CANADA ECONOMICS

US CHAMBER OF COMMERCE. REUTERS. Apr 24, 2017. U.S. Chamber of Commerce chief expects basic NAFTA deal by mid-2018

By Dave Graham

MEXICO CITY (Reuters) - The United States, Mexico and Canada are likely to reach a basic accord over reworking the North American Free Trade Agreement (NAFTA) by the middle of next year, the head of the biggest U.S. business lobby group said on Sunday.

The future of the deal binding the three nations has been in doubt since Donald Trump won the U.S. presidency in November pledging to ditch it if he could not rework terms in favor of the United States, clouding the outlook for Mexico in particular.

However, Thomas Donohue, president and chief executive officer of the U.S. Chamber of Commerce, said that he believed business leaders and policymakers were increasingly aware of the need to get a new deal and move on without disrupting business.

"We're not going to be fooling around with this deal in 2018," he said in an interview with Reuters on a visit to Mexico City where he will meet policymakers and make the case for free trade.

Trump contends that Mexico's growth as a manufacturing power since NAFTA took effect in 1994 has cost jobs in the United States. However, defenders of the deal say it has benefited all three nations and helped American firms compete globally.

The U.S. government has yet to send a letter telling Congress that it intends to launch NAFTA negotiations in 90 days - the notification period required under the fast-track process - so the potential start of talks is now drifting into August.

Donohue said that step should follow in the next few weeks, adding neither Trump nor U.S. firms had an interest in dragging out the NAFTA talks because of the economic damage it would do.

"(Trump) is looking at how to get things done," he added. "And I can tell you that he wants to speed this thing up."

When asked if he thought a basic agreement on a reworked NAFTA would likely be in place by July 2018, Donohue said:

"Yes. That's my opinion. That's my view. The bottom line is we need to move forward on this deal. It is critical to our economic and geopolitical well-being. Period."

Mexico, which sends 80 percent of its exports to the United States, will hold its next presidential election in July next year. President Enrique Pena Nieto's government is hoping to wrap up the NAFTA talks before it takes place.

During his own campaign, Trump threatened to slap hefty tariffs on Mexican-made goods, including a 35 percent tax on cars, and he caused dismay in Mexico with a pledge to build a southern border wall to keep out illegal immigrants.

Since taking office, Trump's tone has softened, though he again railed against NAFTA over the past week and returned to the issue of the wall, saying Mexico would pay for it "eventually."

Nevertheless, Donohue said understanding was growing over the need for a deal that would accelerate, not reduce trade, and argued the prospect of punitive tariffs was receding.

"In fact, we haven't heard of that in a long time," he said. "Because if a country were to put a 35 percent tariff on products moving into their country, the guys you're trading with are going to do it the next morning."

(Reporting by Dave Graham; Editing by Simon Cameron-Moore)

BLOOMBERG CANADA. 24 April 2017.Canadian Housing Optimism Hits Record Amid Curbs on Toronto

by Greg Quinn

- Share of people who see rising home prices highest since 2008

- Weekly polling also shows views on personal finances worsened

Optimism about home prices reached an all-time high in Canada just as policy makers stepped in to curb runaway prices in the country’s largest city.

The share of respondents in the weekly Bloomberg Nanos Canadian Confidence Index who see home prices rising in the next six months climbed to 48.5 percent, the most in records back to mid-2008. The overall confidence index reached 59.1, the highest since March and exceeding the 12-month average of 57.4.

“Bullish sentiment on real estate in Canada continues to drive consumer confidence,” said Nanos Research Group Chairman Nik Nanos.

Ontario Premier Kathleen Wynne and her Finance Minister Charles Sousa introduced a 15 percent foreign buyers tax in the Greater Toronto Area on Thursday, and said the province would allow Mayor John Tory to charge a vacant property levy. Similar moves in Vancouver last year helped slow rapid gains.

The measures follow statements from officials such as Bank of Canada Governor Stephen Poloz and Finance Minister Bill Morneau that 30 percent price gains around the nation’s largest city are probably unsustainable and being driven more and more by speculation.

Real estate optimists outnumber pessimists by more than four-to-one, with 10.9 percent predicting prices will decline. Some 38.2 percent see little change.

The bullish sentiment on home prices is at odds with the survey’s negative balance of opinion on personal finances. On the question of where they stand financially, 28.3 percent of respondents said their pocketbooks had deteriorated over the past 12 months, while 18 percent see an improvement.

Ontario tied with British Columbia for the highest regional confidence, both at 62.9.

Home prices in the Toronto region rose 6.2 percent in March, the biggest one-month gain on record, according the Canadian Real Estate Association. Prices have jumped almost 30 percent in the past 12 months.

Sousa laid out 16 measures to calm the property market last week, including quarterly meetings with Morneau to discuss housing pressure and share what is acknowledged to be scarce data on trends such as foreign purchasers.

“We have seen a very unsubstantiated growth in prices in Toronto,” Jake Abramowicz, a broker at Mortgage Edge, said Wednesday on Bloomberg TV Canada. Foreign buyers may make up 10 percent to 15 percent of the market, he said. “I hear of some open houses and bidding wars coming in where eight out of 10 bids are coming from foreign buyers.”

Outside of the housing market, consumer sentiment may also be getting a lift from a solid labor market and output growth. The survey’s balance of opinion on where the economy will be in six months turned positive for the first time in five weeks, with 23.9 percent saying it would be stronger and 23.2 percent calling for an erosion.

On jobs, the share of people calling their positions secure rose to 48.7 percent from 47 percent last week.

The confidence index is based on telephone polling with a four-week rolling average of 1,000 respondents, and is considered accurate within 3.1 percentage points, 19 times out of 20.

BLOOMBERG. 24 April 2017. Canada Braces for a Lumber War Amid Its Home-Price Psychosis

by Theophilos Argitis

- U.S. expected to impose duties of 20% to 30% this week: BMO

- Central bank already adding ‘negative judgement’ in forecasts

Bank of Canada Governor Stephen Poloz has been highlighting the dangers of protectionism, and the country will probably get a taste this week as the U.S. is expected to issue preliminary countervailing duties on softwood lumber.

Bank of Montreal said in a report last week it expects duties in the range of 20 percent to 30 percent, with additional anti-dumping duties coming later in the year that could reach another 15 percent. And in a round-table interview with reporters Saturday, Poloz said the measures will probably have some impact on the nation’s economy.

“It is an important business for Canada, it’s got a lot of employment in it and it’s geographically diverse,” said Poloz, who was speaking in Washington where he was attending meetings of the International Monetary Fund. “It matters.”

The Bank of Canada has already added a “modest amount of negative judgment” into its forecasts, using a historical analysis of how countervailing duties affected lumber exports in the past, Poloz said.

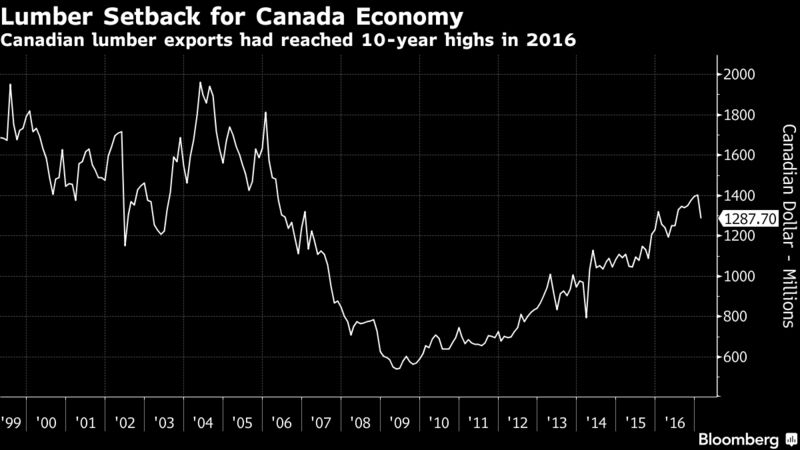

Canada exported almost C$16 billion ($11.9 billion) worth of lumber in the year through February, levels not seen since 2006, as Canadian producers took advantage of unfettered access to the U.S. market after the last softwood lumber pact between the two countries expired in October 2015.

The run-up in lumber sales gave a significant boost to Canada’s struggling export sector last year -- providing about one quarter of the increase in the country’s non-energy exports.

When the U.S. last imposed countervailing and anti-dumping duties on Canadian lumber in 2001, exports fell by about 12 percent over three years.

Poloz Comments

In the interview in Washington, Poloz touched on a number of issues -- from Ontario’s housing measures to geopolitical risk. Here are the highlights:

- Poloz said he’s happy Ontario took steps to slow Toronto’s housing market and expects they will make a “contribution.” He reiterated that he doesn’t think interest rates are the right tool for managing such a risk.

- The Toronto housing market would probably have slowed regardless of any measures, since the price escalation would inevitably sap demand.

- On business investment, he said while companies seem to be more prepared to spend, there’s no sign of the “expansionary investment” the bank is looking for. That sort of investment “as a macro phenomenon, it’s not really there.”

- At a time when global economic data seems to be stronger than policy makers had been expecting, Poloz conceded the long period of serial disappointment could be producing more cautious economic forecasts.

Toronto Housing

The big story last week was the Ontario government’s measures -- 16 in total -- to rein in Toronto’s soaring housing prices, centered around a 15 percent tax on foreign home buyers. The steps were widely applauded by economists and policy makers, including Finance Minister Bill Morneau and Poloz. But will the measures be enough, or are they too late?

That all depends on how effective the moves are at scaring away investors. Or as Morneau told reporters on April 21: “We do believe there is an important issue around psychology in the market that needs to be addressed.”

Expectations that real estate prices will continue rising are the highest since at least 2008, according to the weekly Bloomberg Nanos Canadian Confidence Index released Monday.

Problem is, market psychology can’t be measured.

“That’s kind of a psychological thing, so it’s pretty hard to predict how those measures will affect the way people think,” Poloz said last week. “It’s one thing for me to say that doesn’t look sustainable.”

Blame Game

Are the housing measures too late?

An analysis by Ted Carmichael, a former managing director at the Ontario Municipal Employees Retirement System, shows there have been two major booms for Toronto housing before the current rally: one in the mid-1970s that came with a slowdown in actual prices but no collapse (real prices did fall however), and a much more pronounced one in the late 1980s that came with a crash. Carmichael concludes the current boom probably fits somewhere in between the previous two.

If Toronto’s housing market does take a sharp tumble, there may be plenty of finger pointing:

- Did Ontario Premier Kathleen Wynne’s Liberals wait too long to act, after the federal government moved last year?

- Could Morneau’s measures have been more aggressive -- as Ontario had wanted -- and did he do a good enough job coordinating with the provinces. Many blame British Columbia’s tax on foreign buyers for driving capital flows to Toronto.

- How much blame should go to former Prime Minister Stephen Harper, whose government chose to ignore recommendations from his finance department in 2015 for more measures? Harper’s reluctance to use fiscal policy to offset the slowdown also put pressure on the central bank to cut interest rates, fueling demand.

- Should Poloz have been more concerned about the impact monetary policy was having on the housing market, even if it meant slower economic growth. The previous government’s major criticism of Poloz’s predecessor, Mark Carney, was that he was too preoccupied with financial stability issues.

The first indications of any impact should start coming next week, when the Toronto Real Estate Board is due to report sales and price data for April.

(Earlier versions of this story corrected the date of Poloz’s press conference and decline in lumber exports last decade.)

THE GLOBE & MAIL. Apr. 23, 2017. Home inspectors feeling the burn of Ontario’s hot housing market

KIRAN RANA

The Globe and Mail

Home inspectors are taking a substantial hit to their businesses amid the frenzied bidding for houses taking place in Toronto and the surrounding regions.

In desperation to come up on top in bidding wars, many home buyers are forgoing conditions that may make their offer less appealing to a seller. One of the first conditions to go is need for a home inspection.

“Nobody has a clause for home inspection in this hot housing market,” says Murray Parish, president of the Ontario Association of Home Inspectors, who says his 550 members have experienced a 30 to 50 per cent drop in home inspections over the past few months.

Toronto has seen consecutive years of double-digit price gains. The average sale price for detached homes in the central 416 area code in March was $1.56-million, up 33 per cent from a year earlier. In the 905 region that surrounds the city, detached homes went for an average of $1.12-million, up 34 per cent.

Prices for semi-detached homes, townhouses and condos are all up sharply.

Alan Carson, president of home inspection agency Carson Dunlop, says that while the city of Toronto may be the epicentre of the issue, his business has felt the shock waves even in regions such as Kitchener-Waterloo, Oshawa and Hamilton.

In February, the number of home inspections his company did was down 30 per cent overall. “Buyers aren’t forgoing the inspection because they want to; it’s because they feel like they have to,” says Mr. Carson.

But while there has been a decrease in home inspections on the buyer’s side, Mr. Carson says he’s also seeing an uptick in home inspections being conducted by the seller. When sellers conduct a home inspection and offer the results in a report, they are finding that more buyers are coming to the table, he says.

However, this isn’t enough to completely offset the decline in buyer home inspections.

“We’re frustrated,” Mr. Carson says. “We know people want to protect themselves and are just finding it so hard to do.”

In a more balanced market, 60 to 70 per cent of deals include a home inspection clause, says John Hansen, who runs a home inspection business in Hamilton. “This year, I don’t think it’s even 5 per cent. The market in Hamilton is crazy.”

According to March data, Hamilton home prices shot up 28 per cent from the previous year. In a city where the average price is half that of Toronto, bidding wars are increasingly becoming the norm, as buyers priced out of other regions make aggressive moves to close deals in areas nearby.

The number of home inspections Mr. Hansen says he conducted in March was fewer than half of the amount he did a year prior. It’s making it harder for home inspectors to bring in money, he says, and some have gone out of business. Mr. Hansen says he’s been relying more heavily on his work on septic, well and fireplace inspections to keep him afloat.

In addition to the impact on their businesses, home inspectors warn that forgoing inspections puts buyers at risk.

“You wouldn’t buy a car without taking it for a test drive,” says Mr. Parish. The same rationale, he says, should apply for a purchase that is much bigger.

Mr. Hansen says he worries that buyers – particularly young, first-time home buyers – are placing themselves in a position of financial vulnerability. “They tap out all their resources to get their house …What happens when they find out they have a $20,000 fix?”

The effects are starting to spill over to other businesses as well, says Mr. Parish. Electricians and plumbers who receive business following results from a home inspection are feeling the impact from the lack of referrals.

Mr. Carson is hoping the Ontario government measures announced on Thursday, which include a 15-per-cent tax on foreign home buyers, will cool the housing market.

“I hope it has a positive impact on housing availability and affordability for the average home buyer.”

THE GLOBE & MAIL. Apr. 24, 2017. Canadian housing optimism hits record amid moves to cool Toronto

GREG QUINN

Bloomberg News

Optimism about home prices reached an all-time high in Canada just as policy makers stepped in to curb runaway prices in the country’s largest city.

The share of respondents in the weekly Bloomberg Nanos Canadian Confidence Index who see home prices rising in the next six months climbed to 48.5 per cent, the most in records back to mid-2008. The overall confidence index reached 59.1, the highest since March and exceeding the 12-month average of 57.4.

“Bullish sentiment on real estate in Canada continues to drive consumer confidence,” said Nanos Research Group Chairman Nik Nanos.

Ontario Premier Kathleen Wynne and her Finance Minister Charles Sousa introduced a 15 per cent foreign buyers tax in the Greater Toronto Area on Thursday, and said the province would allow Mayor John Tory to charge a vacant property levy. Similar moves in Vancouver last year helped slow rapid gains.

The measures follow statements from officials such as Bank of Canada Governor Stephen Poloz and Finance Minister Bill Morneau that 30 per cent price gains around the nation’s largest city are probably unsustainable and being driven more and more by speculation.

Real estate optimists outnumber pessimists by more than four-to-one, with 10.9 per cent predicting prices will decline. Some 38.2 per cent see little change.

Finances Worsening

The bullish sentiment on home prices is at odds with the survey’s negative balance of opinion on personal finances. On the question of where they stand financially, 28.3 per cent of respondents said their pocketbooks had deteriorated over the past 12 months, while 18 per cent see an improvement.

Ontario tied with British Columbia for the highest regional confidence, both at 62.9.

Home prices in the Toronto region rose 6.2 per cent in March, the biggest one-month gain on record, according the Canadian Real Estate Association. Prices have jumped almost 30 per cent in the past 12 months.

Sousa laid out 16 measures to calm the property market last week, including quarterly meetings with Morneau to discuss housing pressure and share what is acknowledged to be scarce data on trends such as foreign purchasers.

“We have seen a very unsubstantiated growth in prices in Toronto,” Jake Abramowicz, a broker at Mortgage Edge, said Wednesday on Bloomberg TV Canada. Foreign buyers may make up 10 per cent to 15 per cent of the market, he said. “I hear of some open houses and bidding wars coming in where eight out of 10 bids are coming from foreign buyers.”

Outside of the housing market, consumer sentiment may also be getting a lift from a solid labor market and output growth. The survey’s balance of opinion on where the economy will be in six months turned positive for the first time in five weeks, with 23.9 per cent saying it would be stronger and 23.2 per cent calling for an erosion.

On jobs, the share of people calling their positions secure rose to 48.7 per cent from 47 per cent last week.

The confidence index is based on telephone polling with a four-week rolling average of 1,000 respondents, and is considered accurate within 3.1 percentage points, 19 times out of 20.

–With assistance from Erik Hertzberg

BLOOMBERG. 23 April 2017. Oil Falls Sixth Day as U.S. Rig Count Gain Seen Boosting Output

by Mark Shenk

- Speculator’s WTI net-longs up 4.6%, third-straight gain: CFTC

- Prices rose earlier as dollar, equities rally on French polls

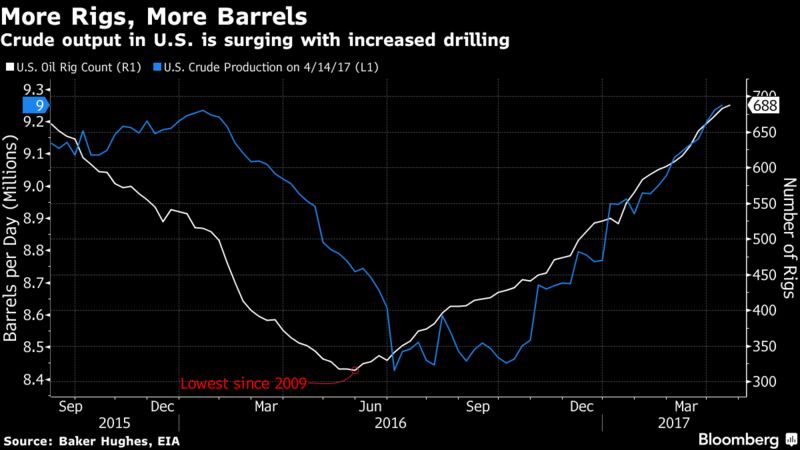

Oil fell a sixth day as the ramp-up of U.S. drilling signaled further production gains in the world’s biggest crude-consuming nation.

Futures extended last week’s 6.7 percent decline in New York. U.S. explorers added 5 rigs last week to cap the longest stretch of gains since 2011, Baker Hughes Inc. data show. An OPEC committee concluded that a six-month renewal of an output-cut deal is needed, delegates with knowledge of the matter said. Money managers boosted wagers that U.S. oil futures would increase in the week to April 18, government data showed. Oil rose earlier along with global equities while the dollar weakened after the first round of the French presidential election.

Oil retreated below $50 a barrel amid concern that rising U.S. crude production would offset efforts by the Organization of Petroleum Exporting Countries to trim a global glut. OPEC will decide at a meeting on May 25 whether to extend its pledged cuts into the second half of the year. U.S. crude production rose to 9.25 million barrels a day in the week ended April 14, the highest since August 2015, Energy Information Administration data show.

"We had another rise in the rig count, which will send output higher, while Saudi Arabia and Russia are being cagey about extending the cuts," John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by telephone. "The market is tired of empty gestures and needs to see solid evidence that they’re having an impact on inventories."

West Texas Intermediate for June delivery fell 46 cents to $49.16 a barrel at 10:50 a.m. on the New York Mercantile Exchange. Total volume traded was about 10 percent below the 100-day average. Prices closed at $49.62 on Friday, the lowest since March 29.

Brent for June settlement declined 38 cents to $51.58 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a $2.42 premium to WTI.

Managed Money

"There’s a lot of managed money in the market," Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by telephone. "If OPEC and the Russians don’t come to an agreement to prolong the cuts on May 25, they are going to flee and this market will be down the toilet. Until the agreement is signed, this market will be vulnerable."

In France, a snap poll by Ipsos showed centrist Emmanuel Macron would win the second round of voting. Macron’s spot in the second election round avoids a contest between the anti-European Union Marine Le Pen and the Communist-backed Jean-Luc Melenchon, curbing threats to the euro zone and encouraging investors to embrace more risk.

"The French vote has lifted all boats," Kilduff said. "Equities are up and the dollar is getting pummeled. Oil was unable to maintain its gains, which underscores the weakness of the market."

OPEC. REUTERS. Apr 24, 2017. Oil recovers some ground, rise in U.S. drilling caps gains

By Ahmad Ghaddar

LONDON (Reuters) - Oil prices recovered some lost ground on Monday after big losses last week, driven by expectations that OPEC will extend output cuts till the end of 2017, although a rise in U.S. drilling capped gains.

Brent crude futures LCOc1 rose 38 cents by 1148 GMT to $52.34 per barrel.

U.S. West Texas Intermediate (WTI) crude oil futures CLc1 added 41 cents to reach $50.03 a barrel.

Prices fell steeply last week on the back of stubbornly high crude supplies, despite a pledge by the Organization of the Petroleum Exporting Countries (OPEC) and other producers to cut output by almost 1.8 million barrels per day (bpd) in the first half of the year.

Oil prices on Monday received a respite after a panel of OPEC and other allied producers recommended an extension of cuts into the second half of 2017, a source said.

"This no longer comes as any surprise, given that the influential Arab Gulf neighboring states had last week already expressed support for an extension to the agreed cuts," Commerzbank said in a note.

Leading Gulf oil exporters Saudi Arabia and Kuwait gave a clear signal at a conference in Abu Dhabi last week that OPEC planned to extend the supply reduction deal.

An expected fall in Iranian production also lent markets some support on Monday, traders said.

Iran's crude oil exports are set to hit a 14-month low in May, suggesting the country is struggling to raise exports after clearing out stocks stored on tankers.

Iranian oil exports, especially to its core markets in Asia, had soared since sanctions were eased in January 2016.

But rising U.S. drilling and production has tempered the bullish sentiment, with investors cutting bullish bets on rising ICE Brent crude futures and options by 9,811 contracts to 427,433 lots in the week to April 18.

In the week to April 21, U.S. drillers added oil rigs for a 14th week in a row, to 688 rigs, extending an 11-month recovery that is expected to boost U.S. shale production in May by the biggest monthly increase in more than two years.

Since a trough in May 27, 2016, U.S. producers had added 372 oil rigs, a rise of 118 percent, Goldman Sachs said in a note.

U.S. crude production is at 9.25 million bpd C-OUT-T-EIA, up almost 10 percent since mid-2016, approaching the level of OPEC's top exporter Saudi Arabia.

(Additional reporting by Henning Gloystein in Singapore; Editing by Edmund Blair)

StatCan. 2017-04-24. Wholesale trade, February 2017

Wholesale sales — Canada

$58.9 billion

February 2017

-0.2% decrease

(monthly change)

Source(s): CANSIM

Wholesale sales edged down 0.2% to $58.9 billion in February, following four consecutive monthly increases. Declines were recorded in four subsectors, led by lower sales in the personal and household goods and the food, beverage and tobacco subsectors.

In volume terms, wholesale sales decreased 0.4%.

Chart 1 Chart 1: Wholesale sales edge down in February

Wholesale sales edge down in February

Lower sales in four subsectors

Sales decreased in four of seven subsectors in February, accounting for 54% of total wholesale sales.

The personal and household goods subsector recorded the largest decline in dollar terms in February, down 1.7% to $8.3 billion, as sales decreased in five of six industries in that subsector. Following an increase of 30.2% in January in the home entertainment equipment and household appliance industry, the industry decreased 14.6% to $846 million. Despite the decline this month, wholesale sales in the industry were 8.7% higher than for the same period in 2016.

Following a flat January, the food, beverage and tobacco subsector reported a 1.0% decline in February to $11.0 billion, led by the food industry (-0.9%).

Sales in the farm product subsector decreased 3.0% to $658 million, while the motor vehicle and parts subsector edged down 0.1% to $11.9 billion. The posted declines for both subsectors in February followed reported increases in January.

The machinery, equipment and supplies subsector rose 0.6% to $11.5 billion, offsetting a 0.6% decline reported in January. The farm, lawn and garden machinery and equipment industry (+9.7%) contributed the most to the gain, attaining its highest level of sales since August 2016.

Sales in the building material and supplies subsector increased 0.6% to $8.1 billion, its fifth consecutive monthly gain, while sales in the miscellaneous subsector rose 0.6% to $7.3 billion for its third increase in four months.

Sales down in eight provinces

Wholesale sales were down in eight provinces in February, accounting for 85% of total wholesale sales. In dollar terms, Ontario and Quebec contributed the most to the decline.

In Ontario, sales fell 0.5% to $30.4 billion in February, following a 6.3% rise in January. Declines were recorded in four subsectors, led by the machinery, equipment and supplies and the food, beverage and tobacco subsectors.

Sales in Quebec decreased for a second consecutive month, down 1.2% to $10.5 billion. While six subsectors reported declines, the largest contributor to Quebec's decrease was the personal and household goods subsector.

Nova Scotia recorded its first decline in three months, with sales dropping 6.4% to $785 million, mostly offsetting a 7.9% gain in January. Sales were down in most subsectors, led by the motor vehicle and parts subsector.

British Columbia recorded lower sales, edging down 0.3% to $5.8 billion. The decline was led by the motor vehicle and parts subsector. This was the province's second consecutive decline.

In Manitoba, sales were down 0.6% to $1.5 billion, with the machinery, equipment and supplies subsector leading the decline. In New Brunswick, sales decreased 0.8% to $550 million, led by weaker sales in the building material and supplies subsector. Both provinces had recorded gains in January.

Sales in Prince Edward Island fell 7.1% to $54 million, a second consecutive monthly decrease and the lowest level since March 2014. The food, beverage and tobacco subsector contributed the most to the decline.

Newfoundland and Labrador posted a third consecutive decrease, with sales down 0.8% to $368 million, primarily on lower sales in the motor vehicle and parts subsector.

In contrast, wholesale sales in Alberta rose for the fifth consecutive month, up 2.9% to $6.7 billion, reaching their highest level since June 2015. The machinery, equipment and supplies subsector led the gain.

In Saskatchewan, sales increased 3.1% to $2.2 billion in February. As in Alberta, higher sales in the machinery, equipment and supplies subsector contributed the most to the rise in this province.

Inventories edge up in February

Wholesale inventories edged up 0.2% to $74.1 billion in February, the sixth gain in seven months.

Chart 2 Chart 2: Inventories edge up in February

Inventories edge up in February

In dollar terms, the miscellaneous subsector (+1.9%) recorded the largest gain, followed by the machinery, equipment and supplies subsector (+0.6%). This was the fourth increase in five months for the miscellaneous subsector and the sixth increase in seven months for the machinery, equipment and supplies subsector.

Inventories in the motor vehicle and parts subsector were up 0.6% in February, partially offsetting a decline in January.

In the personal and household goods subsector (-0.7%), inventories dropped for the first time in three months.

The food, beverage and tobacco subsector (-1.2%) declined for a second consecutive month, while the building material and supplies subsector (-0.2%) posted its fourth consecutive decrease.

The inventory-to-sales ratio rose from 1.25 in January to 1.26 in February. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170424/dq170424a-eng.pdf

________________

LGCJ.: