CANADA ECONOMICS

BRAZIL

BLOOMBERG. 2017 M05 25. Brazil’s Car Wash Scandal Reveals a Country Soaked in Corruption. What may be the largest corruption case in modern history runs deep in Latin America’s largest country.

by Tim Padgett

In U.S. history, entire cities and states have been branded corrupt: Think Richard J. Daley’s Chicago or Huey Long’s Louisiana. But amid even the worst federal scandals, Watergate included, the country has never been nationally profiled as crooked—a venal society from coast to coast, from dogcatcher to commander-in-chief.

Brazil feels that way right now, largely the result of a bribery scandal of Amazonian proportions known in Portuguese as Lava Jato, or Operation Car Wash, believed to be the largest corruption case in modern history. The multibillion-dollar tsunami of sleaze barreling through Latin America’s largest country and economy is deeper and broader than any Trump-Russia allegations pouring out of Washington. And it could force the resignation of Brazilian President Michel Temer, who’s been fingered repeatedly in recent weeks for allegedly orchestrating and receiving millions of dollars in bribes.

The 76-year-old conservative denies the accusations—his lawyer, laughably, says Temer is too old to have to answer them—but he’s not the only Brazilian president under the interrogation lamp. His predecessor, Dilma Rousseff, who was impeached and removed from office last year, and her predecessor and mentor, Luiz Inácio “Lula” da Silva, are also alleged to have received tens of millions of dollars in graft.

Most Brazilians hope Lava Jato will be a crossroads for change. But sadly, that’s been said of most Brazilian scandals

They, too, deny it—but it hardly stops with them. Eight of Temer’s cabinet ministers are under investigation. So are powerful senators such as Aécio Neves, who narrowly lost the 2014 presidential election. The head of Brazil’s Chamber of Deputies, Eduardo da Cunha—who was shameless enough to hide some of the $40 million in bribes he pocketed in a religious shell company called Jesus.com—was convicted in March and sentenced to 15 years in prison. He has appealed the verdict.

Hundreds more legislators, governors, mayors, political bosses, and business executives are caught up in Lava Jato (named for a Brasília gas station where some of the payoff cash was laundered). They’re part of an epic network of bribes, kickbacks, hush money, and money laundering focused mainly on Brazil’s state-run oil company, Petrobras. Its executives, as well as such politicians as da Cunha, took bribes from businesses in exchange for greatly inflated Petrobras work contracts.

Since the scheme was detected three years ago, prosecutors have yet to reach bottom in their investigation—and the total sum of payoffs may exceed $5 billion. The criminality may also cost Petrobras, South America’s largest corporation, $13 billion in contract losses and legal settlements, and it’s already resulted in the layoff of thousands of Petrobras workers. Meanwhile, Odebrecht, the Brazilian construction giant that led the bribery bacchanal, is a disgraced and crumbling conglomerate. Its boss, Marcelo Odebrecht, was sentenced last year to 19 years in prison. He’s now a key witness and negotiating a lighter sentence. “This is a tense moment in our history,” Sérgio Moro, the federal judge heading the Lava Jato prosecution, said recently. “It is a crossroads.”

Moro and most Brazilians hope Lava Jato will be a crossroads for change. But sadly, that’s been said of most Brazilian scandals—which were then followed by even bigger ones. The 1992 corruption impeachment of President Fernando Collor de Mello for influence peddling was supposedly such a crossroads. But a decade later, during Lula’s presidency, came the Mensalão scandal, in which Lula’s Workers’ Party paid deputies and senators $50 million to sway legislation.

Mensalão should have been a turning point, too, especially since Lula’s chief of staff, José Dirceu, was sentenced to 32 years for his involvement—perhaps the first time in Brazil’s history that a high-ranking crooked official heard a cell door close behind him. (Dirceu is appealing the sentence.) But then came Lava Jato, as well as last year’s $2.5 billion federal pension fund scandal and the financial chicanery that tainted Brazil’s 2014 FIFA World Cup and Rio de Janeiro’s 2016 Summer Olympics.

And did I mention the just-as-appalling rot at state and local levels? Many lower-ranking public servants enjoy what Brazilians call O Trem da Alegria—the Joy Train—an embezzlement locomotive that can make overnight millionaires out of backwater bureaucrats such as Lidiane Leite.

When Leite became mayor of the northeastern town of Bom Jardim in 2012, she put the Joy Train in high gear. She gave herself an astronomical raise, bought a Toyota SUV, went on lavish shopping sprees, and attended Champagne parties, bragging about it on social media. Investigators say she pilfered as much as $4 million—a big reason kids in Bom Jardim went without school lunches. After being jailed briefly in 2016, Leite was convicted this year. But her sentence included only a fine and suspension from political activity, not prison time.

Cases like Leite’s are common in Brazil. I once interviewed a small-town mayor in Rio de Janeiro state who rode the Joy Train to make $264,000 a year—then twice the salary of Brazil’s president. Those minor league outrages help explain why major league catastrophes such as Lava Jato never become meaningful crossroads for Brazil’s 208 million people. It’s because corruption is the road in Brazil—a default path that experts estimate costs the country as much as 5 percent of its $2 trillion gross domestic product every year.

“When you think you’re headed to a different Brazil,” says Brazilian-born writer Juliana Barbassa, who investigated questionable spending for the Rio Olympiad, “you usually end up in the same Brazil.”

To understand why, you have to reach back two centuries, to when the country was a monarchy. In 1807, Napoleon’s Iberian invasion forced the Portuguese royal court into exile in Brazil, its colony at the time. The king returned to Lisbon in 1821. But when Brazilians declared independence a year later, they made his son who’d stayed behind their head of state: Emperor Dom Pedro I.

Brazil’s royal rule lasted until 1889. It helped Brazil avoid the civil warfare that plagued fledgling republics such as next-door Venezuela. But it also meant that for its first 67 years, the nation lived under a courtly system based less on public institutions than on personal favors. That bred three cancers, which, while widespread in Latin America, seem most malignant in Brazil.

The first is an incestuous relationship between business and a government run by a chaotic array of political parties. When Brazil became a republic, the palms to be greased now belonged to deputies in congress instead of dukes in castles. Public ethics rarely if ever took root because graft continued to be the accepted public ethos. Lava Jato is simply the latest, largest tumor to grow from that reality. Executives at the meatpacking company JBS SA tell Brazil’s high court that the multimillion-dollar bribes they paid Planalto, the Brasília presidential palace, got them dirt-cheap loans from the state development bank JBS might not have been eligible for otherwise.

The second is staggering economic inequality. The monarchy created a caste structure (Brazil was the last country in the Americas to abolish slavery, in 1888) that kept wealth locked in the hands of the elites who were paying and receiving all those bribes and kickbacks. That squalid arrangement still exists—and it’s a big reason a recent University of Brasília study shows less than 1 percent of Brazil’s population still owns almost half its GDP.

And third, a monstrously bloated bureaucracy. The parasitic royal courtiers of Brazil’s 19th century morphed into the parasitic civil servants of its 20th. And, like Leite, they’re alive and well in the 21st, cadging outrageously inordinate salaries and pensions that drain two-thirds of all public revenue. Yet their performance hardly reflects their pay: In Brazil it takes four months of red tape just to get approval to start a business.

Granted, Moro’s aggressive Lava Jato prosecution spawns hope that at least the serial impunity associated with Brazilian corruption might be ending. Ironically, the legacies of the most recent presidents are also encouraging: Lula put a dent in inequality, bringing some 40 million Brazilians into the middle class; Rousseff ordered the first real anticorruption campaign; Temer’s legislative agenda is a bureaucracy buster.

But it will take a generation or more before Brazil’s future finally overpowers its history, before the ghost of Dom Pedro is finally exorcised from the country.

Padgett is Americas editor at Miami NPR affiliate WLRN.

(Corrects the identification of Brazil as the only new world monarchy in the 14th paragraph.)

________________

STATISTICS HIGHLIGHTS

StatCan. 2017-05-26. Dairy statistics, March 2017

The volume of milk and cream sold in March was 236 595 kilolitres, a decrease of 2.5% from March 2016.

Sales of milk in March decreased 4.0% from the same month a year earlier to 202 815 kilolitres, while cream sales increased 7.9% to 33 780 kilolitres.

Variety cheese stocks on April 1 were at 37 143 tonnes, up 4.4% from the same day a year earlier.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170526/dq170526b-eng.pdf

________________

ENERGY

The Globe and Mail. May 26, 2017. OPEC’s ‘Deflategate,’ the Saudi-Russia bromance and the loonie

MICHAEL BABAD, Columnist

Briefing highlights

- What OPEC-Russia deal could mean

- Oil prices inch up after drop, then fade

- Markets at a glance

- G7 leaders meet in Italy

- U.S. economy grows at tepid 1.2%

- BlackBerry gains $125-million more in Qualcomm settlement

‘Deflategate’

There’s a lot to play out still before markets can gauge the longer-term impact of OPEC’s “Deflategate” on oil prices and the loonie.

Crude prices rose slightly after Thursday’s dive, though are fading again, and the Canadian dollar is inching up again after the OPEC-induced slump.

The loonie had been on something of a roll, if you consider heading back up toward three-quarters of a dollar to be a roll, but then fizzled along with crude, trading so far today between a low of 74.09 cents (U.S.) and a high of 74.44 cents.

This comes after OPEC and non-OPEC producers agreed Thursday to extend their oil output caps by nine months.

Saudi Arabia and Russia had flagged that earlier, so Thursday’s agreement was no surprise. But some had been looking for a lower and/or longer cap, deflating crude prices, which remain down today.

The Canadian dollar, as always, marched to oil’s drummer, having been stronger after less-dovish talk from the Bank of Canada on Wednesday.

“The loonie has been a very good proxy for trading the declining oil story, given that the post-BoC rally in CAD opened the door for interesting top selling opportunities, and traders clearly jumped on the occasion,” said London Capital Group senior market analyst Ipek Oskardeskaya, referring to the Canadian dollar by its symbol.

“Now, it is the same old story,” she added.

“The market was fundamentally disappointed with the OPEC’s nine-month extension plan, and the selloff that hit the oil markets posterior to the OPEC statement could extend, keeping the downside pressure high on the loonie. The 73-cent level appears to be a reasonable target in the coming weeks.”

Part of the problem was the lack of any surprise in yesterday’s pact between OPEC, Russia and the others. The market also wants to see “firming fundamentals,” said Royal Bank of Canada and other observers.

“After Saudi Arabia and Russia announced plans to extend the output agreement by nine months a week and a half ago, expectations had been building going into [Thursday] of an even longer or deeper cut,” said Helima Croft, RBC’s head of commodity strategy in New York.

“Thus, there was no repeat of November’s surprising statement, which contained a much greater degree of specificity (individual country targets) than anticipated,” she added in a report titled “OPEC Deflategate.”

She noted that the Saudi and Russian energy ministers, Khalid al-Falih and Alexander Novak, had been “joined at the hip” for two days through Thursday’s developments.

“They will reunite next week for the St. Petersburg forum; this budding ‘bromance’ marks a clear policy shift on the Russian side,” Ms. Croft said.

“Just two years ago, Novak took to the stage at the OPEC seminar and firmly ruled out co-operation with the organization and even questioned its relevance in the face of U.S. production,” she added.

“Both al-Falih and Novak denied that non-oil market factors (mainly the planned IPO of Saudi Aramco and the March, 2018, Russian elections) played any role in their decision to keep the cuts going until April. However, we continue to contend that they likely did influence the men that they both work for.”

Commodity strategist Michael Tran, Ms. Croft’s colleague at RBC, said the deal should help anchor oil prices in the low $50-a-barrel range, with the potential for West Texas intermediate, the U.S. benchmark, to move to the mid– to high-50s in the second half of the year.

“Months of blatantly clear, global stock draws and prices back in the high $50-a-barrel range may incentivize financially fragile countries to float additional barrels,” Mr. Tran said.

“Alternatively, compliance fatigue could set in if months of status quo strong compliance fails to draw down stubborn inventories and U.S. production continues to surprise to the upside, leaving prices stuck in neutral,” he added.

“Commitment from the cartel is steadfast but sentiment remains fleeting. Only once there is unequivocal evidence of firming fundamentals can OPEC fully regain the narrative.”

The Globe and Mail. Reuters. May 26, 2017. Oil edges up after dip on disappointing OPEC meeting outcome

KAROLIN SCHAPS

LONDON — Oil prices edged back up on Friday after a 5 per cent fall in the previous session on disappointment that an OPEC-led decision to extend current production curbs did not go deeper.

At Thursday’s meeting in Vienna the Organization of the Petroleum Exporting Countries and some non-OPEC producers agreed to extend a pledge to cut around 1.8 million barrels per day (bpd) of output until the end of the first quarter of 2018. The initial agreement would have expired next month.

Producers have expressed confidence that this plan will bring down crude oil stocks to their five-year average of 2.7 billion barrels but the market had hoped for a last-minute agreement on more far-reaching action.

“The problem is that investors look at the impact today, while OPEC focuses on reaching stability in the coming six to nine months, so the long squeeze yesterday was overdone a bit,” said Hans van Cleef, senior energy economist at ABN Amro.

Clawing back some of Thursday’s losses, global benchmark Brent futures were up 17 cents at $51.63 a barrel at 1103 GMT.

U.S. West Texas Intermediate (WTI) crude futures remained below $50, at $49.05, though up 15 cents from their last close.

“The front of the curve declined the most, which at least for now implies that the market doesn’t quite believe that a tightening and/or backwardation is really coming,” said analysts at JBC Energy.

Concerns remain that OPEC-led production cuts will only stimulate a further rise in output from the United States, where producers can operate at much lower costs.

Ann-Louise Hittle, vice president at energy consultancy Wood Mackenzie said the decision in Vienna sent a signal of continued support for oil prices from OPEC which helped U.S. onshore drillers make plans to further raise their production.

U.S. oil production has already risen by 10 per cent since mid-2016 to over 9.3 million bpd, close to the output of top producers Russia and Saudi Arabia.

With U.S. output rising steadily and OPEC and its allies potentially raising production in 2018 to regain lost market share, many traders, including Goldman Sachs, already expect another price slump.

Other assessments pointed to the possibility of output cuts being extended into 2019 in order to bring down both crude oil and refined product stocks.

“Output controls will eventually be extended at least until the end of 2018, and more likely than not into 2019 ... At this pace, it will not be until at least the end of 2018, or indeed, 2019, when surplus inventories can be eliminated,” said analysts at Deutsche Bank.

REUTERS. May 26, 2017. Oversold: Oil traders punish OPEC for promising too much

By Dmitry Zhdannikov, Rania El Gamal and Ernest Scheyder

VIENNA (Reuters) - As OPEC's latest meeting wrapped up in Vienna on Thursday night, ministers congratulated each other on its rare spirit of amity and consensus. The talks were, without a doubt, a success.

But two hours later, one veteran delegate was staring in despair at the numbers flashing red on his smartphone showing crude down some 5 percent to $51 a barrel.

"That is a disaster," he said.

While OPEC has worked hard in recent years on improving communication to ensure the right message is delivered to financial markets, Thursday's experience showed the 14-member group and its non-OPEC allies still have a long way to go.

The problem was not what was delivered, but what appeared to have been promised beforehand, industry analysts said.

OPEC agreed on Thursday to extend its existing production cuts by nine months - more than the initially suggested six months - in tandem with non-OPEC producers, including Russia.

But hints from the group that it could deepen supply cuts, extend them by as long as 12 months, curtail exports and tell the market how exactly it would terminate supply curbs in 2018 had raised market expectations much higher.

"OPEC oversold the meeting to the market way too early," Amrita Sen, from the consultancy Energy Aspects, told Reuters in Vienna.

The market reaction was all the more disappointing given that from OPEC's perspective, the meeting went very well.

"I have been in OPEC close to 20 years. It's the first time that I witness 100 percent compliance (with cuts) from OPEC and close to 100 percent from non-OPEC," Iranian Oil Minister Bijan Zanganeh told Reuters afterward.

OPEC's No.3 producer, Iran has repeatedly clashed in past meetings with OPEC's de-facto leader, its political arch-rival Saudi Arabia.

Russia, which effectively is fighting a proxy war with Saudi Arabia in Syria, said on Thursday its energy cooperation with Riyadh would last well into the future.

In its statement, OPEC said it could extend curbs further or cut more.

Normally, all this would be more than enough to trigger a bull rally.

"It's strange. I don't know why (the market crashed)" Zanganeh said.

WHATEVER IT TAKES

OPEC and non-OPEC oil producers first agreed to cut output in December 2016 - the first joint deal in 15 years - and said the curbs could be extended by a further six months.

The extraordinary move was aimed at battling a global glut of crude that halved prices from 2014, forcing Russia and Saudi Arabia to tighten their belts and leading to unrest in Venezuela and Nigeria.

The cuts helped push oil prices back above $50 per barrel but also spurred growth in the U.S. shale industry, which does not participate in the output deal. That slowed a rebalancing of supply and demand, with global inventories still near record highs.

As the price fell back towards $47 in early May, near a six-month low, Saudi Energy Minister Khalid al-Falih said OPEC would do "whatever it takes" to rebalance the market, including a longer extension for the output cuts.

"If you declare nine months in advance, people are bound to expect more," Sen said. Russia also added to the expectations by saying this week that cuts could be prolonged by 12 months.

The market was also disappointed OPEC did not mention its previously stated plan to bring stocks down from a record high of 3 billion barrels to their five-year average of 2.7 billion, said Olivier Jakob from the Petromatrix consultancy.

"The December meeting was a breakthrough," he said. "The meeting yesterday gives us, however, a feeling that OPEC is fatigued by the lack of results so far and does not have a consensus anymore to have the five-year average in stocks as a policy target."

The fact that Iran, Libya and Nigeria remain exempt from cuts suggested OPEC was not yet ready to take additional measures, Jakob added.

Dave Pursell, managing director at Tudor, Pickering, Holt & Co, a Houston-based bank working with U.S. shale producers, predicted markets would rebalance within six months.

"The market was hoping for deeper cuts," he said. "But I do think oil prices, three months from now, will be higher than they are now."

(Writing by Dmitry Zhdannikov; Editing by Dale Hudson and Sonya Hepinstall)

REUTERS. May 26, 2017. OPEC ponders how to co-exist with U.S. shale oil

By Ernest Scheyder

VIENNA (Reuters) - First, they ignored each other. Then, they went into a bruising fight. Finally, they are talking, albeit with opposing agendas.

The history of the relationship between OPEC and the U.S. shale oil industry has evolved a great deal since the cartel discovered it had a surprise rival emerging in a core market for its oil around five years ago.

U.S. shale bankers came to Vienna this week and OPEC is readying a trip for its top officials to Texas in a bid to understand whether the two industries can co-exist or are poised to embark on another major fight in the near future.

"We have to coexist," said Khalid al-Falih, Saudi Arabia's energy minister, who pushed through OPEC production cuts in December, reversing Riyadh's previous strategy to pump as much as possible and try to kill off U.S. shale with low oil prices.

OPEC and non-OPEC countries led by Russia agreed on Thursday to extend oil output curbs by nine months to March 2018, keeping roughly 2 percent of global production off the market in an attempt to boost prices.

But OPEC now realizes supply cuts and higher prices only make it easier for the shale industry to deliver higher profit after it found ways of slashing costs when Saudi Arabia turned up the taps three years ago.

In the Permian Basin - the largest U.S. oilfield - Parsley Energy Inc (PE.N: Quote), Diamondback Energy Inc (FANG.O: Quote) and others are pumping at the fastest rate in years, taking advantage of new technology, low costs and steady oil prices CLc1LCOc1 to reap profits at OPEC's expense.

OPEC's latest calculus acknowledges the global clout of shale but seeks to hinder its growth by keeping just enough supply on the market to hold prices below $60 per barrel.

"All shale companies in the U.S. are small companies," said Noureddine Boutarfa, who represented Algeria at the meeting. "The reality is that at $50 to $60 a barrel, (the U.S. oil industry) can't break beyond 10 million barrels per day."

That is the level many analysts estimate U.S. oil production will reach next year, in what would be a 1 million bpd rise, a staggering jump for an industry marked during 2015 and 2016 by scores of bankruptcies and thousands of layoffs after a two-year price war with OPEC.

Still, that extra volume may not be enough to meet rising global demand or offset natural declines in traditional oilfields, which OPEC is banking on.

"For all OPEC members, $55 (per barrel) and a maximum of $60 is the goal at this stage," said Bijan Zanganeh, Iran's oil minister. "So is that price level not high enough to encourage too much shale? It seems it is good for both."

Some OPEC members seem keen to show they have shed any prior naivete about shale, making it a key topic during Thursday's meeting after barely mentioning it before. Shale's limitations, including rising service costs, also were discussed.

"We had a discussion on (shale) and how much that has an impact," said Ecuador Oil Minister Carlos Pérez. "But we have no control over what the U.S. does and it's up to them to decide to continue or not."

Mark Papa, chief executive of Permian oil producer Centennial Resource Development Inc (CDEV.O: Quote), was asked by OPEC delegates to give a presentation on shale's potential last week. He appeared to have played his cards close to his chest.

"In terms of the threat, we still don't know how much (U.S. shale) will be producing in the near future," Nelson Martinez, Venezuela's oil minister said after the talk.

WARNING FOR SHALE

By the same token, some U.S. shale leaders may also want a better insight into OPEC thinking and help OPEC understand that shale is not a flash in the pan.

"OPEC looks at shale and it scoffs," said Dave Purcell of Tudor, Pickering, Holt & Co, a U.S. shale investment bank that attended the OPEC meeting for the first time. "There's a rational skepticism globally, but it misses the mark."

For example, the UAE Energy Minister Suhail bin Mohammed al-Mazroui said he did not believe U.S. oil production would rise by 1 million bpd next year.

Some of OPEC's customers are happy to see an alternative. India, the world's third-largest oil consumer, said this week it is looking to the United States for greater supply.

"The new normal has to be accepted," Dharmendra Pradhan, India's energy minister said this week ahead of the OPEC meeting.

OPEC meets again in November to reconsider output policy. While most in the group now appear to believe that shale has to be accommodated, there are still those in OPEC who think another fight is around the corner.

"If we get to a point where we feel frustrated by a deliberate action of shale producers to just sabotage the market, OPEC will sit down again and look at what process it is we need to do," said Nigerian Oil Minister Emmanuel Kachikwu.

(Additional reporting by Rania El Gamal, Ahmad Ghaddar, Dmitry Zhannikov, Alex Lawler, Shadia Nasralla; editing by Dale Hudson and Philippa Fletcher)

REUTERS. May 26, 2017. OPEC oil cut extension renews Asia's crude supply worries

SINGAPORE (Reuters) - The OPEC-led decision to extend a production cut to March 2018 disappointed financial investors, prompting an exit from oil futures markets, while refiners in Asia were mostly concerned with whether it meant they would need to go hunting for crude.

In Vienna, the Organization of the Petroleum Exporting Countries (OPEC) and some non-OPEC producers on Thursday extended a pledge to cut 1.8 million barrels per day (bpd) of output until the end of the first quarter of 2018.

Financial traders did not like what they heard, thinking it meant an ongoing oil glut. "The market voted with its feet", investment bank Jefferies said, dragging crude futures CLc1 LCOc1 down 5 percent to near $50 a barrel. [O/R]

In physical markets, however, where tankers can take weeks or months to deliver up to $100 million in crude oil, refiners want to know if they will be forced to search for new suppliers.

"This is a declaration of a strong will of OPEC as well as non-OPEC producers to tighten overall supply-demand," said Yasushi Kimura, president of the Petroleum Association of Japan, and chairman of petroleum conglomerate JXTG Holdings (5020.T: Quote).

To ensure crude supplies, "we need to carefully monitor OPEC's production cut adherence," Kimura said.

Crude is by far the biggest cost for refiners and the petrochemical industry, shaking margins DUB-SIN-REF whenever benchmark prices take broad swings.

Kimura said the extended cuts could mean demand may exceed supply in 2017, which would be the first time in years.

This would force refiners to start using up reserves, pushing up prices at least until production catches back up with consumption.

"In 2017, global demand is likely to exceed supply ... and crude prices are likely to ... rise toward $60 by the end of the year," JXTG Holdings' Kimura said.

REAL SUPPLY CUTS?

So far, though, the cuts that started in January have barely dented supply in Asia, home to three of the world's four biggest oil consumers.

Exporters were keen to maintain global market share, and they cut domestic supplies or shipments to marginal buyers. As a result, inventories in the big consumer markets have remained bloated, and prices low.

"We have (so far) not had any impact in terms of any cut from any of these (OPEC) sources into India," said B. Ashok, chairman of Indian Oil Corp (IOC.NS: Quote), the country's biggest petroleum company.

OPEC sources said that will change as top exporter Saudi Arabia especially is keen to see a visibly tighter market.

Many refiners, however, are still not expecting a real crude shortage, largely due to ample alternative supplies.

"Crudes that can be processed in our refineries include crudes from the U.S. We have procured some crude even from Canada. We have been procuring crude from Latin America ... Africa, Russia," Ashok said.

ALTERNATIVES AT A PRICE

U.S. producers have become a key alternative source of supply as their output - largely due to shale oil - has soared by 10 percent since mid-2016 to 9.3 million bpd C-OUT-T-EIA, close to Saudi Arabia's and Russia's levels.

These producers have been fast to fill OPEC's gap, with an average of 374,000 bpd of crude from the United States coming to Asia in the first four months of 2017, according to data compiled by Thomson Reuters Oil Research and Forecasts.

That compares with an average of just 48,000 bpd in 2016.

"The cut in OPEC supplies will be offset by higher U.S. crude production," said KY Lin, spokesman for Formosa Petrochemical Corp. (6505.TW: Quote), one of Asia's biggest refiners and petrochemical producers.

Still, most analysts including Goldman Sachs, Jefferies and Barclays, expect prices to gradually rise toward the beginning of 2018 as the market tightens.

While consumers may have to live with higher prices as OPEC and its allies hold back output, the longer the policy lasts, the more the cartel risks losing permanent market share.

"In response to ... OPEC production cuts we are working on diversification of crude oil import sources and looking beyond the Middle East," said Kim Wookyung, a spokeswoman at SK Innovation (096770.KS: Quote), owner of South Korea's largest refiner SK Energy.

(Reporting Osamu Tsukimori in TOKYO, Niha Dasgupta in NEW DELHI, Li Peng Seng in SINGAPORE, and Jane Chung in SEOUL; Writing by Henning Gloystein; Editing by Tom Hogue)

BLOOMBERG. 2017 M05 26. OPEC Insiders Reel After Key Minister Is Fired During Their Meeting

by Angelina Rascouet and Caroline Alexander

- Algerian oil minister learns of dismissal from news report

- Boutarfa was architect of OPEC, non-OPEC production cut deal

As OPEC ministers gathered in Vienna yesterday to agree a nine-month extension of their oil-supply pact, the man credited with bringing about the landmark deal learned from a news broadcast that he had been fired.

The story broke as Algerian Energy Minister Noureddine Boutarfa attended a closed session with counterparts early Thursday afternoon. First came an unconfirmed report from an Algerian TV station, according to delegates who were present. More than an hour later, the nation’s official APS news agency confirmed it.

Noureddine Boutarfa, Algeria's energy minister, speaks to journalists ahead of the 171st Organization of Petroleum Exporting Countries (OPEC) meeting in Vienna, Austria, on Wednesday, Nov. 30, 2016. After weeks of often tense negotiations, OPEC ministers gathering in Vienna expressed renewed optimism about salvaging a deal to cut oil production and prop up global prices.

It should have been a day of triumph for the man whose dogged diplomacy helped seal the historic alliance between producers of more than half the world’s oil, but the decision appears to have been far removed from events unfolding in Vienna. A day earlier, Algeria’s prime minister had been ousted, prompting a cabinet reshuffle that included the appointment of Sonelgaz Chief Executive Officer Mustapha Guitouni as energy minister.

In the job less than a year, Boutarfa was widely expected to keep his post following parliamentary elections earlier this month.

“For Boutarfa, I can’t see any viable explanation,” said Nacer Djabi, a political analyst and sociology professor at the University of Algiers. “All the indications were that he hasn’t failed in his mission.” The abrupt dismissal showed “flagrant disregard” for his accomplishments, he said.

The decision came amid growing concern about political stability in Algeria, where the collapse of oil prices has put a strain on the economy. The country’s 80-year-old president, Abdelaziz Bouteflika, is suffering ill health and has no clear successor.

Boutarfa was caught unawares. As the news swirled around OPEC’s Vienna headquarters, where representatives of allies including Russia were arriving to finalize a broader deal, the minister and his delegation kept mum. Once the official confirmation came, Boutarfa is said to have taken some of his peers aside and spoken to them personally. They in turn congratulated him for his achievement, officials said.

Boutarfa declined to comment for this article.

Representing one of OPEC’s smallest producers and coming from a country with little international clout, Boutarfa played a key role in a deal many had thought was impossible.

He rose to prominence in September when he hosted an extraordinary meeting in Algiers where OPEC reached a preliminary accord to curb production. Later, Russia and 10 other non-OPEC members joined the six-month pact that ultimately would take as much as 1.8 million barrels a day off the market.

Boutarfa enlisted support by shuttling between capitals, from Paris to Moscow to Baghdad, trips recorded on his ministry’s Facebook page. Finally he corralled the ministers in a luxurious but isolated hotel on the outskirts of Algiers over several days until they hammered out an agreement.

Boutarfa “had a big role in getting all the countries together and making the collaboration a success,” Issam Almarzooq, Kuwait’s oil minister, told Bloomberg News on Thursday.

The deal marked an abrupt u-turn from a Saudi-led policy to pump at full throttle. It meant clearing what at first seemed almost insurmountable hurdles -- the bitter rivalry between Saudi Arabia and Iran and the unwillingness of Iraq, Libya, and Nigeria, three producers champing at the bit to restore production they’d lost through internal conflict.

It was the first time OPEC agreed to curtail production in eight years, and would be their first collaboration with Russia -- the world’s biggest energy producer -- in 15 years.

“We appreciate all the efforts he put in while he was a minister with us at OPEC and we wish him good luck,” Suhail Mohammed Al Mazrouei, the energy minister for the United Arab Emirates, told Bloomberg after the meeting.

BLOOMBERG. 2017 M05 25. OPEC, Allies to Extend Oil Cuts for Nine Months to End Glut

by Wael Mahdi , Grant Smith , and Javier Blas

- Group prepared to do whatever is necessary, Al-Falih says

- Oil futures slump as ministers wind up meeting in Vienna

- OPEC Said to Extend Oil Production Cuts for Nine Months

OPEC and its allies extended oil production cuts for nine more months after last year’s landmark agreement failed to eliminate the global oversupply or achieve a sustained price recovery.

The producer group together with Russia and other non-members agreed to prolong their accord through March, but no new non-OPEC countries will be joining the pact and there was no option set out to continue curbs further into 2018. The market was unimpressed as prices tumbled more than 5 percent to under $49 a barrel in New York and more than a billion barrels were traded.

Six months after forming an unprecedented coalition of 24 nations and delivering output reductions that exceeded all expectations, resurgent production from U.S. shale fields has meant oil inventories remain well above the level targeted by OPEC. While stockpiles are shrinking, ministers acknowledged the surplus built up during three years of overproduction won’t clear until at least the end of 2017. The group is prepared for a long game.

"We’ve said we’ll do whatever is necessary,” Saudi Oil Minister Khalid Al-Falih said Thursday after the meeting in Vienna. “That certainly includes extending the nine months further. We’ll cross that bridge when we get to it.”

Al-Falih said the cuts are working, adding that stockpile reductions will accelerate in the third quarter and inventory levels will come down to the five-year average in the first quarter of next year. While he expects a “healthy return” for U.S. shale, that won’t derail OPEC’s goals and a nine-month extension will “do the trick,” he said.

Exemptions Remain

Nigeria and Libya will remain exempt from making cuts and Iran, which was allowed to increase production under the original accord, retains the same output target, Kuwait’s Oil Minister Issam Almarzooq said after the meeting. That deal gave the Islamic Republic room to increase output to a maximum of 3.797 million barrels a day.

The Joint Ministerial Monitoring Committee -- composed of six OPEC and non-OPEC nations -- will continue watching the market and can recommend further action if needed, said Almarzooq.

The market is already giving the committee plenty to think about. Futures dropped as low as $48.45 a barrel in New York on Thursday, before settling at $48.90.

"The market seems to be a bit disappointed as there is no ‘something extra,’” said Jan Edelmann, a commodity analyst at HSH Nordbank AG. “It seems as though OPEC fears letting the stock-draw run too hot.”

The Organization of Petroleum Exporting Countries agreed in November to cut output by about 1.2 million barrels a day. Eleven non-members joined the deal in December, bringing the total supply reduction to about 1.8 million. The curbs were intended to last six months from January, but confidence in the deal, which boosted prices as much as 20 percent, waned as inventories remained stubbornly high and U.S. output surged.

The extension prolongs a rare period of collaboration between OPEC and some of its largest rivals, including Russia. The last time both sides worked together was 15 years ago, and the agreement fell apart soon after it began. The current accord encompasses countries that pump roughly 60 percent of the world’s oil, but excludes major producers such as the U.S., China, Canada, Norway and Brazil.

Without a steer on what will happen beyond March, there’s concern that OPEC could return to the free-for-all production that caused prices to slump from 2014 to 2016, though Al-Falih has insisted the organization will maintain control.

“The fact that we have not elaborated on a specific strategy for the second quarter, the second half of 2018, should not be interpreted as that we don’t have a strategy,” he said. “We will develop it based on the conditions that present themselves at that time.”

Al-Falih earlier announced that OPEC is welcoming a new member, Equatorial Guinea, to its ranks. The African nation will be one of the group’s smallest producers, pumping about 270,000 barrels a day, a little more than neighboring Gabon. It was already participating in the cuts as a non-OPEC producer.

TD BANK. TD Economics. Analysis of economic performance and the implications for investors. The analysis covers the globe, with emphasis on Canada, the United States, Europe and Asia. May 26, 2017. OPEC and Non-OPEC Group Agree to Extend Production Cuts

FULL DOCUMENT: https://www.td.com/document/PDF/economics/special/OPEC_May2017.pdf

________________

HOUSING BUBBLE

The Globe and Mail. May 25, 2017. The case for not biting on Home Capital’s 3.1% GIC

ROB CARRICK

Life is stressful enough without worrying whether your investments are safe.

So if you’re a conservative GIC investor, take a pass on the excellent interest rates that Home Capital is using to attract money through its Home Trust, Home Bank and Oaken Financial operations. At midweek, Oaken offered 2.6 per cent on a one-year guaranteed investment certificate and 3.1 per cent on a five-year term. A five-year bond issued by the federal government yields about 1 per cent these days, while banks are posting five-year GICs in the area of 1.5 per cent.

Home Capital is in the business of lending money to home buyers using funds generated from savers putting money in its high interest savings account and GICs. The company’s recent troubles mean it must offer better rates to attract new money and hold onto funds invested in maturing GICs.

The rationale for ignoring these deals is in no way a comment on Home Capital’s chances of survival and future success. Rather, it’s based on the idea that the kind of person who traditionally gravitates to a GIC does so for a zero-stress investing experience. You may not get that with a GIC from Home Capital, even if its Home Bank, Home Trust and Oaken brands are all covered by Canada Deposit Insurance Corp.

CDIC is a trustworthy safety net for your savings and GIC investments. As long as you stay below the $100,000 limit for eligible accounts, principal and interest combined, you’ll be fine. (CDIC is covered in more depth in this recent column). But I’ve been struck by reader e-mails over the past several weeks in which Home Capital GIC-holders were close to panic, even though they were within CDIC coverage limits in most cases.

One guy I spoke to tried to sell his GIC through his online brokerage, even though a penalty would have applied. He decided not to after getting a message saying a second step was involved – calling the broker to complete the transaction. He explained his nervousness as being a result of the fact that he’s a contract worker who wanted to keep the money in his GIC super-safe.

Money in a CDIC-protected account will not be lost in a bank failure. But it could end up in a kind of administrative limbo for a brief period between a bank’s collapse and payout by CDIC. This federal Crown corporation says it aims to pay deposits in non-registered accounts within three business days from the date a bank fails. People who have invested registered retirement money in GICs affected by a collapse would have to wait longer, perhaps weeks longer.

Rationally speaking, this is a manageable and perhaps even minor risk. But my sense is that investors on the whole are nervous these days, and GIC investors are even more so. Any news headlines about further problems at Home Capital would give them the exact kind of aggravation they sought to avoid by using GICs. Uncertainty about when they get their money would stress them out even more.

It’s been seven years since a five-year federal government bond had an interest rate above 3 per cent. Putting the Oaken five-year GIC rate in that zone was a crafty move by the Home Capital people because there are plenty of investors who have shown a willingness to take on some risk in order to get better interest rates.

If you go for this offer, stay under CDIC’s $100,000 coverage limit for combined principal and interest. This most basic of GIC-investing rules was not followed by some Home Capital GIC buyers in the past, so it’s worth highlighting.

Be especially cautious about buying an Oaken GIC if you’ll rely on it to pay monthly income through a registered retirement income fund. CDIC would protect the value of your GIC investment up to the $100,000 limit, but actual payments of income could be interrupted in a bank failure.

We have to acknowledge that investing is guided by two kinds of fear – fear of losing money and fear of missing out on great returns. If you pass on Home Capital’s rates through Oaken, Home Trust and Home Bank, then the best you could do on GICs at midweek rates was 2 to 2.5 per cent for a five-year term.

These lower rates will be easier to accept if you remember why you bought GICs in the first place – to avoid the stress of worrying about whether your investments are safe.

The Globe and Mail. May 25, 2017. Toronto area home sales sink after cooling measures

JANET MCFARLAND

House sales fell 26 per cent in the Toronto region in the month following the Ontario government’s introduction of a foreign-buyer’s tax as many potential purchasers stepped back and waited to assess the market impact.

In the 30 days after the province announced the immediate introduction of a 15-per-cent foreign-buyer’s tax on April 20, the number of houses sold in the Greater Toronto Area fell 26 per cent compared with the same period last year, according to data compiled by Toronto realtor John Pasalis, president of Realosophy Realty Inc.

Communities north of Toronto saw the greatest declines between April 20 and May 20, with sales falling 61 per cent in Richmond Hill, 46 per cent in Markham and 44 per cent in Newmarket. The City of Toronto recorded a 23-per-cent drop in the number of homes sold, while Brampton and Mississauga west of Toronto had sales declines of 16 per cent and 27 per cent, respectively.

The sales review looked only at freehold homes, including detached and semi-detached houses, but did not include condominiums.

The drop in selling activity is part of a broad cooling in the Toronto region market that began in April as buyers moved to the sidelines while home owners rushed to list their houses to try to cash in before the market peaked.

In the first two weeks of May alone, sales of all types of homes in the GTA fell 16 per cent compared with the same period in May last year, while the number of new listings soared 47 per cent, according to data compiled by the Toronto Real Estate Board.

The average GTA home sold for $890,284 in the first two weeks of May, a 17-per-cent increase from a year earlier, primarily because of large gains earlier this year. But the price was down 3 per cent compared with April, when the average sale price for all types of GTA homes was $920,791.

Mr. Pasalis said he does not believe the new foreign-buyer’s tax is directly responsible for much of the drop in sales since April 20 because foreign buyers were not a large enough part of the market to cause such a significant decline, and many foreign buyers will qualify for rebates of the tax.

Instead, he believes the drop is a result, in part, to a decline in demand from domestic investors who were purchasing second properties to rent or flip. Most investors have stopped buying as they wait to see the impact of a suite of new measures announced by the province in April, including the foreign-buyer’s tax, he said.

“They disappeared – no one is talking about buying money-losing rental properties any more,” Mr. Pasalis said. “The whole excitement and euphoria is kind of gone right now.”

He also believes many other buyers are sitting on the sidelines, feeling “buyer fatigue” after watching prices in the GTA climb rapidly.

The 33-per-cent price increase in March may have been “the straw that broke the home buyer’s back,” after the average cost of a home rose to $917,000 in March from $688,000 a year earlier, he said.

“The whole mood of the market has changed, and that is the bigger factor. People are spooked – investors are spooked, buyers are spooked – and I think that’s the huge issue.”

Mr. Pasalis said many of his firm’s clients have been stepping back and not making offers, hoping prices will fall from the peak, while many sellers are growing desperate for offers, especially if they’ve already bought another house and need to sell quickly.

“Our agents are getting calls from listing agents begging them for offers, just begging them, because the seller is freaking out because they already bought something and they need to sell their house,” he said.

One agent in his firm submitted an offer of $650,000 for a client bidding on a townhouse that was selling for $750,000 a month ago, and the bid was accepted. He said the agent hadn’t expected to get it, but he assumes the seller had no choice.

“It’s going to screw up the market because sellers are going to be looking at February and March prices and buyers are going to be looking at these recent low-ball prices, and we’re going to have an interesting problem there.”

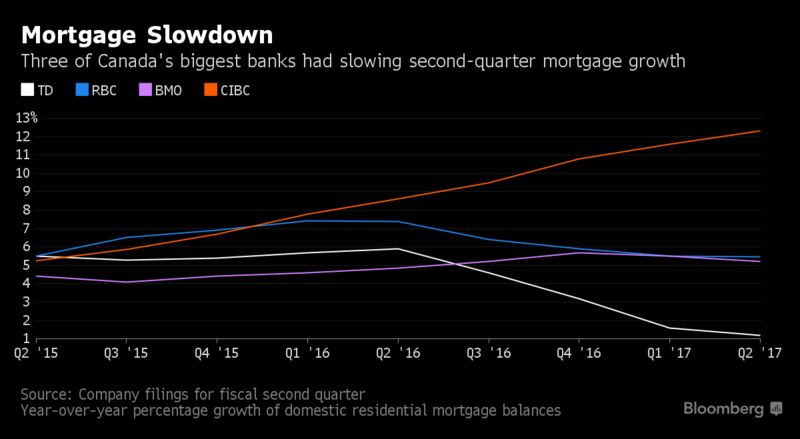

BLOOMBERG. 2017 M05 25. Canadian Mortgage Growth Slows Amid Government Housing Moves

by Doug Alexander

- TD, BMO report home loan balances shrink from first quarter

- RBC annual mortgage growth was weakest since start of 2015

- Canada Banks See Mortgage Slowdown as Nation Taps Brakes

Canadian mortgage growth is slowing as the country’s policy makers step up efforts to cool overheated housing markets in Vancouver and Toronto.

With four of Canada’s biggest banks reporting second-quarter results, the trend shows decelerating growth in home loan portfolios and, in some cases, shrinkage. It’s a welcome sign for officials struggling to curb house prices in two of the nation’s largest cities. The easing follows federal government moves in October to tighten mortgage insurance rules and other measures while opening the door to shift risks of defaulting mortgages to banks.

“It’s not that we’re pulling back, it’s just that the market is slowing a little bit and part of that is the supply in the market was lower," Royal Bank of Canada Chief Financial Officer Rod Bolger said Thursday in a telephone interview.

Royal Bank, the biggest domestic mortgage lender, said average home loan balances rose 5.5 percent to C$224.1 billion ($166.5 billion) from a year earlier, its slowest annual growth since the first quarter of 2015.

Toronto-Dominion Bank and Bank of Montreal saw their mortgage portfolios shrink from the previous quarter for the first time in years. TD’s home loan balances slipped 0.4 percent to C$187.5 billion, the first sequential contraction in two years. Home loan balances were up 1.2 percent from the same period last year -- the slowest annual growth in at least four years.

Toronto-Dominion is seeing the effects of “de-emphasizing" some parts of its mortgage business, including reducing purchases of private-label originations, CFO Riaz Ahmed said in an interview. He also said the country’s residential property market appears to be moderating.

“In the last two weeks of April or so, we did begin to see some cooling in the housing market as sales activity slowed and more supply came to the market,” Ahmed said. “We are happy with that because that’s generally good for Canada and our customers."

Bank of Montreal’s domestic mortgage book also contracted for the first time in two years, with average balances in the quarter slipping about 0.1 percent to C$98.3 billion from three months earlier, according to financial statements by the Toronto-based lender. Bank of Montreal, which has the smallest share of the domestic market among Canada’s five largest lenders, said home loan balances rose 5.2 percent from a year earlier, the slowest annual growth in three quarters.

“There is a little bit of seasonality in the second quarter," CFO Thomas Flynn said Wednesday in a phone interview. “It’s not as active of a mortgage season for us, and it’s also a slightly shorter quarter."

Toronto Prices

Toronto home prices slowed in the first two weeks of May, according to the city’s real estate board, after climbing 25 percent in April from a year earlier and 33 percent in March. Last month, Ontario’s government announced plans for a 15 percent tax on foreign buyers, following similar measures enacted in British Columbia in August.

“We do expect growth in mortgages over the next few years to be somewhat lower than it has been over the last five years," Flynn said. “That’s just reflecting the expectation that the market will continue to be stable but will cool somewhat.”

Canadian Imperial Bank of Commerce was an outlier among the lenders, with mortgage balances jumping 12 percent from a year earlier thanks in part to the firm’s efforts to ramp up a mobile mortgage sales force to about 1,200 advisers.

“It’s a strong part of our business, and something that we focus on," CFO Kevin Glass said in an interview. “We’re not compromising anything in terms of our growth. We like the business and it provides a very good return on capital."

________________

Global Affairs Canada. May 26, 2017. International Trade Minister to lead trade mission on his first official visit to Italy

Ottawa, Ontario - Canada and Italy enjoy a history of strong people-to-people connections based on shared values and cooperation in cultural, social, economic and political areas. These links form a solid foundation on which to expand the two countries’ trading relationship and create more opportunities for the middle class.

The Honourable François-Philippe Champagne, Minister of International Trade, will lead his first official trade mission to Italy from May 28 to 30, 2017. Building on Canada’s significant commercial strengths in Italy, the trade mission will focus on three key sectors: aerospace and defence, agriculture and agri-food, and information and communications technology (ICT). Minister Champagne will also be focused on creating new opportunities for Canada’s wood industry, holding meetings with several possible buyers and partners on the ground.

The delegation will consist of more than 40 Canadian organizations, whose representatives will participate in programs in both Milan and Rome. Minister Champagne and the delegation will join Prime Minister Justin Trudeau on May 30 during the Prime Minister’s official visit to Rome and the Vatican City. In Rome, the business delegation will have the opportunity to attend the Prime Minister’s address to the Italian parliament. Stéphane Dion, Canada's ambassador-designate to Germany and special envoy to the EU and Europe, will also participate in the mission, reflecting his mandate to strengthen ties between Canada and Europe.

In addition to leading the business delegation, Minister Champagne will meet with business and political leaders, including Carlo Calenda, Italy’s Minister of Economic Development. He will also undertake media engagements to promote Canada’s progressive trade agenda and the Canada-EU Comprehensive Economic and Trade Agreement (CETA).

Quotes

“I am very pleased to lead this important trade mission to Italy. Expanding Canada’s trade and investment prospects is key to helping our businesses grow, which in turn generates more jobs and opportunities for Canada’s middle class and those working hard to join it.

“Italy has been a steadfast supporter of CETA. I look forward to the enormous opportunities that CETA will bring for consumers, businesses, and for our workers on both sides of the Atlantic.”

- François-Philippe Champagne, Minister of International Trade

Quick facts

- Canada and Italy have a strong commercial relationship. In 2016, Canadian exports to Italy were valued at about $2.3 billion and Italian imports to Canada at $7.5 billion.

- In 2015, Italian direct investment in Canada was valued at close to $1.6 billion and Canadian direct investment in Italy at $539 million.

- Italy’s aerospace industry is the fourth-largest in Europe and the seventh in the world, making Italy a major player in the global arena of aerospace and defence.

- Italy is Canada’s largest export market for agriculture products in Europe, representing approximately 17 percent of total Canadian agriculture exports to the EU.

- The Italian ICT market generated revenues of €65 billion ($98 billion) in 2014. Active subsectors of interest for Canadian companies include mobile telecom infrastructure, software solutions (including cloud-based platforms), cybersecurity, digital media, financial technologies and the Internet of Things.

________________

LGCJ.: