CANADA ECONOMICS

ECONOMY

The Globe and Mail. 17 Jul 2017. The economy can make or break a prime minister

JOHN IBBITSON

Justin Trudeau’s Liberals enjoy the political benefit of strong economic growth, reflected in the Bank of Canada’s decision last week to raise interest rates. If things are this good in 2019, Andrew Scheer’s Conservatives won’t be able to use the economy as an election issue, leaving the Tories with an uphill fight to unseat the Grits.

But Canada is due for a recession in a year or two or three. Recessions, generally speaking, come around every 10 years or so. And history teaches us that bad economic news is bad political news for the government of the day, even if it isn’t to blame. Consider the Diefendollar.

In the early 1960s, the Canadian dollar came under attack from speculators. Growth in Canada and elsewhere had been sluggish after the roaring postwar years. There had been a recession in 1960-61. To fight off speculators and boost exports, John Diefenbaker’s Progressive Conservative government lowered the value of the loonie, as we now call it, to 92.5 cents U.S. The Liberals and other critics pounced, printing “Diefendollars,” from the “Bunk of Canada,” and accusing the Tories of economic mismanagement. The Conservatives limped out of the election with a weak minority government that lasted less than a year before succumbing to Lester Pearson’s Liberals.

Economic issues did in Pierre Trudeau – twice. After lampooning Conservative Robert Stanfield’s proposed wage and price controls to fight inflation during the 1974 election – “Zap! You’re frozen!” Mr. Trudeau mocked – he turned around and imposed them a year and a half later.

Mr. Trudeau never regained economic credibility. He did, however, regain power after Joe Clark’s brief and bumbling tenure in 1979, only to sink himself once again with the market-distorting National Energy Program (NEP), which sought to redistribute Western oil wealth nationally. Not only did the NEP earn the Liberals the lasting enmity of Alberta voters, it coincided with a brutal recession – unemployment reached 12.8 per cent – that virtually guaranteed the Liberals would lose the next election, which they did.

A decade later, another recession helped consign the Progressive Conservatives to electoral oblivion. The free-trade agreement with the United States caused the closing of branch plants, people hated the new goods and services tax, the Bank of Canada sent interest rates soaring to 14 per cent to fight inflation and Brian Mulroney’s Progressive Conservative government couldn’t get deficits under control. Replacing Mr. Mulroney with Kim Campbell as leader didn’t help. The Tories were obliterated in the 1993 election.

Not all elections are fought on the economy. Paul Martin’s Liberals were defeated in 2006 thanks in part to the sponsorship scandal, even though growth was strong, inflation and unemployment low and the government was running surpluses.

And bad economic news can actually work in a governing party’s favour. Stephen Harper’s capable handling of the 2008-09 recession bolstered his economic cred, earning the Conservatives a majority government in 2011.

But profiting from a recession is an exception to a rule. A serious downturn in or around 2019 would send the Liberal deficits through the roof, both in absolute terms and as a share of gross domestic product, as unemployment claims rise. Efforts to stimulate the economy would balloon an already substantial deficit, raising questions about whether the decision to go into the red when times were good was foolish in retrospect.

A Conservative call for tax cuts to stimulate growth, balanced budgets to rein in interest costs, and spending restraint to bridge the gap might make sense to stressed-out voters. The upcoming NAFTA negotiations could also figure in the mix. Right now, Mr. Trudeau is earning high praise for his skillful handling of the Trump administration. The Prime Minister’s Office and cabinet are deeply engaged with the administration, Congress and state governments, with a view to convincing the Americans that North American free trade is in their as well as Canada’s interests.

But if the NAFTA talks fail and the President’s mercantilist moves – currently he’s threatening to impose a tariff on steel imports – bring on or worsen a recession, then Mr. Trudeau will be attacked by the opposition for failing to protect the economy.

That said, the Liberals could dodge the NAFTA bullet and the economy could continue to grow. In that sense, good news for the Liberals would be good news for everyone. Except Conservatives, perhaps.

The Globe and Mail. 17 Jul 2017. Canada 150 projects given extra funds. Ottawa gives additional $9.3-million to 11 of 38 ‘signature’ programs, but Canadian Heritage says money was already accounted for. Winnipeggers form a ‘Living Leaf’ as part of Canada 150 celebrations on July 1. Canadian Heritage budgeted $79-million in total for a number of ‘signature projects’ and expects an average of 500,000 Canadians to participate in each one, according to the department’s annual report to Parliament.

DANIEL LEBLANC

CHRIS HANNAY

The federal government is awarding millions of dollars in extra funding to some of its key Canada 150 projects to shore up budgets, compensate for lower-thanexpected private fundraising and help projects promote themselves in a crowded field.

Even though Canada Day has come and gone, dozens of Ottawa’s key projects – pitched by private companies and funded from federal coffers – are still under way. Collectively, they seek to engage millions of Canadians in celebrating their country through activities such as public talks, film viewings and competitions.

The funding for these 38 “signature projects” represents almost 40 per cent of the $200-million the federal government is spending to recognize the 150th anniversary of Confederation. The rest of the funds pay for major anniversary events, such as July 1 on Parliament Hill, and hundreds of smaller projects across the country. When combined with the money set aside to fix up community buildings under the Canada 150 Community Infrastructure Program, Ottawa is spending more than half a billion dollars to commemorate the country’s birthday.

A spokesman for the Heritage Minister says the $9.3-million in additional funds for 11 of the signature projects has already been accounted for.

“For us, the eventual need for supplemental funding for some projects had been predicted and there was a reserve in the Canada 150 signature envelope. This is not new money,” spokesman PierreOlivier Herbert said.

Canadian Heritage budgeted $79-million in total for the signature projects and expects an average of 500,000 Canadians to participate in each one, according to the department’s annual report to Parliament.

The biggest top-up was provided to the RDV 2017 Tall Ships Regatta, under which more than 40 “cathedrals of the sea” are scheduled to make stops in Ontario, Quebec and the Atlantic provinces. Approved by the Harper government in 2015, the project initially received $7-million. That amount has been boosted by an extra $3.4-million to cover “docking licence fees,” Canadian Heritage said.

A spokesperson for Heritage explained that the additional funding for Rendez-vous Naval de Quebec, the company behind the program, was used to add 20 days in August to the event and increase the number of cities visited by the tall ships.

The most expensive signature project is Sesqui, a travelling cinematic show that seeks to marry cutting-edge art and technology with a film of Canadian landscapes projected inside custombuilt domes.

The project, billed as “this generation’s Expo 67” in its application for Canada 150 funds, received an initial $9.5-million investment from the government, followed up by an extra $1-million last year when anticipated support from provincial and corporate sponsors did not materialize. Sesqui cut down its national dome tour to just Ontario, but produced new film and virtual-reality content that still allowed it to schedule events in cities across the country.

“We did have our project scope change based on support levels last year, but through partnerships across the country, we’re on target to reach our targets for participation,” spokesperson Sean Moffitt said in an e-mail.

For most of the signature projects, federal Heritage funding is only one source of revenue, with other government or private sources making up the balance.

The Students on Ice Foundation, which received $4.8-million from Heritage to pilot an icebreaker for a 150-day journey from Toronto to Victoria via the Northwest Passage, received an additional $2-million earlier this year to fill a fundraising gap and to participate in Winterlude.

“Over the two years of planning for the Canada C3 project, the scale, scope and budget also grew,” said Students on Ice president Geoff Green. “It became much more than a voyage of celebration. It became a voyage of reconciliation, science, education and a massive communication platform. With all that, the overall project budget went over $10-million.”

In the case of an exchange program called Canada 150 & Me, which initially received $700,000 from the government, organizers found $500,000 in external funding. However, they were still short and the government pitched in an additional $200,000.

Deborah Morrison, president of Experiences Canada, said that as part of the project, 450 kids travelled around the country to participate in forums on issues such as human rights, immigration and the environment.

“Our choice was either to reduce the number of kids travelling or cut back on the programming, and we made a decision together it was worth the additional investment,” she said.

ParticipAction, which received $4.9-million from Heritage, says an extra $500,000 helped it add events to its 150 Playlist program to promote physical fitness.

CEO Elio Antunes said the government is funding only about a third of the project’s overall budget, the rest is coming from corporate sponsors such as Manulife and Chevrolet.

“We have leveraged the government money significantly to attract additional investment,” Mr. Antunes said.

He added that the project got a lot of attention when it debuted late last year, but that became harder to get Canadians engaged as other Canada 150 programs picked up.

“Leading up to July 1, there was lots of activity, both governmentsponsored and otherwise. So it’s been a bit tougher to break through,” Mr. Antunes said.

Another organization received additional funds to expand its plans for the Canada Day weekend.

A non-profit group called WE got an extra $1-million on top of its initial funding of $500,000 to put together a July 2 show on Parliament Hill that featured Prime Minister Justin Trudeau, Gord Downie of the Tragically Hip and artists such as Nelly Furtado.

Organizers predicted a crowd of up to 100,000 for the show, but the RCMP estimate only 14,000 attended. The show was also broadcast online.

Not all signature projects have launched yet.

Vox Pop Labs, which received $576,500, had planned a spring unveiling for its Project Tessera nationwide survey on what it means to be Canadian. But after receiving the results of its original pilot studies, the firm needed time to readjust its methods, CEO Clifton van der Linden said, and Vox Pop’s media partner, CBC, pushed for a fall launch.

4Rs Youth Movement, which received $398,000 to produce a series of gatherings for young people to discuss Indigenous issues, says it hopes to begin its programming in August.

NAFTA

The Globe and Mail. 17 Jul 2017. Majority of U.S. firms say free trade with Canada helps their economy. Poll: U.S. businesses less positive about NAFTA than Canadian trade specifically

More than one in two American businesses say the United States is better off because of free trade with Canada, with particularly strong support in the northeastern U.S., according to a new poll.

A new Nanos survey found that 54 per cent of U.S. businesses think the country’s economy is in a better position because of free trade with Canada, while 15 per cent believe it is worse off, 17 per cent believe there has been no impact and 14 per cent are unsure.

Regionally speaking, surveyed businesses in the northeastern United States had the most positive impression of free trade with Canada, with 59 per cent saying the U.S. economy is better off because of it. Nearly 57 per cent of surveyed businesses in the southern United States had a positive impression of free trade with their northern neighbour, followed by the western United States at 52 per cent and Midwest at 46 per cent.

The United States is expected to release its official NAFTA negotiating objectives on Monday. Canadian officials say talks could start within days, or at most weeks, of Aug. 16 – the first day that U.S. President Donald Trump’s administration is legally allowed to begin NAFTA discussions.

“The key takeaway here is that American businesses see trade with Canada as an opportunity. It’s not a threat,” pollster Nik Nanos said in an interview. »

“When we asked American businesses about the benefits of trade with Canada specifically, a majority see it as a net positive and that this is exceptionally so for any businesses located in the northeastern United States, which is part of the economic heart of the U.S,” Mr. Nanos said.

U.S. businesses feel less positive about the impact of the North American free-trade agreement between Canada, the United States and Mexico.

Forty-five per cent of U.S. businesses surveyed said the economy is in a better position because of NAFTA, while 25 per cent think the economy is worse off and 13 per cent say there has been no impact.

Much like their opinions on free trade with Canada, businesses in the northeastern United States had the most positive view of NAFTA, with about

49 per cent saying it benefits the U.S. economy, followed by businesses in the South at 47 per cent, the West at 45 per cent and the Midwest at 37 per cent.

The survey comes as North American leaders prepare to renegotiate the 1994 trade agreement.

Speaking to a gathering of 31 U.S. governors in Rhode Island last Friday, Prime Minister Justin Trudeau urged state leaders to prevent a resurgence of protectionism.

“Such policies kill growth. And that hurts the very workers these measures are nominally intended to protect. Once we travel down that road, it can quickly become a cycle of tit for tat, a race to the bottom, where all sides lose,” Mr. Trudeau said, adding that he looks forward to renegotiating the agreement “as soon as possible.”

The Trump administration has sent mixed messages on its approach to rewriting NAFTA. In the 2016 U.S. presidential election campaign, Mr. Trump promised to tear up the agreement if he didn’t get a better deal for U.S. workers; he has since assured Mr. Trudeau that he is only seeking tweaks to the agreement. Speaking on Friday in Rhode Island, U.S. Vice-President Mike Pence said the renegotiation would be a “win-win -win” for all three partner countries.

In the survey, businesses also expressed more confidence in the Federal Reserve, which is the U.S. central bank, in supporting economic prosperity than Mr. Trump and Congress. More than four in 10 U.S. businesses believe the Federal Reserve is making a positive (15 per cent) or somewhat positive (28 per cent) contribution toward supporting economic prosperity in the country.

However, 53 per cent of businesses surveyed said they believe the U.S. President is making a negative (43 per cent) or somewhat negative (10 per cent) impact on economic prosperity, while 51 per cent said Congress is making a negative (28 per cent) or somewhat negative (23 per cent) contribution.

This poll was conducted between May 30 and June 10, based on an online survey of 1,058 U.S. businesses and business owners. No margin of error applies to the research.

With reports from Steven Chase

The Globe and Mail. The Canadian Press. Jul. 17, 2017. Trump to reveal list of NAFTA expectations as talks near

ALEXANDER PANETTA

WASHINGTON — After campaigning and complaining about NAFTA for two years, Donald Trump is about to start doing some explaining: the U.S. president is poised to release a list as early as today revealing how he wants to change the deal.

American law requires that the administration publish a list of its objectives entering trade negotiations. The reason this could happen any day is because the administration hopes to start negotiations around Aug. 16 and the law requires this list be posted online 30 days in advance.

Expect the Canadian government to say little in response to the list.

“I can’t imagine that we would start negotiating before the negotiations actually start,” Prime Minister Justin Trudeau said Friday. “We’re going to be responsible about this, to be thoughtful and responsible in how we engage the administration.”

That tight-lipped approach stems from the Canadian government’s overall strategy: Make the Americans lay out their cards first, given that they asked for these negotiations and in the parlance of trade talks are the “demandeur.”

The U.S. has signalled wildly conflicting approaches.

Trump keeps threatening to rip up the trade agreement in the absence of a major renegotiation. His vice-president just delivered a speech exuding collegiality and promising a new NAFTA that would be a “win-win-win.”

The signals to Congress have been equally contradictory.

In a leaked draft of a letter to lawmakers, the administration showed at a desire to play hardball and seek changes that would be deemed non-starters by the other countries. It later released a bare-bones, modest version of that letter.

It was with this letter that the Trump administration formally declared its intention to enter trade negotiations with Canada and Mexico. Those mixed messages are due in part to philosophical differences within Trump’s team about how aggressive to get on trade.

A veteran of U.S. trade negotiations suggests this upcoming notice will fall somewhere between the two versions of those letters to lawmakers: more detailed than the final version, less expansive than the draft.

“It will be more specific but I think still broad-brush bullet points on what they want to accomplish,” said Welles Orr, a senior U.S. trade official under George H.W. Bush and Bill Clinton.

“So no surprises. I don’t expect we’re going to see anything that pops out as ‘Oh, wow, we didn’t see this coming.’ So I think it’ll be kind of perfunctory.”

Here’s what he expects in the new NAFTA: modern chapters on digital commerce, modelled on those in the now-dormant Trans-Pacific Partnership; changes to auto-parts import rules that all three countries can live with; and a bruising fight over dairy.

He predicts the dairy issue will come down to the final wire: “That’s the hotbed issue that’s hanging out there that will be the last issue to get resolved. But if that’s resolved, I don’t see a whole lot of contention on the Canadian side.”

The reason the administration has to publish this list, and release letters to Congress, is because of a deal between the legislative and executive branches of the U.S. government, enshrined in what’s known as a fast-track law.

Under the terms of that deal, U.S. lawmakers relinquish their power to amend an international agreement, as is their right under the U.S. Constitution; in exchange, lawmakers are consulted throughout the negotiating process.

That process includes public hearings — on Tuesday, for instance, the House of Representatives committee in charge of trade will hold a hearing on NAFTA, how it’s worked, and how it could be modernized.

It was Orr’s job to act as a liaison to Congress as the deputy assistant U.S. trade czar.

He believes the administration will deliver more specific marching orders to the negotiating team in the upcoming public notice, including a desire to work quickly. That desire for a fast negotiation could be hindered by the fact that the U.S. trade czar’s office still has numerous positions unfilled.

But he believes it can be done this year: “I think what is going to play out is a relatively short negotiation. Meaning a deal can be probably hatched by December... I think there’s a more expedient need (for Trump) to get a win, that would put a lot of what might be seen as controversial issues to the side for the sake of getting this win.

“This is one of his hallmark campaign issues. He has to have a win. He has got to show that he’s done something. I think he can make some modest improvements — necessary improvements, that brings (NAFTA), frankly, into a more 21st century agreement,” said Orr, now a trade adviser at the Washington law firm Miller & Chevalier.

NAFTA: What does Trump want and when do talks start? A guide: https://www.theglobeandmail.com/news/politics/nafta-renegotiations-what-does-trump-want/article33715250/

The Globe and Mail. 17 Jul 2017. Canada touts U.S. ties in softwood spat. Softwood: ‘We’re helping American families,’ Gallant says. N.B. Premier stresses industry integration. Softwood: ‘We’re helping American families,’ Gallant says

BRENT JANG

New Brunswick Premier Brian Gallant is hoping the tale of Twin Rivers Paper Co. Inc. will help resolve the softwood lumber dispute between Canada and the United States.

The economic damage from the softwood battle isn’t isolated to lumber, as evidenced by the ripple effect across other parts of the forestry sector, such as pulp and paper, he said.

Twin Rivers’ Edmundston pulp mill in New Brunswick and Madawaska paper plant in Maine are prime examples of cross-border co-operation and integrated economies. “This operation is seeing things and people go from one side of the border to the other every single day,” Mr. Gallant said in an interview.

The integration runs deep: Twin Rivers also owns the Plaster Rock Lumber Mill in New Brunswick. That sawmill provides biomass for the co-generation plant at the Edmundston mill, which converts wood chips into pulp. Pulp and steam are moved through a pipeline from New Brunswick to the Madawaska paper mill.

In a recent filing to the Commerce Department, Maine-based Twin Rivers president Ken Winterhalter said punitive U.S. lumber duties raise prices for wood byproducts, threatening a large portion of the nearly 5,900 direct and spinoffs jobs from the company’s operations on both sides of the border.

“The imposition of anti-dumping and countervailing duties on softwood lumber from New Brunswick would drastically increase the cost of the wood chips and biomass used by the Madawaska paper mill,” Mr. Winterhalter said in a letter last month to U.S. Commerce Secretary Wilbur Ross. “These increased costs have the potential to destroy the financial viability of the Madawaska operation and eliminate thousands of jobs in northern Maine.”

Mr. Gallant will be sharing his message of Canada-U.S. economic integration with his provincial and territorial counterparts at this week’s conference of premiers in Edmonton. Alberta Premier Rachel Notley will chair the Council of the Federation’s conference, which will follow a scheduled meeting between the premiers and Indigenous leaders, though some First Nations have said they plan to boycott that Monday gathering.

During a half-hour meeting with Mr. Ross last week in Washington, Mr. Gallant emphasized the importance of flourishing Canada-U.S. trade.

B.C. NDP premier-designate John Horgan plans his own trip to Washington later this month to present British Columbia’s lumber case for improved access to the United States.

Mr. Horgan won’t be attending the event in Edmonton, where the Council of the Federation will meet on Tuesday and Wednesday. He will be sworn in on Tuesday as British Columbia’s new premier as the NDP forms a minority government, backed by the Greens, to oust the provincial Liberals led by Christy Clark.

British Columbia is Canada’s largest lumber exporter into the United States, with a 55.2-percent share of sales volume last year, followed by Quebec (19 per cent), Ontario (7.9 per cent), Alberta (7.8 per cent) and New Brunswick (7 per cent).

The U.S. lumber industry argues that there are market distortions in Canada, such as alleged subsidies for biomass or renewable-energy programs that consume lumber byproducts.

Last month, the Commerce Department said in a preliminary ruling that it will continue to exclude Nova Scotia, Prince Edward Island and Newfoundland from any lumber duties.

All four Atlantic provinces escaped U.S. tariffs and quotas for decades in the long-running softwood dispute dating back to the early 1980s, but New Brunswick lost its exemption in this fifth round of the trade fight.

“We’ve been enjoying this exclusion since 1982,” said Mr. Gallant, who wants New Brunswick to be placed back on the list of provinces exempt from U.S. lumber duties. “We have had a good relationship when it comes to softwood – sure, there could maybe be some tweaks, but good relationships since 1982.”

Hamir Patel, an analyst with CIBC World Markets Inc., cautions that Canada will have to moderate its expectations, and that could mean New Brunswick remains caught in the net of tariffs.

The U.S. Department of Commerce ruled that Canada has been providing subsidies, deciding in April to slap preliminary countervailing duties on the vast majority of Canadian softwood. The United States also imposed anti-dumping duties in June after deciding that Canada is selling softwood at below market value.

Combined, the weighted average tariffs levied by the Trump administration total 26.75 per cent – 19.88 per cent for countervailing duties and 6.87 per cent for anti-dumping levies. New Brunswick-based J.D. Irving Ltd., the largest lumber producer in Atlantic Canada, is paying a combined tariff of 9.89 per cent.

Mr. Gallant said Canadian lumber shipments into the U.S. housing market foster prosperity in both countries.

“We’re helping American families by keeping prices of construction lower,” he said.

The New Brunswick Premier says he is encouraged that Mr. Ross and Chrystia Freeland, Canada’s Foreign Minister, have been cordial.

“He and Minister Freeland are very engaged in talks, which we certainly see as a positive,” Mr. Gallant said.

But given the complexities of the softwood file, finding common ground will be challenging, he said. “We very much recognize it’s an uphill battle.”

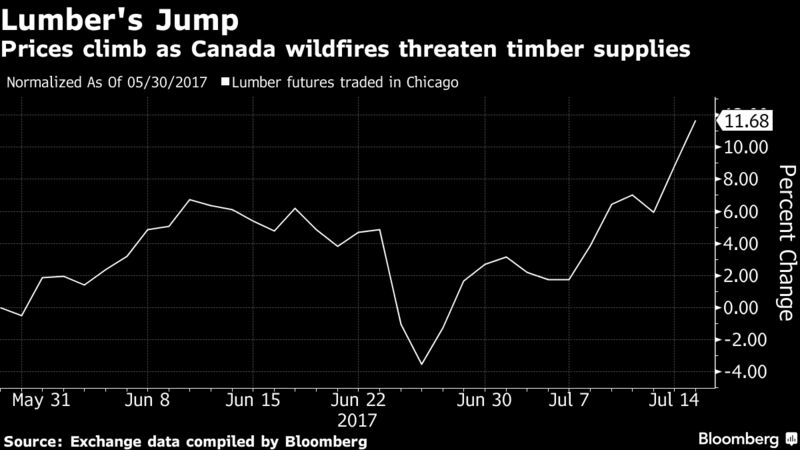

BLOOMBERG. 17 July 2017Sweeping Wildfires Burn Canada's Timber as Lumber Prices Surge

By Jen Skerritt

- Futures rise by CME exchange limit as sawmills forced to shut

- ‘Forests are getting burnt, so that has a supply impact’

- Canada Wildfires Shut Lumber Mills, Enbridge Compressor

Sweeping wildfires across Canada’s British Columbia are threatening timber supplies and sending lumber prices surging.

More than 375 fires have swept across the province, burning forests and forcing sawmills to shut down or evacuate. While the impact on supplies is minimal so far, there are concerns that the blazes will continue to spread amid hot, dry conditions, according to Paul Quinn, an analyst at RBC Capital Markets in Vancouver. Lumber futures on Monday jumped by the exchange limit in Chicago to the highest in more than two months.

“Forests are getting burnt, so that has a supply impact,” Quinn said by telephone. “The worry is they’ll continue to grow and get bigger,” he said, referring to the fires.

Last week, West Fraser Timber Co. suspended operations at three lumber mills that represent annual production capacity of 800 million board feet of lumber and 270 million square feet of plywood. Norbord Inc., the largest North American producer of oriented strand board used in residential construction, has also suspended production at its mill in 100 Mile House in central B.C.

Canada Wildfires Shut Lumber Mills, Enbridge Gas Compressor

On the Chicago Mercantile Exchange, lumber futures for September delivery rose by the $10 trading limit to $387.30 per 1,000 board feet at 11:37 a.m. local time. That’s the highest price for a most-active contract since May 9. Aggregate trading for this time is 44 percent above the 100-day average, according to data compiled by Bloomberg.

Cash prices for some grades of lumber rose 7 percent last week, Quinn of RBC said.

“We’re at the seasonal peak in construction activity, so anything that reduces supply will create some pricing tension,” Mark Wilde, an analyst at BMO Capital Markets in New York, said in an email.

Shares of lumber producers have also climbed in Canada trading. West Fraser Timber rose 6.3 percent last week and reached the highest since July 2015 on Monday. Canfor Corp. was little changed after increasing 7.4 percent last week.

More fire impact:

- Kinder Morgan Inc. said Sunday it continues to closely monitor the fires and is taking preventative measures particularly around its Blackpool pump station near Little Fort, B.C., including setting up a sprinkler system around the perimeter fencing and the pump building.

- Tolko Industries Ltd. shut down its Soda Creek and Lakeview mills, the company said Saturday in a Facebook post, adding that“they will not be operational for the foreseeable future.”

- Taseko Mines has temporarily idled its Gibraltar mine as the wildfires have hindered employee travel to the site, the company said Monday. It’s unclear when milling and mining operations will resume, and there are no fires in the immediate area of the mine, the company said in a statement.

The Globe and Mail. Reuters. Jul. 17, 2017. U.S. dairy lobby increases pressure on Canada as NAFTA fight looms

DAVID LJUNGGREN AND ROD NICKEL

OTTAWA/WINNIPEG — The U.S. dairy lobby is ratcheting up the pressure on Canada as talks to renegotiate NAFTA draw closer, demanding concessions the Canadian government looks unwilling to grant, according to people familiar with the file.

The result could be a brawl that sours efforts to modernize the North American Free Trade Agreement, under which Canada sends most of its exports to the United States. Mexico is the pact’s third member.

U.S. farmers have long chafed about supply management, the term for Canada’s system of tariffs and quotas to keep domestic prices high and imports low. A 2016 deal that allowed Canadian farmers to sell milk proteins to domestic processors at a discount, curbing the flow of American imports, further raised their ire.

Jaime Castaneda, senior vice-president for the U.S. Dairy Export Council, said the influential lobby group will pursue fresh challenges through the World Trade Organization unless Canada stops the proteins sale.

“If we can’t resolve this through negotiations, I believe my members will be very clear that everything is on the table,” he said in a phone interview.

A WTO panel ruled in 2002 that Canada breached its trade obligations through illegal subsidies to its dairy industry, siding with the United States. The U.S. and Canada reached a settlement in 2003.

Castaneda said challenges against the protein sales could eventually result in rulings that force Canada to ditch supply management.

In June, U.S. agriculture secretary Sonny Perdue said he would prefer to address dairy irritants before NAFTA talks begin and said supply management was fine as long as though it did not harm the U.S. industry.

But on July 14 he appeared to toughen his stance, saying through a spokeswoman he felt “all options should be on the table” in the NAFTA talks and that dairy remained a concern.

Although dairy was originally excluded from the original 1994 deal, the United States may push for it to be part of the talks on a new pact.

“I don’t see why it wouldn’t be, when you’re looking at an overall trading relationship ... there is no doubt in my mind that it would be on the table,” said one person familiar with Washington’s approach.

Despite the more strident U.S. line, Prime Minister Justin Trudeau’s government has little interest in compromise.

“We are fully trade compliant and trade in dairy products massively favors the United States,” said a Canadian government source.

Canada’s dairy sector includes C$6-billion ($4.8-billion) in annual farmer milk sales.

Fearing the domestic industry’s lobbying muscle, Canadian politicians of all stripes mostly treat dairy as a sacred cow.

In May, dairy farmers helped ensure the defeat of a Conservative party leader candidate who advocated eliminating supply management.

“Dairy farmers are a force to be reckoned with. I think (politicians) will do well to listen to our concerns,” said Manitoba dairy farmer David Wiens, an executive of the influential Dairy Farmers of Canada.

Dairy is one of several commodities, including lumber and wine, that have sparked complaints by the Trump administration leading into NAFTA talks. U.S. President Donald Trump said in April he would stand up for domestic dairy farmers against what he called unfair Canadian practices.

The American side also wants Canada to start cutting tariffs to allow more imports. As part of the talks on a proposed 12-nation Pacific trade treaty in 2015, Canada agreed to open up 3.25 per cent annually of its dairy supply.

That treaty was still-born and any talk of concessions is now off the table.

“The industry is not prepared to give any additional access to the Canadian market,” said Yves Leduc, head of government relations at the Dairy Farmers of Canada lobby group.

INVESTMENT

StatCan. 2017-07-17. Canada's international transactions in securities, May 2017

Foreign investment in Canadian securities

$29.5 billion, May 2017

Canadian investment in foreign securities

$4.4 billion, May 2017

Source(s): CANSIM table 376-0131.

Foreign investment in Canadian securities amounted to $29.5 billion in May, mainly purchases of government debt instruments. At the same time, Canadian investors increased their holdings of foreign securities by $4.4 billion, led by investments in US debt instruments.

As a result, international transactions in securities generated a net inflow of funds of $25.1 billion in the Canadian economy, a second consecutive large monthly net inflow of funds.

Foreign investment in Canadian securities up significantly

Foreign investment in Canadian securities reached $29.5 billion in May, up significantly from $10.6 billion in April. Foreign investors mainly added government debt securities to their holdings and, to a lesser extent, equities. Since the beginning of the year, foreign acquisitions of Canadian securities have totalled $100.6 billion, compared with $82.0 billion for the same period in 2016.

Chart 1 Chart 1: Foreign investment in Canadian securities

Foreign investment in Canadian securities

Non-resident investment in Canadian bonds was $20.8 billion in May, the largest investment since March 2015. Record acquisitions of provincial government bonds, largely new issues denominated in foreign currencies, were the main contributors to investment activity in May. In addition, non-resident investors purchased $6.4 billion of corporate bonds and $4.3 billion of federal government bonds. Canadian long-term interest rates were down by seven basis points, a fourth straight monthly decline.

Foreign investment in the Canadian money market was $1.4 billion in May. Foreign investors acquired a record $6.5 billion of federal government paper while they reduced their exposure to corporate paper. Canadian short-term interest rates were unchanged and the Canadian dollar appreciated against its US counterpart by less than one US cent.

Foreign investment in Canadian equities amounted to $7.2 billion in May. Foreign purchases on the secondary market accounted for the bulk of this activity. Canadian stock prices were down by 1.5%.

Canadian acquisitions of foreign securities focus on US debt instruments

Canadian investors resumed their acquisitions of foreign securities by adding $4.4 billion to their holdings in May, led by investment in US debt instruments.

Chart 2 Chart 2: Canadian investment in foreign securities

Canadian investment in foreign securities

Canadian investors acquired $5.9 billion of foreign debt securities in May, the first investment in three months and the largest since December 2015. Record acquisitions of US Treasury bills and US corporate bonds were moderated by sales of US Treasury bonds in May. US long-term interest rates were unchanged and short-term interest rates increased by nine basis points.

Canadian investors reduced their holdings of foreign equities by $1.5 billion in May, a second consecutive monthly divestment. Sales of US shares were moderated by acquisitions of non-US foreign shares. US stock prices increased by 1.2%.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170717/dq170717a-eng.pdf

REUTERS. JULY 17, 2017. Foreign investment in Canadian securities jumps in May

OTTAWA (Reuters) - Foreign investors ramped up purchases of Canadian securities in May, driven by increased holdings of Canadian government debt and equities, data from Statistics Canada showed on Monday.

International investors picked up C$29.5 billion ($23.3 billion) in Canadian securities in May, up from C$10.6 billion in April and the second largest amount on record.

Since the beginning of the year, foreign investors have bought C$100.6 billion in Canadian securities, compared with C$82 billion in the same time period last year.

Foreign investors bought C$20.8 billion in Canadian bonds in May, the most since March 2015, buying a record amount of provincial government bonds. Investors also picked up C$7.2 billion in Canadian equities, even as stock prices were down 1.5 percent in the month.

Canadian investors bought C$4.4 billion in foreign securities after reducing their holdings in April. Canadians bought C$1.2 billion in international bonds, including U.S. Treasuries and corporate bonds.

Still, Canadian investors sold C$1.5 billion in foreign equities, the second month in a row investors have reduced their stock holdings.

Reporting by Leah Schnurr; Editing by Jeffrey Benkoe

The Globe and Mail. 17 Jul 2017. Forget nationality. It’s what foreign investors do that matters. McKenna: Canada should be agnostic about investors’ nationalities

BARRIE McKENNA

The Chinese Are Coming, the Chinese Are Coming. Breathless media coverage of a pending deal by a Chinese investor to buy Vancouver’s iconic Grouse Mountain Resorts is reminiscent of that classic 1960s movie, The Russians Are Coming, the Russians Are Coming. The comedy spoofs the paranoia of locals when a Russian submarine runs aground on a tiny New England island in the middle of the Cold War.

China Minsheng Investment Group – China’s largest privately owned investment manager – is near to closing a $200-million purchase of the 485-hectare landmark, whose ski slopes, restaurant, hiking trails and zip lines dominate the vista in North Vancouver, The Globe and Mail reported last week. The McLaughlin family, which owns the property, will say only that it has struck an agreement with a potential purchaser.

The Globe story raised questions about China Minsheng’s links to Communist Party insiders and the Chinese government. It also linked the deal to the role of Chinese buyers in Vancouver’s real estate boom and to national security concerns involving other recent Chinese takeovers of Canadian companies.

So what’s wrong with a Chinese buyer acquiring Grouse Mountain?

It’s not obvious anything is amiss.

The real issue for Canadians is not the nationality of foreign investors, but what they do and how they behave when they get here.

If China Minsheng’s plan is to put an amusement park on Grouse Mountain, or replicate the Hong Kong skyline, that wouldn’t be cool. Marketing materials circulated by Grouse Mountain’s real estate broker suggested a hotel and spa might be built on the site.

Roland Paris, a former foreign policy adviser to Prime Minister Justin Trudeau, mocked fears about the Grouse Mountain deal in a tweet last week. On what grounds, he wondered, would Ottawa justify a national security review, “to safeguard zip-line technology?”

17 Jul 2017The Globe and Mail Metro (Ontario Edition)

The Vancouver Sun similarly dismissed the China scaremongering. If the prospect of Grouse Mountain falling into Chinese hands troubles you, the newspaper pointed out, “rest assured that the mountain is staying where it is.”

Vancouverites, and all Canadians, can take some comfort that the District of North Vancouver has considerable control over any future development of the mountain. The resort is located in an ecologically sensitive area and there are restrictions on what can be built, and where.

Mayor Richard Walton quite rightly insisted that his only concern is that whoever takes over Grouse Mountain respects community interests. “[Decisions] need to be balanced with a very good understanding of regional expectations,” Mr. Walton assured The Globe’s Ian Bailey.

And that’s the point. Canada should be agnostic about the nationality of foreign investors, while maintaining strict oversight of corporate behaviour inside its borders. Bad corporate actors are just as likely to be Canadian as foreign.

Canada is a small open economy that has long depended on foreign investment – outbound and inbound – to make its way in the world. Foreign companies in Canada account for 12 per cent of jobs and roughly half of this country’s goods-and-services exports.

The stock of Chinese foreign direct investment in Canada totalled $21.4-billion in 2016 – a relatively small percentage of the $826-billion worth of foreign direct investment (FDI) in Canada, according to Global Affairs 2017 State of Trade report. There is $13.3-billion of Canadian FDI in China. And China’s investment in Canadian real estate reached $6.4-billion at the end of June, according to an investment tracker compiled by the University of Alberta’s China Institute.

Canada maintains a relatively stringent foreign-investment regime, designed to thwart takeovers that aren’t in the country’s best interests. The Grouse Mountain transaction is too small to trigger a formal Investment Canada review, which is automatic for transactions worth at least $1-billion. And there is no obvious national security risk involved in rocks, trees and ski lifts.

Just look around your own cities and communities. There are plenty of examples of poorly planned and unsightly developments everywhere. Most of them almost certainly predated the arrival of Chinese money.

It’s not about nationality. It’s about regulation.

TRANSPORT

The Globe and Mail. 17 Jul 2017. China-focused firm backs Ottawa rail plan. Toronto-based condo developer, which aims to be a platform for Chinese capital, will spend $5-million to study merits of network

BILL CURRY

A Toronto-based condo developer that specializes in attracting Chinese capital for Canadian real estate is investing in a controversial proposal for a privately run commuter rail network throughout the National Capital Region.

Toronto’s LeMine Investment Group – which has developed condos in Toronto and Ajax – has agreed to spend $5-million on a 120-day study of the merits of a proposed 400-kilometre regional rail network that would connect several small communities outside Ottawa and Gatineau to the downtown core.

In an interview, LeMine chief executive officer Thomas Liu said what impressed him about the project is that it would provide supporting infrastructure that would benefit the public and be financed through the rising property values that would result from putting trains stations in outlying communities.

“It’s a perfect combination,” he said. “That’s what’s amazing about this project.”

Mr. Liu has described his company as having a mandate to be the international investment platform for Chinese capital. Moose Consortium Inc. – the group behind the rail plan – expects major international capital will follow if the study goes well. Mr. Liu’s name came up on the floor of the House of Commons in November, when the NDP raised his attendance at a small $1,500 Liberal Party fundraiser in Toronto to meet with Prime Minister Justin Trudeau. The questions were in the context of the cash-for-access controversy that led the Liberals to introduce reforms for campaign fundraising. Mr. Liu declined to discuss the fundraiser in an interview two weeks ago.

Mr. Trudeau and his government are actively encouraging large-scale foreign investment in Canadian infrastructure.

Moose has been promoting its regional commuter rail idea for several years without any clear sign of traction until now. The first partner companies invested about $500,000 before the deal with LeMine Investment Group. The new partnership also involves a company called Consortia NA, which facilitates private infrastructure projects.

Joseph Potvin, the director-general of Moose, says that if the study is positive, LeMine would at least double that amount for further analysis. Ultimately, the project envisions a $500-million private investment to establish the network, which would use refurbished existing rail lines.

The Moose team says other international investors are prepared to support the project if the initial study is positive. The study is being conducted by Opus International Consultants and Remisz Consulting Engineers Ltd.

The proponents are asking the federal government to endorse the plan, but are not seeking any public money.

The business case is built on capitalizing on the increase in property values that would result from new commuter rail service.

Because the project would cross an interprovincial bridge, Moose says a rarely used section of the Constitution would exempt it from provincial regulation, meaning it would need only federal approval to go ahead.

The plan includes six rail lines that all meet just west of downtown Ottawa at the Prince of Wales Bridge, which opened in 1881 and is not currently in use. On the Ontario side, a western line would run to Arnprior, a southern line would reach Smith Falls and an eastern line would go to Alexandria. On the Quebec side, the plan would serve Bristol to the west, Wakefield to the north and Montebello to the east. All lines would have other stops along the way.

The lines extend much further than the City of Ottawa’s existing plans for a light rail network. The Moose network would primarily serve people who live outside the City of Ottawa.

The project faces many hurdles, including the fact that Ottawa Mayor Jim Watson does not appear to be interested.

“Mayor Watson has not seen or been made aware of a viable proposal from Moose,” said Livia Belcea, the mayor’s spokesperson. Moose appears to have irritated City of Ottawa officials by asking the Canadian Transportation Agency to rule that the city was wrong to remove some track leading up to the Prince of Wales Bridge.

“The [Moose] consortium appears to have no running stock, financing or any of the other indicia of a rail company,” City of Ottawa solicitor Rick O’Connor wrote in a terse e-mail to council members on June 28 in relation to the dispute. The e-mail was sent before Moose secured the LeMine financing.

Mr. Liu, the LeMine CEO, said he would expect the project would begin with two or three stations to demonstrate how the business model would work.

“I see this project as a longterm project,” he said. “I don’t think we are able to develop all of these [communities] within even the next 10 years.”

Liberal MP Greg Fergus, who represents the Quebec riding of Hull-Aylmer across the river from Parliament Hill, said the new investor interest is “exciting” news that changes the way Moose’s proposal should be perceived.

“At a half million dollars, it might not be very credible. At $5-million, it’s all of a sudden a lot more credible,” he said. “And if the market studies that are funded by the private sector come out and say, ‘Yes, this is well worth doing,’ and they’re willing to bankroll several hundred million dollars, then the credibility is already there.”

While some critics of the MOOSE project say it would encourage urban sprawl, Mr. Fergus said it can be good for the environment if people live in densely built suburbs with commuter rail within walking distance.

“It brings so many good things from a health perspective, from an economic perspective,” he said.

Mr. Fergus said behind-thescenes talks are progressing about linking the City of Ottawa and Gatineau transit systems by rail, likely over the Prince of Wales Bridge, which the city owns, but those discussions have not included talk of Moose’s proposal.

“I think all these projects can live together,” he said. “The wonderful thing about trains is you can schedule them.”

AVIATION

BOMBARDIER. The Globe and Mail. 17 Jul 2017. Bombardier begins luxury-jet assembly. Executives are confident the new series, which is a key pillar of the company’s turnaround, will be delivered on schedule

NICOLAS VAN PRAET

Bombardier says it is currently running four Global 7000 luxury jets through final assembly at its Toronto plant while an additional three planes are in flight testing ahead of delivery to initial customers.

Bombardier Inc. has started building its new Global 7000 luxury jet for initial customers, capitalizing on new factory systems to speed up manufacturing as it tries to get the plane certified and into service by the end of 2018.

The Canadian plane maker, which received $372.5-million in federal aid earlier this year – earmarked largely for the new Global jet – said it is running four Global 7000 planes through final assembly in Toronto. At the same time, three Global 7000 jets are in flight testing, with two others expected to join them shortly.

“The program’s development and certification schedule is on track,” Michel Ouellette, senior vice-president in charge of the Global 7000/8000 program, said in a statement released Monday. “Our confidence level is high.”

The Global 7000, which sells for a list price of about $72-million (U.S.), and sister 8000 aircraft, are Bombardier’s biggest business jets. Their development is a key pillar of the company’s turnaround plan as chief executive Alain Bellemare and his team aim to build a luxury-aircraft business that will generate a minimum 8-per-cent pretax margin on revenue of $10-billion by 2020.

It’s not unusual for a manufacturer to start building the first units of an all-new aircraft for customers before testing on the plane is complete and it wins certification from regulatory authorities. But Bombardier says the build-up for the Global 7000 is happening faster than with previous aircraft, partly because of innovations it has introduced on the factory floor.

Those include the introduction of a special interiors test rig at a facility in Dorval, Que. The rig is a replica of the plane’s actual fuselage. Using data collected from the flight-test aircraft, the rig simulates the kind of real-world conditions the plane will be subject to in order to determine the impact on the jet’s highly-customized interiors.

“For the first time at Bombardier, we have a full fuselage that’s testing interior installations that we can bend,” Bombardier spokesman Mark Masluch said. “That is, for us, a kind of gamechanger as far as keeping the [development] schedule.”

Bombardier unveiled the Global 7000/8000 program in 2010 and initially hoped to bring the large-cabin jet to market by 2016. Just months after taking over as CEO, Mr. Bellemare pushed back the date to the second half of 2018, citing complexities with developing a new wing for the aircraft. The company faced a cash crunch at the time that analysts believe also contributed to the decision.

Industry analysts have questioned whether that new wing, a final version of which was only completed this year, would force the company to redo some of its previous flight-testing if authorities consider the new wing to be materially different. Bombardier says no retesting will be required because, though the wing is lighter, it has the same aerodynamics and design as the previous version.

Despite this, some industry observers remain skeptical that the company can meet the timeline it set for the plane’s debut.

“It will be impressive if they can achieve full certification and entry into service by the end of 2018,” said Rolland Vincent, a former Bombardier executive who runs an aerospace consultancy in Plano, Tex. “Bad things happen to good plans.”

A two-year delay on the Global 7000 has cost Bombardier lost sales while industry-wide demand has cooled. “[Bombardier is] going to have to coast on its upfront order book and hope that market conditions improve,” said Richard Aboulafia, of the Teal Group. The company says interest in the plane is strong given its unique combination of range and cabin size.

Bombardier has logged more than 500 flight-test hours on the new aircraft. As part of its trials, the plane has completed hot- and cold-weather environment testing and flown long-range over the North Pole.

The company will likely hire hundreds of people over the next two years to work on finishing the new Global planes’ interiors and is communicating those needs to trade schools, Mr. Masluch said. Woodworkers, upholsterers and other craftspeople will be among those sought out, he said.

HOUSING BUBBLE

StatCan. 2017-07-17. Investment in non-residential building construction, second quarter 2017

Investment in non-residential building construction

$12.4 billion, Second quarter 2017

0.3% increase (quarterly change)

Source(s): CANSIM table 026-0016.

Investment in non-residential building construction totalled $12.4 billion in the second quarter, up 0.3% from the previous quarter. This increase follows three consecutive declines. Nationally, the gain was the result of an increase in spending on the construction of industrial and commercial buildings. The institutional component declined for a second consecutive quarter.

Overall, six provinces posted increases in the second quarter, with Ontario reporting the largest upturn, followed by British Columbia and New Brunswick.

Chart 1 Chart 1: Investment in non-residential building construction

Investment in non-residential building construction

Ontario posted increases in all three components (institutional, industrial, commercial), led by spending on commercial buildings.

In British Columbia, the gain in non-residential construction was mainly the result of higher spending on commercial buildings.

In New Brunswick, non-residential spending in building construction was up 6.6%. The increase was attributable to additional spending on commercial building construction (office and recreational buildings).

Quebec also reported a gain, but it was small (+0.5%), due partly to a strike that affected all construction workers during the final week of May.

The largest decline occurred in Alberta, followed by Saskatchewan. In Alberta, the decrease was mainly the result of lower spending on both institutional and commercial building construction. Despite the decrease in spending, Alberta had the second-highest total spending on non-residential building construction ($2.5 billion), accounting for 20% of total spending for the country. In Saskatchewan, the decrease was primarily the result of lower spending on institutional investment.

Census metropolitan areas

Among the 36 census metropolitan areas (CMAs), 21 saw increased investment in non-residential building construction in the second quarter. Toronto recorded the largest rise, followed by Montréal and Vancouver.

In Toronto, the increase was mainly attributable to an influx in commercial spending, while in Montréal, the increase in spending was mainly the result of an increase in construction of institutional buildings.

The largest declines were reported in Calgary and Edmonton, and in the Ottawa part of the Ottawa–Gatineau CMA. The declines in both Calgary and Edmonton were mainly attributable to commercial and institutional buildings. In Ottawa, the main contributor to the drop was lower spending on construction of commercial buildings.

Industrial component

Investment in industrial projects increased 1.7% to $1.75 billion in the second quarter. At the national level, the increase was attributable to higher investment in the construction of plants for manufacturing and, to a lesser extent, construction of farm buildings and utilities buildings.

Increases were reported in six provinces, with Ontario contributing the most to the overall increase, followed by Alberta.

In Ontario, investment rose 2.9% to $787 million, marking a second straight quarterly gain. Higher spending on plants for manufacturing and on farm buildings were the leading contributors to the gain. The increase in Alberta was mainly the result of higher spending on manufacturing buildings.

In contrast, Quebec posted the largest decline, mainly due to lower spending on maintenance garages and equipment storage buildings.

Chart 2 Chart 2: Commercial, institutional and industrial components

Commercial, institutional and industrial components

Commercial component

Spending on commercial buildings increased by 0.4% to $7.2 billion in the second quarter, led by office building and retail building construction.

Investment in commercial projects rose in six provinces, with Ontario posting the largest gain. The growth in Ontario was mainly the result of increased investment in office and recreational buildings.

Conversely, Alberta recorded the largest declines, followed by Saskatchewan. The decrease in Alberta was attributable to lower spending on office and warehouse buildings. In Saskatchewan, the decrease was due to reduced spending on warehouse and recreational buildings, which more than offset increased spending on shopping centres.

Institutional component

In the institutional component, investment fell 0.7% to $3.4 billion in the second quarter. The national decrease was due to a decline in most institutional building types, which more than offset increased spending on educational buildings.

Declines in investment in institutional projects were recorded in five provinces, with Alberta posting the largest drop.

In Alberta, investment fell 6.9% to $701 million in the second quarter. Lower investment in educational buildings and library facilities were primarily responsible for the decline.

The largest increases in institutional building construction were reported in Quebec and Ontario. In both provinces, the advances were led by increases in spending on educational buildings.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170717/dq170717b-eng.pdf

The Globe and Mail. Jul. 17, 2017. Home sales fall in most markets across Canada

JANET MCFARLAND

House sales fell in a majority of markets across Canada in June, suggesting the real estate sector is cooling just as interest rates are starting to climb and Ottawa is proposing tougher mortgage qualification rules.

Sales fell in Toronto and most nearby cities throughout southern Ontario in June compared to the same month last year, but were also down in an array of markets outside Ontario, including major markets in British Columbia.

Data from the Canadian Real Estate Association shows sales fell in 16 of 26 major markets across the country in June on a year-over-year basis, as well as on a monthly basis compared to May. The total number of homes sold nationally fell 6.7 per cent in June compared to May -- the largest monthly decline since 2010 -- and were down 11.4 per cent compared to June last year.

The slowdown is coming as the Bank of Canada moved last week to increase its key overnight rate for the first time in seven years, raising interest rates to 0.75 per cent from 0.5 per cent. That move came a week after the federal banking regulator, the Office of the Superintendent of Financial Institutions, announced a proposal to toughen mortgage rules this fall by requiring lenders to ensure home buyers could still qualify for uninsured mortgages even if interest rates were two percentage points higher than the offered rate.

The proposals have raised concerns that real estate markets could face a greater correction if interest rates rise further this fall, especially in Greater Toronto Area communities that already faced a significant drop in sales and prices in May and June following the Ontario government’s introduction of a package of reforms to cool the housing market.

CREA chief economist Gregory Klump said the Ontario housing policy changes have clearly prompted many home buyers in the GTA “to take a step back” and assess the market.

“The recent increase in interest rates could reinforce a lack of urgency to purchase or, alternatively, move some buyers off the sidelines before their pre-approved mortgage rate expires,” he said in a statement.

Alex Ocsai, a realtor in the town of Milton west of Toronto, anticipates many people sitting on the fence will start shopping before interest rates rise further, which could provide a boost to sales activity this fall.

“I think the threat of rates going up will bring people away from the sidelines and into the market,” said Mr. Ocsai, who owns Royal LePage Meadowtowne Realty in Milton. “Rates haven’t moved for a long time, so we think right now people are on the sidelines towards the end of the summer waiting to see what will happen, and I think the threat of a rate increase will bring those people out of the woodwork.”

Mr. Ocsai said sales fell 18 per cent in Milton in June compared to a year earlier as new listings spiked, which he believes is the result of many investors and speculators leaving the market.

“We have seen a lot of investors and as much of our share of speculation as anyone else, and it looks like those people are gone,” he said.

The Greater Toronto Area led the national decline in June, with the number of homes sold falling by 38 per cent compared to a year earlier, while numerous other Ontario cities also posted declines in June. Sales fell 23 per cent in Hamilton-Burlington, for example, and 23 per cent in the Niagara region.

Sales also dropped in B.C. in June, with Greater Vancouver seeing 12 per cent fewer sales compared to June last year, while sales fell 13.6 per cent in Victoria and almost 10 per cent in the Fraser Valley region. Regina saw 32 per cent fewer homes sold in June, while sales fell 11.5 per cent in Gatineau and 15.5 per cent in Newfoundland and Labrador.

Toronto Dominion Bank economist Diana Petramala said the national housing market is in its third month of what is expected to be a “soft landing,” with the downturn triggered by changes to provincial and federal housing policies. Toronto in particular has now moved from sellers’ territory to buyers’ territory based on the ratio of available listings to sales in June, she said.

Ms. Petramala said last week’s interest rate increase will help “solidify” the downturn, and mortgage rates will continue to edge higher, predicting there will be three more interest rate increases by the end of 2018. TD forecasts house prices nationally will fall by 2.1 per cent in 2018.

“Much of that weakness will be concentrated in markets in Ontario and B.C., where households are particularly sensitive to higher mortgage rates given the stretched affordability,” Ms. Petramala said in a research report Monday. “Elsewhere in the country, the improving economic conditions should help offset some of the impact of gradual interest rate hikes, with home prices and sales expected to trend higher.”

REUTERS. JULY 17, 2017. Canada home resales drop again as rates rise: real estate group

By Andrea Hopkins

OTTAWA (Reuters) - The resale of Canadian homes fell 6.7 percent in June from May, the largest monthly drop since 2010 and the third straight monthly decline as sales in Toronto plunged, the Canadian Real Estate Association said on Monday.

The industry group said actual sales, not seasonally adjusted, slumped 11.4 percent from June 2016, while home prices surged 15.8 percent from a year earlier, according to the group's home price index.

Prices in and around Toronto, Canada's largest city, led the monthly decline in CREA's home price index, with Toronto prices falling 0.7 percent in the month and prices in nearby Oakville-Milton down 3.6 percent. Compared to a year ago, Toronto prices are up 25.3 percent.

CREA said changes to housing rules in Ontario, Canada's most populous province and home to Toronto, prompted homebuyers to wait and see how the market would react to yet another attempt to rein in the housing boom.

Ontario introduced a 16-point plan to douse speculation blamed for fueling an extended housing boom. The changes included a 15-percent foreign buyers tax similar to one imposed in Vancouver in 2016.

Rising interest rates, including higher mortgage rates and a move by the Bank of Canada last week to hike its official interest rate for the first time in nearly seven years, could also play a role in the cooling market.

"The recent increase in interest rates could reinforce a lack of urgency to purchase or, alternatively, move some buyers off the sidelines before their pre-approved mortgage rate expires," Gregory Klump, CREA's chief economist, said in a statement.

He said buyers who had bought a home before selling their existing home may also "become more motivated to reduce their asking price rather than carry two mortgages" as the falling market gives prospective buyers cold feet.

The report showed new listings fell 1.5 percent in June after two months of record listings in April and May, but sales dropped even further, driving the sales-to-new listings ratio to 52.8 percent, considered balanced territory. The ratio had been in the high-60 percent range just three months ago, when sellers in Toronto could expect multiple offers or bidding wars.

While year-over-year price gains remained in the double digits, the rate of appreciation has slowed and the actual national average price for homes sold in June was C$504,458 ($398,686), up just 0.4 percent from a year earlier, CREA said.

($1 = 1.2653 Canadian dollars)

Reporting by Andrea Hopkins in Ottawa and Fergal Smith in Toronto; Editing by Bernadette Baum

BLOOMBERG. 17 July 2017. Chill Descends on Toronto Housing as Prices Drop Most Since 1988

By Josh Wingrove and Erik Hertzberg

- Three-month average down 14.2% after flood of new listings

- Bank of Canada rate hike expected to further cool market

- Toronto Home Demand Slides as Sales Drop Most in 8 Years

Canada’s hottest housing market is definitely cooling down.

Total home sales in Greater Toronto dropped to 5,977 in June, the lowest level since 2010 and down 15.1 percent from the month prior, data from the Canadian Real Estate Association show. Average prices are down 14.2 percent since March -- the fastest 3-month decline in the history of the data back to 1988 -- while the ratio of sales to new listings sits at its lowest level since 2009.

The June data comes after a series of measures by policy makers to tighten access to the market -- and before the Bank of Canada hiked its benchmark interest rate last week, the first increase since 2010 that will further pinch mortgage eligibility. Prices and sales also fell in nearby regions such as Hamilton-Burlington and Kitchener-Waterloo, CREA data show.

“Changes to Ontario housing policy made in late April have clearly prompted many homebuyers in the Greater Golden Horseshoe region to take a step back and assess how the housing market absorbs the changes,” Gregory Klump, CREA’s chief economist, said in a written statement, referring to Toronto and its surrounding communities.

Sales also fell 4 percent from the previous month in Vancouver, the country’s other hot real estate market, to 3,047 residential units. Greater Vancouver remains Canada’s most expensive market with an average price of C$1.04 million, down 3.2 percent from May.

Lawmakers, concerned that escalating prices could lead to a disorderly correction, imposed measures including tightened mortgage eligibility rules and a tax on foreign buyers. Toronto’s market has lost momentum, while in Vancouver sales plummeted last year on similar measures but have since rebounded.

The bulk of the cool-down is in regions affected by Ontario’s new foreign buyers tax, Bank of Montreal economists Doug Porter and Robert Kavcic wrote in a research note Monday. A re-balancing of sales-to-listing ratios “has taken some serious steam out of pricing power,” they wrote.

The economists expect Toronto to follow Vancouver’s path -- price adjustment at the top of the market with less impact at lower prices. Meanwhile, cities like Montreal and Ottawa look strong.

“The Canadian housing market is chock full of unique stories, both positive and negative,” Porter and Kavcic said. Ontario’s changes “have worked to alter market psychology -- and that is a positive outcome given the speculative dynamics in place a few months ago.”

Sales fell most sharply in Regina, which was down 27.3 percent. Home sales in Canada overall were down 6.7 percent from the previous month, while the average price fell to C$491,770, down 3.4 percent from the previous month. Average prices remained up 0.4 percent from the previous year.

INNOVATION

Innovation, Science and Economic Development Canada. July 14, 2017. Canada’s Innovation Minister and U.S. Commerce Secretary identify new areas for collaboration. Emerging technologies open up new opportunities for U.S.-Canada cooperation to encourage innovation, create jobs

Washington, D.C. – The Honourable Navdeep Bains, Canada’s Minister of Innovation, Science and Economic Development, today held a meeting with U.S. Commerce Secretary Wilbur Ross.

The objective of this meeting, which follows their first encounter in May, was to identify several areas in which emerging technologies could provide new opportunities for bilateral cooperation between Canada and the United States.

The goal is to ensure that both Canadians and Americans have the skills and opportunities to benefit from new industries that emerge. These new industries have the potential to create thousands of well-paying, middle-class jobs on both sides of the border.

The following statement summarizes their discussion:

Minister Bains and Secretary Ross discussed ways in which Canada and the U.S. can work together to ensure that North America remains a world leader in the development and adoption of connected and autonomous vehicles.

The Minister pointed to a number of Canadian firms and research teams that are world leaders in developing the enabling technologies for self-driving cars. When leveraged through cross-border collaboration, this expertise can accelerate innovation, create thousands of jobs and generate new business opportunities that benefit Canadians and Americans alike, especially those who work in the world’s second-largest automotive cluster located in the Great Lakes region.

Minister Bains also identified rare earth elements as another area of opportunity for bilateral cooperation. Rare earth elements are the raw materials that have become essential in manufacturing digital devices, from smartphones to tablet computers, kitchen appliances, cars, jets, even the circuits that control computer networks.

As digital devices have become basic tools of the economy and everyday life, Canada and the U.S. have an opportunity to work together to ensure that both countries continue to have access to a secure and predictable supply of rare earth elements for North America’s manufacturing sector, which is a key engine of job creation.

Additionally, Minister Bains emphasized to Secretary Ross the importance of the balanced and integrated production of steel between Canada and the United States. Any disruption in the cross-border steel trade would hurt citizens and companies in both countries.

Minister Bains assured Secretary Ross that Canada will continue to work with the U.S. to address the excess capacity of steel on the global market and enforce any measures on dumped or subsidized imports from offshore. As an ally of the U.S. in NORAD and NATO, Canada takes the position that it is inappropriate to view the cross-border steel trade through the lens of national security. Canada is a reliable and trusted supplier of goods and equipment to the U.S.

Furthermore, Minister Bains reminded Secretary Ross that the Government of Canada strongly disagrees with the petition filed by Boeing Aerospace Corporation with the U.S. Department of Commerce. The petition alleges the dumping in the U.S. market of aircraft manufactured by Canada’s Bombardier Inc. Minister Bains told Secretary Ross that he will continue to vigorously defend the interests of Canada’s aerospace industry as well as jobs on both sides of the border.

The Globe and Mail. Special. Jul. 17, 2017. MONDAY MORNING MANAGER. Tread the third path to innovation

HARVEY SCHACHTER

We have been trained to see innovation in two ways. The first is incremental improvement, when small tweaks are made to a product in the hopes of expanding its appeal. The other, drawing most of the attention, is disruptive innovation, revolutionary improvements that change markets and industries, as when Nucor introduced the mini-mill to make steel significantly cheaper, Amazon pioneered an online bookstore or Steve Jobs unveiled the iPhone.

David Robertson, a professor of practice at the University of Pennsylvania’s Wharton School, says there’s a third, important approach that executives need to consider. It has been successfully applied at various companies but has drawn little attention.

It consists of multiple, diverse innovations around a central product or service that makes the product more appealing and competitive. An example is Gatorade, which had tried incremental change through different flavours and redesigning its logo to become simply G, but was losing traction to other types of drinks in a shaky economy. The company instead focused on its core customers – serious athletes – and started offering an array of what it called “sports fuel,” such as gels and bars for before a race, and protein smoothies for post-exercise recovery. None of that was revolutionary. But it wasn’t just product tweaks, either. It was a new direction that supplemented the original product.

The complementary innovations operate together and with the key product as a system to carry out a single strategy or purpose – the promise to users. They are not random or opportunistic, based on what is convenient, but carefully brought together to satisfy a compelling user need. Prof. Robertson points to Novo Nordisk, which introduced a human growth hormone to the U.S. market in 1997, 10 years after Genentech. But it offered convenient prefilled injection pens that contained multiple doses, eliminating problems about dosage, and was supplemented by NordiCare, a support program that went far beyond anything else in supporting the user. These elements added up to a better system for users.

The third distinguishing characteristic of the approach is the complementary innovations – even when delivered by outside partners – are closely and centrally managed by the company. Prof. Robertson contrasts that in an interview with IBM PCs, where the company failed to control crucial elements such as the operating system and power chips, losing out on critical financial opportunities. Instead, CarMax has introduced a host of changes to make buying a used car stress-free, including controlling ancillary elements of the deal lsuch as the trade-in, warranty and financing.

“The binary view of innovation – that the only alternative to incremental improvement is radical disruption – is dangerously simplistic,” he writes in The Power of Little Ideas.

“The Third Way is not a replacement for incremental improvements or disruptive innovations; rather, it’s another option that every business leader should understand and consider when faced with an innovation challenge.”

In his research, Prof. Robertson developed a different view of Mr. Jobs, who is celebrated for his disruptive innovations. Yes, the iPhone fits that description. But not iTunes and the iPod. Prof. Robertson found that, originally, Mr. Jobs did not want these innovations to be available to non-Mac users and had to be pushed into reversing himself. They were intended to bolster the appeal of his computer, a third-way constellation of offerings around Apple’s main product. “This may seem like academic hairsplitting, but it’s important for managers to realize he was trying to complement the Mac rather than disrupt the music industry,” Prof. Robertson says in the interview.

In heading down this road, he warns you to expect to grapple with four decisions:

- What is your key product?

- What is your business promise?

- How will you innovate?

- How will you deliver your innovations to consumers?

The key product should be what Prof. Robertson calls one of your “crown jewels.” For Lego, that was the bricks. But when the company moved into diverse new products that weren’t brick-based, such as theme parks and after-school education, it suffered. When it introduced Bionicle, which used plastic pieces to create action figures, and surrounded it with a video game, direct-to-video movies, and licensed merchandise such as Nike shoes, the company had a winner. For Guinness, the crown jewel is its beer. But its Irish Pub Concept helps people outside Ireland to establish pubs with authentic Irish items bought from estate sales in that country and, of course, a chance to enjoy the dry stout.

“Sometimes the best way to innovate is not outside the box, but around the box,” he says.

________________

LGCJ.: