CANADA ECONOMICS

WTO

The Globe and Mail. 11 Jan 2018. Canada to mount WTO challenge amid worries of U.S. NAFTA split. Government lists nearly 180 cases where it claims Washington flouted rules

STEVEN CHASE, OTTAWA

ADRIAN MORROW, WASHINGTON

GREG KEENAN, TORONTO

This sends a signal to the Trump administration that if NAFTA is going to end, and we are going to be treated no better than other countries in the world, then this is the kind of treatment you can expect to receive in return.

CHAD BOWN ECONOMIST AND TRADE EXPERT AT THE PETERSON INSTITUTE

The Canadian government is taking the United States to the world’s trade court in a wide-ranging complaint that accuses Washington of flouting the rules of global commerce.

This comes as expectations grow in Ottawa that President Donald Trump will soon announce the United States intends to pull out of the North American free-trade agreement.

Canadian government officials say they believe it’s increasingly possible Mr. Trump will start the process of withdrawing from NAFTA. Even if Mr. Trump triggers the withdrawal process, Canada will continue to take part in talks to overhaul the trade deal, sources with knowledge of the renegotiation said.

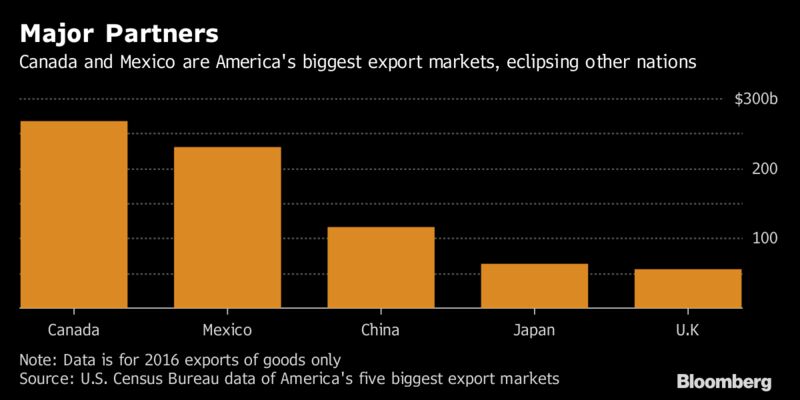

Ottawa does not want to be blamed for the collapse of the deal – or give Mr. Trump a pretext for pulling the plug – so it will show up to the table every day no matter how deadlocked the talks become, the sources said. The new complaint Canada has filed with the World Trade Organization is an unfriendly gesture between two countries that are each other’s biggest trading partner and it appears intent on making the case that the United States has diverged from the rules-based international order that has been built up over successive multilateral trade deals.

The Canadian government is accusing the United States of breaking WTO rules in the way it prosecutes foreign countries for allegedly dumping or subsidizing exports bound for the United States.

The complaint is substantial in magnitude. It lists nearly 180 cases stretching back 20 years and covering not just the U.S. treatment of Canadian companies, but also its handling of imports from dozens of countries ranging from China to South Africa to Argentina.

A spokesman for Foreign Affairs Minister Chrystia Freeland said this challenge is tied to Canada’s latest fight with the United States over softwood lumber. The U.S. government slapped punitive tariffs on Canadian exports to the United States, alleging the goods are subsidized and being dumped at low prices in the American market. The United States strongly criticized the Canadian action on Wednesday, warning it will end up backfiring against Canada because, were it to succeed, it could lead to a flood of imports from China into the United States that would displace other countries’ products.

Nearly half the cases the Trudeau government is championing in its WTO filing are instances in which the United States has penalized shipments from China that it considers subsidized or dumped at below-cost prices.

U.S. Trade Representative Robert Lighthizer called the move “an ill-advised attack” on the American system for monitoring foreign trade.

He pointed out that the vast majority of cases Canada is complaining about don’t even involve Canadian companies.

“For example, if the U.S. removed the orders listed in Canada’s complaint, the flood of imports from China and other countries would negatively impact billions of dollars in Canadian exports to the United States, including nearly $9-billion in exports of steel and aluminum products and more than $2.5-billion in exports of wood and paper products,” Mr. Lighthizer said.

The Canadian government feels this case could add weight to an existing complaint to the WTO over the duties Washington has levied on Canadian softwood.

It’s possible other countries may join this complaint as intervenors, making it a bigger and more embarrassing problem for the U.S. government.

Canada says the United States is breaking WTO rules in myriad ways, including by retroactively applying duties on foreign imports it deems to be subsidized or dumped, and using the lowest price it can find – rather than the average – when calculating alleged infractions.

Critics have accused the Trump administration of wanting to hobble the WTO. Mr. Trump has complained the organization, which came into being because of U.S. support, is biased against American interests.

“The WTO was set up for the benefit [of] everybody but us. … They have taken advantage of this country like you wouldn’t believe,” Mr. Trump told Fox News last year. “We lose the lawsuits, almost all of the lawsuits in the WTO.”

The Canadian move is “bold for sure and slightly risky,” said Christopher Sands, director of the Center for Canadian Studies at Johns Hopkins University in Baltimore. “It’s an escalation for sure,” said Prof. Sands, who said the move may have come because Canadian trade negotiators and politicians believe the strategy of playing nice with the Trump administration has not paid dividends.

He said it could be another step toward what he says is a nightmare scenario for the NAFTA talks, which is that the Americans call a halt to those negotiations and talk separately with Mexico in hopes of signing a bilateral deal before the Mexican elections later this year and U.S. midterm Congressional elections this fall.

Chad Bown, an economist and trade expert at the Peterson Institute in Washington, said Canada’s WTO move sends a stark message to Mr. Trump amid NAFTA talks: If you kill the deal, this is how Canada will fight you in trade disputes.

“This sends a signal to the Trump administration that if NAFTA is going to end, and we are going to be treated no better than other countries in the world, then this is the kind of treatment you can expect to receive in return,” said Mr. Bown, a former official in the Obama administration and at the World Bank.

Mr. Bown said aggressively taking on the United States at the WTO is also something of an insurance policy for Canada: If NAFTA is torn up, or if the revised deal guts its dispute-settlement mechanisms – which the United States has proposed – Ottawa will have to rely on the WTO to pursue Washington.

Mr. Trump has repeatedly threatened to pull out of NAFTA – or at least trigger the withdrawal process to increase pressure on Canada and Mexico.

Canada believes Mr. Trump’s threat is serious: One source said Ottawa was ready for the President to pull the plug last fall and was surprised when the United States instead extended the negotiations to March. Canada is bracing for the possibility Mr. Trump will trigger a withdrawal in the coming weeks.

If Mr. Trump triggers Article 2205, it will give Canada and Mexico six months notice of the United States’ intent to withdraw from NAFTA. Such notice would not automatically mean a withdrawal: It would only give the United States the option to pull out after the six-month period elapses.

NAFTA

The Globe and Mail. 11 Jan 2018. NAFTA uncertainty hits Canadian markets. Dollar: Some of Canada’s largest exporters fell the hardest

DAVID BERMAN

Dollar, government bond yields and blue-chip shares slide on report U.S. is preparing to pull out of trade deal, then make partial rebound after White House denial

The Canadian dollar, government bond yields and a number of bluechip stocks sank on Wednesday after reports that the United States is considering withdrawing from the North American free-trade agreement, raising questions about how Canadian exporters and the domestic economy will respond if the deal is terminated.

The loonie, which began the day comfortably above 80 cents against the U.S. dollar, fell as low as 79.5 cents shortly after noon, before regaining some lost ground. Mexico’s peso also fell sharply.

“Trade uncertainty was just kicked up a notch,” Priscilla Thiagamoorthy, economic analyst at BMO Nesbitt Burns Inc., said in a note.

She added: “Today’s large movements highlight the sensitivity of currencies to any trade news and we could see more wild swings as the spat continues.”

The reversal follows a report from Reuters that said unnamed Canadian government officials believe the United States could signal its intention to withdraw from the trade agreement.

The White House responded to the Reuters story on Wednesday, saying “there has been no change in the President's position on NAFTA.” However, Mr. Trump has repeatedly said he is willing to terminate the agreement if a new deal cannot be struck.

Trade representatives embark upon the sixth round of negotiations later this month in Montreal.

Financial players, including Bank of Montreal strategists and Royal Bank of Canada’s chief executive officer, have noted this week that NAFTA is looking increasingly fragile. However, Wednesday marked the first time that markets reflected the increasing possibility of a U.S. withdrawal from the trade deal.

Government bond yields, which had been rallying in anticipation of interest rate hikes by the Bank of Canada this year, promptly reversed course.

The yield on the the two-year Government of Canada bond fell to 1.74 per cent, down six basis points.

Stocks were also caught up in the shifting outlook.

The benchmark S&P/TSX composite index, which was higher in morning trading, ended the day down 71.29 points or 0.4 per cent, closing at 16,247.95.

Some of Canada’s largest exporters and companies key to the movement of Canadian exports to the United States fell the hardest.

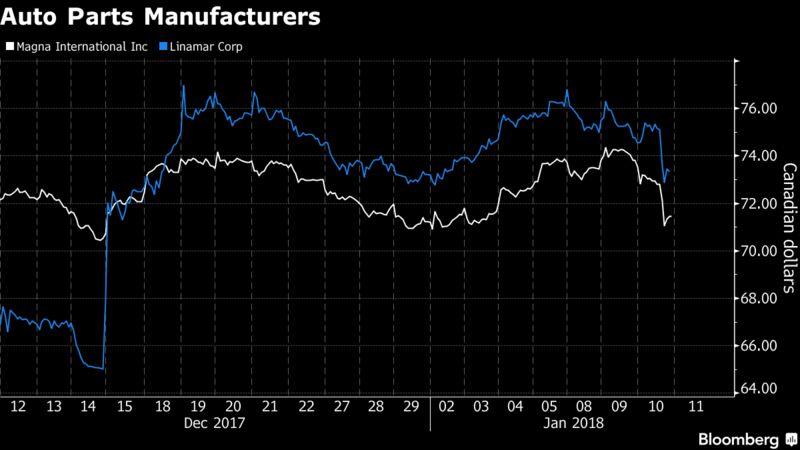

Auto-parts giant Magna International Inc., which analysts believe could be particularly vulnerable to changes in the trade agreement given that its parts are used by U.S. auto manufacturers, fell 3.2 per cent.

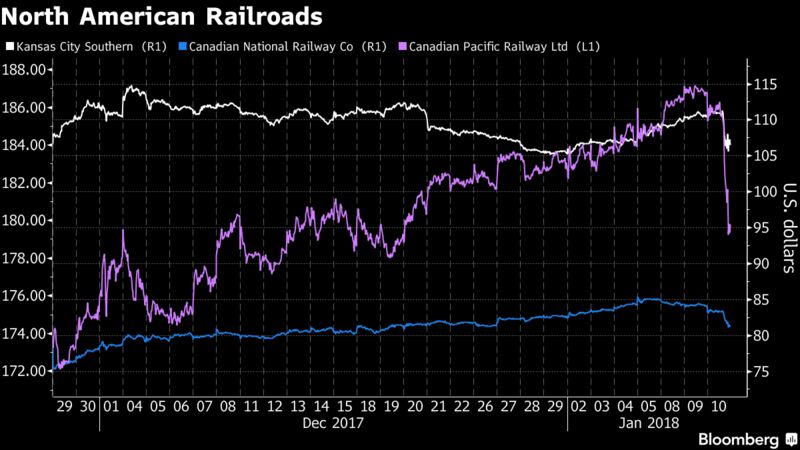

Canadian National Railway Co. fell 2.7 per cent and Canadian Pacific Railway Ltd. fell 3.1 per cent. According to estimates from BMO Nesbitt Burns, both railways derive about 30 per cent of their revenue from trade between the United States and Canada.

Financial markets also readjusted their outlook for Canadian interest rates.

Markets now see a 75-per-cent chance that the Bank of Canada will raise its key interest rate next week, down considerably since Wednesday morning when markets reflected an 88-per-cent chance of a rate hike next week.

“The existing Bank of Canada forecast had assumed no change in trade relationships, so this is a negative for their outlook,” Avery Shenfeld, chief economist at CIBC World Markets, said in a note.

While Mr. Shenfeld still expects the Bank of Canada to raise its key rate next week, he is sticking to his view that the central bank will then hold rates steady until the third quarter, amounting to just two quarter-point hikes this year.

THE GLOBE AND MAIL. JANUARY 11, 2018. On NAFTA, Canada hoping for best, preparing for worst, Freeland says

BILL CURRY, LONDON, ONT.

Foreign Affairs Minister Chrystia Freeland said Canada is hoping for the best but preparing for the worst ahead of the next round of negotiations to renew the North American free-trade agreement.

Speaking with reporters at a cabinet retreat in London, Ont., Ms. Freeland said progress has been made on several fronts and some chapters of the deal are nearly final. However, she noted the U.S. position includes some "extreme" demands that are unacceptable to Canada.

The minister's comments come a day after stock markets fell following reports that Canada is increasingly of the view that the United States will move to formally withdraw from NAFTA later this month when negotiators meet in Montreal.

Ms. Freeland said the Americans have always made it clear that one option would be for the U.S. to invoke article 2205 of NAFTA, which allows any of the three member countries to provide a six-month notice of withdrawal from the deal. Providing that formal notice does not oblige the country to actually withdraw from the deal and there is significant debate about whether U.S. President Donald Trump could pull the U.S. from the pact without support from Congress, where members are generally supportive of NAFTA.

"From the very beginning, the U.S. has been clear and very publicly clear about the possibility that the U.S. would invoke article 2205. That is no secret. That is something that has been very publicly known since even before the beginning of the talks," Ms. Freeland said. "Our approach from the start has been to hope for the best, but prepare for the worst. So Canada is prepared for every eventuality and that is a whole of government preparation."

The three countries are close to concluding chapters on "bread and butter" issues, the minister said, but disagreements remain over what the minister described as "unconventional" and "extreme" positions from the American side. The minister did not list those issues.

"We've been talking with Canadian stakeholders and we have some new ideas that we look forward to talking with our U.S. and Mexican counterparts about in Montreal. So I think if there's goodwill on all sides, we could have a great outcome in Montreal," she said.

The cabinet retreat comes as the Canadian government is launching a wide-ranging court challenge against the United States before the World Trade Organization.

While Ms. Freeland said that case is primary about the continuing cross-border dispute over softwood lumber, federal Trade Minister François-Philippe Champagne suggested Thursday that it was also about sending a broader message.

"We understand that this is our largest trading partner, but I think the American colleagues also understand when you stand strong in sending a message that says we will stand up for our forestry industry, we'll stand up for our aerospace industry, we'll stand up for Canadian workers, you get respect," he said. "When people see that you're firm, you get respect. And I think that the message that has been sent yesterday is one of firmness."

THE GLOBE AND MAIL. JANUARY 11, 2018. NAFTA woes to linger, threatening stocks and Canadian dollar

MICHAEL BABAD, Columnist

Developments like this encapsulate the headline risk that will linger through the next round of NAFTA negotiations

SUE TRINH, ROYAL BANK OF CANADA

The Canadian dollar is well shy of 80 cents (U.S.) today, laid low by the heightened trade uncertainty roiling currencies.

But observers don't think it's enough to sway the Bank of Canada from what they project will be a rate hike next week.

The loonie has traded as low as 79.4 cents (U.S.) and as high as 79.8 cents so far today, sitting now at about where it closed out Wednesday.

As The Globe and Mail's Steven Chase, Adrian Morrow and Greg Keenan report, the Canadian government thinks President Donald Trump may well move to kill the North American free-trade agreement, though Ottawa still plans to sit at the troubled increasingly troubled bargaining table.

At the same time, Canada has launched a far-reaching complaint against the U.S. at the World Trade Organization.

Wednesday's developments knocked several stocks and the loonie, which lost more than half a penny, as The Globe and Mail's David Berman writes.

"CAD and MXN languished at the bottom of the leaderboard, selling off 1 per cent on Reuters headlines indicating that Canada was increasingly convinced that President Trump would shortly announce that the U.S. is pulling out of NAFTA," said Sue Trinh, Royal Bank of Canada's head of Asia foreign exchange strategy in New York, referring to the loonie and peso by their symbols.

"Although a White House official later stated that there was no change in Trump's position on NAFTA, developments like this encapsulate the headline risk that will linger through the next round of NAFTA negotiations on Jan. 23-28 in Montreal."

As Ms. Trinh noted, this isn't going away, no matter what the White House says about the views of Mr. Trump, who says a fair deal or no deal.

"No change in Trump's position on NAFTA still means he's not a fan - and that's the risk investors should be mindful of when it comes to the loonie," said Bipan Rai, executive director of macro strategy at CIBC World Markets.

"There's been lots of complacency on NAFTA in regards to the way the loonie has been trading for several months, and we expected the associated premium to start rising into the next round of negotiations in Montreal."

By that, he meant the premium on the U.S. dollar versus the loonie.

The Canadian dollar has had an interesting ride over the past few days, shooting higher to almost 81 cents after a strong Statistics Canada jobs report Friday that ramped up speculation of a rate hike next week.

Many observers expect Bank of Canada governor Stephen Poloz, senior deputy Carolyn Wilkins and their colleagues to raise their benchmark overnight rate by one-quarter of a percentage point to 1.25 per cent on Wednesday.

Mr. Rai, Ms. Trinh and others don't think the latest news will change that, but the loonie could still suffer, nonetheless.

"The C$ market should (finally) start taking notice and cheapen once the bank meeting is out of the way," Mr. Rai said, adding that killing NAFTA wouldn't be bullish for the U.S. dollar against other currencies, for that matter.

"Our preferred method of expressing loonie weakness would be to buy the EUR and JPY against it," he said, referring to the euro and yen.

Take note of the fact, too, that the Canadian dollar is on the back foot despite the gain in oil prices, which have a traditional correlation. Of late, though, interest rate speculation has been the determining factor. Until Wednesday, of course, when trade uncertainty ramped up.

Trade angst is only one of the things that have rocked markets.

"Headlines related to China, NAFTA and global bond markets have whipsawed global currencies over the past two days. Some have been denied, most lack context and markets have started to settle down," said Mark McCormick, North American head of foreign exchange strategy at TD Securities.

THE GLOBE AND MAIL. REUTERS. JANUARY 11, 2018. Mexico will leave NAFTA talks if Trump triggers withdrawal process

DAVID ALIRE GARCIA, ADRIANA BARRERA AND ANTHONY ESPOSITO

MEXICO CITY - Mexico will leave the NAFTA negotiating table if U.S. President Donald Trump decides to trigger a 6-month process to withdraw from the trade pact, three Mexican sources with knowledge of the talks told Reuters on Wednesday.

Reuters reported earlier in the day that Canada was increasingly convinced that Trump would soon announce the United States intends to pull out of the North American Free Trade Agreement (NAFTA), sending the Canadian and Mexican currencies lower and hurting stocks across the continent.

"I think it's indisputable that if Trump announces a U.S. withdrawal from NAFTA, well at that moment the negotiations stop," said Raul Urteaga, head of international trade for Mexico's agriculture ministry.

The two other sources, who are involved in the trade talks and asked not to be named, said that Mexico remains firm on its position to get up and leave from the negotiating table if Trump goes through with the move.

While a NAFTA termination letter would start the six-month exit clock ticking, the United States would not be legally bound to quit NAFTA once it expires. Washington could use the move as the ultimate sleight of hand as it seeks to gain leverage over Canada and Mexico in talks to update the 24-year-old trade pact.

Trump has long called the 1994 treaty a bad deal that hurts American workers. His negotiating team has set proposals that have alarmed their Canadian and Mexican counterparts.

Among the most divisive are plans to establish rules of origin for NAFTA goods that would set minimum levels of U.S. content for autos, a sunset clause that would terminate the trade deal if it is not renegotiated every five years, and ending the so-called Chapter 19 dispute mechanism.

Though observers in Canada and Mexico have become increasingly gloomy about the upcoming Jan. 23-28 Montreal round in recent weeks, some took heart from a recent speech made by Trump to farmers this week in which he held back from provocative comments about the trade deal.

Urteaga, who was a member of Mexico's original NAFTA negotiating team in the 1990s, said that Trump's speech was an "interesting signal."

"No news, means good news sometimes."

REUTERS. JANUARY 11, 2018. Chances of U.S. leaving NAFTA must be taken seriously: Canada

LONDON, Ontario (Reuters) - The United States must be taken seriously when it says it might walk away from NAFTA, Canada’s foreign minister said on Thursday, a day after government sources said Ottawa was increasingly convinced U.S. President Donald Trump would pull the plug.

Chrystia Freeland also told reporters that Canada had come up with some creative ideas in a bid to solve the toughest challenges facing negotiators when they meet for the sixth and penultimate round of talks to modernize the North American Free Trade Agreement later this month.

Trump has repeatedly threatened to walk away from the 1994 pact between the United States, Canada and Mexico unless major changes are made.

“The United States has been very clear since before the talks started that ... (this) was a possibility and I think we need to take our neighbors at their word, take them seriously, and so Canada is prepared for every eventuality,” Freeland told reporters on her way to a two-day cabinet meeting.

Freeland also said it was “absolutely possible to have a positive outcome” at the Jan. 23-28 talks in Montreal if all three sides showed good will.

The Canadian and Mexican currencies, as well as stocks of firms that rely heavily on North America’s integrated economy, fell on Wednesday after government sources told Reuters they saw an increased likelihood of a U.S. withdrawal.

Reporting by David Ljunggren; Editing by Chizu Nomiyama and Andrea Ricci

REUTERS. JANUARY 10, 2018. Exclusive: Canada increasingly convinced Trump will pull out of NAFTA

David Ljunggren

LONDON, Ontario (Reuters) - Canada is increasingly convinced that President Donald Trump will soon announce the United States intends to pull out of NAFTA, two government sources said on Wednesday, sending the Canadian and Mexican currencies lower and hurting stocks.

The comments cast further doubt on prospects for talks to modernize the trilateral North American Free Trade Agreement (NAFTA), which Trump has repeatedly threatened to abandon unless major changes are made.

Officials are due to hold a sixth and penultimate round of negotiations in Montreal from Jan. 23-28 as time runs out to bridge major differences.

It is not certain the United States would quit NAFTA even if Trump gave the required six months’ notice, since he is not obliged to act once the deadline runs out. Notice of withdrawal could also raise opposition in Congress.

One of the Canadian government sources also said later it was not certain that Trump would move against the treaty and that Ottawa was prepared for many scenarios.

But even the prospect of potential damage to the three nations’ integrated economies sparked market concerns.

Wall Street’s major stock indexes ended lower on Wednesday, partly due to those worries. [.N]

The Canadian dollar weakened to its lowest this year against the greenback on Wednesday as the NAFTA concerns tempered bets that the Bank of Canada will raise interest rates next week.

Mike Archibald, associate portfolio manager at AGF Investments in Toronto, cited “a tremendous amount of uncertainty on the horizon”.

Canadian government bond prices rose across the yield curve and railway, pipeline and other trade-sensitive stocks weighed on the country’s main index.

Mexico’s currency also weakened and stocks extended losses. The S&P/BM IPC stock index fell about 1.8 percent.

“There’s been chatter in the market going into this week that it was coming up,” Quincy Krosby, chief market strategist at Prudential Financial in Newark, New Jersey.

Royal Bank of Canada’s Chief Executive Dave McKay said on Tuesday he believed there was now a greater chance that NAFTA could be scrapped.

“The government is increasingly sure about this ... it is now planning for Trump to announce a withdrawal,” one of the sources, who asked to remain anonymous because of the sensitivity of the situation, said.

Separately, a U.S. source close to the White House quoted Trump as saying “I want out” as the talks drag on with little sign of progress.

A White House spokesman said “there has been no change in the president’s position on NAFTA”.

ALARMED

Trump has long called the 1994 treaty a bad deal that hurts American workers. His negotiating team has set proposals that have alarmed their Canadian and Mexican counterparts.

Among the most divisive are plans to establish rules of origin for NAFTA goods that would set minimum levels of U.S. content for autos, a sunset clause that would terminate the trade deal if it is not renegotiated every five years, and ending the so-called Chapter 19 dispute mechanism.

The head of the U.S. Chamber of Commerce said that economic gains made through tax cuts and the lifting of business regulations would be undone if the U.S. canceled trade deals, including NAFTA.

General Motors Co shares fell 2.4 percent. The Detroit automaker has 14 manufacturing facilities in Mexico, including one that builds large pickup trucks, among the automaker’s most profitable vehicles. Trucks built there could be subject to a 25 percent tariff if the U.S. exits NAFTA.

”We have always said that this is a possibility,” a Mexican government source with knowledge of the talks told Reuters, referring to the prospect of a U.S. withdrawal.

Mexico’s Economy Ministry declined to comment on the report, a ministry spokesman said.

Scott Minerd, Global Chief Investment Officer at Guggenheim Partners, said “if Trump were to announce a NAFTA exit, the stock market would probably pull back by 5 percent or so before advancing to new highs. Most likely the Canadians are reacting to the President’s negotiating posture.”

The Canadian sources said that if Trump did announce the United States was pulling out, Canada would stay at the table, since the talks would continue at a lower level. Mexico has previously said it would walk away if Trump formally announced Washington intended to quit.

Canadian officials say if Trump does announce a U.S. withdrawal, it could be a negotiating tactic designed to win concessions. The talks are scheduled to wrap up by the end of March.

The news broke as the cabinet of Prime Minister Justin Trudeau began gathering in the southwestern Ontario town of London ahead of a scheduled two-day meeting where NAFTA is one of the items on the agenda.

A spokesman for Canadian Foreign Minister Chrystia Freeland - in overall charge of U.S.-Canada relations and the NAFTA file - was not immediately available for comment.

Separately, Canada launched a wide-ranging trade complaint against the United States, the World Trade Organization said on Wednesday, in a dispute that Washington said would damage Canada’s own interests and play into China’s hands.

Additional reporting by Steve Holland in Washington, Joe White in Detroit, Caroline Valetkevitch and Jennifer Ablan in New York, Fergal Smith and Alastair Sharp in Toronto and Ana Isabel Martinez and Dave Graham in Mexico City; Editing by Susan Thomas

NAFTA. MÉXICO. 11 DE JANEIRO DE 2018. México deixará conversas do Nafta caso Trump inicie processo de saída

Por David Alire Garcia e Adriana Barrera e Anthony Esposito

CIDADE DO MÉXICO (Reuters) - O México irá deixar as negociações do Nafta caso o presidente dos Estados Unidos, Donald Trump, decidir ativar um processo de seis meses para se retirar do acordo comercial, disseram à Reuters na quarta-feira três fontes mexicanas com conhecimento das conversas.

A Reuters relatou mais cedo que o Canadá está cada vez mais convencido de que Trump irá anunciar em breve a intenção dos EUA de deixar o Tratado Norte-Americano de Livre Comércio (Nafta), provocando uma queda das moedas do Canadá e México e afetando as ações no continente.

“Eu acho que é indiscutível que se Trump anunciar a retirada dos EUA do Nafta, bem neste momento as negociações param”, disse Raul Urteaga, chefe de comércio internacional do Ministério da Agricultura do México.

As duas outras fontes, que estão envolvidas em conversas comerciais e pediram para não serem nomeadas, disseram que o México continua firme em sua posição de levantar e deixar a mesa de negociações caso Trump siga com a ação.

Embora a carta de saída do Nafta inicie o processo de seis meses para saída, os Estados Unidos não estarão legalmente obrigados a deixar o Nafta assim que o processo terminar. Washington pode usar a ação como uma manipulação conforme busca ganhar vantagem sobre Canadá e México em conversas para atualizar o acordo comercial de 24 anos.

Trump há tempos chama o acordo de 1994 de um acordo ruim que prejudica trabalhadores norte-americanos. Sua equipe de negociações estabeleceu propostas que alarmaram contrapartes canadenses e mexicanas.

Tradução Redação São Paulo, 55 11 5644 7729 REUTERS CMO

NAFTA. CHINA. REUTERS. 10 DE JANEIRO DE 2018. Índices caem em Wall St. por preocupações com China e Nafta

Por Sinead Carew

(Reuters) - Os três principais índices acionários dos Estados Unidos fecharam em queda nesta quarta-feira depois de uma disputa agitada, enquanto os investidores se preocupavam que a China interrompesse as compras de títulos do governo norte-americano e que o presidente dos EUA, Donald Trump, encerrasse um acordo-chave de comércio exterior.

O S&P e o Nasdaq encerraram uma sequência de altas de seis dias depois que a Bloomberg noticiou que a China, maior detentora de títulos do Tesouro dos EUA, poderia reduzir ou parar de comprar os títulos do governo. A notícia enviou rendimentos do Tesouro para uma alta de 10 meses.

O S&P 500 reduziu algumas perdas à medida que os rendimentos se afastavam de seus picos intradiários e os investidores digeriram a notícia da China. Mas o índice perdeu terreno novamente no meio de tarde depois que a Reuters informou que o Canadá está cada vez mais convencido de que Trump logo anunciará a saída dos EUA do Acordo de Livre Comércio da América do Norte (Nafta, na sigla em inglês), citando duas fontes governamentais.

“É uma semana bastante leve para dados econômicos e financeiros. Em uma semana como essa, as manchetes políticas podem ter um impacto maior do que normalmente”, disse Jon Mackay, estrategista de investimento do Schroders Investment Management.

O índice Dow Jones caiu 0,07 por cento, a 25.369 pontos, enquanto o S&P 500 perdeu 0,11 por cento, a 2.748 pontos e o índice de tecnologia Nasdaq recuou 0,14 por cento, a 7.154 pontos.

Os investidores começaram 2018 com grandes esperanças de crescimento forte nos lucros dos EUA. Os bancos iniciarão a temporada de resultados na sexta-feira.

Os ganhos para as empresas do S&P 500 deverão aumentar em 11,8 por cento, com a maior contribuição do setor de energia, de acordo com a Thomson Reuters I/B/E/S.

THE GLOBE AND MAIL. BLOOMBERG. JANUARY 11, 2018. Caisse's Sabia and Brookfield's Flatt shrug off Trump’s NAFTA threat

SCOTT DEVEAU, GREG QUINN AND JOSH WINGROVE

Canada's economy isn't at major risk even if Donald Trump follows through on threats to withdraw from NAFTA, said the heads of two of the country's largest asset managers.

Michael Sabia of Caisse de Depot et Placement du Quebec and Bruce Flatt of Brookfield Asset Management Inc. speaking Wednesday in a panel discussion in Toronto, responded to news that Canadian government officials see an increasing chance the U.S. president will give six months notice to withdraw.

The U.S. pulling out would be "just the prelude to another negotiation," said Sabia, the Caisse chief executive officer who before that was also a senior Canadian government official. Sabia's Montreal-based pension fund has more than $286 billion worth of assets under management, including a substantial portfolio in the U.S.

"We need to think about that in the context of making sure that we handle things in a way that we're well positioned for the subsequent negotiation," he said, adding that the two economies are too intertwined to not require further trade talks. He also noted the U.S. business community is largely opposed to the Trump administration's stance on NAFTA.

Canadian officials who spoke on condition they not be identified declined to say if the chances of Trump saying he will quit the pact are greater than 50 percent. A White House official, speaking on background, said there hasn't been any change in the president's position on the NAFTA.

Round seven

People familiar with the negotiations also said late Wednesday that the U.S., Canada and Mexico are planning a seventh round of negotiations for February in Mexico City even as they focus on preparations for talks in Montreal in two weeks. The talks began in Washington in August and have rotated between the three nations every few weeks since.

Flatt of Brookfield, Canada's biggest alternative asset manager, said any pain from NAFTA tensions would be short-lived, adding there will probably be a new deal in the end. "For some businesses, yes, it's going to suck for a while. It will pass," Flatt said.

Tensions with Canada have spread beyond industries covered by Nafta this year, with the U.S. looking into allegations of unfair subsidies on dairy products and aircraft. The tensions worsened this week when it was revealed Canada had launched a World Trade Organization complaint over American duties. U.S. Trade Representative Robert Lighthizer called that a "broad and ill-advised attack."

Sabia said Canada's economy has options. "The future sources of jobs and growth in the Canadian economy are going to come elsewhere," he said. "It's not as though Canada is some baby seal waiting to be slaughtered. We're not."

BLOOMBERG. 11 January 2018. These Assets Would Be Hit Hardest By the End of Nafta

By Luke Kawa

Investors were put on notice once again Wednesday: U.S. President Donald Trump’s campaign claim that he would exit the North American Free Trade Agreement might not be an empty threat.

Canadian government officials said they see rising odds that the U.S. will seek to rip up the trade deal, a revelation that spurred moves across a swath of stocks, bonds, and currencies. The White House later said its policy hasn’t changed.

The news served as an opportunity for analysts to re-evaluate which companies stand to be hit the hardest should the trade pact be ripped up. Here are the assets to keep an eye on as investors seek to price in a rupture to the preferential trade relationship between the U.S., Canada and Mexico.

The iShares MSCI Canada exchange-traded fund, ticker EWC, dropped 1 percent on Wednesday. The iShares MSCI Mexico ETF, ticker EWW, suffered a decline of 2.2 percent.

Canadian auto-parts makers Magna International Inc. and Linamar Corp. slid 3.2 percent and 1.9 percent, respectively, in reaction to the headlines.

The same goes for U.S. parts maker Lear Corp., which plunged by the most in more than six months.

A breakdown in the trade arrangement between Canada, the U.S., and Mexico could also send these stocks off the rails, given the volume of cross-border traffic.

Analysts at Cowen judged autos and freight carriers to be two of the sectors most at risk as Nafta renegotiation talks dragged on.

Concern about the end of Nafta is also changing the calculus for the Jan. 17 Bank of Canada interest rate decision, with the nation’s two-year yield dropping by the most in 18 months on Wednesday. Dig deeper into derivatives, however, and there are still indications that traders don’t see this overhang serving as a major drag on the loonie relative to the greenback over the next week.

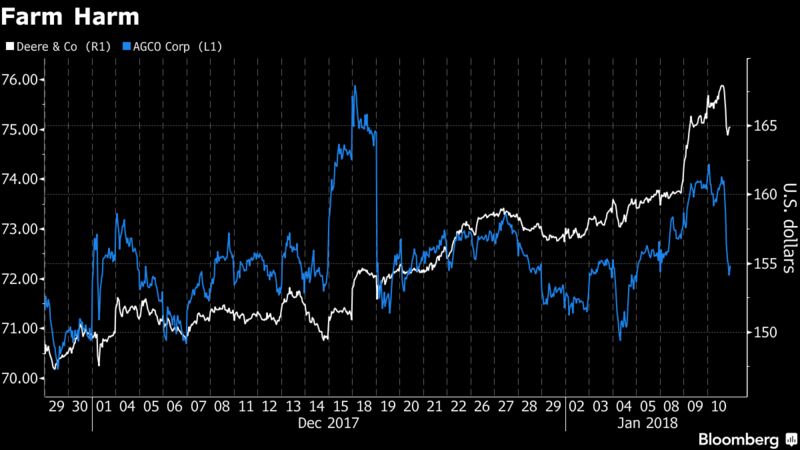

Meanwhile, Trump-loving farmers weren’t shy about showing the president their support for the free-trade deal with Mexico and the U.S. during a recent rally. The end of the pact could pose downside risk to agricultural-equipment makers AGCO Corp. as well as Deere & Co.

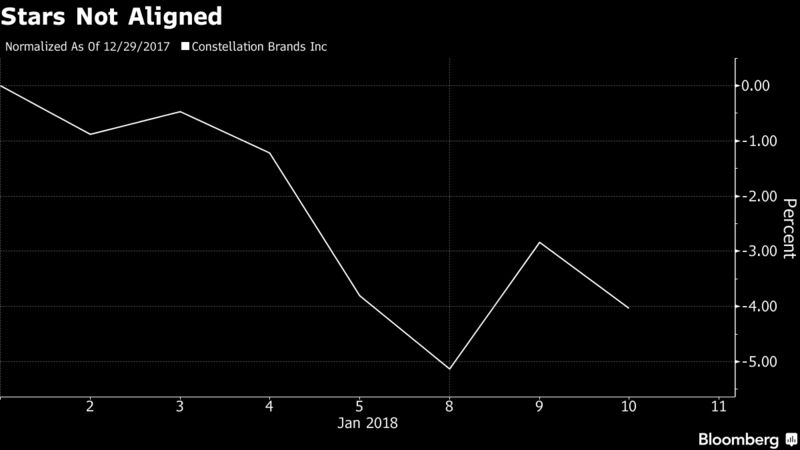

Shares of alcoholic-beverage maker and marketer Constellation Brands Inc. have stumbled out of the gate in 2018, with Wednesday’s flurry of headlines adding to the pain. The company is the owner and U.S. distributor for Mexican beer behemoth Grupo Modelo -- which brews the Negra and Especial brands as well as Corona.

Morgan Stanley, however, thinks the market got this story all wrong.

"Our base case is that a withdrawal from Nafta would actually be a positive for STZ, as it would likely experience an indirect benefit from a potential weakening of the Mexican peso versus the U.S. dollar (given STZ’s beer cost structure is weighted towards the Mexican peso)," writes analyst Dara Mohsenian, reiterating a previous call from October. "The potential negative impact from higher beer taxes is unlikely to play out in our minds, as we believe the administration and Republicans are unlikely to support placing an unpopular regressive tax of consumers in place on beer."

BLOOMBERG. 11 January 2018. Nafta's Dead. Long Live Nafta. A Look at Most Likely Outcomes

By Andrew Mayeda

- Pro-trade lawmakers in Congress could try to block withdrawal

- Negotiations could continue even after Trump gives notice

Markets shuddered on signs the U.S. may be preparing to withdraw from Nafta. But even if President Donald Trump serves notice of a pullout, the trade deal could survive.

Under the accord, the U.S., Canada or Mexico can withdraw after giving six-months’ notice. Scant progress has been made on the thorniest issues ahead of the sixth round this month in Montreal, fueling speculation Trump will follow through on his threat to walk away.

Investors are looking to any clues. Canada’s dollar and Mexico’s peso dropped and Mexican stocks retreated following reports on Wednesday that Canada sees an increasing chance the U.S. will exit Nafta. The White House later said its policy hasn’t changed.

What would happen next has become a topic of debate among trade lawyers in Washington. Here are three possible scenarios, each with its own implications for markets and the North American economy:

Zombie Deal

Just because the president issues a withdrawal notice doesn’t mean the U.S. will formally pull out after six months. Since announcing the U.S. will leave the Paris climate-change agreement, for example, the U.S. has sent signals that it may stay in the accord under certain conditions.

There’s also speculation Congress could prevent the White House from dismantling Nafta. Under the Constitution, Congress has the power to “regulate commerce with foreign nations.” Pro-Nafta groups could challenge Trump’s decision in court, arguing he doesn’t have the authority to withdraw.

Republican lawmakers who support Nafta could also team up with trade-supportive Democrats to block the repeal of the law that formally implements the trade pact. The key issue will be whether the U.S. raises tariffs on Mexican and Canadian goods, many of which cross the border duty-free under Nafta. The president has broad authority over tariffs, but some experts believe Congress could throw up roadblocks.

In other words, Nafta could stagger on well after Trump signals a pullout. Goldman Sachs places higher odds on a withdrawal notice than it does on the U.S. actually raising tariffs.

The End

Or, Nafta really could be toast. In this scenario, Congress doesn’t stand in the way of Trump pulling out of the deal. Tariffs would rise on goods traded in the region, probably causing prices to increase and cutting into company profits.

An increase in duties would potentially hurt growth, cost jobs and spur inflation for all three nations, with Bloomberg Intelligence and Moody’s Analytics predicting Mexico would be the hardest hit.

But none of the countries would be tipped into recession, according to Moody’s, which forecasts most of the pain would come in the first two years after the collapse of the deal, assuming the U.S. and Canada would retain the bilateral agreement that preceded Nafta.

“It’s a big agreement and we would all lose, all three of us would lose if we were to pull out,” former U.S. Trade Representative Carla Hills told Bloomberg TV on Wednesday.

The Start

On the other hand, Trump’s notice could just be the start of the next phase of negotiations.

A withdrawal announcement would surely inflame tensions among the three countries. But after tempers cool, it’s not inconceivable they could return to the table. If Trump gives notice this month, the six months would expire before congressional midterm elections in November. But the U.S. could still work out a new deal once the campaign is over, as long as Trump gets an extension of his fast-track negotiating authority from Congress.

After all, trade agreements typically take years to negotiate. The original Nafta entered into force in 1994, nearly three years after negotiations started.

“He wants to at least throw this into doubt and show toughness before the midterm elections,” said CIBC Chief Economist Avery Shenfeld. “What isn’t clear is whether six months down the road this means the end of Nafta.”

— With assistance by Josh Wingrove

BLOOMBERG. 11 January 2018. Canada Prepares Nafta Autos Discussion With ‘New Ideas’

By Josh Wingrove

- Freeland says Canada to discuss unconventional U.S. proposals

- Country is ‘prepared for every eventuality’ on Nafta, she says

There are signals of a possible breakthrough in one of the biggest sticking points in Nafta discussions after Canada joined Mexico in indicating room for negotiation in the auto sector.

The development comes one day after markets dipped on Canadian fears odds are rising U.S. President Donald Trump will walk away, and suggests officials are looking for progress in upcoming talks in Montreal as a way to keep negotiations moving.

Canada is preparing new talks related to autos at the Montreal negotiations, two government officials said, speaking on condition they not be identified. Mexico has also signaled there’s room for a breakthrough on autos, after the U.S. unveiled contentious proposals in previous discussions. Shares of auto parts makers Magna International Inc. and Linamar Corp. traded higher Thursday after Bloomberg initially reported the news.

Canadian Foreign Minister Chrystia Freeland, speaking to reporters Thursday, said the country would bring “new ideas” for “unconventional” U.S. proposals, though she didn’t say which. One of the Canadian officials said Freeland was referring to the auto sector. Both officials said Canada wouldn’t give a full autos counter-proposal.

The three countries are also “close” to reaching agreements on some individual subjects, known as chapters, of the North American Free Trade Agreement, Freeland said, describing them as “bread and butter” issues. The most contentious U.S. demands are on dairy, automotive content, dispute panels, government procurement and a sunset clause.

“When it comes to the more unconventional U.S. proposals, we have been doing some creative thinking, we have been talking with Canadian stakeholders, and we have some new ideas that we look forward to talking with our U.S. and Mexican counterparts about in Montreal,” Freeland said in London, Ontario in comments aired by the Canadian Broadcasting Corp. “I think if there’s goodwill on all sides, we could have a great outcome in Montreal.”

Officials are jockeying for position ahead of the sixth round of talks which begin Jan. 23 in Montreal. The Canadian dollar, the Mexican peso and the stocks some auto maker and parts makers that rely on Nafta slumped Wednesday after Canadian officials said they think the chances are rising that Trump will give notice of withdrawal from the pact. A White House official later said the president’s position on Nafta hadn’t changed.

The chief executive of the region’s biggest parts supplier, Magna, warned earlier this week that overly complex Nafta changes could leave U.S., Mexican and Canadian manufacturers vulnerable. Magna’s shares rose 0.4 percent as of 11:32 a.m. in New York after the news of Canada’s involvement. Linamar reversed declines, trading up 1 percent.

“If it becomes too complicated, too bureaucratic, too costly that you can’t get low-cost, high-labor products into this region -- then all of a sudden we have damaged the whole Nafta region,” Chief Executive Officer Don Walker said. “It’s going to be a lose-lose-lose.”

Flavio Volpe, president of the Toronto-based Automotive Parts Manufacturers Association, said progress was made on autos during a mini-round of talks last month in Washington. “All sides understand each other’s core imperatives much better now,” he said Thursday in an email. “The tone is respectful and everyone appears to actually want a solution that the others will be able to sign off on.”

Very Clear

The U.S. is proposing to raise the minimum content requirement, for a vehicle or auto part to be traded under Nafta, to 85 percent from the current 62.5 percent, while also requiring that a full 50 percent of content comes from the U.S. The proposals were flatly dismissed by Canada and Mexico. The U.S. also wants to substantially expand the so-called tracing list, which means more products and parts would need their origins tracked and documented.

Freeland didn’t say whether she believes the chances of a U.S. withdrawal notice are rising. Such a notice, which would be given under Article 2205, isn’t binding, meaning it could still be issued and Nafta still survive.

“The U.S. has been very clear since before the talks started that invoking Article 2205 was a possibility, and I think we need to take our neighbors at their word, take them seriously,” Freeland said. “So Canada is prepared for every eventuality.”

Finance Minister Bill Morneau, speaking at the same event, said Canada has “made preparations and considered every scenario” when it comes to Nafta. “What we are trying to achieve is an improvement in Nafta. We know that’s better for Canada and we will continue down that path.”

— With assistance by Greg Quinn

INTERNATIONAL TRADE

EDC. JANUARY 11, 2018. WEEKLY COMMENTARY. Capitalism: Make It or Break It Moment

By Peter G Hall, Vice President and Chief Economist

From ancient traders to the modern day, capitalism is the most enduring and pre-eminent economic system in history. Famously illustrated in Adam Smith’s Wealth of Nations in 1776 as the ‘invisible hand’ guiding self-interested individuals to a common good, capitalism has outlasted other systems, and remains a dominant force today.

Those who have periodically celebrated its victory over other systems – usually command economies of various type – in those pinnacle moments have temporarily forgotten that capitalism has its flaws. Sometimes, rather large flaws. The cure for this amnesia is the periodic recessions we encounter, especially the deeper ones. In the grim aftermath of the Great Depression, John Maynard Keynes struggled with capitalism’s inevitable fluctuations, and proposed an elaborate mechanism for smoothing them out.

Despite the appeal of his elegant, government-led process for offsetting the economy’s wild swings, and the manifold attempts at implementation, Keynes’ proposal has failed to achieve its chief aim. We still experience economic fluctuations with an annoying regularity, and 2008-09 proved that we can still face them on a massive scale. In fact, if anything, globalization as we know it has increased the potential for a rapid cascade of an economic downturn to all parts of the planet. The Great Recession was, in reality, a near-death experience for capitalism as we know it.

Sadly, capitalism is still at risk. The seven years that followed the most recent, and easily the most dramatic, application of Keynes’ formula have tested the general public’s faith in the post-modern version of laissez-faire economics. Millions have been cast out, or never even invited in, to the economic mainstream. Growth has been insufficient to re-absorb workers displaced by the economic crash and its wobbly aftermath, and to absorb millions of potential new yet inexperienced workers. As their numbers have grown, their voices have been heard in the multiple large-scale uprisings that have been all too frequent in the post-2010 period. Their voices were heard in the 2016 US election and the Brexit referendum. Although shy of forming a majority, their ranks registered alarming gains in the stream of European elections sprinkled throughout 2017. If something doesn’t change, those voices could eventually prevail.

Is 2018 the year? An early indication may come in President Trump’s first State of the Union speech on January 30. NAFTA hangs in the balance, and the Administration’s frequent pot-shots at globalization could turn into something more tangible. Through the year, there is a series of key elections that may also bring change: among the large emerging economies, Russia, Brazil and Mexico all go to the polls this year. Cuba faces regime change as the economy slides, and Venezuela will decide its political future. Among developed economies, Italy faces a significant election, and of course, there are the US midterm elections this fall. Some of these may not generate outcomes that favour the current economic structure. But there is hope in key multilateral meetings: the June G7 summit in La Malbaie, Quebec, and the G20 summit in December.

Behind all this buzz is an economy that’s reviving. Naysayers notwithstanding, the US economy has been gaining strength for some time, and Europe is revving up impressively. Growth hasn’t silenced the cynics, though – many feel that this is a last-gasp, an unsustainable puff of optimism that has little staying power. Strong evidence of pent-up demand in both the US and Europe suggests they are very wrong. Capitalism is under repair.

Why are we wrangling, after centuries of experience with capitalism? Well, it’s sort of like a two-wheeled bicycle. It takes faith to believe that a rider can keep it upright in the first place. Get the hang of it, and it’s a smooth and fast way to get places. But all it takes is one nasty crash, and it’s easy to lose all of that confidence. It may take years to regain it. But once it’s back, the time-tested physics kick in again, and off we go.

The bottom line? Is capitalism a perfect system? Far from it. To parody Churchill, it’s the worst form of economic system invented by man – except for all the other ones we try from time to time. It seems that in 2018, we are about to prove that all over again.

CIB

The Globe and Mail. 11 Jan 2018. Canada Infrastructure Bank aims to start approving projects by end of year

BILL CURRY

We don’t know the cadence and the timing until we build our capabilities, so that’s really what we’re focused on.

JANICE FUKAKUSA CHAIR AND ACTING CEO OF THE CANADA INFRASTRUCTURE BANK

The Canada Infrastructure Bank is heading into its first full year of operation without a permanent CEO, but the bank’s chair is hoping the $35-billion entity will be in a position to start approving projects by the end of 2018.

The federal government recently announced that the bank is officially up and running, but there is still much to be done in terms of hiring and setting up the Toronto headquarters.

“We are a startup,” the bank’s chair and acting chief executive Janice Fukakusa said in an interview with The Globe and Mail.

The immediate focus is on practical matters such as establishing a payroll system, hiring expert analysts and approving a permanent CEO.

“We’re hopeful that by the end of 2018, we’ll have looked at some projects. Infrastructure projects are very long term. And it takes quite a long time to look at them, so we are hoping that we will have gotten some to the stage where we are going to be making decisions around investing,” she said, noting that it is difficult to set firm timelines until the CEO and other senior positions are filled. “We don’t know the cadence and the timing until we build our capabilities, so that’s really what we’re focused on.”

The federal Liberals first promised to create a national infrastructure bank during the 2015 election. Finance Minister Bill Morneau ran into controversy throughout the first half of 2017 by including the Canada Infrastructure Bank Act as part of a large budget bill, which critics said limited the potential for debate on a major new initiative. The Senate banking committee opted to hold several days of special hearings on the topic and some senators pushed to have the bank provisions removed from the budget bill. That effort failed by a single vote in June.

The goal of the bank is to provide minority funding or loans to large revenue-generating projects led by the private sector that might not otherwise go ahead. The government has said that $15-billion of the bank’s funds will be divided evenly between public transit, trade and transportation corridors and green infrastructure projects, such as safe water systems and renewable-power generation.

“It’s about leveraging the infrastructure bank investment to attract more capital,” Ms. Fukakusa said. The challenge for the bank is to convince large institutional investors – such as pension funds – that are already investing billions around the world in infrastructure to divert more of that capital to Canadian projects.

The government announced 10 board members on Nov. 16. A month later, the government announced that one of those board members, Bruno Guilmette, would be taking a short-term leave from the board in order to act as interim chief investment officer. Mr. Guilmette is a former senior vice-president of infrastructure at PSP Investments, a $139-billion fund that manages federal government pension plans. He has also managed infrastructure investments for Quebec’s government pension fund.

“Part of what Bruno is going to be doing is looking at staffing … and getting analytical individuals who can support the investors and investor decisions,” Ms. Fukakusa said. Mr. Guilmette has agreed to the interim CIO position until May, at which point it is expected that a CEO will have been selected. The new board members are scheduled to meet in early January to discuss the CEO position.

The fact the bank may not be in a position to approve projects until late 2018 at the earliest is a concern to one advocate for the bank. Independent Senator Doug Black, who now chairs the Senate banking committee, supports the bank and argued against his fellow senators who were pushing for more study and delay.

“I get process. I’m a lawyer, but at some point in time, rubber needs to hit the road,” he said. “It’s time to start reviewing projects. I get that there’s not a CEO there, but they can hire consultants. They have a very skillful board. They can set up an investment committee. Work should be starting.”

Matti Siemiatycki, an associate professor of geography and planning at the University of Toronto and Canada research chair in infrastructure and finance, said it is important that the bank establishes itself as a centre of expertise.

Dr. Siemiatycki said he hopes the bank will ensure that major decisions are based on sound research, rather than political considerations.

“We need to move quickly, but also diligently and make sure we’re really doing the evidence-based assessments to make sure we’re picking the right projects,” he said. “I think 2018 is going to be an important year for this institution to really see how it finds its feet and where it sits in the constellation of a whole host of ministries, agencies, organizations, different levels of government who are all investing heavily in infrastructure.”

ENERGY

THE GLOBE AND MAIL. REUTERS. JANUARY 11, 2018. Oil prices surge to highest since 2014 as global stocks tighten

LIBBY GEORGE, LONDON

Oil prices surged to their highest since 2014 on Thursday on tightening global crude stocks and after OPEC members said they would stick with output cuts for now despite gains in Brent to nearly $70 per barrel.

Brent crude futures hit $69.88, their highest since December 2014. By 1531 GMT, the contract was trading at $69.70, 50 cents above the last close.

U.S. West Texas Intermediate (WTI) crude futures surged to $64.77, also the highest since December 2014, before edging back to $64.42, 85 cents above the last close.

Sentiment received a boost from a surprise drop in U.S. production and lower U.S. crude inventories.

"The steady, if not rapid, decline in U.S. crude oil inventories from persistently high refinery demand and elevated exports has firmly registered with the market," said John Kilduff, partner at Again Capital LLC in New York.

Data from the U.S. Energy Information Administration showed that crude inventories fell by almost 5 million barrels to 419.5 million barrels in the week to Jan. 5.

U.S. production declined by 290,000 barrels per day (bpd) to 9.5 million bpd, the EIA said, despite expectations of output breaking through 10 million bpd.

The drop in production, likely to be because of extremely cold weather that halted some onshore output in North America, was expected to be shortlived.

Analysts said U.S. stock draws were driving the market.

"(U.S.) crude oil inventories are at their lowest level since August 2015," said PVM Oil Associates analyst Tamas Varga. "OPEC is edging ever closer to its desired target of reducing OECD industrial stocks to the five-year average."

On Thursday, UAE oil minister and current OPEC president Suhail al-Mazrouei said he expects the market to balance in 2018 and that the producer group is committed to its supply-reduction pact until the end of this year.

Production cuts led by the Organization of the Petroleum Exporting Countries and Russia, which are set to continue throughout 2018, have underpinned prices.

AMPLE FUEL

Still, downward pressure emerged in the physical market, where Iran and Iraq this week cut prices to remain competitive.

Fuel inventories in Asia and the United States remain ample.

In Asia's Singapore oil trading hub, average refinery profit margins have fallen below $6 a barrel, their lowest seasonal level in five years.

"Markets are getting a bit fatigued and a healthy correction could be on the cards," said Stephen Innes, head of trading for Asia/Pacific at futures brokerage Oanda in Singapore.

BLOOMBERG. 11 January 2018. Oil Reaches $70 a Barrel for First Time in Three Years

By Grant Smith and Ben Sharples

- U.S. crude stockpiles fall for an eighth week, EIA data show

- Brent rises 1.2% to $70.05 a barrel, highest since Dec. 2014

Oil topped $70 a barrel in London for the first time in three years as production cuts by OPEC and rising demand whittle away a global surplus.

Brent crude futures, used in the pricing of more than half the world’s oil, rose as much as 1.2 percent to the highest since Dec. 4, 2014. Prices rallied after the longest stretch of declines in U.S. inventories during winter in a decade.

Oil’s rally shows that the Organization of Petroleum Exporting Countries and its allies are succeeding in clearing the glut triggered by the growth of U.S. shale oil. Prices have also been supported by concerns that supply disruptions could stem from rising political tensions in OPEC members Iran and Venezuela.

“Pretty much all of the fundamental boxes are supportive of the current rally and a bit more,” said Paul Horsnell, head of commodities research at Standard Chartered Plc in London.

Brent for March settlement advanced to $69.90 a barrel on the London-based ICE Futures Europe exchange at 11:28 Eastern time.

With the climb in crude, there are growing signs that OPEC could be falling into a trap it had sought to avoid. Rising prices are putting U.S. production on track to rival both Saudi Arabia and Russia, with output likely to exceed 10 million barrels a day as soon as next month and top 11 million before the end of 2019, according to Energy Information Administration forecasts.

“Seventy dollars is too much,” said Eugen Weinberg, head of commodities research at Commerzbank AG in Frankfurt. “It’s not completely unexpected, given the price momentum. But there will be a reaction in U.S. shale, and OPEC’s strategy will backfire massively.”

Iran has warned that the group risks overheating the market with oil at current levels. OPEC’s members aren’t keen on Brent prices above $60 a barrel because of the potential for more shale output, Iran’s Oil Minister Bijan Namdar Zanganeh said, according to the ministry’s news service Shana.

Oil-market news:

- U.S. crude inventories fell by 4.95 million barrels last week, the eighth consecutive drop, EIA data show.

- OPEC will stick with production cuts for the rest of the year as the group makes headway toward its goal of clearing an oversupply, U.A.E. Energy Minister Suhail Al Mazrouei said Thursday.

— With assistance by Jessica Summers

EMPLOYMENT

StatCan. 2018-01-11. Job vacancies, third quarter 2017

Canadian businesses reported 468,000 job vacancies in the third quarter, up 62,000 (+15.1%) from the third quarter of 2016. The overall job vacancy rate increased 0.3 percentage points to 2.9% in the quarter.

The job vacancy rate represents the number of job vacancies expressed as a percentage of labour demand; that is, the sum of all occupied and vacant jobs.

Vacancies for permanent positions accounted for 80.2% of all job vacancies in the third quarter, up from 78.5% the same quarter a year earlier.

This was the fourth consecutive quarter with year-over-year increases in both the number of job vacancies and the job vacancy rate. As in the second quarter of 2017, year-over-year increases in job vacancies were broadly based across the provinces, industrial sectors and occupations.

Chart 1: Year-over-year change in the number of job vacancies

Compared with the second quarter of 2017, the number of job vacancies (unadjusted for seasonality) in Canada increased by 1.6%, while the job vacancy rate was unchanged, as payroll employment also rose. By comparison, the number of job vacancies declined between the same quarters in 2015 while it had gone up between the same quarters in 2016.

Chart 2: Number of job vacancies in the second and third quarters of 2015, 2016 and 2017

Quebec and British Columbia leading growth in job vacancies

Compared with the same quarter a year earlier, the number of job vacancies in the third quarter of 2017 increased in nine provinces, led by Quebec and British Columbia, while job vacancies fell in Newfoundland and Labrador. In the territories, vacancies rose in Yukon, while they were little changed in the Northwest Territories and Nunavut. Similar changes were observed for the job vacancy rate across provinces and territories.

Employers in Quebec reported 87,000 job vacancies in the third quarter, up 21,000 (+30.6%) from the same quarter a year earlier. At the same time, the job vacancy rate rose by 0.6 percentage points to 2.5%, the largest year-over-year increase for this province since the data became available in 2015. Growth in job vacancies was widespread across sectors, led by manufacturing. Job vacancies increased in all areas, with a notable rise in the economic region (ER) of the Capitale-Nationale, which includes Québec City, followed by Montréal.

Chart 3: Change in the number of job vacancies between the third quarter of 2016 and the third quarter of 2017, by province and territory

According to the Labour Force Survey (LFS), employment in Quebec grew by 2.2% between the third quarter of 2016 and the third quarter of 2017. This compares with 2.0% growth nationally. At the same time, the unemployment rate fell from 7.0% to 6.0% as fewer people searched for work. Over the same period, the ratio of the number of unemployed to the number of job vacancies declined in Quebec, suggesting a relative tightening of the labour market.

In British Columbia, job vacancies continued to increase in the third quarter, rising by 16,000 (+20.2%) on a year-over-year basis. The job vacancy rate also increased to 4.2% in the third quarter, up from 3.6% the same quarter a year earlier and the highest rate in the country. The largest rise in vacancies was in transportation and warehousing, followed by accommodation and food services. British Columbia had the lowest unemployment-to-vacancy ratio among the provinces.

There were 11,000 (+6.1%) more vacancies in Ontario in the third quarter compared with the same quarter a year earlier. Over the same period, the job vacancy rate rose by 0.2 percentage points to 3.0%. Job vacancies rose notably in health care and social assistance as well as in manufacturing. In contrast, vacancies fell in professional, scientific and technical services. Within the province, job vacancies increased the most in the ERs of Hamilton–Niagara Peninsula and Kitchener–Waterloo–Barrie. Job vacancies in Toronto were little changed following four consecutive quarters of year-over-year increases.

The number of job vacancies in Alberta rose by 9,400 (+21.3%) in the third quarter and the job vacancy rate was up by 0.4 percentage points on a year-over-year basis to 2.7%. The number of job vacancies went up in a majority of the 20 industrial sectors, with the largest increases in construction, transportation and warehousing, as well as in mining, quarrying, and oil and gas extraction. Job vacancies rose throughout the province, except in the economic region of Edmonton, where they were little changed.

Employers in Newfoundland and Labrador reported 500 (-12.9%) fewer vacancies in the third quarter compared with the same quarter a year earlier. At the same time, the job vacancy rate declined by 0.3 percentage points to 1.6%, the lowest rate in the country. Over the same period, the LFS showed that the unemployment rate rose from 13.0% to 15.2%. Job vacancies decreased in several sectors, including health care and social assistance.

Job vacancies rise in most broad occupational categories

In the third quarter, the number of job vacancies was up in 7 of the 10 broad occupational categories on a year-over-year basis, led by trades, transport and equipment operators, and sales and service occupations. These occupational groups were also the two largest broad occupational categories in terms of vacancies. Over the same period, job vacancies in management occupations declined while they were little changed in business, finance and administration occupations and occupations in art, culture, recreation and sport.

Job vacancies in trades, transport and equipment operators were up by 24,000 (+41.0%) year over year, with one-third of the increase reflecting more vacancies in motor vehicle and transit drivers. The above-average growth in vacancies in this broad occupational category helped raise its share of national vacancies to 17.9% in the third quarter compared with 14.6% in the third quarter of 2016.

Within sales and service occupations, the largest increase was in food counter attendants, kitchen helpers and related support occupations (+20,000 or +13.5%).

Chart 4: Number of job vacancies by broad occupational group (one-digit NOC¹), third quarter 2016 and third quarter 2017

Widespread increases in job vacancies across the 10 largest industrial sectors

The number of job vacancies in the third quarter rose in 9 of the 10 largest industrial sectors in terms of employment, led by transportation and warehousing, manufacturing and accommodation and food services. At the same time, job vacancies were little changed in professional, scientific and technical services.

On a year-over-year basis, transportation and warehousing was up by 9,200 (+50.0%) in the third quarter, in line with the rise of vacancies for motor vehicle and transit drivers.

Job vacancies in manufacturing rose by 8,800 (+26.4%) in the third quarter, with about half of the increase concentrated in Quebec. The increase in vacancies in manufacturing was consistent with a recent upward trend in the national real gross domestic product for this sector.

Job vacancies were up notably in accommodation and food services (+8,200 or +13.6%), and the majority of the increase was the result of a rise in vacancies in food services and drinking places. The accommodation and food services sector continued to have the highest job vacancy rate among the large sectors at 4.8%, likely reflecting relatively higher turnover.

Most of the smaller sectors (in terms of employment) also registered increases in the number of vacancies. Among these, the mining, quarrying, and oil and gas extraction sector (+3,000 or +128.2%) had a marked rise, with about half of the increase concentrated in Alberta.

Chart 5: Number of job vacancies in the 10 largest industrial sectors, third quarter 2016 and third quarter 2017

The average offered hourly wage is little changed

Nationally, the average offered hourly wage in the third quarter was little changed at $19.85. However, larger changes were observed across broad occupational categories, particularly in natural resources, agriculture and related production occupations, where the offered wage grew by 11.5%.

Changes in the average offered hourly wage for job vacancies can reflect a variety of factors, including wage growth and changes in the composition of job vacancies by occupation, by sector and between part- and full-time positions.

For example, the 11.5% increase of the offered wage in natural resources, agriculture and related production occupations was partly driven by the rise in the number of job vacancies for higher-paying occupations, such as mine service workers and operators in oil and gas drilling, as well as underground miners and oil and gas drillers.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180111/dq180111a-eng.pdf

REUTERS. JANUARY 11, 2018. Canada job vacancies rise in third quarter with gains across sectors

OTTAWA (Reuters) - The number of job vacancies in Canada rose in the third quarter compared to the year before, with openings seen across a number of industries, including transportation and food and accommodation, data from Statistics Canada showed on Thursday.

There were 468,000 jobs open in the third quarter, up 15.1 percent from the third quarter of 2016. The vacancy rate, which measures the share of unfilled jobs out of those available, rose to 2.9 percent from 2.6 percent.

A higher job vacancy rate often points to economic growth. Canada’s labor market saw unexpectedly robust gains in 2017 and contributed to the Bank of Canada’s decision to raise rates twice last year.

Openings for permanent positions accounted for 80.2 percent of all vacancies in the third quarter, up from 78.5 percent the year before.

The number of job openings also rose in nine out of the 10 largest industrial sectors. Vacancies rose 50 percent in the transportation sector as there was more demand for vehicle and transit drivers, while openings in food services and accommodation were up 13.6 percent.

Reporting by Leah Schnurr; Editing by Nick Zieminski

FOREIGN POLICY

DoS. January 11, 2018. Secretary Tillerson Travels to Canada. Heather Nauert, Department Spokesperson

Washington, DC - U.S. Secretary of State Rex Tillerson will travel to Vancouver, Canada, January 15-17, to co-host the Vancouver Foreign Ministers’ Meeting on Security and Stability on the Korean Peninsula with Canadian Foreign Minister Chrystia Freeland. The meeting will bring together nations from across the globe to demonstrate international solidarity against North Korea’s dangerous and illegal nuclear and ballistic missile programs. Discussions will focus on advancing and strengthening diplomatic efforts toward a secure, prosperous and denuclearized Korean peninsula. U.S. Secretary of Defense James N. Mattis will participate in the ministerial welcome dinner on January 15.

The Globe and Mail. 11 Jan 2018. CUBA. Diplomats’ symptoms from Cuba still a mystery

MICHELLE ZILIO, OTTAWA

While many Americans reported injuries after hearing what they described as a high-pitched sound, only one Canadian heard the sound and experienced symptoms afterward. Other Canadian diplomats and their families heard the sound, but didn’t get symptoms.

Nearly a year after Canadian diplomats and their families started experiencing unusual health symptoms in Cuba, the federal government says it still has no idea what has caused the reported nosebleeds, dizziness, sleeplessness and headaches.

A senior Canadian government official said 27 diplomats and their family members have undergone medical testing since the unexplained symptoms began in Havana last March; eight people required follow-up care. The official, who spoke to reporters on the condition of anonymity during a briefing in Ottawa Wednesday, said the government has not reached any conclusions about what caused the symptoms, including whether the affected individuals were victims of a sonic attack.

Twenty-four American diplomats and family members have also suffered injuries, including permanent hearing loss and concussions. Cuba’s ambassador to Canada insists the symptoms were not caused by a sonic weapon. Speaking to The Globe and Mail last month, Julio Garmendia Pena said Cuba is working with Canadian and American authorities to investigate, but that preliminary findings confirm there was no deliberate attack by Cuba or any foreign agents. “In Cuba, there are no sonic weapons and there is no evidence that anyone has [brought] sonic weapons into the country or that anyone has used them,” Mr. Pena said in Spanish through a translator.

“It has been proved that our territory has not been used either by any Cuban citizens or foreign citizens to conduct these attacks. There have not been any attacks.”

U.S. officials told Congress on Tuesday that they are investigating a range of possibilities, such as a deliberate viral attack, beyond the initial theory of a sonic weapon. Secretary of State Rex Tillerson convened a highlevel investigation into the situation this week.

The senior Canadian government official said that while American and Canadian diplomats have experienced similar symptoms, there are differences between the cases. While many Americans reported injuries after hearing what they described as a high-pitched sound, only one Canadian heard the sound and experienced symptoms afterward. Other Canadian diplomats and their families heard the sound, but didn’t get symptoms.

The RCMP are leading the Canadian investigation into the health symptoms, including an environmental assessment of the water and air at the Canadian embassy and residences. However, the Canadian official noted that the government is working in uncharted territory, having never dealt with an incident like this before.

In April, 2017, the U.S. embassy asked Canada if its staff in Havana had heard any strange sounds or experienced any unusual health symptoms. In May, Canadian diplomats and their families came forward with symptoms; 27 people in 10 households were medically tested. The eight individuals, including children, who received follow-up care are either back to work or school, the federal official said. Although one person continues to suffer from headaches, according to the official, no one has been taken to hospital as a result of their symptoms.

Most of the affected individuals experienced their symptoms in May, 2016. The official said two more individuals reported feeling waves of pressure in August and December.

The staffing levels have remained unchanged at the Canadian embassy in Havana, although three diplomatic families have chosen to move back to Canada since the summer. Global Affairs Canada said it has no plans to follow in the footsteps of the United States and withdraw staff from Cuba.

Washington withdrew more than half of its staff from its Cuban embassy last September and warned Americans against visiting the island, citing the health problems suffered by diplomats. Global Affairs said it has no reason to believe Canadian tourists and other visitors could be affected.

Mr. Pena said Cuba is just as puzzled about the health symptoms experienced by diplomats, but remains committed to aiding the ongoing investigation.

“Cuba has always expressed its full, unequivocal willingness to co-operate in the investigation,” Mr. Pena said. “Cuba shares the concerns over these health problems shared by Canadian diplomats and their families.”

SUBSIDIES

THE NATIONAL POST. January 10, 2018. John Ivison: Canada spends $29B a year on business subsidies — and half of it is wasted. The study's analysis is not good news for the federal Liberals, who are in the process of choosing a handful of promising industry 'clusters' for special support

John Ivison, is a political columnist for the National Post, based in Ottawa. Mr. Ivison joined the Post in 1998 from The Scotsman newspaper in Edinburgh. He worked on the Financial Post for five years, becoming deputy editor, before moving into politics, first at the Ontario legislature in Toronto and then on Parliament Hill in Ottawa.

An important new study has for the first time calculated the total amount the federal government and four largest provinces spend on subsidizing businesses — a staggering $29 billion a year — and it estimates more than half of that spending is wasted.

The aim of the spending in most cases is to improve economic performance. But the analysis by John Lester, an executive fellow at the University of Calgary’s School of Public Policy, suggests programs like subsidies to attract foreign companies to shoot movies in Canada don’t work.

“Because government intervention is costly … just under half of overall business subsidies fail to improve economic performance,” he says.

Since nearly one third of all subsidies are not even aimed at economic development — but rather at achieving social objectives like supporting specific industries or regions — the proportion of “questionable” spending reaches 60 per cent of the total, Lester said.