CANADA ECONOMICS

StatCan. 2017-05-17. Monthly Survey of Manufacturing, March 2017

Manufacturing sales

$53.9 billion, March 2017

1.0% increase (monthly change)

Inventory-to-sales ratio

1.35, March 2017

0.00 pts (monthly change)

Inventory-to-sales ratio

1.35, March 2017

0.00 pts (monthly change)

Unfilled orders

$90.2 billion, March 2017

1.8% increase (monthly change)

Source(s): CANSIM table 304-0014.

Manufacturing sales increased 1.0% to a record $53.9 billion in March, reflecting higher sales in the transportation equipment and food industries.

Overall, sales were up in 16 of 21 industries, representing 71% of the Canadian manufacturing sector. Sales of durable goods rose 1.3% to $28.4 billion, while sales of non-durable goods increased 0.7% to $25.4 billion.

In constant dollars, manufacturing sales in volume terms rose 0.2%.

Chart 1 Chart 1: Manufacturing sales rise

Manufacturing sales rise

Transportation equipment and food sales lead the gains

Sales in the transportation equipment industry rose 2.1% to $11.1 billion in March, following two months of declines. The increase was the result of gains in the motor vehicle (+4.5%) and the motor vehicle parts (+1.8%) industries, reflecting higher volumes and prices. After removing the effect of price changes, sales in volume terms increased 3.1% and 0.5% respectively in these industries in March.

In the food industry, sales rose for the second straight month, up 2.6% to a record high $8.9 billion in March. Widespread gains in sales were posted in all nine food industries and reflected higher sales volumes, particularly in the meat, dairy and other food product industries. After removing price effects, sales volumes of the food industry increased 2.2% in March.

Sales in current dollars also advanced in the wood (+3.1%) and computer and electronic product (+5.1%) industries. These gains were widespread and reflected higher volumes and prices in both industries.

These increases were partially offset by a 1.7% decline in the petroleum and coal product industry to $5.0 billion, mostly reflecting lower prices. After removing the effect of price changes, sales volumes of petroleum and coal products edged down 0.2%.

Ontario, British Columbia and Alberta post the largest sales gains

Sales in Ontario increased 1.3% to $25.9 billion in March, largely due to the motor vehicle (+4.1%) and food (+1.8%) industries. These increases were partially offset by lower petroleum and coal product sales (-6.5%).

In British Columbia, sales grew 2.9% on a strong increase in wood products (+10.5%). Sales in Alberta rose 1.6% to $5.8 billion, led by gains in food (+3.9%).

The largest decrease was in Manitoba, where sales fell 1.9% to $1.5 billion, largely due to chemical sales. In Quebec, sales edged down 0.2% to $12.7 billion, mostly due to lower sales in the transportation equipment and wood products industries.

Inventories reach record high

Total inventories increased 1.2% to a record high $72.7 billion in March. This was the fourth consecutive increase in inventories, with 17 of 21 industries posting higher levels. The gains were attributable to the transportation equipment (+3.1%), beverage and tobacco (+9.3%) and machinery (+1.4%) industries.

Chart 2 Chart 2: Inventories reach a record high in March

Inventories reach a record high in March

The inventory-to-sales ratio was unchanged at 1.35 in March. The inventory-to-sales ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Chart 3 Chart 3: The inventory-to-sales ratio is unchanged

The inventory-to-sales ratio is unchanged

Unfilled orders increase

Unfilled orders rose for the third consecutive month, up 1.8% to $90.2 billion in March. Transportation equipment (+1.3%), machinery (+5.2%), and computer and electronic products (+6.6%) were responsible for the increase in unfilled orders in March. Year over year, unfilled orders were up 3.8%.

Chart 4 Chart 4: Unfilled orders increase

Unfilled orders increase

New orders rose for a fourth consecutive month, up 2.6% to $55.4 billion in March. The transportation equipment, computer and electronic product and machinery manufacturing industries contributed the most to the increase in new orders at the national level.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170517/dq170517a-eng.pdf

The Globe and Mail. Reuters. ANALYSIS. May 17, 2017. Canadian factory sales rebound in March on autos, parts gains. Manufacturing sales rise in March on autos, food

Canadian manufacturing sales rebounded in March, driven by gains in the motor vehicle sector and record sales in the food industry, data from Statistics Canada showed on Wednesday.

The 1.0 per cent increase was in line with economists’ expectations, though the gain in volumes was less robust at 0.2 per cent. Sales for February were downwardly revised to a drop of 0.6 per cent from an initially reported 0.2 per cent decrease.

Sales rose in 16 of 21 industries in March, accounting for 71 per cent of the manufacturing sector. The transportation sector led the way, rising 2.1 per cent as the vehicle and vehicle parts industries saw increases in sales volumes and prices.

Food industry sales rose for the second month in a row, climbing 2.6 per cent to a record high of $8.9-billion. Gains were widespread, with all nine food subsectors gaining, particularly meat and dairy.

Overall inventories rose 1.2 per cent to a record high of $72.7-billion, lifted by the transportation equipment and beverage and tobacco sectors. Still, the inventory-to-sales ratio, which measures how many months it would take to exhaust inventories at current sales levels, was unchanged at 1.35.

(Reporting by Leah Schnurr; Editing by Paul Simao)

________________

NAFTA

The Globe and Mail. May 17, 2017. Trump’s ‘massive’ NAFTA demands (and one fascinating statistic)

MICHAEL BABAD, Columnist

Briefing highlights

- Trump seeks 'massive' change to NAFTA

- Observers question why

- ‘Trump trauma’ weighs on stocks

- Canadian dollar at 73.5 cents

- Manufacturing sales climb 1 per cent

- Target posts better-than-expected results

- Trump's demands

Some observers wonder why President Donald Trump has drawn such a line in the sand over the North American free-trade agreement, now demanding “massive” change after calling for just a tweak to the U.S.-Canada relationship.

As some see it, there are far bigger targets for the president. As Mr. Trump sees it, “we’re not going to lose any more.”

His comments came in a wide-ranging interview with the Economist, which posted an edited transcript online.

And what you can read into it is that the Trump administration, even taking into account the expected pre-negotiation posturing, is indeed looking for far more than simple tweaks.

“I don’t know who the people are that would put us into a NAFTA, which was so one-sided,” Mr. Trump said.

“Both from the Canada standpoint and from the Mexico standpoint,” he added, citing the dispute settlement provisions and how Commerce Secretary Wilbur Ross feels about the trade pact.

“So one-sided. Wilbur will tell you that, you know, like, at the court in Canada, we always lose. Well, the judges are three Canadians and two Americans. We always lose. But we’re not going to lose any more. And so it’s very, very unfair.”

When asked if he was looking at a “pretty big” renegotiation of NAFTA, Mr. Trump replied: “Big isn’t a good enough word. Massive.”

The president added that, as reported, he was poised to kill the trade pact. But after word of that leaked, both Prime Minister Justin Trudeau and Mexican President Enrique Pena Nieto phoned separately, urging they renegotiate instead.

Warning America must “be able to make fair deals,” Mr. Trump cited a $70-billion trade deficit with Mexico and $15-billion gap with Canada.

“The timber coming in from Canada, they’ve been negotiating for 35 years,” he said.

“And it’s been ... it’s been terrible for the United States. You know, it’s just, it’s just been terrible. They’ve never been able to make it.”

Asked if the gap with Mexico has to narrow to nothing, Mr. Trump said not necessarily, that he’s “not looking to shock the system,” but it would be good to get there at some point, and that the balance can at times be up and at times down.

He wasn’t asked the same question about Canada, but presumably would have given a similar answer.

Of course, $15-billion is much smaller. And much of the trade represents oil. And Americans love oil. And when you add services to goods, the U.S. has run a surplus.

That $15-billion (U.S.) deficit has been more than offset by a $23-billion surplus in services for the Americans, noted National Bank of Canada chief economist Stéfane Marion.

“Two consecutive years of [a Canadian] deficit has not been observed in a very long time,” he added.

The trade tensions have led to extreme uncertainty that has rippled through markets. Observers warn investment among Canadian companies could suffer until there’s a clearer picture, and that it may be difficult to lure investment dollars here from overseas businesses seeking access to the U.S. through NAFTA.

“Why in the world would U.S. trade policy target its two neighbours and two best customers, when we are so tightly linked, and should be working in concert to compete globally?” said Bank of Montreal chief economist Douglas Porter.

“Until we are fully convinced that this stance is just bluster, we believe the Canadian dollar will remain on the defensive, and the Bank of Canada will remain extraordinarily cautious, given that the long-awaited recovery in export volumes looks to remain even longer-awaited.”

Mr. Porter listed some telling statistics: America’s combined deficit with its NAFTA partners accounts for just 0.4 per cent of its gross domestic product, up a smidgeon from 0.2 per cent in the last year before the agreement.

Canada and Mexico rank as America’s top two export markets, with each “larger than the entire euro area combined and more than double China, the next two largest markets for U.S. exports,” Mr. Porter said.

“Trade with its NAFTA partners is much closer to balance than with any other major trading partners,” he added.

And my favourite statistic where Canada’s concerned: “U.S. GDP is now running above $19-trillion, or $52-billion per day, or $2.2-billion per hour. The entire bilateral trade deficit with Canada accounts for about seven hours of the annual GDP of the United States, while Mexico’s is little more than one day’s worth, and this is the economic disaster the president chooses to hammer on first and foremost?”

The Globe and Mail. Reuters. May 17, 2017. U.S. considering currency clause for NAFTA, trade deals: Wyden

DAVID LAWDER

The Trump administration’s top trade officials are considering seeking a currency clause in the renegotiation of the North American Free Trade Agreement that could serve as a model for future trade deals, U.S. Senator Ron Wyden said on Wednesday.

Speaking to reporters after a meeting between senators and U.S. Trade Representative Robert Lighthizer and Commerce Secretary Wilbur Ross, Wyden said the officials made clear that addressing currency issues was an objective.

REUTERS. May 17, 2017. Changes to U.S.-Canada trade ties may go beyond 'tweaking': Reuters poll

By Anu Bararia

(Reuters) - Canada's trading arrangement with the United States may still be subject to more than minor tweaks, according to economists polled by Reuters who said the Bank of Canada will remain cautious and keep policy on hold well into next year.

After assuring Prime Minister Justin Trudeau in February the North American Free Trade Agreement (NAFTA) only needed "tweaking," President Donald Trump has since accused Canada's dairy industry of protectionism, and has proposed a border tax that has unnerved Canadian policymakers.

The United States has since also imposed duties on Canadian softwood lumber, reviving a trade dispute that first started more than 30 years ago.

When Reuters surveyed the same panel of economists shortly after the February meeting between Trump and Trudeau, they were not concerned there would be any major changes to NAFTA.

But in a new poll conducted May 12-16, they were, and said this could deal a material hit to Canada's economy, which sends over 75 percent of its exports south of the border.

"Concerns on the trade front, particularly after the lumber issue, will likely keep the Bank of Canada on hold at least through this year as it judges how the Canadian economy performs," said Nick Exarhos, economist at CIBC Capital Markets.

"If we were to lose free market access in large parts of the U.S., that would be pretty disastrous for our exports and also for business investment in the Canadian economy," he added.

Taken with uncertainty over what impact the latest government moves will have on a red-hot urban housing market, along with recent problems at mortgage lender Home Capital Group Inc, the central bank seems likely to hold rates where they are for about another year.

Although the Bank of Canada recently raised its economic growth outlook for 2017, the consensus view in the latest poll was for rates to remain at 0.50 percent until the second quarter of next year, versus the first quarter in a poll a month ago. Rates are then expected to rise by 25 basis points.

Forecasts in Reuters polls have vacillated between the first, second and third quarters for the past six months.

Analysts in the poll gave only a median 15 percent probability the next move would be a rate cut. The Bank reduced rates twice in 2015 but has held them steady since.

MORTGAGE MARKET IN FOCUS

Markets will also look to next week's policy statement for any comment on the mortgage market after Bank of Canada Governor Stephen Poloz told a newspaper over the weekend the problems at non-bank lender Home Capital are contained.

Depositors have withdrawn more than 90 percent of funds from Home Capital's high interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

Withdrawals accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business. The company has said the accusations are without merit.

Last year, the federal government tightened mortgage regulations to try and prevent Canadians from taking on too much debt, while the Ontario government last month unveiled a suite of measures, including a foreign buyers tax, aimed at cooling the market in Toronto, Canada's largest city.

A decline in Toronto home sales in April gave an early sign the market is cooling, but economists are uncertain how long and how deep a slowdown will be.

"The Bank will have to do something about the bubbly housing market if the new macro-prudential measures don't work as well in taking some steam out of it," said Krishen Rangasamy, senior economist at National Bank of Canada. "The Bank will eventually change its tone in the second half of the year. In other words - prepare markets for a rate hike."

Canada's household debt-to-income ratio stood at a record 167.3 percent in the fourth quarter, much of it made up of a mortgage debt chasing record high house prices.

(Polling by Kailash Bathija; Editing by Ross Finley and Andrea Ricci)

________________

ENERGY

REUTERS. May 17, 2017. Global oil rises ahead of U.S. inventory data

By Sabina Zawadzki

LONDON (Reuters) - Oil prices strengthened on Wednesday ahead of U.S. crude inventory data that could give investors a clue as to whether an OPEC-led output cut is making progress in reducing a persistent global supply overhang.

Brent crude was up 50 cents at $52.15 per barrel by 1330 GMT (9.30 a.m. ET). U.S. light crude rose 39 cents to $49.05.

Both benchmark prices started the day in negative territory after industry data from the American Petroleum Institute (API) estimated that U.S. crude stocks had risen by 882,000 barrels in the week ending May 12 to 523 million barrels.

That defied expectations of analysts who estimated a draw in the stockpiles of 2.4 million barrels, according to a Reuters survey. Data from the Energy Information Agency, seen as more complete, is due at 1430 GMT (10.30 a.m ET) on Wednesday.

Brent reached $52.63 a barrel and WTI rose as high as $49.66 on Monday after Saudi Arabia and Russia agreed on the need to extend output curbs by members of the Organization of the Petroleum Exporting Countries and other producers.

The supply cuts of 1.8 million barrels per day (bpd) were initially agreed to run during the first half of 2017. Riyadh and Moscow say they should be extended until March. An extension is due to be discussed at an OPEC meeting on May 25.

"The oil rally has paused and whether it can resume depends on today's EIA inventory report," said Ole Hansen, head of commodity strategy at Saxo Bank.

"Having seen an initial short-covering rally, we now need OPEC and non-OPEC producers agreeing on the nine-month extension for the market to begin build up new long positions," Saxo's Hansen said.

OPEC nations such as Kuwait, Iraq, Oman and Venezuela have said they supported an extension to the supply cuts, signaling that the meeting next week will go smoothly. Some analysts have said a deeper cut could even be on the table.

An extension would come as global stocks remain stubbornly high, in part because U.S. production has climbed 10 percent since mid-2016 to 9.3 million bpd, not far off that of top producers Russia and Saudi Arabia.

Jefferies bank said it was lowering its oil price forecasts due to the strong rise in U.S. production, cutting its Brent price estimate for the second half of 2017 to $59 per barrel from $61 previously.

North Sea oil output, generally seen in terminal decline, is expected to jump by a net 400,000 bpd in the next two years with new projects and greater efficiencies.

Trade sources and Reuters shipping data indicated a rising number of tankers storing oil offshore China because facilities on land are full.

(Additional reporting by Henning Gloystein in Singapore; Editing by Edmund Blair and Elaine Hardcastle)

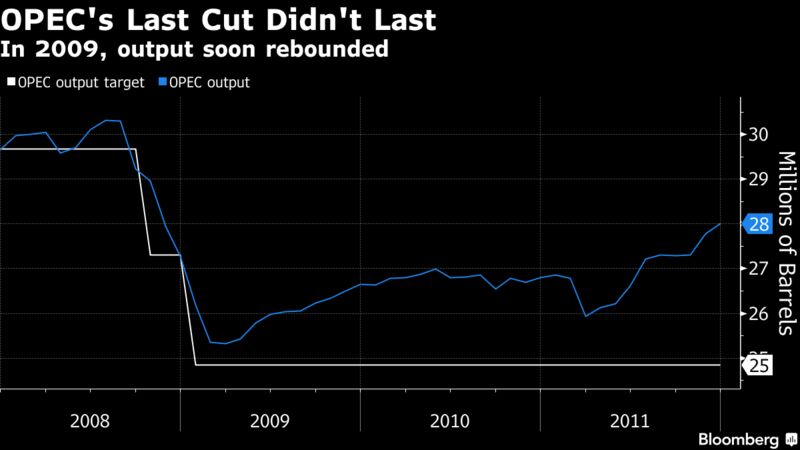

BLOOMBERG. 2017 M05 16. OPEC Risks Deal Fatigue as Maintaining Oil Curbs Get Tougher

by Grant Smith

- Saudi Arabia may need to make further sacrifices on production

- Iraqi compliance to test pact as Nigeria, Libya restore output

OPEC impressed oil traders this year by making almost all the supply cuts it promised. Keeping output down will only get harder.

The Organization of Petroleum Exporting Countries and its partners are expected to extend output curbs into early 2018 when they meet next week, in an ongoing bid to clear a global surplus. Yet the tailwinds that made cutting supply easier in the first half of the year -- from a seasonal lull in demand to temporary oil-field maintenance -- will be gone just as new obstacles are emerging.

To keep a lid on output this summer, Saudi Arabia will need to sacrifice an even bigger share of exports as consumption at home rises. Iraq yearns to expand capacity, and has already used the option of maintenance to keep oil fields idle. Meanwhile Nigeria and Libya, two OPEC nations exempt from the deal, are restoring lost output.

“They’re going to struggle,” said Michael Barry, director of research at consultants FGE in London. “This deal has been remarkable in its implementation. As time goes on, discipline is likely to erode. Almost every country wants their production to go up.”

Brent crude, the global benchmark, was trading 0.7 percent higher at $52.01 a barrel as of 12:46 p.m. in London.

As the world’s fuel-storage tanks remain brimming and prices languish, OPEC and its allies have conceded that the initial plan for six months of production cuts wasn’t long enough. Yet Saudi Arabia and Russia’s proposal that their 24-nation coalition, due to meet in Vienna on May 25, should extend the measures for another nine months may prove an unbearable strain.

“Production curbs for the first quarter of 2017 were comparatively easy to agree to,” said David Fyfe, chief economist at Geneva-based oil trader Gunvor Group. “They’ll likely agree to extend” but “the risk is higher they’ll leak extra barrels onto the market.”

OPEC showed an unprecedented level of commitment to this deal, implementing 96 percent of the cuts it promised during the first four months of the year, according to the International Energy Agency.

Holding Line

Some are optimistic that OPEC and its partners will maintain their resolve. The stakes are high enough that the organization will stick to its commitments, and as inventories decline producers will feel encouraged to stay the course, said Mike Wittner, head of oil market research at Societe Generale SA in New York.

“They’re going to hold the line,” said Wittner. “If we see stock draws happening soon, which we believe will be the case, those signs of success will bolster their determination. When you see light at the end of the tunnel, it’s easier to keep it together.”

Still, strong compliance was often attributable to Saudi Arabia cutting more than it was required, compensating for laggards like Iraq and the United Arab Emirates.

If the kingdom continues to restrain output, it needs to make another sacrifice. The Saudis typically boost production during the summer to maintain exports while meeting increased local demand from air conditioning. Keeping a cap on output would mean foregoing some exports and the revenues they bring.

Iraqi Question

Iraq, which still hasn’t made its full cut, plans to boost production capacity to 5 million barrels a day, an increase of about 6 percent, Oil Minister Jabbar al-Luaibi said on May 11. This won’t conflict with its commitment to freeze output, he said.

“We have question marks around Iraq,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London. “They have been reluctant since the very beginning, and were slow to implement their cuts. Most of the supply restraint in Iraq has come with the help of field maintenance.”

Maintenance in Iraq, Kuwait and the U.A.E. may have accounted for about 500,000 barrels a day of the output halted -- almost half the group’s total cut, according to FGE. For Iraq, this enabled them to avoid compensating foreign companies for unscheduled production shutdowns.

“Several countries basically used maintenance as a way of keeping production down but what they did was pull it forward from later in the year,” said FGE’s Barry. “Now maintenance is over the question is what do they do? More maintenance or cut at other fields? The pressure is on.”

OPEC also faces the challenge that the two members exempted from the deal because of production losses are recovering. Both Libya and Nigeria are showing progress in tackling the political crises that slashed their output.

Disciplinary Issues

Libya is producing at the highest level in more than two years after restarting its largest oil field, according to state-run National Oil Corp., while Nigeria has fixed a pipeline after a one-year halt that could boost its output by about 13 percent.

The 11 non-members joining OPEC’s effort have still only implemented about two-thirds of their promised reduction, according to the IEA, and also face problems in sustaining their curbs. Cutbacks in Russia came alongside the traditional seasonal stagnation in activity, and prolonging them would thwart plans by companies to expand output.

“It was easy to mask maintenance in the first half as voluntary cuts, but quite impossible to do it any further,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “There will be lower discipline within OPEC, and lower discipline from non-OPEC.”

________________

HOUSING BURBLE

BLOOMBERG. 2017 M05 17. Home Capital's Perilous Turnaround Will Only Get Harder

by Allison McNeely

- Company needs to find funding as depositors withdraw cash

- Then, lender has to find a way to finance new mortgages

Home Capital Group Inc. is fighting to find the funds it needs to survive as deposits rush out the door. Then comes the hard part.

The Toronto-based bank has lost more than C$3.5 billion ($2.6 billion) of deposits since the end of March, hurt by Ontario’s securities regulator saying last month that Home Capital had failed to promptly disclose possible fraud among some mortgage applications around two years ago. That blew a hole in the mortgage lender’s balance sheet that can be filled only with new funding. It has started the process with an expensive C$2 billion loan that it already wants to refinance, and a sale of up to C$1.5 billion of assets.

Once the bank has properly replaced the funding lost from fleeing depositors, it faces its next big hurdle: figuring out how to finance new loans so it can stay in business. Home Capital used to hold onto just about every mortgage it makes, but the bank will probably now have to sell them to investors at least for the near term, executives said on a conference call last week. The problem is, Canadian money managers don’t tend to buy the kind of mortgages that Home Capital offers, said Colin Kilgour, a partner at Toronto-based investment bank Kilgour Williams Capital.

Urgency, Weakness

Home Capital’s loans are usually made to borrowers that big banks shy away from, such as people who are self-employed and have irregular income. These loans tend not to be insured by the government, and there really isn’t a market for them in Canada now whether they are sold outright or packaged into bonds, said Kilgour, who focuses on advising companies and investors about securitization.

“They want to create a market for these mortgages, and they’re coming at it from a position of urgency and weakness,” Kilgour said. “It’s going to be tough.” The company does make mortgages that are securitized through government insurance programs but this a small portion of their business.

Home Capital’s funding and its long-term strategy are big enough obstacles that it isn’t clear if Home Capital can stay in business. It disclosed in its latest quarterly filing that there is enough uncertainty to cast significant doubt on its ability to continue as a going concern. Home Capital may have to offload assets en masse or sell itself outright, wrote Jaeme Gloyn, a financial stock analyst at National Bank of Canada, in a note.

A spokesman for Home Capital wasn’t immediately able to comment. In a statement last week, Bonita Then, Home Capital’s interim chief executive officer, said “we will continue to evaluate opportunities that could enable us to return to more normal levels of activity in our traditional on-balance sheet business.”

Home Capital’s shares dropped 6.2 percent to C$8.35 at 10:30 a.m. in Toronto. Shares in the company have fallen more than 60 percent since April 19, the day the regulator made its allegations public.

Private Equity?

Any buyer would likely want to purchase the company’s loans at a significant discount to their face value, given the risks they would be taking, Gloyn said. That includes private equity firms. Competitors are unlikely to absorb Home Capital’s uninsured mortgages because its book is much bigger than theirs, he said.

Director Alan Hibben said on last week’s call with analysts that asset sales wouldn’t be the first priority for the company and would be done only after all other options are ruled out.

“You don’t shrink your way to greatness,” he said. Home Capital has reached out to Canada’s big banks to refinance its costly C$2 billion loan from Healthcare of Ontario Pension Plan, he said in an interview Monday. A deal with private equity would be unlikely, Hibben said.

Lenders tried to kick-start a market for uninsured mortgage-backed securities earlier this year. Home Capital mortgages were said to be included in a prospective residential mortgage-backed securities deal being pitched to investors by Royal Bank of Canada. That deal is on hold amid uncertainty around Home Capital, according to people familiar with the matter.

Seeking Yield

Investors may be willing to buy at least some securities backed by non-prime mortgages at some point, James Price, director of capital markets products at Richardson GMP Ltd., said by phone from Toronto. His firm owns Home Capital bonds.

“There’s still investor demand for higher-yielding mortgage product out there,” he said. “That could be an interesting way for them to offload those assets rather than just a single big purchaser.”

But the market for uninsured mortgages is still relatively small, Dylan Steuart, an analyst at Industrial Alliance Securities Inc., wrote in a note Monday.

“Originating and selling uninsured mortgages to institutional investors has not been a large volume business in Canada, so the jury is still out on the potential success of this model,” Steuart wrote. The company has already done at least one deal, selling up to C$1.5 billion of mortgages to a syndicate of institutional buyers, in a deal facilitated by mortgage financing company MCAP Corp. MCAP has said it would be willing to do more such deals.

Home Capital’s deposit exodus accelerated last month, after the Ontario Securities Commission accused the company of failing to tell its investors in a timely fashion why it was no longer doing business with some mortgage brokers. It had found that those brokers had given fraudulent documentation for loans. Ending those relationships caused its new mortgage lending to drop.

________________

LGCJ.: