CANADA ECONOMICS

StatCan. 2017-05-05. Labour Force Survey, April 2017

Unemployment rate — Canada

6.5%, April 2017

-0.2 pts decrease (monthly change)

Source(s): CANSIM table 282-0087.

Employment — Canada

18,311,000, April 2017

0.0% increase (monthly change)

Source(s): CANSIM table 282-0087.

Employment was little changed in April, while the unemployment rate declined 0.2 percentage points to 6.5%, the lowest rate since October 2008. The decrease was mostly the result of fewer youth searching for work.

Compared with 12 months earlier, there were 276,000 (+1.5%) more people employed and the unemployment rate was 0.6 percentage points lower. Over the same period, the total number of hours worked rose 1.1%.

Chart 1 Chart 1: Employment

Employment

Highlights

In April, employment increased among people 55 and older, while it declined among men aged 25 to 54. Employment was little changed among women aged 25 to 54 and youths aged 15 to 24.

Employment rose in British Columbia and Prince Edward Island, while it was virtually unchanged in the other provinces.

More people were employed in educational services, health care and social assistance, and transportation and warehousing in April. At the same time, employment declined in business, building and other support services, as well as in accommodation and food services.

Public sector employment increased in April, while the number of private sector employees fell. Self-employment was little changed.

Chart 2 Chart 2: Unemployment rate

Unemployment rate

Demographic overview

Employment among the population aged 55 and older rose by 24,000 in April, mostly in full-time work, and their unemployment rate declined 0.6 percentage points to 5.6%. On a year-over-year basis, people 55 and older had the fastest rate of employment growth (+3.6% or +133,000) compared with the other demographic groups. This is primarily the result of the continued transition of the baby-boom cohort into this older age group.

For men aged 25 to 54, employment declined by 20,000 in April, mostly in full-time work, and their unemployment rate increased 0.3 percentage points to 6.1%. Since August 2016, their employment gains have totalled 81,000. On a year-over-year basis, their unemployment rate was down 0.4 percentage points.

Among women aged 25 to 54, employment held steady in April and their unemployment rate was little changed at 5.1%. Compared with 12 months earlier, employment for this group was up 71,000 (+1.2%), virtually all in full-time work.

Employment for youth aged 15 to 24 was little changed in April, while their unemployment rate fell 1.1 percentage points to 11.7% as fewer of them searched for work. This is the lowest unemployment rate for youth since September 2008. On a year-over-year basis, youth employment was virtually unchanged.

Provincial summary

In British Columbia, employment increased by 11,000 in April and the unemployment rate was little changed at 5.5%. Employment in the province has been on an upward trend with notable increases in four of the past five months. Compared with 12 months earlier, employment in British Columbia increased by 80,000 (+3.4%), mostly in full-time work.

There were an estimated 800 more people working in Prince Edward Island in April and the unemployment rate for the province was little changed at 10.3%. Prince Edward Island has had relatively strong employment growth since the autumn of 2016. On a year-over-year basis, employment in the province was up 2,500 (+3.5%).

In Ontario, employment held steady in April. The unemployment rate fell 0.6 percentage points to 5.8%, mostly due to a decline in the number of youth searching for work. This is the lowest unemployment rate for the province since January 2001. Compared with 12 months earlier, employment in Ontario was up 87,000 (+1.2%).

In Quebec, both the employment level and the unemployment rate were little changed in the month. In the 12 months to April, employment in the province rose by 88,000 or 2.1%, mostly in the second half of 2016. On a year-over-year basis, the unemployment rate in Quebec declined 0.8 percentage points to 6.6%.

Employment in Alberta held steady in April after a period of growth that began in autumn 2016. The unemployment rate in the province was 7.9% in April, down 0.5 percentage points from the previous month as fewer people searched for work.

Industry perspective

Employment in educational services rose by 19,000 in April, mostly in Ontario and British Columbia. This offset a similar-sized decline observed the previous month. Compared with 12 months earlier, there were 30,000 (+2.4%) more people working in educational services across Canada.

In health care and social assistance, employment increased by 12,000 in April, with the bulk of the growth in British Columbia. On a year-over-year basis, overall employment in this industry rose by 31,000 (+1.3%).

There were 8,800 more people working in transportation and warehousing in April. The increase was largely in Ontario. In the 12 months to April, there were 24,000 (+2.6%) more people working in this industry at the national level.

In contrast, employment in business, building and other support services fell by 19,000 in April, with declines primarily split between Quebec and British Columbia. Nationally, employment in this industry was virtually unchanged on a year-over-year basis. Business, building and other support services is a broad industry that includes, for example, administrative or cleaning services to buildings, as well as employment services.

Employment in accommodation and food services declined by 12,000 in April, mostly in Ontario and Quebec. For Canada as a whole, employment in this industry was slightly lower than in April 2016.

Public sector employment increased by 35,000 in April, largely in health care and social assistance and educational services. At the same time, the number of private sector employees fell by 51,000. On a year-over-year basis, the number of private sector employees rose by 152,000 (+1.3%), while public sector employment was up 92,000 (+2.6%).

Self-employment was little changed both in the month and compared with April 2016.

Chart 3 Chart 3: Proportion of the employed population working in agriculture, Canada, 1881 to 2016

Proportion of the employed population working in agriculture, Canada, 1881 to 2016

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170505/dq170505a-eng.pdf

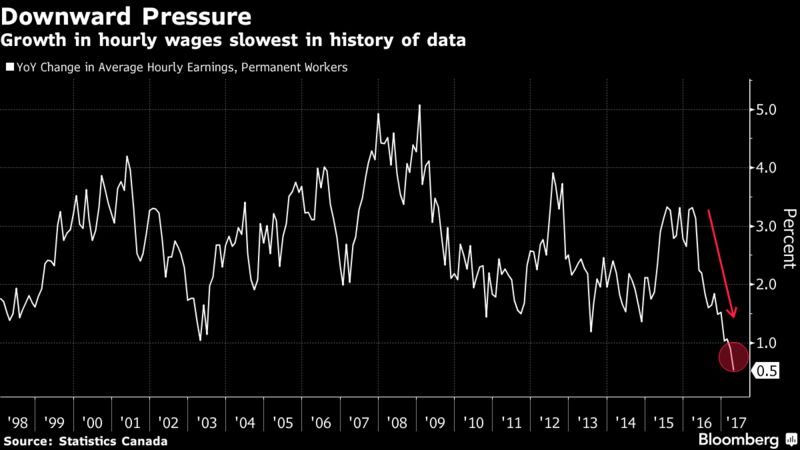

The Globe & Mail. Bloomberg News. May 05, 2017. Canada’s wage gains fall to lowest since 1990s as jobs run stalls

THEOPHILOS ARGITIS

With assistance from Erik Hertzberg

Canada’s run of job gains stalled in April and wage gains slowed to record lows, casting a shadow over what had been a stellar employment performance.

Canada added 3,200 jobs during the month, Statistics Canada reported in Ottawa, less than the 10,000 employment gain forecast by economists. The pace of annual wage rate increases fell to 0.7 per cent in April, the lowest in records dating back to the late 1990s.

Canada’s unemployment rate fell to 6.5 per cent, the lowest since October 2008, but this reflects the departure of 45,500 people from the labor force. About half of those were youth, meaning many young people looking for work have stopped looking.

Key Points While the number of jobs added was relatively small in April, one-month does not make a trend and the recent employment picture has been strong. The country has had positive job gains for six straight months, and over the past nine months has added 277,000 jobs. That’s the best performance since 2012.

Other positive signs include hours worked numbers that show gains of 1.1 per cent over the past 12 months and the falling unemployment rate.

Yet the wages puzzle, which has been cited by the Bank of Canada as evidence of slack in the economy, persists. There’s little sign that what seems to be a robust employment picture is feeding into wages. In fact, it’s the opposite. For historical perspective, wage gains have averaged 2.7 per cent over the past decade.

Adding to the mystery is that Ontario is the major source of wage sluggishness, with pay increases of 0.2 per cent year-over-year. Full-time jobs also are showing slower wage gains than the national average.

Big Picture

Policy makers at the Bank of Canada have been wary of recent upswing in economy data and this report will probably feed their worries even with the job gains. While economic growth has been accelerated and employers are hiring, it’s tough to conclude the recovery has fully taken hold without a pick-up in wages.

Other Details

The nation lost 31,200 full-time jobs, and gained 34,300 part-time jobs during the month.

All the job gains were self-employed and public sector. Canada lost 50,500 jobs in the private sector.

REUTERS. May 5, 2017. Canada jobs growth disappoints in April; unemployment lowest since 2008

OTTAWA (Reuters) - Canadian jobs growth disappointed in April as the economy created fewer jobs than expected, while the unemployment rate fell to its lowest since the global financial crisis amid a drop in the number of young people looking for work.

Economists said the labor market had been due for a pause after a strong run in recent months, and that the report would not change the path of monetary policy. The Bank of Canada is expected to hold interest rates at 0.50 percent later this month.

Employers added 3,200 jobs last month, Statistics Canada said on Friday, short of forecasts for 10,000. The unemployment rate fell to 6.5 percent, the lowest since October 2008, as the participation rate dipped to 65.6 percent from 65.9 percent.

While it was the weakest month for jobs since a decline in hiring in November, the labor market has averaged hiring gains of 22,000 a month over the past six months. That suggests the economy has turned the corner after being hurt two years ago by tumbling oil prices.

"The trend has been explosive for the Canadian job market," said Derek Holt, economist at Scotiabank. "I personally wouldn't throw in the towel on the outlook for the jobs figure when we've had such a strong trend."

The Canadian dollar weakened against the greenback shortly after the report, as investors also digested data showing a strong rebound in jobs growth in the United States.

SUBDUED WAGE GROWTH

Full-time jobs declined by 31,200 in April, offsetting an increase of 34,300 part-time positions, though some economists had expected full-time hiring would pull back after recent strength. Over the last six months, 164,000 full-time positions were created, compared with a decline of 34,000 part-time jobs.

Goods-producing industries added 4,200 jobs, led by increased hiring in the agriculture and natural resources sectors. The services sector shed 1,000 jobs.

Economists noted there were some weak details, including an increase in average hourly wages of just 0.5 percent compared with a year earlier. The Bank of Canada has pointed to the subdued wage growth as evidence of material slack in the economy.

The muted wage growth was likely to keep the central bank on the sidelines in terms of monetary policy changes, said Paul Ferley, assistant chief economist at RBC.

"It's not getting any indication of pressure on the inflation front and they are still concerned about potential trade protectionism emerging in the U.S., so I think they will stay cautious," Ferley said.

(Additional reporting by Alastair Sharp and Fergal Smith in Toronto; Editing by Bernadette Baum)

BMO. ECONOMIC RESEARCH. econoFACTS. ANALYSIS. May 5, 2017. Cdn. Employment Report — April, Demographics Makes its Mark: Slower Jobs, Slower Wages, Lower Joblessness (6.5%)

FULL DOCUMENT: https://economics.bmocapitalmarkets.com/economics/econofacts/20170505b/econofacts.pdf

SCOTIA BANK. ECONOMICS. ANALYSIS. May 5, 2017. Scotia Flash: Record Low For Canadian Wage Growth Keeps BoC Sidelined. Canada, Net Change in Employment (000s) / Unemployment Rate (%), April: 6.5%

FULL DOCUMENT: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/scotiaflash20170505.pdf

TD BANK. TD Economics. ANALYSIS. May 5, 2017. Analysis of economic performance and the implications for investors. The analysis covers the globe, with emphasis on Canada, the United States, Europe and Asia. Canadian Employment: 6.5%

FULL DOCUMENT: https://www.td.com/document/PDF/economics/comment/CanadianEmployment_Apr2017.pdf

RBC. Economic Research. May 5, 2017. Canadian employment up again in April but wages continue to underperform: 6,5%

FULL DOCUMENT: http://www.rbc.com/economics/daily-economic-update/CA%20Employment_Apr2017.pdf

________________

Global Affairs Canada. May 5, 2017. Canada’s new institute to grow private investment in developing countries to be based in Montréal

Montréal, Quebec - The Honourable Marie-Claude Bibeau, Minister of International Development and La Francophonie, today announced the headquarters for Canada’s new Development Finance Institute (DFI) will be located in Montréal.

The new institute will enable partnerships with small and medium enterprises from the private sector. It will mobilize its resources and expertise to promote inclusive green economic growth, while promoting the involvement of women and young entrepreneurs in achieving sustainable development objectives.

The establishment of Canada’s new DFI was confirmed in Budget 2017. The institute will operate as a wholly owned subsidiary of Export Development Canada (EDC). The institute will be capitalized with $300 million over five years to support its work.

Quotes

“Canada’s Development Finance Institute will enable partnerships with the private sector to participate actively in economic and social progress around the world. By leveraging the expertise of small and medium-sized enterprises, including those run by women and youth, we will have a positive and lasting impact on the lives of the world's poorest and most vulnerable populations.”

- Marie-Claude Bibeau, Minister of International Development and La Francophonie

“Canada’s Development Finance Institute will be able to draw from the full range of EDC’s financial capabilities, as well as its experience and networks in emerging markets, to deliver flexible and innovative solutions to its clients and to the ultimate beneficiaries, the poor in developing countries.”

- François-Philippe Champagne, Minister of International Trade

“Canada’s new Development Finance Institute will harness the expertise of Montréal’s development community and financial sector. It will promote investment in the countries that need it most, and ensure we reach the poorest and most vulnerable, especially women and girls.”

- Justin Trudeau, Prime Minister

Quick facts

- Institutes similar to the DFI in other countries have been able to leverage multiple dollars in private sector investment for every public dollar invested.

- The private sector creates nine out of 10 jobs in developing countries.

- Canada’s new DFI will be represented in countries eligible to receive official development assistance, taking into account Canada's most current international priorities, presence and networks to enhance our development impact.

RBC. Economic Research. May 5, 2017. U.S. April payroll employment jumps by 211K: 4.4%

FULL DOCUMENT: http://www.rbc.com/economics/daily-economic-update/US%20Employment_Apr2017.pdf

TD BANK. TD Economics. ANALYSIS. May 5, 2017. Analysis of economic performance and the implications for investors. The analysis covers the globe, with emphasis on Canada, the United States, Europe and Asia. U.S. Employment: 4.4%

FULL DOCUMENT: https://www.td.com/document/PDF/economics/comment/USEmployment_Apr2017.pdf

BLOOMBERG. 2017 M05 5. Trump’s Reciprocal Tax Faces Rough Ride Under World Trade Rules

by Andrew Mayeda and Lynnley Browning

- President says it is a concept he’s strongly working on

- Experts see little effect on trade gap from raising tariffs

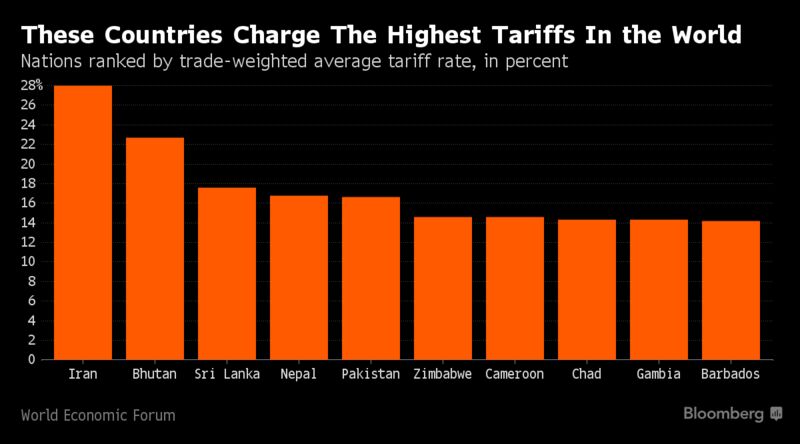

There’s something attractively simple about President Donald Trump’s idea for a reciprocal tax: charge high tariffs on our products, and we’ll ding you right back.

Putting that concept in place without violating America’s international trade obligations -- or pushing up the prices consumers pay for everything from televisions to toothbrushes -- would be another story. Yet Trump’s enthusiasm for the idea of punishing countries that impose high tariffs on U.S. imports with matching tariffs on their exports was evident in an interview with Bloomberg News this week.

“I love a reciprocal tax,” Trump said in the interview. “Nobody can fight it. It’s fair and it’s something that we are working on very strongly.”

It’s the latest in a variety of proposals the Trump administration has floated as a way to reduce the $500 billion U.S. trade deficit on goods and services. Revenue raised could help fund an aggressive plan to cut taxes and ramp up infrastructure spending.

Trump’s crusade for “fair trade” was on view early in his presidency when he invited Harley Davidson executives to park their bikes on the White House lawn, and was alarmed to find the company is charged tariffs of as much as 100 percent to export its products. Since then, he appears to be leaning toward a reciprocal tax as opposed to a border-adjusted tax -- the hotly debated House Republican blueprint -- which would tax companies’ domestic sales and imports while exempting their exports.

One of Trump’s trade lieutenants, Commerce Secretary Wilbur Ross, calls “the concept of reciprocity” a valid idea. “There are structural problems to it, but there’s a logic to it,” he said in an interview Wednesday. The White House declined further comment.

Trade Rules

Trade experts say the measure would almost certainly run afoul of global trade rules. While Trump calls the proposal a “tax,” it actually has to do with the tariffs that countries levy on imported products. As nations joined the World Trade Organization, they agreed to keep their tariffs below a certain level, known in trade argot as the “bound rate.”

However, not all countries have the same tariff ceiling. As the biggest economy in the world, the U.S. has a bound rate of about 3 percent, while an emerging market such as Mexico has a ceiling of about 36 percent.

Countries can charge tariffs up to the bound rates set by the WTO, meaning the U.S. would face a trade complaint if it tried ratcheting up to match Mexico’s tariff rate -- a complaint the U.S. would almost certainly lose, trade experts say. Trade disputes that can’t be resolved bilaterally can take years to finally wind through the global system with a ruling.

Working System

“For anyone not steeped in the strangeness of trade negotiations, what he said makes perfect sense,” said Edward Alden, a senior fellow at the Council on Foreign Relations. “It’s unfortunately not the way the system has worked for a long time. You might have a higher tariff on ladies’ underwear and I might have a higher one on soybeans. It’s all part of the package of concessions that’s been worked out in the negotiations.”

A reciprocal tariff would undermine decades of work by countries to gradually lower trade barriers since WWII, said Dan Ikenson, a trade-policy expert at the Cato Institute in Washington. Other countries would likely retaliate, putting the U.S. at risk of being embroiled in a global trade war, he said.

“It’s a 180-degree turn from the spirit of GATT,” said Ikenson, referring to the 1948 accord that has served as the basis of world trade negotiations. The General Agreement on Tariffs and Trade “was signed in recognition of the fact that protectionism contributed to the decline of the global economy and was one of the contributors to the Second World War.”

Hiking import duties wouldn’t necessarily achieve Trump’s goal of slashing America’s trade deficit. Iran has the highest trade-weighted average tariff rate in the world, according to data compiled by the World Economic Forum. Neither Iran nor the others in the top five -- Bhutan, Sri Lanka, Nepal and Pakistan -- are major contributors to the U.S. trade deficit.

China is easily the biggest source of America’s trade deficit, accounting for $310 billion of last year’s gap, followed by Germany at $68 billion and Mexico at $62 billion.

“At the end of the story, this is not going to have a big effect on the trade deficit, the president’s preferred measure,” said Dany Bahar, a fellow at the Brookings Institution.

Even if the U.S. reduces its trade deficit with individual nations, that won’t solve the underlying fact that America spends more than it saves, meaning the deficit will likely just migrate somewhere else, said Bahar.

A reciprocal tax “does sound an awful lot like a tariff,” Eric Lascelles, chief economist at RBC Global Asset Management, said in an interview. “This is where the lines grow quite blurred between tax policy and trade policy.” The president has a lot more unilateral sway over adjusting tariffs than overhauling taxes, which often needs a green light from Congress.

Imposing or increasing tariff rates can raise costs -- both for consumers and manufacturers using imported materials and relying on integrated supply chains, said Jason Waite, an international trade and regulatory lawyer at Alston & Bird LLP. “It’s not always just the guy buying cheap shoes, it’s also the automaker in the production chain,” he said.

Trump doesn’t seem to differentiate “between taxes and tariffs,” said Vanessa Sciarra, vice president for legal affairs at the National Foreign Trade Council, a trade and lobbying group whose members include Wal-Mart Stores Inc. and Ford Motor Co. The Constitution gives the president “a lot of statutory authority to play with tariffs, so in his mind, it’s probably all flowing in one stream.”

The Globe and Mail. May 04, 2017. Wynne readies Buy Canadian-style policy to turn tables on U.S.

JUSTIN GIOVANNETTI

TORONTO — Ontario Premier Kathleen Wynne’s cabinet is prepared to unleash a Buy Canadian-style policy to turn the tables on any U.S. state that adopts Buy American provisions despite the province’s aggressive lobbying.

The policy was adopted a month ago as the province lobbied Governor Andrew Cuomo to drop his proposed New York Buy American Act, which would have required state entities to buy from U.S. companies on all purchases more than $100,000 (U.S.). Mr. Cuomo abandoned the legislation in early April, however, Ontario’s cabinet had already approved a policy to be used to retaliate if the law passed by forbidding bids from companies based in New York. Companies in the other 49 states would still be free to bid on public tenders. With mounting uncertainty over the future of the North American free-trade agreement and more states eyeing possible Buy American rules, Ontario is keeping the policy ready in case it is needed, a senior government official told The Globe and Mail. The official can’t be named because he isn’t authorized to discuss decisions made by cabinet.

“It would permit Ontario to retaliate against any jurisdiction that undertook prejudicial actions against Ontario’s economy. We were fully prepared to deploy that in response to New York but we didn’t, thankfully. We didn’t want to use it. But it’s sitting ready,” the official told The Globe.

In recent weeks, U.S. President Donald Trump has declared that Canada has been unfair as a trading partner with the United States, leaving Ontario in a difficult position. The province is Canada’s largest economy and has a number of deep trading relationships with U.S. states – it’s either the first or second trading partner for 28 of them. While Ms. Wynne’s government has committed itself to avoiding protectionist measures, it would be forced to adopt proportional measures if Ontario companies were banned from a certain jurisdiction, the official said.

While the policy is designed to be used at the state level, it could be made broader if expected negotiations to revisit NAFTA fail and the United States adopts widespread Buy American rules. Ms. Wynne’s cabinet would need to revise the policy before that could happen.

With Texas currently eyeing Buy American policies, the province is preparing to repeat the lobbying effort that was ultimately successful in New York. While the province’s economy isn’t as closely linked to Texas, Ms. Wynne’s office fears that a major state adopting Buy American rules could encourage others to follow suit.

According to political strategist Charles Bird, Ontario’s trade lobbying could mirror how the province engaged New York: Start with the charm offensive but send a second message that the province is prepared to respond if necessary. Mr. Bird is a principal with the Earnscliffe Strategy Group who has experience advising the federal government.

“There’s been a stated willingness from Ontario and the federal government to get tough and that’s essential,” he said. “At the end of the day, if actions are taken by one side, it’s completely appropriate for the other side to take counter-actions. It’s important for that to be understood by all decision makers.”

Ontario’s cabinet met on Wednesday and a possible renegotiation of NAFTA dominated the discussion for the first time. With Ontario’s economy depending on trade in everything from automotive parts and dairy products to aerospace, the cabinet adopted a more aggressive strategy to increase talks with state leaders. They decided that “the best defence is a good offence,” the official said.

Ms. Wynne has spoken with 12 governors over the past three months, including face-to-face meetings with her counterparts in Michigan, Illinois and Vermont. Her cabinet has endorsed her undertaking more meetings, more often, in the next few months.

“Everyone around that table understood the need for Ontario as a province to get out as soon as possible and articulate our interest in defence of Ontario workers, Ontario businesses and Ontario’s economy,” the senior official said.

“It’s unusual for a province to get this engaged,” the official added.

The province is also considering adding more resources to its trade office in Washington and moving personnel to lobby any states eyeing protectionist rules. The date of the next cabinet meeting has also been moved up to discuss NAFTA again.

In February, Ms. Wynne created a committee that meets monthly and helps guide the province’s evolving trade policy.

Her personal lobbying comes as the federal government has asked all premiers to help on the trade file by speaking about the importance of Canadian trade with U.S. leaders. Conservative, Liberal and New Democrat governments have responded to the call.

In February, while appearing with Canada’s ambassador to the United States, David MacNaughton, Ms. Wynne said provincial leaders bring a different view to trade talks.

“It’s going to be very important and the Prime Minister understands this, that the premiers are involved in those conversations. And that’s exactly the way he wants it to happen because we’ll bring […] slightly different priorities, if not perspectives to add to that discussion,” she said.

Other provinces have toyed with protectionist responses to U.S. trade moves. BC Liberal Leader Christy Clark pledged to put a carbon levy on thermal-coal shipments, which would include those from the United States. The move was seen as retaliation for new U.S. softwood lumber tariffs.

The Globe and Mail. May 04, 2017. Canada must look beyond U.S. in face of Trump’s trade threats, Poloz says

BARRIE MCKENNA

OTTAWA — Canada must look beyond the United States for new trade opportunities in the face of Donald Trump’s protectionist threats, Bank of Canada Governor Stephen Poloz says.

The cloud of uncertainty hanging over Canada’s relationship with the U.S. is already slowing growth in this country, Mr. Poloz warned in remarks prepared for a speech in Mexico City.

“We know that with protectionism, everybody loses eventually, including the country that puts the policies in place,” he said. “And the uncertainty around this threat of increased protectionism is holding back growth.”

The threat of protectionism coupled with President Donald Trump’s promise of steep U.S. business tax cuts is stifling the willingness of Canadian companies to expand and invest, Mr. Poloz said.

The Trump administration imposed duties of up to 24 per cent on Canadian lumber last month, while threatening unspecified future action against Canada’s dairy and energy sectors.

That has helped push the Canadian dollar below 73 cents (U.S.) in recent weeks.

Three-quarters of Canada’s exports went to the U.S. in 2016, leaving Canada extremely exposed to what happens there. Mexico is even more dependent on trade with the U.S.

Part of the solution for both Canada and Mexico is to forge new free trade deals beyond North America, without the U.S. That could include reviving the work that went into the stalled Trans Pacific Partnership (TPP), according to Mr. Poloz.

“The bottom line is there is still scope for both countries to improve access to market outside North America,” he said.

“Canada and Mexico’s shared commitment to open trade means both countries are well placed to thrive, whatever the international environment.”

Officials from Canada and 10 other countries are meeting in Toronto this weekend to explore prospects for reviving the TPP deal without the U.S.

Mr. Poloz called the shelving of the TPP “unfortunate.” In January, Mr. Trump formally pulled the U.S. out of the deal, which his predecessor Barack Obama had championed as a counterweight to the growing clout of China.

“The antidote to uncertainty is certainty,” Mr. Poloz said.

Canada currently has free trade agreements with 15 countries, representing for than a fifth of the global economy. That will grow substantially when the Canada-European Union trade deal comes into force in July.

But if you “take the United States out of the picture,” Canada would have access to just 6 per cent of the world’s GDP, he remarked.

Mr. Poloz also said that the U.S. risks damaging its own economy by restricting the access of Canadian companies to its market. He pointed to the auto parts sector, where Canadian companies have more than 150 plants in the U.S., employing 43,000 Americans.

“It’s hard to imagine how interfering with open trade or implementing other protectionist policies would benefit these people and their families,” he said.

REUTERS. The Globe and Mail. May 5, 2017. TransCanada profit beats on U.S., Mexican pipeline businesses

(Reuters) - Canada's No. 2 pipeline operator, TransCanada Corp TRP.TO, reported a better-than-expected quarterly profit, helped by higher earning from its U.S. and Mexican natural gas pipelines business.

Earnings from its U.S. natural gas pipelines more than doubled, helped by its acquisition of Columbia Pipeline Group Inc last year for about $13 billion.

Profit from its Mexico natural gas pipelines also rose about 162 percent to C$118 million.

The company's net profit attributable to shareholders rose to C$643 million ($467 million), or 74 Canadian cents per share, in the first quarter ended March 31 from C$252 million, or 36 Canadian cents per share, a year earlier.

The latest quarter included about C$48 million in charges, mainly related to the acquisition of Columbia Pipeline Group. The year-ago quarter included charges of about C$211 million, mainly related to the termination of Alberta power purchase agreements.

Excluding items, the company earned 81 Canadian cents per share, beating analysts' average estimate of 74 Canadian cents per share, according to Thomson Reuters I/B/E/S.

Revenue rose 35.5 percent to C$3.39 billion, above analysts' average estimate of C$3.19 billion.

TransCanada, the company behind the controversial Keystone XL pipeline, said on Thursday it would sell stakes in two natural gas pipelines for $765 million.

(Reporting by Arathy S Nair in Bengaluru; Editing by Supriya Kurane)

________________

LGCJ.: