CANADA ECONOMICS

NAFTA

The Globe and Mail. 11 Oct 2017. OPINION. Despite what his aides may insist, Justin Trudeau’s Washington trip is primarily about saving NAFTA. Trudeau seeks ways, means of saving NAFTA from Trump

CAMPBELL CLARK

Justin Trudeau is on a Save-theNAFTA tour. This is no longer just a case of wheedling U.S. President Donald Trump, tête-à-tête, into renegotiating with a little more freetrading spirit. The U.S. President is giving signs he could really trigger a withdrawal from the North American free-trade agreement.

That means a big part of Mr. Trudeau’s trip this week to Washington and Mexico City has to be about Plan B: what to do if Mr. Trump really wants to terminate NAFTA. Can the President be corralled into another path? Delayed? Stopped?

It’s not just the meeting with Mr. Trump. The Prime Minister will also meet with U.S. lawmakers who may be key to blocking Mr. Trump if he does choose to withdraw from NAFTA. And then Mr. Trudeau visits Mexican President Enrique Pena Nieto, who would obviously be an important ally in a lobbying-and-politicking campaign if the talks go off the rails.

In Washington, Mr. Trudeau will meet with members of the powerful House ways and means committee and its subcommittee on trade. Their potential power is critical because Congress, not the President, has constitutional jurisdiction over trade – and, if it’s willing, the power to contest a Trump order to withdraw from NAFTA.

Mr. Trudeau’s entourage insist this trip isn’t a mission to save the trade deal. They don’t want to add drama. The Prime Minister’s Office portrayed the NAFTA elements as add-ons to a trip set up for the PM to attend Fortune magazine’s Most Powerful Women Summit before making his first official trip to Mexico. In other words, Mr. Trudeau will be in the neighbourhood. But this is about saving NAFTA. Mr. Trudeau would be shirking his duty if it wasn’t.

That’s not simply because Mr. Trump has said again, in an interview with Forbes magazine, that he thinks “NAFTA will have to be terminated” to get a better deal. He has made those noises since April, when his aides – along with Mr. Trudeau and Mr. Pena Nieto – talked him out of announcing U.S. withdrawal from NAFTA to mark his 100th day in office.

Withdrawing and negotiating is a tactic. But Mr. Trump’s Buy American/Hire American agenda also clashes with elements of renegotiating a deal. Either way, he doesn’t grasp the danger of this game of chicken. Back in April, Agriculture Secretary Sonny Perdue reportedly had to show him a chart of the damage a NAFTA break would do to pro-Trump farmers. Even triggering the sixmonth notice of withdrawal could cause layoffs in all three countries. Mexico insists it won’t keep negotiating if he does it.

In talks, U.S. negotiators are tabling in-your-face proposals. In the last round, in Ottawa, the United States proposed tight new caps on Canadian companies bidding on U.S. government contracts. In this week’s fourth round, according to The Wall Street Journal, the Americans will propose that vehicles entering the United States duty-free contain 50-per-cent U.S. content – ending free trade for autos. Thomas Donohue, the president of the U.S. Chamber of Commerce, warned on Tuesday that “poison pill” proposals may doom negotiations.

Now Mr. Trudeau, only two months into the talks, is shuttling to meet his counterparts. His team hopes a face-to-face meeting can get to what Mr. Trump wants – and get him to focus on a doable deal. The two have a relationship. When they first met in Washington just eight months ago, Mr. Trump apparently saw Mr. Trudeau as a success. But that’s when the President said that in Canada’s case NAFTA only needed tweaking. That didn’t last.

In Congress, Mr. Trudeau can press other power brokers. The ways and means committee controls taxation and is crucial to one of Mr. Trump’s big priorities: a tax cut. Its chairman, Kevin Brady, represents the border state of Texas and has suggested that Mr. Trump tone down the NAFTA rhetoric. Its trade subcommittee chair, Dave Reichert of Washington State, wants NAFTA updated, not scrapped. With midterm elections looming, many members of Congress won’t want NAFTA drama next year; if they can’t get a quick deal in early 2018, they’ll share Mr. Trudeau’s goal of getting Mr. Trump to step back from withdrawal. If he can’t get the President to say what he needs to make a deal, Mr. Trudeau needs allies to divert him away from breaking one.

The Globe and Mail. 11 Oct 2017. PM arrives in Washington for NAFTA talks. As leaders prepare for fourth round of negotiations, Trump muses publicly about pulling out of trade agreement

LAURA STONE

ADRIAN MORROW, With reports from Greg Keenan, The Canadian Press and Reuters

Canada and the United States are tremendously intertwined. And when one does well, the other does well, and when we both do well together, I think we’re unstoppable. Justin Trudeau Prime Minister

Prime Minister Justin Trudeau arrived in Washington on Tuesday as U.S. President Donald Trump created yet another wave of uncertainty about the fate of free-trade, and NAFTA negotiators hunkered down for another tense round of talks.

Mr. Trump mused publicly again about pulling out of the North American free-trade agreement, setting the stage for an unpredictable week in Washington.

With a January deadline to strike a deal, Mr. Trudeau is visiting Washington and Mexico City this week to meet the leaders of the two other NAFTA countries. His trip comes as the fourth round of talks begins in Arlington, Va., on Wednesday, for which the United States is said to be preparing tough proposals on the automobile and dairy industries.

Discussions on rules of origin, which set out how much North American and U.S. content should be in vehicles to qualify for duty-free status at the borders, are scheduled to take up three days of the talks, according to a schedule obtained by The Globe and Mail. The talks were to last for five days, but have been extended by two days, the Prime Minister’s Office said, owing to the scheduling conflicts of Foreign Affairs Minister Chrystia Freeland and her two counterparts, who will now meet next Tuesday.

At a summit celebrating female business leaders in Washington on Tuesday night, Mr. Trudeau said he looks for areas of agreement when dealing with the mercurial U.S. President, and believes both countries can benefit from a modernized NAFTA.

“You look for things where you find common ground and you look for ways to work together to improve the outcomes not just for your own country, but for both your countries,” Mr. Trudeau told interviewer Pattie Sellers at the Fortune Most Powerful Women Summit at the National Portrait Gallery.

“Canada and the United States are tremendously intertwined. And when one does well, the other does well, and when we both do well together, I think we’re unstoppable.”

He also talked about the importance of adding a gender chapter to NAFTA, which will be discussed at this round of talks.

Mr. Trudeau is set to meet with Mr. Trump in the Oval Office on Wednesday, but he is not taking his message to the President only.

Mr. Trudeau will also address bipartisan members of the House of Representatives Ways and Means committee on Capitol Hill to make Canada’s case about the importance of the trade deal. The committee has jurisdiction over all taxation and tariffs and is responsible for implementing any changes to NAFTA.

Meanwhile, U.S. corporate leaders are becoming increasingly alarmed by the Trump administration’s protectionist demands and threats to withdraw from the pact. A letter to Mr. Trump from 310 chambers of commerce across the country on Tuesday implored the President to “do no harm” to NAFTA.

And Thomas Donohue, president and CEO of the U.S. Chamber of Commerce, the biggest business lobby in the United States, vowed to “fight like hell” to protect NAFTA against the “misguided forces of protectionism.”

“The existential threat to the North American free-trade agreement is a threat to our partnership, our shared economic vibrancy, and clearly the national security and safety of all three nations,” he said in an uncommonly blunt speech to a business audience in Mexico City. “There are several poison-pill proposals still on the table that could doom the entire deal.”

Mexican foreign affairs minister Luis Videgaray said on Tuesday that an end to NAFTA would be a breaking point in U.S.-Mexican relations and affect bilateral co-operation in other areas.

A few hours before Mr. Trudeau’s arrival, Mr. Trump repeated his threat to trigger NAFTA’s withdrawal provisions in an interview with Forbes published on Tuesday.

“I happen to think that NAFTA will have to be terminated if we’re going to make it good. Otherwise, I believe you can’t negotiate a good deal,” the magazine quoted him as saying.

Under NAFTA’s Article 2205, any country can pull out of the deal with six months’ notice. Triggering the article does not mean automatic withdrawal, and Mr. Trump has repeatedly mused about starting the six-month countdown as a way to put pressure on his negotiating partners.

Mr. Trump also crowed in the interview about pulling the United States out of the 11-country Trans-Pacific Partnership in January.

“It would have been a disaster. It’s a great honour to have – I consider that a great accomplishment, stopping that. And there are many people that agree with me,” he said.

Mr. Trump even offhandedly asked Pittsburgh Penguins coowner Ron Burkle on Tuesday to renegotiate NAFTA – adding a surreal layer to the deal-making.

“How about negotiating some of our horrible trade deals,” Mr. Trump asked Mr. Burkle during a White House visit from the Stanley Cup champions.

The White House insisted on Tuesday that Mr. Trump wanted to continue negotiating.

In addition to NAFTA, Mr. Trudeau and Mr. Trump are expected to discuss the dispute over Canadian plane maker Bombardier’s C Series jets and the gridlocked talks over softwood lumber, sources with knowledge of the planned discussions said.

On Thursday, Mr. Trudeau will make his first first official visit to Mexico to talk trade with President Enrique Pena Nieto.

The Globe and Mail. 11 Oct 2017. OPINION. Trudeau will have to persuade his NAFTA counterparts to take a bigger view. It’s time for Trudeau to fish or cut bait in NAFTA talks.

Vice-president and fellow at the Canadian Global Affairs Institute, and a former diplomat

NAFTA negotiators are meeting again in Washington this week with their sights on the “elephants in the room”: the U.S. demands around dispute settlement, rules of origin, “Buy American” on procurement and a sunset clause.

The Americans, who initiated the renegotiation of the North American free-trade agreement to reduce the U.S. trade deficit, are expected to lay out their positions on the various “elephants.” There are also U.S. demands specific to Canada – supply management of our dairy markets – and specific to Mexico – wages, trucking and agricultural exports.

For Prime Minister Justin Trudeau, who is also meeting with President Donald Trump at the White House and then with President Enrique Pena Nieto in Mexico City, this week will be a test of his personal diplomacy. Can he convince his counterparts that a renewal of the North American idea of three sovereign nations, united in managing their common space to mutual advantage, requires taking a bigger view?

Mr. Trump promised to put “America First.” He is delivering and not just in his tweets.

Trade-remedy action by the U.S. Commerce Department is at a 16-year peak. Canada’s Bombardier joins Canada’s softwood industry as the latest victim of punitive penalties. Commerce Secretary Wilbur Ross claimed “NAFTA rules are killing our jobs.” In an unfortunate turn of phrase, U.S. Agriculture Secretary Sonny Perdue said agricultural trade is “like policy toward North Korea – all options are on the table.”

Rescinding NAFTA would be disruptive and hurt all three economies.

In the absence of a free-trade deal with the United States, Most Favoured Nation tariff rates, as negotiated under the World Trade Organization, would apply. The Peterson Institute for International Economics estimates that tariffs on all products would rise to an average of 3.5 per cent for the United States, 4.2 per cent for Canada and 7.5 per cent for Mexico – a terrible deal for all.

This will also result in trade diversion – the markup on Heinz ketchup, for example, could have Canadians switching to Salisbury or Tesco, now that the Canada-Europe trade deal is in place. Continuing trade diversification – a resurrected Trans-Pacific Partnership, potential deals with India and China – need to be part of Mr. Trudeau’s message to Mr. Trump.

A rescinded NAFTA would have an attitudinal effect on border administration. With the Canada-US FTA (1989), border agents took a “pass, friend, pass” attitude, further facilitating the passage of goods, people and services. After the attacks on Sept. 11, 2001, “security and enforcement” replaced “facilitation.” The border thickened.

If NAFTA is to be renovated and not rescinded, Canada and Mexico must redouble their advocacy efforts in the United States. With a focus on the state and local level, the message is simple: Jobs and investment depend on preferred access to Canada and Mexican markets.

Normally, the U.S. president is our shield against congressional protectionism. This time, the protectionist push is coming from the Trump administration. We need to push back with help from allies in the American Farm Bureau Federation, U.S. Chamber of Commerce and auto manufacturers.

In his meetings on Capitol Hill, Mr. Trudeau will repeat to legislators our message about the jobs and investment in their state depending on Canadian trade and investment. The Canadian Business Council recently complemented this with a map that identified 7,705 Canadian-owned businesses across 434 of the 435 congressional districts.

The Trudeau government sees the NAFTA talks as an opportunity to advance its progressive trade agenda. In putting forward Canada’s NAFTA objectives, Foreign Affairs Minister Chrystia Freeland said that “too many working people feel abandoned by the 21st-century global economy.” Mr. Trump and his supporters understand this message. Trade is blamed, even if most change is created by technological innovation and automation.

Trade works – on this, the economic evidence is clear. But if the gains of trade are seen to advantage only the rich and business, then populism will curb and roll back trade liberalization.

What if we put a tiny levy on all North American commerce and then distributed it for training and income-support to sectors and regions adversely affected by trade? It would lift some of the burden from local and state governments. This should be part of Mr. Trudeau’s discussion with Mr. Trump and Mr. Pena Nieto.

If the leaders buy in, then there is no reason that the NAFTA renegotiations cannot gain new life, meet their deadlines and set the model for future progressive trade agreements.

BLOOMBERG. 11 October 2017. Trump’s ‘Poison Pill’ Nafta Proposals Threaten to Derail Talks

By Josh Wingrove and Eric Martin

- The fourth round of talks kick off as Trudeau meets with Trump

- White House expected to make a contentious proposal on cars

Nafta talks have resumed with the U.S. administration looking increasingly isolated in its proposals to change the trade pact, as key figures raised the prospect of a collapse in negotiations.

The fourth round of talks to update the North American Free Trade Agreement began Wednesday in the Washington area as U.S. President Donald Trump continued his threat to walk out. On the eve of talks, the top U.S. business group pledged to fight to preserve the pact and Mexico mused it can live without the accord.

“There is life after Nafta,” Mexican Economy Minister Ildefonso Guajardo said Tuesday in an interview with Radio Formula. Mexico could leave Nafta and have the strength to move on without any serious long-term structural damage to the economy, he said.

Canadian Prime Minister Justin Trudeau -- who has steadfastly struck an optimistic tone as his foreign minister begins to dampen expectations for a quick deal -- will visit the White House Wednesday to discuss trade with Trump.

U.S. Trade Representative Robert Lighthizer kicked off the latest round by announcing an agreement on a chapter on competition. The countries have agreed to increased “procedural fairness in competition law enforcement,” his office said in a statement. It’s the second topic to be agreed on along with the chapter on small- and medium-sized businesses.

‘Hard Work’

Scheduled talks will be extended by two days to Oct. 17 to allow additional time for negotiations, he said. “Thus far, we have made good progress, and I look forward to several days of hard work,” Lighthizer said in the statement Wednesday.

One of the most contentious U.S. proposals is around so-called rules of origin for vehicles, which govern what share of a car must be built within Nafta countries to receive the pact’s benefits. The U.S. is expected to propose substantially raising the regional requirement, from 62.5 percent currently, and potentially add a U.S.-specific content requirement.

An auto-parts industry executive warned Wednesday that tightening the rules of origin for cars will add complexity and costs.

“If the required content to hit the threshold for a Nafta vehicle is too high, people may say, ‘Look, it’s just too difficult, it’s too high, so we’ll just ship the vehicles in,’” Magna International Inc. Chief Executive Officer Don Walker said in an interview ahead of the talks. “In which case, they pay the duty, and it’s a lose-lose.”

U.S. Chamber of Commerce CEO Thomas Donohue, speaking in Mexico City on Tuesday, said the rules of origin proposal would send more business overseas. Donohue pledged to fight “like hell” to defend Nafta if Trump tries to pull out, and urged Lighthizer to get a deal.

He said the 23-year-old accord is facing an “existential threat” because of the Trump administration’s hardline proposals. “There are several poison pill proposals still on the table that could doom the entire deal,” Donohue said.

— With assistance by Andrew Mayeda, and Gabrielle Coppola

BLOOMBERG. October 11, 2017. Trump Threats Cloud Nafta. Negotiations as Talks Enter New Phase. What economists think about Trump’s critique of Nafta.

By Randy Woods

Discussions to modernize the North American Free Trade Agreement are entering a new phase, as negotiators descend on the Washington area this week to salvage the 23-year-old pact that is coming under increased attack.

While the Oct. 11-17 talks are merely the fourth round of ongoing negotiations, they occur amid White House threats to walk away and speculation that the U.S. will put forward contentious proposals that could be a deal-breaker.

At issue is President Donald Trump’s complaint that the deal has failed to shrink America’s merchandise trade deficit with its Nafta partners, which was $87 billion last year. In its push to shrink the gap, the U.S. is expected to offer a proposal as soon as this week that would raise the amount of North American parts in Nafta-made cars, and potentially a U.S.-specific content requirement.

Both Canada and Mexico may balk at those ideas, as will automakers who say they would disrupt global supply chains. Many economists point out that the U.S. proposals are part of a misguided focus on trade gaps.

Accounting for Services

When services are included, the U.S. has an overall trade surplus with Canada.

Balance of trade on

Services

Goods

Mexico

Canada

$20B

+$7B

0

-20

Overall trade balance

-40

-$63B

-60

-80

-100

2000

2000

2016

2016

For starters, the deficit doesn’t account for services, where the U.S. has a surplus with both countries. That narrows its gap with Mexico and turns America’s overall trade deficit with Canada into a surplus—something Canada’s Foreign Affairs Minister Chrystia Freeland has repeatedly highlighted.

The biggest contributors to the deficit with Mexico and Canada are imports of vehicles and their parts, followed by machinery, electronics and oil. Not coincidentally, America’s four biggest exports to its two neighbors are from those four categories, just in a slightly different order. That reflects the free flow of goods that Nafta was designed to facilitate, said Robert Scott, senior economist at the Economic Policy Institute in Washington.

“We have deeply integrated supply chains with Mexico and Canada,” he wrote in an email. For instance, “in oil, we import crude and export refined products.”

Top trade items with Canada, 2016

Imports

Category of Goods

Amount ($B)

Exports

Category of Goods

Amount ($B)

Top trade items with Mexico, 2016

Imports

Category of Goods

Amount ($B)

Exports

Category of Goods

Amount ($B)

And on a macro level, the deficit with Nafta is a small part of the U.S.’s $452 billion current-account gap—a broad measure of trade—which in large part reflects the American propensity to invest and spend rather than save. While there are valid arguments for trying to shrink the current-account deficit, that entails a rebalancing of the overall economy that won’t be solved by renegotiating individual trade deals.

“Going after bilateral deficits is essentially a game of whack-a-mole,” according to Fabio Ghironi, an economics professor at the University of Washington. “Trying to shrink the deficit vis-a-vis any individual trade partner is only going to result in that deficit showing up somewhere else, in some other individual partner, unless there is an overall rebalancing of savings vs. investment.”

BLOOMBERG. 11 October 2017. Auto Industry Warns Trump Is Proposing ‘Lose-Lose’ Changes to Nafta

By Gabrielle Coppola

- Continent’s biggest supplier says higher thresholds add costs

- Consumers may also face rising auto prices, dealer group says

The auto sector is sounding alarms on the Trump administration’s efforts to overhaul Nafta, with North America’s top parts supplier warning an expected push to increase content requirements in cars could result in a “lose-lose” situation.

Changes to rules of origin -- which govern what share of a car must be sourced from Nafta countries for the vehicle to receive the trade pact’s benefits -- will add both complexity and costs, said Don Walker, chief executive officer of Magna International Inc.

“If the required content to hit the threshold for a Nafta vehicle is too high, people may say, ‘Look, it’s just too difficult, it’s too high, so we’ll just ship the vehicles in,’” Walker said in an interview in New York ahead of the talks. “In which case, they pay the duty, and it’s a lose-lose.”

The fourth round of negotiations over the North American Free Trade Agreement is set to begin Wednesday, with signals mounting that the U.S. is putting potentially deal-breaking proposals on the table. The U.S. Chamber of Commerce and Mexico’s auto industry group already have come out against an anticipated proposal for U.S.-specific content requirements. Introducing such a rule, or raising Nafta-made content requirements from today’s 62.5 percent, could risk disruption to the auto industry’s vast supply chain.

Regional Content

“If the regional content is by specific country, I think it adds a lot of complexity, and then every country would probably want regional content,” Walker said. “If you have U.S. content, and Canadian content, and Mexican content, the reporting and the bureaucracy and the tracking becomes so complicated -- and costly, quite frankly.”

It will also be expensive for consumers, Mark Scarpelli, the chairman of the National Automobile Dealers Association, warned Tuesday in Detroit.

“Anything that raises the price of a car will affect ultimately consumers and automobile sales,” he said. “We are concerned, but at the end of the day, we don’t know what the rule-making is going to be.”

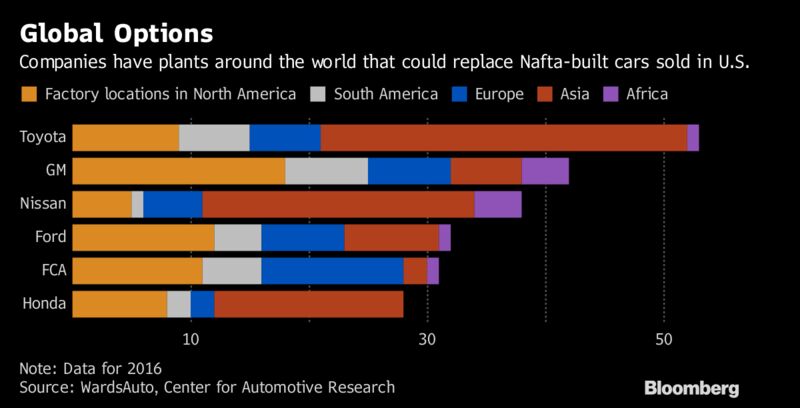

President Donald Trump fixated on the auto industry and carmakers investing in Mexico throughout his campaign and early in his presidency, criticizing companies including Ford Motor Co., General Motors Co. and Toyota Motor Corp. He told workers near Detroit in March that the U.S. would become “the car capital of the world again.”

‘Blizzarding’ Congress

John Bozzella, CEO of the Association of Global Automakers, said the group that represents overseas-based carmakers in the U.S. has been “blizzarding” Capitol Hill to explain why the expected Nafta proposals are a problem. It’s been meeting with members of the Trump administration and lawmakers from states where vehicle manufacturers have a large presence as well as holding “extensive briefings” with Republicans and Democrats on Senate Finance and House Ways and Means committees, he said.

“We’re concerned that we may be on a course to upset the trade balance in Nafta that has unquestionably led to a vibrant and successful auto industry in the United States,” said Bozzella, whose group represents companies including Toyota, Honda Motor Co. and Nissan Motor Co.

The U.S. had a $63-billion trade deficit with Mexico last year, compared with a surplus of $7.7 billion with Canada. The automotive trade deficit with Mexico was $74 billion. In other words, if you took out trade in cars and car parts over America’s southern border, the U.S. would actually be running a trade surplus with Mexico.

Aurora, Ontario-based Magna has over 25,000 employees in U.S. and supplies more original equipment parts by sales to carmakers on the continent than any other supplier, according to Automotive News rankings. Changing the rules now, after automakers and suppliers have invested across the region, would be a costly shift, Walker said.

“There’s been huge investments in Canada, the U.S. and Mexico, that are long-term assets,” he said. “To try and change that would be extremely expensive for the industry.”

— With assistance by Josh Wingrove, Jamie Butters, and Ryan Beene

2017 Annual Meetings of the IMF and the World Bank Group

Department of Finance Canada. October 11, 2017. Minister Morneau in Washington to Promote International Collaboration for Middle Class Growth

Washington, D.C. – The Government of Canada is building an economy that works for the middle class and those working hard to join it. Canada has emerged as the fastest-growing economy of the G7, and the Government remains steadfast in the belief that by working together, international partners can foster better living conditions, job creation and stronger economic growth.

This week, Finance Minister Bill Morneau will attend the 2017 Annual Meetings of the International Monetary Fund (IMF) and World Bank Group in Washington, D.C., where he will underscore the importance of a growing economy.

While in Washington, the Minister will also speak at a symposium on collaboration across multilateral development banks at the Center for Strategic and International Studies. Tomorrow, he will participate in an international panel discussion on CNN entitled How to Strengthen the Global Economy. The annual debate, moderated by CNN's Richard Quest, has become a marquee panel at the IMF Meetings.

Quote

"The best way to strengthen the economy is to make sure the benefits of economic growth are available to the middle class. An economy that helps the middle class, that empowers women, and that has a stable and widely accessible financial system is a strong economy. I am proud that Canada's approach continues to be recognized around the world, and I look forward to continuing our good work with our global partners."

- Bill Morneau, Minister of Finance

2017 Annual Meetings of the IMF and the World Bank Group: https://www.imf.org/external/am/2017/index.htm

The Globe and Mail. OCTOBER 11, 2017. IMF warns Canada over perilous, longer-than-average credit boom

MICHAEL BABAD, Columnist

The boom in Canada has been longer than the average of these benign booms

INTERNATIONAL MONETARY FUND

The IMF appears to be taking pains to warn Canada about a dangerous credit boom.

Indeed, Canada comes in for special mention in an IMF global financial stability report released today.

Canada is not alone as the body also cited a handful of other countries for high credit levels and "debt-servicing pressures."

"In other economies where debt service ratios for the private non-financial sectors have risen to high levels - such as Australia, Brazil, Canada, China, and Korea - there is a particularly strong need for financial sector policy vigilance to guard against any further buildup of imbalances," the IMF said.

Such issues go hand in hand with rising property values, and those in Canada have spiked, largely in the Vancouver and Toronto areas.

Provincial and federal governments, along with regulators, have done just what the IMF suggests, taking action to tame overheated markets. But Vancouver has since rebounded, and Toronto is showing signs of following suit.

With debt levels so high, the Bank of Canada's two recent interest rate hikes were a warning shot on their own, as markets believe more increases will follow, heightening the vulnerability of overburdened consumers.

Indeed, Bank of Nova Scotia warned just last week that it expects average mortgage carrying costs for new home buyers will spike by about 8 per cent in 2018 and 4 per cent a year later.

The IMF compared Canada to both Australia and the United States, noting the stark differences.

"Although not all credit booms lead to recessions it is interesting to compare the credit booms in economies most likely to face payment pressures with past experience," the group said.

"While the boom in Australia is similar to the average of past credit booms that did not lead to a financial crisis, the boom in Canada has been longer than the average of these benign booms, and the boom in China has been steeper than the average of past credit booms that did coincide with a financial crisis," it added.

There was no suggestion about what could happen, however, only comparisons and a history lesson.

"Experience has shown that a buildup in leverage associated with a run-up in house price valuations can develop to a point that they create strains in the non-financial sector that, in the event of a sharp fall in asset prices, can spill over to the economy."

In a special section, the IMF also noted the evolution of household debt levels in Canada and the U.S., which were similar until the financial crisis.

Between 1995 and early 2008, such levels rose to 100 per cent of gross domestic product from 56 per cent in the U.S., and to 80 per cent from 62 per cent in Canada.

"Afterward, U.S. household debt fell to below 80 per cent by early 2017, whereas in Canada, it continued to rise to more than 100 per cent," the IMF said.

"This reflects different house price and unemployment trends, as well as difference in the evolution of net wealth, which left Canadian households relatively better off than their U.S. counterparts."

In Canada, it added, household debt "became more tilted toward" mortgage debt, which rose to 66 per cent of the total by last year. In the U.S., the share of mortgage debt fell while consumer credit rose markedly, largely because of rising student debt.

Not only that, the leverage among Americans stayed "broadly constant," but for the poor, among whom it rose marginally.

"In Canada, on the other hand, debt-to-income ratios increased across all income groups, resulting in an average ratio almost 50 per cent higher than in the United States," the IMF said.

"Moreover, highly indebted households (those with debt-to-income ratios above 350 per cent) held more than $400-billion (Canadian), or 21 per cent of the total household debt in Canada at the end of 2014, up from 13 per cent before the crisis."

And, as every Canadian knows, because they've been warned repeatedly by groups such as the IMF, the OECD, the Bank of Canada and the Bank for International Settlements, "high leveral may expose households to potentially adverse income shocks" that can ripple through an economy.

"The past recession in the United States showed that highly indebted households substantially reduced spending, which contributed to a significant decline in aggregate demand."

FOREIGN AFFAIRS

The Globe and Mail. The Canadian Press. 11 Oct 2017. International relations face increasing uncertainty: Freeland

Canada finds itself navigating the most uncertain moment in international relations since the end of the Second World War, says Foreign Affairs Minister Chrystia Freeland.

Ms. Freeland made the remark on Tuesday in Washington during a panel discussion at a women-in-business summit organized by Fortune magazine. She was being asked about recent comments by the head of the U.S. Senate foreign relations committee.

In a blistering interview, Republican lawmaker Bob Corker suggested that people in the White House must constantly babysit U.S. President Donald Trump to prevent chaos. He also expressed fear the erratic U.S. President might cause “World War III.”

Ms. Freeland refused to discuss Mr. Trump directly, but said there are many things that worry her in the world because old, successful institutions are starting to fracture. She credited post-Second World War trade bodies, as well as the United Nations, the World Bank and the IMF with safeguarding more than 70 years of prosperity.

“There are a lot of things that are concerning in the world right now. I think this is probably the most uncertain moment in international relations since the end of the Second World War,” Ms. Freeland said when asked about Mr. Corker’s comments.

“[The postwar order] has really worked. With time, it has embraced more and more people into a peaceful, prosperous world. It’s been great. And that order is starting to fracture. As a result, we’re seeing tensions in lots of different places.”

She mentioned North Korea as one example.

Her comments come with official Washington on edge, on multiple fronts. Mr. Corker’s comments have yanked away the curtain on a conversation that has been rampant in Washington for months. In private, and in off-the-record chats, numerous Republicans criticize the President and fret about instability.

One well-placed military officer aware of high-level discussions confirmed Mr. Corker’s account.

He described in an off-therecord chat with The Canadian Press how senior brass work constantly to block the worst ideas from the White House for fear of escalating tensions and provoking war.

He cited three indispensable players and offered a dark prognosis of what should happen if chief of staff John Kelly, Defence Secretary James Mattis or national-security adviser H.R. McMaster left government: “Start panicking.”

INTERNATIONAL TRADE

International Trade Balance of Brazil, September 2017; and Canada, August 2017.

DOCUMENT: https://drive.google.com/file/d/0B_zEXJxYybA3QzREeWZIYnNJQVU/view?usp=sharing

BOEING X BOMBARDIER

The Globe and Mail. 11 Oct 2017. Britain turns up heat on Boeing. Minister says Boeing’s U.K. operations are at risk if firm persists in trade dispute with Bombardier

PAUL WALDIE

British Secretary of State for Business, Energy and Industrial Strategy Greg Clark has given the strongest indication yet that Boeing Co.’s commercial and military contracts with the government are at risk because of the aerospace company’s trade dispute with Bombardier Inc.

In a statement to the British House of Commons on Tuesday, Mr. Clark said officials have held a dozen meetings with Boeing executives and he has met with chief executive Dennis Muilenburg to urge him to withdraw the complaint.

Mr. Clark said he also made it clear to Mr. Muilenburg that, “if there is to be a continuing relationship, then we need to have the confidence that [Boeing] will deal fairly with the United Kingdom. If this is to be a strategic partnership, it needs to be a partnership, and partners don’t take the kind of action against an important United Kingdom interest that Boeing are seeking to do.”

When asked specifically by Labour MP Kevan Jones whether Boeing was putting its commercial opportunities in Britain at risk unless it relented, Mr. Clark replied: “Yes.”

The U.S. Department of Commerce has proposed import duties of almost 300 per cent on Bombardier’s C Series aircraft because Boeing alleges the Montreal-based company has received illegal support from the Canadian and British governments, and that Bombardier sells the planes in the United States at absurdly low prices. A final decision on the tariffs is expected early next year.

Mr. Clark reiterated on Tuesday that the British government was “bitterly disappointed” with the U.S. action and added that Britain is working closely with the Canadian government on overturning the decision. He said British assistance to Bombardier, roughly $186-million, was legal and similar to the support the government has given to Boeing and other companies.

British Prime Minister Theresa May has twice spoken to U.S. President Donald Trump about the dispute.

Bombardier employs about 4,200 workers in the U.K., mainly in Northern Ireland at plants that make wings for the C Series. It has been estimated that another 9,000 jobs in the province are indirectly dependent on the Bombardier operation.

Boeing has a sizable presence in Britain as well. The Chicago-based company employs about 2,300 people in Britain, and recently began construction of a $32-million facility in Sheffield, England, that will make parts for actuators, which move the flaps on jet wings. Britain’s Ministry of Defence also has contracts to buy P-8 spy planes and 50 Apache helicopters from Boeing.

Mr. Clark said on Tuesday that while Boeing’s operations in Britain were important, the Bombardier case highlighted a bigger issue. “In participating in the aerospace sector … we expect, just as the Canadian government does, that if you are participating in institutions that are promoting the sector, you’re not at the same time recklessly damaging another very important part of the sector,” he told members of Parliament.

He added that he told Mr. Muilenburg that Boeing’s reputation was at risk in Britain. “We were very clear that Boeing has a reputation in this country that was beginning to grow in a positive way through the investment in Sheffield and elsewhere. And to jeopardize that reputation and relationship by doing something that is completely unjustified is something that I don’t regard as being in the strategic interests of Boeing, and I said that very explicitly.”

REUTERS. OCTOBER 11, 2017. Delta says company will not pay tariffs on Bombardier CSeries jets

NEW YORK (Reuters) - Delta Air Lines (DAL.N) on Wednesday said the carrier would not foot the bill of a 300 percent proposed tariff on Bombardier (BBDb.TO) CSeries jets, leaving the future of the Canadian company’s jets in limbo.

FILE PHOTO: A Delta Airlines jet takes off from Washington National Airport in Washington, U.S., August 9, 2017. REUTERS/Joshua Roberts/File Photo

“We’re not going to be forced to pay tariffs or anything of the ilk,” Delta Chief Executive Ed Bastian said on the carrier’s third-quarter earnings call.

Reporting by Alana Wise

REUTERS. OCTOBER 11, 2017. Workers call on UK PM May to be more visible in Bombardier dispute

Polina Ivanova

LONDON (Reuters) - Workers at Bombardier’s Northern Irish plant called on British Prime Minister Theresa May to be more visible in her attempts to save their jobs after the United States imposed tariffs on planes made by the Canadian aerospace firm.

The United States has backed a complaint brought by Boeing (BA.N) that Bombardier (BBDb.TO) received illegal subsidies and dumped planes at “absurdly low” prices, imposing duties of nearly 300 percent on its C-series aircraft.

Britain is confident that it can successfully fight the ruling, which jeopardizes some 4,200 jobs in Northern Ireland, where it is the biggest manufacturing employer.

“We do feel that the levies that are put on are unfair and will be detrimental to jobs in Northern Ireland,” Ron McDowell, 42, who has been an aerospace fitter for 25 years, told Reuters outside parliament in London, where workers had gathered for a protest.

“What we want is for Theresa May to come out publicly rather than speaking behind closed doors.”

McDowell was one of around 20 protesters who stood behind a sign saying “Back Bombardier: Defend our jobs, skills and communities.”

May and U.S. President Donald Trump discussed Bombardier in a call on Tuesday, after business secretary Greg Clark outlined to lawmakers the government’s case against the suit.

Britain and the trade union Unite argue that Boeing’s case is without merit because it does not make a plane comparable to Bombardier’s C-series.

May has emphasized the strength of Britain’s alliance with the United States since Trump came to power as it prepares to leave the European Union, its biggest trading partner.

However, Jimmy Kelly of the Unite union said the dispute emphasized how Trump’s protectionist policies might undermine May’s hopes for a good trading relationship.

“I just don’t fall for Theresa May saying ‘well I’ve contacted Donald Trump’ and ‘I’ve phoned Donald Trump’. He’s parroting ‘USA, USA, USA’. And post-Brexit, why would he be changing his tune?” he said.

“So I think it’s dismal days for UK workers if this is the indicator.”

Reporting by Polina Ivanova; Writing by Alistair Smout; editing by Stephen Addison

BLOOMBERG. 11 October 2017. Boeing a ‘Subsidy Junkie,’ U.K.’s Labour Says in Bombardier Spat

By Alex Morales and Francine Lacqua

- Spokesman alleges U.S. giant wants to hurt rival’s share price

- Gardiner also seeking EU dumping probe into Monarch 737 deal

- U.K.'s Gardiner Says EU Should Investigate Boeing

Boeing Co. is the “king of corporate welfare,” the U.K.’s main opposition Labour Party said, accusing the U.S. aerospace giant of “egregious hypocrisy” in pursuing an illegal-subsidies claim against Bombardier Inc. that threatens thousands of jobs in Northern Ireland.

The U.S. slapped 300 percent of duties on Bombardier’s C Series aircraft after upholding Boeing’s contention that the Canadian company benefited from state support, allowing it to sell the model more cheaply. Labour’s trade spokesman Barry Gardiner said Wednesday that “no aircraft these days comes to market without support from government,” including those produced by Boeing.

“Boeing has absolutely been sucking at the milk of corporate welfare in America for far too long,” Gardiner said on Bloomberg TV. “They need to understand that the way in which they are playing this does not sit well with U.K. parliamentarians.”

The dispute has caused a headache for U.K. Prime Minister Theresa May, who wants to strike a trade deal with the U.S. as Britain leaves the European Union. At the same time, she needs to protect more than 4,000 Bombardier jobs in Northern Ireland, where she depends on the support of 10 lawmakers from the Democratic Unionist Party to get legislation through Parliament.

Hostile Tactic

Gardiner didn’t mince his words on Boeing, suggesting that the company is itself a “subsidy junkie” and accusing it of bringing the Bombardier case to “crush a competitor” and get hold of “superior technology” -- including wings that are made in Belfast -- by driving down its share price “so that they can try and do a hostile takeover."

A spokesman for Boeing in the U.K. said the U.S. action is about conforming with trade law and that “Boeing complies.” He declined to comment on whether the company was trying to hurt Montreal-based Bombardier’s share price in preparation for a takeover attempt.

Gardiner also said he plans to ask European authorities to investigate whether there is an anti-dumping case to be made against Boeing over its contract to sell 30 of the latest 737 Max 8 jetliners to Monarch Airlines Ltd., which filed for insolvency earlier this month.

The $3.1 billion order, originally placed in 2014, was last year restructured as a sale and leaseback, in which planes are typically purchased from a carrier and then rented back. The nature of the deal, which paved the way for Monarch owner Greybull Capital LLP to make a 165 million-pound ($220 million) capital injection, suggests Boeing sold the 737s “at less than cost price into the European market,” Gardiner said.

Boeing said it doesn’t publicly comment on the financial arrangements of its customers.

Media Campaign

The defense and aerospace giant is under pressure in the U.K. after May, Defence Secretary Michael Fallon and Business Secretary Greg Clark all said it is putting at risk chances of winning future contracts from Britain.

The Chicago-based company on Tuesday took out a wraparound advert in London’s Evening Standard newspaper featuring a picture of a Chinook helicopter hovering over Stonehenge, and has also erected a giant billboard in Westminster subway station, which many lawmakers pass through on their way into the Houses of Parliament.

“We are absolutely coming at Boeing,” Gardiner said. “All the advertisements, all the front covers of the evening newspapers in London that they’ve put on are not persuading anybody other than that they’re playing dirty.”

— With assistance by Tom Keene, Thomas Penny, Benjamin D Katz, and Thomas Seal

The Globe and Mail. 11 Oct 2017. Honeywell to spin off two units, keep aerospace

ALWYN SCOTT

ARUNIMA BANERJEE, Reuters

Honeywell International Inc. said on Tuesday it will pare its focus to four business lines, including aerospace, and spin off two businesses with $7.5-billion (U.S.) in revenue to help fund acquisitions.

REUTERS

An aircraft engine is tested at Honeywell Aerospace in Phoenix in 2016. Honeywell announced on Tuesday that it will focus on four business lines, including aerospace.

The reorganization, which reduces revenue by about 18 per cent, will simplify Honeywell’s broad portfolio, boost growth and give shareholders a tax-free benefit from the new companies, Honeywell chief executive officer Darius Adamczyk said on a conference call on Tuesday.

It also gives the diversified manufacturer scope to change its remaining portfolio along the lines sought by hedge fund Third Point Capital, which agitated for a spinoff of aerospace. Third Point said on Tuesday it was pleased with the changes and backed Mr. Adamczyk’s leadership, though it wants him to keep improving the portfolio. Mr. Adamczyk hinted at more to come, saying the two new businesses “can grow at an accelerated rate.”

The remaining businesses – aerospace, commercial building products, performance materials and safety products – are candidates for more acquisitions, he added.

“I’m very excited about M&A in all four of our businesses. And I think these two spins … give me a lot of different levers to invest our M&A dollars.”

Analysts praised the moves, but said Honeywell had more changes to make and warned that aerospace, with products ranging from jet engines to airplane WiFi systems, may need to merge to gain the size to compete with larger rivals.

A spin-off or merger with General Electric Co.’s aerospace unit would make Honeywell a stronger competitor to United Technologies and a “more powerful supplier to Boeing Co. and Airbus [Group] SE,” Scott Davis, analyst at Melius Research, wrote in a note. “That’s a deal worth thinking about.”

Mr. Adamczyk played down such speculation in a later interview with Reuters. “The way we compete in aerospace is not through scale,” he said. “We are going to compete through technology differentiation.”

Although his comments pointed away from a big deal, Honeywell sought to gain size last year with a $90.7-billion bid for United Technologies Corp. under prior CEO David Cote. Industry experts say Honeywell’s poor record on aerospace parts quality and delivery could hamper its ability to win new orders.

Honeywell shares ended the day down 0.2 per cent in New York trading, after falling 2.3 per cent initially.

Mr. Adamczyk, like his peers at other industrial conglomerates, has been under pressure to reorder a portfolio of disparate businesses that includes automotive turbo chargers, burglar alarms and Xtratuf boots popular in Alaska’s fishing industry.

Third Point had argued since April that a spin-off of aerospace, which accounted for about 38 per cent of revenue in 2016, could generate $20-billion in shareholder value.

But Mr. Adamczyk took a different route, splitting off the home and ADI global distribution businesses, wholesale distributors of security, fire and environmental systems for homes and commercial buildings, into a public company that will absorb some of $554-million in environmental liabilities.

Honeywell will also spin off a transportation business that makes automotive turbo chargers into a second company that will absorb some of $1.54-billion in old asbestos liabilities. The amounts will be determined later, Mr. Adamczyk said.

The auto-parts move follows other companies, including auto supplier Delphi Automotive PLC, that are shedding technology tied to the internal combustion engine as regulators around the world crack down on emissions and talk of mandating a switch to battery-electric vehicles over the next two decades.

With about $16-billion in debt, or 2.5 times operating earnings, Honeywell has limited scope for additional borrowing, Dave Berge, an analyst at Moody’s Investors Service, said.

Honeywell expects to receive about $3-billion in dividends from the spin-offs, adding to its nearly $10-billion in cash.

That “positions the company to do meaningful acquisitions,” said Harsh Acharya, analyst at Diamond Hill Capital Management Inc. in Ohio.

The spin-offs are not due to close until the end of 2018, giving time to work out details – and, as Mr. Adamczyk noted, to consider other offers.

“We are leaning towards the spin route,” he told Reuters. “But if we get compelling offers, we would of course consider them.” Honeywell (HON)

Close: $143.31 (U.S.), down 29¢

________________

LGCJ.: