CANADA ECONOMICS

INTERNATIONAL TRADE

StatCan. 2017-07-06. Canadian international merchandise trade, May 2017

Imports

$49.8 billion, May 2017

2.4% increase (monthly change)

Exports

$48.7 billion, May 2017

1.3% increase (monthly change)

Trade balance

-$1.1 billion, May 2017

Source(s): CANSIM table 228-0069.

Canada's merchandise trade deficit with the world reached $1.1 billion in May, up from a $552 million deficit in April. Imports rose 2.4% to $49.8 billion, led by an increase in aircraft imports. Exports were up 1.3% to $48.7 billion on account of higher unwrought gold exports.

Canada's trade activity has been strong in recent months, with imports and exports both reaching record highs, resulting in a total trade value of $98.5 billion in May. This represents a 13.8% increase over the same month last year.

Chart 1 Chart 1: Merchandise exports and imports

Merchandise exports and imports

Imports rise for a sixth consecutive month

Total imports rose 2.4% in May to $49.8 billion, a sixth consecutive monthly increase. Volumes rose 1.8% while prices increased 0.6%. Higher imports of aircraft and other transportation equipment and parts, motor vehicles and parts, and energy products were responsible for the increase. Year over year, total imports were up 10.2%.

Imports of aircraft and other transportation equipment and parts (+45.9%) led the increase, primarily due to aircraft imports, which rose $527 million to $636 million in May. The import of five new airliners in May contributed the most to the growth.

Imports of motor vehicles and parts rose for a fifth consecutive month, up 3.7% to a record high $9.8 billion. Imports of motor vehicle engines and motor vehicle parts rose 4.4%, coinciding with stronger production and higher exports of motor vehicles in May. Following a 3.1% decline in April, imports of passenger cars and light trucks (+3.4%) rebounded in May.

Imports of energy products (+6.5% to $2.8 billion) also contributed to the overall gain in May. Refined petroleum energy products led the increase (+16.4%), as planned maintenance work at Canadian refineries resulted in increased demand for foreign refined petroleum products in May. Overall, volumes rose 18.8% while prices fell 10.4%.

Record exports led by unwrought gold

Total exports rose 1.3% to a record high $48.7 billion in May, a third consecutive monthly gain, on account of higher volumes. Metal and non-metallic mineral products and motor vehicles and parts were the largest contributors to the increase. Exports excluding energy products rose 3.6% in May. Year over year, total exports were up 17.8%.

Exports of metal and non-metallic mineral products increased 11.1% to a record high $6.2 billion in May. Unwrought precious metals and precious metal alloys (+$731 million) were responsible for the increase, mainly on stronger exports of unwrought gold to the United Kingdom. Most of these shipments were transfers of assets within the banking sector.

Exports of motor vehicles and parts rose 3.6% to $8.5 billion in May. Passenger cars and light trucks posted the largest increase, up 3.0% to $5.8 billion. This gain coincided with a fourth consecutive monthly increase in imports of motor vehicle engines and motor vehicle parts, and followed some downtime at assembly plants in April.

Exports of energy products fell 9.0% to $8.0 billion, largely offsetting the increases in May. Lower exports of crude oil and crude bitumen (-15.2%) were behind this decrease. This was an atypical decline for crude oil in May, a month that usually sees increases with the start of summer. Overall, prices decreased 8.2% and volumes fell 0.9%.

Record imports from the United States

Imports from the United States rose 3.6% to a record high $32.7 billion in May, on higher imports of aircraft and motor vehicles. Exports to the United States edged down 0.3% to $36.3 billion. As a result, Canada's trade surplus with the United States narrowed from $4.8 billion in April to $3.5 billion in May. The Canadian dollar fell 0.9 cents US relative to the American dollar from April to May.

Exports to countries other than the United States were up 6.2%, mainly on higher exports of unwrought gold to the United Kingdom. Imports from countries other than the United States edged up 0.2%, as higher imports from Saudi Arabia (crude oil), China and Belgium were largely offset by lower imports from Germany (passenger cars).

As a result, Canada's trade deficit with countries other than the United States narrowed from $5.3 billion in April to $4.6 billion in May.

Real trade surplus narrows in May

In real (or volume) terms, imports were up 1.8% and exports rose 1.1% in May. Consequently, Canada's trade surplus in real terms narrowed from $814 million in April to $561 million in May.

Chart 2 Chart 2: International merchandise trade balance

International merchandise trade balance

Revisions to April export and import data

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, as well as amendments made for late documentation of high-value transactions. Exports in April, originally reported as $47.7 billion in last month's release, were revised to $48.1 billion in the current month's release. Imports, originally reported as $48.1 billion in last month's release, were revised to $48.6 billion.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170706/dq170706a-eng.pdf

The Globe and Mail. Reuters. Jul. 06, 2017. Canada trade data show economic strength ahead of rate decision

DAVID LJUNGGREN

OTTAWA — Canadian exports and imports both hit record highs in May, Statistics Canada said on Thursday, reflecting continued economic strength ahead of a highly anticipated interest rate decision next week.

Although the trade deficit almost doubled to $1.09-billion, that was partly due to one-time imports of five new airliners. Analysts in a Reuters poll had forecast a shortfall of $530-million.

The Bank of Canada is set to make an interest rate announcement on July 12. Markets increasingly expect a hike to come soon as the economy recovers from a prolonged shock caused by low oil prices.

The central bank, which cut rates twice in 2015 to help contain the damage, has consistently fretted about what it says are disappointing non-energy exports.

Paul Ferley, assistant chief economist at Royal Bank of Canada, said the strength in imports implied a strong domestic economy, and the gain in exports suggested robust demand for Canadian products.

“The Bank of Canada will probably take some comfort from indications that export growth is holding up,” he said.

Canadian companies are more optimistic about future sales and exports, while improving demand should boost investment and hiring, the Bank of Canada said last week, increasing expectations for a rate hike.

Imports climbed 2.4 per cent to $49.77-billion, their sixth consecutive gain, on increased purchases of aircraft and other transportation parts.

Exports rose 1.3 per cent in May from April to hit $48.69-billion, thanks to shipments of unwrought gold to the United Kingdom as well as motor vehicles and parts.

Export Development Canada Chief Economist Peter Hall said eight of the 11 main export sectors had grown for three months in a row.

“This is really strong evidence of a broadly based increase,” he said. “It gives us confidence that there is real muscle behind this.”

Exports to the United States, which accounted for 74.5 per cent of all Canadian exports in May, dipped by 0.3 per cent, while imports from the southern neighbour rose 3.6 per cent. As a result, Canada’s trade surplus with the United States shrank to $3.53-billion from $4.76-billion in April.

Separately, Statscan said the value of Canadian building permits issued in May jumped 8.9 per cent on plans for more construction of residential buildings, particularly in the red-hot market of Ontario.

EDC. 07/06/2017. WEEKLY COMMENTARY. What’s On Your Mind?

By Peter G Hall, Vice-President and Chief Economist

The global see-saw in trade policy perspectives meant that there was lots to discuss with exporters this spring. In a nutshell, our Global Export Forecast theme covered the general debate on trade, the expected outcome, the effect on the global economy and implications for Canada. EDC Economics’ perspective on this led to a lot of great questions. In fact, during my 13-city cross-Canada Let’s Talk Exports forecast tour, I was asked over 50 questions by conference attendees. What exactly was on the minds of Canadian exporters?

Top of the list was the US political situation. Add it all up and this group accounted for 18 per cent of the questions received. This was particularly notable, given that one-third of the presentation dealt with this subject. I suppose we expected that would address most of the questions people had, but it seemed to probe them further, increasing the appetite for more insight. Within this subject, the questions were quite varied, but a number of them dealt with possible strategies for dealing with the new reality, from diversification elsewhere to relocation and negotiation strategies. They kept me on my toes!

Top spot was shared by another key issue: domestic policy, on a whole range of subjects. Recall that during the May-June period, there was an election in British Columbia that threw the issue of trans-mountain fossil fuel pipelines into limbo. There was also minimum wage talk in Ontario, speculation on how federal and provincial policies were hurting or helping the trade policy situation with the US, the standard concerns about government debt levels, US corporate tax reductions and the oft-asked questions on infrastructure. There was a lot up in the air, and in general it remains there, so there was little that could be said definitively in response to these questions outside of describing the economic context and speculating on possible outcomes.

Industry inquiries were close behind, accounting for 16 per cent of all questions asked. These were all over the map, and were essentially focused on regional issues, and in response to recent developments. For example, in Quebec there were questions on the aerospace industry, largely related to the Boeing threats of action against Bombardier. Most popular were a group of questions on the outlook for the oil & gas and mining industries. Housing was a hot topic, as ever, and the softwood lumber dispute led to questions on possible outcomes.

Tightening economic conditions and central bank activities piqued interest in the near term view of interest rates. Given that the presentation included a discussion of near-term monetary policy in Canada and the US, questions were probing the likely effects of tighter liquidity. The response was generally that policy is moving from ultra-loose to a normalization of conditions – with some uncertainty about what that really means. Audiences generally wanted to be assured that higher rates would not kill economic activity, which we were able to do as we believe that rate increases will accommodate nascent growth and prevent it from getting out of hand.

Following closely were questions on currencies. In general, there was worry that policy turbulence and the associated uncertainty would cause currencies – especially ours – to do strange things. As our core forecast presumes no major changes in trade policy, with good reasons given to back up this view, it was then a matter of walking audiences through our currency model, which looks at commodity price movements, Canada-US interest rate differentials, global events that impinge on the value of the greenback, and Canadian domestic developments. As such, our forecast makes the case for currency stability – against both the US dollar and the Euro – amid the policy storm.

The remaining questions dealt with country issues (‘next’ markets were a popular topic), local issues and the balance, an amalgam of questions that were so diverse that they can’t really be classified. Among them were two very interesting questions on the impact of automation on the longer-term outlook.

The bottom line? Audiences were very engaged right across the country, and in a few cases, we had to shut down the question period to respect attendees’ schedules. Policy turbulence suggests that such sessions will be lively for some time to come. If you have any burning questions, please send them along.

AGRICULTURE INVESTMENT

Canada Opportunities Agency. July 6, 2017. Exploring Opportunities for Big Data in Oceans and Agriculture. Big Data Congress brings together leading thinkers and innovators

Halifax, NS – The ability to learn from complex amounts of big data is helping entrepreneurs and businesses make informed decisions about keeping our food safer and becoming more environmentally responsible. That is why the Government of Canada is supporting the Big Data Congress 2017 (BDC2017). The conference will provide insights on how companies can use big data to propel global competition and growth in the oceans and agriculture sectors.

BDC2017 is aimed at helping Atlantic Canadian businesses understand and find innovative ways to use transformative trends in information and the collection of data to help make crucial decisions to improve the bottom line. The Government of Canada understands that idea sharing at conferences such as this, has the potential to expand business activities between Atlantic Canada and international markets.

Today, Andy Fillmore, Member of Parliament for Halifax, announced the Government of Canada is supporting the development and delivery of the 2017 Big Data Congress with a $100,000 non-repayable contribution through the Atlantic Canada Opportunities Agency’s (ACOA’s) Business Development Program. MP Fillmore made the announcement on behalf of the Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development and Minister responsible for ACOA.

This year’s congress will showcase Nova Scotia as a leader in data analytics and demonstrate the vital role analytics play in the innovative advancement of the oceans and agriculture sectors. It will feature keynote speakers, as well as panels, workshops and networking events. This year’s Big Data Congress will be held in Halifax, Nova Scotia from November 6-8, 2017.

This investment builds on the Government of Canada’s new approach to economic development through innovation. Over the next five years, all six regional development agencies, including ACOA, will invest a total of $1.5 billion to strengthen innovation capacity and economic growth across the country. Part of these investments will support initiatives such as the Big Data Congress that assist regional businesses with the development of new technologies to boost their ability to grow beyond our border and compete globally.

Quotes

“The Government of Canada is redefining its vision of economic growth, by drawing Canadians together to create ideas, jobs and improve the lives of our citizens. Initiatives such as the Big Data Congress are an ideal way to implement this strategy, by applying technology to propel global competition and growth.”

− The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development and Minister responsible for ACOA

“The funding announced today demonstrates the Government of Canada’s commitment to the economic progress of our region. The Big Data Congress is a welcome addition to Nova Scotia’s business conferences.”

− Andy Fillmore, Member of Parliament for Halifax

“Atlantic Canada is a respected leader in big data analytics, oceans and agriculture. This Congress is about data-driven innovation in oceans and agriculture that bring to the forefront the business aspects of these industry sectors, which underpin the economy of Atlantic Canada.”

− Michael Shepherd, former Dean of Dalhousie's Faculty of Computer Science and Chair of BDC 2017

Agriculture and Agri-Food Canada. July 6, 2017. New Federal Research Investment to make Beef Sector more Sustainable

Centre Wellington, Ontario – Canada’s beef sector is an important driver of economic growth, contributing $2.69 billion annually to the Ontario economy and supporting 61,000 jobs in the province. The Government of Canada continues to invest in innovation and the overall productivity and competitiveness of the livestock industry.

Agriculture and Agri-Food Minister, Lawrence MacAulay, today announced a $2 million investment with the Beef Farmers of Ontario to enhance the genetic profiling of eastern Canada cow herds to improve feed efficiency. The research will take place within the Elora Beef Research Centre, which is being expanded through a provincial investment announced by Ontario Minister of Agriculture, Food and Rural Affairs Jeff Leal at the same ground-breaking event.

This federal investment is expected to have a direct benefit for producers by reducing the amount of feed needed for every pound of beef, with each cow producing less methane and less manure. Feed costs account for 25 per cent of beef input costs. Industry studies have shown that a one per cent improvement in feed efficiency can result in annual savings of $11.1 million for the sector.

Quotes

“The federal government is proud to partner with the Province of Ontario to support research at a state-of-the-art beef research centre serving all of eastern Canada. This investment will make the beef industry even stronger and more competitive, supporting jobs and economic growth in Ontario and across Canada.”

- Agriculture and Agri-Food Minister Lawrence MacAulay

“I am glad to see this world-class beef hub taking shape, supported by the federal and provincial governments. This research at the University of Guelph is designed to result in long-term savings for the beef sector.”

- MP Lloyd Longfield (Guelph), Member of the House of Commons Standing Committee for Agriculture and Agri-Food

“The Beef Farmers of Ontario is extremely appreciative of the federal government’s contribution to new research projects and equipment at the Elora Beef Research Centre. The competitiveness and long-term viability of the Ontario beef industry is underpinned by key investments in primary research and infrastructure capacity needed to undertake it. Funding committed by Agriculture and Agri-Food Canada will provide critical support to advance beef cattle research and help ensure we are well-positioned to compete in both domestic and international markets.”

- Joe Hill, Vice President, Beef Farmers of Ontario

Quick Facts

- The Beef Farmers of Ontario (BFO) represents the interests of the province’s 19,000 beef farmers, including all sectors of the industry.

- The Ontario Ministry of Agriculture, Food and Rural Affairs has contributed $12.4M to expand the Elora Beef Research Centre.

- The federal investment is being made through the Growing Forward 2 AgriInnovation Program, a five-year, $698 million initiative.

Agriculture and Agri-Food Canada. Global Affairs Canada. July 5, 2017. Statement by the Government of Canada on Market Access for Pulses from Canada to India

Ottawa, Ontario – The Honourable Lawrence MacAulay, Minister of Agriculture and Agri-Food, and the Honourable François-Philippe Champagne, Minister of International Trade, today issued the following statement on continued access for Canadian pulses to India:

“Since 2004, India has granted Canada a series of exemptions to an import regulation regarding mandatory fumigation for pulses. Another exemption has been granted which will allow continued access to the Indian market for Canadian pulse exporters. Exports leaving Canada on or before September 30, 2017, will not require fumigation in Canada. We will maintain on-going trade while officials on both sides continue to work towards a long-term, systems-based solution.

Pulses are a large part of Canada’s contribution to two-way trade between our two nations: In 2016, pulse exports to India were worth over $1.1 billion and accounted for 27.7 percent of Canada's global pulse exports. Canada is a safe and reliable global supplier of pulses, with exports of more than $4 billion annually.

The Government of Canada has worked together with industry to secure this exemption with the Government of India, which will benefit Canadians and Canadian farmers. This is a short term remedy and we continue to work on a long-term, commercially viable solution."

FINANCE

Department of Finance Canada. July 6, 2017. Official International Reserves

The Department of Finance Canada announced today that Canada's official international reserves decreased by an amount equivalent to US$963 million during June to US$84,626 million.

Details on the level and composition of Canada's reserves as of June 30, 2017, as well as the major factors underlying the change in reserves, are provided below. All figures are in millions of US dollars unless otherwise noted.

| Millions of US dollars | |

|---|---|

| Securities | 65,332 |

| Deposits | 9,302 |

| Total securities and deposits (liquid reserves): | 74,634 |

| Gold | 0 |

| Special drawing rights (SDRs) | 7,791 |

| Reserve position in the IMF | 2,201 |

| Total: | |

| June 30, 2017 | 84,626 |

| May 31, 2017 | 85,589 |

| Net change: | -963 |

FULL DOCUMENT: http://www.fin.gc.ca/n17/17-062-eng.asp

G-20

The Globe and Mail. Associated Press. 6 Jul 2017. ACTIVISTS PAINT HAMBURG GREY. Protesters descend on the German city, where Chancellor Angela Merkel will host leaders of the G20 leading economies in a two-day summit starting Friday Police brace for the worst, with violent incidents already under way, as leaders come together in Hamburg. Police brace for the worst, with violent incidents already under way, as leaders come together in Hamburg. A rally is held in Hamburg on Wednesday. Demonstrations must be registered with authorities in Germany before going ahead – otherwise they’re considered illegal and can be immediately broken up.

DAVID RISING

BERLIN - Hundreds of clay-covered actors resembling zombies walk from all parts of the city to the central square in a performance piece entitled 1,000 Gestalten (1,000 Figures). The two-hour show was an appeal for more humanity and self-responsibility ahead of the summit.

U.S. President Donald Trump was met with thousands of protesters when he arrived at meetings in Brussels in May. But with Russian President Vladimir Putin and Turkish President Recep Tayyip Erdogan joining him at the Group of 20 meetings in Germany this week, he likely won’t even be at the top of the list for demonstrators.

Add India’s Prime Minister Narendra Modi, Chinese President Xi Jinping and other leaders whose controversial policies have sparked unrest, mix in the cauldron that is Hamburg – the summit venue is only about a kilometre from the country’s most notorious hotbed of leftwing protest – and the brew could prove explosive.

“G20: Welcome to Hell” is the slogan anti-globalization activists registered for their protests on July 6, when Mr. Trump and other leaders arrive for the July 7-8 summit in the northern port city.

“We are calling on the world to make Hamburg a focal point of the resistance against the old and new capitalist authorities,” said the organizers.

Already in the weeks ahead of the summit, in incidents believed linked to the meeting, police cars have been burned, train lines have been sabotaged and authorities in Hamburg and the nearby city of Rostock have confiscated improvised weapons such as fire extinguishers filled with flammable liquid, material to build gasoline bombs, baseball bats and other items in several raids.

“We have to assume that this is only a tiny percentage of what is still in basements and garages in and around Hamburg,” Hamburg police criminal director Jan Hieber told reporters this week.

In a preview of things to come, police clashed Tuesday night in Hamburg with hundreds of protesters, using pepper spray and water cannons to eventually bring the crowd under control.

The “Welcome to Hell” demonstration is just one of dozens of protests that have been registered under a smorgasbord of themes – including a far-right pro-Trump rally – with more than 100,000 demonstrators from across Europe and beyond taking part.

Officials expect some 8,000 protesters from Europe’s violent leftwing scene, and have been tracking known activists coming in from Scandinavia, Switzerland, Italy and elsewhere, Hamburg police chief Ralf Martin Meyer said.

German Chancellor Angela Merkel has told community organizers in Hamburg that she understood the importance of demonstrations to express criticism and concerns, but urged that they remain non-violent.

Still, German security officials are preparing for the worst, drawing upon decades of experience dealing with violent May Day demonstrations and other protests at major events.

In addition to the no-protest zone, tightly secured transit corridors are set up to ensure that convoys will be able to keep moving lest they become a target for violent demonstrators.

Hamburg is boosting its police force with reinforcements from around the country and will have 20,000 officers on hand to patrol the city’s streets, skies and waterways.

Demonstrations need to be registered with authorities in Germany before going ahead – otherwise they’re considered illegal and can be immediately broken up.

On the outskirts of the city, a former wholesale supermarket has been converted into a special temporary prison with holding cells for 400 people, and judges on hand to decide whether there’s enough evidence to keep them longer term or to set them free.

BLOOMBERG. 6 July 2017. G-20 Seeks to Contain Trump by Avoiding Mentions of Climate Change

Peter Martin and Jessica Shankleman

- Draft communique seeks to advance climate action despite split

- World leaders gather in Hamburg Friday for two-day summit

- The Coming Storm of Climate Change

German Chancellor Angela Merkel is seeking to unite the Group of 20 nations on key environmental goals by steering clear of references to climate change wherever possible, according to a draft being circulated ahead of a summit of world leaders.

A section of the current draft seen by Bloomberg notes the decision of the U.S. to withdraw from the landmark Paris Agreement, while promising collaboration on other less controversial areas such as innovation, sustainable growth and competitiveness.

Climate change has become one of the biggest issues at stake during the G-20 summit, after President Donald Trump last month decided to pull the U.S. out of the 2015 Paris deal that promised to keep global warming “well below” 2 degrees Celsius. Trump has questioned the scientific consensus of climate change, even once suggesting it was a hoax created by China.

“This is about trying to contain Trump and not provoke him,” said Nick Mabey, who used to advise the U.K. government on climate issues and now runs E3G, a policy-research group. “This language would show that he’s isolated on climate change but leave him with a bit of dignity.”

As the world’s second largest emitter, the U.S.’s involvement in the Paris deal is seen as crucial to global efforts to tackle climate change. Investors are concerned that a U.S. exit could have a domino effect around the world, yet no other country has said they will follow Trump in leaving the accord.

While previous G-20 leaders’ summits promised strong action on climate change, the communique currently being considered doesn’t appear to mention the phrase, instead noting the opportunities for job creation “of increased investment into sustainable and clean energy technologies and infrastructure.” It also promotes energy security, a key issue for Trump. The statement is not final and can still change.

As president of the G-20 this year, Germany is seeking to avoid leaving the U.S. as a footnote on the issue of climate change. Merkel wants to avoid a repeat of G-7 talks in Italy in May that confirmed a crack between six member states and the U.S. after environment ministers were unable to find common ground on climate measures.

“The policies produced by the G-20 should be a result of a consensus reached by all members,” China’s Vice Finance Minister Zhu Guangyao told reporters in Hamburg. “No one should be excluded.”

Separate Annex

While the main communique won’t affirm the group’s commitment to tackling climate change, the section of the draft says that the remaining 19 parties will endorse a separate climate and energy action plan which will act as an annex.

The other heads of state and government from G-20 countries as well as the European Union’s leaders will affirm their belief that the 2030 Agenda for Sustainable Development and the Paris Agreement are irreversible, according to the draft statement.

Steffen Seibert, Merkel’s chief spokesman, declined to comment on the G-20 draft’s substance.

“Nothing is decided for now,” he said by email. “There are many options.”

Trump’s withdrawal from the Paris deal has “backfired,” said Mohamed Adow, climate change lead at the charity Christian Aid, by email.

“Far from undermining the Agreement, he has driven climate change to the top of the geopolitical agenda,” Adow said by email.

BLOOBERG. July 6, 2017. The Flashpoints for World Leaders at the Hamburg G-20

By Alan Crawford and Sam Dodge

The Group of 20 summit that starts in Hamburg on Thursday is the most anticipated—and potentially turbulent—meeting of global leaders in years. An unpredictable U.S. president with a protectionist bent, a Russian leader subject to international sanctions and a Chinese president looking to assert a greater global role are just a few of the factors that might stoke tensions.

Sparks could really fly over the policy agenda of free trade, climate change and migration put forward by the German host. Angela Merkel is determined to avoid a repeat of May’s G-7 meeting in Italy, where it was six against one: Donald Trump. Yet she acknowledges that “the discord is obvious” and “it would be dishonest to paper over the conflict.”

Following are what look to be the main flashpoints at the summit and the relative positions of G-20 members with most at stake:

Trade

Open Markets

For

Against

Germany

Merkel

U.K.

May

Brazil

Temer

Argentina

Macri

S. Korea

Moon Jae-in

U.S.

Trump

United States: Donald Trump has shown his disdain for the status quo on world trade. He often describes trade as a zero-sum proposition in which the U.S. has been losing ground for decades and lambasts nations such as Germany that export more to the U.S. than they import as “very bad.” He seeks an overhaul of the global trading order that would elevate the U.S. at the expense of other countries.

Germany: As head of Europe’s top exporting nation, Angela Merkel is under pressure to defend open markets and push back against criticism of Germany’s trade surplus. In the G-20 runup, the chancellor has tried to enlist countries from China and India to Mexico as free-trade allies and continues to push for completion of the TTIP trade deal between the EU and the U.S.

United Kingdom: Aside from holding on to Downing Street, Theresa May has one thing in her inbox: Brexit. Once the U.K. leaves the EU—its biggest market—in 2019, it will live or die by signing free-trade deals, so May is desperate to make the case that Brexit Britain is “open for business.”

Brazil: Says it is the best example of how protectionism has failed and that it now seeks open borders. President Michel Temer wants the final G-20 document to emphasize the importance of multilateral trade rules and contain a specific mention of the WTO (which a Brazilian heads).

Argentina: Only just reentered capital markets after 15 years of isolation, and President Mauricio Macri wants to strengthen trade ties with anyone willing to listen. He’s visited China, Japan, Germany and Davos, all in the name of business, and has expressed a desire to do more bilateral deals with or without the regional trade bloc Mercosur.

Net exports, billions of dollars

300

Germany

Brazil

0

Argentina

–300

United Kingdom

–600

United States

–900

1975

1980

1985

1990

1995

2000

2005

2010

2015

Source: IMF

300

Germany

Brazil

0

Argentina

–300

United Kingdom

–600

United States

–900

1975

1980

1985

1990

1995

2000

2005

2010

2015

Climate

Cutting Carbon Emissions

For

Against

France

Macron

China

Xi

Germany

Merkel

India

Modi

Indonesia

Widodo

U.S.

Trump

China: The world’s biggest polluter aims to occupy the ground the U.S. is vacating, and President Xi intends to put climate at the core of his G-20 agenda.

France: Emmanuel Macron is a major defender of the Paris accord, frequently linking problems such as terrorism and migration to climate change and suggesting France may go further in its carbon targets as a result of the U.S. withdrawal.

Germany: Angela Merkel, a former environment minister who helped forge the precursor to the Kyoto accord, is pushing for G-20 members to hold to the Paris agreement. While keen not to isolate Trump, she will ultimately have to decide if she takes him on over climate change.

India: Prime Minister Narendra Modi has committed to the global agreement on curbing emissions and pledged to “go beyond the Paris accord,” saying “we have a common responsibility to protect our mother planet.”

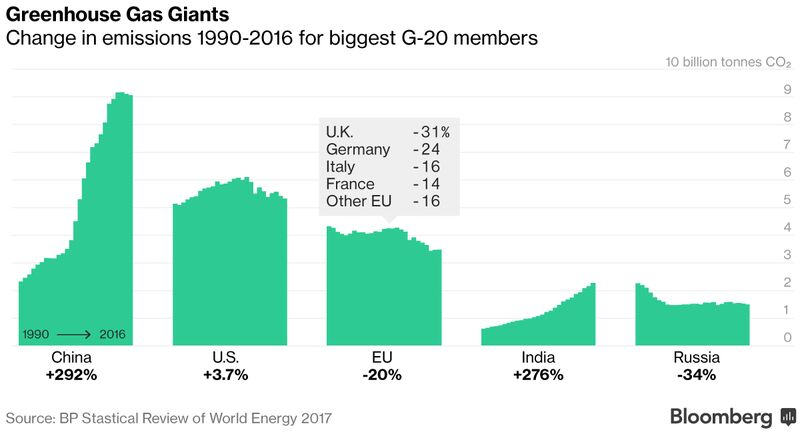

Carbon dioxide emissions, billions of tons

+706%

from 1975 - 2016

China

+15%

United States

+793%

India

-26%

Germany

-31%

France

10

8

6

4

2

1975

2016

1975

2016

1975

2016

1975

2016

1975

2016

Source: BP Statistical Review of World Energy 2017

Migration

Freedom of Movement

For

Against

Turkey

Erdogan

Mexico

Nieto

Italy

Gentiloni

South Africa

Zuma

Australia

Turnbull

U.S.

Trump

Turkey: Hosts more refugees—almost 3 million—than any other country, mostly from war-torn neighboring Syria. That shared interest in migration means for all his public jibes at Merkel and threats to tear up a refugee deal with the EU, President Recep Tayyip Erdogan may have more in common with the German chancellor than with the U.S. president on this issue.

Mexico: Immigrant rights have moved to the top of Mexico’s agenda after the U.S. threatened mass deportations of its citizens. Mexico participates in global refugee programs and has worked to limit the illegal crossing of Central Americans at its southern frontier.

Italy: Migration is a priority for Italian Prime Minister Paolo Gentiloni, whose Mediterranean country is struggling to cope with arrivals of refugees from North Africa and the Middle East. Italy has long felt abandoned by its European Union and other partners, and Gentiloni will be seeking more support for Merkel’s summit attempts to boost growth in Africa through foreign investment to help stem the outward flows of people.

South Africa: For President Jacob Zuma, the issue of migration is about people from mostly sub-Saharan countries such as Nigeria, Malawi, Zimbabwe and Ethiopia who are fleeing war or grinding poverty. Recent years have seen outbreaks of deadly violence against foreigners by South Africans who say the migrants are taking their jobs and opportunities.

International migrants as a percentage of the population

15%

United States

12

Italy

9

6

South Africa

Turkey

3

Mexico

0

1990

1995

2000

2005

2010

2015

Source: United Nations

Trump

Trump Policies

For

Against

Saudi Arabia

Salman

Russia

Putin

Japan

Abe

Canada

Trudeau

France

Macron

Russia: Vladimir Putin has repeatedly praised Trump, who campaigned on a pledge to build better relations with Russia. But Putin has watched with growing concern as investigations into alleged Russian meddling in the U.S. vote have further poisoned relations and Moscow’s opponents in the U.S. have pushed for new sanctions on Russia.

Japan: Abe was the first to visit Trump after Trump won the White House, even golfing with the president. But Abe has also taken care to stress Japan’s investments in the U.S. economy and defended the status of trade ties, including Japanese auto exports.

Saudi Arabia: Crown Prince Mohammed bin Salman was one of the first foreign officials to visit Trump as president, allowing Saudi Arabia to claim “a historic turning point” in relations. Trump chose Saudi Arabia as the first destination on his first foreign trip as president, saying that his meetings there with regional leaders were “beyond anything anyone has seen.”

France: Emmanuel Macron crushed Trump’s hand the first time they met and hasn’t hesitated to take him on since, almost trolling the U.S. leader when he announced his withdrawal from the Paris accords. But he’s invited the president to attend the July 14 Bastille Day celebrations—and Trump accepted.

Canada: Justin Trudeau may find himself a hot commodity at the G-20 with other leaders looking to pick the Canadian premier’s brain for how to deal with his neighbor. With Nafta talks due to begin in August, Trudeau’s cabinet has fanned out to lobby the White House, Congress and key U.S. governors to ward off proposals for a border tax or new trade tariffs.

Percentage of people that have confidence the U.S. president would do the right thing regarding world affairs

Obama

Trump

100%

75

50

25

0

Germany

S. Korea

France

Canada

U.K.

Australia

Japan

Brazil

Mexico

Italy

India

Russia

Survey conducted among 40,448 respondents in 37 countries outside the U.S. from Feb. 16 to May 8, 2017. Obama figures are based on the most recently available data for each country between 2014 and 2016.

Source: PEW Research Center

Source: Data compiled by BloombergWith the assistance of: John Follain, Ilya Arkhipov, Gregory L. White, Peter Martin, Isabel Reynolds, Kanga Kong, Rosalind Mathieson, Jason Scott, Ruth Pollard, Rene Vollgraaff, Toluse Olorunnipa, Glen Carey, Tony Czuczka, Gregory Viscusi, Andres R. Martinez, Nacha Cattan, Raymond Colitt, Nikos Chrysoloras, Charlotte Ryan, Josh Wingrove and Yudith Ho

Picture research: Eugene Reznik

BLOOMBERG. MARKETS. 07/06/2017. G-19 plus 1

President Donald Trump's disdain for the status quo on world trade is likely to be one of the main flashpoints at the G-20 summit in Hamburg, Germany. Also on the rader is North Korea and its recent missile launch, with Trump, who's in Poland this morning, saying that the U.S. is considering "pretty severe things" to retaliate. Chinese President Xi Jinping is expected to put the onus back on the U.S. to find a solution to the Korean problem when he meets Trump on the sidelines of the Hamburg summit.

HOUSING BUBBLE

The Globe and Mail. 6 Jul 2017. Vancouver’s housing market rallies as foreign-buyers tax fails to cool sales. Condos prices are surging in Greater Vancouver while the market for detached properties has bounced back less than a year after a tax on foreign buyers cooled off sales.

BRENT JANG

The benchmark price for detached properties in Greater Vancouver hit a record $1,587,900 in June.

The benchmark price, which is the industry’s representation of typical homes sold, reached a record $600,700 for condos in the region last month, up 17.6 per cent from June, 2016, according to the Real Estate Board of Greater Vancouver.

The townhouse market is also rallying, with the benchmark price climbing 10.7 per cent over the past year to touch a high of $745,700 in June.

By contrast, the region’s benchmark price for detached properties rose 1.4 per cent over the past year to hit a record $1,587,900 in June. That edged out the previous high of $1,578,300 in July, 2016.

While the Barenaked Ladies sang about buying a “nice chesterfield or an ottoman” if they had $1-million, the benchmark price in Greater Vancouver for all housing types set a high last month of $998,700 – leaving little cash for new furniture if you were to purchase a home and be mortgage-free. That price is up 1.8 per cent from May and a 7.9-per-cent gain from June, 2016.

“Two distinct markets have emerged this summer. The detached home market has seen demand ease back to more typical levels while competition for condominiums is creating multipleoffer scenarios and putting upward pressure on prices for that property type,” Greater Vancouver board president Jill Oudil said in a statement Wednesday.

After brisk sales early last year, the number of existing properties changing hands began falling in April, 2016, and continued sliding for several months after the B.C. government imposed a 15-percent tax on foreign buyers in the Vancouver region in August.

The sales slowdown for detached houses, condos and townhouses has continued, with 3,893 properties changing hands last month, down 11.5 per cent from a year earlier. Still, June’s total sales volume rang in 14.5 per cent higher than the 10-year average for that month.

The board prefers to look at benchmark prices instead of average prices, which are skewed upward whenever there is a flurry of high-end sales. The average price for condos sold last month was $656,447, down slightly from the record $656,919 in May but up 15.8 per cent from a year earlier.

The regional price for detached houses averaged $1.71-million in June, down 6.4 per cent from the record $1.83-million in May and a 3.1-per-cent decline over the year.

Figures have not been released yet for June’s average price within the City of Vancouver for detached houses. But in May, the price for detached properties sold within Vancouver’s city limits averaged $2.76-million, up 1.3 per cent from May, 2016, according to Multiple Listing Service data.

Vancouver remains by far Canada’s most expensive housing market. The City of Toronto saw the price for detached houses average $1.5-million in May, down 4.7 per cent from April but up 16.6 per cent from May, 2016. The Ontario government implemented a 15per-cent tax effective April 21 on foreign home buyers in the Greater Golden Horseshoe region, a sprawling land base that surrounds the Greater Toronto Area.

In the B.C. Fraser Valley Real Estate Board’s territory, total sales dropped 10.2 per cent over the past year to 2,571 transactions in June. The price for various properties sold in June averaged $751,584, or a 5.6-per-cent rise from the same month in 2016.

The price for detached houses averaged $1.02-million last month, up 7.4 per cent from a year earlier, according to the Fraser Valley board, whose area includes suburbs such as Surrey and Langley. The benchmark price for detached houses rose 2.1 per cent to $934,600 in June compared with May, and is up 8.5 per cent since June, 2016.

Robert Hogue, senior economist at Royal Bank of Canada, said B.C.’s real estate market has recovered faster than expected. “We still expect poor affordability and rising interest rates to weigh on the market in 2018, keeping resales on a downward track and containing the pace of price increases to low single-digits,” he said in a research note.

The Globe and Mail. 6 Jul 2017. CMHC looks at varied ownership across rental markets. Individual investors and private corporations own about 90 per cent of Canada’s purpose-built rental apartment units and most markets with a higher concentration of individual investors have lower average rents, according to a new report from the Canada Mortgage and Housing Corp.

JOYITA SENGUPTA

The report found that individual investors typically charge lower rental prices and are more prevalent in less-expensive centres such as Quebec, whereas moreexpensive markets such as Vancouver, Edmonton and Halifax had fewer individual investors. The national average rent for a two-bedroom apartment owned by individual investors was about $871. Apartments of the same size owned by corporate owners averaged out at $1,085 and units owned by pension funds had the highest national averages at $1,467.

The exception was Toronto. Despite being one of the most expensive rental markets in the country, the city was in the top seven cities with the highest share of units owned by individual investors at about 50 per cent. However, the report found a smaller disparity in rental prices across different kinds of ownership in the most expensive markets. So, having more individual investors has had little impact on affordability in Toronto, where the average overall rent was $1,327.

Gustavo Durango, senior economist at CMHC and author of the report, said the disparities between rental prices in different markets with a concentration of individual investors could be explained by the kinds of buildings available in those cities.

“It confirms what we already know, which is that markets with lower rent tend to be markets where the average rental building is older than average and tend to be smaller. In Toronto, on average they have newer buildings with newer amenities and they tend to be larger and have swimming pools and such, which lead to a higher rent,” Mr. Durango said.

Benjamin Tal, deputy chief economist at Canadian Imperial Bank of Commerce, said the lack of impact of individual investors on the cost in Toronto just reflects the high demand for rental properties in the city.

“In the big cities, where the issue is affordability, the question is whether or not the conditions are right for an increase in supply,” Mr. Tal said. “We may see an increase in purpose-built rental units, but in the GTA, it won’t be the case because of rent control. You will see the condo space continue to take over there.”

The first of its kind, this report looks to fill a “data gap” that was pointed out to the CMHC by academics and industry stakeholders, particularly having to do with ownership of rental units. The data in the report are based on a new set of questions that were added to the CMHC’s 2016 Rental Market Survey after a series of consultations.

“This is a big first step we took with this report,” Mr. Durango said. “Once we start filling in gaps you start finding other interesting questions worth pursuing.”

For example, in the Prairies and the Atlantic region, real estate investment trusts (REITs) own a larger share of the rental market, despite accounting for only 7.9 per cent of the share of rental units nationwide. They have a major presence in cities such as St. John’s, with a share of almost 50 per cent of the rental stock there, and more than 20 per cent in Edmonton, Saskatoon, Regina and Calgary. Why REITs were more represented in those particular markets was a question Mr. Durango hopes to eventually answer.

The CMHC also looked at foreign ownership of purpose-built rental units and found that they accounted for a fairly small share of the national market, coming in at just 2.4 per cent as of 2016. Toronto, Vancouver and Edmonton were among the cities above the national average in this area, with the highest share being 4.4 per cent in Toronto. Canadians living outside of the country were also lumped into this group.

“Purpose-built units are a long term type of investment. Much of this foreign money is not looking for capital appreciation over years. That’s not for them,” Mr. Tal said.

Mr. Durango said these findings were in line with the findings of the report looking at foreign ownership of condominiums that the CMHC put out in November, 2016. That report said that foreign ownership in Toronto and Vancouver, which had the highest rates in the country, came in at only 2.2 per cent and 2.3 per cent respectively.

THE GLOBE AND MAIL. JUL. 06, 2017. Toronto housing slumps fast after move to deflate bubble

MICHAEL BABAD AND JOSH O’KANE

The Toronto area’s over-the-top housing market is cooling fast, hosed down by government measures meant to stop a bubble from bursting.

Both sales and prices slumped in June for the second straight month in the wake of Ontario’s tax and rent-control measures, numbers released Thursday by the Toronto Real Estate Board show.

The market is expected to cool even more, though economists wonder if the easing will be short-lived, as was the policy-induced slump in Vancouver.

“We are in a period of flux that often follows major government policy announcements pointed at the housing market,” the group’s president, Tim Syrianos, said in releasing the June statistics.

“On one hand, consumer survey results tell us many households are very interested in purchasing a home in the near future, but some of these would-be buyers seem to be temporarily on the sidelines waiting to see the real impact of the Ontario Fair Housing Plan,” he added in a statement.

“On the other hand, we have existing homeowners who are listing their homes because they feel price growth may have peaked.”

Home sales in the Greater Toronto Area plunged 37.3 per cent in June from a year earlier, to 7,974.

On a monthly basis, sales tumbled 21.6 per cent in June from May, which, in turn, saw a 12-per-cent fall from April.

Average prices were still well up from a year earlier, by 6.3 per cent to $793,915, though that marks a far slower pace of increase than the region has seen.

And it doesn’t tell the monthly story: The average home price slipped 8.1 per cent in June from May, following May’s 6-per-cent drop from April.

The MLS home price index, which is seen as a better measure, was still up by more than 25 per cent from June, 2016, though that, too, has slowed.

Listings, too, surged again. New listing climbed 15.9 per cent from a year earlier, with active listing soaring almost 60 per cent.

Toronto housing market: Taking a breather or set for a correction?

The numbers, said Bank of Montreal senior economist Robert Kavcic, continue “to point to a much tamer overall market balance,” as May statistics demonstrated.

“The high end of the market appears to be absorbing the bulk of the policy changes, with single-detached home sales down 45 per cent year-over-year, roughly twice the decline seen in the condo space,” Mr. Kavcic said.

“That’s apparent in price trends too, with detached price growth now slowing to 24 per cent year over year … while condo prices have accelerated to 30 per cent year over year.”

As always in the Toronto area, you have to distinguish between area and home type.

A detached home in the 416 area still goes for an average $1.4-million, and in the 905 region for almost $950,000.

“The end result has been a better supplied market and a moderating annual pace of price growth,” Mr. Syrianos said.

Toronto, Vancouver: Housing bubbles or simply world-class cities?

The real estate group also released results of an Ipsos survey showing that 30 per cent of homeowners may list over the next year. Fifteen per cent want to sell because of the new Ontario measures.

The number of potential first-time buyers declined to 40 per cent from 53 per cent in an earlier poll.

The Ontario plan, which included a tax on foreign speculators and expanded rent control, is just one of the factors playing into the market.

Affordability is another, as are rising interest rates.

The real estate group also cut its forecast for this year to sales of between 89,000 and 100,000, with price increases of between 13 and 19 per cent.

Of course, that takes into account the unrelenting surges that preceded the Ontario measures.

At a media briefing, TREB director of market analysis Jason Mercer said that if sales through the end of 2017 are in the low end of the board’s forecast, around 89,000 sold, “it’ll suggest we haven’t seen many people move back into the marketplace,” likely in connection with a potential Bank of Canada interest rate increase.

“We could see a bit of a whipsaw like we did in Vancouver where we experience a pullback now, but a lot of buyers move back into the marketplace over the next year or so,” Mr. Mercer said when asked if his group had learned any lessons from Canada’s most expensive housing market and its own 15-per-cent foreign buyers tax.

Vancouver condo prices surge amid apparent thaw

Royal Bank of Canada, in a new forecast this week, projected Ontario resales will fall 5.7 per cent by the end of the year, and further 6.9 per cent this year.

Prices, however, will finish out the year 14-per-cent higher, with the pace of growth easing to just 1 per cent in 2018, RBC said.

“Our view is that the introduction of Ontario’s Fair Housing Plan will be a turning point for the provincial market,” said senior economist Robert Hogue.

“We expect the sharp drop in home resales that occurred since the plan’s announcement in April to be largely sustained, even though we believe that the effect of the plan itself will be temporary (perhaps up to six or nine months),” he added in his study.

“Rising interest rates and stretched affordability will be come increasingly restraining forces once the market has adjusted to the policy changes. We project moderate - but healthy- declines in Ontario home resales in both 2017 and 2018.”

How RBC sees your housing market

RBC’s other notable change came in British Columbia, where it sees sales falling 11.4 per cent in 2017 and 7.8 per cent in 2018. Prices will still be up, though, by 2.3 per cent this year, and 1.5 per cent next.

That’s actually better than expected because of the temporary nature of B.C.’s decline, Mr. Hogue said.

“But we still expect poor affordability and rising interest rates to weigh on the market in 2018, keeping resales on a downward track and containing the pace of price increases to low single digits.”

REUTERS. Jul 6, 2017. Toronto home sales tumble in June as buyers move to sidelines

OTTAWA (Reuters) - Home sales in the red-hot Toronto market fell for the third consecutive month in June, while more owners put their properties up for sale as they worried a rapid acceleration in prices had peaked, data showed on Thursday.

Sales in Canada's largest city fell 37.3 percent last month from a year ago, the Toronto Real Estate Board (TREB) said.

New listings rose 15.9 percent from last year, though that was slower than the hefty 48.9 percent annual increase in May.

The Ontario government introduced a number of measures in late April, including a foreign buyers tax, to try to cool the Toronto housing market amid fears of a bubble.

While potential buyers are waiting on the sidelines to gauge the impact of the government's measures, existing owners are listing their homes because they believe price increases may have peaked, TREB's president Tim Syrianos said.

The slowdown comes as the Bank of Canada has set the stage for interest rate hikes that could come as soon as next week. Some have blamed low rates for encouraging consumers to take on too much debt and fueling the housing market.

Higher rates would likely exaggerate the impact of the Ontario measures on the Toronto market, said Robert Kavcic, senior economist at BMO Capital Markets.

"If we do get 50 basis points of rate hikes over the course of the rest of the year, that chips away at affordability a little bit and probably extends the downturn a bit, especially at the higher end of the market," Kavcic said.

Separate data showing Canadian exports and imports hit record highs in May helped reinforce expectations of hikes on the horizon. The central bank cut rates twice in 2015 during the oil price downturn and has held at 0.50 percent since.

The long housing boom in Canada has raised concerns the country could see a painful correction but policymakers have said the ingredients for a U.S.-style crash are not there.

The financial regulator said on Thursday it plans to ban some bundled residential mortgages to clamp down on risky lending.

The average Toronto home price was C$793,915 ($611,880), up just 6.3 percent from last year, compared with a 14.9 percent annual increase in May.

Given Ontario's moves and the possibility of higher rates, TREB forecast 2017 sales at between 89,000 and 100,000 homes, down from 2016's record 113,044 homes.

(Reporting by Leah Schnurr; Editing by Meredith Mazzilli and Phil Berlowitz)

PM

The Globe and Mail. 6 Jul 2017. Amid uncertain times, Trudeau gives sunny speech to Scottish grads.When Hal Morrissey Gillman arrived at the University of Edinburgh for his graduation ceremony on Wednesday, he didn’t expect to see Prime Minister Justin Trudeau.

PAUL WALDIE, EUROPEAN CORRESPONDENT EDINBURGH

“I was surprised to see him,” Mr. Morrissey Gillman said after the ceremony as he clutched his anthropology diploma. “There was no preannouncement about it.”

Mr. Trudeau made the surprise visit to pick up an honorary doctorate and offer some words of wisdom to the graduating class. He talked about the 15 per cent of Canadians who have Scottish connections, he mentioned his grandfather’s Scottish roots and drew laughs when he referred to his own background as a bouncer and snowboard instructor. His advice to students was to concentrate on small things such as doing good deeds and “sending your mom flowers on a day other than Mother’s Day.”

“Your actions, today and tomorrow, big and small, have an impact. So be kind. Say please and thank you. And hold the door,” he said.

His star power was evident in the eyes of many students, who gave him a thunderous ovation and a round of cheers. Afterward, he took a stroll down some city streets afterward, visiting the National Museum of Scotland and paying a visit to the Queen at Holyrood Palace. But the friendly reception he received here in Scotland will fade starting on Thursday when he heads to Hamburg and the beginning of the Group of 20 summit. That’s where the hard work of dealing with issues such as trade, climate change and youth unemployment will be tackled. And that’s what students at the University of Edinburgh were concerned about on Wednesday.

Mr. Morrissey Gillman has no idea what he’ll do now that he has a degree. He appreciated Mr. Trudeau’s uplifting message, but he has bigger things to worry about – such as finding a job.

“That’s the big question,” he said when asked what he plans to do now that he has a degree. Then he turned to his parents and said, “I guess I’ll head home for a little bit. If that’s alright, if you’ll have me?”

These are uncertain times in Scotland. The economy has been struggling for the past two years even as the rest of Britain has roared ahead. Full-time jobs are scarce, the country’s prospects after Brexit don’t look good and the prolonged battle over Scottish independence has left the country’s future uncertain.

“We’re getting a picture which is fairly pessimistic about the prospects for the Scottish economy,” said Stuart McIntyre, a professor of economics at the University of Strathclyde in Glasgow.

The basic numbers don’t look promising. Scotland’s economy shrank in the last three months of 2016 and while it rebounded sharply in the first quarter of 2017, much of the added growth came from one-off items such as a major steel mill coming back on line. And while the unemployment rate has hit a low of 4 per cent, that figure belies the fact that most of the job creation has been through self-employment and that far more people have dropped out of the work force than anywhere else in the United Kingdom. Brexit could make things worse.

“Brexit will be a big headwind,” Prof. McIntyre said. He noted that Scotland’s population is aging at a faster rate than across Britain and that Brexit is expected to restrict immigration. Brexit will be felt “most acutely in Scotland because we have a need for more migration than the rest of the U.K.,” he said. Scotland’s financial sector, a major part of the economy, could be hit, too, from Brexit as firms lose so-called passport privileges that allow them to set up in Britain and serve clients across the European Union.

That’s the kind of message that gives pause to people such as Anna Stopford, who was celebrating her graduation on Wednesday. She welcomed Mr. Trudeau’s visit to the university as well, and knew a fair bit about the Canadian Prime Minister, having studied politics and followed his fortunes online.

“It was quite honouring to have him with us today,” she said. But she’s also worried about the future and her job prospects. “I have no plans,” she said when asked what she’ll do now. “I hear a lot of doom and gloom [about the job market] and it doesn’t seem like a good situation. I think if you are equipped with a good degree and enough experience, I think you’ll be able to find a job. But I don’t have any experience.”

Brexit is troubling for students such as Nick Hawkes, who also graduated with a degree in politics on Wednesday. He enjoyed Mr. Trudeau’s speech and he’d studied Canadian politics as a member of the Commonwealth youth Parliament program. But he also has no idea what he’ll do now and he’s concerned about looking for a job in Britain with Brexit looming.

“Brexit it is quite worrying,” he said. He’s hoping that the British government may soften its approach to negotiations with the EU and leave room for Britain keeping some ties to the bloc. “The world will go on and hopefully we’ll keep on going,” he said.

Another graduate, Jamie McDonald, said he might head to Canada because of Brexit. He studied at McGill University last year and now has a degree in international relations from Edinburgh. He voted against Brexit in last year’s referendum on Britain’s membership in the EU and said if he can’t go to Canada, he’ll stay in Scotland. His hope is that Scotland becomes independent and remains part of the EU. “I think Edinburgh is really an exciting place to be,” he said.

As Mr. Morrissey Gillman celebrated his graduation, his mother, Jackie Morrissey, sang Mr. Trudeau’s praises. She follows him on Twitter and embraces his liberal outlook. “It was so cool that he was here because he does have that kind of ‘wow’ celebrity status,” she said.

She’s optimistic about her son’s future but she’s well aware of the big challenges facing Scotland, including the possibility of independence. The family is divided over Scottish independence but Brexit is bringing them around to the same conclusion. Mr. Morrissey Gillman was alone in voting against independence during the 2014 referendum, but now he’s changed his mind.

“I actually voted No in the first referendum for the sake of unity with the rest of Britain. But obviously the curve ball of Brexit kind of changes all that for me personally.” Now, he’d vote Yes, hoping an independent Scotland would stay in the EU. “That’s our future,” he added.

The Globe and Mail. The Canadian Press. 6 Jul 2017. PM gives the Queen flag from Peace Tower. Prime Minister Justin Trudeau marked Canada’s 150th birthday with the Queen on Wednesday by giving her the Canadian flag that flew on the Peace Tower on Canada Day.

MIA RABSON

EDINBURGH - On a daylong stop in Edinburgh, Mr. Trudeau met with the Queen for a private audience at the Palace of Holyroodhouse, her official Scottish residence, where he presented her with the Maple Leaf raised last weekend.

“It was as it often is, as it always is, a warm and engaged conversation in which she displayed knowledge and interest in a wide range of global affairs and goings on in Canada,” Mr. Trudeau said in a brief statement following the meeting.

The meeting was arranged to mark Canada’s sesquicentennial since the Queen, 91, is no longer able to travel as far as Canada; Prince Charles and the Duchess of Cornwall had attended Canada Day events in her place.

Mr. Trudeau’s conversation with the Queen began with a chat about the fact the Prime Minister had received an honorary doctorate from the University of Edinburgh earlier in the day.

“Probably dismays a number of my former professors to see me as a doctor now,” Mr. Trudeau said as they walked together toward a sitting area.

The Queen said his getting the degree was “lovely.”

While Mr. Trudeau was inside the palace, a small number of protesters approached the gates holding placards calling for an end to the “tar sands” and to grant Indigenous rights.

It was but a tiny taste of what is to come for Mr. Trudeau at the G20 summit in Germany, where tens of thousands of anti-globalization protesters have already started to descend on the northern port city of Hamburg.

As many as 20,000 police have been commissioned to safeguard the event from protesters calling their demonstration “Welcome to Hell – Don’t Let Capitalism Get You Down.”

One of the stated goals of the protesters is to block the roads leading into the site, given there are limited ways in and out.

Fireworks are also expected inside the meeting as the heads of 20 of the word’s largest economies clash over trade, climate change and international security.

For Mr. Trudeau and host German Chancellor Angela Merkel it is the Paris climate-change agreement they want as job No. 1.

Ms. Merkel has been working steadily to try and isolate U.S. President Donald Trump for his decision to withdraw from the agreement, which commits countries to cutting their emissions in an attempt to keep global warming to within two degrees compared to preindustrial levels.

Andrew Light, a senior fellow at the World Resources Institute and member of the climatechange negotiation team under former president Barack Obama, said the hope is that the United States is the only one at the G20 that won’t sign the climatechange section of the communiqué.

But he said there is fear countries such as Russia and Saudi Arabia will use the United States’ backing away to reduce their own commitments in areas such as international climate finance or commitments to stop funding coal development in other countries.

________________

LGCJ.: