CANADA ECONOMICS

TOURISM

StatCan. 2017-06-29. National tourism indicators, first quarter 2017

Tourism spending in Canada

$21.2 billion

First quarter 2017

0.9% increase

(quarterly change)

Source(s): CANSIM table 387-0001.

Tourism spending in Canada rose 0.9% in the first quarter of 2017, following a 0.4% gain in the fourth quarter of 2016. Increased tourism spending by Canadians at home and by international visitors in Canada contributed to the overall growth.

Since the third quarter of 2009, tourism spending has increased every quarter except the third quarter of 2012, when it declined 0.3%.

Chart 1 Chart 1: Tourism spending in Canada increases again

Tourism spending in Canada increases again

Tourism spending by Canadians increases

Tourism spending by Canadians in Canada grew 0.7% in the first quarter of 2017, after increasing 0.4% the previous quarter.

Growth was mainly attributable to increased outlays on passenger air transport (+1.3%) and on non-tourism goods and services (+1.8%), such as groceries and clothing. Tourism spending on recreation and entertainment (+0.9%) also increased.

Spending on travel services (-1.3%) and vehicle fuel (-0.5%) fell in the first quarter.

Chart 2 Chart 2: Tourism spending by Canadians at home advances

Tourism spending by Canadians at home advances

Spending by international visitors rises

Spending by international visitors in Canada rose 1.6% in the first quarter of 2017, following a 0.4% gain the previous quarter, as overnight travel from both the United States and overseas countries increased.

Higher outlays on passenger air transport (+3.4%) and accommodation services (+1.9%) largely contributed to the growth. Tourism spending on recreation and entertainment (+2.2%) and food and beverage services (+1.2%) also increased.

Tourism spending on vehicle fuel (-0.8%) and non-tourism goods and services (-0.4%) were lower in the first quarter, as same-day car travel declined.

Chart 3 Chart 3: Tourism spending by international visitors up

Tourism spending by international visitors up

Tourism gross domestic product advances

Tourism gross domestic product (GDP) rose 0.8% in the first quarter, after edging up 0.1% in the fourth quarter. By comparison, national GDP grew 1.0% in the first quarter following a 0.6% increase the previous quarter.

The increase in tourism GDP was largely due to growth in the transportation (+2.0%) and accommodation (+0.8%) industries. Tourism GDP in non-tourism industries increased 0.3%.

Tourism employment rose 0.3% in the first quarter, after edging up 0.1% the previous quarter. Increases in food and beverage services (+0.5%) and recreation and entertainment (+1.2%) were partially offset by fewer jobs in travel services (-1.3%) and accommodation services (-0.2%). Tourism jobs in non-tourism industries increased 0.5%.

Government revenue attributable to tourism increases in 2016

In 2016, $25.5 billion of government revenue was directly attributable to tourism, up 3.1% from 2015. Domestic tourism spending accounted for 76.2% of this revenue, with the remainder coming from tourism exports.

Taxes on products sold to final consumers ($14.8 billion), such as the GST and HST, were the largest source of government revenue attributable to tourism, followed by corporate and individual income tax ($5.0 billion).

Most of the revenue generated from tourism was collected by the federal, provincial and territorial governments (94.5%). The remainder was collected by municipal and aboriginal governments.

Every $100 spent by non-resident visitors generated, on average, $30.29 in government revenue, down from $30.97 in 2015. Resident visitors generated $27.12 in revenues for every $100 spent, compared with $27.37 in the previous year. Overall, every $100 in tourism spending generated $27.81 in government revenue in 2016, down from $28.11 in 2015.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170629/dq170629b-eng.pdf

AGRICULTURE

StatCan. 2017-06-29. Principal field crop areas, June 2017

Wheat area

22.4 million acres

2017

-3.7% decrease (annual change)

Canola area

22.8 million acres

2017

12.1% increase (annual change)

Soybean area

7.3 million acres

2017

33.2% increase (annual change)

Corn for grain area

3.6 million acres

2017

7.5% increase (annual change)

Source(s): CANSIM table 001-0017.

Canadian producers reported seeding record areas of canola and soybeans in 2017, with the canola area exceeding wheat (all varieties combined) for the first time ever. Seeded acreage of corn for grain and oats also increased. Meanwhile, the areas seeded to all wheat, lentils and barley declined from 2016.

Due to unseasonal early snow last fall, harvesting in some parts of the country was delayed until this spring. Additionally, localized areas reported very wet spring conditions and some flooding occurred in Ontario and Quebec. These conditions may have affected some of the seeded areas reported.

Canola

Canadian farmers reported seeding a record high 22.8 million acres of canola in 2017, up 12.1% from the 20.4 million acres reported in 2016.

The overall increase in canola seeded area was the result of record highs in Saskatchewan and Alberta. Farmers in Saskatchewan planted 12.6 million acres of canola in 2017, up 13.6% from 2016. Meanwhile, producers in Alberta sowed 6.9 million acres of canola this year, an increase of 16.5%. Manitoba farmers seeded 3.1 million acres this year, down 1.1% from a year ago.

Wheat

Canadian farmers reported an overall decrease in the area sown to wheat in 2017, down 3.7% from 2016 to 22.4 million acres. The decrease was the result of a 15.9% drop in area seeded to durum wheat, which fell to 5.2 million acres in 2017. Conversely, the area seeded to spring wheat rose 2.5% to 15.8 million acres.

Provincially, Saskatchewan farmers reported the area seeded to all varieties of wheat decreased for a fourth consecutive year, falling 6.9% from 2016 to 11.3 million acres in 2017. The overall decline was the result of a decrease in durum wheat acres, which fell 18.0% to 4.1 million acres.

Producers in Alberta reported that their total wheat area grew 5.5% from 2016 to 7.1 million acres in 2017. An increase in spring wheat acreage accounted for the overall rise, up 9.8% to 5.9 million acres. Conversely, durum wheat seeded area declined 6.8% to 1.1 million acres.

The total area sown to all varieties of wheat in Manitoba fell 9.0% from 2016 to 2.7 million acres in 2017. This was mainly due to a 5.9% decline from 2016 in spring wheat acres to 2.6 million acres.

Soybeans

Nationally, the total area seeded to soybeans rose to a record high 7.3 million acres in 2017, up 33.2% from 2016. The four largest soybean producing provinces (Ontario, Manitoba, Quebec and Saskatchewan), which account for 99% of the national total, all reached record high levels for seeded soybean acres this year.

In Ontario, farmers seeded 3.1 million acres in 2017, up 13.5% from last year. Manitoba farmers continued their trend of planting more soybean acres, seeding 2.3 million acres in 2017, up 40.1% compared with 2016.

In Quebec, the soybean area increased 22.5% from 2016 to 983,500 acres in 2017, while Saskatchewan farmers seeded 850,000 acres to the crop this year (+254.2%).

Corn for grain

Canadian farmers reported planting 3.6 million acres of corn for grain in 2017, an increase of 7.5% from 2016.

In Ontario, farmers planted 2.1 million acres of corn for grain in 2017, an increase of 4.7% compared with last year. The area seeded to corn for grain in Quebec also rose this year and was reported at 939,000 acres (+5.6%).

Meanwhile, farmers in Manitoba planted 410,000 acres of corn for grain in 2017, up 18.8% from 2016 and a record level seeded for the province.

Barley and oats

Nationally, the total area seeded to barley fell 9.7% from 2016 to 5.8 million acres in 2017. Alberta and Saskatchewan accounted for almost 90% of the national barley seeded area in 2017.

The total acreage seeded to oats rose 13.6% from 2016 to 3.2 million acres in 2017. In Saskatchewan, farmers planted 1.7 million acres (+20.3%), while Alberta's acreage decreased 4.2% to 690,000 acres.

Lentils

Total area seeded to lentils decreased 24.8% from last year's record high, to 4.4 million acres in 2017. This decline was mainly attributable to Saskatchewan's lentil area (which accounts for close to 90% of the total acreage in Canada), which fell 25.8% from 2016 to 3.9 million acres.

Chart 1 Chart 1: Wheat and canola: The race for first place

Wheat and canola: The race for first place

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170629/dq170629c-eng.pdf

BLOOMBERG. 29 June 2017. Canadian Farmers Plant More Canola Than Wheat for First Time Ever

By Greg Quinn and Jen Skerritt

- Wheat sowing declines after excess rain in northern areas

- Spring-wheat futures extend rally to three-year high

Wheat is no longer Canada’s king crop.

Farmers planted more canola this year for the first time since Canada developed the oilseed used to make the cooking oil used in everything from salad dressing to french fries.

Canola planting rose 12 percent to a record 22.8 million acres from a year earlier, Statistics Canada data showed Thursday. Wheat seeding fell 3.7 percent to 22.4 million acres, trailing the 23.2 million the government forecast in April and the 22.8 million expected by analysts in a Bloomberg News survey.

After the data was published, spring-wheat futures jumped by the exchange limit in Minneapolis, extending a rally to a three-year high.

Farmers in Saskatchewan, the province whose flag is emblazoned with a wheat sheaf, cut back on the grain used to make bread. Planting declined 6.9 percent to 11.3 million acres, the fourth straight annual decline. Canola seeding rose 14 percent to a record 12.6 million acres.

“The weather challenges in Saskatchewan and Alberta probably caused a lot of growers to switch from wheat to other crops,” said David Reimann, a market analyst at Cargill Ltd. in Winnipeg, Manitoba. “Canola is easier to seed in wet conditions.”

On the Minneapolis Grain Exchange, spring-wheat futures for September delivery jumped 7.2 percent to $7.5925 a bushel at 9:48a.m. New York time. Earlier, the price jumped by the limit of 60 cents to $7.68, the highest for a most-active contract since May 15, 2014. The grain has surged 41 percent this year amid adverse weather in the northern U.S.

Rain Delays

Seeding in parts of Canada’s prairies was delayed this spring after fields in some areas got too much rain. Planting in northern regions fell two weeks behind schedule after precipitation in April and May was as much as four times the average. In contrast, parts of southern Saskatchewan and Manitoba had less than 60 percent of average precipitation since April 1, according to the nation’s agriculture ministry.

Development of 40 percent of Saskatchewan’s cereal crops is behind normal, according to government reports.

Canola is “one of Canada’s greatest crop inventions” and began with 3,200 acres planted in 1943, Statistics Canada said in describing changes before the country’s 150th anniversary on July 1. Futures on ICE in Canada have dropped 3.2 percent this year.

The survey of 24,500 farms for the latest data was taken from May 26 to June 12, and the final 2017 tally will be released on Dec. 6.

AUTOMOTIVE SECTOR

StatCan. 2017-06-29. Vehicle registrations, 2016

Total vehicle registrations — Canada

33.8 million

2016

1.8% increase

(annual change)

Source(s): CANSIM table 405-0004.

The number of vehicles registered in Canada increased 1.8% from 2015 to 33.8 million in 2016.

The registrations of light road motor vehicles (vehicles weighing less than 4,500 kilograms) rose by 1.6% to 22.4 million, accounting for 92.3% of the total number of motorized road motor vehicles registered in 2016. The remaining consisted of motorcycles and mopeds (716,000 registrations), medium-duty trucks (590,000 registrations), heavy-duty trucks (463,000 registrations) and buses (91,000 registrations).

In addition to these road motor vehicles, 7.3 million trailers and 2.2 million off-road, construction and farm vehicles were also registered.

From a provincial perspective, the number of vehicles registered in Ontario reached 11.9 million (up 2.2% from 2015), followed by Quebec (up 2.5% to 8.4 million) and Alberta (up 0.2% to 5.1 million).

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170629/dq170629d-eng.pdf

The Globe and Mail. 29 Jun 2017. In Canada’s auto-parts factories, Japan now outpaces United States

GREG KEENAN, AUTO INDUSTRY REPORTER TORONTO

A worker inspects vehicles at a Honda plant in Alliston, Ont. Honda and Toyota’s manufacturing units assembled 44 per cent of all passenger cars and light trucks made in Canada last year.

Honda of Canada Manufacturing Inc. and Toyota Motor Manufacturing Canada Inc. assembled more than one million vehicles last year, representing 44 per cent of all passenger cars and light trucks made in Canada.

Those are among the key conclusions of a study done by McMaster University professors Greig Mordue and Brendan Sweeney, who examined the economic impact of Japanese auto investment in Canada between 2001 and 2016. The study was undertaken for the Japan Automobile Manufacturers Association of Canada.

The study comes as federal policy makers and trade negotiators assess what strategy to adopt in talks on renegotiating the North American free-trade agreement and the Japanese companies press for equal treatment with their South Korean and European rivals when it comes to tariffs on vehicles imported into Canada from outside North America.

The increase in output and employment by Japan-based companies is “a story which has kind of been lost in the higher level stats that we’ve read about the Canadian automotive industry as our growth has been offset by a retrenchment by U.S. auto makers and parts makers,” David Worts, executive director of JAMA Canada, said Wednesday.

Those statistics include a drop in overall vehicle production in Canada to 2.357 million last year from the record high of 3.056 million in 1999. Output by Honda of Canada Manufacturing Inc. and Toyota Motor Manufacturing Canada Inc. rose while overall vehicle production in Canada was falling, which means the two Japan-based companies almost doubled their share of Canadian production from 23 per cent in 2001.

Investments by Japanese parts makers to feed expansions by Honda and Toyota led to employment at the components makers to more than double between 2001 and 2016. They employed 17,155 people in Canada last year, compared with 12,000 who were employed at U.S.-based parts firms. Some U.S.-based parts companies have departed entirely from Canada, while others have drastically scaled back their Canadian operations.

“We think the report underscores the need for balanced, open, transparent and equitable trade policies … while maintaining a competitive marketplace for the benefit of Canadian consumers,” Mr. Worts said in a interview.

The long history of U.S. companies in Canada means U.S. interests can overshadow those of other companies when Canada is in trade negotiations or regulating the industry, said Stephen Beatty, vice-president of Toyota Canada Inc.

Industry analysts within government are aware of the size of the Japan-based industry in Canada, Mr. Beatty said, “but impressions die hard. If you go to Ottawa or elsewhere across the country, there’s still an impression of the U.S.-based industry being much more substantial than it actually is today.”

Honda and Toyota face an actual competitive disadvantage compared with South Korean and European companies even though the Japan-based companies have invested billions of dollars here and companies from those regions have not. The Canada-South Korea free-trade deal eliminated a 6.1-per-cent tariff on vehicles imported into Canada from South Korea, while the agreement between Canada and the European Union will do the same thing over the next few years on vehicles imported from Europe.

Japan-based companies are seeking the elimination of the tariff on their vehicles through a Canada-Japan free-trade deal or the Trans-Pacific Partnership trade agreement.

EDC. JUNE 29, 2017. The Outlook for Your Industry

By Peter G Hall, Vice-President and Chief Economist

What’s in it for me? It’s a reasonable question in any business deal, from the grade-school playground to the boardroom of the multinational corporation. It also applies to macro forecasting. It’s fine to know the big picture, and more necessary than ever. But if it is impossible to distill from that the effects at the industry level, then listeners are left to figure it out on their own. Our forecast attempts to bridge the gap by offering something more detailed. In our new forecasting tool, we cover 28 industry categories, complete with performance and forecast data, and visuals on Canada’s presence, by industry, in world markets. What is the outlook on an industry-by-industry basis?

The news is generally good. Overall growth for exports of Canadian goods is forecast to increase by 6 per cent this year and by another 5 per cent in 2018. This year’s numbers are getting a lift from the rebound in commodity prices, but there is other interesting stuff going on as well. The 2018 forecast is less about price movements and more about increased flows of real stuff leaving the plant gate, and it’s linked to the ramp-up in world growth from 3.5 per cent in 2017 to 3.8 per cent in 2018. If anything, it looks like these numbers are conservative. Through April, this year’s exports are up 8.5 per cent over last year, and since last June, growth is rocketing up at an 18.5 per cent pace on an annualized basis. Pretty heady stuff. What’s driving this?

Broadly speaking, this year’s winners are generally the industries that took a drubbing last year. Faced with steep price declines, energy sector exports were off by 17 per cent last year, the aerospace sector dropped 11 per cent and mining shed 3 per cent. It’s a big U-turn for energy exports this year, rising by an expected 18 per cent. At the same time, mining is in for an 11 per cent surge. In both sectors, prices are the principal factor, in addition to volume growth related to the completion of development and expansion projects. The sector is also expected to benefit from cost-containment exercises that will enable higher viable throughput at lower world prices.

Aerospace exports will also see double-digit growth, but not until 2018. Increased global demand and the ramp-up of production of the Bombardier C-Series are behind this impressive acceleration.

In the middle of the pack are three industry groupings. After a slight drop in shipments last year, the chemicals and plastics sector is expected to grow 7 per cent this year and 8 per cent in 2018. This growth is connected to the increase in US industrial production over the short term, and to favourable pricing. Industrial machinery and equipment is forecast to average 5 per cent growth this year and next. The partial revival of the resource sector is partly responsible, along with a general increase in business investment after a 7-year lull. The third ‘middle-growth’ sector is fertilizers, which, after taking a drubbing in 2016 will see two years of stable growth at 4 per cent.

Softer growth will be seen in a number of export sectors. The auto sector will see shipments flatten out in the next two years, partly as a result of sales peaking in the US and capacity limitations in Canada. Activity remains robust in the industry, and near-term investment commitments in Canada are significant. Advanced technology exports have struggled to grow for a number of years, and we expect no material change in shipment levels through 2018. Things will be modestly better in the agri-food sector. Potential growth is very strong, but foreign sales will be limited by available supplies. Upside growth is possible with the signing of the CETA agreement, as the greatest single opportunities under this deal are in the agri-food space.

One final observation: with trade shock-talk swirling, the diversification word has come back into the vernacular. The CETA agreement will boost near-term European sales, increasing our diversification to more traditional markets. In this forecast, exports to emerging markets will rise at a double-digit pace this year, and in many industry sectors, emerging market sales will power ahead at much superior growth rates.

The bottom line? There’s quite a bit of diversity in growth rates by industry sector over the near term. If anything, overall results could be better than foreseen, given recent data. And even in softer sectors, there’s a lot of hot emerging market demand.

FINANCE

Bank of Canada. 28 June 2017. Markets Calling: Intelligence Gathering at the Bank of Canada. By Lynn Patterson, Deputy Governor. CFA Society Calgary. Calgary, Alberta

Introduction

Good afternoon. Thank you for that kind introduction.

As participants in today’s marketplace, you are likely experiencing how quickly technology and markets are evolving. And I can relate. The changes that I saw during my years in fixed-income and equity markets were remarkable. Shortly before I began working in fixed-income markets, if you wanted to sell a bond, you would make a phone call and follow up with a teletype message with all the details. Then, someone in your back office would physically descend into a vault to pull the bond and have it delivered to the buyer by hand. Imagine how sluggish that process would seem to today’s traders who transact and settle securities worth millions of dollars with a couple of taps on the keyboard.

The shifts in market function and participation that we are seeing globally today are as dramatic. Some stem from central bank actions in certain jurisdictions, such as quantitative easing and negative interest rates. Others are the result of regulatory reform, new technologies and investor preferences. Think, for example, of the influx of investors in the commodity space using indexed and exchange-traded funds (ETFs). Or how high-frequency trading (HFT) firms are compressing bid-ask spreads in the futures and equity markets. Or the development in Canada and globally of central counterparties for over-the-counter (OTC) derivatives and repos.

Keeping up to date on new trading practices and how the markets are functioning is important to the Bank of Canada. Our mandate is to “promote the economic and financial welfare of Canada.”1 So we closely monitor the vigour and health of the financial system.

My responsibilities at the Bank include the oversight of our activities in financial markets. This includes market intelligence, which is my topic today.

Now market intelligence can take many different forms, including—in its broadest sense—the macroeconomic insights we gain from talking face to face with businesses operating in the real economy. This includes the important work done by our regional teams on a quarterly basis for our Business Outlook Survey.

I can’t emphasize enough how critical these real-time perspectives are to our overall understanding of economic developments, particularly during periods of heightened uncertainty. They provide us with timely insights that we wouldn’t have been able to see in the data until months later. In my remarks I will highlight an example of how this feeds into our policy decision making. But my focus today will be on the intelligence we gather from financial markets.

Let me start by expanding on the significance of the Bank’s market intelligence. I will then explain how we gather it and how that has evolved. Finally, I will share with you what we are learning and how we use what we learn.

Our Need to Know

The market intelligence we gather is a critical complement to our analytical work. Often, in interpreting data, or through our modelling, we develop a view about the future direction of the economy or inflation. Our intelligence work then offers us an opportunity to corroborate or, occasionally, refute what we see in the data. It helps us fill in the pieces of the puzzle that may be missing or that need greater clarity so that we can refine our judgment surrounding the outlook. It can give us new insights into how markets are functioning and responding to regulatory or other changes. All of this helps us shape Bank policies and is integral to our core functions. Let me say a few words here about those functions.

First is the conduct of our inflation-targeting monetary policy. We have successfully maintained inflation close to our 2 per cent target since 1995. The policy’s effectiveness depends on the efficient transmission of our rate decisions through to capital markets. It is therefore essential that we have a solid understanding of how those transmission channels function and are evolving.

Second, we act as fiscal agent for the federal government, managing its reserves, auctioning its bonds and managing its cash. And that is why it is important for us to assess how market developments could influence these activities.

Third, we are responsible for promoting the efficiency and stability of the financial system. We do this in a number of ways. We consider financial stability issues in our decisions and operations. We provide liquidity facilities and serve as lender of last resort. And we oversee the key payment clearing and settlement systems that support the Canadian economy and financial markets. So we need to understand how market developments could affect the financial system, vulnerabilities to it or the effectiveness of our tools. I should underline that, payment and settlement systems aside, we do not have regulatory responsibilities for financial market participants. This is actually helpful and conducive to open, two-way exchanges. At the same time, we maintain regular and open dialogue with the federal and provincial authorities that do exercise such responsibilities. And we share with them our analysis of potential vulnerabilities and risks.2

The Governor of the Bank of Canada is a member of the Senior Advisory Committee, a non-statutory body that discusses macroprudential policy. Its other members are the Federal Deputy Minister of Finance, the Superintendent of Financial Institutions, the Chair of Canada Deposit Insurance Corporation, and the Commissioner of the Financial Consumer Agency of Canada.

Our intelligence gathering supports these functions by ensuring that we remain well informed of market activity and structure. This is by no means a new activity for us. The Bank has been observing markets since it opened in 1935.

However, until the 2007–09 financial crisis, intelligence gathering by the majority of central banks, including the Bank of Canada, tended to focus on operations and monetary policy formulation.3 But the crisis made it clear that central banks missed some areas where risk was building. We were familiar with traditional markets, such as those for government bonds and foreign exchange, but much less knowledgeable about other areas, such as markets for structured credit and OTC derivatives. Those were some of the areas where leverage had risen to dangerous levels.

In 2009, the G20 called for new regulations to strengthen the stability of the global financial system.4 The measures that have since been put in place range from structural reforms to capital enhancements. They include new solvency and liquidity standards and new risk requirements for products such as OTC derivatives.5

These regulatory reforms have strengthened the global financial system. Today, the institutions at the heart of the system—the banks and other financial intermediaries—are safer and have lower levels of leverage. However, we all know that risk remains. It may now reside in some areas that are not subject to as much or any regulation and, as such, is not easily observed.

The regulations have also affected the intermediary function that banks have long performed. As they look to optimize their use of capital, they are allocating less balance sheet to certain asset classes, such as corporate bonds. This has affected liquidity in these products and altered the way investors execute and trade.

In response to these evolutions in market functioning and behaviour, we have adapted how we track the health of the financial system. We’ve increased the frequency of our checkups, are making contact with a broader set of players and have added new diagnostic tools. We now devote more resources to the who, what, how and why of the vulnerabilities we identify and their interplay with markets.

How We Gather Market Intelligence

To undertake these new tasks, we have expanded our team at the Bank of Canada. Because communication is key—not by email, or tweets, but with in-person meetings and discussions with a wide range of market participants. We augment our conversations with analysis, research and surveys.

To facilitate our exchanges, we maintain and, in some cases, have expanded our presence in Toronto, Montréal and New York. We make regular trips across the country as well as to London and other key international financial centres.

Across Canada, and around the world, we also hear from participants at our speaking engagements. And while we are committed to communicating new information on the outlook and policy only in public settings, the insights we garner in both public and private are invaluable for our policy making.

Internationally, we collaborate closely with other central banks, and many of us sit on committees of various global institutions.6 For example, I’m a member of the Committee on the Global Financial System of the Bank for International Settlements. My participation allows me the opportunity to discuss market functioning from a Canadian perspective, while hearing about developments in other parts of the world.

Another important source of intelligence, one that helps us understand developments in foreign bond markets, is our reserve-management operations, which total roughly US$75 billion in assets denominated in foreign currency.

And, along with other central banks and monetary authorities, we conduct regular surveys of turnover activity in the foreign exchange and OTC derivatives markets to obtain information on their size and structure.

Domestically, our own operations are an important source of intelligence on funding and liquidity. Our traders maintain a continuous dialogue with participants in our Receiver General auctions and repo operations. We combine what they learn with other sources of market intelligence in a framework we developed several years ago to assess financial system vulnerabilities and risks.7 Some of you will be familiar with this framework from our biannual Financial System Review (FSR). (The most recent issue was published earlier this month.) It helps us explicitly identify underlying weaknesses, such as high leverage, asset price misalignments or maturity and funding mismatches that could amplify and propagate shocks.

For example, a few years ago we increased our focus on ETFs, particularly those related to fixed-income instruments, given their increasing popularity among investors. While ETFs are still relatively small in Canada, if they were to grow substantially, they could, in some circumstances, propagate liquidity shocks, especially where the underlying assets they hold are less liquid. We currently have no concerns about the sector but will continue to monitor its functioning and growth.

Our assessments are augmented by meetings with market participants that help deepen our understanding of the vulnerabilities we have identified as well as the underlying drivers of market activity. These meetings are a two-way exchange. We learn about market behaviour from them, and we have an opportunity to explain our policy framework.

With the expansion of our intelligence gathering, we have developed a wider network of contacts. Still, we know the financial sector is dynamic and our work will never cover all of the playing field. Nonetheless, we now capture a broader sweep of market segments and participants. This allows us to gather information when significant events that could affect Canadian markets occur, such as the commodity price collapse, Brexit or the recent US election. The expansion helps us track more closely how markets are positioned going into such events, gauge how they will react, and, in the aftermath, understand the short- or long-term repercussions.

Let me get to that example that underscores why multiple sources of broader market intelligence are so helpful for us, particularly at times when there is a great deal of uncertainty in markets. You may remember that in the months following the commodity price collapse in 2014 the outlook for oil prices was cloudy. The futures curve out to six months was upward sloping. This implied that either market participants were expecting oil prices to rebound or, more negatively, the cost of storage was increasing, given the high level of inventories, and oil prices would remain low.

To obtain a better picture of what was happening, colleagues from our domestic economy department, in particular, staff from the Bank’s office here in Calgary, interviewed some of their contacts in the oil industry. Those discussions led us to conclude that market expectations were likely too optimistic. It was clear that the path to higher oil prices was not assured in the medium term and that the negative real effects on capital spending were going to be larger than what had been suggested by the data. This would have a major impact on the economy. That knowledge fed into our judgment and, ultimately, our decision to lower our policy rate in January and July 2015. Two years later, it is our view that these cuts have helped facilitate the economy’s adjustment to the oil price shock and that the economic drag from lower prices is largely behind us.8 We will be updating our outlook over the next few weeks, and it will be released on July 12 in our Monetary Policy Report.

Lastly, we have established a forum for gathering fixed-income market intelligence. We wanted to better understand the shift in risk taking that we were seeing and its impact on market functioning. So, some two years ago we created the Canadian Fixed-Income Forum (CFIF). Its membership is composed of senior professionals from both buy- and sell-side firms across the country. I co-chair the committee, which meets quarterly. Its goal is to explore developments in the fixed-income market by tapping into the collective expertise of the membership, including areas such as trading practices and changes in market infrastructure. The committee’s efforts involve research and analysis to identify potential enhancements and raise awareness of these issues. All of our meetings, presentations and minutes are published on the Bank’s website.9

What We Are Learning and How We Use Market Intelligence

As the G20 financial system reforms were being put into place there was a lot of concern among market participants about how these reforms could affect bond market liquidity. That’s why one of the first initiatives CFIF undertook was a survey of investors active in the Canadian fixed-income market. We wanted to hear first-hand whether there had been changes in liquidity and, if so, whether that had altered the trading, execution and portfolio-management practices of participants, including active domestic issuers.

We learned a great deal from the survey.10 Participants confirmed that most fixed-income instruments have experienced a slight decline in market liquidity over the past two years. They also told us that liquidity for certain products, such as investment-grade corporate bonds, has deteriorated the most.

One key takeaway was that many participants have adapted to the change in liquidity by adjusting how they manage their portfolios. Those adjustments include taking more time to execute by breaking up their trades into smaller pieces, holding more on-the-run securities, holding less liquid assets for longer periods of time and reducing the turnover in their portfolios. These changes in strategy are especially evident in the corporate bond space. Some buy-side participants also told us that they were willing to provide liquidity by acting in a countercyclical fashion to take advantage of market distortions caused by temporary illiquidity in certain markets.

The survey results are providing CFIF with a foundation for further work in areas where improvements in market functions may be made.

Discussions at CFIF meetings are also inspiring new areas of research. Last year, members commented on the increased use of Canadian bond futures for hedging by the dealers. In analyzing the data, we noted an increased level of participation by high-frequency traders in this space. In response, we undertook a study of HFT in the Government of Canada bond futures market. We used data provided by the Montréal Exchange to understand the impact of HFT on market functioning.11

Our analysis showed that its average effect on market pricing was slightly positive. Both effective and bid-ask spreads, as well as price volatility, declined, while the average depth of the market increased. HFT had a small beneficial impact on the all-in cost of the execution of smaller trades. However, no effect was found on the cost of execution for larger trades (greater than $10 million). It was also clear from the data that many participants now split their trades into smaller blocks, something we have been hearing through CFIF and in discussions with market participants across a range of asset classes.

So what’s on our horizon these days?

As we outlined in the recent FSR, changes in mortgage rules late last year have led to important shifts in mortgage activity. Because of significant growth in house prices in some of Canada’s largest cities, we have seen an important increase in the uninsured mortgage space. This has highlighted the potential need for market participants to develop additional sources of funding, particularly for the smaller lenders in this market.12

To diversify funding sources, one solution would be the development of a private mortgage securitization market. This option has come up in several of our recent conversations. If poorly structured, securitization markets can have significant vulnerabilities.13 However, if appropriately developed, private-label securitization could benefit the economy by helping lenders fund assets while broadening available collateral to promote market functioning. We will continue to monitor developments in this space.

Another initiative we are working on is a new systemic risk survey that we will launch next year. We plan to conduct the survey biannually to seek views on key financial system risks and developments, as well as measure overall confidence in the Canadian financial system. The survey will support our surveillance of the financial system, inform policy decision making and help strengthen our network. We are finalizing the details and expect to launch in early 2018. The results will be published in the FSR.

Conclusion

As a central bank, we rely heavily on our excellent models and incoming data for our forecasts. Yet we know that the intelligence we gather is a critically important complement to them, particularly during times of transition or when sentiment is playing a bigger role. This information gives us a deeper understanding of how the economy is performing and how markets are functioning and evolving. And what we learn from all of it—our models, the data, our analysis and intelligence from our contacts—feeds into our judgment on policy actions.

I want to emphasize that although our policy judgments are guided, in part, by our intelligence gathering, we know that financial markets are dynamic and that we will never have a perfectly complete, up-to-the-minute picture of all activity. We are realistic about this and are constantly learning and seeking to know more. So it is essential that we communicate regularly with participants across all dimensions, be they investors or issuers, the operators of financial market infrastructures, regulators or other capital market facilitators.

And we share much of what we learn. While we are committed to transparency, we are mindful of the need to respect the confidentiality of what we hear from individual firms. We publish our findings broadly in the FSR and other Bank publications and in CFIF minutes posted on our website to educate and raise awareness both domestically and internationally.

So let’s talk. Our ultimate goal is to promote a stable and resilient financial system that serves all market participants. We need and value your collaboration and feedback.

Notes:

- Bank of Canada Act.

- The Governor of the Bank of Canada is a member of the Senior Advisory Committee, a non-statutory body that discusses macroprudential policy. Its other members are the Federal Deputy Minister of Finance, the Superintendent of Financial Institutions, the Chair of Canada Deposit Insurance Corporation, and the Commissioner of the Financial Consumer Agency of Canada.

- Bank for International Settlements, “Market Intelligence Gathering at Central Banks,” December 2016.

- Under the terms of Basel III, the minimum amount of capital that banks must hold was increased by about five times. The largest, most complex firms were obliged to hold even more. The quality of capital that banks must hold was also increased with new standards established for bank liquidity and funding. See Bank for International Settlements.

- Committee on the Global Financial System, “Market-Making and Proprietary Trading: Industry Trends, Drivers and Policy Implications,” CGFS Papers No. 52 (November 2014).

- Bank of Canada staff are active participants in the Financial Stability Board and its Standing Committee on Assessment of Vulnerabilities, the Bank for International Settlements Committee on the Global Financial System and its Markets Committee, as well as the recently formed Global Foreign Exchange Committee.

- See Financial System Review, June 2014

- See Carolyn A. Wilkins, “Canadian Economic Update: Strength in Diversity” (speech to The Associates of the Asper School of Business, Winnipeg, Manitoba, 12 June 2017) and CBC Radio interview the Governor Stephen S. Poloz, 13 June 2017.

- Canadian Fixed-Income Forum page on the Bank’s website.

- See the Canadian Fixed-Income Forum Survey results.

- Canadian Fixed-Income Forum, “High-Frequency Trading in the Government of Canada Bond Futures Market.”

- The uninsured mortgage market is now worth more than $650 billion. See Box 2, Bank of Canada Financial System Review, June 2017.

- Market features that could mitigate those vulnerabilities include standardization of the underlying collateral and transaction structure, meaningful disclosure requirements and risk retention. See Box 3, Bank of Canada Financial System Review, June 2017.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/06/remarks-280617.pdf

VIDEO: https://www.youtube.com/watch?v=uBjnPMlSpX4

The Globe and Mail. 29 Jun 2017. Markets counting on rate increase after Bank of Canada comments. Governor Stephen Poloz suggests two years of ultralow rates have done their work in repairing economy

BARRIE McKENNA

Higher interest rates from the Bank of Canada may now be just two weeks away after Governor Stephen Poloz suggested ultralow rates have done their work to repair the economy.

Financial markets are now pricing in better than two-thirds odds that the central bank will raise its key overnight lending rate by a quarter percentage point at its next rate-setting meeting July 12.

An increase in the overnight rate – the daily rate the bank charges other financial institutions – would immediately raise the cost of variable-rate mortgages and home-equity lines of credit. More importantly, it would start to reverse nearly a decade of low and declining interest rates, dating back to before the most recent recession. Those low rates have been a boon for borrowers, driving home prices and consumer spending higher. But they also have been bad news for savers and those on fixed incomes. And they have also priced many would-be homeowners out of the hottest real estate markets, particularly in Toronto and Vancouver.

If the bank moves next month, it would be the first hike in seven years, pushing the rate to 0.75 per cent from 0.5 per cent.

Mr. Poloz said that excess capacity in the economy is shrinking – thanks in large part to two rate cuts the bank made in 2015 to deal with the fallout from the commodities price crash.

“It does look as though those cuts have done their job,” Mr. Poloz said in an interview with CNBC from Portugal, where he is attending a European Central Bank conference.

“We’re just approaching a new interest-rate decision, so I don’t want to prejudge that, but certainly we need to be at least considering that whole situation now that capacity – excess capacity – is being used up steadily.”

The Globe and Mail. 29 Jun 2017. Rates: Many analysts are now bracing for perhaps two interest hikes this year

Bank of Canada Governor Stephen Poloz says it now looks as though ultralow rates ‘have done their job’ for the economy.

Deputy governor Lynn Patterson struck a similar tone in a speech in Calgary, pointing out that the “economic drag from lower prices is largely behind us.”

The Canadian dollar shot up nearly eight-tenths of a cent (U.S.) to near 77 cents in the hours after Mr. Poloz’s remarks as investors anticipate that higher rates will make Canadian investments more attractive.

Mr. Poloz’s comments are the strongest suggestion yet that a rate hike is coming.

The change in market sentiment has been unusually swift. In just a few weeks, the odds of a rate hike this year have moved to near certainty from a long shot, according to financial markets.

Many analysts are now bracing for one and perhaps two hikes this year – moves that would set the tone for mortgages and other commercial interest rates.

Economists at National Bank of Canada said Wednesday that a July rate hike is now “in the bag.” And the Bank of Montreal moved up its prediction to July 12 from October, citing Mr. Poloz’s latest comments.

“He’s not going to give it away, but that’s a pretty strong and clear-cut signal that a July rate hike is very much on the table,” Bank of Montreal rate strategist Benjamin Reitzes said in a research note.

The bank’s official mandate is to keep inflation near a 2-percent target. But Mr. Reitzes said the central bank may also want to “instill a bit more discipline in the housing market” by putting a chill on borrowing costs.

But other analysts are not convinced the Bank of Canada is ready to pull the trigger on a rate hike just yet. Mark Chandler, a fixed-income and currency strategist at RBC Dominion Securities, pointed out there is still a lot of economic data due in the next week that could influence its decision, including Friday’s release of the central bank’s closely watched Business Outlook Survey.

“We’d like to see the data,” Mr. Chandler said. “I want to know what it was that led to their change in tone.”

CIBC economist Nick Exarhos pointed out that the bank’s shift in tone has been swift and dramatic. Mr. Exarhos said he was dubious earlier in the year when the bank was fixated on the negatives facing the economy. And now he’s treating the more optimistic language with the same caution.

“The Bank of Canada would like to keep the door open to a rate hike in July. Whether they go or not is another question,” added Mr. Exarhos who, for now, is sticking with a prediction of a first rate hike in October.

One awkward bit of economic data for the Bank of Canada is inflation. The bank’s three measures of core inflation remain well below the bank’s 2-per-cent target, and they’re still falling. The Consumer Price Index slipped to 1.3 per cent in May from April’s 1.6 per cent. It was the weakest reading since November, 2016.

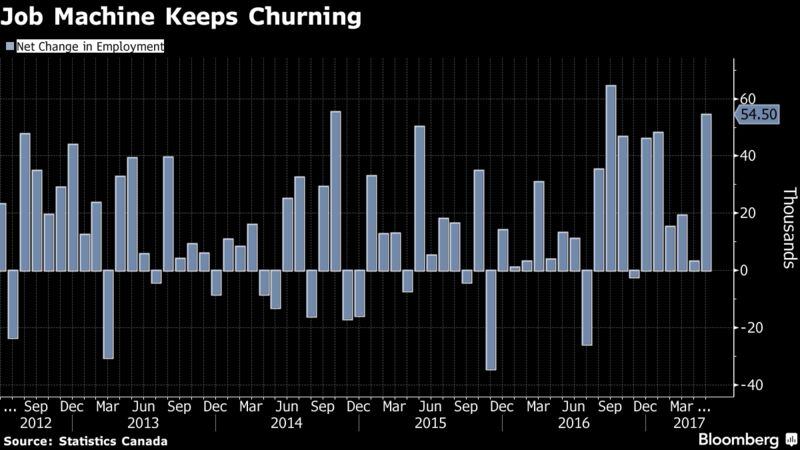

On the other hand, there has been a string of good economic news, including gross domestic product surging ahead at an annual clip of 3.7 per cent in the first quarter, and strong job gains, including 54,500 jobs in May alone.

BLOOMBERG. 29 June 2017. Four Missing Pieces in the Puzzle of Poloz's Shift to Rate Hawk

By Greg Quinn and Theophilos Argitis

- BOC governor’s recovery talk opens door to July 12 rate rise

- Reports on business outlook, GDP and trade to fill in blanks

The door to higher interest rates in Canada is suddenly wide open.

Bank of Canada Governor Stephen Poloz reiterated this week he’s considering raising rates as the economy heats up and spare capacity disappears. It was the latest in a barrage of statements from Poloz and his deputies that suggest the central bank is firmly in the tightening camp, even with oil prices below $50 a barrel and inflation falling further below its 2 percent target.

Investors are certainly buying in, now assigning a 75 percent chance of a rate increase at the July 12 meeting. Two of Canada’s largest lenders -- Bank of Montreal and Bank of Nova Scotia -- are both now predicting hikes next month.

It’s a big shift for the central bank, which just a few months ago was talking about cutting rates rather than raising them. Here are four pieces of data that may provide some insight into Poloz’s shift to rate hawk.

Business Outlook Survey

The Bank of Canada releases its Business Outlook Survey at 10:30 a.m. Friday, and it’s the one big piece of data Poloz has to himself, prompting economists to suggest it may be what’s behind the Governor’s change of tone.

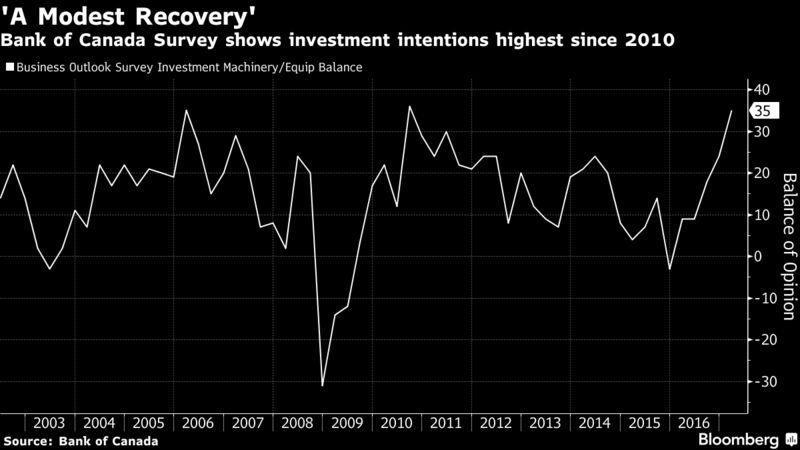

The quarterly report is based on talks with about 100 business leaders and breaks out readings on sales, investment, hiring and inflation expectations. In its last report released April 3, the Ottawa-based central bank found business sentiment continued to show signs of recovery, with executives more optimistic about investment than at any time since 2010. At the same time, 64 percent of those polled saw inflation running between 1 percent and 2 percent, below the bank’s 2 percent goal.

The report “will be important in assessing the degree of comfort the BoC has in what looks like a program over the medium-term to remove the 50 basis points of oil price plunge-related cuts in 2015,” Mark Chandler, head of fixed income research at RBC Capital Markets, said in a note to investors June 28.

Gross Domestic Product

Two hours before the business survey (and the day before Canada’s 150th anniversary celebrations kick off in Ottawa) Statistics Canada is due to report GDP for April, a benchmark of how much momentum is carrying into the second quarter. Economists predict a gain of 0.2 percent on the month, while the anticipated gain of 3.4 percent over the last 12 months would be the fastest since June 2014. That’s a significant mark because it was before the full crash in oil prices and suggests a return to normal conditions.

Trade Balance

Canada’s trade with the world is showing signs of adding to growth after the deficit hit a monthly record in September. The report for May due on July 6 follows April figures showing the volume of exports up 1.1 percent while imports fell 0.3 percent. Over the last year, exports climbed 14.7 percent in April, almost double the 7.4 percent gain in imports.

Job creation

Debt-fueled consumer spending has powered Canada’s economy through the oil crash. One thing that can give Poloz confidence about raising rates without rattling Toronto’s hot housing market is more evidence that the labor market is solid, giving people the paychecks to keep going. The June report published next Friday would have to be a massive disappointment to suggest the economy needs more time to heal. Wages are picking up, and job gains over the last 12 months were the fastest since 2013.

BLOOMBERG. 28 June 2017. Canada July Rate Hike Odds Jump After Poloz Restates Bias

By Theophilos Argitis and Maciej Onoszko

- Swaps trading suggests investors placing 69% odds of July rise

- Poloz tells CNBC that 2015 rate cuts have done their job

The Canadian dollar rallied to a four-month high and investors ramped up bets for a rate increase as early as next month after Bank of Canada Governor Stephen Poloz reiterated the central bank may be considering higher rates.

The nation’s currency jumped 1.2 percent to C$1.3038 per U.S. dollar at 4:50 p.m. in Toronto, the strongest level since February. The loonie traded at 76.7 U.S. cents. Swaps trading suggests investors are placing a 69 percent chance of a rate hike at the bank’s July 12 rate decision, up from 39 percent Tuesday.

“The Poloz comments buttress the change in tone that we’ve seen from the Bank over the past month,” said Bipan Rai, Toronto-based senior foreign-exchange and macro strategist at Canadian Imperial Bank of Commerce. “There’s still some speculative shorts out there that are being squeezed as a result.”

The Canadian dollar is the best performing Group-of-10 currency this month after the central bank unexpectedly adopted a tightening bias two weeks ago with suggestions that stimulus associated with two rate cuts in 2015 may need to be withdrawn. Poloz used similar language in an interview with CNBC.

“Rates are of course extraordinarily low,” Poloz said, adding the bank cut rates by 50 basis points in 2015 to counteract the effects of the oil price shock. “It does look as though those cuts have done their job,” he said, according to a transcript of the interview. “But we’re just approaching a new interest rate decision so I don’t want to prejudge. But certainly we need to be at least considering that whole situation now that the excess capacity is being used up steadily.”

Bank of Montreal is now calling for a rate increase in July as Poloz’s comments “were the final straw” prompting the shift, Benjamin Reitzes, Canadian rates and macro strategist at the bank, wrote in a note on Wednesday. The Bank of Canada’s hasn’t raised rates since 2010.

The comments from the central bank governor extended a sell-off in Canadian government debt. The two-year note fell for a third day, pushing the yield up to 1.04 percent, the highest since January 2015. The rate on 10-year securities added five basis points to 1.62 percent, increasing 21 basis points this month, the steepest increase since November.

CIBC’s Rai doesn’t expect the bank to raise rates next month.

“The market is moving to price in 55-60 percent chance that the bank moves in July but the odds should be more skewed towards 30 percent,” he said. “It’s unlikely that the Bank of Canada will want to front-run second-quarter growth and strengthen the Canadian dollar further.”

INTER-PROVINCIAL TRADE

Innovation, Science and Economic Development Canada. June 29, 2017. Historic Canadian Free Trade Agreement takes effect July 1. Canadian Free Trade Agreement will boost business opportunities and create more jobs

Ottawa – Middle-class Canadians will benefit from more job and business opportunities when the Canadian Free Trade Agreement takes effect on July 1, the country’s 150th anniversary.

This historic agreement will allow Canadians to buy and sell goods, provide services and invest more freely within our own borders, providing more opportunities for Canadian businesses to innovate and create jobs.

The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development, was responsible for the negotiation of this agreement on behalf of the Government of Canada, ensuring the agreement is modern and ambitious.

The agreement, which was announced in April by federal, provincial and territorial governments, will:

- improve the flow of goods, services and investments across provincial and territorial borders, giving consumers more choice and lower prices;

- commit all governments to reduce the patchwork of rules and regulations that can hinder trade and stifle the growth of Canadian businesses; and

- allow licensed professionals with Canadian credentials to work in different parts of the country.

- This agreement is part of the Government’s Innovation and Skills Plan, a multi-year strategy to create well-paying jobs for the middle class and those working hard to join it.

Quotes

“When the Canadian Free Trade Agreement takes effect on July 1, it will open up trade within Canada in virtually every sector of the economy. This agreement is the most ambitious trade deal ever to cover Canada. With this historic accord, Canadians will have opportunities to expand their businesses across the country, which means more jobs will be created and licensed professionals will be able to work in different parts of the country. That’s how free trade leads to a better Canada.”

– The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development

Quick Facts

- The agreement contains a number of historic firsts:

- It enables Canadian businesses to sell goods and services to governments across the country, opening up a business opportunity worth an estimated $4.7 billion annually to broader competition.

- It establishes a process to enhance trade in beer, wine and spirits among provinces and territories.

- Rules in the Canadian Free Trade Agreement will automatically apply to all of the country’s economic activity unless something is specifically and transparently excluded.

- Internal trade cushions Canada against the uncertainties of the global economy. Trade within Canada represents about one-fifth of the country’s gross domestic product, or $385 billion annually. It also accounts for nearly 40 percent of all provincial and territorial exports.

- The Canadian Free Trade Agreement replaces the existing Agreement on Internal Trade, which has been in place since 1995.

CANADIAN FREE TRADE AGREEMENT: http://www.ic.gc.ca/eic/site/062.nsf/eng/h_00053.html

CONSOLIDATED TEXT: http://www.ait-aci.ca/wp-content/uploads/2017/04/CFTA-Consolidated-Text-Final-English.pdf

CYBERSECURITY

The Globe and Mail. 29 Jun 2017. Five Eyes to engage with communications industry. Canada, U.S., Britain, Australia and New Zealand agree to tackle cybersecurity issues such as terrorists’ use of encryption applications

MICHELLE ZILIO

Australian Attorney-General George Brandis visits the storage facility at the National Archives of Australia in Canberra on June 9. Mr. Brandis says the Five Eyes will engage with Internet service providers to develop new protocols for assisting law-enforcement and government agencies.

Officials from five countries including Canada have agreed to “engagement” with communication-service providers on the use of encryption among terrorists and other criminals – which Canadian law enforcement and government agencies have described as an impediment to investigations.

Security and justice officials from Canada, the United States, Britain, Australia and New Zealand – known as the Five Eyes – gathered in Ottawa this week to discuss national-security challenges, including the use of encryption applications such as WhatsApp and Signal by extremists to hide their electronic communications.

“Ministers and Attorneys-General also noted that encryption can severely undermine public safety efforts by impeding lawful access to the content of communications during investigations into serious crimes, including terrorism. To address these issues, we committed to develop our engagement with communications and technology companies to explore shared solutions while upholding cybersecurity and individual rights and freedoms,” read a joint communiqué released by the Five Eyes on Wednesday.

The Five Eyes did not expand on what it means by “engagement” and what possible shared solutions would be.

The alliance is looking at whether security agencies should be able to lawfully access encrypted communications during investigations into serious crimes.

Companies in Five Eyes countries are not required by law to hold decryption “keys” that unscramble encrypted communications, such as text messages, and when they do not, it’s impossible for them to provide government or law-enforcement agencies with data.

For instance, the RCMP were unable to read Islamic State supporter Aaron Driver’s encrypted messages with two well-known members of the terrorist group; Mr. Driver was shot dead during a raid led by the Mounties in August, 2016. While Public Safety Minister Ralph Goodale has acknowledged the significant obstacles encryption presents for Canadian law enforcement and national-security agencies, he said the technology is essential for the growth of Canada’s digital economy and the safeguarding of cybersecurity and online privacy.

On the other hand, British Prime Minister Theresa May and French President Emmanuel Macron recently called for greater access to encrypted communications as a part of their counterterrorism joint action plan. The plan was announced June 13, after a string of terrorist attacks in Britain and France.

Australian Attorney-General George Brandis led the calls for new limitations on encryption for messaging applications heading into the Five Eyes meeting on Monday and Tuesday. Speaking to Australian Broadcasting Corp. Radio National after the meeting in Ottawa, Mr. Brandis said the Five Eyes will engage with Internet service providers and device makers to develop a “series of protocols as to the circumstances to which they will be able to provide voluntary assistance to law enforcement.”

Wesley Wark, a national-security expert at the University of Ottawa, said the Five Eyes are handing off responsibility to the private sector.

“They’re increasingly moving from a legal instrument to enforce some solution or another to a softer regulatory matter and partnerships with the private sector to see if some kind of understanding can be arrived at about how to deal with that very narrow band of communication that might be of concern to nationalsecurity communities,” Dr. Wark said.

He suspects the Five Eyes will not go as far as requiring companies to hold decryption keys, but rather agree among themselves to develop capabilities to decrypt certain types of information upon request and under legal authority. But Dr. Wark says one thing is for sure: The companies, many of which work internationally, will not be open to legislative requirements from governments.

Human Rights Watch executive director Kenneth Roth said a crackdown on encryption threatens the privacy rights of individuals. “Law-enforcement and intelligence agencies are going to have to learn to live with encryption, just as they’ve had to learn to live with other tools that the public uses to preserve its privacy, whether whispering or closing the blinds – the many practical things that people have done for eons to guard against snooping.”

Signal, developed by Open Whisper Systems, and WhatsApp did not reply to The Globe and Mail’s request for comment on Wednesday.

The Five Eyes also committed to supporting a new industry forum led by Google, Facebook, Microsoft and Twitter to address terrorist use of the Internet.

HOUSING BUBBLE

The Globe and Mail. Jun. 29, 2017. Home Capital’s lifeline cost $210-million in latest quarter

JACQUELINE NELSON, INSTITUTIONAL INVESTMENT REPORTER

Home Capital Group Inc. is tallying up the financial toll that months of grappling with investor concerns and a run on its deposits have had on the company even as there are signs of renewed confidence from customers.

The alternative mortgage lender said Thursday that that elevated expenses of $233-million before tax would reduce its operating results for the second quarter of the year, which the company plans to release in August.

The bulk of the costs stem from the onerous $2-billion emergency line of credit that Home Capital secured in late April through a deal led by the Healthcare of Ontario Pension Plan. Home Capital agreed to pay 10-per-cent interest on the drawn portion of the credit line and 2.5-per-cent interest on unused balances, as well as an up-front, non-refundable fee of $100-million to secure the loan.

Home Capital said that this lifeline resulted in $210-million in increased costs in the quarter.

“The serious liquidity event that occurred late in April required the company to take quick and dramatic steps, liquidating assets and arranging a rescue financing facility,” said Robert Blowes, interim chief financial officer, in a statement.

The company also said that $8-million in costs would be recorded due to its settlements reached with both a key regulator and in a class-action lawsuit filed earlier this year against the lender. These costs are what the company expects to absorb after getting some money back from insurance.

The Ontario Securities Commission levelled allegations that Home Capital broke disclosure rules by failing to quickly reveal to investors problems of fraud it had discovered in its mortgage business. Three former high-level executives were named in the case. Home Capital agreed to settle its disputes with the OSC in June.

As Home Capital accounts for these past troubles, the company also said that investor deposits have surged in the days since famed investor Warren Buffett’s firm Berkshire Hathaway pledged to support the struggling mortgage lender. A subsidiary of Berkshire Hathaway said it would take an equity stake of up to $400-million as well as support a new $2-billion credit line.

The initial $153-million equity investment by Berkshire Hathaway, which will give the company a 20 per cent stake in the business and secure its position as the largest shareholder, did not go to a shareholder vote. That required Home Capital’s leaders to secure approval from the Toronto Stock Exchange. The company also said Thursday that it had received conditional listing approval from the TSX and the transaction can now proceed, pending some other closing conditions.

Home Capital’s Guaranteed Investment Certificate (GIC) deposit intake climbed after Mr. Buffett’s involvement was announced late on June 21. Average daily GIC deposits flowing into Home Capital for the week ended June 16 were $25-million. One June 26, the company recorded $70-million in deposits inflows.

Before concerns about Home Capital’s business model and stability emerged earlier this year, the company had a reputation for offering better-than-average interest rates for both GICs and high-interest savings accounts through its various brands: Home Trust, Home Bank and Oaken Financial. In the past few months that company has fought to keep that status by offering even more compelling interest rates – at times were more than double what Canadian banks were offering. Now, with the backing of the Oracle of Omaha, some investment industry professionals have said they would once again recommend Home Capital products to their clients.

“We have been encouraged by the increasing strength of our deposit inflows, particularly since the recent announcement of the equity investment and new credit facility provided by Berkshire Hathaway. We believe that the improvement in deposit taking indicates a significant increase in depositor confidence in the company,” said company director Alan Hibben, in a statement.

Home Capital will hold its annual general meeting in Toronto on Thursday.

With files from Clare O’Hara

The Globe and Mail. 29 Jun 2017. Home Capital deposits soar after backing from Buffett

CLARE O’HARA

Famed investor Warren Buffett’s interest in Home Capital Group Inc. is paying off for the troubled Canadian mortgage firm, as millions of dollars in investor deposits are now flooding back into the company.

The company gained more than $100-million in new deposits between June 20 and 27, including the company’s Oaken Financial savings products and guaranteed investment certificates. Most of the new cash came in after Mr. Buffett’s Berkshire Hathaway Inc. announced on the night of June 21 that it would buy an equity stake of up to $400-million in Home Capital, becoming its largest shareholder, and would extend the firm a $2-billion credit line.

Home Capital’s GIC balances rose by $92-million over the week, while almost $10-million returned to Oaken-branded savings accounts.

Home Capital offers financial products under three separate brands: Home Trust, Home Bank and Oaken Financial.

Home Trust high-interest savings account (HISA) balances stayed flat at approximately $112-million. Several months ago, the company held approximately $2-billion in HISA deposits before trouble hit for the lender.

The Ontario Securities Commission levelled allegations that the company broke disclosure rules by failing to reveal in a timely way problems of fraud it had discovered in its mortgage business. Three former highlevel executives are also named in the case.

Brokers at other financial institutions grew wary of the company and some investment firms decided to cap the amount of deposits clients could hold in Home Capital products. Money began to pour out of its high-interest savings accounts – a run on the bank that nearly led the firm to collapse in early May and forced it to receive emergency financing from a pension fund.

Earlier this year, Home Capital was seen as an attractive mortgage lender that was able to offer better-than-average interest rates for both HISAs and GICs.

Over the past rocky few months, Home Capital has remained aggressive in both the HISA and GIC markets by offering attractive interest rates that at times were more than double what Canadian banks were offering, in a bid to attract more deposits needed to continue its business.

Currently, Oaken Financial GICs are offering 2.75 per cent for a one-year GIC, while Home Trust is slightly less at 2.5 per cent. (Home Trust GICs are sold through the investment-adviser channel while Oaken GICs are sold directly to investors.)

By comparison, Equitable Bank’s one-year rate is posted at 1.45 per cent while Bank of Montreal is offering 0.85 per cent for the same term.

Both Equitable and Home Capital are in the business of providing mortgages to borrowers who have difficulty qualifying for them from a major bank.

After hearing of the potential backing of Berkshire Hathaway in Home Capital, some investment industry professionals said they were once again confident in recommending Home Capital products to their clients.

However, several financial institutions – including Bank of Nova Scotia’s wealth-management arm – have yet to lift a capped limit of $100,000 of Home Capital product that an adviser could sell to a client.

REUTERS. Jun 29, 2017. Home Capital says 'top notch' shortlist for CEO role

By Matt Scuffham

(Reuters) - Canadian lender Home Capital Group Inc's (HCG.TO: Quote) Chair Brenda Eprile on Thursday told shareholders at the company's annual meeting it had attracted a "top notch" list of candidates for its chief executive role and would make an appointment soon.

The company has been searching for a new CEO since March 27 when it terminated the employment of former chief executive Martin Reid.

Reid's departure sparked a withdrawal of funds from Home Capital's high interest savings accounts which accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business.

Home Capital reached a settlement with the commission earlier in June and accepted responsibility for misleading investors about mortgage underwriting problems.

Last week, it received $2 billion in new financing from U.S. billionaire Warren Buffett's Berkshire Hathaway, which it has said gives it a critical platform to recover investor and depositor's confidence.

However, it still needs to address challenges including attracting a new chief executive and chief financial officer.

"It's too early to declare victory," Director Alan Hibben told shareholders.

Earlier on Thursday, Home Capital said it expects to record a loss in the second quarter due to costs related to its efforts to shore up liquidity.

The lender, which is expected to release second-quarter results on Aug. 2, said its expenses would increase by C$233 million ($179 million) before taxes, which includes C$210 million in costs related to its recent liquidity issue.

"The serious liquidity event that occurred late in April required the Company to take quick and dramatic steps, liquidating assets and arranging a rescue financing facility," interim Chief Financial Officer Robert Blowes said.

Home Capital also said it received conditional listing approval from the Toronto Stock Exchange for Berkshire's initial investment of C$153.2 million for a stake of about 20 percent.

The lender, which will conduct its annual shareholder meeting on Thursday, said average daily Guaranteed Investment Certificate (GIC) deposit inflows increased to C$38 million in the week ended June 23 from C$5 million in the week ended May 5.

"We believe that the improvement in deposit taking indicates a significant increase in depositor confidence in the Company", said Hibben.

Shares in Home Capital were up 3 percent to C$17.70 at 1105 EST.

($1 = 1.3009 Canadian dollars)

(Additional reporting by Yashaswini Swamynathan in Bengaluru; Editing by Saumyadeb Chakrabarty and Clive McKeef)

REUTERS. Jun 28, 2017. Action against Home Capital given class status for settlement purposes

(Reuters) - Home Capital Group Inc (HCG.TO: Quote) said on Wednesday that the Ontario Superior Court has certified as a class action an action against the company and certain former officers for settlement purposes only.

The class consists of all parties who acquired common shares of Home Capital from Nov. 5, 2014, through July 10, 2015, Home Capital said.

The settlement is part of a global settlement to resolve the action and related enforcement proceeding by the Ontario Securities Commission (OSC), the company said in a statement.

Earlier in the month, Home Capital, Canada's biggest non-bank lender, agreed on a settlement with the OSC and accepted responsibility for misleading investors about problems with its mortgage underwriting procedures.

The company said the settlement is subject to final approval by the court and by the OSC of the settlement of the regulatory proceeding.

The hearing to approve the OSC settlement is scheduled for Aug. 9, and a hearing to approve the class action settlement is scheduled for Aug. 21, the company said.

(Reporting by Arunima Banerjee in Bengaluru; Editing by Leslie Adler)

BLOOMBERG. 29 June 2017. Home Capital Defends Buffett as Investors Question Discount

By Kristine Owram , Doug Alexander , and Katia Dmitrieva

- Canada mortgage lender says deposits have risen with Buffett

- Buffett buys shares at deep discount, provides credit line

Home Capital Group Inc. defended Warren Buffett’s purchase of shares at a deep discount, saying the investment has bolstered confidence in a mortgage lender that was on the verge of collapse just a month ago.

"We think the Buffett brand brings instant credibility to our deposits and will enable us to continue to rely on this as a stable source of funding," Chair Brenda Eprile told shareholders at the company’s annual meeting in Toronto Thursday.

Buffett’s Berkshire Hathaway Inc. has won approval from the Toronto Stock Exchange for the first portion of its investment in Home Capital, allowing the billionaire investor to buy an almost 20 percent stake at C$9.55 a share. The stock has since soared to C$17, more than triple its May lows when the company faced a run on cash following allegations it misled investors about fraud on some mortgage applications.

The equity purchase is the first step in a C$2.4 billion ($1.8 billion) backstop to bolster the embattled mortgage lender, which could eventually see Berkshire take a 38 percent stake in the company, while providing a C$2 billion credit line.

Financial Hardship

Berkshire will seek approval from shareholders for the second part of its equity investment at a vote expected in September. Berkshire was able to avoid a shareholder vote on the first half of the investment by winning a “financial hardship” exemption from the Toronto Stock Exchange.

Some investors at the annual meeting said they won’t support the second equity sale, given the deep discount offered to Berkshire. The first stock deal and credit line aren’t contingent on approval of the second portion.

“The benefit from having Warren Buffett invest in Home Capital has already been demonstrated,” shareholder David Meyers said in an interview. Meyers holds more than 4,000 shares of the mortgage lender with his wife. “I don’t see the benefit of the second tranche being there given the kind of huge discount that he would receive for the second amount. It’s ridiculous.”

Director Alan Hibben defended the second tranche but told shareholders it’s ultimately up to them.

“If you want to vote it down, you can vote if down and Mr. Buffett really has nothing to say about that at the end of the day," Hibben told investors.

In a press conference after the event, Hibben said shareholders have already benefited from Buffett’s investment.

“The stock was at C$11, now the stock’s at C$17 -- to me that doesn’t look dilutive, it actually looks damn accretive," he said. “The 38 percent is really more a question of, when it hits the fan next time, would you rather have 38 percent of Buffett behind you or 19.9 percent of Buffett behind you? I’d rather have the 38 percent."

Buffett Involved

Tim Bergin, who asked a question at the meeting, said shareholders should back the second equity purchase.

“I think it’d be crazy if shareholders didn’t approve that,” he said in an interview. “Having 40 percent of Buffett involved is huge.”