CANADA ECONOMICS

INFLATION

StatCan. 2018-01-26. Consumer Price Index, December 2017

- Consumer Price Index, December 2017: 1.9% increase (12-month change)

- Source(s): CANSIM table 326-0020: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3260020&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

The Consumer Price Index (CPI) increased 1.9% on a year-over-year basis in December, following a 2.1% gain in November. The all-items excluding gasoline index rose 1.5% year over year in December, matching the increase in November.

Chart 1: The 12-month change in the Consumer Price Index (CPI) and the CPI excluding gasoline

12-month change in the major components

Prices were up in seven of the eight major CPI components in the 12 months to December, with the transportation and shelter indexes contributing the most to the increase. The household operations, furnishings and equipment index declined 0.3% on a year-over-year basis.

Chart 2: Consumer prices increase in seven of the eight major components

Consumer prices for transportation rose 4.9% on a year-over-year basis in December, following a 5.9% increase in November. The movement in transportation prices was led by gasoline, which rose 12.2% year over year in December, after increasing 19.6% the previous month. The purchase of passenger vehicles index increased 3.7% in the 12-month period ending in December.

The shelter index grew 1.4% on a year-over-year basis in December, after increasing 1.2% in November. The natural gas index contributed to the gain in this major component, up 6.2% in December following a 3.1% increase in November.

Consumers paid 2.0% more for food in December compared with the same month the previous year. Food purchased from stores was up 1.5% in the 12 months to December. On a year-over-year basis, higher prices for fresh vegetables (+6.9%) contributed the most to the increase. Prices for food purchased from restaurants rose 2.9% year over year in December.

Household operations, furnishings and equipment costs fell 0.3% on a year-over-year basis in December, after increasing 0.9% in November. This decline was largely due to price decreases in telephone services, down 5.0% year over year in December.

12-month change in the provinces

Consumer prices rose less on a year-over-year basis in eight provinces in December than they did in November. New Brunswick (+2.9%) and Quebec (+1.8%) were the only provinces to post a larger increase on a year-over-year basis in December, compared with the previous month.

Chart 3: Consumer prices rise at a slower rate in eight provinces

The CPI in Alberta rose 2.0% in December on a year-over-year basis, after increasing 2.5% in November. On a month-over-month basis, the gasoline index (-6.8%) in Alberta declined the most among the provinces. Consumers paid higher prices for natural gas (+5.1%) year over year in December.

Consumer prices in Ontario increased 1.5% in the 12 months to December, following a 1.9% gain in November. The telephone services index decreased 6.5% year over year after increasing 3.3% in November, contributing to the slower growth of the CPI in Ontario. Traveller accommodation prices rose 3.0% year over year in December, following a 4.7% increase in November.

The CPI in New Brunswick rose 2.9% in December on a year-over-year basis, after increasing 2.7% in November. Among the provinces, New Brunswick recorded the largest price gain for dairy products, up 2.6% in the 12 months to December. This movement was largely attributable to a monthly decline one year earlier which no longer factors into the 12-month movement.

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI increased 0.2% in December, following a 0.5% gain in November.

In December, six major components increased, while two declined. The transportation index (+0.6%) recorded the largest gain, while the household operations, furnishings and equipment index (-1.1%) registered the largest decrease.

Chart 4: Seasonally adjusted monthly Consumer Price Index

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180126/dq180126a-eng.pdf

THE GLOBE AND MAIL. JANUARY 26, 2018. Inflation slows to 1.9 per cent as consumers get a holiday season price break

DAVID PARKINSON, ECONOMICS REPORTER

Canada's inflation rate dipped back below 2 per cent in December, taking a pause after its November surge, as declining gasoline prices and holiday season discounting gave consumers an end-of-year break.

Statistics Canada reported that the consumer price index slumped 0.4 per cent month over month in December. On a year-over-year basis, CPI inflation ended 2017 at 1.9 per cent, down from 2.1 per cent in November.

The decline was led by gasoline, down 3.3 per cent from November. Prices for home entertainment equipment fell 3.4 per cent, and clothing and footwear fell 3 per cent, evidence of holiday season price cuts. Telephone service prices also tumbled nearly 8 per cent, reflecting a December price war among major cell phone providers.

On the other side of the ledger, food prices were up 0.3 per cent month over month.

Economists had anticipated weakness in December inflation, due to the falling prices at the gas pump as well as retailers' typical late-holiday sales. The holiday effects make December a routinely slow month for inflation: It has declined month over month in nine of the past 10 years.

On a seasonally adjusted basis, factoring out routine end-of-year price cuts, the CPI was actually up 0.2 per cent in December, adding to November's 0.5-per-cent gain.

"We're hardly chalking this up as a negative inflation report," Canadian Imperial Bank of Commerce economist Nick Exarhos said in a research note. "Indeed, much of the weakness in December was tied to gasoline, something we know will more than reverse in the months ahead given the performance of crude prices." (The benchmark North American price for crude oil, the raw material for gasoline, has risen nearly 10 per cent in the past month.)

Still, the December retreat leaves the annual inflation rate slightly below the Bank of Canada's 2-per-cent policy target, its most important guide for setting interest rates. But tellingly for the central bank, its three preferred measures of so-called "core" inflation – those that attempt to remove isolated and short-term gyrations to gauge the underlying inflationary pressures affecting the broader economy – actually edged higher, averaging 1.8 per cent, up from 1.7 per cent in November.

Economists said the overall inflation picture in December looked strong enough to keep the Bank of Canada on track to continue raising interest rates this year, albeit likely slowly and cautiously. The central bank has repeatedly used the word "cautious" for the past several months to describe its approach to future rate increases, even as it raised rates by a quarter of a percentage point earlier this month – its third such increase since last July.

While evidence has been building over the past several months that inflationary pressures are increasing, warranting continuing to raise rates from their historically low levels of the past several years, most economists still see little danger of inflation overheating much beyond the Bank of Canada's target.

"The big picture view is that headline and core inflation are slowly grinding higher, but are mostly staying close to 2 per cent," said Douglas Porter, chief economist at Bank of Montreal, in a research report. "In a nutshell, this is firm enough to keep the Bank [of Canada] in tightening mode, but still mild enough to keep the tightening pace gradual and 'cautious.'"

Speaking this week at the global gathering of economic and business leaders in Davos, Switzerland, Bank of Canada Governor Stephen Poloz reiterated that the bank remains "totally data dependent" in terms of deciding on further rate increases this year. From that standpoint, the inflation data continue to make the case for a continued gradual rate increases this year. The bond market is giving about even odds for another quarter-point rate hike by April, and 90-per-cent likelihood that such a hike will come by July.

However, Mr. Poloz acknowledged the central bank is also "NAFTA dependent." It's a further indication that he is trying to balance a growing economy, tightening labour market and rising inflationary pressures against the risk of a collapse of the renegotiations of the Canada/U.S./Mexico trade pact – which, if it were to happen, could deliver a serious shock to Canada's economic growth story.

"Risks and uncertainty may result in increased caution, but ultimately, achieving the [central bank's 2-per-cent] inflation control target will require further monetary tightening," said Brian DePratto, senior economist at Toronto-Dominion Bank, in a research note. "We remain of the view that the balance of risks versus fundamentals favours the next rate hike falling in July."

StatCan. 2018-01-26. Consumer Price Index: Annual review, 2017

- Annual Average CPI, 2017: 1.6% increase (annual change)

- Source(s): CANSIM table 326-0021: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=3260021&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

In 2017, the annual average increase in the Consumer Price Index (CPI) was 1.6%. This increase followed gains of 1.4% in 2016 and 1.1% in 2015.

Chart 1: Annual average change in the Consumer Price Index (CPI) and the CPI excluding gasoline, 2007 to 2017

Higher gasoline prices contribute to faster growth in consumer prices

Consumer prices for gasoline rose 11.8% on an annual average basis in 2017. This increase follows two consecutive declines in gasoline prices in 2015 and 2016.

Excluding gasoline, the annual average increase in the CPI was 1.3% in 2017, following a 1.8% gain the previous year.

Prices rise in seven of eight major components

Prices were up on an annual average basis in seven of eight major components in 2017. For the second consecutive year, the clothing and footwear index (-0.7%) was the lone major component to record an annual average decrease.

Chart 2: Consumer prices increase in seven of eight major components

On an annual average basis, transportation prices increased 3.9% in 2017, following a 1.1% gain in 2016. The primary upward contributor was the gasoline index, which rose 11.8% on an annual average basis in 2017 following a 6.0% decline in 2016.

The shelter index recorded a 1.7% annual average increase in 2017, following a 1.6% gain in 2016. Prices for fuel oil and other fuels (+13.7%) and natural gas (+9.3%) increased in 2017 after declining the previous year. Meanwhile, the electricity index fell 5.6% on an annual average basis following a 5.7% increase in 2016.

Food prices increased 0.1% on an annual average basis in 2017, after rising 1.5% in 2016. Higher prices for food purchased from restaurants (+2.6%) were largely offset by lower prices for food purchased from stores (-1.0%). Prices for fresh fruit (-3.1%) and fresh vegetables (-1.9%) fell after increasing in 2016. The dairy products index (-1.2%) recorded a larger annual average decline in 2017 than in 2016 when it decreased 0.8%.

Consumer prices for household operations, furnishings and equipment rose 0.2% on an annual average basis in 2017, following a 1.7% increase in 2016. Furniture prices fell 1.6% after increasing 1.3% the previous year. The household appliances index (-1.4%) also registered an annual average decline in 2017, following an increase in 2016. Prices for telephone services (-0.5%) declined more in 2017 than in 2016, when they decreased 0.2%.

Consumer prices rise at a faster rate in seven provinces

All provinces posted gains in consumer prices in 2017, with seven provinces recording larger annual average increases in 2017 than in 2016. The annual average CPI increased the most in Newfoundland and Labrador (+2.4%) and New Brunswick (+2.3%) in 2017.

Chart 3: Consumer prices rise at a faster rate in seven provinces

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/180126/dq180126b-eng.pdf

REUTERS. JANUARY 26, 2018. Canada annual inflation cools in Dec as gasoline prices drop

Leah Schnurr

OTTAWA (Reuters) - Canada’s annual inflation rate dipped as expected in December as gasoline prices cooled, but analysts said the Bank of Canada was likely to stay on a policy-tightening path with inflation still near the central bank’s 2 percent target.

The annual inflation rate was 1.9 percent last month, Statistics Canada said on Friday, down from 2.1 percent in November and matching economists’ forecasts.

Underlying inflation continued to perk up, with two out of three of the central bank’s measures of core inflation higher. CPI common, which the central bank says is the best gauge of the economy’s underperformance, increased to 1.6 percent from 1.5 percent.

Analysts said the report was unlikely to change much for the Bank of Canada, which raised interest rates last week for the third time in seven months as job growth and firmer inflation outweighed uncertainty over the NAFTA trade deal.

Still, Bank of Canada Governor Stephen Poloz said earlier this week that even he did not know what potential there may be for further interest rate hikes this year, reiterating that policymakers remained data dependent.

“For a data dependent central bank, this supports staying on a hike path,” said Derek Holt, vice president and head of capital markets economics at Scotiabank, pointing to the firmer core inflation.

Analysts in a Reuters poll predicted two more increases this year. [CA/POLL]

Rounding out the core inflation gauges, CPI median, which shows the median inflation rate across CPI components, held at 1.9 percent, while CPI trim, which excludes upside and downside outliers, rose to 1.9 percent.

The Canadian dollar saw little initial reaction to the data and was trading firmer against the greenback. [CAD/]

Markets odds of another hike in March were similarly little changed at 23 percent. Another hike is fully priced by May.

Food prices rose 2 percent from a year earlier as consumers paid more for food purchased at stores, particularly fresh vegetables.

The cost of gasoline moderated, with prices up 12.2 percent after the previous month’s annual 19.6 percent surge.

The household operations segment also weighed on inflation, down 0.3 percent due to a drop in the cost of telephone services as major telecom carriers offered temporary promotions.

Reporting by Leah Schnurr; Editing by Bernadette Baum

BLOOMBERG. 26 January 2018. Inflation Holds Near the Bank of Canada’s Target Amid Tighter Economy

By Theophilos Argitis

- December inflation was 1.9%, after 2.1% gain in November

- Core consumer prices rose 1.8% in December, fastest since 2016

Canadian inflation hovered at about the central bank’s 2 percent target for a second month in December, the result of a year of strong growth that is finally beginning to produce signs of more normal price pressures.

Annual inflation was 1.9 percent in December, slightly down from 2.1 percent in November, Statistics Canada reported Friday in Ottawa. It marks only the second time in the past three years the economy has produced two-month inflation averaging at least 2 percent.

The price strength reflects an economy running up against capacity constraints following a stellar performance in 2017. That is adding pressure on the Bank of Canada -- which has kept the expansion going with low interest rates -- to keep hiking borrowing costs to more normal levels.

“This is firm enough to keep the Bank in tightening mode, but still mild enough to keep the tightening pace gradual and cautious,” Doug Porter, chief economist at Bank of Montreal, said in a note.

Investors are anticipating at least two more increases this year, after the Bank of Canada hiked borrowing costs three times since July. The Canadian dollar was little changed following the report at C$1.2328 per U.S. dollar at 8:42 a.m. in Toronto trading.

The pick-up at the end of 2017 brought average inflation for the year to 1.6 percent, which was stronger than 1.4 percent in 2016 and 1.1 percent in 2015. The Bank of Canada expects inflation will stay at about 2 percent on average over the next two years -- in line with an economy around full capacity.

The average of the Bank of Canada’s three key core inflation measures -- which excludes volatile items such as energy and is considered a gauge of inflation pressures -- rose to 1.8 percent in December, the highest since October 2016.

Highlights of Canada December CPI

- The annual inflation rate was in line with economist forecasts

- The slowdown to 1.9% was due to a drop in gasoline prices last month, which fell 3.3% during December

- Annual inflation excluding gasoline was 1.5% in December, unchanged from November

- Telephone service prices fell 7.6% in December, the fastest since at least 1988

- December tends to be a seasonally weak month for consumer prices and that was the case again. On the month, consumer prices were down 0.4%, versus economist forecasts for a 0.3% drop. On a seasonally adjusted basis, the price index rose 0.2% on the month

- For the three so-called core measures, the ‘common’ core rate rose to 1.6%, the ‘median’ core rate was unchanged at 1.9% and the ‘trim’ measure was up to 1.9%

- Ontario had the slowest inflation in Canada (1.5%) even with minimum wage hikes kicking in at the start of 2018. Inflation in that province was muted by a drop in phone service costs

— With assistance by Erik Hertzberg

BLOOMBERG. 26 January 2018. Canada's Poloz Says It's Not Really the End of Easy Money

By Jill Ward and Stephanie Flanders

- Economies still working through ‘a lot of underlying stresses’

- Canada central bank governor speaks in Bloomberg TV interview

Bank of Canada Governor Stephen Poloz said central banks aren’t going to aggressively tighten policy because there are still underlying vulnerabilities in many economies.

Calling this the “‘end of easy money’ is a little too simple,” he said in a Bloomberg Television interview in Davos, Switzerland. “It’s likely that money is going to remain easy for some time yet” because “economies are still working their way through a lot of underlying stresses.”

Central banks are slowly moving away from the emergency stimulus put in place after the financial crisis, and leaders gathered for the World Economic Forum have combined optimism with caution in their assessment of the outlook. The IMF sees global growth accelerating to the fastest pace in seven years, but exuberance in markets, surging debt in China and elsewhere, and political flash points -- from Brexit to North Korea -- are all risks.

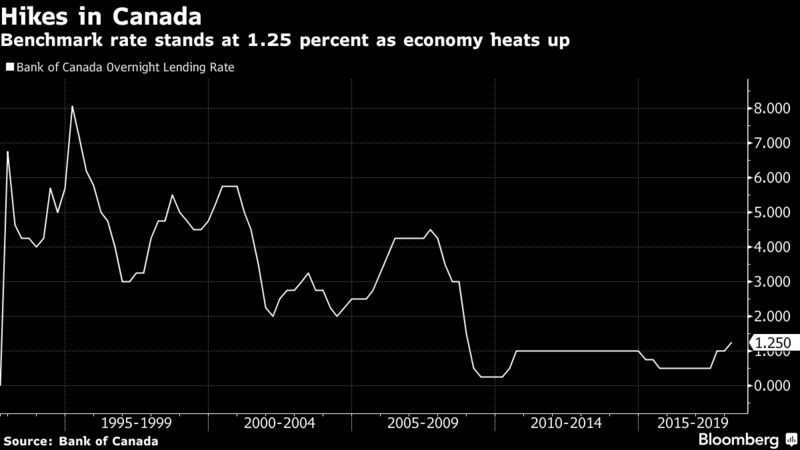

In Canada, officials have raised interest rates three times since mid-2017, including a hike just last week, which took the benchmark to 1.25 percent. Poloz has been trying to gradually bring rates back to more normal levels amid strong growth and a surge in employment, without triggering an unwanted slowdown. He said there’s still “considerable” slack in the labor market.

In the euro area, European Central Bank President Mario Draghi said Thursday that while the economy is improving, policy will remain accommodative for some time to come. Policy makers are considering when they need to end their bond-buying program and how to start signalling that a change is coming.

Poloz said companies are in an expansion phase and policy makers don’t want higher borrowing costs to crimp confidence or hiring plans. He added that concerns about the future of the Nafta trade agreement are weighing on investment decisions.

Growth Ingredients

“What happens in this late stage in the cycle is that investment becomes the principle driver of growth, and that builds more capacity, pulling that capacity out of the labor market and raising potential output,” he said. “We’re watching those ingredients as they unfold, and we can see that it’s underway.”

Asked about central banks’ room for maneuver, Poloz pointed out that the neutral rate of interest is probably lower now than in the past due to the debt overhang.

“The economy finds a new place where interest rates have much more effect than in the past,” Poloz said. “That’s one of the things we have to learn by probing, by moving our way along and assessing how things are evolving.”

One thing he wouldn’t comment on, however, was the conflicting signals coming out of the U.S. on currencies. U.S. President Donald Trump said Thursday that the dollar would get stronger, and that remarks welcoming its weakness made by Treasury Secretary Steven Mnuchin were “taken out of context.”

“I prefer not to talk about currencies at all except perhaps to interpret their moves,” Poloz said. “Exchange rates are what they are. Companies take them into account, central bankers take them into account.”

— With assistance by Theophilos Argitis

NAFTA

Innovation, Science and Economic Development Canada. January 25, 2018. Advancing Canadian relations and research with the U.S. Minister Duncan meets with science and business leaders in North Carolina to advocate for a modernized NAFTA, stronger research relations

Raleigh, North Carolina - With North American Free Trade Agreement (NAFTA) negotiations under way this week, the Honourable Kirsty Duncan, Minister of Science, wrapped up a two-day visit to Raleigh, North Carolina, where she advocated for a modernized NAFTA. During a meeting with the North Carolina Chamber of Commerce, the Minister underscored that Canada is working hard to make updates or improvements to the agreement that benefit all three trading partners.

Canada is North Carolina’s number one trading partner. Annual trade between North Carolina and Canada generates more than $9.7 billion in economic activity. Approximately 250,000 jobs in North Carolina depend on this strong Canada-U.S. trade relationship—jobs that help sustain a healthy, vibrant middle class north and south of the border.

In addition to engaging with the business community, Minister Duncan met with key public and private sector figures, including North Carolina Governor Roy Cooper, U.S. Congressman David Price and Dr. Emlyn Koster, Director of the North Carolina Museum of Natural Science.

The Minister’s numerous meetings with members of North Carolina’s scientific community allowed her to strengthen research links between Canadian and U.S. academic institutions while promoting the Government of Canada’s efforts to increase the participation of women and other under-represented groups in the sciences.

Quotes

“Canada is North Carolina’s number one customer. We buy more goods and services from North Carolina than any other country, products that sustain a strong economy and create jobs north and south of the border. I believe a modernized NAFTA that benefits all partners will create new economic, social, business and research opportunities that will support generations to come.”

– The Honourable Kirsty Duncan, Minister of Science

“For 24 years, NAFTA has created opportunities, jobs and a better life for our peoples. This is why from day one of the negotiations, Canada has brought concrete proposals on how we can modernize NAFTA to the benefit of Canadian, American and Mexican citizens. We are focused on achieving real progress, including in Montréal in the coming days.”

– The Honourable Chrystia Freeland, Minister of Foreign Affairs

Quick Facts

- 247,500 jobs in North Carolina depend on trade and investment with Canada.

- In 2016, North Carolina exported services to Canada worth a total of USD $1.2 billion.

- North Carolina sells more goods to Canada than to its next two largest foreign markets (Mexico and China) combined.

- Canada and the United States share the world’s longest undefended border, over which approximately 400,000 people, as well as goods and services worth $2.4 billion, cross daily.

North American Free Trade Agreement – Resources: http://www.international.gc.ca/trade-commerce/consultations/nafta-alena/toolkit-outils.aspx?lang=eng&_ga=2.157497912.361332789.1516635751-1371245540.1491838080#factsheet

The Globe and Mail. 26 Jan 2018. Canada’s proposal on the auto sector has potential to break NAFTA deadlock, Fiat Chrysler head says. U.S. rethink on NAFTA issues boosts hope for renegotiations

ADRIAN MORROW MONTREAL GREG KEENAN TORONTO

American negotiators are considering Canada’s proposed compromises on three of the most contentious topics in the renegotiation of NAFTA, offering a rare glimmer of hope after months of bargaining deadlock.

What’s more, one of the world’s largest auto companies is backing Canada’s ideas for reshaping vehicle content requirements – cranking up pressure from the U.S. business community on the Trump administration to cut a deal.

Canada has presented proposals on autos, dispute settlement and a process for amending the North American free-trade agreement at the sixth round of talks, in a bid to get Washington to back off protectionist demands in all three areas.

Sources with knowledge of the confidential discussions said the United States has not rejected any of Canada’s pitches. U.S. officials have been asking questions to understand the details of Canada’s ideas, the sources said, and have been willing to discuss them.

Fiat Chrysler Automobiles NV chief executive Sergio Marchionne gave Canada an assist on Thursday. On a year-end financial results conference call, he said Canadian auto proposals could break the deadlock on that key area.

“Within the structure proposed by the Canadians, there appears to be the beginning of a solution to this problem,” Mr. Marchionne said.

Canadian negotiators have offered compromise concepts to assuage U.S. demands that vehicles made in any of the three NAFTA countries contain 85 per cent North American content in order to qualify for duty-free shipment in the free trade zone and that U.S. content in vehicles made in Canada and Mexico amount to 50 per cent.

The Canadian concepts involve changing the way North American content is counted so that research and development, investment in new assembly plants – and some existing factories – and advanced technologies for vehicle electrification and autonomous driving count toward the total.

The idea is that the new rules would help ensure more North American and U.S. content and persuade Washington to take its demand for a hard-and-fast 50per-cent U.S. content rule off the table.

Investment in new plants, which can be $1-billion or more depending on the size of the facility, or investing in existing plants to build higher-technology vehicles could generate credits for auto makers that could be applied to the content requirements, two sources familiar with the negotiations said.

“The concept embedded in the Canadian proposal is defensible,” Mr. Marchionne said on the call. “This whole notion of moving away from some of the antiquated terms that we used in NAFTA back in the nineties is a good thing.”

Mr. Marchionne noted, however, that “it’s very difficult for us to tell you whether this thing is going to be successful or not.”

Canadian chief negotiator Steve Verheul presented the auto proposal to his American and Mexican counterparts, John Melle and Kenneth Smith Ramos, on Wednesday, and lower-level officials were spending Thursday and Friday discussing the finer points of the plan, sources briefed on the talks said.

Mr. Verheul himself expressed some optimism on Thursday, but cautioned there was a long way to go.

“I think it went reasonably well. There’s a lot more thinking to do, a lot more discussions,” he told reporters as he walked between meetings at the Hotel Bonaventure. “The mood is still reasonably constructive.”

Mr. Verheul said American negotiators also said “positive things” about Canada’s proposal to have NAFTA subject to periodic review and possible amendment. The idea, which is backed by Mexico, would allow for the three countries to agree to changes to the deal every few years. This would be an alternative to Washington’s demand for a sunset clause that would kill NAFTA after five years unless all three countries agreed to extend it.

Talks are also moving along on Chapter 11, the portion of the deal that allows corporations to sue governments using special trade panels if the corporations feel their business interests have been unfairly harmed, sources said. The United States wants the ability to opt out of Chapter 11.

Canada and Mexico are now considering setting up an improved version of the current Chapter 11 system that would apply only to the two of them, one source said. This would mean Canadian and Mexican companies could still sue each others’ governments, but American companies would lose this right. A different source said the Mexican government is also mulling the idea of setting up a Chapter 11-style system under its own domestic law to continue providing reassurance to American investors.

Dennis Darby, president of Canadian Manufacturers & Exporters, said he was encouraged Canada is trying to tackle the toughest issues and hoped that the Trump administration’s hard line was merely a “negotiating tactic.”

Auto makers welcomed Canada’s content proposal.

REUTERS. JANUARY 26, 2018. As NAFTA talks drag, Mexico suggests timeline could be extended

David Ljunggren, Allison Lampert

MONTREAL (Reuters) - A senior Mexican official on Friday suggested talks to modernize the North American Free Trade Agreement could be extended to give officials more time to address major disagreements threatening to undermine the $1.2 trillion trade pact.

Officials are planning an extra round of negotiations in Mexico at the end of February, according to sources close to the negotiations.

Teams from the United States, Canada and Mexico are in Montreal for the sixth of seven planned rounds on how to modernize NAFTA but progress is slow. Washington wants major changes to the 1994 pact and addressing various U.S. demands has eaten up time, officials said.

Although the process was initially scheduled to finish by the end of March to avoid clashing with Mexican presidential elections in July, Economy Minister Ildefonso Guajardo said the timeline could be extended.

“This negotiation has a window of opportunity to reach a deal between February and the end of July,” he told Reuters.

Canada, which this week presented a series of suggestions on how to unfreeze the talks, quickly welcomed the idea.

“Canada does not believe that we need put an arbitrary deadline on these negotiations at the cost of a good deal for all three countries. We are happy to continue negotiating,” said a government source.

U.S. chief negotiator John Melle, asked about a possible extension, told Reuters, “I have nothing to say on that. We are pushing ahead.”

A Mexican source briefed on the talks said once the election campaign has started, negotiators could still continue their work but without holding formal rounds.

The three nations are now looking at an extra week of talks in Mexico, possibly starting Feb. 26, ahead of the last round in Washington at the end of March, said the sources.

Whether more talks can help forge an agreement is unclear, given the gulf between the United States and its two partners.

U.S. President Donald Trump’s administration, which blames NAFTA for hurting U.S. manufacturing, wants the North American content of autos to be raised.

Canada responded by suggesting that content would be higher if the value of software and other high-tech materials made by the three nations were taken into account.

An auto industry source said U.S. and Mexican negotiators found the idea interesting but gave no details. Canadian chief negotiator Steve Verheul said on Thursday “there is a lot more thinking” to do about the idea.

Mexico and Canada have dismissed a separate U.S. demand that 50 percent of all autos produced in NAFTA nations must have American-made content. They also object to the idea of a subset case that would allow one party to pull out of the treaty after five years.

Additional reporting by Dave Graham in Mexico City; Editing by Jeffrey Benkoe

WEF

Innovation, Science and Economic Development Canada. January 25, 2018. Canada signs Joint Statement on Science, Technology and Innovation with Switzerland

Davos, Switzerland - Canada and Switzerland signed an agreement today on science and innovation that would promote growth and middle-class jobs.

The Honourable Navdeep Bains, Canada’s Minister of Innovation, Science and Economic Development, on behalf of the Honourable François-Philippe Champagne, Minister of International Trade, along with Swiss Federal Councillor Johann N. Schneider-Ammann, Head of the Federal Department of Economic Affairs, Education and Research, signed the Joint Statement on Science, Technology and Innovation (ST&I) strengthening collaboration between the two countries.

The joint statement promotes collaboration between Canadian and Swiss institutions in relation to science, technology, innovation research and education. While Canadian-Swiss relations are strong and diversified, there is an opportunity to deepen collaboration in the areas of sustainability and the Arctic, as well as in life sciences, clean tech and advanced manufacturing—areas that Canada has identified as key sectors for growth.

The signing took place at the World Economic Forum following a round table between officials of the two countries.

Quotes

“This new agreement gives us the opportunity to deepen an already strong relationship as two innovation nations. With Canada’s strong performance on jobs and growth, and Switzerland’s leadership on innovation and stimulating business research and development, we each have a great deal to offer the other. As a result of this new agreement, Canadian and Swiss companies will also have greater opportunities to collaborate and innovate by having access to leading technologies and scientific advances.”

– The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development

“Strengthening bilateral cooperation with Switzerland reinforces the ability of our scientists, engineers, technicians and those employed across the entire innovation ecosystem to work together. By enhancing cooperation with the Swiss, Canadians will profit on existing collaborations in clean tech, renewable energy, information and communication technologies, Arctic research, and advanced manufacturing. Collaboration in science is the foundation of discovery and the key to creating more jobs at home.”

– The Honourable François-Philippe Champagne, Minister of International Trade

Quick Facts

- Canada and Switzerland enjoy a strong and diverse commercial relationship that covers the full spectrum of trade, investment and innovation.

- Canada has the highest annualized GDP growth rate in the G7.

- In 2017, for the seventh consecutive year, Switzerland was ranked as the world’s most innovative country by the Global Innovation Index.

- The Joint Statement on Science, Technology and Innovation (ST&I) encourages the sharing of best practices; access to technology, market and talent; advanced R&D collaboration; commercialization; and the integration of stakeholders from both countries into global value chains.

The Globe and Mail. 26 Jan 2018. Prime Minister defends ambassador under fire for China trade comments

ROBERT FIFE, DAVOS

STEVEN CHASE, OTTAWA, With a report from The Canadian Press

I believe that because of this political situation with Donald Trump, the Chinese are now more interested than before to do things with us.

JOHN MCCALLUM, CANADIAN AMBASSADOR TO CHINA

Prime Minister Justin Trudeau is defending his envoy to Beijing who says Canada now has more in common with China’s authoritarian regime than with the United States under President Donald Trump.

Former Liberal cabinet minister John McCallum, whom Mr. Trudeau named as ambassador last year to pursue a free-trade deal with Beijing, said this week in China that the election of Mr. Trump has been a game-changer for Canada.

“In some important policy areas such as the environment, global warming, free trade, globalization, the policies of the government of Canada are closer to the policies of the government of China than they are to U.S. policies,” Mr. McCallum said Sunday during a visit by Quebec Premier Philippe Couillard.

Mr. McCallum said he never imagined it would be possible for Canada and China to be so closely aligned – a development he attributed to Mr. Trump’s policies, which include protectionist measures and an anti-climate change stand. “I believe that because of this political situation with Donald Trump, the Chinese are now more interested than before to do things with us” in Canada, he said.

The envoy said the divergence between the United States and China is a boon for Canada. “In a sense, it’s a good thing for me as an ambassador and for Canada with China because, because of these big differences, it gives us opportunities in China. There is no doubt that Canada wants to do more with China, which is what the Prime Minister told me when he asked me to come here.”

At a wrap-up news conference Thursday at the World Economic Forum in Davos, Switzerland, Mr. Trudeau was asked if he agreed with his ambassador’s outlook. He didn’t disavow Mr. McCallum’s comments but said his government’s approach to foreign affairs is to look for common ground with countries, including China.

China’s one-party state has come under significant criticism for its brutal human-rights record as well as its aggression in the South China Sea. According to the Australian Strategic Policy Institute, China has, over the past decade, “effectively seized over 80 per cent of the South China Sea, an area about the size of Western Europe” and built 12 “militarily significant facilities” in the region, including three major fighter bases.

Conservative foreign-affairs critic Erin O’Toole called the Canadian ambassador’s comments rash, saying they risk straining relations with the U.S. government during a difficult renegotiation of the North American free-trade agreement. “To suggest we have more in common with China than the United States at a time when we are trying to remind the U.S. of the special relationship is reckless,” Mr. O’Toole said.

NDP MP Nathan Cullen described Mr. McCallum’s comments as facile, saying the average Canadian might be taken aback to hear a government representative saying this country is more in line with “Communist China than our American cousins.”

The political direction and policies across 50 American states are far closer to Canada’s than China’s, he argued. “We can’t go from best buds because Obama is in office to the U.S. is worse than China because Trump takes over . ... America is a lot more than Donald Trump,” Mr. Cullen said.

Mr. Trudeau said his government wants to work with China on areas where he feels the Chinese are acting as leaders. “On issues like the environment, on issues around trade, we are always looking to work with significant countries, like China that are showing initiative and leadership on that, but it doesn’t mean we are going to agree with them on everything. Far from it,” Mr. Trudeau said.

THE GLOBE AND MAIL. JANUARY 26, 2018. Trump, Davos, Bombardier and NAFTA: The rising threat of a calamitous global trade war

MICHAEL BABAD, Columnist

We’re not looking to get into trade wars. On the other hand, we are looking to defend America’s interests

U.S. TREASURY SECRETARY STEVEN MNUCHIN

Donald Trump's actions may speak louder than Steven Mnuchin's words.

As for actions, we'll see what the U.S. International Trade Commission decides today on Bombardier Inc. And as for words, Mr. Trump took centre stage at the World Economic Forum in Davos amid his "America First" push.

These come as fears of a calamitous global trade war mount, amid fractious negotiations to redo the North American free-trade agreement, stiff duties against Canada's Bombardier, and, most recently, the Trump administration's move against washing machines and solar panels.

"Trump trade wars on the horizon" is how TD securities put it this week.

"We believe that the market is waking up to the idea that trade policy is next on the Trump's administration's agenda following Monday's announcement of tariffs and quotas on solar panels and washing machines," said TD macro strategist Brittany Baumann and Mark McCormick, North American head of foreign exchange strategy.

"Indeed, the introduction of tariffs on marginal sectors of the economy misses the point that a pivot to trade is likely a big theme for the year ahead," they added.

"Recall that the list of Trump's seven campaign promises declared to take action on China's allegedly unfair trade pratices. With tax reform seemingly out of the way, we suspect the next move over the coming months is to pivot toward trade, as a means of touting campaign promises into the mid-term."

Which is not to suggest that the administration has just been sitting on its hands, particularly where Canada's concerned. Consider the actions to date against Bombardier and softwood lumber exports, along with the acrimony so evident in NAFTA negotiations, the sixth round of which are now under way in Montreal.

There's more in the pipeline, too, from Mr. Trump's state of the union address next week through to the November mid-term elections, with trade decisions and further NAFTA negotiations in between.

Like TD's Ms. Baumann and Mr. McCormick, Deutsche Bank also cited the other trade probes that "could result in an escalation" of trade tensions, notably with China.

There's one under way into Chinese technology transfers, known as a Section 301 investigation, and another into whether alumimum and steel imports are a threat to nationsl security, the former being much more serious.

"It is too early to say whether these disputes will result in a more serious escalation of tensions," Deutsche Bank said in its report.

"In our view, the Section 301 investigation presents a substantial risk of escalating trade tensions with China."

Some observers expect no trade war, and many believe NAFTA will be settled peacefully, though in a different form. Others, though, are ringing alarm bells over the risks.

"Global safeguard tariffs announced by President Trump this week alone are unlikely to spark a global trade war," Ms. Baumann and Mr. McCormick said.

"But when viewed as a part of a queue of potential trade actions to come, Trump's actions cannot be overlooked and may imply a broader pivot on U.S. trade policy."

Trade war has been in place for quite a little while, the difference is the U.S. troops are now coming to the ramparts

U.S. COMMERCE SECRETARY WILBUR ROSS, TO CNBC

As The Globe and Mail's Nicolas Van Praet reports, the ITC is scheduled to vote this afternoon on Boeing Co.'s complaint against the Bombardier C Series plane. If it finds no harm, Bombardier will be unfettered to sell the airline in the U.S. without penalty. A decision the other way means overall import duties of almost 300 per cent will stand, making the C Series too expensive. Bombardier would appeal that one.

Like some observers, Nikita Shah of Capital Economics sees no all-out trade war on the horizon, and, indeed, suggests that Mr. Trump's actions may in fact "continue to fall a long way short" of his words.

"If he talks about trade in Davos [today], Trump is sure to stick to his 'America First' script," Ms. Shah, the group's global economist, said prior to the president's speech.

Mr. Trump didn't disappoint on that score, warning of a fight on trade.

"We will enforce our trade laws and restore integrity to the trading system," he told the forum.

"Only by insisting on fair and reciprocal trade can we create a system that works not just for the United States but for all nations," he added.

"The United States will no longer turn a blind eye to unfair trade practices. We cannot have free and open trade if some countries exploit the system at the expense of others. We support free trade but it needs to be fair and it needs to be reciprocal."

No matter what happens, Ms. Shah said, any retaliation against the U.S. appears "remote" because its trading partners want the status quo.

"A year after Trump announced the withdrawal of the U.S. from the Trans-Pacific Partnership, the remaining 11 members agreed a deal this week which will be signed in March. In some respects, Trump's protectionist views have helped to unite countries such as China, Germany and Japan in defence of free trade."

Having said that, of course, Canada has launched a wide-ranging complaint against U.S. at the World Trade Organization, even as NAFTA talks continue.

Like Ms. Shah, Cesar Rojas and Ebrahim Rahbari of the Citigroup economics team rejects the idea of a global trade battle.

"We expect the U.S. to impose sector-specific restrictions, particularly on China, in coming months in pursuit of its 'America First' agenda, but we do not expect full-scale trade wars or the death of NAFTA," they said. "Other economies may inch towards more open trade rather than more protectionism, and the global trade growth rebound looks likely to continue, as global investment continues to recover."

Ms. Shah, too, noted that global trade "is, ironically, enjoying something of a renaissance," citing recent numbers that show world trade climbed 4.5 per cent in the three months to November, year over year, a far faster rate than the corresponding period in 2016.

Note, of course, the ironically.

Citigroup's Mr. Rojas and Mr. Rahbari, while expecting no trade war, believe 2018 could, at least, believe the year of living uncomfortably.

This year "could well be the year when the new U.S. approach to trade policy really takes shape, as tax reform isout of the way, while several administration officials (including the president) remain focused on rebalancing U.S. trade relations," they said.

"In our view, sector-specific measures aimed at China are probably the most significant on the table, but the U.S. will likely renegotiate NAFTA and KORUS (its free-trade agreement with South Korea), while it may also push for changes at the WTO."

As for NAFTA, the "escalation" of tensions between the U.S. and Canada represents the main threat to a deal, given the actions against Bombardier and softwood and Canada's bid at the WTO.

There are only two U.S. states – Michigan and Vermont – where trade with Canada exceeds 10 per cent of their annual economic output, according to University of Calgary economist Trevor Tombe.

MURAT YÜKSELIR/THE GLOBE AND MAIL (SOURCE: TREVOR TOMBE, UNIVERSITY OF CALGARY)

As Deutsche Bank economists see it, there's a greater risk of "negative headlines and a breakdown" in the current NAFTA round, though they, too, believe it will all end with a revamped trade deal.

And, certainly, tensions are running high.

"Recent moves by the Trump administration to impose tariffs on solar panels and washing machines, while largely anticipated, have elevated the risk of retaliatory measures," the Deutsche Bank group said.

"The solar tariffs are largely aimed at China, but the administration has not exempted Canada and Mexico. President Trump also determined that Mexico is not exempt from the washing machine tariffs, adding further pressure to this round of NAFTA negotiations."

AVIATION

The Globe and Mail. 26 Jan 2018. U.S. trade panel set to rule on punishing C Series duties

NICOLAS VAN PRAET

As the U.S. International Trade Commission (ITC) prepares to decide the immediate fate of Bombardier Inc.’s C Series aircraft in the United States, logic might be on the Canadian plane maker’s side. But recent history isn’t.

Four members with the quasijudicial body will vote on Friday afternoon on whether they believe U.S. giant Boeing Co. and the wider American aerospace industry were injured, or could be injured, by Bombardier C Series imports into the United States – planes it says benefited from massive government subsidies allowing them to be sold at less than fair value. A yes vote means duties totalling nearly 300 per cent imposed by the U.S. Department of Commerce will stand, effectively shutting the airliners out of the U.S. market.

The stakes are high. Bombardier chief executive Alain Bellemare is counting on sales from the C Series to help propel a turnaround after the plane maker’s brush with bankruptcy in 2015. The livelihood of thousands of workers is tied to the aircraft. Ironically, a decision to turn to the Quebec government for financial backing to help save the C Series could end up dooming the airliner’s prospects in the world’s biggest market.

Common sense dictates Bombardier should win, according to many observers.

First, Boeing has been the recipient of massive government military contracts in its own right that allowed its commercial jet business to get airborne and enjoy an order backlog topping 5,800 planes at the end of 2017. Second, it doesn’t really have a jet that competes with the smaller CS100 C Series, having abandoned the roughly 100-seat market a decade ago. Interest in Boeing’s 737-700, which typically carries 126 to 138 passengers, has been thin for years. And its revamped 737 Max 7 also remains a tough sell.

As Bombardier’s commercial aircraft boss Fred Cromer put it: “Boeing says it wants a level playing field, but it is not even on the field.” But the record suggests things could cut the other way for Canada’s aerospace champion. Toronto-based Veritas Investment Research Corp. reviewed ITC case history for the past three years and found that 87 per cent of its final rulings in anti-dumping and countervailing duty investigations resulted in affirmations that a U.S. industry was materially injured, or threatened with injury. A review stretching back five years shows the commission affirmed harm in 78 per cent of cases.

A majority of commissioners, three of the four, must find in favour of Bombardier for the plane maker to win. A tie vote goes in favour of the petitioner, in this case Boeing.

The row started last spring when Boeing took legal action against Bombardier for selling 75 C Series planes to Atlanta-based Delta Air Lines at what it says were “absurdly low prices” while benefiting from unfair subsidies from the Canadian, Quebec and British governments. It asked the U.S. government to impose countervailing and anti-dumping duties on the C Series to even things out.

In a final determination issued just before Christmas, Commerce confirmed duties of nearly 300 per cent on Bombardier C Series planes. U.S. President Donald Trump is said to covet such duties as he tries to put in place an “America first” trade strategy that aims to save manufacturing jobs. Boeing is only one of several U.S. companies that have sued foreign rivals in recent months, aligning itself with the political winds to push its own interests.

U.S. trade action against the C Series has angered political leaders in Canada and Europe, casting a shadow over NAFTA trade talks and souring relations between the United States and its trading partners. Canada’s Liberal government cancelled plans to buy new Boeing fighter jets because of the company’s actions and Britain, which is home to a big C Series wings factory, has also threatened to review its defence purchases from Boeing.

Bombardier has a legitimate chance to win, said Simon Lester, a trade policy analyst with the Cato Institute. The ITC is more objective and less political than the commerce department and Bombardier has many facts in its favour, he said.

He noted that Bombardier hasn’t delivered a single C Series in the United States yet, which further complicates the analysis and might make the ITC hesitant to find harm. William Perry, an international trade lawyer who used to work for the ITC, disagrees. He says it’s nearly certain Bombardier will lose the case because the company made the fatal mistake of failing to respond to some questions in the dumping portion of the probe.

Whoever loses Friday’s vote will almost certainly challenge the decision. Among the avenues for appeal for Bombardier is the U.S. Court of International Trade, although the Canadian company might be shy to take on another long court battle in another U.S.centric venue. Canada could also request a review of the decision under NAFTA’s dispute resolution mechanism or seek a panel review at the World Trade Organization, both of which could take years to resolve.

In the meantime, Bombardier has a plan for getting the C Series to U.S. buyers. Through a new partnership with Airbus SE, Bombardier is working on a final assembly line for C Series aircraft at Airbus’s existing manufacturing site in Mobile, Ala. The partners say the line will go ahead regardless of how the Boeing petition concludes and will render any import tariffs non-applicable because C Series built there will be American-made products.

That plan, too, could be challenged by Boeing.

USITC. January 26, 2018. 100- to 150-Seat Large Civil Aircraft from Canada Do Not Injure U.S. Industry, Says USITC.

Bulletin 18-007

Inv. No. 701-TA-578 and 731-TA-1386

Contact: Peg O'Laughlin, 202-205-1819

100- TO 150-SEAT LARGE CIVIL AIRCRAFT FROM CANADA DO NOT INJURE U.S. INDUSTRY, SAYS USITC

BULLETIN

The U.S. International Trade Commission has made negative determinations in its final phase antidumping and countervailing duty investigations concerning 100- to 150-Seat Large Civil Aircraft from Canada.

Note to Users: This bulletin will be replaced by the news release when the release is available. News releases are generally issued approximately three hours after a Commission vote.

Global Affairs Canada. January 26, 2018. Statement by Minister of Foreign Affairs on Bombardier C Series aircraft

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement on the vote by the U.S. International Trade Commission (ITC) that U.S. imports of Bombardier’s C Series aircraft do not represent a threat of injury to Boeing:

“We are very pleased with today’s vote by the ITC, which confirms Canada’s position that Boeing is not commercially threatened by Bombardier’s C Series aircraft.

“Canada’s innovative aerospace industry is a historic and vital sector of our economy, supporting more than 200,000 middle-class jobs across our country. The Government of Canada will always vigorously defend the Canadian aerospace industry and its workers against protectionist trade practices.

“Moreover, Canada-United States trade is important to the prosperity of both our countries. This decision will support well-paying middle-class jobs on both sides of the border.”

BOMBARDIER. January 26, 2018. Bombardier Statement on ITC Vote

Montréal - Today’s decision is a victory for innovation, competition, and the rule of law. It is also a victory for U.S. airlines and the U.S. traveling public. The C Series is the most innovative and efficient new aircraft in a generation. Its development and production represent thousands of jobs in the United States, Canada, and the United Kingdom. We are extremely proud of our employees, investors and suppliers who have worked together to bring this remarkable aircraft to the market. With this matter behind us, we are moving full speed ahead with finalizing our partnership with Airbus. Integration planning is going well and we look forward to delivering the C Series to the U.S. market so that U.S. airlines and the U.S. flying public can enjoy the many benefits of this remarkable aircraft.

BOEING. January 26, 2018. Boeing Statement on International Trade Commission Vote

We are disappointed that the International Trade Commission did not recognize the harm that Boeing has suffered from the billions of dollars in illegal government subsidies that the Department of Commerce found Bombardier received and used to dump aircraft in the U.S. small single-aisle airplane market. Those violations have harmed the U.S. aerospace industry, and we are feeling the effects of those unfair business practices in the market every day.

While we disagree with the ITC’s conclusion today, we will review the Commission’s more detailed opinions in full as they are released in the coming days.

Boeing remains confident in the facts of our case and will continue to document any harm to Boeing and our extensive U.S. supply chain that results from illegal subsidies and dumped pricing. We will not stand by as Bombardier’s illegal business practices continue to harm American workers and the aerospace industry they support. Global trade only works if everyone adheres to the rules we have all agreed to. That’s a belief we will continue to defend.

THE GLOBE AND MAIL. JANUARY 26, 2018. Top U.S. trade agency dismisses Bombardier duties

ADRIAN MORROW AND NICOLAS VAN PRAET

MOBILE, ALABAMA AND MONTREAL - America's top trade agency has dismissed the need for punishing duties of nearly 300 per cent on imports of Bombardier Inc.'s C Series airliners into the United States – a surprise vindication for the Canadian plane maker as attention shifts to its plans to build the marquée aircraft in Alabama.

Bombardier shares punched up nearly 13 per cent to $3.46 in afternoon trading Friday on the Toronto Stock Exchange as some uncertainty lifted for the company.

The U.S. International Trade Commission (ITC), a quasi-judicial federal agency that directs action by the United States against unfair trade practices, ruled Friday that U.S. giant Boeing Co. and the wider American aerospace industry were not injured or could not be injured, by Bombardier C Series imports into the United States.

The ruling, a victory for Bombardier and its government partners, is the final step in a U.S. investigation of Bombardier's 100- to 150-seat C Series plane following a petition by Boeing. It means the ITC disagrees with Boeing that the C Series benefited from massive state subsidies that allowed the airliner to be sold in the United States at less than fair value. And it means duties totalling nearly 300 per cent imposed by the U.S. Department of Commerce on the C Series will be called off.

"Today's decision is a victory for innovation, competition and the rule of law," Bombardier said in a statement. "It is also a victory for U.S. airlines and the U.S. travelling public. The C Series is the most innovative and efficient new aircraft in a generation. Its development and production represents thousands of jobs in the United States, Canada and the United Kingdom."

Boeing issued a harshly worded statement that suggested it could appeal the decision or launch a new petition.

"Boeing remains confident in the facts of our case and will contiue to document any harm to Boeing and our extensive U.S. supply chain that results from illegal subsidies and dumped pricing," the company said. "We will not stand by as Bombardier's illegal business practices continue to harm American workers and the aerospace industry they support."

Threat of a new challenge underscores the urgency with which Bombardier must now work with Airbus SE, its new C Series partner, to finalize their tie-up and get a planned C Series manufacturing line in Mobile, Ala., up and running. Bombardier hasn't booked a single U.S. C Series order since Boeing launched its trade challenge last spring, confirming in a Jan.24 filing to the ITC that there was a "Boeing effect" deterring potential U.S. customers worried about duties.

"There is no returning to the status quo," Bombardier said in a filing. "The only way to counter the risk created by Boeing's petition is through a new U.S. final assembly line."

The odds were stacked against Bombardier in the ITC vote, according to observers. Three of the four ITC commissioners had to vote in its favour to win the case. History was also against it: A survey of ITC decisions over the past three years by Veritas Investment Research shows the commission found injury in 87 per cent of its final rulings in anti-dumping and countervailing duty investigations.

REUTERS. JANUARY 26, 2018. U.S. trade body backs Canada's Bombardier over Boeing in tariff spat

WASHINGTON/MONTREAL (Reuters) - Canada’s Bombardier Inc on Friday won an unexpected trade victory against U.S. planemaker Boeing Co as a U.S. agency rejected imposing hefty duties on sales of Bombardier’s new CSeries jet to American carriers.

Shares of Bombardier, which relies financially on sales of the jet, rose 15 percent. Boeing shares fell slightly.

The U.S. International Trade Commission voted 4-0 to reject Boeing’s claims that it suffered injury by Bombardier underpricing the CSeries in the U.S. market and discarded a Commerce Department recommendation to slap a near 300-percent duty on sales of the 110-to-130-seat jets for five years.

The ITC had widely been expected to side with Chicago-based Boeing, the world’s largest maker of jetliners, which accused Bombardier of dumping the planes, or selling them below cost, in the U.S. market.

The ITC, which currently has four commissioners, did not give an explanation on Friday for its decision.

In a statement, Bombardier called the decision a “victory for innovation, competition, and the rule of law,” and a win for U.S. airlines and the traveling public.

Boeing said it was disappointed that commission did not recognize “the harm that Boeing has suffered from the billions of dollars in illegal government subsidies that the Department of Commerce found Bombardier received and used to dump aircraft in the U.S. small single-aisle airplane market.”

Through a venture with European planemaker Airbus SE, which has agreed to take a majority stake in the CSeries this year, Bombardier plans to assemble CSeries jets in Alabama to be sold to U.S. carriers starting in 2019. The case has sparked trade tensions between the United States and its allies Canada and the UK. Ottawa last year scrapped plans to buy 18 Super Hornet fighter jets from Boeing.

Former ITC chairman Dan Pearson praised the decision by phone.

“Not a single commissioner was willing to buy Boeing’s arguments,” he said. “I think ‘America First’ is a policy of the White House and the Commerce Department,” he said. “But it’s not the policy of an independent agency (like the ITC).”

Reporting by David Shepardson, Lesley Wroughton and Allison Lampert; editing by G Crosse and Bill Rigby

BLOOMBERG. 26 January 2018. Bombardier Gets Surprise Win After U.S. Rebuffs Boeing Trade Case

By Frederic Tomesco, Sarah McGregor, and Randy Woods

- Canadian planemaker calls ruling ‘a victory for innovation’

- Decision clears the way for delivery of C Series to Delta Air

Bloomberg Intelligence’s George Ferguson reports on Bombardier’s win in trade case.

Bombardier Inc. can start shipping C Series jets to Delta Air Lines Inc. as scheduled after a surprise ruling by a U.S. trade tribunal that said the proposed imports won’t hurt American industry.

U.S. companies and workers aren’t being harmed by sales of 100- to-150-seat aircraft from Canada, the International Trade Commission said Friday. The panel’s ruling blocks a Commerce Department decision last month to impose duties of almost 300 percent.

Friday’s vote deals a blow to Chicago-based Boeing Co., which said Bombardier sold the C Series in the U.S. at less than fair value while benefiting from government subsidies. The decision also opens the door for Bombardier to add new U.S. customers while potentially easing trade tensions with Canada and the U.K., where the company builds wings for the aircraft.

“Today’s decision is a victory for innovation, competition, and the rule of law,” Montreal-based Bombardier said in an emailed statement. “It is also a victory for U.S. airlines and the U.S. traveling public. The C Series is the most innovative and efficient new aircraft in a generation.”

Bombardier surged 16 percent to C$3.56 at 2:50 p.m. in Toronto after climbing as much as 23 percent for the biggest intraday gain in three months. That put the shares at their highest intraday level in three years. Boeing fell less than 1 percent to $341.95.

“We are disappointed that the International Trade Commission did not recognize the harm that Boeing has suffered from the billions of dollars in illegal government subsidies that the Department of Commerce found Bombardier received and used to dump aircraft in the U.S. small single-aisle airplane market,” Boeing said in a statement.

“Those violations have harmed the U.S. aerospace industry, and we are feeling the effects of those unfair business practices in the market every day,” the company said.

Delta Deliveries

The ITC vote contrasts with President Donald Trump’s decision this week to slap tariffs on solar panels and imported washing machines on the grounds that they’re harming U.S. industry. That stirred fears that more restrictive trade measures will follow.

The aircraft decision ruling paves the way for Bombardier to begin deliveries of Canadian-built CS100 jets to Delta this year. The U.S. airline threw a lifeline to the slow-selling C Series in 2016 by ordering at least 75 CS100 jets -- a deal with a list value of $5.6 billion at the time.

The carrier said it was looking forward to adding the plane to its fleet.

‘Anti-Competitive’

“Delta is pleased by the ITC’s ruling rejecting Boeing’s anti-competitive attempt to deny U.S. airlines and the U.S. traveling public access to the state-of-the-art 110-seat CS100 aircraft when Boeing offers no viable alternative,” the Atlanta-based airline said.

Three months ago, with the jetliner’s access to the U.S. market in doubt, Bombardier turned to a powerful partner: Airbus SE. The European planemaker agreed to take control of the C Series program as part of a deal that is expected to close later this year.

Bombardier also agreed to help fund a second assembly line for the jets in Mobile, Alabama, where Airbus manufactures narrow-body planes. The ITC ruling calls into question the need for that project, which is estimated to cost $300 million.

‘Absurdly Low’

Boeing, which brought the trade complaint in April, said government subsidies helped Bombardier compete with “absurdly low” prices. Quebec invested $1 billion in 2016 for a minority stake in the C Series. The Canadian government followed last year with a C$372.5 million ($300 million) financing package for two Bombardier jet programs, including the C Series.

Unfair competition threatened the survival of the 737 Max 7, the smallest of Boeing’s upgraded single-aisle jets, the U.S. planemaker said. That plane and the C Series can carry similar passenger loads, depending on how they’re configured. Boeing is in talks about a potential combination with the Canadian company’s top rival, Embraer SA, which sells planes that directly compete with the C Series.

Delta executives insisted the Max 7 was never in the running before the airline picked the C Series. Boeing “simply did not and does not have the right-sized aircraft,” Greg May, Delta’s senior vice president for supply-chain management and fleet strategy, told the panel last month.

Sales Prospects

Some of Delta’s U.S. peers could be tempted to take a look at the C Series now that the prospect of duties no longer exists.

JetBlue Airways Corp., Spirit Airlines Inc. and Sun Country Airlines -- while not Bombardier customers -- all wrote to the Commerce Department and the International Trade Commission last year to express support for the Canadian manufacturer. JetBlue has held discussions with Bombardier about the C Series, Bloomberg News reported in 2016.

Deutsche Lufthansa AG’s Swiss International, the C Series launch customer, and Air Baltic have praised the jet for its better-than-advertised fuel burn and overall performance. Bombardier projects passenger jets carrying 100 to 150 passengers will generate about 6,000 orders globally over the next 20 years.

EMBRAER. BOEING. REUTERS. JANUARY 25, 2018. Brazil defense minister tells Saab no control change for Embraer

RIO DE JANEIRO (Reuters) - Brazilian Defense Minister Raul Jungmann told Saab SAABSb.ST Chief Executive Officer Hakan Buskhe that the transfer of control of Embraer EMBR.SA to Boeing (BA.N) is off the table, the defense ministry said in a statement on Thursday.

Jungmann also ruled out a spin-off or sale of Embraer’s defense or commercial units, the statement added. Saab and Embraer are partners in the development of the Gripen NG fighter.

Boeing Co

342.9

BA.NNEW YORK STOCK EXCHANGE

-0.21(-0.06%)

BA.N

“We are concerned and contractually committed to maintaining control and confidentiality in the transfer of technology developed both by Saab and jointly” with Embraer, Jungmann said according to the ministry.

U.S. planemaker Boeing proposed a tie-up with Embraer in December, but the plans have faced resistance from Brazil’s government, which has a so-called golden share, giving it a right to veto any change of control.

Jungmann has asked the Air Force as well as the Defense and Finance Ministries to keep Saab executives informed of any progress in talks between the companies, adding that any deal would mean building safeguards for Saab with its input.

Reporting by Marta Nogueira; Editing by Cynthia Osterman

________________

LGCJ.: