CANADA ECONOMICS

NAFTA

Global Affairs Canada. January 5, 2018. Round six of NAFTA renegotiations

The sixth round of the renegotiation and modernization of the North American Free Trade Agreement (NAFTA) will take place in Montreal, Canada, from January 23 to 28, 2018.

Global Affairs Canada. January 3, 2018. Canada’s Minister of Public Safety and Emergency Preparedness to promote trade and NAFTA in Kentucky

Lexington Kentucky - The Honourable Ralph Goodale, Minister of Public Safety and Emergency Preparedness, will visit Kentucky on January 4 and 5, 2018, where he will participate in activities focusing on Canada-U.S. trade and business.

Minister Goodale will attend the 23rd Annual Kentucky Chamber Day, hosted by the Kentucky Chamber of Commerce, in Heritage Hall at the Lexington Convention Center in Lexington. The occasion represents the state’s largest gathering of elected officials and business executives. During his visit, Minister Goodale will also meet with Matt Bevin, Governor of Kentucky, Terry Gill, Economic Development Cabinet Secretary, John Tilley, Justice and Public Safety Cabinet Secretary, Ryan Quarles, Commissioner of Agriculture, and Kelly Craft, United States Ambassador to Canada.

“Canada and the United States share one of the closest and most prosperous bilateral relationships in the world,” said Minister Goodale. “I look forward to being in Kentucky, meeting with political and business leaders and discussing the ways we can enhance the trade and economic ties that strengthen the dynamic relationship between our two countries.”

“I am delighted to welcome Minister Goodale here in Kentucky,” said Douglas George, Consul General of Canada in Detroit also responsible for the State of Kentucky. “Minister Goodale’s experience in agriculture, finance, natural resources, public safety and border security makes him a perfect person to speak about the many ties that bind Canada and the state of Kentucky.”

Canada is Kentucky’s largest export market, with nearly 26% of Kentucky’s foreign-bound goods sold to Canada—more than the state’s next two largest markets combined. Annual trade between Kentucky and Canada totals US$10.9 billion, or nearly US$30 million per day, amounting to a US$4-billion trade surplus for Kentucky. Canada-U.S. trade and investment supports about 112,600 jobs in the “Bluegrass State”.

As Minister of the largest non-military department in Canada, Mr. Goodale’s portfolio includes the Royal Canadian Mounted Police, the Canadian Security Intelligence Service, the Canada Border Services Agency and Correctional Service Canada.

Minister Goodale will be available to media at the Annual Kentucky Chamber Day in Lexington. Should you require additional information about this event please refer to the contact section below.

THE GLOBE AND MAIL. THE CANADIAN PRESS. JANUARY 5, 2018. Goodale leads pro-NAFTA sales pitch in Kentucky

OTTAWA - Public Safety Minister Ralph Goodale is in Kentucky today to play the role of NAFTA cheerleader, stressing the importance of the friendship and trade ties between Canada and the United States.

He and a number of fellow cabinet ministers are south of the border to sing the praises of the beleaguered trade deal as yet another critical round of talks – the first of the new year – is set to begin in Montreal later this month.

Goodale's message is largely the same one the government has been trumpeting for months to anyone in the U.S. who will listen: Canada is their state's No. 1 customer and that thousands of their fellow workers hold good jobs that depend on cross-border trade and investment.

He's telling the Kentucky Chamber of Commerce in Lexington, Ky., that while the Canada-U.S.-Mexico trade pact can and should be modernized, it should be done without disruptions that would hurt jobs and trade.

Although U.S. President Donald Trump has mused about killing NAFTA, Goodale is urging his listeners to tell Washington that the trade deal can be improved in a way that will produce a "win-win-win."

Goodale is also stressing emotional links between the two countries, saying his mother's family comes from Illinois and recalling family visits where his preoccupation with hockey ran into his cousins' focus on baseball.

"Canada and the United States are partners in the most prosperous, extensive, dynamic and mutually beneficial relationship in the world," Goodale says in prepared remarks for his Chamber of Commerce speech.

"It deserves and demands our careful attention – as allies, neighbours, friends and, in a lot of cases, family."

Global Affairs Canada. January 5, 2018. Statement from Minister Goodale on his visit to Kentucky

Frankfort, Kentucky - Today, the Honourable Ralph Goodale, Minister of Public Safety and Emergency Preparedness, made the following statement to conclude his visit to Kentucky:

“Canada and Kentucky share one of the most economically important bilateral relationships in North America, with a long history of trade and partnership. Over the past few days, I travelled to the cities of Louisville, Frankfort, Crittenden and Lexington and had productive discussions on additional ways Canada and Kentucky can work together to increase trade and job opportunities.

“During this trip, Matt Bevin, Governor of Kentucky, and I discussed the strong economic ties between Canada and his state. The annual trade between Canada and Kentucky stands at US$10.9 billion per year, and more than 112,000 jobs in Kentucky are supported by Canada-United States trade and investment.

“I had the pleasure of speaking with Kelly Craft, United States Ambassador to Canada and a Kentucky native, and with Kentucky business and community leaders, who shared their ideas on the ways to build upon the productive and valuable relationship between Canada and the United States.

“I also had the opportunity to meet John Tilley, Secretary of the Justice & Public Safety Cabinet in Kentucky, to discuss public safety issues of interest to both Canada and Kentucky, including efforts to combat the opioid crisis and joint law enforcement programs. I met with Ryan Quarles, Kentucky Commissioner of Agriculture, to discuss agricultural trade relations and the upcoming Kentucky trade mission to Canada. Finally, I spoke to the board members of the Kentucky Chamber of Commerce on the Canada-United States economic relationship, the North American Free Trade Agreement and Kentucky business opportunities in Canada. During my visit, I highlighted Canada’s status as Kentucky’s number-one trading partner, our stable business climate, our highly educated and skilled workforce and other reasons that make Canada an ideal destination for American companies to grow their businesses.

“I would like to thank Governor Bevin, Ambassador Craft, Secretary Tilley, Commissioner Quarles, the Kentucky Chamber of Commerce and the people of Kentucky for their hospitality. I look forward to continuing discussions toward increasing trade and business opportunities in Canada and Kentucky.”

REMARKS

Public Safety Canada. Speech. Remarks on trade by Minister Goodale to the Kentucky Chamber of Commerce

Thank you very much Ambassador Craft and Happy New Year everyone! Greetings and good wishes from Prime Minister Trudeau and the Government of Canada. And my sincere appreciation to the Kentucky Chamber of Commerce for inviting me to be with you today.

I'm very glad to be spending the first few days of 2018 in the great Bluegrass State of Kentucky. Your WEATHER certainly makes me feel very much at home—thanks for arranging that. But more importantly, I'm honoured to be visiting the home State of the new United States Ambassador to Canada.

Ambassador Craft, congratulations on your selection. Canada is very pleased with the President's choice for American diplomatic representation in our country. And you are off to a great start in your new role.

Canadians were delighted to welcome you and Joe to Ottawa—and we're looking forward to our work together on trade and investment, public safety issues, defence and security, and much more.

It's important work. Canada and the United States are partners in the most prosperous, extensive, dynamic and mutually beneficial relationship in the world. It deserves and demands our careful attention—as allies, neighbours, friends and (in a lot of cases) family.

My mother's side of OUR family comes from Bushnell, Illinois. The Myers family. In our visiting back and forth, while I was preoccupied with hockey, all my US cousins were basketball fanatics.

It drove them mildly around the bend when I pointed out that basketball was actually invented by a Canadian, James Naismith from Ontario. But they seized on that word "FROM", noting the invention of the game took place AFTER Naismith had moved FROM Canada to Springfield, Massachusetts.

This city of Lexington is great basketball country. I know the Ambassador is a major booster of Kentucky basketball.

The Wildcats have included Canadian players on their roster for four seasons in a row, including recent NBA top-10 draft pick Jamal Murray. And one of the Wildcats' biggest fans is Canadian entertainer Drake, who can sometimes be spotted at Rupp Arena.

Drake is also a big fan of the Toronto Raptors, who are coached by Dwane Casey who played college ball here in Kentucky in the 1970s.

All of this might be dismissed as mere trivia. But it's really more than that. It's a tiny fraction of the mountain of evidence that you find just about everywhere of deep, intricate interconnections between Americans and Canadians in so many dimensions of our lives—in sports, entertainment, family life, business, security, defence, diplomacy ... and our common values of freedom and democracy.

We have fought together for those values in two world wars, and in Korea, the Balkans and Afghanistan. We are united today in our unshakeable resolve to combat the deadly scourge of global terrorism. In a few weeks we will co-host an important international meeting in Vancouver on the threats posed by North Korea.

On the economic front, our partnership is the envy of the world.

And let me express Canadians' deep appreciation to the Kentucky Chamber of Commerce for helping to reinforce that message. The letter that you (and more than 300 other major Chambers from across the United States) sent last October to President Trump was eloquent, powerful and compelling.

The Canada/US relationship NEEDS engaged, informed, influential advocates like you—to defend, promote and strengthen it. Doing so is important to both our countries.

We know—on BOTH sides of our common border—there are anxieties and sensitivities about trade. If a particular industry or sector runs into difficulty, it's sometimes easy to find an excuse for that in foreign trade, in allegations of unfair competition. There's an instinct to throw up barriers ... on both sides.

But first it's crucial to make sure all the facts and all the figures are actually correct, and where genuine unfairness is identified, to deal expeditiously with those precise instances—rather than tanking the whole relationship. Because on both sides of the border, industries and sectors that trade internationally tend to be more efficient, more innovative, pay better wages, and achieve greater success for their communities, for their states or provinces (as the case may be), and for their country.

Between us, we have the longest, most open, unmilitarized, secure and efficient border in the history of the world.

Nearly 400,000 people move across that border every single day.

About $1.8 billion(US) in trade moves across that border every single day.

The latest data shows two-way Canada-US trade in all goods and services at some $635 billion annually, and it's roughly in balance, both ways, with the United States enjoying a small surplus of close to $8 billion.

Our two economies are highly integrated in virtually every sector. Supply chains criss-cross the border and extend throughout our continent. They are vital to our mutual growth and prosperity. And they help to keep the products that we make together in North America fully competitive with the rest of the world.

Here's an interesting factoid—when the United States imports a manufactured good from Canada, it contains on average 26% US content—and much higher than that in sectors like machinery and autos. That's how intricately we are bound together.

Your letter to the President emphasized the particular importance of these efficient, cross-border supply chains for small and medium-sized businesses in both countries, and for agriculture. And for good, solid middle-class jobs.

Nearly 9-million American jobs depend directly on trade and investment with Canada—48 of your 50 States count Canada among their top three customers.

For Kentucky (and more than 30 other States), Canada is your NUMBER ONE customer!

You know the figures:

Two-way trade in goods between Canada and Kentucky is valued at $10.9 billion(US) per year. And YOUR exports to us account for nearly 70% of that total—$7.5 billion(US)—that's a trade advantage in goods in your favour of more than 2-to-1.

Plus, there's another $400 million in Kentucky SERVICES exported to Canada.

Many thousands of Kentuckians enjoy a comfortable life because of a good job here that could conceivably NOT exist without those trade and investment links with Canada.

Take a company like Martinrea, for example. It's a Canadian firm manufacturing sophisticated metal products and autoparts. It employs 1700 people in places like Hopkinsville and Shelbyville.

And Martinrea is only one of more than a hundred Canadian companies that have chosen to build and invest in Kentucky. Others, just in THIS one Congressional District, include CGI Consulting, Stantec Engineering, and retailers Aldo and Lululemon.

Altogether, Canadian-owned firms doing business here are responsible for 9,500 jobs state-wide. And overall trade and investment with Canada creates employment for nearly 113,000 people in Kentucky.

The auto sector and agriculture are two big components of this prosperity.

Nearly half of Kentucky's annual sales to Canada are in high-value cars, trucks and motor vehicle parts. Kentucky is among the Top-5 States for producing trucks and passenger vehicles. There are four major assembly plants in this State.

So Kentucky is a major beneficiary of North America's integrated auto industry and any disruption would have serious consequences here.

In agriculture, Canada was Kentucky's top export market last year. We bought 19% of your export sales in this sector—that just about matches Kentucky's exports to Japan and the United Kingdom combined. Ketchup and tomato sauces were at the top of the list, right after ... alcoholic beverages. Canadians are indeed developing a growing thirst for good Kentucky bourbon.

Following your Chamber's good example, nearly 80 US food and agricultural groups have written to Commerce Secretary Wilbur Ross to underscore the "immediate and substantial harm" that would be caused in their sector by any US withdrawal from NAFTA.

As Kentucky's own Mitch McConnell has observed, for agriculture in particular, "nothing is more important than trade."

In the absence of NAFTA, your agricultural exports would likely encounter tariffs at the Canadian border of more than 12%. Some 50,000 US jobs would be jeopardized. Losses affecting US agriculture could reach $13 billion.

In the auto sector, in the absence of NAFTA, tariffs would likely range from six to nine percent—and remember that autoparts criss-cross our common border multiple times during the assembly process. The costs and losses would add up big time.

Barriers to the existing free-flow of cross-border business would be damaging to Kentucky ... and to Canada. Independent studies suggest that, without NAFTA, trade within North America would decline by more than $120 billion(US) over the next six years.

Without a predictable, balanced, rules-based framework, it would be harder—more expensive and less profitable—for Kentuckians to do business with their largest trading partner. There would be new risks of abrupt and arbitrary decisions, interrupting carefully laid plans. Sure things would become risky bets. Profits, jobs and wages would be jeopardized.

But it doesn't have to come to that.

Canada believes that NAFTA has, by and large, generated fair and balanced benefits on both sides of the border, and we should work to keep it that way.

We want to build on what has already been achieved. Where updates are necessary and improvements can be gained, we are ready and willing to make them—to benefit all NAFTA partners, creating good, middle-class jobs in all three countries. As Vice-President Pence has said, we need to make it a "win-win-win".

By your letter to the President, it's clear you share that approach.

Negotiations continue. Some progress has been made, but the stakes are extremely high and we're entering a critical phase.

I urge you to renew and amplify your message—to promote the exemplary, lucrative, sustainable and vital economic relationship between Canada and Kentucky ... and to avoid a trade disruption or roll-back that would hurt Kentucky's economy and cost many middle-class jobs.

Yes, let's modernize NAFTA. Let's better align it with new realities in trade and investment. But let's get to an outcome that moves us all forward, not backward or sideways. As you said in your letter, first and foremost, let's do no harm.

While trade and NAFTA dominate the public agenda these days between our two countries, there are a host of other issues that we grapple with regularly—especially in my realm of public safety and national security.

I enjoyed a great working relationship with General John Kelly when he headed the DHS. That very much continued under Acting Secretary Elaine Duke. And I'm looking forward to another strong partnership with new Secretary Kirstjen Nielsen—we expect to be meeting in the next few days.

Over the past several months, there have been numerous practical illustrations where effective cross-border collaboration among our agencies has contributed in a major way to safety and security in both our countries. And beyond our bilateral relationship, we work closely together through the G7 group of security Ministers, Interpol, NATO and the Five-Eyes security alliance that also involves the UK, Australia and New Zealand.

We are enhancing our mutual effectiveness in information sharing. We are implementing a new Entry/Exit data sharing system to better identify who is staying and who is leaving our respective countries. We are pursuing new border technologies to better cope with issues like opioids and human smuggling.

We are pressing Internet Service Providers to become more effective in combatting terror and hate on the World Wide Web. And we are both upgrading our capabilities to defend our vital digital networks, information systems and critical infrastructure against hostile cyber attacks—whether from foreign militaries or organized crime or even just the weekend hacker-geek down in the basement in his underwear. Cyber security has emerged as a leading priority.

So there is a lot of good work underway between us.

General Kelly commented several times that as a common priority we should strive to make the Canada/US border "thinner"—that is, strong and secure, but efficient and expeditious for legitimate trade and travel. In the spirit of NAFTA—improving the lives and livelihoods of millions of Americans and Canadians—that is a goal we all embrace.

As one practical illustration, we are working together to expand pre-clearance operations at the border—so more travellers can successfully complete all necessary customs and immigration procedures BEFORE the leave, rather than after they arrive.

Pre-clearance in air travel from Canada to the US has existed since 1952. It now serves about 12 million air passengers every year, departing from eight major Canadian airports. It enables direct flights to American destinations that would otherwise be able to handle only domestic traffic.

Thanks to pre-clearance, Toronto's Pearson Airport has become the 4th largest port of AIR entry into the United States—after JFK, Miami and LAX.

So, building on a good thing, we have negotiated an expansion of pre-clearance—to cover more airports and other modes of transportation too, and to allow for traffic moving also in the opposite direction, from south to north.

The necessary legislation has been enacted in both countries.

And our next step, as signalled by Prime Minister Trudeau and President Trump, is to devise an effective pre-clearance system for moving CARGO safely, efficiently and expeditiously between our two countries.

Ladies and gentlemen, you have been very generous with your time this morning. Thank you for your welcome to Kentucky.

And thank you for treating your Number One Export Customer to such warm hospitality—despite the weather.

In trade, investment, business, jobs and mutual prosperity, Canada and Kentucky are the closest of friends and partners.

We look forward to working with you to maintain the international commercial framework that makes our common success the inspiring success that it has become.

Thank you.

Agriculture and Agri-Food Canada. January 4, 2018. Canada's Minister of Agriculture and Agri-Food to promote trade and NAFTA at American Farm Bureau Federation Annual Convention in Tennessee

Ottawa, Ontario – The Honourable Lawrence MacAulay, Minister of Agriculture and Agri-Food Canada, will visit Tennessee from January 5 to 8, 2018, where he will deliver a keynote address to the American Farm Bureau Federation's annual convention and participate in activities to promote Canada-U.S. trade.

Minister MacAulay will attend the 99th Annual American Farm Bureau Federation Convention and IDEAg trade show in Nashville, Tennessee. The American Farm Bureau Federation Convention is a gathering of more than 5,000 delegates bringing together agricultural producers from all levels and sector representatives from the local, state and national levels. The American Farm Bureau Federation has confirmed that the President Donald. J. Trump will also be addressing the convention, the first sitting U.S. President to do so since George H.W. Bush in 1992.

"The trading partnership between Canada and the U.S. is one that delivers high-quality foods and supports millions of middle-class jobs on both sides of the border," Minister MacAulay said. "Since the beginning of NAFTA, trade in North American agriculture has quadrupled. We will continue to work closely with representatives at all levels in the U.S. to ensure our agricultural sectors continue to grow and prosper."

While in Nashville, Minister MacAulay will participate in a roundtable with U.S. agricultural producer and business groups. Along with his participation at the American Farm Bureau Convention, Minister MacAulay will host a breakfast for all State Farm Bureau Presidents, meet with Zippy Duvall, President of the American Farm Bureau Federation, Jai Templeton, Commissioner of Agriculture for Tennessee, and meet with U.S. Young Farmers and Ranchers. Minister MacAulay will also have the opportunity to meet with a number of his state counterparts who are attending this convention.

Canada is Tennessee's largest agricultural export market shipping $226 million to Canada including baked goods, prepared breakfast cereal, chocolate products and whiskies. Trade and investment with Canada supports approximately 170,300 jobs in Tennessee.

Minister MacAulay will be available to media while attending the convention.

REUTERS. JANUARY 4, 2018. Canada sends ministers to U.S. to boost NAFTA as key talks loom

David Ljunggren

OTTAWA (Reuters) - The Canadian government is sending three cabinet ministers to the United States to stress the merits of NAFTA, officials said on Thursday, paving the way for key talks that could either sink or save the trade pact.

Canada and Mexico object to major changes that Washington wants to make to the North American Free Trade Agreement, and time is running out to settle differences before the negotiations are scheduled to wrap up at the end of March.

Officials will hold the sixth and penultimate round of talks in Montreal from Jan. 23-28.

One cabinet minister is already in the United States and two more will travel this weekend.

Canada, which sends 75 percent of its goods exports to the United States, has been reaching out to U.S. politicians and the business community for almost two years to bolster support for free trade.

“We recognize we are heading into an important period. We are certainly preparing for all scenarios, and we’re hopeful that we can make progress,” a spokesman for Foreign Minister Chrystia Freeland said when asked about the latest visits.

“That’s what we’re focused on achieving, including in Montreal,” Alex Lawrence, the spokesman, said in an e-mailed statement.

Separate news releases announcing the ministerial trips make clear the cabinet members have been instructed to “promote trade and NAFTA.”

Public Safety Minister Ralph Goodale wraps up a two-day trip to Kentucky on Friday while Agriculture Minister Lawrence MacAulay is due to visit Tennessee over the weekend. At the same time, Environment Minister Catherine McKenna will be in San Francisco.

Canadian officials are increasingly pessimistic about the prospects for the 1994 trade treaty, which U.S. President Donald Trump blames for the loss of hundreds of thousands of U.S. manufacturing jobs and a big trade deficit with Mexico.

In a low-level meeting held in Washington last month between the fifth and sixth rounds, negotiators made some progress on less controversial issues but left untouched the thorniest subjects of the sourcing of auto parts, dispute settlement and an expiry clause.

Trade experts predict that unless Canada and Mexico make some concessions in Montreal, Trump will be more tempted to issue a notice of withdrawal from NAFTA, as he has repeatedly threatened if U.S. demands for change cannot be met.

Reporting by David Ljunggren; Editing by Leslie Adler

REUTERS. JANUARY 5, 2018. Canadian dollar to pull back as BoC waits out NAFTA uncertainty

Fergal Smith

TORONTO (Reuters) - The Canadian dollar is likely to weaken over the coming months, a Reuters poll showed, as the Bank of Canada falls further behind the Federal Reserve on interest rate hikes due to an uncertain outlook for NAFTA and tighter domestic mortgage rules.

The loonie, which on Thursday touched its strongest since Oct. 20 at C$1.2490, is forecast to weaken to C$1.2700 per U.S. dollar in three months, the poll of more than 40 foreign exchange strategists taken Jan 2-4 showed on Friday.

It is then expected to recover to C$1.2500 by the end of the year.

The currency has been boosted in recent weeks by a 2 1/2-year high for the price of oil, one of Canada’s major exports, and firm domestic data which raised expectations for a Bank of Canada interest rate increase as soon as Jan. 17. But analysts say the central bank is likely to wait for some uncertainties to clear before raising rates.

“The Fed looks to be more aggressive earlier in the year as compared to the Bank of Canada,” said Mark Chandler, head of Canadian fixed-income and currency strategy at RBC Capital Markets. “We don’t think the bank will follow through this month. We think that they’ll wait and see what the outcome is of some of the trade talks.”

The central bank raised rates for the first time in seven years in July and then again in September. Its benchmark interest rate sits at 1 percent, while the Fed’s is in a range of 1.25 percent to 1.50 percent.

U.S. President Donald Trump has threatened to withdraw from the North American Free Trade Agreement with Canada and Mexico if he cannot rework it in favor of the United States. Officials from the three countries will meet in Montreal Jan. 23-28 for talks on thorny subjects such as autos, dispute settlement and an expiry clause.

The outcome is important to Canada, which sends about 75 percent of its exports to the United States.

The Canadian dollar would need to depreciate by about five percent to offset the increase in tariff levels that a dissolution of NAFTA could trigger, said Nick Exarhos, economist at CIBC Capital Markets.

He had one of the most bearish three-month calls for the loonie at C$1.3300.

The uncertain impact of tighter mortgage rules, which took effect at the start of January, on a once red-hot housing market, and past rate hikes on highly indebted consumers could also delay tightening.

But analysts say that domestic economic growth, which has slowed after rapid expansion in the first half of the year, will be helped by the lagged impact of federal infrastructure spending and the potential for higher commodity prices in 2018.

“The Canadian economy is probably strong enough to justify higher rates down the road,” said Shaun Osborne, chief currency strategist at Scotiabank.

The potential for the U.S. dollar to fall after posting in 2017 its weakest annual performance in 14 years could also help the loonie recover some ground later in the year.

“We are in the early stages of a reversal in the (U.S.) dollar from a longer term secular perspective,” Osborne said. “The Fed is closer to the end of its tightening cycle probably than the start.”

Polling by Indradip Ghosh and Shrutee Sarkar, editing by Larry King

UNEMPLOYMENT

StatCan. 2018-01-05. Labour Force Survey, December 2017

- Employment — Canada: 18,648,000, December 2017, 0.4% increase (monthly change)

- Unemployment rate — Canada: 5.7%, December 2017, -0.2 pts decrease (monthly change)

- Source(s): CANSIM table 282-0087: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2820087&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Employment increased for a third consecutive month, up 79,000 in December. The unemployment rate continued on a downward trend, decreasing by 0.2 percentage points to 5.7%, the lowest since comparable data became available in January 1976.

The employment increase in December was concentrated in part-time work, which rose by 55,000.

The additional employment in December builds on growth observed in October and November. This boosted gains for the fourth quarter to 193,000 or 1.0%, the most robust rate of quarterly growth since the second quarter of 2010.

In the 12 months to December 2017, employment was up 423,000 (+2.3%), with nearly all the gains in full-time work (+394,000 or +2.7%). Over the same period, total hours worked grew 3.1%.

The unemployment rate followed a downward trend in the 12 months to December, falling 1.2 percentage points over this period. A year-end review is presented in a separate section below.

Chart 1: Employment

Chart 2: Unemployment rate

Highlights

In December, employment increased for men and women aged 25 to 54 as well as for people aged 55 and over. There was little overall change for youth aged 15 to 24.

The largest employment gains in December were observed in Quebec and Alberta, while there were smaller increases in Nova Scotia, Saskatchewan, New Brunswick and Prince Edward Island.

There were more people working in the services-producing sector, led by finance, insurance, real estate, rental and leasing. Employment also increased in "other services", educational services, and transportation and warehousing.

In the goods-producing sector, there were more people employed in natural resources.

Employment gains in December were observed among self-employed workers and public sector employees. The number of private sector employees held steady.

More core-aged and older workers

In December, employment increased by 52,000 among core-aged people (25 to 54), with gains of 33,000 for men and 19,000 for women.

The added employment for core-aged men lowered their unemployment rate by 0.2 percentage points to 4.8%—the lowest rate since April 1981. For women in the same age group, the unemployment rate was little changed, also at 4.8%, as the increase in their employment was matched by an additional number of core-aged women participating in the labour market.

In December, there were 33,000 more workers aged 55 and over, including 18,000 men and 15,000 women. The unemployment rate was little changed for this age group: 6.1% for men and 4.5% for women.

Employment for youth aged 15 to 24 held steady in December, following two consecutive monthly gains. An increase in part-time employment (+31,000) was offset by a decline in full-time work (-37,000). Despite little overall employment change in December, the youth unemployment rate fell 0.5 percentage points to 10.3% as fewer youths searched for work.

Quebec and Alberta leading employment growth

Employment in Quebec grew for a third consecutive month, up 27,000 in December. With more people employed and fewer searching for work, the unemployment rate fell by 0.5 percentage points to 4.9%, continuing a notable downward trend that began at the start of 2016.

In Alberta, employment increased by 26,000, mostly in full-time work. The unemployment rate fell by 0.4 percentage points to 6.9%. Employment gains were observed in a number of industries, led by accommodation and food services, and by natural resources.

In December, employment rose by 5,900 in Nova Scotia, the first significant increase since March 2017. The additional employment lowered the unemployment rate in the province by 0.8 percentage points to 8.0%.

In Saskatchewan, employment increased by 5,000, all in part-time work. This is the first notable employment increase in the province since February 2017. As more people searched for work, the unemployment rate increased by 0.4 percentage points to 6.4%.

Following a decline in November, employment in New Brunswick increased by 4,200 in December. The unemployment rate fell by 0.5 percentage points to 7.8%.

In Prince Edward Island, there were 900 additional people working in December, a second consecutive monthly increase. The unemployment rate for the province increased by 1.0 percentage point in December to 9.8%, the result of more Prince Edward Islanders searching for work.

In Ontario, employment was little changed in December, after a notable increase the previous month. The unemployment rate in the province remained at 5.5%.

Chart 3: Unemployment rate by province, December 2017

Employment gains in a number of industries

In December, 25,000 more people were employed in finance, insurance, real estate, rental and leasing, following three months of little change.

Employment was up by 13,000 in the "other services" industry in December. "Other services" include services such as those related to civic and professional organizations, and personal and laundry services.

In educational services, employment rose by 11,000 in December, a second consecutive monthly increase.

In December, 9,500 additional people worked in transportation and warehousing, the first notable employment increase in the industry since the summer of 2017.

Employment in natural resources rose by 5,800 in December.

The number of self-employed workers increased by 28,000 in December. At the same time, public sector employment rose by 22,000, while the number of private sector employees was stable.

Quarterly update for the territories

The Labour Force Survey collects labour market data in the territories, produced in the form of three-month moving averages.

In the fourth quarter, employment in Yukon rose by an estimated 500 people compared with the third quarter, and the unemployment rate was relatively unchanged at 3.6%.

In the Northwest Territories, employment in the fourth quarter was unchanged from the previous quarter. Over the same period, the unemployment rate remained at 7.0%.

Employment in Nunavut held steady in the fourth quarter, while the unemployment rate decreased to 12.1%.

Year-end review, 2017

The following analysis focuses on changes from December 2016 to December 2017.

In 2017, employment increased by 423,000 (+2.3%), the fastest December-to-December growth rate since 2002. In comparison, employment grew by 229,000 (+1.3%) in 2016.

Full-time employment followed an upward trend in 2017, increasing by 394,000 (+2.7%), while part-time employment held relatively steady.

In the 12 months to December, the unemployment rate fell by 1.2 percentage points to 5.7%, the lowest since comparable data became available in January 1976.

Provincial perspective

In Ontario, employment grew 2.5% (+176,000) in 2017, just over double the growth rate recorded in each of the previous two years. Full-time employment accounted for nearly all of the employment gains in 2017. There were more workers in a number of industries, led by wholesale and retail trade; manufacturing; professional, scientific and technical services; and transportation and warehousing. The unemployment rate in the province fell by 0.9 percentage points in 2017 to cap the year at 5.5%.

In 2017, employment in Quebec rose 2.1% (+87,000), slightly below the 2.3% national growth rate. Gains in full-time work accounted for nearly all of the employment growth in the province and coincided with a 1.6 percentage point decrease in the unemployment rate. The unemployment rate has been on a two-year downward trend, falling to 4.9% at the end of 2017, the lowest since comparable data became available in January 1976. See chart Unemployment rate in Quebec, January 1976 to December 2017:

In 2017, British Columbia closed out the year with an employment growth rate of 3.4% (+83,000), similar to that of 2016. The gains in 2017 were almost all in full-time work, and were mainly in health care and social assistance; construction; and finance, insurance, real estate, rental and leasing. In the 12 months to December, the unemployment rate in British Columbia fell by 1.2 percentage points to 4.6%, the lowest among all provinces.

Following a slide in employment from the autumn of 2015 to the summer of 2016, the labour market in Alberta added workers in 2017, with a growth rate of 2.4% (+55,000), the best performance since 2014. The employment gains were attributable to manufacturing; wholesale and retail trade; natural resources; finance, insurance, real estate, rental and leasing; and transportation and warehousing. The unemployment rate fell from 8.5% at the end of 2016 to 6.9% at the end of 2017.

In Manitoba, employment grew by 2.1% (+13,000) in 2017, slightly below the national growth rate. This follows relatively stable levels of employment over the previous two years. The gains in 2017 were mainly in full-time work. The unemployment rate in the province fell by 0.6 percentage points to 5.7% at the end of 2017.

In 2017, employment rose by 6,300 in Nova Scotia, all in full-time work. The unemployment rate was little changed, closing the year at 8.0%.

Following little change in 2016, employment in Prince Edward Island rose 3.9% (+2,800) in 2017, with all of the gains in full-time work. The unemployment rate for the province ended the year at 9.8%.

In New Brunswick, employment was little changed in 2017. However, the unemployment rate fell by 1.5 percentage points to 7.8%, the result of fewer people participating in the labour force.

In 2017, there was little change in both employment and the unemployment rate in Newfoundland and Labrador, as well as in Saskatchewan.

Focus on industries

In the 12 months to December, employment increased by 3.5% in the goods-producing sector and by 2.0% in the services-producing sector.

In the goods-producing sector, employment grew in manufacturing (+5.1% or +86,000), natural resources (+4.6% or +15,000) and construction (+3.6% or +51,000). Employment increases in natural resources in 2017 followed heavy losses recorded over the previous two years (-6.4% in 2015 and -7.3% in 2016).

In the services-producing sector, employment grew in a number of industries, led by transportation and warehousing (+6.3% or +57,000); finance, insurance, real estate, rental and leasing (+4.6% or +53,000); and professional, scientific and technical services (+3.8% or +53,000). Smaller growth rates were recorded in wholesale and retail trade (+2.9%); educational services (+2.1%); and health care and social assistance (+1.3%).

More workers aged 55 and over

In the 12 months to December, the number of employed people aged 55 and over increased 5.3% (+203,000), exceeding the rate of population growth for this group (+2.9% or +311,000).

For women aged 55 and over, employment rose 6.3% (+110,000) in 2017, while their population increased 2.8% (+157,000). The participation rate for this group rose by 0.9 percentage points to 33.5%, and the unemployment rate fell 0.7 percentage points to 4.5% at the end of 2017.

Among men aged 55 and over, employment grew 4.5% (+93,000) in 2017, and the population increased 3.0% (+154,000). Their unemployment rate fell 0.9 percentage points to 6.1%. The participation rate for men in this age group was little changed at 43.9% at the end of 2017.

Among workers aged 55 and over, 8 out of 10 are between the ages of 55 and 64. The estimated year-over-year rate of employment growth in 2017 (unadjusted for seasonality) for this group was 5.4%, while the rate of their population growth was 2.0%.

In comparison, people aged 65 and over comprise a smaller share of older workers, but their proportion has been increasing over the past decade. This group had the fastest year-over-year rate of employment growth among the major demographic groups in December, rising 7.8% and outpacing its rate of population growth (+3.7%). For more information about recent trends among older workers, see Labour in Canada: Key results from the 2016 Census and "The impact of aging on labour market participation rates."

For people aged 25 to 54, employment increased 1.6% (+186,000) in 2017, while their population rose 0.3% (+50,000).

Employment rose 1.7% (+107,000) among men aged 25 to 54, and their unemployment rate fell by 1.4 percentage points to 4.8%. The participation rate for this group was unchanged at 90.9%.

For women aged 25 to 54, employment increased 1.4% (+78,000) in the 12 months to December, and their unemployment rate declined 0.6 percentage points to 4.8%. Their participation rate edged up 0.3 percentage points to 82.9%.

In 2017, employment among young people aged 15 to 24 rose 1.4% (+34,000), while their population declined 0.5% (-20,000). As a result, their employment rate increased 1.1 percentage points to 57.2%. The youth unemployment rate fell by 2.3 percentage points to 10.3%, as 66,000 fewer people searched for work.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180105/dq180105a-eng.pdf

THE GLOBE AND MAIL. BLOOMBERG. JANUARY 5, 2018. ECONOMY. Canada’s jobless rate hits four-decade low as hiring surges

THEOPHILOS ARGITIS

Canada's unemployment rate plunged to the lowest in more than 40 years, suddenly raising the odds of a Bank of Canada rate hike this month.

The jobless rate fell to 5.7 per cent in December, Statistics Canada said Friday in Ottawa, the lowest in the current data series that begins in 1976. The number of jobs rose by 78,600, beating expectations and bringing the full-year employment gain to 422,500. That's the best annual increase since 2002.

The economy showed unexpected resiliency as the year came to an end, with the figures indicating rapidly diminishing slack in the labor market that may quicken the expected pace of interest-rate increases by the Bank of Canada. Since September, Canada added 193,400 jobs – the biggest three-month gain since at least 1976.

"The latest data in hand support a rate hike" in January, said Bill Adams, senior international economist at PNC Financial Services Group in Pittsburgh. "Broad-based growth is still the dominant theme."

Canadian bond yields and the currency soared on the surprisingly strong jobs data. The loonie strengthened to $1.2376 per U.S. dollar, the strongest since September. The dollar buys 80.79 U.S. cents.

Bond prices plunged on expectations the jobs report may prompt the central to raise rates as early as this month. The yield on the two-year government of Canada bond jumped six basis points to 1.77 per cent, close to a seven-year high. The odds of a rate hike at the Bank of Canada's next meeting on Jan. 17 soared to 70 per cent, from 40 per cent yesterday, based on trading in the swaps market.

Export Gain

The good news Friday wasn't just relegated to the jobs market. Statistics Canada reported separately the nation's exporters are beginning to exit from a months long slump, with shipments jumping by 3.7 per cent in November, the biggest one-month gain in more than a year.

While the current jobs data series begins in 1976, the jobless rate may be the lowest since 1974. According to the previous employment data series that ended in 1975, Canada had a jobless rate of 5.6 per cent in November 1974.

Both the employment and jobless rate figures beat the consensus economist forecast for a 6 per cent unemployment rate and 2,000 new jobs. PNC's Adams had the closest prediction to the actual jobs gain, with a 24,000 new job forecast.

The extent of the boom in Canadian jobs this year has largely caught policy makers and economists by surprise, given most have been anticipating an aging workforce to eventually become a drag on employment. Yet it seems the nation's labor market had plenty of pent up supply, and much of it is rising to the surface as the economy continues to do well.

While most of the new jobs in December were part-time, the bulk of new hires in 2017 were full-time. The nation added 394,200 full-time jobs last year, the biggest gain since 1999. The gains last year were led by services with 290,300 new positions. Goods-producers added 132,100 jobs, with an 85,700 increase in manufacturing that was the strongest since 2002.

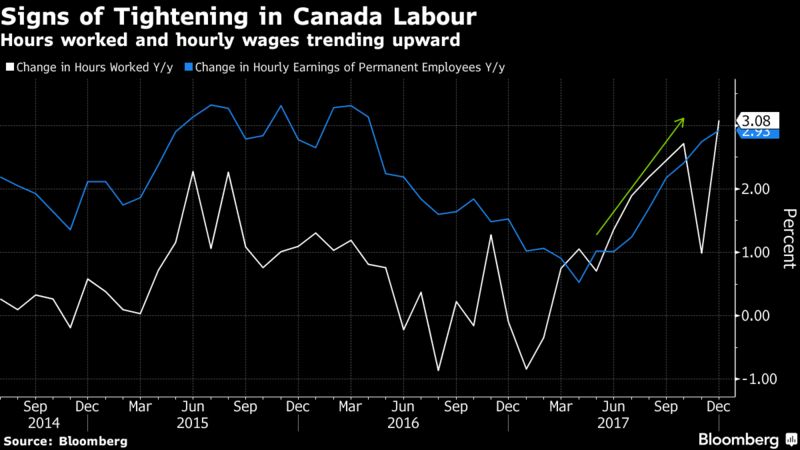

Actual hours worked in December were 3.1 per cent above year-ago figures, the fastest since 2010.

And there are signs that wages – which had been stagnant for much of 2017 – are showing signs of accelerating. Wage gains for permanent employees accelerated to 2.9 per cent, from 2.7 per cent.

"The books closed on a phenomenal year for Canadian employment with another spectacular result for December," Nick Exarhos, an economist at CIBC Capital Markets, said in a note to investors. "In our judgement, that should be enough to see the Bank of Canada hike rates later this month."

–With assistance from Erik Hertzberg

BLOOMBERG. 5 January 2018. Canada's Unemployment Rate Drops to Lowest in Four Decades

By Theophilos Argitis

- Economy adds record number of jobs in final 3 months of year

- Implied odds of a January rate increase jump to 70 percent

The jobless rate fell to 5.7 percent in December, Statistics Canada said Friday in Ottawa, the lowest in the current data series that begins in 1976. The number of jobs rose by 78,600, beating expectations and bringing the full-year employment gain to 422,500. That’s the best annual increase since 2002.

The economy showed unexpected resiliency as the year came to an end, with the figures indicating rapidly diminishing slack in the labor market that may quicken the expected pace of interest-rate increases by the Bank of Canada. Since September, Canada added 193,400 jobs -- the biggest three-month gain since at least 1976.

“The latest data in hand support a rate hike” in January, said Bill Adams, senior international economist at PNC Financial Services Group in Pittsburgh. “Broad-based growth is still the dominant theme.”

Canadian bond yields and the currency soared on the surprisingly strong jobs data. The loonie strengthened to C$1.2376 per U.S. dollar, the strongest since September. The dollar buys 80.79 U.S. cents.

Bond prices plunged on expectations the jobs report may prompt the central to raise rates as early as this month. The yield on the two-year government of Canada bond jumped six basis points to 1.77 percent, close to a seven-year high. The odds of a rate hike at the Bank of Canada’s next meeting on Jan. 17 soared to 70 percent, from 40 percent yesterday, based on trading in the swaps market.

Export Gain

The good news Friday wasn’t just relegated to the jobs market. Statistics Canada reported separately the nation’s exporters are beginning to exit from a months long slump, with shipments jumping by 3.7 percent in November, the biggest one-month gain in more than a year.

While the current jobs data series begins in 1976, the jobless rate may be the lowest since 1974. According to the previous employment data series that ended in 1975, Canada had a jobless rate of 5.6 percent in November 1974.

Both the employment and jobless rate figures beat the consensus economist forecast for a 6 percent unemployment rate and 2,000 new jobs. PNC’s Adams had the closest prediction to the actual jobs gain, with a 24,000 new job forecast.

The extent of the boom in Canadian jobs this year has largely caught policy makers and economists by surprise, given most have been anticipating an aging workforce to eventually become a drag on employment. Yet it seems the nation’s labor market had plenty of pent up supply, and much of it is rising to the surface as the economy continues to do well.

While most of the new jobs in December were part-time, the bulk of new hires in 2017 were full-time. The nation added 394,200 full-time jobs last year, the biggest gain since 1999. The gains last year were led by services with 290,300 new positions. Goods-producers added 132,100 jobs, with an 85,700 increase in manufacturing that was the strongest since 2002.

Actual hours worked in December were 3.1 percent above year-ago figures, the fastest since 2010.

And there are signs that wages -- which had been stagnant for much of 2017 -- are showing signs of accelerating. Wage gains for permanent employees accelerated to 2.9 percent, from 2.7 percent.

“The books closed on a phenomenal year for Canadian employment with another spectacular result for December,” Nick Exarhos, an economist at CIBC Capital Markets, said in a note to investors. “In our judgement, that should be enough to see the Bank of Canada hike rates later this month.”

— With assistance by Erik Hertzberg

INTERNATIONAL TRADE

StatCan. 2018-01-05. Canadian international merchandise trade, November 2017

- Imports: $48.7 billion, November 2017, 5.8% increase (monthly change)

- Exports: $46.2 billion, November 2017, 3.7% increase (monthly change)

- Trade balance: -$2.5 billion, November 2017

- Source(s): CANSIM table 228-0069: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2280069&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canada's merchandise trade deficit with the world totalled $2.5 billion in November, widening from a $1.6 billion deficit in October. Imports were up 5.8% and exports rose 3.7%, both due largely to increased activity in the automotive industry.

Chart 1: Merchandise exports and imports

Widespread increases in imports

Total imports rose 5.8% to $48.7 billion in November, the strongest increase since July 2009. Increases were observed in 10 of 11 sections. Volumes rose 5.0% and prices were up 0.7%. Imports of electronic and electrical equipment and parts, motor vehicles and parts, as well as aircraft and other transportation equipment and parts contributed the most to the growth in November. Year over year, total imports were up 8.1%.

Imports of electronic and electrical equipment and parts rose 10.9% to $5.8 billion in November, driven by increases in all commodity groups. Communications and audio and video equipment, mainly cell phones, posted a 21.6% gain to a record high $2.1 billion. The introduction of new cell phone models, which is atypical for this time of year, was behind the growth observed in November.

Also contributing to the increase were imports of motor vehicles and parts, which rose 5.4% to $9.2 billion. After two consecutive monthly decreases, imports of motor vehicle engines and motor vehicle parts were up 15.7% in November, returning to August levels. Activity in the automotive industry rebounded in November following the planned shutdowns and work stoppages that occurred in September and October.

Imports of aircraft and other transportation equipment and parts also rose in November, up 18.7% to $2.2 billion. Higher imports of ships from South Korea and China were responsible for the increase.

Higher exports driven by passenger cars and light trucks

Total exports rose 3.7% to $46.2 billion in November, with increases observed in 8 of 11 sections. Higher exports of motor vehicles and parts and consumer goods contributed the most to the growth. Overall, prices were up 3.2%, while volumes increased 0.6%. However, excluding exports of motor vehicles and parts, export volumes were down 1.4%.

The export value of motor vehicles and parts increased 14.6% to $7.7 billion in November. Following a decrease of $1.7 billion over four months, exports of passenger cars and light trucks rebounded 21.2% to $5.3 billion in November. As with imports of motor vehicle engines and motor vehicle parts, increased activity in the automotive industry led to a rise in exports. For the section as a whole, volumes rose 13.4%.

Exports of consumer goods also contributed to the growth in November, rising 7.4% to $6.0 billion. Pharmaceutical and medicinal products (+23.7%) posted the strongest increase, due mainly to increased exports to Italy.

Increase in trade with the United States

Imports from the United States rose 6.5% to $31.9 billion in November. Exports to the United States were up 5.4% to $35.2 billion, led by passenger cars and light trucks. As a result, Canada's trade surplus with the United States decreased from $3.5 billion in October to $3.3 billion in November. Comparing November's average exchange rate to October's, the Canadian dollar lost one US cent relative to the American dollar.

Imports from countries other than the United States increased 4.4% to $16.9 billion in November, mainly on higher imports from China (cell phones), Japan (passenger cars and light trucks) and Saudi Arabia (crude oil).

Exports to countries other than the United States fell 1.4% to $11.0 billion, due to lower exports to the United Kingdom (unwrought gold), South Korea (copper ores) and Mexico (canola). These declines were partially offset by higher exports to China (wood pulp).

As a result, Canada's trade deficit with countries other than the United States widened from $5.0 billion in October to $5.9 billion in November.

Sharp increase in real imports

In real (or volume) terms, imports rose 5.0% in November, following a 3.8% decline in October. Real exports were up 0.6%, due mainly to an increase observed in motor vehicles and parts.

Chart 2: International merchandise trade balance

Revisions to October exports and imports

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, as well as amendments made for late documentation of high-value transactions. Exports in October, originally reported as $44.5 billion in last month's release, were essentially unchanged in the current month's release. October imports, originally reported as $45.9 billion in last month's release, were revised to $46.1 billion.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180105/dq180105b-eng.pdf

REUTERS. JANUARY 5, 2018. Canadian oil exports to U.S. dip in November: StatsCan data

CALGARY, Alberta (Reuters) - Canadian exports of crude oil fell 2.4 percent month-on-month in November to 3.28 million barrels per day, Statistics Canada data said on Friday, after a decline in shipments to the United States.

The 80,000 bpd drop in exports to Canada’s biggest customer came in the same month TransCanada Corp’s Keystone pipeline, which carries crude from Alberta’s oil sands to U.S. refineries, was shut down following a leak in rural South Dakota.

Keystone restarted in late November but the 590,000 bpd pipeline is still running with a 20 percent cut in pressure on the orders of U.S. regulators.

Canada exported 3.26 million bpd to the United States in November, down from 3.34 million bpd in October. It also shipped 22,500 bpd to the United Kingdom, the data showed.

The country’s crude oil imports from the United States rose 127,000 bpd to 413,000 bpd, while total imports climbed 51,000 bpd to 635,000 bpd.

Canada also imported crude oil from Saudi Arabia, Nigeria and Norway in November.

Refineries in eastern Canada often import crude from overseas because it is easier to ship barrels by tanker to the Atlantic coast than move them on congested export pipelines and railroads from western Canadian oilfields.

Reporting by Nia Williams; Editing by Andrew Hay

BLOOMBERG. 5 January 2018. Canada's Trade Deficit Unexpectedly Widens on Auto Sector Bounce

By Theophilos Argitis

Canada’s trade deficit unexpectedly widened in November, as a restart of some auto production fueled imports. The higher deficit masked a gain in exports.

Imports surged 5.8 percent in November, the biggest increase since July 2009. The increase in shipments widened the deficit to C$2.5 billion from C$1.6 billion a month earlier, Statistics Canada said Friday.

While widening trade deficits can act as a drag on growth and be perceived as a vulnerability, rising imports may also reflect robust domestic demand. A rise in exports meanwhile -- up 3.7 percent in November -- also suggests Canada is beginning to break out of a slump in shipments to the rest of the world.

The increase in imports in November was led by a 5.4 percent jump in auto-related imports. Imports of motor vehicle engines and parts rebounded following planned shutdowns and work stoppages.

The 3.7 percent gain was the biggest monthly export gain since November 2016, and followed a 2.3 percent gain in October.

Exports in recent months had suffered one of their biggest tumbles ever, fueling concern the nation’s currency accelerated too quickly earlier this year. A recent drop in the Canadian dollar though may be providing some relief.

In volume terms, adjusting for price changes, imports rose 5 percent in November. Export volumes were up 0.6 percent

— With assistance by Erik Hertzberg

CANADA - PACIFIC ALLIANCE

TCS. 05/JANUARY/2017. Canada deepens ties with Pacific Alliance

By Karen McNaught

As one of the first countries invited to become an Associated State of the Pacific Alliance, Canada is gearing up for talks in Australia in January 2018 to negotiate a free trade agreement with Alliance members as a bloc.

The Pacific Alliance is a regional integration initiative created in 2011 by Chile, Colombia, Mexico and Peru. The Alliance’s overarching goals are to foster the free movement of goods, services, capital and people and to promote greater competitiveness and economic growth for member countries. In June 2017, Canada was among the first countries invited to become an Associated State of the Pacific Alliance, along with Australia, New Zealand and Singapore.

This process requires the negotiation of a free trade agreement with the Pacific Alliance as a bloc. With a combined GDP of almost $2.3 trillion, and more than 220 million inhabitants, the Pacific Alliance constitutes an important market for Canada.

Canada currently has one-on-one free trade agreements (FTAs) in place with each of the Pacific Alliance member countries: Chile, Colombia, Mexico and Peru. In August 2017, Canada launched public consultations to get input on the possible negotiation of an FTA with the Pacific Alliance as a bloc. Formal negotiations were subsequently initiated in Cali, Colombia, in October 2017.

Developing closer ties with the Pacific Alliance in general, is a move welcomed by members of the Canadian business community, and the launch of talks to become an Associated State is viewed as an important milestone by many.

Data: Trade Data Online

Source: Office of the Chief Economist, Global Affairs Canada

Merchandise trade between Canada and the Pacific Alliance

| Merchandise trade between Canada and the Pacific Alliance | (Millions $) |

|---|---|

| Canadian Exports in 2007 | $6,716 |

| Canadian Imports in 2007 | $21,467 |

| Total Trade in 2007 | $28,183 |

| Canadian Exports in 2008 | $7,657 |

| Canadian Imports in 2008 | $22,804 |

| Total Trade in 2008 | $30,462 |

| Canadian Exports in 2009 | $6,466 |

| Canadian Imports in 2009 | $21,876 |

| Total Trade in 2009 | $28,343 |

| Canadian Exports in 2010 | $6,714 |

| Canadian Imports in 2010 | $28,320 |

| Total Trade in 2010 | $35,034 |

| Canadian Exports in 2011 | $7,582 |

| Canadian Imports in 2011 | $31,685 |

| Total Trade in 2011 | $39,267 |

| Canadian Exports in 2012 | $7,540 |

| Canadian Imports in 2012 | $31,549 |

| Total Trade in 2012 | $39,090 |

| Canadian Exports in 2013 | $7,552 |

| Canadian Imports in 2013 | $32,252 |

| Total Trade in 2013 | $39,804 |

| Canadian Exports in 2014 | $8,520 |

| Canadian Imports in 2014 | $34,476 |

| Total Trade in 2014 | $42,996 |

| Canadian Exports in 2015 | $9,080 |

| Canadian Imports in 2015 | $37,141 |

| Total Trade in 2015 | $46,221 |

| Canadian Exports in 2016 | $9,905 |

| Canadian Imports in 2016 | $38,114 |

| Total Trade in 2016 | $48,019 |

“We are very interested in Canada’s potential for joining the Pacific Alliance as we see the member countries as part of our strongest emerging markets, specifically in South America” says Todd Burns, president of the Winnipeg, Man.-based Cypher Environmental Ltd. “With Mexico, Chile, Colombia and Peru all having strong mining industries and the need for significant infrastructure development, they fall into a category we hope to capitalize on for the future growth of Cypher.”

Nacho Deschamps, group head of international banking and digital transformation for Scotiabank, agrees: "The Pacific Alliance countries are a major contributor to international banking earnings, which represent 28 percent of the bank's total earnings in 2016.” Mexico, Peru, Chile and Colombia are “key engines” of the bank's growth, serving more than 11 million customers through more than 1,300 branches, Deschamps says.

“These markets have stable and well-capitalized banking systems, strong regulatory environments, credible central banks and strong balance sheets,” notes Deschamps. “The portfolio we have today in these countries has been built over45 years with positive results and we will focus on growing in these markets."

With FTAs in place with each of the Pacific Alliance countries, Canada has established an important presence in these countries. For example, Pacific Alliance member nations accounted for $49.6 billion of Canadian direct investment abroad (CDIA) in 2016, 19 percent of the total CDIA in Latin American countries. Canada’s total merchandise trade with Pacific Alliance countries reached $48 billion in 2016, representing 75 percent of Canada’s two-way trade with the region.

"As the investment figures indicate, the Pacific Alliance countries are critically important to Canadians doing business and investing in Latin America,” says Kenneth Frankel, president of the Canadian Council for the Americas. “We believe these numbers are going to increase further. We also think that the Pacific Alliance countries are an important geopolitical partner for Canada. The importance of the Pacific Alliance will continue to grow as other countries, particularly Argentina and Brazil, look to deepen their relationship with the Pacific Alliance."

The Pacific Alliance member nations are some of Canada’s largest and most “like-minded” trade partners in Latin America and the Caribbean, say members of the Canadian Trade Commissioner Service (TCS).

“With increased economic integration underway among the four dynamic markets of the Pacific Alliance coupled with the launch of Canada-Pacific Alliance FTA negotiations, now is the time to explore new trade and investment opportunities in these four countries,” says Brenda Wills, a trade commissioner in Bogota, Colombia. “The Trade Commissioner Service can help you make valuable in-market connections to help expand your business.”

Canada has been actively deepening its engagement with the Alliance since becoming an observer country in 2012. In 2016, Canada signed the Canada-Pacific Alliance Joint Declaration on Partnership. This was followed by the implementation of four cooperation projects worth more than $23 million over the five-year period from 2016-2021. The projects aim to support education and training, trade promotion for Pacific Alliance small and medium-sized enterprises, and action on climate-related issues.

Doing business in the Pacific Alliance:

- Business Opportunities in Peru and Chile: http://tradecommissioner.gc.ca/webinars-webinaires/0000430.aspx?lang=eng

- Business Opportunities in Mexico and Colombia: http://tradecommissioner.gc.ca/webinars-webinaires/0000428.aspx?lang=eng

ENERGY

REUTERS. JANUARY 4, 2018. Oil retreats after hitting 2015 highs

Henning Gloystein, Dmitry Zhdannikov

SINGAPORE/LONDON (Reuters) - Oil prices fell on Friday, dropping from highs last seen in 2015, as soaring U.S. production undermined a 10 percent rally from December lows that were driven by tightening supply and political tensions in OPEC member Iran.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $61.40 a barrel by 1140 GMT. That was 61 cents, or 1 percent, below their last close. WTI hit $62.21 the previous day, which was its strongest since May, 2015.

Brent crude futures LCOc1 lost 50 cents, or 0.7 percent, to $67.57. The previous day it touched $68.27, also the highest since May 2015.

Traders said political tensions in Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC), had pushed prices higher.

“The protests in Iran add more fuel to the already bullish oil market mood,” said Norbert Ruecker, head of commodity research at Swiss bank Julius Baer.

Oil prices have received general support from production cuts led by OPEC and Russia, which started in January last year and are set to last through 2018, as well as from strong economic growth and financial markets. [MKTS/GLOB]

That has helped to tighten markets. U.S. commercial crude inventories C-STK-T-EIA fell by 7.4 million barrels in the week to Dec. 29, to 424.46 million barrels, according to data from the Energy Information Administration (EIA).

That is down 20 percent from peaks last March and close to the five-year average of 420 million barrels.

CAN THE BULL RUN LAST?

Yet given Iran’s oil production has not been affected by the unrest and that U.S. output C-OUT-T-EIA is soon likely to break through 10 million barrels per day (bpd), a level so far reached only by Saudi Arabia and Russia, doubts are emerging whether the bull run can last.

Bank Jefferies said the oil price “upside from here is not obvious to us” but added that it expects the oil market to remain undersupplied through 2018.

Julius Baer’s Ruecker said that crude prices above $60 project an “overly rosy picture”.

“Oil production disruptions (in Iran) remain a very distant threat ... disruptions in the North Sea have been removed ... (and) U.S. oil production surpassed the 2015 highs in October and is set to climb to historic highs this year,” he said.

Lukman Otunuga, analyst at futures brokerage FXTM, struck a similarly cautious tone, saying: “While the current momentum suggests that further upside is on the cards, it must be kept in mind that U.S. shale remains a threat to higher oil prices.”

To view a graphic on U.S. oil production, storage levels, click: reut.rs/2CqcWaC

Reporting by Henning Gloystein and Dmitry Zhdannikov; Editing by Christian Schmollinger and David Goodman

________________

LGCJ.: