CANADA ECONOMICS

US

THE GLOBE AND MAIL. REUTERS. NOVEMBER 30, 2017. TRUMP ADMINISTRATION. White House planning to replace Tillerson with CIA chief: U.S. official

JOHN WALCOTT, WASHINGTON

The White House has developed a plan to oust Secretary of State Rex Tillerson, who has had an increasingly tense relationship with President Donald Trump, and replace him with CIA director Mike Pompeo within weeks, senior administration officials said on Thursday.

Under the plan, Republican Senator Tom Cotton would be tapped to replace Pompeo at the Central Intelligence Agency, the New York Times reported, citing senior officials.

The Times, the first to report the plan, said it was not immediately clear whether Trump had given final approval to what would be the most significant shakeup in his administration since he took office in January.

Tillerson's departure would end a troubled tenure for the former Exxon Mobil Corp chief executive who has found himself increasingly at odds with Trump over policy challenges such as North Korea and under fire for his planned cuts at the State Department.

Tillerson was reported in October to have privately called Trump a "moron," which the secretary of state sought to dismiss.

That followed a tweet by Trump a few days earlier that Tillerson should not waste his time by seeking diplomatic engagement with North Korea.

John Kelly, the White House chief of staff, developed the transition plan and has discussed it with other officials, the Times reported. Under his plan, the staff reshuffle would happen around the end of the year or shortly afterward.

Tillerson's departure has been widely rumored for months, with attention focused on Nikki Haley, U.S. ambassador to the United Nations, as his likely replacement.

But Pompeo, a former member of Congress, has increasingly moved to the forefront as he has gained Trump's trust on national security matters.

Tillerson, 65, has spent much of his tenure trying to smooth the rough edges of Trump's unilateralist "America First" foreign policy, with limited success. On several occasions, the U.S. president publicly undercut his diplomatic initiatives.

A source familiar with Tillerson's thinking said Tillerson's original plan when he took the job as top U.S. diplomat, was to leave in February.

"His plan was to make it a year and then find a reason to leave. Who knows if that still holds?" the source said.

BLOOMBERT. 30 November 2017. White House Weighs Replacing Tillerson With Pompeo

By Jennifer Jacobs

- Secretary of State has repeatedly clashed with president

- Trump has said Tillerson may leave by the end of the year

The White House is discussing whether to replace Secretary of State Rex Tillerson with CIA Director Mike Pompeo, two White House officials said.

The timing of the shakeup for President Donald Trump’s national security team is unclear. Trump has told advisers that Tillerson might be out of his job before the end of the year, a third person familiar with the matter said, a remarkably brief tenure for a secretary of state who took office in February.

All of the people spoke on condition of anonymity because no decision has been made.

The New York Times reported earlier that White House Chief of Staff John Kelly had developed a plan to replace Tillerson with Pompeo and nominate Senator Tom Cotton, an Arkansas Republican, for Pompeo’s job.

Late on Wednesday, Tillerson canceled plans to speak on Thursday at a World AIDS Day event and sent a deputy instead. Soon after the Times report broke, Tillerson was at the White House as the president welcomed the crown prince of Bahrain.

Repeated Clashes

Trump and Tillerson, the former chief executive officer of Exxon Mobil Corp., have repeatedly clashed, but their relationship had publicly appeared to warm of late. The two men were frequently side-by-side during meetings in Japan, China, Vietnam and the Philippines during Trump’s trip to Asia earlier this month.

He even got a shout-out from the president at a breakfast gathering of business leaders at the U.S. ambassador’s residence in Tokyo early in the trip.

“I want to thank Secretary Tillerson -- Rex -- who has done a tremendous job of leading the dedicated men and women of the Department of State here in Japan and around the world,” Trump said.

Their relationship appeared to sour over the summer, following Trump’s comments about racial protests that led to one death in Charlottesville, Virginia, and a politically charged speech the president gave to a national gathering of the Boy Scouts of America, an organization Tillerson once led.

Relations worsened further in October, after Tillerson had to address reports that he called the president a “moron” following a meeting of the national security team. The secretary of state denounced the report, although he left it to his spokeswoman to deny it. Afterward, Trump suggested staging an IQ-test contest with Tillerson.

Trump didn’t answer a question about Tillerson’s status before the meeting with Bahrain’s crown princes. “He’s here. Rex is here,” he told reporters.

— With assistance by Nick Wadhams

NATIONAL ACCOUNTS

StatCan. 2017-11-30. Canada's balance of international payments, third quarter 2017

- Current account balance: -$19.3 billion, Third quarter 2017

- Source(s): CANSIM table 376-0105: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3760105&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canada's current account deficit (on a seasonally adjusted basis) widened by $3.8 billion in the third quarter to $19.3 billion, as the deficit on international trade in goods expanded for the third quarter in a row.

In the financial account (unadjusted for seasonal variation), strong and continued foreign investment in Canadian bonds again led the inflow of funds into the economy.

Chart 1: Current account balances

Current account

Deficit on trade in goods continues to grow

The deficit on international trade in goods rose $3.6 billion to $8.9 billion in the third quarter, with both exports and imports declining. This was the third consecutive increase of the goods deficit and the second highest deficit on record.

On a geographical basis, the goods deficit with non-US countries was up $1.3 billion to a record $17.0 billion. This mainly reflected deteriorating trade balances with India and the United Kingdom, moderated by a lower deficit with China. Meanwhile, the surplus with the United States fell $2.4 billion to $8.0 billion.

Chart 2: Goods balances by geographic area

Total exports of goods declined $11.0 billion to $131.1 billion in the third quarter, following four straight quarters of increases. Exports of motor vehicles and parts were down $3.5 billion. Work stoppages in the automotive industry and changes to certain models destined for the American market amplified the reduction over the quarter. Exports of energy products fell $2.4 billion on lower prices and, to a lesser extent, lower volumes of crude petroleum and natural gas.

After increasing by $10.7 billion over the first half of the year, total imports of goods were down $7.4 billion to $140.0 billion. Almost all the commodity sections were down in the quarter. Metal and non-metallic mineral products declined by $1.3 billion and consumer goods lost $1.2 billion on lower prices.

Non-goods deficit edges up

The non-goods deficit, reflecting international transactions in services and income, increased slightly to reach $10.4 billion in the third quarter, mainly on a higher portfolio investment income deficit and higher transfer payments.

The overall deficit on international trade in services was unchanged at $6.1 billion. The travel deficit increased $0.3 billion, mostly on higher payments by Canadians visiting non-US destinations. A record number of Canadian travellers went overseas during the quarter. On the other hand, the surplus in commercial services was up $0.3 billion, mainly on lower payments of financial services.

Income receipts on Canadian holdings of foreign securities declined by more than income payments on foreign holdings of Canadian securities in the quarter. Also contributing to the higher non-goods deficit were higher transfer payments, mainly from the government sector.

Financial account

Strong foreign acquisitions of Canadian bonds continue

Foreign investors increased their holdings of Canadian securities by $51.6 billion in the third quarter, an eighth consecutive quarter of strong acquisitions. During that period, foreign portfolio investment has totalled $351.7 billion or 70% of all foreign investment in Canada.

Foreign acquisitions of Canadian bonds reached $51.6 billion in the third quarter, the largest investment since the first quarter of 2015. Record foreign purchases of federal government bonds of $21.8 billion led the investment activity in the third quarter of 2017. Significant new issues of private corporate bonds placed abroad and denominated in US dollars also contributed to the inflows.

Chart 3: Foreign investment in Canadian securities

The Bank of Canada raised its benchmark overnight interest rate by 50 basis points to 1% in the quarter. Meanwhile, Canadian short- and long-term interest rates significantly increased and the Canadian dollar appreciated against its US counterpart by 3.1 US cents.

Non-resident investors withdrew $6.0 billion of funds from the Canadian money market in the third quarter. The foreign divestment was all in government paper, as foreign investors increased their holdings of Canadian corporate paper. At the same time, non-residents added $6.0 billion of Canadian equities to their holdings in the third quarter, mainly shares from the management of companies and enterprises sector.

Canadian investment in foreign securities increases

Canadian investors increased their holdings of foreign securities by $12.0 billion in the third quarter. The purchases were almost evenly split between foreign bonds and foreign shares, and targeted US instruments.

Canadian investment in foreign shares declined from $8.0 billion in the second quarter to $5.4 billion. The activity in the quarter reflected acquisitions of $7.7 billion of US shares. Investors also added foreign debt securities to their portfolios, mainly US corporate bonds.

Direct investment increases and generates a net outflow of funds

Cross-border foreign direct investment activities resulted in a net outflow of funds in the third quarter, as direct investment abroad outpaced direct investment in Canada for an eighth straight quarter.

Direct investment abroad reached $21.6 billion, almost entirely in the form of equity investment. Merger and acquisition activities accounted for just under half of this investment, with the majority in countries other than the United States.

Direct investment in Canada increased to $9.8 billion in the third quarter, following a small divestment in the second quarter. Equity investment made by foreign parents in Canadian affiliates accounted for the bulk of the activity. More than one-third of the direct investment was in the manufacturing sector. Inward cross-border merger and acquisition transactions remained low in the third quarter. In the last eight quarters, this activity totalled only $7.2 billion.

Chart 4: Foreign direct investment

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171130/dq171130a-eng.pdf

REUTERS. NOVEMBER 30, 2017. Canada third-quarter current account deficit grew to near-record high

OTTAWA (Reuters) - Canada’s current account deficit in the third quarter swelled to C$19.35 billion ($15.00 billion), the third largest in history, as the country’s international trade gap in goods continued to expand, Statistics Canada said on Thursday.

Analysts in a Reuters poll had forecast a shortfall of C$19.50 billion. The record deficit was the C$20.20 billion, in the third quarter of 2010.

The trade deficit in goods jumped to C$8.93 billion from C$5.29 billion - the third consecutive increase - as exports declined at a faster rate than imports.

Exports dropped to C$131.08 billion from C$142.08 billion as shipments of motor vehicles and parts fell sharply, hit by work stoppages and changes made to certain models. Imports fell to C$140.00 billion from C$147.37 billion on broad weakness in commodities.

The deficit in trade in services remained virtually unchanged at C$6.13 billion while foreign investment in Canadian securities rose to C$51.59 billion from C$39.49 billion in the second quarter.

Reporting by David Ljunggren; Editing by Steve Orlofsky

INTERNATIONAL TRADE

CANADA-CHINA. Globe and Mail. 30 Nov 2017. SOUNDING THE ALARM ON TRADE WITH CHINA. Ex-envoy voices concern over China trade. A former ambassador to China says the case of two Canadian wine merchants held in Shanghai is a troubling sign of a bigger problem

STEVEN CHASE

ROBERT FIFE

David Mulroney says official warning needed for Canadians doing business in the country in light of recent detainment cases

A former Canadian ambassador to China says Ottawa should issue a prominent and official warning to Canadian business people that commercial disputes in China could result in their being detained and having their passports seized.

David Mulroney, who was this country’s envoy to China from 2009 to 2012, says the case of two Canadian wine merchants held captive in Shanghai is a troubling sign of a bigger problem.

He said this should be of particular concern for the Canadian government right now, when Prime Minister Justin Trudeau is expected to soon announce that Canada has agreed to China’s request to commence free-trade negotiations. Canada would be the first Group of Seven country to consent to bilateral trade talks with Beijing.

John Chang, a Richmond, B.C., businessman has been imprisoned in China for more than 20 months over a customs dispute that has been criminalized. His wife, Allison Lu, has had her passport confiscated so she cannot leave China.

Mr. Chang, who is battling cancer while in detention, was celebrated in Canada for his entrepreneurial skills and regularly participated in trade missions to China with Canadian government officials; he even hosted Chinese athletes at his Richmond winery during the 2010 Winter Olympics. He was named an RBC Top 25 Canadian Immigrant award winner in 2015 for his wine business.

Mr. Mulroney said a high-profile warning is required because such incidents are not isolated.

“It’s necessary because it’s happening. And it’s happening to people who were exemplars of everything the Canadian government wants to say about doing business with China. They were part of China trade missions.”

The former envoy said the number of cases of detention was growing under his tenure in Beijing. And he said he’s worried they will happen more frequently under President Xi Jinping, whose term in office has coincided with a deterioration of human rights and rule of law in China.

The department of Global Affairs currently features one line in its travel advisory for China that says, “Canadian business travellers have been detained and had their passports confiscated as a result of business disputes with their Chinese counterparts.”

Mr. Mulroney said this caution is buried too deep in a multipage document and should instead be given prominent placement in advice offered by Canada to its citizens.

“The warning should be ‘You may be caught up in a business dispute that morphs into a criminal dispute and you will be imprisoned or your passport will be taken away. And our consular ability to help you will be limited or none,’ ” the former envoy said.

“This shouldn’t be page 11 of a 14page document. Move it to page 1 or 2.”

Mr. Mulroney said incidents of Canadians detained in China over commercial disputes were increasing during his tenure in China but that many of those ensnared in such matters preferred to keep quiet about what happened either because they had relatives in China or wished to keep doing business in that country.

“It’s an all-too-common occurrence and it’s designed to intimidate the foreign party. … Suddenly a commercial dispute you would willingly fight out in court is now a matter of your own freedom – and it’s very hard for people not to crumble under that kind of pressure,” the former envoy said.

He noted that these incidents seem to happen particularly to Canadians of Chinese origin. “I don’t know why that is – maybe the Chinese feel they could treat these people with impunity.”

He said Ottawa is not sufficiently addressing what has happened to Mr. Chang and his wife or the implications for Canadian business.

“If a Canadian business person who has been a poster boy for doing business with China is wrongfully imprisoned that is a very difficult and very real issue,” he said.

Perrin Beatty, president of the Canadian Chamber of Commerce, said he does not see a need to issue a more prominent warning for Canadians wanting to do business in China. Anyone who plans to engage with China or Russia should be expected to do their homework on how those countries’ legal and business systems operate, he said.

“Most of our members who are dealing in China are pretty sophisticated and they realize there aren’t the same protections under the law there as there are here,” Mr. Beatty said.

The business lobbyist said the chamber is supportive of Mr. Trudeau’s efforts to open formal negotiations with China on a bilateral free-trade deal, but he also warned the talks should be conducted with considerable care and caution.

There are a lot of worries among Canadian business owners that China has blocked off large sectors of its economy from outside investment.

“We think it is positive that the government is engaging with China. It is going to be the largest economy in the world in a matter of just a few years and Canada needs to be there,” Mr. Beatty said.

BLOOMBERG. 30 November 2017. Canada Tries to Placate Japan After Trade Pact Standoff

By Josh Wingrove

- John Manley says Japan is angered by Canada position on TPP

- Canadian trade minister met with Japanese ambassador Tuesday

Canada is trying to patch up frayed relations with the Japanese government after holding out on signing a major Pacific Rim trade deal championed by Prime Minister Shinzo Abe.

Tensions flared between the two countries after Canada effectively blocked progress on a deal to salvage the Trans Pacific Partnership, an 11-nation trade deal anchored by Japan after U.S. President Donald Trump quit the pact. Canada continues to push for revisions that leave the deal, created in part as a check on China’s economic clout, in limbo -- days before Canadian Prime Minister Justin Trudeau heads to China himself.

Trade Minister Francois-Philippe Champagne said he discussed the issue with Japan’s ambassador to Canada in a meeting in Ottawa on Tuesday. “We cleared a lot of the issues and restated we are partners and friends in many things, and have made progress toward trade in the Asia-Pacific region,” he said in an interview Wednesday. “And I think this is understood now by both sides.”

John Manley, the head of a major Canadian business group who traveled to Japan this month for meetings with government and business leaders, urged Trudeau to call Abe before he heads to China. Manley is a former foreign affairs minister and deputy prime minister in a Liberal government, the party Trudeau now leads.

‘Call Mr. Abe’

“Before landing in Beijing, it’d be wise for him to call Mr. Abe,” Manley, president of the Business Council of Canada representing chief executives, said in a phone interview after his trip to Japan. “The concerns are at the top of the house in Japan.”

Canada ruffled feathers when it balked at an agreement to save the TPP, since rebranded as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), after the U.S. abandoned it.

Japan took the unusual step of issuing a second statement after Abe met Trudeau in Vietnam earlier this month, specifying that a planned TPP summit had been postponed because the Canadian leader had said he was not ready to endorse an outline agreement reached at ministerial level. Japanese media have since mused about proceeding without Canada.

In a speech Thursday, Champagne said changes made so far to the deal include stronger labor and environment provisions, each subject to dispute settlement procedures.

“Our government has recently made some real progress towards what is now an emerging and potentially more lucrative and more viable agreement for Canadians to access this market,” he said Thursday at the Toronto Region Board of Trade. He gave little indication of if Trudeau will open trade talks in China. “We have been clear from the start with our Chinese friends, throughout exploratory talks, that should we move forward, this will take time.”

China Trip

Canada is pressing in part for changes to cultural rules, while Champagne said the auto sector has been another topic of discussion. Manley said that Canadian business wants the trade deal implemented.

“The consensus of people who are interested in it is ‘get it done’ -- both for the business opportunity and the important message that completing TPP will send,” he said. It will show that the world’s multilateral trading system is alive and well despite Trump’s exit, he said.

Trudeau announced this week he’ll travel from Dec. 3 to Dec. 7 to China. The TPP was once seen as a hallmark of U.S. engagement in Asia and a buffer against Chinese clout. Then-Defense Secretary Ash Carter called it more strategically important than having another aircraft carrier battle group in the Pacific.

The trade deal is “an opportunity to have an economic zone in Asia where all of the rules aren’t made by China,” Manley said, adding that Canada’s stance on the CPTPP has confused other nations. “In Japan, they were very explicit that they didn’t understand what Canada was intending. And the Australians told my office the same thing, that they didn’t know what Canada’s intention was.”

Dan Ciuriak, a trade consultant and senior fellow at the Centre for International Governance Innovation, said the U.S. withdrawal from TPP allows Canada to be more aggressive in negotiations. “Canada joined TPP late, and basically was given a fait accomplis,” he said. “The deal that was on paper was basically less favorable to Canada than they would have normally wanted or offered.”

Champagne said Canada continues to participate in talks toward reaching a deal to save the CPTPP. Mexico and Malaysia also each have outstanding issues with the TPP, he said.

“There was a misunderstanding about expectations, mostly regarding timing," he said. “As you know, trade is tough.”

— With assistance by Isabel Reynolds

BLOOMBERG. 30 November 2017. WTO. World Trade Boom Sails Into 2018 as Trump Threatens Barriers

By Enda Curran and Andrew Mayeda

- Flash PMIs for China’s trade partners show strong momentum

- Renewed worries over Trump’s trade policies hang over outlook

It was meant to be the year of the trade war. Instead, it was the year of the trade boom.

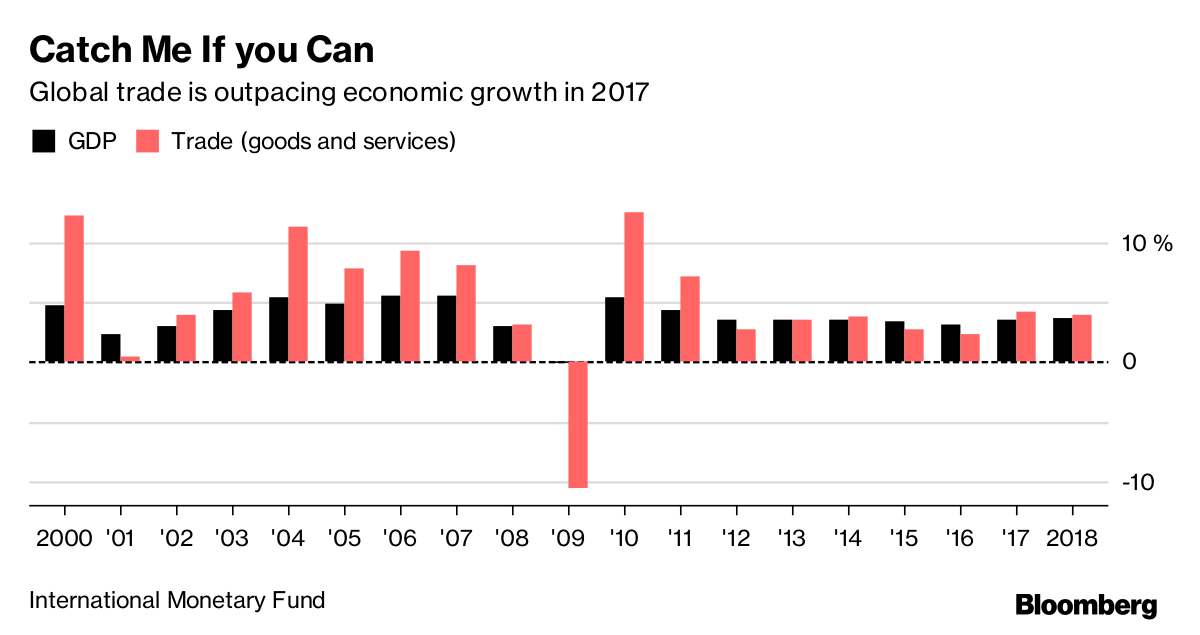

As 2017 draws to a close, the International Monetary Fund is projecting the volume of trade in goods and services will have climbed 4.2 percent over the year, up from 2.4 percent in 2016. That would be the first time trade has outpaced output growth since 2014 and harks back to the pre-crisis days when such outperformance was a regular occurrence.

Among the winners: big manufacturing powerhouses such as Germany and China and producers of electronics like South Korea, which Thursday raised its benchmark interest rate for the first time since 2011 after months of surging exports. Caterpillar Inc. and Samsung Electronics Co. are some of the companies that are cashing in.

Closely watched gauges on manufacturing suggest the recovery should continue into 2018. A weighted average of flash Purchasing Managers Indexes for China’s major trade partners came in at 56.3 in November -- the highest since February 2011, according to Bloomberg Economics. China’s official manufacturing PMI unexpectedly climbed to 51.8 in November.

“A trade boom, rather than a trade war, has been the big theme,” said Chua Hak Bin, a Singapore-based senior economist with Maybank Kim Eng Research.

That doesn’t mean the threat of protectionism has passed. President Donald Trump is still vowing to crack down on countries the U.S. believes don’t trade fairly, and negotiate deals more favorable to America. While the White House is focused on pushing through tax cuts, there are still signs Trump plans to get tough on trade.

The U.S. Commerce Department this week took the unusual move of evoking powers it hasn’t used in more than a quarter century to begin a probe into Chinese aluminum imports that could lead to tariffs. This week, the U.S. joined the European Union in rejecting China’s claim that under the terms of its accession to the WTO it should have graduated last year to market-economy status, which would offer greater protection from anti-dumping duties.

Cautionary Tale

The U.S. move “is a cautionary and potentially significant marker in the U.S. crusade against what are deemed unfair trade practices,” said Patrick Bennett, a Hong Kong-based strategist at Canadian Imperial Bank of Commerce. “The issue of trade protectionism has potential to continue looming large for financial markets.”

The U.S. has taken other steps to tighten trade enforcement and more is expected in 2018 as investigations into Chinese intellectual property practices and other areas continue. The U.S. has proposed changes to the North American Free Trade Agreement that have been rejected by Mexico and Canada, raising the risk that Trump will follow through on his threat to pull out of the deal. The U.S. also wants to revamp its trade deal with South Korea.

“There is a sense that this administration regards with suspicion” multilateral organizations such as the World Trade Organization, said Carlos Gutierrez, who was U.S. Commerce secretary under George W. Bush. He’s now chairman of the National Foreign Trade Council in Washington. He added that Nafta talks "aren’t going anywhere," a distressing situation for global companies that have built supply chains on the assumption they won’t have to pay tariffs within North America.

Since Trump wants to boost U.S. growth, he will be pleased with the bullish outlook for the world economy. But he also wants to reduce the U.S. trade deficit with the rest of the world -- a goal that could slow the recovery in trade if it leads to more barriers.

WTO Meetings

That contradiction will loom over the world’s trade ministers when they meet next month in Argentina at a high-level gathering of members of the World Trade Organization.

WTO Director-General Roberto Azevedo has warned that the Trump administration’s decision to block appointments to the WTO’s appeals panel is undermining its ability to resolve trade disputes. Trump doesn’t feel the U.S. gets a fair shake at the WTO -- an argument other members question, given America’s leading role in creating the trade tribunal and the global rules that underpin it.

“Every country in the world hates the WTO. They just hate all the alternatives worse,” said Rufus Yerxa, president of the National Foreign Trade Council, whose members range from Coca-Cola to Facebook. “That’s really the lesson the U.S. has to draw. It’s easy to hate some system rules. The question is what’s the alternative?”

Strong Momentum

But while the risks stemming from trade tensions remain, the economic backdrop could hardly be rosier. Goldman Sachs Group Inc. and Barclays Plc forecast global growth will reach 4 percent next year.

The trade recovery is fueling confidence elsewhere too. A nascent recovery in investment as companies spend more on upgrading and expanding to meet demand creates a second wave of support. Illinois-based Caterpillar, long a pointer for global growth, has seen increased sales in almost every corner of the world: from Asia to Europe, and Africa to Latin America.

And even with a protectionist Trump presidency, trade pacts continue to get inked elsewhere. The Trans Pacific Partnership, dumped by Trump, has been revived by the eleven remaining members who continue to discuss it.

"The global economy appears set to remain in good shape in 2018 as the broad-based economic strength seen this year will carry over," Oxford Economics wrote in a recent note in which they revised their forecast for world trade higher by 0.5 percentage points to 4.2 percent next year. "We see some scope for further upward revisions."

— With assistance by Bryce Baschuk

EDC. NOVEMBER 30, 2017. WEEKLY COMMENTARY. AUSTRALIA. The Wizardry of Oz

By Peter G. Hall, Vice President and Chief Economist

Often known as the ‘Wonder Down Under’, Australia has captured the world’s imagination in recent decades as a small but mighty nation. The image of the fearless croc fighter in the back country has its parallel in stories of bold economic and trade promotion in some of the toughest locations. Is it all image, or is their any substance to the schtick?

Back in the 1980’s, there was not much difference between Australia and the rest. That was then; more recently, a gap has formed. Average OECD growth dipped to 2.7 per cent from 1992-2007, with Europe at 2.3 per cent, the US at 3.2 per cent and Canada, 3.1 per cent. Australia? Try average growth at 3.7 per cent. Compounded over this length of time, the difference is huge. How about the tough post-recession period? Australia is still managing superior growth. With Canada and the US at 2.1 per cent and Europe at 1.1 per cent, Australia averaged 2.6 per cent between 2010-16 – slower for them, but still superior.

What’s their secret? Australia’s trade intensity is less than Canada’s. Exports and imports only accounted for 30 per cent of the economy back in the late 1970s, likely a result of its distance from major markets. However, since then, that intensity is up about 33 per cent, now sitting at 40 per cent. Export growth has consistently outperformed the rest of the economy, averaging 5.1 per cent annually during the last, long growth cycle. However, instead of shrinking back in the lackluster post-recession years, Australian export growth actually increased to 5.4 per cent annually, flying in the face of the trend.

And the power behind this success? In a word, diversification. It was evident in the details of trade that something started to shift in the 1980’s. Late in the decade, growth in exports to the emerging world was 11 per cent annually, against 7 per cent to traditional OECD customers. (At the time, the OECD accounted for two-thirds of Australian exports). Growth to ASEAN nations was impressive, at an average annual clip of 13 per cent. But atop them all was China, at 15 per cent. Now, growth to ASEAN faltered, averaging just 3.6 per cent annually since. At the same time, OECD growth also swooned, to 2.7 per cent annually, and to an even slower 0.9 per cent in the post-recession period. But growth to China actually accelerated, rising to a scorching 17.7 annual pace in the stretch between 2000 and 2016, more recently ‘easing’ to 10 per cent.

This has revolutionized Australia’s export shares. OECD trade has shrunk to just 38 per cent of exports, while the developing world now grabs 66 per cent of what Australia ships abroad. Over this timeframe, shares to the ASEAN world have stayed constant at roughly 10 per cent. But while the US and Europe collectively account for just 8 per cent of Australia’s exports (formerly it was 20 per cent, evenly split), China has gone from a 3 per cent customer to a 32 per cent one. This is an enormous upheaval in a comparatively short span of time, and demonstrates that Australia’s aggressive marketing plans have been very effective.

What is Australia shipping? Recent numbers by industry are mixed. Weak steel processing in China has dampened coal exports, which were a dynamo during the last cycle. Chemicals and manufactured materials have been similarly laclustre in recent years. But at the same time, higher value-added manufactures have accelerated, crude materials are rising annually by 7 per cent and food – the export of the future, if not the past – is averaging 6 per cent growth annually.

Australia’s success is a lesson to small open economies the world over – it is possible to take on Goliath economies and succeed. With Australia an established developed Asian powerhouse, and promising to be one for some time now, it is one to watch. Canada’s footprint is growing there – it is the number one Asian destination for Canadian foreign direct investment. This growing presence is one of many reasons EDC is opening an office in Sydney this week. Supply chains of the region are integrated into the Australian market, and Canada is increasingly playing a role.

The bottom line? In a world questioning trade, Australia is a classic example of a full-on exporting nation. All the more reason to do business with this small-open-economic powerhouse!

NAFTA

The Globe and Mail. 30 Nov 2017. CP business on track, even if NAFTA talks fail, CEO says. Amid doubts over the future of the North American free-trade agreement, Canadian Pacific Railway Ltd. CEO Keith Creel says he finds the pace of talks “frustrating” but he isn’t losing sleep

ERIC ATKINS

That’s because the diverse revenue streams of Canada’s second-largest railway are not entirely dependent on NAFTA and the bilateral 1987 Canada-United States trade deal would come into force if NAFTA were to be cancelled.

“We’re paying attention to it, but right now, I’m not losing sleep over it,” Mr. Creel said on Wednesday at an investors’ conference in Florida.

The three-way trade agreement between Canada, the United States and Mexico is being renegotiated after U.S. President Donald Trump called the pact a bad deal for his country. Canada and Mexico have resisted U.S. demands that would require North American vehicles contain 50per-cent U.S. content and undercut the agreement’s dispute-resolution mechanisms.

The Alabama-born Mr. Creel said trade between Canada and the United States is “critically important” and he has been meeting with officials and business leaders on both sides as the talks drag on. “What’s being proposed at this point, if I put my Canadian hat on, is not acceptable to Canada. If I put my American hat on, I know what their demands are,” Mr. Creel said. “Is there a deal to be made? I don’t know where the pin’s going to fall. So far, they haven’t made a lot of progress.”

In 2016, Calgary-based CP made 22 per cent of its revenue from shipping into the United States. Another 8 per cent came from U.S. shipments into Canada, according to company reports. Mr. Creel said the freight hauler’s autos business, at 3 per cent of sales, is most exposed to crossborder trade.

Jason Seidl, a transportation stock analyst with U.S. investment bank Cowen and Co., said the end of NAFTA would be have a “net negative impact” on U.S. and Canadian freight carriers, although not all railways would be affected equally. New tariffs and slower border-crossing procedures would reduce freight volumes and reduce network traffic, he said in a research note.

“Freight is, first and foremost, a function of the economy and trade activity,” Mr. Seidl said.

Mr. Seidl said the railway most at risk if NAFTA fails is Kansas City Southern, which relies on Mexican manufacturing – autos and appliances – and agricultural trade for about 45 per cent of its traffic and half its revenue.

Union Pacific Railroad could be affected given its reliance on imports and exports.

CP and Montreal-based Canadian National Railway Co. could also be exposed because both have significant U.S. networks and interchange Mexican freight with both Kansas City and Union Pacific, Mr. Seidl said.

Apart from the NAFTA talks, the battle continues over Canadian softwood exports to the United States. Ottawa is challenging anti-dumping and countervailing duties the United States has imposed on Canadian imports.

Ghislain Houle, chief financial officer of CN, said lumber shipments account for about 8 per cent of the company’s sales. So far, the 25-percent penalty CN’s customers face has not had a big impact on shipments. But threats of quotas could divert Canadian lumber exports to Asian markets through West Coast ports, a shorter and less lucrative haul for CN, Mr. Houle said on Wednesday.

The Globe and Mail. 30 Nov 2017. U.S. Christmas tree shortage a gift for Canadian growers, a scramble for buyers. Exporting boon expected in Central and Eastern Canada, but shoppers, especially in B.C., to face higher prices and limited selection. Trees: B.C. farmers growing higher-value crops because of limited agricultural land

TU THANH HA

JESSICA LEEDER

The scramble to get a beautiful Christmas tree has started. And it’s likely going to be roughest in British Columbia.

While a shortage of Christmas trees in the United States is turning into an exporting boon for growers in Eastern and Central Canada, B.C. shoppers are expected to face stiffer prices and a more dismal selection of evergreens.

“People may not be able to buy the choice of trees they want,” said Art Loewen, whose business, Pine Meadows Tree Farms in Chilliwack, supplies local garden centres. “There will be enough trees, but they might not get the choice they want.”

But for Canadian growers, who suffered through a dark period seven years ago, when they faced a glut of trees from U.S. producers, things have rebounded.

This fall’s orders were exceptional, said Jimmy Downey, whose family farm, Sapinière Downey, is located in Hatley, in Quebec’s Eastern Townships, an area southeast of Montreal that exports 85 per cent of its fir trees to the United States.

This is the first year that most of Mr. Downey’s sales were finalized many months before workers started cutting the trees. “We try to run after our clients. This year, it was the opposite. The clients were running after us to get their trees,” said Mr. Downey, who is president of growers’ group the Association des producteurs d’arbres de Noël du Québec.

“It seems to be a really good year. We are selling to the max,” said Shirley Brennan, executive director of the Canadian Christmas Tree Growers Association.

The scarcity in the United States is, however, a concern in B.C., which relies on U.S. imports. Other parts of Canada are not expected to be affected and big chains such as Loblaw and IKEA said they will be properly supplied for the holiday season.

The problem south of the border has been attributed to a delayed result of the recession that began in 2007. There were fewer sales, less harvesting and, as a result, U.S. growers planted fewer new trees, which need a decade to mature into adequate size.

Mr. Downey said he had been getting more orders from Washington State, where dry conditions might have affected the tree crops.

“You end up with [what] we call a Charlie Brown tree … you only see a few needles and a trunk and branches. It’s not appearing green, it won’t give a nice smell in the house, it’s not marketable,” Mr. Downey said.

B.C. relies on imports from the United States as its limited agricultural land has pushed farmers toward higher-value crops, said Mr. Loewen, an executive with the B.C. Christmas Tree Council.

“We’ve never grown enough of our own and we’ve always imported a lot from the U.S. That has become tougher,” he said.

His business is growing fewer firs because he can’t rent additional acreages any more.

He has had to buy more trees from U.S. suppliers to keep up with the demand, but their prices have gone up. For example, noble firs that he used to buy for $30 or less a unit now cost $50 wholesale.

In addition to higher prices, he said that instead of Fraser or balsam firs, retailers might have to sell grand firs, which don’t keep their needles as well, Mr. Loewen said.

In Nova Scotia, booming demand for real trees in the United States has many growers uncertain of whether they can cut enough trees this December to keep up with wholesale demand.

The province’s Christmas tree industry is large and in the midst of a rebound after going through “a rough period,” said Angus Bonnyman, executive director of the Nova Scotia Christmas Tree Council.

Increasingly, big-box retailers in both Canada and the United States have been turning to Nova Scotia growers to pick up the slack from large U.S. growers, he said.

Whether that will translate into shortages and higher prices at retail tree lots is not yet clear. “There should be a tree for everyone. We wouldn’t want folks to panic,” Mr. Bonnyman said, while suggesting in the same breath that shoppers buy their trees early.

Mr. Bonnyman said there aren’t reliable statistics on the number of trees sent to the United States versus other provinces, where trees are commonly given new tags of origin and sold again.

Growers in Nova Scotia are independent and often family-owned; they are not compelled to disclose sales data.

Even growers who supply the Canadian domestic market feel the pressure from a tree-starved U.S. market.

Cindy Rhodenizer, who runs G.A.R. Tree Farms with her husband in Nova Scotia’s Lunenburg County, supplies one main client, a big-box retailer with stores across Canada.

She said she is routinely asked whether she can sell to the United States.

AGRICULTURE

The Globe and Mail. 30 Nov 2017. ARTICLE. ‘Clean meat’ could be a major revolution for the agriculture sector

LISA KRAMER, Professor of finance at the University of Toronto

Can you have your cow and eat one, too? Soon you may be able to eat meat without killing animals.

I recently had the pleasure of reading a book that will hit the stands on Jan. 2, Clean Meat: How Growing Meat Without Animals Will Revolutionize Dinner and the World, by Paul Shapiro, vice-president of policy at the Humane Society of the United States.

Mr. Shapiro’s book details the cutting-edge biotechnology, known as “clean meat,” by which a few innovative entrepreneurs, academics and venture capitalists are producing meat without farmed animals. In one variation, a sample of a living cow’s flesh can be placed in a bioreactor and the cells will replicate to produce food-grade beef to feed masses. In another approach, no animal cells are required at all. Instead, yeast or mushroom cells are reprogrammed to turn into a beverage that is identical in all ways to cow’s milk, minus the milking of cows. Either way, the technology is intended to redefine the entire animal agriculture industry, resulting in meat, eggs and dairy products that are identical to the products so familiar to consumers.

Why bother? The potential benefits are immense. As with plantbased foods, clean meat places a much smaller toll on the environment than conventional meat production, reducing freshwater consumption, land use, energy inputs and greenhouse gas production.

Consider the fact that it takes about 23 calories to produce a calorie of beef (cows need to eat a lot of plants and consume other energy before becoming food). Cleanmeat proponents expect their final product will require only three calories to produce a calorie of clean meat. This efficiency gain will arise in large part by eliminating the need to grow spines, brains and other disposable by-products. The end result will be a lighter load on the planet.

Additionally, clean meat eliminates the risk of food-borne illnesses such as E. coli and salmonella, since fecal contaminants and pathogens that go hand-in-hand with meat from slaughtered animals are absent from the clean-meat production process. And clean meat promises to help address looming threats of antibiotic resistance. Currently, farmed animals consume the majority of the annual available supply of antibiotics (this occurs in part to prevent and treat the diseases that arise from the crowded housing environments in which farmed animals are raised, but also because antibiotics accelerate the rate of animals’ weight gain, padding the farmers’ bottom line).

A hidden benefit of clean meat is that the production process can substitute healthy fats – such as the omega-3s found in flax seed and algae – in place of the saturated animal fats that are associated with rampant cardiovascular disease among meat eaters.

Furthermore, clean meat poses clear benefits for our collective conscience. Globally, many tens of billions of birds, mammals and sea creatures are killed every year to produce food, and along the way they suffer treatment that would be illegal if applied to cats or dogs. Most of us strive not to dwell on the unpleasant details of conventional meat production. A recent study by agricultural economist Jayson Lusk of Purdue University and his colleagues at Oklahoma State University, published in the journal Animal Welfare, found people are “willfully ignorant” about the way animals are slaughtered. One-third of the study participants chose to stare at a blank computer screen instead of looking at a photo of the stark conditions under which pregnant hogs live on a typical farm. Imagine how great it would be to avoid that heavy sense of guilt, not by looking away, but rather by ensuring the (clean) meat we eat doesn’t necessitate any animals being inhumanely raised and slaughtered.

Surely changes of this magnitude will take a toll on those who rely on the animal agriculture industry for income. Workers in slaughterhouses and concentrated animalfeeding operations will likely have to endure unemployment in the short run. But the loss of these brutal jobs, which come with high accident rates and attendant worker turnover, is not grounds for delaying progress. With technological advancement will emerge new opportunities. Just as Henry Ford’s innovations rendered horse-drawn carriage coachmen unemployed, the widespread proliferation of automobiles created a new economic sector with jobs for factory workers, drivers and mechanics, among others.

Venture capitalists have already cottoned on to the investment opportunities afforded by clean meat, with early funders including Li Kashing, Bill Gates and Richard Branson. Even the world’s largest conventional meat-production company, Tyson, has announced plans to invest in clean meat.

Mr. Shapiro, who will be discussing Clean Meat at the University of Toronto’s Rotman School of Management on Jan. 5, had the pleasure of tasting clean meat at a time when fewer people had done so than have travelled into space. Unlike your chances of travelling to the moon or Mars in your lifetime, the odds of finding clean meat on your plate in the next five or 10 years are astronomically high.

ENERGY

THE GLOBE AND MAIL. REUTERS. NOVEMBER 30, 2017. OPEC agrees to extend oil supply cut for full 2018

ALEX LAWLER

RANIA EL GAMAL

SHADIA NASRALLA

VIENNA - OPEC agreed on Thursday to extend oil output cuts until the end of 2018 as it tries to finish clearing a global glut of crude while signalling it could exit the deal earlier if the market overheats.

Non-OPEC Russia, which this year reduced production significantly with OPEC for the first time, has been pushing for a clear message on how to exit the cuts so the market doesn't flip into a deficit too soon, prices don't rally too fast and rival U.S. shale firms don't boost output further.

The producers' current deal, under which they are cutting supply by about 1.8 million barrels per day (bpd) in an effort to boost oil prices, expires in March.

Two OPEC delegates told Reuters the group had agreed to extend the cuts by nine months until the end of 2018, as largely anticipated by the market.

OPEC also decided to cap the output of Nigeria at around 1.8 million bpd but had yet to agree a cap for Libya. Both countries have been previously exempt from cuts due to unrest and lower-than-normal production.

The Organization of the Petroleum Exporting Countries has yet to meet with non-OPEC producers led by Russia, with the meeting scheduled to begin after 1500 GMT.

Before the earlier, OPEC-only meeting started at the group's headquarters in Vienna on Thursday, Saudi Energy Minister Khalid al-Falih said it was premature to talk about exiting the cuts at least for a couple of quarters and added that the group would examine progress at its next meeting in June.

"When we get to an exit, we are going to do it very gradually ... to make sure we don't shock the market," he said.

The Iraqi, Iranian and Angolan oil ministers also said a review of the deal was possible in June in case the market became too tight.

International benchmark Brent crude rose more than 1 percent on Thursday to trade near $64 per barrel.

CAPPING NIGERIA, LIBYA

With oil prices rising above $60, Russia has expressed concerns that such an extension could prompt a spike in crude production in the United States, which is not participating in the deal.

Russia needs much lower oil prices to balance its budget than OPEC's leader Saudi Arabia, which is preparing a stock market listing for national energy champion Aramco next year and would hence benefit from pricier crude.

"Prices will be well supported in December with a large global stock draw. The market could surprise to the upside with even $70 per barrel for Brent not out of the question if there is an unexpected interruption in supply," said Gary Ross, a veteran OPEC watcher and founder of Pira consultancy.

The production cuts have been in place since the start of 2017 and helped halve an excess of global oil stocks although those remain at 140 million barrels above the five-year average, according to OPEC.

Russia has signalled it wants to understand better how producers will exit from the cuts as it needs to provide guidance to its private and state energy companies.

"It is important ... to work out a strategy which we will follow from April 2018," Russian Energy Minister Alexander Novak said on Wednesday.

PAYROLL EMPLOYMENT

StatCan. 2017-11-30. Payroll employment, earnings and hours, September 2017

- Average weekly earnings — Canada: $985.95, September 2017; 3.1% increase (12-month change)

- Source(s): CANSIM table 281-0063: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2810063&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Average weekly earnings of non-farm payroll employees were $986 in September, up 1.0% from the previous month. Compared with 12 months earlier, earnings increased 3.1%.

Chart 1: Year-over-year change in average weekly earnings and average weekly hours

In general, changes in weekly earnings reflect a number of factors, including wage growth; changes in the composition of employment by industry, occupation and level of job experience; and average hours worked per week.

Non-farm payroll employees worked an average of 32.7 hours per week in September, little changed from both the previous month and 12 months earlier.

Average weekly earnings by sector

Compared with September 2016, average weekly earnings increased in 6 of the 10 largest industrial sectors, led by accommodation and food services. At the same time, earnings declined in retail trade, and were little changed in construction, manufacturing and administrative and support services.

Chart 2: Year-over-year change in average weekly earnings in the 10 largest sectors, September 2017

Average weekly earnings in accommodation and food services increased 6.1% to $394, driven by gains in Ontario, British Columbia and Alberta. Full-service restaurants and limited-service eating places, the largest industry within the sector, contributed the most to the rise.

Average weekly earnings in wholesale trade rose 3.9% to $1,206. The rise in earnings was driven by wholesalers of machinery, equipment and supplies. Ontario, Alberta and British Columbia contributed the most to the earnings increase in this sector.

In professional, scientific and technical services, average earnings were up 3.4% to $1,354. The growth was driven by accounting, tax preparation, bookkeeping and payroll services. Notable increases were observed in Ontario and Quebec.

In health care and social assistance, earnings rose 3.2% to an average of $889 per week. The increase in earnings was most notable in hospitals, as well as in ambulatory health care services. The largest contributors to the growth in this sector were Quebec and Ontario.

For payroll employees in educational services, average weekly earnings were up 2.9% to $1,050. Universities and elementary and secondary schools contributed the most to the year-over-year increase.

Average weekly earnings in public administration grew 2.5% to $1,261, driven by gains in local, municipal and regional public administration. Earnings also increased notably in provincial and territorial public administration. Among the provinces, the largest increase in this sector was observed in Ontario.

In contrast, average weekly earnings in retail trade fell 2.7% to $554, primarily in miscellaneous store retailers and general merchandise stores. The decline was driven by Ontario and Quebec.

Among the smaller industrial sectors, average weekly earnings in finance and insurance rose 8.7% to $1,359, partly due to earnings being at a relatively low point in September 2016. This sector was the largest contributor to the national earnings increase. The growth was spread across most provinces and driven by insurance carriers and credit intermediation.

Average weekly earnings by province

In the 12 months to September, average weekly earnings of non-farm payroll employees increased in nine provinces, led by Ontario, Manitoba and Quebec. Over the same period, earnings decreased in Prince Edward Island.

Chart 3: Year-over-year change in average weekly earnings by province, September 2017

Average weekly earnings in Ontario were up 3.5% to $1,005. Gains were spread across most industries, notably in finance and insurance; professional, scientific and technical services; and public administration. Most of the increase in the province occurred from July to September 2017.

In Manitoba, average weekly earnings increased 3.2% to $916 per week, driven by transportation and warehousing, as well as finance and insurance.

Average weekly earnings in Quebec were up 3.2% to $910. Health care and social assistance; professional, scientific and technical services; and finance and insurance contributed the most to the rise.

In British Columbia, average weekly earnings rose 2.9% to $947. Earnings were up in most large sectors, with wholesale trade, construction, and educational services contributing the most to the rise.

Earnings in New Brunswick increased 2.7% to $897. Earnings increased notably in health care and social assistance; construction; and professional, scientific and technical services. All of the gains in the province occurred from June to September 2017.

In Saskatchewan, average weekly earnings grew 2.5% to $1,014. Among the large sectors, educational services and manufacturing contributed the most to the rise.

Earnings in Nova Scotia were up 2.3% to $871, led by health care and social assistance as well as finance and insurance. This was the third consecutive month where health care and social assistance was the largest contributor to the earnings increase in the province.

In Alberta, average weekly earnings rose 2.3% to $1,142, driven by employment and earnings gains in the high-paying mining, quarrying, and oil and gas extraction sector. In the 12 months to September, employment in this sector increased notably by 10,200 (+10.5%). There were also earnings gains in other sectors, such as wholesale trade and real estate and rental and leasing.

For payroll employees in Newfoundland and Labrador, average weekly earnings rose 1.8% to $1,035. Health care and social assistance, and professional, scientific and technical services contributed the most to the increase. On the other hand, a decline in construction moderated the overall increase in the province.

In contrast, earnings in Prince Edward Island decreased 1.9% to $815. Manufacturing and retail trade contributed the most to the decline. The overall decrease in the province was tempered by a notable increase in health care and social assistance.

Non-farm payroll employment by sector

The number of non-farm payroll jobs rose by 23,800 (+0.1%) from August. The number of payroll employees increased notably in health care and social assistance; manufacturing; and accommodation and food services. At the same time, the number of payroll jobs declined in retail trade and in administrative and support services.

In the 12 months to September, the number of payroll employees rose by 344,300 (+2.1%), marking a third consecutive year-over-year increase of 2.0% or more. Increases were observed in all of the 10 largest sectors, led by manufacturing (+36,800 or +2.5%) and health care and social assistance (+36,400 or +1.9%). The number of payroll jobs also increased notably in educational services (+36,100 or +2.9%), professional, scientific and technical services (+34,600 or +4.0%), construction (+33,300 or +3.4%) and accommodation and food services (+31,700 or +2.5%).

Spotlight on SEPH and LFS: Health care and social assistance

In the 12 months to September, the pace of employment growth has been similar in both of Statistics Canada's monthly surveys with data on employment: the Survey of Employment, Payrolls and Hours (SEPH) and the Labour Force Survey (LFS).

During this period, for example, both surveys showed similar trends in employment in health care and social assistance. In the SEPH, the number of payroll employees in this sector grew 1.9% and has trended up since April, while average weekly earnings were up 3.2%. At the same time, the LFS showed similar year-over-year growth in total employment in this sector (+2.1%).

Chart 4: Number of payroll employees in wholesale and retail trade, Canada, 1961 to 2016

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171130/dq171130b-eng.pdf

________________

LGCJ.: