CANADA ECONOMICS

NAFTA

Global Affairs Canada. January 31, 2018. Minister Freeland to participate in North American Foreign Ministers’ Meeting in Mexico City

Ottawa, Ontario - The importance of the Canada-United States-Mexico relationship is reflected in our strong diplomatic, cultural, educational and commercial relations. Canada remains committed to strengthening its multi-faceted relationship with its North American friends and allies.

The Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced that she will participate in the North American Foreign Ministers’ Meeting in Mexico City, Mexico, with her counterparts from the United States and Mexico on February 2, 2018.

This meeting is an opportunity for the foreign ministers of the United States, Mexico and Canada to take stock of trilateral cooperation on issues of shared interest and to highlight the benefits to all three countries working closely together.

This year, Minister Freeland; Rex Tillerson, U.S. Secretary of State; and Luis Videgaray, Mexico’s Secretary of Foreign Affairs and host for the meeting, will discuss ongoing and future opportunities for trilateral cooperation and collaboration on the economy, including the modernization of the North American Free Trade Agreement (NAFTA), as well as regional and global issues.

Quotes

“I look forward to a positive and constructive meeting with my American and Mexican counterparts this week to discuss shared interests among our countries. In addition to the North American economic and commercial relationship, including NAFTA, we will discuss current regional collaboration on issues including Venezuela, irregular migration, cooperation on transnational crime and the upcoming Summit of the Americas.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick facts

Canada hosted the last North American Foreign Ministers’ Meeting in the city of Québec on January 29, 2016.

Canada-United States

- Canada and the United States share one of the largest trading relationships in the world. Canada buys more goods from the United States than China, Japan and the United Kingdom combined.

- Bilateral trade between our two countries was valued at nearly $882 billion in 2016, and Canada is the largest secure supplier of energy to the United States.

- The two countries share the longest secure border in the world, over which some 400,000 people and $2.4 billion worth of goods and services cross daily.

- Canada is the number one export destination for most American states, and cross-border trade and investment supports nearly 9 million jobs in the United States.

Canada-Mexico

- For more than 70 years, Canada and Mexico have shared a vibrant relationship characterized by deep people-to-people ties, rich cultural connections and growing trade and investment.

- As a result of NAFTA, Canada’s commercial relationship with Mexico is strong and growing. Just last year, Canada reached a milestone with bilateral merchandise trade totalling Can$40.8 billion.

- Through the annual Canada-Mexico Partnership, more collaboration between the public and private sectors is being encouraged in areas such as energy; agri-business; labour mobility; human capital; trade, investment and innovation; environment; mining; and forestry.

- These efforts have resulted in Canadian direct investment in Mexico totalling roughly $17 billion (stock) in 2016, while Mexican direct investment in Canada is nearly $2 billion (stock).

- Nearly 2 million Canadians travel to Mexico every year for business or pleasure.

Canada and United States relations: http://international.gc.ca/world-monde/united_states-etats_unis/relations.aspx?lang=eng

Canada-Mexico relations: http://www.canadainternational.gc.ca/mexico-mexique/canmex.aspx?lang=eng

The Globe and Mail. 31 Jan 2018. Former prime minister Brian Mulroney calls on the U.S. to preserve NAFTA at a key Senate. Former PM echoes Reagan-era message to Trump: ‘protectionism is destructionism’

ADRIAN MORROW, U.S. CORRESPONDENT

Former prime minister Brian Mulroney is calling on the United States to preserve NAFTA, expand free trade and fulfill its traditional role as a leader of the international economic order – or risk being left behind.

In a passionate speech before a key U.S. Senate committee on Tuesday, Mr. Mulroney laid out the case in favour of continental economic integration – the cornerstone of his political legacy – arguing that the North American free-trade agreement has brought enormous economic benefits to all three countries. He also quoted former president Ronald Reagan to send a blunt message to the current one, Donald Trump: “protectionism is destructionism.”

“With an unemployment rate of 4.1 per cent, the lowest of any nation in the industrialized world, it is becoming increasingly difficult to seriously argue that the United States has done poorly with its international trade agreements that create such vast employment opportunities at home and across North America,” Mr. Mulroney told the committee on foreign relations, just hours before the President was set to deliver his State of the Union speech.

The former prime minister’s testimony comes at a crucial time in the renegotiation of NAFTA initiated by Mr. Trump. A day earlier, the three sides wrapped up a round of talks in Montreal, where Canada tried to break the logjam over Mr. Trump’s most protectionist demands. Mexico is also trying to fight back against Trump’s protectionist push. While the United States indicated it would keep negotiating, it largely dismissed Ottawa’s proposal to resolve a key sticking point on vehicle-content requirements in the free-trade zone.

The U.S. Congress will be key to either ratifying an overhauled NAFTA or restraining Mr. Trump if he tries to pull his country out of the deal. Members of the U.S. Senate foreign relations committee are almost unanimous in their support of NAFTA – except for Oregon Democratic Senator Jeff Merkley, who has criticized the loss of jobs to Mexico. Tuesday’s hearing sends a powerful signal that Mr. Trump cannot easily tear up NAFTA without Senate approval.

Thirty five Republican Senators – including Majority Leader Mitch McConnell – sent an open letter Tuesday to Mr. Trump affirming their support for NAFTA and urging him to embrace it as part of his probusiness agenda.

The President’s tone on NAFTA has softened in recent weeks amid a barrage of lobbying by U.S. business interests, many of them encouraged by the Canadian government, and interventions by pro-trade GOP legislators. The senators urged Mr. Trump, who has threatened to tear up NAFTA, to instead modernize the deal to open markets even further.

The hearing was an opportunity for Mr. Mulroney, who testified alongside former U.S. ambassador to Mexico Earl Anthony Wayne and former Mexican economy minister Jaime Serra, to rally congressional backing for the deal.

Mr. Mulroney himself is in an unusual position: The architect of NAFTA and the earlier Canada-U.S. free-trade agreement, he is also on friendly terms with Mr. Trump, famously serenading the President last year during a charity fundraiser at Mar-a-Lago, Mr. Trump’s hotel in Palm Beach, Fla., where the Mulroneys also have a residence.

And in his testimony, Mr. Mulroney was careful not to criticize Mr. Trump directly, even as he took square aim at the protectionist ideals that have animated much of his presidency. Recalling his relationships with former presidents Mr. Reagan, George H.W. Bush and Bill Clinton, Mr. Mulroney said all three understood trade deals were about more than mere transactions.

“They understood that such trade arrangements are a vital constituent part of an enlightened foreign policy, not isolated variables to be picked apart and analyzed on a profit and loss basis,” he said.

He also warned against the destructive effects of protectionism.

“When fear and anger fuel public debate, history teaches us that protectionism impulses can easily become a convenient handmaiden,” he said.

Mr. Mulroney’s message went over well with the senators. While some expressed specific criticisms of NAFTA, particularly on the lack of enforceable labour standards, all appeared to agree that it had to be preserved.

“I believe very strongly that we should stay in NAFTA, and we should do everything we can to make it work, to make it strong,” said Johnny Isakson, a Georgia Republican. “I’m going to continue to vote that way.”

Under questioning from the committee, Mr. Mulroney said he was confident Canada – and the rest of the world – would continue advancing on the freetrade front. And he delivered a stark warning that the United States would “lose” if it continued to hold back.

“I have no doubt whatsoever that the government of Canada made the right decision by signing on to the TPP, as they negotiated a free-trade agreement with Europe, as they’re going to negotiate a free-trade agreement with, hopefully, Japan, India and ultimately China. This is the wave of the future,” he said. “There is an expression in French which says it all: ‘Les absents ont toujours tort.’ Rough translation: ‘If you take yourself out of the game, you’re going to lose.’ ”

Mr. Serra said continental economic integration is so entrenched that the three countries aren’t merely trading but increasingly producing things together.

“Once you scramble an egg, it’s very difficult to unscramble it,” he said.

THE GLOBE AND MAIL. REUTERS. JANUARY 31, 2018. Trudeau doesn’t think Trump will pull U.S. out of NAFTA

DAVID LJUNGGREN, OTTAWA

Canadian Prime Minister Justin Trudeau said in an interview he does not think U.S. President Donald Trump will pull out of NAFTA, despite differences over how to update the trade pact, the Canadian Broadcasting Corp said on Wednesday.

Trudeau's comments were among the most positive made by any Canadian official since talks started last year to revamp a $1.2-trillion treaty that Trump calls a disaster.

"It obviously would be bad if we canceled it, so I don't think the president is going to be cancelling it," Trudeau told the CBC in an interview recorded on Tuesday. The CBC released excerpts on Wednesday.

Trudeau also told the CBC that Canada has multiple contingency plans in the event Washington does announce it plans to withdraw. The Trump administration is demanding big changes to the pact, and this has caused tensions with Canada and Mexico.

Trump's trade chief, speaking in Montreal on Monday after the sixth of eight rounds of talks, rejected proposals for unblocking the negotiations but promised to seek quick breakthroughs.

Foreign ministers from the United States, Canada and Mexico will meet in Mexico City on Friday to discuss the talks and other issues, the Canadian government said on Wednesday.

The talks on renegotiating the 1994 three-party North American Free Trade Agreement began soon after Trump took office a year ago, saying that if it could not be overhauled to better favor U.S. interests and American workers, Washington would pull out of the pact.

In his State of the Union speech on Tuesday, Trump said "America has also finally turned the page on decades of unfair trade deals," but did not mention NAFTA by name.

As recently as Jan. 10, Canadian government sources told Reuters that Ottawa was increasingly convinced the United States would give notice of withdrawal. The news hit stock markets and the Canadian and Mexican currencies.

Asked about contingency plans, Trudeau said "not only do we have a Plan B, we have a Plan C and D and E and F". He declined to give details.

"I think one of the dangers is falling into hypotheticals and chasing rabbits down holes," he told the CBC.

"Just know that we have looked at a broad range of scenarios and have an approach that is going to continue to stand up for Canadian jobs while we diversify our markets."

Canadian Trade Minister Francois-Philippe Champagne has repeatedly said his "Plan B" is to find more overseas markets. Canada currently sends around 75 per cent of all goods exports to the United States.

REUTERS. JANUARY 30, 2018. Mexico says open to changes on rules of origin for autos in NAFTA talks

Sharay Angulo

MEXICO CITY (Reuters) - Mexico said on Tuesday that it was open to changes to rules of origin for automobiles, one of the most contentious issues negotiators face in modernizing the 1994 North American Free Trade Agreement.

Under NAFTA, at least 62.5 percent of the net cost of a passenger car or light truck must originate in the United States, Canada or Mexico to avoid tariffs. U.S. President Donald Trump’s administration wants the threshold raised to 85 percent and it wants half the content made in the United States.

Economy Minister Ildefonso Guajardo said that while Mexico’s automotive industry, represented by AMIA, has expressed the desire to keep the current 62.5 percent regional requirement for autos, ”I have talked with them. I think we have to be realistic.

“I believe that North America can rethink the model ... And I think it’s logical. Let’s be totally honest.”

Eduardo Solis, head of Mexico’s main auto industry group AMIA, has advocated for not touching the rules of origin, saying that he needed to ensure that North America’s auto industry remained competitive.

At the latest round of NAFTA talks in Montreal that concluded on Monday, Trump’s trade chief rejected a Canadian compromise plan to include expenses for engineering, research and development and other high-value work to be counted in higher targets for North American content with the aim of safeguarding high-paying jobs in the region. Mexico called it “innovative.”

Guajardo said the plan “deserves a deeper analysis to try to rescue from it all that is technically valuable.” He added that it was predictable that U.S. Trade Representative Robert Lighthizer would deem the proposal unacceptable.

Flavio Volpe, president of the Toronto-based Automotive Parts Manufacturers’ Association, suggested on Monday that Lighthizer’s tough rhetoric was a negotiating tactic.

Reporting by Sharay Angulo; Writing by Anthony Esposito

GDP

StatCan. 2018-01-31. Gross domestic product by industry, November 2017

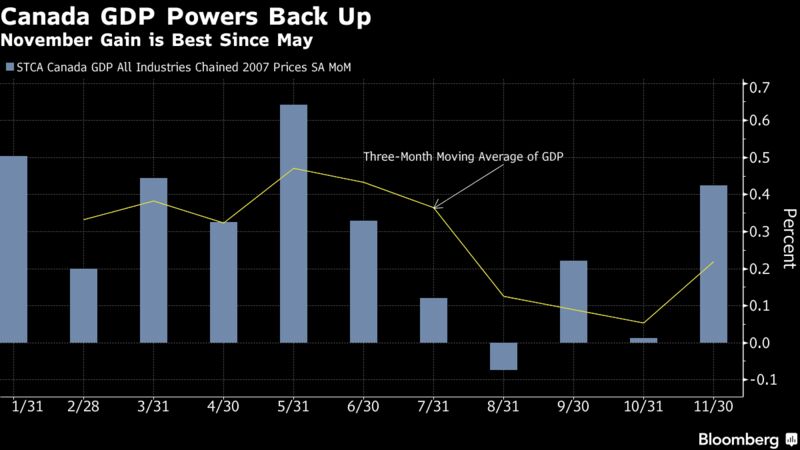

- Real GDP by industry, November 2017: 0.4% increase (monthly change)

- Source(s): CANSIM table 379-0031: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3790031&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Real gross domestic product (GDP) increased 0.4% in November, with widespread growth across industries as 17 of 20 industrial sectors increased.

Goods-producing industries rose 0.8% after declining 0.5% in October. November's gain was mainly due to increases in the manufacturing and mining, quarrying and oil and gas extraction sectors, partly as a result of restoration in production capacity. Meanwhile, services-producing industries rose 0.3%, led by the real estate and rental and leasing, wholesale, and retail trade sectors.

Chart 1: Real gross domestic product grows in November

Largest manufacturing growth in three years

The manufacturing sector was up 1.8% in November, the largest monthly increase since February 2014 as the majority of subsectors grew. Non-durable manufacturing rose 1.1%, while durable manufacturing jumped 2.5%.

Chart 2: Manufacturing output increases in November

The rise in durable manufacturing, the largest monthly increase since December 2011, was led by a 6.5% increase in transportation equipment. Following four consecutive monthly declines, which saw the industry drop by 21.5%, motor vehicle manufacturing rose 14.3% in November. Automotive vehicle assembly increased in part due to the return to production of some plant capacity following shutdowns in September and October. This increased activity was also a factor in the 8.7% rise in motor vehicle parts manufacturing in November. Miscellaneous transportation equipment rose 0.8%, while aerospace product and parts manufacturing was essentially unchanged.

There was increased output in machinery (+3.1%) and furniture and related products (+2.9%). Wood products (-0.5%) declined for the first time in five months.

Non-durable manufacturing was up for the sixth time in seven months in large part due to the 5.3% expansion of chemical manufacturing following three months of declines. Factors contributing to the growth were the end of some plant maintenance shutdowns and higher exports of pharmaceutical and medicine manufacturing products. There was growth in plastic and rubber products (+3.1%), food (+0.9%) and paper (+2.8%) manufacturing. Petroleum and coal products manufacturing declined 6.2%, the largest decrease since May 2016.

Real estate and rental and leasing continues to grow

Real estate and rental and leasing rose 0.4% in November. The output of offices of real estate agents and brokers (+4.0%) was up for the fourth consecutive month as there was increased home resale activity in Ontario and Alberta. However, the level of activity of this subsector remains below its March 2017 level, following provincial government changes to housing regulations in Ontario that came into effect in April of that year.

This increase contributed to the 0.3% rise in professional services, as legal, accounting and related services increased 0.7%. Computer systems design and related services grew 0.7%.

Mining, quarrying, and oil and gas extraction up after October decline

Mining, quarrying, and oil and gas extraction increased 0.5% in November following a 1.1% decline in October.

The oil and gas extraction subsector was up 1.6%, led by 3.7% growth in non-conventional oil extraction. The ramp-up to normal capacity continued at some facilities following maintenance turnarounds that began in mid-September. Conventional oil and gas extraction edged down 0.2%.

Mining excluding oil and gas extraction was down 2.1%, a second monthly decline after rising the six previous months. Non-metallic mineral mining was down 3.3%, due largely to a 5.7% drop in potash mining. Coal mining dropped 7.7%, while metal ore mining was down 0.7% as all industry groups declined, with the exception of iron ore mining (+4.3%).

Support activities for mining and oil and gas extraction fell 4.1% on lower drilling and rigging services. This was a seventh consecutive decline for the subsector after a string of increases that began in the spring of 2016 and ended in April 2017.

Retail and wholesale trade continue to grow

Following 1.2% growth in October, retail trade was up 0.6% in November as 7 of 12 subsectors increased. Electronics and appliance stores gained 8.4% on the strength of promotional events such as Black Friday combined with new product releases. The increases in clothing and clothing accessories (+2.1%) and general merchandise stores (+1.5%) were also influenced by promotional events. Food and beverage stores registered a 1.1% contraction as all industry groups went down. The 0.7% drop at motor vehicle and parts dealers did not offset the 3.3% growth in October.

Wholesale trade increased for the fourth time in five months, rising 0.5% as eight of nine subsectors grew. Motor vehicle and parts wholesaling (+1.6%) led the growth, reflecting increased demand from domestic manufacturing and growth in exports and imports of motor vehicles and parts. Food, beverage and tobacco (+0.9%) and personal and household goods wholesaling (+0.7%) posted gains, while petroleum product wholesaling declined 1.7%.

Finance and insurance sector resumes growth

After four consecutive months of decline, the finance and insurance sector grew 0.3% in November. Depository credit intermediation and monetary authorities and insurance carriers and related activities were both up 0.3%. Financial investment services, funds and other financial vehicles were up 0.5% following four consecutive months of decline, as market activities involving securities, mutual funds and trusteed pension assets increased.

Pipeline leak tempers growth in transportation and warehousing

Transportation and warehousing edged up 0.1% in November as five of nine subsectors grew, led by support activities for transportation (+0.8%), truck (+0.4%) and rail transportation (+1.1%). Air transportation (+0.9%) rose for a sixth consecutive month as there was increased air traffic both from Canadian travellers and travellers to Canada from other countries.

Pipeline transportation was down 3.9% as a pipeline leak in the United States in November affected exports of crude oil, resulting in a 8.1% decline in crude oil and other pipeline transportation. Pipeline transportation of natural gas was up 0.6%.

Construction edges up

Construction edged up 0.1% in November. Non-residential building construction grew 0.9%, while engineering and other construction activities edged up 0.1%. There were slight declines in residential (-0.2%) and repair (-0.2%) construction.

Other industries

Utilities were up 0.7% in November. Electric power generation, transmission and distribution was up 0.4%, while natural gas distribution rose 3.8% from higher demand across all classes of customers.

The public sector grew 0.2% in November following essentially no change in October. Educational services rose 0.2% in November after declining 0.1% in October, partly due to the increase in the universities subsector. The community colleges and CEGEPs subsector declined 0.8% in November, following a 4.6% decline in October, as a result of a five-week strike by Ontario community college faculty staff that ended on November 19, 2017 with the government of Ontario passing back-to-work legislation. In other components of the public sector, there were slight increases in health care and social assistance (+0.2%) and public administration (+0.1%).

Accommodation and food services were unchanged in November, as growth in accommodation services (+0.3%) was offset by a decline in food services and drinking places (-0.1%).

Agriculture, forestry, fishing and hunting (-0.1%) was down for the 9th time in 12 months.

Chart 3: Main industrial sectors' contribution to the percent change in gross domestic product in November

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180131/dq180131a-eng.pdf

THE GLOBE AND MAIL. JANUARY 31, 2018. Economy ‘firing on all cylinders’ as Canada sees best growth in six months

DAVID PARKINSON, ECONOMICS REPORTER

Canada's economy posted its fastest growth in six months in November, as a surge in manufacturing led a broad-based rebound from October's disappointing economic stall.

Statistics Canada reported that real gross domestic product rose 0.4 per cent month over month. That's the biggest one-month increase since May, and a welcome improvement from October's flat reading.

The gain matched economists' consensus estimate, as earlier economic data, particularly in manufacturing and exports, had signalled a solid recovery from October's weakness. Manufacturing output gained 1.8 per cent month over month, a three-year high, largely reflecting a rebound in the automotive sector, as two major auto plants returned from October shutdowns. Motor-vehicle manufacturing soared more than 14 per cent in the month, while auto parts were up nearly 9 per cent.

But November's upturn wasn't a one-sector story; 17 of 20 industries posted gains in the month, indicative of widespread strength. The goods-producing side of the economy surged 0.8 per cent, while service-producing sectors rose 0.3 per cent – for both, the strongest growth in months.

Economists said that after a relatively tepid third quarter (annualized growth of 1.7 per cent, less than half the pace of the first half of the year) and October's weak start to the fourth quarter, the November figures are an encouraging sign that Canada's broad-based economic recovery is on track.

"The Canadian economy fired on all cylinders in November: Production resumptions led the way, but nearly all major sectors reported gains on the month, an encouraging sign," Toronto-Dominion Bank senior economist Brian DePratto said in a research note. "As shown by this month's breadth of growth, the underlying trend for the Canadian economy remains a positive one."

Other strong performers in the month included retail and wholesale trade, up 0.6 per cent and 0.5 per cent, respectively. The mining and oil-and-gas extraction segment also rose 0.5 per cent, recovering from a slump in October, partially reflecting the return of oil-sands production following maintenance downtime.

With some of the early indicators suggesting that December was also a reasonably solid month for the Canadian economy, economists now believe growth in the fourth quarter will probably come in at about 2 per cent annualized when the quarterly data are released about a month from now. That pace would undershoot the Bank of Canada's most recent estimate of 2.5 per cent, released two weeks ago.

However, it's also faster than the central bank believes the economy's capacity is growing. Given that the Bank of Canada already believes the economy is running very close to its full production capacity, the fourth-quarter growth looks sufficient to further tighten an already tight economy – the justification behind the central bank's interest-rate hike in mid-January.

"This report won't change much from a policy perspective for the Bank [of Canada], which remains in cautious tightening mode," said Bank of Montreal economist Benjamin Reitzes in a research note.

Still, some economists are concerned that the economy could be destined for more modest growth in the first half of 2018. In particular, higher interest rates and tighter mortgage regulations could slow the housing and consumer sectors, which have been major drivers of Canada's economic recovery.

"The early evidence points to a big drop off in [home] sales in January, reflecting that tightening of mortgage rules and the sharp increases in both variable and fixed mortgage rates," said Paul Ashworth, chief North American economist for London-based Capital Economics.

Economists are also concerned about how the uncertainty surrounding the future of the North American free-trade agreement, as well as the recent U.S. corporate tax cuts, might affect Canadian business investment – which was another key source of the economy's strength in 2017.

"To sustain further meaningful growth, we're going to need to see investment in export capacity – something we're not convinced is coming in the near term, given the increased attractiveness of the U.S. in light of recent tax cuts, and serious concerns on the trade front regarding NAFTA," said Canadian Imperial Bank of Commerce economist Nick Exarhos in a research report.

REUTERS. JANUARY 31, 2018. Canada economy picks up in Nov with broad-based growth

Leah Schnurr

OTTAWA (Reuters) - The Canadian economy accelerated in November by the most in six months, with activity broad-based across a number of sectors including manufacturing and keeping the Bank of Canada on track to raise interest rates again before long.

Gross domestic product rose by 0.4 percent from October’s flat reading, Statistics Canada said on Wednesday, in line with economists’ expectations and the biggest increase since May 2017.

Growth in oil and gas extraction, and the retail and real estate sectors also contributed to November’s strength. The data saw the Canadian dollar extend gains against the greenback.

Economists said the report put the fourth quarter on track for about 2 percent growth. While that would be below the 2.5 percent that the Bank of Canada anticipates, it would still cap a strong year for the Canadian economy.

The expanding economy is expected to prompt the central bank to raise interest rates again in the coming months, with markets fully pricing in another hike by May. The bank has raised rates three times since last July.

With the economy operating near full capacity, the Bank of Canada does not need to see growth of 3 percent or 4 percent to keep on its tightening path, said Mark Chandler, head of Canadian fixed income and currency strategy at Royal Bank of Canada.

Chandler expects the central bank to hold rates steady at its next meeting in March before raising again in April.

November growth was widespread as goods-producing industries led the way higher with a 0.8 percent gain. The manufacturing sector jumped 1.8 percent, its biggest gain since February 2014, helped by increased production of vehicles and parts.

The oil and gas extraction subsector climbed 1.6 percent as some facilities continued to get back to normal capacity after maintenance that started in mid-September.

Among the services industries, the real estate sector rose 0.4 percent as activity by agents and brokers increased for the fourth month in a row on higher home sales in Ontario and Alberta.

Still, the industry was below its March 2017 level, just before the Ontario government implemented a number of measures to cool the housing market in Toronto and the surrounding areas.

The retail sector grew by 0.6 percent as sales at electronics, appliance and clothing stores were bolstered by Black Friday promotions.

Canadian producer prices dipped in December due to lower costs of energy and petroleum products, separate data showed.

Reporting by Leah Schnurr; Editing by Bernadette Baum and Jeffrey Benkoe

BLOOMBERG. 31 January 2018. Factory Revival Leads Best Canada GDP Growth in Six Months

By Greg Quinn

- Manufacturing climbs 1.8% in November, most since early 2014

- Real estate expands on fourth straight month of broker gains

Canada’s gross domestic product grew at the fastest pace in six months in November, a signal the economy will remain close to full output as the central bank weighs higher interest rates.

Output expanded 0.4 percent from October with about half the gain coming from manufacturing as temporary shutdowns ended at automobile and chemical plants, Statistics Canada said Wednesday from Ottawa. Smaller contributions were spread across another 16 of 20 industries tracked by the agency including real estate, oil and gas extraction and wholesaling.

The gain follows a stall in the previous month and leaves Canada on track for annualized growth of about 2 percent in the fourth quarter. Growth will likely remain at around that pace for 2018. Bank of Canada Governor Stephen Poloz has said he will be cautious in assessing new data to figure out future moves after three rate increases since July.

Last year was marked by a burst of growth in the first half and a slowdown in the second half, as spending by indebted consumers powered ahead and business investment revived following an oil shock two years earlier. Output grew at about a 4 percent annualized pace in the first two quarters of the year, and by 1.7 percent between July and September.

‘Broad’ Strength

Even with a second-half slowdown, Canada is headed for 3 percent growth for 2017, more than double the 2016 pace and expected to be fastest among Group of Seven nations. Other signs Canada’s economy is close to full output include the lowest jobless rate in modern records and consumer price inflation that’s close to the central bank’s 2 percent target.

“You are seeing broad-based strength across the bulk of the economy; that’s more encouraging to me than just the headline alone,” Brian DePratto, senior economist at Toronto-Dominion Bank, said by phone. The GDP figures along with labor market strength suggest the economy is close to full output and justifies another rate increase by July, he said.

Canada’s dollar traded for C$1.2285 against its U.S. counterpart at 9:33 a.m. in Toronto, 0.4 percent stronger than yesterday and the highest since September. Two-year government bond yields were little changed at 1.84 percent.

The strongest gain was in manufacturing with a 1.8 percent jump the biggest since February 2014. Motor vehicle production climbed 14 percent in November, recouping part of a 22 percent fall over the last four months as plants were shut down. Chemical output gained 5.3 percent after three prior declines.

Oil and gas extraction also benefited from a move back to regular production with a 1.6 percent increase, Statistics Canada said. Real estate and leasing climbed 0.4 percent from October, as the contribution from agents and brokers gained for a fourth consecutive month.

Other Details

- The November expansion matched the median forecast in a Bloomberg economist survey

- Retail trade growth slowed to 0.6 percent in November from 1.2 percent in October, while wholesaling climbed 0.5 percent

- Public-sector output also bounced back from a temporary setback, gaining 0.2 percent following the end of a college strike in Ontario, Canada’s most populous province

- The finance and insurance industry expanded for the first time in five months with a 0.3 percent increase

- Statistics Canada in a separate report said that its index of manufacturing prices fell 0.1 percent in December while its raw material costs dropped 0.9 percent

- GDP grew 3.5 percent in November from 12 months earlier

AVIATION

BOEING. THE GLOBE AND MAIL. REUTERS. JANUARY 31, 2018. Boeing forecasts sharp rise in profit, jet output in 2018

ANKIT AJMERA, BENGALURU

Boeing Co on Wednesday forecast full-year profit well above Wall Street estimates as it looks forward to its busiest year ever for plane deliveries, sending its shares up almost 6 per cent.

The world's biggest planemaker said it aims to ship between 810 and 815 commercial aircraft in 2018, as much as 6.8 per cent more than the industry-record 763 jets it delivered in 2017, putting it ahead of European rival Airbus for the sixth year in a row. Airbus delivered 718 jetliners last year.

Both companies are speeding up production at their factories to chip away at the large backlog of orders for new jetliners, created over the past few years as airlines want new, fuel-efficient planes to cope with a surge in demand for air travel.

Helped by the hunger for new jets, Boeing forecast core profit would rise to $13.80 to $14.00 a share in 2018, ahead of analysts' average estimate of $11.96, according to Thomson Reuters I/B/E/S.

For the fourth quarter ended Dec. 31, Boeing's core earnings nearly doubled to $4.80 per share from $2.47 a year earlier, buoyed by rising plane output and a gain from changes to the U.S. tax law.

Boeing shares, which have more than doubled in the past 12 months, rose 5.7 per cent to $356.90 on the New York Stock Exchange.

SETTING THE TABLE

Boeing's commercial planes unit posted an 8 per cent increase in revenue in the fourth quarter to $15.47-billion, while operating profit rose 50 per cent to $1.78-billion.

The company's smaller defense business grow more slowly. Revenue for the unit rose 5 per cent to $5.54-billion while operating profit rose 6 per cent to $553-million.

Boeing's new services business – which maintains and overhauls planes for their owners – posted a 17 per cent increase in revenue to $4-billion in the fourth quarter while operating profit rose 9 per cent to $617-million. Boeing is aiming to hit $50-billion in revenue in that business by 2027.

However, profit margins at the unit narrowed slightly to 15.4 per cent, and Boeing said it expects margins near that level this year.

"Margins weren't as good as I thought," said Sheila Kahyaoglu, an analyst at Jefferies LLC in New York.

Boeing also forecast at least $12.8-billion in free cash flow this year, encouraging Wall Street analysts, who generally view the company's early targets as conservative.

"Actual results could ultimately be higher," Seth Seifman, an analyst at JPMorgan, said in a note to clients. "As a result, we expect the stock to outperform despite its recent run now that management has set the table for a solid 2018."

By raising production while holding down costs, Boeing and Airbus generate more profit and cash. Despite the rising output, their order backlogs have kept growing. Boeing said its total backlog, which includes military aircraft and other products, rose to $488-billion at year-end, compared with $474-billion at the end of the third quarter.

Boeing's core earnings for the latest quarter included a one-time tax gain of $1.74 a share due to the lower U.S. corporate tax rate signed into law last month reducing its deferred tax liabilities in the future.

Excluding the gain, Boeing reported earnings of $3.06 a share. On that basis, Wall Street had been expecting $2.89 a share.

FULL DOCUMENT: http://boeing.mediaroom.com/2018-01-31-Boeing-Reports-Record-2017-Results-and-Provides-2018-Guidance

WEF

BANK OF CANADA. INTERVIEW FOR CNBC. PROGRAM THE SANCTUARY. Bitcoin is 'gambling' and regulations are needed, Canada central bank head says

Karen Tso

Arjun Kharpal

- Stephen Poloz, governor of the Bank of Canada, called bitcoin trading "gambling".

- Poloz said that the Canadian central bank is looking into cryptocurrency regulation.

- He added that blockchain technology is a "true piece of genius."

Bitcoin trading is "gambling," Canada's central bank governor told CNBC on Thursday, adding that he was looking to work with global regulators to develop regulations around cryptocurrencies.

Stephen Poloz, who heads up the Bank of Canada, said buyers of digital coins should "beware" and that he would not call cryptocurrencies assets.

"They are crypto but they are not currencies," Poloz told CNBC during an interview at The Sanctuary in Davos.

"I'm not really sure what they are. They are not assets really … I suppose they are securities technically … There is no intrinsic value for something like bitcoin so it's not really an asset one can analyze. It's just essentially speculative or gambling."

Poloz joins a chorus of central bankers and regulators warning about the dangers of cryptocurrencies which saw huge price surges in 2017.

Lars Rohde, the head of Denmark's central bank, called bitcoin investing "deadly" last year.

Many business leaders have also warned on the dangers of investing in bitcoin including J.P. Morgan CEO Jamie Dimon who famously called the cryptocurrency a "fraud" while investing legend Warren Buffett said the space will "come to a bad ending."

Poloz told CNBC that if the cryptocurrency market, which is highly volatile, were to crash, it would not have bad implications on the wider economy.

"One parallel we could draw would be the tech wreck. When we had the tech wreck, that was a much more widespread exposure. And the fact it had barely had perceptible effect on the real economy because it was not a stock market crash but just a segment of the stock market. But it was highly speculative, there was all kinds of bubbles there," Poloz explained.

"So I think if you take that experience to heart, if something like that were to happen in the cryptocurrency space, it would probably be smaller today … It certainly has the potential. I don't want to minimize the risk that you raised because any mania has the scope to get much bigger."

Poloz told CNBC that the central bank will look to regulate cryptocurrency.

"I have no doubt that at least for the purposes of consumer protection … We will be developing regulations around this space in due course. But what we are being careful to do here is to not stifle innovation," Poloz said.

Blockchain 'genius'

The Canadian central bank chief added though that blockchain technology which underpins cryptocurrency, is "a true piece of genius and it will be applied to many many areas in the economy."

Blockchain is the underlying technology behind bitcoin. It acts as a public record of transactions that is tamperproof and requires no central authority to clear transactions. This technology is seen as a way to make a lot of businesses processes faster and cheaper. The Bank of Canada currently has a project codenamed Jasper, which is looking into how to use the blockchain.

Poloz then turned to the idea of a central bank issued digital currency, and said that if it were to create one, it would be backed by the Canadian dollar. He added that cash is "still doing its job" and that there is no rush to introduce it.

The central banker also added that any fiat-backed digital currency would not necessarily need to run on the blockchain.

"No one's in a rush to get this done. Will it therefore be necessary for it (blockchain) to be part of a digital currency if central banks issued it? Well the answer is I think not," Poloz said.

"The reason that it has such appeal in the case of bitcoin is it gives you finality of settlement that eventually grinds through the distributed ledger and therefore you trust that. Whereas the central bank, if the Bank of Canada, were to issue a digital currency, well you already trust the Canadian dollar, and so you don't need a distributed ledger in order to believe you just received final payment in your digital wallet."

Clarification: This article has been amended to make clear that the Bank of Canada is working with global regulators to create regulation around cryptocurrencies.

VIDEO: https://www.youtube.com/watch?v=LuYUYCgYmHg

________________

LGCJ.: