CANADA ECONOMICS

TPP

CME. November 10, 2017. CME supports government decision to extend TPP negotiations

Toronto - Canadian Manufacturers & Exporters (CME) supports the government’s direction and actions on the Trans-Pacific Partnership (TPP) trade agreement today and urges continued consultation with Canadian industry to ensure a broad-based, fair trade deal that benefits the country through increased value-added exports. The TPP, originally conceived as a trade deal amongst 12 Pacific Rim countries, was fundamentally altered when the United States withdrew from the potential deal earlier this year. With no substantive amendments to reflect this change, the deal would put many Canadian manufacturers, who account for 75 per cent of all exports, at a significant disadvantage.

“CME was instrumental in having Canada invited to the TPP table in 2011 and we continue to believe that an FTA in the Pacific region is the best outcome, however the rules of trade must allow for Canada’s manufacturers to export into the region,” stated Dennis Darby, CME’s President & CEO.

CME has long stated that for any free trade agreement to benefit Canadian manufacturers, and the Canadian economy as a whole, the deal must meet the following principles:

- Create a fair and level playing field for Canadian manufacturers and exporters to ensure that they have the same access to foreign markets as our competitors have to Canadian markets;

- Enable growth in value-added exports from Canada; and,

- Support existing integrated manufacturing supply chains developed through previous trade agreements, especially NAFTA.

“Given the US withdrawal from the agreement, and the amount of US content that is in most Canadian manufactured goods do the deep NAFTA integration, the rules of trade, specifically the product rules of origin, must be aligned to allow for manufacturers to export their products,” explained Darby. “Based on the information we have from negotiators, this has not happened, meaning that the deal would undermine the existing NAFTA agreement, would not allow for many value-added goods exports, and would not create a level playing for our manufacturers.”

“We support the government’s decision to postpone signing the deal now, and strongly encourage them to work with Canadian industry on a TPP deal that can work for the majority of Canada’s exporters,” noted Darby.

NAFTA

Global Affairs Canada. November 15, 2017. Fifth round of NAFTA negotiations in Mexico City

Ottawa, Ontario - The NAFTA Chief Negotiators confirmed today that although the fifth round of NAFTA negotiations will formally begin on November 17, 2017, some negotiating groups will begin meeting on November 15. Nearly 30 negotiating groups will be meeting during the fifth round, which will conclude on November 21.

The three NAFTA ministers—the Honourable Chrystia Freeland, Minister of Foreign Affairs, Ildefonso Guajardo Villarreal, Mexico’s Secretary of Economy, and Ambassador Robert E. Lighthizer, United States Trade Representative—agreed at the end of round four to allow more space between rounds in order to provide negotiators with enough time to analyze the proposals that all three countries have tabled so far and to conduct internal consultations.

In addition, the NAFTA ministers met separately at the recent Asia Pacific Economic Cooperation (APEC) Leaders Meeting in Da Nang, Vietnam, and instructed the NAFTA Chief Negotiators to focus on advancing discussions on tabled proposals as much as possible. Given the substantive discussions held between the ministers at APEC, the ministers agreed not to attend the fifth round so negotiators can continue to make important progress on key chapters advanced in round four.

The Chief Negotiators from Mexico, the United States and Canada will be in constant communication with their respective ministers and will report on the progress reached in round five.

THE GLOBE AND MAIL. NOVEMBER 14, 2017. TRADE. Canada mounts Chapter 19 NAFTA challenge on softwood lumber duties. Ottawa filed its request on Tuesday for a binational panel under the North American free-trade agreement to strike down the United States’s punitive tariffs on Canadian softwood.

BRENT JANG, VANCOUVER

ADRIAN MORROW, WASHINGTON

GREG KEENAN, TORONTO

Canada is taking its lumber fight against the United States to one of the most contentious elements of NAFTA – Chapter 19, which sets up trade panels to settle disputes.

Ottawa filed its request on Tuesday for a binational panel under the North American free-trade agreement to strike down the United States's punitive tariffs on Canadian softwood.

The move comes as Canada takes an increasingly hardball approach to NAFTA renegotiations and just one day before talks resume in Mexico City.

Chapter 19 is one of the key sticking points in NAFTA talks: The Trump administration wants to abolish the panels while Canada has vowed never to give them up.

Ottawa is keen to keep Chapter 19 – and invoke the panel in the current softwood dispute – because Canada has previously emerged victorious when appealing its case through NAFTA in the long-running lumber battle.

"We are enclosing a Request for Panel Review pursuant to Rule 34 of the NAFTA Rules of Procedure for Article 1904 Binational Panel Reviews," according to the letter submitted on Tuesday by the Canadian government to Paul Morris, U.S. Secretary of the U.S. section of the NAFTA Secretariat.

Shipping Canadian softwood south of the border is technically a bilateral matter between Canada and the United States. Prime Minister Justin Trudeau's Liberal government has been hoping to keep the lumber issue separate from NAFTA talks, but the Trump administration has said Canada won't be able to keep the two issues apart so easily.

Ottawa plans, at least for now, to give no ground on the White House's core protectionist demands in hopes that mounting pressure from the U.S. business community will cause the Trump administration to blink.

In Canada's view, U.S. demands in four key areas of NAFTA are non-starters – dispute resolution, including Chapters 11, 19 and 20; a 50-per-cent U.S. content requirement on all vehicles made in Canada and Mexico; severe limits to the amount of American government contracts Canadian and Mexican firms can bid on; and a sunset clause that would force the renegotiation of NAFTA every five years.

Ottawa, however, will try to reach agreement on less contentious areas such as cutting red tape at the border and expanding the deal to cover digital commerce.

Sources with knowledge of the Canadian thinking say the Trudeau government would rather not reach a deal than agree to a bad one, and is bracing for the possibility NAFTA talks will unravel.

U.S. Commerce Secretary Wilbur Ross warned on Tuesday that the U.S. will walk away from NAFTA if key problems are unresolved, adding that Canada and Mexico would suffer far more than the U.S. if the pact is dissolved, Reuters reported.

"I would certainly prefer them to come to their senses and make a sensible deal," Mr. Ross told a Wall Street Journal forum.

"In any negotiation, if you have one party that is not in fact prepared to walk away over whatever are the threshold issues, that party is going to lose," Mr. Ross added.

Dispute resolution is scheduled for just one day of discussion in this session, on Nov. 21 – the last day of this round of negotiations – according to a schedule of the talks obtained by The Globe and Mail.

Among the other controversial subjects, rules of origin – which include the Trump administration's U.S.-content demand for autos – is scheduled for four days of talks from Saturday to Tuesday, and procurement will get two days, on Friday and Saturday. The schedule also lists "balance of payments" as a topic of discussion Sunday, something that could include discussion of the U.S. trade deficit, which the Trump administration has vowed to erase.

On Chapter 19, in which binational trade panels review punitive tariffs – such as the ones the United States is levying on Canadian softwood – Washington wants the panels done away with and such cases handled instead by the regular court system. Ottawa has declared this is a red line and will never agree to lose the panels.

For Chapter 11, which allows companies to sue governments for policy decisions that hurt their businesses, the United States wants the right to opt out of the provision. And on Chapter 20, which directs government-to-government trade disputes, the United States wants tribunal decisions made non-binding, so the losing side can simply ignore them.

In the softwood dispute, the final determination on Nov. 2 by the U.S. Department of Commerce resulted in a countervailing duty of 14.25 per cent and anti-dumping duty of 6.58 per cent against most Canadian lumber. The combined tariffs of 20.83 per cent against the majority of Canadian softwood imports into the U.S. compared with 26.75 per cent in the preliminary findings.

The reduction in tariff rates came as cold comfort to Canadian producers, which had been hoping for a breakthrough softwood deal.

In Tuesday's letter, Canada said the review through Chapter 19 should focus on "the final determination of the U.S. Department of Commerce in the countervailing duty investigation of softwood lumber from Canada."

Canada's Chapter 19 request is backed by seven provinces affected by the duties, with support also from lumber producers that include West Fraser Timber Co. Ltd., Canfor Corp., Tolko Industries Ltd., Resolute Forest Products Inc. and J.D. Irving Ltd. Provincial forestry associations also endorsed the appeal.

Another option is for Canada to take its lumber case to the U.S. Court of International Trade. On Tuesday, the Canadian government kept that option open by writing a separate letter to the U.S. section of the NAFTA Secretariat: "We are enclosing a Notice of Intent to Commence Judicial Review, pursuant to Rule 33 of the NAFTA Rules of Procedure."

Canada could also appeal through the World Trade Organization in 2018, industry observers say.

The Commerce Department's Nov. 2 decision "against Canada's softwood lumber producers is unfair, unwarranted, and deeply troubling," according to a statement issued by Foreign Affairs Minister Chrystia Freeland's office.

"We will vigorously defend our industry against these unfair and punitive duties," added BC Lumber Trade Council president Susan Yurkovich.

The Commerce Department imposed the countervailing duty as a punitive measure against what the U.S. sees as subsidized Canadian lumber, while saying the anti-dumping duty is for selling softwood below market value.

The new anti-dumping rate kicked in on Nov. 8. The new countervailing duty would take effect after the U.S. International Trade Commission votes, by Dec. 7, on the issue of U.S. lumber producers being injured.

This week, the American railway company that owns the Port of Churchill in northern Manitoba, and the rail line connecting it to the rest of the country, served Ottawa with a notice of intent to file a claim under NAFTA's Chapter 11.

OmniTrax claims that the Harper government's decision to dismantle the Canadian Wheat Board and move to a free-market system for farmers to sell their grain robbed the port of vital shipments and made the business non-viable. OmniTrax said it will sue for $150-million unless Ottawa agrees to repair the railway and port and take them off the company's hands.

REUTERS. NOVEMBER 14, 2017. Mexico to respond to tough U.S. proposals at fifth NAFTA round

Sharay Angulo, Dave Graham

MEXICO CITY (Reuters) - Mexico will respond to U.S. demands for changes in content rules for autos and an automatic expiration clause in the NAFTA trade deal when negotiations on reworking the accord begin again this week, a top government official said on Tuesday.

A fifth round of talks to overhaul the North American Free Trade Agreement starts on Wednesday in Mexico City, notable for U.S. demands that the U.S. Chamber of Commerce has labeled “poison pills.”

Foremost among them are a 50 percent minimum U.S. limit in NAFTA automobile content, the scrapping of a key dispute mechanism and inclusion of a sunset clause that will terminate the pact after five years if it is not renegotiated.

The measures soured the mood among U.S., Mexican and Canadian negotiators when put forward last month, and Mexico’s economy minister, Ildefonso Guajardo, said his country would respond to the auto content and sunset clause plans.

“Those responses will be angled very logically toward what we’re hearing from the business world in Mexico and the United States,” Guajardo said at an event in Mexico City.

The three sides would explore what scope there was for narrowing their positions on that basis, he added.

Industry officials across the region have balked at the auto proposals, arguing they would add bureaucratic hurdles, be hard to enforce and could damage the competitiveness of the sector.

In addition to seeking to establish U.S. minimum thresholds, the team led by U.S. Trade Representative Robert Lighthizer has proposed raising the regional content requirement for NAFTA autos to 85 percent from 62.5 percent at present.

The coming round, which runs through Nov. 21, would seek to examine the viability of such ambitious targets, Guajardo said.

“It’s one thing for them to say ‘we want 85 percent regional value’ and another for them to explain how to achieve that technically, understanding how the industry works,” he said.

U.S. President Donald Trump has threatened to withdraw from NAFTA if he cannot rework it to the benefit of the United States, spooking investors and hurting the Mexican peso.

Mexican and Canadian officials have privately voiced skepticism about the prospect of negotiators making substantial progress on the most divisive issues during the current round.

That does not necessarily mean talks will be bad-tempered.

The White House is pushing for congressional approval of Trump’s planned tax cuts, and officials say that could help set a more measured tone for the round, lest trade disputes create friction with NAFTA-supporting Republican lawmakers.

If Trump makes headway on tax cuts, it is more likely to help NAFTA talks than harm them, said Bosco de la Vega, head of Mexico’s National Agricultural Council (CNA), a farming lobby.

“What we know from our U.S. counterparts is that they’re saying, ‘listen: we see that the future of (NAFTA talks) will depend on the success or failure of the tax reform.’ It will have a direct impact on NAFTA. How much? Who knows?” he said.

Meanwhile, Guajardo expressed confidence that negotiators could make progress on less divisive topics in Mexico City.

“There are some chapters we believe we can finalize this round,” he said, noting that talks on telecommunications and regulatory practices were advancing.

Guajardo also addressed the subject of U.S. demands to raise certain Mexican and Canadian duty-free import limits for e-commerce, known as “de minimis,” to the U.S. level of $800, from current thresholds of $50 and C$20, respectively.

That would be one of last things defined in NAFTA talks and will be far from what U.S. companies are targeting, he said.

Additional reporting by David Lawder in Washington, David Ljunggren in Ottawa, Anthony Esposito and Adriana Barrera in Mexico City; Editing by Richard Chang and Steve Orlofsky

BLOOMBERG. 15 November 2017. Nafta Bickering Begins Again Today

By Josh Wingrove , Eric Martin , and Andrew Mayeda

- Negotiators meet Nov. 15-21 in Mexico City for fifth round

- Commerce head Ross says he expects some sort of deal for Trump

Nafta talks are set to pick up Wednesday for round five where they left off a month ago: with tension and animosity in the air.

On Saturday, Mexican Foreign Minister Luis Videgaray made a thinly veiled threat to scale back efforts to police its border with the U.S. if it didn’t like the way the renegotiations were heading. Then on Tuesday, U.S. Commerce Secretary Wilbur Ross warned that the Trump administration was losing patience with the proceedings, and Canada used Nafta -- specifically, a section the U.S. wants to eliminate -- to file a legal challenge of U.S. softwood lumber duties.

At last month’s round, the parties extended talks through March, abandoning a December deadline, after the U.S. introduced its toughest proposals that were essentially rejected by Canada and Mexico. The challenge remains to seal a deal before politics overwhelm the trade agenda next year when Mexico holds presidential elections and the U.S. has congressional midterms.

The fifth round of talks begins in Mexico City on Wednesday before chief negotiators from the U.S., Canada and Mexico arrive Friday for work that will continue through Nov. 21. The session is expected to yield deals on smaller elements to modernize the 1994 accord, while negotiators aren’t expected to delve too deeply into the high-profile U.S. demands. Negotiators are working under the pressure of President Donald Trump’s repeated threats to pull out of the North American Free Trade Agreement.

Secretary Ross said on Tuesday it “would be an enormously complex thing” to get a deal by the end of scheduled talks in March, though he expects “some sort” of agreement for Trump to consider. “Nafta is on a very short time fuse,” he said.

The Mood

Bombshell U.S. demands punctuated the fourth round of talks in Washington, sending the three ministers on their way after a closing statement that saw them exchange their strongest barbs yet.

With U.S. lawmakers focused on tax reform, expectations are that the key battleground issues will more or less be punted into 2018.

The most contentious U.S. demands are on dairy, automotive content, dispute panels, government procurement and a five-year sunset clause, but there are 28 negotiating areas in total. The tough proposals have been essentially rejected by Canada and Mexico, as all parties wait for the other to blink first. Ross stood his ground this week, saying “the idea of a five-year sunset has been part of the president’s thinking since the campaign.”

Mexican Economy Minister Ildefonso Guajardo said Tuesday that his team will ask the U.S. for more details on its proposal to increase the content requirement for cars that qualify for Nafta benefits to 85 percent from the region and to establish a 50 percent minimum for U.S. content. “One thing is to say it, another thing is to analyze the capacity of the industry to achieve it,” Guajardo said.

The Deliverables

Guajardo said negotiations for some chapters are very advanced, such as telecommunications and regulatory practices, and that several topics could be closed in this next round. Negotiators have already firmed up chapters covering competition rules and small- and medium-sized enterprises. Ross said he expects to eventually find agreement for new provisions on intellectual property rights.

BMO Capital Markets Senior Economist Sal Guatieri wrote in a note Wednesday that the countries look likely to focus on less-contentious issues, such as duties charged for online purchases, before discussing so-called “poison pill” proposals from the U.S. “The audience is restless, with calls from American businesses demanding the U.S. government negotiate a deal growing louder,” Guatieri said. “We’ll see if the chorus is loud enough to catch the ears of U.S. trade representatives.”

While adding extra rounds of talks has eased the time pressure on negotiators trying to overhaul the accord, any party can quit the pact with six-months’ notice.

AVIATION

THE GLOBE AND MAIL. REUTERS. NOVEMBER 15, 2017. Airbus in record 430 plane, $50-billion deal with Indigo Partners. Airbus said on Nov. 15, 2017 it has secured the biggest-ever order in its history to supply 430 of its medium-range A320 family of aircraft to U.S. investment firm Indigo Partners, at a catalogue price of $50-billion.

TIM HEPHER AND ALEXANDER CORNWELL

DUBAI - Airbus landed a deal for a record 430 of its A320neo-family jets on Wednesday as U.S. investor Bill Franke raised his bet on budget airlines.

The preliminary deal, worth up to $50-billion, is designed to supply four airlines in which Franke's Indigo Partners has stakes: Frontier Airlines, Mexico's Volaris, Chilean carrier JetSmart and Hungary's Wizz Air.

The 80-year old Franke signed the agreement at the Dubai Airshow amid a flurry of deal-making, as airlines take advantage of a recent slowdown in demand for new aircraft to negotiate competitive prices from leading manufacturers.

Budget airline flydubai on Wednesday committed to buying 175 Boeing 737 Max jets, worth around $21-billion at list prices.

Airbus said it expected to finalise its agreement with Franke in the coming weeks.

The two deals again underscore how budget carriers are rewriting the rule book by combining bargain fares augmented by optional services and upgrades for which passengers pay additional fees.

The Franke deal also marks a dramatic swan-song for Airbus sales chief John Leahy, who is due to retire in the coming months after holding the job since 1994.

The 67-year-old Leahy has overseen the sale of jets worth $1.7-trillion at list prices and helped engineer a rise in Airbus's market share to a par with archrival Boeing from just 18 per cent.

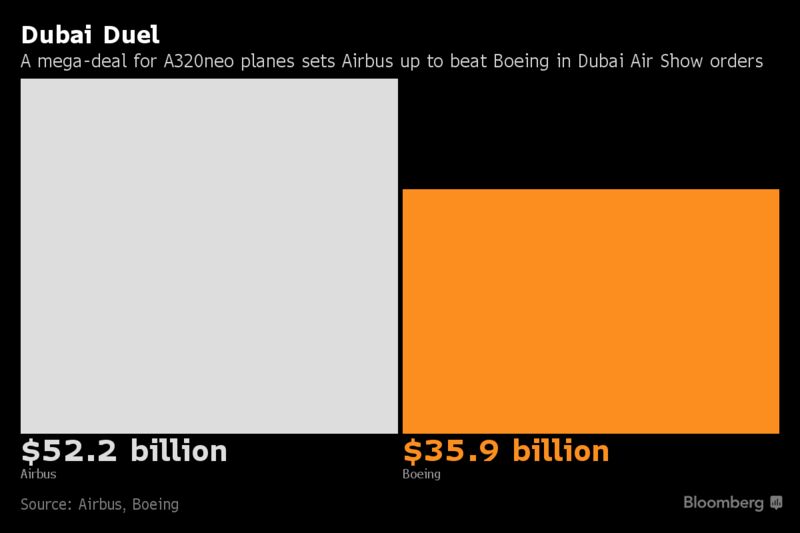

This year, however, Airbus's share of the two giants' combined order tally has dropped to 35 per cent as a rejuvenated Boeing management made advances in Singapore and elsewhere.

Separately, the prospect of a deal to keep Airbus's A380 superjumbo in production beyond the end of the decade remained in suspense, with main customer Emirates seeking guarantees on keeping production lines open.

"I think both sides will take stock and see if something can be agreed later this year," an industry source told Reuters.

REUTERS. NOVEMBER 15, 2017. Biggest deal yet for Airbus as Franke ups bet on budget airlines

Tim Hepher, Alexander Cornwell

DUBAI (Reuters) - Airbus landed its biggest ever airliner deal on Wednesday with an agreement to sell 430 planes worth up to $50 billion to U.S. budget airlines investor Bill Franke.

Bill Franke, Managing Partner of Indigo Partners LLC, attends a news conference at the Dubai Airshow in Dubai, United Arab Emirates November 15, 2017. REUTERS/Satish Kumar

The preliminary deal for A320neo narrowbody jets was signed at the Dubai Airshow and offers a major boost to Airbus, which has lagged arch rival Boeing (BA.N) in deals this year.

It also ensures veteran sales chief John Leahy retires on a high in the coming months.

But Boeing immediately hit back with a provisional agreement to sell 175 planes to budget airline flydubai. Including options to buy a further 50 planes, that deal could be worth $27 billion at list prices.

The deal between Airbus and Franke’s Indigo Partners is the industry’s largest ever by number of aircraft.

Indigo plans to supply the A320neo narrowbody jets to four airlines in which it has stakes: Frontier Airlines, Mexico’s Volaris, Chilean carrier JetSmart and Hungary’s Wizz Air (WIZZ.L).

Airbus (AIR.PA) said it expected to finalize the transaction with the 80-year-old Franke in the coming weeks. Its shares were up 2.5 percent to 85.59 euros at 1150 GMT.

The agreement, along with flydubai’s deal for Boeing’s 737 MAX narrowbody jets, underscores how budget carriers are rewriting the industry rule book by combining bargain fares with optional services and upgrades for which passengers pay extra.

According to some delegates at the air show, the deals also suggest airlines are taking advantage of a recent slowdown in demand for new jets to negotiate competitive prices.

SWAN SONG

The Franke deal marks a dramatic swan-song for Airbus sales chief Leahy, who is due to retire in the coming months after holding the job since 1994.

The 67-year-old has overseen the sale of jets worth $1.7 trillion at list prices and helped engineer a rise in Airbus’s market share to a par with Boeing from just 18 percent.

This year, however, Airbus’s share of the order tally had dropped to 35 percent prior to the Dubai show, as a rejuvenated Boeing management made advances in Singapore and elsewhere.

Airbus management, meanwhile, is dealing with investigations by British, French and U.S. authorities after the company uncovered inaccuracies in sales documents.

Airbus also aims to sell more of its A380 superjumbo, with main customer Emirates seeking guarantees on keeping production lines open.

“I think both sides will take stock and see if something can be agreed later this year,” an industry source told Reuters.

Reporting by Tim Hepher and Alexander Cornwell; editing by Mark Potter and Jason Neely

REUTERS. NOVEMBER 15, 2017. Boeing in 175 plane deal with budget carrier flydubai

Alexander Cornwell, Tim Hepher

DUBAI (Reuters) - Boeing Co. (BA.N) reached a preliminary deal for 175 of its 737 MAX jets with flydubai on Wednesday, potentially committing the budget airline’s fleet to the U.S. planemaker for another decade.

Emirates Chairman Sheikh Ahmed bin Saeed al-Maktoum and Boeing Commercial Airplanes President & Chief Executive Kevin McAllister attend a news conference at the Dubai Airshow in Dubai, UAE November 15, 2017. REUTERS/Satish Kumar

The Dubai-based carrier wants more than 50 of Boeing’s largest narrowbody jet, the 737-10, as well as to-be-determined numbers of its 737-9s and 737-8s, Boeing said in a statement at the Dubai Airshow.

Reuters had reported that Boeing was close to reaching a deal with flydubai for 175 737 MAX jets.

Flydubai Chairman Sheikh Ahmed bin Saeed al-Maktoum told a news conference the provisional deal was struck Tuesday night.

It is flydubai’s third aircraft deal. It agreed to buy 75 737-8 MAX aircraft at the Dubai Airshow four years ago.

“We try to grow as fast as we want,” Chief Executive Ghaith al-Ghaith told reporters.

Delivery of flydubai’s 175 planes will begin in 2019 and be spread across 10 years with some overlap with the delivery of its 2013 order, al-Ghaith said.

The current fleet of flydubai, which started flights in 2009, is all Boeing. It currently only operates 737-8s.

The provisional deal is worth $27 billion, including purchasing options for an additional 50 planes.

Al-Ghaith told Reuters the airline was interested in the new mid-sized jet that Boeing is studying whether to develop, but that it had not been discussed during the 737 negotiations.

Boeing is looking at potentially filling a market gap between narrow and widebody jets with a new aircraft that could seat 220 to 270 passengers.

Boeing Commercial Airplanes Chief Executive Kevin McAllister told the news conference that flydubai’s 737 commitment would be good for jobs in the United States and in the Middle East.

Gulf customers are keen to stress the importance of their orders for U.S. jobs as they are locked in a trade dispute with three major American carriers.

Sheikh Ahmed said the airline had picked the 737s after also looking at Airbus’ (AIR.PA) similar-sized A320s, echoing comments he made this week in his role as Emirates [EMIRA.UL] chairman when he said the 787 had been chosen over the Airbus A350.

Dubai-based Emirates this week committed to buying 40 of Boeing’s 787 Dreamliner.

Emirates and flydubai are both owned by the government of Dubai, which has pushed the two airlines to work more closely.

McAllister said the flydubai and Emirates deals were negotiated separately.

Also on Wednesday, Airbus reached a preliminary deal for a record 430 of its A320neo-family jets from U.S. investor Bill Franke’s Indigo Partners.

Editing by Jason Neely and Mark Potter

BLOOMBERG. 15 November 2017. Airbus Seals $50 Billion Jet Deal to Outdo Boeing in Dubai

By Julie Johnsson , Mary Schlangenstein , and Benjamin D Katz

- Pact for 430 A320 planes is triumph for departing sales chief

- U.S. rival recovers some ground with major Mideast transaction

- Airbus Wins Biggest Ever Deal

Airbus SE announced the biggest commercial-plane transaction in its history, securing an order for single-aisle aircraft valued at nearly $50 billion at the Dubai Air Show, outdoing Boeing Co.’s own $20 billion mega-deal.

Wednesday’s pact for 430 A320neo planes with U.S. investor Indigo Partners marked a turnaround for Airbus at the Gulf expo, where it had been trailing its rival. It’s also a crowning achievement for sales chief John Leahy, who is set to retire after a career in which he has struck deals for more than 16,000 jets and lifted the European planemaker into a duopoly position with Boeing.

For Indigo Partners, led by Bill Franke, the Airbus accord provides upgraded narrow-body aircraft to boost the fleets of low-cost carriers from Denver to Budapest. The planes will go to four companies in Indigo’s investment portfolio: Frontier Airlines, Mexico’s Volaris, East European operator Wizz Air Holdings Plc and Chile’s JetSmart, which began operating this year.

The deal features 273 A320neo jets together with 157 of the larger A321neo variant and is worth $49.5 billion before customary discounts, Airbus said. Leahy, 67, called the transaction “remarkable,” while Franke, 80, who co-founded Indigo in 2002, said it underscores his confidence in the A320 and the bargain fares, no-frills travel model he helped develop.

Airbus shares rose as much as 4 percent and were trading 2.9 percent higher at 85.93 euros as of 11:13 a.m. in Paris, taking the gain this year to 37 percent.

Boeing Retort

Boeing recovered some ground with the sale of 175 737 Max planes, the A320’s main competitor, to FlyDubai, a deal big enough to have dominated most air shows.

While that order will come as an irritation for Airbus, with the airline having been expected to split it between the two manufacturers, the Toulouse, France-based company wasn’t done at the Dubai event. It went on to announce EgyptAir Airlines Co. as the operator of 15 A320neos previously ordered by leasing firm AerCap Holdings NV.

The Indigo deal more than doubles Airbus’s previous order book for the year, which stood at about 290 aircraft as of Oct. 31, pushes the planemaker’s backlog above 7,000 jets and reverses expectations that orders will trail deliveries in 2017.

The haul will also help Airbus catch up to Boeing in the order tally this year, with the European planemaker having chalked up 343 contracts at the end of last month, compared with 690 for its Chicago-based rival as of Nov. 7. The order also trumps a 2015 deal for 250 single-aisle jets worth $27 billion by Indian budget carrier IndiGo. The two companies aren’t related.

The massive A320 win takes the sting out of a possible defeat on the A380 superjumbo, which has so far failed to clinch a follow-up deal with local carrier Emirates at the Dubai show. The companies have been in talks on a deal for about 36 additional double-deckers valued at $15.7 billion, people familiar with the negotiations have said.

The A380 has become all but a fringe product for Airbus, with a total order book of 317 -- more than 100 short of the A320s that Indigo plans to buy.

The breakdown of the Indigo order is as follows:

- Wizz -- 146 planes (72 A320neo, 74 A321neo)

- Frontier -- 134 planes (100 A320neo, 34 A321neo)

- Volaris -- 80 planes (46 A320neo, 34 A321neo)

- JetSmart -- 70 planes (56 A320neo, 14 A321neo)

Boeing’s 737 deal from FlyDubai includes more than 50 of the largest Max 10s, with the balance to be made up of Max 8s and 9s, according to a statement. The carrier, which is due to integrate more closely with Emirates over coming months, also has options on 50 more aircraft.

Emirates itself snubbed Airbus on the first day of the show with a surprise $15 billion order for Boeing 787 wide-body jets, after also looking at the European company’s A350.

The Indigo purchase provides a boost to Airbus Chief Executive Officer Tom Enders, who has found himself on the defensive amid an investigation into bribery allegations at the company. Enders has warned employees that the probe is likely to be a drawn-out process that could result in “serious consequences” and “significant penalties.”

A German who has run Airbus for five years, Enders orchestrated another coup last month when he struck a deal with Bombardier Inc. to take a majority stake in the Canadian company’s C Series jet program. That will give Airbus access to advanced technology while throwing Bombardier a lifeline for its slow-selling aircraft.

Fly-by-Wire Pioneer

The A320 is Airbus’s best-selling product and the aircraft that put the company on the map when it was introduced in the late 1980s with cutting-edge technology such as fly-by-wire controls and a side-stick to steer the plane rather than Boeing’s central yoke.

Airbus was first to pioneer the new-engine variant of its existing single-body model. The A320neo first flew in 2014 and has been delivered to customers around the world. Boeing’s response, the 737 Max, only entered commercial service this year.

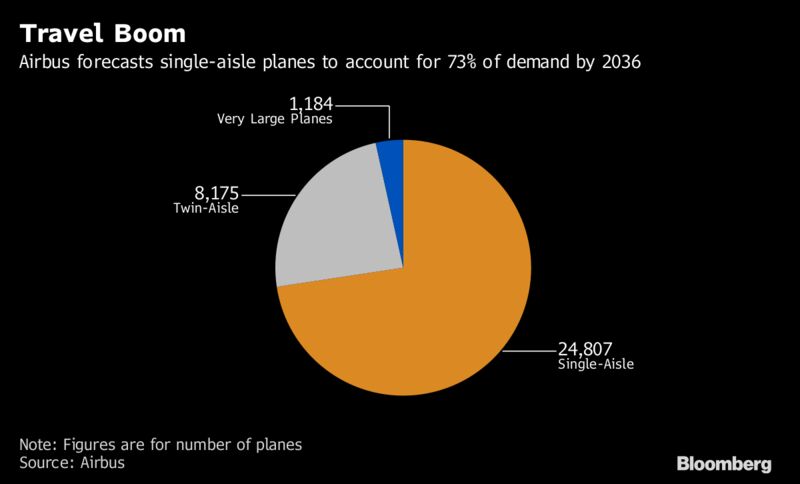

Narrow-body aircraft, which typically seat six abreast in economy class, are the workhorses of the global airline fleet. Burgeoning demand for air travel will push jetliner sales to more than 34,000 worldwide in the next 20 years, according to Airbus’s 2017 global market forecast. Almost three-quarters of that will be single-aisle models, the company said.

While a huge commercial hit, the A320neo hasn’t been without technical faults. Output is being disrupted by manufacturing delays at Pratt & Whitney, a unit of United Technologies Corp., which supplies the plane’s geared turbofan engine. The A320neo is also powered by engines made by CFM International, a venture between General Electric Co. and Safran SA.

Airbus makes the A320 family at different sites around the world, including its main factory in Toulouse, France, as well as in Hamburg, Germany. The company also builds the plane at an assembly line in China, and has recently pushed into the U.S. with a plant in Mobile, Alabama.

— With assistance by Kyunghee Park

________________

LGCJ.: