CANADA ECONOMICS

INTERNATIONAL TRADE

DoC. USITC. 01/10/2018. U.S. Department of Commerce Issues Affirmative Preliminary Countervailing Duty Determination on Uncoated Groundwood Paper from Canada

Today, U.S. Secretary of Commerce Wilbur Ross announced the affirmative preliminary determination in the countervailing duty (CVD) investigation of imports of uncoated groundwood paper from Canada.

“Today’s preliminary decision allows U.S. producers to receive relief from the market-distorting effects of potential government subsidies while taking into account the need to keep groundwood paper prices affordable for domestic consumers,” said Secretary Ross. “The Department of Commerce will continue to evaluate and verify the accuracy of this preliminary determination while standing up for the American business and worker.”

The Commerce Department preliminarily determined that exporters from Canada received countervailable subsidies ranging from 4.42 to 9.93 percent.

As a result of today’s decision, Commerce will instruct U.S. Customs and Border Protection (CBP) to collect cash deposits from importers of uncoated groundwood paper from Canada based on these preliminary rates.

In 2016, imports of uncoated groundwood paper from Canada were valued at an estimated $1.27 billion.

The petitioner is North Pacific Paper Company (WA).

Commerce is currently scheduled to announce its final CVD determination on or about May 22, 2018. If Commerce makes an affirmative final determination and the U.S. International Trade Commission (ITC) makes an affirmative final injury determination, Commerce will issue a CVD order. If Commerce makes a negative final determination or the ITC makes a negative final determination of injury, the investigation will be terminated and no order will be issued.

Enforcement of U.S. trade law is a prime focus of the Trump administration. From January 20, 2017, through January 9, 2018, Commerce has initiated 82 antidumping and countervailing duty investigations – a 58 percent increase from 52 in the previous year.

The CVD law provides U.S. businesses and workers with an internationally accepted mechanism to seek relief from the harmful effects of foreign government unfair subsidization of imports into the United States. Commerce currently maintains 418 antidumping and countervailing duty orders which provide relief to American companies and industries impacted by unfair trade.

The U.S. Department of Commerce’s Enforcement and Compliance unit within the International Trade Administration is responsible for vigorously enforcing U.S. trade laws and does so through an impartial, transparent process that abides by international law and is based solely on factual evidence.

Imports from companies that receive unfair subsidies from their governments in the form of grants, loans, equity infusions, tax breaks, and low-priced production inputs are subject to “countervailing duties” aimed at directly countering those subsidies.

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, and the Honourable Jim Carr, Minister of Natural Resources, today issued the following statement regarding the U.S. Department of Commerce’s preliminary determination in the countervailing duty investigation on imports of Canadian uncoated groundwood paper:

“We are deeply disappointed with the unjustified preliminary countervailing duty rates announced today by the U.S. Department of Commerce.

"Any duties will have a direct and negative impact on U.S. newspapers, especially those in small cities and towns, and result in job losses in the American printing sector.

“Our government is committed to helping our forest industry enhance existing trade relationships and diversify trade with new international markets.

“Canada’s forest industry sustains good, middle-class jobs and provides economic opportunities for rural and Indigenous communities across our country. We will continue to work with our forest industry, provinces and territories, and communities across Canada to defend this vital sector against unfair and unwarranted U.S. trade measures and practices.”

The Globe and Mail. 10 Jan 2018. U.S. deals blow to Canadian newsprint producers with initial countervailing duties. Newsprint: Tariffs are expected to take effect within one week

BRENT JANG

Norpac is targeting products such as newsprint, directory paper, book-grade paper and groundwood printing and writing paper.

The U.S. Department of Commerce has decided to impose initial duties of up to 9.93 per cent against Canadian newsprint sold south of the border.

The Commerce Department made its ruling late Tuesday on countervailing duties, saying Canadian producers of uncoated groundwood paper such as newsprint are receiving subsidies.

A second decision is scheduled by March 7, when the Commerce Department will rule on whether to slap anti-dumping tariffs on Canadian shipments of groundwood into the United States.

U.S. newspaper publishers have been warning that a combination of countervailing and anti-dumping duties will have a devastating impact on an industry already struggling to cope as readers increasingly make the transition from printed products to digital devices.

A wide range of U.S. senators and members of the House of Representatives – Republicans and Democrats – have sided with American newspaper publishers and printers.

But groundwood from Canada is subsidized and being dumped at below market value, according to U.S. manufacturer North Pacific Paper Co., also known as Norpac.

The company, which is based in Longview, Wash., complained to the Commerce Department in August that U.S. paper makers are being hurt by Canadian groundwood.

The three mandatory respondents in the countervailing investigation into subsidies in Canada are Montreal-based firms Kruger Inc. and Resolute Forest Products Inc. and Catalyst Paper Corp. of Richmond, B.C.

The Commerce Department imposed a preliminary countervailing tariff of 9.93 per cent on Kruger, 6.09 per cent on Catalyst, 4.42 per cent on Resolute, 0.65 per cent on White Birch Paper Canada Co. and a weighted average of 6.53 per cent against other Canadian paper mills. The tariffs are expected to take effect within one week.

Norpac, owned by hedge fund One Rock Capital Partners LLC of New York, said subsidies in Canada include breaks on electricity rates and unfair financial assistance.

“Norpac has a world-class facility that can compete with anyone around the world, but we need to be able to compete on a level playing field. This decision will protect American jobs in Washington, Mississippi and Georgia, and may even serve to create jobs in the U.S. as idled paper machines restart,” Norpac chief executive officer Craig Anneberg said in a statement on Tuesday night. “While we understand the concerns recently surfaced by some newspaper publishers, we strongly disagree with the notion that their industry requires low-priced, government-subsidized, imported newsprint from Canada to sustain its business model.”

In sharp contrast to U.S. publishers’ warnings of potential devastation for small-town newspapers, Mr. Anneberg estimates that the impact of the Commerce Department’s countervailing ruling would be less than 5 cents (U.S.) for the average printed newspaper – “a small price to pay to preserve American manufacturing jobs.”

Resolute and Catalyst are the two mandatory respondents in the antidumping probe. Connecticut-based White Birch Paper Co., which runs three Quebec paper mills through its Canadian unit, is the voluntary respondent in both the countervailing and antidumping cases.

Norpac is targeting products such as newsprint, directory paper, book-grade paper and groundwood printing and writing paper. About 80 per cent of newsprint is sold directly to newspaper publishers, Norpac estimates.

Eight U.S. senators expressed their concerns in a joint letter last week to Commerce Secretary Wilbur Ross and U.S. Trade Representative Robert Lighthizer. “People in small towns all over America still depend on their local newspapers,” according to their letter, the latest in a series of political efforts to sway the Commerce Department.

The preliminary countervailing duties against Canadian newsprint producers come as Canada and the United States remain deadlocked during talks to renegotiate the North American free-trade agreement and amid the prolonged fight over softwood lumber.

THE GLOBE AND MAIL. JANUARY 10, 2018. TRADE DISPUTE. Canada takes U.S. to WTO in massive trade complaint

STEVEN CHASE, OTTAWA

ADRIAN MORROW, WASHINGTON

GREG KEENAN, TORONTO

The Canadian government is taking the United States to the world's trade court in a wide-ranging complaint that accuses Washington of brazenly flouting the rules of global commerce.

It's an unfriendly gesture between two countries that are each other's biggest trading partner and it appears intent on making the case that the United States has diverged from the rules-based international order that has been built up over successive multilateral trade deals.

Read also: NAFTA, Trump and Canada: A guide to the trade file and what it could mean for you

The Canadian government is complaining to the World Trade Organization that the United States is breaking WTO rules in the manner in which it prosecutes foreign countries for allegedly dumping or subsidizing imports bound for the United States.

The magnitude of the complaint is remarkable. It lists close to 200 cases stretching back 20 years and covering not just the U.S. treatment of Canadian companies but also its handling of imports from a multitude of countries.

In effect, the Canadian government is mounting this case not only for Canada but for the world. The complaint covers a multitude of U.S. imports from dozens of countries ranging from China to South Africa to Argentina.

A spokesman for Foreign Affairs Minister Chrystia Freeland said this challenge is tied to Canada's latest fight with the U.S. over softwood lumber. The U.S. government slapped punitive tariffs on Canadian exports to the U.S., alleging the goods are subsidized and being sold at below cost in American market.

"It's a pressure move," the spokesman said.

The Canadian government feels this case could add weight to an existing complaint to the WTO over the duties that Washington has levied on Canadian softwood.

It's possible other countries might join this complaint as intervenors, making it a bigger and more embarrassing problem for the U.S. government.

The World Trade Organization arose from a global agreement on international commerce – the General Agreement on Trade and Tariffs signed in the aftermath of the Second World War. The WTO emerged in 1995 after the Uruguay Round of GATT talks.

It's one of the hallmarks of the rules-based international order that countries such as Canada have pledged to defend in an era of rising protectionism both around the world and in the United States.

In the WTO complaint, Canada says the United States is breaking through rules in myriad ways, including retroactively applying duties on foreign imports it deems to be subsidized or dumped, and using the lowest price it can find – rather than the average – when calculating alleged subsidies.

Critics have accused the Trump administration of wanting to hobble the WTO. U.S. President Donald Trump has complained the organization, which came into being due to U.S. support, of being biased against American interest.

"The WTO was set up for the benefit [of] everybody but us . . . They have taken advantage of this country like you wouldn't believe," Mr. Trump told Fox News last year. "We lose the lawsuits, almost all of the lawsuits in the WTO."

REUTERS. JANUARY 10, 2018. Canada takes United States to WTO in complaint over trade remedies

Tom Miles

GENEVA (Reuters) - Canada has launched a wide-ranging trade dispute against the United States, challenging Washington’s use of anti-dumping and anti-subsidy duties, Canada said in WTO filing dated Dec. 20 and published on Wednesday.

Canada appeared to be mounting a case on behalf of the rest of the world, since it cited almost 200 examples of alleged U.S. wrongdoing, almost all of them concerning other trading partners, such as China, India, Brazil and the European Union.

The 32-page complaint homed in on technical details of the U.S. trade rulebook, ranging from the U.S. treatment of export controls to the use of retroactive duties and split decisions by the six-member U.S. International Trade Commission.

Canada said U.S. procedures broke the WTO’s Anti-Dumping Agreement, the Agreement on Subsidies and Countervailing Measures, the General Agreement on Tariffs and Trade and the Understanding on Rules and Procedures Governing the Settlement of Disputes.

Anti-dumping and countervailing duties - punitive tariffs to restrict imports that are unfairly priced or subsidized in order to beat the competition - are a core component of Washington’s trade arsenal, and frequently used to defend U.S. interests.

Such tariffs are allowed under WTO rules but they are subject to strict conditions.

The United States has been under fire for years about the way it calculates unfair pricing, or dumping. It has already lost a string of WTO disputes after its calculation methodology was ruled to be out of line with the WTO rulebook.

Under President Donald Trump, the United States has threatened to expand the use of punitive duties against China and has angered Beijing by refusing to accede to China’s demand to be treated as any other “market economy”.

Trump has also upset Canada by slapping punitive tariffs on Canadian softwood lumber exports, leading to a challenge by Ottawa at the WTO and the North American Free Trade Agreement.

Reporting by Tom Miles; Editing by Robin Pomeroy and Alison Williams

Global Affairs Canada. January 9, 2018. Foreign Affairs Minister advocates for Canada-United States trade in Washington

Ottawa, Canada - No two countries in the world share a stronger or more integrated economic relationship than the United States and Canada. The Government of Canada is working closely with the United States to strengthen our trade relationship and create new opportunities for workers, businesses and middle class families on both sides of the border.

As part of these efforts, the Honourable Chrystia Freeland, Minister of Foreign Affairs, visited Washington, D.C., today to meet with key representatives from the U.S. administration and the Senate and stress the importance of NAFTA as an engine of growth and prosperity for both countries.

The Minister met with Secretary of Commerce Wilbur Ross as well as senators Pat Roberts from Kansas, Lindsey Graham from South Carolina, Jeff Flake from Arizona, Lamar Alexander from Tennessee, Deb Fischer from Nebraska, Elizabeth Warren from Massachusetts and Joni Ernst from Iowa. The Minister also met with House Ways and Means member Dave Reichert, Representative for Washington’s 8th Congressional District.

Quotes

“Canada and the United States enjoy one of the closest relationships of any two countries in the world. We are friends, we are allies and we are partners. For 24 years NAFTA has created opportunities, jobs and a better life for our peoples. This is why, from day one of the negotiations, Canada has brought concrete proposals on how we can modernize NAFTA to the benefit of Canadian, American and Mexican citizens. We are focused on achieving real progress, including in Montréal later this month.”

- The Honourable Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick Facts

- Canada and the United States share the world’s longest secure border, over which approximately 400,000 people, and goods and services worth $2.4 billion, cross daily.

- Canada and the United States share one of the largest trading relationships in the world. Canada is the largest market for the United States–larger than China, Japan and the United Kingdom combined.

- Canada is the number-one export destination for most American states, and cross-border trade and investment support nearly 9 million jobs in the United States.

- Canada and the United States share values and interests on a range of international issues, including human rights, democracy, development, defence, nuclear non-proliferation and counterterrorism.

Canada and United States relations: http://international.gc.ca/world-monde/united_states-etats_unis/relations.aspx?lang=eng

NAFTA

The Globe and Mail. 10 Jan 2018. Why U.S.-dollar assets are best bet if NAFTA talks fail. Berman: Dollar doesn’t yet look as though it is reflecting the end of NAFTA

DAVID BERMAN

If the United States withdraws from the North American freetrade agreement, Canadian investors are going to be scrambling for the best ways to protect themselves from the economic fallout.

The best way: Simply buy U.S. dollars. Now.

Economists, strategists and analysts have been busy over the past several months forming contingency plans should NAFTA talks fail this year.

The latest round of talks begins Jan. 23, in Montreal, and the outlook is hardly optimistic among those in the know.

“I think the probabilities are increasing that you’ll have some type of dynamic where there is an announcement of a scrapping of NAFTA,” Dave McKay, chief executive officer at Royal Bank of Canada, told his audience at a financial conference on Tuesday.

No doubt, scrapping NAFTA could have a profound impact on many Canadian companies, but it’s unclear right now exactly what investors should be doing with their Canadian stocks because there are so many unknowns at this point.

BMO Nesbitt Burns released an exhaustive 42-page report on the subject on Tuesday, which underscored this complexity.

“We routinely receive questions from investors as to which companies would be affected the most if NAFTA is terminated. The answer is complex given the ensuing changes to the trade landscape,” Carl Kirst, director of U.S. equity research, and Bert Powell, director of Canadian equity research, said in their introduction to the BMO report.

That is, what would take NAFTA’s place? It could be a bilateral free-trade agreement between Canada and the United States that leaves out Mexico. Or it could mean World Trade Organization-level tariffs. Or even a zombie-NAFTA, in which the Trump administration terminates the agreement but the U.S. Congress and business groups put up resistance.

And, of course, NAFTA could be renegotiated under different terms.

So when it comes to making calls on key sectors and companies, analysts can do little more than sketch out various scenarios.

Auto parts? Peter Sklar, a BMO analyst who covers the sector, believes the termination of NAFTA would cause an immediate sell-off in auto-parts stocks, including Magna International Inc., given his view the stocks are not reflecting this outcome.

But termination of NAFTA could lead to very high U.S. tariffs, lower most-favoured-nation tariffs or a bilateral free-trade agreement – each with remarkably different outcomes for auto-parts companies. For now, Mr. Sklar has a “market perform” recommendation on Magna, suggesting he sees little reason to run from the stock.

How about apparel retail? John Morris, a BMO analyst, noted Lululemon Athletica Inc. already imports its yogawear from outside North America. Canada Goose Holdings Inc. is more vulnerable, but Mr. Morris believes the company could share some of the pain with wholesalers and consumers. He has a “buy” recommendation on the stock.

Canadian railways could get hit by lower trade volumes crossing the U.S. border: Crossborder trade accounts for an estimated 30 per cent of revenue for Canadian National Railway Co. and Canadian Pacific Railway Ltd.

But BMO has “outperform” recommendations on both stocks, so again, the threat seems too vague to actually sell the stocks and run.

In contrast, though, betting the Canadian dollar will decline looks to be an opportunity that has some upside, and very little downside, should NAFTA survive.

The BMO report is peppered with the forecast that termination of the trade agreement would send the loonie down about 5 per cent as the Bank of Canada reacted to the prospect of weaker domestic economic activity.

“It is critical to note that policy would not stand still in the event of a negative outcome for NAFTA,” Douglas Porter, BMO’s chief economist, said in the report, pointing to looser monetary policy as an example.

If the Canadian dollar could fall against the U.S. dollar, then buying U.S.-dollar assets today – perhaps U.S. stocks, U.S. fixed-income exchange-traded funds or even plain cash – looks like a good idea. On top of whatever you might earn through dividends, distributions or capital gains, there’s also the potential for a 5-per-cent currency tailwind.

With the loonie trading above 80 cents against the greenback – up more than 2 cents since mid-December and up 7 cents since May – the Canadian dollar doesn’t look as though it is reflecting the end of NAFTA yet.

And if NAFTA survives unscathed? Then rising U.S. interest rates could give you a currency tailwind anyway. Or, at worst, you’ve diversified beyond the Canadian dollar at a decent price.

BLOOMBERG. 10 January 2018. Trump’s Nafta Ideas Are a ‘Lose-Lose-Lose’ for Carmakers, Magna Says

By Gabrielle Coppola

- If pact is too complex, regional automakers can’t compete: CEO

- Mexico Nafta chief signaled common ground on U.S. content goal

If North American car companies “don’t have a functional Nafta -- if it becomes too complicated, too bureaucratic, too costly that you can’t get low-cost, high-labor products into this region -- then all of a sudden we have damaged the whole Nafta region,” said Magna International Inc. Chief Executive Officer Don Walker. “It’s going to be a lose-lose-lose.”

When the sixth round of talks to update the North American Free Trade Agreement begins later this month in Montreal, the Trump administration’s demand for more regional -- and specifically more U.S. -- auto content will be on the negotiating table. Although Canadian and Mexican parties originally balked at the proposal to require vehicles have 85 percent Nafta-sourced parts with half coming from the U.S. to avoid duties in the region, Mexico’s Economy Minister signaled Tuesday there may be common ground on the goal of strengthening regional content.

The Montreal talks are “crucial because it’s the first time we have to send clear signals of where we find possible accommodations,” Ildefonso Guajardo told a gathering of Mexican diplomats. For the car industry, “the solution is without a doubt for a strengthened rule of origin in regional automotive content.”

“It sounds like it’s still an uphill battle,” Walker said in an interview Tuesday at CES in Las Vegas. “The question is can they come up with something that all three parties can agree with.”

Magna is among the most protected of Canadian auto-parts manufacturers from a U.S.-specific requirement with about 48 percent of the Aurora, Ontario-based company’s North American plants and equipment located in the U.S. already, according to data compiled by Bloomberg. But it’s the top supplier to carmakers including General Motors Co., Ford Motor Co., and Fiat Chrysler Automobiles NV, and tightening the rules could make it harder for its customers to compete.

“My belief is Nafta should be an efficient trading unit against Europe, China and the rest of Asia,” Walker said. “If we do things internally that drive the cost up and drive us to be less efficient, other regions of the world will look at that and say, ‘That was a great outcome because now we’re more competitive.’ Everyone wants to sell their vehicles under Nafta: It’s a huge market.”

— With assistance by Eric Martin, and Josh Wingrove

BLOOMBERG. 9 January 2018. Trudeau Team Targets Pro-Nafta Republicans Ahead of Fresh Talks

By Josh Wingrove

Justin Trudeau’s lead Nafta minister is reaching out to many of the Republican senators urging the Trump administration to stave off the trade pact’s collapse.

Foreign Affairs Minister Chrystia Freeland met Tuesday with Commerce Secretary Wilbur Ross, a regular critic of the status quo for the North American Free Trade Agreement between the U.S., Canada and Mexico, according to a statement from her office.

With the sixth round of negotiations set to begin in two weeks in Montreal, Freeland was also due to meet with top Republicans who have publicly supported Nafta. They include Arizona’s Jeff Flake, Tennessee’s Lamar Alexander, Pat Roberts of Kansas, Nebraska’s Deb Fischer and South Carolina’s Lindsey Graham, according to a statement from Freeland spokesman Alex Lawrence.

Freeland was also due to meet Democratic Senator Elizabeth Warren of Massachusetts and Republican Congressman Dave Reichert, a member of the powerful Ways and Means Committee, Lawrence said.

A mini-round of Nafta talks in December yielded little progress and Trudeau says Nafta is the file that worries him most. Royal Bank of Canada Chief Executive Officer David McKay said Tuesday the chances of a Nafta withdrawal notice are rising.

EMPLOYMENT

The Globe and Mail. BLOOMBERG. 10 Jan 2018. Poloz can sleep soundly: The Canadian kids are all right. The latest figures show more than half of youth between ages 15 to 24 have a job, the highest share since 2009

LUKE KAWA

Bank of Canada Governor Stephen Poloz cited in his last speech of 2017 “the tough job market for young people” as one of a trio of things keeping him awake at night.

The data, however, should prove a soothing lullaby.

The rising tide of Canadian employment – which has expanded for 13 straight monthly readings, punctuated by a whopping addition of 78,600 jobs in December – has been lifting even the youngest boats. The latest data show 57.2 per cent of Canadians between the ages of 15 to 24 have a job, the highest share since January, 2009. The past calendar year saw the largest improvement in the employment rate for this age bracket since 2002.

“Labour markets are healthy, with falling youth participation the result of increasing education levels – a positive longterm development,” Brian DePratto, senior economist at Toronto-Dominion Bank, said in a research note Tuesday on the issue.

For Mr. Poloz, suboptimal outcomes among young Canadians would be a cause for concern. Their lack of participation limits the top speed at which the economy can grow, while impressionable youth who can’t make their way into the labour market may end up grappling with “a scar that could last a lifetime.”

In his December speech, the governor bemoaned how the youth labour-force participation rate had fallen nearly five percentage points over the past decade. His concern about youth employment is perceived as a dovish signal, an indication he sees continued slack in what is otherwise a red-hot labour market.

Mr. DePratto thinks the concern is overplayed. “This is an area where we disagree that the signal is worrisome,” according to the TD report. “To begin with, a decade ago was a precrisis cyclical high” for youth participation rates “and so perhaps should not be viewed as the best point of comparison”

Young Canadians not in school are just as likely to be in the labour force as they were a decade ago, Mr. DePratto notes, with the participation rate among non-students currently just off its postcrisis peak.

Digging more deeply into the data, subdued youth participation is acutely attributable to Canadian teenagers: a group with a historically low rate of labour-force attachment.

“The data suggest that any deviations in participation have been driven by high school kids changing their behaviour,” said Randall Bartlett, chief economist at the Institute of Fiscal Studies and Democracy. “That doesn’t support the narrative that monetary policy should be formulated on the basis of any supposed weakness in these youth labour-market metrics.”

Indeed, more than 90 per cent of young Canadians outside of the labour force say they don’t want work.

That means the room for cyclical improvement in youth underemployment seems fairly limited, no matter what the central bank does.

The Bank of Canada’s main tool – changes to short-term interest rates – is considered to be a particularly blunt means of influencing economic activity.

Unemployed youth are more likely to look for a part-time job – a sign that a rising youth employment rate might not pack all that big of a punch for the growth of labour input. For example, less than one-fifth of young workers who have a part-time gig say they really want full-time employment, a share that has fallen for three consecutive years.

“Finding a negative story in the employment data is something of a data-mining exercise,” Mr. DePratto writes.

That’s reflected in the fact that all of the country’s six biggest commercial lenders are now predicting the Bank of Canada will raise its policy rate by 25 basis points to 1.25 per cent next week, on the heels of an unemployment rate that’s dropped to its lowest level in more than 40 years and signs that companies are reaching capacity constraints.

“There’s probably less slack in the labour market than there even is in the economy – for me, that’s a big concern and it should be for the bank,” Mr. Bartlett said.

THE GLOBE AND MAIL. JANUARY 10, 2018. Canada's (marvelous?) jobs market: Better than you think or something more ominous?

MICHAEL BABAD, Columnist

Views of the labour market

The beauty of Canada's jobs market appears to be in the eye of the beholder.

Most economists applauded Friday's labour report from Statistics Canada, which showed a spectacular number of jobs created in December and an unemployment rate down to its lowest in decades.

But there are those who say it's even better than it looks, and at least one who questions why Bay Street gushed and the Canadian dollar rose on bets that Friday's strong report signalled an interest rate hike next week.

That view solidified on Monday after an optimistic business outlook survey released by the Bank of Canada. Observers now believe central bank governor Stephen Poloz, senior deputy Carolyn Wilkins and their colleagues will raise their benchmark overnight rate by one-quarter of a percentage point to 1.25 per cent.

"After [Monday's] business outlook survey confirmed there is little slack left in the economy, we officially pulled forward our call for the Bank of Canada to raise rates next week, rather than in March," said Bank of Montreal senior economist Sal Guatieri.

"For a data-dependent bank with an eye on capacity pressures, the survey, coupled with another stellar jobs report, greatly raises the odds on a Jan. 17 move … even as Q4 GDP growth looks to fall shy of the bank's estimate," he added.

"We expect follow-up moves in July and October, with the lengthy pause reflecting concerns at NAFTA trade talks, new mortgage rules and the sensitivity of indebted households."

Mr. Guatieri was referring to troubled negotiations to remake the North American free-trade agreement, the commercial bank regulator's new mortgage qualifying rules, and how the central bank's two 2017 rate hikes might be affecting consumers who have among the highest debt burdens in the world.

Here are some views:

What Statistics Canada reports

The federal agency's monthly labour force survey showed a net 78,600 jobs created in December, most of them part-time positions.

The number of employed Canadians rose to 18.65-million from 18.57-million, and the number without work eased to 1.13-million from 1.16-million.

All of this brought total jobs created last year to 423,000, a jump of 2.3 per cent and most of it in full-time work.

Unemployment, in turn, eased to 5.7 per cent, down by 1.2 percentage points over the course of 2017 to mark the lowest in at least about four decades, based on comparable numbers.

Unemployment among our young people inched down in December to 10.3 per cent from November's 10.8 per cent, a marked easing of 2.3 percentage points over the course of 2017.

This is a monthly surrvey whose findings have raised eyebrows among economists before, with Statistics Canada standing by the numbers.

State of the labour market

"The two-month slide in the jobless rate is the largest such drop since the 1990s," said BMO chief economist Douglas Porter.

"After essentially being landlocked around the 7-per-cent mark for almost four years, the unemployment rate has come a tumblin' down since late 2016," he added.

If Canadian unemployment were measured in the same manner that the U.S. does it, Canada's jobless rate would be 4.8 per cent, Mr. Porter noted.

Which, of course, has a ripple effect.

"In turn, this significant tightening – and we judge that full employment is consistent with a jobless rate of 5.5 per cent to 6 per cent – is beginning to put some upward pressure on wages. Combined with the 20-per-cent rise in Ontario minimum wages at the start of 2018, we could easily see average earnings rise by well over 3 per cent this year."

Because a drop in unemployment can at times be attributed to people dropping out of the work force because they're fed up trying to find a job, Mr. Porter noted that this was not the case.

"December's data quashed that view in a hurry," he said.

"The participation rate for those aged 15-64 reached an all-time high in the month at 78.7 per cent (All of 2017 was a record annual high, as well, so the latest month was no fluke.)"

Another tidbit, this one from Mr. Guatieri: Unemployment in manufacturing has never been lower, having led the way in 2017.

"Despite flat exports, the sector punched well above its weight in job creation last year," he said.

"The 85,700 net new jobs (the most since 2002) accounted for 20 per cent of the total, double the sector's share. Of course, factory employment is still lower than it was four decades ago, and few expect a repeat performance in 2018. Still, workers in the sector can breathe easier, barring an abrupt turn toward trade protectionism."

Better than it looks

Pretty good, right? In fact, it's "even better than you think," according to Benjamin Tal of CIBC World Markets.

The number alone are impressive, said Mr. Tal, but he looked deeper. Here's what he found:

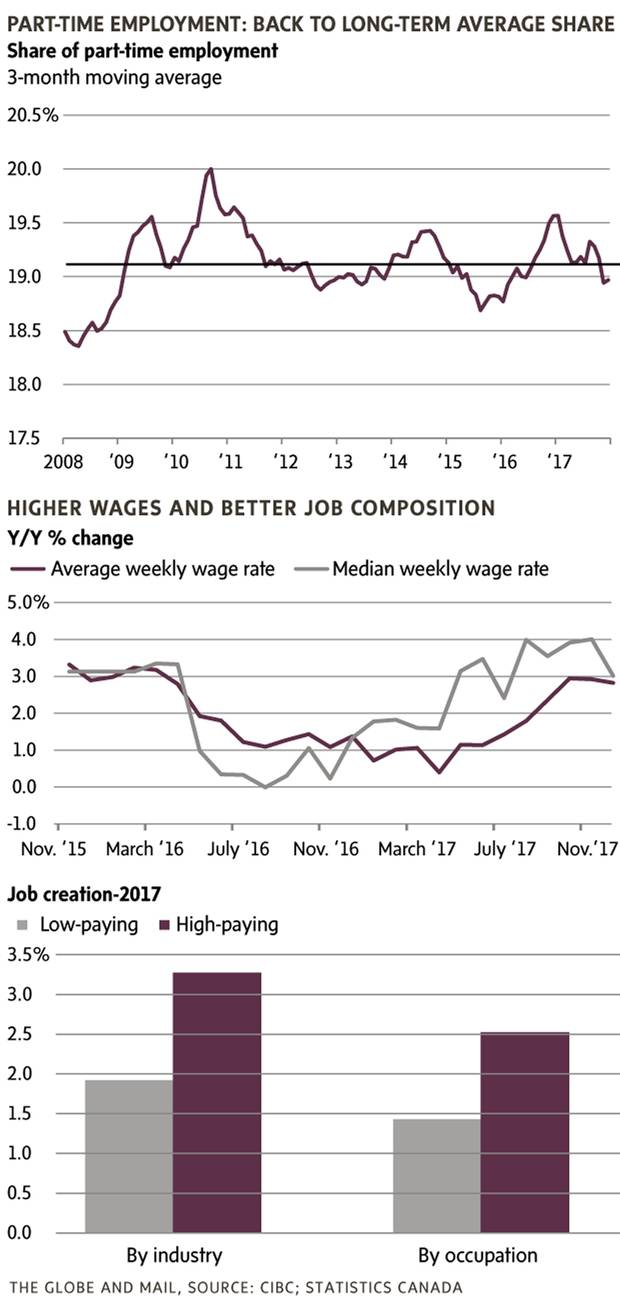

After a run-up in 2016, part-timers are now back to their long-term average sale of overall employment.

Like BMO's Mr. Porter, Mr. Tal noted that pay is on the rise, with both average and median wages perking up, which suggests "broadly based and more inclusive wage gains."

But wait, there's more.

"Even more important has been the improvement in the composition of job creation," Mr. Tal said in his study, released today.

"Regardless of how you measure it, by industry or by occupation, the number of high-paying jobs rose faster last year than the number of low-paying jobs," he added.

"So with wage inflation and job composition pointing in the same direction, real labour income is now rising at its fastest rate in five years."

Youth unemployment is also lower than you'd think because the number takes in those between the ages of 15 and 18 who are still in school, but also looking for jobs.

"It's reasonable to suggest that many of these high-school students should not be classified as unemployed as their main activity is learning," Mr. Tal said, adding that the real overall rate for young folks would be a record low 7 per cent.

"In fact, this factor also works to reduce the headline national unemployment rate by close to 0.5 per cent. That is, if it was not for the 'unemployed' high-school students, the Canadian unemployment rate in December, 2017, would have been 5.2 per cent, as opposed to the headline number of 5.7 per cent."

But hold on, now

David Rosenberg doesn't buy it.

The chief economist at Gluskin Sheff + Associates has damned the overall sentiment for a couple of days now, warning the jobs market isn't as good as you'd think and that it's ridiculous to suggest that it should sway the Bank of Canada next week.

I documented Mr. Rosenberg's comments Tuesday, and you can find them here.

But he returned to the subject in his daily research note again Wednesday, and adding more.

Among his additional points were that 35,600 jobs were lost in December among those between the ages of 20 and 24, the worst showing since April, 2006.

Private-sector jobs in Ontario – "the country's backbone – declined by 5,000 to mark the first loss since April And full-time jobs fell by 13,200.

In Quebec and British Columbia, jobs on the goods-producing side declined by 5,500 and 4,100, respectively.

He also questioned the official, dramatic gain in jobs in Quebec, particularly in the financial industry, where employment rose in December by more than "in the previous 10 years combined!"

And then there's Alberta, where 26,300 jobs were added, a development "that has happened two other times in the past and in the context of an energy boom that we know is not happening today," Mr. Rosenberg said.

"That is equivalent to the U.S. economy generating more than a million jobs in a month," he added.

"As if. And the situation in Alberta was about accommodation and food services - practically an unheard of 8,900 such jobs added in that sector in the province last month. Must have been all that great egg nog being served at the Chateau Lake Louise."

Mr. Rosenberg noted the exceptional rise over a short period in speculation that the central bank will raise rates next week.

"And not just next week, but that the markets now feel three BoC moves for the entire year are a fait accompli?" he said.

"I smell an opportunity here to go long the front end of the Canada curve and resist this recent up-leg in the loonie."

For the record

We should never lose sight of the broader look, notably Statistics Canada's "R8" measure of underployment, which includes discouraged job seekers, those waiting to be recalled, and part-timers who want a full-time job. That measure is down, to be sure, but it still stands at about 8 per cent.

So we'll see where the Bank of Canada comes down on things next week.

"Of course the Bank of Canada will be the first to tell you that the headline numbers are insufficient to justify a shift to a more aggressive rate hiking mode," said CIBC's Mr. Tal.

"You have to dig deeper in search of fragilities that might jeopardize the current expansion and the durability of the recent improvement in wage inflation."

The one thing we can count on is uncertainty, from the NAFTA bargaining table to the monthly mortgage bill, as the central has noted.

"The labour market of 2018 will be tested," Mr. Tal said.

"Minimum wage hikes will act as a negative for job creation as will the headwind blowing from the tricky NAFTA negotiations. The ultimate impact of those forces is unknown. But what we do know is that the labour market is well positioned to face what's coming."

TOURISM

StatCan. 2018-01-10. National tourism indicators, third quarter 2017

- Tourism spending in Canada: $21.8 billion, Third quarter 2017, 1.5% increase (quarterly change)

- Source(s): CANSIM table 387-0001: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3870001&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Tourism spending in Canada rose 1.5% in the third quarter, the same rate as in the second quarter. The increase was driven by tourism spending by Canadians at home, as spending by international visitors in Canada declined.

Chart 1: Tourism spending in Canada increases

Tourism spending by Canadians rises

Tourism spending by Canadians in Canada grew 2.0% in the third quarter, compared with a 1.9% increase in the previous quarter.

Growth was driven by increased expenditures on passenger air transport, which grew at the fastest pace (+6.1%) since the first quarter of 2011. Spending on food and beverage services (+1.9%), pre-trip expenses, such as luggage and motor homes (+2.1%), and accommodation (+1.0%) also increased.

Spending on vehicle fuel (-0.9%) fell in the third quarter, as well as spending on interurban bus transport (-2.1%), which continued to decline because of falling demand.

Chart 2: Tourism spending by Canadians at home increases

Tourism spending by international visitors decreases

Spending by international visitors to Canada decreased 0.4% in the third quarter, after edging up 0.2% in the second quarter.

Lower expenditures on passenger air transport (-1.5%) accounted for most of the decline, followed by food and beverage services (-0.5%) and accommodation (-0.3%).

Chart 3: Decrease in tourism spending by international visitors

Tourism gross domestic product outpaces total economy

Tourism gross domestic product (GDP) grew 1.7% in the third quarter, a faster rate than third-quarter national GDP (+0.6%).

The growth in tourism GDP was driven mainly by transportation (+3.2%) and accommodation (+2.7%). The tourism GDP of food and beverage services (+1.3%) also increased.

Tourism employment rose 0.5% in the third quarter, following 1.1% growth in the previous quarter, led by food and beverage services (+1.1%) and accommodation (+0.8%). Tourism jobs in travel services (-1.1%) and air transportation (-0.5%) decreased.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180110/dq180110b-eng.pdf

ENERGY

REUTERS. JANUARY 9, 2018. U.S. crude inventory fall buoys oil, worries about rally persist

David Gaffen

NEW YORK (Reuters) - Crude oil prices rose but backed away from multi-year highs on Wednesday after U.S. government data showed an increase in fuel inventories and a falloff in refining activity.

U.S. crude inventories fell 4.9 million barrels last week, more than the 3.9-million decline forecast, but bigger-than-expected builds in gasoline and fuel stocks offset that drawdown, the Energy Information Administration reported. [EIA/S]

The market was also bolstered modestly by data showing a sharp decline in U.S. production last week that analysts say could have been the result of extreme cold temperatures across the United States to start the year.

“The lower draw in crude oil stocks, combined with the strong builds in product stocks is bearish news for prices. But market participants could also use the sharp drop in production as an excuse to buy,” said Carsten Fritsch, oil analyst at Commerzbank AG in Frankfurt, Germany.

U.S. West Texas Intermediate (WTI) crude futures were at $63.28 a barrel, up 33 cents, by 11:05 a.m. EST (1605 GMT). Earlier in the session, prices hit $63.67, their highest since Dec. 9, 2014.

Brent crude futures were at $69.02 a barrel, 20 cents above their last close. Brent earlier hit $69.37, its highest since May 2015.

A broad, global market rally, including stocks, has also been fueling investment into crude oil futures. [MKTS/GLOB]

The oil market has been buoyant in the last several weeks, with U.S. crude futures at highs not seen since late 2014, and Brent crude less than $1 per barrel away from a milestone that would, too, be a high point since that same time.

Oil prices have risen more than 13 percent since early December, and there are indications of overheating. Analysts warned that the market is ignoring U.S. production increases at its peril.

The rally has brought out some concerns that the market could overheat, especially as U.S. production is expected to rise to new records later in the year.

On Tuesday, the EIA boosted its expectations for production in coming months, and now sees overall production at record highs, surpassing 11 million barrels per day (bpd) by 2019.

U.S. crude oil production is expected to hit 10 million bpd next month, leaving only Russia and Saudi Arabia at higher levels.

Members of the Organization of the Petroleum Exporting Countries fear current price gains could prompt U.S. shale oil companies to flood the market. OPEC, along with non-members including Russia, cut supply by 1.8 million bpd in a late 2016 agreement that has been extended through the end of this year.

The cuts were aimed at reducing a global supply overhang that had dogged oil markets since 2014.

Additional reporting by Libby George in London and Henning Gloystein and Roslan Khasawneh in Singapore; Editing by Marguerita Choy and David Evans

REUTERS. JANUARY 8, 2018. U.S. crude hits three-year high as prices climb in tight market

Devika Krishna Kumar

NEW YORK (Reuters) - Oil prices edged higher on Tuesday, with U.S. crude touching its highest since December 2014, supported by OPEC-led production cuts and expectations that U.S. crude inventories have dropped for an eighth week in a row.

The Organization of the Petroleum Exporting Countries and allies including Russia are keeping supply limits in place in 2018, a second year of restraint, to reduce a price-denting glut of oil held in inventories.

U.S. West Texas Intermediate (WTI) crude rose $1.23, or 2 percent, to settle at $62.96 a barrel after touching its highest since December 2014 at $63.24.

Brent crude ended the session up $1.04, or 1.5 percent, at $68.82 per barrel after hitting a session high of $69.08, its highest since May 2015. Both contracts had their strongest close since December 2014.

Prices extended gains in post-settlement trade after industry group the American Petroleum Institute said crude inventories fell by 11.2 million barrels in the week to Jan. 5 to 416.6 million, compared with analysts’ expectations for a decrease of 3.9 million barrels. [API/S]

If confirmed by U.S. government data at 10:30 a.m. EST (1530 GMT) on Wednesday, the draw will be the largest since Sept. 2, 2016. U.S. stockpiles fell by 14.5 million barrels during that week.

“You’re so long this market at this point, you could certainly get more interest at these levels,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management.

“This is a little more confirmation of what speculators have been looking for and after tomorrow’s (U.S. government inventory) report, we’ll see if they look to do some profit-taking.”

OPEC is cutting output by even more than it promised and the restraint is reducing oil stocks globally, a trend most visible in the United States, the world’s largest and most transparent oil market. [OPEC/O]

“We expect oil demand growth to outpace non-OPEC supply growth in both 2018 and 2019,” Standard Chartered analysts said in a note.

“In our view, the back of the Brent and WTI curves are both still underpriced. We do not think that prices below $65 per barrel are sustainable into the medium term.”

Many producers, still suffering from a 2014 price collapse, are enjoying the rally, although they are wary it will spur rival supply sources. Iran said OPEC members were not keen on increased prices.

The rise in prices is expected to drive gains in U.S. production during 2018, offsetting curbs by others.

U.S. crude oil production is expected to surpass 10 million barrels per day (bpd) next month, en route to an all-time record months ahead of previous forecasts, the U.S. Energy Information Administration said Tuesday.

Production was expected to rise to an average 10.04 million bpd during the first quarter of this year.

Some analysts have said the rise in U.S. shale oil production could discourage OPEC and Russia to maintain their deal to curb supply until the end of the year for fears of losing market share.

“I am now on the lookout for bearish technical patterns to emerge on oil prices as I believe they will struggle to go north of $65-$75 per barrel given the above fundamental consideration,” said Fawad Razaqzada, technical analyst for Forex.com.

“If WTI were to go back below the 2017 high of $60.48, which was hit late in the year, and the 2018’s opening price of $60.09, then the technical outlook would turn bearish on oil. But for now, the bullish trend remains intact as prices remain above key supports.”

Additional reporting by Alex Lawler in London, Henning Gloystein in Singapore; editing by David Gregorio and Diane Craft

________________

LGCJ.: