CANADA ECONOMICS

CANADA - UK

PM. Itinerary for April 18 to 20, 2018 Ottawa, Ontario - April 17, 2018

Note: All times local

Itinerary for the Prime Minister, Justin Trudeau, for Wednesday, April 18, 2018:

London, United Kingdom

9:45 a.m. The Prime Minister will participate in a youth town hall Q&A with the Mayor of London, Sadiq Khan, and the Prime Minister of New Zealand, Jacinda Ardern to mark the occasion of the 100th anniversary of women's right to vote in Britain, and to discuss gender equality and issues affecting young people.

London's Living Room, 9th Floor

City Hall

Note to media:

Open coverage

2 p.m. The Prime Minister will participate in a roundtable discussion with Small Island and Coastal State leaders to talk about climate change.

Grays Room

Mezzanine Level

InterContinental London Park Lane

Note to media:

Pooled photo opportunity at the beginning of the meeting

3:30 p.m. The Prime Minister will meet with the Prime Minister of the United Kingdom of Great Britain and Northern Ireland, the Right Honourable Theresa May.

1st Floor

10 Downing Street

Note for media:

Photo opportunity of arrival and handshake outside No. 10 and pooled photo opportunity in the garden

4:30 p.m. The Prime Minister will have an audience with Her Majesty The Queen.

Audience Room

Buckingham Palace

Note to media:

Restricted pooled photo opportunity

7:30 p.m. The Prime Minister will attend a welcome reception given by the Prime Minister of the United Kingdom of Great Britain and Northern Ireland.

Level 35

Sky Garden

Note to media:

Host broadcast coverage of reception

8 p.m. The Prime Minister will attend a welcome dinner given by the Prime Minister of the United Kingdom of Great Britain and Northern Ireland.

Level 36

Sky Garden

Note to media:

Host coverage broadcast of opening remarks

Media appearances

An interview with the Prime Minister and Yalda Hakim, BBC News will be broadcast at noon BST and at 6 p.m. BST

Itinerary for the Prime Minister, Justin Trudeau, for Thursday, April 19, 2018:

London, United Kingdom

8 a.m. The Prime Minister will participate in a roundtable discussion with young professionals based in London.

Laurier Room

4th Floor

Canada House

Note to media:

Open coverage for opening remarks

10 a.m. The Prime Minister will participate in the Opening Ceremony of the Commonwealth Heads of Government Meeting (CHOGM).

Ballroom

1st Floor

Buckingham Palace

Note to media:

Live host broadcast only

10:42 a.m. The Prime Minister will participate in an official photograph with Her Majesty The Queen.

Ballroom

1st Floor

Buckingham Palace

Note to media:

Host photographers only

11 a.m. The Prime Minister will participate in the official welcome by the Prime Minister of the United Kingdom of Great Britain and Northern Ireland and the Secretary-General of the Commonwealth, the Right Honourable Patricia Scotland.

Friary Court

St. James’s Palace

Note to media:

Pooled photo opportunity of Leaders’ arrivals at Friary Court

12:15 p.m. The Prime Minister will participate in Executive Session I.

Executive Tent

Lancaster House

Note to media:

Host broadcast coverage of opening remarks

1:15 p.m. The Prime Minister will attend a reception given by the Secretary-General of the Commonwealth.

Queen Anne Room, Throne Room, and Entrée Room

St. James’s Palace

Note to media:

Host photographers only

2:30 p.m. The Prime Minister will participate in Executive Session II.

Executive Tent

Lancaster House

Closed to media

4:15 p.m. The Prime Minister will participate in Executive Session III.

Executive Tent

Lancaster House

Closed to media

6:15 p.m. The Prime Minister will hold a media availability.

Mackenzie Room

Ground Floor

Canada House

Notes to media:

Open coverage

For security purposes, media wishing to cover this event must arrive no later than 5:30 p.m.

Media should arrive via the Pall Mall entrance.

Media wishing to attend will need to present valid UK press cards (http://www.ukpresscardauthority.co.uk/) or possess CHOGM media accreditation for entry.

Space is limited. Please RSVP to: GalleryCanadaGalerie@international.gc.ca

8:30 p.m. The Prime Minister will attend the Leaders’ Dinner for Heads of Government and Spouses given by Her Majesty The Queen.

Picture Gallery

1st Floor

Buckingham Palace

Note to media:

Host broadcast for arrivals and toasts

Itinerary for the Prime Minister, Justin Trudeau, for Friday, April 20, 2018:

London, United Kingdom

9:45 a.m. The Prime Minister will attend the Leaders’ Retreat Opening Session.

Waterloo Chamber

2nd Floor

Windsor Castle

Note to media:

Pooled photo opportunity of Leaders’ arrival

CANADA - FRANCE - CETA

Global Affairs Canada. April 18, 2018. Minister Champagne concludes successful trade mission to Paris

Ottawa, Ontario - Foreign investment creates jobs in Canada, expands trade, boosts productivity, provides access to new technologies, encourages innovation and links Canadian firms to global supply chains to grow trade in key sectors, such as artificial intelligence (AI) and clean technologies (cleantech).

The Honourable François-Philippe Champagne, Minister of International Trade, today concluded a successful trade mission to Paris, France, from April 15 to 18, 2018, with a focus on Canada’s strengths and capabilities in AI and cleantech, as well as on promoting its progressive trade agenda.

During the trade mission, Minister Champagne announced three projects.

The first, jointly announced with the Silingen Group, a German metallurgy company, was the $7-million construction in Hamilton, Ontario, of Silingen’s first zero-waste Canadian factory. The facility, which will begin construction at the end of 2018, will manufacture industrial products from recycled metal waste. New products will be developed and manufactured in Canada in accordance with circular economy rules (keeping resources in use for as long as possible, extracting the maximum value from them while they are in use, then recovering and regenerating products and materials at the end of their service lives) in cooperation with Canadian institutes of technology and universities.

The second announcement was for a $4-million investment fund to be launched in September 2018. The fund was conceived by a law firm and group of industrialists based in Brittany, a region in France, and will be managed and financed by Conseil Québec Investissement Croissance Inc (CQIC), a Canadian subsidiary of France’s FB Croissance. The fund will enable companies in France to finance business projects in Canada, including in Quebec.

The third project announced was the creation of an applied industrial research chair position in human nutrition to be shared between Diana Food, the Institute of Nutrition and Functional Foods at Laval University and the Natural Sciences and Engineering Research Council of Canada (NSERC). Diana Food and NSERC will each invest about $1 million in this project.

Quotes

“I want to applaud the Canadian businesses whose representatives accompanied me on this trade mission to Paris. Over the last few days, we have worked together to further strengthen our trade and investment ties with France, which are already among the strongest in the world.

“Thanks to the continued success of our long-standing friendship, the next chapter of our relationship with France looks even more promising than the previous one. That is especially the case now that the Canada-European Union Comprehensive Economic and Trade Agreement is now in force.”

- François-Philippe Champagne, Minister of International Trade

Quick facts

- France is Canada’s ninth-largest trading partner and fourth-largest in Europe.

- Canada’s cleantech companies are ranked fourth in the world as clean-technology innovators.

- Canada remains a world leader in developing AI technology. A host of companies from local start-ups to established technology giants like Google and Microsoft are investing millions of dollars into AI research in Canada.

- Related products

Backgrounder

Silingen Group - cleantech greenfield - tire recycling plant in Hamilton, Ontario ($7.5 million, 40 jobs)

The Silingen Group is a family-owned company with 80 employees and two factories: one located in Katowice, Poland, and the other in Bamberg, Germany, where the company’s head office is located. The company’s goal in Canada is to create waste recycling units using a waste-free process and without the emission of greenhouse gases.

The Group has decided on Hamilton, Ontario, as the location for its first plant in Canada. The Group is considering opening a second plant in Quebec and perhaps a third one in New Brunswick. The investment for each plant would be $7.5 million, and each would employ 40 people.

FB Croissance Holding - venture capital: $4-million to $10-million investment fund to support French start-ups in Canada

FB Croissance Holding is an investment fund specializing in the financial sector of French start-ups. The fund is managed by the law firm Strateys located in the Brittany region of France.

In December 2017, the FB Croissance fund created a subsidiary in Canada: Conseil Québec Investissement Croissance Inc (CQIC). CQIC will support Strateys’ clients by financing Quebec start-up companies in Canada and will also invest in assisting Canadian and French start-up companies to become established in Canada in the AI, medical technology and biotechnology industries. The fund is expected to invest between $2 million and $4 million over an initial two-year period to support a dozen innovative companies in setting up operations development projects in Canada, including in Quebec.

Diana Food - collaboration in agri-food research ($1.6 million)

Diana Food offers culinary ingredients to enhance the flavour of savory foods, natural food colouring for beverages and confections, and products that bring texture and visual impact to baby food. The company employs more than 1,110 people in 23 countries.

INTEREST RATE

BANK OF CANADA. April 18, 2018. Bank of Canada maintains overnight rate target at 1 ¼ per cent

Ottawa, Ontario - The Bank of Canada today maintained its target for the overnight rate at 1 ¼ per cent. The Bank Rate is correspondingly 1 ½ per cent and the deposit rate is 1 per cent.

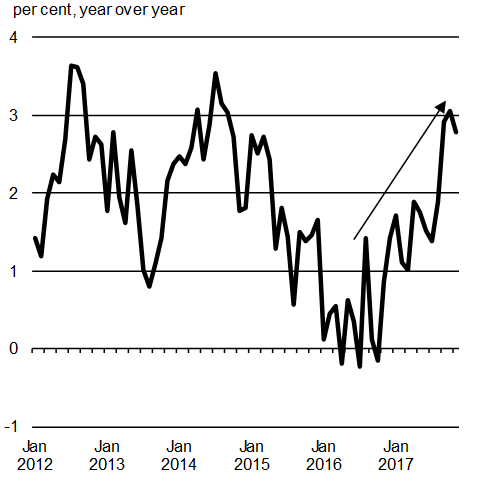

Inflation in Canada is close to 2 per cent as temporary factors that have been weighing on inflation have largely dissipated, as expected. Consistent with an economy operating with little slack, core measures of inflation have continued to edge up and are all now close to 2 per cent. The transitory impact of higher gasoline prices and recent minimum wage increases will likely cause inflation in 2018 to be modestly higher than the Bank expected in its January Monetary Policy Report (MPR), returning to the 2 per cent target for the rest of the projection horizon.

The global economy is on a modestly stronger track than forecast in January, with upward revisions to growth and potential output in a number of major advanced economies. The outlook for the U.S. economy has been further boosted by new government spending plans. However, escalating geopolitical and trade conflicts risk undermining the global expansion.

In Canada, GDP growth in the first quarter was weaker than the Bank had expected, but should rebound in the second quarter, resulting in 2 per cent average growth in the first half of 2018. The economy is projected to operate slightly above its potential over the next three years, with real GDP growth of about 2 per cent in both 2018 and 2019, and 1.8 per cent in 2020. This stronger profile for GDP incorporates new provincial and federal fiscal measures announced since January. It also reflects upward revisions to estimates of potential output growth, which suggest the Canadian economy has made some progress in building capacity.

Slower economic growth in the first quarter primarily reflects weakness in two areas. Housing markets responded to new mortgage guidelines and other policy measures by pulling forward transactions to late 2017. Exports also faltered, partly owing to transportation bottlenecks. Some of the weakness in housing and exports is expected to be unwound as 2018 progresses.

The Bank anticipates that Canadian exports will strengthen as foreign demand increases, but not sufficiently to recover the ground lost during recent quarters. Export growth is being increasingly limited by capacity constraints in some sectors. Continued gains in business investment should build additional capacity in those sectors and in the economy more generally. However, both exports and investment are being held back by ongoing competitiveness challenges and uncertainty about trade policies.

Growth in consumption remains robust, supported by strong labour income growth. Wages have continued to pick up as expected, even after factoring out recent minimum wage increases in Ontario and Alberta. The Bank will continue to assess labour market data for signs of remaining slack.

Some progress has been made on the key issues being watched closely by Governing Council, particularly the dynamics of inflation and wage growth. This progress reinforces Governing Council’s view that higher interest rates will be warranted over time, although some monetary policy accommodation will still be needed to keep inflation on target. The Bank will also continue to monitor the economy’s sensitivity to interest rate movements and the evolution of economic capacity. In this context, Governing Council will remain cautious with respect to future policy adjustments, guided by incoming data.

Information note

The next scheduled date for announcing the overnight rate target is May 30, 2018. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on July 11, 2018.

BANK OF CANADA. April 18, 2018. Monetary Policy Report Press Conference Opening Statement. Opening Statement. Stephen S. Poloz - Governor. Carolyn A. Wilkins - Senior Deputy Governor

Good morning. Senior Deputy Governor Wilkins and I are happy to be with you to answer your questions about today’s interest rate announcement and our Monetary Policy Report (MPR). Before taking your questions, let me briefly offer a few insights into Governing Council’s deliberations.

Inflation is on target and the economy is operating close to potential. That statement alone underscores the considerable progress seen in the economy over the past 12 months.

That said, interest rates remain very low relative to historical experience. This is because the economy is not yet able to remain at full capacity on its own. Furthermore, the sustainability of this level of activity is not assured; although we expected the economy to moderate in the second half of 2017, that moderation has extended into early 2018 and has been more pronounced than expected. Governing Council considered recent economic data very carefully and concluded that the softness early this year was due mainly to two temporary factors.

The first relates to changes to mortgage rules that went into effect at the start of the year. These caused house sales to be pulled forward into the fourth quarter of 2017. Although we are still expecting the housing sector to moderate in 2018 compared with last year, we can expect a partial recovery of activity in the second quarter.

The second factor is the unexpected drop in exports during the first quarter, much of which was related to transportation bottlenecks. This points to a partial recovery in the second quarter and later in the year. Notice that we are expecting only a partial recovery in the level of exports—an issue I will return to in a moment.

Accordingly, we expect a strong rebound in the second quarter after a lacklustre first quarter, with an average growth rate of about 2 per cent in the first half of the year and a return to near-potential growth thereafter. Fiscal stimulus, both provincial and federal, is playing a role in this forecast. We will be monitoring the data for the second quarter very closely in the weeks ahead.

Assuming our forecast remains on track, it is Governing Council’s view that interest rates will need to move higher over time to keep inflation on target. We acknowledge that the forces weighing on the economy mean that monetary policy is likely to remain stimulative to some degree, even if it is less stimulative than today. By this, we mean that interest rates may need to remain below the neutral range until various forces have dissipated. These would include, in particular, the uncertainty around trade conflicts and escalating geopolitical risks.

We have reviewed our work on the neutral interest rate and concluded that it still lies somewhere in the range of 2.5 to 3.5 per cent, given a 2 per cent inflation rate. Another useful benchmark that entered our discussions was the real policy rate, which takes into account the rate of inflation on the policy rate. Today, this benchmark is at minus 0.75 per cent. It is the view of Governing Council that the need for a negative real policy rate continues to diminish steadily, albeit gradually.

Most of our deliberations, therefore, concerned the appropriate pace of interest rate increases. As we have said repeatedly in the past, this is an intensely data-dependent process of risk management. We continue to be faced with four key sources of uncertainty around the outlook for inflation. Each of these represents the potential for either upside or downside risk to the inflation outlook, and therefore needs to be assessed to ensure that our risks remain balanced around the 2 per cent target.

First is the issue of economic capacity. We have done our extensive annual reassessment of economic potential and revised its profile higher, both in terms of its level and growth rate. This means that we have a little more room for demand growth within our 2 per cent inflation target than we believed before. Related to this, it is becoming increasingly evident that Canada’s international competitiveness challenges are hampering our export performance. Many firms are operating at or above their capacity, but are hesitating to invest in new capacity given the uncertain future of the North American Free Trade Agreement, transportation bottlenecks and a shortage of skilled workers, to name a few issues. This reluctance to expand capacity, in turn, also serves to limit growth in our exports.

It is possible that this represents a structural change in the Canadian economy, and the resolution would lie beyond the capability of monetary policy. For the central bank, the net effect on the inflation outlook will be our guide. The Bank is continuing to work on these issues and will offer more research in time for our next MPR in July.

The second issue is the dynamics of inflation itself. Recent data have been very reassuring. Indeed, the convergence of our three core measures around 2 per cent, as we forecast last year, has helped buttress confidence in our inflation models. Our forecast now shows inflation rising modestly above 2 per cent due to temporary factors, and then easing back to about 2 per cent during 2019. In this respect, it is worth underscoring that our target is a range of 1 to 3 per cent and that the average rate of inflation in the last few years has been below the midpoint of the range.

The third issue is wage dynamics. Recent data have been encouraging. Our summary measure of various wage series, called wage-common, shows that wage growth has picked up significantly in the last 18 months. We have noted before that we would expect wages to be growing by around 3 per cent in an economy operating close to capacity. We are approaching that zone now, although the latest figures have been boosted temporarily by minimum wage increases in some provinces. Furthermore, Governing Council acknowledged that these data can be difficult to interpret after a prolonged period of labour market slack. For example, wages tend not to decline during periods of high unemployment as much as our models might predict, and when the economy recovers, there is a lag before average wages respond. All things considered then, we continue to believe that there are elements of excess capacity in the labour market, as well as the possibility of productivity-enhancing labour market churn, that will add to the economy’s capacity.

Fourth, Governing Council has been monitoring the data for evidence that the sensitivity of the economy to interest rates has risen with household indebtedness. This issue will take longer to assess, especially given that the housing market and mortgage lending have also been affected by the new mortgage guidelines. However, we did note that household credit growth has continued to moderate, an important signal that is consistent with the idea that households are beginning to adjust to higher interest rates and the new mortgage rules.

Some progress has been made on the key issues being watched closely by Governing Council, particularly the dynamics of inflation and wage growth. This progress reinforces our view that higher interest rates will be warranted over time, although some degree of monetary policy accommodation likely will still be needed to keep inflation on target. The Bank will also continue to monitor the economy’s sensitivity to interest rate movements and the evolution of economic capacity. In this context, Governing Council will remain cautious with respect to future policy adjustments, guided by incoming data.

With that, Senior Deputy Governor Wilkins and I would be happy to answer your questions.

Monetary Policy Report – April 2018: https://www.bankofcanada.ca/wp-content/uploads/2018/04/mpr-2018-04-18.pdf

THE GLOBE AND MAIL. APRIL 18, 2018. Bank of Canada holds rates steady, remains ‘cautious’ on future hikes

BARRIE MCKENNA

The Bank of Canada is continuing to build a case for higher interest rates – just not right now.

The central bank kept its key rate unchanged at 1.25 per cent on Wednesday, citing weakness in housing, trade and investment in export-oriented sectors.

Even though many of the key ingredients for higher rates are falling into place, the bank said it remains “cautious with respect to future policy adjustments.”

Canada’s economy is operating with “little slack,” while inflation is edging higher and is now roughly in line with the central bank’s critical 2-per-cent target, according to a statement accompanying its rate decision. Consumption growth also remains “robust,” helped by rising wages.

The bank has raised its key rate three times since last June. And investors and economists still expect at least one more hike this year.

Canadian Imperial Bank of Commerce economist Andrew Grantham says the statement suggests the Bank of Canada will make another rate hike, likely in July, but it’s “in no rush” to move again after that.

Part of the bank’s go-slow stance on rate hikes is because the economy’s capacity to grow is also expanding. The bank boosted its estimate of potential output growth by two to four percentage-points in each of 2018, 2019 and 2020, according to its latest Monetary Policy Report, released Wednesday. The median is now expected to be 1.8 per cent in all three years.

If the bank is right, more capacity will allow the economy to grow at a faster clip going forward, without sparking inflation.

The economy is now expected to grow at an annual rate of 1.3 per cent in the first three months of this year, down from the 2.5 per cent it forecast in January, the central bank said.

For 2018, the bank is calling for the economy to grow 2 per cent, down from a previous estimate of 2.2 per cent. But growth will be a bit stronger than expected in 2019 and 2020, at 2.1 per cent 1.8 per cent respectively, reflecting federal and provincial fiscal measures, according to the bank.

For now, at least, Bank of Canada Governor Stephen Poloz and his top officials seem more preoccupied with factors holding back the economy than all the things going right.

“Both exports and investment are being held back by ongoing competitiveness challenges and uncertainty about trade policies,” the bank said.

Meanwhile, tighter federal mortgage rules, introduced in January, are weighing on housing activity, particularly in the once-booming Toronto market.

It added that “some of that weakness” in housing and exports will be unwound later in the year.

The bank also warned that “escalating geopolitical and trade conflicts risk undermining the global expansion.”

In recent months, the United States and China have squared off with threats of steep tariffs on thousands of each others’ main exports. The tit-for-tat moves have sparked fears of a damaging global trade war between the world’s two largest economies.

The future of the North American free trade agreement also remains unclear. U.S. officials have suggested in recent weeks that a tentative agreement may be near on key details, including auto sector rules, but many other contentious issues remain unresolved.

The bank also highlighted “transportation bottlenecks” – an apparent reference to ongoing struggles by Canada’s two major railroads to keep up with shipments of grain, lumber, crude oil and other commodities in recent months.

Particularly worrying is the fact that Canada is still losing its share of non-energy imports in the vital U.S. market, even as the Canadian dollar has depreciated in recent years, the bank pointed out in the Monetary Policy Report. The bank blamed the problem on competition from China, protectionism as well as a contraction of the auto sector, triggered by the failure of car plants in Canada to get work on new lines of vehicles.

And inflation is perking up. The bank said it now expects the consumer price index to rise 2.3 per cent this year, versus a previous estimate of 2 per cent. The bank says inflation will be 2.1 per cent in both 2019 and 2020.

The single greatest downside risk to that outlook is “a notable shift toward protectionist global trade policies,” according to the forecast.

Among the bank’s other main worries: a hit to heavily indebted borrowers from higher interest rates as well as “a sizeable decline in house prices” in some markets. On the upside, the U.S. economy could grow faster than expected, boosting demand for Canadian exports.

REUTES. APRIL 18, 2018. Bank of Canada holds rates, prospects rise for a July hike

Andrea Hopkins, Leah Schnurr

OTTAWA (Reuters) - The Bank of Canada held interest rates steady on Wednesday, as expected, but said more hikes will be needed over time and pointed to a pick up in wage growth and inflation, two issues that have concerned the central bank.

It has increased rates three times since July 2017.

“We think the bank is on track to raise rates by July,” said Sal Guatieri, senior economist at BMO Capital Markets.

“Clearly any bad news on the trade protectionism front or NAFTA talks would delay the Bank of Canada or if we see the housing market weakening more than expected in response to the tougher mortgage rules,” Guatieri added.

The Canadian dollar weakened slightly against its U.S. counterpart as some investors had bet on a surprise hike or more hawkish language from policymakers, but the currency could regain some strength as markets digest the full monetary policy report that accompanied the rate decision.

“I think the statement will be read as making clear that further rate hikes are probably going to be needed over the course of this year, and with that some modest strength (in the Canadian dollar) could emerge,” said Paul Ferley, assistant chief economist at Royal Bank of Canada.

The bank reiterated that policymakers “will remain cautious” with respect to future rate moves as it watches to see how Canada’s highly indebted households manage the higher borrowing costs.

While the bank trimmed its economic growth forecast for 2018 it hiked the outlook for 2019, saying the economy is operating with little slack and the temporary factors weighing on inflation have largely dissipated.

Projected growth in the United States, Canada’s largest trading partner, has been boosted by government spending plans, but the bank said rising geopolitical and trade conflicts risk undermining global expansion. The renegotiation of NAFTA prompted by U.S. President Donald Trump has weighed on business confidence and delayed investment.

The bank said exports will strengthen as demand increases, but said growth is increasingly being limited by capacity constraints. Exports and investment to build capacity are being held back by competitiveness challenges and trade worries.

While changes in mortgage rules pulled forward housing activity to late 2017 and exports faltered in the first quarter on transportation bottlenecks, the weakness in both are expected to unwind, the bank said.

Reporting by Andrea Hopkins and Leah Schnurr; Editing by Jeffrey Benkoe and Susan Thomas

BLOOMBERG. 18 April 2018. Poloz Holds Rates, Sees More Room for Canada's Economy to Grow

By Theophilos Argitis

- Bank of Canada raises its forecasts for potential output

- Markets are anticipating two more rate hikes this year

Bank of Canada Governor Stephen Poloz is showing faith in the economy’s ability to prolong its current expansion without fueling inflation, in a rate decision Wednesday that kept interest rates on hold even as it raised the outlook for growth.

The Ottawa-based central bank offered an upbeat assessment of an economic expansion that’s running close to capacity, and said borrowing costs will eventually rise. But policy makers reiterated the economy continues to need stimulus and repeated the need for caution on future rate adjustments. The currency dropped and bond yields dipped slightly.

Wednesday’s release codifies Poloz’s narrative that Canada is at the “sweet spot” of the business cycle where growing demand is actually generating new capacity as companies invest to meet sales, a process he said the central bank has an “obligation” to nurture.

“Higher interest rates will be warranted over time, although some monetary policy accommodation will still be needed to keep inflation on target,” the central bank said in its rate statement.

Fine Tuning

Poloz is trying to fine-tune a return of interest rates back to more normal levels, hoping to raise them just enough to prevent inflation from creeping up, and not so quick as to trigger an unwanted slowdown. He’s already lifted borrowing costs three times -- in July, September and January -- even as he maintained his cautious stance.

The Canadian dollar slipped after the report, down 0.4 percent to C$1.202 per U.S. dollar at 10:44 a.m. Toronto time. Two-year government bond yields were down slightly at 1.88 percent, from 1.89 Tuesday.

Investors predict Poloz may raise borrowing costs twice more this year, which would bring the benchmark rate to 1.75 percent, still below what the bank considers a “neutral level” of between 2.5 percent and 3.5 percent.

There’s little indication the central bank is in any rush. In the broader report, the central bank said monetary policy is “expected to support economic activity over the projection horizon,” which goes through 2020.

Potential Growth

The central bank is “clearly in no rush still regarding the pace of future increases,” Andrew Grantham, an economist at CIBC in Toronto, wrote in a note to investors, citing the central bank’s comments about the transitory nature of higher inflation. CIBC expects the next increase at the July meeting.

A key component of the monetary policy report was the sharp upward revision to the central bank’s assessment of how much the economy can grow without fueling inflation, a signal policy makers are more at ease with capacity constraints.

It now forecasts potential output to grow by 1.8 percent in 2018 and 2019, before accelerating to 1.9 percent in 2020. In January, the central bank had forecast potential growth for the next two years to average 1.6 percent.

That means that even with the stronger growth outlook, the economy has more room to grow without generating inflationary pressures.

Slower-than-expected growth in the first quarter, meanwhile, leaves the economy with more potential slack than was the case at the end of last year, the Bank of Canada said.

Upward Revisions

The central bank now sees first-quarter growth at 1.3 percent, down from a January forecast of 2.5 percent. Forecasts for 2018 were also brought down to 2 percent, from 2.2 percent. But 2019 growth was revised up to 2.1 percent from 1.6 percent.

It’s a vote of confidence in the business community’s ability to take over from the economy’s main driver of growth -- consumer spending -- which is expected to slow over the next two years.

The optimism was everywhere in the documents, even as the central bank acknowledged geopolitical uncertainties and the potential competitiveness impact of U.S. tax reforms as a drag on investment and exports.

The bank cited transportation bottlenecks for weakness in exports in recent months, and expects this to be reversed. Investment is down in the first quarter, due mainly to the completion of energy projects in 2017. But the positive trend in investment spending is expected to reassert itself in the second quarter. Even housing activity is expected to pick up in the second quarter, after a sharp contraction in the first quarter.

Even the global economy is doing better than forecast in January, the central bank said, making upward revisions to growth and potential output.

Policy makers were largely sanguine on inflation, which is nonetheless expected to return close to the bank’s 2 percent target in 2019 once the temporary impacts dissipate.

— With assistance by Greg Quinn, Luke Kawa, and Erik Hertzberg

BLOOMBERG. 18 April 2018. Why Poloz Just Got Bullish on How Fast Canada Can Grow

By Luke Kawa

We can do better.

That’s the prime reason why Bank of Canada Governor Stephen Poloz elected to hold off on raising rates in April, saying the Canadian economy has more room to grow than previously expected.

The central bank upped its estimate for potential growth -- how fast an economy at full capacity can expand without generating too much inflation -- to 1.8 percent over the next two years from a projection of 1.6 percent in the January report. It’s a substantial upgrade from its previous review that had potential growth at 1.4 and 1.5 percent in 2018 and 2019, respectively.

These new estimates formally put numbers to the growth narrative that Poloz highlighted in recent speeches: The Canadian economy is in a “sweet spot” where new investment can increase the nation’s growth capacity and bring people off the sidelines and into the workforce without generating too much inflation.

This is “a phase worth nurturing,” he said in Kingston, Ontario. “We actually have an obligation to test this framework and find where those limits actually are, because that creates benefits for everyone.”

Changes of tenths of a percentage point -- as well as revisions to historical data -- make a big difference. A higher top speed for growth means there’s more economic slack than previously envisaged, informing the central bank’s decision to keep rates unchanged at this juncture.

Underlying Poloz’s bullish assessment is the belief that Canadian businesses need to expand, and will elect to do so domestically. In turn, the investment spending increases labor productivity as more equipment boosts worker output per hour.

The monetary policy report notes that three-quarters of industries have a capacity utilization rate within 5 percentage points of their post-2003 peak. The business outlook survey, meanwhile, indicates that sales expectations have firmed. Taken together, this implies that there’s a real need for investment to meet higher demand.

The chief concern is that protectionism, which remains the central bank’s top risk to the outlook, coupled with the U.S. tax overhaul means businesses will choose to expand capacity outside of Canada. A “wide range of outcomes” are still possible for the North American Free Trade Agreement, per the report, which did not acknowledge recent reported progress in talks between Canada, Mexico, and the U.S.

“Differences in fiscal and regulatory policies could have a more negative impact on investment, and thus productivity, than is currently expected,” the Governing Council wrote.

In the near term, revisions to Canada’s capital stock and spending loom large in the bank’s upgrade to labor productivity. However, that same data “may be revised down later this year,” according to the report, citing a recent underwhelming Statistics Canada survey of investment intentions for this year.

There’s also the chance that the decline in investment is structural and linked to population aging. Older people tend to have a lower demand for durable goods and a higher need for services in the labor-intensive, low-productivity segments of the economy like health care. Digitalization of the economy, meanwhile, works the other way, potentially raising potential growth.

Indeed, imports of machinery and equipment -- a leading indicator of productivity-enhancing investment -- have softened in the first two months of 2018.

A separate discussion paper published by central bank staffers in October 2017 concluded that even under an alternative scenario in which the potential level of growth was ultimately 1 percent higher than forecast by 2020, the effects on inflation would be “small” and “therefore does not affect the stance of monetary policy.”

BLOOMBERG. 18 April 2018. Bank of Canada Sees 3% as Potential Wage Growth for Economy

By Greg Quinn

The Bank of Canada released details of how it’s assessing developments in the labor market, saying wage growth remains below levels that would be consistent with no slack.

The central bank’s latest quarterly economic forecast highlighted stronger corporate hiring plans, while noting that policy makers remain vigilant for “signs of remaining slack.”

Here are some of the bank’s views on the labor market, published Wednesday in Ottawa along with its decision to hold the policy interest rate at 1.25 percent:

- Current estimates of underlying wage growth are at 2.7 percent

- That’s up from 2.3 percent in the fourth quarter 2017 and 1.1 percent in mid-2016

- Rate of growth of 3 percent “has historically been consistent with an economy in which there is no labor market slack”

- “Wage growth is somewhat below what would be expected were the economy operating with no excess labor”

- Income growth has been “strong” even after stripping out higher legislated minimum wages

- “The labor market continues to improve across sectors and regions”

- “The Bank will continue to assess labor market data for signs of remaining slack,” such as elevated long-term unemployment and low youth participation

- Job vacancies have risen and are “considerably higher than the typical annual expansion of employment”

- Global growth potential is being boosted by higher labor force participation, particularly in the U.S. and Europe, the Bank of Canada said

CPTPP

THE GLOBE AND MAIL. REUTERS. APRIL 18, 2018. Trump changes his tune, slams TPP once again

President Donald Trump said again on Twitter on Tuesday that he does not like the landmark Trans-Pacific Partnership deal for the United States.

“While Japan and South Korea would like us to go back into TPP, I don’t like the deal for the United States,” he tweeted.

“Too many contingencies and no way to get out if it doesn’t work. Bilateral deals are far more efficient, profitable and better for OUR workers. Look how bad WTO is to U.S.”

The original 12-member agreement, which included Japan but not South Korea, was known as the TPP. It was a signature trade policy of President Barack Obama, but he was unable to secure Congressional support for the deal.

It was thrown into limbo when Trump withdrew from the deal three days after his inauguration in January 2017, a move he said was aimed at protecting U.S. jobs.

Following the U.S. withdrawal, the remaining 11 countries renegotiated parts of the TPP, and in March, they signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) - also known as TPP-11.

AVIATION

The Globe and Mail. 18 Apr 2018. Li Ka-shing in hunt for Bombardier’s Toronto site. Two Canadian investors also on short list for manufacturer’s aerospace plant in city’s northwest. Bombardier: Sale of Toronto site likely to be the first stage in battle at city hall

JEFF GRAY

RACHELLE YOUNGLAI

GREG KEENAN

NICOLAS VAN PRAET

Hong Kong billionaire Li Ka-shing and two Canadian investors have made Bombardier’s short list of buyers for the manufacturer’s aerospace plant and surrounding lands in northwest Toronto, according to sources familiar with the matter.

Bombardier is mulling bids from three frontrunners. Mr. Li’s CK Asset Holdings Ltd., a team-up by Torontobased developers Great Gulf and Dream Unlimited Corp., and Montreal-based PSP Investments, the federal public service’s pension plan, are all said to be vying for the property.

But whoever wins the competition to buy the sprawling and largely empty 371-acre site could faces huge hurdles. Bombardier is facing off with its union, Unifor, which opposes the sale. And any new landowner will want to win the city’s approval to rezone at least some of the site, which is currently reserved only for uses such as factories or offices.

Nevertheless, the site is accessible by Toronto’s subway system and is seen as prime real estate in a city grappling with a shortage of land, housing and office space. It became one of the most sought-after potential development sites and attracted the attention of multiple buyers including an unsolicited bid from a startup manufacturer, Avro Bourdeau Aerospace Corp.

The Bombardier Downsview site, which includes the plant, runway and other land, is currently assessed at a value of just $153.16-million for property-tax purposes. However, sources said bids of more than $700million have been offered.

Buyers on the short list are bidding in the belief they will develop the land into so-called mixed use − a combination of office, residential and retail spaces − which would command high prices, the sources said. The next round of bids is due before the end of the month, they said.

Dream president Michael Cooper and PSP separately declined to comment. Great Gulf’s commercial arm known as First Gulf did not comment.

CK Asset Holdings could not immediately be reached for comment. Avro Bourdeau said its $800-million bid − the only one that includes preserving the airplane manufacturing business on the site − was rejected.

Bombardier wants to sell the Toronto property as a way to generate cash from an asset that’s not being used to its full potential. The company says it only uses about a tenth of the site and shoulders the full cost of using the two-kilometre-long runway.

“It’s an amazing piece of land,” Bombardier chief executive Alain Bellemare told analysts on the company’s earnings call in February. “We can do the same type of work somewhere else and really unlock huge value.”

Bombardier currently builds Global luxury jets and Q400 turboprop planes at the Downsview site. The Montreal-based company has raised the option of moving these manufacturing operations to Toronto’s Pearson international airport.

Proceeds from a Downsview deal and those of a recent share sale could contribute as much as US$1-billion of cash to shore up Bombardier’s balance sheet or to help buy back a minority stake in its train business from the Caisse de dépôt et placement du Québec, JP Morgan analyst Seth Seifman said in an April 13 note.

Although the land is for sale, Bombardier management has never expressed any intention publicly to sell the Q400 business itself. The unit was once considered a shaky part of Bombardier’s commercial aircraft lineup, but in recent months it has begun to see the fruits of a bolstered marketing and sales effort implemented two years ago, winning new orders from India’s SpiceJet among others.

Still, history suggests Bombardier would entertain offers for the turboprop business if they were reasonable, AltaCorp Capital analyst Chris Murray said. “You have to be realistic and remember Bombardier has sold other programs in the past as they reached maturity,” he said, including de Havilland Canada assets now owned by Viking Air Ltd. and its water-bomber business.

Avro Bourdeau also made an offer to purchase Bombardier’s regional jet business. The assembly of those jets is now done in Mirabel, Que., but Avro Bourdeau’s plan would shift that work to Downsview.

Bombardier’s rejection letter said Avro Bourdeau had no experience manufacturing airplanes and questioned the company’s ability to obtain financing. But the company’s CEO Marc Bourdeau said he interpreted the rejection letter as a negotiating tactic.

“We don’t believe that Bombardier is going to send [Q400 production] over to Pearson,” said Mr. Bourdeau, citing the costs of purchasing real estate, shifting tooling to another plant and halting production of the planes for up to a year while the assembly line is transferred out of Downsview.

Mr. Bourdeau acknowledged that his plan would require public and government support, but noted that it conforms with Toronto’s requirement that the land retain its current industrial zoning.

A Bombardier spokesman declined to answer questions about options for the Downsview site and the company’s intentions for the planes built there. “We have nothing to announce,” said Simon Letendre.

The sale of the Toronto site will likely be the first stage of a potentially long battle at city hall. The entire area, much of which is taken up by Bombardier’s test runway or is vacant, is zoned for employment use: factories or offices.

“The employment lands, once they are gone they are gone forever,” long-time local Councillor Maria Augimeri said. “You can’t buy them back, you can’t manufacture them. And they create the base for Toronto’s economy. ”

In addition to the loss of the 3,600 aerospace manufacturing jobs, a sale could also see a new buyer scrap Bombardier’s runway, which would loosen flightpath-related building-height restrictions.

Unifor is in the midst of negotiations on a new contract, but has received no answers to its questions to the company about the future of the site and the Q400 and Global programs, Unifor president Jerry Dias said.

The current contract has a socalled work ownership clause that requires approval of the union before major changes can be made, such as Bombardier’s plan two years ago to outsource cockpit and wing assembly of the Q400.

Toronto Mayor John Tory told reporters recently that preserving the employment lands was his “going-in position” in any talks over the property, and that keeping that zoning must be the city’s “principle focus.”

Mr. Tory also said there was plenty of residential land nearby: “I don’t accept the notion that every single piece of land without exception … should be just allocated because we just decide we are going to have condo towers and apartment buildings everywhere. We need places for people to work.”

Employment lands are also taxed at a much higher rate, and they need fewer services than residential zones, making keeping them in the city important to the municipal government’s bottom line.

However, lobbying is already under way. Bombardier has hired Toronto-Dominion Bank to handle the sale. Ashley Martis, a director with TD’s real estate arm, registered as a lobbyist earlier this month and met with senior officials in the mayor’s office, senior city officials and Toronto chief planner Gregg Lintern, according to the city’s lobbyist registry.

Mr. Lintern said he outlined in his meeting with TD how complex any potential rezoning would be.

With a file from reporter Jacqueline Nelson.

G7

Department of Finance Canada. April 18, 2018. G7 Finance Ministers' Joint Statement on North Korea

Ottawa, Ontario – North Korea's continued development of weapons of mass destruction (WMD) and ballistic missile programs poses a grave threat to international peace and security. We remain committed to the complete, verifiable, and irreversible denuclearization of the Korean peninsula and dismantlement of North Korea's WMD and ballistic missile programs, but North Korea must match its words with concrete actions. To support this goal, we will continue to take action to impose maximum economic pressure on North Korea, in keeping with relevant United Nations Security Council Resolutions (UNSCRs).

We are concerned by North Korea's evasion of international sanctions and its continued ability to access the international financial system. North Korea does little business in its own true name and uses a network of agents, front and shell companies, and complex ownership structures to access the international financial system.

As the UN Panel of Experts (PoE) noted in its March 2018 report, in 2017, more than 30 representatives of North Korean banks have been operating outside of North Korea, in contravention of UNSCRs. The PoE also noted that DPRK trade representatives continue to play a role in the country's prohibited programs, including by acting as fronts for designated entities and individuals, as well as engaging in commercial activities that violate the UNSCRs. We call on all countries to fully and effectively implement their UNSCR obligations with respect to North Korea and, in this regard, to expeditiously expel these bank and trade representatives in accordance with their UN obligations.

Financial institutions in G7 countries also play an important role in the fight against North Korea's illicit global financial activity, and we will engage and share information with them, as appropriate, to expose North Korea's deceptive financial practices and thereby protect the integrity of the international financial system. We call on countries to similarly engage their financial institutions so they will be on alert and take steps to implement necessary additional scrutiny to ensure that they are not processing transactions on behalf of sanctioned North Korean entities.

ENERGY

StatCan. 2018-04-18. Crude oil and natural gas: Supply and disposition, January 2018

- Production of crude oil and equivalent products: 21.6 million cubic metres, January 2018, 1.8% increase (12-month change)

- Exports of crude oil and equivalent products: 17.4 million cubic metres, January 2018, 4.4% increase (12-month change)

- Source(s): CANSIM table 126-0003: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=1260003&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canada produced 21.6 million cubic metres (135.9 million barrels) of crude oil and equivalent products in January, up 1.8% compared with the same month in 2017.

Crude oil production

Compared with the same month a year earlier, January production increases of non-upgraded crude bitumen (+6.0%), light and medium (+5.6%), and equivalent products (+20.7%) were largely offset by decreases in synthetic (-9.4%) and heavy (-4.2%) crude oils. A temporary outage at an Alberta facility contributed to the reported decreases in synthetic crude.

Meanwhile, the gains in non-upgraded crude bitumen in January were driven by higher in-situ production (up 3.2% to 8.0 million cubic metres), and lower volumes being sent for further processing (-11.8% to 5.8 million cubic metres). Mined production decreased 7.8% to 6.3 million cubic metres.

Chart 1: Production of crude oil and equivalent products

Crude oil extraction and oil sands extraction

In January, crude oil production (excluding equivalent products) totalled 19.9 million cubic metres, up 0.5% from the same month a year earlier. Oil sands extraction (formerly non-conventional oil extraction), which consists of non-upgraded crude bitumen and synthetic crude oil, edged down 0.4% to 13.7 million cubic metres.

Over the same period, oil extraction (formerly conventional oil extraction) of light, medium and heavy crude oils increased 2.3% to 6.2 million cubic metres.

Chart 2: Crude oil and oil sands extraction

Provincial production

Alberta produced 17.5 million cubic metres of crude oil and equivalent products in January, up 2.6% from the same month a year earlier, accounting for 81.1% of total Canadian production. Saskatchewan (11.1%) and Newfoundland and Labrador (5.2%) were also key producing provinces.

Refinery use of crude oil

Input of crude oil to Canadian refineries totalled 8.6 million cubic metres in January, down 2.2% from the same month a year earlier. Light, medium and heavy crude oils accounted for 64.9% of the total, while crude from oil sands represented the remaining 35.1%. Light and medium crude (4.4 million cubic metres) and synthetic crude (2.5 million cubic metres) continued to be the main types of oil used by Canadian refineries.

Exports and imports

Exports of crude oil and equivalent products were up 4.4% year over year to 17.4 million cubic metres in January. The increase was largely attributable to higher exports from Newfoundland and Labrador, up 67.5% to 1.1 million cubic metres. The vast majority of exports (88.4%) were still transported via pipelines to the United States, while exports by other means (including rail, truck, and marine) to the United States accounted for 8.4%. The remaining 3.1% of exports went to countries other than the United States.

Imports to Canadian refineries were down 13.2% to 2.8 million cubic metres.

Chart 3: Exports and imports of crude oil and equivalent products

Closing inventories

Closing inventories of crude oil and equivalent products were down 2.4% from the same month a year earlier to 18.7 million cubic metres in January. The total was comprised of transporters (-2.0% to 12.1 million cubic metres), fields and plants (-10.4% to 2.7 million cubic metres) and refineries (+2.6% to 4.0 million cubic metres).

Natural gas production

Marketable natural gas production in Canada totalled 15.2 billion cubic metres in January, up 4.9% from the same month a year earlier. Production of natural gas was concentrated in Alberta (68.8%) and British Columbia (29.1%).

Additional information on natural gas is available in "Natural gas transmission, storage and distribution," published in The Daily on April 18, 2018.

Table 126-0003 1

Supply and disposition of crude oil and equivalent

monthly (cubic metres)

Data table

The data below is a part of CANSIM table 126-0003. Use the Add/Remove data tab to customize your table.

Selected items [Add/Remove data]

Geography = Canada

Units of measure = Cubic metres

Units of measure = Cubic metres

| Supply and disposition 2 | 2017 | 2018 | |||

|---|---|---|---|---|---|

| September | October | November | December | January | |

| footnotes | |||||

| Crude oil production | 18,343,175 | 18,681,441 | 19,721,503 | 20,663,965 | 19,869,777 |

| Equivalent products production | 1,573,009 | 1,708,105 | 1,706,370 | 1,749,498 | 1,737,054 |

| Imports 5 | 3,742,173 | 3,622,706 | 3,501,596 | 4,054,066 | 4,228,810 |

| Exports | 15,564,792 | 16,172,912 | 15,039,104 | 16,247,401 | 17,432,751 |

Footnotes:

Changes have been made to the content and methodology of the Monthly Supply and Disposition of Crude Oil and Equivalent. These new changes have resulted in the creation of CANSIM table 126-0003. Consequently, the information in this table is no longer directly comparable with information that was previously made available in CANSIM table 126-0001. This historical table will remain available for historical revisions.

Total supply could be calculated by adding Crude oil production, Equivalent products production, and Imports. Total disposition could be calculated by adding Input to Canadian refineries, Exports, and Inventory changes.

Non-upgraded production of crude bitumen is equal to the sum of In-Situ crude bitumen production and mined crude bitumen production, less the amount of crude bitumen sent for further processing.

Condensate includes both lease condensate and plant condensate.

Imports include both pipeline and non-pipeline imports.

Deliveries to refineries and exports do not add to total supply due to losses, other uses and inventory changes.

Source: Statistics Canada. Table 126-0003 - Supply and disposition of crude oil and equivalent, monthly (cubic metres unless otherwise noted), CANSIM (database). (accessed: )

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180418/dq180418d-eng.pdf

FINANCE

Department of Finance Canada. April 18, 2018. Government of Canada Adopts Regulations to Support a Sound and Resilient Financial System

Ottawa, Ontario – The Government of Canada is committed to building greater confidence in Canada's strong and well-functioning financial sector. An economy that works for the middle class and those working hard to join it relies on trust and confidence in our financial institutions.

Today, the Government published regulations in Part II of the Canada Gazette that implement key features of the Bank Recapitalization (Bail-in) Regime, introduced in 2016 for Canada's domestic systemically important banks. The regime provides authorities with an additional tool to deal with the unlikely failure of a major bank, in a manner that preserves financial stability while protecting the interests of taxpayers.

The regulations identify which types of debt instruments will be subject to the regime. The bail-in regulations do not apply to deposits—including chequing accounts, savings accounts and term deposits such as Guaranteed Investment Certificates—which will continue to benefit from the Canada Deposit Insurance Corporation deposit insurance framework.

The regime is consistent with international standards and fulfills the Budget 2016 commitment to introduce a bail-in regime.

Backgrounder

The Canadian financial system is one of the safest and soundest in the world. Canadian banks were able to maintain their access to debt and equity markets through the 2008 global financial crisis while banks from many other nations were not. Canadian banks continue to benefit from an effective and modern regulatory and supervisory regime.

The 2008 financial crisis highlighted the fact that some banks are "systemically important"—so important to the functioning of either the global financial system or to a domestic economy that their failure would impose unacceptable costs on the economy and financial system and, potentially, taxpayers. A central goal of the global financial reform agenda has been to ensure taxpayers are not on the hook to cover future losses by banks.

In response, Canada designated six "domestic systemically important banks" (D-SIBs):

- Bank of Montreal

- Bank of Nova Scotia

- Canadian Imperial Bank of Commerce

- National Bank of Canada

- Royal Bank of Canada

- Toronto-Dominion Bank

In line with international standards, Canada has put into place measures to reduce the likelihood of failure for these banks and measures to reduce the potential impact of any failure on taxpayers.

The Bank Recapitalization (Bail-in) Regime

The Government maintains a broad suite of tools to manage a failing bank, whether systemically important or not. The new Bank Recapitalization (Bail-in) Regime is intended to complement these by giving authorities an additional tool for use in the unlikely, extreme scenario of a D-SIB's failure.

The regime is consistent with international standards developed by the international Financial Stability Board and endorsed by the G20 in response to the global financial crisis. Many other jurisdictions have already taken similar steps to enhance their bank resolution toolkits, including the United States and all European Union member states. As in other jurisdictions, the Canadian regime will also require systemically important banks to maintain sufficient total loss absorbing capacity (TLAC)—which is the capital plus debt convertible into equity under the recapitalization regime—in line with internationally established TLAC standards.

Canada's Bank Recapitalization (Bail-in) Regime will allow authorities to quickly convert some of a failing bank's debt into common shares in order to recapitalize the bank and help restore it to viability. This gives authorities an additional tool to deal with the unlikely failure of a major bank in a way that allows the bank to remain open and operating, while preserving financial stability and protecting the interests of taxpayers. This regime also gives bank creditors and shareholders additional incentives to monitor banks' risks.

The Bail-In Regulations

The legislative framework for the bail-in regime received Royal Assent in June 2016. Draft regulations were pre-published for public consultation in the Canada Gazette, Part Iin June 2017. The final regulations published today in the Canada Gazette, Part II, along with guidance being released by the Office of the Superintendent of Financial Institutions on TLAC, represent key final steps in implementing the bail-in regime.

The regulations set out key features of the regime, including that the rules would only apply to debt issued by D-SIBs that is unsecured, tradable, transferable, and has an original term to maturity of at least 400 days. Such debt is held predominantly by foreign and domestic institutional investors, such as asset and fund managers, typically as a small portion of these investors' overall portfolios.

The bail-in regulations do not apply to deposits, including chequing accounts, savings accounts and term deposits such as Guaranteed Investment Certificates, which will continue to benefit from the Canada Deposit Insurance Corporation deposit insurance framework. As such, deposits are not convertible under the regime.

In addition to the scope of liabilities that would be subject to the regime, the regulations set out:

- the process and considerations that will be followed when carrying out a conversion;

- the disclosure requirements applicable to bank-issued instruments subject to conversion; and

- the process to compensate investors who are made worse off as a result of a conversion and accompanying resolution actions, relative to liquidation of the bank.

FULL DOCUMENT: https://www.fin.gc.ca/n18/18-029-eng.asp

Department of Finance Canada. 2018-04-18. Tax Fairness for the Middle Class and Opportunity for All Canadians. Backgrounder

Canadians deserve to feel confident that their hard work will be rewarded with greater opportunities and a fair chance at success. A fair tax system forms the foundation for a stronger middle class and a growing economy, instills confidence in Canadians and helps to create opportunities for everyone.

Small businesses are a key driver of Canada's economy, accounting for 70 per cent of all private sector jobs. Low and competitive tax rates allow Canadian businesses to invest in their success, and create more good, well-paying jobs.

The Government is supporting hard-working small business owners by reducing the small business tax rate to 10 per cent, effective January 1, 2018, and to 9 per cent, effective January 1, 2019. By 2019, the combined federal-provincial-territorial average income tax rate for small business will be 12.6 per cent—the lowest in the G7 and the fourth lowest among members of the Organisation for Economic Co-operation and Development.

At the same time, the Government is taking steps to ensure that Canada's internationally competitive corporate tax rates are being used to support jobs and growth—by encouraging investment in things like machinery, equipment and skills training—rather than to create unfair tax advantages for the wealthy at the expense of others. Before the Government began taking action, someone earning $300,000 with a spouse and two adult children could, in some circumstances, use a Canadian-controlled private corporation (CCPC) and the small business tax rate to get tax savings that amount to roughly what the average Canadian earns in a year.

In July 2017, the Government engaged Canadians in an open discussion on proposals to address tax planning strategies using private corporations. In October 2017, the Minister of Finance took this feedback into account in announcing changes to the Government's proposed approach to address these strategies. Specifically, the Government announced that:

- It would cut taxes for small businesses, providing them with up to $7,500 in federal tax savings per year. For the average small business, this will leave an additional $1,600 per year for small business entrepreneurs and innovators to reinvest in new equipment, in growth and job creation.

- It would move forward with simplified proposals to limit income sprinkling, while making sure that family members who make a meaningful contribution to the business are not affected. Detailed legislative proposals to address income sprinkling were subsequently released on December 13, 2017, giving owners of private corporations until the end of 2018 to adjust to the proposed exclusion for significant shareholdings.

- It would move forward in Budget 2018 with measures to limit the tax deferral opportunities related to passive investments, while providing business owners with flexibility to build a cushion of savings for business purposes and deal with personal circumstances, such as for maternity leave, sick days or retirement.

- It would not move forward with parts of the July 2017 proposals due to concerns that they could have unintended consequences, particularly relating to the ability of farmers and fishers to hand down their business to the next generation.

Budget 2018 Actions to Ensure the Fair Treatment of Passive Investment Income

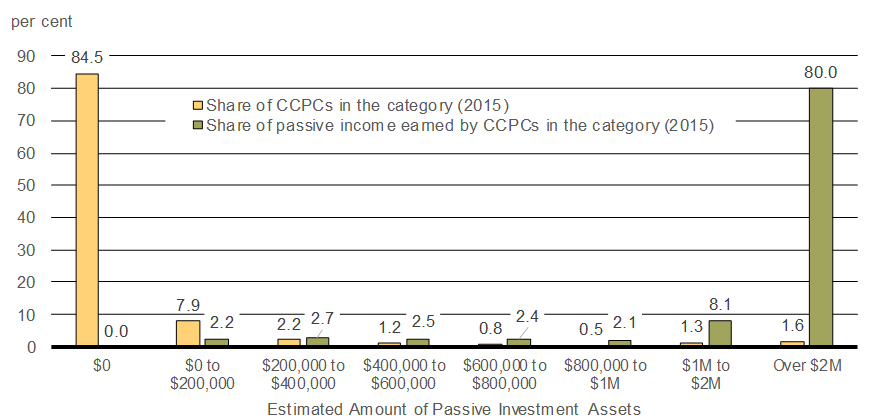

Currently, it is estimated that $300 billion1 in passive investments is being held by private corporations that are actively engaged in a business. About 80 per cent of this wealth is concentrated in 2 per cent of CCPCs. The Government is taking action to limit tax deferral benefits related to passive investment, while recognizing the role of savings within the business to provide a financial cushion to the business and to entrepreneurs. More than 97 per cent of private corporations will not be affected by the changes proposed in Budget 2018.

The passive investment tax changes proposed in Budget 2018 strike a balance between the need to ensure fairness and the need to support business investment and growth—without introducing undue complexity.

The small business tax rate is designed to help businesses get the capital they need in order to grow and focus on their day-to-day operations, not to provide tax advantages for the wealthiest to accumulate large, personal savings within a corporation. Known as passive investments, these portfolios of assets (such as stocks, bonds or real estate) are held within a private corporation and generate an income not related to the active business. Owners of private corporations can gain a tax advantage when they accumulate a large amount of wealth with income taxed at the small business rate, rather than the personal rate. Some of these savings are intended primarily for personal use.

Through Budget 2018, the Government proposes two measures that will improve the fairness of the tax system, while still enabling entrepreneurs to save within their business.

The first measure proposes to limit the ability of private corporations with significant passive savings to benefit from the preferential small business rate. The current small business deduction limit allows for up to $500,000 of business income from an active business to be subject to the lower small business tax rate. Access to the lower tax rate is phased out on a straight-line basis for associated CCPCs with between $10 million and $15 million of aggregate taxable capital employed in Canada.

Budget 2018 proposes to introduce an additional eligibility mechanism for the small business deduction, based on the corporation's passive investment income. This will be simpler and more targeted than proposals originally outlined in the July 2017 consultation.

Under the proposal, if a corporation and its associated corporations earn more than $50,000 of passive investment income in a given year (equivalent to $1 million in passive investment assets, assuming a 5-per-cent rate of return), the amount of a corporation's active income eligible for the small business tax rate would be gradually reduced. The small business deduction limit would be fully phased out once passive income reaches $150,000 per year (equivalent to $3 million in passive investment assets, assuming a 5-per-cent rate of return). For the limited number of corporations earning that level of passive income or more, their businesses' active income would be taxed at the general corporate income tax rate. With this proposal, the Government is slowly withdrawing access to the small business tax rate if a business is accumulating large sums of passive investments.

For those earning less than $50,000 of passive income each year, there would be no change in tax treatment under this first measure. Moreover, the tax applicable to investment income remains unchanged—refundable taxes and dividend tax rates will remain the same, unlike the July 2017 proposal.

In addition, capital gains from the sale of assets used in the business or from the sale of shares of connected corporations, where these corporations are engaged in an active business and certain conditions are met, will not be taken into account for purposes of this measure.

For instance:

- A private corporation with passive investment assets of less than $1 million at a 5-per-cent rate of return would be unaffected by the proposal, and could continue to earn up to $500,000 in active business income at the small business tax rate.

- A private corporation with passive investment assets of $1.4 million at a 5-per-cent rate of return could earn up to $400,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $2 million at a 5-per-cent rate of return could earn up to $250,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $2.5 million at a 5-per-cent rate of return could earn up to $125,000 in business income per year without being affected by the proposal.

- A private corporation with passive investment assets of $3 million or more at a 5-per-cent rate of return would pay the general corporate tax rate on business income earned.

With these two proposals, less than 3 per cent of private corporations will be affected. It is estimated that more than 90 per cent of the tax impact from the two measures will be borne by households in the top 1 per cent (i.e., the wealthiest). In contrast, the reduction in the small business tax rate will be available to all small CCPCs.

These proposed measures will enhance the fairness of the tax system in a manner that is more targeted and simpler than the approaches proposed in the Government's July 2017 consultation paper, while ensuring Canada's low small business taxes continue to help companies grow and create jobs. They will take effect on a go-forward basis, applying to taxation years that begin after 2018.

Impact of Proposed Budget 2018 Passive Investment Changes

Less than 3 per cent of corporations will be affected. 90 per cent of the tax impact will be borne by households in the top 1 per cent (i.e. the wealthiest).

In contrast, the benefits of the reduction in the small business tax rate will be available to all small businesses. As a result, small businesses will be able to keep up to $7,500 more of their profits.

Those affected by the two proposals put forward in Budget 2018 earn on average $175,000 of passive investment income annually, which for most will represent only one of many sources of income. Passive income of $175,000 would represent passive assets of about $3.5 million (assuming a 5-per-cent rate of return).

By keeping taxes low for small businesses and ensuring that everyone pays their fair share of tax, the Government's actions are helping to create greater opportunities, including jobs, for all Canadians, and delivering on its fundamental promise: that hard work will be rewarded, and that every Canadian can have a real and fair chance at success.

Distribution of CCPCs and their Share of Taxable Passive Investment Income (2015)

Categorized by Magnitude of Passive Investment Assets

Note: No data is available on the value of passive investments held in private corporations. The asset values used to produce the chart were imputed from passive investment income amounts reported by private corporations for tax purposes, using a hypothetical rate of return of 5 per cent. The amounts include capital gains, portfolio dividends and other investment income, such as interest.

1 No data is available on the value of passive assets held in private corporations. The $300 billion estimate is imputed from passive income reported by CCPCs for tax purposes, using a hypothetical rate of return of 5 per cent. The amounts include capital gains, portfolio dividends and other investment income, such as interest.

Department of Finance Canada. 2018-04-18. More Jobs, a Growing Economy, and a Stronger Middle Class. Backgrounder

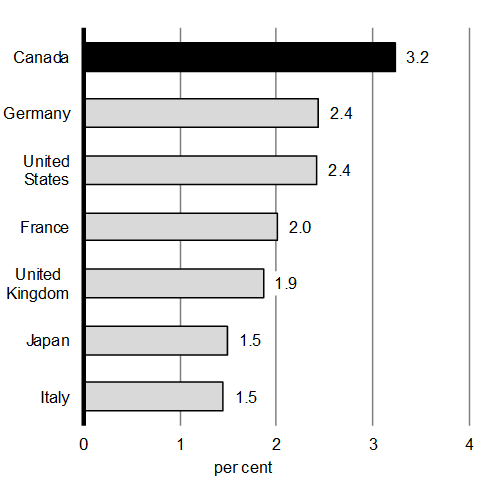

Today, Canada leads all Group of Seven (G7) countries in economic growth and Canadians are feeling more confident about the future—whether their plan is to save for a first home, pay down their debt, or go back to school to train for a new job. As a result, the Government is about to invest in the things that matter to Canadians, while making steady improvements to the Government's bottom line.

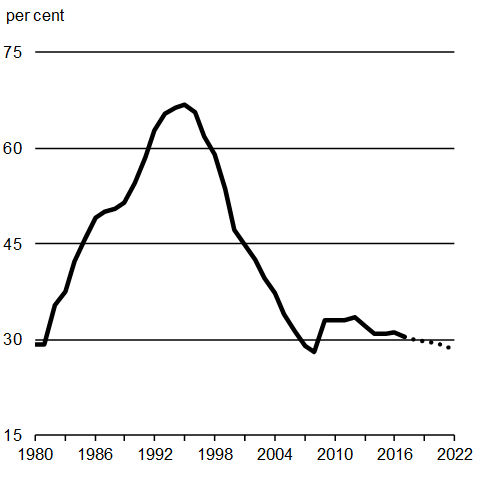

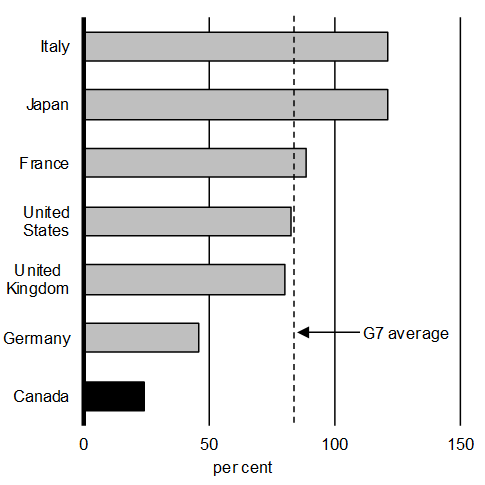

Canada's strong fiscal fundamentals—anchored by a low and consistently declining debt-to-GDP (gross domestic product) ratio—means that Canada can make the investments that will strengthen and grow the middle class, and lay a more solid foundation for our children's future.

According to the International Monetary Fund (IMF), Canada's net debt-to-GDP ratio is by far the lowest among G7 countries and less than half the G7 average.

The Government's investments in people and in the communities they call home are delivering greater opportunities for the middle class, and for all Canadians. Targeted investments, combined with the hard work of Canadians, have helped create good, well-paying jobs—and will continue to strengthen the economy over the long term.

Measures like the middle class tax cut and the Canada Child Benefit have provided Canadian families with more money to save, invest, and spend in their communities. Historic investments in public transit, green infrastructure, and social infrastructure—such as early learning and child care and affordable housing—combined with investments in an ambitious Innovation and Skills Plan and the significant steps we are taking to achieve equality, will ensure that Canadians have the support they need to compete and succeed.

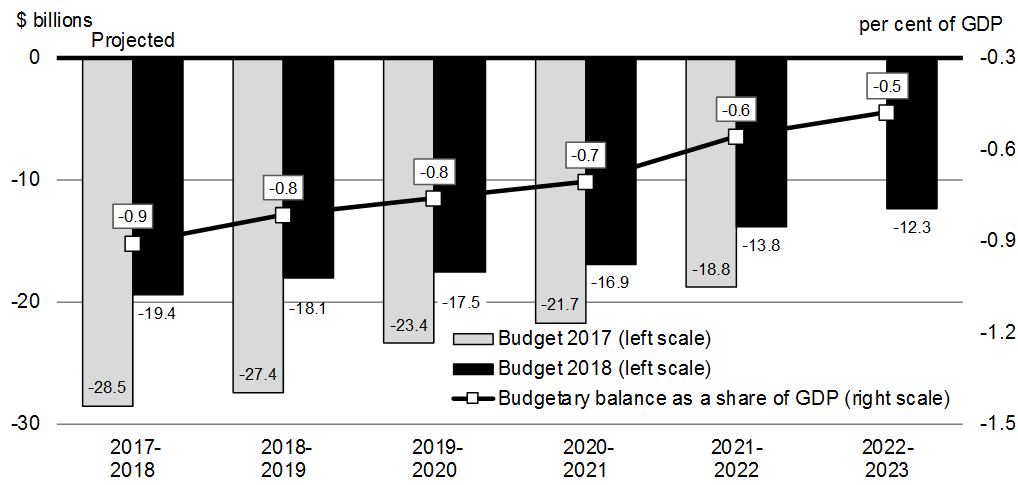

Budget 2018 builds on this plan of investment, while maintaining a clear focus on fiscal responsibility and continuously improving fiscal results.

Canadian Economic Context

The Government's plan to invest in people, in communities, and in the economy has put more money in the pockets of Canadians, has helped create more well-paying jobs, and is giving Canadians greater confidence in their future.

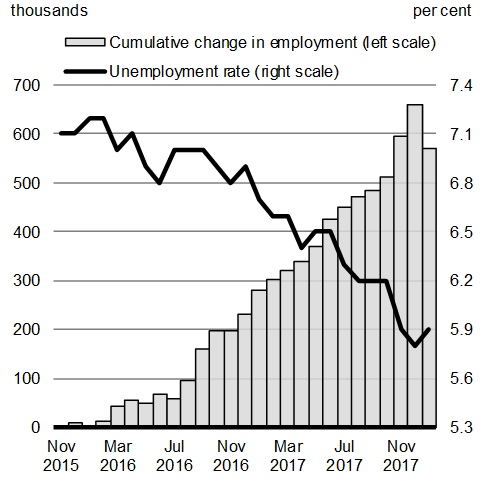

Since November 2015, Canadians have created almost 600,000 new jobs and the unemployment rate has fallen from 7.1 per cent to 5.9 per cent—close to its lowest level in over four decades. The Canadian economy has been remarkably strong, growing at a pace well above that of all other G7 countries since mid-2016 (Chart 1).

Chart 1

Labour Market Since November 2015

Source: Statistics Canada.

Average Real GDP Growth Since 2016Q2

Source: Haver Analytics.

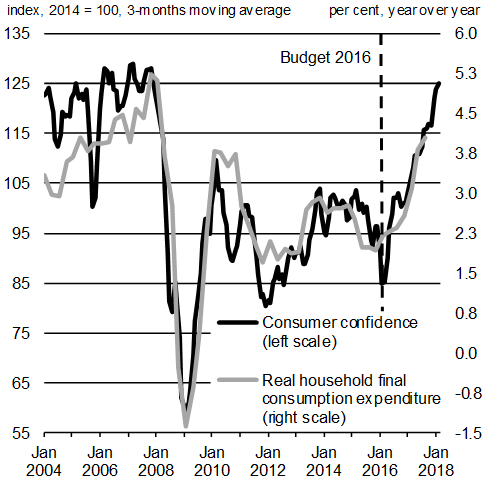

Strong output growth and a robust labour market—along with the measures that the Government has put in place to support the middle class over the past two years—are driving higher levels of Canadian consumer and business confidence and supporting wage growth (Chart 2). This positive sentiment and higher earnings are translating into solid growth in household spending and a recovery in business investment, which should continue to support economic growth.

Chart 2

Real Household Consumption Growth and Consumer Confidence

Sources: Statistics Canada; The Conference Board of Canada.

Growth in Average Weekly Earnings

Source: Statistics Canada, Survey of Employment, Payroll and Hours (SEPH).

Going forward, growth is expected to remain robust. However, risks remain that could affect the economic outlook—underscoring the importance of continuing to make responsible investments.

Budget 2018 Investments

Through Budget 2018, the Government continues to strengthen the middle class and make investments to support Canada's long-term economic growth. Challenges posed by population aging, global climate change, and rapid technological innovation underscore the importance of strong leadership and a forward-looking approach to continue growing the middle class and ensuring all Canadians are able to contribute to—and benefit from—Canada's prosperity.