CANADA ECONOMICS

BRAZIL

BLOOMBERG. 2017 M05 24. Brazil’s Temer Faces Brewing Mutiny by Allies Amid Corruption Scandal

by Samy Adghirni , Mario Sergio Lima , and Simone Preissler Iglesias

- Ministry set on fire by demonstrators outside Congress

- No consensus on replacement for president in indirect vote

- Violent Protests Against Temer Rock Brazil Markets

- How Temer Scandal Is Impacting Brazil's Markets

Demonstrations against embattled Brazilian President Michel Temer exploded into scenes of violence across the capital city of Brasilia Wednesday. Protesters set fire to the Agriculture Ministry, trashed several government buildings and clashed repeatedly with police, prompting the government to deploy the armed forces.

The outpouring of violence -- the worst to hit Brasilia in years -- ratcheted up the pressure on Temer just as he sought to suppress a revolt in his own party by lawmakers who want to oust him after last week’s damaging graft allegations.

As protests raged, government allies inside the presidential palace debated whether to stick with the embattled president. The best solution to remove Temer, who is being investigated by the prosecutor-general on corruption and cover-up charges, is for the top electoral court to annul the 2014 election result in which he shared a ticket with ousted President Dilma Rousseff, according to half a dozen legislators from his ruling PMDB party who spoke to Bloomberg News. The court will retake the case on alleged illegal campaign financing on June 6.

Wednesday’s violent scenes weighed on financial markets and challenged the optimistic government view that it would be possible for Temer to rebuild his coalition and advance an economic reform agenda investors consider crucial to fix the country’s public finances and help pull Latin America’s largest economy out of recession.

The decision to deploy the armed forces also provoked an outcry from lawmakers, as well as a Supreme Court judge, who questioned the move given Brazil’s history with the military. The decree prompted legislators to come to blows, with the scuffles resulting in the suspension of a congressional session for the second time in two days.

Mutiny

Temer met with PMDB Senators on Wednesday morning in an effort to tackle the dissidents. After the meeting, one Temer aide said the rebels account for no more than a handful of the party’s Senators.

But some legislators from other allied parties share concerns. The largest member in the government’s allied base, the PSDB, held its own meeting to discuss its future in the coalition. Afterwards Senator Tasso Jereissati told reporters that his party’s main concern was the country’s stability.

The nation was rocked last week by news of a Supreme Court-authorized probe into Temer on allegations of passive corruption and obstruction of justice, only days before Congress had planned to vote on a pension bill considered central to the administration’s efforts to fix the country’s depleted public coffers and pull its economy out of recession.

Some of the dissident lawmakers told Bloomberg News that they favor a negotiated resignation in which Temer agrees to not stall possible court decisions against him with appeals. Senator Renan Calheiros, the current leader of Temer’s PMDB party in the upper house, has become the most outspoken advocate of a "negotiated exit" for Temer.

Yet Temer, a 76 year-old career politician, refuses to budge, saying charges against him were trumped up and the evidence doctored.

Opposition legislators have filed numerous impeachment requests against the president. The OAB, Brazil’s influential bar association, intends to file its own petition on Thursday. For any of the requests to proceed, they would to be accepted by house speaker Rodrigo Maia. In comments to reporters on Wednesday, he urged patience. "I cannot evaluate such a serious matter in a ’drive-thru’," he said. "It’s not a decision that you make overnight.

Possible Substitutes?

Another factor that buys Temer time is the lack of consensus on a possible substitute. Under the current law, Congress would elect an interim leader until the October 2018 general elections, should Temer leave office.

Some of the names discussed in the halls and elevators of Congress’s modernist building in Brasilia include the PSDB’s Jereissati, former Supreme Court Chief Justice Nelson Jobim, ex-President Fernando Henrique Cardoso, and current Supreme Court Chief Justice Carmen Lucia Rocha. Also the current head of the lower house, Rodrigo Maia, was suggested by senior legislators as an alternative.

In order to help rebuild support among legislators and their constituents, Temer is pushing a series of pork barrel projects, such as wage increases for public tax collectors, debt refinancing for small and mid-size companies, as well as land ordinance regulations sought by farmers, according to a person with direct access to the president who asked not to be named.

________________

HOUSING BUBBLE

The Globe and Mail. May 25, 2017. Citi on Canada: A solid outlook, a housing correction, a loonie that won't hit par

MICHAEL BABAD, Columnist

Briefing highlights

- A look at Citi's Canadian outlook

- Bank sees Toronto housing correction

- Loonie to rise, but won't reach parity

- Markets at a glance

- OPEC extends production cap

- Guloien to retire as Manulife chief

- Profits up at RBC, CIBC, TD

- TD sees no widespread sales practice problems

- Rayonier to acquire Tembec

It always helps to know what your neighbour is saying about you, particularly if that neighbour happens to be a big U.S. bank.

So here’s how Citigroup sees Canada at this point: The economy is on a “solid” track, unemployment is declining, the loonie is weak though will perk up, and both monetary and fiscal policies are easy.

And built into the economic forecast is a Toronto housing market correction.

“Real GDP is on track to expand at a 4-per-cent pace in 1Q 2017, led by stronger consumer demand for goods, services, and homes, as well as a modest rebound in business investment,” said economist Dana M. Peterson at Citi Research.

“The rise in inventories should offset the sizeable net exports drag anticipated,” she added as part of a new global outlook.

“Job gains and hours worked continue to expand and the unemployment rate is falling. However, [core consumer price index] and wage inflation continue to slow, signalling some remaining slack in the Canadian economy.”

The Bank of Canada, too, noted the strength of the first quarter in its rate statement Wednesday, and a weaker showing after that.

Citi projects economic growth in Canada at 2.6 per cent this year, 2 per cent in each of the following three years, and 1.9 per cent in 2021.

It also sees the loonie eventually rising, though never reaching parity with the U.S. dollar over that time-frame: Just over 74 cents (U.S.) this year, just below 73 cents in 2018, and then 75.2 cents, 78.7 cents and 83.3 cents.

Unemployment is forecast to ease, to 6.5 per cent next year.

“Several factors should contribute to Canada’s ongoing recovery, including completion of the internal structural adjustment away from commodities; a moderate U.S. expansion; slightly higher oil prices; easy domestic monetary and fiscal policies; and a weak Canadian dollar,” Ms. Peterson said in the report.

Citi first trimmed its 2018 economic growth forecast earlier, as the Ontario government unveiled several measures to deflate the housing bubble in and around Toronto, cutting its projection to 2 per cent from an earlier 2.2 per cent.

Ms. Peterson added in an interview that a housing correction takes about a year to play out. And it’s already under way in Toronto, having started in the second quarter, she said.

So looked at another way, that would shave growth in gross domestic product by 1 per cent over the course of four quarters.

That correction, by the way, would see home-price growth in Toronto slowing, not contracting outright.

And here’s something worth closing with: Just as activity moved east to Toronto after B.C.’s tax on foreign buyers of Vancouver-area properties, Ms. Peterson is now watching to see what happens in Montreal.

The Globe and Mail. May 25, 2017. TD, RBC and CIBC post profit gains despite mortgage, U.S. concerns

CHRISTINA PELLEGRINI - CAPITAL MARKETS REPORTER

Three major Canadian banks reported higher second-quarter profits on Thursday, shrugging off concerns about the health of the domestic mortgage market as well as slower business activity in the U.S.

During the three months ended April 30, profit at Toronto-Dominion Bank increased by 22 per cent to $2.5-billion, rising from $2.05-billion a year ago. It benefited from a low effective tax rate and from the fact that it set aside less money to cover bad loans. It generated $8.5-billion in revenue, from $8.3-billion last year.

Royal Bank of Canada saw its net income increase 9 per cent in the second quarter to $2.8-billion, buoyed by robust results in capital markets, wealth management and investor and treasury services. Its revenue in the period climbed to $10.3-billion, up from $9.53-billion a year ago.

Lastly, Canadian Imperial Bank of Commerce reported net income of $1.05-billion during the second quarter, rising from $941-million during the same three-month period last year. Its results were fuelled by lower provisions and expenses and a reduced tax rate. It also said revenue across the bank jumped to $3.7-billion, from $3.6-billion.

These results follow in the steps of Bank of Montreal, which said on Wednesday that its second-quarter profit jumped 28 per cent. It earned $1.25-billion, up from $973-million a year ago when results were hampered by a restructuring charge.

REUTERS. May 25, 2017. Canada home prices not coming down yet thanks to low rates: Reuters poll

By Anu Bararia

(Reuters) - Efforts to rein in Toronto's hot housing market and recent problems at mortgage lender Home Capital are unlikely to hurt Canada's national real estate market as low borrowing costs continue to stoke demand, according to a Reuters poll of analysts.

Matching British Columbia's move last year for Vancouver, Ontario's provincial government introduced a 15 percent tax on property purchases by foreign buyers in Toronto in April as part of 16 measures to cool the property market.

Prices in the two markets have increased at double-digit rates, driven by cheap credit and speculation, and sparking concerns of a housing bubble.

Analysts polled said that although Ontario's measures will cool activity in Toronto and its surrounding areas, the effect will be modest and temporary.

"Low interest rates are going to be oxygen ... that keeps the fire going in the Toronto and BC housing markets - and that fire has spread to southern Ontario as well," said Sal Guatieri, senior economist at BMO Capital Markets.

"Clearly, without such low interest rates, we probably would not be seeing house prices rising as dramatically as they are."

A weaker Canadian dollar, which has dropped 24 percent since the 2014 drop in oil prices, is also offsetting policy changes both in Vancouver and Toronto by making prices look relatively cheap to some foreign investors, Guatieri said.

PRICES JUMP

The Bank of Canada has kept interest rates at 0.50 percent since 2015, when it lowered them to offset tumbling oil prices. Earlier this week, the central bank said government measures to rein in the housing market have not yet had a substantial cooling effect.

Despite multiple steps taken by the federal and provincial governments, prices in Canada have nearly doubled over the past decade and are expected to climb 9 percent this year. That's the biggest expected jump since polling for 2017 began two years ago and stronger than the 4.7 percent forecast in February's poll.

House price inflation is estimated to cool to 3.0 percent in 2018, against 3.5 percent expected earlier.

Prices in Toronto and Vancouver are likely to climb 13 and 5 percent respectively this year, versus 9.5 and 2 percent forecast three months ago.

Asked about the risk of a sharp correction, more than half of the analysts said it was somewhat or very likely in Toronto and Vancouver but unlikely nationally.

"The Vancouver and Toronto markets are particularly vulnerable to an economic shock, given their high prices and household debt levels relative to household income," said Robert Hogue, senior economist at Royal Bank of Canada.

However, the pace of homebuilding nationally could bring some respite. Housing starts are predicted to average 204,300 per quarter this year, up from 185,300 expected in February.

HOME CAPITAL

Recent problems at mortgage lender Home Capital, Canada's biggest non-bank lender, are unlikely to affect investors' confidence in the Canadian mortgage market, analysts surveyed said.

Depositors have withdrawn more than 90 percent of funds from Home Capital's high interest savings accounts since March 27, when the company terminated the employment of former Chief Executive Martin Reid.

Withdrawals accelerated after April 19, when Canada's biggest securities regulator, the Ontario Securities Commission, accused Home Capital of making misleading statements to investors about its mortgage underwriting business. The company has said the accusations are without merit.

The average Canadian household owed C$1.67 ($1.24) for every dollar of disposable income in the fourth quarter, mainly in the mortgage market. With rates unlikely to rise for another year, borrowings could spike further.

Respondents also said that if U.S. President Donald Trump acts on protectionist threats and makes substantial changes to the North American Free Trade Agreement, that could hurt the Canadian property market through broader damage to the economy. [CA/POLL]

Canada sends about three-quarters of its exports south of the border.

"If we do see heavy-handed protectionist measures from the U.S., that could curb Canadian exports and tip the economy into a recession. It will clearly pose a significant risk to the Toronto and Vancouver housing markets," Guatieri said.

($1 = 1.3429 Canadian dollars)

(Polling by Kailash Bathija; Editing by Bernadette Baum)

BLOOMBERG. 2017 M05 25. Canadian Mortgage Growth Slows Amid Government Housing Moves

by Doug Alexander

- TD, BMO report home loan balances shrink from first quarter

- RBC annual mortgage growth was weakest since start of 2015

With four of Canada’s biggest banks reporting second-quarter results, the trend shows that growth in home loan portfolios is easing and in some cases shrinking. It’s a welcome sign for Canadian officials struggling to curb residential prices in two of the nation’s largest cities. The federal government tightened mortgage rules and added other measures in October while opening the door to shifting risks of defaulting home loans to lenders.

Toronto-Dominion Bank, Canada’s largest lender by assets, reported Thursday that domestic residential mortgage balances slipped 0.4 percent to C$187.5 billion ($140 billion) compared with the prior three-month period, the first contraction in two years. Home loan balances were up 1.2 percent from the same period last year -- the slowest annual growth rate in at least four years.

Toronto-Dominion is seeing the effects of “de-emphasizing" some parts of its mortgage business, including reducing purchases of private-label originations, Chief Financial Officer Riaz Ahmed said in an interview. He also said the country’s residential property market appears to be moderating.

“In the last two weeks of April or so, we did begin to see some cooling in the housing market as sales activity slowed and more supply came to the market,” Ahmed said. “We are happy with that because that’s generally good for Canada and our customers."

Royal Bank of Canada, which has the biggest share of domestic mortgages, said average home loan balances rose 5.5 percent to C$224.1 billion from a year earlier, its slowest annual growth since the first quarter of 2015. Chief Executive Officer David McKay said he was “encouraged” by April data regarding the Toronto market.

“New listings were up 34 percent from the prior year, which suggests some potential easing of the supply-demand constraints that contributed to rising home prices," McKay said Thursday on a call with analysts after posting quarterly results. “We believe the housing market will continue to be supported by steady population growth, which is partially driven by immigration, household income gains and low interest rates."

The country’s financial industry has been focused recently on the woes of Home Capital, the Toronto-based alternative-mortgage lender whose share price plummeted after it was accused by regulators of misleading investors on an internal probe into falsified mortgage applications. McKay told analysts Thursday that he didn’t see Home Capital as posing a broader risk to the country’s mortgage market.

“I don’t view it as a positive development nor do I view it as systemic,” McKay said.

Bank of Montreal’s domestic mortgage book shrunk for the first time in two years, with average balances in the quarter slipping about 0.1 percent to C$98.3 billion from three months earlier, the Toronto-based firm said Wednesday. Bank of Montreal, which has the smallest share of the domestic market among Canada’s five largest lenders, said home loan balances rose 5.2 percent from a year earlier, the slowest annual growth in three quarters.

“There is a little bit of seasonality in the second quarter," CFO Thomas Flynn said in a phone interview. “It’s not as active of a mortgage season for us, and it’s also a slightly shorter quarter."

Canadian Imperial Bank of Commerce appeared to be an outlier among Canadian lenders, with mortgage balances jumping 12 percent from a year earlier. Still, growth from the prior quarter eased to 2.3 percent -- the slowest sequential gain in a year.

Regional Differences

Increases in Toronto home prices slowed in the first two weeks of May, according to the city’s real estate board, after climbing 25 percent in April from a year earlier and 33 percent in March. Last month, Ontario’s government announced plans for a 15 percent tax on foreign buyers, following similar measures enacted in British Columbia in August.

“We are seeing some regional differences -- the Vancouver market cooling, the Toronto market heating -- but that was prior to the recent changes," said David Williams, CIBC’s head of retail and business banking, adding that it’s probably too early to see the effect of government measures.

Bank of Montreal expects slower growth in Canadian mortgages, which will happen “gradually,” Flynn said.

“We do expect growth in mortgages over the next few years to be somewhat lower than it has been over the last five years," Flynn said. “That’s just reflecting the expectation that the market will continue to be stable but will cool somewhat.”

Toronto-Dominion, Royal Bank and CIBC all reported second-quarter profit that beat analysts’ estimates, with lower loan-loss provisions helping boost results at all three lenders.

BLOOMBERG. 2017 M05 24. Toronto Homeowners Are Suddenly in a Rush to Sell

by Kim Chipman

- Home Capital woes combined with new tax measures cool market

- Listings soar in first half of May as sellers rush in

After a double whammy of government intervention and the near-collapse of Home Capital Group Inc., sellers are rushing to list their homes to avoid missing out on the recent price gains. The new dynamic has buyers rethinking purchases and sellers asking why they aren’t attracting the bidding wars their neighbors saw just a few weeks ago in Canada’s largest city.

“We are seeing people who paid those crazy prices over the last few months walking away from their deposits,” said Carissa Turnbull, a Royal LePage broker in the Toronto suburb of Oakville, who didn’t get a single visitor to an open house on the weekend. “They don’t want to close anymore.”

Home Capital may be achieving what so many policy measures failed to do: cool down a housing market that soared as much as 33 percent in March from a year earlier. The run on deposits at the Toronto-based mortgage lender has sparked concerns about contagion, and comes on top of a new Ontario tax on foreign buyers and federal government moves last year that make it harder to get a mortgage.

“Definitely a perception change occurred from Home Capital,” said Shubha Dasgupta, owner of Toronto-based mortgage brokerage Capital Lending Centre. “It’s had a certain impact, but how to quantify that impact is yet to be determined.”

Read more: Canadian Real Estate Sentiment Slips

Early data from the Toronto Real Estate Board confirms the shift in sentiment. Listings soared 47 percent in the first two weeks of the month from the same period a year earlier, while unit sales dropped 16 percent. Full-month data will be released in early June.

A couple months ago amid robust demand, it was common for sellers to price their homes on the low side to spur bidding wars. Such tactics won’t work now, according to Century 21 Millennium Inc. brokerage owner Joanne Evans.

“The frenzy is over -- it’s over,” said Evans, who focuses on Toronto suburbs such as Brampton. “Sanity is returning to the marketplace.”

Recent competition for homes had some prospective buyers so desperate they were buying properties “sight unseen,” said Shawn Zigelstein, a Toronto-area agent with Royal LePage Your Community Realty. Others made offers without an inspection.

Realtor signs in Brampton.Photographer: Mark Sommerfeld/Bloomberg

In February, home-inspection firm Carson Dunlop saw a 34 percent drop in volume. Business has improved since then, with the first two weeks of this month putting the Toronto-based company on track to be unchanged from May 2016, according to founder Alan Carson.

“The market does seem to be shifting,” he said.

Prices Moderate

The average selling price in the Toronto area was C$890,284 ($658,000) through May 14, up 17 percent from a year earlier, yet down 3.3 percent from the full month of April. The annual price gain is down from 25 percent in April and 33 percent in March. Toronto has seen yearly price growth every month since May 2009. The last time the city saw gains of less than 10 percent was in December 2015.

Brokers say some owners are taking their homes off the market because they were seeking the same high offers that were spreading across the region as recently as six weeks ago.

“In less than one week we went from having 40 or 50 people coming to an open house to now, when you are lucky to get five people,” said Case Feenstra, an agent at Royal LePage Real Estate Services Loretta Phinney in Mississauga, Ontario. “Everyone went into hibernation.”

Toronto real estate lawyer Mark Weisleder said some clients want out of transactions.

“I’ve had situations where buyers are trying to try to find another buyer to take over their deal,” he said. “They are nervous whether they bought right at the top and prices may come down.”

Confidence Wanes

Brokers say the 15 percent foreign buyers’ tax announced by Ontario on April 20 and the ongoing struggles at Home Capital are sapping confidence. That’s more than offset concerns about tighter rent controls that developers have said will limit housing supply and keep prices high.

Weekly polling data show real estate price expectations have come down, in a sign that Canadians are anticipating housing markets in Toronto and Vancouver will finally cool. The share of people saying home prices will rise in the next six months fell for a second week to 46 percent, according to data compiled by Nanos Research Group for Bloomberg News. That’s down from a record 50.1 percent two weeks ago.

The fate of Home Capital, known as a “b-lender” because it caters to new immigrants and other homebuyers who can’t get a traditional bank loan, remains in question. A run on deposits and stock plunge began late last month after regulators accused the company of misleading investors about potentially fraudulent mortgage applications.

“Home Capital is affecting things because people who can’t get mortgages from the banks rely on them and other b-lenders,” said Lorand Sebestyen, an agent with iPro Realty Ltd. in Toronto. “If you can’t get the mortgage then you obviously can’t buy anything and it’s going to affect the market, especially for the higher-priced properties.”

Market Fear

The firm went into survival mode as concern about Toronto’s housing market was escalating, with Bank of Canada Governor Stephen Poloz warning the gains were unsustainable. Worries about a market bubble morphed into nervousness about whether Canada might be on the brink of a financial meltdown. Rising household debt and runaway housing prices led to credit rating downgrades for the country’s six biggest banks this month by Moody’s Investors Service.

“It’s fear,” Century 21’s Evans said. “It’s another contributing factor to the fear of ‘what’s going to happen?”’

Home Capital’s competitors have seen a surge in demand as more brokers steer clients away from the struggling lender, Dasgupta said. Those lenders in turn are experiencing slower response times due to a backlog of borrowers.

“Home Capital is a bigger deal than the government announcement,” Weisleder said. “It’s had a bigger impact on the market.”

Rental Time

Still, not all sellers are feeling pinched.

Michael Hartmann put his north Toronto home up for sale on May 17, and it sold on May 22, the first day he began taking offers. The 53-year-old professor at McMaster University’s DeGroote School of Business in Hamilton, Ontario, decided not to take his agent’s advice to price the house on the low side in an attempt to stir up a bidding war.

He nudged the price up to be more in line with other homes in the neighborhood and sold it for C$1.65 million, C$10,000 above asking price. Hartmann said he and his wife will take their time before choosing their next move.

“We are in the fortunate position as empty-nesters that we don’t have to rush back into the market,” he said. “We have the advantage of seeing whether we go back in and buy in Toronto or somewhere else in Canada or go abroad.”

In the meantime, they plan to rent.

BLOOMBERG. 2017 M05 24. San Francisco Goes From First to Worst in U.S. Home-Price Gauge

by Prashant Gopal

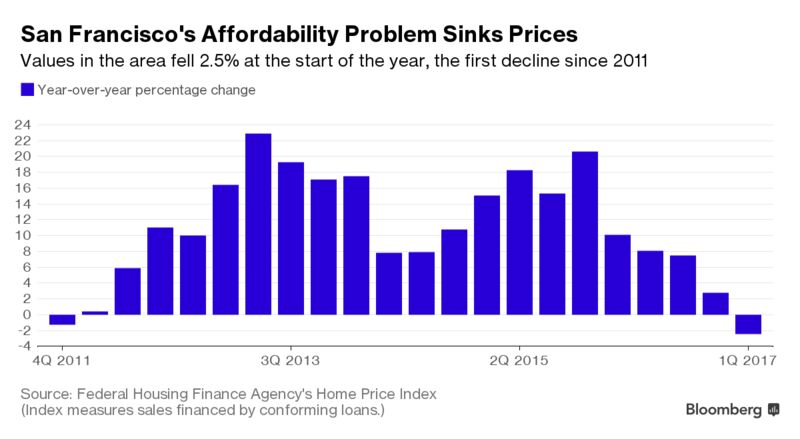

- Prices drop 2.5 percent in first decline since 2011, FHFA says

- Buyers may be held back by affordability constraints

- QuickTake: The American Dream of Home Ownership

Single-family home prices in the region that includes San Francisco and San Mateo counties dropped 2.5 percent from a year earlier, the worst performance among the 100 largest U.S. metropolitan areas, according to an index released Wednesday by the Federal Housing Finance Agency. Grand Rapids, Michigan, a relatively affordable area where prices jumped 13.7 percent, had the biggest gain.

San Francisco is cooling after a booming technology industry, with its big salaries, fueled soaring values in recent years and made real estate unaffordable for most buyers in the market. Home prices rose 10 percent in last year’s first quarter and 15 percent in the first part of 2015, when its gains led the nation, FHFA data show. The area’s median home price in the first quarter was $1.1 million, making it the most expensive of the 100 largest metros, according to real estate website Trulia.

“We’re seeing signs that the housing market is slowing down,” Ralph McLaughlin, chief economist for Trulia, a unit of Zillow Group Inc., said in a telephone interview. “Homebuyers in the Bay Area have just been stymied by affordability fatigue.”

The FHFA index may leave out a large portion of buyers in the region. It only measures purchases financed with conforming loans, which in the San Francisco Bay area are capped at $636,150, well below the median price of more than $1 million.

“Those homeowners who would qualify for conforming loans are the ones that have seen the biggest drops in inventory and the biggest increases in prices over the past five or six years,” McLaughlin said. “It’s no surprise that if there is any cohort impacted by a very frustrating home market, it’s going to be those buyers.”

CoreLogic Data

CoreLogic Inc. also released data Wednesday showing a decline in values. In April, the median price for all home sales in San Francisco County was $1.3 million, down 4 percent from a year earlier. The number of transactions fell 12 percent, according to the data provider, which doesn’t limit its research to homes bought with conforming loans.

Patrick Carlisle, an analyst at San Francisco market tracker Paragon Real Estate Group, said the first quarter isn’t a good gauge because relatively few homes are sold during the early part of the year. Carlisle said he sees a flattening on the higher end of the market, not on the lower end where inventory remains tight.

“San Francisco led the whole country in its recovery,” Carlisle said. “It’s not surprising that the market that blasted off first and rose the most is now the one that is cooling first.”

________________

SOFTWOOD LUMBER

REUTERS. May 25, 2017. Rayonier Advanced Materials to buy Tembec in forest products push

(Reuters) - Rayonier Advanced Materials (RYAM.N: Quote) said it would buy Canada's Tembec Inc (TMB.TO: Quote) for $807 million including debt to expand its business into packaging and forest products, sending Tembec's shares to a five-year high on Thursday.

Tembec shareholders will get C$4.05 ($3.02) in cash, or 0.2302 of a Rayonier share, for every Tembec share they own, the companies said.

The offer price is at a premium of 37.3 percent to Tembec's Wednesday close. The deal includes $487 million in debt.

The deal comes at a time when Canada is resisting a move by the United States to impose tariffs on Canadian lumber imports.

Rayonier, which supplies cellulose commonly found in cellphones, computer screens, filters and pharmaceuticals, said it would finance the cash portion of the deal with cash in hand and debt.

Tembec's shares surged nearly 36 percent to $4.02, while Rayonier's were up 2.8 percent.

BofA Merrill Lynch is Rayonier's financial adviser and Wachtell, Lipton, Rosen & Katz, McCarthy Tétrault LLP and Hogan Lovells is its legal adviser.

Scotia Capital and National Bank Financial is Tembec's financial adviser and Stikeman Elliott LLP, Cahill Gordon & Reindel LLP, Dechert LLP and Slaughter and May is its legal adviser.

(Reporting by Yashaswini Swamynathan and Ahmed Farhatha in Bengaluru; Editing by Martina D'Couto)

________________

ENERGY

REUTERS. May 25, 2017. OPEC extends oil output cut by nine months to fight glut

By Alex Lawler, Rania El Gamal and Ernest Scheyder

VIENNA (Reuters) - OPEC decided on Thursday to extend cuts in oil output by nine months to March 2018, OPEC delegates said, as the producer group battles a global glut of crude after seeing prices halve and revenues drop sharply in the past three years.

The cuts are likely to be shared again by a dozen non-members led by top oil producer Russia, which reduced output in tandem with the Organization of the Petroleum Exporting Countries from January.

OPEC's cuts have helped to push oil back above $50 a barrel this year, giving a fiscal boost to producers, many of which rely heavily on energy revenues and have had to burn through foreign-currency reserves to plug holes in their budgets.

Oil's earlier price decline, which started in 2014, forced Russia and Saudi Arabia to tighten their belts and led to unrest in some producing countries including Venezuela and Nigeria.

The price rise this year has spurred growth in the U.S. shale industry, which is not participating in the output deal, thus slowing the market's rebalancing with global crude stocks still near record highs.

By 1150 GMT (7:50 a.m. ET), Brent crude had fallen 1.3 percent to around $53 per barrel as market bulls were disappointed OPEC would not deepen the cuts or extend them by as long as 12 months. [O/R]

OPEC oil ministers were continuing their discussions in Vienna after three hours of talks. Non-OPEC producers were scheduled to meet OPEC later in the day.

In December, OPEC agreed its first production cuts in a decade and the first joint cuts with non-OPEC, led by Russia, in 15 years. The two sides decided to remove about 1.8 million barrels per day from the market in the first half of 2017, equal to 2 percent of global production.

Despite the output cut, OPEC kept exports fairly stable in the first half of 2017 as its members sold oil from stocks.

The move kept global oil stockpiles near record highs, forcing OPEC first to suggest extending cuts by six months, but later proposing to prolong them by nine months and Russia offering an unusually long duration of 12 months.

"There have been suggestions (of deeper cuts), many member countries have indicated flexibility but ... that won't be necessary," Saudi Energy Minister Khalid al-Falih said before the meeting.

CUTS EXCLUDE NIGERIA AND LIBYA

He added that OPEC members Nigeria and Libya would still be excluded from cuts as their output remained curbed by unrest.

Falih also said Saudi oil exports were set to decline steeply from June, thus helping to speed up market rebalancing.

OPEC sources have said the Thursday meeting will highlight a need for long-term cooperation with non-OPEC producers.

The group could also send a message to the market that it will seek to curtail its oil exports.

"Russia has an upcoming election and Saudis have the Aramco share listing next year so they will indeed do whatever it takes to support oil prices," said Gary Ross, head of global oil at PIRA Energy, a unit of S&P Global Platts.

OPEC has a self-imposed goal of bringing stocks down from a record high of 3 billion barrels to their five-year average of 2.7 billion.

"We have seen a substantial drawdown in inventories that will be accelerated," Falih said. "Then, the fourth quarter will get us to where we want."

OPEC also faces the dilemma of not pushing oil prices too high because doing so would further spur shale production in the United States, the world's top oil consumer, which now rivals Saudi Arabia and Russia as the world's biggest producer.

"A nine-month extension is insufficient at shale's current trajectory. The strategic challenge of shale is still to be addressed," said Jamie Webster, director for oil at Boston Consulting Group.

(Additional reporting by Ahmad Ghaddar, Vladimir Soldatkin and Shadia Nasralla; Writing by Dmitry Zhdannikov; Editing by Dale Hudson)

REUTERS. May 25, 2017. Oil slips as OPEC prepares to extend output cuts

By Christopher Johnson

LONDON (Reuters) - Oil prices fell on Thursday as OPEC prepared to extend limits to production by nine months to March 2018 in an attempt to drain a glut that has depressed markets for almost three years.

The cuts are likely to be shared again by a dozen oil exporters outside OPEC led by top producer Russia, which reduced output in tandem with the Organization of the Petroleum Exporting Countries from January.

OPEC's cuts have helped to push oil back above $50 a barrel this year, giving a fiscal boost to producers, many of which rely heavily on energy revenues and have had to burn through foreign-currency reserves to plug holes in their budgets.

Brent crude oil LCOc1 dropped as much as $1.24 a barrel to a low of $52.72 on Thursday before regaining ground to trade 20 cents lower at $53.76 by 1350 GMT (9:50 a.m. ET). U.S. light crude CLc1 was 20 cents lower at $51.16.

Both benchmarks were still up over 15 percent from May lows.

OPEC and other producers had been widely expected to agree to extend a cut in oil supplies of 1.8 million barrels per day (bpd) until the end of the first quarter of 2018.

OPEC's current deal, agreed at the end of last year, only covers the first half of 2017.

Saudi Arabia's energy minister, Khalid al-Falih, said ministers did not see a need to reduce oil output further:

"There have been suggestions (of deeper cuts), many member countries have indicated flexibility but ... that won't be necessary," Falih said.

That disappointed some investors.

"A nine-month extension of the output cuts is already baked into prices," said Olivier Jakob, energy markets analyst at Swiss consultancy Petromatrix. "This shows there's not much more OPEC can do."

"It is a disappointment that OPEC hasn't done more to balance the markets," he added.

Amrita Sen, analyst at consultancy Energy Aspects agreed.

"Nine months was priced in," Sen said.

Energy consultancy Wood Mackenzie said keeping existing oil output at current levels for another nine months would result in a 950,000 bpd production increase in the United States, thus undermining OPEC's efforts to balance supply and demand.

U.S. oil production C-OUT-T-EIA has already risen by more than 10 percent since mid-2016 to more than 9.3 million bpd as drillers take advantage of higher prices and the supply gap left by OPEC and its allies.

(Additional reporting by Henning Gloystein in Singapore; editing by Jason Neely, Edmund Blair and Pritha Sarkar)

BLOOMBERG. OPEC, Allies Said to Extend Oil Cuts for Nine Months to End Glut

by Wael Mahdi and Grant Smith

- OPEC Said to Extend Oil Production Cuts for Nine Months

The producer group together with Russia and other non-members agreed to prolong their accord through March, two delegates familiar with the decision said after a meeting in Vienna, asking not to be identified before an official announcement is made.

Six months after forming an unprecedented coalition of 24 nations and delivering output reductions that exceeded expectations, some of the world’s largest oil producers have faced the fact that they’ve fallen short of their goal. While stockpiles are shrinking, ministers acknowledged that the surplus built up during three years of overproduction won’t clear until at least the end of 2017.

Saudi Oil Minister Khalid Al-Falih said Thursday that the cuts are working, saying stockpile reductions will accelerate in the third quarter and inventory levels will come down to the five-year average in the first quarter of next year. While he expects a “healthy return” for U.S. shale, that won’t derail OPEC’s goals and a nine-month extension will “do the trick,” he said.

The Organization of Petroleum Exporting Countries agreed in November to cut output by about 1.2 million barrels a day. Eleven non-members joined the deal in December, bringing the total supply reduction to about 1.8 million. The curbs were intended to last six months from January, but confidence in the deal, which boosted prices as much as 20 percent, waned as inventories remained stubbornly high and U.S. output surged.

OPEC agreed earlier Thursday to prolong their own output cuts by nine months. Nigeria and Libya will remain exempt from making cuts and Iran, which was allowed to increase production under the original accord, retains the same output target, Kuwait’s Oil Minister Issam Almarzooq said after the meeting.

________________

LGCJ.: