman Hua Chunying said. “China will take proper measures to safeguard its rights and interests.”

The decision may also harm relations with key allies including Canada and Mexico, which are already locked in discussions over U.S. demands to change the North American Free Trade Agreement. Canada is the biggest foreign supplier of U.S. steel.

The European Union has suggested such an action by the U.S. would face a legal challenge at the World Trade Organization. At home, consumers could see price hikes for everything from cars to beer cans that would be triggered by tariffs.

Defense Secretary James Mattis had lobbied the president for targeted options on steel, warning that sweeping measures could undermine U.S. relations with its allies. European officials have argued that it doesn’t make sense to penalize members of the Nato defense alliance in the name of security.

Republican Pressure

Trump was under pressure from lawmakers in his Republican party to soften the blow on foreign steel. Businesses from beverage firms to automakers have warned a crackdown could raise prices in their industries and cost jobs. However, U.S. steel producers and workers have called on Trump to defend their industry as it grapples with the effects of overcapacity in China.

The decision may play well in Rust Belt states such as Pennsylvania and Ohio that Trump won after promising a tougher approach to trade.

The announcement will end months of uncertainty over the steel and aluminum market. Last April, the president ordered Commerce to study the impact of steel and aluminum imports on national security under seldom-used section 232 of the 1962 Trade Expansion Act. The department submitted its final reports to the president in January.

U.S. rhetoric appears to be getting more aggressive going into the midterm elections, though Beijing still has plenty of ways to hit back, according to Dwyfor Evans, head of Asia-Pacific macro strategy at State Street Global Markets in Hong Kong.

“On financial assets, let alone trade, the Chinese can turn around and basically spook the Americans,” Evans told Bloomberg Radio Thursday. “The Chinese can always rebound with a comment that they own a hefty amount of U.S. Treasuries they can obviously withdraw.”

— With assistance by Andrew Mayeda, Randy Woods, Yinan Zhao, Miao Han, Martin Ritchie, Enda Curran, Doug Krizner, Juliette Saly, Peter Martin, and Toluse Olorunnipa

Global Affairs Canada. March 1, 2018. Statement by Canada on steel and aluminum

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement:

“As a key NORAD and NATO ally, and as the number one customer of American steel, Canada would view any trade restrictions on Canadian steel and aluminum as absolutely unacceptable.

“Any restrictions would harm workers, the industry and manufacturers on both sides of the border. The steel and aluminum industry is highly integrated and supports critical North American manufacturing supply chains. The Canadian government will continue to make this point directly with the American administration at all levels.

“Canada is a safe and secure supplier of steel and aluminum for U.S. defence and security. Canada is recognized in U.S. law as a part of the U.S. National Technology and Industrial Base related to national defence.

“The United States has a $2-billion surplus in steel trade with Canada. Canada buys more American steel than any other country in the world, accounting for 50% of U.S. exports.

“It is entirely inappropriate to view any trade with Canada as a national security threat to the United States. We will always stand up for Canadian workers and Canadian businesses. Should restrictions be imposed on Canadian steel and aluminum products, Canada will take responsive measures to defend its trade interests and workers.”

INDUSTRY

MARKIT. REUTERS. MARCH 1, 2018. Canada manufacturing growth dips in February; employment at 6-month high: Markit

OTTAWA, (Reuters) - The pace of growth in the Canadian manufacturing sector eased modestly in February as new orders dipped, though the measure of employment rose to the highest level in six months, data showed on Thursday.

The Markit Canada Manufacturing Purchasing Managers’ index (PMI), a measure of manufacturing business conditions, declined to a seasonally adjusted 55.6 last month from 55.9 in January.

A reading above 50 shows growth in the sector.

New orders edged down to 55.6 from 56.4. But new export orders rose to 54.4 from 53.3, the highest level since November 2014, helped by increased sales to U.S. clients.

Companies also faced greater backlogs of work, with the measure rising to 55.0 from 53.7, its highest level since the survey began in 2010. Some firms pointed to bottlenecks in the supply chain, as well as greater workloads.

The need to boost capacity lifted the gauge of employment to 56.0 from 55.9. Canada’s labor market was robust last year, but economists expect the gains will moderate in 2018.

Reporting by Leah Schnurr; Editing by Chizu Nomiyama

INTERNATIONAL TRADE

EDC. MARCH 1, 2018. Data Deluge: Diving In or Drowning?

By Peter G Hall, Vice President and Chief Economist

“Knowledge will increase.” Three simple words at the end of a once-famous chronicle dating back to ancient Babylon, spoke of a distant future that looks a lot like now. Today’s exponential explosion of data is historically unprecedented, and shows no sign of abating. Some say that new data is doubling every year; some predict it will double every 12 hours. Whether or not they are right, the current measured increase is staggering. For the average small or medium-sized business, this is pretty daunting stuff. So, are we going to drown, or should we dive in?

The Global Datasphere Prediction

The numbers are mind-blowing. Vastly greater computing power has led to greater data generation and processing, which has fed demand for ever-more-powerful computers. Data is now being collected not just by humans and businesses, but by machines and sensors – at 50 times the pace. In 2017, International Data Corporation predicted that the global datasphere would rise from 16.1 zetabytes (a trillion gigabytes) to 163 zetabytes by 2025 – a ten-fold increase in nine years. It’s hard to fathom figures like this, as there seem to be a limited number of things around us to compare them with. Again, it’s daunting; what do we do with it?

Top Responding to the Oceans of Data

A quick reaction is that this is something only the big players can do. This is for the Googles, Facebooks and Amazons of the world to manage, and only they can collect, store, analyze and respond to the signals that these vast oceans of data are sending out. True, they and those like them have invested heavily in systems to collect the vast amounts of data flowing through their networks. True again, they have armies of analysts poring over the data, or alternatively, creating algorithms to process the data and produce insights through correlation and regression analyses – it’s a data geek’s paradise.

Knowledge is Power

If knowledge is power, then it seems that the large players indeed have a scale advantage that will inexorably increase corporate concentration, and ultimately give rise to knowledge monopolies that exclude and ultimately eliminate smaller players without the means to keep up or catch up. Some clearly believe that the Fourth Industrial Revolution will have a lot of casualties that fit this very description. Is this a sad inevitability, or is there a way that even small businesses can harness the changes?

Answering that question will take more than this missive’s single page, but here are some top-line things to think about. First, everyone wants to own a monopoly; kids experience this early on playing the game of the same name. Your firm’s data is your monopoly; nobody else owns it unless you want them to. It is your unique window on the world, and the more you have, the more insight is available for decision-making.

Second, proactively collecting this unique data is a strategic decision. It has never been easier to do, but data gathering can often be a decision that is easy to put off, in favour of more urgent, immediate business issues. Often the data is already there, and simply needs to be organized. However, data is increasingly being collected by smarter machines. Failing to invest continually in technologically up-to-date machinery cheats companies out of valuable feedback that is likely critical to operational planning. Social media is also a huge data inlet.

Third, it’s not enough to collect the data; it’s also imperative to invest in processing it. This can be outsourced, but there’s a risk of leaking out the secret sauce of the future. Increasingly there are tools that enable processing, leading to the determination of ‘next-level’ business and market trends. As time progresses, it will be more necessary – and lucrative – to onboard effective data analysis tools.

Fourth, when the insights pour in, experimentation is likely the next step. Larger companies are trying new things out all the time in an effort to prove or disprove market movements. Not all experiments will succeed, but there is no doubt that with practice, a ‘digital read’ of the marketplace will grow. Finally, successful experiments need a good execution plan.

The bottom line?

Among the assets belonging to a firm, data rarely makes it onto the balance sheet. Whether the accountants agree or not, data is fast becoming one of the most important business assets, as it increasingly holds the keys to future relevance. Big firms of the future already have a data strategy – and with today’s technology, it’s never been cheaper to do.

BALANCE OF PAYMENTS

StatCan. 2018-03-01. Canada's balance of international payments, fourth quarter 2017

- Current account balance: -$16.3 billion, Fourth quarter 2017

- Source(s): CANSIM table 376-0105: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3760105&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canada's current account deficit (on a seasonally adjusted basis) declined by $2.2 billion in the fourth quarter to $16.3 billion, mainly on a lower goods deficit.

In the financial account (unadjusted for seasonal variation), transactions in the form of currency and deposits led the inflow of funds into the economy in the quarter as portfolio and direct investment activity mostly offset each other.

For the year 2017, the current account deficit reached $63.9 billion, which was $1.4 billion less than the deficit recorded in 2016. In the financial account, transactions in securities generated a significant net inflow of funds in 2017, which was largely offset by an outflow from direct investment transactions as direct investment abroad exceeded direct investment in Canada.

Chart 1: Current account balances

Current account

Deficit on trade in goods narrows

The deficit on international trade in goods narrowed by $1.9 billion to $7.2 billion in the fourth quarter, following three consecutive increases.

For the year as a whole, the deficit reached $23.9 billion, compared with a record deficit of $25.9 billion in 2016.

On a geographical basis, the goods deficit with non-US countries was up $0.7 billion to a record $17.6 billion in the fourth quarter. This mainly reflected deteriorating trade balances with the European Union countries and with China, moderated by lower deficits with Japan and Mexico. Meanwhile, the surplus with the United States was up $2.6 billion to $10.5 billion.

Chart 2: Goods balances by geographic area

Total exports of goods were up $6.4 billion to $137.7 billion in the fourth quarter, following a significant decline of $10.7 billion in the third quarter. Exports of energy products increased by $2.8 billion, mainly on higher crude petroleum prices.

Total exports of goods were up $28.0 billion in 2017, with stronger exports of energy products accounting for most of the gains.

Total imports of goods were up $4.5 billion to $144.9 billion in the fourth quarter. Imports of energy products increased $1.2 billion as prices of crude petroleum rose. Aircraft and other transportation equipment and parts were up $1.2 billion, mostly on higher imports of aircraft.

For 2017, imports grew by $26.1 billion with increases spread among several sections.

Non-goods deficit decreases

The non-goods deficit, reflecting the difference between Canada's receipts and payments on international transactions in services and income, narrowed $0.4 billion to $9.2 billion in the fourth quarter. Higher profits on Canadian direct investment abroad contributed the most to this decline.

The deficit on investment income decreased $0.8 billion to $1.5 billion in the fourth quarter, a fourth consecutive quarterly reduction. Profits earned by Canadian direct investors rose $1.7 billion. This was partially offset by higher income earned by foreign investors, both direct and portfolio, on their financial assets in Canada.

The overall deficit on international trade in services rose $0.3 billion to reach $6.5 billion. Payments of commercial services were up $0.6 billion, mainly due to financial services which posted a strong increase following a decline in the third quarter. The travel deficit decreased $0.2 billion in the fourth quarter as a record number of foreign tourists visited Canada.

For the year 2017, the services deficit increased $1.8 billion to $25.1 billion, mostly on higher payments of financial services, notably with the United Kingdom, and transport services with non-US countries. Despite a record number of foreign tourists during the year, the travel deficit expanded in 2017 as spending by Canadians travelling abroad was up by more than receipts from non-residents travelling to Canada.

Financial account

Foreign investment in Canadian bonds remains strong

Foreign investment in Canadian securities totalled $37.9 billion in the fourth quarter, down from $51.1 billion in the third quarter. The investment activity mainly targeted the Canadian bond market.

On an annual basis, foreign investment in Canadian securities totalled $188.5 billion in 2017, led by record foreign acquisitions of Canadian bonds.

Non-resident investment in Canadian bonds reached $41.2 billion in the fourth quarter, a fourth consecutive quarter of strong investment. New issues of Canadian private corporate bonds placed in foreign markets, largely denominated in foreign currencies, accounted for the bulk of the investment activity.

Foreign investors withdrew $6.1 billion of funds from the Canadian money market in the quarter, mainly corporate paper. At the same time, they added $2.9 billion of Canadian equities to their holdings, the lowest investment since the third quarter of 2015. Canadian stock prices were up 3.7% and the Canadian dollar depreciated slightly against its US counterpart in the quarter.

Chart 3: Foreign portfolio investment

Record Canadian purchases of foreign shares

Canadian investors acquired $33.7 billion of foreign securities in the fourth quarter, led by record purchases of foreign shares.

On an annual basis, Canadian investment in foreign securities totalled $84.7 billion in 2017, up significantly from a $13.8 billion investment in 2016.

Canadian investors increased their holdings of foreign shares by a record $29.6 billion in the fourth quarter. This activity reflected strong acquisitions of both US and non-US foreign shares. At the same time, Canadian investors acquired $4.0 billion of foreign debt securities, largely US instruments.

Direct investment in Canada remains low

Direct investment abroad was $19.4 billion in the fourth quarter, comparable to the level of investment observed in the previous two quarters. The investment was largely in the form of equity instruments in foreign affiliates and was mainly directed to the United States.

Direct investment in Canada remained low at $8.3 billion in the fourth quarter. Equity investments made by foreign parents in Canadian affiliates accounted for all of the activity in the quarter, mainly in the form of reinvested earnings.

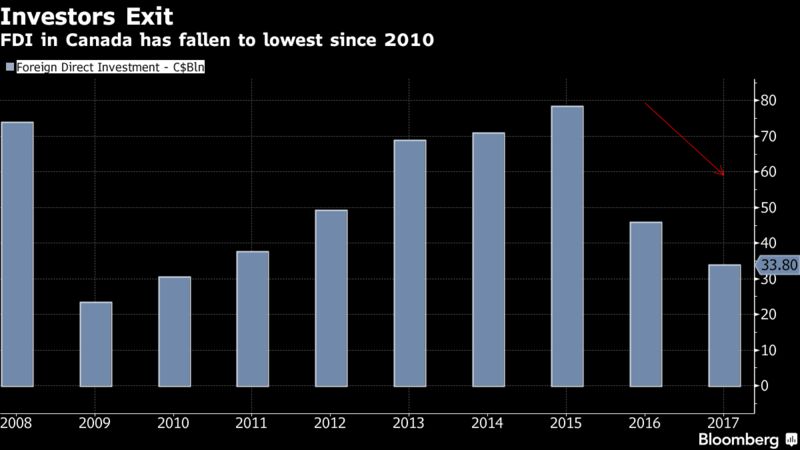

For the year 2017, direct investment in Canada amounted to $33.8 billion, the lowest level of investment since 2010 and well below the record of $126.1 billion observed in 2007. Cross-border mergers and acquisitions generated a withdrawal of funds from Canada for the first time since 2007, when these data started to be compiled.

Chart 4: Foreign direct investment

The other investment category generates inflow of funds from abroad

The other investment category of the financial account, which mainly reflects cross-border transactions conducted by Canadian banks, generated a net inflow of funds of $19.1 billion in the fourth quarter. A significant increase in currency and deposits held by non-residents in Canada and denominated in foreign currency contributed the most to the activity.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180301/dq180301a-eng.pdf

REUTERS. MARCH 1, 2018. Canada current account deficit narrows in fourth quarter

OTTAWA (Reuters) - Canada’s current account deficit narrowed in the fourth quarter as the country posted a smaller shortfall in the trade of goods after three consecutive quarters of increases, data from Statistics Canada showed on Thursday.

The C$16.35 billion ($12.72 billion) current account gap was smaller than economists’ forecasts for a deficit of C$17.80 billion. The third quarter was downwardly revised to show a deficit of C$18.59 billion from the initially reported C$19.35 billion shortfall.

For 2017 overall, Canada saw a current account gap of C$63.93 billion, smaller than the previous year’s C$65.37 billion gap.

Despite the improvement in the current account gap for the fourth quarter, it still accounts for about 3 percent of gross domestic product, which should restrict any longer-term upside for the Canadian dollar, said Robert Kavcic, senior economist at BMO Capital Markets.

The international trade deficit in goods shrank to C$7.16 billion in the fourth quarter as Canada’s trade surplus with the United States increased to C$10.47 billion.

Canada’s goods deficit with countries other than its neighbor to the south widened to a record C$17.63 billion due to wider trade gaps with the European Union and China, though that was tempered by smaller deficits with Japan and Mexico.

But direct investment in Canada for the year fell to C$33.8 billion on a non-adjusted basis, the lowest level since 2010 as cross-border mergers and acquisitions prompted a withdrawal of funds from Canada for the first time since 2007.

Reporting by Leah Schnurr; Editing by Frances Kerry and Jonathan Oatis

BLOOMBERG. 1 March 2018Foreign Direct Investment in Canada Plunges on Oil Exodus

By Theophilos Argintis

- Cross-border acquisitions negative for first time since 2007

- Nafta worries also help send FDI down 26% to lowest since 2010

Foreign direct investment into Canada plunged last year to the lowest since 2010, hampered by an exodus of capital from the nation’s oil patch and worries about the fate of the North American Free Trade Agreement.

Direct investment dropped 26 percent in 2017 to C$33.8 billion ($26.3 billion), Statistics Canada reported Thursday in Ottawa. Capital flows dropped for a second year, and are down by more than half since 2015. The investment that did take place was from reinvested earnings of existing operations. Net foreign purchases of Canadian businesses turned negative for the first time in a decade, which means that foreign companies sold more Canadian businesses than they bought.

The shrinking investment underscores how the energy slump is lingering in a Canadian economy that last year also began to face the additional headwind of growing U.S. protectionism. It also marks a setback for Prime Minister Justin Trudeau’s Liberal government, which has emphasized attracting foreign companies.

Falling foreign direct investment is important. The country’s economy has relied heavily on foreign funding since the global recession -- totaling more than C$500 billion since 2008 and about C$130 billion over the past two years alone, according to balance of payment data.

Unlike portfolio investment, foreign direct investment is considered a stable source of funding that comes with the additional benefits of a transfer of know-how. Instead, an increasing amount of Canada’s funding needs are being met by short-term funds denominated in foreign currencies -- which makes the country more vulnerable to a sudden loss of interest from foreign investors.

ConocoPhillips and Royal Dutch Shell Plc are among the companies that led the exodus from the nation’s energy sector last year. The biggest foreign investment in Canada last year was the purchase by Hong Kong’s richest man, Li Ka-Shing, of Reliance Home Comfort, a water heater and air conditioner firm for C$2.82 billion.

And the numbers continue to move in the wrong direction. According to Bloomberg data, foreign acquisitions of Canadian businesses fell to C$3.8 billion in the fourth quarter, the lowest since 2009.

— With assistance by Erik Hertzberg

CANADA - INDIA

The Globe and Mail. 1 Mar 2018. Trudeau won’t be back in India any time soon

CAMPBELL CLARK, Columnist

In 1958, when then-prime minister John Diefenbaker visited India, officials in the Department of External Affairs were asked to draw up a briefing note with pros and cons for whether Dief should go on a tiger hunt. One of the cons, according to historian Ryan Touhey, was “Prime Minister could be eaten by tiger.”

Nowadays, officials might warn Justin Trudeau that if he returns to India, he could be eaten alive.

His eight-day charm offensive didn’t just fail to enchant. India is now engaged in the diplomatic version of hissing and spitting. The official spokesman for India’s Ministry of External Affairs issued a statement that more or less called Mr. Trudeau a liar.

Suggestions there was Indian plotting to embarrass the PM, made by a senior Canadian official – who was backed by Mr. Trudeau in the House of Commons on Tuesday – were, according to India’s spokesman, “baseless and unacceptable.”

This is not an everyday occurrence. Big, serious, relatively friendly countries such as India don’t issue statements to trash Canadian prime ministers for what they just said in Question Period.

Sure, Venezuela’s deputy foreign minister blasted Stephen Harper’s statement on the death of president Hugo Chavez as “insensitive and impertinent.” But testy words from an outlier country aren’t in the same ballpark. Mr. Trudeau was courting India.

It was embarrassing enough that Jaspal Atwal, a man convicted of trying to kill an Indian cabinet minister in 1986, when he was a Canadian member of a banned Sikh terrorist group, showed up at one of Mr. Trudeau’s receptions in India. But then a senior security official told reporters, on condition he not be named, that the whole business might have been orchestrated by Indian factions – even though Mr. Atwal had been invited by a Liberal MP. And when Mr. Trudeau was pressed on that in the Commons on Tuesday, he backed up the official – saying that if a senior official said it, that’s because it’s true.

That amounts to the PM accusing the Indian government of sandbagging his trip. India is annoyed.

“This is a total failure in diplomacy,” said Anita Singh, research fellow at Dalhousie University’s Centre for the Study of Security and Development, who specializes in Canada-India relations. Mr. Trudeau’s trip was a series of preventable errors, from reciting standard Canadian phrases about shared values that don’t mean much to India to not having a clear idea what the goals of the mission were, she said. When an official raised the spectre of an Indian plot in public, it amounted to “juvenile diplomacy.”

So don’t expect Mr. Trudeau to be returning to India anytime soon. Politically, that’s like sticking his head in a tiger’s maw.

That’s the real damage for Canada-India relations: the lost opportunity. There weren’t such important and fruitful government-to-government relations that Canadians have to fret about near-term consequences. It’s missed potential.

Canada’s relations with India haven’t been smooth. India doesn’t see Canada as a priority. Progress have been elusive. But some had felt that with effort, there might be an opportunity to change that with Indian Prime Minister Nahendra Modi, elected in 2014.

Now, Ms. Singh said, we can expect a “lull” for a few years.

Relations have been worse – but usually that took an atomic bomb.

That’s what chilled relations in the 1970s. Canada had given India a nuclear reactor in 1955 to supply energy, and India used it to develop nuclear weapons, conducting their first atomic test in 1974. The Canadians were blindsided, Mr. Touhey said, feeling the Indians had played them.

In 1996, prime minister Jean Chrétien organized a Team Canada mission to India – but then, in 1998, India tested fusion weapons and sparked a regional arms race with Pakistan. Canada recalled its high commissioner and cancelled $54-million in aid. India, essentially, told Canada to get lost.

There have been off-and-on efforts to reconnect since. Mr. Harper’s Conservatives helped India regain access to global civilian nuclear supplies and launched free-trade talks. But progress was slow – those free-trade talks, and others, just kept grinding on. Among Canadian officials, there’s suspicion Indian counterparts are playing them, or frustration with India’s bureaucratic inertia. Before it was defeated, Mr. Harper’s government thought the savvy, dynamic Mr. Modi might have the political will to change things. His 2015 visit to Canada was almost triumphant.

It’s hard to imagine Mr. Modi visiting again soon. It’s a good bet Mr. Trudeau isn’t going to rush back to India, even if he’s invited. The next charm offensive might not come for years. The diplomatic pros are outweighed by the political cons – and the latter could be deadly.

The Globe and Mail. 1 Mar 2018. Trudeau stands by adviser as India calls claims of involvement in Atwal affair ‘baseless’

MICHELLE ZILIO

Justin Trudeau is defending his national-security adviser Daniel Jean after India publicly denied that it was behind the presence of a convicted would-be assassin during the Prime Minister’s trip to the country last week.

The Indian government issued a news release on Wednesday calling the Canadian allegations “baseless and unacceptable.” Mr. Trudeau stood by Mr. Jean on Wednesday, after the Conservatives accused his national-security adviser of briefing the media last week on what they call a “conspiracy theory,” suggesting India tried to sabotage the Prime Minister’s trip. Asked about the Indian government’s statement, the Prime Minister’s Office referred to Mr. Trudeau’s comments on Wednesday saying that the government will always listen to the advice of its public service.

“Daniel is a distinguished public servant who has served governments, regardless of their political stripe, for over 35 years,” Mr. Trudeau said during the daily Question Period. “We will always stand by our nonpartisan professional public service.”

Leading off Question Period on Wednesday, Conservative MP and former RCMP officer Jim Eglinski revealed that he once chased Jaspal Atwal down a British Columbia highway after the Sikh extremist tried to kill an Indian cabinet minister.

In an interview with The Globe and Mail, Mr. Eglinski said Mr. Atwal has no business being in the presence of the Prime Minister. He was baffled as to how Mr. Trudeau and his Liberal delegation failed to flag Mr. Atwal, who was invited to two receptions with Mr. Trudeau in India last week.

“We had a Prime Minister that was in India. He had three ministers of Indian descent with him that were fully aware of who Mr. Atwal was. Why they ever got themselves in this situation and invited him is inexcusable,” Mr. Elginski said.

Mr. Eglinski’s memories flooded back last week when he saw the now-infamous photos of Mr. Atwal with Mr. Trudeau’s wife, Sophie Grégoire Trudeau, and Liberal Infrastructure Minister Amarjeet Sohi in India.

“When I saw that on the news, I said, ‘Hey, that’s the guy I chased down the road,’ ” Mr. Eglinski said.

“Why would anybody want to be associated with him?”

Mr. Eglinski was the RCMP detachment commander in Gold River, B.C., on May 25, 1986, when he was called to respond to shooting on a logging road in the area. Upon arriving on the scene, Mr. Eglinski discovered that Indian cabinet minister Malkiat Singh Sidhu had been shot in his vehicle. He helped move Mr. Sidhu into an ambulance and then took off after the four suspects. One of them was Mr. Atwal, who was arrested in Campbell River, B.C., soon after the attack.

Mr. Eglinski was also involved in the subsequent investigation into Mr. Atwal, who was eventually convicted of the attempted murder of Mr. Sidhu. Although Mr. Atwal has served his time in jail, Mr. Eglinski says he’s still a risk.

“Has he changed? I still think he’s a dangerous individual and anybody in government should be very cautious in dealing with him,” Mr. Eglinski said.

“He should be treated for what he was.”

Mr. Trudeau said last week that Liberal MP Randeep Sarai – one of 14 MPs on the trip to India – invited Mr. Atwal to a reception at the Canadian high commissioner’s residence in New Delhi. Following a meeting with Mr. Trudeau on Tuesday night, Mr. Sarai announced he would be stepping down as the Liberals’ B.C. caucus chair.

After initially pointing the finger at Mr. Sarai, the Canadian government later spread the blame to “factions in India” that it says may have orchestrated the Atwal matter.

Speaking to reporters on Parliament Hill on Wednesday, Liberal MP Wayne Easter said the Atwal matter demonstrates the need for better vetting practices at official events.

“It was an error, and there’s always lessons you can learn, and that’s probably one of the ones we learned [in] this case,” Mr. Easter said.

Mr. Atwal was a member of the International Sikh Youth Federation, which is deemed a terrorist group in Canada and India, when he was convicted of the attempted murder of Mr. Sidhu. He was also charged but never convicted in the brutal 1985 beating of Ujjal Dosanjh, an opponent of the Sikh separatist movement who went on to serve as NDP premier of B.C. as well as a federal Liberal cabinet minister.

Speaking to The Globe on condition of anonymity last week, a senior government source said the Indian factions in question are concerned about the threat of Sikh extremism, especially among the Sikh diaspora in Canada, and believe that the Canadian government is too complacent on the matter. The source also said Mr. Atwal was recently removed from a blacklist of people banned from India.

Mr. Atwal told The Canadian Press that any suggestion the Indian government helped him get off the blacklist or into the reception is a “total lie.”

ENERGY

The Globe and Mail. BLOOMBERG. 1 Mar 2018. Energy slump slows Canada’s investment plans

GREG QUINN

Canadian business investment is being weighed down for a fourth straight year by weakness in Alberta’s energy industry.

Spending plans for oil and gas capital projects this year are down 12 per cent to $33.2-billion from 2017, according to a Statistics Canada survey published on Wednesday in Ottawa. The spending total has declined in each of the past four years from a peak of $76.1-billion. The province of Alberta was the biggest contributor to the decline.

Weakness in energy limited the gain in overall spending on non-residential construction and machinery and equipment to 0.8 per cent for 2018, to $238.6-billion.

That’s a slowdown from the 2017 increase of 3 per cent and still below the total of $272.1-billion set in 2014 before a plunge in crude oil prices.

Business investment has been one of the weak spots in a broad Canadian economic expansion, with growth being led more by government and consumer spending.

Bank of Canada policy makers have said a shift to an expansion led by business is important to create a durable recovery.

“Forget about Canadian businesses opening their wallets this year,” Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce in Toronto, wrote in a research note.

Even with gains outside energy, over all private spending plans are poised to fall 1.1 per cent this year. Public-sector spending plans are up 4.1 per cent.

HIGHLIGHTS OF THE REPORT

Spending plans for 2018 in the province of Alberta are down 5.3 per cent to $54.1-billion; in the most populous province of Ontario they are up 7.8 per cent to $73.9-billion Notable gains in capital spending plans this year include a 9.9-per-cent rise in real estate rental and leasing to $14.1billion, 6.2 per cent to $16-billion in manufacturing and 6.5 per cent to $32.4-billion in public administration.

The survey of 25,000 organizations was taken from September, 2017, to January, 2018.

Canadian Finance Minister Bill Morneau, speaking in Ottawa on Wednesday morning, said the discounted price paid for Canadian oil “has a significant impact on people’s investments,” and that he hopes government measures to overhaul pipeline reviews will turn around a decline in energy sector spending.

“Our intent is to follow through to get to an assessment approach that will give people more project certainty, and we hope that will lead to more investment over time.”

________________

LGCJ.: