CANADA ECONOMICS

CANADA - US

GLOBAL AFFAIRS CANADA. October 23, 2017. Foreign Affairs Minister to hold photo opportunity with U.S. Ambassador to Canada

The Honourable Chrystia Freeland, Minister of Foreign Affairs, will meet with Ambassador Kelly Craft, the new U.S. Ambasador to Canada, in the afternoon of Monday, October 23, 2017, 4:00 p.m. ET, in Ottawa. A photo opportunity will precede the meeting.

The Globe and Mail. 23 Oct 2017. U.S. ambassador to Canada must mend an old friendship. Kelly Craft must mend relationship between old friends at odds

JOHN IBBITSON

Kelly Craft presents her credentials to Governor-General Julie Payette on Monday, taking up residence as the 31st ambassador of the United States to Canada. None of her predecessors faced what she faces.

The disputes between the two countries threaten the foundations of what used to be the world’s closest bilateral relationship. Ottawa and Washington are diametrically opposed on a raft of major issues. Most Canadians dislike and distrust U.S. President Donald Trump, who may become the first elected president since Franklin Roosevelt not to visit Ottawa.

Other than that, things are fine.

David Jacobson was U.S. ambassador during Barack Obama’s first term. Polls showed 80 per cent of Canadians approved of the former president.

“I always felt I had the wind at my back,” Mr. Jacobson said in an interview. But an Ekos poll showed 80 per cent of Canadians disapprove of Mr. Trump. “Whatever I felt blowing at my back, Ambassador Craft may feel blowing in her face.”

The most important file, by far, is the troubled NAFTA renegotiations. The Americans inserted so many poison pills into last week’s talks in Washington that they should have been charged with attempted murder.

The question now, as all sides prepare for the next round in Mexico City, is whether the United States genuinely wants to renew the freetrade agreement or intends to simply walk away from it. As ambassador, Ms. Craft’s job is to convince Canadians that the Americans are sincerely interested in reaching a deal, while making sure Washington understands that there is no way the Canadians will put up with things such as a five-year expiration date or an end to dispute-resolution mechanisms.

Others have been working this file for months, including Canadian Ambassador David MacNaughton. Ms. Craft has some catching up to do.

Climate change is another major irritant between the two countries. The Trump administration served notice that the United States will withdraw from the Paris accord, even as the Trudeau government implements a national carbon strategy to meet Canada’s commitments.

On this crucial file, Ms. Craft will arrive with baggage. Her husband, Joe Craft, owns Alliance Resource Partners, one of the biggest coalmining operations in the eastern United States.

Canada continues to robustly support NATO; Mr. Trump thinks it’s freeloading. The President is friendly with Russian leader Vladimir Putin; Canada’s relations with Moscow are so icy that Foreign Minister Chrystia Freeland has been banned from entering the country. The Trudeau government is angling for a seat on the United Nations Security Council; the Trump administration just pulled the United States out of UNESCO. Bombardier. Softwood. It goes on.

Never, in the life of the two countries, have they disagreed on so much. For the first time in 35 years, when pollsters began asking the question, more Canadians view the United States unfavourably than favourably. I have spoken to people across this country about this President. Most don’t just disapprove of him, they fear him. They fear that he could undermine U.S. democracy, cause an economic crisis or lead the world into nuclear war.

For Mr. Jacobson, the challenge for the new ambassador is to lower the temperature in the relationship, to focus on policy over personality, to explain the reasoning behind the American position on so many conflicting files and, more importantly, to explain this country to the administration in Washington.

“You have to explain to them what’s doable and not doable, how things are going to be received and perceived by the Canadian government and the Canadian people,” Mr. Jacobson said. “You have to help to set priorities.”

The good news is, the new ambassador is said to be warm, personable, keenly intelligent and a good listener. “She’s is truly a delightful person,” said Mr. Jacobson, who met with her recently and came away impressed. “If anyone can succeed in the circumstances she is stepping into, it is someone like her.”

Canada and the United States both need Ms. Craft to succeed as ambassador to Canada. We wish her well. Although if Mr. Trump cancels NAFTA, she might as well go back to Kentucky.

Global Affairs Canada. October 21, 2017. Canada addresses water quality issues in lakes Champlain and Memphremagog

Ottawa, Ontario - Joint stewardship of the environment is a cornerstone of Canada-United States relations. Our countries have a history of effective cooperation on issues affecting shared bodies of water.

Global Affairs Canada today announced that the Government of Canada is taking action to address water quality concerns in lakes Champlain and Memphremagog, both located along the Canada–U.S. border in southern Quebec.

Following growing public concerns regarding water quality and algal blooms in the two lakes, the governments of Canada and the United States have asked the International Joint Commission (IJC) to further examine these issues. Algal blooms can produce toxins that make people, wildlife and pets sick and as a result, can impact recreational activities and local economies.

The IJC study will review current efforts to address algal blooms and high nutrient levels, and make recommendations on how to improve water quality in both lakes.

Quick facts

- Established by the Boundary Waters Treaty of 1909, the IJC is a binational organization mandated to prevent and resolve disputes, primarily those concerning water quantity and quality, along the Canada–U.S. border.

- Canada’s participation in the IJC is the responsibility of Global Affairs Canada. The Canadian share of the IJC’s 2017-18 budget was over $10 million.

- The IJC has extensive and unique experience in handling the full range of regional transboundary water issues, including its high-quality work related to flooding in the Lake Champlain–Richelieu River basin.

Canada addresses flooding issues in Lake Champlain–Richelieu River basin: https://www.canada.ca/en/global-affairs/news/2016/09/canada-addresses-flooding-issues-lake-champlain-richelieu-river-basin.html

International Joint Commission: http://www.ijc.org/en_/

Canada and United States relations: http://international.gc.ca/world-monde/united_states-etats_unis/relations.aspx?lang=eng

BOMBARDIER

The Globe and Mail. Reuters. 23 Oct 2017. Airbus turmoil raises questions about C Series deal

TIM HEPHER

Airbus SE’s coup in buying a $6-billion (U.S.) Canadian jetliner project for a dollar stunned investors and took the spotlight off a growing ethics row last week, but internal disarray has raised questions over how smoothly it can implement the deal.

The European plane maker secured the deal for Bombardier’s C Series program by pledging to throw its marketing might behind the loss-making jets, just as the Airbus sales machine reels from falling sales and internal and external corruption investigations.

Chief executive Tom Enders has urged staff to keep calm in the face of French reports describing payments to intermediaries and growing concern over fallout from the investigations.

But the mood at the group’s Toulouse, France, offices remains grim.

“Bombardier asked for an ambulance and Airbus sent a hearse,” said one person with close ties to the company.

French media attention on the growing scandal helped to camouflage talks to buy the C Series. Rumours circulated in late August that Mr. Enders and a colleague were visiting Paris to meet investigators. In fact, they were holding the first of several secret dinner meetings with Bombardier.

But the same affair, which first came to light in 2016, has begun to cloud sales momentum. In the first nine months of the year, Airbus accounted for only 35 per cent of global jet sales in its head-to-head battle with U.S. rival Boeing Co.

The Airbus sales operation is demoralized and in disarray, multiple aerospace and airline industry sources said, with some blaming Mr. Enders for turning the company against itself.

Two people said the situation is so tense that some employees have begun to shy away from selling in problematic countries, rather than risk being drawn into the probe.

Soon-to-retire sales chief John Leahy has been asked to stay until the end of the year to help steady the operation, but his successor has not been officially confirmed, adding a sense of vacuum that has also sapped morale.

Mr. Leahy designated his deputy Kiran Rao as his successor earlier this year but the chaos engulfing Airbus means now is not considered the right time for major new announcements.

A spokesman for Airbus, which has long predicted a slower year after an order boom, dismissed reports of instability.

“We have a great sales team … but it is fully understood that they cannot repeat records every year; and the year is not over,” he said.

Mr. Enders has strongly defended his decision in 2016 to report flawed paperwork to British authorities, which prompted British and French investigations focusing on a system of sales agents run by a separate Paris department that has since been disbanded.

Airbus says no evidence of corruption has been uncovered, but Mr. Enders has pledged to continue the overhaul of sales practices historically shared between Toulouse and Paris.

REUTERS. OCTOBER 23, 2017. Boeing, Mitsubishi Heavy in deal to cut costs of 787 wing production

(Reuters) - Boeing Co and Japan’s Mitsubishi Heavy Industries Ltd (MHI) announced they have agreed on steps to reduce the cost of producing the wings of the 787 Dreamliner.

MHI is the sole supplier of the 787 composite wings and manufactures them at its factory in Nagoya. The deal with MHI fits with Boeing’s company-wide drive of reducing its cost structure.

Under the new agreement announced in a joint statement on Monday, MHI will pursue increased efficiency in its production system and supply-chain through lean production methods, automation and other activities.

The pair will also study advanced aerostructure technologies for future generation commercial aircraft.

MHI said last year Boeing was seeking a new round of lower prices and changes in payment terms as the U.S. manufacturer stepped up efforts to conserve cash.

Delays in the 787 development and delivery, due in part to difficulties of managing a global supply chain, prompted Boeing to produce more of the upcoming 777X widebody, including the wings, at home despite MHI’s attempts to keep the work in Japan.

Japanese participation in the production of 777X parts will fall to 21 percent from 35 percent of the 787. MHI will however produce fuselage sections for the 777X program.

Reporting by Jamie Freed; Editing by Muralikumar Anantharaman

INTERNATIONAL TRADE

Global Affairs Canada. October 22, 2017. Canada launches negotiations toward deepening its trade partnership with the Pacific Alliance

Ottawa, Ontario - Canada is a trading nation. Canadians’ standard of living depends on robust international trade as a key driver of economic growth for a prosperous middle class. Canada’s strong and rules-based system is recognized the world over, and the Government of Canada is focusing on the Americas and the Pacific region as an opportunity to further diversify its trade and create opportunities for Canadian businesses and families.

The Honourable François-Philippe Champagne, Minister of International Trade, welcomes the first round of free trade negotiations between Canada and the Pacific Alliance taking place from October 23 to 27, in Cali, Colombia. A free trade agreement with the Pacific Alliance offers the prospect to modernize and streamline our existing bilateral agreements with all four Pacific Alliance countries, expand key aspects of these agreements, as well as include progressive trade elements, such as gender, labour, environment and SMEs.

These free trade negotiations seek to confirm Canada as an Associated State of the Pacific Alliance. This is a strategic opportunity for Canada to advance its progressive and diversified trade agenda with key emerging markets, and sends a strong signal to the world on the importance of free trade to increase growth and prosperity.

Quotes

“On my recent trips to Chile, Colombia and Mexico, I was very excited by the untapped potential for trade between Canada and the Pacific Alliance countries, with their growing middle classes and open, market-driven economies. We share a goal of greater regional economic integration and freer, more progressive trade that can help create more middle class jobs and opportunities. This new step represents a strategic opportunity for Canada to advance its ambitious progressive and diversified trade agenda with important and like-minded emerging markets.”

- François-Philippe Champagne, Minister of International Trade

- The Pacific Alliance is a regional initiative founded in 2011 by Chile, Colombia, Mexico and Peru aimed at fostering the free movement of goods, services, capital and people among member countries.

- With a combined GDP of $2.3 trillion and a total population of more than 220 million, the Pacific Alliance represents a considerable market for Canada.

- Canada’s total merchandise trade with the Pacific Alliance was more than $48 billion in 2016. The four member countries account for more than 75 percent of Canada’s two-way merchandise trade with the whole Latin America region.

International Trade Minister welcomes invitation by the Pacific Alliance to start negotiations to deepen trading relations with Latin America: https://www.canada.ca/en/global-affairs/news/2017/06/international_tradeministerwelcomesinvitationbythepacificallianc.html?=undefined&wbdisable=true

Joint declaration on a partnership between Canada and the members of the Pacific Alliance: http://www.international.gc.ca/americas-ameriques/pacific_alliance_pacifique/declaration.aspx

Canada and the Pacific Alliance: http://www.international.gc.ca/world-monde/international_relations-relations_internationales/pacific_alliance-alliance_pacifique/index.aspx?lang=eng

NAFTA

The Globe and Mail. 23 Oct 2017. Canadian dairy industry faces a choice: grow or fade away

BARRIE McKENNA, Columnist

It’s not clear that domestic dairy processors are ready for the wideopen free trade that seems likely to result from continuing NAFTA talks.

If Canada’s tightly regulated dairy regime is about to come crashing down, someone forgot to tell Gay Lea Foods.

The Mississauga-based dairy processor, owned by 1,300 Ontario dairy farmers, is spending $250-million over four years to modernize and expand its operations across Canada.

Last week, the company acquired a cheese maker in Calgary – Alberta Cheese Co. This Wednesday, it will open a large new butter and dairy ingredients plant in Winnipeg, part of a joint venture with Vitalus Nutrition Inc. of Abbotsford, B.C.

They are risky bets, given the troubled state of talks to overhaul the North American free-trade agreement. U.S. negotiators are demanding Canada immediately open up as much as 17 per cent of its heavily protected dairy and poultry markets, and within a decade entirely dismantle the supply-management system that controls the sectors.

Gay Lea’s aggressive growth strategy appears to hinge on a different scenario – namely, that Canada’s dairy industry remains largely sheltered from foreign competition. Ottawa will continue to restrict most imports through quotas and a steep tariff wall, and prices and production levels will remain strictly regulated.

If the United States gets its way, all that would end, including Canada’s 270-per-cent tariff on milk.

Gay Lea knows it must become more competitive if it’s going to survive as the United States and other countries chip away at Canada’s protected market in various trade negotiations. But it’s not clear that it and other Canadian processors are ready for wide-open free trade after decades of underinvestment. Two of Gay Lea’s competitors, Agropur and Saputo, have chosen to spend heavily outside Canada. Both companies now process more milk in the United States than in Canada.

Gay Lea, on the other hand, has focused on the domestic market. Its expansion plans are based on being able to buy milk from Canadian farmers at the lower wholesale prices that prevail in the United States and elsewhere, rather than generally higher domestic prices. Canadian farmers pushed for the creation this year of a new price class specifically for milk destined for the production of dairy ingredients, such as protein concentrates. The new milk pricing scheme has stemmed the flow of cheaper imported dairy ingredients from the United States – a source of tension with the Trump administration.

Lower prices have given Gay Lea and other processors the confidence to invest in new production. As with Gay Lea, Parmalat Canada is boosting its capacity to produce dairy ingredients by adding a new production line at its dairy in Winchester, Ont. – one of its 16 Canadian plants.

A whole lot more investment and consolidation will be needed if the border opens wide. Structured as it is now, the Canadian dairy industry would face problems of scale. And Canadian processors are generally not positioned to export to the United States or anywhere else.

A single U.S. company – Dean Foods of Dallas – processes as much milk as the entire Canadian industry. Dean Foods makes everything from milk and protein ingredients to yogurt and ice cream at 66 plants across the United States, including many clustered near the Canada-U.S. border.

For farmers, the economies of scale look even more challenging. The average Canadian dairy farm has 85 cows. In the United States, it’s closer to 200, and the largest farms have thousands of animals. Nothing in Canada matches Fair Oaks Farms, in Fair Oaks, Ind. The operation has 32,000 cows and produces enough milk to supply the city of Chicago.

The long-held fear is that an open border would decimate the Canadian industry – that Canada would not be able to compete with large industrial farms and more efficient processing plants in the United States.

The outcome of the NAFTA negotiations is highly uncertain. Ottawa has insisted it won’t buckle to the U.S. demands on dairy. The United States is threatening to walk away from NAFTA, but it’s unlikely to relent in demanding a more open border on U.S. dairy exports to Canada.

The dairy industry is facing the same challenges the rest of the economy did, circa 1988, on the eve of the original Canada-U.S. freetrade agreement. The companies that invested heavily and positioned themselves for a larger market thrived.

The rest faded away.

Gay Lea and other Canadian dairy players will have to figure out a way to be competitive beyond the sheltered domestic market. And that will mean getting into the export market.

The Globe and Mail. 23 Oct 2017. China and the United States: clash or convergence?

DEREK BURNEY

FEN OSLER HAMPSON

As attention focuses on the dimming prospects for NAFTA, the threat from North Korea and the fate of the Iran nuclear deal, among other global flashpoints, less notice is being given to what may be the most consequential event of the moment: the 19th National Congress of the Communist Party of China in Beijing. President Xi Jinping is on course to consolidate his political power in the world’s most populous country to an extent unseen since the days of Deng Xiaoping.

Mr. Xi’s Castro-like 31⁄2-hour sermon to the party faithful, which clearly tested the attention spans of senior party elders such as former presidents Jiang Zemin and Hu Jintao, contained more than a whiff of confident nationalism. Mr. Xi served notice that China has global ambitions and that its system of authoritarian capitalism has nothing to learn from Western values of democracy and human rights.

What is already happening in China is significant enough. What the future portends signifies the extent to which China’s growing economic and military power may dominate the remainder of this century. Worth watching will be whether the unadulterated grip on power of Mr. Xi personally and the Communist Party he leads can continue to manage the benefits and the social pressures of its remarkable surge as smoothly and successfully as it has to date.

Mr. Xi faces many serious internal challenges, including taking control of China’s growing mountain of public debt, which some estimate to be double the country’s GDP; reducing the number of state-owned enterprises, which still dominate the economy and feed rampant corruption; tackling the country’s major environmental crisis in water and air-borne pollution; and addressing the growing income gap between China’s rich, urban classes and the rural poor.

The One Belt, One Road infrastructure program is China’s biggest foreign policy initiative. Billions are being spent in the regions neighbouring China to build trade routes through Pakistan and Central Asia. This program provides benefits for China’s neighbours, but the motives are not altruistic: It will reduce China’s dependence on its eastern seaboard and the Strait of Malacca as the channel for its imports and exports; and it is critical to strengthening China’s competitive position vis-à-vis the United States and to increasing its influence over its immediate neighbours.

Having few qualms about governance and human rights standards well below the norm, China has no inhibitions about major investments in countries that others, particularly Western countries, generally shun – North Korea, Zimbabwe, Myanmar or Uganda being among the most notable.

Unquestionably, China’s power, prestige and influence is on the rise globally. Against the cacophony emanating these days from Washington and the bumbling track record in Europe, China stands out as a beacon of relative stability – an authoritarian stability that is attractive to leaders of a similar bent, including those in Ankara and Moscow.

China’s ambitions for greater global influence are not inspired by any special desire to be a force for good in the world – rather, as a force for what is good for China. In that sense, though, China’s approach is really not that different than the “America First” nationalism enunciated in varying degrees these days by the Trump administration.

The key question going forward is whether these competing visions and competitive super-egos will clash or converge on global issues. North Korea is a case in point. When the Trump administration signalled brashly that it would suspend all trade with any country that maintained trade links with North Korea, Beijing made some modest moves to limit its trade links with Pyongyang but essentially ignored the U.S. threat. The Chinese decided prudently and pragmatically that there was no value in engaging in the Twitter universe of Donald Trump. That in itself is reassuring.

Despite all the huffing and puffing about Chinese currency manipulation and its trade surplus, the United States has yet to take any remedial action against China on trade. (Canada offers a much easier target for Mr. Trump’s outsized and misdirected anti-globalization tirades.) Clearly, the symbiotic nature of their economic relationship cuts both ways.

The challenge more broadly for the “liberal international order,” one on which U.S. leadership has been the essential element for more than seven decades, will be managing China’s increasing global influence as the U.S. appetite to lead continues to wane.

Derek Burney was Canada’s ambassador to the United States from 19891993. Fen Osler Hampson is chancellor’s professor at Carleton University and the author of the forthcoming book Master of Persuasion: Brian Mulroney’s Global Legacy.

THE GLOBE AND MAIL. OCTOBER 23, 2017. BMO warns non-NAFTA nations on U.S.: They're coming for you next

MICHAEL BABAD, Columnist

The Canada/U.S. imbalance represents seven minutes of output from the U.S. economy in any given year (i.e., a short coffee break)

DOUGLAS PORTER, BANK OF MONTREAL

As negotiations over the North American free-trade agreement sour, Bank of Montreal has a warning for non-NAFTA nations: They're coming for you next.

And that may happen sooner rather than later as American trade issues rise to the fore this week and into next month.

"The strident U.S. stance may all be bluster, aimed at extracting maximum concessions from its two smaller trading partners, but there is no doubting the seriousness of the administration's protectionist leanings and the dark outlook for NAFTA," said BMO chief economist Douglas Porter.

"And lest the rest of the world think this is just Mexico and Canada's problem, we would remind that these two account for barely 10 per cent of the U.S. trade deficit," he added in a report on the NAFTA talks, where U.S. Trade Representative Robert Lighthizer accused the Canadians and Mexicans of being intransigent.

"One would have to believe that the administration is coming for those responsible for the other 90 per cent of the gap next."

We may learn more this week, given that a big U.S. report on World Trade Organization infractions is expected by Thursday.

Mr. Trump also heads to Asia next month, where he'll no doubt talk trade, among other things.

The U.S. has been adamant about reducing trade deficits. And while Mexico is certainly well up the list, so, too, are China, Japan, Germany, Ireland and Italy. So there are many targets for the U.S. administration.

"Despite continuing to demur from the currency manipulation issue, China will remain a priority medium-term target of the administration's activist trade policy," said currency strategists at JPMorgan Chase.

"Not just is China responsible for an overwhelming share of the US trade deficit … but a recent speech and discussion with USTR Lighthizer underscored how the administration still views China as the primary trade relationship the US intends to address and reorder .

In mid-November, the next round of NAFTA negotiations are scheduled to take place in Mexico City.

That the NAFTA negotiations are tough should be no surprise. Mr. Lighthizer is doing exactly what Mr. Trump pledged to do, and clearly taking a hard line in negotiations.

Even then, we still don't know whether the American team "is exercising aggressive negotiation tactics, or displaying ideological inflexibility," said currency strategists at JPMorgan Chase.

"But what has become clear, with the announcement to an extension and slowing of the negotiations, is that the threat to trade disruption was not an acute risk this past week," they said.

That's the good news.

"The bad news is that there is open tension between the parties, the discussions are replete with 'significant conceptual differences,' and many of the U.S. demands have been deemed non-starters by Canada and Mexico," said BMO's Mr. Porter.

"By all accounts, what we have here is a failure to negotiate in good faith."

Asked whether he was referring to the U.S., Mr. Porter said: "Well, yes, although the U.S. Trade Rep seemed to be accusing Canada and Mexico of the same."

As Mr. Porter noted, the U.S. current account deficit is "right in line" with its three-decade average and "by almost any measure, poses no serious threat to the economy."

Remember, too, that Canada has fairly balanced trade with its biggest partner, and that the Americans desperately want so much of what we export to them: Oil.

Canada and Mexico, particularly the former, account for a small part of that shortfall, even though they represent more than 30 per cent of all trade flows with the U.S., BMO noted.

"In fact, over the past four quarters, trade in goods and services between Canada and America has been almost precisely balanced; the 'huge' imbalance was US$246-million, or 0.001 per cent of U.S. GDP," Mr. Porter said.

"Put another way, the Canada/U.S. imbalance represents seven minutes of output from the U.S. economy in any given year (i.e., a short coffee break)," he added.

Odds on NAFTA

The odds against a renewed NAFTA are rising, given the hostility evident in the last round.

"We had assumed that common sense would prevail and that some type of modernized NAFTA deal would eventually emerge," said David Madani, senior Canada economist at Capital Economics.

"But this now looks like wishful thinking."

Indeed, observers are revising the possibility of the talks collapsing. Higher.

Elsa Lignos, Royal Bank of Canada's global head of foreign exchange strategy in London, now looks at it this way:

- The "lower likelihood" first scenario of a NAFTA 2.0: "It is hard to imagine President Trump signing a new NAFTA that is no less protectionist than the current treaty."

- The "medium likelihood" of talks just plodding on through political developments such as Mexico's mid-2018 election: "There would be moments of drama but markets would get used to fading them quickly, as they do with Trump's threats on North Korea."

- The "higher likelihood" of talks collapsing: "We see a higher risk that Trump acts before his current Trade Promotion Authority (TPA) expires in July 2018 … While legal challenges and Congress may prevent that from leading to a complete disbanding of NAFTA, markets are not priced for this uncertainty, in our view."

The TPA gives a president the authority to strike trade agreements. The current version runs out next summer without a renewal from Congress, and pro-trade politicians could block that, Ms. Lignos noted.

"The timing of TPA expiry is important as it may spur action by the Trump administration ahead of the July deadline," she said.

"Without TPA the president loses the mandate to negotiate new deals but also to withdraw from existing deals."

Citigroup has also redrawn the outlook, though still sees NAFTA succeeding.

"The probability of NAFTA renegotiations disintegrating and the dissolution of the agreement entirely has risen," said Sergio Luna of Citi Research.

"Nonetheless, we continue to assign the greater probability (70 per cent) to the outcome where NAFTA remains in place and is made incrementally better amid the renegotiation process."

NAFTA outcome probability tree

NAFTA outcomes

25%

Easy passage

45%

Rough road,

but easy passage

30%

Negotiations end badly

27%

U.S. exits

1.5%

Canada or Mexico exit

1.5%

Status quo

25.7%

Canada and Mexico stay

1.3%

Canada and/or Mexico exit

1.4%

U.S. exits

0.1%

U.S. stays with remaining partner

THE GLOBE AND MAIL, SOURCE: CITI RESEARCH

Here's are Citi's three scenarios, based on "what an advocate or a critic might say" after the latest round of talks:

- The three countries strike a new deal by early next year, and approval is fast-tracked in the U.S.

- The strongest probability: A deal is struck by mid-2018, followed by a "time out" and then approval.

- Collapse as "one or more parties" call it quits: "We note that this does not automatically trigger dissolution of the agreement, and that NAFTA would remain in place unless two parties withdraw from the agreement."

Markets believe there's a 30-per-cent chance of NAFTA being killed, but "we believe the likelihood is lower," Mr. Luna said.

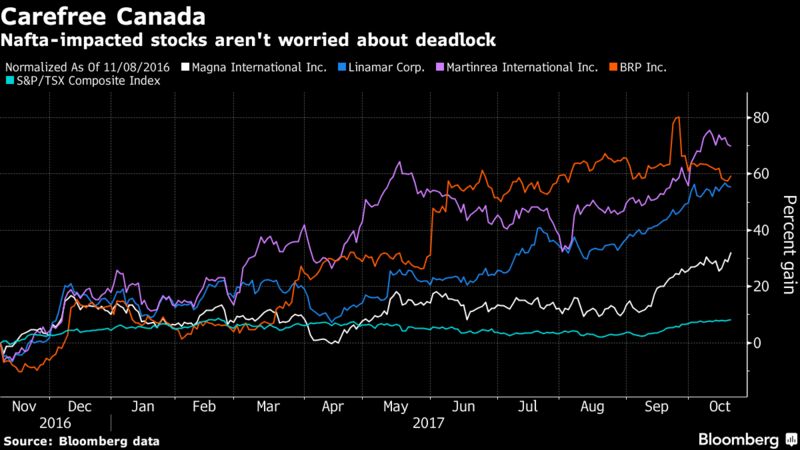

BLOOMBERG. 23 October 2017. Nafta Impasse Draws a Yawn as Canadian Stocks Near Record High

By Kristine Owram

- Canadian investors push ‘Nafta’ stocks higher as talks stall

- Magna, Linamar, BRP among gainers as loonie holds steady

- TD CEO Says Nafta Collapse 'Dramatic' for Bank, Economy

President Donald Trump’s threat to tear up the North American Free Trade Agreement is falling on deaf ears in Canadian markets.

Magna International Inc. and other Canadian companies that rely on trade with the U.S. and Mexico are rising even as Trump attacks the “worst trade deal ever made” and negotiators exchange barbs over “troublesome” U.S. demands to overhaul the pact. Canadian stocks are on the cusp of a record high, while the loonie has gained 6.4 percent this year versus the U.S. dollar.

Investors are looking past the bluster of the stalled trade talks, betting that either a deal will get done, or that a collapse won’t have the dramatic impact that some economists are predicting.

“Sensible minds will prevail,” paving the way for a deal, Bharat Masrani, chief executive officer of Toronto-Dominion Bank, said in an interview with Bloomberg Television. Toronto-Dominion is Canada’s largest lender by assets, with more branches in the U.S. than in Canada.

A basket of stocks most likely to be affected by the death of Nafta is up 31 percent since Trump’s election as U.S. president, and most are holding up well even after the trade rhetoric soared during the fourth round of talks that ended last week.

Car Parts Rally

Auto suppliers are considered one of the most at-risk sectors if Nafta disintegrates, yet Martinrea International Inc. is up 70 percent since the election, Linamar Corp. has gained 55 percent and is close to a two-year high. Magna International has added 32 percent, closing Oct. 20 at a two-year high. Ski-Doo maker BRP Inc., which has plants in Canada, the U.S. and Mexico, is up 59 percent and both major Canadian railways have seen double-digit gains.

Of the Canadian companies that could be hit if Trump follows though on his threats, only dairy producer Saputo Inc. is down since the U.S. election. The Montreal-based company has been hurt by U.S. demands to dismantle Canada’s dairy quotas and tariffs.

It’s unlikely Nafta will be blown up because the U.S. would "instantly put itself at a disadvantage," said Brett House, deputy chief economist at Bank of Nova Scotia, Canada’s third-biggest bank. Even if the trade deal was scrapped, the average tariff that the U.S. would charge outside of Nafta would be about 3.5 percent, while Canada’s would be 4.3 percent and Mexico’s would be 7.1 percent, meaning U.S. exporters would have to pay more than their Canadian and Mexican counterparts.

What’s more, Canada and the U.S. may be able to fall back on a bilateral trade agreement that was in place before Mexico was added via the Nafta deal 23 years ago. That would lessen the blow for Canadian companies in a post-Nafta world.

Investors in Canada and Mexico have been shrugging off "every tweak, every hiccup, every inflammatory outburst from Washington," House said. Most of Canada’s export-oriented manufacturing sectors are operating at capacity and could divert their products to other markets if needed, he added.

Even if Nafta fell apart, investors need only look at Canada’s lumber stocks for reassurance that life goes on without free trade.

The U.S. slapped duties of as much as 31 percent on softwood lumber imports from Canada this year in a move to protect its domestic industry. Shares of producers have surged to all-time highs since then as a shortage of timber, exacerbated by several devastating hurricanes in the southern U.S., boosted demand for Canadian wood even with the higher tariffs.

“There’s such a shortage of supply of this stuff in the United States that the price can get pushed up by tariffs and it’s not going to reduce the demand for Canadian goods at all,” House said in an interview. “It just makes things tougher on American consumers."

Still, some analysts are warning that investors may be overly complacent about the potential for Canadian stocks to fall if Nafta is scrapped.

"We would expect both the currency and the Canadian equity market to sell off in such a scenario," Ian de Verteuil, head of portfolio strategy at Canadian Imperial Bank of Commerce, wrote in a recent note.

— With assistance by Erik Schatzker

VENEZUELA

BLOOMBERG. 23 October 2017. Venezuela’s Behind on Its Debt and Facing Two Huge Bond Payments

By Katia Porzecanski , Christine Jenkins and Ben Bartenstein

- Government-run oil giant PDVSA owes $985 million on Friday

- Country is already late on $350 million of interest payments

- Venezuela Faces Bond Market Day of Reckoning

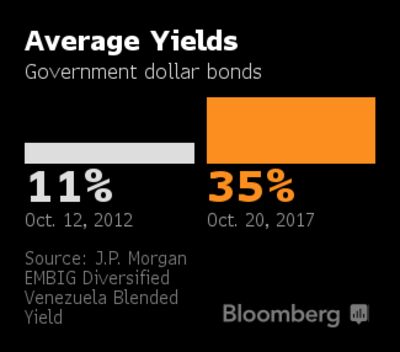

Ever since the price of oil collapsed in mid-2014, there’s been a broad consensus among the bond-market crowd that Venezuela was going to default. Not immediately, they said, but at some point down the road.

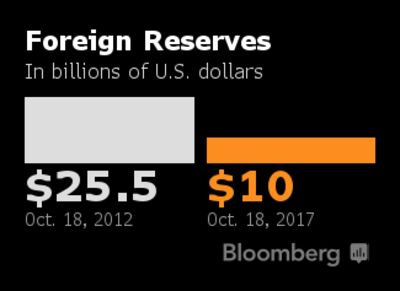

Three years on, that time may have arrived. On Friday, the government-run oil giant PDVSA owes $985 million. Six days later, it’s on the hook for another $1.2 billion. Not only is that a daunting sum for a country whose foreign-currency reserves recently dipped below $10 billion for the first time in 15 years, but it figures to be a logistical nightmare too.

Increasingly isolated by U.S. financial sanctions that have spooked banks and other intermediaries in the bond payment chain, Venezuela has already fallen behind on interest payments worth $350 million that were due earlier this month. Those payments had a grace period -- a buffer of sorts that gives the country an additional 30 days to work out the technical glitches and deliver the cash. The principal portions of the payments owed over the next two weeks contain no such language. Miss the due date and bondholders can cry default. Prices on the notes due Nov. 2 acutely reflect those risks: They’re at just 92 cents on the dollar.

“This is Venezuela -- they’re very disorganized with these types of things,” said Alejandro Grisanti, the director of the Caracas-based research firm Ecoanalitica. “Every day, it’s harder for them to pay.”

The government had another $237 million in interest payments come due Saturday, and the National Public Credit Office has yet to announce their payment. A delay in those payments would bring the total in arrears to $587 million.

A default would be a painful end to what has proven one of the more profitable, and strange, trades in emerging markets over the past two decades. While the plunge in crude prices deepened an economic collapse and triggered a humanitarian crisis unprecedented in the nation’s history, President Nicolas Maduro, like his predecessor and socialist mentor Hugo Chavez, has been determined to meet all foreign bond payments. He’s cut imports to free up hard currency for debt payments, tapped China and Russia for loans and mortgaged some of the country’s gold stash.

And because yields on the bonds have been so high, the returns have been eye-catching: over 9 percent per year on average over the past 20 years. This combination -- outsize profits for Wall Street traders and shortages of food and medicine for Venezuelans back on the ground -- has been so jarring that it even led to the coining of a new term for the nation’s debt: hunger bonds.

The fine print on these next two principal payments puts Venezuela in a tricky spot. If PDVSA were to deliver the funds even one day late, investors can rally together to demand the immediate payment of the rest of the money they’re owed. (Lacking the funds to pay back all the debt at once, Venezuela would likely look to enter into restructuring talks with creditors -- a step that’s complicated by the sanctions.)

It isn’t clear, to be sure, that investors would want to

immediately escalate the situation. For one, getting 100 cents on the dollar a few days, or even weeks, late would be much less painful than enduring legal battles and restructuring negotiations that are likely to drag on for months, if not years. What’s more, analysts estimate that creditors could get as little as 30 cents on the dollar in the end. There’s broad reluctance to unnecessarily upset the gravy train, even if it’s showing signs of tipping over.

“It is better for bondholders to get cash, even late,” said Lutz Roehmeyer, who helps oversee about $14 billion at Landesbank Berlin Investment GmbH, the 13th-largest reported holder of PDVSA’s 2017 bonds. “Most of the bonds are with U.S. funds or local investors who won’t have an incentive to trigger a default.”

Investors in the credit-default swaps market, though, have a different set of incentives. They would seek to get ISDA, the ruling body in the swaps market, to declare a default, which would trigger payouts on the contracts.

Foreign Reserves

Venezuela could still also make the payments on time. While $10 billion in foreign reserves isn’t much for a country that now owes some $140 billion to foreign creditors, it’s still enough to pay the bills for a while.

And the Maduro government has surprised the bond market before, making payments the past couple years that many traders had anticipated would be missed. Some of those now betting that these next two payments will also be made actually point to the $350 million currently overdue on the other notes as an encouraging sign. Those arrears indicate, they contend, that officials are prioritizing the payment of bonds with no grace period at the expense of those they can put off without penalty.

Even if Venezuela can make the payments due this year, investors say that, unless oil prices stage some sort of miraculous comeback, they still see default as an inevitable outcome. Credit-default swaps show they’re pricing in a 75 percent chance of a PDVSA default in the next 12 months and 99 percent in the next five years.

“When oil prices were high, they threw the best parties” and “put none of the money away in the bank,” said Ray Zucaro, the chief investment officer at Miami-based RVX Asset Management, which holds PDVSA securities. “So when the spigot turned off with oil prices, it left them in a bind because they had spent way too much, they had borrowed way too much.”

— With assistance by Melinda Grenier

BLOOMBERG. 9 August 2017. Why Venezuela Doesn’t Get It Over With and Default

By Katia Porzecanski

- Venezuela Inches Closer to Dictatorship

Predicting when Venezuela will finally default has been a decade-long parlor game for bond buyers, but recent events add urgency to the exercise. After years of mismanagement, the country appears closer and closer to running out of money. Adding to investors’ concern is the increasingly anti-democratic turn of President Nicolas Maduro, whose move to rewrite the constitution and strip power from congress has been met with U.S. sanctions. Still, for all the turmoil, Venezuela has a track record of paying its debts, and investors who’ve held on through the worst of times have been rewarded with some of the world’s best bond returns.

1. What are investors’ main concerns?

First, the economics look bad. Foreign reserves have dwindled to a 15-year low of about $10 billion, a grim figure considering Venezuela and the state oil company known as PDVSA are due to pay about $13 billion in debt before the end of 2018. Combine that with oil prices at half of what they were just three years ago, slumping crude output in a country that gets 95 percent of its export revenue from that one resource, triple-digit inflation and a rapidly shrinking economy, and it’s a tough road ahead. Second, the level of political turmoil is unprecedented, with deadly street protests against Maduro’s government raging on a near daily basis, open calls for the military to stage a coup and shortages of food and medicines as the government prioritizes debt payments over imports of basic goods.

2. How creditworthy is the country?

Venezuela isn’t current with most of its key economic statistics, so the most basic data an investor would use to gauge the country’s creditworthiness aren’t available. One key number is the current account balance, a broad measure of trade that looks at money moving in and out of the country, including bond interest payments. Normally, a government would borrow money to plug any gap, but steep borrowing costs preclude such a tactic for Venezuela. Estimates of the size of the country’s current account deficit vary depending on which economist you ask and assumptions about how much the country has slashed imports to keep paying its debts. Still, we can be pretty sure that the situation is unsustainable.

3. When will the money run out?

To make ends meet, the government is blowing through central bank reserves. That hoard now consists of just $1 billion in cash, with much of the balance made up of gold bars, according to investment bank Torino Capital. Venezuela can buy itself some time by continuing to take advance payments for its oil from China and Russia -- as long as they’re willing to pay them. And it can keep reducing imports. However, the economy depends on foreign manufacturers for everything from antibiotics to baby formula, and shortages have already become severe, so the humanitarian costs are significant.

4. Why doesn’t Venezuela just get it over with and default?

That choice has confounded socialists and capitalists alike, but it boils down to the risk that Venezuela’s international oil assets could get seized by creditors or tied up in court. Through PDVSA, Venezuela -- home to the world’s largest petroleum reserves -- has offshore refineries and oil receivables that investors will almost certainly try to make a play for if their bonds go unpaid. PDVSA’s Houston-based refining arm, Citgo Holding Inc., has also been used as collateral to back some bonds. And if creditors start going after Venezuela’s oil assets, buyers of its crude are apt to turn to other sources, depressing not only demand but the price of Venezuela’s main treasure.

5. How do the U.S. sanctions play into this?

So far, sanctions have been limited to freezing the assets of individuals (including Maduro himself), and don’t have a direct effect on the country’s ability to pay. But speculation has grown that the U.S. could impose steeper economic penalties, such as a ban on oil imports from Venezuela. Analysts across Wall Street have said such a move would make it incredibly difficult for Maduro to stay current on his obligations for much longer. About 40 percent of Venezuela’s petroleum exports go to the U.S., bringing in about $10 billion. While the country could find other buyers, it’d probably have to sell at a discount because of higher transportation costs. Sanctions could also keep U.S. companies partnered with PDVSA from continuing their operations in the country, adding another dent in production. All told, oil-related sanctions could cost $7 billion in revenue, Torino estimates. Furthermore, if sanctions effectively eliminate any business ties between the U.S. and Venezuela, the incentives for Maduro to keep paying would eventually dry up. And Maduro could just blame the default on the yanquis.

6. What would a debt restructuring look like?

It would be enormously complicated. Not only would creditors have to figure out a sustainable repayment plan for the government, there also would need to be a workable solution for PDVSA, since it would likely default around the same time. Fights between creditors would be inevitable as they sorted out who’s entitled to what. In addition to all the bonds, Venezuela owes billions of dollars in awards resulting from international arbitration disputes and to private companies with cash trapped in the country, while PDVSA and its subsidiaries have a slew of outstanding loans. Another question is whether investors could even engage with Venezuela or PDVSA if sanctions end up barring U.S. entities from doing business with them.

7. What if there was a change of government?

Investors believe a new government would work for a faster resolution and is a necessary condition for getting a restructuring done. Still, a new regime would almost certainly seek assistance from the International Monetary Fund, which would probably recommend imposing steep losses on creditors. And some opposition leaders have warned they’ll flat-out refuse to honor certain debts -- like bonds bought by Goldman Sachs Asset Management -- that they say are part of a fund-raising effort by the dictatorship that skirts congressional oversight. Critics of the Goldman deal said the bank had thrown the government a lifeline through “hunger bonds,” so named because Venezuelans are going underfed so the regime can keep up debt payments.

8. Is there any precedent for Venezuela’s situation?

There are some similarities to the devastating case of Romania in the 1980s when dictator Nicolae Ceausescu imposed Draconian austerity measures in an obsessive drive to pay off the country’s foreign debt by the end of the decade. Living standards plunged as food, heating, electricity and medical care were rationed. Ceausescu knocked out the debt, but by then, public anger was so high that he was overthrown and executed a few months later.

CONSUMER DEBT

BANK OF CANADA. THE GLOBE AND MAIL. OCTOBER 23, 2017. CONSUMER DEBT. Already pinched, many Canadians anxious about higher rates: survey

JOSH O’KANE

The return of rising interest rates is leaving Canadians anxious as they come to grips with the reality of historically high consumer debt.

Nearly half of Canadians are now concerned about repaying their debts, while four in 10 say that further rate increases may leave them "in financial trouble," according to a poll released Monday morning by insolvency firm MNP Ltd. In September, Canadian households' credit-market-debt-to-disposable-income ratio hit 167.8 per cent, the latest in a string of national indebtedness records.

Stephen Poloz will reveal the Bank of Canada's latest interest rate announcement and monetary policy report Wednesday – and after two 0.25-per-cent increases already this year, the prospect of another is leaving Canadians fearful. Borrowing costs are now centre-stage for the many consumers who took advantage of Canada's low interest rates these past few years.

Earlier this month, the Bank of Nova Scotia revealed a similarly foreboding forecast for Canadians looking to get into the housing market: even if home prices remain relatively stable, average mortgage carrying costs for new buyers could rise by about 8 per cent next year and another 4 per cent in 2019. That would "easily" outpace the bank's projected average annual per-capita household income growth of 2.5 per cent, chief economist Jean-François Perrault wrote in an Oct. 5 report.

A separate report this month from HSBC Securities (Canada) Inc.'s chief economist David Watt – titled "Cometh the hangover" – fired a similar warning shot, saying "complacency" toward consumer debt could damage economic growth. "We are concerned about how smoothly household deleveraging from record debt levels will evolve alongside attempts by policy makers and regulators to manage frothy housing markets in key regions," Mr. Watt wrote. "The potential for an accident to occur is elevated."

MNP revealed its findings Monday as part of its Consumer Debt Index, conducted by Ipsos, which surveyed 2,005 Canadian adults between Sept. 18 and 21. It found that 42 per cent of consumers aren't confident they'll be able to cover all living and family expenses in the next year without taking on more debt. One in three respondents said they're already feeling the heat from rate increases this year, and seven in 10 said they will now be more careful with how they spend money.

It found millennials to be the most affected by rate increases: 40 per cent say they already feel the effects, just more than half say they're worried about being able to repay their debts, and 38 per cent say rising rates could send them towards bankruptcy. The bankruptcy figure for millennials is 10 percentage points more than the average of all age cohorts.

The insolvency firm also found that since its last survey was conducted in June, the average Canadian now has $149 less each month after paying bills and obligations. And while respondents were more confident than during the last survey about being able to take on a one-point interest-rate increase, their confidence fell significantly when asked specifically about a $130-a-month increase in interest payments.

WHOLESALE

StatCan. 2017-10-23. Wholesale trade, August 2017

Wholesale sales — Canada: $62.8 billion

August 2017: 0.5% increase (monthly change)

Source(s): CANSIM table 081-0011

Wholesale sales rose 0.5% to $62.8 billion in August, led by the personal and household goods and motor vehicle and parts subsectors.

Sales were up in four of the seven subsectors, together representing 47% of total wholesale sales.

In volume terms, wholesale sales rose 0.4%.

Chart 1: Wholesale sales rise in August

Wholesale sales rise in August

Gains mainly attributable to the personal and household goods and the motor vehicle and parts subsectors

Sales in the personal and household goods subsector rose for the ninth consecutive month—posting the largest gain in dollar terms in August, rising 3.3% to a record $9.0 billion. Sales were up in four of the six industries, with the textile, clothing and footwear industry contributing the most to the gain.

Sales in the motor vehicle and parts subsector increased for the third time in four months, up 2.0% to $11.8 billion. The growth in the subsector was attributable to higher sales in the motor vehicle industry, which recorded its second consecutive monthly gain. There were higher imports of passenger cars and light trucks in August, and motor vehicle manufacturing sales increased.

Following two months of declines, the miscellaneous subsector rebounded in August, up 1.6% to $8.1 billion. Sales were up in four of the five industries, led by the recyclable material industry.

The building materials and supplies subsector posted the largest decline in August, down 3.5% to $8.7 billion and its first decrease in six months. Two of the three industries declined in August, with the lumber, millwork, hardware and other building supplies industry contributing the most to the downward movement.

Sales increase in five provinces, led by Ontario, Quebec, and British Columbia

In Ontario, wholesale sales rose 0.8% to $32.1 billion, on the strength of higher sales in the personal and household goods (+6.4%) and the motor vehicle and parts (+0.6%) subsectors. The gain was slightly offset by lower sales in the machinery, equipment and supplies subsector (-1.6%).

Wholesale sales in Quebec increased for the fifth time in six months, up 1.0% to $11.3 billion in August. Four of the seven subsectors reported higher sales, led by the motor vehicle and parts (+5.8%) and the food, beverage, and tobacco (+2.5%) subsectors.

In British Columbia, sales were up 0.7% to $6.7 billion. Sales increased in five of the seven subsectors, with the machinery, equipment supplies (+7.6%) and the miscellaneous (+10.8%) subsectors leading the gain.

Wholesale sales in Alberta (-2.0%) fell in five of the seven subsectors. The food, beverage and tobacco (-5.1%) and the machinery, equipment and supplies (-3.9%) subsectors contributed the most to the decline.

Inventories up for the fifth consecutive month

Wholesale inventories climbed for the fifth consecutive month, up 0.2% to a record $80.8 billion in August. Increases were recorded in three of the seven subsectors, representing 45% of total wholesale inventories.

Chart 2: Inventories up in August

Inventories up in August

Inventories in the building material and supplies subsector rose 1.7% in August, accounting for the largest gain in dollar terms of all subsectors. The building material and supplies subsector has posted the highest level of growth of all subsectors in 2017, increasing 8.9% from January.

Inventories rose 1.1% in the personal and household goods subsector, a fourth increase in five months. Inventories have grown by 7.6% over this five-month period, led by the textile, clothing and footwear industry.

The food, beverage and tobacco subsector (+1.5%) posted a sixth consecutive monthly increase, on the strength of higher inventories in the food industry (+1.5%).

The miscellaneous subsector (-2.5%) reported the largest dollar value decline in August, with the agricultural supplies industry (-4.5%) leading the decrease. Despite the decline in August, inventories in the miscellaneous subsector were 18.8% higher than in August 2016.

The inventory-to-sales ratio remained constant at 1.29 from July to August, an indication that both inventories and sales have been increasing at the same pace. This ratio is a measure of the time in months required to exhaust inventories if sales were to remain at their current level.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/171023/dq171023a-eng.pdf

THE GLOBE AND MAIL. REUTERS. OCTOBER 23, 2017. Canadian wholesale trade rises 0.5 per cent in August on goods, autos

FRED LUM

OTTAWA - Wholesale sales rose 0.5 per cent to $62.8-billion in August, Statistics Canada reported Monday.

The agency said the increase was led by the personal and household goods and motor vehicle and parts subsectors.

Wholesale sales rose 0.4 per cent in volume terms for the month.

CIBC economist Nick Exarhos said the result was in line with the consensus estimate by economists, with volumes tracking a tick weaker.

"The general trend in wholesale has been smartly higher since the middle of 2016, after a two-year period of going nowhere," Exarhos wrote in a note to clients.

The data point comes as the Bank of Canada prepares to make its latest pronouncement on interest rates this week and release its updated forecast for the economy in its fall monetary policy report.

The central bank is expected to keep its target for the overnight rate on hold at one per cent, but economists will scrutinize its outlook.

The economy started the year on a hot streak posting large gains through the first six months of 2017. The strength helped convince the Bank of Canada to raise its key interest rate twice this year, but growth is expected to be slower in the second half of the year.

Wholesale sales in August were up in four of the seven subsectors tracked that together represent 47 per cent of total wholesale sales.

The personal and household goods subsector rose 3.3 per cent to a record $9.0-billion, while the motor vehicle and parts subsector increased 2.0 per cent to $11.8-billion.

The building materials and supplies subsector fell 3.5 per cent to $8.7-billion.

Wholesale sales were up in five provinces, led by Ontario, Quebec and B.C.

Ontario gained 0.8 per cent to $32.1-billion, while Quebec increased 1.0 per cent to $11.3-billion.

British Columbia saw wholesale sales rise 0.7 per cent to $6.7-billion. Wholesale sales in Alberta fell 2.0 per cent.

________________

LGCJ.: