CANADA ECONOMICS

HOUSING

The Globe and Mail. 23 Nov 2017. Ottawa looks to provinces for billions to support housing plan. Prime Minister Justin Trudeau released a $40-billion national housing program on Wednesday, but the plan counts on the provinces to contribute billions and key elements won’t begin until after the next federal election.

BILL CURRY

JEFF GRAY

With reports from Justine Hunter in Victoria and Les Perreaux in Montreal

The 10-year program assumes the provinces will be willing to match federal spending plans in some areas, meaning further negotiations will be needed before the details are worked out. Quebec in particular says it wants to hammer out its own agreement with Ottawa.

The main new initiative announced on Wednesday is a $4-billion Canada Housing Benefit, which would provide rent support for about 300,000 low-income households and would begin in 2020. Ottawa expects the provinces to cover half of the cost.

Ottawa is also responding to one of the most pressing concerns raised by Canada’s cities, offering $4.8-billion to address the fact that many long-standing social-housing agreements with Ottawa were scheduled to expire over the coming years.

Standing in front a construction site where work is under way on a new mixed-income redevelopment of the Lawrence Heights publichousing complex in northwest Toronto, the Prime Minister said he was confident the provinces would endorse and help pay for what he called his “once-in-a-generation” housing plan.

“What we have heard from our provincial partners here in Ontario and across the country, our municipal partners, is a level of excitement and a level of commitment to getting this done,” Mr. Trudeau told reporters.

But even Ontario Housing Minister Peter Milczyn, who was invited to the same podium to praise Mr. Trudeau’s announcement, would not firmly commit to new spending on Wednesday.

“There is more money here on the table from them, so obviously, now that there is a partnership to be had, we’ll be working with them,” Mr. Milczyn said in an interview. The Federation of Canadian Municipalities praised the announcement as a “breakthrough” for Canadian cities pushing for help in dealing with a shortage of affordable housing.

The housing plan provides details as to how Ottawa will spend the $11.2-billion over 11 years that was announced in the March budget. The budget had pledged to address concerns over expiring social-housing contracts, but the government had not announced a dollar figure for that pledge until Wednesday. Other parts of the strategy are paid for out of funding for housing that had previously been in place.

Some observers questioned why the program was limited to low-income Canadians and does not address the fact that many other Canadians are also struggling to find an affordable home.

“I thought it would be much more encompassing,” Conservative MP Karen Vecchio said. “We hear this government talk a lot about the middle class. What is this doing to help the middle class? All it’s doing is providing government subsidies, but it’s not providing a plan for the future.”

Jeremy Kronick, a senior policy analyst with the C.D. Howe Institute, expressed similar concern that the program does not address the broader housing pressures in Canada’s largest cities.

“This is about targeting low-income and homelessness,” he said. “These are noble goals and ones to be proud of, but these measures do not deal with middle-class affordability issues in our major cities.”

Some provinces provided a positive initial reaction, but cautioned that many details need to be worked out and understood.

B.C. Premier John Horgan said federal support for social housing will help his province focus on broader affordability issues. He promised more provincial action on that front when his government releases its February budget.

“We need to bring on more housing and it needs to be not just onebedroom apartments in the sky,” he said. “We need to build houses and homes for families and that means two- and three-bedroom units. That means building density around transportation corridors.”

Alberta Minister of Seniors and Housing Lori Sigurdson said in an interview that she welcomed the announcement and was not surprised by the focus on cost-sharing between governments.

“There’s lots more work to be done to understand it all, but I think it’s a step in the right direction,” she said in an interview.

The Quebec government saluted the federal commitment of funds but wants to negotiate a funding agreement outside the national program so the province can continue to run housing, said Lise Thériault, the Quebec minister in charge of housing.

She said her province will want a “bilateral and asymmetric agreement to support our programs and objectives. We’re ready to sit down now.”

“We want to remain the project manager for housing on our territory,” Ms. Thériault said in an interview. “The federal government won’t dictate priorities to Quebec.”

Federal documents released on Wednesday state that the goal is to promote diverse communities with a mix of incomes and uses that are near transit, work, grocery stores and public services.

Brent Toderian, a consultant and former chief planner for the city of Vancouver, said those are laudable goals, but that it is not immediately clear how Ottawa can influence decisions that are ultimately in the hands of provinces and municipalities.

Mr. Toderian said the plan could be positive if it connects with other federal programs such as transit and climate-change funding to encourage more neighbourhood density and reduce car dependence.

“When you start to put these programs together, you start to see a city-building momentum. And that’s a good thing,” he said. “I think there’s a series of moves, including this housing strategy, that show the federal government understands the challenges of cities, and that’s a nice change.”

Many housing advocates welcomed the federal government’s commitment to a new portablehousing benefit. B.C. already has similar program. So does Ontario, but it is currently quite small, funded by the provincial and federal governments and administered by municipalities.

In Toronto, for example, about 4,000 people now receive housing supplements that range from $250 to $400 a month to help them find a home amid the city’s skyrocketing private market rents.

“It gives people a little more purchasing power, a few more options in where they choose their housing,” said Greg Suttor, a former adviser to Ontario’s Housing Ministry who is now a researcher with the Wellesley Institute, an urban-health think tank in Toronto. “I am not saying it is transformative, but it helps.”

Housing and anti-poverty advocates have criticized the lack of a large federal role in the construction of new social housing since the early 1990s – a hole the federal Liberals hoped to fill with their long-awaited plan.

But activists in several cities across the country, including those with the Ontario Coalition Against Poverty in Toronto, staged demonstrations and marches on Wednesday to warn that federal money is spread too thin over too many years to address urgent housing needs.

The Globe and Mail. 23 Nov 2017. National Housing Strategy falls short

Campbell Clark, Columnist

Announcement doesn’t quite meet the billing of a National Housing Strategy The bad news is that calling what the Liberal government released on Wednesday a National Housing Strategy exaggerates the scope of the plan. It was an outline of the rudiments of a federal low-income housing strategy, with roughly drawn directions for policy. The good news is that they were the right directions.

One is that Ottawa is taking on a larger role in expanding the supply of low-income housing, by subsidizing the building or renovation of more units, with an emphasis on mixed-use, mixed-income housing. Another is a new housing “portable” benefit that is supposed to help families afford housing where they can get it, and which doesn’t have to be used in designated community housing.

Both are needed. That should be no secret. The rise of housing costs in some places, notably Toronto and Vancouver, makes the pressures felt by lower-income families seem obvious.

Still, Wednesday’s announcement doesn’t quite meet the billing of a National Housing Strategy. To fulfill that grand promise, you’d have to expect an examination of the broad range of housing.

It might, for example, have considered policies to encourage the expansion of the stock of rental units in cities such as Vancouver. Penny Gurstein, a professor in the University of British Columbia’s school of community and regional planning, argues that a housing strategy has to find some equity for renters in a city that is mostly renters. City businesses find it hard to find service workers because they can’t afford to live there, she argued, so housing policies have to allow for mixed-income cities. A national strategy might have examined possible ways to help those who fear they won’t ever afford to buy a house, a topic that the document released on Wednesday didn’t address substantively. It didn’t address the wide range of affordability issues that worry Canadians. The Liberals’ political opponents will find opportunities in what they left out.

But this strategy offered a few good directions. The federal government’s touted “return” to subsidizing housing is important. Ottawa never completely left the business, but spending dwindled. Contrary to what Prime Minister Justin Trudeau said, that cannot be pinned solely on Stephen Harper’s decade – the decline has been pretty steady since Brian Mulroney was in power.

Back in the 1980s, Wilfrid Laurier University professor Geoffrey Nelson noted, there were 25,000 new lowincome units being built each year. Now, the federal government is saying it will quadruple the number of new units subsidized by Ottawa, to roughly 10,000 a year from roughly 2,500.

It’s less than many social-housing advocates say is necessary, but substantially more than before. It’s hard to imagine a government with persistent deficits committing much more. (The government called it a 10-year, $40-billion strategy, but that includes loans and provincial matching funds, and no clear breakdown added up to that sum. One Canada Mortgage and Housing Corp. official provided figures that indicate the whole strategy will employ $16-billion in new federal money over 10 years.)

Some federal money, $2-billion, will be spent on that new housing benefit, which can be used to pay rent anywhere rather than being restricted to social-housing units. It’s a good idea that doesn’t go far enough.

One problem is that it depends on financially pressed provinces matching the funds to make a total spend of $4-billion. And it won’t start till 2020. It will take time to work out the details with provinces, but Ottawa is almost certainly relieved there is an excuse to avoid raising its short-term deficit higher.

A portable benefit is a good idea. It can alleviate waiting lists for community housing. It encourages lower-income families to rent in mixed-income buildings, which might help break down the income stratification that occurs in cities with high housing costs. It helps people move for work or education.

The problem is that the proposal is stretched. The federal government, presumably hoping to claim it would help a large number of people, decided the average benefit will be $2,500 a year. That’s a little more than $200 a month. “That won’t go very far,” Prof. Nelson said. The strategy would probably go farther with more of its funding devoted to that benefit.

But the strategy shouldn’t be dismissed for being incomplete and even flawed. New Democrats will argue it doesn’t do enough. Conservatives will probably complain it doesn’t help home buyers. But it does point Ottawa’s low-income housing policy in some of the right directions.

BLOOMBERG. 23 November 2017. OECD Warns on Rising Debt Risk as Canadians Most in the Red

By Mark Deen

Canadian bank towers stand in Toronto on Monday June 17 2013. Photographer: Brent Lewin

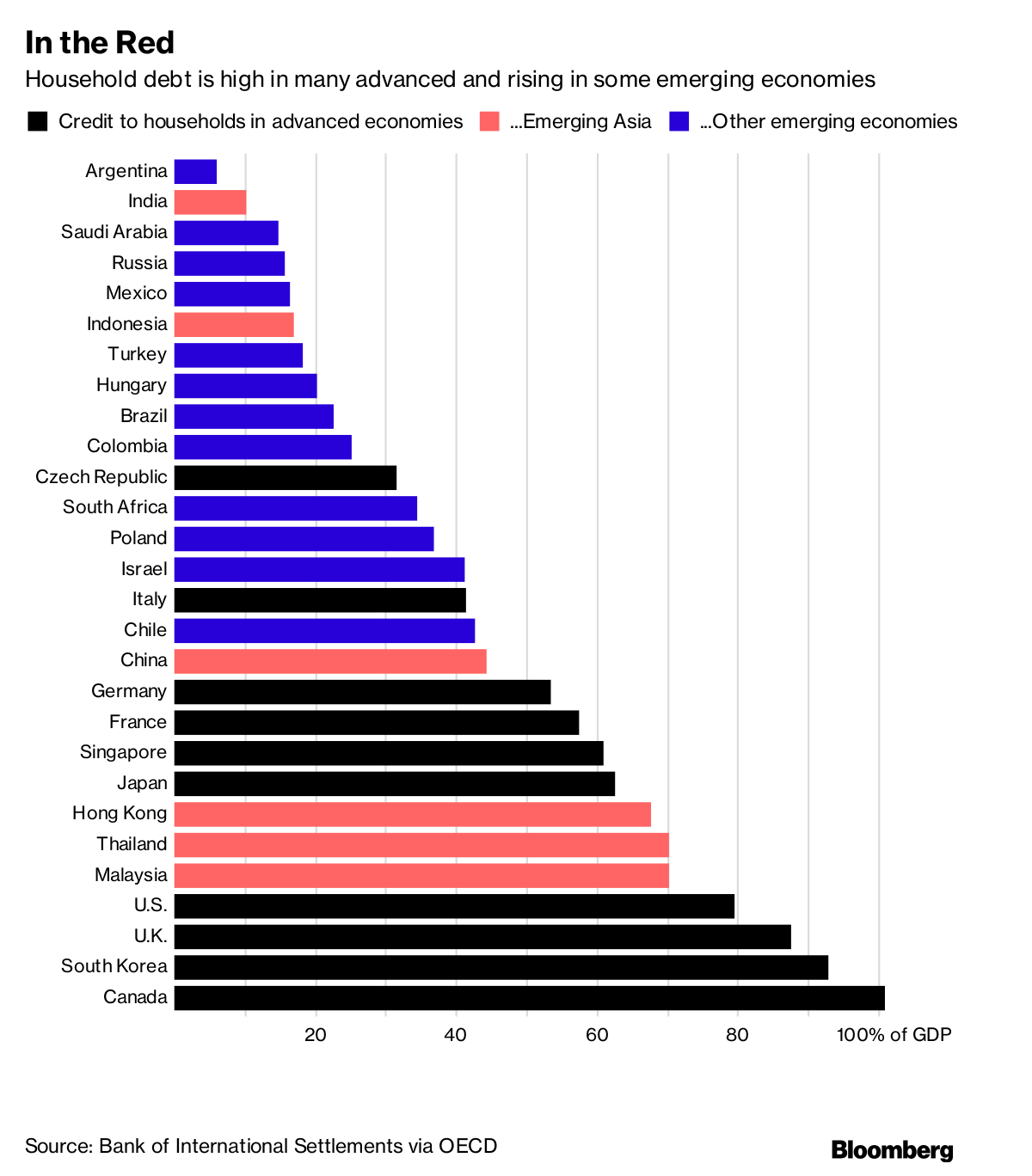

The OECD warned that rising private debt loads in both advanced and developing economies pose a risk to growth as Canada, South Korea and the U.K. lead the world in household borrowing.

“Household and corporate debt in many advanced and emerging market economies is high,” the Organization for Economic Cooperation and Development said Thursday in a pre-released section of a report to be presented next week. “While higher indebtedness does not necessarily imply that problems are just around the corner, it does increase vulnerability to shocks”

With the global economy showing its most even expansion since the financial crisis, debt levels and credit quality are among the risks that could trigger a downturn. Consumer debt tops 100 percent of gross domestic product in Canada, with South Korea and Britain both above 80 percent.

On corporate borrowing, the OECD warned about a shift in risk from banks to the bond market and a “substantial” decrease in credit quality.

NAFTA

The Globe and Mail. 23 Nov 2017. Article. NAFTA renegotiations are taking on water. Does Canada have a lifeboat?

LAWRENCE HERMAN, Counsel with Herman & Associates, former Canadian diplomat who practises international trade law and a senior fellow of the C.D. Howe Institute

What does the Trudeau government do? Does it refuse any Trump invitation for new bilateral talks? It’s a challenging question, but needs to be considered because that seems to be where we are heading.

There was zero progress at the North American free-trade agreement renegotiations in Mexico this week. In fact, the talks took a decidedly backward step, with the United States refusing to move off its red-line positions, something that was predictable given the updated negotiating objectives released by the U.S. Trade Representative ahead of this week’s session.

This is an “America First” administration, after all, with no interest in accommodation, increasing the likelihood of eventual U.S. withdrawal from the agreement, an action that President Donald Trump has repeatedly threatened, in spite of intensifying business and political pressures to the contrary.

Given that gloomy prospect, let’s look at how things could unfold over the next while, bearing in mind that things are fluid and the situation could change.

First, the negotiations could soon end, even ahead of the 2018 deadline, either with an American walkout or with all three negotiating teams agreeing that there’s no point in continuing the process. It could be ended definitively or just suspended for the time being. Ending or suspending the negotiations doesn’t terminate the agreement, however. It’s what happens next that counts.

With negotiations at an impasse, Mr. Trump could send in the sixmonth U.S. withdrawal notification required under NAFTA Article 2205 – which says that a party “may” withdraw from the agreement on six months notice – attempting to ratchet up the pressure on Canada and Mexico with the threat of formal withdrawal hovering in the background.

After the six-month period ends and without Canada and Mexico caving on U.S. demands, Mr. Trump could send Canada and Mexico the definitive U.S. withdrawal notice. If he does and the United States walks out, that doesn’t terminate NAFTA as a binding treaty. Under Article 2205, it continues in force between Canada and Mexico. More on this point later.

Here’s where things get more difficult to predict.

If Mr. Trump notifies U.S. withdrawal without congressional approval, Congress could try to thwart him, a point discussed before on these pages. The Canadian government has been assiduously lobbying congressional leaders and committees – in both the House and the Senate – in a massive and well-orchestrated fullcourt press, the strategy being to ensure that if and when NAFTA withdrawal is put to the Congress, both houses will turn it down.

Whether that would happen is a good question. Sentiment in Democratic and Republican caucuses has shifted decidedly toward protectionism, spurned by Mr. Trump’s own rhetoric and Bernie Sanders’ anti-free-trade crusade on the Democratic side.

Moreover, Congress is fully preoccupied with enacting tax reform legislation and won’t jeopardize those efforts by confronting the President on trade matters. On this hypothesis, if Mr. Trump seeks approval, some observers predict Congress would vote in favour of withdrawal. That’s a discouraging prospect. Whatever Congress does or does not do, there will be immediate court action by opposition groups seeking a restraining order and putting the issue of presidential authority versus the powers of Congress on trial. The argument is that Congress has exclusive constitutional authority over international trade plus the fact that neither Fast-Track nor the NAFTA Implementation Act contains withdrawal authority, meaning only Congress can authorize a U.S. pullout.

The result will be continuing uncertainty as U.S. courts deal with an epic constitutional battle. In the meantime, the trade agreement struggles along as a leaky vessel, as business tries to navigate these legally and politically roiling waters.

It’s always possible that with negotiations suspended, Mr. Trump won’t try to force through formal U.S. withdrawal, at least initially, but could tweet his annoyance at Canada and Mexico as unfair trading partners, accusing each as unwilling to compromise and using extensive executive powers to tighten the screws to force both countries back to the bargaining table. Under this scenario, goodwill would dissipate, making it impossible to settle trade wars such as softwood lumber and the Boeing-Bombardier battle, or even more mundane trade irritants.

If Mr. Trump actually tossed the NAFTA-withdrawal grenade, he would likely include withdrawing from the 1989 Canada-U.S. freetrade agreement as well, which has similar withdrawal provisions. He could then say, notwithstanding lack of congressional approval and continuing court challenges, that he’s prepared to sit down and talk with Canada about a totally new bilateral trade deal. Indeed, judging from his public comments, that seems to be the White House strategy.

As stated earlier, NAFTA says that if one party withdraws, the agreement isn’t terminated but remains in force for the other two parties, meaning Canada and Mexico. How does Canada (or Mexico for that matter) sit down face-to-face with the Americans when they are still legally bound to each other under the agreement?

What does the Trudeau government do? Does it refuse any Trump invitation for new bilateral talks? It’s a challenging question, but needs to be considered because that seems to be where we are heading.

All this says navigating these stormy and perilous waters in the next weeks won’t be easy. The good ship NAFTA is in danger of sinking. Canadians need to have lifeboats ready.

TELECOMUNICATION

The Globe and Mail. 23 Nov 2017. Canada and the U.S. stand divided at the crossroads of net neutrality

MICHAEL GEIST, Canada Research Chair in Internet and E-Commerce Law at the University of Ottawa, faculty of law

This week’s announcement that the U.S. telecommunications regulator plans to roll back net-neutrality regulations sparked an immediate backlash from those who fear that the decision will turn the internet into a cable-like service dominated by the carriers and deep-pocketed giants that can afford to pay new fees to keep their content on the fast lane.

The U.S. order, which would also block states from carrying out their own versions of policies that stop telecom carriers from leveraging their gatekeeper status by treating similar content or applications differently, is set for a vote next month.

Abandoning net neutrality will have an impact in the United States since evidence suggests that, without net-neutrality rules, carriers will pick winners by differentiating connectivity based on the willingness of internet companies, sites and services to pay additional fees. The experience in countries without net-neutrality rules bears this out. Some European countries feature pricing plans that look like cable packages with limited access to a select group of websites or internet services. On the flip side, European data show that providers that rely on neutral services offer better prices and larger data allowances.

From a Canadian consumer perspective, the effect of the U.S. decision will be more indirect. What separates the Canadian net-neutrality approach from the U.S. direction is that consumers and creators – not telecom companies or internet service providers (ISPs) – are in control when it comes to internet usage.

Unlike the United States, Canada has emerged as a world leader in supporting net neutrality with clear endorsements from both political leaders and the Canadian Radio-television and Telecommunications Commission. Navdeep Bains, the federal Minister of Innovation, Science and Economic Development, responded to the U.S. developments by affirming that “Canada will continue to stand for diversity and freedom of expression. Our government remains committed to the principles of net neutrality.”

Canadian Heritage Minister Mélanie Joly has similarly emerged as a notable proponent of net neutrality. Despite pressure from some cultural groups to abandon net neutrality by mandating preferential treatment of Canadian content, Ms. Joly has affirmed that the principle remains at the core of Canadian cultural policy, saying in September that “we will continue to champion the internet as a progressive force and an open space without barriers. As a government, we stand by the principle of net neutrality.”

The Canadian commitment to net neutrality has been similarly endorsed at the regulatory level. The foundation of Canadian policy lies in several CRTC decisions that restrict practices such as managing internet traffic to limit speeds for some applications or creating pricing plans that “zero rate” certain content that does not count as part of monthly data-consumption caps. Moreover, Canadian law features clear safeguards against unjust discrimination, undue preferences or controlling the content of communications.

While the change in U.S. administration has led to a dramatic shift in net-neutrality policy, the same will not occur in Canada. New CRTC chair Ian Scott told an industry conference earlier this month that “as companies continue to innovate in their offerings to Canadians, the CRTC will continue to ensure that Canada’s internet neutrality provisions are respected … the owners and operators of the country’s communications may not discriminate against content based on its origin or destination.”

Canadian consumers may be shielded from net-neutrality abuses, but the effects of the U.S. decision may still be felt north of the border. Since Canadian internet traffic often transits through the United States, there are concerns that Canadian data could get caught by non-neutral policies. Moreover, Canadian internet services hoping to attract U.S. customers may face demands for payments to have their content delivered on the fast track. Since the renegotiations of the North American free-trade agreement include a chapter on digital trade, Canadian negotiators should be pushing for the inclusion of a strong, enforceable net-neutrality provision.

The United States has been a remarkably innovative country for internet services with the vast majority of leading companies starting there before venturing abroad. It is striking how those companies – Google, Netflix, Twitter – remain ardent supporters of net neutrality, effectively acknowledging the debt they owe to rules that helped them to become household names around the world. Without U.S. net-neutrality safeguards, the range of choices that ultimately make their way onto the consumer and business landscape may be curtailed, a discouraging development that will affect everyone.

CANADA - CHINA

The Globe and Mail. 23 Nov 2017. China’s shadow looms over the West

With reporting from Alexandra Li

After a publisher scraps a book on Communist Party’s influence in Australia, its author warns that Canada is also at risk of Beijing-led campaigns that rely on shadowy government agencies to promote President Xi’s agenda among Chinese living overseas. Nathan VanderKlippe and Jeff Gray report

Alarmed by creeping Chinese influence on Australian political life, Clive Hamilton set out to investigate.

Businesses and people connected to China had already become the biggest foreign financial contributors to the country’s political parties. But “it seemed to me there was much more going on,” said Prof. Hamilton, a scholar at Charles Sturt University.

He found much to write about – only to become, himself, the subject of China’s efforts to promote its agenda around the world, after fears of retaliation by Beijing caused his publisher to back away from a book containing his findings.

Now, he is warning about the risks of China’s rising power – including in Canada, which has become an important target for a Beijing-led campaign that relies on shadowy government-funded agencies to spread influence among Chinese living overseas.

Such “united front” work has been called a “magic weapon” by President Xi Jinping, who echoed a formulation that dates all the way back to Mao Zedong. But Mr. Xi has overseen an effort to enhance China’s international standing unparalleled in recent history, either in China or among countries such as Russia or Turkey, whose foreign-influence campaigns Beijing has eclipsed in scale and ambition.

China has cast its united-front efforts both as a necessary corrective to negative images of the country and a bid to invite participation in its domestic development by the worldwide community of ethnic Chinese.

“We have expanded to the maximum extent the boundaries of unity and called on Chinese people from every corner of the world to secure the core interests of our country, and to contribute to our reform and development,” Zhang Yijiong, administrative vice-minister of the United Front Work Department of the Communist Party Central Committee, said in a rare public appearance in late October.

Critics, however, accuse Beijing of threatening the sovereignty of foreign political systems.

It was that risk that Prof. Hamilton sought to document.

He tracked the rivers of money flowing into the Australian education system that “have made the universities beholden to China and extremely reluctant to do anything that might upset Beijing.” He dug into work by Chinese emissaries “to turn the Chinese diaspora in Australia into a highly effective weapon for Beijing’s diplomacy in this part of the world.” He looked at opinionmakers espousing views favourable to China, some of whom “have been won over through financial ties to Chinese organizations.” He looked at Chinese-language media in Australia, 90 per cent of which now “adopt a pro-Beijing political stance.”

He assembled his findings into a book, Silent Invasion: How China is Turning Australia into a Puppet State, in which he named the people he identified as being at the forefront of China’s influence campaign.

But months before the book’s planned release, his long-time publisher, Allen & Unwin, told him it could no longer go forward as planned, saying in an e-mail it was worried about “potential threats to the book and the company from possible action by Beijing.”

In the e-mail, first published by Australian media last week, the publisher cited “Beijing’s agents of influence” and said printing the book would raise “the very high chance of a vexatious defamation action against Allen & Unwin, and possibly against you personally as well.”

“There have been, as far as I’m aware, no specific threats made to the publisher,” Prof. Hamilton said. “But, in a way, that’s more worrying, because it means the mere shadow of Beijing is enough to cause them to pull the plug on this book.”

China’s immense consumer market and economic power have made it a coveted business partner for countries around the world, not least Australia, which has benefited from its relative geographic proximity.

But in courting Beijing, Australia has allowed China to gain so much sway, Prof. Hamilton warns, that “it will take a decade of determined effort to unwind the program of influence that has been executed in this country.”

And, he says, other countries would do well to heed what he has experienced – including Canada,

where schools at all levels are increasingly reliant on tuition dollars from Chinese students, while Ottawa has approved controversial investments in sensitive sectors as it holds talks toward a free-trade agreement with Beijing.

Canada is far less economically reliant on China than Australia. But its large population of Chinese immigrants has also made it a target for the United Front Work Department and other arms of the Communist Party and Chinese government tasked with exerting Beijing’s influence abroad. A 2016 book, United Front Theory

and the Frontier of Its Practice, says groups of large, relatively new immigrants overseas are “one of the most heated topics” for Chinese study, which has led researchers to devote special attention to countries such as Canada.

The book then provides a description of networks of influence among the roughly one million Chinese immigrants who have arrived in Canada since 1980.

Everyday Chinese in Canada continue to show “a very limited degree” of political interest – but that, the authors suggest, provides fertile ground for united-front influence.

“The positive effects of Chinese political organizations and the encouragement from Chinese political parties have not been fully exploited,” says the book, whose primary authors are Chen Mingming, a retired Chinese foreign affairs official, and Xiao Cunliang, who was for-

merly in charge of united-front work in a Chinese province.

“The huge increase in population has given Chinese people stronger political influence in Canada. The number of Chinese people running for all levels of government positions is increasing. Some Chinese elites have had very impressive performances in elections,” the authors write in the book, which The Globe and Mail obtained in Beijing.

Both researchers declined interview requests; Mr. Xiao hung up on a reporter.

United-front work internationally serves two primary purposes: to understand what is happening amongst overseas Chinese and to use them to further Beijing’s objectives, said Gerry Groot, a Chinese studies scholar at The University of Adelaide who has extensively studied the trend.

Ethnic Chinese in positions of influence overseas are particularly valuable.

“They hope to be able to use those sort of representatives directly or indirectly to help promote positions which are useful to China or to the Communist Party,” Prof. Groot said.

“They hope that ethnic Chinese will be much more sympathetic to Chinese positions and be able to persuade audiences in other countries of the validity of those positions.”

Indeed, a United Front teaching manual specifically cites electoral candidates in the Greater Toronto Area as fertile ground.

The manual, first reported by the Financial Times, does not claim Chinese involvement in selecting or prodding candidates to stand for election. But it notes the electoral success of ethnically Chinese in the Toronto area between 2003 and 2010, suggesting that United Front operatives should be “broadly united, aggressively guiding and passionately serving” newly emigrated Chinese overseas, particularly those with high status or possibility for advancement.

For example, according to a Financial Times translation, the document says that in elections across “all the cities and towns in the Toronto area” in 2003, 25 “overseas Chinese” took part and six won.

By 2010, it says, there were 41 “overseas Chinese” candidates in local, regional and school trustee elections in Toronto, Richmond Hill, Markham, Vaughn and elsewhere, although it does not provide specifics or list how many won seats.

A scan of election results yielded numbers roughly in line with the United Front manual.

In 2010, the director of the Canadian Security Intelligence Service warned that cabinet ministers in two provinces, as well as several municipal politicians in British Columbia, were suspected of operating under foreign influence.

Toronto’s deputy mayor, Denzil Minnan-Wong, has been a city councillor in Toronto since the 1990s. A prominent Conservative and ally of Mayor John Tory, Mr. Minnan-Wong is the Canadian-born son of a Chinese immigrant father. He has met often with China’s consular officials to discuss doing business with the city.

He denied having been approached by any organization seeking to extend China’s “soft power.” But, in an interview, he acknowledged being exposed to Chinese pressure.

He was once called into a meeting with Chinese consular officials and urged not to travel to Taiwan, which mainland China claims is a breakaway province.

“I have travelled to Taiwan before. And the Chinese government has expressed concern to me that they’re not pleased,” Mr. Minnan-Wong said. He went anyway.

Still, critics say China’s efforts are so wide-reaching that its “foreign influence activities have the potential to undermine the sovereignty and integrity of the political system of targeted states.”

That was the conclusion of AnneMarie Brady, a University of Canterbury professor who recently published a paper documenting extensive Chinese interference in New Zealand, which has included one local politician openly pledging to promote China’s policies in Tibet and translating a local party campaign slogan into a Chinese language saying from China’s Mr. Xi.

“New Zealand, like many other states in the world, is becoming saturated with the PRC’s political influence activities,” Prof. Brady wrote, referring to the People’s Republic of China.

Those Chinese efforts create profound questions for diverse, democratic countries, where free speech is cherished and the idea of casting suspicion on an ethnic group is considered repugnant. At the same time, China’s united-front efforts target a specific ethnic group.

“It’s a very difficult problem. And it’s one that the united-front departments like because Western liberal democracies can tie themselves up in knots trying to figure out how best to cope with this,” Prof. Groot said.

He added: “We need to be very clear-eyed about the fact that China as a party state has all sorts of reasons and means to try to influence ethnic Chinese overseas.”

Prof. Hamilton has argued for tougher laws in response to “this new kind of influence that is being exerted on nations like Australia and Canada.”

Australia, for example, is planning new rules to force the registration of foreign agents. Canada has no such legislation, although such a law has long existed in the United States, where the U.S. China Economic and Security Review Commission recently recommended registering Chinese journalists as foreign agents.

Prof. Hamilton also called for Western countries to be vigilant in guarding their own values as China links its economic clout with a desire for global influence.

“Humans have a remarkable capacity to be blinded by money,” he said. “And we are seeing that blindness exploited at all levels.”

ENERGY

The Globe and Mail. Reuters. 23 Nov 2017. Cautious optimism for Keystone XL

TransCanada Corp. is “cautiously optimistic” about prospects for construction of its Keystone XL pipeline even after the state of Nebraska denied the company’s preferred route, the leader of Alberta said on Wednesday.

The comments by Premier Rachel Notley, whose government spoke with TransCanada representatives after the decision, were the first indication of the company’s stand on Monday’s announcement from the Nebraska Public Service Commission. TransCanada has so far said only that it will evaluate the decision.

A spokesman for TransCanada, which has been trying to advance the Alberta-Nebraska pipeline for nearly a decade, said the company took note of Ms. Notley’s comments and reiterated that it will review the decision. In a conference call, Ms. Notley said: “They are cautiously optimistic. The new route was not an entire surprise to them.”

The Globe and Mail. 23 Nov 2017. First Nations bond raises $545-million for oil deal. Oil sands: Similar deals could help mollify pipeline opponents

JEFF LEWIS

A half-billion-dollar bond issue led by two Alberta-based First Nations is being touted as a model for greater Indigenous investment in the economy that could also help blunt opposition to major oil sands pipelines.

The $545-million issue led by the Fort McKay and the Mikisew Cree First Nations closed on Wednesday, with funds earmarked to buy a 49per-cent stake in an oil-storage facility owned and operated by oil sands giant Suncor Energy Inc.

The offering, which was structured and marketed by Royal Bank of Canada, is the largest business investment by a First Nation entity in Canada, its backers said. A top executive with the bank said the issue was oversubscribed by three times, showing strong demand for the unique financing.

The deal is a major step forward for Indigenous participation in the oil sands and could be emulated in infrastructure projects across Canada, including stalled pipelines, Fort McKay Chief Jim Boucher said in an interview.

It shows that opposition to multibillion-dollar energy projects is not intractable, he said.

“It’s a new way of doing business,” he said.

“I think it provides an opportunity for First Nations to enter the Canadian economy in a much more substantive way than what we’re doing now.”

Calgary-based Suncor announced the sale of a minority interest in its East Tank Farm last year in a bid to deepen ties with local communities.

Fort McKay paid $350-million for a 34.3-per-cent stake, with the Mikisew paying $147-million for a 15-per-cent interest.

But closing was contingent on the First Nations obtaining financing.

The $1-billion storage facility will handle crude from Suncor’s $17-billion Fort Hills bitumen mine, which is due to start up by the end of the year. A newly formed joint venture between the Fort McKay and Mikisew will collect fees for storing crude.

Discussions on how to finance such a deal go back more than two years.

Oil’s collapse from more than $100 (U.S.) a barrel hit the Fort McKay First Nation hard. Revenues at its Fort McKay Group of Companies, which provide services to the oil industry, plunged 30 per cent to about $440-million (Canadian) overnight, Mr. Boucher said.

Layoffs mounted and capital projects were shelved, prompting a search for a more stable source of income. Mr. Boucher said the facility will generate about $14-million in revenue a year over 25 years.

The energy industry has said for a long time that equity agreements can be a key way to build support among First Nations for major oil sands pipelines. Enbridge Inc., for example, funded ownership stakes valued at $300-million for 26 Indigenous groups in its Northern Gateway project, covering a 10-per-cent slice of its equity.

Gateway was killed last year by Ottawa at the same time the Liberals approved rival Kinder Morgan Canada Ltd.’s $7.4-billion Trans Mountain expansion, designed to nearly triple the flow of crude along an existing right-of-way.

Kinder Morgan has pointed to benefit agreements valued at more than $400-million with 51 First Nations along the route as evidence of strong support for the pipeline, but the project remains mired in opposition and legal challenges.

For the Fort Mckay and Mikisew, success from the deal hinges on steady cash flow generated by terminal fees, helping to support a triple-B (high) credit rating from DBRS Ltd. for the newly formed company.

Suncor chief operating officer Mark Little said similar deals could help mollify pipeline opponents, although he cautioned they take time. “There’s been a lot of good talk. I think there’s a lot of good intention. It’s just getting across the goal line is difficult,” he said in an interview.

The Globe and Mail. Reuters. 23 Nov 2017. OPEC officials signal supply cut’s success

Two OPEC members said the group’s supply cuts are bringing world supply into balance, as ministers prepare for the cartel’s meeting on Nov. 30, when an extension to their deal is anticipated.

Qatar oil minister Mohammed alSada said on Wednesday in Bolivia that the supply agreement between members of the Organization of Petroleum Exporting Countries and other producers should be extended further into 2018.

“In my view, an extension of the agreement will help us in stabilizing the market,” Mr. al-Sada said on the sidelines of the Gas Exporting Countries Forum in Santa Cruz, Bolivia.

He said OPEC has been successful in draining world inventories to bring stocks closer to their five-year average, but the group needs more time to tighten supply further.

Similarly, Venezuela’s oil minister Eulogio Del Pino said on Wednesday that the oil market has finally found balance, as inventories are declining.

REUTERS. NOVEMBER 23, 2017. OPEC agenda points to short meeting to set oil policy

Reuters Staff

LONDON (Reuters) - A draft agenda for OPEC’s meeting on Nov. 30 in Vienna pencils in three hours for the group’s oil ministers to decide whether to extend their oil supply curbs, indicating that decision-making is expected to run smoothly.

The members of Organization of the Petroleum Exporting Countries, Russia and nine other producers are curbing oil output by about 1.8 million barrels per day until March 2018. They are expected to extend the deal at the Vienna meeting.

Three hours would be a short meeting by the standards of OPEC, whose gatherings have in the past sometimes stretched into the early hours of the morning as ministers argued about policy.

OPEC Secretary General Mohammad Barkindo said on Nov. 7 the group was seeking to achieve consensus before the meeting on how long to extend the pact on curbing production.

A closed session of just OPEC ministers and the secretary general is scheduled to begin at 1200 noon (1100 GMT), according to the agenda posted on OPEC’s website.

This will be followed at 3 p.m. (1400 GMT) by a combined meeting of OPEC and non-OPEC ministers and delegates. After that, there will be a news conference.

The full agenda is as follows:

- 10 a.m. (0900 GMT): Opening session of the 173rd meeting of the conference, with attendance by all OPEC heads of delegation, delegates and journalists.

- 1200 noon (1100 GMT): Closed session of the 173rd meeting of the conference, with attendance by OPEC heads of delegation and the OPEC secretary general

- 3 p.m. (1400 GMT): Third OPEC and non-OPEC Ministerial Meeting

- Opening Session: Attendance by all OPEC and non-OPEC producing countries’ heads of delegation and delegates, journalists.

- Plenary Session: Attendance by all OPEC and non-OPEC producing countries’ heads of delegation and delegates

- Closed Session: Attendance by all OPEC and non-OPEC producing countries’ heads of delegation and the OPEC secretary general

- Time to be confirmed: Joint news conference by the president of the OPEC conference, Russia’s energy minister and the OPEC secretary general.

Reporting by Alex Lawler; Editing by Edmund Blair

REUTERS. NOVEMBER 23, 2017. OPEC chatroom dead as Qatar crisis hurts Gulf oil cooperation

Rania El Gamal, Dmitry Zhdannikov

DUBAI/LONDON (Reuters) - OPEC’s most powerful internal alliance, bringing together the oil producer group’s Gulf members, is disintegrating fast.

As a six-month-old spat between Saudi Arabia and Qatar deepens, the organization’s Gulf ministers will have to scrap their tradition of meeting behind closed doors to agree policy before OPEC holds its twice-yearly talks, OPEC sources say.

“We used to have a WhatsApp group for all ministers and delegates from the Gulf. It used to be a very busy chatroom. Now it’s dead,” said a senior source in the Organization of the Petroleum Exporting Countries.

Four other sources said there had been no official contact on oil policy between the Gulf Arab nations, in a grouping known as the Gulf Cooperation Council (GCC).

The GCC includes OPEC members Saudi Arabia, the United Arab Emirates, Kuwait and Qatar and non-OPEC Oman and Bahrain. OPEC meets on Nov. 30 in Vienna to decide whether to extend global output cuts beyond March.

OPEC kingpin Saudi Arabia and the UAE cut ties with Doha in June, saying Qatar backed terrorism and was cozying up to rival Iran. Qatar rejected the accusation.

“The ministers can’t meet,” another OPEC source said. “They may relay the message through the Kuwaiti or the Omani oil ministers, but Saudi and the UAE cannot meet publicly with the Qataris.”

Kuwait and Oman have refrained from taking sides in the dispute, over which Kuwait’s Emir Sheikh Sabah has led regional mediation.

SHI‘ITE OPEC ALLIANCE

To be sure, OPEC has survived worse crises and operated under even greater strain, including the Iran-Iraq war in the 1980s, Iraq’s invasion of Kuwait in 1990 and proxy wars fought by Saudi Arabia and Iran over the past decade.

None of the OPEC sources suggested the Qatar crisis would derail a widely expected decision by OPEC to extend price-boosting output cuts until the end of 2018, as almost all producers agree on the need to maintain policy.

But dialogue within OPEC is likely to be complicated as the stand-off strikes at the heart of OPEC’s efforts to form a united front to stabilize a fragile oil market. It may also weaken the group’s Sunni faction at a time when predominantly Shi‘ite Iran and Iraq are raising their game.

As OPEC president in 2016, Qatar was instrumental in bringing together oil producers - including non-OPEC Russia - to agree the supply-reduction deal.

”If the GCC is dead politically, then it will certainly have implications for OPEC policies. Not that it will necessarily

disrupt decision-making, but it is making it more challenging and complicated,” the senior OPEC source said.

“Qatar is not talking to the Saudis or the UAE, so OPEC’s Sunni wing is weaker. On the other hand you have the rapprochement between Iran and Iraq, a Shi‘ite alliance long in the making,” the senior source added.

With the world’s fourth- and fifth-largest oil reserves, Iraq and Iran are seen as the OPEC countries with the largest output growth potential and hence together can be the biggest challengers to the leading role Riyadh has played for decades.

Iraq has resisted calls from the United States to lessen its reliance on Tehran after Iran effectively helped Baghdad stifle a Kurdish independence referendum. Iran also plans to import significant volumes of Iraqi oil.

“The Saudis perfectly understand that challenge and are doing their utmost to lessen Iran’s influence on Iraq,” a third OPEC source said.

Relations between Riyadh and Baghdad have been improving in recent months, with the two states joining hands to coordinate their fight against Islamic State and on rebuilding Iraq.

With a thaw in relations, Saudi Energy Minister Khalid al-Falih visited Iraq in October to call for increased economic

and energy cooperation, the first Saudi official to make a public speech in Baghdad in decades.

Editing by Dale Hudson

AVIATION

The Globe and Mail. 23 Nov 2017. Brexit uncertainty deepens as agency shares grim economic outlook

PAUL WALDIE, EUROPEAN CORRESPONDENT LONDON

Britain’s future outside the European Union is looking a lot less rosy as the economy slows, Brexit talks stall and the government lurches from crisis to crisis.

The picture got gloomier on Wednesday, when an independent government finance agency slashed its outlook for the country’s economy in each of the next five years and said productivity will deteriorate as well, remaining at a 10-year low. It was the biggest downgrade in the history of the agency, the Office for Budget Responsibility, which also signalled that the country faces much more uncertainty after Britain formally leaves the EU in March, 2019.

The dire warnings were released a few hours after Philip Hammond, the Chancellor of the Exchequer, unveiled the Conservative government’s annual budget. Mr. Hammond put a better spin on the outlook, saying the country “has a bright future,” and adding that the Tories are laying a solid platform for Brexit. “In this budget, we express our resolve to look forwards not backwards; to embrace that change, to meet those challenges head on and to seize those opportunities for Britain,” he told the House of Commons.

The budget contained a host of new spending measures, from increased support for the health service to plans for more public housing, as well proposals to help people buying their first home. Mr. Hammond also set aside £3-billion ($5-billion) over the next two years for Brexit preparations.

So far, the Brexit process has been a quagmire. Britain and the EU began negotiations on a future relationship last March, and little has been accomplished. The talks have stalled mainly over how much Britain must pay to settle EU financial commitments such as pension obligations and some ongoing program budgets. Some estimates put the figure as high as €60-billion (or $90-billion).

Britain has offered to pay just €22-billion. Prime Minister Theresa May said this week that she is prepared to increase that amount, although she did not indicate by how much. She is eager to move on to trade talks, but the EU’s chief negotiator, Michel Barnier, has insisted he will not discuss a trade agreement until the financial issue is resolved. And he has given Ms. May two weeks to come up with a figure. EU leaders are to meet on Dec. 14 and 15 to decide whether sufficient progress has been made for trade talks to begin.

Ms. May is also under pressure at home, with infighting among cabinet ministers, and scandals that have forced two ministers to resign. Calls have also been growing within the Conservative Party caucus for Ms. May to step down. And if that was not enough, political turmoil in Germany, with Chancellor Angela Merkel facing a possible election, could also affect the Brexit process and delay EU decisionmaking.

Amid all of that, the British economy has soured in recent months, with business investment slowing over concerns about the government’s handling of Brexit.

This week, the head of Airbus’s British operations told a parliamentary committee the company could move some of its British wing-building production elsewhere. “I need to let you know, committee, that other countries would dearly love to design and build wings,” said Katherine Bennett. “Some of them already do; we do build wings in China now, and believe you me, they are knocking at the door as a result of the situation we are in in this country.”

Wednesday’s report from the OBR raised more concerns. Productivity, which is the amount of output produced per hour worked, has been a concern for years in Britain and several other western countries. From the end of the Second World War until the start of the financial crisis in 2008, productivity increased by about 2 per cent annually. Higher productivity is crucial because it boosts company profits and brings higher wages and more tax revenue for governments. However, productivity in Britain has essentially flat-lined since 2008, rising by 0.1 per cent on average annually.

The OBR said that trend will not end soon. It cut its average annual productivity growth forecast for the next five years from 1.7 per cent to less than 1 per cent. That led the agency to lower its forecast for economic growth this year from 2 per cent to 1.5 per cent and make similar reductions in each year up to 2021. And it could get worse. The agency said it has no idea how Brexit will affect the forecast. “Given the uncertainty regarding how the government will respond to the choices and tradeoffs it faces during the [Brexit] negotiations, we still have no meaningful basis on which to form a judgment as to their final outcome,” it said.

“According to the OBR, it will be 2022 until we are outpacing the [euro zone],” said a report from economists at the Royal Bank of Scotland. “All sobering stuff. And it hung over the entire budget, limiting the Chancellor’s room for manoeuvre.”

Mr. Hammond promised to address productivity by increasing spending on new technology programs, high-speed railways, infrastructure and education with particular emphasis on mathematics.

INTERNATIONAL TRADE

EDC. NOVEMBER 23, 2017. The Market for Clean Technology

By Peter G. Hall, Vice President and Chief Economist

2008 was the best of times, and the worst of times. It truly was a tale of two ‘ecos’: the economy, which had grown long and strong, a stunning double-length growth cycle analysts were calling a high-growth ‘new normal’. And then there was the resulting global environmental system wracked by ozone depletion, climate change, and increasing catastrophic effects of natural disasters. With a legacy of inadequate international accords that tried but failed to fix the problem, new approaches were needed. In the aftermath of the 2008 economic crisis and subsequent disasters (e.g., Japan), the global clean technology industry has flourished, driven by imperatives of clean, sustainable, inclusive growth. Will this trend continue?

Before answering, it’s important to know why the ‘cleantech’ industry blossomed. As we now know all too well, that 2008 ‘best of times’ economic fairy tale turned into a nightmare. What ensued was actually a colossal role reversal: what became the worst of times for the economy arguably became the best of times for cleantech. Given the great strain that had been put on the ecosystem, hundreds of billions of dollars of what may well have been the most significant, swift and synchronized stimulus package the world has ever seen were devoted to cleaning up the environment – in both industrialized and emerging markets alike. In this way, the Great Recession was actually a great gift.

So what exactly is cleantech? It’s defined as any process, product or service that reduces [adverse] environmental impacts. Cleantech permeates all sectors of the economy, as our environmental footprint can be found in every conceivable activity. The most common applications are found in manufacturing, mining, oil & gas, transportation, power generation, water, agriculture, recycling and other energy efficiency activities.

Since 2008, momentum in the cleantech industry has taken on a whole new meaning. Huge impetus for advancement of the industry was given by the Paris Agreement. The COP-21 process has led countries, states and cities to commit to tangible emission-reduction goals. Known as ‘nationally determined contributions’, these efforts are at the forefront of the transition towards a lower-carbon economy. There is also special attention on countries at particular risk of environmental degradation, notably islands and other low-lying areas.

Other key factors are increasing demand for cleantech solutions. Increasingly, consumers are looking for products and services with a lower environmental footprint, and in many cases, will pay more for them. Corporations are far more aware of the reputation effects of poor environmental stewardship, especially in today’s social media context. Capital is much more available for cleantech applications. Competition is yet another factor: formulate new and cost-effective clean technologies, and it can be a bonanza. In that vein, innovative research and development is driving down costs and the need for subsidies. All this is enabling multi-front changes in the environmental code. Also known as regulation, this function will remain a key factor that drives innovation and presses demand ever further, as amply shown in places like Germany, Scandinavia and California.

The global cleantech industry is growing rapidly, with major investments forecast for all modes of transport, industrial applications, and solar and wind, battery storage and smart grids in the power sector. China alone made nearly $270 billion in green investments in 2016 and plans to commit nearly $300 billion annually in the next four years. India’s targets will require between $120 and $130 billion in green investments by 2022.

Canada is in the game. Canada’s share of the global cleantech market is estimated at 1.5 per cent. We currently have 800 companies in the industry, with collective revenue of $10 billion. Nearly 80 per cent of these are exporters. EDC has made support of these and emerging cleantech exports a key part of our strategy – a topic that our CEO Benoit Daignault is discussing at the Economic Club cleantech event on Monday, November 27 in Ottawa.

The bottom line? Post-recession initiatives are fusing together the economy and the environment in ways that may well make them mutually reinforcing – perhaps for the first time.

RETAIL TRADE

StatCan. 2017-11-23. Retail trade, September 2017.

- Retail sales — Canada: $49.1 billion, September 2017, 0.1% increase (monthly change)

- Source(s): CANSIM table 080-0020: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=0800020&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Retail sales edged up 0.1% to $49.1 billion in September. Higher sales at gasoline stations, particularly due to higher prices, were the main contributor to the gain. Excluding sales in this subsector, retail sales declined 0.2%.

Sales were up in 5 of 11 subsectors, representing 52% of retail trade.

After removing the effects of price changes, retail sales in volume terms decreased 0.6%.

Chart 1: Retail sales edge up in September

Higher sales at gasoline stations

Receipts at gasoline stations (+2.6%) were up for a second consecutive month. This gain reflected higher prices at the pump, largely due to supply disruptions caused by Hurricane Harvey. In volume terms, sales at gasoline stations declined 2.5%.

Store types traditionally associated with housing purchases and home renovation showed growth in September. Sales at building material and garden equipment and supplies dealers (+2.6%) and furniture and home furnishings stores (+2.3%) more than offset declines seen in August. This was the third gain in four months at building material and garden equipment and supplies dealers.

After decreasing 2.5% in August, sales at food and beverage stores were up 0.3% in September. The main contributors to the gain were convenience (+3.7%) and supermarkets and other grocery (+0.3%) stores.

Clothing and clothing accessories stores posted a 2.8% sales decline. The decrease was mainly attributable to clothing stores (-3.4%). Lower sales were reported at shoe stores (-3.7%) for a third consecutive month. Meanwhile, jewellery, luggage and leather goods stores (+3.0%) recorded higher sales for the first time in four months.

Sales at motor vehicle and parts dealers were down 0.5% in September. Results were mixed among store types, as lower sales at new (-0.5%) and used (-4.9%) car dealers more than offset the increase at other motor vehicle dealers (+3.9%).

Sales at sporting goods, hobby, book and music stores (-1.5%) declined for a fifth consecutive month.

Sales up in five provinces

Retail sales were up in five provinces in September.

Ontario (+0.5%) reported the largest increase in dollar terms, on the strength of higher sales at gasoline stations. Excluding sales in this subsector, retail sales in Ontario decreased in September.

Sales in British Columbia (+0.4%) increased for the sixth time in seven months.

In Alberta (+0.3%), sales were up for the fourth time in six months. Higher sales at new car dealers more than offset lower sales at gasoline stations.

Sales in New Brunswick (+2.1%) increased for the eighth time in nine months.

In Quebec, retail sales decreased 0.5%.

Following four consecutive monthly increases, Nova Scotia (-2.5%) posted lower sales in September, largely as a result of weaker sales at new car dealers.

Retail sales decrease in two of three census metropolitan areas measured

Nearly 30% of total retail sales take place in Canada's three largest census metropolitan areas (CMAs)—Toronto, Montréal and Vancouver.

In September, seasonally adjusted retail sales declined in Montréal (-1.1%) and Toronto (-0.8%), while Vancouver reported a 0.7% gain.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales totalled $1.2 billion in September, accounting for 2.4% of total retail trade. On a year-over-year basis, retail e-commerce increased 16.7%, while total unadjusted retail sales rose 6.4%.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171123/dq171123a-eng.pdf

THE GLOBE AND MAIL. REUTERS. NOVEMBER 23, 2017. Retail sales rise less than expected in September; auto sales fall

OTTAWA - Canadian retail sales rose far less than expected in September as the boost from higher gasoline prices was offset by a decline in purchases of vehicles and clothing, data from Statistics Canada showed on Thursday.

The 0.1 per cent increase was short of economists' forecasts for a gain of 0.9 per cent, while volumes fared worse, declining by 0.6 per cent. August's sales were upwardly revised to a decline of 0.1 per cent from the initially reported 0.3 per cent decrease.

Gasoline sales rose for the second month in a row in September, up 2.6 per cent, as supply disruptions caused by Hurricane Harvey in the United States lifted prices at the pump.

But that was tempered by a 0.5 per cent decline in sales of motor vehicles as Canadians bought fewer new and used cars. It was the first time vehicle sales declined since June. Excluding vehicles, retail sales were up 0.3 per cent.

A 2.8 per cent decline in sales of clothing and accessories also weighed on overall retail sales. In all, sales were up in just five out of 11 sectors, accounting for 52 per cent of retail trade.

Sales at stores associated with home purchases was one source of strength, with building material and garden equipment sales up 2.6 per cent, while furniture purchases increased by 2.3 per cent.

REUTERS. NOVEMBER 23, 2017. Canada September retail sales rise less than expected, pointing to slower growth

Leah Schnurr

OTTAWA (Reuters) - Canadian retail sales rose far less than expected in September as higher gasoline prices were offset by a decline in purchases of vehicles and clothing, pointing to cooler economic growth and reinforcing expectations the central bank is on hold until next year.

The 0.1 percent increase reported by Statistics Canada on Thursday was short of economists’ forecasts for a gain of 0.9 percent, while volumes fared worse, declining by 0.6 percent. Retail sales rose 0.5 percent in the third quarter, slowing from the second quarter’s 1.4 percent gain.

“It was a pretty downbeat report on all fronts,” said Robert Both, macro strategist at TD Securities. “This should be pretty negative for the monthly GDP print next week.”

The Canadian dollar weakened against the greenback immediately following the report. [CAD/]

The figures underscored expectations economic growth will slow in the second half of the year after a strong performance in the first six months of 2017 that put Canada at the top of the Group of Seven pack.

The slower pace of growth, along with muted inflation and uncertain North American trade policy, is expected to keep the Bank of Canada on hold when it meets next month after raising interest rates twice earlier this year.

Traders are now pricing a 90 percent probability that the central bank will keep rates at 1 percent at its December meeting.

Gasoline sales climbed for the second straight month in September, rising 2.6 percent, as supply disruptions caused by Hurricane Harvey in the United States lifted prices at the pump.

But that was tempered by a 0.5 percent decline in sales of motor vehicles as Canadians bought fewer new and used cars, while sales of clothing and accessories dropped 2.8 percent.

Sales at stores associated with home purchases were one source of strength in September, with building material and garden equipment sales up 2.6 percent, while furniture purchases increased by 2.3 percent.

Combined with an unexpected drop in September wholesale trade earlier this week, the data point to “slim to no growth” for the month, said Nick Exarhos, economist at CIBC.

“The stalling in recent figures on the economy support our view that the Bank of Canada is likely on the sidelines until the spring of next year,” Exarhos wrote.

Additional reporting by Fergal Smith in Toronto; editing by Diane Craft

BLOOMBERG. 23 November 2017. Retail Sales Disappoint Again as Canadian Growth Slows

By Theophilos Argitis

- Receipts increase just 0.1% versus forecasts for 1% gain

- Sales stall since June after one of best starts on record

Sales for Canadian retailers continued to disappoint in September, adding to evidence consumers are paring back in the second half of this year.

Retail sales rose 0.1 percent during the month, versus forecasts for a 1 percent gain, after dropping 0.1 percent in August, Statistics Canada said Thursday from Ottawa. Receipts for the country’s retailers have been flat over the past four months, after one of the best starts to a year for the industry on record.

It’s a slowdown that suggests the tailwinds spurring growth earlier this year are waning. That includes the effects of a ramp up in child benefits by the federal government last year that had a clear impact on consumption, but are now no longer adding to growth.

Thursday’s release is the last major piece of output data ahead of third quarter gross domestic product numbers next week, and is the second release this week that showed unexpected weakness in activity. Statistics Canada reported Tuesday that wholesale sales fell 1.2 percent in September.

Economists are estimating annualized third-quarter growth of 1.8 percent, down from 4.5 percent in the second quarter.

“The stalling in recent figures on the economy support our view that the Bank of Canada is likely on the sidelines until the spring of next year,” Nick Exarhos, an economist at CIBC World Markets, said in a note to investors.

The Canadian dollar fell as much as 0.2 percent to C$1.2723 per U.S. dollar after the retail report.

Details of September Retail Sales:

- Retail sales rose 0.1% versus forecasts for 1% gain

- In volume terms, sales fell 0.6% and are down 1.3% since June

- Excluding gasoline stations and motor vehicle sales, receipts were down 0.1%

- Falling auto and clothing sales offset higher gasoline prices

- Receipts of car and parts dealers were down 0.5% in September

- Excluding car dealers, sales were up 0.3% versus expectations for a 1% gain

— With assistance by Erik Hertzberg

EDUCATION

Employment and Social Development Canada. 2017-11-23. Backgrounder: Canada Learning Bond

Employment and Social Development Canada (ESDC) is accepting project proposals from organizations for new and/or innovative approaches designed to increase awareness and take-up of the CLB to help improve life outcomes for children, with a particular emphasis on vulnerable populations, including Indigenous children. Proposals must align with at least one of the following three themes: support for Indigenous populations, facilitated access to education and research and innovation.

The CLB is money that the Government of Canada deposits directly in Registered Education Savings Plans for children from low-income families, born in 2004 or later, to help pay for their post-secondary education. The CLB provides an initial payment of $500 plus $100 for each year of eligibility, up to age 15, for a maximum of $2,000. Personal contributions are not required to receive the CLB.

To be eligible for the CLB, a child must be from a low-income family and:

- be born on or after January 1, 2004;

- be a resident of Canada;

- have a valid Social Insurance Number (SIN); and

- be named as a beneficiary to an RESP.

The child’s primary caregiver (PCG) and, effective January 2018, the spouse or common-law partner of the PCG, can request the CLB on behalf of an eligible child. The PCG is the person who is eligible to receive the Canada Child Benefit in the child’s name. The child’s PCG must have applied for the Canada Child Benefit for the child through the Canada Revenue Agency and must continue to file income tax returns, allowing eligibility to be validated. Children in care qualify for the CLB.

________________

LGCJ.: