CANADA ECONOMICS

ECONOMY

OFFPRINT. e-Gonomics. Canada ECONOMICS. IMF. IMF 2017 Article IV Consultation with Canada.

FULL DOCUMENT: https://drive.google.com/file/

IMF. July 13, 2017. IMF Executive Board Concludes 2017 Article IV Consultation with Canada

On July 5, 2017, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation [1] with Canada. The 2017 Article IV consultation centered on policies to secure stronger, inclusive, and self-sustaining growth, while preventing the further build-up of housing market imbalances.

The economy has regained momentum, supported by the authorities’ pro-active growth strategy, but complex adjustments are still at play. While personal consumption is robust, business investment remains weak, non-energy exports have underperformed, and housing market imbalances have risen. Externally, the global outlook has improved, but uncertainty surrounding global trade and risks of economic fragmentation may negatively affect the durability of the Canadian recovery.

The positive momentum in the economy is expected to continue in the near term. A strong U.S. economy, expansionary fiscal and monetary policy, and stable oil prices are expected to lift real GDP growth to 2.5 percent in 2017 and 1.9 percent in 2018. Residential construction is expected to expand at a more moderate pace, reflecting tighter macroprudential measures. The increase in exports and stable domestic demand will generate growth in business investment and, along with an increase in national savings, narrow the current account deficit to 3 percent of GDP by 2018.

The medium-term outlook is less upbeat because of structural impediments. Weak external competitiveness, low labor productivity growth, and population aging are expected to limit potential growth to about 1.8 percent, below the recent average of 2.6 percent.

Risks to the outlook are significant. On the upside, stronger-than-expected growth in the U.S. could boost export and investment in the near term. On the downside, risks stem from several potential factors—including the risk of a sharp correction in the housing market, high uncertainty surrounding U.S. policies, or a further decline in oil prices—that can be mutually reinforcing. Policy choices will therefore be crucial in shaping the outlook and reducing risks.

Executive Board Assessment [2]

Directors commended the authorities for successfully reinvigorating the Canadian economy, although they noted that the ongoing recovery is skewed toward consumption. At the same time, there are uncertainties around the economic outlook.

Directors agreed that fiscal policy should be geared toward ensuring that the cyclical recovery is secure and inclusive. The fiscal stance should remain expansionary in 2017, while in 2018, as the output gap closes, no further increase in the deficit would be required. Directors noted that if downside risks materialized, additional fiscal stimulus should be the first line of defense. At the provincial level, fiscal consolidation should continue but at a gradual pace. Directors emphasized that maintaining fiscal discipline over the medium term will be important. They welcomed the authorities’ commitment to set debt‑to‑GDP on a declining path, and some Directors called for the reinstatement of a fiscal rule once the economy stabilizes around its potential.

Directors agreed that monetary policy should stay accommodative and be gradually tightened as signs of durable growth and inflation pressures emerge. They recognized that monetary easing could complement fiscal stimulus, and may need to be considered along with unconventional measures if economic activity contracts significantly, although there is a risk that it could exacerbate housing imbalances.

Directors agreed that the proposed Canada Infrastructure Bank (CIB) would help foster long‑term growth. Its success would depend on ensuring a transparent project selection process that balances public and private interests. Communicating clearly the CIB’s benefits could help persuade the public of the need for user fees and the involvement of the private sector in public infrastructure.

Directors noted that Canada’s financial sector is well capitalized and has strong profitability, but that there are rising vulnerabilities in the housing sector. In this regard, Directors generally encouraged the authorities to consider a further tightening of macroprudential and tax‑based measures to protect the resilience of the household and banking sectors. Directors also encouraged the federal and provincial governments to continue to work collaboratively in addressing housing issues.

Directors took note of the differences in view between the staff and the authorities regarding the characterization of the provincial property transfer taxes on non‑residents. Many Directors noted that the taxes did not have the objective to restrict capital flows and their effect on aggregate capital flows is likely minimal. While taking note of the staff’s explanation that, under the Institutional View on the liberalization and management of capital flows, the taxes would be considered capital flow management measures, some Directors felt that the measures appeared justified in view of the stated intent to address housing affordability concerns. Many Directors pointed to the practical challenges involved in analyzing borderline cases and formulating appropriate policy advice. In this context, a number of Directors urged staff to assess the benefits and costs of alternative macroprudential and tax‑based measures vis‑à‑vis competing policy objectives.

Directors agreed that revitalizing productivity is key to boosting Canada’s long‑term growth. Structural policies should be transparent, well targeted, create an “innovation‑ and competition‑friendly” business environment, and implemented in coordination between federal and provincial authorities. A holistic review of the tax system would help assess the scope for improving efficiency, while maintaining Canada’s tax competitiveness. More could also be done to reduce FDI restrictions and regulatory barriers to entry in key sectors of the economy.

Directors agreed that diversifying Canada’s export markets would facilitate its integration into global supply chains. They commended the Comprehensive Economic and Trade Agreement with the EU and encouraged Canada to pursue closer trade integration with Asia.

Canada: Selected Economic Indicators

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[2] At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country's authorities. An explanation of any qualifiers used in summings up can be found here: http://www.imf.org/external/np/sec/misc/qualifiers.htm.

IMF. July 13, 2017. IMF COUNTRY FOCUS. Unlocking Canada's Future Growth Through Infrastructure

By Kotaro Ishi, David Gentry, and Cheng Hoon Lim, IMF Western Hemisphere Department

While the Canadian economy has regained momentum, the outlook is less upbeat. In its annual assessment of the Canadian economy, the IMF said higher infrastructure spending can spur short-term and long-term growth.

Canada’s economy expanded at an annual pace of nearly 4 percent in the first quarter of 2017—the fastest growth rate among the Group of 7 countries. With the economy’s adjustment to lower oil prices almost complete, growth is expected to accelerate to 2.5 percent this year, up from 1.5 percent in 2016.

However, the recovery comes mainly from stronger consumer demand and housing activity, with business investment and nonenergy exports remaining weak. This raises questions about the sustainability of the recovery at a time when Canada’s economic outlook is subject to significant risks from rising housing market imbalances and greater uncertainty about U.S. trade and tax policies.

Looking ahead, low productivity growth and population aging will also weigh on potential growth. To support the economy, the Canadian government is looking at ways to raise infrastructure spending—a key factor that improves productivity, the report said.

An aging population

Historically, Canada’s economic growth has been largely driven by growth in the labor market. However, Canada, as many other economies, is experiencing a rapid aging of its population, as the “baby boomers” born after World War II reach retirement age. The number of persons aged 15-64 (the working age) as a share of the total population has fallen by about 2 percentage points since 2010—from about 69 percent—and is projected to fall another 7 percentage points over the next 20 years.

The government has launched ambitious structural reforms to reverse the declining trend in Canada’s long-term growth, such as reducing barriers to internal trade, improving the innovation framework, investing in education and training, and promoting high-skilled immigration. The Canadian government has also made infrastructure spending a cornerstone of its growth strategy as various studies have shown that, if done right, investing in infrastructure brings both short-term and long-term payoffs. The federal government plans to double public investment to Can$187 billion (equivalent to 7½ percent of GDP) over the next decade.

A new infrastructure bank

As part of its infrastructure investment plan, the federal government recently created a new Canada Infrastructure Bank, which will become operational by late 2017. It will focus on large, complex, and revenue-generating projects, which are in the public interest but would not be feasible because the risks are too large and the financial returns too small to attract private investors. The Canada Infrastructure Bank will work closely with provincial and local governments, as well as private sector investment partners, to transform the way infrastructure is planned, funded, and delivered in Canada. The infrastructure bank is authorized to invest Can$35 billion.

By attracting private capital, demand for budget resources would be lowered, reducing public borrowing or freeing up taxpayer money for other high priority projects. The Canada Infrastructure Bank differs from the Public Private Partnerships model, in which the government retains ownership of the asset and funds the project from the budget.

Securing public acceptance

Public acceptance of the Canada Infrastructure Bank’s basic strategy is a precondition to its success. The government and the Canada Infrastructure Bank need to enhance public understanding of the benefits of involving private investors by pointing out that they bring their technical competence, discipline, and creativity to help reduce risk and lower the overall project cost.

Publication of the selection criteria for projects and investors—and competitive selection of investors—will give the public confidence that their interest is being served at the least cost.

The CIB is an important new tool to promote long-term growth in Canada, the report said.

The Globe and Mail. Jul. 13, 2017. Reuters. IMF warns Canada on housing, trade; urges caution on rate hikes

OTTAWA — The International Monetary Fund said on Thursday that while Canada’s economy has regained momentum, housing imbalances have increased and uncertainty surrounding trade negotiations with the United States could hurt the recovery.

The report, written before the central bank raised interest rates by a quarter of a percentage point on Wednesday to 0.75 percent, also said the Bank of Canada’s current monetary policy stance is appropriate, and it cautioned against tightening.

“While the output gap has started to close, monetary policy should stay accommodative until signs of durable growth and higher inflation emerge,” it said, adding that rate hikes should be “approached cautiously.”

In a statement following its annual policy review with Canada, the IMF cautioned that risks to Canada’s outlook are significant - particularly the danger of a sharp correction in the housing market, a further decline in oil prices, or U.S. protectionism.

It said financial stability risks could emerge if the housing correction is accompanied by a recession, but said stress tests have shown Canadian banks could withstand a “significant loss” on their uninsured residential mortgage portfolio, in part because of high capital position.

House prices in Toronto and Vancouver have more than doubled since 2009 and the boom has fueled record household debt, a vulnerability that has also been noted by the Bank of Canada. Some economists believe the rate hike this week was at least partly aimed at reducing financial system imbalances.

“The main risk on the domestic side is a sharp correction in the housing market that impairs bank balance sheets, triggers negative feedback loops in the economy, and increases contingent claims on the government,” the Fund said, reiterating previous warnings about Canada’s long housing boom.

The Fund also warned U.S. trade protectionism could hurt Canada’s economy, and laid out a scenario for an increase in tariffs that could come with the renegotiation of the North American Free Trade Agreement.

It said if the United States raises the average tariff on imports from Canada by 2.1 percentage points and there is no retaliation from Canada, there would be a short-term negative impact on real GDP of about 0.4 percent.

The Fund recommended that fiscal policy continue to take the lead in supporting the recovery, but said no further stimulus will be required as the economy regains strength - unless downside risks materialize.

FINANCE

EDC. WEEKLY COMMENT. 12 July 2017. Is Inflation Back?

By Peter G Hall,

Vice-President and Chief Economist

Prices are rising again in a way we haven’t seen for years. That’s usually enough to set off groans all over. After all, inflation is one of the two ingredients of the ‘misery index’, generally regarded as an economic no-no. We’ve been without it for so long that the word itself had all but dropped from the vernacular. But its absence brought no joy; it was missing for all the wrong reasons – weak demand, structural challenges, uncertainty on multiple fronts. So if it’s back, should we be ecstatic, relieved or worried?

Recent history serves up a good answer. Prices rose sharply in 2008 as demand pressed the limits of productive capacity the world over, and concern mounted. Recession fixed that: consumer prices plunged, tumbling onto the red in the US, Canada and Japan, and getting close to negative numbers in Europe. But the movement didn’t calm concerns, it exacerbated them. Inflation is bad, but deflation is worse. Perplexity turned into panic as job 1 became stabilization. Considerable efforts paid off: prices did revive, meandering in a slow-growth range for about 5 years. We still weren’t happy, though, as prices were reflecting stubbornly sluggish demand. Then in mid-2014, panic 2.0: prices slumped again, sparking fears that even the meager growth we were seeing was faltering.

Those worries lasted about a year. Then, in late 2015, prices found their feet again, and rose, although growth was quite modest. We still weren’t happy. It seems that at long last, the world swung into gear in mid-2016. Since then, prices in most of the developed world have climbed up into target range, and in some cases, above target for brief episodes.

Are we happy yet? Not exactly; the speed of the price updraft has ignited concern that the ultra-loose monetary policy of the past 7 years will send prices skyward. Monetary authorities are all talking tightening, including plans for a balance sheet normalization that will see the mopping up of excess liquidity, first by the Fed, and then others in sequence. Their worry is that they’ll get behind the curve; given the lags in the monetary transmission mechanism, they need to act on inflation 12-18 months ahead of its onset to achieve stability. Seeing this, businesses are keen to know how to arm themselves for higher borrowing costs, and consumers, well used to cheap money by now, are concerned about the impact on their finances.

The worries are well-founded. Years of sub-par growth have stanched investment and hiring. Now, nascent growth is putting pressure on the tightly-managed capacity in place. Broad evidence of pent-up demand suggests that there’s lots of growth still coming. If anything, price pressures are going to be with us in the coming months. It’s key to know that this new price spurt – obvious in North America, Western Europe and even Japan – is happening for good reasons, conditions we have longed for since the recession. In that sense, a little inflation is not a bad thing. But as it occurs, the greater worry is managing price expectations. If those get out of hand, they’re difficult to control without tough monetary medicine.

Canada’s recent experience is similar to everyone else’s, although the context for us is a bit different. Where others are seeing pent-up demand, Canada’s internal fundamentals are more frothy. Consumers are carrying outsized and growing debt loads, making them more acutely sensitive to interest rate hikes. The housing market is in bubble territory, and also vulnerable to monetary tightening. But the irrepressible intensity of domestic activity together with recent red-hot export growth now has the Bank of Canada in rate-ratchet mode.

The shift is a key challenge not only for Canada but for monetary authorities everywhere. What we are witnessing is a welcome but worrisome regime shift, from ultra-loose financing to what we used to know as normal. Step-wise moves are necessary to avoid disrupting growth, but choosing the appropriate tightening path is not for the faint of heart. What is clear is that there is now less uncertainty about the need to move; even the ‘doves’ are thinking they need to be faster rather than slower.

The bottom line? It seems like when it comes to demand conditions, we have what we all wished for. But we’re still not happy. Realizing our dreams comes with a price tag that these days seems to be changing rapidly. Buckle up for the ride!

The Globe and Mail. 13 Jul 2017. Rates: Bank coy on timing of next hike

Higher rates will help to cool the housing market and rein in debt-fuelled purchases of cars and other consumer items.The move to higher rates isn’t just a Canadian phenomenon. Central bankers in the United States and Europe are also talking about ending emergency measures put in place to keep credit flowing after the 2008-09 financial crisis. U.S. Federal Reserve chair Janet Yellen told Congress on Wednesday that the economy is now healthy enough to handle further steady increases in its benchmark interest rate as well as a start to selling its $4-trillion store of commercial bond holdings later this year.

One of the puzzles for the Bank of Canada and other central banks is that inflation is still low and falling. Central bankers typically raise rates to keep inflation in check. That isn’t the problem in Canada, where consumer prices have been rising at well below the bank’s 2-per-cent inflation target.

But Mr. Poloz said he’s looking beyond current conditions, focusing on where inflation will be a year or two from now. “Reacting only to the latest inflation data would be akin to driving while looking in the rear-view mirror,” he explained to reporters in Ottawa after the rate announcement.

Inflation may weaken further in the months ahead before getting back to the 2-per-cent target by the middle of next year as excess capacity in the economy fades, according to the Bank of Canada’s Monetary Policy Report, released on Wednesday. The bank argues that recent declines in inflation are largely temporary – the result of lower gasoline prices, electricity rebates in Ontario, intense food-price competition and unexpectedly weak car prices.

The bank is still being coy about when its next rate hike will come. The bank will “remain highly data-dependent,” Mr. Poloz insisted. “Monetary policy is not on a predetermined path.”

Many economists are expecting at least one more rate hike this year, most likely in October, when the bank releases its next quarterly forecast.

Bank of Montreal chief economist Douglas Porter said the Bank of Canada’s move begins a process that could see the central bank’s key rate bumped up to 1.5 per cent by mid-2018. “And so the tide begins to turn,” he said.

Unless inflation continues to fall, Canadians should expect more rate hikes, TD economist Brian DePratto said.

The Bank of Canada said the 3.5-per-cent annual pace of GDP growth in the first quarter will “moderate” over the rest of the year, but remain “above potential.” Among other things, the bank expects consumer spending, exports and business investment to drive growth in the months ahead.

The bank pointed out that housing activity has already abated, particularly in the Toronto area, where homes sales have fallen sharply.

The bank now estimates that the socalled output gap – a measure of excess labour, factory capacity and the like – will close “around the end of 2017.” That’s significantly sooner than its assessment in April that the gap would disappear in the first half of next year.

The Bank of Canada cut rates twice in 2015, taking out what Mr. Poloz called “insurance” against the fallout from the collapse in the price of oil and other commodities.

The Bank of Canada now expects the economy to grow 2.8 per cent this year, or faster than the 2.6-per-cent pace it predicted in its April forecast. GDP growth will slow to 2 per cent in 2018 and 1.6 per cent in 2019, the bank said.

The Globe and Mail. 13 Jul 2017. Banks boost prime rates after BoC hike. Higher borrowing costs could sting Canadian households carrying heavy levels of debt

TIM SHUFELT

JAMES BRADSHAW

It will take very little time for many Canadian borrowers to feel the effects of the first rate hike in seven years.

After the Bank of Canada raised its key overnight lending rate by 25 basis points – a quarter of a percentage point – on Wednesday morning, the country’s largest banks quickly followed suit. By the end of the day, the Big Six banks had all raised their prime lending rates to 2.95 per cent from 2.7 per cent, effective Thursday. As the basis for most variable loans, the higher prime rate will immediately result in additional borrowing costs on products like variable-rate mortgages, home equity lines of credit, and other credit lines.

The domino effect of rate hikes could become a familiar theme in the months ahead as further potential rate hikes put scrutiny on overly indebted Canadian borrowers, many of whom could be tested by higher interest costs. For banks, the rise in rates will help boost profits earned on loan portfolios by providing better margins.

“Borrowers should be prepared for rates to continue to push up toward historic norms,” said James Laird, co-founder of rate-comparison site RateHub.ca. “We’re still in an abnormally low interest-rate environment.”

Meanwhile, Canadian savers with little debt who are hoping to finally start to earn decent returns on savings may have to continue to be patient. Returns on deposits not linked to prime rates are typically much slower to respond to a rising rate environment, Mr. Laird said.

“They’re much quicker to pass along the hike when they’re the ones collecting the interest, rather than when they’re the ones paying it.”

That appears to have been the case the last time the Bank of Canada raised rates.

Starting in June, 2010, three successive 25-basis-point rate hikes lifted the overnight lending rate from emergency levels brought on by the global financial crisis.

Rates: No change yet on guaranteed investment certificates

As the Bank of Canada rate rose to 1 per cent from 0.25 per cent, Canadian banks hiked their prime rates in lockstep. But the returns on guaranteed investment certificates remained just where they were through the rest of the year, averaging below 2 per cent, according to Bank of Canada data.

The course of rate policy in 2010 was ultimately interrupted by renewed weakness in the global economy, including the European sovereign debt crisis. Then the oil price shock beginning in 2014 forced Bank of Canada governor Stephen Poloz to again cut rates.

Now, once again the domestic economy has improved enough to justify a reduction of monetary stimulus. While Wednesday’s rise of 25 basis points still leaves rates at ultra-accommodative levels from a historical perspective, Canadian borrowers have grown unaccustomed to rates moving upward, Mr. Laird said.

“In 2010, [the hikes] didn’t feel shocking, since we had just seen some crazy moves on the way down, getting to all-time lows faster than anybody expected. Now, seven years later, the market has gotten used to these rates. So today’s rise feels a little more jarring.”

After announcing the hike on Wednesday, the central bank acknowledged that the economy may be more sensitive to higher interest rates than in the past given the country’s amount of household debt. Canadian households owed $1.67 in debt for every dollar in disposable income at the end of last year. Since 2009, when the housing boom started, total household debt has risen more than 50 per cent to $2-trillion and mortgages account for about 66 per cent of that, according to Statistics Canada.

“We will need to gauge carefully the effects of higher interest rates on the economy,” the central bank wrote.

Higher interest rates are good for banks, which profit from the difference between the interest they charge borrowers and what they pay to savers.

So while prime rates generally move in tandem with the central bank’s benchmark rate, in 2015, when the Bank of Canada cut its overnight rate by 25 basis points twice during the year, most banks responded by cutting their primes by just 15 basis points.

Passing through the full hike will help boost the banks’ margins.

The Globe and Mail. 13 Jul 2017. Parkinson on what it means for the economy. The Bank of Canada, a famously inflation-targeting central bank, is raising interest rates in defiance of its own inflation measures. At least for a while.

DAVID PARKINSON

The central bank’s willingness to seriously bend its own rules on inflation suggests a couple of possible explanations. One is that it has given up waiting for inflation to do what inflation is supposed to do in an economic recovery, and is turning to other economic signposts to guide its policy decisions. Another is that it has other reasons to lift rates off their floor and it is jumping through a window of opportunity before it starts to close.

I’d suggest it’s a little from column A, a little from column B.

The decision Wednesday by the central bank to raise its key rate to 0.75 per cent from 0.5 per cent comes at a time when Canada’s consumer price index inflation rate is a mere 1.3 per cent – nowhere near the Bank of Canada’s official target of 2 per cent. The bank’s own preferred measures for core inflation – which are supposed to cut through transitory gyrations and inherently volatile sectors to gauge the underlying inflation colouring the economy more broadly – also show an average reading of 1.3 per cent. » The Bank of Canada doesn’t believe these inflation measures are giving us an accurate accounting of inflation in this country. It’s now looking at an output gap (the difference between what the economy is producing and what it is capable of producing at full capacity) that it expects will close by the end of this year – several months sooner than it projected in its last quarterly outlook in April – reflecting what looks like a sustained and broad-based pickup in economic growth this year.

Normally, inflation would signal when an economy is nearing capacity, by rising. That’s precisely why the Bank of Canada started targeting inflation more than a quarter-century ago, because it serves as a timely monthly proxy of capacity pressures. It’s not doing so now. The bank is, essentially, declaring inflation to be wrong – at least temporarily.

Inflation has looked wrong to this central bank many times during this unusually long and decidedly weird post-Great Recession recovery. It has swung from signalling a false low to a false high and back again. The central bank even adopted three new measures for core inflation late last year, to try to see through temporary distortions and get to true underlying inflation; now, it is saying that those, too, are tainted by temporary distortions.

So Bank of Canada Governor Stephen Poloz has decided to wait no more for inflation to show its head, amid mounting statistical evidence of the economic upturn’s staying power. While the apparent rapid closing of the output gap may justify the decision, there may be other reasons why the country’s monetary policy brain trust is impatient to get going on rate hikes.

Frankly, any central bank with near-zero interest rates right now should be concerned about getting their rates off the floor before the next economic slowdown comes. With the U.S. economy already running very close to full employment, its expansion might be lucky to have two years left in it. Canada might have a little longer, as its recovery was delayed by the oil shock, but even the Bank of Canada expects growth to slow significantly in 2019.

If the bank were to wait until inflation found its way back to the 2-per-cent target – which it projects for mid-2018 – that would leave it with precious little time to restore rates before growth may start to slow again. Should a slowdown turn into an outright recession, a late start on rate hikes would leave it with very little room to provide help to such a flagging economy. Alternatively, a late start might force it to raise rates more quickly, which would ratchet up the pressure on a highly sensitive area for Canada’s economy – its perilously high household debts.

“There is clearly an advantage to adopting an earlier and more gradual rate hike path, to allow a more gradual adjustment to higher rates in the highly leveraged household sector,” Royal Bank of Canada senior economist Nathan Janzen said in a research note this week. “To achieve that, rates have to begin to rise before the economy is overheating and inflation pressures have emerged.”

We can certainly expect one more rate hike in the second half of the year. The bank believes the economy has largely completed its adjustment to the oil-price collapse, which implies that, at very least, it no longer needs the two rate cuts it made in 2015 to speed up that adjustment. A second quarter-point increase would succeed in removing that oilshock stimulus.

After that, the route is still upward, but the path gets a bit foggy.

A closing of the output gap around year end would justify further hikes, to keep the economy from overheating. But Mr. Poloz suggested the labour market still has slack that, if tapped as demand grows, could give the economy more potential output and delay reaching full capacity a little longer.

More crucially, the bank signalled it isn’t comfortable ignoring inflation for long. Indeed, the rate announcement explicitly tied future rate-hike decisions to “incoming data as they inform the bank’s inflation outlook.”

If inflation doesn’t shake off its doldrums in the next few months, the bank may have to decide again whether to follow its inflation-targeting mandate, or follow its gut. It’s unclear how many times it can go to that well before it has discredited its inflation target beyond repair.

Rate hike shows BoC bending inflation rules – at least for now

The Bank of Canada, a famously inflation-targeting central bank, is raising interest rates in defiance of its own inflation measures. At least for a while.

The central bank’s willingness to seriously bend its own rules on inflation suggests a couple of possible explanations. One is that it has given up waiting for inflation to do what inflation is supposed to do in an economic recovery, and is turning to other economic signposts to guide its policy decisions. Another is that it has other reasons to lift rates off their floor and it is jumping through a window of opportunity before it starts to close.

I’d suggest it’s a little from column A, a little from column B.

The decision Wednesday by the central bank to raise its key rate to 0.75 per cent from 0.5 per cent comes at a time when Canada’s consumer price index inflation rate is a mere 1.3 per cent – nowhere near the Bank of Canada’s official target of 2 per cent. The bank’s own preferred measures for core inflation – which are supposed to cut through transitory gyrations and inherently volatile sectors to gauge the underlying inflation colouring the economy more broadly – also show an average reading of 1.3 per cent.

Parkinson: We can certainly expect one more interest-rate hike in the second half of the year

The Bank of Canada doesn’t believe these inflation measures are giving us an accurate accounting of inflation in this country. It’s now looking at an output gap (the difference between what the economy is producing and what it is capable of producing at full capacity) that it expects will close by the end of this year – several months sooner than it projected in its last quarterly outlook in April – reflecting what looks like a sustained and broad-based pickup in economic growth this year.

Normally, inflation would signal when an economy is nearing capacity, by rising. That’s precisely why the Bank of Canada started targeting inflation more than a quarter-century ago, because it serves as a timely monthly proxy of capacity pressures. It’s not doing so now. The bank is, essentially, declaring inflation to be wrong – at least temporarily.

Inflation has looked wrong to this central bank many times during this unusually long and decidedly weird post-Great Recession recovery. It has swung from signalling a false low to a false high and back again. The central bank even adopted three new measures for core inflation late last year, to try to see through temporary distortions and get to true underlying inflation; now, it is saying that those, too, are tainted by temporary distortions.

So Bank of Canada Governor Stephen Poloz has decided to wait no more for inflation to show its head, amid mounting statistical evidence of the economic upturn’s staying power. While the apparent rapid closing of the output gap may justify the decision, there may be other reasons why the country’s monetary policy brain trust is impatient to get going on rate hikes.

Frankly, any central bank with near-zero interest rates right now should be concerned about getting their rates off the floor before the next economic slowdown comes. With the U.S. economy already running very close to full employment, its expansion might be lucky to have two years left in it. Canada might have a little longer, as its recovery was delayed by the oil shock, but even the Bank of Canada expects growth to slow significantly in 2019.

If the bank were to wait until inflation found its way back to the 2-per-cent target – which it projects for mid-2018 – that would leave it with precious little time to restore rates before growth may start to slow again. Should a slowdown turn into an outright recession, a late start on rate hikes would leave it with very little room to provide help to such a flagging economy. Alternatively, a late start might force it to raise rates more quickly, which would ratchet up the pressure on a highly sensitive area for Canada’s economy – its perilously high household debts.

“There is clearly an advantage to adopting an earlier and more gradual rate hike path, to allow a more gradual adjustment to higher rates in the highly leveraged household sector,” Royal Bank of Canada senior economist Nathan Janzen said in a research note this week. “To achieve that, rates have to begin to rise before the economy is overheating and inflation pressures have emerged.”

We can certainly expect one more rate hike in the second half of the year. The bank believes the economy has largely completed its adjustment to the oil-price collapse, which implies that, at very least, it no longer needs the two rate cuts it made in 2015 to speed up that adjustment. A second quarter-point increase would succeed in removing that oilshock stimulus.

After that, the route is still upward, but the path gets a bit foggy.

A closing of the output gap around year end would justify further hikes, to keep the economy from overheating. But Mr. Poloz suggested the labour market still has slack that, if tapped as demand grows, could give the economy more potential output and delay reaching full capacity a little longer.

More crucially, the bank signalled it isn’t comfortable ignoring inflation for long. Indeed, the rate announcement explicitly tied future rate-hike decisions to “incoming data as they inform the bank’s inflation outlook.”

If inflation doesn’t shake off its doldrums in the next few months, the bank may have to decide again whether to follow its inflation-targeting mandate, or follow its gut. It’s unclear how many times it can go to that well before it has discredited its inflation target beyond repair.

The Globe and Mail. 13 Jul 2017. Central bank bets on growth. With rate hike, Bank of Canada bets on growth

JEREMY KRONICK

Canadian monetary policy has just seen one of its most significant U-turns in recent years. On May 24, the Bank of Canada announced that it was holding its overnight rate steady. The tone of the announcement was less dovish than the previous one, but contained nothing to indicate impending rate increases. Shortly after the May announcement, markets were predicting a 5-per-cent chance of a rate increase in July. However, in the days preceding Wednesday’s announcement, that probability surpassed 90 per cent. With the bank increasing rates on Wednesday, how did we get so quickly from there to here?

Let’s start with the case for the rate hike. Unemployment has fallen to 6.5 per cent, GDP growth in the first quarter of 2017 was robust at 3.7 per cent – and broad-based instead of concentrated on the housing sector – exports have been growing smartly and the June employment numbers came in stronger than expected. Furthermore, business investment has picked up and the Bank of Canada’s latest Business Outlook Survey prefigures more good news on that front.

The BoC’s own models are now projecting that the Canadian economy will be at full capacity by the end of 2017, earlier than before, with inflation reaching the 2-per-cent target by the middle of 2018. This would suggest that a return to levels of interest rates compatible with full employment and 2-per-cent inflation should start sooner rather than later to avoid having to increase rates too sharply later on, or risking a substantial overshooting of the inflation target.

What about the case against? The bank uses its forwardlooking indicators and its forecasting models to set an interest-rate path that will return inflation to target within six to eight quarters. It has been doing this since it adopted an explicit inflation target in 1991. But inflation has been consistently below 2 per cent for the past five years. The latest reading for May (released on June 23) was 1.3 per cent, lower than market expectations of 1.5 per cent, and well below the 2-per-cent target. This persistent undershooting of the inflation target supports waiting until inflation was clearly increasing before initiating a tightening cycle.

Additionally, projections in the bank’s Monetary Policy Report were based on a price of oil in the range of $50 (U.S.) to $55. The actual price has been fluctuating in the mid-40s, which does not bode well for a strong recovery in Alberta (and, to a lesser extent, in Saskatchewan and Newfoundland and Labrador).

Other uncertainties point in the direction of holding rates steady in the short run for insurance purposes. Inflation in the United States, like in Canada, is weak, and this may lead the U.S. Federal Reserve to hold off on its planned rate hikes. Impending NAFTA renegotiations are a cloud hanging over the evolution of Canada’s exports.

The market itself shrugged off these competing views on the Canadian economy and responded abruptly to a series of speeches and interviews by Governor Stephen Poloz and members of the bank’s governing council. As the media and markets latched onto the more overtly hawkish tone by the bank, the market probability of a rate increase moved up. The bank decision to hike rates, in the end, reflects a belief that the positive news will continue, eventually causing inflation to take hold if action is not taken.

As for what will happen going forward, the wording of Wednesday’s announcement was ambiguous. On the one hand, the announcement stressed that the bank expects the output gap to close by the end of 2017, earlier than previous estimates. Such an occurrence, with inflation at target, would entail more rate hikes as we move toward a so-called “neutral rate” somewhere between 2.5 per cent and 3.5 per cent.

However, the bank also ended its news release stating that future changes to the overnight target rate will occur only if economic data warrant such moves. With the bank having made one U-turn since the previous announcement, the odds of another look slim.

Jeremy Kronick is a senior policy analyst at the C.D. Howe Institute; Steve Ambler is the David Dodge Chair in Monetary Policy at the C.D. Howe Institute, professor of economics at the University of Quebec at Montreal, senior fellow of the Rimini Centre for Economic Analysis and a member of the Inter-University Centre on Risk, Economic Policies and Employment (CIRPEE).

The Globe and Mail. Jul. 13, 2017. Big Six banks hike prime rates, moving in step with Bank of Canada increase

TIM SHUFELT AND JAMES BRADSHAW

It will take very little time for many Canadian borrowers to feel the effects of the first rate hike in seven years.

After the Bank of Canada raised its key overnight lending rate by 25 basis points – a quarter of a percentage point – on Wednesday morning, the country’s largest banks quickly followed suit. By the end of the day, the Big Six banks had all raised their prime lending rates to 2.95 per cent from 2.7 per cent, effective Thursday. As the basis for most variable loans, the higher prime rate will immediately result in additional borrowing costs on products like variable-rate mortgages, home equity lines of credit, and other credit lines.

The domino effect of rate hikes could become a familiar theme in the months ahead as further potential rate hikes put scrutiny on overly indebted Canadian borrowers, many of whom could be tested by higher interest costs. For banks, the rise in rates will help boost profits earned on loan portfolios by providing better margins.

“Borrowers should be prepared for rates to continue to push up toward historic norms,” said James Laird, co-founder of rate-comparison site RateHub.ca. “We’re still in an abnormally low interest-rate environment.”

Meanwhile, Canadian savers with little debt who are hoping to finally start to earn decent returns on savings may have to continue to be patient. Returns on deposits not linked to prime rates are typically much slower to respond to a rising rate environment, Mr. Laird said.

“They’re much quicker to pass along the hike when they’re the ones collecting the interest, rather than when they’re the ones paying it.”

That appears to have been the case the last time the Bank of Canada raised rates.

Starting in June, 2010, three successive 25-basis-point rate hikes lifted the overnight lending rate from emergency levels brought on by the global financial crisis.

As the Bank of Canada rate rose to 1 per cent from 0.25 per cent, Canadian banks hiked their prime rates in lockstep. But the returns on guaranteed investment certificates remained just where they were through the rest of the year, averaging below 2 per cent, according to Bank of Canada data.

The course of rate policy in 2010 was ultimately interrupted by renewed weakness in the global economy, including the European sovereign debt crisis. Then the oil price shock beginning in 2014 forced Bank of Canada governor Stephen Poloz to again cut rates.

Now, once again the domestic economy has improved enough to justify a reduction of monetary stimulus. While Wednesday’s rise of 25 basis points still leaves rates at ultra-accommodative levels from a historical perspective, Canadian borrowers have grown unaccustomed to rates moving upward, Mr. Laird said.

“In 2010, [the hikes] didn’t feel shocking, since we had just seen some crazy moves on the way down, getting to all-time lows faster than anybody expected. Now, seven years later, the market has gotten used to these rates. So today’s rise feels a little more jarring.”

After announcing the hike on Wednesday, the central bank acknowledged that the economy may be more sensitive to higher interest rates than in the past given the country’s amount of household debt. Canadian households owed $1.67 in debt for every dollar in disposable income at the end of last year. Since 2009, when the housing boom started, total household debt has risen more than 50 per cent to $2-trillion and mortgages account for about 66 per cent of that, according to Statistics Canada.

“We will need to gauge carefully the effects of higher interest rates on the economy,” the central bank wrote.

Higher interest rates are good for banks, which profit from the difference between the interest they charge borrowers and what they pay to savers.

So while prime rates generally move in tandem with the central bank’s benchmark rate, in 2015, when the Bank of Canada cut its overnight rate by 25 basis points twice during the year, most banks responded by cutting their primes by just 15 basis points.

Passing through the full hike will help boost the banks’ margins.

With a file from Reuters

REUTERS. JULY 12, 2017. BoC's Poloz says watch the data, but markets will watch his lips

By Andrea Hopkins and Leah Schnurr

OTTAWA (Reuters) - Bank of Canada Governor Stephen Poloz signaled Wednesday's interest rate hike with recent speeches and interviews to ensure nobody was surprised, but from now on he would really rather let the numbers do the talking.

In raising rates for the first time in seven years, and for the first time on his watch, Poloz said policymakers will now look to data to decide when they can hike again, and urged financial markets to do the same.

"For us the ideal setting is where everybody is looking at the same data, and everybody is coming to a similar understanding of what's going on and wouldn't be hanging on to the bank's every word," Poloz told a news conference.

But with anemic inflation data pointing away from an interest rate increase, analysts said they will need hints from the central bank to determine what the data means to policymakers. Especially as key data, including on inflation and wages, leading into Wednesday's decision did not suggest a July hike was imminent until a flurry of central bank speeches and interviews in late June guided markets to expect one.

"It's not how I interpret the data, it is how they interpret the data," said senior rates strategist Andrew Kelvin at TD Securities, which had expected the bank to hold rates steady rather than hike because the Consumer Price Index (CPI) had shown subdued inflation.

"As much as we are all looking at the same data and there is this ideal that we can just form the same conclusion ... it's very clear that markets find the bank's comments to be a more compelling guide than any evolution in the data, particularly when you look at where CPI is."

The bank raised interest rates by 25 basis points to 0.75 percent on Wednesday.

While the bank used its quarterly monetary policy report on Wednesday to explain how it expects inflation pressures to build, Poloz also said it has adopted a habit of using a speech between policy-setting meetings to describe how it sees the latest data, acknowledging it can't rely on data alone to guide markets.

"I think they probably learned a little bit of a lesson here," said Brett Ryan, senior U.S. economist at Deutsche Bank in New York. "It would serve them well ... to do a little bit better job on communicating to the market what their reactions are to some of the near-term data."

Reporting by Andrea Hopkins and Leah Schnurr; Editing by James Dalgleish

BLOOMBERG. 13 July 2017. Poloz Credits Government for Growth, But Trudeau's Still Nervous

By Josh Wingrove

- Canadians pessimistic even with G-7’s fastest growing economy

- ‘We could easily see a psychological chill,’ Nanos says

- Bank of Canada Shows It's the Fed of the North

Stephen Poloz called it “good news for Canada” -- its economy is leading the Group of Seven in growth and the era of rock-bottom rates is ending. It won’t be all good news for Justin Trudeau.

The Bank of Canada raised its benchmark interest rate Wednesday for the first time since 2010, saying growth is broad-based and predicting a return to full capacity by the end of the year. That growth, if sustained, should also trim the federal deficit.

And yet, in politics, it’s more complicated. All five big Canadian banks followed Governor Poloz and raised their prime lending rates. Canadians will now see interest rates rise amid concerns of a housing correction and as they carry near-record levels of debt.

In other words, the view from the ground isn’t as rosy. “The disconnect is real,” pollster Nik Nanos, chairman of Nanos Research, said in an interview. “It doesn’t feel like good times for Canadians.”

This is, in part, an outcome of Trudeau’s making. Poloz said “the fiscal plan” helped lead to a rate hike before touching on the political balancing act, however inadvertently. “I know not everybody will think a higher interest rate is good news, but it’s a symptom of an improving economy.”

Finance Minister Bill Morneau, avoiding commenting directly on the rate hike, said the strengthening economy gives people “resilience” to deal with changes. He then echoed a line used by other government officials that reveals anxiety growth is too narrowly felt: “There’s more work to do.” He’s signaling the government has no plan to change course, or start clawing back deficits.

Consumer Fragility

“What’s clear is that as our economy does better, more and more people have the tools and the resilience to face the future with confidence,” Morneau said in a statement Wednesday. “We will move forward by continuing with an approach that’s working, always with a strong middle class and long-term economic growth as our goals.”

Nanos polling, conducted weekly for Bloomberg, has steadily shown Canadians aren’t jubilant about an economy that’s the envy of their G-7 peers. The Bloomberg Nanos Canadian Confidence Index is a tale of two recoveries. The sub-index measuring expectations for housing and the overall economy sits at 56.6, up from 54.4 at the end of last year, according surveys concluded July 7. However, the sub-index measuring job security and personal finances is largely unchanged at 59.9, compared to 59.3 at the end of last year.

The index is essentially showing that Canadians’ pocketbooks haven’t improved as quickly as their expectations for the economy overall. Almost 60 percent of respondents say that their personal finances haven’t changed in the last year, the highest proportion making that claim in almost a year and above the 2008-2017 average of 54 percent.

Nanos attributes the nervousness to Canada’s hot housing market. Policy makers have been taking steps to tighten mortgage eligibility and cool off the torrid pace of price growth in Toronto and Vancouver in particular.

On housing, “what I’ll call a perceptual fragility among consumers has actually been created by the government and the bank” by low rates and Canadians are now nervous their homes will slump in value, Nanos said. “We could easily see a psychological chill among consumers as they wait to see.”

Trudeau Sees ‘Anxiety’

Trudeau and Morneau attended Group of 20 meeting in Hamburg this month -- a summit marked by anti-capitalist demonstrations that included clashes between police and protesters. Since taking power in 2015, Trudeau has overhauled benefit payments to boost them in particular for low-income families with children, as well as for the unemployed. His core economic message is around the middle class, which might explain his reluctance to trumpet Canada’s robust job gains.

The prime minister’s political rivals frequently criticize his spending plan, which includes deficits of nearly C$30 billion ($24 billion) annually, more than three times what Trudeau campaigned on. Stronger growth will likely stoke calls for him to begin reining it in, and rising rates will also weigh on that figure as the government’s own borrowing costs jump.

A new child benefit program, which kicked in one year ago, was cited by Poloz as a driver of growth. Federal infrastructure spending is set to take up the baton and is “something we can look forward to” as fiscal policy, Poloz said. And yet the prime minister hints at his frustration that too few feel invited to the party.

“I understand skepticism and even frustration of people who see these meetings come and go without watching their benefits or their opportunities increase,” Trudeau told reporters in Hamburg. “We know the anxiety citizens are feeling around the world is real. And it is up to us as leaders whose responsibility it is to serve their citizens, to serve the future of their countries, to allay those fears by offering opportunity, confidence and help to the middle class and those working hard to join it.”

Canadian Medicine

The path forward for Trudeau gets more complicated. Poloz is now, in effect, taking money out of the system as the government’s infrastructure plan prepares to put more in. The introduction of the Canada Child Benefit is a one-time, big-ticket program. Canada is also rebounding from a major forest fire that sapped oil production last year. All that may be juicing growth at an unsustainable pace, and risks remain from U.S. policy changes -- though Poloz said Wednesday people seem to be setting them aside.

Markets nonetheless expect additional rate hikes. David Rosenberg of Gluskin Sheff & Associates Inc. said in a research note Wednesday that “more tightening, through rates and the currency, are likely coming.” That will boost Canadians’ debt service costs and could fuel economic anxiety with an election due in late 2019. Trudeau and Morneau, as such, will steer clear of taking credit for any rate hikes, Nanos said.

“This is kind of like getting medicine,” Nanos said after Poloz’s press conference. “Interest rates is the medicine he’s dispensing to Canadians and it takes a while for that to work through, in terms of Canadians believing that’s good for them.”

BLOOMBERG. 13 July 2017. Bank of Canada Gives Indebted Consumers a Vote of Confidence

By Theophilos Argitis and Erik Hertzberg

- Bank of Canada forecasting consumer spending at new highs

- Projections downplay disorderly unwind of housing market

- Why the Bank of Canada May Be More Hawkish Than You Think

Record household debt? A housing bubble? No worries.

Bank of Canada Governor Stephen Poloz’s decision Wednesday to raise interest rates was a major vote of confidence in the country’s indefatigable households, with policy makers expecting the remarkable run of spending to continue, despite bloated debt levels and record real estate prices.

Households will account for about two-thirds of growth over the next three years, the central bank projected Wednesday. That would extend a pattern over the past 15 years that has seen consumers carry the bulk of the economic load. The difference: Canadian households have never owed so much.

“That part of it -- the composition -- didn’t sit completely comfortably with me,” Mark Chandler, head of fixed income research at Royal Bank of Canada, said in a telephone interview.

The chart below shows how the numbers imply household consumption will rise to new highs as a share of GDP.

The Bank of Canada estimates household spending will contribute 1.9 percentage points to projected growth of 2.8 percent this year. Outside of stronger household spending in 2017, the outlook for everything else over the next three years is little changed from April. In 2018, household spending is adding 1.3 percentage points to projected growth of 2 percent.

The projections downplay any major chance of a disorderly unwind of Canada’s housing markets. The whither-Canada story had featured prominently in investor circles earlier this year, stoked by house price gains that far exceed incomes; the recent run on deposits and share collapse at mortgage lender Home Capital Group Inc.; and a downgrade of the nation’s banks by Moody’s Investors Service.

The consumption boom has been driven by a binge on cheap credit to purchase big-ticket items like homes and cars, pushing the ratio of household debt to disposable income to nearly 170 percent. Any increase in borrowing costs will eventually make it more expensive for Canadians to pay interest on the C$1.5 trillion ($1.2 trillion) in mortgage credit and C$581 billion in consumer credit they have racked up.

Hawkish Stance

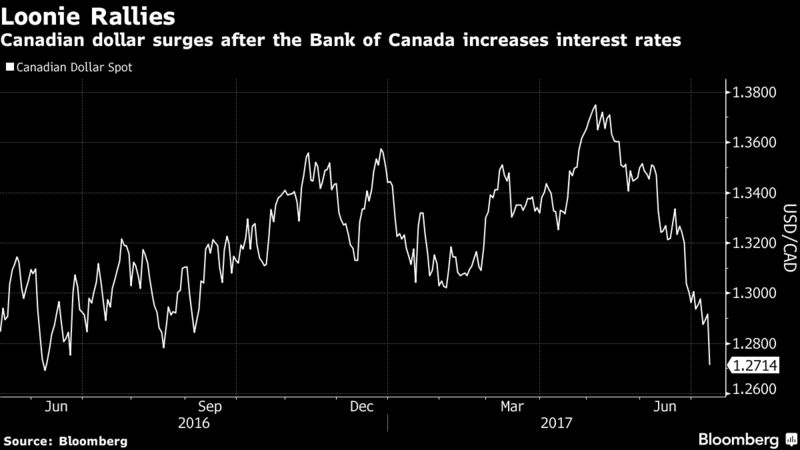

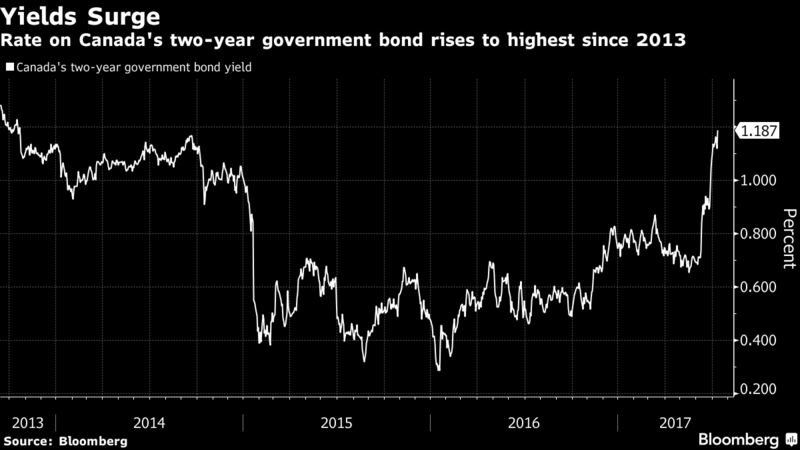

Wednesday’s rate decision was seen as a hawkish move by the Bank of Canada that set the central bank on a path of normalization. The Canadian dollar jumped to a one-year high after the central bank raised interest rates for the first time since 2010, with the yield on the country’s two-year government bonds surging to the highest since 2013.

A research roundup of the rate decision can be found here.

Coverage Wrap

Here is a wrap of Bloomberg coverage of the Bank of Canada’s move. Read the full TOPLive blog of the rate decision, here.

Bank of Canada Takes First Cautious Step Toward Higher Rates

- Canada cautiously became the first Group of Seven country to join the U.S. in raising interest rates on Wednesday, feeding speculation the world’s central bankers are entering a tightening cycle.

Damn Disinflation, Full Speed Ahead With a Canadian Rate Hike

- If economics were behind the policy action, the Bank of Canada might be cutting rates to address the anticipated slowdown and arrest the sinking pace of core inflation, writes Richard Yamarone of Bloomberg Intelligence.

Canadian Oil Patch Losing Loonie’s Cushion as Poloz Lifts Rates

- The Bank of Canada’s decision to increase its benchmark interest rate by a quarter point to 0.75 percent will raise borrowing costs for oil producers already grappling with prices stuck near $45 a barrel.

Poloz Credits Government for Growth, But Trudeau’s Still Nervous

- Stephen Poloz called it “good news for Canada” -- its economy is leading the Group of Seven in growth and the era of rock-bottom rates is ending. It won’t be all good news for Prime Minister Justin Trudeau.

Poloz Case for Tightening Rests on View Inflation Will Rebound

- Bank of Canada Governor Stephen Poloz just raised interest rates, even as the latest data show inflation creeping further below his 2 percent target. That means the central bank is betting price pressures will turn around as an economic recovery gains momentum.

CIBC Boosts Loonie Forecast After Rate-Hike Rally Clobbers Bears

- The loonie is soaring, and it’s not coming down any time soon, according to one of Canada’s biggest banks.

Canadian Banks Lift Prime Rate to Match Monetary Tightening

- Canada’s six biggest banks raised their prime lending rates for the first time since September 2010 after the nation’s central bank tightened policy on Wednesday.

Loonie Strengthens to One-Year High After Canada Raises Rates

- The Canadian dollar jumped to a one-year high after the central bank raised interest rates for the first time since 2010.

BlackRock Sees Canada Stocks Rebounding After Rate Increase

- The Bank of Canada’s first interest-rate increase since 2010 is confirmation of an improving economy and better conditions for equities, according to the world’s largest money manager.

The Bank of Canada Shows It’s the Federal Reserve of the North

- A North American central bank hiking rates in the face of strong job growth and deteriorating core inflation rates, citing temporary factors for the drop-off in price pressures. No, it’s not Janet Yellen’s Federal Reserve -- it’s Stephen Poloz’s Bank of Canada.

CIBC Is the Most Exposed to Canadian Interest-Rate Fluctuations

- CIBC is predominately sensitive to shifts in Canadian interest rates, as the bulk of its operations are domestic. Given a 25-bp policy interest rate increase and potential for a second increase, CIBC will likely see relief from recent interest-margin pressure.

BLOOMBERG. 12 July 2017. Loonie Strengthens to One-Year High After Canada Raises Rates

By Maciej Onoszko

- Canadian dollar rallies 1.6%, most among developed currencies

- Yields rise, taking two-year rate to highest since 2013

- More Room to Run for the High-Flying Canadian Dollar

The Canadian dollar jumped to a one-year high after the central bank raised interest rates for the first time since 2010.

Canada on Wednesday became the first Group-of-Seven member to join the U.S. in tightening amid growth that’s forecast to be the fastest in the developed world. While the move was anticipated by most economists surveyed by Bloomberg, traders were surprised when policy makers downplayed weak inflation and said the output gap will close earlier than previously projected.

“The market is wrestling with the fact they are much more upbeat on growth and their view that the downturn in inflation is temporary,” said Daniel Wilson, a New York-based markets economist at ANZ Banking Group Ltd. “While we might see some more follow-through, further gains in the Canadian dollar will be much harder to come by now.”

The loonie gained 1.7 percent to C$1.2704 as of 1:50 p.m. in Toronto, extending its advance in the past month to 4.9 percent, the biggest increase among 31 major currencies tracked by Bloomberg. It touched C$1.2681 earlier, its strongest level since June 2016.

Canadian government bonds fell, pushing short-term yields up more than those on long-term securities, even as sovereign bonds rose globally. The yield on the country’s two-year government bond surged seven basis points to 1.2 percent, the highest since 2013. Five-year bond yields added five basis points to 1.5 percent, while the rate on 10-year securities rose three basis points to 1.88 percent.

“The Bank of Canada is by no means done in terms of the work they have to do,” said David Stonehouse, a Toronto-based portfolio manager who helps oversee C$6 billion in fixed-income assets at AGF Management Ltd. “There’s enough strength and enough justification to see a continuation of the move, both with respect to short-term rates and the Canadian dollar.”

The stock reaction was muted. The S&P/TSX Composite Index rose as much as 1 percent before the central bank decision was announced, later giving up much of those gains. However, this appeared to have more to do with a drop in crude oil prices following the release of U.S. energy data rather than the rate hike.

CIB

The Globe and Mail. 13 Jul 2017. Bank of Canada shifts gears with first rate hike since 2010. Poloz cites economic growth in setting benchmark at 0.75 per cent, pushing Big Six banks to raise rates

BARRIE McKENNA

The Bank of Canada’s first interest-rate hike in seven years has set in motion a complex unwinding of a near-decade-long era of easy money.

The central bank raised its overnight lending rate by a quarter-percentage-point Wednesday, to 0.75 per cent from 0.5 per cent, citing “bolstered” confidence that the Canadian economy has emerged from years of sputtering growth.

Some borrowers are already paying the price. Canada’s largest banks matched the central bank’s move by raising their prime rates effective Thursday by a quarterpercentage-point to 2.95 per cent. Prime rates influence the cost of borrowing on floating-rate loans, including variable-rate mortgages, credit lines and student loans.

Bank of Canada Governor Stephen Poloz justified the hike, saying he’s increasingly convinced that the Canadian economy has “turned the corner” after a series of false starts, including the oil price plunge in 2014 and 2015.

“Growth is broadening across industries and regions and therefore becoming more sustainable,” the bank explained in a statement.

The Bank of Canada’s burgeoning optimism sent the Canadian dollar shooting up more than a full cent to nearly 79 cents (U.S.) on Wednesday as investors brace for further rate hikes in the months ahead.

Ultra-low interest rates have encouraged Canadians to load up on mortgage debt in recent years, driving up home prices and home construction, particularly in and around Toronto and Vancouver. But they have also penalized savers and made it tough for pension funds to generate healthy returns. » Higher rates will help to cool the housing market and rein in debt-fuelled purchases of cars and other consumer items.

The move to higher rates isn’t just a Canadian phenomenon. Central bankers in the United States and Europe are also talking about ending emergency measures put in place to keep credit flowing after the 2008-09 financial crisis. U.S. Federal Reserve chair Janet Yellen told Congress on Wednesday that the economy is now healthy enough to handle further steady increases in its benchmark interest rate as well as a start to selling its $4-trillion store of commercial bond holdings later this year.

One of the puzzles for the Bank of Canada and other central banks is that inflation is still low and falling. Central bankers typically raise rates to keep inflation in check. That isn’t the problem in Canada, where consumer prices have been rising at well below the bank’s 2-per-cent inflation target.

But Mr. Poloz said he’s looking beyond current conditions, focusing on where inflation will be a year or two from now. “Reacting only to the latest inflation data would be akin to driving while looking in the rear-view mirror,” he explained to reporters in Ottawa after the rate announcement.

Inflation may weaken further in the months ahead before getting back to the 2-per-cent target by the middle of next year as excess capacity in the economy fades, according to the Bank of Canada’s Monetary Policy Report, released on Wednesday. The bank argues that recent declines in inflation are largely temporary – the result of lower gasoline prices, electricity rebates in Ontario, intense food-price competition and unexpectedly weak car prices.

The bank is still being coy about when its next rate hike will come. The bank will “remain highly data-dependent,” Mr. Poloz insisted. “Monetary policy is not on a predetermined path.”

Many economists are expecting at least one more rate hike this year, most likely in October, when the bank releases its next quarterly forecast.

Bank of Montreal chief economist Douglas Porter said the Bank of Canada’s move begins a process that could see the central bank’s key rate bumped up to 1.5 per cent by mid-2018. “And so the tide begins to turn,” he said.

Unless inflation continues to fall, Canadians should expect more rate hikes, TD economist Brian DePratto said.

The Bank of Canada said the 3.5-per-cent annual pace of GDP growth in the first quarter will “moderate” over the rest of the year, but remain “above potential.” Among other things, the bank expects consumer spending, exports and business investment to drive growth in the months ahead.

The bank pointed out that housing activity has already abated, particularly in the Toronto area, where homes sales have fallen sharply.

The bank now estimates that the socalled output gap – a measure of excess labour, factory capacity and the like – will close “around the end of 2017.” That’s significantly sooner than its assessment in April that the gap would disappear in the first half of next year.

The Bank of Canada cut rates twice in 2015, taking out what Mr. Poloz called “insurance” against the fallout from the collapse in the price of oil and other commodities.

The Bank of Canada now expects the economy to grow 2.8 per cent this year, or faster than the 2.6-per-cent pace it predicted in its April forecast. GDP growth will slow to 2 per cent in 2018 and 1.6 per cent in 2019, the bank said.

ENERGY

REUTERS. JULY 13, 2017. Talks between Brookfield, Renova cool over management rights, sources say

By Guillermo Parra-Bernal

SAO PAULO (Reuters) - The reluctance of Renova Energia SA's largest shareholder to give up management of the debt-laden Brazilian renewable power firm threatens to derail takeover talks with Brookfield Asset Management Inc, three people familiar with the matter said on Thursday.

Power utility Cia Energética de Minas Gerais SA wants to be part of a Brookfield-led turnaround of Renova, two of the people said. The utility known as Cemig (CMIG4.SA) owns 34.2 percent of Renova.

That stance could sink Brookfield's proposed 1.6 billion-real ($499 million) cash offer for control of Renova, the people said. Cemig plans to first sound out interest from distressed debt giant Oaktree Capital Management LP and two other unidentified funds in Renova, two of the people said.

Reuters reported on Friday that Canada-based Brookfield would buy out the combined 63.5 percent that Cemig, Light SA and RR Participações SA have in Renova for 810 million reais. The Canadian firm would then pump an additional 800 million reais into Renova to win full management rights.

Cemig and Brookfield declined to comment. Rio de Janeiro-based Light referred questions on Renova to Cemig, which also controls it.

Snubbing Brookfield, which has made a number of high-profile infrastructure and energy takeovers in Brazil in the past year, is "risky for Renova since it faces a heavy repayment calendar and a fragile cash position," said one of the people, who asked for anonymity due to the sensitivity of the matter.

Renova's units (RNEW11.SA), the company's most widely traded class of stock, have gained almost 30 percent since Jan. 2, on expectations a takeover could save the company from a chronic cash shortage or even bankruptcy. Reuters first reported that Renova could be taken over on March 1.

Renova has struggled with a severe cash crunch over the past couple of years. Financing conditions for Renova, which was founded in 2001, worsened significantly when a partnership with SunEdison Inc collapsed weeks before the latter filed for bankruptcy protection in the United States.

Exiting Renova would allow Cemig, Brazil's No. 3 power utility, to facilitate the refinancing of almost 5 billion reais of debt maturing this year. This week, Chief Financial Officer Adezio Lima said the partial or full sale of Cemig's and Light's stakes in Renova could take up to 60 days.

Interest in Brazil's renewable power industry is growing, especially among foreign investors who see it as a resilient play despite declining electricity consumption and a harsh recession.

Additional reporting by John Tilak in Toronto and Luciano Costa in São Paulo; Editing by Cynthia Osterman

GOVERNMENT

Global Affairs Canada. July 12, 2017. Foreign Affairs Minister to attend National Governors Association summer meeting

Ottawa, Ontario - Canadians and Americans benefit from a unique friendship, one strengthened by shared geography, common interests and deep economic ties.

The Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced that she will accompany the Prime Minister to the National Governors Association (NGA) summer meeting on July 14, 2017, in Providence, Rhode Island.

The NGA, based in Washington, D.C., provides United States governors with a forum to speak freely and collaborate on national and state policies. The summer meeting, hosted by Gina Raimondo, Governor of Rhode Island, will bring together governors from more than 30 states and will also be attended by representatives from other countries.

While at the meeting, the Minister will meet with several governors and speak about the unparalleled economic partnership between Canada and the United States.

Quotes

“Our countries’ track record is one of economic growth and middle-class job creation. This meeting will provide the government with a valuable opportunity to directly engage with U.S. state governors, advance shared economic priorities and focus on how we can increase the flow of goods and people across our shared border.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick Facts

- The National Governors Association is led by an executive committee of nine governors, currently chaired by Terry McAuliffe, Governor of Virginia.

- Canada is the number one customer for a majority of U.S. states. Nearly nine million U.S. jobs depend on trade and investment with Canada.

- The United States is Canada’s most important economic partner and commercial market. Nearly $882-billion worth of goods and services was traded bilaterally in 2016.

- Canada and the United States share the world’s longest undefended land border, close to 9,000 kilometres (5,500 miles) long.

- Canada works closely with the United States, both at the state government level and with other U.S. stakeholders, to address climate change and promote clean growth.

HOUSING BUBBLE

StatCan. 2017-07-13. New Housing Price Index, May 2017

New Housing Price Index — Canada

May 2017

0.7% increase (monthly change)

Source(s): CANSIM table 327-0056.

Toronto and Vancouver were largely responsible for a 0.7% monthly rise in new house prices in Canada in May.

Chart 1 Chart 1: New Housing Price Index

New Housing Price Index

New Housing Price Index, monthly change

Toronto was the largest contributor to the national gain, rising 1.1% from April to May. Builders linked higher prices to market conditions, a shortage of developed land and higher construction costs.

Prices for new houses in Vancouver rose for a third consecutive month, up 2.2% in May and the largest increase for this census metropolitan area since May 2007. Builders cited favourable market conditions as the main reason for the gain.

Builders in Guelph (+1.7%), London (+1.5%) and St. Catharines–Niagara (+0.9%) also reported market conditions as the primary driver of higher new house prices.

Prices were down in five metropolitan areas and unchanged in nine.

New Housing Price Index, 12-month change

New house prices in Canada rose 3.8% over the 12-month period ending in May, led by a 9.0% increase in Toronto.

Chart 2 Chart 2: The metropolitan region of Toronto posts the highest year-over-year price increase

The metropolitan region of Toronto posts the highest year-over-year price increase

Other notable year-over-year gains were in the Southern Ontario communities of St. Catharines–Niagara (+7.2%), Kitchener–Cambridge–Waterloo (+6.5%) and London (+6.5%).

Prices were down in six metropolitan areas, with Calgary (-0.9%) posting the largest decrease.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170713/dq170713b-eng.pdf

_________________

LGCJ.: