CANADA ECONOMICS

BRAZIL

The Globe and Mail. May 17, 2017. Brazil roiled as President Temer reportedly taped arranging bribe

STEPHANIE NOLEN

RIO DE JANEIRO — Brazilians awoke to fresh political turmoil Thursday morning as federal police moved against key allies of the president and arrested a prosecutor in response to secret tapes about bribery, allegedly made by a meat baron as part of a plea bargain.

Late on Wednesday, the newspaper O Globo reported that President Michel Temer was caught in a secret audio recording authorizing the head of meatpacking giant JBS SA to pay bribes to buy the silence of disgraced political leader Eduardo Cunha, who is serving a 15-year prison sentence for corruption.

The recording was reportedly delivered to the Supreme Court on Wednesday as part of evidence in a plea-bargain deal that JBS’s Joesley Batista is seeking in relation to the mammoth Lava Jato graft investigation.

On Thursday, police raided the homes and offices of Senator Aecio Neves, head of the right-wing Brazil Social Democratic Party, who narrowly lost the last presidential election and was considered a contender for the job in 2018. Mr. Batista reportedly recorded him asking for $870,000 on March 24 to help pay for lawyers; Mr. Neves is under investigation for a range of financial crimes. The Supreme Court has now ordered him removed from his senate seat. His sister, Andrea Neves, the architect of his campaigns, has reportedly also been arrested this morning.

Police are also conducting raids on the office of Rodrigo Loures, a member of the lower house of Congress who is considered Mr. Temer's right hand man; the Supreme Court also ordered him removed from his seat.

And in a first for Lava Jato, police have arrested a federal prosecutor, Angelo Goulart Villela, who is charged with leaking secret information to political figures suspected of corruption. Mr. Batista allegedly photographed him in secret meetings with suspects.

The news roiled Brazil, as a nation that thought itself inured after three years of political turmoil confronted a dramatic ratcheting up of the level of chaos and uncertainty.

Brazil's stock market reacted immediately to the tide of political news with a steep fall on opening. The Ibovespa futures market fell 10 per cent in the first minutes of trading, and the Brazilian real is down five per cent against the U.S. dollar. Bond trading is suspended. Markets had rallied recently on the expectation that Mr. Temer would pass a series of financial austerity measures -- but investor response suggests those new laws look increasingly unlikely to pass.

On Thursday night, television channels cut from regular programing to air scenes from Brasilia of top political leaders rushing red-faced and panic-stricken through the hallways of Congress, on their way to meet with Mr. Temer.

The President’s office released a statement confirming he met with Mr. Batista in March but denying the allegations: “President Michel Temer never solicited payments to obtain the silence of former [Congress] deputy Eduardo Cunha. He never participated and never authorized any action with the objective of avoiding testimony or co-operation with the justice system by the former member.”

The Lava Jato investigation has involved a succession of stunning revelations but never anything like this: all previous plea bargains have related to the recounting of bribery and other illegal actions committed in the past. But Mr. Batista, and his brother Wesley, with whom he runs JBS, appear to have been working together with police to entrap political figures in criminal activity.

O Globo reports that in recent weeks trusted Batista staffers delivered sacks of cash containing $217,000 (Canadian) in numbered bills, tagged with traceable chips, as bribes to politicians, while police filmed.

Mr. Batista allegedly told Lava Jato prosecutors that he has paid $2.2-million to Mr. Cunha just since last October. The tape reportedly records the President saying, “You need to keep this up, got it?”

Mr. Cunha, an evangelical preacher, was the Speaker of the lower house of Congress and the most powerful man in the country until his ignominious downfall. He spearheaded the impeachment of former president Dilma Rousseff last year. Mr. Temer recently told an interviewer that Mr. Cunha told him he would make sure she was ousted after she refused to shut down an investigation into his actions. In March, Mr. Cunha was sentenced to 15 years for corruption and money-laundering, for taking bribes to ensure the awarding of lucrative state contracts – and then funnelling the money to Swiss bank accounts.

As he was forced out of office, Mr. Cunha warned that he had damaging information on virtually all of his political colleagues – and the O Globo story suggests that Mr. Temer and others have been keen to ensure he didn’t share that information.

The Batista brothers have been charged with “crimes against the national finance system,” including misuse of loans from a national development bank.

The Globe and Mail. Apr. 12, 2017. Fresh round of corruption allegations rocks Brazil’s political establishment

STEPHANIE NOLEN

RIO DE JANEIRO — Brazil’s beleaguered president Michel Temer is scrambling to hold together his coalition as a fresh round of corruption allegations shakes the political establishment.

A Supreme Court judge has authorized investigations into a broad swath of the country’s most powerful political actors, lifting the immunity they enjoy as sitting politicians: the list includes nearly a third of the members of Mr. Temer’s cabinet, plus 29 senators, 42 federal deputies, 12 governors and five former presidents.

This is a new phase of the sprawling, and still expanding, Lava Jato corruption case that has shredded the Brazilian political establishment and had knock-on effects across Latin America.

Justice Edson Fachin stripped immunity from 108 people who now hold office and sent cases against 211 others to lower courts. (Only the Supreme Court can authorize investigation of a sitting Brazilian politician). Some of Mr. Temer’s closest allies are on the list; so is Eduardo Paes, the high-profile ex-mayor of Rio, accused of taking bribes related to the 2016 Summer Olympic Games.

The investigations stem from allegations that executives at Brazil’s largest construction firm, Odebrecht SA, paid bribes to politicians from all parties in an effort to win lucrative contracts and influence legislation. Seventy-seven senior Odebrecht staffers, including the company’s chief executive officer, Marcelo Odebrecht, signed a deal to provide information to prosecutors in exchange for leniency in sentencing.

The Odebrecht plea bargain list has been the subject of intense speculation here for months; pieces of it had leaked to media. And many of the politicians named were in any case already facing charges or scrutiny related to other parts of Lava Jato, which has been under way for three years.

But when Justice Fachin unsealed the Odebrecht testimony on Tuesday evening, scandal-weary Brazilians discovered they could still be shocked.

“Disclosure [of the list] confirms to the public that the corrupt ties between the public and private sectors are not specific to one party – they are a systemic feature of Brazilian politics,” Claudio Couto, a political scientist at the Getulio Vargas Foundation, a university in Rio, wrote in the newspaper O Globo on Wednesday.

The list speaks to the degree of institutionalized corruption here, with five of Brazil’s six past presidents in the democratic era named on the list. Itamar Franco, who replaced a president impeached for graft, is the only former president not named; he is deceased.

Mr. Temer is named in the Odebrecht plea bargain but Brazilian law says a sitting president cannot be investigated for crimes committed before he took office. (Hearings began last week into a separate case, before the electoral court, in which Mr. Temer is accused of accepting illegal funding for his last campaign for office. That case is not expected to conclude before his mandate runs out next year.)

The new investigations severely complicate Mr. Temer’s situation as he tries to pass an unpopular package of reforms on which he has staked his government. He is seeking to cut the generous pension program and reduce labour protections; the changes are part of an austerity program that the country’s business and financial sectors say will be key to ending a sharp recession, and foreign investors and ratings agencies are watching Mr. Temer’s ability to get the laws passed.

Finance Minister Henrique Meirelles is predicting the list will delay the passage of the bills, as Congress members shift their focus to the allegations, but that the package will eventually become law, Folha de Sao Paulo reported Wednesday.

Among those on the Odebrecht list is Mr. Temer’s chief of staff, Eliseu Padilha, a veteran deal maker who was tasked with getting the votes to pass the pension reform. Rodrigo Maia, Speaker of the lower house and second in line to the presidency, and Eunicio Oliveira, the leader of the Senate, are also now under investigation. Mr. Maia replaced Eduardo Cunha, the once-powerful politician recently sentenced to 15 years on graft charges, while Mr. Oliveira replaced a Senate leader forced out of the job for corruption charges.

Also now investigated: Foreign Minister Aloysio Nunes; Trade and Industry Minister Marcos Pereira; Agriculture Minister Blairo Maggi; the secretary-general of the presidency, Moreira Franco, who oversees the infrastructure investment program; and the ministers of communications, cities, culture and national integration.

The list once against shifts the field of competition for the 2018 federal elections, with leaders of all parties named. Aécio Neves, leader of the opposition Brazilian Social Democracy Party, who narrowly lost the presidency to Dilma Rouseff in 2014, is named in five separate cases.

Mr. Maia, the head of the lower house, was one of the few politicians to respond immediately to the allegations; he said his innocence will be proved during the investigation. The former presidents named, including Ms. Rousseff, Luiz Inacio Lula da Silva and Fernando Henrique Cardoso, have all declared their innocence in the past. They will be prosecuted in the court of Judge Sergio Moro, who has become something of a cult hero in Brazil as he oversees the Lava Jato investigations.

Mr. Temer took power nearly a year ago, after the impeachment of Ms. Rousseff, who was accused of financial mismanagement. In the first six month of his presidency he was forced to fire and replace six cabinet ministers for reasons related to corruption and abuse of power, including one caught on tape talking about shutting down Lava Jato.

“The most troubling part is that the names on the list are not just names: they are leaders in Congress and in parties,” Prof. Couto wrote. “When they are targeted [for investigation], their organizational capacity decreases, which will lead to instability in the near future. Then Congress can react in one of two ways: positively, trying to improve their legitimacy. Or negatively, trying to pass laws that will get rid of their problems. That’s the biggest risk today.”

BLOOMBERG. MARKETS. May 18, 2017. Brazil turmoil

Political turbulence made an unwelcome return to Brazil after one of the country's largest newspapers reported that a secret recording exists of President Michel Temer approving a payment to Eduardo Cunha, the mastermind behind last year's impeachment of former president Dilma Rousseff. Lawmakers called for Temer's resignation last night, putting at risk the president's reform program that had buoyed markets. The country's stocks and currency are expected to drop sharply in Thursday's trading.

BLOOMBERG. May 18,2017. Brazil plunges back into crisis

President Michel Temer's future was thrown into doubt after O Globo newspaper reported that he was involved in an alleged cover-up involving the jailed mastermind behind Dilma Rousseff's impeachment last year. The paper said a secret recording has emerged of Temer approving a payment to Eduardo Cunha, the former head of the lower house. Temer's office denied the allegations. But Brazilian markets, which have surged over the past year on the back of Temer's economic reforms, look poised to take a hit today.

BLOOMBERG. 2017 M05 18. In Selling Brazil, Investors Flee From Market They Once Embraced

by Filipe Pacheco

- ‘Temer rally’ under threat as currency, bonds plunge

- Crisis embroils president once seen as market savior

- Brazil Markets Sink Triggering Circuit Breaker

As Brazilian markets tumble amid the latest furor surrounding President Michel Temer, traders are selling one of the best-performing markets of the past year and a half.

Before today, the real had gained almost 20 percent over 18 months, while the benchmark Ibovespa index of stocks jumped 42 percent. The yield on the country’s real-denominated bonds due 2027 tumbled almost 700 basis points since peaking at 16.87 percent in January 2016. The currency plunged more than 8 percent on Thursday, while stocks slid 10 percent before trading was halted. Dollar-bond yields soared.

Brazilian assets are “going to be at heavy risk of further punishment as this news continues to develop, and it’s likely that investors will now develop a risk-off approach to the market,” said Jameel Ahmad, the vice-president for market research at foreign exchange brokerage FXTM.

The country’s currency was the biggest gainer last year among 16 major peers as Temer promised to calm Brazil’s political waters and implement much-needed economic reforms. The currency had depreciated 33 percent the year before, as the government of his predecessor, Dilma Rousseff, struggled to boost the economy while her popularity plunged.

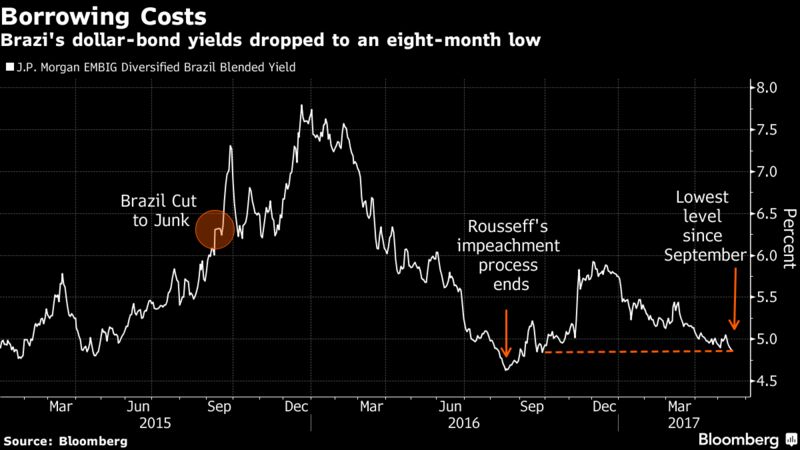

The cost of borrowing for the Brazilian government as measured by the country’s dollar bonds soared as the political crisis developed last year and the country’s credit was cut to junk by the three major rating companies. Yields recovered after Rousseff’s impeachment.

BLOOMBERG. 2017 M05 17. U.S. Stocks, Dollar Rebound; Brazil Shares Plunge: Markets Wrap

by Robert Brand

- Rush for havens as Trump turmoil sparks jump in volatility

- Latest Brazilian political crisis hits emerging assets

U.S. stocks rebounded from the worst selloff of the year and the dollar strengthened as data reinforced optimism in the economy even as political events continued to roil Washington. Brazilian assets plunged amid a government crisis.

Technology and bank shares resumed rallies, boosting U.S. equities a day after the Trump administrations travails sparked concern that his agenda is imperiled. Measures of jobless claims and regional manufacturing topped estimates, adding to signs economic growth is on firm footing. The dollar benefited from weakness in emerging-market currencies as political turmoil engulfed Brazil. The Ibovespa lost more than 8 percent.

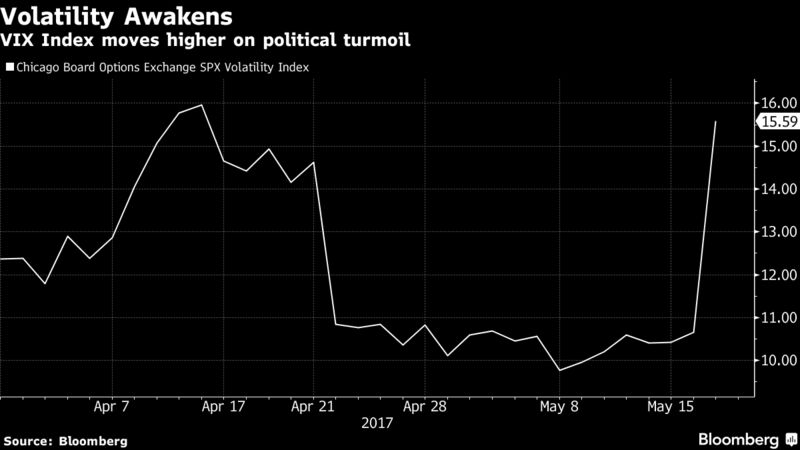

As the confusion surrounding Trump threatens to derail the policy agenda that helped push global equities to records as recently as Tuesday, a gauge of U.S. stock volatility surged the most since the U.K. voted to leave the European Union last June. Many of the trades sparked by the president’s November election have now reversed, with the dollar all but erasing its post-election rally.

“The market will revert to much higher volatility and this could be the start of it,” said Richard Haworth, chief investment officer of 36 South Capital Advisors, a London-based hedge fund which bets on rising price swings. “The sharp move this week reflects how short volatility the market was -- how complacent.”

The Justice Department Wednesday appointed a special counsel to probe Russia’s role in the 2016 election, deepening a crisis fueled by reports Trump asked FBI Director James Comey in February to halt an investigation before firing him last week.

Read our Markets Live blog here.

What’s ahead for investors:

- Federal Reserve Bank of Cleveland President Loretta Mester speaks on the economy and monetary policy in the U.S. Odds of a June Fed rate hike settled around 60 percent, while full pricing of a next hike shifted to November from September, per Fed-dated OIS rates.

- U.S. Treasury Secretary Steven Mnuchin offers his first congressional testimony since taking office, appearing before the Senate Banking Committee on issues ranging from the rollback of Dodd-Frank financial regulations to his decision not to name China a currency manipulator.

- And ECB minutes of the April 27 meeting, after which Mario Draghi pointed to a broad-based economic upswing, will give more clues on its internal debate about tapering.

Here are the major moves in the markets:

Stocks

- The S&P 500 rose 0.5 percent to 2,367.75 at 10:37 a.m. in New York, after the benchmark gauge slumped 1.8 percent on Wednesday, its worst day since Sept. 9.

- The Stoxx Europe 600 Index declined 0.4 percent, paring a drop that reached 1.2 percent.

- A Japan-traded ETF tracking Brazil’s Ibovespa Index tumbled 7.5 percent, the most since November, as political crisis returned to the country after last year’s impeachment process.

Currencies

- The Bloomberg Dollar Spot Index increased 0.2 percent, after dropping 0.5 percent on Wednesday to the lowest level since Nov. 8.

- Brazil’s real led declines among emerging-market currencies, slumping 5.1 percent. South Africa’s rand weakened 2.3 percent.

- The euro fell 0.4 percent to $1.1119, after four straight days of gains. The British pound jumped 0.4 percent to $1.3018 after data showed retail sales rose more than expected in April.

Bonds

- The yield on 10-year Treasuries was little changed at 2.22 percent, following the biggest gain for the note since July.

- Benchmark yields in France and Germany fell five basis points.

- Bonds of state-controlled energy company Petroleo Brasileiro SA dropped by the most in six months amid a political crisis in Brazil.

- The company’s 800 million euros of notes due in January 2025 led the slump, falling 4.5 cents on the euro to 102 cents, the biggest decline since November.

Commodities

- Gold futures slumped 0.6 percent to $1,251.10, halting a six-day advance sparked by haven demand.

- Zinc led a retreat in industrial metals, dropping 3.4, as political turmoil in the U.S. threatened the outlook for the world’s biggest economy. Copper slumped 2 percent.

- West Texas crude rose 0.4 percent to $49.27 a barrel, after jumping 0.8 percent in the previous session.

Asia

- The MSCI Asia Pacific Index slid 0.8 percent, the most since April 6. Japan’s Topix slumped 1.3 percent while a volatility measure on the Nikkei 225 Stock Average jumped to the highest this month.

- The Hang Seng China Enterprises Index of mainland shares traded in Hong Kong retreated 1.1 percent.

________________

STATISTICS HIGHLIGHTS

StatCan. 2017-05-18. Canada's international transactions in securities, March 2017

Foreign investment in Canadian securities

$15.1 billion, March 2017

Canadian investment in foreign securities

$15.4 billion, March 2017

Source(s): CANSIM table 376-0131.

Foreign investment in Canadian securities amounted to $15.1 billion in March, largely in Canadian corporate instruments. At the same time, Canadian investors added $15.4 billion of foreign securities to their holdings, led by acquisitions of US equities.

For the first quarter as a whole, foreign investment in Canadian securities exceeded Canadian investment in foreign securities by $28.8 billion, led by issuances of new Canadian shares to non-resident investors in February.

Chart 1 Chart 1: Canada's international transactions in securities, quarterly

Canada's international transactions in securities, quarterly

Foreign investment in Canadian securities focuses on corporate instruments

Foreign investors acquired $15.1 billion of Canadian securities in March, largely Canadian corporate instruments. Foreign acquisitions of Canadian securities reached $60.7 billion in the first quarter, up considerably from previous quarters.

Chart 2 Chart 2: Foreign investment in Canadian securities

Foreign investment in Canadian securities

Non-resident investors added $8.9 billion of Canadian bonds to their holdings in March. The investment activity was mainly in corporate bonds, as foreign investors reduced their exposure to government bonds. Foreign investment in private corporate bonds was $7.3 billion, mainly new issues denominated in US dollars. Meanwhile, foreign investors reduced their holdings of federal government bonds by $1.6 billion, a third consecutive monthly divestment. Canadian long-term interest rates were down by 12 basis points in the month.

Foreign investors added $2.9 billion of Canadian money market instruments to their holdings in March. Strong foreign acquisitions of corporate paper were moderated by a reduction in foreign holdings of provincial government paper. Foreign investors also acquired $1.4 billion of federal government paper in the month. Canadian short-term interest rates were up by seven basis points and the Canadian dollar edged down against its US counterpart in March.

Non-resident investors acquired $3.3 billion of Canadian equities in March, following a record high $35.9 billion investment in February. The investment in February was led by new issues of Canadian shares to non-resident investors resulting from cross-border mergers and acquisitions. In contrast, the investment in March mainly resulted from secondary market purchases. Overall, foreign acquisitions of Canadian equities in the first quarter totalled $38.2 billion. Canadian stock prices were up by 1.0% in the month and by 1.7% in the quarter.

Canadian investors buy US shares

Canadian investment in foreign securities reached $15.4 billion in March, the highest investment since December 2015. This activity was led by acquisitions of US equities. Canadian purchases of foreign securities reached $31.9 billion in the first quarter of the year.

Chart 3 Chart 3: Canadian investment in foreign securities

Canadian investment in foreign securities

Canadian investors acquired $16.1 billion of foreign equities in March. Record purchases of $20.2 billion of US equities were moderated by sales of non-US foreign equities in the month. US stock prices were virtually unchanged at the end of March.

Canadian investors reduced their holdings of foreign debt securities by $735 million in March. A record divestment of $2.5 billion in US corporate bonds was moderated by acquisitions of $1.3 billion in US Treasury instruments. US long-term interest rates were up by six basis points and short-term interest rates were up by 22 basis points in the month.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170518/dq170518a-eng.pdf

REUTERS. May 18, 2017. Foreigners buy C$15.1 billion in Canadian securities in March

OTTAWA (Reuters) - Foreign investment in Canadian securities continued in March, driven by purchases of corporate bonds and equities, and bringing acquisitions in the first quarter to a record, data from Statistics Canada showed on Thursday.

International investors bought C$15.1 billion ($11.1 billion) in Canadian securities in the month. Although that was a step down from February's monthly record of C$39.2 billion, foreign acquisitions hit a quarterly record of C$60.7 billion in the first three months of the year.

Foreigners bought C$8.9 billion in Canadian bonds in March, mainly drawn by corporate bonds as investors reduced their holdings of government debt.

Purchases of stocks slowed to C$3.3 billion from a record C$35.9 billion the month before. While the large investment in February had been largely the result of mergers and acquisitions, March's increase was mainly due to investment in the stock market.

Meanwhile, Canadians bought C$15.4 billion in foreign securities, the highest investment since December 2015.

(Reporting by Leah Schnurr Editing by W Simon)

StatCan. 2017-05-18. Employment Insurance, March 2017

Regular Employment Insurance beneficiaries — Canada

551,070, March 2017

-0.5% decrease (monthly change)

Regular Employment Insurance beneficiaries (year-over-year change) — Canada

March 2017, 0.7% increase (12-month change)

Source(s): CANSIM table 276-0022.

In March, 551,100 people received regular Employment Insurance (EI) benefits, down slightly (-2,900 or -0.5%) from February.

There were fewer beneficiaries in six provinces, notably Alberta (-4.1%), Prince Edward Island (-3.4%) and Nova Scotia (-2.4%). Smaller decreases were recorded in New Brunswick (-1.7%), British Columbia (-1.3%) and Newfoundland and Labrador (-1.1%).

In contrast, the number of beneficiaries increased in Quebec (+1.9%) and Saskatchewan (+1.7%), while there was little change in Ontario and Manitoba.

The number of people receiving regular benefits edged up 3,800 or 0.7% in the 12 months to March.

In general, changes in the number of beneficiaries reflect various situations, including people becoming beneficiaries, those going back to work, and those no longer receiving regular benefits.

Chart 1 Chart 1: Regular Employment Insurance beneficiaries

Regular Employment Insurance beneficiaries

Provincial and sub-provincial overview

In March, the number of people receiving benefits in Alberta was down 4.1% to 84,400, the third consecutive monthly decline. Data from the Labour Force Survey (LFS) show that employment in Alberta has been on a slight upward trend since the autumn of 2016. Fewer beneficiaries were observed across the province, including the census metropolitan areas (CMAs) of Calgary (-4.0%) and Edmonton (-3.0%). On a year-over-year basis, however, the number of beneficiaries in the province was up 21.1%.

In Prince Edward Island, the number of people receiving benefits declined 3.4% in March to 7,800. There was a decrease in beneficiaries throughout the province. Compared with March 2016, the number of beneficiaries increased by 2.9%.

The number of beneficiaries in Nova Scotia fell 2.4% to 28,600 in March, offsetting a similar-sized increase the previous month. Areas outside the CMA of Halifax and the census agglomerations (CAs) contributed most to the decrease. In the 12 months to March, the number of beneficiaries in the province was up 3.9%.

In New Brunswick, 33,100 people received benefits in March, down 1.7% from the previous month. More than two-thirds of the decrease came from the CMAs of Saint John (-7.9%) and Moncton (-5.0%). On a year-over-year basis, the number of beneficiaries in the province was little changed.

In March, the number of people receiving benefits in British Columbia was down 1.3% to 52,700. There were declines in the CMAs of Kelowna (-4.0%) and Victoria (-1.2%), while Vancouver edged down (-0.8%). Meanwhile, Abbotsford–Mission registered an increase (+2.2%). Compared with March 2016, the number of EI recipients in the province declined by 2.1%. The number of beneficiaries in British Columbia has been on a downward trend since the autumn of 2016, coinciding with strength in the provincial labour market. According to data from the LFS, the unemployment rate in the province was 5.4% in March, the lowest among the provinces.

In Newfoundland and Labrador, 36,800 people received benefits in March, down 1.1% from the previous month. The number of beneficiaries declined 1.4% in the CMA of St. John's. On a year-over-year basis, the number of people receiving benefits in the province increased 8.6%.

In Quebec, 134,600 people received benefits in March, up 1.9% compared with the previous month. This increase largely occurred in the CMAs, particularly in Trois-Rivières (+6.6%), Québec (+3.2%) and Gatineau (+2.5%). In Montréal, the number of beneficiaries increased by 1.0%.

Despite the monthly increase, the number of beneficiaries in Quebec decreased on a year-over-year basis by 7.4%, the fastest decline among the provinces. Furthermore, the number of beneficiaries in Quebec has remained at historically low levels, coinciding with strength in provincial employment, especially in the second half of 2016. According to data from the LFS, Quebec's unemployment rate decreased 1.0 percentage point to 6.4% in the 12 months to March.

The number of beneficiaries in Saskatchewan was up 1.7% to 18,400 in March, the first monthly increase since October 2016. The rise in the number of people receiving benefits was largely found in the CMAs of Saskatoon (+5.9%) and Regina (+4.8%). Compared with March 2016, the number of recipients in the province was up 14.1%.

Employment Insurance beneficiaries by occupation

In the 12 months to March, the number of people receiving benefits was up in 6 of the 10 broad occupational groups, most notably art, culture, recreation and sport (+11.9%), management (+7.4%), health (+7.0%) and sales and service (+5.3%). On the other hand, there were fewer beneficiaries whose last job was in manufacturing and utilities (-4.1%), natural and applied sciences (-1.6%) and trades, transport and equipment operators (-1.1%). There was little change in natural resources, agriculture and related production occupations.

Chart 2 Chart 2: Regular Employment Insurance beneficiaries by occupation, March 2016 to March 2017

Regular Employment Insurance beneficiaries by occupation, March 2016 to March 2017

Employment Insurance claims

The number of EI claims totalled 230,100 in March, virtually unchanged from the previous month. The number of claims provides an indication of the number of people who could become beneficiaries.

In March, notable changes in the number of claims were observed in every province except Newfoundland and Labrador. Decreases were led by Alberta (-5.5%), where the number of claims has been trending downward since the autumn of 2016. Claims in the province have been gradually returning to levels seen before the commodities downturn that began in the latter half of 2014.

Chart 3 Chart 3: Employment Insurance claims by province, February 2017 to March 2017

Employment Insurance claims by province, February 2017 to March 2017

Claims also declined in Quebec (-4.9%), Prince Edward Island (-3.8%), Saskatchewan (-2.2%) and Manitoba (-2.1%).

In contrast, the number of claims increased in Ontario (+5.5%), Nova Scotia (+2.2%), New Brunswick (+1.7%) and British Columbia (+1.3%).

Compared with March 2016, EI claims were down 2.9% at the national level.

Chart 4 Chart 4: Employment Insurance claims

Employment Insurance claims

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170518/dq170518b-eng.pdf

________________

G-7 HIGHLIGHTS

Department of Finance Canada. May 11, 2017. Minister Morneau Promotes Fairness for the Middle Class at G7 Meetings in Italy

Bari, Italy – The Government of Canada is committed to building an economy that works for the middle class and those working hard to join it. By working together with G7 countries and international institutions such as the International Monetary Fund and the World Bank Group, the Government of Canada can improve global growth prospects that will lead to greater fairness and prosperity for Canadians and people around the world.

Finance Minister Bill Morneau is in Bari, Italy, this week to take part in the G7 Finance Ministers and Central Bank Governors Meetings. Minister Morneau will share Canada's ambitious plan to make smart investments that will create jobs, grow Canada's economy, and provide more opportunities for the middle class. The Minister will also share Canada's approach of being open to the world, trade and investment, and embracing diversity and gender equality as strengths and drivers of economic growth.

At the meetings, the Minister will reaffirm Canada's commitment to economic policies that help grow the middle class, take action against international tax evasion and avoidance, and emphasize the importance of open trade and policy coordination to support global economic growth. The Minister will attend G7 symposiums on inequality and growth, and on finance, regulation and growth. He will also participate in G7 sessions on the global economy, inequality and growth, International Financial Institutions coordination, security as a global public good, and international taxation.

With its most recent budget, the Government of Canada moved to ensure the economy of tomorrow works for every Canadian, with targeted investments for long-term growth and actions to promote tax fairness at home and internationally.

Department of Finance Canada. May 12, 2017. Readout: Minister of Finance Meets With United States Secretary of the Treasury at G7 Meetings in Italy

Bari, Italy – The Honourable Bill Morneau, Canada's Minister of Finance, met today with Steven Mnuchin, Secretary of the Treasury of the United States of America, on the margins of the G7 Finance Ministers Meetings in Bari, Italy. They discussed a range of issues regarding the economic ties of Canada and the U.S.

In recognition of both countries' common focus to create jobs and foster economic growth for the middle class, Minister Morneau emphasized how the secure and efficient flow of goods, services, capital and people across the Canada-U.S. border is vital to the livelihoods of millions of Americans and Canadians.

Canada and the U.S. enjoy one of the closest relationships between any two countries in the world, with the North American Free Trade Agreement serving as the backbone of our trade relationship. This trade partnership is held up as an international model to follow. It is balanced and fair, and supports growth, innovation and well-paying middle class jobs in both countries.

Canada and the U.S. continue to engage in productive discussion. Minister Morneau and Secretary Mnuchin spoke about the importance of preserving and strengthening the Canada-U.S. trade relationship, and reinforced its role in raising the standard of living of middle class families in both countries. Minister Morneau defended Canada's position on open trade and recent trade issues such as softwood lumber. To that end, the Government of Canada disagrees strongly with the baseless duties applied to Canadian softwood lumber products, and remains committed to working with the U.S. Administration to achieve a durable long-term solution.

The Minister and Secretary concluded their meeting by acknowledging the longstanding and unique economic partnership Canada and the United States enjoy, and committed to maintaining strong cooperation and an open dialogue to further develop this important relationship.

Quick Facts

- Canada-United States bilateral trade in goods and services reached nearly $882 billion in 2016.

- Canada and the United States benefit from robust trade and investment ties and integrated economies that support millions of Canadian and U.S. jobs. Nearly 9 million American jobs depend on trade and investment with Canada.

- Nearly 400,000 people and over $2 billion worth of goods and services cross the Canada-United States border every day.

Department of Finance Canada. May 13, 2017. Minister Morneau Reaffirms the Importance of Fairness and Trade in Improving Global Economic Growth at G7 Meetings in Italy

Bari, Italy – Canada's greatest strength is the diversity of its people and a spirit of openness to the world, allowing the Canadian economy to benefit directly from international trade and investment to create good, well-paying jobs for middle class Canadians.

At the G7 Finance Ministers and Central Bank Governors Meetings in Bari, Italy, Finance Minister Bill Morneau advocated Canada's progressive approach to trade and demonstrated how it is creating growth that strengthens the middle class.

The G7 meetings provided an excellent opportunity for the Minister to reaffirm Canada's position as a key political and commercial partner, and the importance of open trade and policy coordination in improving the pace of global economic growth and dealing with shared challenges. The Minister also highlighted Canada's traditional leadership in supporting sustainable development and poverty reduction, advancing women's economic empowerment, and tackling international tax evasion and avoidance.

Minister Morneau had the opportunity to meet bilaterally with the President of the World Bank as well as his G7 counterparts from Japan, Italy and the U.S. During his meeting with U.S. Treasury Secretary Steven Mnuchin, Minister Morneau reaffirmed Canada's commitment to a strong and mutually beneficial bilateral relationship and discussed the recent positions taken by the U.S. administration on trade issues with Canada.

G-7 DOCUMENTS: http://www.g7italy.it/en/documenti-ministeriali

________________

NAFTA

Global Affairs Canada. May 18, 2017. Statement by Foreign Affairs Minister on NAFTA

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement in response to the U.S. administration’s notification to Congress of its intent to renegotiate the North American Free Trade Agreement (NAFTA):

“NAFTA’s track record is one of economic growth and middle-class job creation, both here in Canada and throughout North America. Nine million American jobs depend on trade and investment with Canada. Our integrated economies and supply chains support millions of jobs across the continent.

“Today’s formal announcement by the U.S. administration is required by the U.S. Congress. This three-month notice period has long been anticipated and is specifically a part of the U.S. domestic process.

“In recent months, with respect to NAFTA, my colleagues and I have been listening to Canadians from across the country and from all sectors and backgrounds. We will continue to consult closely with the provinces and territories, industry, unions, civil society, think tanks, academics, Indigenous peoples, women, youth and the general public. This will enable us to assess what matters most to Canadians and to advance our interests.

“We are at an important juncture that offers us an opportunity to determine how we can best align NAFTA to new realities—and integrate progressive, free and fair approaches to trade and investment.

“We are steadfastly committed to free trade in the North American region and to ensuring that the benefits of trade are enjoyed by all Canadians.”

The Globe and Mail. May 18, 2017. Trump set to trigger NAFTA countdown, reports say

ADRIAN MORROW

WASHINGTON — President Donald Trump’s administration is set to trigger the 90-day countdown to the renegotiation of the North American free-trade agreement, according to U.S. media reports – setting the stage for talks to begin in earnest in mid-August.

United States Trade Representative Robert Lighthizer will send the long-delayed formal notice to Congress that the administration plans to reopen NAFTA on Thursday, Bloomberg reported. After this, the administration must wait 90 days before starting formal talks with Canada and Mexico.

Renegotiating or pulling out of NAFTA was one of Mr. Trump’s key campaign promises. He blames the deal for hollowing out America’s manufacturing sector in the Rust Belt – which delivered Mr. Trump his presidential victory – and has said the pact allows Canada and Mexico to exploit the U.S.

Mr. Trump last month accused Canada of “taking advantage” of the U.S. on both dairy and softwood lumber. He also considered an executive order that would have started the process of pulling the U.S. out of NAFTA, but changed his mind after phone calls from Prime Minister Justin Trudeau and Mexican President Enrique Pena Nieto.

Congressional notification, a legal requirement before talks can start, was been delayed as the Senate dragged its feet on confirming Mr. Lighthizer as Trade Representative. Mr. Lighthizer was finally confirmed last week, sworn in Monday and has spent the last three days in meetings with members of Congress.

The formal start of the process comes as Mr. Trump battles the fallout over an investigation into his campaign team’s ties with Russia, and accusations the President has tried to thwart the investigation. The conflagration could consume much of the time and attention the administration would otherwise have focused on trade talks.

The latest draft of the notification letter contains few specific negotiating objectives, leaving unclear what exactly the U.S. will ask for when talks start. The draft lays out some broad themes but says specific demands will be decided on in the coming months.

The draft, posted online by Inside U.S. Trade, talks about a “modernization” of NAFTA, but steers clear of the protectionist language that permeated an earlier draft circulated in March. The letter lists the digital economy, intellectual property protections, labour and environmental standards as possible areas of discussion. The draft also says the U.S. will look for better enforcement of the provisions of the deal.

“I am pleased to notify the Congress that the President intends to initiate negotiations with Canada and Mexico regarding modernization of the North American Free Trade Agreement,” the draft reads. “Many chapters are outdated and do not reflect modern standards.”

The March version of the letter contained an exhaustive and wide-ranging list of negotiating objectives, largely designed to tilt the trade playing field in the U.S.’s favour. Among other things, the earlier draft suggested that Buy America policies and tax provisions meant to favour U.S. goods could be among the things demanded by negotiators.

It also floated abolishing NAFTA trade panels – which have previously ruled in Canada’s favour in the long-running softwood lumber dispute – and tightening “rules of origin,” measures meant to discourage auto makers and other manufacturers from buying parts from outside the NAFTA zone.

None of these are mentioned in the new version of the letter.

Under U.S. trade law, Congress delegates authority to the President to negotiate deals, but with several conditions attached, including the 90-day notification period. Congress will also have to sign off on the eventual renegotiated deal.

Despite the delay in the formal process, informal discussions have been going for months between the three governments.

Foreign Affairs Minister Chrystia Freeland was in Washington this week to meet with Mr. Lighthizer, Commerce Secretary Wilbur Ross and Secretary of State Rex Tillerson. Ms. Freeland has also been in regular contact with her Mexican counterpart, Luis Videgaray.

The Globe and Mail. Reuters. May 16, 2017. Trump trade officials prefer trilateral NAFTA deal: U.S. senators

DAVID LAWDER

WASHINGTON — The Trump administration’s top trade officials hope to keep the North American Free Trade Agreement as a trilateral deal in negotiations with Canada and Mexico to revamp the 23-year-old pact, senators said on Tuesday.

Several members of the Senate Finance Committee said Commerce Secretary Wilbur Ross and new U.S. Trade Representative Robert Lighthizer told them in a closed door meeting that they would prefer the current three-nation format but left open the possibility of parallel bilateral agreements with Canada and Mexico.

“Their preference is trilateral,” Democratic Senator Debbie Stabenow told reporters after the meeting.

Republican Senator Charles Grassley of Iowa said from the meeting it sounded to him as if a trilateral deal was more likely “unless there’s problems” with that approach.

“If trilaterally you aren’t getting anyplace, I suppose then you do it bilaterally,” Grassley said.

Ross, who has floated the idea of doing two bilateral trade deals with Canada and Mexico, declined to confirm the administration’s preference for a trilateral approach.

“Right now it is a trilateral deal and we shall see what comes in the future but the important thing is to get to the substance,” Ross told reporters after leaving the meeting, adding that talks would be “long and complicated.”

The meeting was one of several on Capitol Hill this week involving Lighthizer, who was sworn in as U.S. trade representative on Monday, that are required for the Trump administration to trigger the start of the NAFTA negotiating process with a 90-day consultation period.

Farm state senators said they also warned Ross and Lighthizer not to take actions that would damage agricultural exports to Canada and Mexico.

“We made it pretty clear that’s a priority, that we don’t want to see ag hurt,” said Senator John Thune, a South Dakota Republican. “NAFTA by and large has been good for agriculture, and we’re seeing some disruptions in the ag marketplace today because of uncertainty about where this is headed.”

Senator Ron Wyden of Oregon, the Finance Committee’s top Democrat, said Ross and Lighthizer assured him they would push to drop NAFTA’s dispute-resolution mechanism. Trump has complained that the mechanism is biased against the United States.

BLOOMBERG. 2017 M05 18. U.S. Seeks to Shift Trade Tides as It Starts Nafta Overhaul

by Andrew Mayeda and Billy House

- Lighthizer says bringing back manufacturing jobs is priority

- U.S. goal is to retain three-way deal, Lighthizer says

President Donald Trump’s administration took its first formal step toward renegotiating the North American Free Trade Agreement, setting the stage for talks that could influence more than $1.2 trillion in annual trade and shake up corporate supply chains.

U.S. Trade Representative Robert Lighthizer gave official notice to Congress on Thursday of the government’s intention to renegotiate the 23-year-old accord with Mexico and Canada. Lighthizer was required to do so under a law that enables the president to fast-track trade legislation through Congress. Over the next 90 days, Lighthizer will consult with lawmakers on the position the U.S. will take in negotiations, which could begin as early as Aug. 16.

Click here to see the administration’s letter to Congress.

“The president’s leadership on trade will permanently reverse the dangerous trajectory of American trade,” Lighthizer told reporters Thursday on a conference call. “While our economy and businesses have changed considerably, Nafta has not. Most chapters are clearly outdated and do not reflect the most recent standards in U.S. trade agreements.”

Reworking the trade deal was a central promise of Trump’s election campaign, during which he called Nafta a “disaster” and blamed it for costing millions of U.S. jobs and hollowing out the manufacturing sector. The administration has made reducing the trade deficit a priority, and Lighthizer suggested Thursday the U.S. will seek to lure back firms that have moved production to Mexico. The U.S. had a $62-billion trade deficit with Mexico last year.

“Sectors like manufacturing, particularly with regard to Mexico, have fallen behind,” Lighthizer said. “When we lose manufacturing facilities, we lose the thousands of good-paying jobs associated with those facilities, directly impacting middle-class Americans.”

‘Relatively Successful’

Lighthizer noted that Nafta has been “relatively successful” for certain sectors of the U.S. economy, such as agriculture, investment services and energy. However, he added that the agreement doesn’t do enough to address digital commerce and intellectual property, and labor and environmental matters are treated as an “afterthought.”

The U.S. hopes to retain the existing three-way structure of the deal, Lighthizer said. “There is value in making the transition to a modernized Nafta as seamless as possible,” he said. “We’re going to give renegotiation a good strong shot.”

Lighthizer said the administration will consider other options if three-way talks fail. After threatening to withdraw from the 1994 agreement last month, Trump reconsidered in favor of a renegotiation but said he’ll terminate America’s involvement if talks don’t go his way.

Trump’s efforts to find the political capital to support a new trade pact will be complicated by controversies engulfing the White House. Former FBI director Robert Mueller this week was named special counsel overseeing a probe into Russia’s role in the 2016 election. The president was already facing a backlash over his firing of FBI director James Comey.

Currency Issues

Lighthizer said USTR will publish its negotiation objectives at least 30 days before formal talks begin, which could happen as early as Aug. 16. He told reporters he hopes to conclude negotiations this year.

Lighthizer, during discussions with a congressional committee this week, indicated that currency issues will be on the table during the Nafta revamp, according to a Democratic senator who was briefed on the matter. Lighthizer told senators that “it would be fair to say that” currency issues “would be part” of a new Nafta deal, Ron Wyden, of Oregon, told reporters.

Under its fast-track authority, the White House has to give Congress 90 days’ notice before it formally starts renegotiating a trade deal. During that time, the administration must meet with members of the House Ways and Means and Senate Finance Committees, with a view toward coming up with the principles the U.S. will adopt during the negotiations.

Other issues expected to come up in Nafta talks include so-called rules of origin, which dictate the amount of North American-made parts that must be used in assembled products such as cars. The U.S. has also indicated it would like to overhaul the process under which foreign companies can be challenged in court by the state, and strengthen the ability of government contracts to give preference to U.S. companies.

BLOOMBERG. 2017 M05 16. U.S. Retailers Urge Trump's New Trade Envoy to Save Nafta

by Lindsey Rupp

- Administration should ‘do no harm’ in renegotiating treaty

- Industry’s largest trade group send letter to Lighthizer

- Retail CEOs Renew Border-Tax Fight

The largest U.S. retail associations called on new Trade Representative Robert Lighthizer to support the North American Free Trade Agreement, aiming to salvage an accord that has come under fire from his boss.

Leaders of the American Apparel & Footwear Association, the National Retail Federation, Retail Industry Leaders Association and U.S. Fashion Industry Association sent a letter to Lighthizer on Tuesday urging him to tread lightly on the 23-year-old pact. Nafta supports hundreds of thousands of U.S. textile and clothing jobs, along with retail operations in all 50 states, the organizations said.

“We agree that the agreement should be updated to reflect today’s business reality and better prepare for future trade patterns,” the groups said in the letter. “However, we ask for support from the administration to ensure that renegotiation will ‘do no harm’ to the successful supply chains that we rely on today.”

Lighthizer was sworn in Monday, clearing the way for the administration to seek an overhaul of Nafta. President Donald Trump called the treaty a “disaster” during the election campaign and has threatened to withdraw from the agreement with Mexico and Canada if renegotiated terms aren’t favorable enough.

In a draft letter circulated in March that laid out its goals, the administration told lawmakers it wanted to strengthen the U.S. manufacturing base and “level the playing field” with its Nafta trading partners on tax treatment. Retailers, which rely heavily on imports, have opposed any changes that would tax imports at a higher rate.

‘Broad Consensus’

“Our approach is if you look across the textile, apparel and footwear industry, there’s a very broad consensus that Nafta works -- that it creates jobs, that there’s a supply chain that supports workers and communities on both sides of the border,” Steve Lamar, executive vice president of the AAFA, said in an earlier interview. “Perhaps it can be improved, but we don’t want to start the negotiations from the perspective that this is a bad agreement.”

Retail groups say Nafta could be updated to account for digital commerce, which was virtually nonexistent when the agreement was enacted in 1994.

“The ultimate concern for the business community at large is failure to come to a deal that ends in the U.S. pulling out of Nafta,” said Jonathan Gold, vice president of supply-chain and customs policy at the NRF. “We don’t think that should be on the table.”

An imperiled Nafta comes during a challenging time for apparel retailers. Falling prices, increased competition and a lack of style trends have made it harder for clothing companies to maintain sales and profit. Now they may lose access to Mexico, a country that supplies goods at prices Americans are willing to pay.

If the trade deal changes, apparel trade groups say the industry could be faced with rising costs and another blow to its already-fragile profit margins. Mexico is the largest Latin American supplier of apparel products to the U.S. and the fifth-biggest worldwide -- behind countries like China and Vietnam -- according to the U.S. Department of Commerce.

“A renegotiated Nafta needs to enhance the economic cooperation with these key trading partners,” the retail groups said in Tuesday’s letter. “Any improvements should provide for seamless integration with the existing Nafta agreement.”

REUTERS. May 18, 2017. Trump turmoil could lead investors to reassess risk appetite

By Jamie McGeever

LONDON (Reuters) - The turmoil in Washington surrounding Donald Trump's presidency is rattling world markets, and the burst of volatility could force investors into a strategic or tactical rethink of how much risk they are happy to face.

Increasingly damaging revelations about the Trump administration's and election team's dealings with Russia triggered the biggest fall on Wall Street on Wednesday since last September and a stock market slump around the world.

After months of major stock markets posting record highs and historically low volatility across a range of asset classes, a reversal was always on the cards.

Now that it has come, the question is whether it ends up being a one-off or marks the start of a prolonged reversal which sees investors cut back on risk and adopt more defensive positions.

A broad U-turn would likely require one or a mix of the following scenarios: impeachment proceedings against Trump get underway, his growth-boosting legislative reform agenda is delayed, the U.S. economy begins to contract.

None of them are mutually exclusive, and it remains to be seen if events play out that way to any degree. But the "Trump trade" that lifted stocks, the dollar and bond yields appears to have evaporated.

The dollar, two- to 10-year Treasury yield curve and yields on 10-year Treasury Inflation-Protected Securities (TIPS) are all back where they were before Trump was elected in November. After months of relative plain sailing, investors are now bracing for stormier weather.

"We have to be cognizant of volatility. It's a question of keeping risk levels appropriate, and that's something we were doing anyway. Our portfolios were well-positioned," said James Athey, portfolio manager at Aberdeen Asset Management in London.

"Do we dial back further? That's the conversation we'll be having over the next day or two," he said, noting that he had cut back on "short" positions in safe-haven fixed income assets and the Japanese yen in recent weeks.

Aberdeen has $480 billion of assets under management.

SURPRISE, SURPRISE

The VIX index .VIX of implied volatility on the S&P 500 .SPX was jolted from its slumber on Wednesday and chalked up its seventh-biggest rise in percentage terms since its launch in 1990.

This followed news that Trump had asked then-FBI Director James Comey to close an investigation into ties between former White House national security adviser Michael Flynn and Russia.

Joost van Leenders, strategist and portfolio manager, multi asset solutions at BNP Paribas Investment Partners, which oversees 580 billion euros of assets, said he and his colleagues are discussing U.S. political risk on a daily basis.

"We were cautiously positioned to start with, so for now we don't have to change our position, but I do not rule out future changes," he said.

Some, like Tom Wu, chief investment officer, Global Investments, Yuanta Securities Investment Trust, Taiwan's second-largest fund manager, aren't holding back.

"An impeachment might happen, or it might not. Any uncertainty, including this uncertainty, is something that investors don't care for. So we'll be unloading all of our holdings in U.S. stocks this month," he said.

Few investors will follow that example, but many reckon U.S. markets are expensive. The U.S. economy is already into its third-longest expansion ever, and a recent fall in the U.S. economic surprises index suggests it is running out of steam.

The gap between the U.S. and European surprises indexes is the widest in two years, U.S. corporate earnings growth is double-digit but still lagging the euro zone, and the political turmoil that was supposed to beset Europe this year is concentrated in the United States.

"There is no recession in the pipeline, but the U.S. economy could slow next year," said Didier Borowski, head of macroeconomic research at Amundi, Europe's largest asset manager with 1.27 trillion euros of assets.

"So part of the correction is welcome because from a valuation standpoint, the U.S. equity market was in bubble territory," he said.

CASHING IN

As stocks slide, safe-haven assets like bonds that had been shunned in the months following Trump's election win in November are back in demand.

The spread between two- and 10-year Treasury yields US10US2=TWEB is its smallest since before the presidential election. This so-called yield curve flattening suggests investors are losing faith in the economy's ability to withstand higher interest rates.

Money markets have slashed the probability of the Federal Reserve raising rates next month to less than 60 percent from over 90 percent last week.

John Taylor, portfolio manager at Alliance Bernstein, which has $498 billion of assets under management, said the political, economic and market volatility is keeping them on the defensive.

"Our cash position is quite large – 10 percent vs below 5 percent historically ... and we will stick to assets with strong fundamentals, such as bank bonds and local currency emerging market debt," Taylor said.

(Reporting by Jamie McGeever; Additional reporting by Abhinav Ramnarayan in London and Faith Hung in Taiwan; Editing by Hugh Lawson)

REUTERS. May 18, 2017. Dollar nurses losses as Washington rocked by new probe into Trump campaign

By Hideyuki Sano

TOKYO (Reuters) - The dollar wallowed near six-month lows against a basket of major currencies on Thursday as the U.S. political crisis appeared to deepen, threatening to delay efforts by President Donald Trump to implement his economic stimulus plans.

"Political instability in the United States is shaking markets. You put a brake on investments to the U.S. when you see those headlines," said Bart Wakabayashi, Tokyo Branch Manager of State Street Bank.

The Justice Department appointed a former FBI director as special counsel to investigate possible collusion between President Donald Trump's 2016 campaign team and Russia.

The appointment of a special counsel follows Trump's dismissal of James Comey, his FBI director who was investigating Russia's role in the U.S. election.

Media then reported that Trump may have interfered with a federal investigation, a serious allegation that could even lead to his impeachment if verified.

"Some politicians might try to begin the impeachment process, and if they do, that would take much time to carry it out, and while it is ongoing, it would be almost impossible to push fiscal stimulus through," said Masashi Murata, currency strategist for Brown Brothers Harriman in Tokyo, noting that it took almost two years for the Bill Clinton impeachment process to proceed though Congress.

The dollar index, which tracks the greenback against six major rivals, fell as low as 97.333 .DXY on Wednesday, its lowest level since Nov. 9, having given up all the gains it had made following the U.S. presidential election in November.

It last stood at 97.588, flat from late U.S. trade, and down more than 2 percent over the past four sessions.

Trump's surprise election victory had initially sparked buying in the dollar and U.S. assets on hopes for his tax cuts and infrastructure spending plans, but such "Trump trades" have been wound back.

The dollar index has now fallen more than 5 percent from its 14-year high of 103.82 set on Jan 3, despite expectations of higher U.S. interest rates that should bolster the U.S. currency.

The Federal Reserve raised rates in March and its officials have said there could be two or three more rate hikes this year.

Yet, U.S. political turmoil and softer-than-expected U.S. economic data such as retail sales, consumer inflation and housing starts in the past week is leading market players to discount the chance of more rate hikes.

Fed Fund futures <0> are now pricing in only about 60 percent chance of a rate hike by June, compared to around 90 percent earlier this month, and are no longer pricing in a 100 percent chance of a hike even by December.

Against that backdrop, the dollar dropped 2.09 percent against the yen on Wednesday, its biggest fall since July 29 last year.

It fell to a three-week low of 110.53 yen early on Thursday before bouncing back slightly to 111.25 yen JPY=, up 0.5 percent from late U.S. levels on bargain-hunting by Japanese investors.

The yen gave a limited response to data showing Japan's GDP grew an annualized 2.2 percent in the first quarter, handily beating economists' forecast of 1.7 percent rise.

"Although the headline GDP was stronger than expected, the GDP deflator was deeper into negative, pointing to persistent deflationary pressure," said Minori Uchida, chief currency analyst at the Bank of Tokyo-Mitsubishi UFJ.

The euro EUR= hit a six-month high of $1.1174 and last stood at $1.1143, down 0.1 percent on the day.

"My feeling is that the current level of the euro is too high, and isn't sustainable based on fundamentals, when U.S. growth and the economy are not so bad, so I'm feeling that the current levels are a very good chance to sell the euro against the dollar," Brown Brothers Harriman's Murata said.

"I'm guessing that some ECB officials will speak up about euro strength having a downside for the eurozone economy," he added.

The Swiss franc CHF= hit a six-month high of 0.9772 to the dollar on Wednesday before easing back to 0.9805.

Against the euro, to which the Swiss currency is closely tied, the franc firmed to 1.0923 franc per euro EURCHF= from last week's eight-month low of 1.0988.

(Reporting by Hideyuki Sano; Additional reporting by Lisa Twaronite in Tokyo; Editing by Eric Meijer)

________________

ENERGY

EDC. WEEKLY COMMENTARY. May 18, 2017. The Crude Truth About the Oil Market

By Peter G Hall, Vice President and Chief Economist

Global oil prices are on the move again. Market watchers would be quick to say that that’s nothing new, given swings that can occur on a daily or weekly basis. But the recent $8 drop in West Texas Intermediate crude revived fears that a steeper drop could be in the works. Producers don’t seem satisfied that the recent range will hold; no doubt they are jaded by the wide gyrations of the past three years – or longer. At the same time, a broader audience is looking at the effect of crude oil’s latest movements on our dollar, and wondering where things are headed. Are prices settling into a range, or can we expect further shifting?

If the past two decades have taught this industry something, it’s that price forecasts are very hard to get right. Careers have been established – and obliterated – by crude price calls. Fifteen years of price stability at the mid-$20 level stretching through 2002 duped analysts into believing the industry had achieved some sort of ‘new normal’. The unabated price runup that followed changed that thinking, with the focus switching to the insatiable demand of emerging markets. Zap forward to late 2007, and the ‘new normal’ was more like $100. Then it got really wild. Prices rocketed up to $150 by mid-2008, and the calls for $200 by year-end started to come in.

The Great Recession put paid to those calls. Red-faced pundits had to concede that the early-2008 spike was momentary, as they drafted together a set of reasons explaining the year-end price of just $35. Funny thing, for a brief moment, that level was tagged as our new reality. Prices did revive in short order, though, rising to a more defensible $75 per barrel and staying there for a little over a year. What then happened came as a bit of a shock: despite weakened post-recession demand, prices moved back into the $90-$100 range, and stayed there for three-and-a-half years. That kind of stability convinced market watchers that this indeed was the ‘true new normal’ that had eluded us. Others concluded that if tepid world growth could yield these sorts of prices, that eventual revival would push them even higher. The bulls were out again!

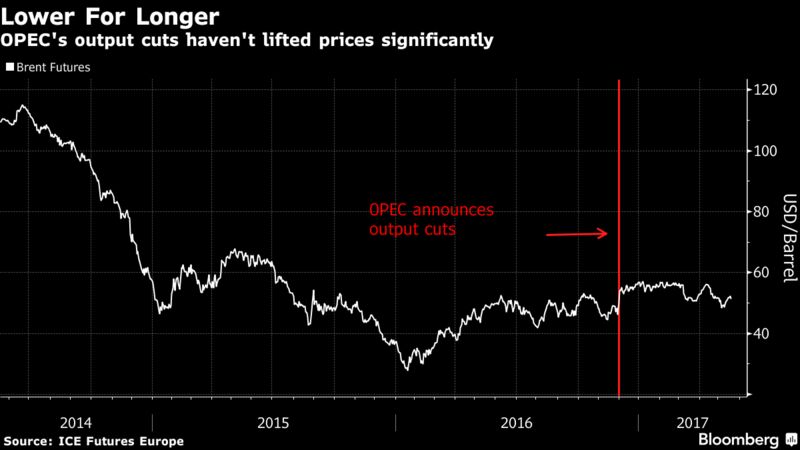

What then happened was, in general, a shocker. Prices plunged precipitously from mid-2014 to a shocking $25 per barrel in January, 2016. They revived to the $50 range by mid-2016, a relief for the industry, but a level that still required a lot of adjustment. Prices looked stable until recently (oh no – not another ‘new normal’?). So…where to from here?

For some perspective on the two-decade roller-coaster ride, a little history. The price rise in the early 2000’s was likely spurred by a combination of emerging market demand and adjustments in developed markets’ consumption patterns brought on by low prices. The price spike was fed first by broad fears that supplies were structurally short, with no near-term remedy, and then by market speculation. Recession fixed those fears, but only briefly. Stimulus – initially government spending, and then quantitative easing (QE) – re-ignited prices and kept them artificially high through mid-2014. The return of growth ended the need for QE, and as the taps were turned off, a key support for commodity prices was removed. The market was left to fend for itself, and in the freefall, one by one market attempts to support prices failed.

Why? High prices spurred lots of investment in technology and key projects around the world. As output increased, it became obvious that supply was once again well ahead of demand, as far as anyone could reasonably see into the future. It now seems that US shale is the global swing producer, with lots of supply ready to come back into market at about the $60 level. Behind that are other global projects and investment plays, delayed for now but ready for the green light if prices rise. That sounds a lot like an argument for the current range being a new normal. Well, it may persist for awhile, but if we are right in thinking that there is near-term upside potential for global growth, then upward revisions to demand – and prices – would naturally follow.

The bottom line? Crude oil prices are likely range-bound in the mid-$50 per barrel range for now. Our forecast calls for an average of $54 this year and $57 in 2018. As such, we believe the recent swoon to be short-lived. But today’s range is no new normal. The current upshift in global demand will ultimately do the same for crude prices.

The Globe and Mail. Reuters. May 18, 2017. Oil falls as market stays well supplied despite cuts

CHRISTOPHER JOHNSON

London — Oil prices fell on Thursday on signs that the market remained well supplied with crude despite efforts by OPEC and other big exporters to curb production and support prices.

Signs of a deepening political crisis in Washington accelerated the decline in prices with investors becoming increasingly cautious following the latest reports of links between Russia and the team in the White House.

Brent crude fell $1.10 a barrel to a low of $51.11 and was trading around $51.30 by 1050 GMT. U.S. crude oil was 84 cents a barrel lower at $48.23.

Traders said news that the campaign to elect President Donald Trump last year had at least 18 undisclosed contacts with Russians had unsettled investors.

“Sentiment is fragile so it does not take much to rock the boat even further,” said Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank. “This is a general risk-off move.”

Both crude oil benchmarks rose on Wednesday after news of a drawdown in U.S. crude inventories and a dip in U.S. output. The U.S. Energy Information Administration said inventories fell 1.8 million barrels in the week to May 12 to 520.8 million barrels.

But the U.S. crude drawdown was smaller than expected and the oil market remained extremely well supplied, analysts said.

A surplus of U.S. supply has led to large volumes of crude being exported from the United States to northern Asia, undermining the OPEC-led efforts to tighten the market.

The Organization of the Petroleum Exporting Countries and other producers including Russia pledged to cut output by almost 1.8 million barrels per day (bpd) in the first half of 2016, a deal likely to be extended until the end of March 2018.

Other producers have been quick to fill any supply gaps.

Shipping data in Thomson Reuters Eikon shows that U.S. crude exports to Asia have soared from a handful of tankers a quarter throughout 2015 and 2016 to 10 tankers in the first quarter of 2017 and that figure is expected to rise.

OPEC ministers meet in Vienna on May 25 to decide production policy for the next six months and are expected to prolong their agreement to limit production, perhaps by up to nine months.

UBS oil analyst Giovanni Staunovo said he saw a 60 per cent probability of OPEC extending output cuts. That should help tighten the oil market and push up prices as demand rises gradually this year, he said.

REUTERS. May 18, 2017. Canadian dollar dips, weighed by lower oil prices

TORONTO (Reuters) - The Canadian dollar edged lower on Thursday against its U.S. counterpart as oil prices fell, while political uncertainty in Washington weighed further on stocks.

U.S. crude oil prices CLc1 fell 1 percent to $48.58 on signs that the market remained well supplied with crude despite efforts by the Organization of the Petroleum Exporting Countries and other big exporters to curb production and support prices.

A selloff in U.S. stocks looked set to extend into its second day as a series of scandals cast a shadow over Donald Trump's presidency and the future of his pro-growth agenda.

Safe-haven currencies, such as the yen and the Swiss franc, have outperformed on the political uncertainty at the expense of commodity-linked currencies like the Canadian dollar, which are more sensitive to the outlook for global growth.

At 9:23 a.m. ET, the Canadian dollar CAD=D4 was trading at C$1.3613 to the greenback, or 73.46 U.S. cents, down 0.1 percent, according to Reuters data.

The currency traded in a range of C$1.3582 TO C$1.3669. On Wednesday it touched its strongest in nearly three weeks at C$1.3573.

Foreign investment in Canadian securities amounted to C$15.1 billion in March, led by buying of corporate instruments, Statistics Canada said.

Canadian government bond prices were mixed across a flatter yield curve, with the two-year CA2YT=RR down 1 Canadian cents to yield 0.664 percent and the 10-year CA10YT=RR climbing 12 Canadian cents to yield 1.439 percent.

Canadian inflation data for April and retail sales data for March are due on Friday.

(Reporting by Fergal Smith; Editing by Nick Zieminski)

BLOOMBERG. 2017 M05 18. OPEC Loses Power of Surprise as Majority Back Cuts Extension

by Alex Longley and Steve Voss

- Group meets May 25 to decide whether to continue output curbs

- Most members have already said they would extend current deal

- Emirates NBD's Bell Sees Bloated Oil Market

With a week to go until OPEC meets to discuss the group’s production policies, a majority of the group’s members have already set out their positions: they want to extend a round of oil output cuts to eliminate a glut.

Seven out of 13 members of the Organization of Petroleum Exporting Countries -- representing 84 percent of the producer club’s collective output -- have publicly stated support for continuing their supply curbs. Their pronouncements may diminish the impact of the meeting if it does go as planned.

“The communication has been very clear,” said Jan Edelmann, a commodity analyst at HSH Nordbank AG. “So the actual meeting might be a bit of a non-event.”

OPEC’s meeting is still the most anticipated event for oil-watchers since the group announced its production cuts on Nov. 30 in an effort to end a three-year glut and steady the market. The curbs, in place since the beginning of the year, have failed to sustain higher prices as U.S. competitors have increased supplies. In response, OPEC and its allies are signaling that they won’t let up in their efforts.

OPEC members Saudi Arabia, Iraq, Iran, the United Arab Emirates, Kuwait, Venezuela and Algeria have said they back some sort of extension of output cuts, or would do so if other members do. Those nations, which include the club’s six biggest producers, in April pumped a combined 26.6 million barrels a day, according to the group’s secondary source data. The current deals allows Iran to increase production and exempts two other members, Libya and Nigeria.

Meanwhile, four of the 11 non-OPEC nations that joined supply cuts -- Russia, Azerbaijan, Oman and South Sudan -- have said they would also support extending the curbs. Last month they collectively produced 12.9 million barrels of crude a day, data from the Paris-based International Energy Agency show. Russia accounts for 85 percent of that output.

Some other nations now cutting supplies haven’t yet stated their positions. Kazakhstan, which is trying to increase production at its giant new Kashagan field, won’t automatically extend its current cuts, its energy minister has said.

Prices Stalled

Oil analysts say that even though some producers have shown willingness to prolong production cuts, the market wants to see that those nations actually comply with an extension before a meaningful price increase occurs.

“People are going to be judging the result of producer action in the data,” Harry Tchilinguirian, head of commodities strategy at BNP Paribas SA in London, said by phone. “It’s for the market to take stock of the fact that there are logistical lags.”

Brent crude, the global benchmark, traded at $51.89 a barrel at 3 p.m. in London. It has moved within a band of about $12, with a high above $58 a barrel, since the output cuts were announced late last year.

Hedge Fund Losses

Speculators amassed the equivalent of more than a billion barrels of long positions in oil when OPEC and other nations agreed to cut production late last year. That led some of the market’s biggest hedge funds to incur heavy losses on bullish bets as inventories globally struggled to draw down. Weakness in both the U.S. and the North Sea markets sparked a price sell-off at the end of April, and hedge funds have pared record bets on crude prices rallying.

Still, some Wall Street banks expect higher prices later in the year, with Goldman Sachs Group Inc. and Citigroup Inc. saying earlier this month that now is the time to buy oil. OPEC will probably achieve its goal of returning inventories to their five-year average if it extends cuts by nine months, according to Bloomberg calculations.

It remains to be seen how OPEC and its allies will proceed. Most participating nations back a nine-month extension, Algerian Energy Minister Noureddine Boutarfa said in Moscow Thursday. Saudi Arabia and Russia earlier this week said they favored such an agreement. The next day, Iraq said it would back a six-month extension and is committed to reducing its share of output. Russian Energy Minister Alexander Novak has also indicated that as many as five additional countries might be brought into the production accord.

“Just about all uncertainties have dissipated and barring some unforeseen event it looks as though the 24-country agreement is set for perhaps a nine-month extension,” Citigroup analysts including Chris Main wrote in a report. “Any surprise would likely come from an effort to deepen agreed cuts.”

________________

BOMBARDIER

The Globe and Mail. Reuters. May 17, 2017. U.S. opens probe into Boeing's dumping claims against Bombardier

DAVID LAWDER

WASHINGTON — U.S. government officials on Thursday are set to begin investigating Boeing Co’s unfair trade claims against Canadian rival Bombardier, a two-track action that could lead to U.S. duties on Bombardier’s new jetliner and also pits Boeing against Delta Air Lines Inc.

The U.S. Commerce Department is poised to announce the launch of its investigation. U.S. International Trade Commission (USITC) staff will hear testimony from both companies and from Bombardier customer Delta in the case.

Boeing alleges that Bombardier’s new 100-150 seat C Series jetliners are being dumped below cost in the U.S. market and are unfairly subsidized by Canadian taxpayers. Delta agreed last year to buy dozens of C Series planes at a price that Boeing says was well below Bombardier’s cost and risks eroding future sales of its 737 and new 737 MAX narrowbodies.

Bombardier has countered that the petition would have a serious impact on airlines, innovation and competition in the aerospace industry.

The case has increased trade tensions between the United States and Canada - along with disputes over Canadian softwood lumber and U.S. milk protein products - as both countries prepare for a possible renegotiation of the North American Free Trade Agreement under the “America First” trade policy of U.S. President Donald Trump.

The Commerce Department is expected to proceed with the anti-dumping and anti-subsidy claims, trade lawyers and experts said.