CANADA ECONOMICS

ECONOMY - GDP

StatCan. 2017-09-29. Gross domestic product by industry, July 2017

Real GDP by industry, July 2017: 0.0% increase (monthly change)

Source(s): CANSIM table 379-0031.

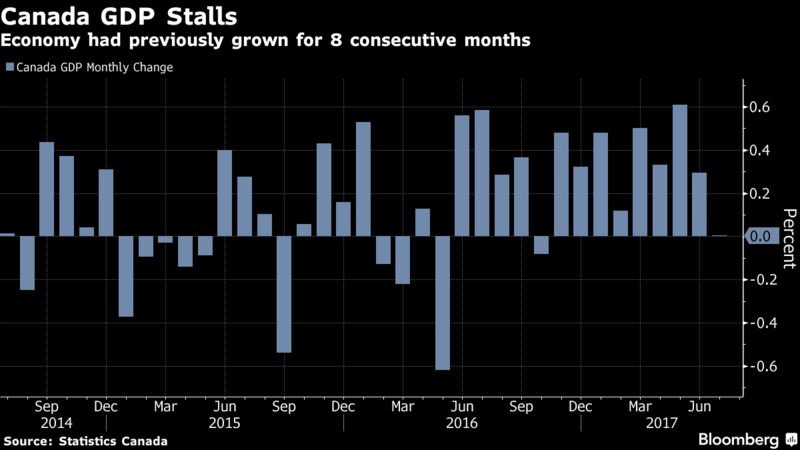

After rising for eight consecutive months, real gross domestic product (GDP) was essentially unchanged in July as 11 of 20 industrial sectors grew.

Chart 1 Chart 1: Real gross domestic product is essentially flat in July

Real gross domestic product is essentially flat in July

Goods-producing industries contracted 0.5%, the first decrease in five months, largely as a result of declines in mining, quarrying and oil and gas extraction and in manufacturing. Services-producing industries increased 0.2%.

The mining, quarrying, and oil and gas extraction sector contracts

The mining, quarrying, and oil and gas extraction sector contracted 1.2% in July, mainly due to a 1.8% decline in the oil and gas extraction subsector.

Chart 2 Chart 2: Mining, quarrying, and oil and gas extraction declines in July

Mining, quarrying, and oil and gas extraction declines in July

Non-conventional oil extraction was down for the fourth time in five months, decreasing 3.0%. Conventional oil and gas extraction decreased for the first time in five months, declining 0.8% as a result of lower crude petroleum extraction.

Mining excluding oil and gas extraction rose 0.9%. Metal ore mining rose 3.4%, led by strength in copper, nickel, lead and zinc mining (+4.5%) and iron ore mining (+7.1%), while gold and silver ore mining decreased 2.2%. Coal mining was up 1.0%. Non-metallic mineral mining declined 2.7% as lower output from potash mines (-12.6%) more than offset an increase in other non-metallic mineral mining.

Support activities for mining, oil and gas extraction declined 1.2%, down for the third consecutive month, due to declines in support activities for oil and gas extraction on lower drilling services.

Wholesale trade grows

Wholesale trade activity rose 2.0% in July, the highest monthly gain since September 2014. Growth was broadly-based across the sector as seven of nine subsectors were up. Leading the growth was a 5.3% increase in building material and supplies wholesaling. Machinery, equipment and supplies wholesalers recorded a 2.3% increase on the strength of increased activity across most industry groups. Motor vehicle and parts wholesaling rose 1.9% on the strength of stronger sales of motor vehicles.

The manufacturing sector declines

The manufacturing sector was down 0.4% in July. This sector has generally been posting increased activity since the second half of 2016.

Durable manufacturing declined 0.9%, following four consecutive months of growth. The largest contributor to the decline was a 5.6% decrease in the transportation equipment manufacturing subsector. Motor vehicle manufacturing was down 13.5%, in part as a result of changes in vehicle models being produced in Canada. Motor vehicle parts manufacturing was down 7.1% while miscellaneous transportation equipment decreased 1.0%. In other durable manufacturing subsectors, machinery manufacturing dropped 3.6% while non-metallic mineral product and miscellaneous manufacturing increased.

Non-durable manufacturing was up 0.3% in July after being essentially unchanged in June. Increases in plastic and rubber products (+2.0%) and chemical products manufacturing (+1.3%) more than offset declines in food (-0.7%) and petroleum and coal products manufacturing (-0.7%).

Finance and insurance declines

The finance and insurance sector declined 0.6% in July, its largest decline since April 2015. Depository credit intermediation and monetary authorities declined 1.0% on decreased activity at banking, monetary authorities and other depository credit intermediaries. Financial investment services, funds and other financial vehicles were down 0.8%, with the timing of Canada Day and of the United States' Independence Day having an effect on the level of market activity. Insurance carriers and related activities rose 0.3%.

Construction declines

The construction sector declined 0.5% in July, after posting one of its largest gains in the last four years in June following work stoppages in Quebec in May. Residential construction was down 0.9% as new construction of double and row houses declined, along with housing alterations and improvements. Non-residential construction grew 0.6% as industrial and commercial constructions were up while public construction edged down. Repair construction was down 1.3% while engineering and other construction was essentially unchanged.

Transportation and warehousing edges down

Transportation and warehousing edged down 0.1% with five of nine subsectors showing decreases. Pipeline transportation was down 1.9%, partly due to wildfires in British Columbia forcing the temporary closure of some pipelines, as movement of natural gas (-3.2%) and crude oil (-0.7%) by pipeline declined. Rail transportation was down 1.2% as movement by rail of coal, automotive products, grains and fertilizers and industrial products declined. Support activities for transportation was down 0.8%. Partly offsetting the declines was growth in air transportation (+2.2%), warehousing and storage (+1.4%) and transit, ground passenger, scenic and sightseeing transportation (+0.6%).

Retail trade edges down

The retail trade sector edged down 0.1% as its 12 subsectors were evenly split between increases and decreases. The largest declines in terms of activity were at gasoline stations (-3.0%) and electronics and appliance stores (-4.9%). These were partly offset by growth at food and beverage stores (+0.8%) and health and personal care stores (+0.4%).

The utilities sector grows

The utilities sector was up 1.7% in July. Higher demand for electricity in Western Canada, in order to cope with a hot and dry July, led to a 2.3% gain in electric power generation, transmission and distribution. Natural gas distribution was down 0.9% from lower residential demand.

Real estate and rental and leasing grows

Real estate and rental and leasing edged up 0.1% in July following two consecutive months of decline.

For the fourth month in a row, activity at the offices of real estate agents and brokers contracted, down 1.5%. Housing resale activity decreased in most markets, led by continued declines in and around the Greater Toronto Area.

Other industries

The public sector (education, health care and public administration) rose 0.2% as all three components increased.

Professional services rose 0.5% on the strength of increases in legal, accounting and related services (+1.2%), computer systems and related services (+0.5%) and architectural, engineering and related services (+0.6%).

Accommodation and food services rose 0.4% as activity at food services and drinking places was up 0.5%, while accommodation services increased 0.3%.

Agriculture, forestry, fishing and hunting was down for the ninth time in ten months.

Chart 3 Chart 3: Main industrial sectors' contribution to the percent change in gross domestic product in July

Main industrial sectors' contribution to the percent change in gross domestic product in July

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170929/dq170929a-eng.pdf

THE GLOBE AND MAIL. SEPTEMBER 29, 2017. ECONOMY. Economy takes a breather; return to ‘realistic’ growth seen

FRED LUM, THE GLOBE AND MAIL

DAVID PARKINSON, ECONOMICS REPORTER

Canada's economic growth stalled in July, snapping an eight-month winning streak, serving up evidence that the hot economy has headed into a more temperate phase in the second half of the year.

Statistics Canada reported that Canadian real gross domestic product was flat in July, on a seasonally adjusted basis, compared with June – the first time since October, 2016 that the economy failed to show month-over-month growth.

Economists had expected the economy to cool down entering the third quarter, after posting average month-over-month growth of 0.4 per cent in the prior three months, and a stellar 4.5-per-cent annualized growth pace for the second quarter as a whole. But the July result was weaker than the median forecast of a 0.1-per-cent uptick in the month.

Despite the disappointment, economists characterized the July setback as an understandable breather in what has been a faster-than-expected economic expansion this year. Forecasters anticipate a more reasonable but still healthy pace of growth in the second half of the year, and the July pause serves as early evidence that this moderation has begun.

"The flat July GDP result represents a rare misstep for the Canadian economy in 2017. While we would never read too much into any one month, it could also mark a return to a more sustainable and realistic growth rate for the economy, after a year of staggeringly good news," said Douglas Porter, chief economist at Bank of Montreal, in a research note.

A key contributor to the slowdown was a 1.8-per-cent drop in oil and gas extraction, the second straight monthly drop, as the sector's rapid resurgence this year from its oil-shock doldrums shows signs of levelling off. But output in the sector was also dented by a small fire at Syncrude's Mildred Lake, Alta. upgrader in early July, which, together with some maintenance work, left the facility producing at roughly half of its capacity for the month – suggesting the sector likely bounced back in August.

Similarly, manufacturing sector's 0.4-per-cent decline in July was substantially tied to longer-than-normal summer maintenance slowdowns in the auto sector, which may have set the stage for an August rebound. Motor vehicle and parts manufacturing fell 9.1 per cent month over month.

Still, those weren't the only sources of weakness in the July numbers. Several other key industries also pulled back from recent gains, including construction (down 0.5 per cent month over month), and retail trade (down 0.1 per cent).

Goods-producing industries declined 0.5 per cent month over month, their first contraction since February. Services-producing industries grew 0.2 per cent, their 16th straight month of expansion.

The July figures set the tone for what economist expect will be a moderation in the economy in the second half of the year, after real GDP grew at a torrid pace of more than 4 per cent annualized in the first half. Forecasts call for third-quarter growth to be in the range of 2 to 2.5 per cent annualized.

"The message in today's figures is that Canadian GDP will cool in the back half of the year, with less economic slack leaving less room for the economy to grow above its potential," said Canadian Imperial Bank of Commerce economist Nick Exarhos in a research report.

The emerging signs of a slower pace for the economy also support the case for the Bank of Canada to take a pause in its interest-rate increases over the next few months, after the growth surge in the first half of the year spurred the central bank to raise rates twice over the summer. Stephen Poloz, the head of the Bank of Canada, hinted as much in a speech in St. John's, Nfld., earlier this week.

Second-half growth is still expected to be well above what the Bank of Canada considers its "potential" – the rate at which the economy can expand without triggering inflation, which the central bank estimates is less than 1.5 per cent – which certainly keeps further rate increases on the table. But the slower pace will mean that whatever excess capacity there is in the economy will be eaten up less slowly. The size of this so-called output gap, and how quickly it is closing, is a key consideration in the timing of future interest-rate increases.

"The BoC will see no additional GDP releases prior to the next rate decision on Oct. 25, and, alongside Governor Poloz's remarks this week, it seems that the case for yet another quick follow-up rate hike is weak at this point," BMO's Mr. Porter said. "We continue to look for the Bank [of Canada] to take a pause for now, with the next hike pencilled in for January."

REUTERS. SEPTEMBER 29, 2017. Canada GDP growth halts in July, leaves room for gradual rate rise

Leah Schnurr

OTTAWA (Reuters) - Canadian economic growth slowed to a halt in July, hit by a decline in manufacturing and oil extraction and giving the central bank room to take its time to further raise interest rates.

The gross domestic product was unchanged in the month, Statistics Canada said on Friday, falling short of economists’ expectations for an increase of 0.1 percent and ending eight consecutive months of growth. The economy grew by 0.3 percent in June.

The Bank of Canada raised interest rates in July and September after the country’s economy posted the fastest growth of the Group of Seven major economies in the first half of 2017.

Analysts expect the pace of expansion to cool in the second half of the year.

“We suspect that the slower start to Q3 gives us the flavor of things to come,” Nick Exarhos, economist at CIBC, wrote in a note.

“That’s another reason why we see the Bank of Canada using a more gentle hand with tightening from here,” he added.

Comments by Bank of Canada Governor Stephen Poloz earlier this week suggested another rate hike is not imminent, and the GDP report could provide more reason for the bank to tighten slowly.

Interest rate futures are pricing 22.5 percent odds of a hike at the bank’s next monetary policy meeting in October, while the probability of an increase in December declined to 65.2 percent from 75.2 percent before the data was released. BOCWATCH

“On the heels of the dovish tone to the governor’s speech earlier this week, it does make a rate next month look less likely, all else equal,” said Andrew Kelvin, senior rates strategist at TD Securities.

The Canadian dollar weakened against the greenback following the report.

The mining, quarrying and oil sector fell 1.2 percent, dragged lower by the fall in oil extraction and support services for petroleum and mining. However, mining activity rose.

Manufacturing fell 0.4 percent as transportation equipment and vehicle production decreased. Construction declined 0.5 percent as fewer homes were built, while home improvement activity was also down.

Wholesale trade rose 2 percent, its biggest increase since September 2014, on broad-based gains across industries including building materials, and machinery and equipment.

Separate data showed Canadian producer prices rose by a less-than-expected 0.3 percent in August on higher costs for energy and petroleum products as some refineries in the United States were shut down due to Hurricane Harvey.

Additional reporting by Fergal Smith in Toronto; Editing by W Simon

BLOOMBERG. 29 September 2017. Canadian Growth Spurt Stalls With GDP Unchanged in July

By Theophilos Argitis and Erik Hertzberg

- Slowing housing market was among the biggest drags on economy

- Motor vehicle manufacturing was down 13.5 percent in July

Canada’s economy showed signs of cooling in July, in line with expectations the nation’s expansion would return to more sustainable levels after recording some of the fastest growth in decades.

Gross domestic product was little changed from the prior month, Statistics Canada said Friday from Ottawa, ending an eight-month string of gains. Economists had forecast a 0.1 percent increase, according to a Bloomberg survey. Slumping oil and automobile production and a slowing housing market were among the biggest drags on growth.

Over the past year, Canada’s economy has been running at a pace rarely seen in the past couple of decades, with growth coming in at an annualized 4.5 percent in the second quarter. The above-potential growth has been soaking up excess capacity in the economy, prompting the central bank to raise interest rates twice since July.

“We suspect that the slower start to the third quarter gives us the flavor of things to come, with our forecast for the back half of the year tracking half the pace seen at the start of 2017,” Nick Exarhos, an economist in Toronto at Canadian Imperial Bank of Commerce, said in a note. “That’s another reason why we see the Bank of Canada using a more gentle hand with tightening from here.”

Highlights of Canada July GDP Report

- Oil and gas output was down 1.8%, leading a 0.5% drop for goods producing industries.

- A 2% gain in wholesale output led gainers. Excluding wholesale, GDP would have been down 0.1%

The Canadian dollar slumped on the report, dropping 0.3 percent to C$1.2461 per U.S. dollar as of 9:01 a.m. in Toronto trading.

Friday’s report is the last set of GDP data before the Bank of Canada’s next rate decision on Oct. 25. Governor Stephen Poloz said this week policy makers would proceed “cautiously” as they gauge the impact of the two rate increases.

Even with very little growth in August and September, Canada’s economy would still probably be poised to grow at a rate of 2 percent or more in the third quarter, which would be above what the central bank deems is the economy’s potential.

Monthly growth has averaged 0.4 percent in the previous eight months, the strongest since at least 2010.

“Although the economy began the third quarter poorly, there’s still considerable built-in momentum from the strong ending to the second quarter,” said David Madani of Capital Economics. “So, barring another flat reading in August, we aren’t overly concerned by one weak monthly GDP report.”

Other Details

- The figures seem to show the slump in housing has become a drag. Credit intermediation was down 1%, residential construction dropped 0.9% and activity at real estate agents declined 1.5%. The finance and insurance sector’s decline of 0.6% was the fastest since April 2015

- Manufacturing dropped 0.4%, the most since February, led by a 13.5% drop in motor vehicles

- Services-producing industries were up 0.2%, led by wholesale

- Overall construction was down 0.5%, the biggest drop this year

Innovation, Science and Economic Development Canada. September 29, 2017. Industry leaders shaping Canada’s future economic growth. Leaders from six innovative sectors will guide federal efforts to create new business opportunities and jobs for Canadians

Ottawa – Six industry leaders are being tasked with guiding the Government of Canada’s efforts to ensure middle-class Canadians have access to well-paying jobs today and in the future. The six leaders will chair the Government’s Economic Strategy Tables, which represent high-growth industries identified in Budget 2017.

The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development, today announced the appointment of the next two Economic Strategy Table chairs:

- Karimah Es Sabar, CEO of and partner in Quark Venture of Vancouver, British Columbia, who will chair the health/bio-sciences table; and

- Audrey Mascarenhas, President and CEO of Questor Technology of Calgary, Alberta, who will chair the clean technology table.

The latest appointees join Charles Deguire, Co-founder of Kinova Robotics of Boisbriand, Quebec, who will chair the advanced manufacturing table; and Murad Al-Katib, President and CEO of AGT Food and Ingredients of Regina, Saskatchewan, who will chair the agri-food table.

Each chair will preside over a group of approximately 15 members as they guide federal efforts to create the conditions for long-term growth that lead to new business opportunities and middle-class jobs for Canadians.

There are technology disruptions in virtually every sector of the economy, and the Government is ensuring that Canadian businesses and people have the information and skills they need to benefit from all emerging technologies.

The Economic Strategy Table chairs were selected based on the advice of industry leaders and associations as well as federal government departments. The chairs, working with federal government departments, will choose the 15 members for their working tables. Industry chairs and table members represent a diverse group of experts from six high-growth sectors.

The Economic Strategy Tables will set ambitious growth targets for Canadian innovators, identify sector-specific challenges and create a roadmap to support Canada’s global success.

The remaining chairs of the digital industries and clean resources tables will be appointed and announced in the coming weeks.

The Economic Strategy Tables are part of the Government’s Innovation and Skills Plan to create well-paying jobs and strengthen the middle class by investing in high-growth sectors where Canada has a globally competitive advantage.

Quotes

“The sectors that drive innovation are where the middle-class jobs of today and tomorrow are created. Our government is committed to working with entrepreneurs and innovators to generate new business opportunities, create good middle-class jobs and equip Canadians with the skills they need for the jobs of the future. Our government looks forward to working with industry partners through the Economic Strategy Tables to turn high-growth Canadian companies into global successes.”

– The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development

“The sustainability of health care for the future is one of my top priorities. Finding patient-focused innovations is essential to improving access to care. I look forward to seeing Canadian-led innovations that will help fuel a health care revolution that will ensure Canadians in all parts of our nation have better access to care.”

–The Honourable Ginette Petitpas Taylor, Minister of Health

“Our government is making major investments in clean technology innovation and clean resources to strengthen competitiveness and environmental performance. The expert advice provided by these leaders and their Economic Strategy Tables will identify bottlenecks and barriers to innovation, helping to pave the way for natural resource sectors to be clean growth leaders, create well-paying jobs for Canadians and achieve our climate change goals.”

– The Honourable Jim Carr, Minister of Natural Resources

“The environment and the economy go together, and we know that economies around the world are shifting toward cleaner growth. Our government’s commitment to supporting clean innovation will give Canadian entrepreneurs a competitive edge to grow, create jobs and be part of the solution to tackling climate change.”

– The Honourable Catherine McKenna, Minister of Environment and Climate Change

Quick Facts

- The Economic Strategy Tables will meet regularly starting in fall 2017.

- Each table will present a report of its findings and recommendations by summer 2018.

- These tables will support the Government’s goal of doubling the number of high-growth Canadian companies to 28,000 from 14,000 by 2025.

FULL DOCUMENT: https://www.canada.ca/en/innovation-science-economic-development/news/2017/09/industry_leadersshapingcanadasfutureeconomicgrowth.html

NAFTA

The Globe and Mail. 29 Sep 2017. U.S. plays hardball in NAFTA talks with Buy America demands. Proposal would drastically cut bidding by Canadian companies on government-funded infrastructure projects

ROBERT FIFE

Chrystia Freeland Foreign Affairs Minister I say this with some pride that mutual access to government procurement contracts was one of the great achievements of CETA. We would like to encourage our immediate neighbours to meet the levels of ambition that we have been able to achieve with our partners across the Atlantic.

President Donald Trump’s negotiators tabled stringent Buy American demands at the NAFTA talks in Ottawa that would drastically curtail bidding by Canadian companies on U.S. governmentfunded infrastructure projects, insiders have told The Globe and Mail.

One Canadian insider described the U.S. demands as the “worst proposal in any trade agreement” that has ever been presented, saying it is being strongly resisted by Canada and Mexico.

The Trump administration proposal calls for boosting the minimum dollar threshold for government projects available for foreign bidders.

It would also cap the total amount that Canadian and Mexican companies can receive in American procurement contracts at what U.S. companies get in those countries.

Sources, with knowledge of the U.S. proposal, said the oil-rich Persian Gulf country of Bahrain would have greater access to bid on infrastructure and other government procurement work in the United States than Canada.

“It should be attributed for what it is. Shock value with a first offer and, obviously, it is unacceptable and they know that,” a Canadian source, close to the North American free-trade agreement negotiations, told The Globe on Thursday.

Canadian trade lawyer Lawrence Herman said U.S. negotiators are taking their marching order from an anti-free-trade President who espouses an America First policy that favours American companies and workers. »

“They only want a deal on their terms. Why would we expect anything less than the highly aggressive and demanding set of terms that the U.S. is putting on the table?” Mr. Herman said in an interview. “The U.S. position is a bullying one and they are presenting proposals that will be extremely difficult for Canada and Mexico to accept or even negotiate over.”

Under the North American freetrade agreement, Canada and Mexico are exempt from Buy American requirements as long as the contract is being offered by a U.S. government agency and the amount is above certain thresholds. The U.S. proposal would remove those guarantees and block any attempts by Canada to include state and municipal procurement in the 23-year-old trade pact.

Foreign Affairs Minister Chrystia Freeland alluded to the Buy American proposal on Wednesday at the conclusion of five days of talks during the third round of negotiations to revamp NAFTA.

Ms. Freeland said a rewritten NAFTA should emulate the kind of “mutual access” that was achieved in the Canada-European Union trade agreement (CETA). She wants companies to be able to bid on U.S. government contracts but also procurement work at the state and municipal level.

“I say this with some pride that mutual access to government procurement contracts was one of the great achievements of CETA,” she told a news conference. “We would like to encourage our immediate neighbours to meet the levels of ambition that we have been able to achieve with our partners across the Atlantic.”

Under the European trade deal, Canadian firms will now have unfettered access to the $5-trillion EU procurement market, the world’s largest.

Former U.S. deputy trade representative Matt Gold said the Trump administration’s demands go against the whole concept of free trade and would only spur a protectionist counterattack from Canada and Mexico.

“We have never seen free-trade reciprocity work that way

before,” said Prof. Gold, who teaches international trade law at Fordham University. “The right response for Canada would be to say: ‘That’s fine, but we are going to cap the number of American goods and services providers that can bid on Canadian contracts.’ ”

Ontario Premier Kathleen Wynne has already threatened to respond to protectionist measures if the United States implements Buy American policies. In April, she was part of the lobbying that led to the defeat of a Buy American proposal in New York state.

Prof. Gold, who served under former president Barack Obama, said the U.S. Buy American proposal misses the point of free trade and the fact that while Canada gets access to the much larger U.S. market for government procurement, it also faces far greater competition from U.S. bidders for government contracts in Canada.

Mr. Trump vowed in April to pursue a “Buy American, Hire American” agenda, which his negotiators are attempting to force into the new NAFTA deal. He signed an executive order making it official administration policy and mandated federal agencies to assess it in their compliance with a number of Buy American laws.

Dan Ujczo, an international trade lawyer with the cross-border law firm Dickinson Wright, said Mr. Trump’s Buy American order appears to be sweeping in scope.

“The way that I’ve interpreted the Buy American provisions is that this applies to everything, including those old [Canada-U.S.] defence procurement agreements from the 1950s,” Mr. Ujczo said.

Ms. Freeland was blunt in her assessment of the Trump administration on Wednesday, saying it is “unconventional” and “overtly protectionist.” Although the Trump White House believes erasing the United States’ trade deficit – the amount that imports exceed exports – should be the country’s top priority, Ms. Freeland argues trade deficits are not a problem and that overall economic growth is all that matters.

Officials are bracing for even tougher times ahead in the next round of NAFTA talks in mid-October in Washington, when the United States is expected to table its demands for trade-dispute settlement mechanisms and stricter restrictions on auto and autoparts content.

U.S. negotiators are expected to introduce a proposal that would increase the requirements on the content of automobiles to be manufactured in North America for vehicles to qualify for tax-free status under NAFTA. The Americans are also expected to demand higher U.S. content in autos and auto parts.

Mr. Trump, who has repeatedly criticized NAFTA as an unfair deal for the United States, has called for the rules of origin for autos to be tightened, citing trade deficits of $64-billion (U.S.) with Mexico. Trade between the United States and Canada is balanced, with the U.S. having a surplus in services and a deficit in goods trade, largely because of Canadian energy exports.

The United States is also expected to push for the end of Chapter 19 in the NAFTA pact that provides a binational dispute-resolution system to challenge anti-dumping and countervailing duties. Canada has said it would walk away from the talks if the Americans insist on scrapping this provision.

BOMBARDIER. The Globe and Mail. The Canadian Press. 29 Sep 2017. Pallister calls for calm in Boeing battle. Manitoba Premier says ‘cooler heads’ more helpful in trade war as Quebec’s Couillard remains steadfast that he ‘will not tone down’

Manitoba Premier Brian Pallister is calling for more cooler heads and less overheated rhetoric in the burgeoning aerospace trade war centred on Boeing Co. and Bombardier Inc.

It was a plea that was immediately rebuffed by Quebec Premier Philippe Couillard, who has said “not a bolt, not a part, of course not a plane of Boeing” should enter Canada until the conflict is resolved.

“I will not tone down. I will tone up if I need to do it,” Mr. Couillard said on Thursday at Bombardier’s assembly plant in Mirabel, north of Montreal. “I will fight for Quebec.”

The Quebec Premier has called on Ottawa to take a hard line against Boeing after the U.S. Department of Commerce proposed a 219-per-cent duty on jets manufactured by rival Bombardier.

The department’s preliminary findings say Bombardier benefited from improper government subsidies, giving it an unfair advantage when selling its C Series jets south of the border.

“It’s an unacceptable attack towards an industry, a province and a country and we shall prevail,” Mr. Couillard said.

Earlier in the day, Mr. Pallister said Mr. Couillard’s emotional call for a Boeing boycott is understandable, but not helpful.

“That overheated rhetoric and emotional language, though understandable because of the concerns the Premier has … is not necessarily as helpful as cooler heads and a demonstration of an understanding that our trade is a very important mutual benefit to Canadian and U.S. economies,” Mr. Pallister said Thursday after an announcement in Morden, Man.

“I would always be one who promotes open trade and encourage all to remember that there are mutual benefits in our relationships.”

The Manitoba capital is home to a Boeing manufacturing facility that employs 1,400 people and is the third biggest aerospace centre in the country.

Winnipeg Mayor Brian Bowman called Mr. Couillard’s comments unhelpful.

“His comments do not appear to acknowledge the reality that Quebec is not the only province affected by this dispute,” Mr. Bowman said in a statement Thursday.

“While I respect that the Premier of Quebec is going to stand up for jobs in Quebec, his comments are an oversimplification of the dispute and are not helpful for the Canadian aerospace sector as a whole.”

This dispute goes beyond a region of the country, he said.

“Cooler heads need to prevail so we can continue to collectively find ways to grow this sector, not obstruct it.”

Mr. Couillard argues the $1-billion (U.S.) invested by the province in Bombardier’s C-Series program was not a subsidy and Bombardier is being targeted by its larger aerospace rival even though Boeing has also benefited from decades of government assistance.

Unifor president Jerry Dias, who represents Boeing workers, said both Bombardier and Boeing receive government support. This trade dispute threatens the ability of government to support the industry, Mr. Dias said.

“Boeing is playing a very dangerous game, not just for Bombardier but for themselves,” he said. “This whole thing is poisoning the well water.

“If we don’t fight this now, the fallout can be just brutal.”

But Mr. Pallister said the Canadian and U.S. economies are so intertwined, he’s confident the two countries will weather the storm.

“We have the strongest international co-operative relationship of any two countries in the world,” he said. “We will get through this.” Bombardier (BBD.B) Close: $2.21, up 11¢ Boeing (BA) Close: $254.27 (U.S.), down $1.01

BOMBARDIER. The Globe and Mail. The Canadian Press. 29 Sep 2017. Manitoba Premier calls for cooling of rhetoric in Boeing, Bombardier spat. Canada vs. Boeing: Haunted by the ghost of Airbus

ALEXANDER PANETTA

Raymond Conner Vice-chairman of Boeing What Airbus did is they entered … the smaller [plane market] … and then moved on from there. … Today we are fighting for our lives to maintain upper 40’s or 50 per cent [market share]. … What [Airbus has] done in 40 years, we had to do in 100.

An awkward encounter above Washington’s Pennsylvania Avenue last spring provided early evidence of a rift between the Canadian government and the world’s largest aerospace company.

Boeing International president Marc Allen, in Ottawa this month, said the aerospace company watched Airbus ‘enter the market in a very similar fashion’ to what Bombardier is doing now.

Representatives of the Boeing Co., wound up hastily leaving a meeting at Canada’s embassy after a tense conversation with the ambassador.

They had arrived to discuss business with the Canadian government. The giant plane maker has been hoping to add a multibillion-dollar fighter-jet sale to its more than $94-billion (U.S.) in annual revenues.

But it so happened this visit fell on the same day Boeing filed a trade action against Canada’s largest aerospace player, the far smaller Bombardier Inc. It also happened that the Canadian hosts were given little warning.

Word filtered up to the topfloor office of ambassador David MacNaughton about an hour beforehand about the trade action, which this week resulted in a nearly 220-per-cent preliminary duties on Bombardier sales.

“[Mr. MacNaughton] called them out of the meeting,” one source said.

Two sources say the ambassador delivered a message similar to what’s now the Canadian government’s public mantra: “I don’t do business with people suing me,” and, “You shouldn’t treat customers this way.”

The Boeing people decided it was better to leave. The meeting was over.

What the Canadian government has heard from Boeing is that the company is torn between two imperatives: completing the military sale with Canada and avoiding what it perceives to be a colossal mistake of its past.

The company has said this publicly.

In an interview with The Canadian Press, Marc Allen, president of Boeing’s international division, said: “We watched another competitor come up and enter the market in a very similar fashion.”

That competitor was Airbus Group SE, in the 1970s.

A consortium of French, German, and British interests, Airbus started small in the U.S. market, with European subsidies propping up its twin-engine and single-aisle planes. But the product lines, and the planes, grew, and by the 1990s the company had become a U.S. giant in its own right, muscling aside smaller players such as McDonnell Douglas.

Now, Airbus is aiming for 50 per cent of the American market after opening its first jetliner plant in the United States.

Boeing fears a repeat. After Bombardier’s sale of 75 midsized planes to Delta Air Lines, it launched a complaint based on Bombardier’s various forms of assistance from Canadian and Quebec taxpayers.

Never mind that Boeing is by far the No. 1 recipient of U.S. government subsidies. It drew $14.4-billion in various forms of assistance since the 1990s according to the website Subsidy Tracker, far more than any other U.S. company and far more than what Bombardier received. The U.S. Export-Import bank is jokingly referred to in Washington as “the Bank of Boeing.”

And Boeing doesn’t even make planes similar to those Bombardier sold Delta. One Washington critic, Dan Ikenson of the freemarket Cato Institute, compares this to a snowplow maker suing a bicycle company.

What matters is a smaller rival can grow, Boeing says.

It repeated that cautionary tale of Airbus several times during a day-long hearing before the U.S. International Trade Commission.

“Airbus, in 40 years, has an airplane now in every single market segment,” Boeing’s vice-chairman Raymond Conner said.

“What Airbus did is they entered … the smaller [plane market] … and then moved on from there. … Today we are fighting for our lives to maintain upper 40s or 50 per cent [market share]. The impact is real and it sometimes takes many years to materialize.

“What [Airbus has] done in 40 years, we had to do in 100.”

Washington aeronautics consultant Richard Aboulafia says Boeing is making a grave error. It is antagonizing governments and companies in several countries, including Britain, where Bombardier has more than 3,000 employees, and angering big U.S. buyer Delta.

That’s not all.

He says it’s harming itself in two other ways: jeopardizing future military contracts in those countries and stoking protectionist sentiment in an industry that relies on international trade.

And Boeing might find its efforts pointless in the end as the Department of Commerce duty could be overturned by the more historically neutral ITC, or by the U.S. domestic trade court, or other international panels.

“People said the entire Vietnam War was the triumph of tactics over strategy,” Mr. Aboulafia said.

“You could win a battle and then find yourself having outraged [everyone] … Can [Boeing make] an effective trade complaint? Yeah, probably. What are the second-order effects? Oh my dear God, that’s a strategic question. [They would] rather not think strategically.”

He heaps scorn on the idea that this is the ghost of Airbus, stirring again.

Mr. Aboulafia said it’s not the 1970s. The planes are different, the market is different and Canada’s subsidies to Bombardier are nowhere close to as threatening as an international consortium being propped up by different countries.

Of the attempt to draw parallels, he says: “That’s what you’d think if you had no sense of strategic history.”

The Globe and Mail. SEPTEMBER 28, 2017. NAFTA TALKS. Trump team plays hardball in NAFTA talks with Buy America demands

CHRIS WATTIE, REUTERS

ROBERT FIFE, OTTAWA BUREAU CHIEF

President Donald Trump's negotiators tabled stringent Buy American demands at the NAFTA talks in Ottawa that would drastically curtail bidding by Canadian companies on U.S. government-funded infrastructure projects, insiders have told The Globe and Mail.

One Canadian insider described the U.S. demands as the "worst proposal in any trade agreement" that has ever been presented, saying it is being strongly resisted by Canada and Mexico.

The Trump administration proposal calls for boosting the minimum dollar threshold for government projects available for foreign bidders. It would also cap the total amount that Canadian and Mexican companies can receive in American procurement contracts at what U.S. companies get in those countries.

Sources, with knowledge of the U.S. proposal, said the oil-rich Persian Gulf country of Bahrain would have greater access to bid on infrastructure and other government procurement work in the United States than Canada.

"It should be attributed for what it is. Shock value with a first offer and obviously it is unacceptable and they know that," a Canadian source, close to the NAFTA negotiations, told The Globe on Thursday.

Canadian trade lawyer Lawrence Herman said U.S. negotiators are taking their marching order from an anti-free-trade President who espouses an America First policy that favours American companies and workers.

"They only want a deal on their terms. Why would we expect anything less than the highly aggressive and demanding set of terms that the U.S. is putting on the table," Mr. Herman said in an interview. "The U.S. position is a bullying one and they are presenting proposals that will be extremely difficult for Canada and Mexico to accept or even negotiate over."

Under the North American free-trade agreement, Canada and Mexico are exempt from Buy American requirements as long as the contract is being offered by a U.S. government agency and the amount is above certain thresholds. The U.S. proposal would remove those guarantees and block any attempts by Canada to include state and municipal procurement in the 23-year-old trade pact.

Foreign Affairs Minister Chrystia Freeland alluded to the Buy American proposal on Wednesday at the conclusion of five days of talks during the third round of negotiations to revamp NAFTA.

Ms. Freeland said a rewritten NAFTA should emulate the kind of "mutual access" that was achieved in the Canada-European Union trade agreement (CETA). She wants companies to be able to bid on U.S. government contracts but also procurement work at the state and municipal level.

"I say this with some pride that mutual access to government procurement contracts was one of the great achievements of CETA," she told a news conference. "We would like to encourage our immediate neighbours to meet the levels of ambition that we have been able to achieve with our partners across the Atlantic."

Under the European trade deal, Canadian firms will now have unfettered access to the $5-trillion EU procurement market, the world's largest.

Former deputy assistant U.S. trade representative for North America Matt Gold said the Trump administration's demands go against the whole concept of free trade and would only spur a protectionist counter-attack from Canada and Mexico.

"We have never seen free trade reciprocity work that way before," said Prof. Gold, who teaches international trade law at Fordham University. "The right response for Canada would be to say: 'That's fine but we are going to cap the number of American goods and services providers that can bid on Canadian contracts.'"

Ontario Premier Kathleen Wynne has already threatened to respond to protectionist measures if the U.S. implements Buy American policies. In April, she was part of the lobbying that led to the defeat of a Buy American proposal in New York state.

Prof. Gold, who served under former president Barack Obama, said the U.S. Buy American proposal misses the point of free trade and the fact that while Canada gets access to the much larger U.S. market for government procurement, it also faces far greater competition from U.S. bidders for government contracts in Canada.

President Trump vowed in April to pursue a "Buy American, Hire American" agenda which his negotiators are attempting to force into the new NAFTA deal. He signed an executive order making it official administration policy and mandated federal agencies to assess it in their compliance with a number of Buy American laws.

Dan Ujczo, an international trade lawyer with the cross-border law firm Dickinson Wright, said Mr. Trump's Buy American order appears to be sweeping in scope.

"The way that I've interpreted the Buy American provisions is that this applies to everything, including those old [Canada-U.S.] defence procurement agreements from the 1950s," Mr. Ujczo said.

Ms. Freeland was blunt in her assessment of the Trump administration on Wednesday, saying it is "unconventional" and "overtly protectionist." Although the Trump White House believes erasing the U.S.'s trade deficit – the amount that imports exceed exports – should be the country's top priority, Ms. Freeland argues trade deficits are not a problem and that overall economic growth is all that matters.

Officials are bracing for even tougher times ahead in the next round of NAFTA talks in mid-October in Washington, when the U.S is expected to table its demands for trade dispute settlement mechanisms and stricter restrictions on auto and auto parts content.

U.S. negotiators are expected to introduce a proposal that would increase the requirements on the content of automobiles to be manufactured in North America for vehicles to qualify for tax free status under NAFTA. The Americans are also expected to demand higher U.S. content in autos and auto parts.

President Trump, who has repeatedly criticized NAFTA as an unfair deal for the United States, has called for the rules of origin for autos to be tightened, citing trade deficits of $64-billion (U.S.) with Mexico. Trade between the U.S. and Canada is balanced, with the U.S. having a surplus in services and a deficit in goods trade, largely because of Canadian energy exports.

The U.S. is also expected to push for the end of Chapter 19 in the NAFTA pact that provides a binational dispute resolution system to challenge anti-dumping and countervailing duties. Canada has said it would walk away from the talks if the Americans insist on scrapping this provision.

- With a report from Campbell Clark

BOMBARDIER. REUTERS. SEPTEMBER 29, 2017. WTO opens panel on Canada's Bombardier subsidies: Brazil ministry

BRASILIA (Reuters) - The World Trade Organization opened a dispute settlement panel on Friday to rule on Brazil’s complaint that Canada has hurt its commercial jet industry by subsidizing Bombardier Inc’s (BBDb.TO) CSeries jets, the Brazilian foreign ministry said.

The chief executive of Bombardier’s Brazilian rival Embraer SA (EMBR3.SA) told Reuters on Wednesday that a U.S. decision to slap steep anti-subsidy duties on the CSeries should bolster Brazil’s case at the WTO.

Reporting by Lisandra Paraguassu; Writing by Brad Haynes; Editing by Bernadette Baum

BOMBARDIER. THE GLOBE AND MAIL. REUTERS. BLOOMBERG. SEPTEMBER 29, 2017. Bombardier suffers another blow as WTO to probe subsidies in Brazil row

BRYCE BASCHUK

FREDERIC TOMESCO

The World Trade Organization approved Brazil's request to investigate Canada's alleged use of more than $3-billion in government subsidies to produce Bombardier Inc. aircraft.

The South American nation began WTO consultations in February, saying Canada ran afoul of trade rules because its policies unfairly bolstered the domestic aerospace industry to the detriment of Brazilian plane maker Embraer SA. Canada offered billions of dollars in loans, equity infusions, grants, and tax credits to Bombardier, Brazil said.

The probe by the Geneva-based trade body adds to pressure on Montreal-based Bombardier just days after the U.S. Commerce Department slapped import duties of about 220 per cent on the company's C Series jets. That followed an investigation that began after a complaint by Boeing Co.

Read also: Globe editorial: On the book of Bombardier vs. Boeing, skip to Chapter 19

"We are confident that the investments and contribution programs mentioned in Brazil's petition are in full compliance with all WTO and international trade rules," Bombardier spokesman Simon Letendre said by email.

A spokesman for the Canadian international trade ministry said the government will defend Bombardier and the Canadian aerospace industry. "All aircraft-producing countries provide some form of support to their aircraft industry," the spokesman, Joseph Pickerill, said by email. "Canada will be examining closely Brazilian government support."

At the WTO, Brazil said Canada's various aircraft subsidies violate WTO rules because they are contingent on export performance and require the use of domestic over imported goods.

'Fair Trade'

Subsidies have allowed Bombardier to sell its aircraft at "artificially low prices," Embraer Chief Executive Officer Paulo Cesar Silva said in a statement. "In order to ensure that competition in the commercial aviation market continues to be between companies, and not governments, it is essential to restore a level playing field, respecting fair trade conditions."

The WTO will now appoint three dispute-settlement panelists to determine whether Canada's various financing programs for Bombardier violated international trade rules. Though such investigations typically take less than a year, a ruling in the case may be extended to 2019 because of delays and staffing shortages at the WTO.

"This is par for the course for the aerospace industry," Cam Doerksen, an analyst at National Bank Financial in Montreal, said in an interview. "Canada and Brazil have had previous aircraft fights at the WTO. This dispute is not something that's measured in months. It will take years."

BOMBARDIER. REUTERS. SEPTEMBER 29, 2017. Bombardier signs deal with India's SpiceJet for 50 Q400 prop planes

Allison Lampert

(Reuters) - Bombardier Inc has finalized a deal to sell up to 50 Q400 planes to India’s SpiceJet valued at $1.7 billion by list prices, its largest single order to date for the turboprop plane, the Canadian company said on Friday.

The deal for 25 turboprops and another 25 options gives a needed boost to the company’s Q400 program, following recent lackluster demand, sending shares up 3 percent on Friday.

The company has had a challenging week. On Tuesday, the U.S. imposed preliminary anti-subsidy duties that would effectively block Bombardier jet sales in a key market if upheld.

The stock fell 14 percent on Wednesday on prospects for growth in its core units, putting it under pressure to find new markets for its jets and a potential new train partner.

For turboprops, the Canadian plane-and-train maker is trailing its European rival and market leader ATR, which controls about 75 percent of the market and is co-owned by Airbus SE and Leonardo SpA . Brazilian rival Embraer SA also said this month it would consider returning to the prop market.

The SpiceJet sale was announced as an initial letter of intent in June, and is Bombardier’s first order for a 90-seat version of the aircraft, up from the current largest model which has been configured with 86 seats.

Plane makers are being asked to pack more seats into aircraft to lower costs per seat and a 90-seat Q400 would be especially attractive for regions such as the Asia-Pacific, a turboprop industry source who does not work for Bombardier said.

“This is a big deal for them,” said the source, who spoke on condition of anonymity because he is not authorized to talk to the media. “I don’t think a 90-seater is for every market, but there’s certainly a market for it.”

Passengers in North America typically want more space when they travel and the Q400 is configured with up to 78 seats for that market.

Separately on Friday, the World Trade Organization opened an expected dispute settlement panel to rule on Brazil’s complaint that Canada hurt its commercial jet industry by subsidizing the CSeries, the Brazilian foreign ministry said.

Canada has previously contested Brazil’s complaint in the WTO trade case which could drag on for years.

Reporting by Allison Lampert in Montreal and Yashaswini Swamynathan in Bengaluru; editing by Patrick Graham and Susan Thomas

BLOOMBERG. 29 September 2017. U.S. Demands Risk Scuttling Nafta Talks

By Eric Martin , Josh Wingrove , and Andrew Mayeda

- Proposals on procurement, textiles, fruit seen as contentious

- U.S. President Donald Trump has threatened to pull out of pact

- Room for Improvement in Nafta Talks, Says Capistran

U.S. officials in Nafta negotiations are making proposals on battleground issues that Canada and Mexico would never agree to, intensifying doubts of reaching compromise on their tight timeline, according to three officials familiar with the talks.

U.S. proposals on government procurement, textiles and fresh produce are seen by the Canadian and Mexican governments as red-line issues with little or no hope of agreement, said the officials, who spoke on the condition of anonymity because the discussions are private. The last round of talks that ended Wednesday in Ottawa took on a more negative tone at times compared with previous sessions, the officials said.

The U.S. stance sets up a showdown in the next negotiating session in Washington from Oct. 11-15. Officials expect the U.S. will present contentious proposals on automotive rules of origin -- the share of a car that must be made in the three countries to get Nafta’s tariff-free benefits -- and on an overall U.S.-specific content requirement. They expect those will also be essentially impossible for the other countries to accept.

The U.S. Trade Representative’s office, which is leading the U.S. Nafta negotiations, didn’t immediately respond to requests for comment.

President Donald Trump has made cutting the trade deficit as the top-line goal of a Nafta re-negotiation, and autos is the main source of America’s $64 billion goods gap with Mexico. The administration launched the revamp in August by warning that a revised version of the deal that underpins $1.2 trillion of trade annually must have better terms for American workers and industries.

Two of the officials speculated that the U.S. is designing such hard-line positions to make it impossible to reach a settlement.

Trump has repeatedly threatened to pull out of Nafta, saying in an interview in April that he was “psyched” to terminate the deal but reconsidered after Canada and Mexico asked him to renegotiate instead. Commerce Secretary Wilbur Ross reiterated the threat earlier this month, adding that Nafta “has not worked the way it was intended.”

U.S. Trade Representative Robert Lighthizer told reporters Wednesday that “significant progress continues to be made” in areas including competition, state-owned enterprises, digital trade and telecommunications. But he said “there is an enormous amount of work to be done, including on some very difficult and contentious issues.”

The goal of reaching a deal this year is "very, very optimistic" and will be "very, very difficult," Lighthizer said. "But there are reasons to do it. So when there are reasons to do it, we have a lot of motivation."

The parties are aiming to secure a deal before the political calendar fills up next year with presidential elections in Mexico, congressional mid-terms in the U.S. and provincial votes in Ontario and Quebec.

Clothes, Fruit

On government procurement, the U.S. is proposing to cap its market for contracts at a dollar-for-dollar level with the combined Canada-Mexico market, according to the three officials. That would mean the total value of contracts the Canadians and Mexicans could access, together, couldn’t exceed the total value that U.S. firms could win in those two countries, the officials said.

Given the scale of the U.S. economy and population, this could effectively leave the two with less access to U.S. procurement than some other countries, the officials said.

The U.S. is also said to be proposing to eliminate preferential tariffs on textiles from Canada and Mexico over two years -- an idea described by the officials as an assault on the sector in those countries.

Finally, the U.S. wants to essentially open so-called “seasonal products,” such as fruit, to dispute-resolution mechanisms that would be expected to lead to disputes with U.S. growers and possibly tariffs, which could hinder Mexican exports, according to two officials.

The officials likened the potential fallout to the case of Boeing Co.’s challenge against Canadian-owned Bombardier Inc., which led to imposition of preliminary duties on Tuesday by the U.S. Commerce Department and will put a chill on the aerospace sector.

Constructive Talks

If one of the three countries were to walk away from talks, a next step would likely be issuing a six-month notice of withdrawal from the pact, though that wouldn’t guarantee an exit. Steps after that get murky -- trade powers in the U.S. are divided between Trump and the U.S. Congress. An attempted U.S. exit could trigger political and legal battles.

Mexico and Canada have said they want a modernized Nafta and have downplayed Trump’s threats. “As the negotiations move forward, it is important we have the will to table positions that encourage constructive discussions," Mexican Economy Secretary Ildefonso Guajardo told reporters Wednesday.

The third round of talks ended with an agreement on a Nafta chapter related to small- and medium-sized businesses. The duty imposed on Bombardier while talks took place hung over the final day of discussions, with Canadian Foreign Minister Chrystia Freeland calling the U.S. “a protectionist administration” in relation to the issue.

________________

LGCJ.: