CANADA ECONOMICS

INTERNATIONAL TRADE

StatCan. 2017-12-05. Canadian international merchandise trade, October 2017

- Imports: $45.9 billion, October 2017, -1.6% decrease (monthly change)

- Exports: $44.5 billion, October 2017, 2.7% increase (monthly change)

- Trade balance: -$1.5 billion, October 2017

- Source(s): CANSIM table 228-0069: http://www5.statcan.gc.ca/cansim/a26?lang=eng&retrLang=eng&id=2280069&&pattern=&stByVal=1&p1=1&p2=31&tabMode=dataTable&csid=

Canada's merchandise trade deficit with the world totalled $1.5 billion in October, narrowing from a $3.4 billion deficit in September. Exports were up 2.7% on higher exports to the United States, while imports decreased 1.6% on lower imports of motor vehicles and parts.

Chart 1: Merchandise exports and imports

Widespread increases in exports

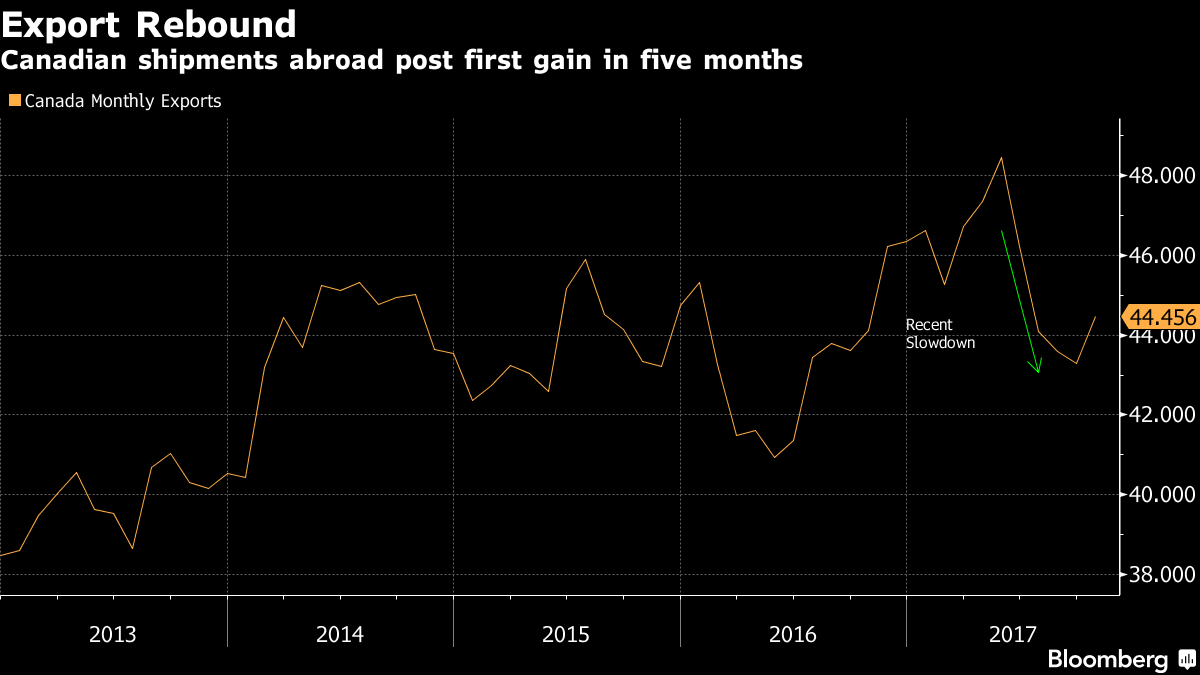

Total exports increased 2.7% to $44.5 billion in October, following four consecutive monthly declines. Prices were up 1.5% and volumes increased 1.2%. Advances were observed in 9 of 11 sections, led by basic and industrial chemical, plastic and rubber products (+12.4%). There were also notable gains in metal and non-metallic mineral products (+4.5%); farm, fishing and intermediate food products (+7.7%); and energy products (+2.7%). Year over year, total exports were up 0.8%.

The increases within the basic and industrial chemical, plastic and rubber products, as well as the energy products sections were driven by similar factors in October. Exports of lubricants and other petroleum refinery products (gasoline blending stock), up 44.5%, and refined petroleum energy products (diesel and fuel oils), up 18.4%, rose for a second consecutive month, mostly on higher US demand. A recent drawdown in inventories of refined petroleum products in the United States (especially on the East Coast) led to increased exports from Canadian refineries.

Exports of farm, fishing and intermediate food products also increased in October, rising 7.7% to $2.8 billion, mostly on higher volumes. Higher exports of canola seed and canola oil were responsible for the increase, partly on higher Chinese demand for Canadian canola. There were also increased exports of canola seed to Mexico, the United Arab Emirates, Pakistan and Japan.

Decrease in imports driven by motor vehicles and parts

Total imports were down 1.6% to $45.9 billion in October, mainly due to a decrease in motor vehicles and parts. Other notable movements included metal ores and non-metallic minerals (-20.1%) and aircraft and other transportation equipment and parts (+16.2%). Overall, import volumes decreased 3.9% while prices rose 2.4%. Year over year, total imports rose 0.9%.

Imports of motor vehicles and parts fell 8.1% to $8.7 billion in October, on lower imports of passenger cars and light trucks as well as motor vehicle engines and motor vehicle parts. Passenger cars and light trucks were down 8.8% in October, returning to June levels after three consecutive monthly increases. Also contributing to the decrease were lower imports of motor vehicle engines and motor vehicle parts, down 11.1%. Work stoppages and planned shutdowns in the automotive industry led to a sharp decrease in the demand for automotive components in October.

Also decreasing in October were imports of metal ores and non-metallic minerals, down 20.1% to $983 million. Other metal ores and concentrates (-21.8%) contributed the most to the decline. After peaking in September, imports of zinc ores from Alaska decreased in October.

Partially offsetting the decreases were higher imports of aircraft and other transportation equipment and parts, up 16.2% to $1.8 billion. Imports of aircraft (+$291 million) led the increase, with new airliners from the United States contributing the most to the gain.

Higher exports to the United States

Exports to the United States rose 4.1% to $33.3 billion in October, led by unwrought gold. Imports from the United States were down 0.6% to $29.8 billion, partly on lower imports of zinc ores. As a result, Canada's trade surplus with the United States widened from $2.0 billion in September to $3.5 billion in October. The Canadian dollar lost 2.1 US cents on average relative to the US dollar from September to October.

Imports from countries other than the United States fell 3.3% to $16.1 billion, on lower imports from Mexico (light trucks), Japan (gold bullion) and Saudi Arabia (crude oil).

Exports to countries other than the United States were down 1.4% to $11.1 billion on lower exports to the United Kingdom and China (both unwrought gold). Partially offsetting these declines were higher exports to the Netherlands (metallurgical coal) and Switzerland (aircraft).

As a result, Canada's trade deficit with countries other than the United States narrowed from $5.4 billion in September to $5.0 billion in October.

Sharp drop in real imports

In real (or volume) terms, imports decreased 3.9% in October, the largest decline since October 2016, with more than half of the decrease coming from motor vehicle and parts. Real exports rose 1.2% on widespread increases. Consequently, Canada's trade balance in real terms went from a $2.0 billion deficit in September to $131 million surplus in October.

Chart 2: International merchandise trade balance

Revisions to September exports and imports

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, as well as amendments made for late documentation of high-value transactions. Exports in September, originally reported as $43.6 billion in last month's release, were revised to $43.3 billion in the current month's release. September imports, originally reported as $46.7 billion in last month's release, were essentially unchanged in the current's month release.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171205/dq171205a-eng.pdf

THE GLOBE AND MAIL. REUTERS. DECEMBER 5, 2017. Canada export sector shows sign of life, trade deficit shrinks

DAVID LJUNGGREN, OTTAWA

Canada's hard-hit export sector showed unexpected signs of strength in October, posting the first increase since May on higher shipments to the United States while imports continued to disappoint.

As a result, Canada's trade deficit shrank to a five-month low of $1.47-billion from $3.36-billion in September, Statistics Canada said on Tuesday.

Analysts polled by Reuters had forecast a shortfall of $2.70-billion. The deficit was the lowest since the $1.02-billion seen in May.

Exports grew by 2.7 per cent – the biggest month-on-month increase since March – in part due to higher shipments of energy products to the United States to make up for a recent drawdown in refinery inventories. Nine of 11 export categories posted advances.

The data most likely came too late to influence the Bank of Canada. Analysts expect the central bank to keep interest rates unchanged when it unveils its next decision on Wednesday.

The central bank, which has long fretted about sluggish non-energy exports, says uncertainty surrounding the future of the North American Free Trade Agreement is one of the biggest risks facing Canada's exporters.

Jennifer Lee, senior economist at BMO Capital Markets, said that while the data showed encouraging signs, one month's figures did not make a trend.

"It will help them (the Bank of Canada) put a little bit more of a positive tone but I think overall they are going to sound cautious tomorrow, just given that NAFTA is the overriding piece of uncertainty right now," she said in a phone interview.

The Canadian dollar initially edged up after the data, rising to $1.2626 to the U.S. dollar, or 79.20 U.S. cents, from $1.2648, or 79.06 U.S. cents, before the data were released. It later gave up all the gains.

"We're finally seeing the rebound we've been waiting for months ... the good news is that the gains are broad-based," Stephen Tapp, deputy chief economist at Export Development Canada.

Imports dipped by 1.6 per cent on weaker demand for motor vehicles and parts amid work stoppages and planned shutdowns in the automotive industry.

Exports to the United States jumped 4.1 per cent, while imports slipped by 0.6 per cent. As a result, the trade surplus with the United States, which accounted for 74.9 per cent of Canadian goods exports in October, expanded to $3.52-billion from $2.02-billion in September.

BLOOMBERG. 5 December 2017. U.S. Sales Help Canadian Exporters Emerge From Lengthy Slump

By Theophilos Argitis

- BMO sees ’room for improvement’ after first gain in 5 months

- Trade deficit narrows to C$1.5 billion, the lowest since May

Canada broke out of its months-long export slump in October, thanks to the U.S.

Exports advanced 2.7 percent in October, the first gain in five months, Statistics Canada said Tuesday from Ottawa, driven largely by a jump in sales to the the country’s biggest trading partner. The increased shipments halved the trade deficit to C$1.5 billion ($1.2 billion), below economist forecasts for a C$2.7 billion deficit.

It was unexpected strength for a trade sector that has been a great disappointment to policy makers this year, hampering an economy that is otherwise firing on all cylinders. Canada’s economy slowed sharply in the third quarter due to weak exports.

“This is a positive report, but there’s a still lot of room for improvement,” Benjamin Reitzes, a strategist at BMO Capital Markets in Toronto, wrote in a research note.

Exports in recent months had suffered one of their biggest tumbles ever, fueling concern the nation’s currency accelerated too quickly earlier this year. A recent drop in the Canadian dollar though -- down almost 5 percent since peaking in September -- may be providing some relief. So is steady domestic demand in the U.S.

Canada’s improved trade performance was driven by a 4.1 percent increase in exports to the U.S., helping to widen Canada’s surplus with its largest trading partner to C$3.5 billion in October from C$2 billion a month earlier. Separately, the Commerce Department reported the U.S. trade deficit widened in October to a nine-month high.

One factor was a jump in shipments of refined petroleum products, which Statistics Canada said may have been due to lower inventories along the East Coast.

Other Details

- In total, Canada recorded higher shipments in nine of 11 sectors tracked by the agency

- Imports fell 1.6 percent in October, reflecting an 8.1 percent drop in the motor vehicle category. The agency cited work stoppages and planned shutdowns for the drop

- Deficits between June and September were revised down by C$666 million

- In volume terms, adjusting for price changes, exports rose 1.2 percent while imports fell 3.9 percent

— With assistance by Erik Hertzberg

CANADA - CHINA

Innovation, Science and Economic Development Canada. December 5, 2017. Gearing up for the 2018 Canada-China Year of Tourism. Canada prepares to welcome a record number of visitors from China next year

Beijing, China - Canada and China enjoy strong people-to-people ties. More than 1.8 million Canadians have some Chinese ancestry, and Mandarin and Cantonese are the most spoken languages in Canada after English and French. Next year, Canada will have a unique opportunity to showcase all of its amazing and exciting attractions to Chinese visitors, while helping to create well-paying middle-class jobs in communities across Canada.

As both countries gear up for the 2018 Canada-China Year of Tourism (CCYT), the Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism, and Li Jinzao, Chairman of the China National Tourism Administration, unveiled the official CCYT logo during an event at the headquarters of Weibo, one of China's largest online media companies.

The logo, which will be used throughout the year to raise awareness of the Year of Tourism, is based on circle designs found in both Canadian and Chinese cultures, representing unity and collaboration while reinforcing the strong people-to-people ties that link our countries. The logo includes images of a panda and a polar bear, animals of national significance for both countries.

Canadian tourism and hospitality businesses interested in promoting the Canada-China Year of Tourism are encouraged to download the logo from Canada.ca/ccyt2018. Additional information on how businesses can prepare to welcome more Chinese tourists is also available on the site.

Quotes

“I am happy to join Prime Minister Trudeau and my colleagues on this important trip to China. Canada’s relationship with China is built on strong family and people-to-people ties. Diversity is our strength, and the Canada-China Year of Tourism is a fabulous opportunity to build on these ties and showcase the many amazing events and attractions for which Canada is world-renowned. I am looking forward to welcoming a record number of Chinese visitors in 2018, which means more middle-class jobs for Canadians.”

– The Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism

Quick Facts

- Tourism is Canada’s largest service export and employs one in ten Canadians.

- China is Canada’s third-largest tourism source market, behind the United States and the United Kingdom.

- As part of Canada’s New Tourism Vision, Canada has committed to doubling the number of Chinese tourists by 2021.

- In 2016, 610,100 Chinese nationals visited Canada and their spending totalled $1.5 billion.

Canada-China Year of Tourism website: http://www.ic.gc.ca/eic/site/100.nsf/eng/home

PM. December 4, 2017. Canada announces new partnerships with China to grow shared prosperity Beijing, China

The Prime Minister, Justin Trudeau, today announced new joint partnerships with China after successfully concluding, with His Excellency Li Keqiang, Premier of the State Council of the People’s Republic of China, the second Annual Leaders’ Dialogue.

Canada and China are working to build a stronger, more stable relationship to create good, middle-class jobs and more opportunities for people in both countries.

With that goal in mind, the two leaders announced new initiatives to grow our shared prosperity.

The Prime Minister and the Premier look forward to continuing exploratory discussions towards a comprehensive trade agreement between Canada and China. With China, as with all of our trading partners, we are committed to pursuing trade that benefits everyone, that puts people first and reflects Canadian values, especially when it comes to the environment, labour, and gender.

The two leaders issued the Joint Statement on Climate Change and Clean Growth which highlights the ongoing bilateral collaboration and the potential for enhanced engagement. The two countries will also expand cooperation and increase ministerial dialogue to promote clean growth and combat climate change by fully implementing the Paris Agreement.

In the context of the National Security and Rule of Law Dialogue, the Prime Minister directed his officials to redouble their efforts regarding the threat of opioids.

Both countries agreed to increase collaboration on agriculture and tourism, which will include expanding market access to give Canadian producers new opportunities to enhance their competitiveness. They also committed to supporting more opportunities for youth and student exchanges, such as internships at Canadian missions in China.

To strengthen the cultural and economic relationship between Canada and China, both countries agreed to co-chair the inaugural meeting of the Canada-China Joint Committee on Culture in Ottawa, in February 2018, to discuss matters of mutual interest, including creative industries and the arts.

Finally, the two leaders discussed important regional issues, including North Korea and Myanmar. In the spirit of open and frank dialogue, both sides agreed to maintain a dialogue on human rights on the basis of equality and mutual respect, and to expand practical cooperation and exchanges, including on the rule of law, and to address their differences constructively.

Quotes

“While in Beijing, Premier Li and I had discussions on a range of issues, from growing trade and investment, to combating climate change, to the importance of free expression. I look forward to continuing discussions towards a comprehensive trade agreement, which will open up greater opportunities for people on both sides of the Pacific.”

— The Rt. Hon. Justin Trudeau, Prime Minister of Canada

“Increasing trade and investment with our partners in the Asia-Pacific region is essential if we are to create long-term prosperity and an economy that creates jobs and works for the middle class. China is Canada’s second largest trading partner, and its vast market offers significant opportunities for Canadian businesses of all sizes. It is time for a more strategic, long-term, and comprehensive approach to economic engagement with China.”

— The Hon. François-Philippe Champagne, Minister of International Trade

“I am proud of the ongoing collaboration between Canada and China on climate change and the environment. Canada and China understand the need to protect our environment for future generations and the economic opportunity of clean growth. Environmental protection is key to our progressive trade agenda and will provide even greater opportunities for businesses to provide innovative solutions for clean air, water and soil that will lead to good, middle-class jobs and prosperity in both countries. Canada and China are committed to work together to provide global leadership on combatting climate change through implementation of the Paris Agreement.”

— The Hon. Catherine McKenna, Minister of Environment and Climate Change

Quick facts

- Prime Minister Trudeau and His Excellency Li Keqiang, Premier of the State Council of the People’s Republic of China, last met in September 2016 in Canada when the two leaders held an inaugural meeting of the Canada-China Annual Leaders’ Dialogue.

- China is Canada’s second-largest trading partner, largest and fastest growing source market for international students, and third-largest source of tourists.

- Canada’s merchandise exports to China were almost $21 billion in 2016, an increase of four per cent over 2015, with top exports being forest and agricultural products, copper and iron ores, and motor vehicles.

- In 2016, Canada and China agreed to designate 2018 the Canada-China Year of Tourism, which includes initiatives to increase the flow of tourists and promote cultural activities.

See Also:

- Backgrounder: Canada-China Joint Initiatives and Agreements: https://pm.gc.ca/

eng/news/2017/12/04/canada- china-joint-initiatives-and- agreements - Joint Statement on Climate Change and Clean Growth: https://pm.gc.ca/eng/

news/2017/12/04/canada-china- joint-statement-climate- change-and-clean-growth - Prime Minister Trudeau welcomes upcoming Canada-China Year of Tourism: https://pm.gc.ca/eng/

news/2017/12/04/prime- minister-trudeau-welcomes- upcoming-canada-china-year- tourism - Prime Minister to strengthen bilateral and commercial ties on trip to China: https://pm.gc.ca/eng/

news/2017/11/26/prime- minister-strengthen-bilateral- and-commercial-ties-trip-china

Canada-China Relations: http://www.

The Globe and Mail. 5 Dec 2017. Canada, China free-trade talks fail to launchSTEVEN CHASENATHAN VANDERKLIPPE

BEIJING - Speaking in Beijing, PM hints Canada is holding out for ambitious deal, predicts ‘significant’ agreementThe fate of expected free-trade talks between Canada and China is now uncertain after Prime Minister Justin Trudeau emerged from a meeting with Premier Li Keqiang Monday to announce the two countries will merely keep exploring whether to launch negotiations.It had been widely anticipated that Canada would become the first Group of Seven countryto commence free-trade talks with China. China’s ambassador to Canada earlier this fall predicted a decision shortly and business leaders publicly anticipated that Mr. Trudeau’s December trip to China was planned with this in mind.An industry source, however, said the word has gone out among businesses with a stake in Chinese trade that there is still hope for a deal before Mr. Trudeau’s official visit to China ends and that negotiations are still alive.Companies are being told there is the possibility of an agreement to move forward withtalks on reducing tariffs, as well as non-tariff barriers that can be used to frustrate foreign imports.The sticking point is the scope of negotiations. Businesses are being informed that there may be more discussions between Mr. Trudeau and Mr. Li to try to reach a deal on launchingtalks. Mr. Trudeau dined with Mr. Li on Monday night and is scheduledto dine with Chinese President Xi Jinping on Tuesday evening. Among the points of disagreement is the Liberal government’s effort to ensure talks will include setting standards for labour andthe environment, the industry source said.The source said China’s ambassador to Canada, Lu Shaye, has been telling Canadians that Beijing is ready to agree to the same sort of trade deal struck with Australia in 2014.There is widespread agreement among business groups and trade analysts that the Australia-China deal is not ambitious enough and that Canada has to achieve more – including strong rules to allow them to challenge Chinese efforts to frustrate Canadian imports.Speaking later to reporters on Monday after his initial meetingthat day with Mr. Li, Mr. Trudeau declined to reveal what topics stalled the launch of free-tradetalks.But he said Canada was holding out for a better deal.“The deals we move forward on will be in Canada’s interest and I think Canadians expect we do the work to ensure the trade deal we embark upon [is] goingto be the right one for Canadians.”The Prime Minister, however, broadly suggested Canada wants a more ambitious deal. One ofthe criticisms levied at the trade deals signed by China to date isthat they are not far reaching enough, and while they cut tariff barriers, they do not address the non-tariff barriers China is known to deploy against foreign imports.“There wasn’t one specific issue,” Mr. Trudeau said when asked what is holding up the launch of talks. “There is a coming together on the sense this isgoing to be a big thing, not a small thing.”He declined to name the obstacles stopping Beijing and Ottawa from commencing negotiations.Mr. Trudeau nevertheless predicted Canada would one day start such talks – a day that will not apparently come during histrip to China this week. “This will be a significanttrade agreement that we will eventually move towards because of the scale of the Chinese economy.”The Prime Minister provided no timeline for what might happen next, except to say Canada and China will continue exploratory discussions.Mr. Trudeau is scheduled to leave Beijing on Tuesday night for the business hub of Guangzhou, where he will spend two days promoting Canadian business.The Canadian government appears conscious of the factthat as a major industrialized economy and a member of the G7, it could set a bad precedent for future trade deals if it agreesto a low-ambition scale of talks. “China is very aware that this is a precedent as they move forward with the first trade deal with a G7 country and there is a desire to make sure we get it right,” the Prime Minister said.Signs that something was wrong emerged throughout the day in Beijing as meetings between Mr. Trudeau and Mr. Li continued longer than expected.Just before Mr. Trudeau and Mr. Li emerged from their Monday meeting without the longanticipated agreement to launch free-trade talks, the Chinese backed out of a planned news conference to discuss the Li-Trudeau visit.Mr. Li did speak briefly: “We will continue to work on the FTA – that is, exploratory talks or a feasibility study.”“China is open to such talks,” he added.The two countries have, however, expressed differing views on the scope of a trade agreement, with Beijing interested in a more pared-down deal similarto what it has with Australia, and Ottawa pushing for a comprehensive, modern treaty.Beijing has long sought Canada’s presence at the free-trade negotiating table in part because such talks would grant it fresh leverage to convince other G7 countries to follow suit.Launching free-trade talks with China was supposed to be part of a pivot toward Asia as economic relations with the United States sour.Mr. Trudeau, who once professed admiration for China’s “basic dictatorship” because it allows the Chinese to “turn their economy around on a dime,” has for some time set his sights on closer alignment with Beijing. His outreach is meant to undothe damage that business leaders and analysts said Stephen Harper caused to Sino-Canadianties by a more standoffish and hawkish approach.China has for years pressed Canada to launch trade talks, seeking access to a major Western economy with close ties tothe United States.The Canadian business community has been less enthusiastic, saying in consultations withthe Canadian federal government that the thorniest issues intrade with the authoritarian country are unlikely to be resolved by such a pact.The lack of an agreement on Monday suggests difficult questions remain. But it is “not disappointing,” said Jiang Shan, a former head of the economics section at the Chinese embassy in Canada.“Both sides are movingtoward the right direction,” he said. “Free trade is good for both sides.”

BEIJING - Speaking in Beijing, PM hints Canada is holding out for ambitious deal, predicts ‘significant’ agreementThe fate of expected free-trade talks between Canada and China is now uncertain after Prime Minister Justin Trudeau emerged from a meeting with Premier Li Keqiang Monday to announce the two countries will merely keep exploring whether to launch negotiations.It had been widely anticipated that Canada would become the first Group of Seven countryto commence free-trade talks with China. China’s ambassador to Canada earlier this fall predicted a decision shortly and business leaders publicly anticipated that Mr. Trudeau’s December trip to China was planned with this in mind.An industry source, however, said the word has gone out among businesses with a stake in Chinese trade that there is still hope for a deal before Mr. Trudeau’s official visit to China ends and that negotiations are still alive.Companies are being told there is the possibility of an agreement to move forward withtalks on reducing tariffs, as well as non-tariff barriers that can be used to frustrate foreign imports.The sticking point is the scope of negotiations. Businesses are being informed that there may be more discussions between Mr. Trudeau and Mr. Li to try to reach a deal on launchingtalks. Mr. Trudeau dined with Mr. Li on Monday night and is scheduledto dine with Chinese President Xi Jinping on Tuesday evening. Among the points of disagreement is the Liberal government’s effort to ensure talks will include setting standards for labour andthe environment, the industry source said.The source said China’s ambassador to Canada, Lu Shaye, has been telling Canadians that Beijing is ready to agree to the same sort of trade deal struck with Australia in 2014.There is widespread agreement among business groups and trade analysts that the Australia-China deal is not ambitious enough and that Canada has to achieve more – including strong rules to allow them to challenge Chinese efforts to frustrate Canadian imports.Speaking later to reporters on Monday after his initial meetingthat day with Mr. Li, Mr. Trudeau declined to reveal what topics stalled the launch of free-tradetalks.But he said Canada was holding out for a better deal.“The deals we move forward on will be in Canada’s interest and I think Canadians expect we do the work to ensure the trade deal we embark upon [is] goingto be the right one for Canadians.”The Prime Minister, however, broadly suggested Canada wants a more ambitious deal. One ofthe criticisms levied at the trade deals signed by China to date isthat they are not far reaching enough, and while they cut tariff barriers, they do not address the non-tariff barriers China is known to deploy against foreign imports.“There wasn’t one specific issue,” Mr. Trudeau said when asked what is holding up the launch of talks. “There is a coming together on the sense this isgoing to be a big thing, not a small thing.”He declined to name the obstacles stopping Beijing and Ottawa from commencing negotiations.Mr. Trudeau nevertheless predicted Canada would one day start such talks – a day that will not apparently come during histrip to China this week. “This will be a significanttrade agreement that we will eventually move towards because of the scale of the Chinese economy.”The Prime Minister provided no timeline for what might happen next, except to say Canada and China will continue exploratory discussions.Mr. Trudeau is scheduled to leave Beijing on Tuesday night for the business hub of Guangzhou, where he will spend two days promoting Canadian business.The Canadian government appears conscious of the factthat as a major industrialized economy and a member of the G7, it could set a bad precedent for future trade deals if it agreesto a low-ambition scale of talks. “China is very aware that this is a precedent as they move forward with the first trade deal with a G7 country and there is a desire to make sure we get it right,” the Prime Minister said.Signs that something was wrong emerged throughout the day in Beijing as meetings between Mr. Trudeau and Mr. Li continued longer than expected.Just before Mr. Trudeau and Mr. Li emerged from their Monday meeting without the longanticipated agreement to launch free-trade talks, the Chinese backed out of a planned news conference to discuss the Li-Trudeau visit.Mr. Li did speak briefly: “We will continue to work on the FTA – that is, exploratory talks or a feasibility study.”“China is open to such talks,” he added.The two countries have, however, expressed differing views on the scope of a trade agreement, with Beijing interested in a more pared-down deal similarto what it has with Australia, and Ottawa pushing for a comprehensive, modern treaty.Beijing has long sought Canada’s presence at the free-trade negotiating table in part because such talks would grant it fresh leverage to convince other G7 countries to follow suit.Launching free-trade talks with China was supposed to be part of a pivot toward Asia as economic relations with the United States sour.Mr. Trudeau, who once professed admiration for China’s “basic dictatorship” because it allows the Chinese to “turn their economy around on a dime,” has for some time set his sights on closer alignment with Beijing. His outreach is meant to undothe damage that business leaders and analysts said Stephen Harper caused to Sino-Canadianties by a more standoffish and hawkish approach.China has for years pressed Canada to launch trade talks, seeking access to a major Western economy with close ties tothe United States.The Canadian business community has been less enthusiastic, saying in consultations withthe Canadian federal government that the thorniest issues intrade with the authoritarian country are unlikely to be resolved by such a pact.The lack of an agreement on Monday suggests difficult questions remain. But it is “not disappointing,” said Jiang Shan, a former head of the economics section at the Chinese embassy in Canada.“Both sides are movingtoward the right direction,” he said. “Free trade is good for both sides.”

The Globe and Mail. 5 Dec 2017. OPINION. Liberal China syndrome

When Prime Minister Justin Trudeau emerged Monday from a meeting with China’s Premier Li Keqiang to announce that, surprise, our two countries are not starting free-trade talks, it was widely interpreted as a personal snub of the Prime Minister, and a loss for the government. But in time, what didn’t happen on Monday may come to be seen as less of an embarrassment, and more of a blessing.

Canada has a long list of reasons to be cautious about entering into a trade deal with China. Our potential partner is not a free-market democracy; it’s an absolute dictatorship, sitting atop a state-dominated economy. It’s also not a ruleof-law country. And perhaps most importantly, describing

the deal that Ottawa and Beijing were until Monday believed

to be about to start negotiating as a “free-trade agreement” diminishes the scope and scale of what Beijing is after.

In the 21st century, what we reflexively still call free-trade agreements should really be called trade, investment and intellectual property agreements. They’re about far more than just lowering barriers to trade, because so many of those barriers have already been shaved down or entirely dismantled.

According to the World Bank, the global weighted mean applied tariff rate is less than 3 per cent. According to the World Trade Organization, Canada’s average tariff applied to non-agricultural imports from countries with Most Favoured Nation status, a list that includes China, is just 2.2 per cent.

Look around your own home, and consider how many of your possessions – from clothes to computers and from plastic nik naks to hockey sticks – were made in China. In 2016, Canada imported more than $64-billion worth of goods from China, up from less than $5-billion two decades ago.

China is already Canada’s second-largest trading partner, and China’s exports to this country mostly face low duties. Even without a free trade agreement, thanks to the WTO, Canada already has free-ish trade with China on most goods, at least when it comes to products exported from China to Canada. We’d be happy to see those tariffs fall to zero, but on average, the existing tariff regime for most non-agricultural

goods is already low.

Canada wants greater access for Canadian goods and services exported to the Chinese market, but Beijing has signalled that the price for that is, among other things, greater access to the Canadian market for Chinese investors.

Canada currently reviews large foreign takeovers, and has long been particularly wary of takeovers of Canadian companies whose businesses involve national security, sensitive

technologies and advanced intellectual property. On intellectual property, China is a routine violator of patent and copyright law. And when it comes to military technology, China is understandably treated as a potential adversary by our closest ally, the United States. Earlier this year, the Trudeau government gave a speedy green light to

the takeover of Norsat International by a Chinese firm. Norsat makes radio systems used by Canada’s NATO allies; handing the technology over to Beijing was seen as an attempt to court China.

That’s why its incomplete and even misleading to describe

the Canada-China exploratory talks as having been about “free trade.” What was on the table, and may be again soon, is bigger than that.

Because Canada is a rule-of-law country, the elements of

the international agreements we sign become effectively enforceable under Canadian law. Those include investor protections. Ottawa can’t just sign a trade and investment agreement and then routinely violate or ignore it – but Beijing can. Even an agreement said to be incorporated into China’s domestic law remains contingent. In China, the law is whatever Xi Jinping and the hard men of Beijing say it is.

As a middle power, Canada’s traditional answer to an imbalance of force between us and a bigger interlocutors has been to try to work through multilateral institutions – where

the many Lilliputians at least have a shot at tying down one

giant Gulliver.

Beijing may be able to offer Canada greater access to the Chinese market, but there will be a price to be paid in return. And given the disparity between the solidity of the Canadian legal system and the ephemeral nature of the Chinese one, Canada’s negotiators in any future talks could find themselves making certain and enforceable concessions in return for uncertain, unenforceable rewards.

The need for tact in dealing with Beijing means the Trudeau government cannot abandon its talks about talks with China. But it should be in no hurry to conclude them.

THE GLOBE AND MAIL. DECEMBER 5, 2017. CANADA-CHINA RELATIONS. Trudeau presses human rights, cases of jailed Canadians, with China

STEVEN CHASE, BEIJING

Prime Minister Justin Trudeau lauded the achievements of his second official visit to China, and his efforts to raise human-rights concerns, after the widely anticipated launch of trade talks with Beijing was delayed by further haggling.

Mr. Trudeau had been expected to launch free-trade negotiations during this trip.

Discussions were ongoing Tuesday as Canada and China tried to agree on the scope of talks.

Canada's international trade minister Francois-Philippe Champagne ended up changing his travel plans Tuesday night in order to redouble the effort between Canada and China to agree on terms for the talks.

Mr. Champagne had intended to head to the Beijing airport with Mr. Trudeau's entourage, which was going to the southern business hub of Guangzhou where the prime minister is speaking at a gathering of business elites. But circumstances changed and Mr. Champagne stayed in Beijing.

Mr. Trudeau, for his part, defended the effort he has put into raising human-rights concerns with Chinese Premier Li Keqiang. At least five Canadians are in detention in China under controversial circumstances in cases that critics say are unreasonable imprisonment.

"I brought them up last night – human rights and consular cases – with Premier Li and I will certainly be addressing those issues with President Xi," he said of a planned dinner with the head of state.

The Prime Minister said he stressed to Mr. Li how important it is for Canada to be granted consular access to imprisoned Canadians.

"We discussed the continued opposition Canada has, as a matter of principle, to the death penalty."

Business leaders who had journeyed to China to join Mr. Trudeau in opening up trade talks voiced their concern that Canada sorely needs new markets in light of souring economic relations with the United States. After the Trump administration had tabled a series of demands for rewriting NAFTA that Canada and Mexico have decried as unreasonable, businesses are planning for the possibility the United States will tear up the continental deal.

"Our biggest risk is that we ship 270,000 tonnes a year of beef to the United States and possibly facing losing that NAFTA agreement … which I think is a possibility that we have to take seriously," John Masswohl, an executive with the Canadian Cattlemen's Association, told reporters at business roundtable in Beijing.

As The Globe and Mail reported Monday, sticking points preventing free-trade talks from launching include resistance to the Liberal government's effort to ensure that talks will include setting standards for labour and the environment.

Mr. Trudeau declined to reveal details of talks with the Chinese but said his government wants to see future trade agreements "account for things like labour protection, environmental standards and gender."

Following a dinner with Chinese President Xi Jinping Tuesday, Mr. Trudeau flies to the business hub of Guangzhou where he will promote Canadian business at a global forum of chief executive officers.

China's ambassador to Canada, Lu Shaye, has been telling Canadians that Beijing is ready to agree to the same sort of trade deal struck with Australia in 2014.

There is widespread agreement among business groups and trade analysts that the Australia-China deal is not ambitious enough and that Canada has to achieve more – including strong rules to allow them to challenge Chinese efforts to frustrate Canadian imports.

Mr. Trudeau said he and Chinese leaders agreed to co-operate further to fight climate change and promote clean technology and collaborate further on tourism and agriculture.

He played down the lack of progress on launching free-trade talks, saying Canada and China are being careful to ensure they get it right.

"This is not an overnight process."

He contrasted his warm relationship with Beijing to the approach taken by former prime minister Stephen Harper.

"There was a fits and start approach … a hot and cold approach, particularly in the previous government, to China. We want to make sure the progress we make is solid and steady," Mr. Trudeau said.

The Liberal leader, who once professed admiration for China's "basic dictatorship" when asked which foreign country he most admires – because it allows the Chinese to "turn their economy around on a dime" – on Tuesday declined to repeat an answer that drew significant criticism and derision back in 2013. Asked again which other country he most admired, Mr. Trudeau choose the United Kingdom for its parliamentary system.

"As we look at electoral structures … we've had a certain level of discussions around electoral and democratic reform in Canada that have me looking to the mother of all Parliaments. The U.K. does a significantly better job of programming legislation, getting it through the House," he said, adding that his Liberal government borrowed the idea of a once-a-week Prime Minister's Question Period from the U.K., where the leader of the government fields all questions asked that day.

Mr. Trudeau was asked what he's doing in China to demonstrate he is committed to more than just business deals, but instead subjects such as human rights. He replied that answering questions from Canadian journalists is how he shows he cares about freedom of the press.

"I am happy to be here now taking a broad range of questions from the media on a broad range of issues to demonstrate that I truly believe a free and informed and independent process is something necessary to support for a society to thrive. This is something I demonstrate all around the world."

THE GLOBE AND MAIL. DECEMBER 4, 2017. At a Chinese Internet giant, Trudeau sells Canada – but is denied a live broadcast

NATHAN VANDERKLIPPE, BEIJING

The publicity materials for Justin Trudeau's inaugural event in China this week promised a splashy debut.

"Why would this great leader, famous for his good looks and youth, choose to visit Sina first?" asked the official news account of the company, a Chinese online giant that made Mr. Trudeau the guest of honour at its Beijing headquarters on his second official visit to China.

The company promised answers, and "broadcast and reporting of the entire proceedings," when Mr. Trudeau arrived Monday morning.

But in a country that rarely allows foreign leaders unfiltered access to its people, no live images of Mr. Trudeau appeared to the millions of people who tuned in on Sina-owned Weibo, one of the country's largest social media and digital broadcast platforms.

Mr. Trudeau spoke for nearly an hour in an event to promote Canada as a tourism destination. He described his own campfire surf-and-turf bachelor party in Newfoundland – calling the province's Jockey Club brand "good terrible beer" – admitted to once buying a sleeveless lumberjack jacket at Toronto's Kensington Market and promised: "It's not just me. Everyone is nice in Canada."

But Chinese viewers at first saw only a delayed 36-second clip of Mr. Trudeau, in which he urged them to "make sure you're following me on Weibo." It was a supportive gesture for a micro-blogging service whose users outnumber Twitter users – but whose operations are also a key element of China's censorship regime.

Only hours later was more of Mr. Trudeau's appearance made available.

Determined to control what its people can hear, China gives foreign leaders the ability to speak live to its people on only very few occasions. In 2009, when it gave that privilege to a U.S. president, it cut away from a speech by Barack Obama when he said: "recall that earlier generations faced down fascism and communism not just with missiles and tanks, but with sturdy alliances and enduring convictions."

Mr. Trudeau made no such political remarks in his Sina appearance, speaking only about the "extraordinary" experience of backpacking through China in the early 1990s. For his efforts, he won tens of thousands of new followers.

"We are very pleased to have reached so many Chinese Web users, via the country's largest social-media platform," said Chantal Gagnon, press secretary to Mr. Trudeau.

"I can assure you that he always stands up for freedom of expression, at home and abroad."

But the importance of Weibo, as a medium for both expression and repression, underscores the difficult balances that China can require of foreign democratic leaders eager to join hands with the world's second-largest economy, but nervous about appearing too supportive of an autocratic regime.

Mr. Trudeau, however, offered no public comment Monday on the role Weibo plays in aiding the Chinese government's bid to purge online discourse of discussions it deems off-limits – and punish those who violate its demands.

"Companies like Sina-Weibo are required by law to police their networks. This means that many companies have put in place extensive censorship and surveillance systems," said Ron Deibert, director of the Citizen Lab with the Munk School of Global Affairs at the University of Toronto.

Mr. Trudeau "has many values and interests to balance in representing Canada's engagement with China, from human rights to the economy," Mr. Deibert said. And the words of a Canadian prime minister are unlikely to accomplish much in changing policies that are core to the social controls used by the Communist Party to retain unchallenged power.

"But that doesn't mean he should say nothing," said Mr. Deibert, whose lab has been a leader in documenting the ways Chinese online companies use increasingly sophisticated technology to parse speech and delete offending commentary.

Weibo itself has struggled to comply with government censorship demands. In June, it was forced to briefly halt its video service for "failing to promote core socialist values." Three months later, it openly advertised for 1,000 people to join its team of "Weibo supervisors," who are paid to monitor and report content.

The company took few chances with Mr. Trudeau's visit. It invited more than a dozen local "KOL" figures – "key opinion leaders" with large online followings – to attend, but barred them from bringing in camera equipment.

Mr. Trudeau's silence on Sina's role in policing free speech drew criticism from human rights advocates.

"By failing to challenge Sina Weibo's censorship during his visit there, Prime Minister Trudeau sent the message that Canada isn't worried about that behaviour," said Sophie Richardson, China director for Human Rights Watch.

She warned that in using Weibo as a platform to promote tourism, Canada "will almost certainly have to subject itself to censorship, including not being able to post certain words that are deemed sensitive by the Chinese government."

Canada should condemn any such acts, she said, and "commit to publicly reporting all attempts by Chinese authorities to censor any information."

Tourism is a major push for Canadian officials as they seek to boost Canadian profits from China's rise. Chinese tourists have in recent years become a coveted and heavy-spending demographic of travellers.

But Canada badly lags other countries in wooing them. Last year, Australia counted 1.2 million Chinese tourist arrivals; France had two million visitors. Canada had 610,139 overnight arrivals from China.

Ahmed Hussen, Canada's Minister of Immigration, Refugees and Citizenship, said last month "Canada can easily double or triple or quadruple the numbers."

Next year has been designated an official year of Canada-China tourism, and Chinese tourism firms are already moving to promote Canada.

Chinese tourists have, to this point, largely come to Canada in summer. But Caissa International, a Beijing-based travel firm, has recently launched tours to ice fish, aurora-watch and take part in Quebec's Winter Carnival.

"2018 marks a brand new era for China-Canada travel," said Liu Yi, a project manager with Caissa.

Mr. Trudeau on Monday made his own pitch, plugging Canada's natural beauty and "a diversity of cultures, of languages, of personal experience that is hard to find anywhere else in the world."

He took the stage with four millennial Chinese who recently took trips to Canada funded by Canadian tourism authorities.

Mr. Trudeau presented himself as a fellow traveller, striking common cause in the thrills and stresses of discovering new places – and then returning home to discover that "you no longer quite fit" into the spaces left behind.

He also offered a joke about what qualifies as typical Canadian food.

"You can put maple syrup on anything and that makes it Canadian," he said.

With a report from Alexandra Li

REUTERS. DECEMBER 4, 2017. Canada's Trudeau says will keep exploring trade deal with China

Michael Martina

BEIJING (Reuters) - Canada will continue to explore a free trade agreement with China, Canadian Prime Minister Justin Trudeau said, as it weighs its options after the United States threatened to pull out of the North American Free Trade Agreement (NAFTA).

Speaking after a meeting with Chinese Premier Li Keqiang on Monday, Trudeau said that if “done properly”, such an agreement would benefit both countries and strengthen the middle class.

“It’s an opportunity that makes sense for Canadian businesses,” he said at the start of a five-day trip to China. “Canada is and always has been a trading nation. But the landscape of trade is shifting and we need to adjust to it.”

Li said China remained open to exploring a free trade deal with Canada as part of joint efforts to safeguard world trade liberalisation and advance globalisation.

“We have an open attitude toward the process of negotiations, and an open attitude towards their contents,” Li said.

Canada is considering whether to launch talks on a free trade deal with China, which wants a trade pact similar to the ones it has with Australia and New Zealand.

But Trudeau, aware of domestic unease at the idea, is moving slowly. Although polls consistently show Canadians are split over the merits of a trade deal, Canada needs to diversify exports to offset the possible damage done if the United States pulls out of NAFTA.

Speaking to reporters on Tuesday, Trudeau reiterated that a deal with China was not an “overnight process”.

“And once we get to the stage of negotiating a trade agreement, that’s going to take years, as well,” he said.

Trudeau’s visit, which began on Sunday, comes as plane maker Bombardier Inc is eager to win a breakthrough order from Chinese carriers for its CSeries jet, whose fuselage is made in China.

But the chance of sealing such deals has become more cloudy after Canada encouraged Bombardier to sell a controlling stake in the CSeries programme to Airbus

“On the agricultural front, I‘m pleased to announce the Canadian beef and pork will have greater access to the Chinese market,” Trudeau said at the Monday briefing, without elaborating.

China has been loosening restrictions on beef imports this year to feed the appetite of the country’s growing middle class for more Western food.

Trudeau said he also agreed with Li a joint statement that affirms a commitment to “mitigating the global threat of climate change” and lays out a plan for closer collaboration.

Reporting by Michael Martina; Editing by Nick Macfie

BLOOMBERG. 5 December 2017. Key Trudeau Minister Stays in Beijing for Talks After Xi Dinner

By Chris Fournier and Josh Wingrove

- Chinese leader sees ‘new vitality’ but doesn’t mention trade

- Business holds out hope FTA negotiations can still be launched

China and Canada continue to haggle over terms to launch free trade negotiations, with Justin Trudeau’s lead minister on the file staying behind in Beijing for talks.

The Canadian prime minister dined with President Xi Jinping Tuesday evening in the capital before flying out to Guangzhou. The meeting came after a false start the day before, when Trudeau and Premier Li Keqiang abruptly changed their plans for a joint press conference and expected announcement.

However, before Trudeau departed Beijing an aide to Trade Minister Francois-Philippe Champagne abruptly left the prime minister’s plane. Spokesman Joseph Pickerill said in an email talks were ongoing after a productive two days.

At issue, in part, are “progressive” chapters on subjects like labor, the environment and gender that Trudeau sees as essential to any potential deal. He said Monday he didn’t want to start negotiations if the countries -- which have held exploratory talks -- didn’t expect they’d be able to complete them. The to-and-fro comes after Canada angered Japan by balking at a deal to salvage the Trans Pacific Partnership as it pushes for further changes.

Trudeau told reporters earlier Tuesday he would continue to discuss a free-trade agreement with China “as the next step in the larger framework of our partnership,” adding that formal talks are “something that we are very much interested in, that we know China is very much interested in.”

Leaders Meeting

The Chinese president received the Canadian prime minister Tuesday evening at the Diaoyutai State Guesthouse, an elaborate building in a walled compound in western Beijing. Xi and Trudeau shook hands in front of a row of flags before adjourning to a meeting room, each flanked by five senior officials. One was Wang Yi, China’s foreign minister who caused a stir last year when he scolded Canadian journalists for asking about human rights on a visit to Ottawa.

Xi’s warm remarks didn’t include any mention of a trade deal. “I’m sure this visit will be a success and inject new vitality into China-Canada relations,” he said. “Both of our countries have their advantages and are highly complementary in the field of cooperation. Our cooperation will have even greater impact as we broaden this path.”

Trudeau, however, cited “important conversations” about trade and hailed bilateral ties between the nations. “I look forward to discussing with you the many areas in which Canada and China can continue to collaborate for regional and indeed global progress.”

Potential Deal

Canadian business leaders traveling in China said it was still possible for the two countries to reach a deal to launch FTA negotiations. “Until they say no they’re not going to do it, then they’re still working toward making it happen,” said John Masswohl, director of government and international relations for the Canadian Cattlemen’s Association, representing the beef sector.

Preston Swafford, chief nuclear officer at SNC Lavalin Group Inc. and chief executive officer of Candu Energy Inc., told reporters in Beijing Champagne was unable to meet with executives because he was in talks with his Chinese counterparts.

David Mulroney, a former Canadian ambassador to China, said Monday’s developments likely embarrassed Li and that launching formal talks -- while still possible -- was unlikely before Trudeau’s trip to China concludes Thursday.

AVIATION

The Globe and Mail. 5 Dec 2017. Bombardier’s Belfast site tapped to build new Airbus engine component. Company will develop and manufacture a new thrust reverser for A320neo aircraft. The company’s manufacturing site in the city, part of its aerostructures and engineering services unit, will develop and manufacture a new engine component for Airbus.

NICOLAS VAN PRAET, MONTREAL

Bombardier Inc. says its manufacturing site in Belfast has been chosen to build a new engine component for Airbus Group SE’s A320neo airliner.

The site, part of Bombardier’s aerostructures and engineering services unit, will develop and manufacture a new thrust reverser for engine nacelles on Airbus’s Pratt & Whitney-powered A320 planes. A nacelle is the outer casing on an aircraft engine.

No financial details were disclosed. The contract will provide a boost to Bombardier’s effort to build out its aerostructures business, a $1.7-billion-ayear unit that supplies complex metallic and composite structures and components for the Montreal-based plane maker and other clients.

Roughly three-quarters of the unit’s volume currently consists of in-house manufacturing for Bombardier aerospace programs such as the Global 7000 luxury jet and C Series commercial airliner. One-quarter comes from external customers, including Airbus.

The unit’s earnings-before-interest-and taxes (EBIT) margin in the latest quarter, before special items, was 9.3 per cent.

“The question that is on our mind is how do we further grow volume at aerostructures,” Bombardier chief executive Alain Bellemare said on the company’s Nov. 2 earnings call. “We want to create more value because we have great capabilities.”

Airbus might provide one path. The European plane maker and Bombardier announced a deal Oct. 16 that will see Airbus win control of Bombardier’s C Series program in exchange for providing its global marketing and procurement power. Bombardier has said it believes Airbus’s involvement will double the value of the C Series program, just in terms of manufacturing cost and after-market support alone.

“We are delighted to have been selected as a supplier on this new nacelle, which will enable us to build on the relationship we already have with Airbus,” Stephen Addis, vice-president of customer services and programs for the aerostructures unit, said in a statement on Monday.

Bombardier shares rose 5 cents to $3.14 in Monday trading on the Toronto Stock Exchange. They have gained nearly 32 per cent since the Airbus deal was announced.

BOMBARDIER (BBD.B) CLOSE: $3.14, UP 5¢

INTERNATIONAL RESERVES

Department of Finance Canada. December 5, 2017. All 2017 Official International Reserves

The Department of Finance Canada announced today that Canada's official international reserves increased by an amount equivalent to US$3,418 million during November to US$86,805 million.

Details on the level and composition of Canada's reserves as of November 30, 2017, as well as the major factors underlying the change in reserves, are provided below. All figures are in millions of US dollars unless otherwise noted.

NOTES:

- Net change in securities and deposits resulting from foreign currency funding activities of the Government. (Issuance of foreign currency liabilities used to acquire assets increases reserves, while maturities decrease reserves). During November, Canada bills increased by US$9.1 million to a level of outstanding bills of US$2,404 million and Canada issued a 5-year US$3 billion global bond.

- "Return on investments" comprises US$95 million of interest earned on investments and a US$136 million decrease in the market value of securities.

- "Revaluation effects" reflect changes in the market value of reserve assets resulting from movements in exchange rates. In November, the revaluation effect was mainly due to the appreciation of the euro and the pound sterling.

- "Net government operations" are the net purchases of foreign currency for government foreign exchange requirements and for additions to reserves.

- "Foreign currency securities" include maturities of foreign currency debt, cross-currency swap payments and an estimate of interest payments on foreign currency liabilities.

- "Securities lent under repurchase agreements" are included in total reserves. Collateral provided in securities lending transactions is not included in total reserves.

- Cash invested under repurchase agreements is included in total reserves. Collateral provided in securities lending transactions is not included in total reserves.

The Department of Finance Canada announced today that Canada's official international reserves increased by an amount equivalent to US$3,418 million during November to US$86,805 million.

Details on the level and composition of Canada's reserves as of November 30, 2017, as well as the major factors underlying the change in reserves, are provided below. All figures are in millions of US dollars unless otherwise noted.

| Millions of US dollars | |

|---|---|

| Securities | 69,932 |

| Deposits | 6,825 |

| Total securities and deposits (liquid reserves): | 76,757 |

| Gold | 0 |

| Special drawing rights (SDRs) | 7,911 |

| Reserve position in the IMF | 2,137 |

| Total: | |

| November 30, 2017 | 86,805 |

| October 31, 2017 | 83,387 |

| Net change: | 3,418 |

ENERGY

The Globe and Mail. REUTERS. 5 Dec 2017. OPEC oil output slips to lowest mark since May

ALEX LAWLER, LONDON

OPEC oil output fell in November by 300,000 barrels a day (b/ d) to its lowest since May, a Reuters survey found, pressured by a drop in Angolan and Iraqi exports, strong compliance with a supply cut deal and involuntary declines.

OPEC’s adherence to pledged supply curbs rose to 112 per cent from October’s 92 per cent, the survey found. Top exporter Saudi Arabia pumped below its OPEC target, as did all other members except Ecuador, Gabon and the United Arab Emirates.

The Organization of Petroleum Exporting Countries is reducing output by about 1.2 million b/d as part of a deal with Russia and other non-member producers, which have also committed to production cuts.

Oil is trading near a two-year high supported by falling inventories, strong demand and high compliance with the promised curbs. The producers at a Nov. 30 meeting extended the deal until

the end of 2018, as expected. “Based on the recent past, we can start the New Year with relative optimism as far as conformity is concerned,” said Tamas Varga of oil broker PVM.

The biggest drop in output in November, of 100,000 b/d, came from Angola, where exports fell

to a 13-month low. Angolan exports have been curbed in recent months by field maintenance.

The second-largest came from Iraq. Output and exports in northern Iraq fell in mid-October when Iraqi forces retook control of oil fields from Kurdish fighters who had been there since 2014, and declined further last month.

A boost in exports from Iraq’s south, the outlet for most of the country’s crude, to 3.5 million b/d in November has not quite offset the decline from the north, the survey found.

THE GLOBE AND MAIL. BLOOMBERG. DECEMBER 4, 2017. OPINION. With the OPEC meeting done, oil demand is getting into the driver’s seat

JASON SCHENKER

Now that OPEC and non-OPEC members have agreed to extend oil production cuts through the end of 2018, the priorities for markets will be global demand and shale oil production. The demand side looks strong for the year ahead, and shale investments will be held back by three factors: a backwardated forward curve (or when near-term futures are costlier than later contracts), a desire by drillers to not get burned like in early 2016 after prices collapsed, and a dwindling number of ideal distressed assets for investors to buy.

Demand was a hot topic at the Organization of the Petroleum Exporting Countries meetings in Vienna, referenced repeatedly by OPEC President and Saudi Oil Minister Khalid Al-Falih. As with all commodities, oil is bought and not sold. This means oil demand is the most important driver of prices in the short term. And OPEC's forecasts for oil demand growth in the year ahead are strong.

What underpins this expectation of oil demand growth? A strong macroeconomic outlook, in which major economies are likely to show solid levels of growth and monetary policy is likely to remain relatively loose globally. While progression through the credit cycle presents some risks, those are likely to be a greater concern in 2019, but not 2018.

Strong leading indicators for near-term economic growth and oil prices are global manufacturing purchasing manufacturing indexes (PMIs). These have been expanding, which is a positive sign for oil demand and prices. November releases showed expansions in the Chinese Caixin, the U.S. ISM and the euro zone manufacturing PMI. The euro zone was particularly strong, posting the highest level since April, 2000, and the second-highest reading in history.

Oil supply is also a concern, but not OPEC's supply. The biggest concern is a resurgence in shale oil drilling. But these concerns may be a bit overblown. One critical factor holding back U.S. shale oil drilling is the backwardated forward curve. This shows that the price of oil is likely to be cheaper in the future than in the present. And it reflects high levels of hedging in the market. Some argue that large amounts of hedging activity indicates that the shale boom is on solid footing. But there may be another implication: no one wants to get burned. The period from the end of 2014 through the middle of 2016 was a painful time for many oil and gas companies, as prices plunged and they had trouble meeting debt payments. Many drillers are still fearful – or at best, they are cautious.

This means that while shale oil drilling will continue, the hedging of prices is likely to be active. In order to incentivize high levels of drilling, the entire forward curve would need to be much higher than it currently is in order to protect drillers. Put another way, much higher oil prices across the curve would likely be necessary to reverse the trend in rising crude oil prices since April, 2016. Oil prices that are marginally higher would likely result in only marginal increases in oil production rather than a big increase in barrels of additional shale.

Investors have tried to avoid getting burned again by limiting their investments to high-value distressed shale assets. But while investment in shale funds has risen, it is becoming more challenging to find these kinds of assets. Oil prices around current levels means that high-quality distressed assets are becoming scarcer. I personally know of a number of funds that are struggling to deploy their capital, because they have very specific requirements for sweetheart oil deals. Such deals will be even tougher to find in 2018. Much like the backwardation in the forward curve, this risk aversion that has been codified into oil and gas investment mandates is also likely to limit shale oil supply.

As the so-called Central Bank of Oil, OPEC doesn't set targets for oil prices, but it is targeting the five-year average for global oil inventories. The policy of OPEC and non-OPEC members has been explicitly designed – and extended – to drive OECD oil inventory levels lower to the five-year average. But technical trading factors may prove to be more important for the price of crude in the immediate term. West Texas Intermediate prices are above the critical 30- and 100-day moving averages, and they remain above a long-term trend that has been in place since April, 2016 (blue line in graph).

If that trend remains supported, oil prices could continue to rise, and drilling will increase. However, without a more significant rise in oil prices, shale drilling is unlikely to rise enough to stop the decline in oil inventories to the five-year average level. And with strong growth as the backdrop, we are likely end up with both lower oil inventories and higher average oil prices in 2018.

________________

LGCJ.: