CANADA ECONOMICS

FIFA - WORLD CUP 2026

Canadian Heritage. March 13, 2018. The Government of Canada Announces its Support-in-Principle for the United 2026 bid to Co-host the 2026 FIFA World Cup™ in Canada, Mexico and the United States

TORONTO, ON - Today, the Honourable Kirsty Duncan, Minister of Science and Minister of Sport and Persons with Disabilities, announced that the Government of Canada is supporting-in-principle the United 2026 bid to co-host the 2026 FIFA World Cup™ in Canada, Mexico and the United States.

Held every four years, the FIFA World Cup™ is the most prestigious tournament for the Fédération Internationale de Football Association (FIFA). Co-hosting this international event watched by billions of people worldwide would provide considerable sport, social, community, cultural and economic benefits as well as showcase Canada around the world.

While Canada has never hosted the FIFA World Cup™ for Men, it has successfully hosted all other FIFA competitions, including the record setting FIFA Women’s World Cup Canada 2015™. Held in six cities and provinces from coast to coast across Canada, 1.35 million spectators that attended the newly expanded 24-team competition contributed to an economic impact of nearly a half-a-billion dollars.

The soccer governing bodies for Canada, Mexico and the United States jointly announced on April 10, 2017, that they would pursue a bid for the 2026 FIFA World Cup™.

The importance of the Canada-United States-Mexico relationship is reflected in our strong diplomatic, cultural, educational and commercial relations. Canada remains committed to strengthening its multi-faceted relationship with its North American friends and allies. The collaboration of our three governments in support of the United Bid for the 2026 FIFA World Cup™ is another example of how much our three countries can achieve when we work together toward common goals.

On June 13, 2018, FIFA will announce if United 2026, Morocco, or neither bidder will host the 2026 FIFA Men’s World Cup.

Quotes

“Hosting major sporting events allows Canadian athletes to compete at home in front of their families, friends and fans. It is also a significant opportunity for Canadians to witness, first-hand, world-class sport competitions. What better place to host the 2026 FIFA World Cup™ than in our multicultural cities where every team is a home team!”

—The Honourable Kirsty Duncan, Minister of Science and Sport and Persons with Disabilities

“On behalf of Canada Soccer, I would like to thank the Government of Canada for their support of the United Bid to host the 2026 FIFA World Cup™ in Canada, Mexico and the United States. Canada has raised the bar for women’s and youth FIFA competitions including the most recent record-setting FIFA Women’s World Cup Canada 2015™ and as the only G7 country to have not hosted the men’s competition, we are more than ready to welcome the world along with our neighbours in Mexico and the United States.”

—Steven Reed, President, Canada Soccer and Co-chair, United Bid Committee

Quick facts

- The FIFA Women’s World Cup Canada 2015 and the FIFA U-20 Women’s World Cup Canada 2014 helped generate $493.6 million in economic activity for Canada.

- The Government of Canada is the single largest investor in Canada’s sport system, promoting sport participation among all Canadians and providing support for young athletes, their national and multisport organizations, and the hosting of international events so that our athletes can compete with the best.

- If the event is awarded to United 2026, the Government of Canada will provide up to $5 million to support continued development of event plans and budgets that will inform future decisions around specific funding for the event.

Backgrounder

Overview

The FIFA World CupTM, held every four years, is the most prestigious tournament for the Fédération Internationale de Football Association (FIFA).

On April 10, 2017, the soccer governing bodies for Canada, Mexico, and the United States jointly announced that they will pursue a bid for the 2026 FIFA World CupTM. Morocco is currently the only other eligible nation that is bidding.

On December 18, 2017, the Canadian Soccer Association submitted a formal request for hosting support and funding for the 2026 FIFA World CupTM.

On June 13, 2018, 211 FIFA members will vote to determine if United 2026, Morocco, or neither will host the 2026 FIFA World CupTM.

Important Steps in the Bid Process

- March 16, 2018: Submission of the United 2026 Bid Book to FIFA.

- June 13, 2018: a FIFA Congress vote will occur to determine if United 2026 or Morocco is awarded the 2026 FIFA World CupTM; if neither bid is awarded the event, the process is then open to all other FIFA members.

Success of Hosting the Recent FIFA World CupTM for Women

Major international sport events provide an opportunity to bring together athletes, spectators and tourists from across the world and to showcase a country on the international stage. Hosting such events can offer host countries and cities a powerful catalyst for cultural, social and economic growth.

In 2015, Canada hosted the FIFA World CupTM for Women from June 6 to July 5, 2015. It was held in six cities from coast to coast across five time zones: Vancouver, Edmonton, Winnipeg, Ottawa, Montréal and Moncton. The 52‑match tournament attracted 576 of the world’s top players and 48 coaches from 24 countries.

The Women’s World Cup Canada 2015TM and the FIFA U-20 Women’s World Cup Canada 2014TM helped generate $493.6 million in economic activity for Canada.

There were opportunities to leverage the FIFA Women’s World Cup Canada 2015TM for social development goals both within host cities and across the country. One example was “Live Your Goals,” a dedicated FIFA development campaign aimed at inspiring girls and young women to get involved in soccer and stay in the game.

As we move forward, all governments and sport partners will discuss planning and development of legacy and leveraging initiatives if United 2026 is awarded the event.

Sport Legacy and Indigenous Partnership

Soccer is the sport with the most participants in the world. Hosting the 2026 FIFA World CupTM would provide the opportunity to continue to grow participation rates for both girls and boys in Canada and for the Canadian men’s and women’s national teams to compete against the best soccer players in the world. Hosting the event could invigorate both men’s and women’s high-performance soccer in Canada and the next generation of athletes.

Major sport events provide opportunities to positively impact and engage Indigenous groups, promote sport within Indigenous communities and showcase Indigenous culture as part of a broader celebration of diversity and inclusion. These activities contribute to and promote reconciliation.

Multicultural Communities in Canada

Canada welcomes approximately 300,000 new immigrants each year from all over the world. One fifth of Canadians were born elsewhere and chose to immigrate here. During the FIFA World CupTM, Canadians from all backgrounds will come to cheer on their roots and their favourite teams together. Canada is a country that celebrates our diversity as a strength. Every team is a home team.

FULL DOCUMENT: https://www.canada.ca/en/canadian-heritage/news/2018/03/the-government-of-canada-announces-its-support-in-principle-for-the-united-2026-bid-to-co-host-the-2026-fifa-world-cup-in-canada-mexico-and-th.html

US TARIFFS ON STEEL AND ALUMINIUM

The Globe and Mail. 13 Mar 2018. Ottawa weighs tactics to forestall dumping of steel. Hiring of border inspectors, higher tariffs under consideration as flood of metals from China, other countries expected in Canada as a way to circumvent U.S. levies

ROBERT FIFE, OTTAWA

GREG KEENAN, TORONTO

The federal government is examining new measures to stop China and other countries from dumping cheap steel and aluminum in Canada as a way to skirt recent hefty U.S. tariffs.

A senior government official told The Globe and Mail on Monday that Ottawa is consulting widely with industry executives on the best measures to combat an expected flood of offshore steel and aluminum.

No final decision has been made, but federal actions could include the hiring of more border inspectors or possibly higher tariffs to stop unfair global dumping. Prime Minister Justin Trudeau acknowledged on Monday that he personally reassured U.S. President Donald Trump last week that Canada won’t become a transit station for offshore steel and aluminum into the U.S. market.

Mr. Trudeau spoke by telephone with Mr. Trump on Monday to thank him for the “special consideration extended to Canada” while stressing that the steel and aluminum industries are critical to jobs on both sides of the border, his office said in a statement. President Trump temporarily exempted Canada and Mexico from new tariffs of 25 per cent on foreign steel and 10 per cent one on aluminum; he imposed those tariffs last week, citing China’s dumping of excess product at below market rates as a national-security threat.

Joseph Galimberti, president of the Canadian Steel Producers Association, said Ottawa is being urged to add staff to Global Affairs Canada and hire more inspectors for the Canada Border Services Agency.

He said the government needs to monitor steel imports more closely so that if shipment volumes are rising, it can react quickly to stop Canada from becoming a dumping ground into the U.S. market.

Trade actions against offshore steel initiated by the government and brought to the Canadian International Trade Tribunal would likely carry a greater sense of urgency than those brought by industry, Mr. Galimberti said in an interview.

Mr. Trudeau said his government is working hard to ensure that the exemptions stay in place and took issue with the U.S. President’s decision to use the tariffs as a bargaining chip.

Mr. Trump has threatened to expand the steel and aluminum duties to the two countries if there is no progress on meeting U.S. demands in the negotiations on the North American free-trade agreement.

Foreign Affairs Minister Chrystia Freeland is heading to Washington on Tuesday for two days of talks with Commerce Secretary Wilbur Ross and U.S. Trade Representative Robert Lighthizer as well as key congressional leaders. Her office said the talks are focused on pushing the ball forward on the NAFTA talks.

Mr. Trudeau said that the consequences of putting tariffs on steel and aluminum in Canada “would mean pain for workers here in Canada but also job losses and difficulties for workers and their families in the United States,” he said. “That is because the level of integration within our two markets is deep, complex and profitable to both of our countries.”

Mr. Trudeau argued that Canada − the largest supply list of steel to the United States − is a key American defence ally and noted Canadian steel is used to manufacture U.S. tanks and Canadian aluminum is in America warplanes.

Mr. Trudeau also took Canada’s case to U.S. cable channels on Monday with appearances on MSNBC and CNN. He is scheduled to tour steel mills in Hamilton, Sault Ste. Marie and Regina this week.

Executives in the steel-processing sector describe the manner in which countries and importers get around tariffs as being akin to a sheet of paper. If there’s a tariff on a piece of paper, turn it into a paper airplane and it’s in a different category and no longer subject to a tariff.

So steel-processing centres in Canada could import metal from China or India or other countries subject to the tariff and then sell it to an auto-parts maker or an energy company that turns it into something with a different tariff code.

This form of processing allows it to be stamped “made in Canada” and could avoid the U.S. tariff, which is why the federal enforcement officials will need to identify the country of origin of the original steel, said one industry executive who asked that his name not be used because he is not authorized to speak to the media.

PM. Itinerary for Tuesday, March 13, 2018 Ottawa, Ontario - March 12, 2018

Itinerary for the Prime Minister, Justin Trudeau, for Tuesday, March 13, 2018:

Hamilton, Ontario

9:30 a.m. The Prime Minister will participate in a brief tour and meet with workers of Stelco Hamilton Works.

Stelco Hamilton Works

386 Wilcox Street

Note to media:

Pooled photo opportunity

11:45 a.m. The Prime Minister will participate in a roundtable with steel industry leaders.

Sheraton Hamilton Hotel

116 King Street West

Notes to media:

Photo opportunity at the beginning of the roundtable

Media are asked to arrive no later than 11:15 a.m.

2 p.m. The Prime Minister will participate in a brief tour of the ArcelorMittal Dofasco plant. A media availability will follow.

ArcelorMittal Dofasco

1330 Burlington Street East

Notes to media:

Pooled photo opportunity of tour

Open coverage of media availability

Media are asked to arrive no later than 1 p.m.

Media must register with Amy Gringhuis (amy.gringhuis@arcelormittal.

Attire: Long pants, long sleeve shirts, and closed toe footwear must be worn. Appropriate personal protective equipment will be provided.

Media appearances

8:10 a.m. An interview with the Prime Minister will air on CHCH, Morning Live.

9:05 a.m. An interview with the Prime Minister will air on 900 CHML, The Bill Kelly Show.

The Globe and Mail. THE CANADIAN PRESS. 13 Mar 2018. A respite from the ‘steel city’. Hamilton, a city long known for manufacturing, has another claim to fame – its waterfalls

NICOLE THOMPSON

On a brisk afternoon in early March, the water from Hamilton’s Tew Falls crashes onto a snow-covered rock. Icicles hang on either side of the ribbon waterfall, and snow is sprinkled on ledges in the gorge.

The falls are a smaller, lower-key alternative to the juggernaut of Niagara Falls, about an hour’s drive southeast. They’re visible from a platform that’s easily accessible from a close by parking lot.

Although Hamilton has long been known as Canada’s “steel city” because it’s home to a large manufacturing industry, natural attractions are becoming part of its revamped image.

Owing to its position along the Niagara Escarpment, Hamilton abounds with waterfalls. City officials say it has “the highest number of waterfalls of any urban area of its size” – at least a hundred of them are scattered across the city, with varying degrees of accessibility.

Some, such as Tew Falls and nearby Webster Falls have platforms for easy viewing, while others require a bit of a hike – although enthusiasts insist the views are worth it.

“For some reason, the waterfalls just fill me up,” says Jodi Voutour, who tries to make it out to some of Hamilton’s waterfalls at least twice a week. “They lift my spirits. There’s something cleansing and releasing about them.”

The 10-year resident of the city says she prefers the falls that are harder to access, although would-be hikers have to be careful not to slip and fall.

“People should continue to visit the waterfalls, but also respect the land and be aware of their footing so we don’t have as many injuries,” she says.

The city itself instructs visitors to stay away from the area right beside waterfalls, as they are typically near a very steep drop and the land can become unstable. It also advises that some areas are prone to flash flooding, while others have polluted water and aren’t suitable for swimming.

But the city also acknowledges the falls’ potential to draw visitors. In 2007, an official report ranked the waterfalls based on accessibility, visual appeal and “awefactor.”

Tew Falls and Webster Falls placed first and second, respectively.

In the winter, the falls are an icy respite from the city. But after a few months, they’re surrounded by lush greenery.

It’s in stark contrast to the image Hamilton puts forth to the rest of the country.

“When people think of Hamilton, they think of dirty, industrial steel town, right? And actually, it’s so much more than industrial and dirt and grime,” Ms. Voutour says. “If you come to these waterfalls, there’s so many hidden beauties, you wouldn’t even think.”

“I know during the summer a lot of the waterfalls are so crowded, so overpopulated. I choose to go in the downtimes … early in the mornings or in the wintertime, when not as many people venture out,” Ms. Voutour says.

She and one of her friends regularly head to a waterfall early in the morning and bring along an MP3 player with a portable speaker, she says.

“We skip along and dance our little booties off,” she says with a laugh.

The Globe and Mail. 13 Mar 2018. Tariff exemption may help NAFTA talks: Morneau

PAUL WALDIE, LONDON EUROPEAN CORRESPONDENT

Finance Minister Bill Morneau says Canada’s ability to win an exemption from proposed U.S. tariffs on steel and aluminum should help in the continuing NAFTA negotiations.

“I think that the demonstration of our relationship that came through this discussion is one that bodes well for the future in terms of any future discussion around tariffs, or for that matter, around NAFTA, showing that we can get to good outcomes through the use of our relationships and the explanation of how important it is that we work together,” Mr. Morneau said after a speech to a business group in London.

Last week, U.S. President Donald Trump excluded Canada and Mexico from new import duties of 25 per cent on steel and 10 per cent on aluminum. However, the President connected the tariff decision to the talks about a new North American free-trade agreement between Canada, the United States and Mexico, saying the tariffs could be imposed depending on the outcome of the negotiations.

Mr. Morneau said Canada does not believe the steel and aluminum issues should be tied to the NAFTA talks, but he said the fact that Canada won an exemption was a positive sign. “We worked hard to explain how integral we are to the North American market,” he said, adding that he was “cautiously optimistic” about a new NAFTA agreement.

“We’ve shown that we can deal with steel and aluminum tariffs as something that’s a separate issue and we’ll continue down those paths.”

Canada is also keen to reach a post-Brexit trade deal with Britain that would have as few trade barriers as possible, he added. Britain cannot formalize any new trade agreements until it is completely out of the European Union, a process that could take until 2020.

The Canada-EU trade deal has been cited as an example for a future trading relationship between Canada and Britain, as well as between Britain and the EU. That deal, however, covers only a limited number of areas.

The Globe and Mail. BLOOMBERG. 13 Mar 2018. EU vows to resist ‘bullies’ as Trump urges bloc to axe U.S. tariffs

NIKOS CHRYSOLORAS

The European Union’s trade chief dismissed Donald Trump’s threat to impose tariffs on car imports, as the U.S. President reiterated that the EU must eliminate barriers to its market for American goods, adding to signs that a widening transatlantic rift could escalate into an all-out trade war.

“Secretary of Commerce Wilbur Ross will be speaking with representatives of the European Union about eliminating the large Tariffs and Barriers they use against the U.S.A.,” Mr. Trump tweeted on Monday. “Not fair to our farmers and manufacturers.”

His comments came as EU Trade Commissioner Cecilia Malmstrom accused the Trump administration of using trade “to threaten and intimidate” Europeans. “But we are not afraid, we will stand up to the bullies,” Ms. Malmstrom said, adding that trade has been used “as a scapegoat.”

After announcing tariffs on steel and aluminum imports, Mr. Trump threatened over the weekend that he may now place higher levies on European cars, telling supporters at a rally that the countries of the EU have banded together “to screw the U.S. on trade.” The latest spat comes as disputes over areas ranging from climate change to Middle East policy strain the bonds holding together the world’s closest political and military alliance.

USA

THE GLOBE AND MAIL. MARCH 13, 2018. Tillerson firing further complicates Nafta negotiations

JOANNA SLATER AND ADRIAN MORROW

U.S. President Donald Trump on Tuesday fired Secretary of State Rex Tillerson, a former oil executive whose brief and troubled tenure as the country’s top diplomat was marked by friction both with the White House and with the foreign service.

Mr. Trump is naming Mike Pompeo, the director of the U.S. Central Intelligence Agency and a former member of Congress from Kansas, as Mr. Tillerson’s replacement. Gina Haspel, Mr. Pompeo’s deputy, is being tapped to lead the U.S. spy agency, which would make her the first woman to hold the post. The Senate must confirm the nominations of Mr. Pompeo and Ms. Haspel.

Read also: White House departures: The list so far

Mr. Tillerson’s exit comes at a moment of high tension in U.S. diplomacy, only days after Mr. Trump shocked the foreign-policy establishment and members of his own party by agreeing to a face-to-face meeting with North Korean leader Kim Jong-un.

Mr. Tillerson appeared to have a cordial relationship with Ottawa during an often tense period in Canada-U.S. relations, even as Mr. Trump frequently accused his neighbour to the north of cheating on trade and threatened to tear up the North American free-trade agreement.

Mr. Trump told reporters Tuesday morning outside the White House that he and Mr. Tillerson disagreed on certain matters, including the future of the Iran nuclear agreement.

Donald J. Trump

✔

@realDonaldTrump

Mike Pompeo, Director of the CIA, will become our new Secretary of State. He will do a fantastic job! Thank you to Rex Tillerson for his service! Gina Haspel will become the new Director of the CIA, and the first woman so chosen. Congratulations to all!

8:44 AM - Mar 13, 2018

82K

63.2K people are talking about this

Twitter Ads info and privacy

Mr. Tillerson had a “different mindset, a different thinking,” said Mr. Trump. “I think Rex will be much happier now.” By contrast, he said that he and Mr. Pompeo had “a very similar thought process” and “very good chemistry.”

Mr. Trump has made little secret of his dislike for Mr. Tillerson, particularly after reports emerged last fall that the Secretary of State had called the President a “moron” following a meeting on America’s nuclear arsenal. Mr. Tillerson did not refute the comment initially, but his office later issued a denial.

From Ottawa’s perspective, the uninfluential Mr. Tillerson was not Canada’s most important ally within the administration. Outgoing chief economic adviser Gary Cohn was more frequently cited as a point of contact.

Defence Secretary Jim Mattis and Treasury Secretary Steve Mnuchin were the Canadians’ two most important contacts in winning the recent exemption from steel and aluminum tariffs, said one senior source. National Security Adviser H.R. McMaster and Jared Kushner, the President’s son-in-law and adviser, are also significant channels for Ottawa.

Mr. Tillerson is the latest in a series of high-profile departures from the White House. Since the start of February, Mr. Trump has lost his chief economic adviser, his communications director and his staff secretary.

The former chief executive of ExxonMobil, Mr. Tillerson did not know Mr. Trump prior to the 2016 election. When he was summoned to a meeting at Trump Tower in New York, he believed he was there to offer advice on global affairs and was stunned when Mr. Trump offered him the job of secretary of state. Mr. Trump was reportedly drawn to Mr. Tillerson because he looked the part, saying the silver-haired executive was like something out of “central casting” for the top diplomat role.

Over the past 14 months, Mr. Trump repeatedly undercut Mr. Tillerson’s diplomatic efforts in public and dramatic ways. Last September, Mr. Tillerson offered to negotiate with North Korea in a bid to ease tensions. But the President disparaged the offer on Twitter: “Save your energy Rex, we’ll do what has to be done!”

Last year, even as Mr. Tillerson hoped to resolve a dispute between Qatar and several other Gulf countries that were blockading it, Mr. Trump seemed to take the side of Doha’s rivals: He called Qatar a “funder of terrorism at a very high level” and said the blockade was “necessary.”

Mr. Tillerson sometimes seemed far more concerned than his boss about Russian interference in the 2016 U.S. presidential election and, more recently, the poisoning of a former Russian spy and his daughter in the United Kingdom with a nerve agent. The latter incident was “a really egregious act” that “clearly” originated in Russia, Mr. Tillerson said Monday. He also called Russia “an irresponsible force of instability in the world” in a statement. By contrast, White House spokeswoman Sarah Huckabee Sanders condemned the incident Monday but repeatedly declined to link it to Russia.

Inside Foggy Bottom, the State Department headquarters in downtown Washington, Mr. Tillerson was a divisive figure. His effort to reorganize the foreign service was deeply unpopular with employees. His tenure at the department was characterized by low morale, high-profile resignations and enduring vacancies at the top of the U.S.diplomatic apparatus.

Mr. Tillerson “managed to alienate almost every major power centre that a secretary of state would want to foster,” said Daniel Drezner, a professor of international politics at the Fletcher School of Law and Diplomacy at Tufts University. Mr. Tillerson’s reorganization of the department was an “unmitigated disaster.”

Mr. Pompeo could make an immediate impact by properly staffing the top levels of the State Department and taking steps to raise morale, said Prof. Drezner.

If confirmed, Mr. Pompeo would appear to be the first director of the CIA to go on to assume the post of the secretary of state. Previous CIA directors have proceeded to helm the Defence Department, but not the State Department.

Mr. Pompeo is a Harvard-educated lawyer who was elected to Congress in 2010 and became CIA director last year. He has been a steadfast ally to Mr. Trump and is known to hold hard-line views on matters of foreign policy. Mr. Pompeo has called the Iran nuclear agreement a “disastrous deal” that he would like to scrap.

ECONOMY

BANK OF CANADA. March 13, 2018. Canadian economy carrying untapped potential, Bank of Canada Governor Poloz says.

Kingston, Ontario - The Canadian economy is carrying untapped potential that could prolong the expansion without causing inflation pressures, Governor Stephen S. Poloz said today.

In a lecture at Queen’s University, Governor Poloz said that the Canadian economy is currently in the phase of the economic cycle where companies need to expand capacity to meet rising demand. “Growing their sales further means increasing investment, leading to the creation of new jobs and increased aggregate supply,” the Governor said. “Obviously, this is a phase worth nurturing.”

Governor Poloz pointed to several sources of untapped potential economic growth, including increased participation in the workforce by youth, women, indigenous peoples, Canadians with disabilities and recent immigrants to Canada. “It is not much of a stretch to imagine that Canada’s labour force could expand by another half a million workers,” he said, which would permanently raise the country’s capacity to grow without leading to higher inflation.

An inflation-targeting central bank can facilitate the creation of new potential output by following a risk-management approach to monetary policy, the Governor said. “If the economy builds more supply than usual, that will put downside risk on inflation; if less, that will create upside risk to inflation, and it is our job to balance those risks,” Governor Poloz said. “We cannot know in advance how far the capacity-building process can go, but we have an obligation to allow it to occur.”

Canada’s untapped potential extends to the future of work, the Governor explained. The investments made today in existing and new companies will exploit technological breakthroughs and create tomorrow’s jobs in new and existing sectors, even as they disrupt some established industries, he said. Many new jobs are created in sectors where the required skills are not very different from those being disrupted, the Governor added. “Throughout history, technological advances have always led to rising productivity and living standards, and they have always created more jobs than they destroyed.”

FULL DOCUMENT: https://www.bankofcanada.ca/wp-content/uploads/2018/03/press_130318.pdf

THE GLOBE AND MAIL. MARCH 13, 2018. ECONOMY. Tapping new hiring pools key to growing economy without sparking inflation: Poloz

BARRIE MCKENNA

OTTAWA - Bank of Canada Governor Stephen Poloz says tapping new pools of workers, including women and new immigrants, would allow Canada's economy to keep growing without sparking inflation.

Boosting the participation rate of women, new immigrants, youth, indigenous people and the disabled would add roughly half a million workers to Canada's labour market, Mr. Poloz pointed out in a speech at Queen's University in Kingston, Ont.

"The bank has concluded that there remains a degree of untapped potential in the economy," Mr. Poloz said. "It means Canada may be able to have more economic growth, a larger economy, and therefore more income per person, without generating higher inflation."

The remarks suggest the central bank may move much more tentatively in the coming months as it looks to hike its key interest rate – now at 1.25 per cent – to a more normal level. The bank judges that the neutral rate is between 2.5 per cent to 3.5 per cent – the point where interest rates neither spur new economic activity nor put the brakes on growth.

"The governor's choice of [speech] topics is in line with our view that he's looking for reasons to take rate hikes slowly," Canadian Imperial Bank of Commerce chief economist Avery Shenfeld said in a research note. CIBC expects just one more hike this year from the central bank.

The Canadian dollar fell on Mr. Poloz's remarks, losing more than half a cent by midafternoon to trade at 77.26 US cents.

Inflation has been picking up in recent months, but still remains slightly below the central bank's 2 per cent target.

"There are likely to be significant economic benefits associated with allowing the economy to find its way to a higher, more productive economic equilibrium," Mr. Poloz said.

"We cannot know in advance how far the capacity-building process can go, but we have an obligation to allow it to occur."

Canada's economy has reached a "sweet spot," where many companies are running flat-out and will need to invest and add new capacity if they want to continue growing, according to Mr. Poloz.

"This is a phase worth nurturing," he said.

Mr. Poloz said the central bank is keeping a close eye on this creation of new economic potential as part of its "risk management approach" to monetary policy.

"If the economy builds more supply than usual, that will put downside risk on inflation," he said. "If less, that will create upside risk to inflation, and it is our job to balance those risks."

For example, adding half-a-million workers to the labour pool would boost Canada's potential output by 1.5 per cent, or $30-billion a year, according to estimates by the central bank.

The biggest gain would come by raising the participation rate of prime-age women (those 25 to 54 years old) – now at 83 per cent versus the 91 per cent for men.

Mr. Poloz cited the example of Quebec, which has dramatically raised the participation rate of prime-age women to 87 per cent from 74 per cent over the past two decades by subsidizing child care and extending paid parental leave.

The country as a whole would add 300,000 people to the workforce by matching Quebec's female labour force participation rate.

The federal government took a step in that direction in last month's budget by announcing extended parental leave benefits through Employment Insurance to encourage dual-parent families to share child care duties. The government also said it would create 40,000 new subsidized child care spaces.

Youth represent another source of untapped potential. Mr. Poloz said the participation rate of 15 to 24-year-olds is still below the level experienced before the last recession. Getting back to that threshold would add another 100,000 people to the labour force, he said.

It's more complicated than just making more workers available. Mr. Poloz pointed out that job vacancies are also climbing – reaching 470,000 last fall. Many employers say they can't find workers with the right skills.

THE GLOBE AND MAIL. THE CANADIAN PRESS. MARCH 13, 2018. OECD raises outlook for Canadian economic growth to 2.2 per cent

OTTAWA - The OECD is raising its economic forecast for Canada amid a strengthening global economy, but also warns that tensions are appearing that could threaten global growth.

The Paris-based economic think-tank says trade protectionism remains a key risk that would negatively affect confidence, investment and jobs.

The OECD comment follows moves by the U.S. to impose tariffs on steel and aluminum imports from most countries in the world, with Canada and Mexico exempted.

The OECD says it now expects the Canadian economy to grow 2.2 per cent this year, up from an earlier prediction of 2.1 per cent.

It also raised its Canadian growth outlook for next year to 2.0 per cent compared with its forecast in November for 1.9 per cent.

The OECD says the revised outlook compares with growth of 3.0 per cent last year in Canada.

REUTERS. MARCH 13, 2018. Bank of Canada: degree of untapped potential remains in economy

David Ljunggren

KINGSTON, Ontario (Reuters) - A degree of untapped potential remains in the Canadian labor market, meaning the economy may be able to generate more growth without higher inflation, the head of the Bank of Canada said on Tuesday, suggesting the central bank can take its time raising interest rates.

Reiterating that the central bank will not take a mechanical approach to rates that will likely be higher over time, Bank of Canada Governor Stephen Poloz said policymakers cannot know in advance how far the capacity-building process can go but have an obligation to let it occur.

Economists said Poloz’s comments underscored the bank’s dovish message of caution after hiking rates three times since July and sent the Canadian dollar lower against the greenback.

The central bank, like others, is trying to lift rates off low levels without snuffing out economic growth, while navigating a number of unknowns, including the future of U.S. trade policy.

“We all know that interest rates are low and that suggests that in a more normal period they would be higher than they are today. But getting there from here is a very gradual process,” Poloz said at a news conference.

“Even I don’t know when interest rates may go up again, and that’s because we are truly dependent on the data as they evolve.”

Although the labor market has become healthier over the past year, there is still some slack, Poloz said in his speech. Increased investment by existing and new companies and more jobs turnover should create more supply in the economy through higher productivity and employment, he said.

“This sticks with their mentality that they can be gradual in raising rates,” said Josh Nye, economist at Royal Bank of Canada.

“The emphasis on the economy having more room to run without generating inflationary pressure gives it a dovish tone overall.”

Despite Canada’s low unemployment rate, a wider range of data point to“a degree of untapped supply potential in the economy,” Poloz said.

“This is important, for it means that Canada may be able to have more economic growth, a larger economy, and therefore more income per person, without generating higher inflation,” he said.

As this process involves upside and downside risks to inflation, the central bank will remain particularly data-dependent, Poloz said.

Poloz said Canada is in the“sweet spot” of the economic cycle and there was reason to be optimistic about the economy despite the uncertainties.

Reporting by David Ljunggren in Kingston, writing by Leah Schnurr and Dale Smith in Ottawa; editing by Diane Craft and Jonathan Oatis

BLOOMBERG. 13 March 2018. Poloz Sees Potential to Fuel Canada Expansion Without Inflation

By Theophilos Argitis and Greg Quinn

- Bank of Canada has an ‘obligation’ to nurture capacity

- Half a million Canadians can be drawn into the labor force

Bank of Canada Governor Stephen Poloz said the nation’s economy carries plenty of untapped potential that allows policy makers to prolong an expansion without fueling inflation.

Poloz said the nation is at the “sweet spot” of the business cycle where growing demand is actually generating new capacity as companies invest to meet sales, a process he said the Bank of Canada has an “obligation” to nurture. He also estimated there are currently about half a million Canadians who can still be drawn into the labor force under stronger economic conditions.

“The bank has concluded there remains a degree of untapped supply potential in the economy,” Poloz said, according to the prepared text of remarks delivered Tuesday at Queen’s University in Kingston, Ontario. “This is important, for it means that Canada may be able to have more economic growth, a larger economy, and therefore more income per person, without generating higher inflation.”

How quickly the economy expands without triggering inflation is a key question for the Bank of Canada. The faster policy makers believe it can run before overheating, the longer they can afford to wait on raising interest rates. And Poloz’s comments seem to be leaning toward faster growth for longer.

It’s a controversial position. The economy is as close to full capacity as it’s been in a decade, and the central bank’s conventional models are likely telling it to raise interest rates more quickly and aggressively. There is also the matter of low borrowing costs fueling record household debt, possibly the biggest risk to the nation’s economy going forward.

Rate Outlook

The Bank of Canada has increased borrowing costs three times since July, but has taken a cautious stance on further rate adjustments. Investors are pricing in at least two more hikes by the end of this year, which would bring the benchmark policy rate to 1.75 percent. The central bank estimates that its neutral interest rate -- a rate that keeps the economy neither too hot nor too cold -- is between 2.5 percent and 3.5 percent.

“It should be clear that there are likely to be significant economic benefits associated with allowing the economy to find its way to a higher, more productive economic equilibrium, if this can happen within our inflation-targeting regime,” Poloz said, adding that interest rates will eventually need to rise to more normal levels.

The Canadian dollar, which is among the worst performing major currencies this year, fell another 0.7 percent to C$1.2932 per U.S. dollar at 12:37 p.m. in Toronto trading.

Bank Mandate

“The Governor’s choice of topics is in line with our view that he’s looking for reasons to take rate hikes slowly,” Avery Shenfeld, chief economist at CIBC World Markets, said in a note to investors. “We’ll retain our call for only one more quarter point hike this year.”

Canada’s economy grew by 3 percent growth for all of 2017, almost a percentage point above U.S., and the central bank is predicting an expansion of 2.2 percent this year. That’s prompted some to question whether historically low interest rates are appropriate for an economy the Bank of Canada estimates has the potential to grow just 1.6 percent without inflation

Targeting growth isn’t technically part of the central bank’s mandate. The Bank of Canada’s primary objective is to target inflation, and Poloz’s strategy is based on the premise that the erosion of productive capacity in recent years can be in part repaired, which would help keep prices in check.

Cheaper credit, for example, will help boost investment and bring more people into the work force -- such as women, youth and the long-term unemployed, according to Poloz’s argument. If the economy can pull in half a million more Canadians into the labor force (an increase of 2.7 percent), that would mean a boost to output of as much as 1.5 percent, or C$1,000 ($774) per Canadian every year.

“We expect to see increased investment -- both in existing and brand new companies -- as well as labor market churn create more supply through higher productivity and employment,” Poloz said.

The central banker cited a number sources of untapped labor market slack, including youth participation rates that still seem low based for this stage of the cycle. There is also scope to increase participation rates among women, Poloz said, citing policy successes in Quebec that helped more women enter the labor force. He also downplayed the importance of the jobless rate -- which is at a 40-year low -- as a gauge of full employment, saying it doesn’t capture the persistent impact on the labor force of the prolonged downturn since the recession.

“When you go through prolonged cycles, which is what we had, legacy things happen,” Poloz said at a press conference after the speech. “That means you have to dig a little deeper to understand truly how the labor market is evolving.”

Poloz reiterated that in addition to questions around the true level of the economy’s potential growth rate there are a number of other uncertainties -- from household debt levels to U.S. trade policy -- the central bank is taking into account as it rejects a “mechanical” approach to policy and remains cautious on interest rates, he said.

“We cannot know in advance how far the capacity-building process can go, but we have an obligation to allow it to occur,” Poloz said.

— With assistance by Erik Hertzberg

INTERNATIONAL TRADE

StatCan. 2018-03-13. Trade by Importer Characteristics – Goods, 2016

In 2016, 148,886 Canadian enterprises imported $497.2 billion worth of goods. Small and medium enterprises (SMEs) accounted for 98.6% of all importing enterprises, but for less than half (46.7%) of total import values.

By comparison, the number of Canadian enterprises exporting goods was 43,255 in 2016. Similar to importers, SMEs accounted for 97.4% of all exporters in the country, while they were responsible for 40.8% of all export sales.

A small number of enterprises in the country were therefore responsible for a large proportion of the international merchandise trade activity. For example, the top 100 importing enterprises in Canada accounted for nearly half of total import values in 2016. Similarly, the top 100 exporting enterprises accounted for 56.6% of all export sales.

Consequently, the average value of imports and exports performed by SMEs and large enterprises differs greatly. In 2016, a single SME imported $1.6 million worth of goods on average, compared with an average import value of $130.8 million for a single large enterprise. The difference was even more pronounced on the export side, with an average export value of $4.3 million for a single SME exporter and $231.9 million for a single large enterprise.

In addition, the trading patterns of SME importers and exporters were quite different in terms of the number of trading partners they dealt with. Nearly 60% of all SME importers sourced goods from more than one country in 2016. In contrast, fewer than 30% of SME exporters shipped goods to more than one country.

Chart 1: Share of number of importing and exporting small and medium enterprises (SMEs), by number of partner countries, 2016

The wholesale trade sector accounts for nearly half of all Canadian imports of goods

Importer characteristics can also be analyzed based on establishments in addition to enterprises. The establishment better reflects the primary industrial activity and the province of the importer. One enterprise can have multiple establishments operating in different provinces and industries.

The wholesale industry was responsible for the majority of imports from 2010 to 2016, followed by the manufacturing and the retail trade industries. In 2016, 30,940 establishments in the wholesale industry imported $235.9 billion worth of goods.

Overall, imports of goods declined by $4.7 billion in 2016 compared with 2015. Declines were reported in every province except Nova Scotia, Ontario and British Columbia. The largest decrease was in Alberta, where imports fell by $3.4 billion. The mining, quarrying and oil and gas extraction sector was the largest contributor to the decline, but the effect was moderated by an increase in imports from the construction sector. These changes reflected the impact of the wildfires in northern Alberta, followed by the rebuilding and repair efforts in this area.

A significant share of Ontario's imports are conducted between related parties

Imports can be presented based on the nature of the two parties involved in the transaction. If one party to the transaction holds 5% or more of the shares of the other party it is dealing with, the import is deemed to take place between related parties. This provides information on the extent of intra-firm trade in Canada's international trade activity and highlights the integrated nature of trade in a globalized environment.

More than two-fifths (43.1%) of all goods imported by Canadian enterprises were purchased from a related party located outside of Canada in 2016.

More than half of Ontario's imports in 2016 were conducted between related parties. Most of the related-party trade in Ontario took place in the wholesale industry, which accounted for 70.3% of the province's total related-party trade. Ontario's main products imported from related parties were motor vehicles, engines, telephones and substances used for medical treatment.

Chart 2: Share of import value conducted between related and unrelated parties, by province, 2016

Import patterns differ depending on the country allocation of imports

On a geographical basis, imports can be allocated to the country in which the final stage of production or manufacture occurs (country of origin) or the last country from which the good was exported before entering the Canadian economy (country of export). Trade patterns differ depending on the country basis selected for the analysis.

On the country of export basis, Canadian enterprises imported $319.0 billion worth of goods from the United States in 2016. On the country of origin basis, the value of imports from the United States was lower at $256.9 billion. This activity reflects the movement of goods purchased by US companies from foreign countries and then sold to Canadian enterprises. These goods mainly included computer equipment, cellular devices and machine parts in 2016.

For China, imports by Canadian enterprises on the country of export basis totalled $35.3 billion in 2016, compared with a value of $59.8 billion on the country of origin basis. This, again, illustrates the movement of goods assembled or manufactured in China and purchased from another country before entering the Canadian economy. Cellular devices, computer equipment and toys were some of the most common commodities imported from China via another country in 2016.

Chart 3: Top five importing countries in 2016, by country of origin and country of export

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180313/dq180313b-eng.pdf

AGRICULTURA

Canadian Food Inspection Agency. March 13, 2018. The Government of Canada is working with the poultry industry to reduce the risk of Salmonella illness from frozen raw breaded chicken products.

Ottawa, ON – Ensuring that Canadians have access to safe and healthy food is a top priority for the federal government. The Canadian Food Inspection Agency (CFIA), along with their federal food safety partners, Health Canada and the Public Health Agency of Canada, as well as industry, remind Canadians about the importance of always fully cooking frozen raw breaded poultry products prior to consumption, as well as using proper food handling techniques and following cooking instructions to limit the risk of foodborne illnesses as salmonella is commonly found in raw chicken and frozen raw breaded chicken products.

Extensive efforts have been made by the federal food safety partners and the industry to increase consumer awareness that these products are raw and need to be fully cooked before consumption, as well as significant attempts by the industry to improve labelling and cooking instructions on packages. Despite these efforts, frozen raw breaded chicken products continue to be identified as a source of salmonella infection in Canada.

As such, the CFIA is working with industry to identify and implement measures at the manufacturing/processing level to reduce salmonella to below a detectable amount in frozen raw breaded chicken products such as chicken nuggets, chicken fingers, chicken strips, popcorn chicken and chicken burgers that are packaged for retail sale. This approach focuses the responsibility on the poultry industry and represents a fundamental change to existing requirements for frozen raw breaded chicken products.

These new measures call for processors to identify salmonella as a hazard and to implement changes in order to produce an end product that reduces salmonella to below a detectable amount. The CFIA has granted industry a 12-month implementation period, to begin immediately, to make these changes.

Quotes

"The CFIA is proud to be working side-by-side with our industry partners to protect the health of Canadians from the ongoing risks of salmonella infection associated with frozen raw breaded chicken products."

Dr. Aline Dimitri, Deputy Chief Food Safety Officer of Canada

"The poultry industry’s objective is to provide consumers with affordable, safe poultry products, every day. We will continue to work with CFIA to ensure consumers have access to safe frozen raw breaded chicken products."

K. Robin Horel, President and CEO, Canadian Poultry & Egg Processors Council

- In the last 10 years the incidence of salmonella illness in Canada has steadily increased. This increase has been driven by Salmonella enteritidis (SE), the most common strain of salmonella in the food supply that is often associated with poultry.

- While frozen raw breaded chicken products often appear to be "pre-cooked" or "ready-to-eat," these products contain raw chicken and are intended to be handled and prepared the same way as other raw poultry. The safety of these products rests with the consumer who is expected to cook it, according to the directions on the package.

- In 2015, industry voluntarily developed additional labelling on frozen raw breaded chicken products that included more prominent and consistent messaging, such as "raw," "uncooked" or "must be cooked" as well as explicit instructions not to microwave the product and they voluntarily introduced adding cooking instructions on the inner-packaging bags.

FULL DOCUMENT: https://www.canada.ca/en/food-inspection-agency/news/2018/03/the-government-of-canada-is-working-with-the-poultry-industry-to-reduce-the-risk-of-salmonella-illness-from-frozen-raw-breaded-chicken-products.html

INCOME AVERAGE

StatCan. 2018-03-13. Canadian Income Survey, 2016

- Median after-tax income, economic families and persons not in an economic family: $57,000; 2016; 0.4% increase (annual change)

- Source(s): CANSIM table 206-0011: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2060011&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canadian families and unattached individuals had a median after-tax income of $57,000 in 2016. Median after-tax income increased from 2011 to 2014, but held steady in 2015 and 2016. The slower growth in 2015 and 2016 was associated with the resource price slowdown, which began in the second half of 2014.

After-tax income is comprised of income from market sources and government transfers. Market income includes employment income, retirement income and income from investments, while government transfers include benefits to seniors, child benefits, Employment Insurance benefits, social assistance and other benefits.

While growth in overall median after-tax income slowed in 2015 and 2016, there was also a significant increase in government transfer income. Median income from government transfers rose from $5,800 in 2014 to $7,400 in 2016. About half of this rise was due to increased child benefits, which became a larger source of income for families with children.

In 2014, the median child benefit received by couple families with children were $2,500. This rose to $3,400 in 2015, and to $4,000 in 2016. For a lone-parent family, the median benefits rose from $5,100 in 2014 to $5,800 in 2015, and then to $6,400 in 2016.

Chart 1: Median after-tax income, median market income and median government transfers for families and unattached individuals, Canada, 2000 to 2016

Income by family type

Couples with children had a median after-tax income of $94,500 in 2016, up 5.6% from 2012. Lone-parent families had a median income of $44,600, while couples without children had a median after-tax income of $76,400. Unattached non-seniors had an after-tax income of $30,400.

Senior families, where the highest income earner was 65 years of age or older, had a median after-tax income of $57,800 in 2016, up 4.7% from 2012. Overall, market income (up 8.7% since 2012) has contributed more to this growth than government transfers. Unattached seniors had a median after-tax income of $26,100 in 2016.

Incidence of low income

According to the after-tax low income measure (LIM-AT), 4.6 million people or 13.0% of the population lived in low income in 2016, down 1.2 percentage points from almost 5 million people in 2015. Provincially, British Columbia (-2.9 percentage points), Manitoba (-2.3 percentage points) and Quebec (-2.2 percentage points) all had lower LIM-AT rates in 2016.

For children under 18 years of age, 957,000 or 14.0% lived in low income in 2016, down from just under 1.1 million or 16.1% in 2012. The child low-income rate of 14.0% in 2016 was relatively low by historical standards, including the most recent low of 14.7% in 2014.

There were 828,000 (14.2%) seniors living in low income in 2016, virtually unchanged from 2015. Low income was particularly high for unattached seniors. Senior men not in an economic family had a low-income rate of 32.5%, compared with 34.3% for women in the same demographic group. According to the LIM-AT, low income among seniors has been steadily increasing since the mid-1990s.

Employment income

In 2016, 20.7 million people had employment income, virtually unchanged from 2015. Median employment income for all workers was $33,300 in 2016, up 1.8% from 2012 but virtually unchanged from 2015.

In 2016, 11.5 million people worked both full year and full time. Median employment income for these workers was $51,700 in 2016, up 2.0% from 2012. Alberta ($59,000) had the highest level in 2016, while Prince Edward Island ($44,000) had the lowest. Since 2012, median employment income among full-year and full-time workers has risen in four provinces: Newfoundland and Labrador (+7.7%), New Brunswick (+6.3%), Manitoba (+5.0%) and Quebec (+4.7%).

Alberta continues to adjust to the oil price shock

Alberta, Canada's largest oil producing province, was still adjusting to the consequences of a rapid drop in world oil prices in 2016, which started in the second half of 2014.

Although Alberta continued to have the highest median employment income among the provinces, it also experienced the largest year-over-year decrease for 2016 at 6.3%. In addition, the number of people employed full time and full year fell 6.3% in 2016, from 1.5 million to 1.4 million. This decrease was largely driven by men, whose ranks fell by 7.5%, from 844,000 workers in 2015 to 781,000 workers in 2016.

Families and unattached individuals in Alberta became more reliant on Employment Insurance (EI) benefits. Since the oil price drop in 2014, the number of families and unattached individuals receiving EI benefits rose by 53.6% to 275,000 in 2016. Among this group, the median benefit received rose from $5,800 in 2014 to $8,300 in 2016.

Men aged 25 to 54 in Alberta have seen the largest increase in EI use. The number of EI recipients among men in this age range nearly doubled, from 64,000 in 2014 to 125,000 in 2016, while their median benefits rose from $5,000 to $8,600. In comparison, women aged 25 to 54 had no change in their median EI benefit received.

Despite the changes in the labour market, the Alberta after-tax low income rate of 8.1% remained the lowest among the provinces.

Median after-tax income by province

Similar to employment income, families and unattached individuals in Alberta ($70,200) also had the highest median after-tax income in 2016, while Quebec had the lowest ($49,500). Since 2012, Newfoundland and Labrador (+7.7%), Manitoba (+6.3%) and British Columbia (+5.6%) all had increases in their median after-tax income, while the other provinces had little or no change.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180313/dq180313a-eng.pdf

LABOUR MARKET

BANK OF CANADA. March 13, 2018. Today’s Labour Market and the Future of Work. Remarks. Stephen S. Poloz - Governor. Chancellor David Dodge Lecture in Public Finance 2018. Kingston, Ontario

I am delighted to be back at Queen’s, where I earned an undergraduate degree in economics some 40 years ago. I remember this time of year well. It is a stressful time—whether you are stressed about starting your career, getting into your next degree program, or just getting this year’s work done.

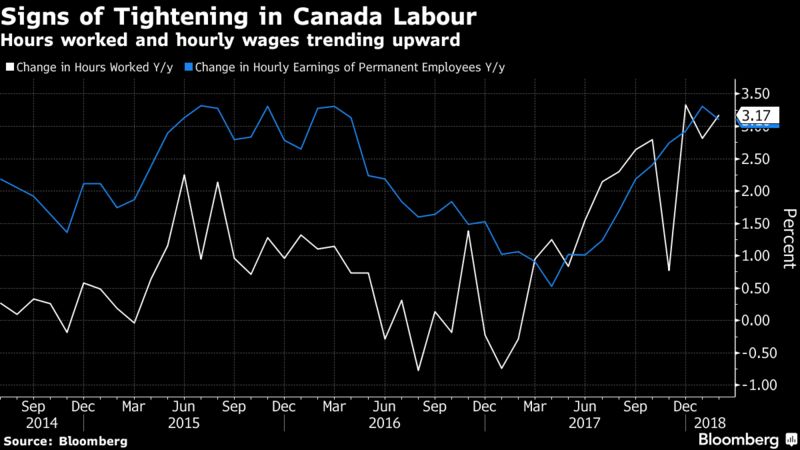

Those of you who hope to join the workforce may be feeling both excitement and nervousness about an uncertain future. At least the macroeconomic situation you face is a positive one. The economy has created 283,000 jobs over the past 12 months, and the unemployment rate is as low as it has been in more than 40 years.

However, this may still leave you wondering about the future. We have all heard stories of people struggling to get a foot in the door, of being overqualified and underemployed, and of the challenges of building a stable career in the “gig economy.” Meanwhile, automation and digitalization are disrupting entire industries and threatening to make some jobs obsolete.

Given this backdrop, I will use my time today to talk about Canada’s labour market—why the central bank pays such close attention to it, and what role monetary policy can play in its performance. I will also take the risk of speculating a little on what lies further ahead for you—on the future of work.

Labour, economic supply and potential output

Let me start with why the Bank of Canada—whose central objective is to target low and stable inflation—cares so much about the labour market. Simply put, it is because inflation is driven by the balance of demand and supply in the economy, and the labour market is the heart of that balance.

When demand is less than supply, inflation tends to fall, and vice versa. When supply and demand are roughly in balance, inflation tends to stabilize around the level where people’s inflation expectations lie—in Canada’s case, our target of 2 per cent annual inflation.

To maintain this balance, a central bank needs to understand all the elements that make up supply and demand. At the top of the list for supply is labour. The more people available to work, and the more productive they are, the greater the contribution that labour makes to supply. In every economy, demographic forces and immigration determine the available workforce.

A complementary role in supply growth is played by investment. Investment spending expands or improves an economy’s capital stock—the machinery and equipment available to workers, as well as infrastructure such as roads, ports or information technology networks. New investment can give existing workers updated tools that raise their productivity. Or, it can mean an expansion of the firm, which is accompanied by new job creation. Both channels raise the economy’s potential output.

Canada has reached the phase of the economic cycle where investment usually takes over as the lead engine of growth and this capacity-building process becomes central. I think of this phase of the cycle as the “sweet spot,” where rising demand actually drives the creation of new supply. With many companies operating near their capacity limits, growing their sales further means increasing investment, leading to the creation of new jobs and increased aggregate supply. Obviously, this is a phase worth nurturing.

By far the most potent form of business investment is the creation of brand new companies. New firms apply the latest technologies in novel ways, sometimes creating completely new industries. As successful new firms exploit new technologies, they can grow very rapidly. Their sales growth chart sometimes looks like a hockey stick, or the left side of the Eiffel Tower.

You can imagine how the creation of numerous new companies might affect the overall performance of our economy. Each firm that sees hockey-stick growth adds disproportionately to the overall productivity of the economy. Indeed, historically, a large share of an economy’s gains in productivity and new job creation have come from young companies.

This is why a period of slow productivity growth is usually associated with slow rates of new company formation. We are—at long last—finally seeing some encouraging signs in these data. This follows a long lacklustre stretch in the wake of both the global financial crisis and the period of high oil prices and exceptional Canadian dollar strength from 2010 to 2013.

Importantly, this process of rapid growth generates higher incomes that people spend in every sector of the economy, benefiting everyone. However, newly created economic growth is disruptive, sometimes destroying existing companies and jobs along the way. This may sound like today’s issue, but it has been a characteristic of economic growth for all time. It was aptly described a long time ago by Joseph Schumpeter as “creative destruction.” I will say more about this process in a few minutes.

However, none of this highly desirable economic growth can happen unless there are people available to fill the newly created jobs. Accordingly, a healthy, well-functioning labour market is critical, particularly at this stage of the business cycle.

There are many ways to measure labour market health. We start with the unemployment rate because it is intuitive and the most commonly reported indicator. It is also as low as it has been since 1976 when Statistics Canada started tracking it this way, which is good.

But the unemployment rate does not tell the whole story. To illustrate, imagine someone whose company closed back in 2010 and who gave up looking for work after months or years of unemployment. This person is no longer participating in the labour market and so is not counted as unemployed. But he or she could still be pulled back into the workforce if the right opportunity came along and so represents a potential source of new supply.

Furthermore, no analysis of the labour market is complete without considering the impact of demographics, specifically, the impact of the Baby Boom generation. The first Baby Boomers began to enter the labour market in the early 1960s and fuelled labour force and economic growth for the next 50 years. This demographic support is now fading. Immigration can help provide an important offset, but we should also be doing everything we can to develop untapped sources of labour supply within our existing population.

Breaking down the numbers

After looking at a much wider range of labour market indicators, the Bank has concluded that there remains a degree of untapped supply potential in the economy. This is important, for it means that Canada may be able to have more economic growth, a larger economy, and therefore more income per person, without generating higher inflation. So, let me turn to a deeper analysis of that issue.

Young people represent one source of untapped potential. Yes, the unemployment rate for people in the 15 to 24 age group has declined to around 11 per cent. However, youth are not participating in the workforce as much as they did 10 years ago.

Traditionally, labour force participation rates decline during recessions and rebound during periods of economic growth. But while most other population groups have seen their participation rates recover from the Great Recession, that has yet to occur for young Canadians.

Some have argued that this should not be a concern, because it reflects an increasingly popular choice to remain in school and get more education. In cases where that is true, I certainly agree. School enrolment has increased over the last decade. However, the full story is more complex.

For one thing, many students historically have chosen to work and go to school at the same time. I am sure that many of the students in this room have a part-time job, not just to earn money but also to gain valuable work experience. I know I did. However, the current participation rates of all student groups—males and females, 15 to 19 years old and 20 to 24 years old—are all below pre-crisis levels. Further, while young people who are not at school have higher labour force participation rates than students do, their rates are all lower than they were before the crisis.

Because this drop in youth participation coincided with the crisis and Great Recession, I cannot believe that everything we are seeing today simply represents people choosing to stay out of the workforce. Clearly, a good part of the decline is tied to the economic cycle, and a shortage of opportunities. Other forces, including demographics, may be acting here as well.

The key point is that youth represent an important untapped source of potential economic growth. If the youth participation rate were to return close to its level before the crisis, more than 100,000 additional young Canadians would have jobs.

An even more significant source of economic potential is higher labour force participation by women. While about 91 per cent of prime-age men participate in the labour force, the rate for women is only about 83 per cent.

History suggests that this gap can narrow. Consider Quebec, where, 20 years ago, the prime-age female participation rate was about 74 per cent. The provincial government identified barriers keeping women out of the workforce and acted to reduce them, particularly by lowering the cost of child care and extending parental leave provisions. Within a few years, proportionately more prime-age Quebec women had jobs than women in the rest of Canada. Today, Quebec’s prime-age female participation rate is about 87 per cent.

If we could simply bring the participation rate of prime-age women in the rest of Canada up to the level in Quebec, we could add almost 300,000 people to our country’s workforce. The recent Federal Budget introduced some new measures in this direction.

There’s more. Employment rates among indigenous peoples—one of the youngest demographic groups in Canada—remain well below those of the rest of the country. And, as Senior Deputy Governor Carolyn Wilkins pointed out in a speech last month, technological advances are breaking down barriers that have been keeping some of the millions of Canadians who live with disabilities out of the workforce.

Finally, much could be done to speed up the integration into the workforce of the growing number of recent immigrants. This would allow their important contribution to the workforce to increase more rapidly over time.

Put it all together, and it is not much of a stretch to imagine that Canada’s labour force could expand by another half a million workers. To put this thought experiment into perspective, this could increase Canada’s potential output by as much as 1.5 per cent, or about $30 billion per year. That’s equal to a permanent increase in output of almost $1,000 per Canadian every year, even before you factor in the possible investment and productivity gains that would come with such an increase in labour supply. Clearly, that is a prize worth pursuing.

The role of monetary policy

The central bank has no role in implementing specific policies aimed at breaking down barriers to labour force participation. However, that does not mean we have no role to play at all. The Bank can certainly use its monetary policy to help bring about a stronger, better functioning economy while still pursuing our inflation-targeting goal. This is particularly important in the current phase of the economic cycle, with demand prompting investment that can pull more people into the workforce.

Statistics Canada data show that job vacancies have been rising quickly, reaching a record 470,000 last autumn. And we hear from business leaders that many of these vacancies are going unfilled because they cannot find workers with the right skills. To have companies looking for so many skilled workers is surely a sign of a strong economy. It shows the need for more targeted education, as well as on-the-job training programs that the employer tailors to fill a specific need.

But another important way to fill job vacancies is a process that economists call labour market churn. Basically, churn describes the way people switch to jobs that better match their skills and experience. Churn falls sharply during recessions, because people are less likely to take a chance on a new opportunity and companies are more inclined to hold onto their skilled workers. However, in periods of strong growth and rising wages, we often see people who are already employed become more willing to leave their current position and switch to a higher-paying job.

When one person takes that step, he or she leaves an opening that needs to be filled. A period of job switching follows, where people move into better employment. Ultimately, people who have been outside the labour force then see more opportunities and can be drawn back in.

Of course, we will never have a perfect matching of all workers and jobs. The regional nature of our economy means the perfect job to match a person’s skills and experience might be thousands of kilometres away. Further, there are still too many barriers that prevent workers in one province from moving to a job in another province.

Labour market churn is a highly complex process that is difficult to predict. So is the creation of new economic supply through investment prompted by strong demand or new firm creation. But it should be clear that there are likely to be significant economic benefits associated with allowing the economy to find its way to a higher, more productive economic equilibrium, if this can happen within our inflation-targeting regime. We cannot know in advance how far the capacity-building process can go, but we have an obligation to allow it to occur.

This is why the Bank has been careful to explain that it cannot take a mechanical approach to policy in this context, even though we believe that interest rates are likely to move higher over time. In fact, we have described this as a risk-management process. If the economy builds more supply than usual, that will put downside risk on inflation; if less, that will create upside risk to inflation, and it is our job to balance those risks.

Of course, these are not the only issues we are watching closely. My colleague, Deputy Governor Tim Lane, listed many of these in his progress report speech last week. The issues include heightened uncertainty about future US trade policies, changes in inflation dynamics, wage behaviour and the impact of interest rates on the economy, given high levels of household debt. In this situation, we will remain cautious in considering future policy adjustments and dependent on incoming data to guide our assessments.

The future of work

So far, I have been talking about the untapped potential in today’s economy. Let me now say a few words about the future of work, and what theory and history suggest may be in store.

We are at the start of what has been called the fourth industrial revolution. The integration of digital technologies in virtually every part of our lives is just getting started. Like all revolutions in human history, we can expect it to cause some significant dislocations. And like all economic progress since the beginning of time, it will involve creative destruction.

The first industrial revolution saw the introduction of the steam engine and led to the first factories and urbanization. This spawned the Luddite movement—textile workers who fought against the technology that threatened their livelihood.

In the second industrial revolution, electricity and the internal combustion engine changed the way goods could move around the globe. Countries began to specialize more, and international trade became key to connecting supply and demand.

In the third industrial revolution, advances in computing power and communications technology led to breakthroughs in the way information could be stored, processed and transmitted. The associated advances in global logistics enabled even greater specialization in production—the development of global supply chains—making the world even more dependent on trade to connect supply and demand.

Importantly, all of these revolutions caused hardship for people in industries that were disrupted. Yet, the enormous gains in productivity and the advances these new technologies spawned form the basis of our modern economy.

Whenever a groundbreaking technology arrives, a predictable pattern follows. The technology disrupts existing industries, leading to job losses. Governments can, and do, have in place safety-net policies to cushion the blow for people directly affected. And, as I mentioned before, new companies will exploit these technologies to create new types of jobs and entirely new industries. The hockey-stick growth and productivity gains help boost income, which flows throughout the entire economy. This in turn increases demand in every sector of the economy, creating new job opportunities and raising living standards.

Let me give an example from Canada’s history. At Confederation, 151 years ago, about half of working Canadians were employed in agriculture in one form or another. As new technologies disrupted farming, fewer people were needed on the farm, yet farm output continued to expand. The same technologies created new opportunities for those who moved to cities. By the 1920s, only one-third of Canadians were still involved in agriculture. By the 1950s, that figure was down to 15 per cent and, today, it is less than 2 per cent. And, yet, agricultural output has more than tripled over the past century.

Here at the start of the fourth industrial revolution, new applications are creating jobs that were unimaginable just a few years ago. When most of us were kids, we did not dream about what we would create with a 3-D printer, because 3-D printing had not been invented yet. Ten years ago, there were no smartphone app developers, or cloud computing engineers or social media managers.

It is human nature to focus on the negative. So, when we think about autonomous vehicles, for example, people tend to dwell on the jobs that will begin to disappear for truckers and taxi drivers. Clearly, governments need to support people who bear the brunt of technological change.

At the same time, we need to remember the positives—all the new jobs that will be created and the people who will be needed to build these vehicles, to write their software, to maintain the fleets once they are built, to redesign and construct roads, to coordinate traffic and so on. What is more, truly creative entrepreneurs will think about new ways to apply this technology, for example, to boost independence and productivity for many people living with disabilities.

Beyond this, we also need to remember the income-generating effect of these new jobs. The higher incomes that are generated create demand, not just in the new sectors but also for other goods and services throughout the economy, including such ordinary things as housing and home renovations. This income-generating effect is likely one factor behind Canada’s strong job growth last year in sectors such as manufacturing and construction—jobs where the required skills are not too far removed from those required in sectors of the economy that are being disrupted.

The bottom line is this: throughout history, technological advances have always led to rising productivity and living standards, and they have always created more jobs than they destroyed. This is not to understate the pain that disruption can cause for individuals—we owe it to them to work hard to create pathways forward, so all can participate in the evolving economy.

Conclusion

It is time for me to conclude.

The Bank of Canada has plenty of reasons to care about the state of the labour market. It has become a good deal healthier over the past year or so, but we still see some slack remaining. We expect to see increased investment—both in existing and brand new companies—as well as labour market churn create more supply through higher productivity and employment. However, these uncertain processes entail both upside and downside risks to inflation, and our monetary policy remains particularly data-dependent as we balance those risks.