CANADA ECONOMICS - Special - Outlook 2018

THE GLOBE AND MAIL

MICHAEL BABAD, Columnist

Part 1, Monday: Stocks: A risky mechanical bull. DECEMBER 31, 2017

The challenge ahead is to safely navigate between euphoria and danger

JEFF HUSSEY, RUSSELL INVESTMENTS

Riding the stock market in 2018 may well be like trying to ride a mechanical bull: Bumpy and risky, and hopefully you don't fall flat on your butt.

Stocks have come a long way in the 10 years since the financial crisis, setting record after record in 2017. And though the question on everyone's mind is how long this long rally can run, analysts still see the bull market continuing in 2018, with at least modest gains in Canada.

"By rights, the current market cycle should be shuffling into retirement, putting its feet up and taking things easy," said Jeff Hussey, global chief investment officer at Russell Investments.

"It is, after all, nearly nine years old, the second-longest bull market on record and positively geriatric by the standard of these things," he added in Russell's 2018 outlook.

"But this cycle belongs to the baby boomer generation, and like them, refuses to succumb to dotage. It's having a vigorous later life while frittering away the next generation's inheritance."

All of which raises the key question of "how to make the most of late-cycle returns while preparing for the inevitable downswing," as Mr. Hussey sees it.

"Late cycle can be the most challenging phase," he said.

"Valuations are stretched, central banks are taking away the punch bowl and fundamentals look long in the tooth. But markets may surge as investors, buoyed by their recent success, become overconfident and start believing (again) that this time is different."

Thus, strategy is crucial particularly for those who, like the market, are late in the cycle. Investors should diversify, and have a "robust dynamic asset-allocation process" at hand.

"Without a solid process, there is the very real risk of being drawn into euphoria at the market peak and capitulating with despondency at the cycle bottom," Mr. Hussey warned.

Here's what analysts expect at this point:

Mundane works, in our view

BRIAN BELSKI, BMO CAPITAL MARKETS

Canadian stocks

Risks may abound – there are housing bubbles, NAFTA uncertainties and the resumption of Bank of Canada rate hikes to keep in mind – but market observers expect gains nonetheless.

"While we expect a fair bit of volatility in 2018 after a 2017 lull, recession risks entering 2018 are low and should allow for modest positive returns for Canadian equities," the Russell report said, adding "we expect a fair bit of uncertainty around our central forecast for the Canadian market."

That central forecast would put the S&P/TSX composite index at 16,900 by the end of the year.

Laurentian Bank Securities, in turn, is calling for the TSX to close out 2018 at 18,000.

"We remain globally neutral with an underweight on U.S. equity and overweight positions in Canada, other developed markets and emerging markets," Laurentian's chief strategist Luc Vallée and senior economist Eric Corbeil said in their lookahead.

Buoying the TSX, they forecast, will be stronger commodities, with West Texas intermediate oil at $67 (U.S.) a barrel by late 2018, providing the production cap agreement among OPEC and other countries holds.

"This should contribute to the outperformance of Canadian equities and the Canadian dollar," they said.

Brian Belski's "base case" for the TSX puts the index at 17,600. The chief investment strategist at BMO Capital Markets has a bull case for 19,000 and a bear scenario for 14,500.

"If we were going to choose a word to explain the Canadian stock market environment heading into 2018, that word would be 'mundane,'" Mr. Belski said in his outlook.

"Mundane works, in our view," he added.

"Admittedly, the term is far from exciting. However, in a marketplace (Canada) that feeds on negativity, starves for total return and considers it a failure unless gold is at $2,000 and WTI is at $80 and going up – increasingly consistent broader equity market performance could prove to be an alternative to other regions in the world."

Mr. Belski listed financial, material and industrial stocks as overweight, and energy at market weight.

Laurentian's Mr. Vallée and Mr. Corbeil are "neutral" on gold, expect a recovery in forestry and agriculture stocks, forecast outperformance in financials and consumer staples, and consider REITs "excellent hedges against inflation, and their yield is expected to remain higher than that of long-term government bonds."

Sorry to be such a party pooper

DAVID ROSENBERG, GLUSKIN SHEFF + ASSOCIATES

U.S. stocks

First, note what David Rosenberg has to say about breadth.

By late December, when the Dow Jones industrial average was up 25 per cent on the year and reaching for the 25,000 mark, the chief economist at Gluskin Sheff + Associates pointed out the 2017 rally was "very narrowly based," with just the top 10 stocks driving 80 per cent of the rise.

"If it had been left to the other 20 stocks to do all the heavy lifting, the Dow would be sitting at 21,620," Mr. Rosenberg said on Dec. 20. "Not bad, but nowhere near 25,000."

A broad market is a strong one, and a narrow market weaker, Mr. Rosenberg noted.

"Sorry to be such a party pooper."

And on that note, the calls among analysts may differ, but the idea's the same.

Mr. Belski's base case for the S&P 500 is 2,950. His bull case is 3,250, and his bear scenario is 2,200.

"The resiliency of U.S. companies has proven itself time and time again throughout this bull market, and investors desperately need perspective and discipline, in our view," Mr. Belski said.

"As such, we believe there is no reason to expect that a dramatic reversal in longer-term fundamentals is imminent," he added.

"Rather, the slope of our long-standing secular bull market call remains positive. In fact, we believe U.S. stocks are transitioning toward a renewed era of transparent investing, one defined by high-quality assets and fundamental bottoms-up stock picking."

JPMorgan Chase, envisioning a "Goldilocks scenario," puts the S&P 500 at 3,000 by the end of the year. So does Credit Suisse, citing stronger earnings and economic growth, as well as lower tax rates. Laurentian forecasts 2,800.

Capital Economics and Russell don't expect a barn-burner of a year, the latter saying "we forecast lacklustre U.S. equity market returns in 2018 and view end-of-cycle risks as becoming elevated thereafter."

As Capital Economics sees it, a strong economy won't necessarily translate to the markets.

"Equities look overvalued and, at this late stage of the economic cycle, we would expect gains in nominal GDP to accumulate to workers in the form of higher incomes rather than to firms as higher profits," said Paul Ashworth, the group's chief U.S. economist.

"The dollar's rebound will also hit the value of overseas profits and financial sector profits will be restrained by a flatter yield curve. The upshot is that we expect equity markets to do no better than trend sideways in 2018."

The risks

Let me count the ways: NAFTA, President Donald Trump, Canada's housing market, the Bank of Canada, the Federal Reserve, geopolitics, and trade and military wars. (And if bitcoin's your thing, then there's that.)

A number of challenges exist in navigating Canadian equities in 2018

CREDIT SUISSE

The big risk for Canada is the fate of the North American free-trade agreement, with talks toward a new pact already troubled amid Mr. Trump's demand for a fair deal and his broader trade agenda.

"We believe the market is not currently contemplating a significant negative outcome, in part because a NAFTA rescission may result in Canadian-U.S. trade being subject to the Free Trade Agreement (FTA) of 1987," Credit Suisse said in its outlook.

"In any event, the near-term impacts of even that type of disruption would likely substantially impact the [Canadian dollar], capital flows and trade patterns amidst the uncertainty."

Then there's the state of the housing market, with new mortgage rules from the commercial bank regulator, among other things, how aggressively the Bank of Canada tightens, and how the Fed moves under a new chair.

"Late-cycle tailwinds should be conducive for domestic equities, while potential over-tightening by the BoC remains a critical watchpoint," the Russell report said.

We should not underestimate what Mr. Trump's trade policies could mean. Or, for that matter, the potential impact of other flash points.

"Global growth could falter if the U.S. enters trade wars with its principle trading partners, namely Canada, Mexico and China," said Laurentian's Mr. Vallée and Mr. Corbeil.

"These could cause real havoc on the markets if the domestic value of U.S. denominated debt held outside the U.S. swells to unsustainable levels as the [U.S. dollar] appreciates," they added.

"Second, political risks in the Middle East and Asia are numerous and tensions have reached new highs recently. These would cause flights to quality which would favour U.S. assets and the U.S. dollar."

In a bubble market it’s known as the ‘bigger fool’ theory

JASPER LAWLER, LONDON CAPITAL GROUP

And then there's bitcoin

You can't have a discussion like this one without talking about bitcoin, particularly if you want to look at risks.

"The introduction of bitcoin futures at the CBOE and CME propelled the cryptocurrency into the limelight of financial markets," said Matthias Bouquet of JPMorgan Chase.

"At a time when volatilities across asset classes have plummeted, this presents us with the oddity of an asset with extreme daily moves."

The rise of bitcoin and others like it have raised many questions about their future, and added to the pressure on regulators and monetary authorities who are scrambling to figure out what to do about them.

Consider the fact that, as Royal Bank of Canada documented, the value of cryptocurrencies surged in 2017 to hit almost $500-billion (U.S.) by mid-December, having started the year at about $18-billion.

Cryptocurrencies have "the potential to transform financial services," said RBC economist Mathias Hartpence.

"Can governments regulate the cryptocurrency and blockchain financial ecosystem and not stifle innovation?" Mr. Hartpence said in a report on five notable things in 2017.

"Recently, China curtailed cryptocurrency exchanges, whereas Japan recognized bitcoin as an official form of payment," he added.

"As the pre-financial crisis experience shows, 'bad innovation' is possible, however Canada risks losing out if it fails to nurture an ecosystem that evolves into a foundational aspect of the future economy."

Bitcoin ran up late in 2017, often striking ridiculous gains by the day, and at times by the hour, before "investors were introduced to the law of gravity" at one point and the value plunged 25 per cent in one day, noted Jasper Lawler, head of research at London Capital Group.

This happened after the founder of Lifecoin dumped his holdings, likely fuelling "insecurity" in cryptocurrencies.

"Long-term holders will be used to this level of volatility but newer crypto traders could be permanently put off," Mr. Lawler said.

"The exponential price rise seen recently needs new investors to sustain it," he added at the time.

"In a bubble market it's known as the 'bigger fool' theory; you can buy high as long as there is a fool willing to buy it off you even higher. Previous price pullbacks have only strengthened the conviction of bitcoin traders when the price rebounded."

Part 2, Tuesday: Loonie (lame), interest rates (pain). JANUARY 2, 2018

An important caveat will rear its ugly head again in January - NAFTA negotiations

BIPAN RAI AND JEREMY STRETCH, CIBC WORLD MARKETS

Expect a still-lame Canadian dollar whose fortunes may improve as 2018 rolls on, and higher interest rates that will no doubt cause pain for many.

But playing into both forecasts is the acrimony at the NAFTA bargaining table: Depending on how talks for a new North American free-trade agreement play out, the loonie could end up far weaker, and interest rates less painful, were the economy to take a hit.

"We remain of the view that the market is complacent in pricing in NAFTA termination risk," Bipan Rai, executive director of macro strategy at CIBC World Markets, and his colleague Jeremy Stretch, head of G10 foreign-exchange strategy, warned in a 2018 forecast.

Of course, a full 10 years after the financial crisis, we're still in a low-rate environment, having suffered, too, through a crude price shock that devastated the oil patch.

The Bank of Canada is now on tenterhooks for other reasons, including the NAFTA uncertainty and the fact that we didn't let something like a crisis stand in the way of borrowing to the point of where many of us are now living under the threat of higher rates.

Currency analysts believe the value of the loonie would plunge if NAFTA dies. The Trump administration has oft threatened to kill it if the President doesn't get what he considers a fair deal, so forecasts for the Canadian dollar tend to come with a caveat.

Observers generally believe Canada, the U.S. and Mexico will strike a deal in the end. So for now, and absent the death of NAFTA, interest rates will factor heavily into the fortunes of the loonie, which has been bounced around on the outlooks for the Bank of Canada and Federal Reserve, its U.S. counterpart.

The dollar ended the year at 80.3 cents (U.S.). Amid the many forecasts for 2018, currency, here are six:

CIBC's Mr. Rai and Mr. Stretch project a loonie worth just over 78 cents through the first half of the year.

"The BoC has indicated a few times now that potential growth is expected to expand - which means that near-term growth won't be inflationary," they said.

"Still, the uptrend in the common core measure of inflation suggests that pressures are building, though the bank is likely to wait until Q4 data is released in early March. That should be enough to keep the loonie supported though an important caveat will rear its ugly head again in January - NAFTA negotiations."

Société Générale, in turn, is on the higher side, calling for a Canadian dollar that tops 83 cents through the year.

Bank of Montreal's longer-term outlook forecasts the currency at above or about 76.5 cents through the first three quarters of the year, pulling closer toward the 77-cent mark late in 2018 and actually hitting it in the second quarter of 2019, then picking up further.

Laurentian Bank Securities expects the trading range to shift to about 77 to 87 cents. But the "complete derailment" of NAFTA talks would drive it to between about 71.5 and 74 cents, said chief strategist Luc Vallée and senior economist Eric Corbeil.

Royal Bank of Canada sees a weaker loonie to start with, at just above 75 cents in the first quarter and just shy of 77 cents in the second.

After that, said RBC technical strategist George Davis, the currency should perk up to almost 79 cents in the third quarter and about 80.5 cents in the fourth.

"We continue to see topside risks for USD/CAD in Q1 2018 as the cautious tone that has emanated from the Bank of Canada since October is expected to remain in place," Mr. Davis said, using their symbols to refer to the U.S. dollar versus the loonie.

"New mortgage regulations that come into effect in the new year, as well, as another more contentious round of NAFTA renegotiations in January present upside risks to USD/CAD in Q1," he added, which in reverse, of course, means downside for the loonie.

"In addition, the BoC will want to evaluate the impact of their two recent rate hikes on the Canadian consumer - now carrying record levels of debt."

David Rosenberg, chief economist at Gluskin Sheff + Associates, also cited "increased odds" of a weaker currency, which, given the circumstances, could help buoy the economy and Canadian companies.

"Let's face it, the economy here is going to need another dose of some currency-related stimulus," Mr. Rosenberg said, citing the cocktail of NAFTA uncertainty, new mortgage rules and a "clouded fiscal picture" because of the outlook for taxation.

"In any event, the resultant weakening in the loonie is a positive underpinning for many of our sectors, and, again, that includes energy," he added.

"There are a host of other Canadian companies in our portfolio that have U.S.-dollar revenue streams in areas like real estate, banks, insurers and forest products, that are going to benefit from this renewed period of Canadian dollar weakness."

Of course, it is winter so a lame loonie's not going to help our snowbirds any.

Ultimately, though, the re-normalization process should get back under way

MARK CHANDLER AND SIMON DEELEY, RBC

Which brings us to what to actually expect from Bank of Canada Governor Stephen Poloz, senior deputy Carolyn Wilkins and their colleagues.

The central bank raised rates twice in 2017 as Canada's economy improved markedly before slowing later in the year. As Mr. Davis noted, Mr. Poloz is gauging the impact, given the rise in borrowing costs being so painful to many stretched families.

They'll be even more stretched if, as expected, the Bank of Canada raises rates again this year, possibly up to three times to bring its benchmark overnight rate to 1.75 per cent from its current 1 per cent.

"Early 2018 brings a trio of factors - NAFTA renegotiations, new housing regulations and Ontario's minimum wage legislation - which could temporarily restrain the economy and keep the central bank on the sideline for a period," said Mark Chandler, head of Canadian rates strategy at RBC Dominion Securities, and rates strategist Simon Deeley.

"Ultimately, though, the re-normalization process should get back under way and, cumulatively, we see 75 basis points of rate increases in 2018."

The Bank of Canada's delay in this initially uncertain climate means the currency could be "under some pressure" early this year, Mr. Chandler and Mr. Deeley said, given that its lag, as the Fed tightens, would not be loonie-friendly.

But "some recovery is anticipated once the BoC begins to match the pace of Fed tightening with [West Texas intermediate] oil prices expected to average U.S. $58/barrel for the year."

Some observers don't think the Bank of Canada will move that forcefully.

"Even though we perceive the risks of an economic slowdown to be increasing, unless very unfavourable developments regarding NAFTA negotiations fail to be compensated by a lower CAD we don't expect a recession [in 2018]," said Laurentian's Mr. Vallée and Mr. Corbeil.

"We now see, at best, the Bank of Canada raising its policy rate once by 25 basis points in 2018, later during the year," they added.

"However, Canadian long-term rates will continue to face some upward pressures because of increasing long-term interest rates on the U.S. bond market."

David Rosenberg, chief economist at Gluskin Sheff + Associates, cited the latest weak reading on gross domestic product, which showed manufacturing activity notably soft.

Which, in turn, "makes you wonder why markets had seemed so convinced lately that the BoC would want to raise rates and have the Canadian dollar jump, which is exactly what we don't need at the present time," Mr. Rosenberg said.

"If the U.S. government is going to play hardball with Canada on trade, the only way we can combat the negative shocks from the blatant protectionism from the Trump team will be through the currency."

All bets are off if NAFTA dies. Were that to happen, analysts believe the central bank would roll back last year's rate hikes and possibly cut further.

And it's not just the death of NAFTA, but other possible scenarios, as well, that could change the outlook.

"We now judge the odds of an unfavourable outcome, either an abrogated NAFTA or a zombie NAFTA (with talks failing but abrogation held up, say, by legal actions), are better than even," said economists at Bank of Montreal.

"Reflecting the increased economic risk, we now judge there are net downside risks to our 2018 forecast (rate hikes in March, July and October)."

Part 3: You (still) can't afford it: Housing, mortgages and Canada's banks. JANUARY 3, 2018

Canada’s housing market has defied the incessant talk of its imminent demise for years

DOUGLAS PORTER, BANK OF MONTREAL

Many Canadians couldn't afford to buy a home last year. More won't be able to afford one this year. And many of us arguably can't afford the ones we've got.

That's the state of at least some of the housing markets in Canada, where prices are starting 2018 at just about double the levels of the crisis era.

Which shows you what Canadians have been doing for the past many years: We've borrowed heavily amid emergency low interest rates to bury ourselves in debt and drive home prices ever higher., to the point where we wonder if our kids will ever own a home.

This is the year of the writing on the wall as interest rates rise and new rules from the Office of the Superintendent of Financial Institutions, the commercial bank regulator, make it harder to get a mortgage.

This, in turn, will ripple through the economy, from consumer spending to bank lending.

"Real estate in Canada has been on a tear in the last few years," National Bank of Canada economists said in a recent report.

"Prices have almost doubled since 2009 and starts have averaged nearly 200,000 annually over the last five years," they added.

"Over all, the importance of housing in the economy as a whole has also increased, leaving the country more exposed to a housing shock."

Such a shock isn't in the forecasts of economists, though the risks are there. And they do expect a pullback in the market.

Still, as Bank of Montreal chief economist Douglas Porter put it, "Canada's housing market has defied the incessant talk of its imminent demise for years."

Here's how things stand at the beginning of a year that promises to be a crucial one for every industry with a hand in residential real estate:

The market isn’t in a death spiral

ROBERT HOGUE, ROYAL BANK OF CANADA

Market stability

Economists generally see a soft landing, as opposed to a meltdown, but they also wonder whether the key Greater Toronto Area will follow Vancouver's example, with its government-induced slowdown being only short-lived.

And they're casting their eyes further afield, from Vancouver and Toronto to cities such as Montreal and Ottawa.

Certainly, last year was "mostly the story of Ontario - and more precisely, the Greater Toronto Area and nearby cities," as RBC senior economist Robert Hogue put it.

"Frenzied bidding wars were commonplace. Market dynamics were perverse: The more prices rose, the more buyers came in (afraid of being priced out) and sellers stayed out (earning a good return by just waiting). Prices skyrocketed by 30 per cent year over year, which clearly threatened the stability of the market."

But that was then. Now we have Ontario's Fair Housing Plan, which, among other things, borrowed from the B.C. government with a tax on foreign speculators.

This appears to have worked, for now, at least.

"In just a few months, the GTA market was back in balance," Mr. Hogue said.

"Sanity returned. Prices began to moderate. A modest rebound in activity since August tells us that the market isn't in a death spiral. It's been a healthy correction."

The trend to a general cooling in the housing market will continue

MATTHEW STEWART, THE CONFERENCE BOARD OF CANADA

Sales and prices

We start 2018 with the new OSFI mortgage rules, the promise of higher rates and whatever impact lingers from the attempts of the B.C. and Ontario governments to tame the Vancouver and Toronto area markets.

There are many forecasts, and they differ, but all call for something slower.

The Canadian Real Estate Association projects a 5.3-per-cent drop in sales, to just shy of 499,000 homes, and a decline of 1.4 per cent in the national average price, though that would be skewed by the "record number of higher-priced" houses in Toronto last year that we won't see again in 2018.

Prices in Ontario, the group said, will fall 2.2 per cent, but will hold the line in British Columbia.

RBC, in turn, projects sales will slide 4 per cent, but benchmark prices will rise 2.2 per cent, a markedly slower pace than in 2017 but growth, nonetheless.

Toronto-Dominion Bank expects price growth to almost flat-line, also with no contraction.

Matthew Stewart, in turn, director of national forecasting at The Conference Board of Canada, expects the national average resale price to fall for the first time since the recession, but only by about 1 per cent and pretty close to the CREA forecast.

"The trend to a general cooling in the housing market will continue in the medium term, due to slowing household formation, moderating employment growth, and higher interest rates," he said.

And here's the bottom line, from a forecast by RBC economists: "The risk of a full-blown housing market crash occurring in 2018 is low, in our opinion. The majority of housing markets are in balanced condition and expected to remain so in 2018. This will maintain some degree of support for home prices, which are forecast to rise again in 2018, albeit at a considerably slower pace."

Today the hit would be twice that

NATIONAL BANK OF CANADA

Affordability

Obviously, noted National Bank, the impact of rising interest rates will vary between cities.

"In some markets, notably Vancouver and Toronto, a rate hike could prevent new buyers from entering the market, putting home prices under pressure," the bank said.

"Consider the effect on new buyers of a one-point increase in mortgage rates in those cities. Twenty years ago such a hike would have increased the burden of debt service by 4 per cent of median income. Today the hit would be twice that."

In their latest look, RBC's Mr. Hogue and his colleague Craig Wright, the bank's chief economist, found affordability in Vancouver, Toronto and Victoria at the worst levels ever in the third quarter of 2017, with "tensions rising" in Ottawa and Montreal, though not yet out of hand.

Just look at what's happened since the crisis, based on how RBC measures affordability:

Rising interest rates will bring with them "serious implications" on that front this year, Mr. Hogue and Mr. Wright warned.

"We estimate that, everything else remaining constant, a 75-basis-point increase in mortgage rates would lift RBC's aggregate measure for Canada by approximately 2.5 percentage points," they said in their quarterly report.

"All markets would be affected but the effect would be more substantial in high-priced markets - more than five percentage points in the case of Vancouver."

Of course, there are other factors at play, too, such as higher incomes, to help blunt the blow.

Still, "rising interest rates and more stringent qualifying rules for uninsured mortgages coming into effect in January are poised to raise the bar significantly for many buyers in Canada."

It could well be that the banks are already beginning to tighten up the lending spigots

DAVID ROSENBERG, GLUSKIN SHEFF + ASSOCIATES

Mortgages

Well, first of all, it's going to be harder for some people to get one.

Or they'll have to scale back their mansion dreams given the new OSFI stress tests for uninsured mortgages, which force some buyers to show they could handle rates much higher than the ones they're being offered.

Then, more importantly for costs, there are rising rates to factor in.

"Household income would need to climb by 8.5 per cent to fully cover the increase in home-ownership costs arising from a 75-basis-point hike in mortgage rates," said RBC's Mr. Hogue and Mr. Wright.

The latest OSFI numbers suggest Canadians were scrambling to beat the new rules, noted National Bank analyst Gabriel Dechaine, with an 18-per-cent increase in uninsured mortgages in October compared with a year earlier.

And that could be carrying into the early part of this year.

"We expect that accelerated growth of uninsured mortgage volumes could persist in coming months as borrowers attempt to avoid tougher [OSFI] guidelines," Mr. Dechaine said.

"Moreover, the trend could continue in early 2018, as bank customers "buy time' by obtaining mortgage preapproval, which could allow them to purchase a home under older underwriting guidelines for an extended period (i.e., up to 120 days)."

David Rosenberg, chief economist at Gluskin Sheff + Associates, suggested as 2017 was winding down that "it could well be that the banks are already beginning to tighten up the lending spigots."

We anticipate the demand for mortgages could be tested by mid-2018

JOHN AIKEN, BARCLAYS

The banks

There's "added uncertainty as the impact of the new mortgage rules could weigh on the banks' mortgage origination growth," said Barclays analyst John Aiken, noting some of the banks themselves suggest the new regime could affect between 5 and 10 per cent of new mortgages.

Mr. Aiken estimated that growth in mortgages and home equity lines of credit, or HELOCs, eased in the final three months of 2017, to 1.5 per cent from 2.4 per cent in the third quarter. And it all makes for short- and longer-term issues.

"We believe recent positive monthly home sales activity (August to October), could offer a reprieve from the slower summer selling season (four straight monthly declines between April to July), supporting mortgage growth to start off the year," Mr. Aiken said in a lengthy report in the country's major banks.

But "exacerbated by the slower winter selling season, we anticipate the demand for mortgages could be tested by mid-2018," Mr. Aiken warned.

"Heading into [the first quarter of 2018], however, we anticipate mortgage growth will remain positive, and, on a consolidated basis, we are forecasting the pace of growth to ebb further from Q4's run rate, up 1 per cent sequentially."

All of that said, Barclays is "becoming more enthusiastic" on the outlook for the big banks amid the economic backdrop and gradually rising interest rates.

"Further, there does not appear to be too much disruption on the horizon that would cause any concerns regarding employment in North America and, while we cannot forecast anything but some moderation in credit, we do not see any material deterioration as being likely," Mr. Aiken said.

"That said, we do not expect much of a ramp-up in earnings growth for the Big Six (5.2-per-cent average growth against 5.6 per cent for consensus)," he added.

"However, as earnings outside of Canada are expected to accelerate (in the face of potential slowdowns in domestic earnings), relative exposures and strategies are now more important in determining relative performance."

The rush to beat the new rules, of course, could be setting the banks up for something slower as 2018 rolls on.

"While these borrowing strategies could lead to surprisingly high mortgage volume growth into the new year, we believe evidence thereof could amplify concerns of a mortgage (and broader housing sector) activity drop-off in the balance of the year," said National Bank's Mr. Dechaine.

"Although we are not housing bears, we do appreciate investor sensitivity around housing-related issues that can easily dampen sentiment."

Note this, too: The latest report on economic growth showed shrinkage in the finance and insurance sector of 0.2 per cent in October, Gluskin Sheff's Mr. Rosenberg pointed out, bringing to four months the string of contractions.

"Over this interval, output in this key sector has declined at a 3.5-per-cent annual rate," Mr. Rosenberg said.

"We have not seen a stretch of weakness like this since the bank stocks took it on the chin in 2011. Before that, it was February, 2009."

Part 4, Thursday: Eroding wealth, frightful finances

Wasn’t that a party?

THE IRISH ROVERS

Some of us no doubt woke up this morning wondering how we're going to achieve that New Year's resolution to get our houses in order.

Welcome to 2018, the year of living frugally for many of us.

Canadian families are facing heavier debt burdens, higher credit costs and eroding wealth. Because, you know, we didn't let a little thing like a financial crisis teach us that partying for 10 years might not be such a good thing.

This year could be a tough one for many of us as interest rates rise, new mortgage rules come into effect and we realize we should have paid attention when the Bank of Canada, the Bank for International Settlements, the Organization for Economic Co-operation and many others were waving their arms frantically.

"This rise in their debt-servicing costs will likely be a shock to many Canadians who have been enjoying relatively flat interest charges on their debt for the last eight years," warned Matthew Stewart, who heads up national forecasting at The Conference Board of Canada.

There promises to be a broader economic impact, as well, as consumers pull back.

Here's how things look for Canadian households a decade after the crisis:

The bigger problem now is that falling house prices are squeezing household net worth

DAVID MADANI, CAPITAL ECONOMICS

Eroding wealth

It's not by much. Yet.

But notice that dip at the top right corner of this chart, which shows a fairly steady rise since the depths of the crisis.

Up until this point, we could tell ourselves that at least our wealth was rising along with our debts. No longer, it would seem, although there have been dips in this fever line before and much will be decided by whatever happens to home prices.

But "household net worth as a share of household income contracted for the second straight quarter, consistent with reported falling home values and shrinking housing equity," as David Madani pointed out, referring to the worrisome fever lines in that chart.

"The recent increases in interest rates and tougher mortgage rules [this] year will only make matters worse," said Mr. Madani, senior Canada economist at Capital Economics in Toronto.

Mr. Madani used a scenario of average home prices falling by 20 per cent. In his words, that's hypothetical, and goes beyond what many economists see happening. Indeed, Vancouver's housing market has already perked back up after the B.C. government slapped a tax on foreign buyers in the area, and economists believe Toronto may follow Vancouver's path. So the pace of price growth may simply slow rather than contract outright nationally.

Nonetheless, our net worth would erode by about $1-trillion were prices to fall by Mr. Madani's hypothetical 20 per cent, he calculated.

Governments and regulators have been struggling with how to tame housing markets, and ever-rising consumer debt, largely in the Vancouver area and southern Ontario. The latest mortgage rule changes from the commercial bank regulator, the Office for the Superintendent of Financial Services, are just coming into effect, so we'll see the impact in later data.

As the chart shows, net worth among Canadian households now stands at 860.7 per cent of our disposable income, having edged down again in the third quarter as property values eased in the first such move since the crisis.

That's a far cry from the 670.43 per cent of the third quarter of 2008, but note that this latest number came as household residential property values fell by $3-billion over the three months.

"Owners' equity in real estate fell four ticks to 74.4 per cent, but that's still above the historical average of the series (which starts in 1990)," added Benjamin Reitzes, Canadian rates and macro strategist at Bank of Montreal, referring to Statistics Canada's quarterly reports.

"This ratio has trended higher since 2011, but Q3's decline might be the end of that trend as the new OSFI rule further dampens the housing market."

Perhaps what draws attention … is not its level but its rapid expansion

NATIONAL BANK OF CANADA

Debt burden

This is the key number that has been raising eyebrows as Canadians shrugged their shoulders after the financial crisis and headed back to the bank to borrow more.

It's the ratio of household debt to disposable income, and it now tops 171 per cent as of the third quarter of last year, a level that's among the highest in the world.

"Perhaps what draws attention to Canadian household debt is not its level but its rapid expansion since the 1990s," economists at National Bank of Canada said in a new report, noting the marked run-up from 85 per cent 25 years ago.

It may have climbed higher in the fourth quarter, too, as economists wonder whether home buyers rushed to beat the new mortgage rules.

"However, that suggests we could see some flattening out of the ratio in 2018 - though don't bet on it as housing has been persistently resilient," said BMO's Mr. Reitzes.

Along with this comes the debt-service ratio, or how much we have to pay in principal and interest, also compared to disposable income. It's obviously going to rise along with interest rates as the Bank of Canada moves gradually this year.

This ratio rose in each of the first three quarters of 2017, but "remains in line with levels that have prevailed since 2010, so no sign of stress there yet," Mr. Reitzes said.

"Look for a continued creep higher as interest rates are likely to climb further in 2018, which is a reason for the BoC to tighten cautiously."

The reality is bound to be less threatening

CRAIG WRIGHT AND ROBERT HOGUE, ROYAL BANK OF CANADA

These are what underscore those New Year's resolutions.

The Bank of Canada is expected to raise its benchmark lending rate up to three times this year, from its current 1 per cent after the two hikes of 2017.

Some economists expect something less forceful, but the bottom line is that rates are going to rise further still. There are pressures from elsewhere, too, given that mortgage rates are linked to the bond market.

"Interest payments on debt will rise 12 per cent in 2018 and a further 9 per cent in 2019, the two largest gains since 2007," warned The Conference Board's Mr. Stewart.

Here's another calculation, from Royal Bank of Canada chief economist Craig Wright and senior economist Robert Hogue: "Our view is that the days of ultralow interest rates in Canada are over. We expect the Bank of Canada to build on the increases it made to its overnight rate in July and September by hiking it again three times in 2018 by a total of 75 basis points. And we expect longer-term rates to rise in tandem … Household income would need to climb by 8.5 per cent to fully cover the increase in home ownership costs arising from a 75-basis-point hike in mortgage rates."

While that highlights the "material vulnerability" among Canadian families, however, "the reality is bound to be less threatening as other factors such as income gains will mitigate part of the impact," said Mr. Wright and Mr. Hogue.

Consumers now have a very slim savings buffer

NICK EXARHOS, CIBC WORLD MARKETS

The impact

Canadians are lousy at keeping their debts in check …

… but we're pretty good at paying what we owe. Even when house prices correct, to use a gentle term.

"Canada has witnessed some big price corrections since the late 1980s that corresponded with big shifts in the macro environment, notably in Toronto and Vancouver, and yet each time mortgage arrears barely budged," noted Derek Holt, Bank of Nova Scotia's head of capital markets economics.

Still, "the worry is that Canadian households, which have a notoriously high and rising debt-to-income ratio, will not be able to afford higher debt payments," said economist Paul Matsiras of Moody's Analytics, a sister company to the rating agency.

"If income growth disappoints, debt loads may become unmanageable and trigger insolvencies."

Even if that weren't to happen, we still have to meet those rising costs. And so we'll pull back our spending elsewhere.

"True, strong employment gains in 2017 will be met with strong wage growth in 2018, supporting consumer pocket books," said Nick Exarhos of CIBC World Markets.

"But data through Q3 outlined that consumers now have a very slim savings buffer, and some of the strength in consumption was supported by a ramp-up in non-mortgage credit - something which will face the headwinds of a few more rate hikes from the Bank of Canada," he added.

"Don't expect the consumer to fall off a cliff, but the underlying dynamics for the sector won't live up to 2017's stunning results."

Here's how Mr. Madani of Capital Economics illustrated his point: The household savings rate tends to rise as net worth declines, so go back to his suggestion that a 20-per-cent drop in home prices would equate to an erosion in wealth of $1-trillion.

"That would be consistent with an increase in the saving rate from 2.6 per cent, where it was in the third quarter, to around 3.5 per cent," Mr. Madani said.

"Assuming no change in income, this amounts to a 1-per-cent shock to household consumption, or more than half a percentage point of GDP."

Canadian consumers have been a mainstay, accounting for about two-thirds of 2017's economic growth, noted RBC, so a pullback has obvious consequences.

Like Mr. Madani, RBC's Mark Chandler and Simin Deeley also noted the "normal response" of the savings rate falling, to that 2.6 per cent from 4.2 per cent over the course of a year, as wealth and asset prices rose. Notably, home prices.

But RBC forecasts that sales of existing homes in Canada will fall 4 per cent this year, with the gains in benchmark resale prices slowing to 2.2 per cent from 2017's 11.1 per cent.

With the labour market also projected to show gains at a slower pace, "the consumer is expected to contribute much less to overall growth - just 1.2 percentage points in 2018," said Mr. Chandler, head of Canadian rates strategy at RBC Dominion Securities, and rates strategist Mr. Deeley.

Part 5, The economy, oil and NAFTA

Canada continues to face prominent domestic risks

DAVID WATT, HSBC BANK CANADA

Canada may have been the economic star of the G7 in 2017. But this year we're tapped out, possibly crapped out and maybe hung out.

Tapped out because consumers will be forced to ease up on spending that has pumped economic growth.

Possibly crapped out because the oil market could be like a roll of the dice in a craps game, and Canada has already thrown a "7 out" on one count.

And maybe hung out - to dry - at the NAFTA bargaining table.

It's not that it's going to be bad. Rather, we'll see more moderate economic growth, softer employment gains, and pressure on business investment amid the angst over the fate of the North American free-trade agreement.

"A key reason for the slowdown in growth in the next two years that we forecast is our expectation that the contribution of consumer spending will decline," said David Watt, chief economist at HSBC Bank Canada.

"Canada continues to face prominent domestic risks owing to heavily indebted households, external risks owing to trade policy uncertainties, and a heavy reliance on foreign portfolio flows to fund a large current account deficit," he added in his 2018 forecast.

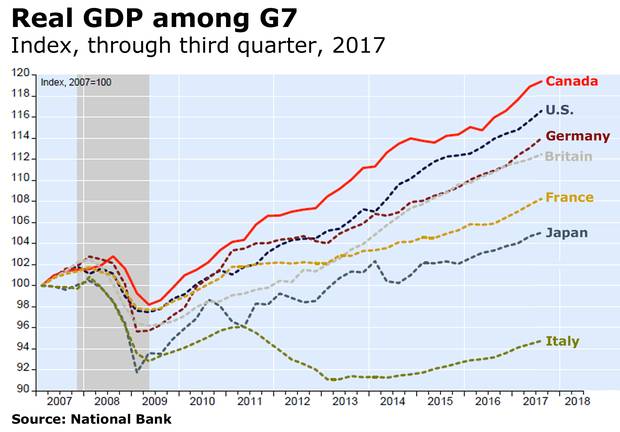

The final numbers should show Canada led the U.S., Germany, Britain, France, Japan and Italy in economic growth in 2017, at a pace of about 3 per cent after an exceptionally strong first half of the year and a weaker second six months. But that was so last year.

"Canada's economy was the envy of the G7 nations last year, but it will grow more moderately in 2018," Bank of Montreal senior economist Sal Guatieri said in a new forecast.

"Still, in the words of our central bank Governor, this is the year the economy returns 'home,' or the 'intersection' of full employment and 2-per-cent inflation."

Here's the picture at the dawn of 2018:

The Canadian economic environment … should remain volatile

LUC VALLÉE AND ERIC CORBEIL, LAURENTIAN BANK SECURITIES

Economic growth

We had a nice run in 2017 - in the first half, at least -as the economy continued to rebound from the oil shock.

Indeed, Canada "has been a star performer in the last few years, suffering less than other advanced economies from the 2008 financial crisis and recovering faster," National Bank of Canada said in a review of last year.

And we're expected to hold that distinction when the books are closed on 2017.

"Canada's economy is on track to end 2017 with a G7-topping expansion of 3 per cent, the largest since 2011," National Bank economists said.

Here's where it gets a bit dicey.

Forecasts for 2018 suggest growth will downshift to about 2 per cent or slightly more as consumer spending eases and questions surround the the oil market.

Also clouding the outlook are negotiations to overhaul NAFTA amid repeated threats by the Trump administration to kill the pact unless the U.S. gets what President Trump considers a fair deal.

Negotiations aren't going well at this point, with American demands that Canada and Mexico warn are non-starters.

Many observers believe some form of NAFTA will survive. But there's always a warning with that, leaving an uncertain climate for the Bank of Canada and Canadian companies pondering how and where to invest.

"The bottom line is that, in spite of strong global growth, the risks are such that the Canadian economic environment and the Canadian dollar should remain volatile [this] year," Laurentian Bank Securities chief strategist Luc Vallée and senior economist Eric Corbeil said in a recent forecast.

"Because we expect the price of oil to increase and NAFTA to be renewed, but U.S. tax cuts to favour U.S. competitiveness, the Canadian dollar should end the year only marginally stronger than it currently is," they added.

"This should nevertheless continue to benefit large Canadian exporters at the expense of domestically-oriented businesses, more dependent on highly leveraged domestic consumers."

The fresh forecast from BMO's Mr. Guatieri suggests economic growth of 2.2 per cent this year.

"The downshift will stem from fading support from three earlier drivers: stimulative financial conditions, enhanced child benefit payments, and the sharp recovery in oil-producing regions," Mr. Guatieri said.

"In addition, higher interest rates and tougher mortgage rules will slow the housing market," he added.

"On the plus side, resource prices should remain firm as the global economy strengthens. Canadian exporters will slightly benefit from the extra dollars the U.S. government will leave in the pocketbooks and coffers of American households and companies."

If the past is a precedent, we had better enjoy the next 12 months

DAVID ROSENBERG, GLUSKIN SHEFF + ASSOCIATES

Global economies

Key to Canada's fortunes, of course, are those of other countries, particularly the U.S.

And given the length of this economic expansion, Americans should enjoy it while it lasts.

"I have to wonder what it means to be heading into a new year with the global economy in sync, the [Federal Reserve] tightening policy, the U.S. treasury curve flattening, the equity markets hitting new highs, the credit cycle peaking out, extremely low volatility and investor complacency equally high, excessive valuations across most asset classes, and a U.S. labour market that is drum tight," said David Rosenberg, chief economist at Gluskin Sheff + Associates.

"As I dig into my memory bank, this backdrop is eerily similar to 1988, 1999 and 2006. And what we know about each of those years is that the one that followed was the last of the cycle."

Many economists have flagged this late-in-the-cycle issue, wondering when it ends with a thud.

"So if the past is a precedent, we had better enjoy the next 12 months," Mr. Rosenberg warned.

"The economic expansion and bull market won't necessarily end in 2018, but they will be on their last legs, nonetheless."

BMO and Toronto-Dominion Bank each forecast economic growth in the U.S. of 2.6 per cent.

Summing up U.S projections, here's TD chief economist Beata Caranci and her colleagues: "There is little doubt that we are in a mature economic cycle, but economic cycles don't have expiration dates stamped on them. Recessions are usually a by-product of policy errors.

"With [U.S.] consumers relatively light on debt and interest rates likely to rise gradually, this expansion still has life."

Outside of the U.S., BMO senior economist Jennifer Lee said "progression" will be Europe's theme in 2018, compared with "survival" last year.

French President Emmanuel Macron "will continue to build the ranks of [his party] En Marche, and convince the country to embrace his reforms, which include cutting taxes (not just for the wealthy!), and relaxing labour laws," Ms. Lee said.

"He needs to win over his EU counterparts with his vision for a stronger and more unified Europe, or a 'Europe that protects,'" she added.

"France needs Germany's support and Germany does not want to take a back seat to France. However, Chancellor [Angela] Merkel must first strengthen her own leadership."

In Britain, of course, the big challenge is negotiating the Brexit regime for trade with the rest of the European Union.

In Japan, Ms. Lee said, "tight labour markets will hold back economic growth," though higher capital spending and central bank policies will help the cause.

And in China, "President Xi [Jinping] will wave the globalization flag, allow foreigners more access to the country's financial sector, fend off more protectionist views from the U.S., and warn of the need to reduce debt, all while trying to calm the North Korean waters," she added.

"We still look for economic growth to slow, from about 6.8 per cent in 2017 to a still-healthy 6.6 per cent in 2018."

Alberta is still expected to lead the way, followed by B.C., Ontario and Quebec

BEATA CARANCI, MICHAEL DOLEGA AND DINA IGNJATOVIC, TD

The provinces

Remember when, in crude's heyday, Alberta ruled the country before the oil shock?

Alberta has bounced back, doing well last year. And, according to TD's latest forecast, it will lead the country in economic growth this year, at 3 per cent. The heart of Canada's oil industry would be followed by B.C., Ontario and Quebec.

"Given that the recent surge in economic activity has absorbed much of the existing economic slack - the oil-producing provinces are an exception - our view that economic growth will decelerate across nearly all regions in 2018-19 remains intact," TD's Ms. Caranci, senior economist Michael Dolega and economist Dina Ignjatovic said in their forecast.

BMO, in turn, is still betting on B.C.

"British Columbia is expected to reclaim its title as the fastest-growing province for the third time in four years, after likely losing it to a resurgent Alberta last year," said Mr. Guatieri.

"Still, like most regions, it will grow more moderately in 2018. The good news is that many provinces are already nearing full employment, with Quebec's jobless rate the lowest since at least 1976 and Ontario's taking aim at this feat."

The larger concern is that households are spending too much

NATHAN JANZEN, ROYAL BANK OF CANADA

Areas of growth

The mighty Canadian consumer, buoyed to this point by mighty consumer borrowing, is expected to pull back as interest rates rise. And we're going to feel it.

Consider these statistics from Royal Bank of Canada senior economist Nathan Janzen: In 2016, consumer spending as a share of gross domestic product reached its highest level since 1965. And in the first three quarters of last year, the average quarterly rise in spending, at 4.2 per cent, marked the best showing since before the financial crisis and recession.

In a report on how inflation slowed amid such strong economic growth last year, Mr. Janzen said a lack of demand clearly was not the reason.

"Given rising household debt levels, the larger concern is that households are spending too much, not too little," he said.

That shouldn't be the larger concern this year, though, because tapped-out consumers are going to have to spend less to juggle their payments as interest rates rise.

"With employment growth also expected to slow (13,000 per month on average), the consumer is expected to contribute much less to overall growth - just 1.2 percentage points in 2018," Mark Chandler, head of Canadian rates strategy at RBC Dominion Securities, and RBC rates strategist Simon Deeley said in a forecast.

The Bank of Canada, of course, has been hoping for a shift from the consumer to the exporter, but the trade sector "will struggle to get back on track" this year, as Matthew Stewart, director of national forecasting at The Conference Board of Canada, put it.

"As was the case in 2017, activity in Canada's export sector will continue to be uneven in 2018, with growth being fuelled largely by the energy and service sectors," Mr. Stewart said.

"While the non-energy merchandise export sector will contribute to overall export growth in 2018 … several sectors continue to face hurdles and will expand at only a sluggish pace," he added.

TD projects imports will rise 4.9 per cent this year, eclipsing the 4.7-per-cent gain in exports.

The latest numbers, reported today, show Canada's trade deficit swelling in November to $2.5-billion from $1.6-billion in October. Exports climbed 3.7 per cent but that was eclipsed by a 5.8-per-cent rise in imports.

Business investment is yet another crucial area of uncertainty as NAFTA negotiations lumber on. How do you plan where to invest when you can't gauge the relationship with your biggest trading partner?

"Trade uncertainty is already weighing on business investment, with firms examining foreign investment opportunities as opposed to domestic opportunities," HSBC's Mr. Watt warned. "This trend could be exacerbated if NAFTA is terminated."

As Mr. Stewart noted, business investment finally perked up in 2017 after "two dismal years" that saw non-energy investment sink by 8.9 per cent, cumulatively.

"The financial performance and investment intentions of Canadian businesses rose significantly throughout the summer but then fell back again in the fall as the economy slowed," Mr. Stewart said.

"Nonetheless, business sentiment still appears to be more positive overall than it has been at any time in the last few years. Many firms are also operating close to full capacity, and with sales expected to continue to grow, they will have little choice but to go ahead with overdue investments."

Buoying investment last year and in 2018 has been and will be spending on machinery and equipment and intellectual property.

"After an increase of just 0.5 per cent in 2017, we expect non-residential business investment outside the energy sector to rise by 3.4 per cent in 2018 and 2.2 per cent in 2019," Mr. Stewart said.

"While this pickup in non-energy investment will support further increases in capacity and economic growth, the levels remain depressed and are unlikely to surpass their recent 2014 highs until 2022."

Then there's the energy industry, so key to Canada's outlook amid the rebound from the oil shock.

"In 2015 and 2016, steep declines in energy investment (which includes upstream oil and gas, pipelines, exploration, and power sector investment) weighed down overall business investment across Canada," Mr. Stewart said "While oil and gas prices remain relatively weak, they have recovered from their recent lows, allowing for energy sector investment to begin to recover in 2017," he added.

"With the energy sector's financial performance set to improve in 2018, further gains in investment are expected. Nevertheless, investment volumes remain low and will stay well below their previous highs throughout the forecast period."

We are rapidly running out of workers

DOUGLAS PORTER, BMO

Unemployment

Economists tell us that the jobs market is on fire. And it is. And that unemployment has finally dipped below 6 per cent a decade after the financial crisis. Which it has.

But we shouldn't lose sight of the fact that 1.1 million people are still without work. And that economists expect last year's strong pace of job gains to slow.

TD economists forecast that unemployment will average 6 per cent this year, while BMO sees 5.8 per cent.

The latest numbers, released today by Statistics Canada, show another month of exceptional gains in December, with job creation of 79,000 and an unemployment rate down to 5.7 per cent, the lowest since at least early 1976.

Over the course of last year, employment rose by 2.3 per cent, or 423,000, with almost all of the increase in full-time work.

BMO chief economist Douglas Porter believes unemployment will ease to a "modern-day low" across the OECD this year.

"While many continue to stress over robots stealing our jobs in the future, we are rapidly running out of workers in the here and now," Mr. Porter said in his 2018 projection.

"By late 2017, jobless rates were approaching multi-decade lows in the U.S. (4.1 per cent), Canada (5.9 per cent), Japan (2.8 per cent), Germany (3.6 per cent) and even the U.K. (4.2 per cent) " he added.

"Given that we see global growth coming close to matching [last] year's solid gains in 2018, look for the job market to tighten notably further. With hiring plans remaining robust in many regions, the OECD harmonized unemployment rate will hit the lowest level in almost 50 years."

We anticipate that provinces will ease expenditure constraints as revenue growth increases

MOODY’S INVESTORS SERVICE

Government spending

Some of us are about to hit the jackpot.

"On the fiscal front, Ontario, Quebec and British Columbia are now all running balanced budgets, and the big shift in 2018 could be toward opening the fiscal taps - we've already seen this process start," said BMO senior economist Robert Kavcic.

"Indeed, looming elections in Quebec and Ontario should prompt more tax relief and spending increases, while British Columbia's new government still has some big-dollar promises to fulfill," he added.

"On the flip side, Alberta will likely start assembling the pieces for the 2019 election campaign, and with the credit rating under further pressure this year (and a traditionally conservative voter base getting antsy), the move in that province will likely be toward more fiscal consolidation."

Then there's the federal fiscal program, and we've already seen some results from the child benefits scheme.

"Higher transfers for child benefits have helped support consumer spending over the past year, while total government investment in infrastructure is growing at its fastest pace since the 2009–10 stimulus spending," said The Conference Board's Mr. Stewart, projecting real infrastructure spending will rise 3.7 per cent this year.

The worsening power struggle between Saudi Arabia and Iran could upend oil markets

HELIMA CROFT, MICHAEL TRAN AND CHRISTOPHER LOUNEY, RBC

Oil

Forecasts may differ, but observers believe crude prices should rise as long as OPEC can keep it together.

Which, of course, would be a boon to our energy-dependent provinces.

"The oil-producing regions are all benefiting from higher output, but the dynamics in each province remain quite different," TD economists said in a recent economic snapshot.

"Alberta is in the midst of a sharp rebound after contracting by 3.7 per cent in each of the last two years, with part of the bounce due to the recovery from last year's wildfires … The oil industry is providing the largest lift to economic growth, with rig counts up by 80 per cent and production up by double digits so far [in 2017]."

TD projects oil prices around the mid-50 mark this year, while Laurentian Bank forecasts $67 (U.S.) a barrel for West Texas intermediate by the end of 2018.

But hold that thought.

This depends on the production cap agreement holding among OPEC and non-OPEC countries.

"So far, the one-year agreement has helped reduce excess inventories by 50 per cent," said Laurentian's Mr. Vallée and Mr. Corbeil.

"Extending the agreement until the end of [2018] would be enough to swiftly eliminate the remaining excess oil inventories by next fall. This should be supportive of higher oil prices throughout the year."

Of course, the Middle East is in turmoil. There's trouble, too, in other regions, and this could, in fact, buoy prices.

"We have warned that the worsening power struggle between Saudi Arabia and Iran could upend oil markets in 2018 and provide a significant upside surprise to oil," RBC's Helima Croft, head of commodity strategy, and her colleagues, commodity strategists Michael Tran and Christopher Louney, said in a recent report.

Then there are the recent protests in Iran.

"While we see no near-term oil disruption risk stemming from the unrest, which has left over 20 people dead, we do think the protests could have important implications for the JCPOA nuclear deal," Ms. Croft said separately, referring to Iran's 2015 agreement with the U.S. and others.

The White House supports the protests, and has warned of fresh sanctions, she noted, meaning it would probably "feel emboldened" to revoke sanction waivers that ended with the Iranian agreement.

"These waivers cover investment in the Iranian upstream sector, as well as the requirement for consuming countries to make significant reductions in their Iranian crude imports every six months," she pointed out.

Ms. Croft, Mr. Tran and Mr. Louney warned of other flash points for the oil markets.

Indeed, they have done so for years, citing "stressed" producer nations "ill-equipped to endure the economic and political calamity" brought on by the oil shock.

"However, as long as the market was so well supplied, geopolitics was treated as an afterthought or in some cases entirely irrelevant in the face of short-cycle U.S. production," they said in a separate commodities outlook, noting OPEC would subsequently decide to take 1.8 million barrels a day out of the market.

"Now against the backdrop of a tightening market, a politically-driven supply disruption is deemed much more consequential," Ms. Croft, Mr. Tran and Mr. Louney added.

"In our view, 2018 looks set to be the year when several of the geopolitical stories that we have been closely monitoring migrate from being mere risks to being material market realities.

Among what they describe as a "house of cards":

Venezuela is risky business: "It is poised to see its production drop substantially once again [this] year given the depth of its economic despair and its accelerating effects on oil production. The debt crisis only worsens Venezuela's prospects, but its oil sector would likely be in a death spiral anyways."

Iran's nuclear deal appears "bleak" after President Donald Trump's decision to decertify it last year: "It is highly unlikely that Trump will be able to reconstruct the international coalition of the willing that came together to sanction Iran in 2012. However, we think that a snapback of U.S. sanctions would curb the enthusiasm of European and some Asian corporates to follow through with plans to invest in the Iranian upstream sector and could force foreign refineries to source less crude from Iran, especially if the threat of being locked out of U.S. capital markets were revived."

Over all, said Mr. Tran, "oil prices will ebb and flow over the coming months, and while we are not raging bulls with prices at current levels, our conviction in the rising floor means that dips will likely be supported in the event that prices dip back into a low- to mid-$50/barrel price environment."

The "production hiccups" in the North Sea and Libya, he added, serve as examples of how such disruptions can become "magnified" in a climate of the declining storage surplus.

"We see prices relatively rangebound this year, with WTI largely fastened to the $55-$65 a barrel mark as the tug of war continues with U.S. production pitted against an otherwise firming fundamental backdrop, but headlines from Iran, Saudi Arabia and others serve as a good reminder that geopolitical risk can quickly change the calculus," Mr. Tran said.

But Canada has its own issues and has yet to get the full benefits of the "oil party," said BMO's Mr. Guatieri, looking at the difference between Western Canada Select oil and West Texas intermediate, the U.S. benchmark.

That's where throwing a "7 out," which means you lose, comes into it.

"OPEC's output cuts and rising social unrest in Iran have lifted crude prices for U.S. and world producers, but not Canadian drillers," Mr. Guatieri said.

"In fact, the price of Western Canada Select has actually fallen in recent months amid a supply glut (partly due to the closure of the Keystone pipeline after an oil spill) and seasonal weakness," he added this week.

"The hefty $26 discount versus the U.S. price is the largest in nearly four years. This is the worst of both worlds for Canada, as it portends higher fuel costs for households and businesses but no offsetting lift to incomes in oil-producing regions."

If there is an 800-pound gorilla in Canada’s outlook, it is the potential trade threat from NAFTA

MARK CHANDLER, SIMON DEELEY, RBC

NAFTA

No, the world won't end if NAFTA does. But there would be an obvious upset given Canada's dependence on trade with the U.S. and the complex integration of certain industries.

"While our analysis shows that abandoning the agreement would not spark a recession in Canada, growth would slow significantly in the short run and more severely in certain provinces," warned Moody's Analytics economist Paul Matsiras.

Mr. Trump has oft threatened to kill NAFTA if he doesn't get what hea fair deal. And even though economists expect at least something to be salvaged, those threats are not to be taken lightly.

Were the deal to die, Canada would have been hit by a financial shock, an oil shock and a trade shock over the course of a decade.

"By most accounts, negotiations to this stage have been contentious ahead of the reported March, 2018, deadline, with no agreement in particular on parts content for motor vehicles or on a dispute settlement mechanism that might be agreeable to all parties," said RBC's Mr. Chandler and Mr. Deeley.

"These issues are seen as key for an agreement, and the longer they remain in limbo, the more chance there is that the U.S. administration will choose to 'tear up the agreement' ahead of mid-term elections."

If NAFTA dies, the question would be what comes next. Would Canada and the U.S. revert to their old free-trade pact? Or would the Trump administration simply adhere to the World Trade Organization regime?

RBC believes the latter scenario would erode Canadian gross domestic product by about 1 per cent over five to 10 years.

TD economists also studied that scenario, which would include Canadian retaliation amid higher tariffs.

"In a hypothetical scenario where NAFTA is terminated by the end of 2018, economic growth in the following year would be shaved by roughly 0.7 per cent from our baseline," TD said.

"This would leave GDP growth at roughly 1 per cent, which would still impart pain, but not devastation - an outright contraction in activity appears unlikely."

In fact, the bigger threat would be to corporate and consumer confidence, notably with "firm behaviour and supply chains needing time to adjust," the TD study said.

"By this token, even in the event that a new agreement is reached after some delay, the near-term uncertainty could prove a larger weight on growth than anticipated."

Of course, the Canadian dollar would plunge to compensate, and the stocks of trade-dependent companies would be roiled, further throwing the country into turmoil.

________________

LGCJ.: