US ECONOMICS

CORONAVIRUS

DoS. 19/03/2020. Global Level 4 Health Advisory—Do Not Travel (March 19, 2020)

The Department of State advises U.S. citizens to avoid all international travel due to the global impact of COVID-19. In countries where commercial departure options remain available, U.S. citizens who live in the United States should arrange for immediate return to the United States, unless they are prepared to remain abroad for an indefinite period. U.S. citizens who live abroad should avoid all international travel. Many countries are experiencing COVID-19 outbreaks and implementing travel restrictions and mandatory quarantines, closing borders, and prohibiting non-citizens from entry with little advance notice. Airlines have cancelled many international flights and several cruise operators have suspended operations or cancelled trips. If you choose to travel internationally, your travel plans may be severely disrupted, and you may be forced to remain outside of the United States for an indefinite timeframe.

On March 14, the Department of State authorized the departure of U.S. personnel and family members from any diplomatic or consular post in the world who have determined they are at higher risk of a poor outcome if exposed to COVID-19 or who have requested departure based on a commensurate justification. These departures may limit the ability of U.S. Embassies and consulates to provide services to U.S. citizens.

For the latest information regarding COVID-19, please visit the Centers for Disease Control and Prevention’s (CDC) website.

You are encouraged to visit travel.state.gov to view individual Travel Advisories for the most urgent threats to safety and security. Please also visit the website of the relevant U.S. embassy or consulate to see information on entry restrictions, foreign quarantine policies, and urgent health information provided by local governments.

Travelers are urged to enroll in the Smart Traveler Enrollment Program (STEP) to receive Alerts and make it easier to locate you in an emergency. The Department uses these Alerts to convey information about terrorist threats, security incidents, planned demonstrations, natural disasters, etc. In an emergency, please contact the nearest U.S. Embassy or Consulate or call the following numbers: 1(888) 407-4747 (toll-free in the United States and Canada) or 1 (202) 501-4444 from other countries or jurisdictions.

If you decide to travel abroad or are already outside the United States:

- Consider returning to your country of residence immediately using whatever commercial means are available.

- Have a travel plan that does not rely on the U.S. Government for assistance.

- Review and follow the CDC’s guidelines for the prevention of coronavirus.

- Check with your airline, cruise lines, or travel operators regarding any updated information about your travel plans and/or restrictions.

- Visit travel.state.gov to view individual Travel Advisories for the most urgent threats to safety and security.

- Visit our Embassy webpages on COVID-19 for information on conditions in each country or jurisdiction.

- Visit the Department of Homeland Security’s website on the latest travel restrictions to the United States

- Visit Keeping workplaces, homes, schools, or commercial establishments safe.

The below is attributable to Spokesperson Morgan Ortagus:

Secretary of State Michael R. Pompeo spoke today with Mexican Foreign Secretary Marcelo Luis Ebrard Casaubon on coordinating a plan to restrict non-essential travel across our shared border in response to the COVID-19 pandemic. The two leaders discussed the importance of creating a uniform North American strategy to reduce public health risks to our communities and more effectively address rising challenges jointly. They also discussed ways to reduce the adverse impact the COVID-19 crisis is having on the economy and to prioritize continuing essential cross-border commerce and trade.

VENEZUELA

U.S. Department of State. 03/19/2020. United States Calls for Humanitarian Release of Wrongfully Detained Americans in Venezuela. Michael R. Pompeo, Secretary of State

With the Maduro regime now acknowledging that COVID-19 cases are appearing in Venezuela, we are extremely concerned about the risk for the five U.S. citizens and one U.S. resident from Citgo who are currently languishing in the notorious Helicoide prison in Caracas. These wrongfully detained men all have weakened immune systems due to cumulative health problems and face a grave health risk if they become infected. Seventeen hearings have been cancelled. They have already spent more than two years in jail without an ounce of evidence being brought against them; it is time to release them on humanitarian grounds.

INTERNATIONAL TRANSACTIONS

DoC. BEA. March 19, 2020. U.S. International Transactions, Fourth Quarter and Year 2019. Current Account Deficit Narrows by 12.4 Percent in Fourth Quarter.

Current Account Balance, Fourth Quarter

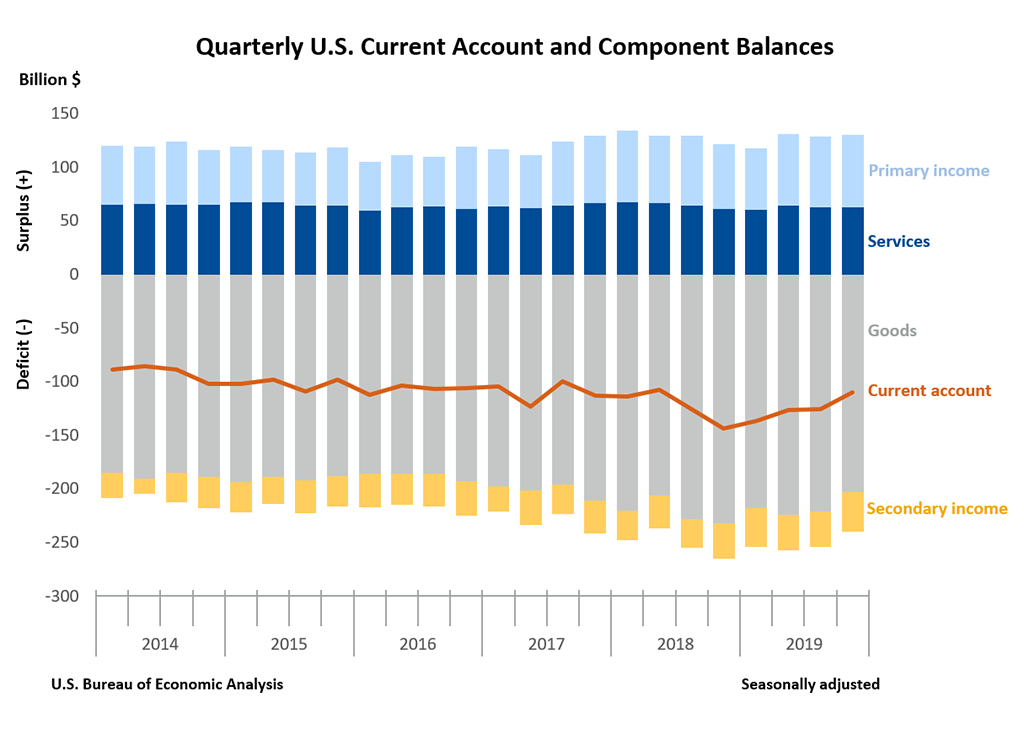

The U.S. current account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $15.6 billion, or 12.4 percent, to $109.8 billion in the fourth quarter of 2019, according to statistics from the U.S. Bureau of Economic Analysis (BEA). The revised third quarter deficit was $125.4 billion.

The fourth quarter deficit was 2.0 percent of current dollar gross domestic product (GDP), down from 2.3 percent in the third quarter.

The $15.6 billion narrowing of the current account deficit in the fourth quarter mainly reflected a reduced deficit on goods that was partly offset by an expanded deficit on secondary income.

Current Account Transactions (tables 1-5)

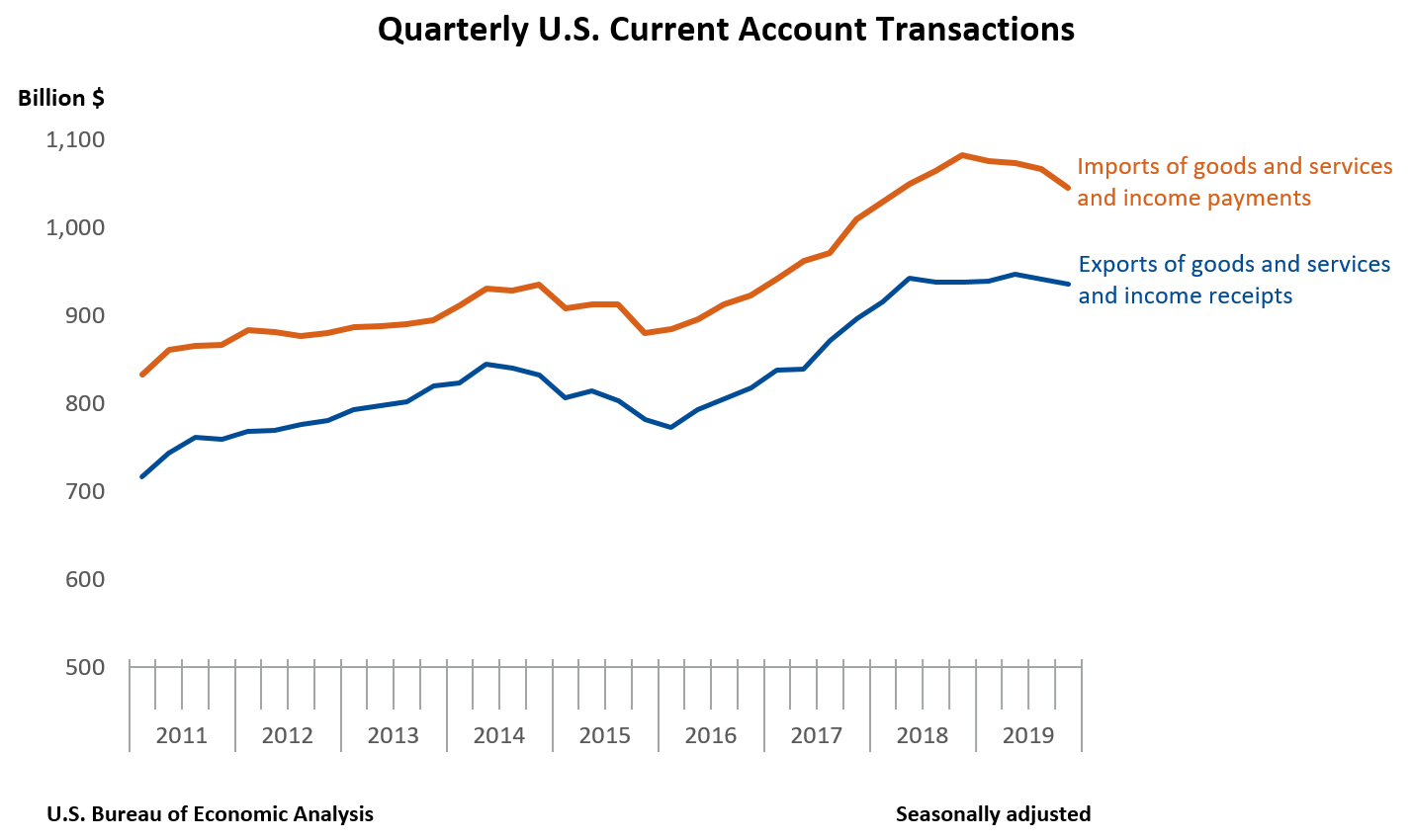

Exports of goods and services to, and income received from, foreign residents decreased $5.1 billion, to $936.1 billion, in the fourth quarter. Imports of goods and services from, and income paid to, foreign residents decreased $20.7 billion, to $1.05 trillion.

Trade in Goods (table 2)

Exports of goods decreased $2.5 billion, to $409.7 billion, led by a decrease in foods, feeds, and beverages, mainly soybeans. Changes in the other major categories were nearly offsetting. Imports of goods decreased $20.6 billion, to $612.5 billion, mainly reflecting decreases in consumer goods, led by apparel, footwear, and household goods, and in automotive, vehicles, parts, and engines, led by trucks, buses, and special purpose vehicles.

Trade in Services (table 3)

Exports of services increased $2.8 billion, to $213.9 billion, mainly reflecting increases in travel, primarily other personal travel, and in other business services, mostly professional and management consulting services. Imports of services increased $2.3 billion, to $151.0 billion, reflecting increases in all major categories. Increases were led by travel, mainly other personal travel.

Primary Income (table 4)

Receipts of primary income decreased $2.8 billion, to $278.0 billion, and payments of primary income decreased $4.2 billion, to $210.7 billion. The decreases in both receipts and payments mainly reflected decreases in other investment income, mostly interest on loans and deposits.

Secondary Income (table 5)

Receipts of secondary income decreased $2.5 billion, to $34.4 billion, mainly reflecting a decrease in private sector fines and penalties, a component of private transfer receipts. Payments of secondary income increased $1.9 billion, to $71.7 billion, mainly reflecting an increase in U.S. government grants.

Financial Account Transactions, Fourth Quarter (tables 1, 6, 7, and 8)

Net financial account transactions were −$71.8 billion in the fourth quarter, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

Fourth quarter transactions increased U.S. residents' foreign financial assets by $1.0 billion. Transactions increased direct investment assets, mainly equity, by $35.2 billion; portfolio investment assets by $18.9 billion, resulting from large and mostly offsetting transactions in equity securities and debt securities; and reserve assets by $0.2 billion. Transactions decreased other investment assets, primarily loans, by $53.4 billion.

Liabilities (tables 1, 6, 7, and 8)

Fourth quarter transactions increased U.S. liabilities to foreign residents by $71.9 billion. Transactions increased direct investment liabilities, mainly equity, by $43.5 billion and other investment liabilities, mainly loans, by $56.5 billion. Transactions decreased portfolio investment liabilities, mainly short-term debt securities, by $28.2 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$0.9 billion in the fourth quarter, reflecting net borrowing from foreign residents.

Updates to Third Quarter 2019 International Transactions Accounts Balances

Billions of dollars, seasonally adjusted | ||

| Preliminary estimate | Revised estimate | |

|---|---|---|

| Current account balance | -124.1 | −125.4 |

| Goods balance | −219.6 | −220.9 |

| Services balance | 62.2 | 62.5 |

| Primary income balance | 68.7 | 65.9 |

| Secondary income balance | −35.5 | −32.9 |

| Net financial account transactions | −47.9 | −76.4 |

Current Account Balance, Year 2019

The U.S. current account deficit widened by $7.4 billion, or 1.5 percent, to $498.4 billion in 2019. The deficit was 2.3 percent of current dollar GDP, down from 2.4 percent in 2018.

The $7.4 billion widening of the current account deficit in 2019 mainly reflected an expanded deficit on secondary income and a reduced surplus on services that were partly offset by a reduced deficit on goods.

Current Account Transactions (tables 1-5)

Exports of goods and services to, and income received from, foreign residents increased $28.3 billion, to $3.76 trillion, in 2019. Imports of goods and services from, and income paid to, foreign residents increased $35.6 billion, to $4.26 trillion.

Trade in Goods (table 2)

Exports of goods decreased $21.5 billion, to $1.65 trillion, mainly reflecting a decrease in capital goods, mostly civilian aircraft. Imports of goods decreased $42.6 billion, to $2.52 trillion, mainly reflecting a decrease in industrial supplies and materials, mostly petroleum and products.

Trade in Services (table 3)

Exports of services increased $18.2 billion, to $845.2 billion, mainly reflecting an increase in other business services, primarily professional and management consulting services. Imports of services increased $28.1 billion, to $595.4 billion, reflecting increases in all major categories. Increases were led by travel, mostly other personal travel.

Primary Income (table 4)

Receipts of primary income increased $38.9 billion, to $1.12 trillion, and payments of primary income increased $35.9 billion, to $866.1 billion. The increases in both receipts and payments mainly reflected increases in other investment income, mostly interest on loans, and in portfolio investment income, mostly dividends on equity and investment fund shares.

Secondary Income (table 5)

Receipts of secondary income decreased $7.4 billion, to $142.8 billion, mainly reflecting a decrease in private transfers, mostly insurance-related transfers. Payments of secondary income increased $14.3 billion, to $281.7 billion, mainly reflecting an increase in private transfers, mostly insurance-related transfers.

Financial Account Transactions, Year 2019 (tables 1, 6, 7, and 8)

Net financial account transactions were −$395.9 billion in 2019, reflecting net U.S. borrowing from foreign residents.

Financial Assets (tables 1, 6, 7, and 8)

Transactions in 2019 increased U.S. residents' foreign financial assets by $426.9 billion. Transactions increased direct investment assets, mainly equity, by $197.7 billion; portfolio investment assets, resulting from large and mostly offsetting transactions in equity securities and debt securities, by $35.9 billion; other investment assets, mostly bank deposits, by $188.7 billion; and reserve assets by $4.7 billion.

Liabilities (tables 1, 6, 7, and 8)

Transactions in 2019 increased U.S. liabilities to foreign residents by $784.4 billion. Transactions increased direct investment liabilities, mostly equity, by $310.8 billion; portfolio investment liabilities, resulting from large and partly offsetting transactions in equity securities and debt securities, by $231.6 billion; and other investment liabilities, mostly bank deposits, by $242.0 billion.

Financial Derivatives (table 1)

Net transactions in financial derivatives were −$38.4 billion in 2019, reflecting net borrowing from foreign residents.

Upcoming Update to the U.S. International Transactions Accounts

The annual update of the U.S. international transactions accounts will be released along with preliminary estimates for the first quarter of 2020 on June 19, 2020. A preview of the annual update will appear in the April 2020 issue of the Survey of Current Business.

Change to the European Union

With the release of "U.S. International Transactions, First Quarter 2020 and Annual Update" on June 19, 2020, statistics for the area grouping "European Union" will exclude the United Kingdom, which withdrew from the European Union effective February 1, 2020. For more information, see "What is the impact of the United Kingdom's withdrawal from the European Union on BEA's data products?"

Prototype Tables

With the release of the international transactions accounts (ITAs) on September 19, 2019, BEA introduced two new tables that present: (1) geographic detail by type of transaction (ITA table 1.4) and (2) annual trade in goods and services with expanded country and geographic area detail (ITA table 1.5). These tables were released as prototypes, along with prototypes for the other standard ITA tables that reflect changes that will be introduced with the annual update in June 2020. These prototype tables have been updated to incorporate the statistics from this release. In addition, several of the prototype tables have been modified to include new subcategory detail and other minor changes. For details, see "Prototype Tables for the International Transactions Accounts" (updated March 19, 2020). These prototype tables are provided alongside the current standard presentation to prepare data users for the upcoming changes. With the release of "U.S. International Transactions, First Quarter 2020 and Annual Update" on June 19, 2020, the prototype tables will replace the existing tables as the standard presentation. The prototype tables, published as addenda to the current tables, are available in BEA's interactive data application.

FULL DOCUMENT: https://www.bea.gov/system/files/2020-03/trans419.pdf

________________

ORGANISMS

CORONAVIRUS

THE WORLD BANK GROUP. MARCH 17, 2020. World Bank Group Increases COVID-19 Response to $14 Billion To Help Sustain Economies, Protect Jobs. Focus on private sector and workers spearheaded by IFC to mitigate financial and economic impact of crisis

WASHINGTON, March 17, 2020 — The World Bank and IFC’s Boards of Directors approved today an increased $14 billion package of fast-track financing to assist companies and countries in their efforts to prevent, detect and respond to the rapid spread of COVID-19. The package will strengthen national systems for public health preparedness, including for disease containment, diagnosis, and treatment, and support the private sector.

IFC, a member of the World Bank Group, will increase its COVID-19 related financing availability to $8 billion as part of the $14 billion package, up from an earlier $6 billion, to support private companies and their employees hurt by the economic downturn caused by the spread of COVID-19.

The bulk of the IFC financing will go to client financial institutions to enable them to continue to offer trade financing, working-capital support and medium-term financing to private companies struggling with disruptions in supply chains. IFC’s response will also help existing clients in economic sectors directly affected by the pandemic--such as tourism and manufacturing—to continue to pay their bills. The package will also benefit sectors involved in responding to the pandemic, including healthcare and related industries, which face increased demand for services, medical equipment and pharmaceuticals.

“It’s essential that we shorten the time to recovery. This package provides urgent support to businesses and their workers to reduce the financial and economic impact of the spread of COVID-19,” said David Malpass, president of the World Bank Group. “The World Bank Group is committed to a fast, flexible response based on the needs of developing countries. Support operations are already underway, and the expanded funding tools approved today will help sustain economies, companies and jobs.”

The additional $2 billion builds on the announcement of the original response package on March 3, which included $6 billion in financing by the World Bank to strengthen health systems and disease surveillance and $6 billion by IFC to help provide a lifeline for micro, small and medium sized enterprises, which are more vulnerable to economic shocks.

“Not only is this pandemic costing lives, but its impact on economies and living standards will likely outlive the health emergency phase. By ensuring our clients sustain their operations during this time, we hope the private sector in the developing world will be better equipped to help economies recover more quickly,” said Philippe Le Houérou, Chief Executive Officer of IFC. “In turn, this will help vulnerable groups to more quickly recover their livelihoods and continue to invest in the future.”

Having mobilized quickly at the time of the 2008 global financial crisis and the Western African Ebola virus epidemic, IFC has a successful track record of implementing response initiatives to address global and regional crises hampering private-sector activity and economic growth in developing countries.

The IFC response has four components:

- $2 billion from the Real Sector Crisis Response Facility, which will support existing clients in the infrastructure, manufacturing, agriculture and services industries vulnerable to the pandemic. IFC will offer loans to companies in need, and if necessary, make equity investments. This instrument will also help companies in the healthcare sector that are seeing an increase in demand.

- $2 billion from the existing Global Trade Finance Program, which will cover the payment risks of financial institutions so they can provide trade financing to companies that import and export goods. IFC expects this will support small and medium-sized enterprises involved in global supply chains.

- $2 billion from the Working Capital Solutions program, which will provide funding to emerging-market banks to extend credit to help businesses shore up their working capital, the pool of funds that firms use to pay their bills and compensate workers.

- A new component initiated at the request of clients and approved on March 17: $2 billion from the Global Trade Liquidity Program, and the Critical Commodities Finance Program, both of which offer risk-sharing support to local banks so they can continue to finance companies in emerging markets.

IFC will maintain its high standards of accountability, while bearing in mind the need to provide support for companies as quickly as possible. IFC management will approve projects based on credit, environmental and social governance and compliance criteria, as applied in past crisis responses.

FULL DOCUMENT: https://www.worldbank.org/en/news/press-release/2020/03/17/world-bank-group-increases-covid-19-response-to-14-billion-to-help-sustain-economies-protect-jobs?cid=ECR_E_NewsletterWeekly_EN_EXT&deliveryName=DM57220

THE WORLD BANK GROUP. MARCH 11, 2020. Ensuring healthcare on the frontlines of conflict and crisis

MUHAMMAD ALI PATE

FRANCK BOUSQUET

Hameed, a 12-year-old boy from Yemen, was fortunate to receive treatment for a cholera infection at a public hospital north of the capital, Sana'a. It wasn't his first bout with cholera --he had already survived one previous infection. Like millions of children in Yemen, he is at constant risk. Cholera transmission is closely linked to inadequate access to clean water and sanitation facilities, which is common in slums and camps for internally displaced persons and refugees.

In addition to cholera, one-third of the global disease burden from HIV, tuberculosis and malaria, and some of the highest levels of maternal, newborn and child deaths are to be found in countries impacted by fragility, conflict and violence. It’s not surprising that these are some of the poorest health outcomes globally. Major crises stretch already weak health systems and often put vulnerable groups—particularly women, children, ethnic minorities, people with disabilities, the elderly and LGBTI populations —at risk of being excluded from receiving basic services like healthcare.

For a development actor like the World Bank Group (WBG), the priority is preserving essential institutions and primary healthcare systems in situations of crisis and conflict so that all people can access the health services they need. This includes strengthening health systems to cope with health emergencies, as well as providing services for the most vulnerable crisis-hit communities, many of whom may be displaced and for whom continuity of services is a challenge. Building institutional capacity for the long term is crucial to ensure such resilience and mitigate the effects of future crises and conflicts.

Supporting primary care in South Sudan, Yemen and Jordan

In countries affected by fragility and conflict, the government’s ability to deliver basic health services to all people is often compromised. In many situations, the state is not in control of and able to deliver services to the entire population. In South Sudan, where maternal and child mortality and morbidity rates are among the highest in the world, and child malnutrition is severe, the Provision of Essential Health Services Project is bringing high-impact health services to women and children that will benefit more than 3.5 million people, with a special focus on high-risk communities and internally displaced persons. The project is also training health professionals in the treatment and counseling of sexual and gender-based violence victims. It is being implemented in partnership with the International Committee of the Red Cross (ICRC) and United Nations Children's Fund (UNICEF).

Yemen is another example. Since 2015, lack of access to basic healthcare, water and sanitation services for 18 million Yemenis due to the ongoing conflict contributed to the largest-ever recorded cholera epidemic and the worst child malnutrition rates in the world. The Yemen Emergency Health and Nutrition Project enabled the delivery of critical health and nutrition services, including addressing the cholera outbreak that affected Hameed through integrated health, nutrition, water and sanitation interventions.

Preserving primary health systems, improving service delivery resilience, and providing support to conflict-affected poor and vulnerable Yemenis have been a top priority. Since the start of the project in January 2017, approximately 12 million Yemeni children had been reached by nationwide vaccination campaigns, more than 1.6 million people had been treated for cholera, 4.3 million women and children had received basic nutrition services and 16 million had been reached by health and nutrition interventions. The project is currently supporting around 50 percent of the public primary and secondary healthcare facilities across Yemen. This project has also seen innovative partnerships with UN organizations, including the World Health Organization and UNICEF as implementing partners.

Both these projects are examples of how organizations with complementary mandates in the humanitarian and development sectors can work together to both deliver critical health services and invest long-term to make the health system more resilient during crises , thus operationalizing the Humanitarian-Development Nexus to preserve Yemen’s human capital.

With 70.8 million people now forcibly displaced worldwide due to conflict and instability, there are major challenges to the health of those who are displaced as well as communities hosting them. In Jordan, for example, financing to support the Jordan Emergency Health Project helps to deliver critical primary and secondary health services to poor uninsured Jordanians as well as Syrian refugees. Over the past year, the project supported the Government of Jordan to deliver more than 5 million primary and secondary health care services. New additional financing includes a contribution of $58.9 million for the next four years from the Global Concessional Financing Facility (GCFF), which supports middle- income countries impacted by fragility and conflict—since crises and conflict affect countries at all income levels.

Mental health and pandemics

An often-neglected component of health services during emergency situations is mental health. In Afghanistan, many people have experienced frequent traumatic events resulting in a large number of mental health problems. One in two Afghans suffers from psychological distress and one in five is impaired because of mental health issues. The Sehatmandi Project, co-financed by IDA, the Afghanistan Reconstruction Trust Fund and the Global Financing Facility, provides essential health services across the country. This includes community-based services and basic psychosocial counseling at primary health care level, as well as the management of severe and acute mental health problems and professional psychosocial counseling in about half of the country. In 2018, more than 2.2 million people received mental health services in all 34 provinces of the country compared to around half a million people in 2009.

Health security from pandemic threats is another area we need to tackle head on. All countries are at risk from outbreaks such as measles, MERS, Zika, dengue, Ebola, or now COVID19, but none more so than low-income and countries in fragile situations. The drivers of health security threats in these places include poor sanitation, lack of access to clean water, poor governance, poor education, insufficient public health-care expenditures, poorly regulated private health services, instability and conflict. IDA, the World Bank’s fund for the poorest, is an important part of how countries can be better prepared to tackle the root causes of disease outbreaks. Human capital is a cross-cutting theme of the new IDA 19 policy package which includes ambitious targets for delivering essential health services for countries with the greatest needs. Quality health services --- especially for the poorest people – is the bedrock for improving country outcomes.

The World Bank Group strategy for fragility, conflict and violence

Investing in and protecting human capital is also a key element of the first institution-wide strategy on fragility, conflict and violence (FCV) of the World Bank Group, which has recently been released. Health is a critical element of these investments – before, during and after crises. To ensure that country programs support the development needs of communities in all FCV-impacted countries, the strategy is built on the four key pillars of crisis prevention, staying engaged during conflict taking a long-term development approach, helping countries transition out of crisis and helping mitigate the cross-border impacts of FCV situations like forced displacement.

The strategy also focuses on how to operationalize these approaches, learning lessons from past engagements—by introducing changes to World Bank policy and programming and scaling up focus on partnerships and personnel to ensure that the institution is fit for purpose to tackle FCV challenges. As the number and intensity of FCV challenges increases, addressing them becomes even more mission critical for the WBG—given that up to two-thirds of the extreme poor globally will live in FCV settings by 2030.

FULL DOCUMENT: https://blogs.worldbank.org/dev4peace/ensuring-healthcare-frontlines-conflict-and-crisis?cid=ECR_E_NewsletterWeekly_EN_EXT&deliveryName=DM57220

The World Bank's response to COVID-19 (coronavirus): https://www.worldbank.org/en/who-we-are/news/coronavirus-covid19

IMF. MARCH 19, 2020. COVID-19 Pandemic and Latin America and the Caribbean: Time for Strong Policy Actions

By Alejandro Werner

COVID-19 is spreading very quickly. This is no longer a regional issue—it is a challenge calling for a global response. Countries in Latin America and the Caribbean have been hit later than other regions from the pandemic and therefore have a chance to flatten the curve of contagion.

Efforts on multiple fronts to achieve this goal are underway. In addition to strengthening health policy responses, many countries in the region are taking measures of containment, including border closures, school closings, and other social distancing measures.

For the region, a 2020 with negative growth is not an unlikely scenario.

These measures, together with the world economic slowdown and disruption in supply chains, the decline in commodity prices, the contraction in tourism, and the sharp tightening of global financial conditions are bringing activity to a halt in many Latin American countries—severely damaging economic prospects. For the region, the recovery we were expecting a few months ago will not happen and a 2020 with negative growth is not an unlikely scenario.

Deep impact

The resulting increase in borrowing costs will expose financial vulnerabilities that have accumulated over years of low interest rates. While the sharp fall in the oil price is expected to benefit the oil importing countries in the region, it will dampen investment and economic activity in countries that are heavily dependent on oil exports.

In the event of a local outbreak, service sector activity will likely be hit the hardest as a result of containment efforts and social distancing, with sectors such as tourism and hospitality, and transportation particularly affected.

Moreover, countries with weak public health infrastructures and limited fiscal space to ramp up public health services and support affected sectors and households would come under significant pressure.

The economic impact of the pandemic is likely to vary due to regional and country-specific characteristics.

South America will face lower export revenues, both from the drop in commodity prices and reduction in export volumes, especially to China, Europe and the United States which are important trade partners. The sharp decline in oil prices will hit the oil exporters especially. The tightening of financial conditions will affect negatively the large and financially integrated economies and those with underlying vulnerabilities. Containment measures in several countries will reduce economic activity in service and manufacturing sectors for at least the next quarter, with a rebound once the epidemic is contained.

In Central America and Mexico, a slowdown in the United States will lead to a reduction in trade, foreign direct investment, tourism flows, and remittances. Key agricultural exports (coffee, sugar, banana) as well as trade flows through the Panama Canal could also be adversely affected by lower global demand. Local outbreaks will strain economic activity in the next quarter and aggravate already uncertain business conditions (especially in Mexico).

In the Caribbean, lower tourism demand due to travel restrictions and “the fear factor”—even after the outbreak recedes—will weigh heavily on economic activity. Commodity exporters will also be strongly impacted and a reduction in remittances is likely to add to the economic strain.

Policy priorities

The top priority is ensuring that front-line health-related spending is available to protect people’s wellbeing, take care of the sick, and slow the spread of the virus. In countries where there are limitations in health care systems, the international community must step in to help them avert a humanitarian crisis.

In addition, targeted fiscal, monetary, and financial market measures will be key to mitigate the economic impact of the virus. Governments should use cash transfers, wage subsidies and tax relief to help affected households and businesses to confront this temporary and sudden stop in production.

Central banks should increase monitoring, develop contingency plans, and be ready to provide ample liquidity to financial institutions, particularly those lending to small and medium sized enterprises, which may be less prepared to withstand prolonged disruptions. Temporary regulatory forbearance may also be appropriate in some cases.

Where policy space exists, broader monetary and fiscal stimulus can lift confidence and aggregate demand but would most likely be more effective when business operations begin to normalize. Given the extensive cross-border economic linkages, the argument for a coordinated, global response to the epidemic is clear.

Countries are starting to take policy initiatives in this direction. For example, additional funds are being secured for health spending in many countries including Argentina, Brazil, Colombia, and Peru. Moreover, Brazil announced an emergency economic package on March 17 that is targeted for supporting the socially vulnerable, maintenance of employment, and combatting the pandemic.

For our part, the IMF stands ready to help mitigate the economic fallout from the coronavirus and we have several facilities and instruments at our disposal.

In closing, I would like to iterate the importance of decisive actions by all of us to limit the economic fallout from the coronavirus and avert a humanitarian crisis. The Fund stands ready to assist and work with member countries in these difficult times.

FULL DOCUMENT: https://blogs.imf.org/2020/03/19/covid-19-pandemic-and-latin-america-and-the-caribbean-time-for-strong-policy-actions/?utm_medium=email&utm_source=govdelivery

________________

ECONOMIA BRASILEIRA / BRAZIL ECONOMICS

CORONAVIRUS

PR. 19/03/2020. CORONAVÍRUS. Bolsonaro anuncia fechamento de fronteira com mais oito países para conter avanço do coronavírus. Portaria publicada nesta quinta-feira trata de estrangeiros vindos da Argentina, Bolívia, Colômbia, Guiana Francesa, Guiana, Paraguai, Peru e Suriname

Apartir desta quinta-feira (19), estrangeiros vindos da Argentina, Bolívia, Colômbia, Guiana Francesa, Guiana, Paraguai, Peru e Suriname não poderão entrar no Brasil por meio das fronteiras terrestres. A portaria publicada no Diário Oficial da União desta quinta restringe a entrada no País por 15 dias, prazo que pode ser prorrogado conforme recomendação da Agência Nacional de Vigilância Sanitária (Anvisa).

A medida foi justificada pelo fato de a Organização Mundial da Saúde ter declarado emergência em saúde pública de importância internacional em decorrência da infecção humana pelo coronavírus (covid-19). A restrição decorre de recomendação técnica e fundamentada da Anvisa por motivos sanitários relacionados aos riscos de contaminação e disseminação do coronavírus.

O presidente da República, Jair Bolsonaro, afirmou que o Governo Federal continuará trabalhando para encontrar novas soluções para a questão do fechamento das fronteiras. ¨Mais ações a caminho pensando também no inevitável impacto financeiro das famílias envolvidas¨, disse em suas redes sociais.

A medida não se aplica ao brasileiro, nato ou naturalizado; ao imigrante com prévia autorização de residência definitiva em território brasileiro; ao profissional estrangeiro em missão a serviço de organismo internacional, desde que devidamente identificado; e ao funcionário estrangeiro acreditado junto ao Governo brasileiro.

Não foram afetados o livre tráfego do transporte rodoviário de cargas, a execução de ações humanitárias transfronteiriças previamente autorizada pelas autoridades sanitárias locais e o tráfego de residentes de cidades gêmeas com linha de fronteira exclusivamente terrestre.

Como sanção aos que descumprirem as medidas, foram definidas a responsabilização civil, administrativa e penal do agente infrator e a deportação imediata do agente infrator, com inabilitação de pedido de refúgio.

Na quarta-feira (18), foi publicada portaria que suspende entrada de estrangeiros vindos da Venezuela por 15 dias. De acordo com o texto, uma portaria específica sobre as fronteiras terrestres com Uruguai ainda será publicada.

MRE. DCOM. NOTA-46. 19 de Março de 2020. Declaração dos Presidentes do Mercosul sobre coordenação regional para a contenção e mitigação do coronavírus e seu impacto

Os Chefes de Estado e Altos Representantes da República Federativa do Brasil, da República do Paraguai, da República Oriental do Uruguai e da República Argentina, no marco de uma reunião virtual convocada pela Presidência Pro Tempore paraguaia do Mercosul,

CONSIDERANDO

Que a pandemia causada pelo COVID-19 não respeita fronteiras, exigindo coordenação regional eficiente e permanente, com base em boas práticas baseadas em evidências científicas e em diretrizes e orientações emitidas pelas organizações competentes.

Que os Estados Partes tomaram medidas de prevenção e contenção que buscam minimizar a propagação da doença e adotar planos estratégicos capazes de responder a situações causadas pelo movimento de pessoas e de bens, pelo trânsito e transporte, pela produção e comércio, economia e finanças públicas, bem como em outros setores.

Que é necessário criar espaços multissetoriais de coordenação regional, que tratem desse problema com uma perspectiva estratégica e solidária, colocando os cidadãos no centro dos esforços coletivos,

DECLARAM SUA VONTADE DE

- Facilitar o retorno de cidadãos e residentes dos Estados Partes no MERCOSUL para seus locais de origem ou residência, para o que realizarão um intercâmbio periódico de listas de pessoas que manifestaram vontade de retornar. Os Ministérios das Relações Exteriores e os responsáveis por imigração e transporte realizarão tarefas de coordenação para tornar efetiva essa medida. No caso de Estados que possuem companhias aéreas nacionais em atividade, os respectivos governos administrarão as operações de retorno, de acordo com suas possibilidades.

- Levar em consideração as especificidades próprias das comunidades residentes nas áreas de fronteira no processo de planejamento e execução de medidas aplicáveis à circulação de bens, serviços e pessoas, a fim de reduzir seu impacto nas referidas comunidades.

- Notificar os demais Estados Partes das medidas que foram adotadas ou serão adotadas para as fronteiras. Os Ministérios das Relações Exteriores podem estabelecer um sistema de compilação, organização e difusão.

- Identificar e promover a remoção de obstáculos que dificultem ou impeçam a circulação de bens e serviços e estudar medidas cuja adoção leve à agilização do trânsito e transporte de insumos e produtos de primeira necessidade, incluindo os necessários para alimentação, higiene e cuidados com a saúde.

- Avaliar a conveniência, oportunidade e possibilidade de redução das tarifas aplicadas aos produtos e insumos destinados à prevenção de doenças e assistência à saúde, no contexto da emergência sanitária causada pelo Covid-19.

- Providenciar para que os Ministros das Relações Exteriores, Saúde, Interior/Segurança organizem reuniões virtuais periódicas por setor, nas quais compartilharão informações, boas práticas e coordenarão ações em áreas de interesse comum.

- Convocar organizações multilaterais de crédito, em particular o BID, CAF e FONPLATA, para avaliar conjuntamente linhas de ação que contribuam para enfrentar efetivamente os desafios decorrentes do combate à disseminação do coronavírus e suas consequências nos Estados Partes da MERCOSUL.

18 de março de 2020

MRE. DCOM. NOTA-45. 19 de Março de 2020. Nota

Como resultado de gestões conjuntas do Itamaraty, do Ministério do Turismo e da ANAC junto ao governo peruano e a companhias aéreas, informamos sobre a realização de voos especiais a Lima, amanhã, 20 de março, com o objetivo de repatriar brasileiros que se encontram retidos no Peru em decorrência do surto de coronavírus.

A Embaixada do Brasil em Lima coordena a operação no local, em conjunto com a LATAM e a Gol.

BACEN. 19 Março 2020. BC e Federal Reserve estabelecem uma linha de swap de liquidez

O Banco Central do Brasil e o Federal Reserve (banco central dos Estados Unidos) estabeleceram uma linha de swap de liquidez em dólares americanos no montante de US$ 60 bilhões, ampliando a oferta potencial de dólar no mercado doméstico.

Esta linha não implica condicionalidades de política econômica e será utilizada para incrementar os fundos disponíveis para as operações de provisão de liquidez em dólares pelo BC.

O acordo de swap entre o Banco central do Brasil e o Federal Reserve permanecerá em vigor por pelo menos seis meses. A linha de liquidez soma-se ao conjunto de instrumentos disponíveis do BC para lidar com a alta volatilidade dos mercados em decorrência da pandemia da Covid-19.

O anúncio de hoje inclui também as autoridades monetárias da Austrália, Dinamarca, Coreia do Sul, México, Noruega, Nova Zelândia, Singapura e Suécia. O Federal Reserve também possui linhas de swap de liquidez em dólares americanos com o Banco do Canadá, o Banco da Inglaterra, o Banco do Japão, o Banco Central Europeu e o Banco Nacional Suíço.

O BC tomará as medidas regulamentares e operacionais necessárias para a implementação desta iniciativa, observando-se os limites e condições a serem estabelecidos pelo Conselho Monetário Nacional.

FED. March 19, 2020. Federal Reserve announces the establishment of temporary U.S. dollar liquidity arrangements with other central banks

The Federal Reserve on Thursday announced the establishment of temporary U.S. dollar liquidity arrangements (swap lines) with the Reserve Bank of Australia, the Banco Central do Brasil, the Danmarks Nationalbank (Denmark), the Bank of Korea, the Banco de Mexico, the Norges Bank (Norway), the Reserve Bank of New Zealand, the Monetary Authority of Singapore, and the Sveriges Riksbank (Sweden). These facilities, like those already established between the Federal Reserve and other central banks, are designed to help lessen strains in global U.S. dollar funding markets, thereby mitigating the effects of these strains on the supply of credit to households and businesses, both domestically and abroad.

These new facilities will support the provision of U.S. dollar liquidity in amounts up to $60 billion each for the Reserve Bank of Australia, the Banco Central do Brasil, the Bank of Korea, the Banco de Mexico, the Monetary Authority of Singapore, and the Sveriges Riksbank and $30 billion each for the Danmarks Nationalbank, the Norges Bank, and the Reserve Bank of New Zealand. These U.S. dollar liquidity arrangements will be in place for at least six months.

The Federal Reserve also has standing U.S. dollar liquidity swap lines with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank.

AGRICULTURA

IBGE. 19/03/2020. Em 2019, cresce o abate de bovinos, suínos e frangos

O abate de bovinos cresceu 1,2% em 2019, atingindo 32,44 milhões de cabeças. Foi a terceira alta consecutiva na série histórica anual, após as quedas registradas entre 2014 e 2016. O abate de suínos aumentou 4,5% e atingiu novo recorde, chegando a 46,33 milhões de cabeças. O abate de frangos também subiu 1,9% em 2019, depois de dois anos de queda, totalizando 5,81 bilhões de cabeças de frango.

A aquisição de leite chegou a 25,01 bilhões de litros, com alta de 2,3%. Já a aquisição de couro caiu 5,0% em relação a 2018 ao somar 33,34 milhões de peças. A produção de ovos aumentou 6,3% e chegou a 3,8 bilhões de dúzias, novo recorde na série histórica iniciada em 1987.

Tabela 12 - Número de animais abatidos por espécie e variação,segundo os meses

Brasil - 2018 - 2019 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Mês | Número de animais abatidos (mil cabeças) e variação (%) | ||||||||

| Bovinos | Suínos | Frangos | |||||||

| 2018 | 2019 | Variação | 2018 | 2019 | Variação | 2018 | 2019 | Variação | |

| Total do ano | 32 043 | 32 436 | 1,2 | 44 337 | 46 331 | 4,5 | 5 698 494 | 5 805 393 | 1,9 |

| Total do 1º Trimestre | 7 773 | 7 927 | 2,0 | 10 725 | 11 299 | 5,3 | 1 478 794 | 1 438 152 | -2,7 |

| Janeiro | 2 677 | 2 771 | 3,5 | 3 686 | 3 897 | 5,7 | 511 752 | 503 811 | -1,6 |

| Fevereiro | 2 434 | 2 542 | 4,4 | 3 331 | 3 659 | 9,8 | 464 629 | 464 323 | -0,1 |

| Março | 2 662 | 2 615 | -1,8 | 3 708 | 3 743 | 0,9 | 502 413 | 470 018 | -6,4 |

| Total do 2º Trimestre | 7 768 | 7 939 | 2,2 | 10 835 | 11 396 | 5,2 | 1 376 796 | 1 425 160 | 3,5 |

| Abril | 2 619 | 2 642 | 0,9 | 3 674 | 3 816 | 3,9 | 484 736 | 478 561 | -1,3 |

| Maio | 2 313 | 2 839 | 22,7 | 3 098 | 4 008 | 29,4 | 406 447 | 503 789 | 23,9 |

| Junho | 2 836 | 2 458 | -13,3 | 4 062 | 3 572 | -12,1 | 485 613 | 442 810 | -8,8 |

| Total do 3º Trimestre | 8 317 | 8 499 | 2,2 | 11 587 | 11 750 | 1,4 | 1 426 424 | 1 471 807 | 3,2 |

| Julho | 2 853 | 2 944 | 3,2 | 4 008 | 4 051 | 1,1 | 470 995 | 508 961 | 8,1 |

| Agosto | 2 934 | 2 876 | -2,0 | 4 091 | 3 960 | -3,2 | 506 899 | 496 800 | -2,0 |

| Setembro | 2 530 | 2 678 | 5,9 | 3 487 | 3 740 | 7,3 | 448 530 | 466 046 | 3,9 |

| Total do 4º Trimestre | 8 185 | 8 071 | -1,4 | 11 190 | 11 886 | 6,2 | 1 416 479 | 1 470 274 | 3,8 |

| Outubro | 2 813 | 2 915 | 3,6 | 3 922 | 4 136 | 5,4 | 501 885 | 516 272 | 2,9 |

| Novembro | 2 664 | 2 612 | -2,0 | 3 664 | 3 830 | 4,5 | 464 697 | 475 578 | 2,3 |

| Dezembro | 2 708 | 2 545 | -6,0 | 3 605 | 3 920 | 8,8 | 449 898 | 478 424 | 6,3 |

| Fonte: IBGE, Diretoria de Pesquisas, Coordenação de Agropecuária - Pesquisa Trimestral do Abate de Animais Nota: Os dados relativos ao ano de 2019 são preliminares. | |||||||||

Abate de bovinos cresce 1,2% e tem terceira alta consecutiva anual

Em 2019, foram abatidas 32,44 milhões de cabeças de bovinos, um aumento de 1,2% em relação ao ano anterior. Essa foi a terceira alta consecutiva na série histórica anual, após as quedas registradas em 2014, 2015 e 2016. O crescimento foi impulsionado por aumentos em 15 das 27 Unidades da Federação, sendo os mais expressivos em Mato Grosso (+430,55 mil cabeças), Mato Grosso do Sul (+291,51 mil), São Paulo (+224,23 mil) e Santa Catarina (+60,15 mil). As quedas mais intensas ocorreram no Pará (-283,22 mil), Goiás (-199,50 mil) e Rio Grande do Sul (-167,86 mil).

Mato Grosso continuou liderando o ranking das UFs, com 17,4% da participação nacional, seguido por Mato Grosso do Sul (11,1%) e Goiás (10,3%).

Já no 4º trimestre de 2019, foram abatidas 8,07 milhões de cabeças de bovinos, quantidade 1,4% menor que a do 4° trimestre de 2018 e 5,0% inferior à do 3º trimestre de 2019.

Abate de suínos aumenta 4,5% e atinge novo recorde em 2019

No ano passado, foram abatidas 46,33 milhões de cabeças de suínos, um aumento de 4,5% (+1,99 milhão de cabeças) em relação ao ano de 2018. A série anual mostra que houve crescimentos ininterruptos dessa atividade, culminando em novo recorde em 2019.

O abate cresceu em 20 das 25 UFs participantes da pesquisa. Entre aquelas com participação acima de 1,0%, houve aumentos Santa Catarina (+845,89 mil cabeças), São Paulo (+300,27 mil), Minas Gerais (+295,40 mil), Mato Grosso (+253,65 mil), Rio Grande do Sul (+191,65 mil), Goiás (+140,47 mil) e Mato Grosso do Sul (+31,77 mil). Em contrapartida, a principal queda ocorreu no Paraná (-90,74 mil cabeças).

Santa Catarina manteve a liderança no abate de suínos em 2019, com 27,0% do abate nacional, seguido por Paraná (19,9%) e Rio Grande do Sul (18,1%).

No 4º trimestre de 2019, foram abatidas 11,89 milhões de cabeças de suínos, alta de 1,2% em relação ao trimestre imediatamente anterior e aumento de 6,2% em relação ao mesmo período de 2018. Foram registrados os melhores resultados para os meses de outubro, novembro e dezembro, determinando assim, novo recorde para a série histórica iniciada em 1997.

Abate de frangos sobe 1,9%, primeira alta desde 2016

Em 2019, foram abatidas 5,81 bilhões de cabeças de frango, aumento de 1,9% (+106,90 milhões de cabeças) em relação a 2018. Essa foi o primeiro crescimento na atividade após dois anos seguidos de queda.

Houve altas no abate em 15 das 25 UFs que participaram da pesquisa. Entre aquelas com participação acima de 1,0%, ocorreram aumentos no Paraná (+94,52 milhões cabeças), Santa Catarina (+52,34 milhões), Goiás (+15,00 milhões), Minas Gerais (+14,93 milhões), Bahia (+5,12 milhões), Mato Grosso (+4,24 milhões) e Pará (+2,62 milhões). Já as quedas ocorreram no Rio Grande do Sul (-39,15 milhões), São Paulo (-20,49 milhões), Distrito Federal (-15,08 milhões) e Mato Grosso do Sul (-11,15 milhões).

O Paraná continuou liderando amplamente na participação nacional, com 32,5%, seguido por Santa Catarina (14,1%) e Rio Grande do Sul (14,0%).

No 4º trimestre de 2019, foram abatidas 1,47 bilhão de cabeças de frangos, ficando estável (-0,1%) em relação ao trimestre imediatamente anterior e um aumento de 3,8% na comparação com o mesmo período de 2018. Numa comparação mensal, foi o melhor resultado para o mês de outubro da série histórica.

Aquisição de leite aumenta 2,3% e bate mais um recorde

Os laticínios sob serviço de inspeção sanitária captaram, no ano passado, 25,01 bilhões de litros, um acréscimo de 2,3% em relação a 2018, mantendo a sequência de resultados positivos desde 2017, e um recorde na série histórica, iniciada em 1997.

A aquisição de 552,42 milhões de litros de leite a mais em nível nacional resultou do aumento no volume captado em 18 das 26 UFs participantes da Pesquisa Trimestral do Leite. Os maiores aumentos ocorreram no Paraná (+186,16 milhões de litros), Minas Gerais (+181,60 milhões), Goiás (+112,49 milhões), São Paulo (+57,60 milhões) e Ceará (+55,14 milhões). Houve quedas em oito estados, sendo a mais expressiva verificada no Rio Grande do Sul (-79,35 milhões).

Minas Gerais manteve a liderança, com 25,0% de participação nacional, seguida por Rio Grande do Sul (13,2%) e Paraná (13,1%).

Já no 4º trimestre de 2019, a aquisição de leite foi de 6,65 bilhões de litros, uma redução de 0,9% em relação ao 4º trimestre de 2018. Quanto ao trimestre imediatamente anterior, o volume foi 5,6% maior. Comparando o 4º trimestre de 2019 com o mesmo período em 2018, houve decréscimo de 57,38 milhões de litros de leite em nível nacional.

Aquisição de couro cai 5% em 2019

Em 2019, os curtumes investigados pela Pesquisa Trimestral do Couro – aqueles que curtem pelo menos cinco mil unidades inteiras de couro cru bovino por ano – declararam ter recebido 33,34 milhões de peças inteiras de couro cru bovino, uma queda de 5,0% em relação a 2018.

A redução de 1,77 milhão de peças de couro foi impulsionada pela retração do recebimento de peles bovinas em 11 das 20 UFs que possuem pelo menos um curtume ativo enquadrado no universo da pesquisa. As variações negativas mais significativas ocorreram no Pará (-412,99 mil peças), Paraná (-381,73 mil), Rio Grande do Sul (-321,55 mil), Goiás (-294,27 mil) e Mato Grosso (-283,95 mil). Já os aumentos mais significativos ocorreram em Rondônia (+301,89 mil) e Minas Gerais (+66,41 mil).

Entre as UFs, Mato Grosso continua liderando em 2019, com 16,6% de participação nacional, seguido por Mato Grosso do Sul (13,8%) e São Paulo (11,8%).

No 4º trimestre de 2019, os curtumes investigados declararam ter recebido 7,89 milhões de peças de couro, uma redução de 8,1% em relação ao trimestre imediatamente anterior e queda de 12,4% frente ao 4° trimestre de 2018. O comparativo entre os 4°trimestres de 2018 e 2019 indicam queda de 1,12 milhão de peças no total adquirido pelos estabelecimentos.

Produção de ovos aumenta 6,3% e chega a 3,8 bilhões de dúzias

A produção de ovos de galinha foi de 3,83 bilhões de dúzias em 2019, representando aumento de 6,3% em relação ao ano anterior. A série anual mostra que houve crescimento ininterrupto dessa atividade, um recorde da série histórica, iniciada em 1987.

O aumento de 226,92 milhões de dúzias de ovos veio de 21 das 26 UFs com granjas enquadradas no universo da pesquisa. Os aumentos mais expressivos ocorreram em São Paulo (+53,60 milhões de dúzias), Ceará (+30,37 milhões), Minas Gerais (+30,0 milhões), Paraná (+29,36 milhões), Espírito Santo (+20,26 milhões) e Mato Grosso (+18,24 milhões). Já a maior queda ocorreu no Rio Grande do Sul (-4,71 milhões), seguida pelo Distrito Federal (-2,43 milhões). As quedas em Alagoas, Rio Grande do Norte e Bahia, somadas não chegaram a cinco milhões de dúzias.

O estado de São Paulo seguiu liderando o ranking das UFs, com 29,0% da produção nacional, seguido, pelo segundo ano consecutivo, por Espírito Santo (9,4%). Minas Gerais (9,3%) e Paraná (9,1%) vem logo em seguida. A Região Sudeste foi responsável por quase metade da produção de ovos em 2019: originou 48,1% do total produzido.

Foram produzidas 985,69 milhões de dúzias de ovos de galinha no 4º trimestre de 2019, um aumento de 1,4% em relação à produção do 3º trimestre e 4,7% acima do 4º trimestre de 2018. A produção de ovos do 4º trimestre de 2019 foi a maior da série histórica.

Com o cruzamento de informações cadastrais das granjas, a partir dos dados apurados em 2019, verificou-se que mais da metade das granjas, 1.125 (55,1%), produziram ovos para o consumo, respondendo por 81,0% do total de ovos produzidos, enquanto 915 granjas (44,9%) produziram ovos para incubação, respondendo por 19,0% do total de ovos produzidos.

Abate de suínos e produção de ovos e leite atingem recordes em 2019. Abate de suínos alcançou 46,33 milhões de cabeças, aumento de 4,5% em relação a 2018

O ano de 2019 do setor pecuário foi marcado por recordes no abate de suínos e na produção de ovos, impulsionados pela demanda da China, que sofre efeitos da peste suína africana. O abate de suínos alcançou 46,33 milhões de cabeças, aumento de 4,5% em relação a 2018, com alta em 20 dos 25 estados pesquisados, enquanto a produção de ovos chegou a 3,83 bilhões de dúzias em 2019, aumento de 6,3% em relação ao ano anterior, com crescimento em 21 dos 26 estados. Outro recorde foi a produção de leite, que atingiu 25,01 bilhões de litros, alta de 2,3% sobre a quantidade registrada em 2018.

Os dados são da Estatística da Produção Pecuária, que o IBGE divulga hoje (19). A pesquisa mostra também que o abate de bovinos cresceu 1,2%, somando 32,44 milhões de cabeças, com expansão em 15 dos 27 estados. Enquanto o abate de frangos cresceu 1,9% para 5,81 bilhões de cabeças, após dois anos consecutivos de queda na comparação anual. As altas no abate de frangos foram registradas em 15 dos 25 estados pesquisados.

Em contrapartida, os curtumes tiveram queda de 5% ao registrarem 33,34 milhões de peças inteiras de couro cru bovino, com decréscimo em 11 dos 20 estados que possuem pelo menos um curtume ativo.

“Foram registrados aumentos nas exportações de suínos por conta da peste suína africana incidente na China. No final do ano, também houve um aumento nas exportações de bovinos, chegando a 22% do que foi produzido. A China não importou apenas suínos, mas também mais bovinos e frangos. No mercado interno, com o aumento dos preços das carnes bovinas, devido ao crescimento das exportações, houve a procura por outras proteínas, como os ovos, que registraram novo recorde”, analisa o supervisor das pesquisas de pecuária do IBGE, Bernardo Viscardi.

Dados trimestrais

No 4º trimestre de 2019, o abate de bovinos caiu 1,4% e os de suínos e frangos subiram 6,2% e 3,8%, respectivamente, no último trimestre de 2019, em comparação com o mesmo período do ano anterior. Já em relação ao terceiro trimestre de 2019, o abate de bovinos reduziu 5%, o de frangos variou -0,1% e o de suínos subiu 1,2%.

No último trimestre do ano passado, foram abatidas 8,07 milhões de cabeças de bovinos, com uma produção total de 2,09 milhões de toneladas de carcaças, aumento de 0,9% em comparação com o mesmo período de 2018, porém, 4,8% abaixo da quantidade aferida no terceiro trimestre de 2019. Considerando a série histórica iniciada em 1997, trata-se do segundo melhor resultado para um quarto trimestre desde 2013, quando foram produzidas 2,20 milhões de toneladas de carcaças bovinas.

Suínos

O abate de suínos alcançou 11,89 milhões de cabeças, aumentos de 6,2% em relação ao mesmo período de 2018 e de 1,2% na comparação com o 3° trimestre de 2019, no melhor resultado para o trimestre, determinando assim, novo recorde para a série histórica iniciada em 1997. O peso acumulado das carcaças foi de 1,06 milhões de toneladas, no 4º trimestre de 2019, com altas de 7,9% em relação ao mesmo período de 2018 e estabilidade (0,1%) na comparação com o 3º trimestre de 2019.

Frangos

Já o abate de frangos chegou a 1,47 bilhão de cabeças, aumento de 3,8% no 4º trimestre de 2019, em relação ao mesmo período de 2018 e situação de estabilidade (-0,1) na comparação com o 3º trimestre de 2019. Em uma comparação mensal dentro da série histórica, foi registrado o melhor resultado para o mês de outubro. O peso acumulado das carcaças foi de 3,40 milhões de toneladas no 4º trimestre de 2019, aumento de 1,9% em relação ao mesmo período de 2019 e queda de 1,5% na comparação com o 3º trimestre do ano passado.

Leite e ovos

A aquisição de leite cru feita pelos estabelecimentos que atuam sob inspeção sanitária municipal, estadual ou federal, foi de 6,65 bilhões de litros, equivalente a uma redução de 0,9% em relação ao 4° trimestre de 2018, e a um incremento de 5,6% em comparação com o trimestre imediatamente anterior. Considerando a série histórica, esta é a segunda maior captação de leite acumulada em um 4° trimestre, superada apenas pelo total registrado no período equivalente do ano anterior.

Já a produção de ovos de galinha foi a maior já alcançada, atingindo 985,69 milhões de dúzias no 4º trimestre de 2019. Esse número foi 1,4% maior que o registrado no trimestre imediatamente anterior e 4,7% superior ao apurado no 4º trimestre de 2018.

Couro

A pesquisa também mostra que os curtumes com pelo menos 5 mil unidades inteiras de couro receberam 7,89 milhões de peças de couro no 4º trimestre do ano passado. Esse total, representa reduções de 12,4% em relação a igual período de 2018 e 8,1% frente ao 3° trimestre de 2019.

DOCUMENTO: https://agenciadenoticias.ibge.gov.br/agencia-sala-de-imprensa/2013-agencia-de-noticias/releases/27167-em-2019-cresce-o-abate-de-bovinos-suinos-e-frangos

________________

LGCJ.: