CANADA ECONOMICS

AVIATION

BLOOMBERG. 11 December 2017. Canada Plans Jet Announcement as Boeing Loses Sale

By Josh Wingrove and Greg Quinn

- Press conference Tuesday also includes Canada’s top solider

- Government weighs buying used Australian planes as stopgap

F/A-18F Super Hornet fighter jets, manufactured by Boeing Co. Photographer: Carla Gottgens/Bloomberg

The Canadian government is set to announce a stopgap measure to replace its aging fleet of fighter jets after abandoning plans to buy planes from Boeing Co. because of a trade dispute.

Four of Prime Minister Justin Trudeau’s cabinet ministers are due to appear at a press conference in Ottawa on Tuesday, along with Canada’s top soldier. The government didn’t specify the reason, but two government officials, speaking on condition they not be identified, said it was related to the fighter jet replacement program, which is Canada’s most pressing military procurement file. Canada is working to buy interim fighters as it prepares to launch a full bidding process for a replacement fleet.

The prime minister ruled out buying F-18 Super Hornets from Boeing in September due to the U.S. company’s trade challenge against Bombardier Inc. over commercial aircraft, and began talks with Australia on buying used F/A-18s. Canada had earlier planned to buy 18 new Super Hornets as a stopgap, at an estimated cost of $5.23 billion.

Boeing said in a statement Friday it respects the Canadian government’s decision, and didn’t give any indication it would drop its challenge of Bombardier, even if it means losing the Super Hornet sale. “We will continue to support all efforts to build an environment of free and fair competition marked by compliance with agreed upon rules,” the company said.

‘On Track’

Trudeau’s procurement minister, Carla Qualtrough, said in a television interview last month the government was considering the used Australian jets as a stopgap measure and expected to launch its competition for a full fleet replacement in early 2019. That competition may include Lockheed Martin Corp.’s F-35, she said, though Trudeau campaigned in 2015 on not buying that jet.

“That’s still the target and we’re on line, we’re definitely on track to do that,” Qualtrough told CTV in November, adding Canada is still looking for an interim way to “replenish our fleet until the full fleet replacement is in place.” Defense Minister Harjit Sajjan said in February he “will not be buying used aircraft for our air force,” a pledge that would be jettisoned by an acquisition of Australian planes.

Trudeau’s political opposition has criticized the purchase of used jets, with Conservative lawmaker Tony Clement urging against the “ill-advised purchase of a bucket of bolts.”

NAFTA

BLOOMBERG. 12 December 2017. Trump May Actually Be Right About the Trade Deficit With Canada

By Theophilos Argitis , Erik Hertzberg , and Josh Wingrove

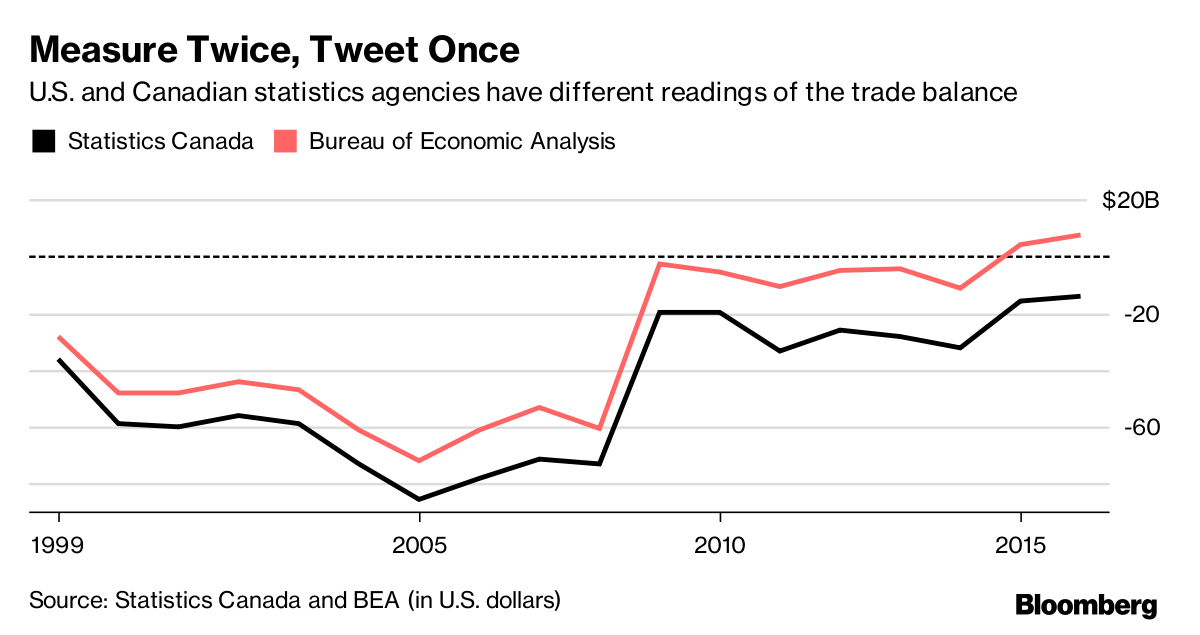

- U.S., Canadian data differ by $22.3 billion on overall balance

- Each country claims the other is running a trade surplus

Caroline Freund, Peterson Institute senior fellow, discusses the U.S. trade deficit and Nafta negotiations.

Does the U.S. run a trade deficit or surplus with Canada? It depends where you look.

President Donald Trump asserted -- again -- Friday the U.S. runs “a pretty good trade deficit” with Canada. The claim was quickly rebuffed by Canada’s ambassador to the U.S., David MacNaughton, who cited American data saying the opposite was true.

Canadian officials tend to use U.S. data to make their case and the Bureau of Economic Analysis has calculated the U.S. had a $7.7 billion surplus in 2016. But Statistics Canada data show it’s Canada with the surplus in goods and services, totaling C$18.8 billion ($14.6 billion) last year. That’s a $22.3 billion difference between the two measures.

The debate isn’t just academic. The two countries, along with Mexico, are renegotiating the North American Free Trade Agreement, which Trump says needs to be corrected for trade imbalances. A mini-round of talks is happening this week in Washington, but with Canadian and U.S. statistics showing opposite pictures of the status quo any remedy remains unclear.

MacNaughton zeroed in on the issue last week when he took to Twitter in response to Trump. The ambassador also noted a $36 billion U.S. surplus in manufacturing in a Bloomberg TV interview Thursday, again citing American data. “If what the U.S. is interested in is trade balances, I’d really like to see some proposals come as to how to right the trade balance between Canada and the United States, which is in your favor.”

Goods and Services

To be sure, it’s not clear what the bottom line would look like if the two measures were harmonized, or which methodology better reflects the true state of trade between the two countries.

For example, it could be argued Canada’s statistics agency is overstating exports. Canadian businesses often import goods from third countries such as China only to re-export those goods to the American market. Statistics Canada records that as a Canadian export; the U.S. data would record that as an import from China, not Canada.

In other instances however, the U.S. data may be failing to capture some Canada exports, particularly services that are much more difficult to measure than goods. The Statistics Canada data show a much larger number -- in the order of $15 billion a year -- in Canadian service exports to the U.S. than is captured by the American numbers. While statisticians aren’t sure exactly why, one explanation may be that U.S. firms with operations in Canada aren’t reporting their foreign costs as service imports.

Trump’s Numbers

Since it’s the Trump administration crying foul, Canadian officials say it’s only fair to use the U.S. government’s own assessment of trade imbalances.

“Canada does not see trade balances as a useful measure of the benefits of trade, but since the U.S. does, we’re using their own data that clearly states the United States has a trade surplus with Canada,” Adam Austen, a spokesman for Foreign Affairs Minister Chrystia Freeland, said in an emailed statement.

Or maybe what the discrepancy between the two national measures is showing is neither side is right. If commercial flows can swing between surplus and deficit depending on how it’s measured, that could be a rough indication the trade relationship between the two countries has become balanced, more or less. Whichever data is used, the deficit (or surplus) is still relatively small compared to total trade between the two countries -- between 1 and 2 percent.

And that’s a big change from the past when the trade balance was clearly in Canada’s favor, no matter which methodology was used. The C$18.8 billion surplus estimated by Statistics Canada for 2016 is the smallest since 1994, the year Nafta came into effect. Since then, Canada’s cumulative surpluses have totaled C$1.2 trillion, the Statistics Canada figures show.

BLOOMBERG. 11 December 2017. Mexico to Discuss Security With U.S. in Parallel to Nafta

By Eric Martin

- Nation’s foreign, interior ministers said to visit Washington

- Top diplomat said bad trade outcome could hurt other efforts

Mexico’s top diplomatic and interior officials will visit Washington this week to discuss security cooperation with their U.S. counterparts at the same time that negotiators work to overhaul Nafta, according to four people familiar with the plans.

The visit by Mexican Foreign Relations Minister Luis Videgaray and Interior Minister Miguel Angel Osorio Chong to meet with Secretary of State Rex Tillerson and Homeland Security Secretary Kirstjen Nielsen on Thursday is a follow-up to meetings in May, according to the people, who asked not to be named before the agenda is made public. It’s aimed at coming up with strategies to combat transnational criminal organizations, the people said. The press office of the Mexican Foreign Ministry and the U.S. State Department declined to immediately comment.

The meetings coincide with a sitdown by negotiators from the U.S., Mexico and Canada to update the North American Free Trade Agreement at the demand of U.S. President Donald Trump, who says the deal is responsible for hundreds of thousands of lost manufacturing jobs in the U.S. In an interview last month, Videgaray said that if the Nafta renegotiation encounters trouble, it could impact other areas of cooperation with the U.S. such as security and immigration. Mexico this year has seen homicides surge to the highest levels of this century, surpassing the previous record levels of the drug war from 2010 to 2012.

“It’s good for Mexico that we cooperate with the U.S. on security and also on migration and many other issues,” Videgaray said in the interview in Vietnam on Nov. 11. “But it’s a fact of life and there is a political reality that a bad outcome on Nafta will have some impact on that,” he said. “We don’t want that to happen, and we’re working hard to get to a good outcome.”

Videgaray told reporters last month that Mexico is prepared for the end of Nafta if it can’t reach a deal with the U.S. and Canada that benefits the nation. The three countries in August began talks to rework the pact after Trump pledged during the 2016 campaign to overhaul or end it.

This Week’s Talks

The latest meetings to revamp Nafta, taking place at the Mayflower Hotel, will run through Friday, largely out of the spotlight. Cabinet-level officials aren’t scheduled to attend for the second time since negotiations began, and the Trump administration is preoccupied with efforts to push through tax cuts by year-end and avoid a government shutdown. Videgaray’s portfolio includes the broad bilateral relationship with the U.S., while a team led by Economy Minister Ildefonso Guajardo has been focused on the commercial details of the Nafta negotiation.

Among the issues up for consideration, Nafta negotiators this week will spend the most time discussing topics including rules of origin, which govern content requirements for goods to qualify for duty-free benefits. They’ll also hold sessions on digital trade and state-owned enterprises, among other subjects, according to an agenda of the talks. Thorny issues like agriculture and dispute settlement don’t appear on the schedule.

— With assistance by Nick Wadhams

HOUSING

The Globe and Mail. 12 Dec 2017. Statscan is set to release foreign ownership numbers for Toronto and Vancouver next week. Statscan to release foreign-ownership data. CMHC, policy makers disagree on the impact investment from outside Canada has on housing markets in major cities

Fresh data on foreign investment in Toronto and Vancouver, Canada’s largest cities, will be released next week in a move economists say could shed light on what is driving demand – and a potential bubble – in the country’s housing market.

While the Canada Mortgage and Housing Corp. has said foreign investment accounts for only about 10 per cent of sales activity, policy makers and voters alike have seized on the issue as a driving force behind precarious markets in both cities.

Statistics Canada’s $39.9-million, five-year project to better measure the market – using land registries and tax records, among other data – will kick off on Dec. 19 with the foreigninvestment data for Toronto and Vancouver, which together account for about 50 per cent of home sales by value.

“It’s a good thing that this is coming, but it would have been better to have it years ago. Government policy has been reactive, whether they had evidence or not to base a reaction on,” said David Madani, senior economist with Capital Economics.

The most obvious example of policy made without proof of a need for it is the 15-per-cent foreign-buyers tax, levied in Toronto and Vancouver in 2017 and 2016, respectively, by provincial governments under pressure to do something about soaring housing prices.

While the tax initially dampened sales in both Toronto and Vancouver, demand has came trickling back, confirming the conviction of those who said foreign buyers were never behind the housing boom.

“We assume it is foreign ownership … increasing the price of housing, but is it true? The big questions are still there, we don’t know and until we get proper data, we are not quite sure,” said Anik Lacroix, an assistant director at Statistics Canada who is leading the project.

While the unknowns of foreign buyers is the highest-profile gap in the data, Ms. Lacroix hopes to tackle many others, including where buyers get their down payments, how many homes are vacant, how much demand comes from investors and speculators and how much prices have actually been rising.

With much of the current data coming from the real estate industry, official figures will help government and regulators better manage the market.

Ben Williams, director of housing indicators and analytics at the CMHC said there is no silver bullet that will answer all the questions on housing, but they are braced for high expectations as the new data starts rolling out.

THE GLOBE AND MAIL. DECEMBER 12, 2017. PERSONAL FINANCE. Shut out of the housing market, Gen Y is killing it on debt reduction

ROB CARRICK, Columnist

Not owning a house can do wonders for your personal finances.

Over the past two decades, the only segment of the population with any momentum in becoming debt-free is the young adult under age 35. Prohibitively expensive housing is a big part of the story. No house = less debt.

Insolvency and debt expert Scott Terrio says houses draw you into debt through mortgages and the cost of upkeep, maintenance and improvements. If you stay on top of your debts, your bank will probably invite you to borrow more money.

"Houses do two things to you – they nail you on expenses you didn't think about and they make you more creditworthy," said Mr. Terrio, an estate administrator at Cooper & Co. Ltd. "Banks are quite happy to say, here's two credit cards and a line of credit."

While there has been a lot of talk about the high level of household borrowing in Canada, many people are debt-free. Just under 30 per cent of all families had no debt last year, compared with 28.9 per cent in 2012, 30.6 per cent in 2005 and 32.7 per cent in 1999. Beneath these numbers from Statistics Canada are some surprisingly different stories of how various generations are handling debt.

The number of debt-free families led by someone 55 and older has fallen sharply since 1999, while families led by someone 35 and younger have shown the most improvement.

More debt freedom for Generation Y is notable when you look at some of the economic challenges this group faces. It's not just expensive houses in many cities. Tuition fees are rising faster than inflation, and the average student who borrows to cover costs owes $28,000 at graduation, according to the Canadian Federation of Students. From there, young adults move into an unwelcoming job market where full-time, career-building jobs can be scarce.

The rise of debt freedom for millennials is connected to unaffordable housing markets, and also to moving back home after graduation from college or university. Once considered a "failure to launch," young adults living at home with their parents can now be viewed as making a sensible compromise for their greater financial good. Even if they're paying modest rent, young adults living at home should be able to attack their debts with maximum force.

According to Mr. Terrio, another advantage for young adults is their willingness to use the internet to get their financial questions answered. "Millennials tend to be pretty financially literate," he said. "These people were born and raised on computer and for them, Google is something they do all the time, all day every day."

If you're researching personal finance online, there's no way to miss the importance of paying down debt. Mr. Terrio said young adults are best positioned for success in eliminating debt because they don't tend to have as many obligations as older people. "They're not sending kids to daycare, they're not paying for their kid's hockey, they're not carrying a HELOC [home equity line of credit] or a mortgage. If you've got $20,000 in debt and no expenses, you can pay it off in no time."

The under-35 cohort is also the only one where the percentage of debt-free families was higher last year (23.4 per cent) than in 1999 (20.4 per cent). The most shocking decline in debt-free households was in the 65 and older crowd. Back in 1999, 72.6 per cent of families in this group were debt-free; last year, 58 per cent earned this distinction.

Mr. Terrio does presentations for seniors groups from time to time and says he gets bombarded with questions from people in the audience. His theory on why debt is such an issue in this demographic is the growing need to help family members financially. "If you're a senior, you could be funding as many as four generations right now – yourself, your kids, your grandkids and you might even be funding elderly parents in care."

Statscan singled out mortgages as a contributor to debt among seniors. Just under 14 per cent of families led by someone 65 and older had a mortgage in 2016, compared with 7.7 per cent in 1999.

The demographic with the debt-free population most in decline since 1999 are families in the 55 to 64 range. Again, houses play a role. This is exactly the age at which parents would be helping their adult children buy a home.

MINING

The Globe and Mail. REUTERS. 12 Dec 2017. Canadian miners in good position to benefit from EV battery financing. Cobalt and lithium producers could get help in developing deposits of critical ingredients. Electric-vehicle batteries are manufactured at a factory in China in September.

NICOLE MORDANT, VANCOUVER

A string of potential financing deals in Canada comes after a handful of predominantly lithium miners in Australia – the world’s biggest lithium producer – secured investment from mainly Chinese auto makers and battery makers this year looking to lock in future raw-material supply.

Canadian developers of cobalt and lithium mines stand to benefit from a round of investments from the makers of electric vehicles and the batteries powering them, a potential game-changer for small miners short on money to develop deposits of these critical battery ingredients.

Toronto-listed cobalt companies, eCobalt Solutions Inc. and Fortune Minerals Ltd., are in talks, ranging from preliminary to more advanced, with more than a dozen groups, including car and battery makers, on financing their projects, their chief executives told Reuters.

The interest in miners from downstream players along the battery supply chain – a new area of investment for most – would provide a lifeline to miners at time when equity funding for developers remains relatively tight after a five-year downturn on weak metals prices.

“We anticipate additional transactions in the coming months and years. It is a function of demand-supply imbalance,” said John Kanellitsas, president and vice-chairman of Lithium Americas Corp., which raised nearly $300-million (U.S.) this year for a project in Argentina.

A string of potential financing deals in Canada comes after a handful of predominantly lithium miners in Australia – the world’s biggest lithium producer – secured investment from mainly Chinese auto makers and battery makers this year looking to lock in future raw-material supply.

Lithium mine developers have been able to secure funding earlier than their cobalt peers as fears of a supply shortage started in late 2015, when cobalt was still in surplus.

Like lithium, cobalt’s price has doubled – but most of that upswing has come this year on concerns of multiyear shortfalls in the next decade as demand from the electric-vehicle sector surges.

Cobalt’s fortunes are more closely tied to batteries than lithium’s: About 55 per cent of all cobalt goes into battery chemicals, compared with about 40 per cent for lithium, according to a Dec. 4 BMO Nesbitt Burns Inc. report.

Although there are no guarantees that deals will be struck, the cobalt miners, who have been advancing their projects for more than a decade, are in their strongest position yet to secure funding, Cormark Securities analyst MacMurray Whale said.

That is because of deficit forecasts due to constrained supply and expected soaring demand from the electric vehicle market. “All those elements together suggest to me that it can’t be better,” Mr. Whale said.

With more than 1,200 publicly listed mining companies, Canada has long been the global hub for mine developers with projects around the world.

Vancouver-based eCobalt’s “path forward” is to first sign a long-term supply agreement, called an offtake, with one or more customers to provide a portion of the funds it needs to develop its Idaho cobalt project, chief executive officer Paul Farquharson said in an e-mail.

Once in place, this would significantly lower the risk for the project, making it more attractive for banks to provide debt financing and other investors to fund the balance.

ECobalt outlined plans on Dec. 7 to produce for offtake a cobalt concentrate, a less-processed cobalt product than initially planned – a step that could slash as much as $100-million, according to analysts, off its previous project capital cost estimate of $187-million.

ECobalt is the most likely of the Canadian cobalt developers to secure financing, possibly within six months, Eight Capital analyst David Talbot said.

Canada’s Nemaska Lithium Inc. and Mason Graphite Inc., which both have projects in Quebec, could also secure funding in coming months, Mr. Talbot said.

Graphite is another battery ingredient, but unlike cobalt and lithium, batteries are not graphite’s main end use.

ECobalt’s Idaho project has unique advantages over other projects, including that about 75 per cent of its revenue will come from cobalt and that it is located in a safe political jurisdiction, Mr. Talbot said.

Almost all cobalt is produced as a by-product from copper and nickel mines, meaning output increases are dependent on other markets.

More than half of the world’s cobalt comes from Democratic Republic of the Congo, a country racked by political instability and legal opacity, and where child labour is used in mines – a worry for auto makers looking to secure ethically sourced battery raw materials.

Fortune expects to secure finance in 2018 once it releases a feasibility study on an expanded project, CEO Robin Goad said.

“Our biggest advantage is to be able to market our project as a Canadian source of supply,” Mr. Goad said.

The Globe and Mail. 12 Dec 2017. Be careful plugging into the lithium rally. Increasing supply is likely to put a lid on future gains, one consultant says

IAN McGUGAN, ANALYSIS

Lithium, a lightweight metal essential to the latest generation of high-tech batteries, possesses two features most investments lack.

For one thing, future demand is nearly certain to surge as battery-driven vehicles grab an increasing share of the automotive market. For another, a handful of companies now dominate production of lithium.

Combine growing demand with today’s oligopoly of producers and it’s clear why three major U.S.-listed lithium miners have been among the best nonbitcoin investments of 2017. Shares of Sociedad Quimica Y Minera de Chile, the Chilean giant better known as SQM, have surged 80 per cent since January. Over the same period, Albemarle Corp., up 45 per cent, and FMC Corp., up 53 per cent, have also enjoyed dazzling runs.

Are there more profits to come? It seems likely, although investors probably won’t see a repeat of this year’s gains any time soon.

The biggest reason for optimism is the increasingly positive outlook for electric vehicles. “We have a much more bullish demand outlook” for lithium than a few months ago, says Alex Laugharne, a principal consultant for metals watcher CRU. He points to China’s growing push to put more electric cars and trucks on its roads as the primary reason for his optimism.

However, Mr. Laugharne cautions that increasing supply is likely to put a lid on future gains in lithium prices. The metal is found in abundant quantities, most notably in the lithium triangle that sprawls across Chile, Argentina and Bolivia. As smaller players, such as Toronto-listed Orocobre Ltd. and Nemaska Lithium Inc., rush to bring projects on stream and bigger companies move to expand production, surging output will bring the market back into balance within a couple of years.

Lithium carbonate typically fetched around $11,500 (U.S.) a tonne this year, nearly double the prevailing price two years ago. Prices may increase slightly next year, Mr. Laugharne says, but will probably fade back to $9,000 to $10,000 a tonne in 2019.

A similar viewpoint comes from Joel Jackson, an analyst at Bank of Montreal. “We see lithium carbonate prices up a little in 2018 before falling in 20192021 and stabilizing” around $10,000 a tonne, he said in a recent report. If prices do stabilize around $10,000 a tonne, existing producers should continue to enjoy strong profit margins, according to Mr. Jackson.

Still, investors would be wise to choose their stocks carefully. Most of the biggest producers are diversified companies with interests that extend well beyond lithium. Each poses its own set of risks.

SQM, for instance, is engaged in a battle with Corfo, the Chilean government economic development agency. The official body has alleged that SQM, the world’s second-largest lithium producer, failed to live up to its contractual obligations. Arbitration efforts have fizzled so far and SQM warned in November that it does not expect a resolution until the end of 2018.

The outcome of the dispute is key to SQM’s future because Chile has declared lithium to be a strategic material and imposes tight quotas on production of the metal. History stands in the way of any easy settlement between the company and the government: SQM was privatized in the 1980s by the government of the country’s ex-dictator, Augusto Pinochet, and is still controlled by Julio Ponce Lerou, Mr. Pinochet’s former son-in-law. Corfo has declared that Mr. Ponce must give up control of the company before SQM can negotiate any expanded quota for lithium output.

On top of all that, one of SQM’s major shareholders, Potash Corp. of Saskatchewan Ltd., has put its 32-per-cent stake up for sale as part of the conditions imposed by India for approving Potash Corp.’s merger with rival Agrium Inc. The stake is expected to fetch $5-billion or more.

In short, investors in SQM are buying into a tangle of political issues as well as an uncertain ownership picture. They also have to factor in the outlook for SQM’s other businesses, which include fertilizers and industrial chemicals. Lithium produces only about 27 per cent of the company’s sales.

Albermarle, the world’s largest miner of lithium, is a much simpler proposition but has its own question marks, related to its rapid growth plans. The company, based in Charlotte, N.C., makes a range of specialty chemicals. For now, Albermarle gets about 40 per cent of its revenues from lithium, but it is expanding aggressively in the area and says it intends to capture half of the growth in the worldwide lithium industry.

FMC, based in Philadelphia, is also a diversified chemical producer. Lithium is responsible for only about 10 per cent of its revenue, making it anything but a pure play on the metal. However, its agricultural chemical business is attractive in its own right.

None of the three major major lithium miners is cheap: SMC trades for 35 times earnings, while Albermarle changes hands at a 47 times multiple and FMC goes for 61 times. For now, Albermarle is Mr. Jackson’s preferred way to bet on a lithium future. He has an “outperform” rating on the stock with a $160 target price, well above its current $130 range. It’s expensive, he cautions, but “we continue to believe that paying up for Albemarle is prudent.”

ENERGY

THE GLOBE AND MAIL. REUTERS. DECEMBER 12, 2017. Brent crude tops $65, first time since 2015, on U.K. pipeline outage

DAVID MOIR

ALEX LAWLER

LONDON - Oil rose above $65 a barrel for the first time since mid-2015 on Tuesday following a shutdown of the UK's biggest North Sea oil pipeline, which helps set the benchmark for global prices.

The Forties pipeline, which was scheduled to pump 406,000 barrels per day (bpd) in December, was shut down on Monday after cracks were found in what traders believe is the first unplanned outage for some years.

Brent crude, the global benchmark, was up by 36 cents at $65.05 at 1414 GMT, after breaking above $65 for the first time since June 2015 and trading as high as $65.83. U.S. crude rose 31 cents to $58.30.

"With no timeframe yet available as to when supplies through the Forties pipeline will resume, bulls are in control," said Ole Hansen of Saxo Bank.

Forties is important for the global oil market because the crude it carries normally sets the price of dated Brent, a benchmark used to price physical crude around the world and which underpins Brent futures.

"The disruption to Forties is not just about missing barrels, it is also about losing a key component for the main seaborne crude oil benchmark," said Olivier Jakob, analyst at Petromatrix.

Analysts and traders said the outage was likely to cause significant delays in the loading of Forties crude cargoes.

"There are going to be loads," a trade source said, adding that the number was hard to estimate until the pipeline's restart date is known.

Oil also gained support from expectations the latest reports on U.S. inventories will show a further tightening of supplies.

U.S. crude stocks are expected to fall by 3.8 million barrels, a fourth straight week of decline, according to analysts polled ahead of reports from industry group American Petroleum Institute and the government's Energy Information Administration.

The API is scheduled to release its data for last week at 2130 GMT on Tuesday. The EIA follows on Wednesday.

Oil supply cuts led by the Organization of the Petroleum Exporting Countries this year have helped to whittle away an excess of inventories which built up following a supply glut that began to emerge in late 2014.

But U.S. crude has lagged the rally in Brent in part because of rising U.S. oil production.

As a result, Brent has jumped to a premium to U.S. crude of more than $7, the highest in more than two years.

REUTERS. DECEMBER 11, 2017. Oil tops $65, first time since 2015, on UK pipeline outage

Alex Lawler

LONDON (Reuters) - Oil rose above $65 a barrel for the first time since mid-2015 on Tuesday following a shutdown of the UK’s biggest North Sea oil pipeline, which helps set the benchmark for global prices.

The Forties pipeline, which was scheduled to pump 406,000 barrels per day (bpd) in December, was shut down on Monday after cracks were found in what traders believe is the first unplanned outage for some years.

Brent crude LCOc1, the global benchmark, was up by 36 cents at $65.05 at 1414 GMT, after breaking above $65 for the first time since June 2015 and trading as high as $65.83. U.S. crude CLc1 rose 31 cents to $58.30.

“With no timeframe yet available as to when supplies through the Forties pipeline will resume, bulls are in control,” said Ole Hansen of Saxo Bank.

Forties is important for the global oil market because the crude it carries normally sets the price of dated Brent, a benchmark used to price physical crude around the world and which underpins Brent futures.

“The disruption to Forties is not just about missing barrels, it is also about losing a key component for the main seaborne crude oil benchmark,” said Olivier Jakob, analyst at Petromatrix.

Analysts and traders said the outage was likely to cause significant delays in the loading of Forties crude cargoes.

“There are going to be loads,” a trade source said, adding that the number was hard to estimate until the pipeline’s restart date is known.

Oil also gained support from expectations the latest reports on U.S. inventories will show a further tightening of supplies.

U.S. crude stocks are expected to fall by 3.8 million barrels, a fourth straight week of decline, according to analysts polled ahead of reports from industry group American Petroleum Institute and the government’s Energy Information Administration. [EIA/S]

The API is scheduled to release its data for last week at 2130 GMT on Tuesday. The EIA follows on Wednesday.

Oil supply cuts led by the Organization of the Petroleum Exporting Countries this year have helped to whittle away an excess of inventories which built up following a supply glut that began to emerge in late 2014.

But U.S. crude has lagged the rally in Brent in part because of rising U.S. oil production C-OUT-T-EIA.

As a result, Brent has jumped to a premium to U.S. crude of more than $7 CL-LCO1=R, the highest in more than two years.

Additional reporting by Henning Gloystein; Editing by Susan Fenton

REUTERS. DECEMBER 11, 2017. Oil hits two-year-and-a-half year high on pipeline shutdown, stocks take breather

Ritvik Carvalho

LONDON (Reuters) - Oil prices jumped to their highest in more than two years on Tuesday after the shutdown of a North Sea pipeline knocked out significant supply from an already tightening market.

A pedestrian stands to look at an electronic board showing the stock market indices of various countries outside a brokerage in Tokyo, Japan, February 26, 2016. REUTERS/Yuya Shino

World stocks took a break from a three-day rally.

Brent crude futures, the global benchmark for oil prices, rose above $65 a barrel -- their highest since mid-2015 -- after Britain’s Forties pipeline was shut due to cracks as a cold snap sweeps the country. [O/R]

The Forties pipeline is important for the global oil market because the crude it carries normally sets the price of dated Brent, a benchmark used to price physical crude around the world and which underpins Brent futures.

The shutdown comes as oil supply cuts by the Organization of the Petroleum Exporting Countries (OPEC) have helped chip away an excess of inventories built up following a global supply glut which began to emerge in late 2014.

“The disruption to Forties is not just about missing barrels, it is also about losing a key component for the main seaborne crude oil benchmark,” said Olivier Jakob, analyst at Petromatrix.

U.S. crude oil futures CLc1 were last 0.7 percent higher at $58.41 a barrel.

Prices of gas across Europe also soared following an explosion at Austria’s main gas transfer hub and as Russian gas

Meanwhile, the MSCI index of world equities .MIWD00000PUS, which tracks stocks across 47 countries, was flat after posting three straight days of gains. Wall Street futures indicated a positive open. ESc1

The jump in oil helped boost energy-heavy European stock indices, with the pan-European STOXX index .STOXX rising 0.3 percent by afternoon in London. Europe’s oil and gas sector index hit its highest in a month. .SXEP

Earlier in Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS drifted off 0.3 percent, having bounced 2 percent in the past three sessions, with markets consolidating in the hope an upswing in global growth could outlast a likely hike in U.S. interest rates this week.

Commodity-linked currencies also got a boost from the pick up in oil prices. The Australian dollar and the New Zealand dollar were both over half a percent higher while the Norwegian crown rose 0.6 percent.

CENTRAL BANK SEASON FINALE

Investors continued their policy vigil with the U.S. Federal Reserve set to end its two-day meeting on Wednesday, while the European Central Bank and the Bank of England will meet for the last time in 2017 on Thursday.

JPMorgan economist David Hensley suspects the Fed will revise up its growth forecast while trimming the outlook for the unemployment rate, potentially adding upside risk to the “dot plot” forecasts on interest rates.

“The dot plot previously called for three hikes in 2018; it is a close call whether this moves to four hikes,” he warned, a shift that would likely boost the dollar but could bludgeon bonds.

“For its part, the European Central Bank (ECB)is likely to emphasize its low-for-long stance and continue to distance itself from the Fed,” he added. “The staff is likely to revise up its 2018 growth forecast, while we think the core inflation forecast will reveal an even slower recovery than before.”

The divergence in Fed and ECB policy was supposed to be bullish for the dollar, given it had widened the premium offered by U.S. two-year yields US2YT=RR over German yields DE2YT=RR to 256 basis points from 188 basis points this time last year.

The last time the spread was that plump was in 1999.

Yet the euro is currently up 12 percent on the dollar this year, while the dollar is down 8 percent on a basket of currencies .DXY - an indication interest rate differentials aren’t everything in forex.

The dollar was idling at 113.50 yen JPY=, just off a one-month top of 113.69, while the index that measures it against a basket of peers was down 0.1 percent. .DXY

There was a little more action in bitcoin, which was last up over half a percent on the day at $16,633 on the Bitstamp exchange BTC=BTSP. The cryptocurrency’s newly launched 1-month futures contract <0> fell 4 percent to stand at $17,830 on its second day of trading.

Gold remained out of favour at $1,242.51 an ounce XAU= having suffered its biggest weekly drop since May last week.

For Reuters Live Markets blog on European and UK stock markets see reuters://realtime/verb=Open/url=http://emea1.apps.cp.extranet.thomsonreuters.biz/cms/?pageId=livemarkets

Reporting by Ritvik Carvalho; additional reporting by Wayne Cole in SYDNEY, Alex Lawler in LONDON; Editing by Jeremy Gaunt

The Globe and Mail. THE CANADIAN PRESS. 12 Dec 2017. Canadian firms undermining anti-coal efforts: report. Six financial companies are investing in plants overseas, according to environmental group

MIA RABSON, OTTAWA

Canada’s national pension fund manager is among a group of Canadian companies that are undermining the federal government’s international anticoal alliance by investing in new coal power plants overseas, an environmental organization says.

Friends of the Earth Canada joined with Germany’s Urgewald to release a report on Monday looking at the top 100 private investors putting money down to expand coal-fired electricity – sometimes in places where there isn’t any coalgenerated power at the moment.

The report lists six Canadian financial companies among the top 100 investors in new coal plants in the world. Together, Sun Life, Power Corp., Caisse de dépôt et placement du Québec, Royal Bank of Canada, Manulife Financial and the Canada Pension Plan Investment Board have pledged $2.9-billion toward building new coal plants overseas.

Urgewald tracks coal plants around the world and reports there are 1,600 new plants in development in 62 countries, more than a dozen of which don’t have any coal-fired plants now.

While Environment Minister Catherine McKenna is claiming to be a global leader on phasing out the dirtiest of electricity sources, private investors are “undermining that commitment,” Friends of the Earth senior policy adviser John Bennett says.

Last month, Canada and Britain teamed up to launch the Powering Past Coal Alliance, trying to bring the rest of the world on side with a campaign pledge to phase out coal as a power source entirely by 2030 for the developed world and 2050 for everyone else.

Twenty national governments and at least seven subnational governments – five of them from Canada – signed on to the alliance last month. The hope is to increase the number to 50 by the time the United Nations 24th climate-change conference takes place in November, 2018.

Ms. McKenna will meet with leaders and officials from the alliance this week in Paris, where French President Emmanuel Macron is hosting a climatechange meeting to mark the two-year anniversary of the Paris climate-change accord. This meeting is largely focused on international climate finance as the world tries to meet the goal to have $100-billion a year to invest in climate-change mitigation and adaptation projects in the developing world by 2020.

The accord commits the world to keeping the average global temperature from rising more than two degrees Celsius over preindustrial levels by the end of the century. To do that, scientists suggest global carbon emissions have to start dropping in fewer than three years, and the only way that is going to happen is by shutting down coal plants.

Coal is responsible for almost half of global carbon-dioxide emissions.

Ms. McKenna’s office did not respond to a request for comment.

Last week, Ms. McKenna was in China, where she said she was talking about phasing out coal. While China is trying to cut its own coal use, it uses more coal to make power than the rest of the world combined. Hence, Ms. McKenna said it’s currently impossible to expect China to commit to eliminating it.

Ms. McKenna said she wasn’t planning to raise the issue of China investing in new plants outside its borders. Urgewald’s data show Chinese-owned companies are behind about 140 new coal plants in development outside China.

Turns out Canadian money is also financing international coal plants, through private investors.

Dale Marshall, national program manager for Environmental Defence, said the Paris meeting this week has a lot of work to do trying to figure out how national governments can increase their commitments but also leverage more from the private sector.

BOMBARDIER - TRAIN

THE GLOBE AND MAIL. THE CANADIAN PRESS. DECEMBER 12, 2017. Bombardier lands deal to sell Aventra trains in U.K.

BERLIN - Bombardier Transportation has signed a deal to supply 333 new rail cars, along with a contract for maintenance work, with a U.K. rail company.

Corelink Rail Infrastructure and West Midlands Trains will receive 333 new Bombardier Aventra vehicles for use on the United Kingdom's West Midlands Trains franchise.

The rolling stock and maintenance contracts are worth about $928-million Canadian.

Bombardier will produce the electric carriages at its facility in Derby, England, with the new trains expected to be delivered between 2020 and 2022.

Bombardier was named the preferred bidder for the contract in October.

"Our modern Aventra trains will be built in the Midlands for the Midlands, and will transform the travel experience for passengers on the new West Midlands Trains franchise," said Richard Hunter, the U.K. managing director for Bombardier Transportation.

"This is part of a huge investment happening up and down the country and will make a real difference to passengers," said Chris Grayling, the U.K. secretary of state for transport.

"We are delivering the biggest rail modernization program for over a century. West Midlands passengers will see longer, more frequent trains, faster journeys and a more reliable service for passengers."

Montreal-based Bombardier's transportation division is headquartered in Berlin.

________________

LGCJ.: