CANADA ECONOMICS

VENEZUELA

Global Affairs Canada. October 20, 2017. Canada to host Lima Group meeting on Venezuela

Ottawa, Ontario - Canada is deeply concerned by the deteriorating political and economic crisis in Venezuela and is working intensively with like-minded countries, through the Lima Group and the international community, to advocate for the restoration of democracy and the protection of human rights for the Venezuelan people.

The Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced that Canada will host the third ministerial meeting of the Lima Group in Toronto, Ontario, on October 26, 2017.

At the meeting, Minister Freeland, along with the foreign minister of Peru, Ricardo Luna, as co-chair, will host foreign ministers of the Lima Group to explore ways in which countries of the hemisphere can seek a solution to the Venezuelan crisis. To this end, the group will discuss options to broaden cooperation with other partners, maintain pressure on the Maduro regime, and translate its unwavering support for the Venezuelan people into further concrete actions.

On the margins of the Lima Group meeting in Toronto, Minister Freeland will also hold bilateral meetings with her counterparts, as well as participate in a panel on Venezuela hosted by the Munk School of Global Affairs and the Canadian Council for the Americas. The conference will bring together international experts to discuss the political and economic crisis in Venezuela and what can be done to promote the restoration of a prosperous and democratic Venezuela.

Quotes

“Canada has taken a leadership role in addressing the crisis in Venezuela, in cooperation with other countries in the region. Together with our like-minded partners, we will continue to increase pressure on the Maduro regime. Our objective is clear: a peaceful solution to the crisis and the restoration of democracy and human rights for all Venezuelans.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick facts

- The first Lima Group meeting was attended by Argentina, Brazil, Canada, Chile, Colombia, Costa Rica, Guatemala, Guyana, Honduras, Jamaica, Mexico, Panama, Paraguay, Peru and Saint Lucia.

- The group was established on August 8, 2017, to coordinate the countries’ efforts and bring international pressure on Venezuela.

- This is the third ministerial meeting of the Lima Group. Signatories to the Lima declarations, in the group’s joint statements, have committed to closely monitoring events in Venezuela until the full restoration of democracy in the country is achieved.

BOMBARDIER

The Globe and Mail. 20 Oct 2017. Delta won’t pay jet tariffs, CEO says. Airline expected to receive planes from final assembly plant in Alabama in wake of Airbus acquisition of C Series stake

KELLY YAMANOUCHI, New York Times News Service

In the middle of a “Buy American” trade dispute over jets Delta Air Lines Inc. is buying from a Canadian manufacturer, Delta chief executive Ed Bastian says the airline will not pay any of the massive tariffs proposed by the Trump administration.

He now expects Delta will take delivery of the jets from a final assembly facility in Mobile, Ala., thanks to a blockbuster deal announced this week.

“I can tell you Delta is not going to pay any tariffs,” Mr. Bastian said at a media event at the company’s headquarters this week.

In wide-ranging remarks, Mr. Bastian voiced support of U.S. President Donald Trump’s tax-reform plan and said Delta would continue to oppose so-called religious freedom state legislation.

Delta, one of the largest employers in Georgia, has nearly $40-billion in operating revenue annually.

The Atlanta-based company’s deal to buy 75 C Series CS100 jets has been in the crosshairs of the Trump administration.

The low prices Delta negotiated in the deal prompted rival Boeing Co. to allege that Bombardier Inc. was getting illegal subsidies and dumping its product into the U.S. market.

The Trump administration slapped Bombardier with proposed duties of nearly 300 per cent that could quadruple the price of the jets and raise the cost of flying.

This week, Airbus SE announced it will buy a majority stake in Bombardier’s C Series business and add a final assembly line for the planes at the Airbus plant in Mobile.

Mr. Bastian said he was aware of the discussions on the Airbus-Bombardier deal over the past few weeks. If the deal goes through, “I would expect we’d be taking the C Series out of Mobile,” he said. “I’m optimistic that the Airbus-Bombardier investment will help minimize some of the political concerns.”

Bombardier CEO Alain Bellemare said during a news conference Monday that the U.S. assembly line will allow the aircraft to “become a domestic product, for which you have no import duty applied to a domestic product.” That would be a route for Delta to avoid paying tariffs.

Delta plans to use the planes to fly out of its hubs in Seattle or New York, or in Texas, where Delta would go up against rivals United, American and Southwest. The CS100 could replace regional jets.

Mr. Bastian said he could not understand why Boeing filed the complaint against the deal.

“I don’t get it. I’m mystified. And I’ve said that to Boeing many times,” Mr. Bastian said.

Still, he said Delta “will be taking more Boeing aircraft into the future.”

“Boeing has every opportunity to win us,” Mr. Bastian said. “However, Boeing is going to need to continue to earn the right to win that next decade of support.”

Mr. Bellemare said Bombardier will continue to fight the Boeing petition and the deal with Airbus is not driven by Boeing’s action.

“We’ve said we’re going to look at all options to protect our access to the U.S. market, so we can protect the overall value of the C Series aircraft, and that’s what we’re doing,” Mr. Bellemare said.

Mr. Bastian has said there may be a delay when Delta gets its C Series jets “as we work through the issues,” beyond the schedule for the planes to begin arriving in spring 2018.

Airbus would acquire 50.01-percent interest in the C Series Aircraft Limited Partnership, based on an agreement subject to regulatory approvals. If approved, the deal is expected to close in the second half of 2018.

While Mr. Bastian called the U.S. Commerce Department’s proposed tariffs on Bombardier “absurd” on CNBC late last month, he is in favour of the President’s proposed tax reforms and reiterated his support on Wednesday.

“There’s no question we’re unabashedly in support of finding a better way to bring our corporate rates down to a competitive level on an international scale,” Mr. Bastian said. “It will allow us to create jobs, it will allow us to grow markets, it will allow us to reinvest.”

Amid the possibility of legislation on religious freedom being reintroduced in the next session of the Georgia General Assembly, Mr. Bastian said Delta’s opposition to such measures will remain unchanged.

Such measures could limit the government from interfering with people who base their actions on religious beliefs. Opponents worry that could, for example, give business owners legal cover to refuse service to gay couples.

On Wednesday, Mr. Bastian said: “We will not tolerate discrimination of any variety, no matter how well people want to try to cloak it in protecting religious freedoms. We see it as discriminatory and our position will remain as strong as ever.”

Delta Air Lines (DAL)

Close: $52.27 (U.S.), down 59¢

The Globe and Mail. 20 Oct 2017. ARTICLE. Bombardier-Airbus deal exposes the folly of corporate welfare

MARK MILKE, Author of multiple reports on subsidies to business

“They got the money, hey/You know they got away/They headed down south/ and they’re still running today.” – From Take the Money and Run, the

Steve Miller Band, 1976

Not exactly, for taxpayers, but some context for those who missed the details: Montreal-based Bombardier just inked a proposal with Paris-based Airbus to bring the company into the C Series Aircraft Limited Partnership. That company will, assuming the deal is approved by shareholders, be owned by three parties: Airbus (50.01 per cent), Bombardier (31 per cent) and Investissement Québec (19 per cent), give or take a decimal point.

The benefit for Bombardier is that part of its C Series production will now happen at Airbus facilities in Alabama.

That will blunt the intended punitive tariffs of nearly 300 per cent that were soon to be imposed by the U.S. Commerce Department on Bombardier jets; that related to allegations from Boeing that Bombardier was unfairly subsidized by Canadian governments.

For those unaware, Investissement Québec is Quebec’s provincially owned “investment” agency. It deposited $1-billion (U.S.) in this same partnership just 16 months ago, for a 49.5-per-cent stake, while Bombardier held the remaining share.

The new agreement with Airbus, for no extra investment, thus substantially dilutes the shares of both Bombardier and the Quebec government.

That injection of cash from Quebec taxpayers came in addition to other taxpayer grants and loans over the decades. From what can be found and totalled, Bombardier’s first disbursement from the federal government arrived in 1966. In the decades since, and including merged companies and adjustments for inflation to arrive at consistent dollar figures, about $4.1-billion (Canadian) has been granted, lent or “invested” by the federal government.

That includes $350-million announced in 2008 by the Conservative government for the C-Series program and $372.5-million this past February by the Liberal government, with part of that funding also for the C Series.

No one who reads the academic, peer-reviewed economic literature on government subsidies to business can arrive at any conclusion other than what such literature routinely finds: When governments attempt to pick winners and losers with tax dollars, they inevitably lose money; the ostensible economic effects pointed to by subsidy supporters are almost always overstated; most “investment,” “targeting” or attempts to build “clusters” – “super” or otherwise – merely displace capital flows, economic outcomes and employment and tax revenues from one jurisdiction to another; government attempts to game the market often end up with negative economic outcomes. The flight of part of Bombardier’s taxpayer-subsidized C Series production to Alabama is only the latest example.

Taxpayer-financed incentives are, of course, merely another form of protectionism. So while Bombardier made this move to ward off the U.S. government’s intended tariffs, the company itself can hardly complain given Canadian government support over the decades. The Boeing ploy was just tit-for-taxpayerfinanced-tat.

One positive in all this: The Bombardier-Airbus deal finally rips away the pretense that corporate welfare is about domestic job creation.

Politicians, worldwide, have used taxpayers as a prop for their political and interventionist games at a cost to real people and over useful domestic priorities for such money, for decades.

For example, it is indefensible that Brazil, the poorest country among the jurisdictions that compete to subsidize the aerospace sector, spends tax dollars on “its” aerospace companies while richer countries such as France, Britain, the United States and Canada do the same for their so-called domestic companies.

Which points to a remedy: stronger free-trade agreements that ban taxpayer financing for corporations. That remedy would free up tax dollars for what should be domestic priorities. Here’s one Canadian example: more defence spending for a military that has been neglected for decades.

The response to this is often that governments will never change course. That is simply untrue. The 1990s-era provincial governments of Mike Harris and Ralph Klein both dramatically reduced spending on corporate welfare.

Also, governments can co-operate on ridding the planet of unhelpful policy when they choose to. Internationally, as the OECD reported just last week, governments around the world are “rapidly dismantling harmful tax incentives worldwide,” i.e., uneconomic preferential tax treatment.

In addition, since the 1940s, countries through various international bodies and agreements have steadily lowered tariffs and duties on each other’s goods and services.

Point: Progress is possible, including on ineffective, unproductive subsidies that cost taxpayers, in every country, their money. The avenue to such an end is likely through strengthened free-trade agreements.

THE GLOBE AND MAIL. THE CANADIAN PRESS. REUTERS. OCTOBER 20, 2017. BOMBARDIER-AIRBUS. Airbus has no plans to buy out Bombardier after C Series partnership

ROSS MAROWITS, MONTREAL

Airbus has no plans to buy out minority C Series partners Bombardier and the Quebec government, Airbus chief executive Tom Enders said Friday.

According to terms of the deal announced Monday, Airbus had the option to buy out Bombardier in about seven years, and the Quebec government in 2023.

Following a joint appearance with Bombardier CEO Alain Bellemare at the Montreal Board of Trade, Enders said that's not the European giant's plan.

"We have no intention to buy out the others because we know they are great partners and if they want to stay on the journey going forward they are very welcome to that," he told reporters.

Read also: How Airbus landed Bombardier's C Series

He said the priority is to close the deal next year that gives Airbus majority control, build a second assembly line in Alabama, sell more aircraft and make the program a huge success.

Earlier, Enders told business leaders that he expects Boeing won't give up easily after launching a trade action with the U.S. government against the C Series that has resulted in 300 per cent preliminary duties on imports.

"The B guys will certainly throw everything into our way they can figure so the coming months might be a little bit rough and tough but we've seen that before," he said.

Ultimately he said the C Series will weather the challenge and prevail.

Enders added that Canadians have nothing to fear from Airbus, saying the company will add to Montreal's large aerospace cluster and provide more opportunities for local suppliers, universities and aerospace training schools.

"We're not taking anything away here," he said, adding that he knows there are concerns by some members of the public.

"If anything we will add, we will add to Canada, we will add to the success of the Canadian aerospace industry, Bombardier and suppliers and certainly we will add to the world-wide success of Airbus."

Airbus has already sent lobbyists to Washington to show how the partnership will create U.S. jobs that President Donald Trump has advocated.

Bombardier CEO Alain Bellemare added that Airbus' support will assuage customers who were worried about the future of the C Series.

He says the result will be many more sales that will benefit Bombardier's Mirabel production facility even though a second assembly line will be built in Alabama.

Bellemare reacted forcefully to questions about Airbus not paying any cash for the transaction.

"The point is it's not coming from dollars, it's coming from the value that they bring to the program and that is the reason why the value of this program will more than double," he told reporters.

REUTERS. OCTOBER 20, 2017. Airbus expects to sell 'thousands' of CSeries jets: CEO

Allison Lampert

MONTREAL (Reuters) - Airbus (AIR.PA) Chief Executive Tom Enders said on Friday he believed Bombardier Inc’s (BBDb.TO) CSeries planes would capture half the market for smaller single-aisle aircraft with the sale of “thousands” of the 110-to-130 seat jets.

“I see no reason why we should not be able to capture 50 percent of that market,” Enders said in Montreal at a breakfast organized by the city’s chamber of commerce. “I think we will sell thousands.”

Europe’s largest aerospace group on Monday agreed to take a majority stake in the CSeries program for $1, a move expected to reduce costs while bolstering the plane’s sales and giving Canada’s Bombardier a possible way out of a damaging trade dispute with Boeing Co (BA.N) and U.S. regulators.

The lightweight, carbon-composite jet, which costs $6 billion to develop, has won performance accolades but failed to secure a sale in 18 months.

On Thursday, the head of a major U.S. airplane leasing company said the deal boosts confidence in the CSeries program, but is unlikely to drive a flurry of immediate sales.

Customers will likely remain cautious until the trade dispute is closer to being resolved and the venture with Airbus closes in late 2018.

Some analysts have suggested that Airbus’s 50.01 percent stake in the CSeries could reverberate throughout the aerospace industry, triggering a riposte from other planemakers, including Boeing itself.

Commercial aerospace has four main powers dominated by Airbus and Boeing, which share the market above 150 seats.

Brazil’s Embraer (EMBR3.SA) and Canada’s Bombardier compete in the market between 100 and 150 seats as well as in the market for smaller regional jets.

Enders, who addressed Montreal’s business leaders with Bombardier Chief Executive Alain Bellemare, said the industry-changing venture would have a ripple effect, but didn’t specify what he meant further. “New alliances will be formed,” he said.

Editing by Franklin Paul and Bernadette Baum

THE GLOBE AND MAIL. October 20, 2017. GRAPHIC. What's so remarkable about the C Series? A closer look

GRAPHICS BY JOHN SOPINSKI

INFLATION

StatCan. 2017-10-20. Consumer Price Index, September 2017

September 2017: 1.6% increase (12-month change)

Source(s): CANSIM table 326-0020

The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in September, following a 1.4% gain in August. The all-items CPI excluding gasoline rose 1.1% year over year in September, matching the gain in both July and August.

Chart 1: The 12-month change in the Consumer Price Index (CPI) and the CPI excluding gasoline

The 12-month change in the Consumer Price Index (CPI) and the CPI excluding gasoline

12-month change in the major components

Prices were up in six of the eight major CPI components in the 12 months to September, with the transportation and shelter indexes contributing the most to the year-over-year rise. The clothing and footwear index and the household operations, furnishings and equipment index both declined on a year-over-year basis.

Chart 2: Consumer prices increase in six of the eight major components

Consumer prices increase in six of the eight major components

Transportation costs rose 3.8% on a year-over-year basis in September, following a 2.8% increase in August. For a third consecutive month, gasoline prices were the largest contributor to the gain in transportation prices and also to their acceleration. The gasoline index rose 14.1% in the 12 months to September, largely due to supply disruptions caused by Hurricane Harvey. The purchase of passenger vehicles index accelerated 1.0% year over year in September, up from a 0.7% increase in August.

Consumer prices for food were up 1.4% on a year-over-year basis in September, after increasing 0.9% in August. Prices for food purchased from stores grew 0.9% year over year in September, largely due to the price declines reported in September 2016 not counting as part of the current 12-month movement. Prices for food purchased from restaurants rose 2.7% in September, up slightly from a 2.6% year-over-year gain in August.

Recreation, education and reading costs rose 2.1% on a year-over-year basis in September, matching the increase in August. Tuition fees grew 3.0% in the 12-month period ending in September.

In September, the household operations, furnishings and equipment index (-0.4%) declined on a year-over-year basis for the third consecutive month. The telephone services index contributed the most to this continued decline, down 3.1% in the 12 months to September. Consumers also paid 3.3% less for furniture in September compared with the same month a year earlier.

The clothing and footwear index declined 2.3% on a year-over-year basis in September. Prices for women's clothing contributed the most to the decrease in this major component, falling 4.6% in September, following a 1.9% decline in August. Men's clothing prices also posted a year-over-year decrease, falling 2.7%. In contrast, prices for clothing material and notions rose 3.5% in the 12 months to September.

12-month change in the provinces

Consumer prices rose more on a year-over-year basis in September than they did in August in seven provinces, while two provinces registered decelerations.

Chart 3: Consumer prices rise at a faster rate in seven provinces

Consumer prices rise at a faster rate in seven provinces

The CPI in Manitoba increased 1.5% on a year-over-year basis in September, after rising 0.9% in August. Consumers paid 3.4% more in the 12 months to September for food purchased from stores, which was a larger increase than in any other province. The fresh vegetables index (+11.7%) contributed the most to this rise in prices. Among the provinces, prices for household equipment fell the most year over year in Manitoba during September.

In British Columbia, the CPI gained 2.0% year over year, matching the increase in August. The homeowners' replacement cost index (+7.1%) contributed the most to the rise in the CPI in this province, and also matched the gain in August. The gasoline index (+8.9%) decelerated on a year-over-year basis compared with August. British Columbia was the only province to register a deceleration in this index.

Consumer prices in New Brunswick rose 1.7% year over year in September, following a 1.8% increase in August. The telephone services index fell 2.5% in the 12-month period ending in September, which contributed the most to the decline in prices in this province. The traveller accommodation index decreased by 4.5% on a year-over-year basis in September, following a 15.0% increase in August. In contrast, consumers paid more for recreational vehicles and outboard motors in September compared with the same month a year earlier.

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI increased 0.2% in September, matching the gain in August.

Chart 4: Seasonally adjusted monthly Consumer Price Index

Seasonally adjusted monthly Consumer Price Index

In September, five major components increased on a seasonally adjusted monthly basis, while three decreased.

On a seasonally adjusted monthly basis in September, the transportation index (+1.1%) posted the largest gain, while the clothing and footwear index (-1.0%) posted the largest decline.

Chart 5: Tuition fees index, annual average, Canada, 1975 to 2016

Tuition fees index, annual average, Canada, 1975 to 2016

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171020/dq171020a-eng.pdf

StatCan. THE GLOBE AND MAIL. OCTOBER 20, 2017. Little need for ‘urgency’ on rates as inflation still tame, analysts say

DAVID PARKINSON, ECONOMICS REPORTER

A hurricane-related surge in gasoline prices helped send Canada's inflation rate to a five-month high in September, in a key economic release that comes just days before the Bank of Canada's next interest-rate decision.

Another release, though, showed that higher pump prices weren't enough to keep Canada's retails sales from a surprise decline in August.

Statistics Canada reported that Canada's consumer price index was up 1.6 per cent year over year in September, up from August's 1.4 per cent. It was the third straight month that the country's year-over-year inflation rate has risen, after sinking to a 20-month low of 1 per cent in June. Inflation has now returned levels last seen in April.

The latest evidence of a rising inflation trend comes as the Bank of Canada's top brass prepares for a rate decision next Wednesday, its first since the two consecutive rate increases it announced in July and September. The central bank has been anticipating a pick-up in inflation in light of Canada's brisk economic pace this year – and, indeed, used that argument as part of its justification for its rate hikes. But the inflation rate remains well below the bank's target of 2 per cent, which serves as its formal guide for rate policy.

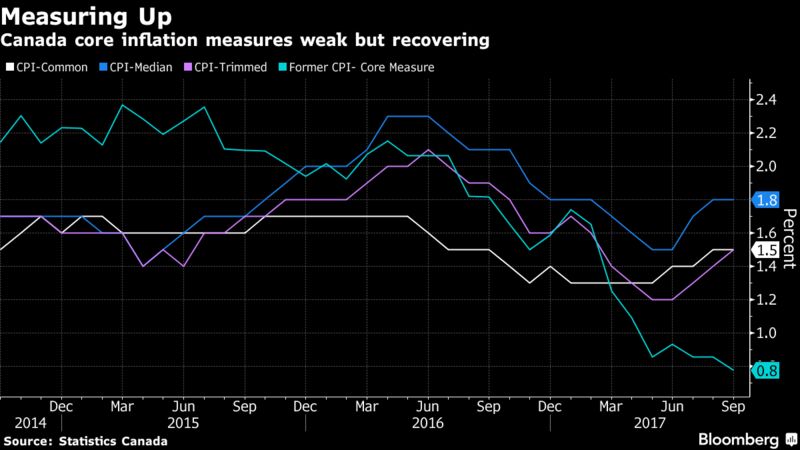

And there was little pick-up in the Bank of Canada's three preferred measures for so-called "core inflation" – gauging broad underlying price pressures in the economy, after filtering out temporary blips and isolated pockets of price volatility. On average, the three core readings came in at 1.6 per cent; two of the three measures held steady, while one edged up 0.1 percentage point.

The key driver of the overall inflation rate in September was gasoline – historically one of the most volatile components of CPI. Pump prices jumped 5.9 per cent month over month, on top of a 2.9-per-cent rise in August; both months reflected the impact of Hurricane Harvey, which forced the temporary shutdown of about one-quarter of U.S. refining capacity in late August and into September, straining North American fuel supplies. On a year-over-year basis, gasoline prices were up 14 per cent.

Excluding gasoline, the annual inflation rate would have been a much more modest 1.1 per cent in September, unchanged from July and August, Statscan said.

"Outside of energy prices, inflation made little progress in September," said Toronto-Dominion Bank senior economist James Marple in a research note. "With inflation still showing some signs of softness, there is little need for urgency on the monetary policy front."

Economists suggested that the rise in the Canadian dollar – which is up more than 7 per cent against its U.S. counterpart since early June, when the Bank of Canada started hinting at pending rate increases – may be cooling inflation, as it dampens the cost of imports.

At the same time as the inflation report, Statistics Canada also released retail sales numbers for August, which showed a disappointing decline of 0.3 per cent month over month, reversing much of July's 0.4-per-cent gain. And that drop came despite higher prices for retail goods, particularly gasoline; on a volume basis, excluding the impact of price changes, retail sales slumped 0.7 per cent in the month.

Gas-station sales were up 3.1 per cent month over month, largely due to the rise in pump prices. Sales in the auto sector rose 0.7 per cent. But food and beverage sales fell 2.5 per cent, snapping four straight months of increases.

As well, Statscan noted that retail segments tied to housing investment also showed declines, with the building materials and gardening equipment/supplies down 1.9 per cent, while home furnishings fell 2.4 per cent. The declines may be a symptom of the recent slowing of the red-hot housing market in Toronto and surrounding regions.

"While the retail dip doesn't destroy the bigger picture of consumer strength, it reinforces the theme that overall growth is now set to cool after a strong run," said Douglas Porter, chief economist at Bank of Montreal, in a research note. He suggested that the latest evidence of slowing should be enough to keep the Bank of Canada on hold in next week's rate decision.

"We continue to look for GDP [growth] to ease to around a 2 per cent annual rate in the third quarter [from 4.5 per cent in the second quarter], and for the Bank of Canada to now stand aside for the remainder of this year to reassess," Mr. Porter said.

StatCan. REUTERS. OCTOBER 20, 2017. Canada annual inflation rises in September on gasoline, food costs

OTTAWA (Reuters) - Canada’s annual inflation rate rose to the highest in five months in September on higher prices for gasoline and food, moving closer to the central bank’s target, data from Statistics Canada showed on Friday.

The annual inflation rate rose to 1.6 percent last month from 1.4 percent in August, the highest since April and matching economists’ forecasts.

Underlying measures of inflation watched by the Bank of Canada also firmed, with CPI trim, which excludes upside and downside outliers, rising to 1.5 percent.

CPI median, which shows the median inflation rate across CPI components, held at 1.8 percent after the previous month was revised higher, while CPI common, which the central bank says is the best gauge of the economy’s underperformance, was unchanged at 1.5 percent.

The Bank of Canada, which is largely expected to hold interest rates at 1 percent next week after two back-to-back increases, has an inflation target of 2 percent.

Overall, prices were up in six of the eight major components of the consumer price index, led by a 3.8 percent annual increase in transportation costs. That was driven by higher gasoline prices amid supply disruptions due to Hurricane Harvey.

Food prices rose 1.4 percent, partly due to some of last year’s dampening effects starting to wear off. Higher shelter costs also boosted inflation, with prices up 1.4 percent.

Reporting by Leah Schnurr; Editing by Chizu Nomiyama

RETAIL

StatCan. 2017-10-20. Retail trade, August 2017

Retail sales — Canada: $48.9 billion

August 2017: -0.3% decrease (monthly change)

Source(s): CANSIM table 080-0020

After increasing 0.4% in July, retail sales declined 0.3% in August to $48.9 billion. Sales were down in 8 of 11 subsectors, representing 57% of retail trade.

Lower sales at food and beverage stores more than offset higher sales at gasoline stations and motor vehicle and parts dealers. Excluding the latter two subsectors, retail sales were down 1.3%.

In volume terms, retail sales decreased 0.7%.

Chart 1: Retail sales decrease in August

Retail sales decrease in August

Food and beverage stores post the largest decline

Following four consecutive monthly increases, sales at food and beverage stores (-2.5%) declined in August. The decrease was largely attributable to lower sales at supermarkets and other grocery stores (-2.8%). Sales at specialty food stores (+1.4%) were up for the third month in a row.

Sales were down at store types traditionally associated with housing purchases and home renovation in August. Sales at building material and garden equipment and supplies dealers (-1.9%) and furniture and home furnishings stores (-2.4%) declined for the second consecutive month.

Gasoline stations (+3.1%) posted their first sales gain in four months, largely reflecting higher prices at the pump. According to the Consumer Price Index, on an unadjusted basis, the price of gasoline rose 2.9% in August.

Sales at motor vehicle and parts dealers increased 0.7%, attributable to higher sales at new car dealers (+0.7%) and, to a lesser extent, used car dealers (+5.6%).

Sales at clothing and clothing accessories stores (+0.5%) continued their upward trend in August. Results were mixed among store types, as higher sales at clothing stores (+1.2%) more than offset the declines at shoe (-1.6%) and jewellery, luggage and leather goods (-1.8%) stores.

Retail sales down in six provinces

Retail sales were down in six provinces in August. Lower sales in Quebec and British Columbia accounted for the majority of the decline.

Quebec (-1.2%) reported the largest decrease in dollar terms, largely as a result of lower sales at new car dealers.

Following five straight monthly increases, British Columbia (-1.0%) posted lower sales in August. Sales were down across most store types.

After increasing 1.3% in July, retail sales in Saskatchewan fell 2.0%. The decline was largely attributable to lower sales at motor vehicle and parts dealers and food and beverage stores, and coincided with the application of the Provincial Sales Tax to insurance services.

Retail sales in Ontario (+0.3%) rose for the fifth time in six months.

In Nova Scotia (+1.7%), sales increased for the fourth consecutive month on higher sales at new car dealers. Excluding sales at this store type, retail sales in Nova Scotia decreased in August.

Retail sales decrease in two of three census metropolitan areas measured

Nearly 30% of total retail sales take place in Canada's three largest census metropolitan areas (CMAs)—Toronto, Montréal and Vancouver.

In August, seasonally adjusted retail sales declined in Vancouver (-1.1%) and Montréal (-1.0%), while Toronto reported a 2.9% gain.

E-commerce sales by Canadian retailers

The figures in this section are based on unadjusted (that is, not seasonally adjusted) estimates.

On an unadjusted basis, retail e-commerce sales were $1.2 billion in August, accounting for 2.3% of total retail trade. On a year-over-year basis, retail e-commerce increased 41.9%, while total unadjusted retail sales rose 8.8%.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171020/dq171020b-eng.pdf

StatCan. REUTERS. OCTOBER 20, 2017. Canada's surprise Aug retail sales drop boosts bets central bank will hold rates

Leah Schnurr

OTTAWA (Reuters) - Canadian retail sales unexpectedly fell in August, pointing to a slowdown in growth after a hot first half of the year and bolstering expectations the Bank of Canada will refrain from hiking interest rates again next week.

Separate data from Statistics Canada on Friday showed the annual inflation rate rose to 1.6 percent in September, matching forecasts and the highest in five months.

Markets and economists focused on the retail sales report, which showed sales fell 0.3 percent, against forecasts for a 0.5 percent increase. Volumes declined 0.7 percent, the biggest decrease since March 2016.

Analysts said the figures were in line with anticipated slower economic growth in the second half of the year after a strong performance that put Canada at the top of the Group of Seven.

“The Canadian economy is notably cooling down after the remarkable run it had up until about the middle part of the year,” said Doug Porter, chief economist at BMO Capital Markets.

“The retail sales result does fit with that pattern of somewhat more modest activity.”

It also solidified bets the Bank of Canada will hold interest rates at 1.0 percent when it meets next week after two back-to-back increases. Market odds of no move rose to 81 percent from 72.8 percent before the data was released. [CA/POLL]

The Canadian dollar weakened against the greenback following the two reports. [CAD/]

The decline in sales was led by a 2.5 percent drop at food and beverage stores, as well as stores that are typically linked to home purchases and renovations.

The increase in September’s inflation rate was driven by higher gasoline prices amid supply disruptions caused by Hurricane Harvey, as well as more expensive food and shelter costs.

While underlying measures of inflation firmed somewhat, economists said they were still far enough away from the central bank’s 2 percent target to allow policymakers to take their time raising rates from here.

CPI trim, which excludes upside and downside outliers, rose to 1.5 percent.

CPI median, which shows the median inflation rate across CPI components, held at 1.8 percent after the previous month was revised higher, while CPI common, which the central bank says is the best gauge of the economy’s underperformance, was unchanged at 1.5 percent.

Still, many are betting the central bank will have room to hike again in December, with market odds at 47.2 percent.

Additional reporting by Susan Taylor in Toronto; Editing by Phil Berlowitz

BLOOMBERG. 20 October 2017. Retail Drop, Subdued Inflation Put Bank of Canada Rates on Hold

By Theophilos Argitis

- August retail sales fall 0.3%, versus 0.5% gain forecast

- Outside of gasoline, few signs of inflationary pressures

An unexpected decline in retail sales and scant evidence of inflation pressure will give the Bank of Canada little reason to press ahead with a third-straight rate increase next week.

Statistics Canada reported Friday retail sales declined 0.3 percent in August, versus a median forecast of a 0.5 percent gain. They also showed that excluding a jump in gasoline, inflation was little changed in September.

The two indicators are the last of any significance before the Bank of Canada’s Oct. 25 rate decision, and suggest no urgency for Governor Stephen Poloz to increase borrowing costs again after two hikes since July. The Canadian dollar fell 0.6 percent to C$1.2558 after the report. Odds of a rate increase next week fell to about 19 percent, from 21 percent yesterday, swaps trading suggests.

“A very slow turn in prices, and what looks like another ho-hum month for GDP augurs for a dovish take on the Bank of Canada on Wednesday next week,” Nick Exarhos, an economist at CIBC Economics, said in a note to investors.

The retail sales number was the big disappointment, and reinforces expectations the nation’s economy is heading for a slowdown after strong growth earlier this year. Monthly retail sales are little changed since touching a 2017 high in May. In volume terms, sales fell 0.7 percent in August, the biggest decline since March 2016.

Motor vehicle sales were one sector of strength, and the total number also got a boost from higher gasoline prices. But excluding those two sectors, sales were down 1.3 percent.

Canadian consumer price inflation in September jumped to its highest level since April on gasoline prices, but the gain was less than expected.

Annual inflation accelerated to 1.6 percent on the higher gas prices, versus economist expectations for 1.7 percent. Excluding gas, the annual inflation rate was unchanged at 1.1 percent. The average of the Bank of Canada’s three key core inflation measures was 1.6 percent, versus 1.57 percent in August. The core rate is the highest since January

While the inflation rate remains below the central bank’s target, the Bank of Canada has justified this year’s rate hikes by citing quickly vanishing excess capacity in the economy and by claiming the forces keeping inflation subdued are temporary.

Outside of gasoline however, the report showed inflation pressures remain muted in most sectors.

— With assistance by Erik Hertzberg, and Greg Quinn

ECONOMY

Department of Finance Canada. October 19, 2017. Finance Minister Announces Fall Economic Statement for October 24

Ottawa, Ontario – When you have an economy that works for the middle class, you have a country that works for everyone. The Government of Canada's plan to invest in people, in communities and in the economy is working. As it takes the next steps in its plan, the Government will build on successes achieved over the last two years—from the more than 400,000 jobs that have been created, to lower taxes for the middle class and for small business, to a renewed relationship with Indigenous Peoples.

Finance Minister Bill Morneau today announced that the Fall Economic Statement will be tabled on October 24, 2017.

The Statement will build on a plan that is working, and take important next steps to ensure the middle class and those working hard to join it share in the success we achieve as a country. The Statement will also affirm the Government's plan to reduce the small business tax rate to 9 per cent, while ensuring that this preferential rate is used to support growth and job creation, and not to provide tax advantages for the wealthy few.

On October 5, 2017, Minister Morneau met with private sector economists to gather their views on the Canadian and global economies, which will be reflected in the Fall Economic Statement. Canada has the fastest growing economy among G7 nations, with second-quarter real gross domestic product (GDP) growth hitting 4.5 per cent. For the fiscal year that ended March 31, 2017, the budget deficit is $11.6 billion less than originally projected in Budget 2016.

Following consultations and open dialogue with stakeholders across the country, and with the needs of families as its highest priority, the Government is building an economy that works for the middle class and those working hard to join it.

Quick Facts

- Canada's underlying economic and fiscal fundamentals remain sound: over the last four quarters, real GDP has grown at an average rate of 3.7 per cent—the strongest four-quarter period of expansion since 2006. The labour market has also been strong, with over 400,000 new jobs created in the last two years.

- The Government of Canada has taken significant steps towards helping families regain the confidence needed to help drive the economy forward. This includes cutting taxes for 9 million Canadians, introducing a new Canada Child Benefit, and strengthening the Canada Pension Plan so that future generations of workers can retire with dignity.

- The Government is committed to sound fiscal management as it continues to make investments to support long-term economic growth and a strong middle class, while preserving Canada's low-debt advantage for current and future generations.

Quote

"Our plan to grow and strengthen the middle class is working, but there is more to do. As our economy grows we will make sure the benefits of that growth are felt by the middle class. And we will continue to listen to Canadians as we move forward to level the playing field and invest in Canada's future, while supporting the middle class and those working hard to join it."

- Bill Morneau, Minister of Finance

INTERNATIONAL TRADE

The Globe and Mail. The Canadian Press. 20 Oct 2017. Global growth boosts Canadian exports

Export Development Canada says exports are growing significantly as both the U.S. and the global economy continue to improve.

The Crown corporation said in a report out on Thursday that overall exports are expected to grow 8 per cent in 2017, led by “massive gains” in the commodity space, and 4 per cent next year.

“Things are definitely improving with respect to the U.S. and global economies, notwithstanding the issues around trade negotiations and political risk,” Todd Evans, principal at EDC Economics, said in an interview ahead of the report’s release. “When it comes to a synchronized global upturn, this is pretty good. In terms of that synchronicity it’s pretty much as good as it gets.”

At $77-billion, EDC says oil and gas exports are forecast to have grown by 31 per cent, after production was hit last year by the Fort McMurray, Alta., wildfire.

________________

LGCJ.: