CANADA ECONOMICS

ECONOMY - GDP

StatCan. 2017-06-30. Gross domestic product by industry, April 2017

Real GDP by industry

April 2017

0.2% increase (monthly change)

Source(s): CANSIM table 379-0031.

After increasing 0.5% in March, real gross domestic product (GDP) rose 0.2% in April as 14 out of 20 sectors grew.

Chart 1 Chart 1: Real gross domestic product grows in April

Real gross domestic product grows in April

Service-producing industries increased 0.3% on widespread growth across sectors. Goods-producing industries were essentially unchanged as growth in mining, quarrying, and oil and gas extraction was largely offset by a decline in manufacturing.

Mining, quarrying, and oil and gas extraction continues to grow

The mining, quarrying, and oil and gas extraction sector (+1.2%) grew for the third time in four months in April. Support activities for mining and oil and gas extraction registered double-digit growth for a second consecutive month, increasing 11% as both drilling and rigging services expanded.

Chart 2 Chart 2: Mining, quarrying, and oil and gas extraction continues to grow in April

Mining, quarrying, and oil and gas extraction continues to grow in April

Oil and gas extraction declined 0.8% in April as a decrease in non-conventional oil extraction more than offset growth in conventional oil and gas extraction. The decline in non-conventional oil extraction in April was largely the result of ongoing production difficulties at an upgrader facility in Alberta, following a fire and explosion there in March.

Mining excluding oil and gas extraction was up 2.7% in April after declining the previous two months. Metal ore mining grew 2.7% as iron, gold and silver, and other ore mining expanded. Non-metallic mineral mining rose 2.0% following three consecutive decreases, primarily due to higher potash output and exports. Coal mining increased 5.1% as strength in coal exports continued.

Transportation and warehousing gains in April

Transportation and warehousing was up 1.0% in April as a majority of subsectors posted gains. Leading the growth was a 3.3% increase in rail transportation as rail movement of coal, grain and fertilizers, forest products and intermodal freight increased. Pipeline transportation rose 1.6% as transportation of natural gas (+3.1%) and crude oil (+0.2%) grew in part due to higher exports. Air (+2.0%) and truck (+0.8%) transportation were up, while postal services and couriers and messengers services declined.

Wholesale and retail trade continue to grow

Wholesale trade increased for the fourth time in five months in April, with a 0.5% gain. Machinery, equipment and supplies wholesalers (+4.8%) and food, beverage and tobacco wholesalers (+1.6%) accounted for all growth in the sector, while all other subsectors contracted. The largest decline in terms of output was a 1.9% decrease in miscellaneous wholesaling, with the chemical (except agricultural) and allied product and recyclable material industries accounting for most of the decline.

Retail trade grew 0.5% in April as 8 of 12 subsectors increased. With the exception of December, retail trade has risen every month since July 2016. Leading the growth in April in terms of output was a 4.1% increase at clothing and clothing accessories stores which more than offset a decline in March. Building material and garden equipment and supplies dealers posted growth of 3.1%, the largest increase since May 2015. General merchandise stores expanded 1.9% for a fourth consecutive month of growth. Motor vehicle and parts dealers registered a 1.1% decline as activity at new car dealers contracted.

Professional services continues to rise

Activity at professional services grew 0.5% in April. Leading the growth was a 1.5% rise at legal services. Architectural, engineering and related services were up 0.4%, continuing a recovery in this subsector after registering annual declines every year following 2012.

Arts, entertainment and recreation up for the fourth time in five months

The arts, entertainment and recreation sector grew 2.8% in April, up for the fourth time in five months. The increase was primarily the result of a 7.0% gain in performing arts, spectator sports and related industries, and heritage institutions, as five Canadian teams took part in the first round of the National Hockey League playoffs in April and strong professional basketball and baseball attendance continued. The growth was offset in part by a 0.5% decline in the amusement, gambling and recreation industries.

Construction continues to edge up

The construction sector edged up 0.1% in April, rising for a sixth consecutive month. Engineering and other construction rose 1.6%. Non-residential construction edged up 0.1%, as growth in commercial construction was partially offset by declines in public and industrial construction. Residential construction declined 0.9% in April following five consecutive months of growth, as construction of single, double and row houses declined along with home alterations and improvements.

Finance and insurance up slightly

The slight 0.1% increase in finance and insurance came from a 1.6% gain in financial investment services, funds and other financial vehicles. This was largely offset by declines in depository credit intermediation and monetary authorities (-0.2%) and insurance services and related activities (-0.1%).

Manufacturing declines

The manufacturing sector continued its fluctuations since the beginning of 2017 with a 0.9% decline in April, largely offsetting a 1.0% increase in March as 12 of 18 subsectors declined.

Non-durable manufacturing contracted 0.4% as the majority of subsectors were down. The largest contributors to the decline were beverage and tobacco (-9.1%) and petroleum and coal products manufacturing (-1.2%). These declines were offset in part by gains in chemical (+1.2%) and food manufacturing (+0.9%).

Durable manufacturing was down 1.2% as 7 of 10 subsectors contracted. The largest decline among the subsectors was in machinery manufacturing (-2.9%). Transportation equipment manufacturing contracted 1.3% in April, reflecting declines in motor vehicle (-3.3%) and motor vehicle parts manufacturing (-3.2%).

Other industries

Real estate and rental and leasing services edged up 0.1% in April. There was a 0.6% contraction in the real estate agents, brokers and related services industry as home resale activity slowed in Central Canada.

Accommodation and food services were up 1.1% in April after declining 0.2% in March. Food services and drinking places rose 1.3% while accommodation services increased 0.4%.

Utilities edged up 0.1% in April. Natural gas distribution grew 5.3% while electric power generation, transmission and distribution declined 0.6%.

The public sector (education, health care and public administration) edged up 0.1% in April as education and public administration rose, while health care remained unchanged.

Agriculture, forestry, fishing and hunting was down for a fourth consecutive month, declining 0.4% in April.

Chart 3 Chart 3: Main industrial sectors' contribution to the percent change in gross domestic product in April

Main industrial sectors' contribution to the percent change in gross domestic product in April

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170630/dq170630a-eng.pdf

The Globe and Mail. The Canadian Press. Jun. 30, 2017. Canada’s economy grows 0.2 per cent in April

OTTAWA — The Canadian economy had another month of solid growth in April, building on strength seen in the first quarter and supporting expectations the Bank of Canada will soon begin increasing interest rates.

Statistics Canada said Friday the economy grew 0.2 per cent in April compared with an increase of 0.5 per cent in March.

The result matched the expectations of economists, according to Thomson Reuters.

“While the April GDP report is no big surprise, it maintains a now lengthy run of Canadian data matching or topping expectations, and forecasts for 2017 growth just keep climbing,” Bank of Montreal chief economist Doug Porter wrote in a report.

“In a word, there’s nothing here to dissuade the Bank of Canada from looking to start removing some of the stimulus, likely starting just next month.”

The day's breaking business stories.

Sign up for Top Business Headlines newsletter here.

Sign Up Now

The Bank of Canada’s key interest rate target sits at 0.5 per cent. An increase in the rate will likely prompt Canada’s big banks to raise their prime rates, a move that will drive up the costs of variable-rate mortgages and other borrowing tied to the benchmark rate.

Expectations that the Bank of Canada could raise rates sooner rather than later have ramped up in recent days following comments by Stephen Poloz that interest rate cuts made in 2015 have done their job. Poloz noted that the economy enjoyed surprisingly strong growth in the first quarter.

Statistics Canada said the growth in April came as service-producing industries increased 0.3 per cent, helped by widespread gains.

The arts, entertainment and recreation sector climbed 2.8 per cent for the month, helped by the five Canadian teams in the first round of the NHL playoffs and strong professional basketball and baseball attendance.

Meanwhile, Statistics Canada says goods-producing industries were essentially unchanged for the month as an improvement by mining, quarrying, and oil and gas extraction was largely offset by a drop in manufacturing.

Mining, quarrying, and oil and gas extraction gained 1.2 per cent despite a 0.8 per cent drop in oil and gas extraction due to the impact of the Syncrude Mildred Lake oilsands upgrader fire in March.

The manufacturing sector fell 0.9 per cent in April.

REUTERS. Jun 30, 2017. Canada's economy grows 0.2 percent in April, solid start for second quarter

OTTAWA (Reuters) - Canada's economy grew by 0.2 percent in April on widespread strength, Statistics Canada said on Friday, indicating a solid start to the second quarter as the Bank of Canada mulls a hike in interest rates next month.

The increase - which matched the forecast of analysts in a Reuters poll - marked the sixth consecutive month of growth after a long slump caused when oil prices crashed in 2014.

The Bank of Canada cut rates twice in 2015 to keep the economy on track. This week two top policymakers at the central bank said that strategy had worked, ramping up market expectations for a rate rise in July.

Statscan said 14 out of 20 sectors grew in April. Service-producing industries posted a 0.3 percent gain while the goods sector was largely unchanged as growth in mining, quarrying and oil and gas extraction was largely offset by a decline in manufacturing.

Wholesale and retail trade both increased while arts, entertainment and recreation jumped by 2.8 percent, in part because five Canadian hockey teams took part in the first round of play-offs.

(Reporting by David Ljunggren; Editing by Bernard Orr)

BLOOMBERG. 30 June 2017. Canada's GDP Grows for a Sixth Month, Adding to Rate-Hike Pressure

By Greg Quinn

- Economy expanding at fastest 12-month pace since oil shock

- Desjardins joins those expecting Poloz to raise rates in July

Canada’s economy grew for a sixth consecutive month with gains in a majority of industries, underlining the central bank’s view a durable recovery from an oil shock is emerging.

Gross domestic product grew 0.2 percent in April, Statistics Canada said Friday from Ottawa, matching the median forecast in a Bloomberg survey of economists.

Highlights

- Fourteen out of 20 sectors grew on the month, led by a 2.7 percent gain in mining and a 1 percent rise in transportation and warehousing

- The expansion over the last 12 months of 3.3 percent is the fastest since June 2014

- Canada’s booming housing market showed some signs of cooling in April, when Ontario introduced measures to constrain the Toronto market. Residential construction fell for the first time in six months with a 0.9 percent decline, and activity by agents and brokers fell 0.6 percent

Big Picture

Canada’s dollar and bond yields jumped this week on comments from Governor Stephen Poloz suggesting he favors raising his 0.5 percent interest rate, with investors betting that could come as early as the central bank’s July 12 meeting. Poloz and his deputies cited gains that are broadening to include more industries and regions, even those most hurt by the fall in crude prices to below $50 a barrel. A Bank of Canada survey of business confidence is due for release later Friday morning, which may further bolster the case for tightening.

Economist Reaction

Jimmy Jean, a strategist in the fixed-income group at Desjardins Capital Markets in Montreal, changed his forecast Friday morning to predict a rate increase in July. “Given the persistence of the messaging, the motives provided for the change in tone, the ongoing strength of the data and the market’s repricing, the logical culmination of recent developments is a decision to begin rolling back the 2015 cuts right away,” he wrote in a research note.

Doug Porter, Bank of Montreal chief economist: The GDP report “maintains a now lengthy run of Canadian data matching or topping expectations, and forecasts for 2017 growth just keep climbing. ... There’s nothing here to dissuade the Bank of Canada from looking to start removing some of the stimulus, likely starting just next month.”

CIBC World Markets Chief Economist Avery Shenfeld: Canada’s economy is on pace for annualized growth of about 2.5 percent in the second quarter, “more than enough to justify the recent change in tone from the Bank of Canada.”

Other Details

- Service-industry production increased 0.3 percent while goods production was flat, Statistics Canada said.

- Manufacturing dropped 0.9 percent in April, undoing a 1 percent gain the previous month.

- The energy industry showed mixed results, including a 0.8 percent setback in oil and gas extraction after a fire at an upgrader in Alberta in March. Support services for mining and energy companies jumped 11 percent.

- Retail trade grew 0.5 percent in April, as did the wholesaling industry.

REUTERS. Jun 30, 2017. All well for world economy at mid-year? Up to a point

By Jeremy Gaunt

LONDON (Reuters) - So strong is the belief in the growth momentum of the global economy as it enters the second half of 2017, the point has been reached in the economic cycle where data not meeting expectations is dismissed as an aberration.

Flash purchasing managers' indexes for services in Europe in June, for example, were weaker than anyone in a Reuters poll had predicted, but the market paid scant attention. "Way below expectations, but let's not worry," was the mantra.

Such economic Panglossianism - all for the best in the best of all worlds - is based on what seems to be a majority view among policymakers and economists that the world is enjoying a broad expansion.

"Faster growth this year reflects a synchronized improvement across both advanced and emerging market economies," Brian Coulton, Fitch Ratings' chief economist, wrote in an outlook projecting 2017 would have the fastest world growth - 2.9 percent - since 2010.

Backing up this view, central banks in the United States, euro zone and Britain are leaning toward tightening, albeit with a cacophony of mixed signals about when.

Financial markets are now pricing in a 90 percent chance of a euro zone rate hike by July next year, for example, to go with the Federal Reserve's ongoing upward tweaks.

There are, however, some inconvenient trends out there that will need consideration in the second half.

First, there have been some signs of a dip in economic activity, while inflation remains, in most places, stubbornly nonchalant toward the huge monetary stimulus thrown at it.

The Citi Economic Surprise Index, which moves in tandem with data beating or underclubbing expectations, has plunged for the main industrial nations this year and is at negative levels not seen since 2011.

Real U.S. gross domestic product has been increasing, but the pace has been slower in each of the past two quarters up to the fairly slow annualized 1.4 percent in January-March.

A report by the Atlanta Fed suggests second quarter growth will bounce back - but as a result of stronger home sales, a reflection of cheap money, offsetting sluggish equipment and inventory investment.

Durable goods orders declined sharply and jobs growth slowed at their last readings.

In the euro zone, the overall picture is relatively positive with a current 1.9 percent year-on-year growth rate - but there are centers of trouble, such as in Italy, the bloc's third largest economy. And while deflation may have gone, inflation is still below target.

The jobless rate is lower, but still above 9 percent (twice that for the young), consumer spending has been easing and wage growth is stubbornly slow.

China, meanwhile, has avoided the slowdown some feared. Indeed, factories grew at their quickest pace in three month in June.

But an official crackdown on excessive debt and shadow banking has been enough of a risk to economic stability to make the central bank cautious about taking further action, particularly ahead of this year's Communist Party Congress.

In Japan, the government has raised its overall view of the economy because of growth in private consumption. But the latest data showed retail sales rising less than expected with slowing sales of durable goods and clothes.

Britain, facing the huge unknown of leaving the European Union, is a case unto itself, with plummeting consumer confidence.

CHECK UP

None of this is to say that the world economy is not in good shape, with (non-British) consumer and business confidence generally rising.

There are "mixed signals", David Folkerts-Landau, group chief economist at Deutsche Bank, wrote to clients, but these reflect "momentum softening in the margin, but still robust".

But enough uncertainties exist for the Bank of International Settlements - the central bankers' banker - to warn of risks ahead from a turning financial cycle, unmanageable household debt, and weak productivity growth among others.

These are hard to track, but there will be a number of data spot-checks in the coming week.

Full purchasing manager indexes and equivalents such as Japan's Tankan will show whether manufacturing and services growth is keeping up with expectations or succumbing to a mild slowdown.

Germany, France and Britain will also release their latest industrial output numbers.

Finally, the end of the week brings the U.S. non-farm payrolls data for June. The number of new jobs is expected to rise from May's release, but still reflect a much lower pace of job creation than at the beginning of the year.

In addition to the numbers, there will be talk. The Group of 20 nations meets in Berlin at the end of the week - seeking some kind of unity with U.S. President Donald Trump to keep things going through the second half and beyond.

(Editing by Alison Williams)

FINANCE

Bank of Canada. June 30, 2017. Business Outlook Survey - Summer 2017

Responses to the summer Business Outlook Survey suggest that business activity is continuing to gain momentum, buoyed by indications that domestic demand will improve further. Positive business prospects are increasingly widespread across regions and sectors.

Overview

- Building on a pickup in sales over the past 12 months, firms expect sales growth to improve further, driven by strength in services and recovering activity tied to the commodity sector. Foreign and domestic demand both provide positive impetus, although risks from potential US policy changes cloud the outlook.

- Although the balance of opinion on investment edged down, plans to increase spending remain widespread and have become more focused on expanding capacity to accommodate stronger demand. Service firms most often cited spending on technology and software. The indicator of hiring intentions, in turn, reached a record high.

- Capacity pressures increased overall, although from low levels in regions tied to energy. Together with rising indicators of labour shortages, responses suggest that slack is being absorbed.

- Despite strong forward-looking indicators of business activity, survey results point to only modest growth in future input and output prices. Inflation expectations edged down and are concentrated in the lower half of the Bank’s inflation-control range.

- Credit conditions are unchanged, as most firms saw no change in the terms and conditions for obtaining financing.

- The Business Outlook Survey indicator, which summarizes the survey results, continued to move up to its highest level since 2011, suggesting a broad-based improvement in business sentiment.

Business Activity

After hovering around zero for nearly two years, the balance of opinion on past sales growth moved up (Chart 1), in part owing to the diminishing drag from commodity-related activity. The balance of opinion on future sales increased, mainly because fewer firms anticipate slower sales growth (Chart 2, blue bars). Firms generally expect sales growth to continue to build over the coming 12 months. In particular, a positive domestic sales outlook is increasingly widespread across regions and sectors: businesses expect activity to recover in energy-related sectors and to remain high in housing; as well, many respondents see benefits from the low level of the Canadian dollar for their domestic sales because it promotes tourism and dampens competition from US firms. This better sales outlook is underpinned by a solid, broad-based improvement in order books and sales inquiries (Chart 2, red line).

Chart 1: Past sales growth

* Percentage of firms expecting faster growth minus the percentage expecting slower growth

Chart 2: Future sales growth

* Percentage of firms expecting faster growth minus the percentage expecting slower growth

** Percentage of firms reporting that indicators have improved minus the percentage reporting that indicators have deteriorated

** Percentage of firms reporting that indicators have improved minus the percentage reporting that indicators have deteriorated

Many firms noted that sustained US demand, backed by a positive business climate, bodes well for their sales outlook. Based on an improvement in orders from foreign customers, firms’ expectations for export growth have rebounded somewhat from the modest level recorded in the previous survey. As examples, businesses cited healthy activity in the US construction sector, increased demand for information technology (IT) services and oil, demand from Asia and Europe, and the low level of the Canadian dollar, together with their own efforts to expand into foreign markets.

A number of businesses noted actual or potential benefits, such as stronger US demand for their products, from possible US policy changes, including the Keystone XL pipeline approval and other supportive energy policies. However, the uncertainty around future trade-related negotiations and protectionist measures clouds the outlook for several respondents, who referred to risks such as the adverse effect of higher border taxes on their business or on their clients. In response to the new US policy environment, most affected firms are opting for a wait-and-see approach, with some delaying or changing their expansion plans.

While moderating somewhat from its level in the spring survey, the balance of opinion on investment in machinery and equipment remains elevated and continues to point to an increase in investment over the next 12 months (Chart 3). Compared with previous surveys, the focus of firms’ investments has shifted toward expanding capacity to accommodate growing sales, with many businesses referring to improving domestic demand as the main driver of their investment decisions. Service firms frequently cited spending on technology, including IT systems or infrastructure, hardware and software.

Chart 3: Investment intentions

* Percentage of firms expecting higher investment minus the percentage expecting lower investment

The balance of opinion on employment intentions over the next 12 months increased significantly, reaching its highest level on record (Chart 4). Positive hiring intentions are broad-based across all sectors and regions, even in energy-producing regions. Firms most frequently mentioned the need to keep up with strong demand and plans to expand their business.

Chart 4: Employment intentions

* Percentage of firms expecting higher levels of employment minus the percentage expecting lower levels

Pressures on Production Capacity

The indicator of capacity pressures moved up and stands above the modest readings over the past two years amid the downturn in the energy sector (Chart 5). Respondents signalled that improving demand was the main factor pushing them closer to capacity, and labour-related constraints have become more prevalent (Box 1). Capacity pressures are concentrated in British Columbia and Ontario, where robust demand has increased competition for labour, but remain modest in other regions, particularly the Prairies.

Chart 5: Capacity pressures

Both measures of labour shortages increased (Chart 6), suggesting that labour markets are tightening. Somewhat more firms than in the spring survey reported that labour shortages are restricting their ability to meet demand (Chart 6, blue bars), although reports of binding shortages are widespread only in British Columbia. The balance of opinion on the intensity of labour shortages (Chart 6, red line) rose sharply. This reflects a generalized view among firms that finding labour has become more difficult than it was a year ago, despite still-substantial slack in energy-producing regions.

Chart 6: Labour shortages

* Percentage of firms reporting more intense labour shortages minus the percentage reporting less intense shortages

Note: The Q2 2006 results are not strictly comparable with those of the other surveys, owing to a difference in the interview process for that survey

Prices and Inflation

On balance, firms expect input price growth to rise somewhat over the next 12 months (Chart 7). Businesses in the goods sector often referred to an expected recovery in commodity prices. A number of firms also mentioned emerging price pressures from other inputs, such as contract labour (related to real estate development, for example), as well as recovering subcontractor costs for firms linked to the energy sector. Nevertheless, wholesale and retail firms expect slower input price growth associated with fading upward pressure from the past depreciation of the Canadian dollar.

Chart 7: Input prices

* Percentage of firms expecting greater price increases minus the percentage expecting lesser price increases

The balance of opinion on output prices turned positive in the summer survey (Chart 8), reflecting expectations of modest output price growth over the next 12 months. Firms reported a desire to pass on higher input costs or to rebuild margins as demand recovers. While competition is still restraining the ability of many firms to raise prices, respondents in some sectors now expect some easing of the intense competitive pressures witnessed over the past 12 months.

Chart 8: Output prices

* Percentage of firms expecting greater price increases minus the percentage expecting lesser price increases

Chart 9: Inflation expectations

Expectations for total CPI inflation over the next two years edged down and continue to be concentrated within the Bank’s 1 to 3 per cent inflation-control range (Chart 9). The majority of firms expect inflation to be in the lower half of the range, representing the widespread view that inflationary pressures will be limited.

Credit Conditions

For the third consecutive quarter, the balance of opinion on credit conditions remains near zero (Chart 10), indicating that the terms and conditions for obtaining financing were unchanged over the past three months. The view that credit conditions are unchanged was widespread across most regions, sectors, firm sizes and sources of financing.

Chart 10: Credit conditions

* Percentage of firms reporting tightened minus the percentage reporting eased conditions. For this question, the balance of opinion excludes firms that responded “not applicable.”

Business Outlook Survey Indicator

The Business Outlook Survey (BOS) indicator is a summary measure of the main survey questions and serves as a gauge of overall business sentiment. In the summer survey, it continued to move up after a period of weakness in the wake of the oil price shock (Chart 11). Results for nearly all the BOS survey questions are above their historical averages, pushing the indicator to its highest level since 2011. This result provides clear evidence of a generalized improvement in business sentiment.

Chart 11: BOS indicator

* The BOS indicator extracts common movements from the main BOS questions. For a description and interpretation of the indicator, see Box 1 in the Spring 2017 Business Outlook Survey and L. Pichette and L. Rennison “Extracting Information from the Business Outlook Survey: A Principal-Component Approach,” Bank of Canada Review (Autumn 2011): 21–28.

Box 1: Capacity Pressures and Labour Shortages Are Starting to Increase

The Business Outlook Survey (BOS) includes a series of questions to gauge the extent of pressures on firms’ capacity, including any constraints related to labour. The survey questions on capacity pressures (firms’ ability to meet an unexpected increase in demand, Chart 5) and on labour shortages (Chart 6, blue bars) help assess the overall level of slack in product and labour markets, respectively. To better understand the dynamics of slack, respondents are also asked whether their capacity pressures and their labour shortages are more or less intense than they were 12 months ago. The question on changes in capacity pressures (Chart 1-A, blue bars), introduced in the third quarter of 2015, thus mimics the existing question on the intensity of labour shortages (Chart 6, red line and Chart 1-A, red bars).

Both indicators remained below zero until late 2016, as firms stated that, on balance, pressures on their production capacity had decreased compared with 12 months ago. The results signalled that excess capacity was increasing and that labour was becoming more readily available, as demand was subdued in the context of the downturn in the energy sector.

Toward the end of 2016 and in early 2017, both indicators held close to zero, implying that significant slack remained but was no longer increasing. In the summer 2017 survey, firms saw capacity pressures rising, citing stronger demand as the driving factor. Similarly, for the first time in more than two years, results indicate that, in all regions, it has become more difficult, on balance, to find labour.

Although these results, taken together, suggest that excess supply is gradually being absorbed across regions, starting points differ importantly. On the one hand, the energy downturn has left businesses in affected regions still operating with excess capacity. On the other hand, businesses in Central Canada report a gradual tightening, while reports of labour shortages are now widespread in British Columbia. Occupations in short supply range from high- to low-skilled, including IT professionals and experienced staff to compensate for retirements, and construction-related workers (in light of elevated activity in some housing markets).

Businesses facing constraints tend to plan on increasing investment and employment in response. Some firms also judge that efforts to retain and compete for labour are starting to feed into wages. Looking ahead, firms anticipate some further tightening in capacity overall, owing to labour-related constraints and improving demand.

Chart 1-A: Capacity pressures and labour shortages are more intense compared with 12 months ago

* Percentage of firms reporting more intense capacity pressures (or labour shortages) minus the percentage reporting less intense capacity pressures (or labour shortages)

The Business Outlook Survey summarizes interviews conducted by the Bank’s regional offices with the senior management of about 100 firms selected in accordance with the composition of the gross domestic product of Canada’s business sector. This survey was conducted from May 8 to June 5, 2017. The balance of opinion can vary between +100 and -100. Percentages may not add to 100 because of rounding. Additional information on the survey and its content is available on the Bank of Canada’s website. The survey results summarize opinions expressed by the respondents and do not necessarily reflect the views of the Bank of Canada.

The Globe and Mail. Jun. 30, 2017. BoC sees broad business recovery, sets stage for rate hike

BARRIE MCKENNA

OTTAWA — If Bank of Canada Governor Stephen Poloz wanted more evidence that it may be time to start raising rates, he got it with an unequivocally upbeat reading of the mood of Canadian businesses.

Virtually all key indicators of business activity are picking up, including sales momentum, demand, investment plans, capacity pressures, plus the highest-ever reading of hiring intentions, according to the central bank’s latest quarterly Business Outlook Survey, released Friday.

“CEOs basically just told the [Bank of Canada] to start hiking,” Bank of Nova Scotia economist Derek Holt said in a research note.

A composite indicator of the various survey results reached its highest level in six years. The Canadian dollar held solidly above 77 cents (U.S.) after the release of the report. Separately, Statistics Canada reported Friday that the country’s economy grew by 0.2 per cent in April, setting the stage for a solid second-quarter showing.

“Businesses activity is continuing to gain momentum, buoyed by indications that domestic demand will improve further,” the report said. “Positive business prospects are increasingly widespread across regions and sectors.”

There are now reports of growing labour shortages for the first time in more than two years, particularly in British Columbia.

The bank said occupations in short supply include both high and low-skilled workers, including information technology professionals, experienced staff to take over from retiring employees and building trades workers.

The survey is one of the key pieces of information that Mr. Poloz and his central colleagues use to set monetary policy. The survey gathers the views of senior executives at 100 companies across the country, chosen to reflect the make-up of the Canadian economy.

The odds that the central bank would raise its key interest rate by a quarter percentage-point at its next rate-setting meeting July 12 have gone from a long shot to a near sure-thing in recent weeks, according to financial markets. A rate hike next month – to 0.75 per cent from 0.5 per cent – would be the first increase in Canada in seven years, and the first move of any kind since the bank cut rates twice in 2015.

After the survey’s release, the chance of a July rate hike shot up to 84 per cent from 73 per cent, according to financial markets.

The bullish survey mirrors recent comments from top Bank of Canada officials, who have become increasingly convinced the economy has turned the corner from the devastating oil price collapse.

One of the only downbeat bits of data was on the inflation front, where expectations of price increases “edged down,” according to the bank. Indeed, all three of the Bank of Canada’s measures of core inflation remain well below its two-per-cent target.

Among the key survey findings:

- 50 per cent of businesses expect sales growth to pick up in the next year; only 19 per cent expect slower sales growth.

- Many firms cite the benefits of the low Canadian dollar, now at roughly 76 cents (U.S.), in driving tourism and lessening competition from U.S. rivals.

- Investment intentions dropped slightly from the first-quarter survey, but remain high, with 48 per cent of respondents saying they will increase spending on machinery and equipment.

- Two-thirds of companies say they plan to boost employment over the next 12 months, and positive hiring intentions are “broad-based across all sectors and regions.”

- Nearly half of firms said they would have problems meeting future demand increases.

- Forty per cent of respondents said the intensity of labour shortages has increased.

- Most businesses reported no change in credit conditions.

REUTERS. Jun 30, 2017. Bank of Canada sees rising capacity pressure among firms

By Andrea Hopkins and Leah Schnurr

OTTAWA (Reuters) - Canadian companies are more optimistic about future sales and exports, while improving demand is driving capacity pressures that should boost investment and hiring, the Bank of Canada said on Friday.

Firms expect sales growth to improve further after a pickup in the last 12 months, driven by strength in services and a bounceback in the commodity sector, the central bank said in its quarterly business outlook survey.

"Respondents signaled that improving demand was the main factor pushing them closer to capacity, and labor-related constraints have become more prevalent," the bank said.

The indicator of hiring intentions reached a record high and some firms believe competition for labor is starting to feed into wages, the bank said.

While some firms mentioned emerging price pressures from inputs and companies want to pass on higher costs to rebuild margins as demand recovers, competition continues to restrain their ability to raise prices and inflation expectations edged down, remaining at the lower end of the bank's 1 to 3 percent inflation control range.

Overall, the survey suggested a continued recovery in business sentiment after two years of weakness, and it will likely feed into expectations that the Bank of Canada will begin raising interest rates, possibly as early as next month.

Indications that domestic demand will improve further buoyed business activity, and "positive business prospects" are increasingly widespread across regions and sectors, the bank said.

Businesses expect activity to recover in energy-related sectors and to remain high in housing. In addition, many respondents see benefits from the low-level of the Canadian dollar for domestic sales because it promotes tourism and dampens competition from U.S. firms, the bank said.

Many firms said sustained U.S. demand boosted expectations for export growth from the modest level recorded in the previous survey, though uncertainty about future trade-related negotiations and U.S. protectionism continues to cloud the outlook.

The survey of about 100 firms showed capacity pressures and labor shortages are more intense compared with the last survey in April.

"Similarly, for the first time in more than two years, results indicate that, in all regions, it has become more difficult, on balance, to find labor," the bank said in a separate box illustrating capacity pressures.

"Businesses facing constraints tend to plan on increasing investment and employment in response. Some firms also judge that efforts to retain and compete for labor are starting to feed into wages."

(Reporting by Andrea Hopkins and Leah Schnurr; Editing by Bernard Orr)

BLOOMBERG. 30 June 2017. Bank of Canada Sees the Strongest Business Outlook Since 2011

By Greg Quinn

Canadian business leaders reported the strongest outlook since 2011 including record hiring plans, according to a central bank survey.

The overall Business Outlook Survey Indicator -- an aggregate gauge -- measured 2.81, up from 0.73 in the last report, according to the Bank of Canada’s quarterly Business Outlook Survey published Friday in Ottawa.

Results for nearly all survey questions were above historical averages and the positive outlook is also more widespread across different industries and regions of the country, it said.

“This result provides clear evidence of a generalized improvement in business sentiment” the bank’s report said of the rise in the summary indicator.

Key Points

- The balance of companies looking to make new investments edged down but “remains elevated”

- The overall view of future sales growth was the highest since 2014

- The difference between those expecting faster sales growth and those expecting lower sales growth at 31 percentage points. The share of businesses expecting an increase in future sales growth was 50 percent, versus 19 percent who see a decline

- The balance of opinion on hiring intentions rose to 58 percentage points, the highest on record

- The share of companies expected to increase investment in machinery and equipment was 48 percent in the survey, while those projecting a decline was 19 percent. The 29 percentage point balance of opinion remained “elevated,” close to 35 percent in the last report that was the highest since 2010

Big Picture

The survey may give insight into why Governor Stephen Poloz switched this month to signal he’s prepared to raise interest rates. Swaps trading suggest investors are placing about a 70 percent chance of a rate hike at the central bank’s next decision July 12.

Other Highlights

- There is “only modest growth in future input and output prices”

- Inflation expectations edged down, with 70 percent of firms predicting inflation of between 1 percent to 2 percent

- Pressures on firms’ capacity to produce are the highest since the second quarter of 2015

- Most affected companies are taking a wait-and-see approach around risks from the U.S. such as trade protectionism, the central bank report said. Other companies see opportunities such as for enhanced energy trade

BLOOMBERG. 30 June 2017. Optimism Growth Will Last Strengthens Poloz's Case for Rate Hike

By Greg Quinn

- Investors see an 84% chance of rates increasing in July

- GDP up 3.3% from a year ago, business outlook best since 2011

Canada’s economy continued to grow at a solid pace at the start of the second quarter, with businesses expecting the party to last, reinforcing expectations the Bank of Canada will raise interest rates next month.

Statistics Canada released April gross domestic product data on Friday that showed the country’s economy expanded at a 0.2 percent monthly pace, and grew by 3.3 percent over the past 12 months. In a separate report, the Bank of Canada released a survey of business leaders that showed the strongest outlook since 2011.

The GDP figure puts the country on pace for annualized growth of between 2.5 percent and 3 percent in the second quarter, a strong follow-up to a 3.7 percent expansion in the first quarter that was by far the fastest among Group of Seven countries. The business survey, meanwhile, will give Bank of Canada Governor Stephen Poloz more confidence in the sustainability of the expansion as he considers a rate increase.

“It validates everything,” said Jimmy Jean, a strategist in the fixed-income group at Desjardins Capital Markets in Montreal. “The question is not only do they go in July but when is the next one?”

Investors increased bets on a hike at the central bank’s rate decision July 12. Swaps trading now suggests an 84 percent chance of an increase, up from about 70 percent earlier Friday. Odds are also growing for a second round of tightening later in the year.

The Canadian dollar, which has gained 6 percent from early May, was up 0.2 percent to C$1.2994 per U.S. dollar at 11:18 a.m. in Toronto trading.

The currency and bond yields jumped this week on comments from Poloz suggesting he favors raising his 0.5 percent interest rate. He and his deputies have been citing gains that are broadening to include more industries and regions, a trend that was substantiated in Friday’s releases.

GDP Report

- Canada’s economy grew for a sixth consecutive month with gains in a majority of industries, underlining the central bank’s view a durable recovery from an oil shock is emerging

- Fourteen out of 20 sectors grew on the month, led by a 2.7 percent gain in mining and a 1 percent rise in transportation and warehousing

- The expansion over the last 12 months of 3.3 percent is the fastest since June 2014

- Canada’s booming housing market showed some signs of cooling in April, when Ontario introduced measures to constrain the Toronto market. Residential construction fell for the first time in six months with a 0.9 percent decline, and activity by agents and brokers fell 0.6 percent

Business Outlook Survey

- Results for nearly all survey questions were above historical averages and the positive outlook is also more widespread across different industries and regions of the country, it said

- The overall view of future sales growth was the highest since 2014

- The balance of opinion on hiring intentions rose to 58 percentage points, the highest on record

- Pressures on firms’ capacity to produce are the highest since the second quarter of 2015

The Globe and Mail. Jun. 30, 2017. Higher interest rates will increase Ottawa’s budget deficits, report warns

BILL CURRY

OTTAWA — A new forecast warns that rising interest rates will ultimately produce larger deficits as the federal government faces higher borrowing costs on its $637-billion debt.

Canada’s economy is now humming along, with new April GDP data showing a strong start to the second quarter. Several consecutive months of positive economic news have increased expectations that Bank of Canada Governor Stephen Poloz will start increasing interest rates in July, which is much sooner than most observers have expected.

But a new fiscal forecast from the University of Ottawa’s Institute of Fiscal Studies and Democracy predicts higher-than-expected borrowing costs will throw off Finance Minister Bill Morneau’s deficit projections over the coming years.

For the next three years, stronger-than-expected economic growth will be good news for Ottawa’s bottom line. The report projects a deficit of $18.4-billion for 2017-18, which is an improvement over the $28.5-billion deficit forecast in the March, 2017, budget. But rather than continuing on a shrinking trend, as outlined in the budget, the institute says deficits will start getting bigger. By 2020-21, the institute estimates that deficits will be larger than current official forecasts.

“Federal government deficits are expected to rise quickly toward the end of the forecast after showing some improvement over the next few years,” writes Randal Bartlett, the institute’s chief economist. “The forecast for ever-increasing deficit over time suggests that the federal government would be wise to consider committing to a plan to return to more manageable budget balances.”

The main reasons why the institute expects higher deficits are lower corporate profits due to moribund energy prices and rising debt service costs. Mr. Morneau’s 2017 budget said the size of the federal debt would climb to $756.9-billion in 2021-22 from $616-billion in 2015-16. In spite of that increase, Ottawa expects the size of the federal debt as a percentage of GDP will decline slightly. The institute agreed with that claim.

The institute’s report questions the federal government’s approach to managing the federal debt, noting that Ottawa has recently shown a preference for short-term borrowing.

“The federal government has recently focused on issuing debt at relatively short-term maturities, thereby capitalizing on low borrowing costs when short-term interest rates were low,” the institute’s report states. “But given much of this debt is going to need to be rolled over in relatively short order and the Bank of Canada is expected to begin hiking rates as early as July, 2017, this strategy looks as though it may backfire.”

The Globe and Mail. Reuters. Jun. 30, 2017. Loonie notches nine-month high on higher oil prices, domestic growth

FERGAL SMITH

TORONTO — The Canadian dollar strengthened on Friday to a 9-month high against its U.S. counterpart, boosted by higher oil prices and domestic growth which supported the Bank of Canada’s more hawkish stance.

Canada’s economy expanded by 0.2 per cent in April after a 0.5 per cent increase in March, Statistics Canada said. The gain matched analysts’ estimates.

It leaves the economy on track to grow at a 2.5 per cent pace in the second quarter, which is “more than enough to justify the recent change in tone from the Bank of Canada,” Avery Shenfeld, chief economist at CIBC Capital Markets said in a research note.

Hawkish comments earlier this week from Bank of Canada Governor Stephen Poloz have raised expectations for an interest rate hike as early as next month.

Chances of a Bank of Canada rate hike in July have increased to one-in-two from just 20 per cent after subdued inflation data last week, data from the overnight index swaps market shows.

Oil prices climbed for a seventh straight session in their longest bull run since April but were still set for the worst first-half performance since 1998.

U.S. crude prices were up 0.87 per cent at $45.32 a barrel.

At 9:14 a.m. ET (1314 GMT), the Canadian dollar was trading at $1.2991 to the greenback, or 76.98 U.S. cents, up 0.1 per cent.

The currency’s weakest level of the session was $1.3011, while it touched its strongest since Sept. 9 at $1.2947.

Investors will digest the Bank of Canada’s business outlook report, due for release at 10:30 a.m. ET. An improvement in business investment or sales expectations would underscore the central bank’s recent shift to a more hawkish stance.

Canadian government bond prices were lower across a steeper yield curve. Global bond markets have been pressured this week by the likelihood that central banks will become less accommodative.

The two-year price dipped 0.5 Canadian cent to yield 1.083 per cent and the 10-year declined 26 Canadian cents to yield 1.737 per cent.

The gap between the 2-year yield and its U.S. equivalent narrowed by 1 basis point to a spread of –28.3 basis points, its narrowest since Nov. 10, as Canadian bonds underperformed.

INVESTMENT

REUTERS. Jun 30, 2017. Canada Pension Plan to buy U.S. REIT Parkway for $1.2 billion

By Matt Scuffham

TORONTO (Reuters) - Canada Pension Plan Investment Board said on Friday it would buy Houston-based real estate investment trust Parkway Inc (PKY.N: Quote) for $1.2 billion, its second significant U.S. investment this week.

Canada's biggest public pension fund, which is one of the world's biggest real estate investors, will pay Parkway stockholders $19.05 per share and a $4 special dividend, the companies said on Friday.

Shares of Parkway were up 12.3 percent at $22.87 in morning trading. That was slightly below the $23.05-per-share deal value, which represented a 14 percent premium to the stock's average price in the past month.

"Parkway fits well with CPPIB's long-term real estate strategy to hold stable, high-quality assets in large U.S. markets," said Hilary Spann, who heads the pension fund's U.S. real estate investment arm.

Parkway, in which private equity firm TPG Capital has a 9.8 percent stake, said it owned 19 Houston properties totaling about 8.7 million square feet.

CPPIB Chief Executive Officer Mark Machin had said in November that he saw U.S. opportunities arising from President Donald Trump's election victory, citing the expectation of increased fiscal stimulus, less regulation and more economic activity.

The CPPIB, which manages Canada's national pension fund and invests on behalf of 20 million Canadians, has been diversifying from its domestic market by acquiring assets such as real estate and infrastructure around the world in addition to buying publicly traded stocks and bonds.

The pension fund is most heavily invested in the United States, which accounts for about 39 percent of its C$317 billion ($245 billion) of assets, according to its 2017 annual report. Asia is a distant second at 18 percent.

On Wednesday, CPPIB agreed to invest up to $1 billion to buy oil and gas assets in the United States in a partnership with Encino Energy Ltd

HFF Securities LP was Parkway's financial adviser, and Hogan Lovells US LLP was its legal adviser.

(Additional reporting by Yashaswini Swamynathan in Bengaluru; Editing by Anil D'Silva and Lisa Von Ahn)

CANADA - US / TECHNOLOGY

BLOOMBERG. 30 June 2017. Trudeau Versus Trump Is a Win for Toronto Tech and Innovation

By Natalie Wong

- Okta opens 60-seat office following Uber, Amazon expansions

- Canada’s top universities are seeing foreign applications rise

Silicon Valley startups are tapping into Toronto’s tech talent.

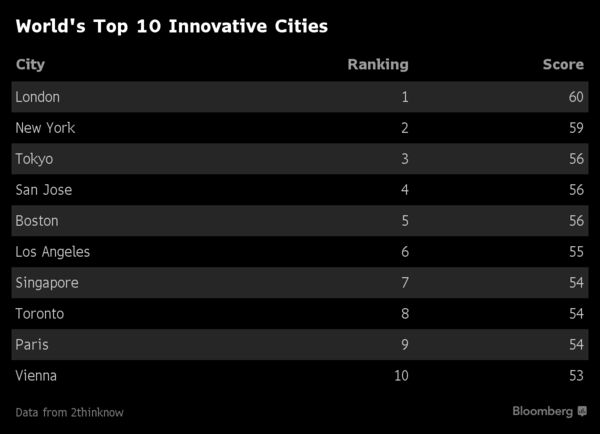

Okta Inc., which JPMorgan Chase & Co. calls one of the fastest growing public software firms, opened a 60-seat office this month on trendy King Street West. Lured by a deepening pool of engineers in a city routinely ranked among the world’s most innovative, the company is following peers such as Uber Technologies Inc. and Amazon.com Inc. across the border.

Okta chose Canada’s biggest city because it’s home to the University of Toronto and is near the University of Waterloo, which are "educational sector leaders in developing future tech leaders," said Armen Vartanian, vice president of global workplace services. "With respect to the talent supply that’s there, this is effectively a no-brainer for us."

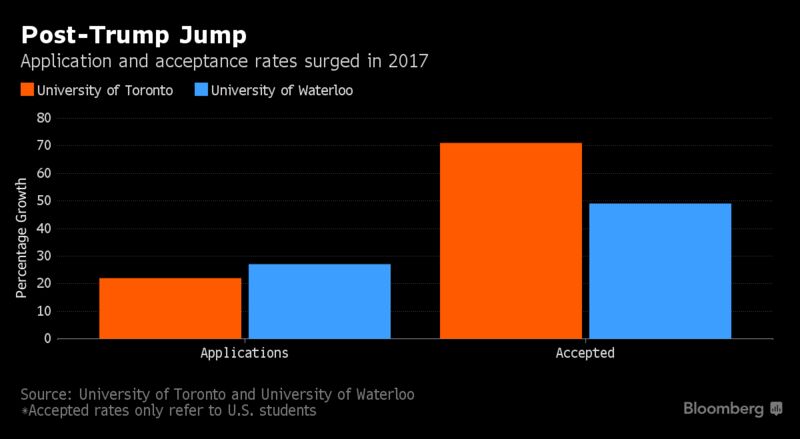

A big draw for start ups is a jump in potential graduates as U.S. President Donald Trump’s policies divert foreign students to Canada. Sensing an opportunity to wean his economy away from a reliance on commodities, Prime Minister Justin Trudeau is offering fast-track visas to high-skilled workers and increasing funding for innovation.

Trudeau’s administration clarified on June 12 that only firms growing 10 percent to 20 percent can avail of a new program that brings high-skilled foreign workers into the country in as little as two weeks, effectively ringfencing the approvals for the tech sector.

He has also extended a popular venture capital financing program started by the previous government and added another C$950 million to spread around tech hubs in Canada. He gave C$125 million ($96 million) specifically to support the country’s budding artificial intelligence research programs.

"The tech innovation ecosystem in Toronto has just been blowing up," said Bilal Khan, founding managing director of OneEleven, a startup accelerator backed by OMERS and Royal Bank of Canada, that’s played home to successful Canadian tech companies including Wealthsimple and Big Viking Games. "This is a government that gets it, that’s willing to invest both time and support to build out the ecosystem."

Meanwhile American applications to Canadian tech companies are increasing following the election of Trump. Shopify Inc. reported a 40 percent increase in the first quarter of 2017 over all of 2016, and Zoom.ai Inc. saw a 31 percent rise from nearly zero for engineering roles, Karen Greve Young, vice president of partnerships at MaRS Discovery District, another Toronto tech incubator, told Bloomberg TV Canada.

Uber last month hired University of Toronto Associate Professor Raquel Urtasun to lead its first non-U.S. branch of the Advanced Technologies Group at the MaRS Discovery District. In a blog post, Travis Kalanick, former CEO and co-founder, said "Toronto has emerged as an important hub of artificial intelligence research, which is critical to the future of transportation."

Shares of San Francisco-based Okta, the $2.2 billion company that helps companies secure their internal communications, rose more than 38 percent when they debuted this April and are trading 37 percent above their offer price.

Higher Salaries

Back in the city’s schools, students cite career prospects and diversity as an important plus for Toronto. That’s especially true "at a time when there is political turmoil in other parts of the world," Daksh Sikri, an Indian-born recent engineering graduate from the University of Toronto, told the campus newspaper.

Rival University of Waterloo is overseeing a C$88 million building project to accommodate 1,200 more engineering students. Some C$33 million of this was funded by the federal government, said Pearl Sullivan, Waterloo’s dean of engineering.

Talented job applicants are receiving multiple offers from competing companies, a precursor to increased salaries, according to OneEleven’s Khan. Meanwhile employers applied for about 16 percent fewer U.S. H-1B visas for highly skilled workers this year than in 2016, possibly reflecting concern that the Trump administration is taking a more restrictive approach to the program.

"Words matter," Khan said, referring to Trump’s protectionist rhetoric and growing sentiment that the U.S. is closing to immigrants. "It’s incredible because at that exact moment, Canada threw its doors wide open."

________________

LGCJ.: