CANADA ECONOMICS

UNITED NATIONS - SECURITY COUNCIL

The Globe and Mail. 7 Nov 2017. Canada seeks to boost bid for UN seat

MICHELLE ZILIO

Canada is leading an effort to unlock more private-sector financing for the United Nations, and in turn boost its chances of winning a Security Council seat. Canada is working to boost its chances of winning a United Nations Security Council seat by leading an effort aimed at unlocking more private-sector financing to help fill an annual $7-trillion development-funding gap between now and 2030.

Speaking to The Globe and Mail, Canadian ambassador to the UN Marc-André Blanchard said he and his Jamaican counterpart Courtenay Rattray are heading up a group of 60 countries focused on obtaining more private-sector capital, through channels such as pension, private equity and insurance funds, to help meet the UN’s 2030 Sustainable Development Goals. The SDGs call on countries to adopt 17 sustainabledevelopment goals focused on ending poverty, fighting inequality and tackling climate change over the next 13 years.

“If you believe in the Agenda 2030, we need to scale-up financing rapidly and it is obvious that you cannot do that without the private sector,” Mr. Blanchard said.

“If we think we can continue to do this the same way – to do development the way we’ve been doing for the last 50 years – we won’t get there.”

Mr. Blanchard said innovative SDG financing is his top priority as ambassador and a key part of Canada’s pitch for one of the 10 rotating, non-permanent seats on the UN Security Council for 2021-22.

“It’s a demonstration that Canada can make things happen, like very few other countries. As part of the campaign, this is a proof point of what we can be doing,” he said.

Mr. Blanchard said the Group of Friends of SDG Financing is discussing what countries can do to ensure that private-sector investments help achieve the sustainable-development goals. For instance, he pointed to Africa, where he said traditional development assistance from governments is important, but isn’t enough to meet the needs of some countries, places where 70 per cent of the population is under the age of 30. He said that urgency to create opportunities for young people is something the private-sector – particularly in Canada – should capitalize on.

“What is the antidote to the youth bulge? It’s opportunities for young people. How do you create opportunities for young people? It’s with access to energy, infrastructure, health care, education, financial services – all things that Canada is one of the world leaders in,” Mr. Blanchard said.

While there is some interest from the private sector in aligning investments with the SDGs, Mr. Blanchard said there are also concerns about regulatory gaps, the rule of law and corruption in some countries. He said the West, including Canada, tends to “overestimate risk and underestimate the opportunities in emerging markets.”

“We need to really revisit this issue of how we assess risk and what is a risk. We also need to better inform our business community and our society about the opportunities.”

More specifically, Mr. Blanchard has his eyes set on pension, private equity and insurance funds, which together hold more than $80-trillion in assets, or 10 times more than what’s needed each year to implement the SDGs by 2030.

In addition to private-sector financing, the Group of Friends will seek new sources of public and philanthropic funding for the SDG goals.

Mr. Blanchard, a high-powered lawyer from Quebec and long-time Liberal, said he has cemented a number of countries’ support for Canada’s 2021-22 bid for a Security Council seat, but could not provide specifics since the election is done by secret ballot.

Canada hasn’t held a seat on the UN’s most powerful branch since 2000. The previous Conservative government withdrew Canada’s candidacy for a seat in 2010 when it became clear it would lose to Portugal.

Mr. Blanchard also spoke candidly about his relationship with the U.S. ambassador to the UN, and former Republican governor of South Carolina, Nikki Haley.

“We are close friends. From a professional point of view, she’s been a very effective ambassador to the United Nations. She is widely respected,” Mr. Blanchard said.

“We obviously do not agree on everything, but we have an excellent working relationship.”

Mr. Blanchard said he and Ms. Haley share an interest in management, peace operations and development reform at the UN. He said they recently worked together to “one by one” rally two-thirds of the world’s countries to attend an event on those subjects, presided over by U.S. President Donald Trump, during the UN General Assembly in September.

BOMBARDIER

The Globe and Mail. The Canadian Press. 7 Nov 2017. Héroux-Devtek weighs in on Airbus stake in C Series. Landing-gear maker’s CEO says deal is good for supply chain, but Boeing is unlikely to change the way it does business in Canada

ROSS MAROWITS

Airbus SE’s majority ownership in the C Series could be positive for Canada’ aerospace industry, the head of Boeing landing-gear supplier

Héroux-Devtek Inc. said on Monday. “I think it could be quite good for the Quebec, Canada supply chain [to] service Airbus from here,” chief executive Gilles Labbé said during a conference call to discuss its fiscal second-quarter results.

Boeing’s European rival reached a deal last month with Bombardier to purchase a 50.01-per-cent stake in the C Series commercial jet.

Airbus said Canada will become its fifth “home base” and first outside Europe, allowing the Canadian industry to tap into the company’s supply chain. It plans to build a second C Series assembly line in Alabama while maintaining the primary line in Mirabel, Que.

The Canadian government responded to a trade petition launched by Boeing against the C Series by threatening to cancel the planned purchase of 18 Boeing Super Hornet fighter planes to temporarily augment Canada’s aging fleet of CF-18s.

Héroux-Devtek is a large supplier on Boeing’s 777 and 777X aircraft.

Mr. Labbé said he doesn’t expect Boeing’s challenge will have a negative impact on Canadian suppliers.

Boeing has 2,000 people working in Canada and invests $4-billion (U.S.) a year.

“I don’t think they will change their way of doing business given the circumstances,” he told analysts.

“Canada is part of their supply chain in a big way so I think it’s positive. … We need a customer like that to continue to put some work in Canada.”

The aircraft landing-gear maker said it earned $3.2-million (Canadian) or nine cents per share for the quarter ended Sept. 30. That compared with a profit of $9.5-million or 26 cents per share in the same quarter last year.

On an adjusted basis, Héroux-Devtek said it earned nearly $4.1-million or 11 cents a share, down from $5.7million or 16 cents a share.

Sales fell to $89.7-million compared with $91.6-million a year earlier.

Héroux-Devtek announced a deal last month to acquire Compania Espanola de Sistemas Aeronauticos (CESA), a subsidiary of Airbus SE, for roughly $205-million.

Derek Spronck of RBC Capital Markets said Héroux-Devtek’s momentum is beginning to build after a good quarter.

“When we look out over the next two years, we see operational and financial momentum building for the company,” he wrote in a report.

Mr. Spronck said the anticipated acceleration in the Boeing 777/777X program and its position in the Embraer Legacy 450/500 and the Dassault Falcon 5X mark the “beginning of an inflection” in earnings growth. Héroux-Devtek (HRX) Close: $14.80, down 28¢

REUTERS. NOVEMBER 7, 2017. Russia's Aeroflot sizes up Airbus, Boeing for narrow-body order

Jamie Freed

SINGAPORE (Reuters) - Fast-growing Russian airline group Aeroflot (AFLT.MM) is considering a “sizeable” order for Airbus SE (AIR.PA) A320neo family and Boeing Co’s (BA.N) 737 MAX narrow-body aircraft, a top executive said on Tuesday.

The country’s biggest airline has yet to order the next generation of fuel-efficient aircraft to replace its fleet of 146 A320 family jets and 54 737-800s as of June 30.

“That is something that we are looking at,” Aeroflot Deputy General Director for Strategy and Alliances Giorgio Callegari told Reuters of the potential order on the sidelines of the CAPA Asia Summit 2017.

“Probably in the next year we will at least know the direction. It will be a sizeable order,” he said, declining to provide estimated numbers.

Callegari said Aeroflot wanted to retain both Airbus and Boeing narrow bodies in its fleet because it used them in different seating configurations and did not want to be reliant on a single manufacturer.

Aeroflot, which has an average fleet age of just 4.1 years, increased capacity across its premium and low-cost carriers by 16.2 percent in the nine months ended Sept. 30 and still filled a higher percentage of its seats than in the prior year.

It expects the growth rate to slow slightly in the fourth quarter, with a full-year capacity forecast of 12-14 percent growth, Callegari said.

Russian aviation market conditions were particularly challenging in 2015 and 2016, after sanctions by the United States and Europe, along with weak oil prices, hit the Russian economy and the rouble, killing consumer demand.

Demand started to recover along with the economy and Aeroflot has benefited from its scale and the bankruptcies of Russian carriers Transaero in 2015 and VIM Airlines this year.

“The market is proving us right and offering us the possibility of growing,” Callegari said. “Others don’t seem to have such a successful approach. It makes some market segments more approachable because they cease to operate.”

However, Aeroflot reported a 40 percent drop in its non-consolidated net income under Russian Accounting Standards (RAS) in the nine months ended Sept. 30 to 25.5 billion rubles ($437.72 million), which ATON brokerage attributed to a lack of foreign exchange gains compared to last year.

Aeroflot is a member of the SkyTeam alliance alongside carriers including Delta Air Lines (DAL.N), Air France KLM SA (AIRF.PA) and China Eastern Airlines Corp Ltd (600115.SS).

It has codeshare arrangements with other airlines but has yet to agree a joint venture deal allowing it to coordinate scheduling and pricing.

“We are having constructive conversations with a number of parties but no joint ventures are finalised yet,” Callegari said, adding airlines in Europe and Asia were the focus of talks.

($1 = 58.2565 rubles)

Reporting by Jamie Freed; additional reporting by Jack Stubbs in Moscow; Editing by Gopakumar Warrier

NAFTA

REUTERS. NOVEMBER 6, 2017. Some NAFTA talks to get early Nov. 15 start in Mexico: sources

MEXICO CITY (Reuters) - U.S., Mexican and Canadian officials will kick off some of the next round of talks to rework the North American Free Trade Agreement slightly ahead of schedule on Nov. 15, four officials familiar with the process said on Monday.

The fifth round of NAFTA negotiations is due to be held between Nov. 17 -21 in Mexico City. However, some groups from the three nations will begin meeting from Nov. 15, the four officials said, speaking on condition of anonymity.

“Some topics that will likely be discussed during those days include textiles, services, labor, and intellectual property. It’s very possible other topics will be added,” one of the officials said.

Mexico’s Economy Ministry said in a statement the fifth round would begin on Nov. 17 as planned and that some groups could meet beforehand to review the agendas of the chief negotiators.

One of the officials said the chief negotiators would begin meetings as planned from Nov. 17 and that holding preparatory discussions beforehand was not unusual.

“This doesn’t have any substantial impact (on the talks),” another of the officials familiar with the matter said.

A U.S. lobbyist familiar with the process said: “I hear they wanted to move textiles earlier into the schedule.”

U.S. President Donald Trump has threatened to withdraw from NAFTA if he cannot rework it in favor of the United States. His negotiating team set out proposals in the previous round that caused dismay among Mexican and Canadian counterparts.

Among the most divisive were proposals to establish rules of origin for NAFTA goods that would set minimum levels of U.S. content for autos, a sunset clause that would terminate the trade deal if it is not renegotiated every five years, and to end the so-called Chapter 19 dispute mechanism.

One of the officials said it was possible a counterproposal would be made in the next round on the sunset clause, but was skeptical about the prospect of exploring a compromise on the demand to enshrine U.S. national content in rules of origin.

Reporting by Adriana Barrera, David Ljunggren, Dave Graham and Ginger Gibson; Editing by Tom Brown

BLOOMBERG. 6 November 2017. Nafta Negotiators Extend Length of Upcoming Round

By Eric Martin and Josh Wingrove

- Under the new schedule, talks will run Nov. 15 through Nov. 21

- Early start aimed at improving logistics for meetings

Nafta negotiators plan to begin meeting in Mexico City two days ahead of schedule this month in order to give themselves more time to discuss the myriad issues covered under the 23-year-old trade pact, according to two people familiar with the plans. Mexico’s stock index briefly extended its gain.

Negotiators have organized talks to revamp the North American Free Trade Agreement into different rounds, and last met in October during round four in the Washington area.

The fifth round will run Nov. 15-21 rather than Nov. 17-21 as originally planned, according to the people, who asked not to be identified as the preparations aren’t public yet. Negotiators are giving themselves more time because they want to avoid scheduling conflicts, as many of them are discussing multiple topics that would overlap without the two additional days, one of the individuals said. The chief negotiators will join talks on Nov. 17 as previously scheduled, the other person said.

The decision to extend the round comes after officials from the U.S., Canada and Mexico last month abandoned a December target to wrap up talks to revamp Nafta, saying they needed until the end of March to negotiate a new deal. They also extended the time between each round, giving themselves more space to consider proposals.

Negotiations grew contentious during the fourth round, when the U.S. made controversial demands on dairy, automotive content, dispute panels, government procurement and a sunset clause, under which Nafta would expire after five years unless the parties can agree to extend it. At the closing press event, U.S. Trade Representative Robert Lighthizer said he was “surprised and disappointed by the resistance to change.”

The fifth round of negotiations, which will take place in Mexico City, will begin with meetings on textiles, labor, services and intellectual property, one of the people said. As in the last round, participants will discuss the controversial topic of rules of origin in the second half of the round. The rules govern what share of a product must be sourced within Nafta to receive the pact’s benefits.

Chief technical negotiators for the three countries will meet again in Washington Dec. 11-15, though the nations’ ministers aren’t expected to attend those meetings, the person said.

Mexico’s IPC stock index advanced 0.9 percent to 48,967.01 in Monday afternoon trading.

APEC - TPP

BLOOMBERG. 6 November 2017. Bid to Save the TPP Trade Deal Comes to a Head

By Josh Wingrove and Maiko Takahashi

- APEC summit involves remaining 11 TPP nations after U.S. exit

- Japan pressing for deal, Canada calling for improvements

The push to salvage a Pacific-rim trade pact will come to a head this week as nations diverge on whether it should be preserved, abandoned or renegotiated from scratch after President Donald Trump pulled the U.S. out of the deal.

The Asia-Pacific Economic Cooperation leaders’ meeting in Danang, Vietnam, will bring together the remaining 11 members of the Trans-Pacific Partnership, with both Japan and Vietnam raising the prospect of concluding a deal. Japan -- the world’s third-largest economy -- continues to advocate for the TPP amid warnings that its collapse, or even a move to redo it, would hurt growth.

“We want to maintain the high standard and find a way to seal the deal between the 11 countries,” Japanese Economy Minister Toshimitsu Motegi said last week. “A list has emerged of sections that each country wants to freeze and we have made progress on cutting it back. What’s left are issues that are important to each country, or that they are particularly concerned about.”

The pact would have covered 40 percent of the global economy, going beyond traditional deals by including issues like intellectual property, state-owned enterprises and labor rights. After years of painful negotiation, and close to the ratification stage at thousands of pages, it was thrown into disarray when Trump withdrew the U.S. in one of his first acts as president this year, arguing the move was needed to protect U.S. jobs.

The agreement was seen as a hallmark of U.S. engagement with Asia under the prior administration and a buffer against China’s rising clout. Then-Defense Secretary Ash Carter called it more strategically important than having another aircraft carrier battle group in the Pacific. Since the U.S. withdrawal, remaining nations have struggled to take the deal forward.

Read more: Free Trade and Its Foes

Two Japanese officials, speaking on condition of anonymity, said last week they expected a TPP-11 deal to be reached in Vietnam, with one adding that about 20 issues still needed to be resolved.

The logic for a deal remains compelling, Australian Prime Minister Malcolm Turnbull said Saturday. The TPP would improve market access and support the rule of law -- and the world was “dangerously short of both,” he said.

TPP was nonetheless built in large part around U.S. participation. And with the world’s largest economy gone, others have voiced concerns. The pact’s second-largest remaining economy, Canada, is pushing to beef up what it calls “progressive” elements of the deal while maintaining market access, warning that could take some time.

“What is very much alive is the objective of open, principled, rules-based trade. The vehicle, the instrument to get there -- that’s what the leaders will have to discuss,” Trade Minister Francois-Philippe Champagne said in an Oct. 30 interview. Canada has hosted talks to save the TPP, and Champagne said he wasn’t proposing a full-scale renegotiation. “Certainly, I think it’s months, if not years, ahead in terms of bringing everyone along.”

New Zealand

One key TPP hurdle was removed last week when New Zealand Prime Minister Jacinda Ardern announced a ban on foreigners buying existing homes, a law set to be rushed through to essentially take effect before TPP would.

Still, Ardern told reporters in Sydney on Sunday that New Zealand would pursue changes to the deal’s investor-state dispute-settlement clauses “as far as we are able,” including at APEC. Similar concerns in Europe almost scuttled the Canada-EU trade deal, which recently took provisional effect.

In an interview on Tuesday, Ardern said New Zealand would benefit from the TPP.

“There are clear benefits for our exporters in this agreement,” she said. She declined to comment on whether the dispute settlement issue would be a deal breaker, saying she wanted to “maintain and preserve New Zealand’s negotiating position.”

Peru meanwhile is more focused on talks toward a trade-and-investment agreement between a smaller group of countries than trying to save the TPP without the U.S., a Peruvian official said, speaking on condition of anonymity.

Nafta Watch

Mexico, the TPP’s fourth-largest economy, has worked with Japan and others to reach an accelerated TPP pact. Mexico and Canada, however, are in the midst of talks to keep Trump from walking away from another deal -- the North American Free Trade Agreement, for which the TPP was a de facto modernization. Nafta talks have stalled on five contentious U.S. proposals, with the next round set for later this month in Mexico.

Trump, during a visit to Japan as part of his first trip to Asia as president, again chided the country for what he said was an unfair trade advantage, especially in the auto sector. He told business leaders Monday that TPP was “not the right idea” and he envisioned easing trade restrictions in another way, outside the TPP framework, without going into detail.

While some hope for a quick deal in Vietnam, Canada is pushing for certain things to be added to the pact, Champagne said. It is seeking to maintain market access components while strengthening elements such as environment and labor provisions and adding others to reach a “better deal.”

Divergent Views

The remaining TPP countries have varying views, he said. “There is a spectrum -- if we think negotiating with three is difficult, imagine negotiating with 11,” he said, an allusion to Nafta talks, adding: “if you look from a Canadian perspective, it’s never been a better time to diversify.”

David Mann, chief Asia economist at Standard Chartered Plc, has said that reaching an agreement would hinge on how the countries agreed to treat trade in services. Motegi, Japan’s minister, said the countries have had four meetings towards saving the deal, which he said would boost opportunities for small and medium-sized companies to expand in Southeast Asia.

“A borderless society is coming, in terms of information,” Motegi said, adding: “Of course it’s not only about trade in things, but the movement of people and information. I think it will bring merits in various areas. This is a global age, and Asia is the center of growth. Japan can take advantage of that growth -- that’s an extremely important merit.”

— With assistance by Isabel Reynolds, John Quigley, Matthew Brockett, Nguyen Dieu Tu Uyen, Michelle Jamrisko, and Matthew Burgess

ENERGY

The Globe and Mail. Bloomberg. 7 Nov 2017. Oil prices climb amid Saudi roundup. A promise to cap production by Nigeria’s oil minister and U.S. dollar’s drop added upward momentum

JESSICA SUMMERS

Oil prices have climbed by $15 (U.S.) from their nadir this year to breach $57 a barrel on Monday, spurred by a cascade of events that began with widespread arrests among Saudi Arabia’s elite.

The arrests raise “the spectre of instability in the kingdom,” said John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund.

“It’s another round of jawboning here to get this nervous market higher.”

Futures rallied 3.1 per cent in New York to levels last seen in June, 2015.

Dozens of princes, government ministers and billionaires were arrested in a sweeping anti-corruption probe, including high-ranking officials involved with state oil producer Saudi Aramco.

Although the shake-up involving the world’s biggest crude exporter underpinned crude’s rally, a promise by Nigeria’s oil minister to cap production joined with the U.S. dollar’s drop added upward momentum as the session progressed. “The geopolitical supply risk premium is starting to bear its head in the market right now because OPEC supply cuts have made it relevant,” said Michael Loewen, a commodities strategist at Scotiabank in Toronto.

Now that OPEC “has capped supply and demand has continued to grow higher over time, we are near balanced and that means supply risk is more important.”

Oil has climbed for four straight weeks in New York on signs a global glut is shrinking in response to output caps implemented by the Organization of Petroleum Exporting Countries and allied producers including Russia.

At the Nov. 30 gathering, Saudi Arabia, Iraq and other major suppliers are expected to make the case for extending the limits beyond their March expiration.

The low point for oil prices in New York this year was $42.05 a barrel in June.

Monday’s gain also kicked up company shares with the S&P 500 Energy Index advancing as much as 2 per cent, led by increases from driller Chesapeake Energy Corp. and the oil field services company Baker Hughes.

In Canada, shares of oil and gas stocks over all surged 2.5 per cent, with Suncor Energy Inc. gaining 0.8 per cent and Cenovus Energy Inc. 5.1 per cent.

West Texas Intermediate for December delivery jumped $1.71 to settle at $57.35 a barrel on the New York Mercantile Exchange. That’s the biggest gain since Sept. 25 on a percentage basis.

Total volume traded was about 27 per cent above the 100-day average.

Brent for January settlement surged $2.20 to settle at $64.27 on the London-based ICE Futures Europe exchange, the largest rise since July. The premium at which Brent traded to January WTI was $6.70.

Security forces arrested 11 princes, four ministers and dozens of former ministers and prominent businessmen, according to Saudi media and a senior official who spoke on condition of anonymity.

The Nigeria oil minister’s comments that the producer is willing to limit output added to the bullish price momentum, according to Tariq Zahir, a New York-based commodity fund manager at Tyche Capital Advisors LLC.

“That news basically was out there already, but it definitely helped.” Mr. Zahir said in a telephone interview.

Meanwhile, the Bloomberg Dollar Spot Index, a gauge of the dollar against 10 major peers, dropped as much as 0.3 per cent.

A weaker greenback boosts the appeal of commodities as an investment.

THE GLOBE AND MAIL. REUTERS. NOVEMBER 7, 2017. OPEC sees slower growth in demand for its oil as rivals pump more

ALEX LAWLER, LONDON

Global demand for OPEC's crude will rise in the next two years more slowly than expected, the group forecast, as a recovery in prices resulting from an OPEC-led supply cut stimulates renewed output growth from non-members.

The Organization of the Petroleum Exporting Countries also said in its 2017 World Oil Outlook that rapid adoption of electric vehicles could cause oil demand to plateau in the second half of the 2030s, denting OPEC's longer-term prospects.

OPEC and rivals including Russia have been cutting output in 2017 to get rid of a glut. A resulting price rise is spurring a rebound in non-OPEC supply, the report shows, but OPEC still expects its market share to increase further down the line.

"It is evident that this major commitment to production adjustments has been central to the rebalancing process that the market has undergone this year," OPEC Secretary-General Mohammad Barkindo wrote in a foreword to the report.

"The long-term focus for additional liquids demand remains on OPEC."

Demand for OPEC crude will reach 33.10 million barrels per day (bpd) in 2019, the report said. While up from 32.70 million bpd in 2016, the 2019 figure is down from 33.70 million bpd forecast in last year's report.

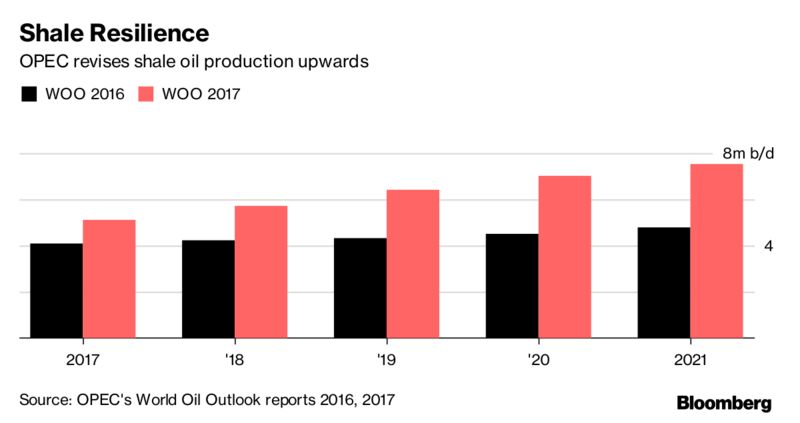

OPEC raised its forecast for the supply of tight oil, which includes U.S. shale. It said a rise in prices in 2017, plus sustained demand growth, had resulted in a higher forecast for supplies outside OPEC.

"The medium-term outlook for non-OPEC liquids growth has changed quite considerably," OPEC said in the report, referring to its 2016 forecasts. "Most strikingly, U.S. tight oil production has exceeded previous growth expectations."

Oil prices hit their highest since July 2015 on Monday, trading above $62 a barrel.

This year's report did not mention the oil price it assumes. Last year's report assumed OPEC's basket of crude oils would reach $65 in 2021.

HIGHER FORECAST FOR TIGHT CRUDE

Global output of tight oil will reach 7.0 million bpd by 2020 and 9.22 million bpd in 2030, the report said, as Argentina and Russia join North America as producers.

Last year's estimates were 4.55 million bpd by 2020 and 6.73 million bpd by 2030.

Years of high prices – supported by OPEC output restraint – helped boost non-OPEC supply and make non-conventional oil, such as shale, viable. This exacerbated a glut, leading to the 2014 price collapse that the OPEC-led cut was designed to tackle.

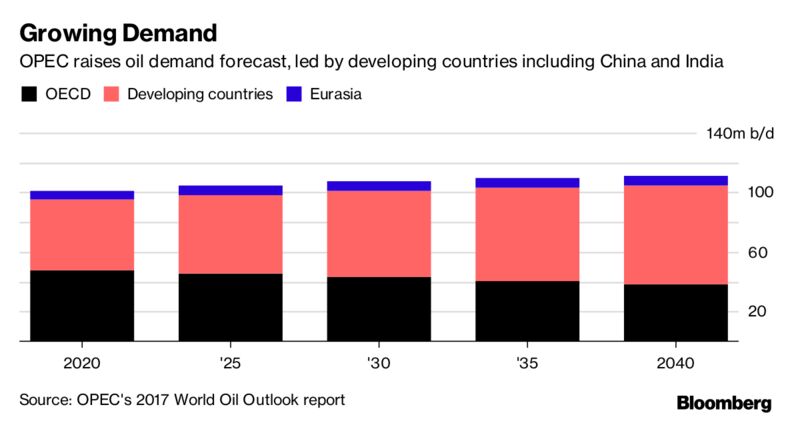

OPEC also increased its medium-term world oil demand forecast, expecting oil use to reach 102.3 million bpd by 2022 – 2.24 million bpd more than in last year's report.

Demand is seen at 111.1 million bpd in 2040, up from 109.4 million bpd expected last year, with OPEC's share of the world oil market expected to rise to 46 per cent from 40 per cent in 2016.

Still, OPEC, which normally forecasts ever-increasing oil demand, said more widespread use of electric vehicles (EVs) than assumed in the report's main scenario could trim this figure.

"In just a few years, EVs have gone from being completely unaffordable, impractical and not particularly nice, to representing a valid option for a niche pool of customers," OPEC said.

The 2040 oil demand forecast could be curbed to 108.60 million bpd if electric vehicles are adopted more widely than assumed in the report's reference case.

"Moreover, global oil demand is estimated to plateau around this level in the second half of the 2030s," OPEC said.

OPEC. REUTERS. NOVEMBER 7, 2017. OPEC seeks consensus on duration of oil cut pact before meeting

VIENNA (Reuters) - OPEC is seeking to achieve consensus agreement before a meeting on Nov. 30 on how long to extend a global pact to curb oil production, OPEC’s secretary general said on Tuesday.

The Organization of the Petroleum Exporting Countries, plus Russia and nine other producers, are cutting oil output by about 1.8 million barrels per day (bpd) until March 2018 in an effort to eradicate a supply glut that has weighed on prices.

The deal has supported prices, which are trading at a more than two-year high, but an overhang of stored oil has yet to be fully eradicated and producers are considering extending the deal at the Nov. 30 meeting.

“Extensive consultations are currently ongoing to reach some consensus before Nov. 30 on the duration beyond the March 2018 deadline,” OPEC’s Mohammad Barkindo told reporters.

”I have not heard so far any participating country that is violently objecting to extending the decision.

The producers are in the process of inviting other countries to the Nov. 30 meeting, Barkindo said, with a view to joining the deal. He declined to name the countries concerned.

Reporting by Alex Lawler and Shadia Nasralla; Editing by David Goodman

REUTERS. NOVEMBER 7, 2017. Canadian Natural sees 17 percent rise in 2018 production

(Reuters) - Canadian Natural Resources Ltd (CNQ.TO) (CNQ.N) on Tuesday forecast a 17 percent rise in 2018 production, although it lowered its capital budget for the year.

The company joins a growing a list of North American oil producers that have cranked up their oil output, while cutting back on spending.

“Modest drilling programs will ensure cost control, which is essential in this commodity price environment,” Chief Operating Officer Tim McKay said in a statement

Canada’s largest independent petroleum producer said overall production in 2018 is expected to range between 1.1 million and 1.2 million barrels of oil equivalent per day (boe/d).

The company is estimating 2017 production of 833,000 to 883,000 boe/d.

Overall crude oil and natural gas liquids (NGLs) production is expected to range between 815,000 and 885,000 barrels/day in 2018, up 23 percent from a year earlier, helped by the completion of the phase 3 expansion at its Horizon oil sands project.

The company plans to spend C$4.3 billion ($3.37 billion) in 2018, lower than C$4.9 billion in 2017.

Last week, the company reported a third-quarter profit, rebounding from a year-earlier loss, helped by higher production and average realized prices for crude oil and NGLs.

Reporting by John Benny in Bengaluru; Editing by Anil D'Silva

REUTERS. NOVEMBER 6, 2017. Chevron green lights its first Canadian shale development

Nia Williams

CALGARY, Alberta (Reuters) - Chevron Canada, a unit of global oil major Chevron Corp, is forging ahead with its first ever Canadian shale play development, targeting the East Kaybob region of central Alberta’s Duvernay formation.

The decision, announced by the company on Monday, is a rare bright spot for Canada’s oil industry, which was hard hit by the global crude price downturn. International energy firms sold off nearly $23 billion in assets this year alone.

Chevron will initially develop around 55,000 acres in the Duvernay. That could eventually spur more drilling in other parts of the 330,000 acre portion of the shale formation controlled by Chevron Canada, company spokesman Leif Sollid said.

He did not comment on Chevron’s expected production or capital spend in the Duvernay, citing corporate disclosure rules, but said it was a major step forward for the company which has spent three years appraising the Kaybob area.

“This is a very significant business opportunity for Chevron Canada and our very first foray into development in the liquids-rich Duvernay,” Sollid told Reuters.

“Since we began appraisal drilling we have made significant improvements in costs and cycle times by applying Chevron’s learnings in other North American shale plays including the Permian in Texas.”

The Duvernay formation is one of Canada’s top shale plays and holds the country’s largest marketable resources of unconventional light shale oil and condensate, according to the national energy regulator.

Canada’s energy industry is still dominated by the vast oil sands sector in northern Alberta, but investment is climbing in the Duvernay and Montney shale basins, which offer faster returns and lower capital requirements than the oil sands.

Chevron first acquired leases in the Duvernay around eight years ago and is now one of the region’s biggest landholders.

The company also holds undeveloped land in the Liard and Horn River basins in western Canada, a 20 percent stake in Canadian Natural Resource Ltd’s Athabasca Oil Sands Project and non-operator interests in a handful of deepwater projects off the east coast of Canada.

As part of Chevron’s East Kaybob development Calgary-based Pembina Pipeline Corp will spend C$290 million building infrastructure to ship and process gas and condensate, which is expected to be in service by mid to late 2019.

“We look forward to continuing to develop future Duvernay infrastructure needs over the long-term,” said Jaret Sprott, Pembina’s vice president of gas services.

Reporting by Nia Williams; Editing by Tom Brown

BLOOMBERG. 6 November 2017. Chevron Not Totally Giving Up on Canada, Plans Shale Push

By Kevin Orland

- Development covers 55,000 acres in liquids-rich Duvernay play

- Company earlier sold off Canadian gas stations, refinery

Chevron Corp. is planning a significant drilling program in the Duvernay shale formation, marking a vote of confidence in Canada’s energy industry in a year when it joined other majors in selling assets there.

The initial development in the East Kaybob section of the formation will encompass about 55,000 acres (22,000 hectares), the San Ramon, California-based company said Monday. Chevron has a net 70 percent operating interest in about 330,000 acres in the Duvernay.

The drilling program may boost morale in the Canadian energy industry, which has seen energy majors including Royal Dutch Shell Plc, Marathon Oil Corp. and ConocoPhillips divest billions of dollars of assets in Alberta’s oil sands. Chevron itself sold its gas stations and refinery in British Columbia in a $1.1 billion deal earlier this year.

Chevron’s operations in the Duvernay, a liquids-rich formation in west-central Alberta, will use long-term infrastructure agreements with Pembina Pipeline Corp. and Keyera Corp. Calgary-based Pembina expects a capital cost of C$290 million ($228 million) for its portion of the project, with an in-service date of mid- to late-2019.

The decision follows a three-year appraisal program, according to the company statement.

Chevron shares rose 1.8 percent to $117.04 Monday in New York. The stock is little changed this year.

BLOOMBERG. 7 November 2017. OPEC Fights Back—and This Time, It’s Driving Oil Prices Up

By Christopher Sell

OPEC’s finally getting some credibility back behind its swagger, ahead of the oil group’s meeting later this month in Vienna.

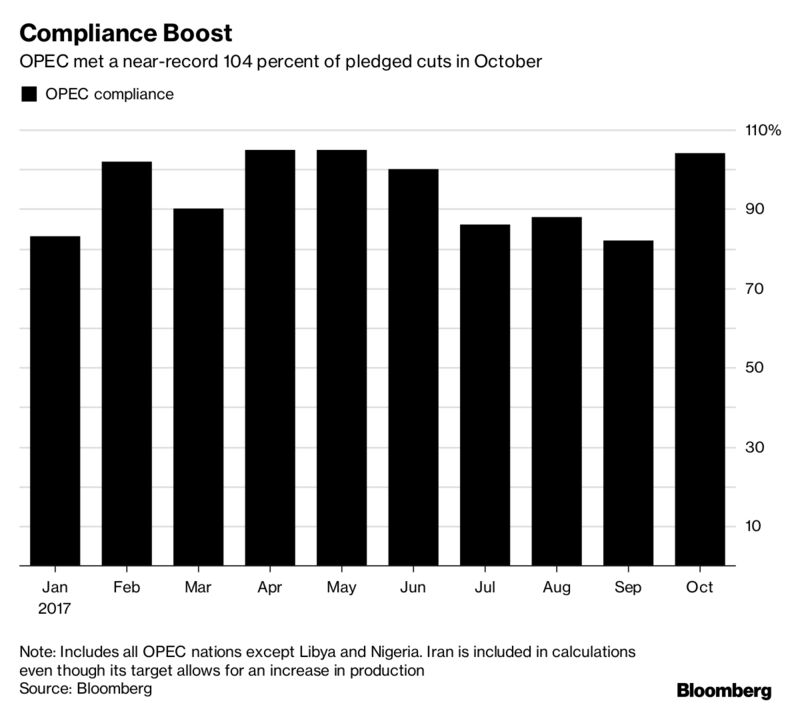

The cartel’s members complied to the tune of 104 percent in October on orders to pull back 1.2 million barrels a day, according to Bloomberg data. Stockpiles are drawing and Brent closed at at two-year high of $64.27/b on Monday.

So what’s changed?

Some say a rise in geopolitical risk has pushed up prices, but other analysts think there’s a more permanent shift underway.

"We do not see the latest rise in prices as speculative," said Paul Horsnell, global head of commodity strategy at Standard Chartered, in a recent note. "We think the move reflects the start of a widespread re-evalution."

Traders, he said, are rethinking how much oil will be produced and drawn down from stockpiles, especially in the U.S.

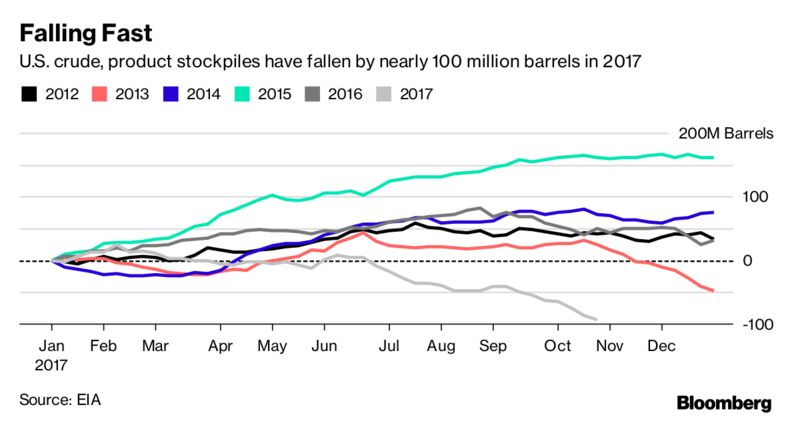

Looking at the U.S. gives several encouraging signs. Stockpiles compared to the five-year average have continually fallen in 2017. U.S. crude and product inventories, including the SPR, have fallen by 93.8 million barrels since since January. Latest weekly data from the EIA show that U.S. crude stockpiles have drawn by a further 2.4 million barrels to 454.9 million barrels. That’s the seventh consecutive weekly draw.

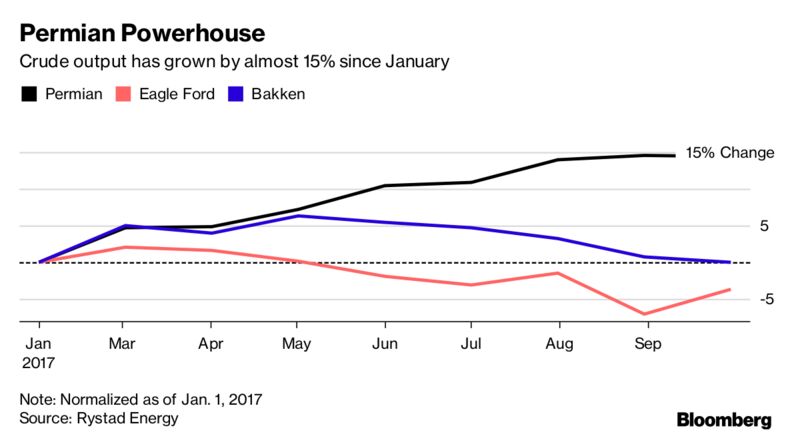

It isn’t just stockpiles, U.S. shale output growth is tapering off. Permian production has grown almost 15 percent to 2.43 million barrels a day in September from 2.13 million barrels a day in January, while the Bakken is relatively unchanged and the Eagle Ford falling to 1.13 million barrels a day from 1.7 million barrels a day, according to BTU Analytics data.

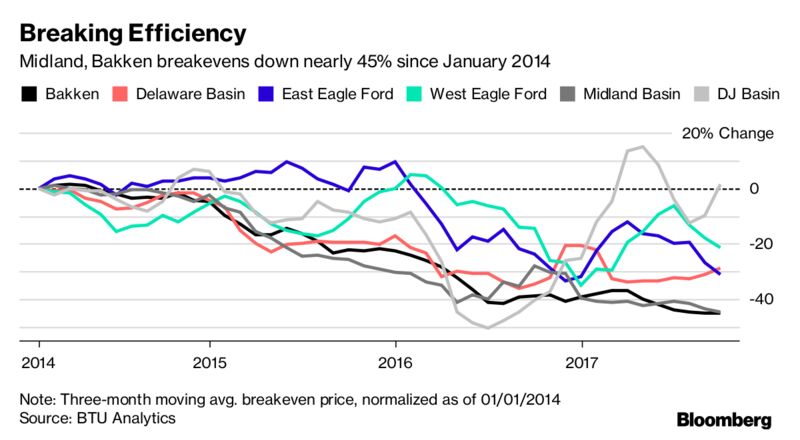

This slowdown has come even as breakevens in key basins have fallen, with costs in both the Midland basin and West Eagle Ford declining by around 45% since January 2014, according to BTU Analytics. And while shale output is likely to get cheaper until mid-2019, according to Ebele Kemery, head of energy investing at JPMorgan in New York, the "greatest leaps forward in lowering costs are now behind us," said Michael Poulsen, senior oil risk analyst with Global Risk Management.

Meanwhile, OPEC compliance with production cuts agreed last year rose by 23 percent month-on-month to 104 percent in October, according to a Bloomberg survey published on Wednesday. That’s the second-highest level since the organization began curbing output in January. OPEC output fell by 180,000 barrels a day to 32.59 million barrels a day, Bloomberg data show.

While prices are a bit better now, the coming years don’t look so great. OPEC is probably going to need to sustain its cuts for another year. Even if the cuts finish in late 2018, it’s looking at zero growth in demand for its crude until 2025 as shale takes all the new market share.

OPEC’s World Oil Outlook 2017, published today, gives further encouragement. OPEC expects shale oil production to peak after 2025 and decline from about 2030. OPEC will then be required to increase its own output from about 33 million barrels a day in 2025 to 41.4 million in 2040, according to the report.

BLOOMBERG. 7 November 2017. OPEC Now Says U.S. Shale Will Grow Even Faster Than They Previously Thought

By Angelina Rascouet

- Group raises forecast for shale oil output in annual report

- Shale producers show ‘resilience and ability to bounce back’

OPEC said shale oil production will grow considerably faster than expected over the next four years after the group’s output cuts triggered a crude-price recovery that helped U.S. producers.

North American shale output will soar to 7.5 million barrels a day in 2021, the Organization of Petroleum Exporting Countries said in its World Oil Outlook report on Tuesday. That’s 56 percent higher than it forecast a year ago. The revised outlook illustrates OPEC’s dilemma: with supply curbs also helping its rivals, demand for the group’s crude will remain little changed until shale oil output peaks after 2025.

U.S. shale oil “most strikingly” exceeds previous expectations after showing the “resilience and ability to bounce back,” OPEC said. “This growth is heavily front-loaded, as drillers seek out and aggressively produce barrels from sweet spots in the Permian and other basins.”

OPEC assumes shale oil production growth will mostly originate from the U.S., with some contribution from Canada, Argentina and Russia over the forecast period to 2022. North American shale production for 2017 is now seen at 5.1 million barrels a day, up by almost a quarter from last year’s World Oil Outlook report.

OPEC and its partners, including Russia, are meeting in Vienna on Nov. 30 to decide whether to extend the deal to curb production beyond the end of March. Since Jan. 1, they’ve targeted output cuts of about 1.8 million barrels a day in a bid to reduce global stockpiles.

Brent crude has rebounded more than 10 percent this year, trading at more than $62 a barrel in London.

OPEC expects shale oil production to peak after 2025 and decline from about 2030. OPEC will then be required to increase its own output from about 33 million barrels a day in 2025 to 41.4 million in 2040, according to the report.

OPEC raised its forecast for global oil demand by 2.3 million barrels a day in 2021 compared with last year’s report. The group said demand growth will be particularly robust in 2020 as regulations to reduce shipping pollution kick in, leading to higher refinery runs to provide the required fuels.

OPEC also raised its oil demand forecast in 2040 by 1.7 million barrels a day to about 111 million barrels. China and India will lead the demand growth, offsetting declines in developed nations, it said.

JOB MARKET

THE GLOBE AND MAIL. NOVEMBER 7, 2017. The complete - and uglier - picture of Canada's jobs market

MICHAEL BABAD, Columnist

The jobs market, unabridged

We were all agog last week when Statistics Canada reported that employment surged by 35,000 in October. And rightly so, as Canada has now created 208,000 jobs over the course of a year.

The federal agency's latest labour force survey also put unemployment at 6.3 per cent in October, up a notch from September's 6.2 per cent and with more than 1.2 million people out of work.

These are the numbers we tend to focus on, even though Statistics Canada provides a much broader look.

And we should never forget the other, uglier measures of employment.

The Bank of Canada certainly isn't ignoring these other measures, and its view of the jobs market will help determine when it raises interest rates again. It's also one of the reasons analysts believe Canada won't see a rate increase until well into next year.

"Growth in employment has remained strong at the national level and has been broad-based across sectors and regions," the central bank said in its latest monetary policy report, though it added that "the unemployment rate has continued to fall, but its decline likely overstates the degree of improvement in the labour market,"

That report was released in October, just before the latest Statistics Canada survey, which means the Bank of Canada was still looking at September's rate.

That makes little difference, though, because the central bank's labour market indicator is notably elevated.

Thus, the official jobless rate may be too optimistic, certainly as the Bank of Canada sees it.

"In particular, the bank's labour market indicator, a composite indicator, is still relatively high. Its current level reflects the fact that the long-term unemployment rate remains elevated, average hours worked remain low and wage growth continues to be modest."

Look, too, at Statistics Canada's broader measure, which includes people who have given up looking for a job, those waiting to be recalled or awaiting job answers, and those in part-time positions who want to work full-time.

Both the Bank of Canada and broader Statistics Canada measures are still "above the troughs seen pre-recession (about 0.5 of a percentage point higher in both cases)," said Mark Chandler, Royal Bank of Canada's head of Canadian rates strategy.

In the U.S., however, the jobless rate is 0.3 of a percentage point less than the 2007 low, and underemployment has already hit its previous cyclical low.

"These statistics lend some credence to Governor Poloz's assertion that the U.S. may be some two years ahead of Canada in its cycle," Mr. Chandler said.

"In our view, caution means the BoC may not raise rates again until April 2018."

There are also other measures of how much we earn.

Statistics Canada's last two labour force surveys showed average hourly wages rising by more than 2 per cent. Indeed, that measure perked up to 2.4 per cent in October.

"However, as shown [in the chart below], it is not clear from alternative wage measures that this updraft is firmly intact," Mr. Chandler said.

The Bank of Canada also flagged wages as an issue in its monetary policy report, with Mr. Poloz noting "continued softness" even amid an official unemployment rate now back to pre-crisis levels.

"This softness is due in part to the excess capacity in the labour market …. and the link between excess demand and higher wages also operates with a lag," Mr. Poloz said.

"But it is also possible that other factors, including globalization, may be affecting wage dynamics."

TRADE PROMOTION

Innovation, Science and Economic Development Canada. November 7, 2017. Minister Chagger to travel to Boston, Massachusetts

Ottawa — The Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism, will travel to Boston from November 7 to 9, 2017. Minister Chagger will meet with business and government leaders from the United States to emphasize the Government of Canada’s commitment to supporting clean technologies and an integrated North American supply chain.

During her trip, Minister Chagger will also participate in the following events.

Wednesday, November 8, 2017

10:15 a.m. Tour of the Greentown Labs facility and announcement

Location:

Greentown Labs

28 Dane Street

Somerville, Massachusetts

12:00 p.m. Tour of the Greenbuild International Expo and meeting with Canadian companies.

Location:

Boston Convention and Exhibition Center

415 Summer Street

Boston, Massachusetts

4:00 p.m. Women in business and innovation round table

Location:

CIC Cambridge Innovation Center

Boston, Massachusetts

Thursday, November 9, 2017

12:50 p.m. Keynote address at the New England–Canada Business Council Energy Trade & Technology Conference

Location:

Seaport Hotel

One Seaport Lane

Boston, Massachusetts

Innovation, Science and Economic Development Canada. November 6, 2017. Parliamentary Secretary Alaina Lockhart to deliver remarks at the International Aboriginal Tourism Conference

Calgary, Alberta — Alaina Lockhart, Parliamentary Secretary for Small Business and Tourism and Member of Parliament for Fundy Royal, will deliver opening remarks at the International Aboriginal Tourism Conference.

Date: Tuesday, November 7, 2017

Time: 8:30 a.m.

Location:

Grey Eagle Resort and Casino

3777 Grey Eagle Drive

Calgary, Alberta

________________

LGCJ.: