CANADA ECONOMICS

NAFTA

REUTERS. FEBRUARY 22, 2018. Exclusive: As Trump trashes NAFTA, Mexico turns to Brazilian corn

P.J. Huffstutter, Adriana Barrera

CHICAGO/MEXICO CITY (Reuters) - Mexican buyers imported ten times more corn from Brazil last year amid concern that NAFTA renegotiations could disrupt their U.S. supplies, according to government data and top grains merchants.

Mexico is on track to buy more Brazilian corn in 2018, which would hurt a U.S. agricultural sector already struggling with low grains prices and the rising competitive threat from South America.

U.S. farmers, food processors and grain traders have spent months trying to prevent trade relationships from falling apart if the North American Free Trade Agreement implodes. They are trying to protect more than $19 billion in sales to Mexican buyers of everything from corn and soybeans to dairy and poultry.

Despite their efforts, South American corn shipments to Mexico are surging. Mexican buyers imported a total of more than 583,000 metric tonnes of Brazilian corn last year – a 970 percent jump over 2016, according to data from Mexico’s Agrifood and Fishery Information Service (SIAP).

The purchases all came in the last four months of last year. They followed visits by Mexican government officials and grains buyers to Brazil and Argentina to explore alternative supply options in the months after U.S. President Donald Trump took office and threatened to tear up the trade pact.

Mexico has long been the top importer of U.S. corn, and is the second largest buyer of U.S. soybeans, giving Mexico leverage in corn-belt states that are staunch Trump supporters but also strongly back the trade status quo.

Mexico’s Economy Minister Ildefonso Guajardo, who is overseeing Mexico’s NAFTA neogitating team, encouraged the country’s major grain buyers last year to explore South American corn to strengthen his hand at the negotiating table, saying the country needed a “Plan B” in case Washington pulled out of the trade deal.

Cheaper prices for Brazilian corn drove some of purchases by Mexican buyers. But in other cases, they bought Brazilian corn even when it cost more than U.S. supplies, executives and traders told Reuters.

“We bought from Brazil for two reasons,” said Edmundo Miranda, commercial director of Grupo Gramosa, one of Mexico’s top grains merchants. “One, because it was competitive. Two, to see how practical and profitable it was to buy from Brazil or Argentina given the possibility of trade tariffs because of NAFTA renegotiations.”

Gramosa and its domestic rival Comercializadora Portimex didn’t import any Brazilian corn in 2016. But last year, they imported nearly 260,000 metric tonnes of it - worth about $44 million at current prices - between September and December. The deals have not been previously reported.

U.S. corn exports to Mexico also rose, despite the rapid increase in the flow from Brazil, because Mexico needed record imports in 2017 to compensate for the impact of a drought on domestic corn production.

Mexico boosted U.S. imports by 6.6 percent, according to U.S. Department of Agriculture (USDA) data. Mexico buys far more corn from the United States than Brazil, taking 14.7 million tonnes in 2017, according to U.S. government data.

U.S. Agriculture Secretary Sonny Perdue said Thursday that he does not see a threat from Brazil to U.S. corn sales to Mexico because the U.S. has the advantage of proximity and logistics.

“We have a tremendous logistical advantage to sell to Mexico, with railways going directly from the corn area to Mexico,” said Perdue, speaking at the USDA Agricultural Outlook Forum, in Arlington, Virginia.

He acknowledged Brazil has the advantage of being able to grow two crops per year because of more favorable weather.

Brazil continues to make inroads into U.S. market share and Mexican purchases of Brazilian corn continued in January, rising to 100,000 metric tonnes from none a year earlier, according to Mexican government and trade sources.

TENSE TALKS

Trump has said he will scrap NAFTA if his administration cannot negotiate trade terms with Mexico and Canada that are more favorable to the United States. The next round of talks is later this month.

An end to NAFTA, farm and trade groups say, would likely lead to increased tariffs on grains trade, hurting one of the electoral constituencies that carried Trump to power. During his campaign, Trump promised farming communities that agriculture would benefit from his presidency.

White House spokeswoman Lindsay Walters said the Trump administration aims to increase market access for U.S. agriculture in NAFTA renegotiations. U.S. agriculture has “generally done well under NAFTA,” Walters said, but “there is more work to be done.”

U.S. agriculture industry groups have fought to keep their trade advantages since Trump took power, eager to retain tariff-free or low-tariff access when trading with Mexico, Canada and other countries.

Most larger farming enterprises and trade groups involved in supplying the largest food staples are pro-NAFTA. Smaller farmers have been more critical as they have struggled to compete with some of the cheaper imports that resulted from NAFTA.

‘LOSING CONFIDENCE’ IN U.S. GRAINS

The U.S. is already on course to lose its position as the top global corn exporter. Brazil is gaining by producing cheaper supplies that help offset higher freight costs to some destinations such as Mexico. Deteriorating U.S. trade relations with Mexico - which buys nearly a quarter of U.S. corn exports - could accelerate Brazil’s rise.

Mexican importers that have bought from Brazil have also often found a higher-quality product.

“I have the American; I have the Brazilian and the Argentinian; which one do I buy from? The cheapest,” said Alfredo Castillo, marketing manager of Portimex. “If they’re at the same price, I’ll go for the Brazilian.”

Staff from the U.S. Grains Council, an industry trade group, have met numerous times with Mexican buyers and government officials to reinforce the importance of grain trade between the two countries, council officials said.

Last November, the council and the National Soybean Growers Association jointly sent a team from the U.S. to Mexico, tasked with saving trade in grain and oilseeds worth nearly $4.4 billion per year.

The officials received a somewhat frosty reception in Mexico, said Thomas Sleight, chief executive officer of the U.S. Grains Council.

While most wanted to keep buying U.S. grains, one Mexican feed manufacturer told the Americans: “We’re losing confidence in the U.S. as a reliable supplier,” said Sleight, declining to name the customer.

Mexican officials gave the same message to a U.S. trade mission that traveled there in December, said Kevin Skunes, president of the U.S. trade group National Corn Growers Association.

“They all were very clear: They will look other places,” said Skunes, who was on the trade mission and met officials including the livestock secretary at the Mexican agricultural ministry.

LOSING BUYERS FOR GOOD?

Trade officials in the dairy industry have also spent months trying to stave off rivals in key export markets.

Tom Vilsack, former secretary of agriculture under the Obama Administration, joined a group of dairy processor and trade executives and flew to Mexico several times last year to meet with processors and government officials to preserve dairy contracts.

The stakes are also high for the U.S. poultry sector, which exports products worth more than $1 billion a year to Mexico and could see the southern neighbor slap a 75 percent tariff on U.S. chicken and turkey under its commitments to World Trade Organization rules.

U.S. farm groups are concerned about the longer-term repercussions of losing market share. Once Mexican buyers establish new networks, winning back the business will be tough even if trade relations with the U.S improve, they say.

“Once you lose a market, even a small portion of that market, you might never get that amount back,” Skunes said.

Reporting by P.J. Huffstutter in Chicago and Adriana Barrera in Mexico City; Additional reporting by Marcelo Teixeira in Sao Paulo, Frank Jack Daniel in Mexico City, Timothy Gardner in Washington, D.C., Ana Mano in Arlington, Virginia, and Caroline Stauffer and Karl Plume in Chicago; Editing by Simon Webb and Brian Thevenot

CANADA - USA

Global Affairs Canada. February 22, 2018. President of the Treasury Board Brison and Parliamentary Secretary Leslie to promote Canada-U.S. trade at National Governors Association meeting in Washington, D.C.

Ottawa, Ontario – Canada and the U.S. share one of the most mutually beneficial economic relationships in the world. Canada is the number one market for most U.S. states and is among the top three customers for the majority of states. Canada buys more American goods than China, Japan and the United Kingdom combined. The Government of Canada is committed to strengthening this important relationship and to creating new opportunities for workers and businesses on both sides of the border.

As part of these efforts, the Honourable Scott Brison, President of the Treasury Board, and the Honourable Andrew Leslie, Parliamentary Secretary to the Minister of Foreign Affairs, will visit Washington, D.C., on February 23 and 24, 2018, to attend the National Governors Association (NGA) Winter Meeting.

The meeting presents a great opportunity to meet and engage governors on the Canada-U.S. trade relationship, and to underscore the importance of Canadian trade to their states. It is also an opportunity to discuss the benefits of further regulatory cooperation between the two nations.

The NGA is a bipartisan organization of governors of the 55 American states, territories and commonwealths. The Prime Minister and Minister of Foreign Affairs participated in the NGA’s summer meeting in July 2017.

Quotes

“Millions of middle-class jobs on both sides of the border depend on trade between our two countries. That’s why Canada and the United States are committed to regulatory cooperation. We want to make it even easier for businesses large and small to trade goods across our border. By continuing to work together, both of our countries will continue to prosper.”

- The Honourable Scott Brison, President of the Treasury Board

“For 24 years, NAFTA has created opportunities for millions of Canadians and Americans. We remain committed to ensuring that this trading relationship continues to create middle-class jobs on both sides of the border. I look forward to underscoring this point with governors from across the United States in Washington later this week. ”

- Lt.-Gen. (ret.) The Honourable Andrew Leslie, Parliamentary Secretary for the Minister of Foreign Affairs

Quick Facts

- Canada and the United States share the world’s longest secure border, over which approximately 400,000 people, and goods and services worth $2.4 billion, cross daily.

- Canada and the United States share one of the largest trading relationships in the world. Canada is the largest market for the United States with US$267 billion worth of goods and services exported to Canada in 2016—larger than China, Japan, and the United Kingdom combined.

- Cross-border trade and investment between Canada and the United States supports nearly 9 million jobs in the United States.

- The Canada-U.S. Regulatory Cooperation Council brings together regulators from both Canadian and U.S. departments with health, safety and environmental protection mandates to reduce unnecessary differences between their regulatory frameworks.

See Also

- North American Free Trade Agreement - Resources: http://www.international.gc.ca/trade-commerce/consultations/nafta-alena/toolkit-outils.aspx?lang=eng&_ga=2.9781430.2044189505.1519075289-419424296.1488419833#factsheet

- North American Free Trade Agreement - Important News: http://international.gc.ca/trade-commerce/consultations/nafta-alena/important_news-nouvelles_importantes.aspx?lang=eng

- Canada-U.S. relations: http://international.gc.ca/world-monde/united_states-etats_unis/relations.aspx?lang=eng

CANADA - INDIA

Itinerary for February 23 and 24, 2018 Ottawa, Ontario - February 22, 2018

Note: All times local

Itinerary for the Prime Minister, Justin Trudeau, for Friday, February 23, 2018:

New Delhi, India

9 a.m. The Prime Minister will attend an official greeting ceremony.

Rashtrapati Bhavan (Presidential Palace)

Note for media:

Open coverage

9:30 a.m. The Prime Minister will participate in a wreath laying ceremony.

Raj Ghat (Gandhi Memorial)

Note for media:

Open coverage

10:15 a.m. The Prime Minister will meet with the Minister of External Affairs of India, Sushma Swaraj.

Taj Diplomatic Enclave Hotel

Note for media:

Pooled photo opportunity at the beginning of the meeting

12 p.m. The Prime Minister will meet with the Prime Minister of India, Narendra Modi.

Hyderabad House

Closed to media

12:30 p.m. The Prime Minister, the Minister of Innovation, Science and Economic Development, Navdeep Bains, the Minister of Foreign Affairs, Chrystia Freeland, the Minister of Defence, Harjit Sajjan, the Minister of Infrastructure and Communities, Amarjeet Sohi, the Minister of Science and Minister of Sport and Persons with Disabilities, Kirsty Duncan, and the Minister of Small Business and Tourism, Bardish Chagger will hold an expanded bilateral meeting with the Prime Minister of India.

Conference Room, Main Floor

Hyderabad House

Note for media:

Pooled photo opportunity at the beginning of the meeting

1:15 p.m. The Prime Minister will participate in an exchange of agreements ceremony with the Prime Minister of India and will deliver remarks.

Ballroom, 2nd Floor

Hyderabad House

Note for media:

Open coverage

2:45 p.m. The Prime Minister will participate in a roundtable with Chief Executive Officers.

Taj Diplomatic Enclave Hotel

Note for media:

Pooled photo opportunity at the beginning of the meeting

5 p.m. The Prime Minister will meet with the President of India, Ram Nath Kovind.

Morning Room, Ground Floor

Rashtrapi Bhavan (Presidential Palace)

Note for media:

Pooled photo opportunity at the beginning of the meeting

6:30 p.m. The Prime Minister will hold a media availability.

Nizwan Room, 1st Floor

Taj Diplomatic Enclave Hotel

Note for media:

Open coverage

Itinerary for the Prime Minister, Justin Trudeau, for Saturday, February 24, 2018:

New Delhi, India

9:30 a.m. The Prime Minister will participate in a hockey event with Canadian Olympic Gold Medalist, Hayley Wickenheiser.

High Commission of Canada

Note for media:

Open coverage

12 p.m. The Prime Minister and Ms. Grégoire Trudeau will deliver remarks at the Young Changemakers Conclave 2018.

Indira Gandhi Stadium

Note for media:

Open coverage

The Globe and Mail. CANADIAN PRESS. 22 Feb 2018. PM denies support for Sikh separatism. During state visit, Trudeau says Canada supports a united India while condemning violent extremism

MIA RABSON; AMRITSAR, INDIATHE

SEAN KILPATRICK/THE CANADIAN PRESS

Prime Minister Justin Trudeau visits the Golden Temple in Amritsar, India, on Wednesday.

Prime Minister Justin Trudeau says he made it “very, very clear” to the chief minister of Punjab that Canada supports a united India and condemns violent extremism, describing repeated allegations from the leader of the predominately Sikh region that Canadian ministers are separatists as misunderstandings and false.

Mr. Trudeau and his Defence Minister, Harjit Sajjan, met Amarinder Singh on Wednesday in part to try and mend fences with the state.

Mr. Trudeau’s position is that Canada supports a united India and absolutely condemns violence for any cause, but will not crack down on those advocating peacefully for an independent Sikh state because that is a freedom-of-speech issue.

“We will always stand against violent extremism, but we understand that diversity of views is one of the great strengths of Canada,” Mr. Trudeau said. “I was able to make that very clear to him.”

Tensions between Canada and India have risen in recent years over Indian concerns about a rise in Sikh extremism coming from some of Canada’s Sikh communities. Mr. Trudeau’s appearances at some Sikh events where extremist supporters also showed up caused unhappiness in India. Indian Prime Minister Narendra Modi has raised the issue with Mr. Trudeau several times and it likely will come up again when the two leaders meet in Delhi on Friday.

Last April, Mr. Singh said he was not interested in meeting any Canadian cabinet ministers because he thought Canada’s approach was too soft regarding Sikh Canadians who favour an independent Sikh homeland called Khalistan. He snubbed Mr. Sajjan when the minister visited India in April, calling him and the other three Sikh ministers in Mr. Trudeau’s cabinet “Khalistani sympathizers.”

He repeated those allegations just two weeks before Mr. Trudeau left for India and Mr. Sajjan and Infrastructure Minister Amarjeet Sohi both vehemently denied any ties to separatist movements. Mr. Sajjan called the comments defamatory.

In a Facebook post made on Wednesday after the meeting, Mr. Singh said he was “happy to receive categorical assurance” from Mr. Trudeau that Canada supports a united India.

“His words are a big relief to all of us here in India and we look forward to the government’s support in tackling fringe separatist elements,” Mr. Singh wrote.

In a conversation with reporters later on Wednesday, Mr. Trudeau would not say whether he believes there is actually a fringe Sikh separatist problem in Canada. He said only Canada has been working with Indian authorities to keep people safe from violent extremism.

“We will continue to work on these issues wherever they arise,” he said.

Mr. Singh welcomed Mr. Trudeau warmly at a hotel in Amritsar and asked him about his trip so far. He was polite, but more guarded, in greeting Mr. Sajjan.

The meeting almost didn’t take place. Although Mr. Singh told Indian media he would meet Mr. Trudeau at the Golden Temple in Amritsar during the Prime Minister’s visit, Mr. Trudeau’s office said before leaving for India that wasn’t going to happen and no meeting was being arranged.

That changed Sunday when Mr. Sajjan himself asked for a meeting with himself, Mr. Trudeau and Mr. Singh.

Earlier in the day, Mr. Trudeau spent time at the Golden Temple, the holiest site in Sikhism, where thousands of worshippers lined the walkways and called out religious greetings as Trudeau passed.

Both Mr. Singh and Mr. Trudeau seemed to indicate their meeting was a reset on the relationship that can now turn to fostering economic and cultural ties between Canada and Punjab.

The Globe and Mail. 22 Feb 2018. Several political realities are intersecting during Justin Trudeau’s taxing visit to IndiaAfter awkward India visit, will Trudeau learn his lesson?

SONYA FATAH, Assistant professor at the Ryerson School of Journalism

Photo ops have limitations, as Justin Trudeau is learning on his inaugural visit to India as Prime Minister of Canada. Mr. Trudeau may not have thought family photographs shot against the backdrop of the magnificent Taj Mahal or in the rustic confines of the elephant conservation centre in Mathura would backfire. If the delegation returns without making substantial gains to trade numbers, while incurring losses to the enduring cultural relationship between the two countries, the optics of this visit may not have the intended impact.

ADNAN ABIDI/REUTERS

Canadian Prime Minister Justin Trudeau, his wife, Sophie Grégoire Trudeau, daughter, Ella Grace, and son Xavier pose for photographers while visiting the holy Sikh shrine of Golden Temple in Amritsar, India, on Wednesday.

Six days into his eight-day visit to India, Mr. Trudeau is yet to meet Indian Prime Minister Narendra Modi. Welcomed by a junior Agricultural Minister at the tarmac and having finally met with Punjab’s Chief Minister, Amarinder Singh, the overarching result of his diplomatic mission has been a series of photo opportunities.

So far, very little has moved to push the scale up on the lowly $8-billion of Indo-Canadian annual trade.

The Trudeau government is trying to keep the focus of his current visit on economic progress and job creation – Mr. Trudeau tweeted the creation of 5,800 new jobs and a number of agreements adding up to $1-billion. But the Hindu nationalist party in power – with Mr. Modi at its apex – is using this prime ministerial visit as a game changer on a more divisive cultural issue: Khalistan, a separatist Sikh nation. Indian media coverage of the Canadian delegation has focused almost squarely on the support for Khalistan in Canada.

Several political realities are intersecting on this challenging visit. Mr. Trudeau’s cabinet consists of four ministers of Indian origin, all of them Sikh. There is also a personal history with Amarinder Singh, who visited Canada ahead of his election as the Sikh-majority Punjab state’s chief minister and was denied access to Indian congregations.

Also, Mr. Trudeau’s previous participation in public events such as the Khalsa Day parade where separatist leaders – as well as those behind the 1985 Air India bombing – are lionized. Finally, there is a concern of growing support for Khalistan among the Canadian diaspora, heightened by the decision of gurdwaras across Canada to bar the entry of official Indian delegations to their premises. Given that Canada has long harboured a reputation as a place where diaspora groups congregate to support separatist movements (Sri Lanka, India, for example), Mr. Trudeau may return from India more attuned to particular realities of the vote banks and donors whose support he seeks.

Still, the reality is there isn’t much support for Khalistan in India today. In Punjab, falling farm incomes and drug abuse are larger, more pressing concerns.

The ruling Bharatiya Janata Party, over which Mr. Modi presides, has a vested interest in building more mileage out of the Khalistan issue, something created when the opposition party, the Indian National Congress was in power. Its then leader Indira Gandhi presided over the illconceived and fateful Operation Blue Star, when one of the holiest of Sikh sites in Amritsar, the Golden Temple, was stormed.

And Canadian gurdwaras are not the only ones to have shuttered their doors to Indian officials – gurdwaras in the United States and Britain have followed suit, part of a strategic response to the November arrest of a British Sikh activist on charges of allegedly seeking to attack Hindu nationalist leaders.

India has rolled out the red carpet for more contentious visits, such as that of Chinese president Xi Jinping to India when China’s border behaviour has been far more threatening to India’s national interests.

India’s response to Canada’s visit has more to do with what was on offer. Not enough, it seems, in terms of strategic economic advantage, the result of which has been a brouhaha about Khalistan and a snub to the visiting Prime Minister.

But a good lesson may come of this at a domestic, cultural level. Mr. Trudeau, as well as the NDP’s Jagmeet Singh, may be looking to a sizable Sikh vote base to strengthen their electoral position – but that’s doesn’t mean they should fall back on free speech whenever they are questioned on the Khalistan issue, especially given Canada’s own history with the Khalistan movement.

Many younger Canadians don’t remember or connect the 1985 Air India bombing to the Khalistan movement and the Canadian government’s response to that bombing and the judicial verdicts were never enough.

When Mr. Trudeau – or any Canadian leader for that matter – attends cultural parades partly as a photo opportunity or to strengthen the possibility of donations from those camps, it’s important to know a man widely considered the leader of one of the biggest mass murders of Canadian citizens – Talwinder Singh Parmar in this case – is being honoured.

The lesson from this India mission is clear. It may no longer be enough to turn a blind eye and parachute into cultural events without investigating the forces behind them. Not for a photo opportunity, and not for a slice of the vote bank either.

The Globe and Mail. 22 Feb 2018. EDITORIAL. Welcome to India, sort of

Official visits are full of low-hanging fruit for journalists. They’re expensive, prone to gaffes, and controversies drop from them like overripe apples. Still, even by those standards, Justin Trudeau’s current junket through India has been unusually fraught.

The trouble started on the tarmac in New Delhi, when the Indian government dispatched a junior minister to greet the Prime Minister and his family. This had the look of a snub. Mr. Trudeau didn’t even get a welcome tweet from his counterpart, the media-savvy Narendra Modi.

If a slight was intended, it was probably over ongoing Indian concerns that Ottawa is soft on Sikh separatism. Perhaps as a result, Mr. Trudeau has met few, if any, senior central government officials since his arrival.

His first high-level meetings appear to be on Friday, including a tête-à-tête with Mr. Modi. The Hindustan Times quoted a veteran diplomat this week who said he had never seen an official trip to the country featuring so few official engagements with the Indian government.

In the meantime, Mr. Trudeau has sat down with business tycoons and regional leaders, and seen – or rather been seen at – a great many religious sites.

The PM is not on vacation. He has done government business every day of the trip. But he also seems to be doing two things of dubious value. The first is playing domestic politics. If an image of the Trudeau clan in front of the Taj Mahal appears in fundraising e-mails next year, don’t be astonished.

The second is burnishing Brand Canada. Mr. Trudeau sees doing PR for the country as central to his job, and he’s good at it. But if the theory is that his mere presence anywhere in the world automatically redounds to Canada’s benefit, that is still not enough to justify a very expensive eight-day trip.

There are serious issues to broach in the Indo-Canadian relationship. India recently slapped a 50-per-cent tariff on yellow peas, a major Canadian export to the country. There’s a foreign-investment protection deal pending between the two countries. And there are perennial environmental and security issues to discuss.

Maybe Mr. Trudeau’s agenda for his meeting with Mr. Modi is chockablock with this stuff. Our fingers are crossed.

But India already seems puzzled by the informality of Canada’s visit. We can see why.

The Globe and Mail. 22 Feb 2018. India’s water crisis opens channel to Canadian collaboration. Opportunities abound in transforming our homegrown technology and services into actual solutions for rapidly expanding country

STEWART BECK, RAJIV LALL

With an expanding economy and more than 800 million people relying on pulses for their protein, Canada will always play a role in India’s protein security and its food security in general.

Stewart Beck is president and chief executive of the Asia Pacific Foundation of Canada and a Canadian career diplomat who served abroad in India, China, Taiwan and the United States.

Rajiv Lall is founder, managing director and CEO of IDFC Bank and chairman of the Asia Business Leaders Advisory Council.

Canada is fortunate that food security is not a political concern, nor is weather an annual factor in determining our GDP. Food security, on the other hand, is critical for many countries in Asia, with India perhaps being the most affected.

We imagine that India’s food security is a priority topic during Prime Minister Justin Trudeau’s five-city tour of the country this week. India is facing a perfect storm in water management, with serious agricultural effects. A rapidly increasing population is placing an untenable load on limited water-related infrastructure and on the diminishing groundwater tapped for India’s massive agricultural needs. Add to this mix the complex implications of climate change – including changes to rainfall patterns, floods, droughts and saltwater intrusion – and the situation is dire. More than 70 per cent of India’s surface and groundwater is now contaminated, reports India’s own Energy and Resources Institute.

While Canada has been negotiating a free-trade pact with India since 2010, and a foreign investment protection agreement since 2004, both deals will take a back seat this week as the Trudeau government focuses on more immediate issues affecting trade and investment with Asia’s new economic juggernaut. In particular, there will be an effort to persuade the Indian government to overturn its decision to impose up to a 50-per-cent duty on certain pulses imported from Canada.

The duty reflects a good monsoon season last year, which increased crop yields, and the desire of the Indian government to develop its own self-sufficiency in this agricultural sector. In reality, with an expanding economy and more than 800 million people relying on pulses for their protein, Canada will always play a role in India’s protein security and its food security in general.

Canada, with its related expertise, research and technologies, is also well positioned to capitalize on the opportunity to help India respond to its daunting water and agriculture challenges. Innovative technological solutions and new financing mechanisms will be key to collaboration in this sector and to broader engagement with India.

Canada’s advantages in the water value chain are twofold. First, we are a global leader in specialized areas such as membrane technology, water purification, and waste-water recapture and treatment. Second, Canada has substantial expertise in water services including consulting, engineering, data analysis and construction.

In fact, according to Canada’s Blue Economy Initiative, which seeks to make the country a global leader in water sustainability, approximately 500 of the 600 Canadian companies active in this space specialize in waterrelated services.

Transforming these made-inCanada technologies and services into actual, scalable solutions for India calls for innovative approaches to the opportunity.

One of the challenges facing Canadian water businesses is their size and scale. To be successful in an emerging market such as India’s requires deep pockets and financial instruments that will allow Canadian firms to demonstrate the viability of their technologies. These currently do not exist.

Although Export Development Canada has excellent tools to deploy to assist Canadian exporters, it is essentially an asset base lender. It does not, at this time, have the ability to support the necessary demonstration projects required to satisfy a potential client that the technology will, in fact, provide the needed solution.

Addressing this funding lacuna for Canadian water technology companies and matching it with the research and technology outputs from the government’s recent announcement of supercluster funding for Protein Industries Canada can be and should be a key factor in our strategic relationship with India. In the short term, we are a commodity exporter of an essential protein element in the Indian diet – but we need and should be a strategic partner in ensuring India’s long-term food and water security.

One hope for Mr. Trudeau’s visit to India is for the two leaders to not only address the bilateral irritant of an increased tariff, but to look beyond to creative ways to connect and innovate around the critical water challenges facing India.

On March 2 in Toronto, the meeting of the Asian Business Leaders Advisory Council with the Asia Pacific Foundation of Canada will be addressing these strategic aspects of Canada’s relations with Asia. We expect insights from the Prime Minister’s mission to India will feature prominently in the discourse. Its challenges are our shared opportunities.

THE GLOBE AND MAIL. THE CANADIAN PRESS. FEBRUARY 22, 2018. Trudeau says Sikh extremist should not have been invited to reception

MIA RABSON, NEW DELHI

A man who was convicted of trying to assassinate an Indian cabinet minister in 1986 should not have been invited to receptions held in Delhi, Prime Minister Justin Trudeau said Thursday.

His statement came after a senior official in Trudeau's office said an invitation issued to Jaspal Atwal for a reception was a mistake and was rescinded as soon as it was discovered.

But the error wasn't caught until after Atwal had already attended a reception with Trudeau on Tuesday evening and posed for photos with both Sophie Gregoire Trudeau and Infrastructure Minister Amarjeet Sohi.

Trudeau told reporters in New Delhi prior to a speech at the Canada-India Business Summit where several hundred Canadian and Indian business people were gathered that it was wrong to issue the invitation.

"The individual in question never should have received an invitation and as soon as we found out we rescinded the invitation immediately," said Trudeau. "Obviously we take this situation extremely seriously."

A spokeswoman with the Prime Minister's Office said earlier that Atwal is not part of the PM's official delegation to India and that the PMO is "in the process of looking into how this occurred."

But as it turns out, Atwal was added to the guest list by British Columbia MP Randeep Sarai, one of the 14 MPs in India with Trudeau.

"The member of parliament who included this individual has and will assume full responsibility for his actions," Trudeau said.

Sarai also issued his own statement taking full responsibility and said he should have used better judgement.

Officials in the Prime Minister's Official wouldn't comment on the vetting process that allowed the two invitations to slip through. A spokesperson said they do not comment on matters relating to the PM's security.

The news about Atwal came a day after Trudeau said he condemned violent extremism and tried to convince the chief minister of Punjab that his government was not sympathetic to the Sikh separatist cause.

The embarrassing setbacks raise questions about the adequacy of both security and diplomatic preparations for Trudeau's trip. Trudeau appeared grim Thursday morning during a visit to the Jama mosque, one of the biggest mosques in India. He did not respond to a question thrown at him at a mosque photo op, nor did he respond when the questions were repeatedly shouted to him at a cricket pitch in Delhi Thursday afternoon.

Media were kept more than 50 metres away from Trudeau at the cricket pitch where his three children, Xavier, Ella-Grace and Hadrien, each took turns with a cricket bat while Trudeau looked on.

Trudeau and his family also visited the Sacred Heart Catholic church in Delhi Thursday, where he and his family lit candles and prayed.

Atwal was a member of the International Sikh Youth Federation, a banned terrorist group in Canada and India, when he was convicted of the attempted murder of an Indian cabinet minister. He was one of four men who ambushed and shot Malkiat Singh Sidhu in a car on Vancouver Island in 1986. Sidhu was wounded.

Atwal was also convicted in an automobile fraud case and was charged, but not convicted, in connection with a 1985 attack on Ujjal Dosanjh, a staunch opponent of the Sikh separatist movement's push for an independent Sikh state of Khalistan. Dosanjh went on to become premier of British Columbia and a federal cabinet minister.

Wednesday afternoon Trudeau met with Punjab Chief Minister Amarinder Singh who has repeatedly accused the Trudeau government and several of his cabinet ministers of being Khalistani sympathizers. Khalistan is the name of the independent Sikh state sought by some members of the Sikh community.

Trudeau told Singh Canada supports a united India and said he would look into concerns financing for Sikh separatist extremists was coming out of Canada, and Singh was happy with the meeting. Singh has not yet responded to the news Atwal was part of this trip.

Tensions between Canada and India have risen in recent years over Indian concerns about a rise in Sikh extremism coming from some of Canada's Sikh communities. Trudeau's appearances at some Sikh events where extremist supporters also showed up caused unhappiness in India.

Indian Prime Minister Narendra Modi has raised the issue with Trudeau several times and it likely will come up again when the two leaders meet Friday in Delhi.

INTERNATIONAL TRADE

Atlantic Canada Opportunities Agency. 2018-02-20. Atlantic Canadian multi-sectoral trade & investment mission to China. Backgrounder

Context

Federal ministers and Atlantic premiers announced they will lead a multi-sectoral trade and investment mission to China in November 2018.

The mission will support Atlantic Canadian businesses and organizations in the food, clean growth, education and tourism sectors that are looking to create new partnerships and build business-to-business relationships in China, Canada’s second largest trading partner after the United States.

This mission supports the trade and investment pillar of the Atlantic Growth Strategy which is designed to expand Atlantic Canada’s international markets, and promote and position the region to attract new investments and tourism.

Mission Objectives

- Facilitate market access for Atlantic Canadian small- and medium-sized enterprises that are export-ready and have an ability to do business in the Chinese market.

- Create trade and investment opportunities to promote Atlantic Canadian food and clean growth products.

- Promote Atlantic Canadian education institutions to Chinese students interested in pursuing their education in Canada.

- Promote Canada as a prime tourism destination by leveraging the Canada-China Year of Tourism.

- Strengthen cultural and economic relationships between Canada and China.

Sectors targeted for recruitment

- Food and beverage producers including seafood

- Clean growth

- Education sector

- Tourism (Atlantic Canada as a destination)

Companies will be recruited to participate based on the objectives of the mission, their alignment with the target sectors and their level of export readiness.

Program and itinerary

The mission’s itinerary and the business program are currently under development. The goal of the

multi-sectoral trade and investment mission is to maximize opportunities for the participating Atlantic Canadian businesses and educational institutions.

The business program will include: business briefings and business-to-business meetings tailored to participants’ needs and organized by the Canadian Trade Commissioner Service in China, site visits, and networking events that will include diplomatic briefings with federal ministers and Atlantic premiers.

Recruitment

The Atlantic Canada Opportunities Agency (ACOA) will work closely with trade officials from other federal organizations and the Atlantic provincial governments to identify companies and educational institutions that could benefit from this trade and investment mission.

Businesses and educational institutions that are interested in being part of the multi-sectoral trade and investment mission to China can express their interest by communicating with the ACOA office nearest them.

Additional updates on mission planning will be made available over the coming months.

EDC. FEBRUARY 22, 2018. WEEKLY COMMENTARY. Uh-oh – Is Inflation Back?

By Peter G Hall, Vice President and Chief Economist

Last week markets were jolted by an unexpected increase in US consumer prices. Suddenly, all the talk is about inflation spikes, expectations for the next few months, whether the Fed is behind the curve, and so on. Just a month ago, I spoke about tame price increases as a sign of sustained growth. Was that preliminary – are we really in for an inflation shocker?

Are we in for an inflation spike?

RLet’s look at the numbers. The January increase in the US Consumer Price Index (CPI) was 0.31 per cent. While that may not look like much, if it continued for a year at that pace we’d be talking about 3.8 per cent growth. That’s a problem; it’s a lot higher than the Fed’s target range. Then consider that for the past seven months, growth has averaged an annual pace of 3.6 per cent. Are the worry-warts right?

Not so fast – energy costs were a huge source of the run-up. Strip them out of the price series together with the volatile food category, and so-called ‘core’ inflation is a bit different. The last two months have seen strong gains, at an annual rate of 3.6 per cent. Over the same seven-month stretch, though, the average is just 2.5 per cent. But aren’t the most recent numbers really what matter? Good point – let’s have a look at the details.

Top Surprising rise in vehicle costs

Breaking it down into core goods, it’s clear that apparel costs shot up in January. This is likely just a seasonal movement. A more concerning change is the rise in vehicle costs – that may be a signal of something deeper. But remember, in this segment, we were worried about oversupplies and bloated inventories just a year ago; there hasn’t been a lot to indicate significantly tighter supplies since then. However, given capacity constraints in the industry, we will keep this under close scrutiny.

Costs of core services have ramped up recently, but only to the growth pace experienced in 2016, which at the time raised few eyebrows. Shelter costs are definitely above the Fed’s overall price target, but they have been there for awhile. A key mover of core service costs is vehicle insurance, which is on a steady upswing. So far, it’s isolated and as such, not a worry.

Certain hybrid measures of core inflation are a bit more concerning. For example, strip out not only food and energy but also homeowners’ rent and tobacco, and core is rising more than at any point in the post-recession period. A few other hybrid measures come up with the same result. So, are we worried?

I’ve long said that after a very long period of worry about the opposite – disinflation, or worse still, outright deflation – that a little inflation is not a bad thing. Those two dreaded ‘D’ words are ones for which central banks have a very limited playbook. Inflation? They have that one down pat.

That could be cold comfort, though, if it means that a much tighter interest rate stance is needed. Is that where things are going? Again, not so fast. Sluggish post-recession growth – a decade-old reality – has conditioned a lot of economic behavior to expect and therefore prepare for much less than the economy is capable of. Today’s higher growth is a wake-up call that finally more capacity is needed. As we work through this interim adjustment period, it would be natural to experience temporary price increases. Indeed, they are in effect the economy’s call to action. Given the capacity the US has to add to its capacity, and clear evidence of pent-up demand, the Fed’s role is not to stanch out-of-control growth, but to guide a manageable growth upshift.

Preparing for the rate of inflation

How should we prepare for and approach this shift? First, there are likely to be regular moments of price-panic, but given what’s really happening, in each occurrence it should fade quickly. Second, rates will continue to rise – not just at the short end of the market, but increasingly on the long end. Five- and ten-year yields are now on a path that looks a lot more like a return to normal, baking in a rate of inflation at, not below, target level, and also moving toward a more standard risk premium for longer paper. Savvy companies appear keen to lock in lending ahead of what looks like a steady run of increases.

The bottom line?

Prepare for interesting monthly price movements – not just in the US, but across the pond as well. But try to tune out the scaremongers – as far as we can see, this is a welcome by-product of an economy that is finally getting back on its feet. It has been a long wait.

The Globe and Mail. 22 Feb 2018. With two new global deals, Canada’s container trade growth is forecast to surpass the U.S. Marine shipper says two global deals will help raise imports and exports by 7% this year, compared with just 2% south of the border

Over all, we see Canada’s trade prospects very favourably compared to not just North America but globally.

JACK MAHONEY, MAERSK LINE CANADA PRESIDENT

The signing of two major trade deals with global trading partners will help send Canada’s growth in imports and exports by container surging past that of the United States, marine shipper Maersk Line says.

As free-trade talks with the United States and Mexico drag on, Canada launched a trade agreement with Europe in September and is set to sign a deal in March to join an 11-country trading bloc that includes Japan, Chile and Malaysia.

Canada’s overseas trade in containerized goods – everything from clothing to auto parts and chilled pork – will rise 7 per cent this year, compared with U.S. growth of 2 to 4 per cent, Maersk says in a new report on trade.

“Over all, we see Canada’s trade prospects very favourably compared to not just North America but globally,” said Jack Mahoney, president of container-ship company Maersk Line Canada, whose parent company operates more than 600 ships around the world. “We think it all comes from this atmosphere where trade is seen as good for the country.”

Containerized imports and exports rose by 7 per cent in 2017, and are positioned to rise again in 2018 with the launch of the Comprehensive Economic and Trade Agreement with Europe, according to Maersk Line, which calls on container terminals at most North American ports, including Vancouver, Prince Rupert, Montreal and Halifax.

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is expected to be signed in March and will eliminate most duties for Canadian goods in countries that together account for about 16 per cent of the world’s gross domestic product.

Meanwhile, North American freetrade talks are set to resume this week in Mexico City after previous sessions failed to overcome contentious points in the three-way agreement.

Mr. Mahoney said in a phone interview he expects CPTPP will boost exports and bring steady and sustained rising volumes of two-way trade to Canada’s West Coast.

The boom in trade has set volume records at Halifax and Prince Rupert, and has spurred terminal expansions in Montreal and Vancouver. At Prince Rupert, container-terminal operator DP World recently expanded capacity by 60 per cent in a move that capitalizes on the port’s reputation as a congestion-free facility with faster trips to major markets. Maersk says the port is one to three days closer to Asia than U.S. West Coast ports, and containers reach Chicago, Montreal or Toronto more quickly than from U.S. hubs.

These factors have helped Prince Rupert become a major entry point for goods destined for U.S. markets. Just one-third of the imported cargo at Prince Rupert has a domestic destination, with the rest headed for Chicago, Memphis and other U.S. cities in the Midwest.

The rise in containerized trade is also being felt in Montreal and Halifax. The Port of Halifax shipped a record number of containers in 2017, a 16-per-cent rise over the previous year. The Port of Montreal recently said it is going ahead with the $750-million construction of a new container terminal on the south shore of the St. Lawrence River. Like Halifax, much of Montreal’s cargo travels to and from Europe and the Mediterranean. The boxes are carried by ships, trains and trucks and used to move most consumer goods, including furniture and electronics, as well as machinery and bagged agricultural products.

The business of moving cargo containers has been a rare bright spot for the Canadian railways this winter, a period marked by heavy snowfall and cold temperatures that have slowed most rail traffic.

Canadian railways have moved 5 per cent more container carloads this year, compared with the same period last year, according to the American Association of Railroads, including their U.S. networks. By contrast, shipments of most other freight – including metals, grains and chemicals – have declined.

Speaking at an investors conference in Florida on Wednesday, Ghislain Houle, chief financial officer of Canadian National Railway Co., said the rapid growth in freight volumes that began last year has challenged the company’s ability to keep its trains moving, especially in winter.

“If anything, we grew [in Prince] Rupert a little faster than we would like,” Mr. Houle said.

Speaking at the same conference, Keith Creel, chief executive officer of Canadian Pacific Railway Ltd., said expanded container capacity at Vancouver’s GCT Deltaport helped drive up the freight carrier’s volumes by 5 per cent in 2017.

ENERGY

BLOOMBERG. 22 February 2018. Permian's Mammoth Cubes Herald Supersized Future for Shale

By Alex Nussbaum

- Cube development emerges as Permian enters manufacturing mode

- Encana’s mammoth 19-well plot at center of growing debate

In the scrublands of West Texas there’s an oil-drilling operation like few that have come before.

Encana Corp.’s RAB Davidson well pad is so mammoth, the explorer speaks of it in military terms, describing its efforts here as an occupation. More than 1 million pounds of drilling rigs, bulldozers, tanker trucks and other equipment spread out over a dusty 16-acre expanse. As of November, the 19 wells here collectively pumped almost 20,000 barrels of crude per day, according to company reports.

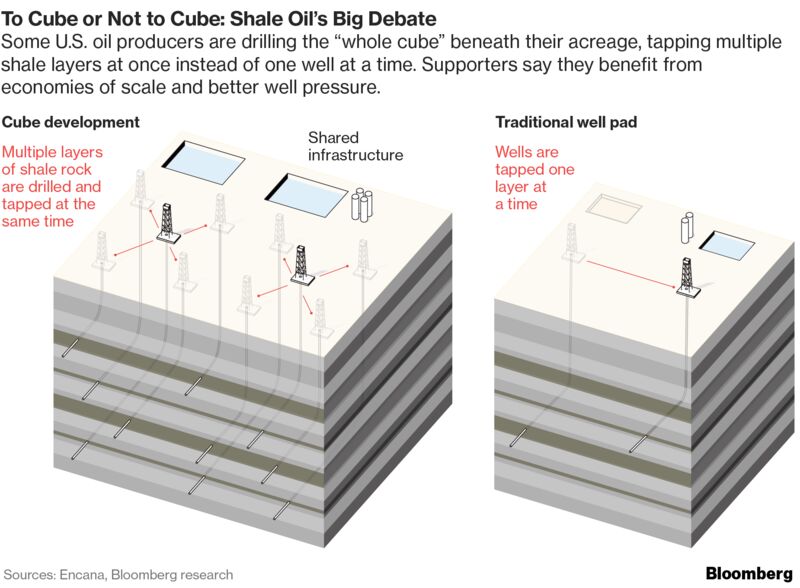

Encana calls this “cube development," and it may be the supersized future of U.S. fracking, says Gabriel Daoud, a JPMorgan Chase & Co. analyst who visited Davidson last year. The technique is designed to tap the multiple layers of petroleum-soaked rock here in Texas’ Permian shale basin all at once, rather than the one-or-two-well, one-layer-at-a-time approach of the past.

After a years-long land grab by explorers, “the Permian is graduating," according to Daoud. “Now it’s all about entering manufacturing mode."

With the new technique, Encana and other companies are pushing beyond the drilling patterns that dominated during the early, exploratory phases of the shale revolution. Now, operators are assembling projects with a dozen or more well bores that touch multiple underground layers of the Permian and other shale plays simultaneously, tapping the entire 3-D “cube" beneath a producer’s acreage.

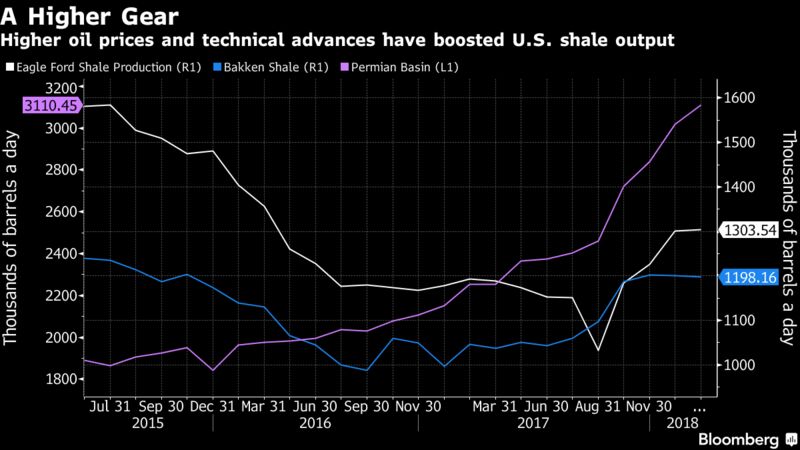

The shift has been controversial, with some of the biggest names in oil shying away from the approach as too aggressive and expensive. But if proponents are right, the cube could accelerate a drilling boom that’s already helped push U.S. production past an historic 10 million barrels a day, rewriting the rules of global energy markets along the way.

Along with the Davidson pad, Calgary-based Encana has 12- and 14-well operations in Texas as well as a 28-well behemoth in the Montney shale play in Alberta and British Columbia.

Devon Energy Corp. said on Wednesday that it has more than 10 multi-zone projects scheduled for 2018, including the 11-well Boomslang pad in the Permian and the 24-well Showboat project in Oklahoma. Concho Resources Inc., another early champion, debuted its Brass Monkey operation in the Permian last year, with 10 wells that dive underground and then burrow about two miles horizontally.

“We have just started to get into the manufacturing and harvest mode of the shale revolution," Concho Chief Executive Officer Tim Leach said on a conference call.

Not Cheap

The operations aren’t cheap. A project the size of RAB Davidson may have cost Encana $120 million, according to JPMorgan’s Daoud. Included in the calculations are the cost of the extra wells, bigger tank batteries, added pumping power, extended pipeline networks and additional labor required in cube development, among other expenses.

Proponents, though, say it saves money in the long run, thanks to economies of scale and improved well productivity rates. One driller bragged about employing several drilling contractors on the same pad and leveraging one’s price against the other, the analyst recalled.

Encana didn’t respond to messages seeking comment, but on a conference call in November, company officials said all of their 2018 wells will be part of large-scale pads. Per-well costs dropped by a quarter at the Montney cube, Encana reported.

The alternative is “a high-cost, scattered approach to development” that “risks sterilizing resources in the long-run,” CEO Doug Suttles told analysts.

Unconvinced

Not everyone’s convinced. Major Permian operators including Pioneer Natural Resources Co. and EOG Resources Inc., while expanding their well pads, have nonetheless taken a more conservative approach. Along with the initial cost, skeptics cite the potential for logistical nightmares in going too big. Some worry about undercutting innovation and note it’s hard to diagnose problems on individual wells when a dozen or more are running all at once.

“It’s all a question of return," said Kimberly Ehmer, a spokeswoman for EOG Resources. “The impact to returns is not clear-cut until you understand the impact to well productivity and other operations costs."

The Houston-based explorer has limited itself to six- to eight-well pads thus far, she said in an email.

It’s too early to say which side, if either, is right, although that may change this year as more results become available from large-scale production. For now, there’s no sign cube wells are any less productive, said Sarp Ozkan, a director at Houston-based researcher DrillingInfo Inc.

A move toward cube development could spur more consolidation, he said, as companies without the financial or administrative might to pull off industrial-size operations get snapped up or pushed out.

It also could have a big influence on oil and gas markets: If the industry takes a more cautious approach, U.S. output could fall below forecasts in the coming years, easing some of the downward pressure on prices. If Permian producers master manufacturing mode, on the other hand, the global supply glut may only get worse.

“You add all the numbers up and what you start to come up with is very, very scary," Ozkan said in a telephone interview. “The production potential is only as high as the demand will allow it to go."

— With assistance by Dave Merrill

AVIATION

THE GLOBE AND MAIL. REUTERS. FEBRUARY 22, 2018. Boeing applies to stay in race to supply Canada with 88 new fighter jets

OTTAWA - Boeing Co which is locked in a trade dispute with the Canadian government, has applied to stay in the race to supply Canada with 88 new fighter jets, the government said on Thursday.

Boeing is one of five potential contenders to supply the jets, including U.S. rival Lockheed Martin Corp.

Canada is due to release the exact specifications for the jets next year and officials say the deal is worth between C$15-billion ($11.80-billion) and C$19-billion.

Reuters revealed last week that the U.S. aerospace giant, which angered Canada by launching a trade challenge against planemaker Bombardier Inc, would remain in the race.

None of the potential contenders is obliged to put forward their jets in the competition.

The government said the firms eligible to take part are:

- Lockheed-Martin, which makes the F-35 stealth fighter

- Boeing, which makes the F-18 Super Hornet

- Airbus, which makes the Eurofighter

- Saab AB, which makes the Gripen

- Dassault Aviation, which makes the Rafale

REUTERS. FEBRUARY 22, 2018. Bombardier CFO says used business jet market inching toward sellers

MONTREAL (Reuters) - The market for higher-end, pre-owned business jets is beginning to favor sellers, after years where buyers had the upper hand because of elevated supply, Bombardier Inc’s (BBDb.TO) chief financial officer said on Thursday.

“You’re starting to see that turn into being a bit of a sellers’ market on the used side, for good aircraft anyway,” CFO John Di Bert told the Barclays industrial conference in Miami. “That absorbs a lot of demand that was out there.”

The supply of pre-owned aircraft, which ballooned after the 2008 financial crash, has limited demand for new jets in recent years, with deliveries of new planes seen staying flat until 2019, forecasters said in October.

But business jet makers are seeing even fewer choices of pre-owned aircraft available to buyers which they expect will boost demand for new corporate aircraft.

In 2017, business jet deliveries grew by 1.3 percent, rising from 667 to 676 units, according to figures released this week from the General Aviation Manufacturers Association (GAMA).

Canadian plane-and-train-maker Bombardier, one of the world’s largest makers of business jets, previously had $500 million in used aircraft inventory, which it takes as trade-ins from customers.

The company is now “fully sold out,” Di Bert said.

Bombardier Inc

3.9

BBDB.TOTORONTO STOCK EXCHANGE

+0.05(+1.30%)

BBDb.TO

BBDb.TOGD.N

A spokeswoman for Gulfstream Aerospace, a Bombardier rival and a division of General Dynamics Corp (GD.N), was not immediately available to comment.

Bombardier Chief Executive Alain Bellemare also told the conference he expects rising interest from the United States, Russia, China and the Middle East to boost demand for top-end business jets above the current market of about “60-ish” jets a year.

Bombardier’s ultra-long-range Global 7000 is expected to enter service later this year, challenging the Gulfstream 650, which is currently alone at the high end of the market.

Bellemare said the company would wait for the Global 7000 to enter service before deciding whether to go ahead with its sister business jet, the Global 8000.

Reporting by Allison Lampert, editing by G Crosse

RETAIL TRADE

StatCan. 2018-02-22. Retail trade, December 2017

- Retail sales — Canada: $49.6 billion; December 2017; -0.8% decrease (monthly change)

- Source(s): CANSIM table 080-0020: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=0800020&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Following three consecutive monthly increases, retail sales decreased 0.8% in December to $49.6 billion. Despite this decline, retail sales were up 1.5% in the fourth quarter and up 6.7% for the year.

Sales fell in 6 of 11 subsectors, representing 42% of retail trade.

Lower sales at general merchandise; health and personal care; and electronics and appliance stores more than offset gains at motor vehicle and parts dealers and food and beverage stores. Excluding motor vehicle and parts dealers, retail sales decreased 1.8%.

Retail sales in volume terms were also down 0.8% in December.

Chart 1: Retail sales decrease in December

Lower sales at general merchandise stores

After reporting increases in October and November, sales at general merchandise stores were down 5.3% in December.

Sales at health and personal care stores decreased 3.8%, mainly due to weaker sales in Ontario.

Following a 12.7% increase in November with new product releases and strengthened promotional activity surrounding Black Friday, sales at electronics and appliance stores were down 9.1% in December. Sales in this subsector grew 7.2% in the fourth quarter.

Motor vehicle and parts dealers reported a 2.1% increase in December, following a 3.4% decrease in November. Higher sales at new car dealers (+2.9%) more than offset declines at used car dealers (-1.3%), other motor vehicle dealers (-1.6%), and automotive parts, accessories and tire stores (-0.7%).

Receipts at food and beverage stores increased 1.4%, primarily due to stronger sales at supermarkets and other grocery stores (+1.6%). All other store types in this subsector reported gains.

Sales down in six provinces

While sales fell in six provinces, the overall decline in retail sales was largely attributable to Ontario (-1.6%), which registered its first decrease in six months. Retail sales in the Toronto census metropolitan area (CMA) were down 1.9%.

Sales in British Columbia declined 0.6%. The Vancouver CMA (-1.4%) posted its third decrease of 2017.

Following two months of gains, Quebec edged up 0.1% in December, on the strength of higher sales in the Montréal CMA (+0.5%), up for the third consecutive month.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales totalled $1.9 billion in December, accounting for 3.4% of total retail trade. On a year-over-year basis, retail e-commerce increased 4.1%, while total unadjusted retail sales rose 3.2%.

Retail sales in 2017

Sales at Canadian store retailers grew 6.7%, the highest annual growth rate since 1997, reaching $588 billion in 2017. The increase was partially attributable to higher prices, as sales in volume terms were up 5.4%. Sales were up in every province, with Ontario (+6.4%) leading the way. Retail sales bounced back in Alberta (+7.5%) following declines in 2015 and 2016.

Job growth reflected in higher retail sales

Sales in the retail sector picked up in 2017 on the strength of improved labour market conditions in Ontario, Quebec, British Columbia and Alberta. Based on Statistics Canada's Labour Force Survey, employment increased by 427,000 from December 2016 to December 2017, as Canada's unemployment rate fell by 1.1 percentage points to 5.8%, one of the lowest rates on record.

Following a slide in employment from the autumn of 2015 to the summer of 2016, the labour market in Alberta added 55,000 workers in 2017. The unemployment rate fell from 8.6% at the end of 2016 to 7.0% at the end of 2017. These gains played a role in stronger retail sales in Alberta, where sales were down in both 2015 and 2016.

Motor vehicle and parts dealers, gasoline stations lead increase

In 2017, Canada surpassed two million new motor vehicles sold in a single year for the first time, as an 8.1% increase in units of trucks sold more than offset a 2.1% decrease in passenger vehicles. In dollar terms, sales at motor vehicle and parts dealers (+9.0%) were the largest contributor to the increase in retail sales in every province except Manitoba.

Sales at gasoline stations increased 12.9%, as gasoline prices continued to recover following sharp declines between mid-2014 and early 2016 due to a significant downturn in the global price of oil. According to the Consumer Price Index, the average price of gasoline was 11.8% higher in 2017 compared with 2016. Removing the effects of price changes, sales in volume terms at gasoline stations were up 1.6%.

Excluding sales at motor vehicle and parts dealers and gasoline stations, retail sales increased 4.7% in 2017. Building material and garden equipment and supplies dealers (+12.7%) led this increase.

Sales at food and beverage (+1.6%) and general merchandise (+4.7%) stores grew at a lower rate than Canadian store retailers overall, leading to a lower share of retail sales taking place in these subsectors in 2017.

Retail e-commerce continues to grow

Internet-based sales from both store and non-store retailers rose 31% to $15.7 billion in 2017. Retail e-commerce represented 2.6% of total retail sales, compared with 2.1% in 2016. During the November and December holiday shopping season, retail e-commerce accounted for 3.5% of total retail sales, up from 3.2% in 2016, in part due to strong retail e-commerce sales in November 2017. Approximately one-quarter of retail e-commerce sales took place during the holiday shopping season.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180222/dq180222a-eng.pdf

REUTERS. FEBRUARY 22, 2018. Canada's December retail sales fall in blow to fourth quarter

OTTAWA (Reuters) - Canadian retail sales unexpectedly declined in December as a pullback at electronics stores offset higher purchases of new cars, putting fourth-quarter economic growth on track to be below the central bank’s forecast.

The 0.8 percent drop reported by Statistics Canada on Thursday surprised economists, who had anticipated an increase of 0.2 percent. It was the biggest decline since March 2016, while volumes also fell 0.8 percent.

Sales at electronics and appliance stores tumbled 9.1 percent, giving back some of November’s surge on the back of Black Friday promotions, which occur the day after the U.S. Thanksgiving holiday and have become increasingly important for Canadian retailers.

Overall, declines were broad-based, with sales down in six out of 11 sectors, including general merchandise stores, where purchases dropped 5.3 percent.

Analysts said the disappointing reading put the economy on track for growth of about 2 percent in the fourth quarter, below the Bank of Canada’s 2.5 percent forecast. Statistics Canada will release fourth-quarter growth figures next week.

The potential growth miss was likely to keep the central bank cautious in raising interest rates further, economists said, and solidified bets the bank will leave rates unchanged at its upcoming March meeting.

“Don’t expect the totally data-dependent Bank of Canada to change its dovish language anytime soon, as it will take a solid dose of positive data surprises to make (Governor Stephen) Poloz decidedly hawkish again,” Fred Demers, chief Canada macro strategist at TD Securities, wrote in a note.

The Canadian dollar weakened to a two-month low against the greenback immediately following the report. [CAD/]

Market odds that the bank will remain on hold on March 7 rose to 96 percent, though another rate hike is fully priced in by July. The bank has raised rates three times since July 2017 amid a strengthening economy and job market. BOCWATCH

The monthly decline in retail sales was tempered by a 2.1 percent increase in sales at motor vehicle and parts dealers as Canadians bought more new cars. Excluding autos, retail sales fell 1.8 percent.

Despite December’s decline, Canadian consumers put in a strong showing in 2017, with retail sales up 6.7 percent for the year, the highest annual growth rate since 1997, the statistics agency said.

Sales last year were lifted by higher prices, as well as robust vehicle sales, which cracked the 2 million mark for the first time.

Reporting by Leah Schnurr; Editing by Bernadette Baum and Paul Simao

BLOOMBERG. 22 February 2018. Canadian Retail Sales Drop Unexpectedly at End of a Banner Year

By Theophilo Argitis

Canadian retailers ended their strongest year in two decades on a down note, with a disappointing Christmas shopping season pulling back sales in December.

Receipts fell 0.8 percent to C$49.6 billion in the last month of 2017, Statistics Canada reported Thursday. It was the biggest monthly decline since March 2016. Economists were expecting no change during the month.

For all of 2017, sales were up 6.7 percent, the biggest increase since 1997. The year was largely a tale of two halves for retailers with a surge in the first six months masking a deceleration in the second half.

The retail slowdown paralleled growth overall, given consumers have been the main driver of Canada’s economy in recent quarters. The retail release is the last major piece of output data ahead of fourth quarter gross domestic product numbers due March 2.

Economists have been projecting annualized growth in the final quarter of 2017 of about 2 percent, which would be a slight increase from 1.7 percent in the third quarter. The Bank of Canada has been projecting growth of 2.5 percent in the fourth quarter

The retail report is also the third release over the past two weeks that showed unexpected weakness in activity in December. There have been unexpected declines in wholesale sales and manufacturing shipments for the month.

Highlights of Retail Sales Report

- In volume terms, sales fell 0.8 percent in December

- The drop happened despite a 2.1 percent gain in auto sales

- Excluding autos, sales were down 1.8 percent versus economist estimates for 0.3 percent growth

- Sales fell in six of 11 categories tracked by Statistics Canada, representing 42 percent of retail trade

- Sales at general merchandise stores were down 5.3 percent, while receipts from electronics and appliance stories were down 9.1 percent. Statistics Canada cited a shift in promotional activity into November for the drop. Overall, sales by electronics and appliance stores were up 7.2 percent in the fourth quarter

- Ontario recorded the biggest decline last month, with a 1.6 percent drop

- Motor vehicles were a main driver of total retail sales in 2017, up 9 percent for the year, led by trucks. Canada surpassed two million car sales in 2017 for the first time ever

— With assistance by Erik Hertzberg

________________

LGCJ.: