CANADA ECONOMICS

APEC - TPP

THE GLOBE AND MAIL. REUTERS. NOVEMBER 10, 2017. APEC SUMMIT. TPP trade pact in disarray as Canada holds up talks

MAI NGUYEN AND MATTHEW TOSTEVIN

DANANG

Efforts to revive the Trans Pacific Partnership (TPP) trade deal foundered on Friday when Canadian Prime Minister Justin Trudeau failed to show up for a meeting to agree a path forward without the United States.

The lack of a deal on the sidelines of the Asia Pacific Economic Co-operation (APEC) summit underscored the convulsions in global trade policy since U.S. President Donald Trump abandoned the TPP early this year in the name of an "America First" approach.

Speaking ahead of the APEC summit, Trump said he only wanted bilateral trade deals in Asia - and deals in which the United States was not at a disadvantage.

Ibbitson: Canada desperately needs a revived TPP as NAFTA talks falter

It was left to President Xi Jinping of China to champion a multilateralist vision of trade with a speech in the Vietnamese resort city of Danang that described globalization as an irreversible trend.

It was partly to counter China's growing dominance in Asia that Japan had been lobbying hard for the TPP pact, which aims to eliminate tariffs on industrial and farm products across an 11-nation bloc whose trade totalled $356 billion last year.

Japan said ministers from the 11 remaining countries reached broad agreement to push ahead with it on Thursday, though Canada had said that was not true.

The leaders of 10 of the countries arrived for a meeting on Friday, but officials said Trudeau did not.

"The Canadian side said today they are not yet at the stage where its leader can confirm the agreement reached among ministers," Japanese Prime Minister Shizo Abe told reporters, adding that all the other leaders had agreed.

Canadian officials said the TPP was not dead and they were still at the table in Danang. They say Canada cannot be rushed into an agreement if it isn't beneficial enough for Canadian jobs.

"If we need to keep working at other tables, so be it. Let's get it right," said one Canadian official.

Canada's position is complicated by renegotiation of the North American Free Trade Agreement (NAFTA) with the Trump administration.

An agreement to push forward TPP would have been a boost for the principle of multilateral trade deals as opposed to the Trump approach.

BUFFETED BY TRUMP

APEC, whose leaders hold their full summit on Saturday, has itself been buffeted by the changes under Trump.

Talks between trade and foreign ministers from the group failed to reach agreement on their usual joint statement in the face of U.S. demands to remove language about supporting free trade and fighting protectionism.

"I see a tremendous shift," Malaysian Prime Minister Najib Razak said at the summit. "I see the rise of globalization, the rise of more inward-looking (policies), which ironically is against the whole philosophy of setting up of APEC."

Trump set out a strong message which made clear there was no turning back - particularly in a region which he believes is taking U.S. jobs by running trade surpluses with the United States.

"We are not going to let the United States be taken advantage of any more," Trump said. "I am always going to put America first, the same way that I expect all of you in this room to put your countries first."

He expressed a willingness to do bilateral deals in the region on the basis of mutual respect and mutual benefit, while saying the United States had suffered from World Trade Organization (WTO) rules by obeying them while others did not.

"It signalled clearly a move away from the rules-based multilateral system that the U.S. has actually done very well under," James Fatheree of the U.S. Chamber of Commerce business lobby group told Reuters. "We have done well in helping lead the system."

President Xi made clear China's aspiration to take that leadership role in a speech that immediately followed Trump's.

"Should we steer economic globalization, or should we dither and stall in the face of challenge? Should we jointly advance regional co-operation or should we go our separate ways?" Xi asked. "Openness brings progress, while self-seclusion leaves one behind."

BLOOMBERG. Canada Wants a Good TPP Deal More Than a Fast One

By Rosalind Mathieson

- TPP-11 will happen but it is a matter of timing, Canada says

- TPP ministers to present plan at APEC on how to salvage deal

Canada is sounding a note of caution as nations push this week to save a blockbuster Pacific trade pact, saying speed shouldn’t take priority over getting a good deal.

“We are at the table, we’re being constructive, we’re being creative but let’s be honest, some are difficult discussions,” Trade Minister Francois-Philippe Champagne said in an interview in Vietnam on the sidelines of the Asia-Pacific Economic Cooperation summit. “This is not about speed, this is about outcomes."

The Trans-Pacific Partnership -- a pact that would knit together 40 percent of the global economy -- has been in doubt since Donald Trump withdrew the U.S. in one of his first acts as president, citing a perceived risk to U.S. jobs. Since then, the remaining 11 nations, which include Canada, Japan and Australia, have struggled for a way forward.

Trade ministers have been meeting in Vietnam before presenting their proposal on salvaging the deal to TPP country leaders this week. Some of the TPP discussions this week have been difficult even though they were constructive, Champagne said. A briefing to wrap up the ministerial meeting late on Wednesday was canceled after a delay of several hours, and talks have continued into Thursday.

“I don’t look at trade about this Friday, I look at trade over decades," he said on Wednesday. "For Canada it’s far more important to get the right deal than a fast deal. What we are here to do is set the terms of trade in the Asia-Pacific region for decades to come.”

Suspending Provisions

Canada has been advocating a "progressive and inclusive" deal that would ensure chapters on labor and the environment are "right," Champagne said. It also wants to preserve the rights of states to regulate in the best interests of their citizens, he said.

“That is what Canada insists on the table, that we preserve that,” the minister said.

The discussions on TPP have centered on suspending some of the provisions now that the U.S. is no longer in the deal. Malaysia’s Trade Minister Mustapa Mohamed has said doing that would avoid a protracted and painful renegotiation.

Champagne said using suspensions could be a way to preserve unity on the deal. “I believe in the suspension of certain provisions,” he said. “IP has been mentioned a couple of times.”

Asked if the risk was that too much would be cut out, he replied: “We have all agreed that it needs to be a high-standard agreement and that remains.”

Strategic Deal

The agreement was seen as a hallmark of U.S. engagement with Asia under the prior administration and a buffer against China’s rising clout. Then-Defense Secretary Ash Carter called it more strategically important than having another aircraft carrier battle group in the Pacific.

It would go beyond traditional deals by including issues like intellectual property, state-owned enterprises and labor rights. Champagne said Canadians expect any agreement to benefit the middle class and “give a chance to the small and medium-sized business to join the global trade.”

“This needs to be about a win-win situation for all,” he added. “We need to ensure we get to the right outcome. We need to take the time that it takes."

World Trade Organization Director-General Roberto Azevedo urged the remaining TPP nations to find agreement.

“Trade liberalization is contagious, once you get members negotiating liberalization regionally it is easier for them to do it in other settings as well, including in the WTO,” he said Wednesday in an interview in Vietnam. “They inspire the work of the multilateral system.”

“You never start with something at the multilateral level,” he added. “First you test it, you test it bilaterally, you test it regionally. If those things work, if those rules take root, then they begin to multilateralize these things. I am hopeful TPP-11 will be successful. ”

— With assistance by Haslinda Amin, and Nguyen Dieu Tu Uyen

THE GLOBE AND MAIL. BLOOMBERG. NOVEMBER 10, 2017. Trump, Xi duel over visions of global trade

PETER MARTIN, JENNIFER JACOBS AND JUSTIN SINK

Chinese President Xi Jinping and U.S. President Donald Trump laid down starkly contrasting visions for Asia's future Friday, with Xi pledging a new era of globalization propelled by his nation's economic might as Trump offered America's largess only to those who play by his rules.

In back-to-back speeches to business leaders at the Asia-Pacific Economic Co-operation summit in Vietnam, Xi and Trump in effect competed for the region's economic affections, with divergent blueprints of what the 21st Century economy should look like.

Speaking moments after Trump told the same audience the U.S. would not seek multilateral trade deals and wanted to make the system fairer for Americans, Xi painted a picture of a global order that would bring collective benefits, saying, "let more countries ride the fast train of Chinese development."

"The concept of globalization should pay more attention to openness and tolerance, while the direction should focus on balance," Xi said. China will "continue to build an open economy and work hard to achieve mutual benefits," he added. "Opening up will bring progress and those who close down will inevitably lag behind."

Trump used his speech to catalogue the ills of globalization, saying too many countries had flouted the rules for years with impunity – with even the World Trade Organization turning a blind eye. In doing so, these countries had harmed American workers and U.S. companies.

"We are not going to let the United States be taken advantage of any more," Trump said.

Reciprocal Trade

Trump too laid out a path for how other countries could join with America to boost their economy: He offered economic partnerships with the U.S. but only through bilateral trade pacts, and he pledged never to again join a multilateral deal like the Trans-Pacific Partnership that would have bound the U.S. to 11 countries as a bulwark against China.

"I will make bilateral trade agreements with any Indo-Pacific country that wants to be our partner and will abide by the principle of fair and reciprocal trade," Trump said.

Both men came to this forum in Vietnam facing deep skepticism in the room. Asian nations harbor concerns about being dominated economically by China. While Xi has spoken strongly in support of the global trading order this year there's been little tangible evidence of Beijing following through.

In a January survey of 462 U.S. companies by the American Chamber of Commerce in China, more than 60 per cent expressed little or no confidence that China would open its markets in the next three years. China still ranks 59th out of 62 countries evaluated by the Organization for Economic Cooperation and Development in terms of openness to foreign direct investment.

TPP Doubts

In a major speech aimed at domestic audiences at China's 19th Party Congress in October, Xi's language on reform stuck closely to previous pledges while promising to make sure that China's Communist Party "leads everything."

Still, nations also have doubts about the U.S. under Trump. After Asian countries tied up with America on TPP, Trump tore up the deal – leaving them wondering if Trump was turning his back on the region as he pursued an "America First" agenda.

When the U.S. enters into a trade relationship, Trump said, "we will from now on expect that our partners will faithfully follow the rules, just as we do. We expect that markets will be open to an equal degree on both sides and that private industry, and not government planners, will direct investment. For too long and in too many places, the opposite has happened."

Power, Patronage

Trump also said those who play by the rules will be the U.S's closest economic partners and that the U.S. is seeking friendly ties in the region. "We don't dream of domination," Trump said. "We will not make decisions for the purposes of power or patronage."

Xi's remarks came after he pledged during a state visit to China by Trump to further open his economy to foreign investors. Following the visit, China announced a plan to open its financial sector by removing ownership limits on its banks and asset-management companies.

The remarks signal a continuation of Xi's drive to cast himself as a champion of global free trade as the Trump administration challenges China's barriers to access for foreign companies. Earlier this year, Xi launched his push-back against protectionism in a speech to billionaires and government officials gathered at the World Economic Forum in Davos, Switzerland.

Xi pledged to continue opening the Chinese economy to foreign players and to undertake structural reforms, echoing remarks he delivered Beijing on Thursday. "In the next fifteen years, China wants to set up a new platform for the co-operation of all parties in entering the Chinese market," Xi said.

Xi called on the region to make "continuous progress" toward what would be known as the Free Trade Area of the Asia-Pacific and to quickly complete negotiations on a 16-nation Asia trade pact known as the RCEP.

During Trump's visit to Beijing on Thursday, Xi didn't respond directly to Trump's charges of unfair trade practices, but said he was committed to opening up China's economy. He cited new deals with U.S. companies as "great examples" of the potential "win-win nature" of ties.

REUTERS. NOVEMBER 10, 2017. TPP trade pact in disarray as Canada holds up talks

Mai Nguyen, Matthew Tostevin

DANANG, Vietnam (Reuters) - Efforts to revive the Trans Pacific Partnership (TPP) trade deal foundered on Friday when Canadian Prime Minister Justin Trudeau failed to show up for a meeting to agree a path forward without the United States.

The lack of a deal on the sidelines of the Asia Pacific Economic Cooperation (APEC) summit underscored the convulsions in global trade policy since U.S. President Donald Trump abandoned the TPP early this year in the name of an “America First” approach.

Speaking ahead of the APEC summit, Trump said he only wanted bilateral trade deals in Asia - and deals in which the United States was not at a disadvantage.

It was left to President Xi Jinping of China to champion a multilateralist vision of trade with a speech in the Vietnamese resort city of Danang that described globalisation as an irreversible trend.

It was partly to counter China’s growing dominance in Asia that Japan had been lobbying hard for the TPP pact, which aims to eliminate tariffs on industrial and farm products across an 11-nation bloc whose trade totaled $356 billion last year.

Japan said ministers from the 11 remaining countries reached broad agreement to push ahead with it on Thursday, though Canada had said that was not true.

The leaders of 10 of the countries arrived for a meeting on Friday, but officials said Trudeau did not.

“The Canadian side said today they are not yet at the stage where its leader can confirm the agreement reached among ministers,” Japanese Prime Minister Shinzo Abe told reporters, adding that all the other leaders had agreed.

Canadian officials said the TPP was not dead and they were still at the table in Danang. They say Canada cannot be rushed into an agreement if it isn’t beneficial enough for Canadian jobs.

“If we need to keep working at other tables, so be it. Let’s get it right,” said one Canadian official.

Canada’s position is complicated by renegotiation of the North American Free Trade Agreement (NAFTA) with the Trump administration.

An agreement to push forward TPP would have been a boost for the principle of multilateral trade deals as opposed to the Trump approach.

BUFFETED BY TRUMP

APEC, whose leaders hold their full summit on Saturday, has itself been buffeted by the changes under Trump.

Talks between trade and foreign ministers from the group failed to reach agreement on their usual joint statement in the face of U.S. demands to remove language about supporting free trade and fighting protectionism.

“I see a tremendous shift,” Malaysian Prime Minister Najib Razak said at the summit. “I see the rise of anti-globalisation, the rise of more inward-looking (policies), which ironically is against the whole philosophy of setting up of APEC.”

Trump set out a strong message which made clear there was no turning back - particularly in a region which he believes is taking U.S. jobs by running trade surpluses with the United States.

“We are not going to let the United States be taken advantage of anymore,” Trump said. “I am always going to put America first, the same way that I expect all of you in this room to put your countries first.”

He expressed a willingness to do bilateral deals in the region on the basis of mutual respect and mutual benefit, while saying the United States had suffered from World Trade Organisation (WTO) rules by obeying them while others did not.

“It signaled clearly a move away from the rules-based multilateral system that the U.S. has actually done very well under,” James Fatheree of the U.S. Chamber of Commerce business lobby group told Reuters. “We have done well in helping lead the system.”

President Xi made clear China’s aspiration to take that leadership role in a speech that immediately followed Trump‘s.

“Should we steer economic globalisation, or should we dither and stall in the face of challenge? Should we jointly advance regional cooperation or should we go our separate ways?” Xi asked. “Openness brings progress, while self-seclusion leaves one behind.”

Reporting by Mai Nguyen, Matthew Tostevin, Kiyoshi Takenaka, Michael Martina, A. Ananthalakshmi, Steve Holland; Editing by Richard Borsuk and Nick Macfie, Larry King

REUTERS. NOVEMBER 10, 2017. China widens foreign access to its giant financial sector

BEIJING (Reuters) - China will raise foreign ownership limits in financial firms in a step granting access to a tantalizing multi-trillion dollar financial services market, as the world’s second-biggest economy seeks to position itself as a major global finance hub.

The move, announced on Friday by vice finance minister Zhu Guangyao, comes a day after U.S. President Donald Trump reiterated calls for better access to Chinese markets in meetings with Chinese President Xi Jinping.

Xi is driving broad economic reforms by opening up China’s capital markets, internationalizing the yuan currency, and seeking technical know-how through the pursuit of massive inbound and outbound investments.

The latest changes include raising the limit on foreign ownership in joint-venture firms involved in the futures, securities and funds markets to 51 percent from the current 49 percent.

They will take effect immediately following the drafting of specific related rules, Zhu told a news conference, adding China is “formulating a timetable and roadmap for financial sector reform and opening up”.

The foreign business community gave a cautious welcome to the news.

“Financial services further opening definitely has been high on our list,” said Ken Jarrett, President of American Chamber of Commerce in Shanghai.

“It’s a step in the right direction. We’ll have to see the detailed rules. In China you always have to pay attention to the fine print to see how quickly it moves, but to finally ease up on the cap is something that is welcome.”

Peter Alexander, managing director of Z-Ben Advisors, a Shanghai-based consultant for the fund industry, sees Friday’s announcement as a measured step towards bigger changes down the road.

“This is part of a methodical and deliberate process. We fully expect foreign asset managers at some point in the next several years to have full control of their own ventures.”

The plan to ease ownership restrictions comes as Beijing faces mounting pressure from Western governments and business lobbies to remove investment barriers and onerous regulations that restrict overseas companies’ operations in its markets.

During his trip to Beijing this week, Trump said that trade between the two nations was unfair, and called for greater market access for U.S. companies.

“We really have to look at access, forced technology transfer, and the theft of intellectual property, which just, by and of itself, is costing the United States and its companies at least $300 billion a year,” Trump said.

“Both the United States and China will have a more prosperous future if we can achieve a level economic playing field. Right now, unfortunately, it is a very one-sided and unfair one.”

CHANNELING FOREIGN MONEY

Reuters reported on Tuesday that China planned to allow global banks to take a stake of up to 51 percent in their onshore securities ventures for the first time and tie up with local non-financial firms.

China has been sluggish to give foreign players more access to its financial sector, but has promised to quicken the pace as foreign investment into Asia’s economic powerhouse slows.

China has implemented strict capital controls to contain capital outflows, while opening up new channels for foreign money to come into the domestic markets.

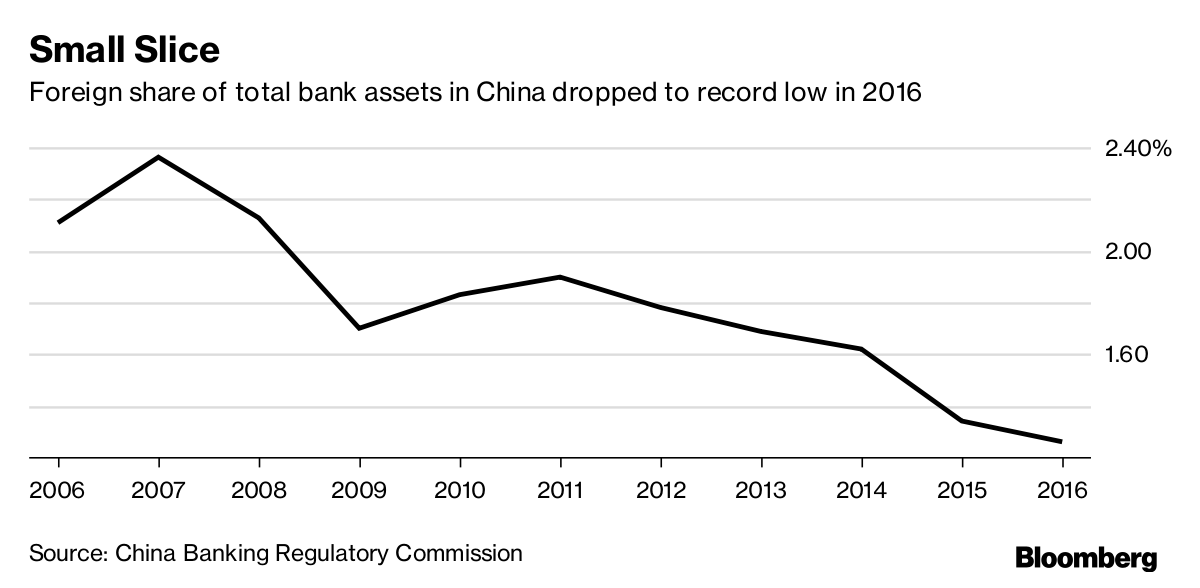

Foreign financial firms are still small players in the financial sector, and the sheer size of the market is a big lure for overseas players.

Foreign banks account for just 1.4 percent of the total 181.7 trillion yuan ($27.37 trillion) of banking assets in China, according to a 2017 study by KPMG. Their average returns on assets and on equity, were about half the level of their domestic rivals, said the study.

UBS (UBSG.S), which holds a 25 percent interest in domestic firm UBS Securities Co Ltd, said the changes were an important step in further opening up China’s financial sector.

“China is a key market for UBS and, as indicated previously, we continue to work towards increasing our stake in UBS Securities Co Ltd”, said Eugene Qian, Chairman of UBS China Strategy Board and Member of the Asia Pacific Executive Committee.

A spokesperson for JPMorgan (JPM.N), which sold its 33.3 percent stake in its China securities JV to First Capital in December 2016, said the company “welcomes any decision made by the Chinese Government that looks to liberalize its financial sector further”.

TOO LITTLE TOO LATE?

Some industry watchers said the changes are too little too late.

“This looks good, but in reality it is pretty small and it is too late,” said Keith Pogson, head of the Asia financial services team at EY.

“If you are an international investment bank, you will be there for the sake of your global franchise and having it as part of your network, not because you think you will make much money in China.”

All the same, markets reacted positively to the news, with insurers and futures-related firms rallying strongly.

New China Life Insurance (601336.SS) jumped nearly 6 percent after the announcement, while Ping An Insurance (2318.HK) (601318.SS) advanced more than 4 percent and China Pacific Insurance Group (601601.SS) rose over 3 percent.

China will drop foreign ownership restrictions on local banks and asset management companies, Zhu said.

Full foreign ownership of local firms involved in the futures, securities and funds markets will not be permitted until after three years, while full overseas ownership of insurance firms will be allowed only after five years.

For most foreign investment banks, including the likes of Goldman Sachs, the prospect of playing in a huge market seemed too good to pass up.

“We welcome today’s announcement and look forward to playing a greater role in China’s capital markets,” a spokesperson for Goldman Sachs said.

Reporting by Kevin Yao and Stella Qiu; additional reporting by John Ruwitch in Shanghai, Matthew Miller in Beijing and Jennifer Hughes and Umesh Desai in Hong Kong; Writing by Elias Glenn; Editing by Shri Navaratnam

BLOOMBERG. 10 November 2017. TPP Trade Deal Gets Bogged Down Near Finish Line

By Rosalind Mathieson , Isabel Reynolds , and Nguyen Dieu Tu Uyen

- Japan’s Abe told regional leaders he welcomed framework deal

- TPP leaders’ meeting put off, no statement yet issued

After a day of confusion, a much-anticipated framework agreement on a Pacific trade deal was at risk of being scuppered, raising the prospect the pact -- already many years in the making -- could be delayed further.

Trade ministers from the 11 countries in the Trans-Pacific Partnership reached a tentative agreement in Vietnam on Thursday, according to an official with direct knowledge of the talks. However, a Friday meeting of TPP-country leaders to approve the plan was deferred and the deal is now in flux, the official said, asking not to be identified when discussing private matters.

Signs emerged late Friday that Canada could be holding up the process. Japanese Prime Minister Shinzo Abe said the Canadian delegation had said it was not yet ready for a leaders’ agreement, broadcaster NHK reported. Japan’s Economy Minister Toshimitsu Motegi is expected to comment later in the day.

The official with knowledge of the discussions said Canada had been a no-show for the leaders’ meeting. Canadian Prime Minister Justin Trudeau’s office referred questions to his trade minister, Francois-Philippe Champagne. A spokesman said it’s not only Canada with reservations.

“We made progress today and Minister Champagne is still at the negotiating table, but as we said coming in there is no rush to conclude,” Pierre-Olivier Herbert said in an email, citing the auto, agriculture and culture sectors as concerns, along with intellectual property. “There are outstanding issues for more than one country.”

Renewed Push

TPP leaders have another chance to get some sort of agreement -- most likely a deal for ministers to keep talking and a time frame for doing so -- during the broader Asia-Pacific Economic Cooperation summit being held in Vietnam on Saturday. A fresh attempt will be made to secure a joint statement, a Vietnamese government official said. But that could add another wrinkle: The APEC grouping includes countries outside the TPP sphere, including the U.S. and China.

The deal, which would have covered 40 percent of the global economy, was thrown into disarray when Donald Trump withdrew the U.S. in one of his first acts as president due to a perceived risk to American jobs, leaving other countries scrambling to keep the deal alive. The TPP discussions in Vietnam have centered around suspending some parts of the agreement in a bid to move forward without America’s involvement.

The apparent failure to get even a tentative agreement came after Abe had told Mexican President Enrique Pena Nieto and other regional leaders earlier in the day he welcomed the outline deal as a way of flying the flag for free trade. Then Abe’s talks with Trudeau went on for longer than expected. Abe and Trudeau met for around an hour and exchanged opinions mostly on TPP, Japan’s foreign ministry said in a statement.

The TPP was seen as a hallmark of U.S. engagement with Asia under the prior administration and a buffer against China’s rising clout. Then-Defense Secretary Ash Carter called it more strategically important than having another aircraft carrier battle group in the Pacific. It would go beyond traditional deals by including issues like intellectual property, state-owned enterprises and labor rights.

Difficult Discussions

Champagne, the Canadian trade minister, said in a Wednesday interview that speed shouldn’t take priority over reaching a good agreement. He tweeted a denial overnight of Japanese media reports that a deal had been reached.

“We are at the table, we’re being constructive, we’re being creative but let’s be honest, some are difficult discussions,” Champagne said. "For Canada it’s far more important to get the right deal than a fast deal. What we are here to do is set the terms of trade in the Asia-Pacific region for decades to come.”

Champagne said Canadians expect any agreement to benefit the middle class and “give a chance to the small and medium-sized business to join the global trade.”

Malaysian Prime Minister Najib Razak told the APEC CEO summit on Friday there had been progress by ministers in the talks and he was “reasonably confident” of an outcome.

“There was a meeting last night that went on until three this morning and we are coming up with our statement,” he said. “Of course there is work to go through, the process of ratification and some side matters that will now need to be worked out. But at least we’ve managed to salvage some kind of free trade agreement.”

— With assistance by John Boudreau, and Josh Wingrove

BLOOMBERG. 9 November 2017. Pacific Nations Scramble to Save TPP After Trump’s Exit

By Rosalind Mathieson

- Australia says trade deal is ‘very close’ to being secured

- Canada is aiming for a good TPP agreement over a fast deal

Pacific nations are scrambling to agree on how to salvage a blockbuster trade pact after days of talks in Vietnam, with Australia confident of an outcome but Canada warning it wants a good deal over a fast one.

Trade ministers meeting on the sidelines of the Asia-Pacific Economic Cooperation summit are due to present their proposal on the future of the Trans-Pacific Partnership to leaders on Friday afternoon. As of Friday morning there remained uncertainty as to whether an agreement had been reached, or would be reached, and what sort of statement the leaders might release.

The pact, which would have covered 40 percent of the global economy, was thrown into disarray when Donald Trump withdrew the U.S. in one of his first acts as president, leaving the remaining 11 countries scrambling to keep the deal alive. The discussions in Vietnam have centered around suspending some parts of the agreement in a bid to move forward without America’s involvement.

“We are hopeful of securing a deal inside the next 24-48 hours,” Australian Trade Minister Steve Ciobo said Thursday in an interview in Vietnam. “We’re not there yet -- there’s still a bit of work to do but we’ve been making steady progress,” he said.

“Like any deal it’s not done until it’s done and there’s still work to be completed, but we are very close and with a final nudge over the next day I hope we will get there,” Ciobo added.

Malaysia Prime Minister Najib Razak told the APEC CEO summit on Friday there had been progress by ministers in the talks and he was “reasonably confident” of an outcome.

“There was a meeting last night that went on until three this morning and we are coming up with our statement,” he said. “Of course there is work to go through, the process of ratification and some side matters that will now need to be worked out. But at least we’ve managed to salvage some kind of free trade agreement.”

That optimism contrasts with Canada, whose trade minister Francois-Philippe Champagne said in an interview Wednesday that speed shouldn’t take priority over getting a good agreement.

‘Difficult Discussions’

“We are at the table, we’re being constructive, we’re being creative but let’s be honest, some are difficult discussions,” Champagne said. "For Canada it’s far more important to get the right deal than a fast deal. What we are here to do is set the terms of trade in the Asia-Pacific region for decades to come.”

Reports in the Japanese media late Thursday night of a deal were swiftly denied by Canada, the pact’s second-largest remaining economy. "Despite reports, there is no agreement in principle on TPP," Champagne said on Twitter. His country is pushing to beef up what it calls "progressive" elements of the pact, such as those on labor rights.

Japanese Finance Minister Taro Aso told reporters in Tokyo on Friday there were still details being hammered out, citing Mexico and Vietnam as two holdouts. One official involved in the talks said the Vietnamese negotiators had walked out of the meeting late Thursday evening after disagreement flared with another delegation.

Japanese Chief Cabinet Secretary Yoshihide Suga however said ministers were in alignment on quickly bringing TPP into effect. “I have received a report that people on the ground are making final adjustments to have the leaders confirm an outline agreement,” he told reporters.

The TPP was seen as a hallmark of U.S. engagement with Asia under the prior administration and a buffer against China’s rising clout. Then-Defense Secretary Ash Carter called it more strategically important than having another aircraft carrier battle group in the Pacific.

‘Changed the Metrics’

It would go beyond traditional deals by including issues like intellectual property, state-owned enterprises and labor rights. Champagne said Canadians expect any agreement to benefit the middle class and “give a chance to the small and medium-sized business to join the global trade.”

Ciobo said the U.S. withdrawal had “changed the metrics” for a number of countries. “That means there will be some aspects of it where we will agree to suspend the operation of certain parts of it, and that’s been the basis upon which we’ve been able to get now, I hope, an agreement.”

Speaking in an interview on Tuesday, Trade Minister Mustapa Mohamed indicated Malaysia had shifted from its prior stance that Trump’s decision to withdraw the U.S. meant the pact needed to be renegotiated.

“We’ve been talking with our colleagues on some provisions which could be suspended,” Mustapa said, without providing specifics. “Renegotiation would take a long time. All of us agreed that to renegotiate would probably take five, 10 years, so that’s not on. That’s a no go.”

— With assistance by Josh Wingrove, Isabel Reynolds, and Andy Sharp

BLOOMBERG. 10 November 2017. China Gave Trump a Win on Trade and He Didn’t Even Know It

Jennifer Jacobs, Peter Martin and Craig Gordon

- Chinese make move to allow more foreign investment in banks

- Move is like what Trump was seeking but China didn’t tell him

American and other securities firms scored what looks like a big win Friday when China announced new rules allowing them to own 51 percent stakes in joint ventures. It’s just the sort of market-opening move President Donald Trump was seeking on his first trip as president to Beijing.

Except Trump didn’t know it was coming.

He didn’t even ask for it in specific terms on the trip, say people familiar with the situation -- even though it’s been at the top of the wish list for U.S. financial firms for years. The State Department didn’t know either.

It is the single most-important thing that happened while Trump was in China, business experts agree, and he would have been well within his rights to trumpet it on Twitter. China has resisted letting overseas firms have controlling stakes inside the country, but experts say it’s a critical step to allowing investment to flourish inside that nation’s tightly controlled economy.

And yet it didn’t even merit a mention in the 1,392-word statement the White House released about what happened while Trump was in China.

U.S. officials sought to downplay the significance of the development, saying it’s just one small step when China needs to fundamentally remake its approach to letting foreign investment onto its shores.

Trade Deficit

Some financial experts disagree, saying that it’s an important development for individual banks seeking to strengthen their foothold in the world’s second-largest economy -- something that also would help Trump with his goal of reducing the U.S. trade deficit with China.

In one way, the lack of notice to Trump reflects a very Chinese approach to such matters, to do things that benefit China, and only in the manner and in the timing that suits China’s needs.

“China has planned for this for a very long time, and now is the right time to announce it because Trump is visiting," said Iris Pang, a China economist at ING Groep NV in Hong Kong.

In another way, it puts the relationship between Trump and Chinese President Xi Jinping in a clearer light. During the trip, Trump boasted of the closeness and warmth between the two men, and White House aides stressed repeatedly that the trip was about cementing that relationship, not individual wins.

Xi’s Timing

But Xi easily could have bestowed this gift upon Trump during his visit by telling him about the pending move -- ahead of one of their joint appearances, for instance -- something to blunt the theme in the coverage that Trump has very little to show despite already spending almost a week in the Asian region, either on trade or North Korea.

The fact is that Xi didn’t let show just how hard it will be to make the achievements concrete in the future.

The exact timing of the openings are not yet known and few details were offered in today’s announcement. There are also many ways that Chinese policy makers could slow-walk market opening, Tom Orlik, the Chief Asia Economist at Bloomberg Economics in Beijing wrote in a note.

In addition, U.S. banks may approach investments in Chinese banks with some caution, considering ongoing concerns over leverage in the Chinese economy and shadow-banking exposures. What’s more, banks including Bank of America Corp. and Goldman Sachs Group Inc. have in recent years exited their stakes in Chinese lenders, seeking to avoid punitive capital imposts on minority shareholdings, a legacy of regulations introduced after the financial crisis.

HSBC’s Stake

After sales by Citigroup Inc. and others, HSBC Holdings Plc has been left as the only one with a major holding, in the form of its 19 percent stake in Bank of Communications Co.

Andrew Polk, co-founder of research firm Trivium China in Beijing, said he doesn’t know why this announcement wasn’t folded in with Trump’s trip. He believes past work between U.S. and Chinese trade negotiators had brought this item to the point of being announced -- and suggested that if Trump had just asked directly, the Chinese might have given it to him or told him ahead of time.

But the real motivation for China isn’t offering the U.S. a concession -- it’s about the Chinese government wanting to boost foreign direct investment, or FDI.

China is "panicked about the extremely low levels of FDI inflows they have and now realize that to get higher FDI inflows they’ll have to do some more opening. This is part of that," Polk said.

China’s growing debt pile is a major economic risk. Total debt will reach 292 percent of output in 2019 and 328 percent in 2022, up from 162 percent in 2008, according to projections by researchers at Bloomberg Economics.

No Way to Compete

Polk said the Chinese are making changes in sectors, like banking, where their built-in advantage is so huge, a little more outside money won’t really challenge them. "They’d never have done this 10 years ago," he said. Now, "just with the size of these things, there’s no way a foreign firm can compete."

Polk believes this is a big deal for individual firms, less so in the overall picture of China’s economy, because the amounts are still relatively small. "It’s not a big deal in the relationship between China and outside entities. If you’re HSBC or Standard Chartered then it could be a big deal for your business," he said.

— With assistance by Jeff Kearns

BLOOMBERG. 9 November 2017. China Makes Historic Move to Open Market for Financial Firms

- Nation removes foreign ownership limits on lenders, fund firms

- Announcement coincides with Trump’s first state visit to China

China took a major step toward the long-awaited opening of its financial system, saying it will remove foreign ownership limits on banks while allowing overseas firms to take majority stakes in local securities ventures, fund managers and insurers.

The new rules, unveiled at a government briefing on Friday, will give global financial companies unprecedented access to the world’s second-largest economy. The announcement bolstered the reform credentials of Chinese President Xi Jinping less than a month after he cemented his status as the nation’s most powerful leader in decades. It also coincided with Donald Trump’s visit to Beijing, though the U.S. president didn’t know it was coming.

Foreign financial firms applauded the move, with JPMorgan Chase & Co. and Morgan Stanley saying in statements that they’re committed to China. UBS Group AG said it will continue to push for an increased stake in its Chinese joint venture. While China has already made big strides in opening its equity and bond markets to foreign investors, international banks and securities firms have long been frustrated by ownership caps that made them marginal players in one of the fastest-expanding financial systems on Earth.

“It’s a key message that China continues to open up and make its financial markets more international and market-oriented," said Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong. "How important a role foreign financial firms can play remains to be seen.”

The relaxation of ownership rules follow a period in which most overseas lenders lost interest in direct stakes in their Chinese counterparts. After sales by Citigroup Inc., Goldman Sachs Group Inc. and others, HSBC Holdings Plc is the only international bank with a major holding -- a 19 percent stake in Bank of Communications Co. HSBC has been building its business on the mainland as part of a “pivot to Asia” under outgoing Chief Executive Officer Stuart Gulliver.

Overseas companies will probably focus on increasing their presence in China’s insurance, securities and fund-management industries, which have “significant room for development,” said Oliver Rui, professor of finance at the China Europe International Business School in Shanghai. The lending business, which is dominated by government-run behemoths like Industrial & Commercial Bank of China Ltd., will attract less interest because it’s a “saturated” industry and foreigners lack a competitive edge, he said.

Regulators are still drafting detailed rules, which will be released soon, China’s Vice Finance Minister Zhu Guangyao said at the briefing in Beijing. Here’s what we know so far:

- Foreign firms will be allowed to own stakes of up to 51 percent in securities ventures; China will scrap foreign ownership limits for securities companies three years after the new rules are effective

- The country will lift the foreign ownership cap to 51 percent for life insurance companies after three years and remove the limit after five years

- Limits on ownership of fund management companies will be raised to 51 percent, then completely removed in three years

- Banks and so-called asset-management companies will have their ownership limits scrapped

Policy makers had hinted at an opening in recent months. Just yesterday, China’s Foreign Ministry said entry barriers to sectors such as banking, insurance, securities and funds would be “substantially” eased “in accordance to China’s own timetable and road map.” People’s Bank of China Governor Zhou Xiaochuan advocated for greater competition in the financial industry in June, while one of his colleagues penned an article last month arguing that increased foreign participation would help the sector adopt better corporate governance and risk management practices.

The announcement’s timing, on the day Trump ended his first visit to China as U.S. president, offered the chance for him to claim some credit for the opening and for warmer ties between the two world powers. But Trump didn’t even ask for it in specific terms on the trip, according to people familiar with the situation, and it wasn’t mentioned in the White House’s 1,392-word statement on what happened during the president’s trip to China.

Read more: Bloomberg Gadfly’s take

Bloomberg News reported in September that the PBOC was drafting a package of reforms that would give foreign investors greater access to the financial services industry, citing people familiar with the matter. JPMorgan Chief Executive Officer Jamie Dimon said earlier this year that the bank was patiently negotiating with Chinese regulators for structures that would eventually give it full control.

“I believe China has planned for this for a very long time, and now is the right time to announce it because Trump is visiting," said Iris Pang, a China economist at ING Groep NV in Hong Kong. China is likely to push for improved access to U.S. markets for its financial firms, she added.

Foreign banks held 2.9 trillion yuan ($436 billion) of assets in China at the end of 2016, accounting for 1.26 percent of the nation’s total banking assets, the lowest share since 2003, according to the China Banking Regulatory Commission. They earned 12.8 billion yuan in the nation last year, less than 1 percent of the profits at Chinese counterparts.

Meanwhile, most foreign-backed securities joint ventures are minnows in China. JPMorgan First Capital ranked 120th out of China’s 125 brokerages by net income in 2015, according to the Securities Association of China. UBS Securities Co., whose 296 million yuan profit was the biggest among foreign-backed joint ventures, ranked 95th.

Even if they take full control of their China ventures, international financial companies will face multiple challenges. One of the biggest is competition from government-controlled rivals, who currently dominate the nation’s financial system and have longstanding relationships with giant state-owned companies that drive much of China’s economic activity.

Then there’s the country’s record debt burden, which amounts to an estimated 260 percent of gross domestic product after government-run lenders pumped up the economy with easy money in recent years. The country suffered its first onshore corporate bond default in 2014 and has seen at least 20 defaults so far this year. Prominent investors including Hayman Capital Management’s Kyle Bass and billionaire George Soros have warned that the country could be headed for a financial crisis.

There’s little sign of an imminent blowup. Bank earnings in China swelled to 2.1 trillion yuan last year, up four-fold since 2008, and profits in the securities industry have more than doubled over the same period to 123 billion yuan, according to regulatory data.

Chinese authorities have also taken steps to curb excesses in the banking system, embarking on a campaign this year to clean up some of the nation’s riskiest financial products. The potential influx of foreign capital and expertise could help China manage the aftermath of the credit binge and help prevent a repeat, according to Tom Orlik, the Chief Asia Economist at Bloomberg Economics.

Overseas firms will “calculate the risk-reward margin carefully," said Raymond Yeung, chief Greater China economist at Australia & New Zealand Banking Group in Hong Kong. "That said, the scale of the market is something they won’t ignore.”

— With assistance by Alfred Liu, Xiaoqing Pi, Jeff Kearns, Gary Gao, Dingmin Zhang, Jun Luo, and Cathy Chan

CANADA - CHINA / FREE TRADE AGREEMENT

Global Affairs Canada. November 10, 2017. Results of public consultations on possible Canada-China free trade agreement

Ottawa, Ontario - Canada and China have a long-standing relationship in the realms of trade, science, culture and education. Expanding trade, as part of a comprehensive, longer-term strategic approach to this relationship, is a priority for the Government of Canada and the best way to secure more opportunities and good-paying jobs for the middle class.

As part of the government’s commitment to transparency and openness, Global Affairs Canada conducted public consultations on a possible Canada-China free trade agreement. More than 600 stakeholders and partners, including businesses and industry associations, academics, labour unions, non-governmental organizations and Indigenous groups, took part in the consultations.

Today, Global Affairs Canada published a report summarizing what it has heard from a wide range of Canadians during the public consultation period. The Government of Canada remains committed to hearing from Canadians as it continues this consultation process.

RESULT: http://international.gc.ca/trade-commerce/consultations/china-chine/what_we_heard-que_nous_entendu.aspx?lang=eng

ECONOMY

REUTERS. NOVEMBER 10, 2017. Global Economy: Communication breakdown?

Catherine Evans

LONDON (Reuters) - A flattening of government bond yield curves that may presage an economic downturn could prompt verbal interventions in the coming week by central bankers still struggling to hit this cycle’s inflation targets.

European Central Bank chief Mario Draghi, U.S. Federal Reserve Chair Janet Yellen, Bank of Japan Governor Haruhiko Kuroda and Bank of England head Mark Carney will form an all-star panel on Tuesday at an ECB-hosted conference in Frankfurt.

The subject? “Challenges and opportunities of central bank communication.”

Curve-flattening on both sides of the Atlantic, but more markedly in the United States, suggests investors have doubts over the future path of inflation and may be starting to price in a downturn just as the global economy picks up speed.

Since the Fed began raising rates in 2015, the difference between long- and short-term U.S. yields has shrunk to levels not seen since before the 2008 financial crisis, reaching 67 basis points US2US10=RR -- its flattest in a decade -- in the past week.

That partly reflects uncertainty about the passage of a Republican-sponsored bill to cut U.S. taxes, which has hauled down longer-term projections of inflation while expectations for upcoming rate increases push short-term yields higher.

With curve-flattening typically signaling a muted outlook for both growth and inflation, the trend suggests investors see a risk that the Fed’s current monetary tightening cycle will start to slow the world’s biggest economy.

A flatter curve, which makes lending less profitable, also poses a risk to the banking sector, nursed back to fragile health by central banks after it nearly collapsed a decade ago. But with crisis-era policies still largely in place, how would central banks cushion the impact of a downturn?

RECESSION RISK

S&P Global Ratings said in the past week that it sees a 15-20 percent risk of a U.S. recession in the next 12 months based on economic conditions, government policy uncertainty and continued gradual tightening by the Fed.

Citing economic indicators that show the expansion is either in or approaching a late cycle -- though not overheating -- it forecast robust GDP growth in the second half of 2017.

“Still, monetary policy risk remains in the coming months that is not captured in our quantitative assessment,” S&P said.

”The economy has now more or less closed the output gap ...That means monetary policy is more likely to transition away from the current accommodative stance.

“Furthermore, if a sizeable fiscal stimulus from the U.S. government is to indeed go through in the coming months, it increases the chance of the Fed tightening policy more aggressively.”

Market expectations that the Fed will continue to tighten gradually have generally been preserved by U.S. President Donald Trump’s decision to appoint Jerome Powell as Fed Chair when Yellen’s term expires in February.

But with a number of Fed vacancies to be filled, analysts at ING say the policy-setting Federal Open Market Committee could yet take on a hawkish hue.

“The combination of upside risks to growth and mounting inflationary pressures, as well as a hawkish rotation in the make-up of Fed voters, suggests that markets are too cautious in only pricing in one (rate) hike next year,” they wrote.

“We’re expecting a December rate hike, and these various factors mean there is upside risk to our call for two further rate rises next year. What’s more, the long end of the (yield) curve will also have to deal with additional supply from the Fed’s balance sheet reduction programme.”

Powell, a 64-year-old Fed board governor and former investment banker, will take over an economy that has been expanding for more than eight years and where unemployment has fallen to its lowest since the early 2000s.

Under his leadership the Fed is widely expected to continue to raise borrowing costs gradually, as Yellen began to do in late 2015, and to shrink the central bank’s $4.5 trillion balance sheet.

It has raised rates twice this year and is widely expected to do so again -- to a target range of 1.25 to 1.5 percent -- next month.

Investors in Europe are also focused on potential future price growth, although the European Central Bank’s more accommodative stance means a different dynamic for bond markets.

The hunt for returns drove the German yield curve, Europe’s benchmark, to its flattest in about two months in the past week, though that trend was reversed on Thursday and Friday.

Market measures of long-term inflation expectations in the bloc have risen in recent months but remain well below the ECB’s near-2-percent target, giving funds confidence that the value of those investments will not be materially eroded. EUIL5YF5Y=R

The ECB’s decision last month to extend its asset purchase program until at least September and pledge to keep rates at record lows until well after that scheme ends have helped push bond yields across the bloc to multi-month lows.

The European Commission said on Thursday that it expected the euro zone economy to grow at its fastest pace in a decade this year before slowing somewhat. A flash estimate of third-quarter GDP in the euro area will be released on Tuesday and October’s inflation reading on Thursday.

A clutch of other Fed policymakers will also be out and about, while Draghi, Kuroda and Carney are all due to make speeches during the week.

Reporting by Catherine Evans; editing by John Stonestreet

ENERGY

REUTERS. NOVEMBER 9, 2017. Oil markets creep higher on supply pact expectations

Nina Chestney

LONDON (Reuters) - Crude oil markets were slightly higher on Friday, supported by continuing supply cuts and expectations that an output deal will be extended at the end of the month.

Brent crude was at $64.22 a barrel at 1017 GMT, up 27 cents from the previous close and 43 cents off a more than two-year high of $64.65 reached this week.

U.S. West Texas Intermediate (WTI) crude was at $57.26, up 9 cents and also not far from this week’s peak of $57.92, its highest in more than two years.

The higher prices are a result of efforts led by the Organization of the Petroleum Exporting Countries (OPEC) and Russia to tighten the market by cutting output, as well as strong demand and rising political tensions.

There are also expectations in the market that OPEC’s next meeting on Nov. 30 will agree to extend cuts beyond the current expiry date in March 2018.

“Clearly the market is still convinced that OPEC will succeed in tightening the market to a sufficient extent by extending its production cuts. Attention is therefore paid to any news that supports this view,” Commerzbank analysts said.

“Even significantly weaker Chinese crude oil imports in October and an increase in U.S. crude production to a record level failed to exert any lasting pressure on oil prices.”

On Friday Saudi-owned Al Hayat newspaper cited UAE Energy Minister Suhail bin Mohammed al-Mazroui as saying that oil producers will have little difficulty taking a decision on extending the pact.

“The market needs a bit of a correction. No one is talking about not extending the cut,” he told the newspaper, adding that it is more a case of deciding on the duration of an extension.

Also supporting prices is strong demand in southeast Asia, where the number of tankers holding oil in storage around Singapore and Malaysia has halved since June.

However, technicals signal that gains might not be sustained, some analysts say.

“The uptrend that has dominated oil futures contracts for most of the last five months is still in place, but it is beginning to look weary,” said Robin Bieber, chart analyst at London brokerage PVM Oil Associates.

“RBOB’s (gasoline futures) action is evidence of this. Watch the five-day moving averages very carefully. The trend is OK while these are intact - below, and the contracts are very vulnerable to a correction lower to the eight-day moving averages,” he added.

U.S. bank Goldman Sachs also warned of greater price volatility ahead, citing rising tensions in the Middle East, especially between OPEC members Saudi Arabia and Iran, along with soaring U.S. oil production.

Additional reporting by Henning Gloystein in Singapore; Editing by David Goodman

REUTERS. NOVEMBER 9, 2017. Oil markets creep higher on supply pact expectations

Nina Chestney

LONDON (Reuters) - Crude oil markets were slightly higher on Friday, supported by continuing supply cuts and expectations that an output deal will be extended at the end of the month.

A pump jack is seen at sunrise near Bakersfield, California October 14, 2014. REUTERS/Lucy Nicholson/File Photo

Brent crude was at $64.22 a barrel at 1017 GMT, up 27 cents from the previous close and 43 cents off a more than two-year high of $64.65 reached this week.

U.S. West Texas Intermediate (WTI) crude was at $57.26, up 9 cents and also not far from this week’s peak of $57.92, its highest in more than two years.

The higher prices are a result of efforts led by the Organization of the Petroleum Exporting Countries (OPEC) and Russia to tighten the market by cutting output, as well as strong demand and rising political tensions.

There are also expectations in the market that OPEC’s next meeting on Nov. 30 will agree to extend cuts beyond the current expiry date in March 2018.

“Clearly the market is still convinced that OPEC will succeed in tightening the market to a sufficient extent by extending its production cuts. Attention is therefore paid to any news that supports this view,” Commerzbank analysts said.

“Even significantly weaker Chinese crude oil imports in October and an increase in U.S. crude production to a record level failed to exert any lasting pressure on oil prices.”

On Friday Saudi-owned Al Hayat newspaper cited UAE Energy Minister Suhail bin Mohammed al-Mazroui as saying that oil producers will have little difficulty taking a decision on extending the pact.

“The market needs a bit of a correction. No one is talking about not extending the cut,” he told the newspaper, adding that it is more a case of deciding on the duration of an extension.

Also supporting prices is strong demand in southeast Asia, where the number of tankers holding oil in storage around Singapore and Malaysia has halved since June.

However, technicals signal that gains might not be sustained, some analysts say.

“The uptrend that has dominated oil futures contracts for most of the last five months is still in place, but it is beginning to look weary,” said Robin Bieber, chart analyst at London brokerage PVM Oil Associates.

“RBOB’s (gasoline futures) action is evidence of this. Watch the five-day moving averages very carefully. The trend is OK while these are intact - below, and the contracts are very vulnerable to a correction lower to the eight-day moving averages,” he added.

U.S. bank Goldman Sachs also warned of greater price volatility ahead, citing rising tensions in the Middle East, especially between OPEC members Saudi Arabia and Iran, along with soaring U.S. oil production.

Additional reporting by Henning Gloystein in Singapore; Editing by David Goodman

EMPLOYMENT

Employment and Social Development Canada. November 10, 2017. Minister Duclos to speak at the MaRS Social Finance Forum

The Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development, will deliver a keynote speech at the MaRS Social Finance Forum.

Information for EI claimants

EI maternity benefits and leaves

The Employment Insurance (EI) program provides temporary income support to replace lost employment income to individuals who are off work due to pregnancy and childbirth, and caring for a newborn or newly adopted child.

The Employment Insurance (EI) program provides temporary income support to replace lost employment income to individuals who are off work due to pregnancy and childbirth, and caring for a newborn or newly adopted child.

- EI maternity benefits currently provide up to 15 weeks of benefits to EI-eligible birth mothers, including surrogates, related to childbearing and to support physical and/or emotional recovery during the weeks surrounding the birth. These benefits are currently payable as early as 8 weeks prior to the expected week of birth of the child.

As of December 3, 2017, pregnant workers will be able to claim the existing 15 weeks of EI maternity benefits as early as 12 weeks before the expected week of birth of the child, up from the current 8 weeks. This will provide pregnant workers with more flexibility to better take into account their personal, health and workplace circumstances when choosing when to begin receiving their maternity benefits.

Maternity benefits will continue to be paid at the current benefit rate of 55 percent of average weekly earnings, up to a maximum of $543 per week in 2017.

EI parental benefits and leaves

- EI parental benefits currently provide up to 35 weeks of support to EI-eligible parents (biological and adoptive parents) who leave the workforce to care for a newborn or newly adopted child. Parental benefits are offered per family and may be shared—they can be taken at the same time or separately by eligible parents. Benefits may be taken in the 52 weeks following the week of birth of the child or placement of a child for adoption. The benefit and corresponding leave under the Canada Labour Code are available to eligible opposite-sex and same-sex parents.

For children born or placed for adoption on or after December 3, 2017, claimants may choose the standard parental benefit, as originally provided in the Employment Insurance Act, or an extended parental benefit which provides a lower benefit rate over a longer duration (up to 18 months).- Standard parental benefit:

Receiving EI parental benefits over a period of up to 12 months, at the current benefit rate of 55 percent of average weekly earnings, for up to 35 weeks, to a maximum of $543 per week in 2017.

These weeks of benefits are payable in the period that begins the week in which the child or children of the claimant are born or the child or children are placed with the claimant for the purpose of adoption, and end 52 weeks later. - Extended parental benefits

Receiving EI parental benefits over a period of up to 18 months, at a lower benefit rate of 33 percent of average weekly earnings, for up to 61 weeks, to a maximum of $326 per week in 2017.

These weeks of benefits are payable in the period that begins the week in which the child or children of the claimant are born or the child or children are placed with the claimant for the purpose of adoption, and end 78 weeks later.

Parents will need to choose the same parental benefit (standard or extended) when applying for EI benefits and indicate how many weeks they each plan to take. Parents will be able to receive the benefits at the same time or separately. The choice of standard or extended benefits by the first claimant who completes the EI application’s selection (on a complete application) will be binding for the two claimants.

Once parental benefits have begun being paid on a claim, even as little as $1, the parent’s choice will be irrevocable and not subject to reconsideration or appeal under the Employment Insurance Act.

- Standard parental benefit:

Part III of the Canada Labour Code provides corresponding unpaid job-protected maternity and parental leaves for employees under federal jurisdiction[1]. Corresponding changes were made to the Canada Labour Code to provide unpaid parental leave of up to 63 weeks and up to 78 weeks of unpaid leave combined with maternity and parental leaves. There are no changes to the job tenure or notification provisions related to these leaves for workers in federally regulated workplaces.

For employees working in provincial and territorial jurisdictions, employment standard protections for maternity and parental leaves and eligibility requirements vary.

Since 2006, the Québec Parental Insurance Plan offers maternity, parental, adoption and paternity benefits to residents of the province of Quebec. Accordingly, Quebec residents are not eligible for EI maternity or parental benefits. The Plan is the only federal–provincial agreement related to maternity and parental benefits currently in place.

EI caregiving benefits:

The EI program currently offers two caregiving benefits: the Parents of Critically Ill Children benefit, available to parents caring for a critically ill child; and the Compassionate Care benefit, available to individuals providing end-of-life care to a family member. As of December 3, 2017, there will be additional support for EI‑eligible caregivers who leave work to care for a family member: the Family Caregiver benefit for adults. The suite of caregiving benefits will be grouped into two categories: Family Caregiver benefits (for adults and children) and Compassionate Care benefits.

- Family Caregiver benefits

- Family Caregiver benefit for adults

Starting December 3, 2017, the new Family Caregiver benefit for adults announced in Budget 2017 will allow eligible Canadians to receive up to 15 weeks of benefits to provide care or support to an adult family member 18 years of age or older who is critically ill (i.e. whose life is at risk as a result of illness or injury and has experienced a significant change in their baseline state of health). - Family Caregiver benefit for children

Up to 35 weeks of benefits will continue to be available while providing care or support to a child under 18 years of age who is critically ill (i.e. whose life is at risk as a result of illness or injury and who has experienced a significant change in their baseline state of health).

Starting December 3, 2017, this benefit, formerly known as the Parents of Critically Ill Children benefit, will be renamed the Family Caregiver benefit for children. Eligibility will be extended to any eligible family member providing care to the child, rather than being limited to parents. The definition of family member will be broadened to include relatives beyond the immediate family and individuals who are not relatives but are considered to be like family. For example, an aunt or uncle could be eligible to receive the benefit to provide care to a critically ill child. These changes were introduced to accommodate the needs of diverse family situations and provide enhanced flexibility and access to this benefit.

Medical doctors and nurse practitioners will be allowed to sign a medical certificate to certify that a child is critically ill, rather than only specialist medical doctors.

- Family Caregiver benefit for adults

Claimants can share these Family Caregiver benefits either concurrently or separately, and receive their benefits when most needed within a 52-week period.

- Compassionate Care benefit

The Compassionate Care benefit provides up to 26 weeks of benefits to individuals who are away from work to care for or support a family member who has a serious medical condition with a significant risk of death in the next 26 weeks.

If the health condition of the family member deteriorates, caregivers could combine the Family Caregiver benefit with the existing Compassionate Care benefit.

Effective December 3, 2017, a medical certificate signed by a medical doctor or nurse practitioner will be acceptable when applying for the Compassionate Care benefit.

Information for employers

Employers should be aware of the changes to EI benefits and corresponding leave provisions under Part III of the Canada Labour Code proposed in Budget 2017, as they may have an impact on their supplementary benefits to EI maternity, parental and caregiving benefits, also known as top-ups. All the EI benefits and Canada Labour Code changes, and complementary adjustments to the Employment Insurance Regulations, will be brought into effect on December 3, 2017. Employers should review the terms of any collective bargaining agreements, employment contracts and benefit plans they hold or administer, to assess any implications they may have for their organization and members.

EI Family Supplement

The EI Family Supplement provides additional income support to low-income families with children, while they are receiving EI benefits. To be eligible, EI claimants must have an annual family net income of less than or equal to $25,921, have one or more children under the age of 18, and receive the Canada Child Benefit.

The EI Family Supplement provides additional income support to low-income families with children, while they are receiving EI benefits. To be eligible, EI claimants must have an annual family net income of less than or equal to $25,921, have one or more children under the age of 18, and receive the Canada Child Benefit.

Budget 2017 includes enhanced support through the EI Family Supplement so that low-income families would receive the Family Supplement top-up amount while they are receiving EI benefits, i.e. up to 18 months of combined maternity and parental benefits.

[1] Part III of the Canada Labour Code applies to about 904,000 employees (or 6 percent of all Canadian employees) working for 18,310 employers in industries such as banking, telecommunications, broadcasting and inter-provincial and international transportation (including air, rail, maritime, and trucking), as well as federal Crown corporations and certain activities on First Nations reserves.

Employment and Social Development Canada. November 10, 2017. Minister Duclos attends the 10th Social Finance Forum to discuss new innovative approaches to improve social and economic outcomes for people and communities

Toronto, Ontario - The Government of Canada is moving forward on its commitment to develop a Social Innovation and Social Finance Strategy to unlock new innovative approaches that improve the well-being of Canadians and support the social enterprise sector and social economy in Canada. In support of this commitment, the Honourable Jean‑Yves Duclos, Minister of Families, Children and Social Development, spoke today at the 10th annual Social Finance Forum held at Toronto’s MaRS Discovery District.

Social innovation is a new solution to a social or economic problem which delivers better results than traditional approaches. Social finance is a tool that seeks to mobilize private capital for the public good. Both social innovation and social finance often involve collaboration across different levels of government, charities and the not-for-profit and private sectors to act on a common social issue.

Hosted by the MaRS Centre for Impact Investing, the Social Finance Forum attracts more than 400 investors, entrepreneurs and business leaders and as such, is one of the biggest gatherings of social finance professionals in the country. Minister Duclos spoke about the Social Innovation and Social Finance Co-Creation Steering Group and the recent launch of an online consultation process. As part of the Government’s ongoing efforts to develop a strategy with the community of stakeholders it is intended for, the Steering Group is asking Canadians and community leaders from across the country to share their stories and innovative solutions to enduring social problems.

Quotes

“The time has come for the Government to look beyond traditional approaches. By taking part in events such as this one and listening to Canada’s innovators and job creators, we are putting innovation at the forefront of our social policies. Only when leaders from all fields come together to share their ideas and approaches will we co‑develop a strategy that generates tangible solutions to real issues, and creates truly measurable outcomes for Canadians most in need.”

– The Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development

“As part of our commitment to strengthen the middle class and help those working hard to joint it, our government is bringing a new spirit of innovation to social policy. Collaboration is a key principle of social innovation. We want to hear from innovative thinkers and doers, and those working within our communities. Remaining true to this principle, we intend to work together to co-create a strategy with, and not simply for Canadians.”

– The Honourable Patty Hajdu, Minister of Employment, Workforce Development and Labour

Quick Facts

- Membership of the Social Innovation and Social Finance Strategy Co‑Creation Steering Group was announced in June 2017. Composed of 17 passionate and diverse leaders, practitioners and experts from multiple fields, the Group plays a central role in the co‑development of the Social Innovation and Social Finance Strategy with the Government of Canada.

- In order to gather ideas from communities across Canada and keep in line with the Strategy’s collaborative approach, the Social Innovation and Social Finance Strategy Co-Creation Steering Group launched an online consultation process on September 29, 2017. Canadians are invited to share their views through the online engagement before the end of December 2017.

- Social innovation, social enterprise and social finance have been successfully used in countries like the United States and the United Kingdom. For example, in the United Kingdom, government support for social finance over the past five years has helped generate over $1 billion (£600 million) in social investment and grow the domestic social enterprise sector, which now employs 2.3 million individuals.

- In recent years, the Government of Canada has been exploring social innovation and social finance to increase the effectiveness of its programs. It is already testing new types of partnerships and approaches (e.g. social impact bonds, micro-loans, pay-for-performance and support for social enterprises).

- Since 2014, several Employment and Social Development Canada grants and contributions programs, including the Homelessness Partnering Strategy and the youth employment program Skills Link, have launched open calls for proposals seeking submissions for innovative projects.

NAFTA

GREG KEENAN, AUTO INDUSTRY REPORTER

The Trump administration’s proposals for new auto rules in the North American free-trade agreement appear to be influencing investment decisions even before a decision has been made on whether the agreement lives or dies. Auto companies considering major long-term investments are “probably either waiting or they’re going to be biased to invest more in the U.S. until there’s an outcome here,”

Magna International Inc. chief executive officer Don Walker said Thursday.

Magna is awaiting the outcome of negotiations, which so far have included the United States insisting that vehicles made in the United States, Canada and Mexico contain 85 per cent North American content in order to be shipped duty-free within the three countries. A second key U.S. proposal is that vehicles imported to the United States from Canada and Mexico contain at least 50 per cent U.S. content. Mr. Walker did not comment on those proposals when asked about NAFTA Thursday on the company’s third-quarter financial results conference call, but Magna’s position is that the end of NAFTA would be hugely disruptive to the North American auto sector and would increase costs of production.

The auto parts giant has rejected specific country of origin content requirements as “contrary to the objective of a free-trade agreement.” Mr. Walker said Magna has been “actively engaged” in the discussions the auto sector has had with various governments about NAFTA, but has not made any changes to its own investment plans.

The auto industry has stepped up its lobbying efforts in Washington after the fourth round of talks concluded in October with Canada and Mexico rejecting the U.S. auto demands, which also included a new clause requiring renegotiation of the deal every five years and a proposal to eliminate a chapter that provides for resolution of disputes.

The American Automotive Policy Council, which represents the Detroit Three auto makers, said on Thursday that the industry has the largest stake of any industrial sector in the outcome of the NAFTA negotiations, which resume in Mexico City next week.

The duty-free benefits of NAFTA save auto makers in the United States about $10-billion (U.S.) annually, the association’s president, Matt Blunt, said in a presentation in Washington.

“If President Trump withdraws from the pact, it’s basically a $10billion tax on the auto industry and consumers in America,” Mr. Blunt’s presentation said.

The group said the current rule of origin requiring that vehicles contain 62.5 per cent North American content is the highest of any trade agreement in the world. It added that vehicles assembled in Canada and Mexico and exported to the United States have a high level of U.S. content, although it did not specify how high.

“If the rule of origin is set too high, auto makers could decide to pay the 2.5 per cent U.S. import tariff on cars and SUVs, rather than try to meet the rule of origin,” the presentation said.

Magna reported record third-quarter financial results. Sales hit $9.5billion, up from $8.8-billion a year earlier. Profit was steady at $503-million, while share profit rose to $1.36 from $1.29.

The company’s shares fell in early trading Thursday amid some softness in the forecast for results from its Getrag transmission manufacturing unit.

Magna International (MG)

Close: $67.05, down 82¢