CANADA ECONOMICS

BOMBARDIER

The Globe and Mail. 19 Oct 2017. Delta says it did not play a role in Airbus-Bombardier deal

ALANA WISE, Reuters

Delta Air Lines Inc.’s chief executive on Wednesday said the carrier did not play a role in pushing an industry-changing deal between plane makers Airbus SE and Bombardier.

Inc., as a regulatory spat between the United States and Canada threatened the future of a Bombardier plane program.

Delta CEO Ed Bastian praised the deal between Europe’s Airbus and Canada’s Bombardier, which would see Airbus take an ownership stake of the troubled Bombardier C Series program, as a net positive for the U.S. economy.

The agreement for Bombardier to cede a 50.01-per-cent stake in the C Series to Airbus, and to likely move the plane’s final production stages from Canada to an Airbus facility in Alabama, secures the future of the jet and gives Bombardier a possible way out of a highstakes trade dispute with rival Boeing Co.

“I’m optimistic that the Airbus-Bombardier investment will help minimize some of the political concerns,” Mr. Bastian said at the carrier’s media day in Atlanta.

Mr. Bastian maintained that he was “mystified” as to why Boeing has sought to oust the narrow-body jet program through a complaint against Bombardier to the U.S. Commerce Department.

The issue between the two manufacturers, in which Chicago-based Boeing alleged that unfair Canadian subsidies to Bombardier have allowed the plane maker to dump the C-Series in the United States at an “absurdly low” price, has pushed into a broader discussion between the United States and Canada over fair trade policies.

Delta has an order for 75 C Series at a list price of more than $5-billion (U.S.).

Delta Air Lines (DAL)

Close: $52.86 (U.S.), up 10¢

THE GLOBE AND MAIL. OCTOBER 19, 2017. New Metrolinx CEO Phil Verster on Bombardier delays and what to do about Union

OLIVER MOORE

There's more construction in store for Union Station, says the new CEO of Metrolinx, who in his first weeks on the job has concluded that the transit hub has to operate much more efficiently.

Phil Verster, a South African who has worked most recently in the United Kingdom, took the top slot at the regional transit agency earlier this month. He enters the job tasked with implementing the $13.5-billion plan dubbed Regional Express Rail (RER), which would mean greatly improved GO Transit service. And he arrives as the agency weathers controversy about bowing to government influence in its support for some transit stations.

Mr. Verster sat down with The Globe and Mail in his office this week to discuss what to do about Union Station, his frustration with Bombardier's chronic delays in producing light-rail vehicles (LRVs) for Toronto-area projects, his interpretation of agency independence and why he spends time every week riding GO, listening to his customers.

What are you hearing from them?

People I talk to are very satisfied with frequency and punctuality. The biggest comments I get back is that in the peak, services are very crowded. I get strong feedback on the need for WiFi on our trains, which I share. It is something that we're going to look at. I get very positive response on Presto. People do remark that in the past it's not been always that great, but broadly speaking a very positive response on Presto. And generally a sense that our customer-focused staff are very good. There's nothing that replaces being on site, talking to customers firsthand, and I just think that's hugely valuable.

Have you been out in the peak to assess the crowding customers have talked about?

I've spent peak periods down here at Union and I think if we focus on getting Union to operate effectively we will address quite a lot of the congestion. Union is absolutely key.

What has to be done to improve Union?

I'm very keen on level boarding. It allows lower dwell times, it allows for better throughput of fleets. If we are going to move towards a higher-frequency service, operations through that corridor needs to be segmented. The key in a busy corridor is to minimize [train] crossings. Even if it's half a minute, it's a half a minute lost. Definitely [we're looking to buy] a signalling system solution that is more automated. It allows you to safely manage a huge capacity of trains through a narrow corridor with great effect.

Part of that whole solution will include a rebuild of the platforms. We must build up the platforms, but the platforms aren't right. They're too narrow. In order to get increased capacity through that corridor, we going to have to sacrifice some of [the current platforms]. We have to come up with a combination of bay and through platforms, which we'll have less of because we need wider platforms where people come up. We have to create wider width around those entry points, because it's simply unsafe. I've asked the team to look at a Union station platform layout that's different. As we're going to redo the platforms, [we'll] lift the platforms to the right level.

I think a lot of Torontonians who've lived through the Union station rebuild going on now will quail to hear that there's another rebuild on the horizon

You can separate the two. The current rebuild is very much in the customer-service areas, and I don't foresee that anything we are doing on the current rebuild will change when we start to address what platforms look like and how platforms are constructed. Whatever's being done now is good investment and will improve the customer experience for years to come.

Region Express Rail is obviously the biggest part of your mandate. Why are you right person to lead the expansion plan?

RER presents us with that unique opportunity where we can run our existing services – which are intense, we move 69 million people a year – to something that has three or a four times higher capacity, while we maintain current services. And this is the type of railway activity that I've been involved in for a couple years now, building railways and developing it while you run services on an ongoing basis.

Metrolinx has lost a couple of legal rounds to Bombardier now, first over the LRVs and then over the GO contract. Are we going to see a different approach to dealing with Bombardier under your leadership?

I am extremely disappointed in Bombardier's delivery and it's not acceptable. For there to be a successful relationship there should be an alignment of objectives and I will be challenging Bombardier continuously to adjust to achieve that alignment with our objectives.

When Metrolinx and Bombardier were in court over the LRVs the agency thought they'd win for sure. And it was a crashing loss. Is that a cautionary tale for going back to court with Bombardier?

We do not want to manage our business through the courts. The focus should never be to end up in a legal dispute to resolve performance issues. The focus should always be for Bombardier to fix the difficulties and problems that they have had in their production processes, and I'm still not convinced that they have achieved enough progress.

There's a provincial election next year and a Conservative government could change Metrolinx in dramatic ways. Why would you come to an agency with that uncertainty hanging over it?

It's a huge opportunity to contribute to a fantastic program. When I consider what Metrolinx's role is, it is to provide independent excellent advice to government on how to operate our transit solution, how to provide excellent planning and options on how to continue to improve mobility across the region. I think the purpose of what we are here to deliver will continue to be a requirement, and whichever way the world develops we will still have a requirement to move passengers and to provide the exact same service as we provide now.

You talk about providing independent advice, and certainly on a strategic level it's the government's decision, say, to do a program like RER or not to do a program like RER. But if the government of the day wants to have a station at a certain spot and MX doesn't believe that's the right thing to do, should MX simply follow the government lead or is that an [instance] where you should act independently?

It's unambiguous for me that when we put proposals to government, the proposals should be giving government options and it's government's choice which option they decide upon. And what they're doing on Kirby and Lawrence East [stations] for example, is exactly that. We will now continue to do what's best practice. A typical transit program would have three or four business-case stages. And when you look at those stages, different decisions are required at each junction, and I think the commitment that our chair has given for us to follow through on those two stations to the next stage of business case review is exactly the right one. That's how it needs to be done, and that's how [we'll] continue to do that.

You talk about best practices. Is it best practice for the board to approve a station, or two stations in this case – that the analysis it commissioned found did not make sense but was what the ministerial level wanted?

My previous answer sort of [lays out] how I see things should be done, and what I've explained is how I think it should be done and how I will continue to do it and how I will steer our organization going forward

Are you willing and able to say no to a minister of transportation when you're in this role?

Clearly is depends on what question I'm being asked. It is my very strong view that a technically independent transit authority with independent, solid, fact-based advice is of huge benefit to the province. Independence is not independence with a capital I, it is independence with a small I, in the space of domain knowledge and technical expertise to deliver transit solutions. That is our role, and any policy decisions and choices that must be exercised is for elected representatives to exercise.

This interview has been edited for length.

REUTERS. OCTOBER 19, 2017. Airbus A330neo stages delayed maiden flight

Tim Hepher

TOULOUSE, France (Reuters) - Airbus (AIR.PA) on Thursday staged the delayed maiden flight of its A330neo jetliner, an upgraded version of its profitable A330 series designed to buttress European sales against the latest model of the Boeing (BA.N) 787 Dreamliner.

The wide-bodied, long-distance jet took off from the planemaker’s Toulouse headquarters under overcast skies, watched by top executives from Airbus and Britain’s Rolls-Royce (RR.L), which supplies the engines.

In service since the 1990s, the A330 family is Airbus’s biggest-selling wide-body jet but the arrival of Boeing’s composite-body Dreamliner has eroded that position.

Airbus hopes the A330neo’s refreshed design with new engines will help it defend its position in the lucrative 250-300 seat market, as a second honeymoon in the market and a burst of orders caused by production delays at Boeing start to peter out.

Chief Operating Officer Fabrice Bregier said Airbus had decided to improve the plane’s maximum take-off weight by around 4 percent to 251 tonnes so that the A330neo can serve longer routes such as Kuala Lumpur to London from 2020.

Separately, Bregier said Airbus still expected to deliver “around 200” of the smaller A320neo aircraft in 2017, but added that meeting this previously stated target would be tough.

Bregier said Pratt & Whitney (UTX.N), whose industrial problems have delayed deliveries of Airbus jets, was testing re-designed parts for its engines and expected to start delivering the modified version at the end of this year.

That suggests Airbus hopes to end an 18-month crisis over Pratt & Whitney engine delays some time next year.

For now, undelivered jets continue to crowd the tarmac in Toulouse as Pratt & Whitney diverts engines from the production line to a pool of spares to supply airlines that are having to take engines out of service for early maintenance.

The majority of the delayed jets are destined for airlines that have selected Pratt & Whitney’s new Geared Turbofan engine. CFM International, co-owned by General Electric (GE.N) and Safran (SAF.PA), is also supplying engines for the A320neo.

MID-YEAR DELIVERY

The A330neo’s debut flight was also delayed by the late completion of Trent 7000 engines from Rolls-Royce, which has been juggling demands with two other development projects.

Rolls-Royce says the bigger new engines are 10 percent more efficient and half as noisy as the previous generation.

Airbus said the A330neo would enter service in the middle of next year compared with an original target of fourth quarter this year, when the project was launched in 2014.

The A330neo and A320neo are examples of relatively cheap upgrades being carried out by Airbus and Boeing to take advantage of a leap forward in engine design, while also bringing out costlier all-new models like the A350 and 787.

Airbus earlier this week announced plans to absorb the high-tech but financially troubled CSeries aircraft of Canadian rival Bombardier in a deal that offers it new technology and a wider geographic presence in exchange for lending its marketing clout.

Airbus is now touting Canada as its “fifth home nation” after Britain, France, Germany and Spain where it was founded.

Once the deal is completed in around a year’s time, the new-generation CSeries is expected to fill a gap below Airbus’s current portfolio in the market for 100-150 seats.

Reporting by Tim Hepher; Writing by Richard Lough; Editing by David Holmes and Adrian Croft

NAFTA

The Globe and Mail. 19 Oct 2017. ARTICLE. It should have been clear that the NAFTA talks were on thin ice from the start. Trump’s zero-sum game has likely doomed NAFTA

LAWRENCE HERMAN, Former Canadian diplomat who practises international trade law and a senior fellow of the C.D. Howe Institute in Toronto

Round 4 of the NAFTA negotiations ended in exceptional bitterness on Tuesday, with the United States presenting a series of outrageously unacceptable proposals. While the negotiating deadline was extended into early 2018, the talks are heading downhill and will likely hit the wall before then.

It’s interesting that commentators are now talking about the need for a Plan B (or C or D) for Canada, when it should have been clear that these talks were on a perilous slope from the outset.

While policy wonks were once full of naive optimism about modernizing the North American free-trade agreement, a cold shower of realism would have doused that rosy glow. The problem is these negotiations were never born of common objectives among likeminded governments. We’re in these talks because of a diktat from one source – U.S. President Donald Trump.

After repeatedly condemning NAFTA as a “disaster” and the “worst trade agreement ever,” Mr. Trump wasn’t going to go gentle into that good night. He was obviously going to follow through with aggressively one-sided demands to Canada and Mexico – and that’s what they are – or else.

U.S. presidents set the tone for their administrations in inaugural addresses to the country and the world at large. Remember Franklin Roosevelt and “We’ve nothing to fear but fear itself,” or John F. Kennedy’s “Ask not what your country can do for you …”

In the case of Mr. Trump, it was a bombastic and inward-looking declaration that it would be “America first and only America first” during his term of office.

The U.S. approach to these negotiations is unprecedented, the opposite of countries sitting down in good faith to reach a balanced and mutually agreeable outcome. Mr. Trump will have none of that; to the contrary, it’s all about a zerosum, take-no-hostages game used by him in putting together real estate deals.

Faced with this reality, comments about the need for alternative plans for Canada are part of a deeper concern over an uncertain trade and political relationship with the United States.

To be fair, the negotiations haven’t totally collapsed. Not yet. That will probably come in the next while, as the Trump team realizes that Canada and Mexico won’t cave and a new deal (even if it were remotely in the cards) won’t be done by the agreed deadline.

Even the extended deadline into 2018 is totally unrealistic, the result of expedient political calculations that a new NAFTA needed to be concluded before the Mexican presidential elections next July and before the U.S. midterm election period gets into full swing in the summer. Prying these complex negotiations into an unsuitable time period alone probably condemned the talks to failure.

Following the acrimonious meetings this past week, the political atmosphere will darken. Whether and when the talks can resume in earnest after tempers cool is uncertain given the take-it-or-leave it approach of the Trump team.

Mr. Trump could soon follow through with his earlier threat and present the U.S. six-month notice of intent to withdraw under NAFTA Article 2205. That notice in itself doesn’t abrogate the treaty but paves the way for formal withdrawal after the six-month period ends.

Whether Mr. Trump can actually pull the United States out of NAFTA without congressional approval, however, is the burning question. It’s never happened before. Many experts say that Congress’s constitutional authority over international trade means he’ll need that approval. This will be the subject of much argument and inevitable court challenges. It will take months to get this resolved, probably going all the way to the U.S. Supreme Court.

In the meantime, without any clear answer on the constitutional front, NAFTA will remain in force but things will be uncertain and messy as far as the trilateral trading relationship in concerned. No one will know what rules will apply going forward.

Some have pointed out that if NAFTA is terminated, the 1988 Canada-U.S. free-trade agreement (FTA) will then be reactivated and with it all the preferential elements for Canada, such as zero duties. That seems legally correct but is an incomplete analysis. The fact is, the FTA is equally at risk under the Trump administration.

The FTA contains the same sixmonth withdrawal notice as NAFTA. It seems hardly plausible that Mr. Trump would threaten to withdraw from NAFTA without pulling the plug on the FTA as well. It contains things that the Trump team would find as unpalatable as in NAFTA, such as the automotivecontent rules, supply-management guarantees, procurement obligations and the binational panel review system.

Any renegotiation of the FTA would be as contentious and nasty as what we’ve witnessed these past days in the NAFTA talks.

This ride into the valley of uncertainty is not unexpected. But if there’s anything positive coming out of all of this, it’s that Canadians are now thinking actively about life after NAFTA. Better to activate plans B, C and D before these negotiations slide down to what looks like their inevitable demise.

THE GLOBE AND MAIL. OCTOBER 19, 2017. OPINION. Canada desperately needs a revived TPP as NAFTA talks falter

JOHN IBBITSON, Columnist

Since there is now a clear and present danger that NAFTA talks will collapse, Canada must look for alternative trading partners. And on this front, there is good and important news.

If things continue to go well, the 11 remaining members of the Trans-Pacific Partnership will commit to proceeding with the pact when leaders meet in Vietnam next month for the APEC summit, even though the United States is no longer part of the accord.

With the North American free-trade talks in disarray, a revived TPP is vital to Canada's future trading interests. Canada badly needs this deal.

As the Business Council of Canada declared in a letter to Trade Minister François-Philippe Champagne that has been obtained by The Globe and Mail, "the TPP 11 could be more beneficial to Canada than the original agreement." That's because Canada would have preferential access to Japan, the world's third-largest economy, and other TPP markets, while the United States remained frozen out.

For example, as a recent report from the Canada West Foundation points out, ratifying the TPP would allow Canadian beef producers duty-free access to the Japanese market. American competitors would face a 50-per-cent tariff.

Canada would also have preferred access to important new markets, such as Malaysia and Vietnam. If Mexico also ratifies the TPP, as it surely will, the other two partners in NAFTA would be signalling to the United States that they remain committed to free and open trade, including with each other, even if the Americans do not.

Finally, the pact would be there, intact and functioning, ready for American accession, should President Donald Trump leave the stage and sanity return to that country's political life.

TPP 11 reinforces the folly of Mr. Trump's anti-globalist agenda. American businesses will be disadvantaged as other Pacific nations continue to lower barriers. And the ultimate beneficiary will be China.

As the Trudeau government mulls Chinese proposals to develop stronger trading ties, the arguments for saying no become steadily less compelling.

Yes, China is a strategic competitor to the West in the Pacific. Yes, its government is authoritarian and its state-owned enterprises murky and perhaps untrustworthy.

But what choice does Canada or any other U.S. ally have, given the Trump administration's hostility to open trade? As Perrin Beatty, head of the Canadian Chamber of Commerce, observed in an interview: "If the United States is not prepared to deepen ties with its trading partners, then it leaves other nations with no choice but to pursue alternatives."

With the TPP ratified, Canada will be in a stronger position if and when it begins trade talks with China next year. Don't forget: The original purpose of the TPP was to create a trading block that would contain China – and perhaps, one day, draw China in – preserving American power in the Pacific.

Mr. Trump foolishly threw away that advantage by withdrawing the United States from the TPP. But it remains in the interest of Pacific nations to band together in mutual self-interest.

Let's be clear: The TPP is no substitute for NAFTA. The end of continental free trade in North America would be calamitous for this country, disrupting supply chains and undermining private-sector investment. No European or Asian trade agreement can substitute for unfettered access to the world's largest economy.

And the forces that produced Trumpism – and Brexit, and the rise of nativism in continental Europe – must be addressed. Income inequality in a knowledge economy is pernicious, fostering racial and class tensions and undermining democratic pillars.

But it remains worthwhile for Canada and the 10 other members of the TPP – Australia, Brunei, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam – to hang together, hoping the Americans will eventually join, hoping China and India will one day join as well, hoping that the Pacific and Atlantic trading zones one day merge into a new global trading agreement.

Right now, this is a distant hope. But until the globalization momentum resumes, the TPP is all we've got.

BLOOMBERG. 19 October 2017. Economists Say Nafta’s Collapse Would Hurt the Economy, With Mexico Hit Most

By Andrew Mayeda

- Mexican factories would suffer and shed low-skilled workers

- Trump’s election promise to help manufacturing won him support

The collapse of the North American Free Trade Agreement would likely damage yet not derail the continent’s economy and business models of global corporations.

That’s the conclusion of economists trying to envisage life after the 23-year-old accord as increasingly tense negotiations over how to revamp it fuel speculation that President Donald Trump will follow through on his threat to withdraw.

Without Nafta, the U.S. and Mexico would charge each other the higher tariffs they now levy on other members of the World Trade Organization. Those run as high as 7 percent on average in Mexico and 3.5 percent in the U.S., although Canada and America may be able to fall back on a pre-Nafta free-trade deal.

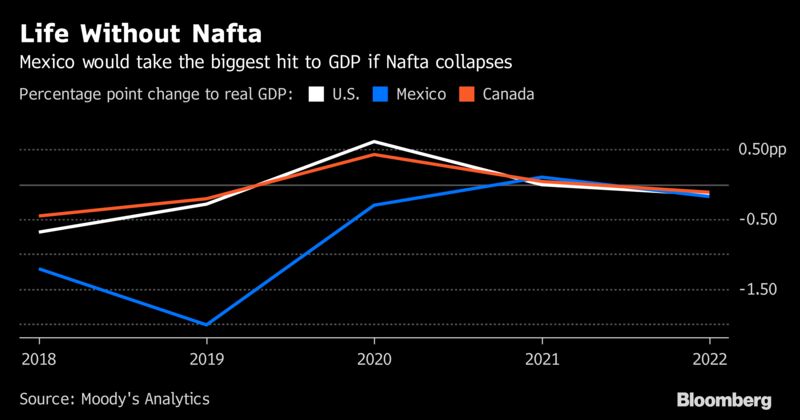

An increase in duties would potentially hurt growth, cost jobs and spur inflation for all three nations with Bloomberg Intelligence and Moody’s Analytics predicting Mexico would be the hardest hit.

But none of the countries would be tipped into recession, according to Moody’s. It forecasts most of the pain would come in the first two years after the breakdown of the deal, assuming the U.S. and Canada would work out a bilateral arrangement.

“It will be bad for business, but it wouldn’t be cataclysmic,” said Mark Zandi, chief economist at Moody’s Analytics. “It will be disruptive to supply chains.”

Mexico has been the biggest winner from the pact among the three countries. Companies from General Motors Co. to Caterpillar Inc. shifted production south of the U.S. border to take advantage of cheaper wages, helping Mexico stabilize its economy after a debt crisis in the 1980s.

It also stands to lose the most from a Nafta exit. Mexico would shed almost 1 million low-skilled jobs, compared with slightly more than 250,000 in the U.S. and 125,000 in Canada, according to ImpactEcon, an economic consulting firm based in Colorado. The ImpactEcon estimate doesn’t assume survival of the U.S.-Canada FTA.

Mexico’s manufacturing sector would be most at risk if the accord ends, especially in the auto industry, according to an analysis by Bloomberg Intelligence. The U.S. had a $74 billion automotive trade deficit with Mexico last year -- outsizing the overall $63 billion shortfall.

Private investment in Mexico has already been falling on trade-related uncertainty, and would likely suffer further on a Nafta exit. But the short-term impact could be limited, since it could take time for companies to adjust their supply chains, and Mexico would likely remain competitive relative to the U.S. because of its low labor costs, according to BI.

A party can withdraw from the pact with six months’ notice, though it would probably trigger legal and political battles because the full extent of the president’s authority over trade is unclear. The path for reshaping America’s trade ties with Mexico and Canada could take years to work out. Congress’s trade powers would help frame a withdrawal and Trump’s successor could even decide to re-enter talks.

Negotiators bought more time by extending Nafta talks through March after the U.S. during the latest discussions this month unveiled hardline demands that were rejected by Mexico and Canada.

In Dispute

Similar to the expected impact of Britain’s exit from the European Union, tariffs might not be the biggest obstacle to business. The pact’s demise would dismantle the system of independent tribunals that govern investment on the continent. For example, U.S. companies would lose a safeguard that prevents Canada or Mexico from seizing their assets.

A weakening of protections for American companies would disproportionately hurt Mexico, where legal buffers for corporations aren’t as robust, said Carlos Capistran, head of Mexico and Canada economic research at Bank of America Merrill Lynch.

“The impact of higher tariffs may actually not be that large,” he said by phone. “I’m worried about the impact on investment.”

Helping Workers?

One of the keys to Trump’s election last year was his appeal among voters in states hurt by the decline in manufacturing employment, such as Ohio and Pennsylvania.

Some companies would probably move production back to the U.S. if the president withdraws from the deal, said Michael Stumo, chief executive officer of Coalition for a Prosperous America, a non-profit group that has supported the administration’s skepticism toward free trade. However, addressing currency imbalances would be a more durable way of shifting trade flows, he added.

But others argue that companies would simply shift production to lower-cost production hubs in Asia, rather than return the U.S. to its manufacturing glory days.

“It’s unlikely Nafta’s termination would lead to meaningfully higher job gains in the U.S.,” said Michael McDonough, global director of economic research at Bloomberg Intelligence. “Companies would probably pass higher prices on to consumers rather than spend billions over many years to bring capacity back to the U.S.”

— With assistance by Catarina Saraiva

ECONOMY

StatCan. 2017-10-19. Study: Recent developments in the Canadian economy, Fall 2017

This article in the Economic Insights series, released semi-annually, provides an integrated summary of recent changes in output, employment, household demand, international trade and prices.

Organized as a statistical summary of major indicators, the report is designed to inform about recent developments in the Canadian economy, highlighting major changes in the economic data during the first two quarters of 2017 and into the summer months. Unless otherwise noted, the tabulations presented in this report are based on seasonally adjusted data available in CANSIM on October 6, 2017.

Recent Developments in the Canadian Economy: Fall 2017: http://www.statcan.gc.ca/pub/11-626-x/11-626-x2017075-eng.pdf

StatCan. 2017-10-19. Employment Insurance, August 2017

Regular Employment Insurance beneficiaries — Canada: 524,150

August 2017: -1.8% decrease (monthly change)

Regular Employment Insurance beneficiaries (year-over-year change) — Canada

August 2017: -8.0% decrease (12-month change)

Source(s): CANSIM table 276-0022

The number of regular Employment Insurance (EI) beneficiaries decreased by 9,600 (-1.8%) to 524,200 in August. This decline continues a downward trend that began in October 2016.

The number of beneficiaries fell in eight provinces, led by Manitoba (-8.0%) and Alberta (-4.0%). There were also declines in Prince Edward Island (-2.6%), New Brunswick (-2.0%), Newfoundland and Labrador (-1.9%), Ontario (-1.5%), Nova Scotia (-1.2%) and Quebec (-1.1%). The number of EI beneficiaries increased in Saskatchewan (+1.9%), while it was little changed in British Columbia.

In general, changes in the number of beneficiaries can reflect a number of different circumstances, including people becoming beneficiaries, those going back to work, those exhausting their regular benefits, and those no longer receiving benefits for other reasons.

Compared with August 2016, the number of EI recipients in Canada declined by 8.0%. Following the EI policy changes that came into effect in July 2016, the number of beneficiaries was unusually high in the latter half of 2016. These policy changes eliminated higher eligibility requirements for new entrants and re-entrants to the labour market, simplified job-search responsibilities for beneficiaries, and extended the duration of EI benefits for regions affected by the 2014-2016 commodities downturn. Consequently, historical comparisons with August 2016 are not recommended, and the rest of this analysis focuses on month-to-month changes.

Chart 1 Chart 1: Regular Employment Insurance beneficiaries

Regular Employment Insurance beneficiaries

Provincial and sub-provincial overview

Following a notable increase in July, the number of beneficiaries in Manitoba declined 8.0% to 15,600 in August. The decrease was driven largely by the census metropolitan area (CMA) of Winnipeg (-10.8%).

In Alberta, 67,200 people received benefits in August, down 4.0% from the previous month. The number of beneficiaries in the province has been on a downward trend since the end of 2016. Within Alberta, the declines were spread across the province, including Edmonton (-4.1%) and Calgary (-3.0%).

The number of beneficiaries in Prince Edward Island decreased 2.6% to 7,600 in August, with declines spread across the province.

In New Brunswick, the number of EI recipients was down 2.0% to 31,800. Within the province, there were fewer people receiving EI benefits in Saint John (-3.9%) as well as in areas outside the CMAs and census agglomerations (CAs) (-2.4%).

There were 39,100 EI recipients in Newfoundland and Labrador, down 1.9%. While St. John's (-1.3%) had fewer people receiving benefits, most of the decline was observed in areas outside of the CMA and CAs (-2.2%).

The number of beneficiaries in Ontario decreased 1.5% to 133,100 in August, offsetting the increase observed in July. There were decreases in 8 of 15 CMAs in the province, led by Windsor (-11.0%), Peterborough (-6.3%) and St. Catharines–Niagara (-5.7%).

Nova Scotia had 27,600 people receiving benefits in August, down 1.2% from the previous month. In Halifax, the number of beneficiaries decreased by 3.2%.

In Quebec, the number of beneficiaries declined by 1.1% to 130,900. There were declines in Ottawa–Gatineau (Quebec part) (-4.0%) as well as in the CAs (-2.8%), while in Montréal the number of beneficiaries edged down.

Saskatchewan had more EI beneficiaries in August, up 1.9% to 18,400. Most of the increase was observed in areas outside of CMAs and CAs (+2.7%).

Although the number of EI recipients was little changed in British Columbia, this was not the case for some areas within the province. There were fewer beneficiaries in Abbotsford–Mission (-12.0%) and Kelowna (-1.7%).

Employment Insurance beneficiaries in major demographic groups

In August, all major demographic groups had fewer beneficiaries compared with the previous month, except for men aged 15 to 24, among whom there was little change. The overall decline was 3.0% for women and 1.0% for men.

Employment Insurance claims

Following an increase in July, the number of EI claims decreased 4.9% to 234,300 in August. The number of claims provides an indication of the number of people who could become beneficiaries.

Among the provinces, claims declined the most in British Columbia, down 16.9% in August. In July, there was a notable increase in the number of claims in the province, which may reflect the forest fires that prompted the declaration of a provincial state of emergency from July 7 to September 15. The decline in August mostly offsets the increase observed in July.

The number of EI claims also decreased in Ontario (-9.4%), Saskatchewan (-6.5%), Manitoba (-3.6%), Alberta (-2.0%) and Newfoundland and Labrador (-1.2%). On the other hand, there were more claims in New Brunswick (+6.2%), Prince Edward Island (+2.9%), Quebec (+1.8%) and Nova Scotia (+1.7%).

Chart 2 Chart 2: Employment Insurance claims

Employment Insurance claims

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171019/dq171019a-eng.pdf

TOURISM

Innovation, Science and Economic Development Canada. October 19, 2017. Creating stronger business and personal ties between Canada and China. Destination Canada promotes stronger people-to-people ties through tourism at Showcase Canada Asia

Ottawa - Canada enjoys strong people-to-people and business-to-business ties with China, and the Government of Canada is committed to further developing these ties to take full advantage of new trade opportunities that support the middle class in both countries.

At Showcase Canada Asia this week, Canadian tourism firms met with more than 100 travel agents, tour operators and other buyers from mainland China, Taiwan and Hong Kong. The annual event, organized by Destination Canada, helps strengthen business relationships with Asia, one of Canada’s fastest growing sources of tourists. In 2016, more than 610,000 Chinese tourists visited Canada—an increase of 23.6 percent over 2015.

This year, Destination Canada also used Showcase Canada Asia to raise awareness of the 2018 Canada-China Year of Tourism. This opportunity will allow Canada and China to build on the people-to-people ties that keep us connected to welcome more tourists in both countries. The ties between our two countries run deep: nearly 1.5 million Canadians have Chinese ancestry, and Mandarin and Cantonese are Canada’s most widely spoken languages after English and French.

The 2018 Canada-China Year of Tourism will feature exciting activities and events across Canada and China. This special year is a unique opportunity for Canada to showcase the best it has to offer and capitalize on the benefits of a vibrant tourism sector to create good middle-class jobs for many years to come.

Quotes

“Canada and China have strong ties, built on mutual economic cooperation and deep family connections. Events like Showcase Canada Asia are a great way to encourage Canadian tourism suppliers to take full advantage of the potential that China’s growing middle class represents. As we approach the 2018 Canada-China Year of Tourism, I look forward to seeing Canada welcoming a record number of Chinese tourists and showing them why Canada is such a great place to visit.”

– The Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism

“Showcase Canada Asia is a great way for Canadian tourism businesses from coast to coast to build relationships with Chinese buyers. This year we have 230 Canadian sellers, representing 11 provinces and territories, including 8 Aboriginal businesses. China is one of our fastest growing markets, and I look forward to seeing this growth continue as we leverage the 2018 Canada-China Year of Tourism to inspire Chinese travellers to take in the variety of experiences that we offer across the country.”

– David F. Goldstein, President and CEO, Destination Canada

- China plays a central role in Canada’s New Tourism Vision. The Government of Canada is committed to doubling the number of Chinese visitors by 2021 as part of that vision.

- China is Canada’s second-largest single-nation trading partner. Two-way merchandise trade between Canada and China totalled almost $86 billion in 2016.

- Canadians of Chinese descent account for roughly 4.5 percent of Canada’s population.

FULL DOCUMENT: https://www.canada.ca/en/innovation-science-economic-development/news/2017/10/creating_strongerbusinessandpersonaltiesbetweencanadaandchina.html

CORRUPTION

Global Affairs Canada. 2017-10-18. Canada adopts Justice for Victims of Corrupt Foreign Officials Act. Backgrounder

In May 2016, Senator Raynell Andreychuk introduced Bill S-226, Justice for Victims of Corrupt Foreign Officials Act, into the Senate. The Government of Canada announced its support in May 2017 with amendments such as the addition of a provision for offences and punishments, and a stronger delisting mechanism. Bill S-226 received Royal Assent on October 18, 2017.

With Royal Assent, Bill S-226 has entered into force, creating a new legal framework. The Justice for Victims of Corrupt Foreign Officials Act enables Canada to restrict dealings in property and freeze the assets of:

- Foreign nationals who are responsible for or complicit in gross violations of human rights against individuals seeking to exercise, protect, or defend their rights and freedoms or individuals seeking to expose illegal activity carried out by foreign public officials; and

- Foreign public officials or their associates who are responsible for, or complicit in, acts of significant corruption in a foreign state.

The Special Economic Measures Act (SEMA) is also amended to allow for the imposition of sanctions in response to gross and systematic human rights violations in a foreign state, or for acts of significant corruption by foreign public officials or their associates.

As well, the Immigration and Refugee Protection Act is amended to render inadmissible to Canada those individuals listed under the new law or under SEMA’s new human rights and corruption triggers.

Global Affairs Canada. October 18, 2017. Canada adopts Justice for Victims of Corrupt Foreign Officials Act

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today welcomed the adoption of the Justice for Victims of Corrupt Foreign Officials Act and amendments to the Special Economic Measures Act (SEMA). These changes are the result of cross-partisan collaboration and strong leadership by the sponsors of this legislation in the Senate and House of Commons.

This new law enables Canada to take further action to respond to cases of human rights violations and significant acts of corruption anywhere in the world. Canada will have the ability to impose asset freezes and travel bans on those responsible for these reprehensible acts or their accomplices. Amendments to SEMA allow Canada to impose economic sanctions when gross and systematic violations of human rights are happening in a foreign state, or for acts of significant corruption by foreign public officials or their associates.

This law and the SEMA amendments bolster Canada’s broad suite of existing human rights and anti-corruption tools, and ensure that Canada’s sanctions law is calibrated to deal with current international realities. Canada will continue to take a comprehensive approach to address each unique case, which may include the use of sanctions, as necessary.

Quotes

“Canada has a strong reputation around the world as a country that holds clear and cherished democratic values and stands up for human rights. This new law, which has received cross-partisan support in Parliament, is a clear demonstration that Canada takes any and all necessary measures to respond to gross violations of human rights and acts of significant foreign corruption.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement on Bill S-226, the Justice for Victims of Corrupt Foreign Officials Act:

“Canada has a strong reputation in the world as a country that holds clear and cherished democratic values and stands up for human rights.

“Today the House of Commons gave its unanimous consent to Bill S-226, the Justice for Victims of Corrupt Foreign Officials Act, along with amendments to the Special Economic Measures Act and the Immigration and Refugee Protection Act.

“Should Bill S-226 be passed by the Senate and receive royal assent, it will enable Canada to sanction, impose travel bans on and hold accountable those responsible for gross human rights violations and significant corruption. This will ensure that Canada’s foreign policy tool box is effective and fit for purpose in today’s international environment. It will also provide a valuable complement to our existing human rights and anti-corruption tools.

“I am delighted by today’s important progress and that these necessary changes have received cross-partisan collaboration and support. I would especially like to thank Senator Raynell Andreychuk, who has shown tremendous leadership in shepherding and sponsoring this legislation; Professor Irwin Cotler, a long-time advocate for this legislation; and the many Canadians who have supported these changes for years.”

Canadian Economic Sanctions: http://www.international.gc.ca/sanctions/index.aspx?lang=eng&_ga=2.39253984.231094919.1508427101-1371245540.1491838080

HUMAN RIGHTS

The Globe and Mail. 19 Oct 2017. Magnitsky-style law will target Russians, Venezuelans: source

MICHELLE ZILIO

Russian and Venezuelan human rights abusers are expected to be among the first group of individuals targeted by Canadian government sanctions in the coming weeks under a new Magnitsky-style law.

Canada became the fourth country to adopt a Magnitsky law on Wednesday when Bill S-226 received royal assent. The legislation is named after Russian whistle-blower Sergei Magnitsky, who accused Russian officials of a massive tax-fraud regime before being beaten to death in a Moscow jail in 2009, and is meant to sanction human-rights abusers around the world.

Speaking to The Globe and Mail, a Canadian government official said Russian and Venezuelan humanrights abusers are expected to be among those sanctioned by the law over the coming weeks. While the official would not say who the sanctions will specifically target, they said Canada will consult the United States’ law, which has sanctioned 44 people since 2012. Britain and Estonia have also passed Magnitskystyle sanctions.

U.S.-born financier and anti-Putin campaigner Bill Browder, who has led the international effort to sanction human-rights abusers worldwide in memory of Mr. Magnitsky, said he wants to see Mr. Magnitsky’s killers named in the first round of Canadian sanctions.

“We’ve been in touch with the government in parallel to the legislative process, providing evidence and information about those people who were responsible for Sergei Magnitsky’s killing. We’re hoping that it happens relatively soon,” he said.

Mr. Browder hired Mr. Magnitsky as the lawyer for his Moscow-based Hermitage Capital Management hedge fund in 2005. Mr. Magnitsky was arrested in 2008 and died in prison in 2009 after accusing Russian officials of theft. Investigations by Russia’s human-rights council eventually concluded he was beaten to death by prison staff.

In a tweet on Wednesday, the Russian embassy in Ottawa said “Russophobes” could rejoice that Parliament had approved Bill S-226, “causing irreparable damage” to Russia-Canada relations. Earlier this month, Russia made its retaliation plan clear.

“We warn again that in case the pressure of the sanctions put on us increases … we will widen likewise the list of Canadian officials banned from entering Russia,” Russian Foreign Ministry spokeswoman Maria Zakharova said in an Interfax news agency report on Oct. 4.

A number of Canadian officials, including Foreign Affairs Minister Chrystia Freeland, were banned from entering Russia in 2014 after Canada sanctioned members of Russian President Vladimir Putin’s circle over the annexation of Crimea.

Over the coming weeks, Global Affairs Canada will work with Treasury Board to establish a list of individuals to be sanctioned under the Magnitsky law. While it is expected that Russian and Venezuelan human-rights abusers will be among the first people targeted, the Canadian government official said the law could eventually be used against individuals in Myanmar. The Liberal government has repeatedly demanded that Myanmar’s de facto leader Aung San Suu Kyi and the country’s military end the violence that has displaced more than 580,000 Rohingya Muslims over the past eight weeks.

Marcus Kolga, a human-rights activist and Russian foreign-policy expert who helped Mr. Browder with his advocacy efforts in Canada, said he and Mr. Browder are trying bring Mr. Magnitsky’s wife, Natasha, son, Nikita, and mother, Natalya, to Canada soon to meet with the parliamentarians who made Bill S-226 possible. They are also hoping the Magnitsky family can meet with Prime Minister Justin Trudeau and Ms. Freeland, whose Liberal government openly supported the Magnitsky legislation.

“It’s important that the Magnitskys connect with this piece of legislation and are able to thank the people who made it happen, because the law offers them a small, but important piece of justice,” Mr. Kolga said.

The Magnitsky family has applied for visas to travel to Canada as soon as possible; Natasha and Nikita live in London while Natalya still lives in Moscow.

BLOOMBERG. 19 October 2017. VENEZUELA. OPINION. Venezuela's Empty Elections. Steadfast pressure is the best way to ensure that Venezuela's soft autocracy one day returns to democracy.

By The Editors

"A triumph of peace and democracy." That's how Venezuelan President Nicolas Maduro described his government's implausible victory in last weekend's gubernatorial elections. In fact, it is a further hardening of the soft autocracy that used to be South America's richest democracy.

Maduro's government entered the polls with an approval rate of about 24 percent in a collapsed economy with inflation nearing 1,000 percent, widespread hunger and residents fleeing by the tens of thousands. Somehow, it managed to win 54 percent of the vote and 17 out of 23 governorships.

The opposition has rejected the results and has rightly demanded an audit. The government's pre-election shenanigans included disqualifying the opposition's most popular candidates, keeping losers of primaries on the ballot to confuse voters, moving 200 polling places at the last minute, selective power outages, and allowing no independent outside observers. Moreover, Maduro mandated that any winning candidate must swear loyalty to the constituent assembly that has usurped the powers of the opposition-controlled legislative assembly.

By trumpeting this "win," Maduro undoubtedly hopes to undermine growing international censure and provide cover for his long-time backer China -- and new supporter Russia -- to provide him with a badly needed economic lifeline.

Instead, the opposite needs to happen. From Canada on down, many of the hemisphere's governments have blasted the irregularities of last weekend's farce. With a presidential election scheduled for next year, they need to push hard for a full audit, the restoration of independence to Venezuela's once vaunted electoral council, and the unhindered presence of outside election observers.

Governments need to expose and punish the complicity of Venezuela's highest officials in corruption scandals. They need to support the work by the Organization of American States to hold Venezuela to account for human rights abuses. More need to join coordinated sanctions against individuals accused of such crimes -- something the European Union is taking up this week. And the U.S. can ratchet up financial pressure on Venezuela by constricting its oil company's access to short-term credit, while signaling a greater willingness to ban exports of U.S. oil products to Venezuela and, if necessary, imports of Venezuelan oil. All these measures can and should be complemented by declarations of robust support, if Venezuela changes its ways, for international efforts to reschedule its mind-boggling debt and restart its economy.

Maduro wants to preserve the facade of democracy while hollowing out its rights and privileges. But democracies hold free, fair and transparent elections. They don't hold political prisoners. And they allow their citizens to peacefully express their beliefs and pursue their economic livelihoods. Until Venezuela returns to that path, steadfast pressure is the best way to ensure that its soft autocracy doesn't become a dictatorship.

INTERNATIONAL TRADE

EDC. OCTOBER 19, 2017. WEEKLY COMMENTARY. Export Outlook by Industry

By Peter G. Hall, Vice President and Chief Economist

Last week’s Commentary launching EDC’s Global Economic Outlook emphasized that current or prospective exporters are at a decision point. In spite of continued geopolitical risks – including here in North America – and lingering structural weaknesses, our position is that a true global recovery is underway. And, if we’ve got it right, the conditions are ripe for these companies to seize some of these nascent opportunities. EDC’s Global Export Forecast provides a sector-by-sector glimpse into where these opportunities might exist.

First the growth story. After two years of moderating growth, the global economy will post a stronger showing in 2017-2018. Developed markets (DM) have turned a corner with the majors (US, Japan, Euro Area) all posting stronger performances. More promising for Canada’s exporters is that the US will accelerate further into 2018. In the emerging market (EM) space, we see an even stronger outlook. Of note in 2017 both Brazil and Russia are forecast to resume growth following two years of recession.

So, with both the developed and the emerging worlds expanding, what impact will this have on Canadian exports? 2017 was a remarkable year with eight per cent export growth, led by massive gains in the commodity space. Growth will taper off somewhat in 2018. Service exports growth will be more balanced, at six per cent each year. The vast majority of Canada’s goods exports (88 per cent) continues to be destined for developed markets. As such, the DM growth story, led by the US, is critical to Canada’s near-term exports of goods. While a much smaller 12 per cent share, EM exports will nonetheless post very impressive 12 per cent growth in 2017 before settling in at just three per cent next year.

Now let’s take it down to the sector-level as this growth won’t mean the same thing for all sectors of exports. Standing at CAD 77 billion and forecast to grow by an astounding 31 per cent, energy had by far the greatest impact on the value of Canada’s exports in 2017. The intense growth will be short-lived as growth flatlines in 2018. While Alberta will experience the bulk of this growth, Newfoundland and Labrador will also reap the benefits of the Hebron project coming online.

Not to be outdone, the ores and metals sector boasts double-digit growth in 2017, propelled by stronger iron ore prices, before coming back down to earth in 2018. Canada’s gold exports see good growth over the forecast period owing to increased production. Ongoing geopolitical risks, often driving up demand for gold as a ‘safe haven asset’, provides a boost to prices.

The only other sector group seeing double-digit growth in 2017 is Industrial Machinery and Equipment. The driving force behind this growth story is the US, which might seem surprising given many of the signals coming out of the US recently (e.g. policy uncertainty, NAFTA renegotiation, etc.). However, in spite of much of the hubbub surrounding the US, we are seeing recovering US business investment really starting to take off and this is playing out in Industrial Machinery and Equipment export numbers. Much of this momentum carries forward into 2018.

2017 will see aerospace exports climb back into positive territory with four per cent growth. The sector has recently received considerable attention with the US Commerce Department imposing preliminary duties against certain Canadian aerospace exports to the US. While this decision has raised concerns within Canada (with Quebec being particularly perturbed) a final ruling is not expected until 2018. In any event, our forecast is that aerospace exports will continue growing into 2018.

The forestry sector will see export growth slowing in 2017 and 2018. One the one hand the sector is benefiting from demand coming from the US as housing starts continue climbing as economic growth gains momentum. Countering this is the ongoing softwood lumber dispute between Canada and the US which will adversely impact Canadian exports, largely from British Colombia, until a settlement is reached.

The Bottom Line: It’s been a long time coming, but as presented in our Global Economic Outlook, global growth is back. Canada’s exporters are set to continue gaining from this growth throughout 2017 and 2018. The opportunities vary sector by sector and there are many variables to consider and risks to mitigate. Our Global Export Forecast is but one tool in the Canadian exporter toolkit to provide insight and guidance and help our companies when it comes time to make those decisions.

________________

LGCJ.: