CANADA ECONOMICS

2017 Annual Meetings of the International Monetary Fund (IMF) and World Bank Group

Department of Finance Canada. October 14, 2017. Minister Morneau Concludes Successful IMF and World Bank Meetings

Washington, D.C. – Canada is committed to help strengthen the global economy while ensuring the benefits of economic growth benefit all, especially its middle class and those working hard to join it.

This week, Finance Minister Bill Morneau participated in the 2017 Annual Meetings of the International Monetary Fund (IMF) and World Bank Group in Washington, D.C. The meetings, which concluded today, provided an opportunity to discuss ways to promote shared and sustainable economic growth, as well as Canada's commitment to contribute to greater fairness and prosperity for middle class Canadians and people around the world.

While in Washington, the Minister also spoke at the Center for Strategic and International Studies on opportunities for collaboration across multilateral development banks, and took part in a CNN panel discussion on the global economy. All week, he emphasized the importance of pursuing policies that not only create long-term sustainable growth, but also produce tangible results for everyone.

Quote

"By working together, the international community can improve the global economy. But economic growth is not enough. We need to create growth that benefits our people. This is what Canada is doing. We have an ambitious plan to make smart investments that create jobs and provide opportunities for all Canadians, thereby ensuring an economy that works for the middle class."

- Bill Morneau, Minister of Finance

- Statement Prepared for the International Monetary and Financial Committee of the Board of Governors of the International Monetary Fund: https://www.imfconnect.org/content/dam/imf/Spring-Annual%20Meetings/AM17/IMFC%20Statements%20Public/IMFC-S-36-17-15%20Stmt%20-%20Mr.%20Morneau%20-%20Canada.pdf

- Communiqué of the Thirty-Sixth Meeting of the International Monetary and Financial Committee (IMFC): http://www.imf.org/en/News/Articles/2017/10/14/cm101417-communique-of-the-thirty-sixth-meeting-of-the-imfc

IMF. October 14, 2017. Communiqué of the Thirty-Sixth Meeting of the International Monetary and Financial Committee (IMFC). Chaired by Mr. Agustín Carstens, Governor of the Bank of Mexico

Global economy

The global upswing in economic activity continues, as we strive for higher, sustainable, broad-based growth. The outlook is strengthening, with a notable pickup in investment, trade, and industrial production, together with rising confidence. But the recovery is not yet complete, with inflation below target in most advanced economies, and potential growth remains weak in many countries. Near-term risks are broadly balanced, but there is no room for complacency because medium-term economic risks are tilted to the downside and geopolitical tensions are rising.

Policy response

The welcome upturn in global activity provides a window of opportunity to tackle key policy challenges and stave off downside risks, including by ensuring appropriate buffers, and to maximize returns on structural reforms to raise potential output. We reinforce our commitment to achieve strong, sustainable, balanced, inclusive, and job-rich growth. To this end, we will use all policy tools—monetary and fiscal policies and structural reforms—both individually and collectively. We will work together to reduce excessive global imbalances in a way that supports global growth by pursuing appropriate and sustainable policies. Strong fundamentals, sound policies, and a resilient international monetary system are essential to the stability of exchange rates, contributing to strong and sustainable growth and investment. Flexible exchange rates, where feasible, can serve as a shock absorber. We recognize that excessive volatility or disorderly movements in exchange rates can have adverse implications for economic and financial stability. We will refrain from competitive devaluations, and will not target our exchange rates for competitive purposes. We reaffirm our commitment to communicate policy stances clearly, avoid inward-looking policies, and preserve global financial stability. We welcome the conclusions of the G-20 Hamburg Summit on trade and are working to strengthen its contribution to our economies.

Supporting the recovery and reinvigorating growth prospects: Monetary policy should remain accommodative, where inflation is still below target and output gaps are negative, consistent with central banks’ mandates, mindful of financial stability risks, and underpinned by credible policy frameworks. Monetary policy, however, must be accompanied by other supportive policies. Fiscal policy should be used flexibly and be growth-friendly, while enhancing resilience, avoiding procyclicality, and ensuring that public debt as a share of GDP is on a sustainable path. To boost productivity and promote inclusiveness, fiscal policy should prioritize high-quality investment, support structural reforms, including more efficient tax systems, and promote labor force participation. Structural reforms, well-sequenced and adapted to individual country circumstances, should aim to lift productivity, growth, and employment; promote competition and market entry; and enhance resilience, especially given present high debt levels, while effectively assisting those bearing the cost of adjustment.

Safeguarding financial stability : We will continue to strengthen the resilience of the financial sector to support growth and development, including addressing legacy issues in some advanced economies and vulnerabilities in some emerging market economies, as well as monitoring potential financial risks associated with prolonged low interest rates and continued accommodative monetary policy. Effective financial supervision and macroprudential frameworks are key to guard against financial stability risks. We stress the importance of timely, full, and consistent implementation of the agreed financial sector reform agenda, as well as finalizing remaining elements of the regulatory framework as soon as possible.

Promoting inclusion and building trust in institutions : We will strive to implement domestic policies that develop an adaptable and skilled workforce and enhance inclusion, so that the gains from technological progress and economic integration are widely shared. We will strengthen governance to enhance the credibility of institutions and build support for reforms needed to raise growth and adjust to a rapidly changing environment.

Cooperating to tackle shared challenges : Recognizing that all countries benefit from cooperation, we will work to tackle common challenges, support efforts toward reaching the 2030 Sustainable Development Goals (SDGs), and support the orderly functioning of the international monetary system (IMS). We will work together to achieve a level playing field in international taxation; address tax and competition challenges, as appropriate, raised by the digitalization of the economy; tackle the sources and channels of terrorism financing, corruption, and other illicit finance; and address correspondent banking relationship withdrawal. We will support countries dealing with the macroeconomic consequences of pandemics, cyber risks, climate change and natural disasters, energy scarcity, conflicts, migration, and refugee and other humanitarian crises.

IMF operations

We welcome the Managing Director’s Global Policy Agenda. The IMF has a key role in supporting the membership to seize the window of opportunity to:

Sustain the recovery : We call on the IMF to provide member-tailored advice on the policy mix to deepen the global recovery. We support the work on fiscal rules and medium-term frameworks and the application of the fiscal space framework in bilateral surveillance. We support efforts to further enhance surveillance activities, including embedding analysis of macro-financial issues in IMF surveillance. We look forward to the Interim Surveillance Review, which will take stock of the IMF’s policy advice across the membership. We welcome further work on the impact of prolonged low interest rates and the role of macroprudential policies. We support continued progress toward addressing data gaps.

Raise prospects for sustained growth : We call on the IMF to continue to analyze the causes of the productivity slowdown and the measurement challenges of the digital economy, and help members identify structural reform priorities and analyze their impact on macroeconomic resilience. We support drawing lessons from applying the Infrastructure Policy Support Initiative in surveillance and work updating the framework for assessing public infrastructure management. We welcome the IMF’s continued support to the G-20 Compact with Africa initiative to improve investment frameworks and foster private sector investment.

Assist low-income countries (LICs) and small and fragile states : We extend our sympathy to those hit by natural disasters, and welcome the IMF’s readiness to help. We call on the IMF to identify policies and scale up capacity development that will help LICs and small and fragile states unlock their growth potential and enhance resilience to shocks, including by encouraging ex-ante risk management strategies, and through advancing economic diversification, enhancing revenue mobilization, and containing rising public debt vulnerabilities. We welcome the IMF’s work in support of the 2030 SDGs, where relevant to its mandate. We look forward to the review of LIC facilities, including options to help countries prepare for, and respond to, natural disasters and recover from conflicts. We welcome financial commitments made so far and look forward to the successful completion of mobilization efforts to ensure adequate PRGT loan resources over the medium term.

Bolster trust and resilience : We look forward to further work on good governance and addressing corruption issues, where these are macro-critical, while ensuring evenhanded treatment across the membership. We support further efforts to strengthen policy frameworks, including on fiscal issues, AML/CFT, and financial regulation and supervision. We also support the IMF’s work on inequality. We look forward to the review of the framework for debt sustainability analysis for countries with market access. We welcome the update of the IMF/World Bank low-income countries (LIC) debt sustainability framework, which is expected to become operational in the second half of 2018, benefiting from staff’s technical support. We call for enhanced transparency on debt issues.

Promote cooperation across countries : We support the IMF’s increased efforts to provide a rigorous, evenhanded, and candid assessment of imbalances and exchange rates in both Article IV consultations and the External Sector Report, further refining the external sector assessment methodologies, and the review of policies on multiple currency practices. We support the strengthened analysis of spillovers from domestic policies to the global economy as part of the IMF’s surveillance. We also look forward to enhanced communication on, and the effective and consistent implementation of, the IMF’s Institutional View on capital flows, while further exploring the role of macroprudential policies to increase resilience to large and volatile capital flows. We welcome work studying the macroeconomic impacts of fintech and virtual currencies. We support the IMF’s collaboration with international standard setters to help members complete the global financial regulatory reform agenda. We support the IMF’s continued role in international taxation and domestic revenue mobilization, including through the Platform for Collaboration on Tax, and in helping countries strengthen capacity to tackle illicit finance and address correspondent banking relationship withdrawal. We support the IMF’s continued assistance to countries dealing with macroeconomic problems arising from shocks, including those affected by conflict, refugee crises, and natural disasters. We emphasize the importance of the IMF’s collaboration with other multilateral institutions in pursuit of shared objectives.

Strengthen the IMS : We continue to support the work streams toward further strengthening the global financial safety net (GFSN): collaborating with Regional Financing Arrangements; exploring possible enhancements to the IMF’s lending toolkit; and examining the possible broader use of the SDR. We look forward to the review of IMF-supported programs and use of conditionality.

Support the membership with capacity development : We welcome the IMF’s provision of capacity development to complement its surveillance and program engagement, and look forward to the forthcoming review, aimed at strengthening its effectiveness and accountability.

We reaffirm our commitment to a strong, quota-based, and adequately resourced IMF to preserve its role at the center of the GFSN. We are committed to concluding the 15th General Review of Quotas and agreeing on a new quota formula as a basis for a realignment of quota shares to result in increased shares for dynamic economies in line with their relative positions in the world economy and hence likely in the share of emerging market and developing countries as a whole, while protecting the voice and representation of the poorest members. We call on the Executive Board to work expeditiously toward the completion of the 15 th General Review of Quotas in line with the above goals by the Spring Meetings of 2019 and no later than the Annual Meetings of 2019. We welcome the first progress report to the Board of Governors and look forward to further progress by the time of our next meeting. We welcome the new commitments received under the 2016 Bilateral Borrowing Agreements. We call for full implementation of the 2010 governance reforms.

We reiterate the importance of maintaining the high quality and improving the diversity of the IMF’s staff. We also support promoting gender diversity in the Executive Board.

Our next meeting will be held in Washington D.C., on April 21, 2018.

FULL DOCUMENTS: http://www.imf.org/en/News/Articles/2017/10/14/cm101417-communique-of-the-thirty-sixth-meeting-of-the-imfc

Attendance

INTERNATIONAL MONETARY AND FINANCIAL COMMITTEE. Attendance. October 14, 2017

Chairman

Agustín Carstens, Governor, Bank of Mexico

Managing Director

Christine Lagarde

Members or Alternates

Mohammed Aljadaan, Minister of Finance, Saudi Arabia

Obaid Humaid Al Tayer, Minister of State for Financial Affairs, United Arab Emirates

Haruhiko Kuroda, Governor, Bank of Japan

(Alternate for Taro Aso, Deputy Prime Minister, Minister of Finance and Minister of State for Financial

Services, Japan)

Nicolás Dujovne, Minister of the Treasury, Argentina

Malusi Gigaba, Minister of Finance, South Africa

Philip Hammond MP, Chancellor of the Exchequer, United Kingdom

Ardo Hansson, Governor, Bank of Estonia

Arun Jaitley, Minister of Finance, India

Dong Yeon Kim, Deputy Prime Minister and Minister of Strategy and Finance, Korea

Bruno Le Maire, Minister for the Economy and Finance, France

Mohamed Loukal, Governor, Bank of Algeria

Ueli Maurer, Head of the Federal Department of Finance, Switzerland

José Antonio Meade, Secretary of Finance and Public Credit of Mexico

Henrique Meirelles, Minister of Finance, Brazil

Alamine Ousmane Mey, Minister of Finance of the Republic of Cameroon

Steven T. Mnuchin, Secretary of the Treasury, United States

Bill Morneau, Minister of Finance, Canada

Pier Carlo Padoan, Minister of Economy and Finance, Italy

Jiří Rusnok, Governor, Czech National Bank, Czech Republic

Wolfgang Schäuble, Federal Minister of Finance, Germany

Tharman Shanmugaratnam, Deputy Prime Minister & Coordinating Minister for Economic and

Social Policies, Singapore

Anton Siluanov, Minister of Finance, Russian Federation

Johan van Overtveldt, Minister of Finance, Belgium

Xiaochuan Zhou, Governor, People's Bank of China

Observers

Jaime Caruana, General Manager, Bank for International Settlements (BIS)

Sri Mulyani Indrawati, Chairman, Development Committee (DC)

Valdis Dombrovskis, Vice-President, European Commission (EC)

Mario Draghi, President, European Central Bank (ECB)

Mark Carney, Chairman, Financial Stability Board (FSB)

Deborah Greenfield, Deputy Director-General for Policy, International Labour Organization (ILO)

Angel Gurria, Secretary-General, The Organisation for Economic Co-operation and Development (OECD)

Ayed S. Al-Qahtani, Director, Research Division, Organization of the Petroleum Exporting Countries

(OPEC)

Achim Steiner, Administrator of the United Nations Development Programme and Chair of the United

Nations Development Group

Richard Kozul-Wright, Director, Division on Globalization and Development Strategies, United Nations

Conference on Trade and Development (UNCTAD)

Ayhan Kose, Director, Development Economics Prospects Group, The World Bank (WB)

Roberto Azevêdo, Director-General, World Trade Organization (WTO)

ECONOMY

BANK OF CANADA. October 16, 2017. Business Outlook Survey - Autumn 2017. Results of the Autumn 2017 Survey

Results from the autumn Business Outlook Survey point to continued positive business sentiment across the country, with business activity becoming entrenched. Firms’ prospects remain healthy, although several survey indicators have moderated from the strong summer results.

Overview

After recovering in the summer survey, the balance of opinion on past sales growth edged down but remains positive (Chart 1). While sales activity accelerated for the first time since the energy downturn for firms in affected regions, some businesses experienced a moderation in growth after a strong year. Prospects for the coming 12 months remain robust; a large majority of firms foresee a rise in sales volumes, with some further pickup in sales growth (Chart 2, blue bars), suggesting that growth is becoming entrenched. For domestic sales, a number of firms expect a return to a more sustainable pace (in housing, retail trade and tourism, for example). Following recent restructuring efforts in the energy sector, affected firms are cautiously optimistic about their sales prospects, as a turnaround in activity is starting to be felt in the related supply chain. The sales outlook is backed by yet another widespread year-over-year improvement in indicators of future sales (Chart 2, red line and Box 1).

- Building on solid results in the summer, responses to the autumn survey reflect expectations for sustained sales growth across regions, with firms in some sectors anticipating a return to a more sustainable pace. Overall positive sales prospects rest on an ongoing turnaround of activity in energy-producing regions and supportive foreign demand.

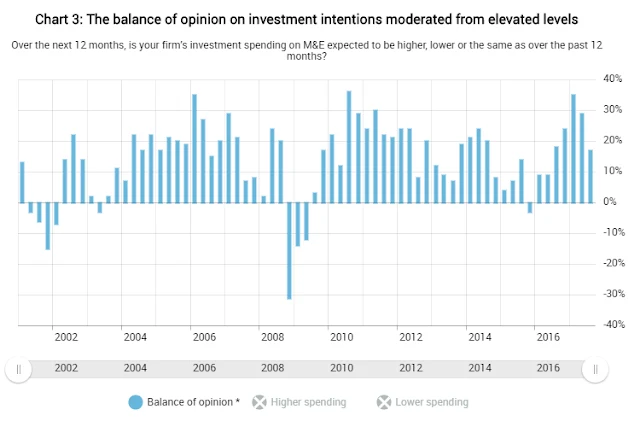

- Investment and employment indicators softened from recent highs, pointing to continued, though somewhat less widespread, plans to increase investment and hiring.

- There is a generalized view among firms that capacity and labour market pressures have intensified over the past year, suggesting that slack is being absorbed amid robust demand. That said, difficulties in meeting demand and reports of binding labour shortages are not yet widespread.

- Expectations for growth of input and output prices are stable, as an uptick in costs for labour and non-commodity inputs is offset by the recent appreciation of the Canadian dollar. After two years of little change, inflation expectations moved up but remain modest overall.

- Credit conditions, beyond the increase in the policy rate, are unchanged; for the majority of firms, access to credit remains easy, or relatively easy.

- The Business Outlook Survey indicator, which summarizes the survey results, declined from its high level in the summer survey but remains positive and continues to point to healthy business sentiment.

After recovering in the summer survey, the balance of opinion on past sales growth edged down but remains positive (Chart 1). While sales activity accelerated for the first time since the energy downturn for firms in affected regions, some businesses experienced a moderation in growth after a strong year. Prospects for the coming 12 months remain robust; a large majority of firms foresee a rise in sales volumes, with some further pickup in sales growth (Chart 2, blue bars), suggesting that growth is becoming entrenched. For domestic sales, a number of firms expect a return to a more sustainable pace (in housing, retail trade and tourism, for example). Following recent restructuring efforts in the energy sector, affected firms are cautiously optimistic about their sales prospects, as a turnaround in activity is starting to be felt in the related supply chain. The sales outlook is backed by yet another widespread year-over-year improvement in indicators of future sales (Chart 2, red line and Box 1).

Foreign demand is also providing a lift to export prospects, with firms reporting improved orders from foreign customers compared with 12 months ago. Expectations for US growth have moderated somewhat from recent surveys, but respondents expect foreign demand for commodities and the still-supportive level of the Canadian dollar to underpin their exports. Despite lingering uncertainty about US policies, most firms reported no impact on the outlook for their business.

* Percentage of firms reporting faster growth minus the percentage reporting slower growth

* Percentage of firms expecting faster growth minus the percentage expecting slower growth

** Percentage of firms reporting that indicators have improved minus the percentage reporting that indicators have deteriorated

* Percentage of firms expecting higher investment minus the percentage expecting lower investment

The indicator of employment intentions fell back after surging in the summer survey (Chart 4). Hiring intentions nevertheless remain positive across all regions and continue to be elevated in the service sector, where firms often cited sound demand as a reason for adding staff. At the same time, hiring intentions in the goods sector have moderated, following the recovery observed in previous surveys.

Pressures on Production Capacity

After increasing in the summer survey, the indicator of capacity pressures is roughly unchanged (Chart 5). Although the degree of slack differs across regions, there is a widespread view that capacity pressures have increased over the past 12 months, and, on balance, firms expect pressures to intensify over the next year. Capacity constraints are more prevalent in the goods sector: as in the summer survey, firms most often referred to sales growth and labour-related constraints as reasons for difficulties in responding to an unexpected increase in demand.

Firms are increasingly reporting that labour shortages are more intense than a year ago, pushing the indicator of labour shortage intensity to its highest level since the 2008–09 recession (Chart 6, red line). Reports of more intense shortages are prevalent across all regions and sectors, pointing to tightening labour markets. Yet, the number of firms judging that such shortages are limiting their ability to meet demand is unchanged and remains modest overall (Chart 6, blue bars). Slack remains in energy-producing regions, and, so far, binding shortages are prevalent only in hot sectors such as tourism, construction and information technology, where some firms reported raising wages in response. Finding talent in more remote areas and replacing retirees are also challenges for some firms.

After increasing in the summer survey, the indicator of capacity pressures is roughly unchanged (Chart 5). Although the degree of slack differs across regions, there is a widespread view that capacity pressures have increased over the past 12 months, and, on balance, firms expect pressures to intensify over the next year. Capacity constraints are more prevalent in the goods sector: as in the summer survey, firms most often referred to sales growth and labour-related constraints as reasons for difficulties in responding to an unexpected increase in demand.

Firms are increasingly reporting that labour shortages are more intense than a year ago, pushing the indicator of labour shortage intensity to its highest level since the 2008–09 recession (Chart 6, red line). Reports of more intense shortages are prevalent across all regions and sectors, pointing to tightening labour markets. Yet, the number of firms judging that such shortages are limiting their ability to meet demand is unchanged and remains modest overall (Chart 6, blue bars). Slack remains in energy-producing regions, and, so far, binding shortages are prevalent only in hot sectors such as tourism, construction and information technology, where some firms reported raising wages in response. Finding talent in more remote areas and replacing retirees are also challenges for some firms.

* Percentage of firms reporting more intense labour shortages minus the percentage reporting less intense shortages

Note: The summer 2006 results are not strictly comparable with those of the other surveys, owing to a difference in the interview process for that survey.

Note: The summer 2006 results are not strictly comparable with those of the other surveys, owing to a difference in the interview process for that survey.

Prices and Inflation

Firms expect input price growth to remain similar to that observed over the past 12 months, as indicated by the zero balance of opinion (Chart 7). The majority expect no change in the pace of input cost growth, although several firms, particularly in Western Canada, cited a pickup in prices of non-commodity inputs such as subcontractor prices. However, some offset to increasing costs is coming from lower prices for imported inputs due to the recent appreciation of the Canadian dollar.

* Percentage of firms expecting greater price increases minus the percentage expecting lesser price increases

The balance of opinion on output prices also fell to zero in the autumn survey (Chart 8), implying stable output price growth ahead. Several firms plan to pass on lower costs for imported inputs to their customers, and exporters now receive lower export prices expressed in Canadian dollars. These downward pressures on sales prices from the recent appreciation are partly offset by emerging labour cost pass-through. Some businesses also sense that demand is firm enough to support upcoming price increases.

* Percentage of firms expecting greater price increases minus the percentage expecting lesser price increases

* Percentage of firms expecting greater price increases minus the percentage expecting lesser price increases

For the first time since the energy downturn, inflation expectations marked a small gain (Chart 9), with somewhat more firms expecting consumer price growth to be in the upper half of the Bank’s inflation-control range. Although still the minority, these firms referred to a strong economy and minimum wage increases as contributing factors. Most respondents still expect below 2 per cent price growth, based on the recent trend in inflation.

Credit Conditions

As in recent surveys, credit conditions remained unchanged, beyond the direct effect of the increase in policy rates (Chart 10).1 Some firms, particularly small and medium-sized firms in industries related to commodities and real estate, reported higher borrowing costs or tighter non-price conditions. Meanwhile, a few others cited more favourable borrowing rates or an improvement in market receptiveness to new issuance of debt or equity, which they often attributed to a recent improvement in their performance.

* Percentage of firms reporting tightened minus the percentage reporting eased. For this question, the balance of opinion excludes firms that responded “not applicable.”

Business Outlook Survey Indicator

The Business Outlook Survey (BOS) indicator, a summary measure of the main survey questions, decreased from its elevated level in the summer survey (Chart 11). It remains positive, however, with several BOS survey questions holding above their historical averages, indicating that business sentiment continues to be healthy overall.

* The BOS indicator extracts common movements from the main BOS questions. For a description and interpretation of the indicator, see Box 1 in the Spring 2017 Business Outlook Survey and L. Pichette and L. Rennison “Extracting Information from the Business Outlook Survey: A Principal-Component Approach,” Bank of Canada Review (Autumn 2011): 21–28.

Box 1: A Generalized Improvement in Indicators of Future Sales Points to Sustained Growth Ahead

Firms participating in the Business Outlook Survey are asked to evaluate how their indicators of future sales (such as order books, advance bookings and sales inquiries) have changed compared with 12 months ago (Chart 2, red line). The aggregate indicator is therefore based on firms’ concrete signs of future sales activity. It shows a strong forward-looking correlation with GDP growth, providing useful signals for future trends in economic activity.2

In the autumn survey, the balance of opinion on indicators of future sales remained firmly positive, edging down only slightly from the historical high reached in the summer survey. Firms cited a building backlog of work, more calls and interest from clients, lower vacancy rates, new business or product lines, and new markets or customers. Some also mentioned an uptick in sales after consolidation in their industry or returns on their own efforts to seize business opportunities.

Nevertheless, some caution persists. A few firms believe that the comeback in energy-related activity is tapering off or that oil prices below US$50 per barrel are still too low to foster optimism. Potential policies and protectionist sentiments south of the border also remain a concern. A couple of firms also expressed unease about the housing market outlook amid rising mortgage rates and stricter regulations.

Breaking down the results by region or sector provides a clearer illustration of the drivers and dynamics of firms’ sales indicators. Chart 1-A shows the contributions to the overall balance of opinion by region. While the Prairies were a drag on the overall result for much of the energy downturn, firms in this region reported a net improvement in more recent surveys with the turnaround in the energy sector. In fact, all regions are now aligned to contribute positively. Similarly, analysis by sector provides evidence that all sectors are participating in the recent upswing (Chart 1-B). Taken together, the results show a generalized upturn in sales prospects and point to sustained GDP growth ahead.

* Percentage of firms reporting that recent indicators have improved compared with 12 months ago minus the percentage of firms reporting that indicators have deteriorated.

* Percentage of firms reporting that recent indicators have improved compared with 12 months ago minus the percentage of firms reporting that indicators have deteriorated.

Note: Regional and sectoral results rely on a small sample size.

The Business Outlook Survey summarizes interviews conducted by the Bank’s regional offices with the senior management of about 100 firms selected in accordance with the composition of the gross domestic product of Canada’s business sector. This survey was conducted from August 24 to September 19, 2017. The balance of opinion can vary between +100 and -100. Percentages may not add to 100 because of rounding. Additional information on the survey and its content is available on the Bank of Canada’s website. The survey results summarize opinions expressed by the respondents and do not necessarily reflect the views of the Bank of Canada.

Notes

- As in the Senior Loan Officer Survey, firms are asked about the cost of credit, expressed as spreads over base rates rather than as the level of rates. Thus, if borrowing costs increase by no more than the recent increase in the policy rate (meaning that the spread over the prime rate is unchanged), credit conditions as reported in the survey are unchanged.

- For background information on this series, see the Backgrounder on the Business Outlook Survey Question on Future Sales Indicators

THE GLOBE AND MAIL. THE CANADIAN PRESS. OCTOBER 16, 2017. ECONOMY. Canadian businesses still bullish despite U.S. worries, rising rates: BoC

FRED CHARTRAND

BARRIE MCKENNA

OTTAWA - Businesses in Canada remain bullish about their prospects, shaking off concerns about U.S. protectionism, rising interest rates and still-low energy prices, according to the Bank of Canada's fall business outlook survey.

The mood has cooled from the summer, but the results still "point to continued positive business sentiment across the country, with business activity becoming entrenched," according to the report, released Monday.

The bank characterized business sentiment as "healthy overall."

Companies remain generally upbeat about future sales, investment and hiring, according to the survey of senior managers from 100 businesses across the country, conducted Aug. 24 to Sept. Sept. 19.

"Capacity and labour market pressures have intensified over the past year, suggesting that slack is being absorbed amid robust demand," the bank said.

The business outlook survey is one of the last pieces of information Governor Stephen Poloz and his central bank colleagues take in before their next scheduled interest rate-setting announcement Oct. 25. The bank has raised its key interest rate twice so far this year – a total of half a percentage-point to one per cent – and financial markets are expecting one more hike between now and January.

Among the highlights of the survey:

- 63 per cent of respondents said orders and other future sales prospects have improved versus 8 per cent reporting a deterioration. The rest reported no change.

- 42 per cent said their pace of sales growth will pick over the next year, compared to 23 per cent who expect slower sales growth. Thirty-five per cent expect no change.

- Businesses in the energy-producing provinces reported higher sales activity for the first time since the 2015 oil price collapse.

- 41 per cent of companies expect to spend more on machinery and equipment over the next 12 months versus 24 per cent who intend to invest less. The rest expect no change.

- 48 per cent of respondents expect to add workers over the next year, compared to just 14 per cent who expect to cut their workforce. The rest expect no change.

- 47 per cent of companies say they will have difficulty meeting demand in the next 12 months.

A separate survey of loan officers, also released Monday, shows "virtually unchanged" business lending conditions.

THE GLOBE AND MAIL. THE CANADIAN PRESS. OCTOBER 14, 2017. BoC’s Poloz says Canada's growth to slow down in second half of 2017

FRED CHARTRAND

JOSH WINGROVE

WASHINGTON - Canadian growth will moderate in the second half of the year, as the Bank of Canada remains in "intense data-dependent mode" in its consideration of whether to raise interest rates again at a time inflation is sluggish, Governor Stephen Poloz said.

Poloz, speaking to reporters Saturday in Washington, said there's a sense of "comfort" that the global economy continues to improve while adding that Canada, which is leading the Group of Seven in growth, has not seen all citizens benefit equally.

"It still hasn't reached everybody," Poloz said. "We're still an economy with, you know, with our head in the oven and our feet in the freezer."

For those people who haven't benefited, it "doesn't resonate with them if you say everything's on track. And it's almost always that way with Canada and it's almost always that way with the world."

Poloz has twice raised rates this year, and plans to proceed "cautiously" while assessing the impact of the moves. The bank's next rate decision is scheduled for Oct. 25, with markets reflecting about a one-third chance of another increase, data compiled by Bloomberg show.

'Data-Dependent'

Poloz characterized this year's rate increases as having offset two cuts made to buffer the economy when global oil prices were falling sharply. The adjustment to the oil-price shock is now "behind us" in Canada, he said, when asked about rates.

The policy maker spoke on the sidelines of International Monetary Fund meetings in Washington while a fourth round of talks toward an overhauled North American Free Trade Agreement continued at a nearby hotel.

It's difficult to analyze the impact on the Canadian economy if the U.S. were to leave Nafta, as President Donald Trump has regularly threatened, Poloz said. The impacts could vary substantially by sector, he said, while rippling through the whole economy.

"We've got to wait and see what shock we're presented with," he said. "Trade is a really important driver for our economy." The negotiations, along with this year's interest-rate hikes, remain "sources of angst" for some Canadians, Poloz said.

An "element of speculation" in the popular Toronto and Vancouver housing markets looks like it's dissipated, Poloz said, though he said demand remains strong in both cities and that supply is probably not growing fast enough to keep up.

Supply, Demand

"What we do know is the laws of demand and supply have not been repealed," he said. "The ingredients remain in place, so you have to continue to watch that financial stability risk, as we will."

Canada's strong economy and associated employment and wage growth have mitigated the financial stability risk of a hot housing market by giving people more money to pay their bills, he said.

The nation has seen an uptick in investment and hiring intentions, he said, which is "positive for productivity." He downplayed concerns about sluggish inflation.

Growth is allowing many Canadians to find work in their fields, opening up other positions, and boosting productivity, he said, adding that wages don't always "move much" during this stage of the economic cycle. Those developments, over time, will "push out" what Poloz called the intersection between full capacity and his target for 2 percent inflation.

This is a "sweet spot of the cycle where you're actually creating new capacity which is permanent," he said.

Inflation MIA?

"It's one of the things that I'm often puzzled about, is how many folks are writing about how inflation's been missing in action and all that. Well, that's exactly what happens at this stage of the cycle. It's pushed out further. And that's a good thing."

Growth has been driven in part by the fiscal policy of Prime Minister Justin Trudeau's government, which is running budget deficits to finance, in part, expanded child benefit payments aimed at low-income families.

The so-called Canada Child Benefit has had a "pretty significant" impact on the Canadian economy, Poloz said, adding it could be one of the reasons Canada has seen rising labor-force participation. "What it did is put a floor under some folks," Polozsaid, adding it may have allowed formerly stay-at-home parents to afford childcare or a second car and therefore more easily reenter the workforce.

REUTERS. OCTOBER 16, 2017. Bank of Canada third quarter business survey eases, but firms optimistic

Andrea Hopkins, Leah Schnurr

OTTAWA (Reuters) - Canadian companies are optimistic about future sales and there is a general view that capacity and labor market pressures have intensified over the past year, suggesting slack is being absorbed amid robust demand, the Bank of Canada said on Monday.

While Canadian business sentiment is positive, investment and employment indicators softened from recent highs, pointing to less widespread plans to increase investment and hiring, the central bank said in its quarterly Business Outlook Survey.

“Prospects for the coming 12 months remain robust; a large majority of firms foresee a rise in sales volumes, with some further pickup in sales growth, suggesting that growth is becoming entrenched,” the bank said.

For the first time since the energy downturn, inflation expectations moved up but remain modest overall, the survey showed, as higher costs for labor and non-commodity inputs were offset by the recent strengthening of the Canadian dollar.

While firms reported that labor shortages are more intense than a year ago, pushing the labor shortage intensity to its highest point since the 2008-09 recession, difficulties in meeting demand and reports of binding labor shortages are not yet widespread, the bank said.

“Although the degree of slack differs across regions, there is a widespread view that capacity pressures have increased over the past 12 months, and, on balance, firms expect pressures to intensify over the next year,” the bank said in the survey.

Somewhat more firms expect consumer price growth to be in the upper half of the bank’s inflation control range, based on a strong economic growth and minimum wage increases, though that is a minority view. Most respondents still expect price growth to be below 2 percent, based on the recent trend in inflation, the bank said.

Foreign demand is providing a lift to export prospects, with firms reporting improved orders from abroad compared to 12 months ago. While expectations for U.S. growth have moderated, respondents expect demand for commodities and the “still-supportive” level of the Canadian dollar to underpin exports.

“Despite lingering uncertainty about U.S. policies, most firms reported no impact on the outlook for their business,” the survey said.

Reporting by Andrea Hopkins and Leah Schnurr; Editing by Marguerita Choy

BLOOMBERG. 16 October 2017. Poloz Says Canada’s Economy Entered ‘Sweet Part’ of Business Cycle

By Josh Wingrove and Theophilos Argitis

- Governor puzzled by claims that inflation ‘missing in action’

- Bank of Canada is in intense data-dependent mode: Poloz

Canada’s economy may be entering into a “sweet part” of the business cycle where it can run at a faster pace without triggering inflation pressure, Bank of Canada Governor Stephen Poloz said.

Poloz, speaking to reporters Saturday in Washington, said there are signs investment could become a more important part of the growth story. Such spending not only fuels the expansion, but at the same time grows the economy’s production capacity and potentially helps to mitigate inflation, he said.

“It’s one of the things I’m often puzzled about, is how many folks are writing about how inflation’s been missing in action and all that,” Poloz said, adding any increase in potential growth could be temporary. “Well, that’s exactly what happens at this stage of the cycle. It’s pushed out further and that’s a good thing.”

While the Bank of Canada has forged ahead with two interest rate increases since July, policy makers have more recently conveyed a message of caution that’s prompted investors to pare expectations for how quickly they will continue hiking. The bank’s next rate decision is scheduled for Oct. 25, with markets reflecting about a one-third chance of another increase, data compiled by Bloomberg show.

Poloz has cited “heightened uncertainty” about the economic outlook and inflation, and, like the Federal Reserve, the Bank of Canada has tightening with little sign of inflationary pressure, a vote of confidence in a framework that assumes a predictable relationship between inflation and the output gap.

In Washington, Poloz reiterated his confidence in these models and said it may be faster-than-expected capacity growth -- which gives the economy more room to expand -- that explains why analysts are overestimating inflation.

Not Broken

“Inflation models for sure are not broken. They’ve always done a good job and continue to do a good job,” Poloz said. “You always overestimate inflation at this stage of the cycle. It’s good because it’s the sweet part of the cycle, where you’re actually creating new capacity which is permanent. It’s a very positive thing.”

The nation has seen an uptick in investment and hiring intentions which is “positive for productivity,” Poloz said. Growth is allowing many Canadians to find work in their fields, opening up other positions and boosting productivity, and wages don’t always “move much” during this stage of the economic cycle, the governor said.

Those developments, over time, will “push out” what Poloz called the intersection between full capacity and his target for 2 percent inflation.

Growth has been driven in part by the fiscal policy of Prime Minister Justin Trudeau’s government, which is running budget deficits to finance, in part, expanded child benefit payments aimed at low-income families.

The Canada Child Benefit has had a “pretty significant” impact on the economy, Poloz said, adding it could be one of the reasons the country has seen rising labor-force participation. “What it did is put a floor under some folks,” Poloz said, adding it may have allowed formerly stay-at-home parents to afford childcare or a second car and therefore more easily re-enter the workforce.

Rate Hikes

Poloz characterized this year’s rate increases as having offset the two cuts made in 2015 to buffer the economy when global oil prices were falling sharply. The adjustment to the oil-price shock is now “behind us” in Canada, he said, when asked about rates.

From here on, the Bank of Canada will be in “intense data-dependent mode,” said Poloz, who objected to the characterization by one reporter of his monetary policy as being on a “tightening” path.

“Well, I don’t think we’ve ever said anything like that. Have we?" he said. “We’ve taken those two cuts off the table and what we’ve said is we’re in the intense data-dependent mode,” Poloz said. “We’ve gone to some lengths in my speech just a couple weeks ago to explain what data dependence actually means.”

Slower Growth

Canadian growth will moderate in the second half of the year, Poloz said, and will eventually slow down to its potential growth rate in line with long-term fundamentals such as demographics.

There’s a sense of “comfort” that the global economy continues to improve, he said, while adding Canada, which is leading the Group of Seven in growth, hasn’t seen all citizens benefit equally.

“We’re still an economy with, you know, with our head in the oven and our feet in the freezer,” he said.

For those people who haven’t benefited, it “doesn’t resonate with them if you say everything’s on track. And it’s almost always that way with Canada and it’s almost always that way with the world.”

The policy maker spoke on the sidelines of International Monetary Fund meetings in Washington while a fourth round of talks toward an overhauled North American Free Trade Agreement continued at a nearby hotel.

Nafta Talks

It’s difficult to analyze the impact on the Canadian economy if the U.S. were to leave Nafta, as President Donald Trump has regularly threatened, Poloz said. The impacts could vary substantially by sector, he said, while rippling through the whole economy.

“We’ve got to wait and see what shock we’re presented with,” he said. “Trade is a really important driver for our economy.” The negotiations, along with this year’s interest-rate hikes, remain “sources of angst” for some Canadians, Poloz said.

On housing, Poloz said an “element of speculation” in the popular Toronto and Vancouver housing markets looks like it’s dissipated, though demand remains strong in both cities and supply is probably not growing fast enough to keep up.

“What we do know is the laws of demand and supply have not been repealed,” he said. “The ingredients remain in place, so you have to continue to watch that financial stability risk, as we will.”

NAFTA

The Globe and Mail. 16 Oct 2017. White House lays out NAFTA agenda. Demands include rules on U.S. content in vehicles, weakening the dispute-resolution system and five-year kill switch on deal

ADRIAN MORROW

The Trump administration has thrown down all of its major demands in the renegotiation of the North American free-trade agreement, pushing for sweeping protectionist changes that would decisively tilt the playing field in favour of the United States at the expense of Canada and Mexico.

In the fourth and most substantial round of talks so far, at a Washington-area hotel, American negotiators formally presented demands for U.S. content in autos, the gutting of the deal’s dispute-resolution system and a sunset clause that would terminate NAFTA in five years unless the three countries agree to keep it. The United States had previously laid out a demand to restrict Canadian and Mexican access to American government contracts.

The United States also privately acknowledged that its deadline for finishing discussions by the end of the year might be unrealistic. One source said U.S. officials floated scheduling negotiations as late as February, 2018, to their Canadian and Mexican counterparts.

But while the U.S. agenda has been spelled out in detail, the White House’s ultimate aim remains murky.

Government officials, members of industry and expert observers could not agree whether the United States’ tough demands are designed to extract concessions or provoke the collapse of talks.

One source contended the United States itself does not know and is simply throwing out as many demands as possible while it tries to sort out a plan. Another person, who had been briefed on the American negotiating position, said the United States seems content with either a revised deal or tearing up NAFTA. “It’s ‘my way or the highway.’ Both options would be acceptable,” this person said.

Both Canada and Mexico are determined to hold the line against the U.S. onslaught and not walk away from the table, the sources said. The aim is to keep the ball squarely in the United States’ court, forcing the Trump administration to decide whether it is willing to bargain down to make a deal or make good on threats to tear up the pact.

On Sunday night, Mexican Economy Secretary Ildefonso Guajardo visited the hotel for a closed-door pep talk with his negotiating team. Loud cheering and applause could be heard from the room as he spoke.

“Mexico will not leave the table,” he told reporters after emerging from the session.

For now, the toughest sessions mostly consist of Canadian and Mexican negotiators trying to convince their U.S. counterparts that their positions are bad and would hurt the economies of all three countries, one source said.

The American demands are so protectionist that even the U.S. trade negotiators, mostly career civil servants rather than political staff, often do not seem to agree with them, said two people briefed on the talks. One person said U.S. officials will often simply present the proposals but not make much effort to defend their merits when challenged by Canadian and Mexican counterparts. Another person said some U.S. negotiators have tried to distance themselves from the demands by explaining they are only following the White House’s orders.

Flavio Volpe, president of the Automotive Parts Manufacturers Association, said the U.S. demands were designed to knock Canada off its game in hopes of either triggering concessions or the collapse of the talks.

He predicted they would not succeed.

“The [American] proposals appear to be geared to sow an emotional response from Canada and Mexico. I was reminded that it’s a negotiation, and I think they will learn about us in our response,” said Mr. Volpe, who was in Washington to advise the Canadian government.

In an Oval Office meeting with Prime Minister Justin Trudeau on Wednesday, the first day of the current round of negotiations, U.S. President Donald Trump threatened to pull out of NAFTA.

But some stakeholders dismissed much of Mr. Trump’s rhetoric as negotiating bluster.

“There’s a lot of posturing,” Ken Neumann, Canadian director of the United Steelworkers, said in an interview at the union’s Washington office as negotiations unfolded across the river. “When you get up in the morning and listen to Twitter, it doesn’t quite translate into what the real world’s all about.”

Congress could also prove a check on Mr. Trump’s ability to shred NAFTA: If Mr. Trump pulled out of the deal, legislators would likely have to pass a law repealing its provisions, such as lower tariffs. And members of the House ways and means committee, which handles trade, expressed no interest in blowing up the deal.

“We didn’t talk about anything imploding,” said Dave Reichert, a Washington State Republican who chairs the trade subcommittee, following a meeting with Mr. Trudeau Wednesday. “We’re just talking about looking forward to having an agreement that benefits the people who live in Canada, the United States and Mexico.”

Negotiations continue Monday. On Tuesday, Canadian Foreign Minister Chrystia Freeland, Mr. Guajardo and U.S. Trade Representative Robert Lighthizer will meet in Washington to conclude this round. The three sides will reconvene in Mexico City later this month.

The top American demand in this round was that vehicles made in Canada and Mexico contain at least 50-per-cent U.S. content in order to qualify for duty-free shipment throughout the NAFTA zone, a requirement that would not apply to vehicles made in the United States, while North American content in all NAFTA zone autos would rise from 62.5 per cent to 85 per cent and every component of a vehicle – down to the steel – would count toward that total.

The United States also formally demanded countries be allowed to opt out of Chapter 11 dispute-resolution panels, which allow corporations to sue governments for political decisions that hurt their business; and that Chapter 20 panels, which adjudicate trade disputes between governments, be demoted to an advisory role, allowing a losing country to disregard their decisions and retaliate against the other country.

The Globe and Mail. 16 Oct 2017. ARTICLE. What Canadian business leaders want in a new NAFTA

DAVID HERLE

ALEX SWANN

David Herle and Alex Swann are principals at the Gandalf Group.

After Donald Trump was elected President, Canadian business leaders treated his commitment to renegotiate or scrap the North American free-trade agreement as the same kind of political rhetoric they had heard before from Bill Clinton, Barack Obama and Jean Chrétien. It was assumed Mr. Trump would tweak the agreement to say he had changed it, but leave it fundamentally in place.

Executives are now worried he was much more serious than they had hoped. Canadian business now thinks major changes as it relates to Canada are in the offing, and complete termination of the agreement is not unthinkable.

This worry may be one reason why Canadian business leaders are not more positive about the economy. The vast majority think the economy will grow over the next year. However, despite better than expected results recently, and forecasts for future growth being revised up, very few Canadian executives think the economy will grow strongly. We know from years of research with the C-Suite that the U.S. market remains uppermost in the minds of most Canadian businesses, and NAFTA is seen as a key piece of that.

For that reason, the priorities of Canadian business are to protect and enhance NAFTA, while the Trump administration is coming at this from a protectionist point of view.

Arguably the most important element for Canada is maintaining the trade agreement’s “Chapter 19” dispute-settlement mechanism. There is unanimity in the C-Suite that Canada must insist on this. Even if significant concessions were offered by the United States in exchange for scrapping the mechanism, the C-Suite would be loath to give it up. It has been core to Canadian interests from the beginning, when Brian Mulroney insisted on it in 1988 over U.S. objections, and personally intervened with Ronald Reagan to get it included.

Beyond that, there is a clear hierarchy of C-Suite objectives for a redesigned NAFTA. Few care strongly about protecting supply management and exemptions for Canadian cultural industries, or ensuring a common minimum wage.

The top priorities are clear. Canadian business wants access to government procurement in the United States, and want to remove the spectre of “Buy America” policies that have been floating around state capitals. And the C-Suite wants a freer flow of workers across borders, with more professions eligible for ready access to work visas.

The C-Suite is interested in ensuring a level playing field on the environment. They are not advocating for the lowest possible bar, but standards for all three countries to live up to a commitment by all NAFTA partners to fight climate change. Perhaps this is because they sense Canada is on an irrevocable path to greenhouse gas reduction commitments and they want to ensure NAFTA partners come along. Perhaps the C-Suite believes the world needs strong action on the environment. Either way, it is one of several ways in which the Canadian business agenda for NAFTA is very different from what the Trump administration brings to the table.

The Globe and Mail. 16 Oct 2017. ARTICLE. Interest rate hikes and NAFTA talks are among executives’ biggest fears

WILLY KRUH, KPMG’s global chairman of consumer markets

After years of unprecedentedly low interest rates, the Bank of Canada made the decision this summer to raise its key rate on two occasions. While historically a rate of 1 per cent is incredibly low, raising it further is giving Canada’s business community concern.

With speculation that the central bank could raise rates again this year, we have to go back all the way to January, 2009, to find the last time it was above 1 per cent. This means Canadian consumers and businesses have been benefiting from near-zero lending rates for almost nine years. Bank prime was 4.5 per cent just prior to that – a number that seems unfathomable to many today.

Canada’s C-Suite thinks the recent hikes will hurt their bottom line and more than two-thirds oppose further increases. On top of the C-Suite’s concern for their own companies has to be concern about the health of Canadian consumers. With long-term low rates, consumers did exactly what the Bank of Canada wanted us to do – borrow and spend to get our economy out of the recession. But years of cheap money also meant we racked up debt at a record rate and today, for every dollar of household disposable income, Canadians hold a staggering $1.68 in debt.

While a half-percentage-point climb in mortgage rates isn’t likely going to lead to a slew of defaults, it does mean consumers will have less money to spend elsewhere. Those recent hikes mean the annual cost of carrying a $500,000 mortgage went up $2,500 and, when added to higher payments to cover car loans, lines of credit and other debt, consumers are feeling the financial squeeze. With consumer spending representing close to 60 per cent of Canadian GDP, this is a dangerous tightrope to walk.

Canadian business leaders are also starting to worry about where the United States is headed on NAFTA negotiations. In March, there was a near unanimous viewpoint by the C-Suite that the U.S. administration would seek only minor tweaks. Now, seven in 10 believe there will be major changes to the deal and 40 per cent think it’s somewhat likely the United States will terminate NAFTA altogether.

While only time will tell where the negotiations will land, the risk that NAFTA will be torn up should be a wake-up call to Canadian business about the long overdue need to diversify our trade globally. I had hoped that following a financial crisis that nearly crippled the United States and much of the global economy we would have seen more domestic firms get serious about venturing outside of Canada and trading with other markets, but that just hasn’t happened. According to Statistics Canada, in 2011, 72 per cent of Canada’s exports went to the United States. By 2016, that increased to 75 per cent. In absolute terms, the value of exports to the United States climbed about $63-billion over that period and by less than $2-billion with the rest of the world.

I believe the United States will always be our largest trading partner and greatest friend, but Canadian businesses have to look stateside far more often than they do now. Today, Canada has 11 freetrade agreements currently in force outside of NAFTA – but you wouldn’t know it looking at the current percentage of trade with the United States. The new CanadaEuropean Union Comprehensive Economic and Trade Agreement (CETA) holds great promise. Currently, this market represents only about 8 per cent of our exports. The Trans-Pacific Partnership (TPP) also holds great promise, with or without the United States.

No matter what the outcome of the NAFTA negotiations, the issues and rhetoric that have clouded these talks clearly demonstrate the perils of relying mainly on one trade partner.

The Globe and Mail. 16 Oct 2017. ARTICLE. Why a new NAFTA needs strong digital protections

GARY SHAPIRO, President and CEO of the Consumer Technology Association, which represents more than 2,200 consumer technology companies

Renegotiating NAFTA presents an opportunity to craft effective liability and safe-harbour measures on an international level that will hold users accountable and allow companies that host digital content to invest in new jobs instead of legal fees.

When U.S. president Bill Clinton, Canadian prime minister Brian Mulroney and Mexican president Carlos Salinas signed the North American free-trade agreement in 1993, it was hailed as a triumph of co-operation and communication – a model trade deal allowing an open exchange of goods, services and prosperity among Mexico, Canada and the United States.

But NAFTA 1.0 precipitated a major cornerstone for communication, co-operation and prosperity – the Internet, which supported international creativity, collaboration, innovation and commerce. As negotiators continue to meet in Washington, we must affirm our commitment to digital technology, the critical underpinning of the 21st-century economy. In an updated NAFTA, there are several key considerations negotiators should pursue. Reducing barriers to digital trade NAFTA makes no mention of digital trade, which – given that the United States exports $400-billion (U.S.) in technology services – seems like an oversight. Except it wasn’t: The first digital purchase wasn’t made until 1994, after NAFTA went into effect.

Creating a supportive environment for digital trade involves prohibiting customs duties on digital content and preventing forced data localization. This not only allows information to flow freely between borders, it enables Canadian and U.S. businesses to seize the opportunities from cloud computing, which relies on distributed computing resources.

It also means establishing predictable liability protections, so that online platforms can facilitate communications without being made to be a censor or artificial gatekeeper. We saw this play out in domestic U.S. politics with the 2012 SOPA/PIPA protests, when millions of people stood against over-broad anti-piracy laws that had the potential to shut down many popular sites.

Renegotiating NAFTA presents an opportunity to craft effective liability and safe-harbour measures on an international level that will hold users accountable and allow companies that host digital content to invest in new jobs instead of legal fees. We should also resist the trend, emerging in Europe, of requiring Internet companies to take worldwide actions that harm consumers and innovation based on requirements of a single country or jurisdiction. Protecting the rights of IP owners, users and Internet intermediaries Fair use, the first-sale doctrine and other copyright limitations and exceptions provide a framework that gives innovators the freedom to create new ideas and technologies, while also protecting their rights to their own creative content.

The United States, Canada and Mexico operate under differing copyright frameworks. For example, unlike the “fair dealing” doctrine in Canada and “fair use” in the United States, Mexico lacks any such doctrine to protect creative, personal, transformative or otherwise benign uses of protected content. The country also has unusually lengthy copyright-term provisions, keeping important cultural contributions of its citizens out of the public domain.

Moreover, Mexico lacks a “safeharbour” provision that protects Internet companies that are willing to take action when properly notified of infringing content, and also lacks corresponding protections from non-IP liability. Similarly, a recent Canadian court decision requiring a U.S. company that was not charged with any copyright violation to delist specific search results on a worldwide basis is troubling. (It’s being challenged in a U.S. court.) As evidenced by the differing rules on copyright between Canada and Mexico, technical barriers to trade can have a significant impact on new technologies.

If pursued, these policy initiatives will shape the economy of the future, unlocking new opportunities for innovation and creativity. If we don’t address topics in a trade negotiation between three of the world’s largest economies, we send a signal to the rest of world that we don’t care.

Canada, Mexico and the United States already seem to be in agreement in some areas, including many of the principles that help to promote digital trade in the Trans-Pacific Partnership (TPP) discussions. These discussions should lay the groundwork for agreements to come, including NAFTA.

Let’s work together – as neighbours – to craft a modernized trade deal that promotes the technologies and jobs of the future and ensures prosperity across North America.

THE GLOBE AND MAIL. OCTOBER 16, 2017. The loonie and trade: Can Canada live without NAFTA? Yes. We. Can.

MICHAEL BABAD, Columnist

Should NAFTA die

Ask David Madani if Canada can live without the North American free-trade agreement and he'll say something like: Yes. We. Can.

The senior Canada economist at Capital Economics said as much in a new report titled "Life without NAFTA wouldn't be catastrophic."

Mr. Madani and other observers say the tariffs that could result wouldn't be particularly troublesome, and the Canadian dollar's adjustment to a new trade regime would likely offset them, regardless.

They hasten to add that the loss of the dispute-resolution system would be a big hit, but, as The Globe and Mail's Adrian Morrow reports, U.S. negotiators are demanding gutting those provisions, anyway.

As The Globe and Mail's Barrie McKenna reported this weekend, Chicken Little may well have been off-base in the initial fears surrounding the Trump administration's demands to redraw the trade pact and the President's repeated threats to kill it.

"Even if the U.S. administration decides to unilaterally withdraw from NAFTA, we aren't convinced that would spell immediate disaster for Canada's economy," Mr. Madani said.

"All things considered, the economy wouldn't be doomed without NAFTA, mainly because of the offset from a potentially lower Canadian dollar," he added.

"But the advantages from NAFTA's speedy dispute-settlement process would be missed, and this could hurt business confidence and investment down the road, possibly at a time when the economy can least afford another setback."

As my colleague Mr. McKenna reported, there would, of course, be immediate disruption, and, no doubt, some of it ugly. And longer term, you've got to consider everything from the number of NAFTA-supported jobs to supply chains to companies luring business to Canada by selling the NAFTA experience.

Much would depend on what could replace NAFTA, if anything. Some have suggested a reversion to the old Canada-U.S. free-trade pact, but Mr. Madani questioned that, saying that relying on World Trade Organization rules would be more likely. Certainly at first, anyway.

But under the WTO's "most favoured nation" regime, American tariffs on Canadian goods would come in at an average 2.1 per cent, Mr. Madani suggested.

"Given that Canada's exports are worth just over 30 per cent of GDP and that close to three-quarters of exports go to the U.S., we admit these trade tariffs would negatively impact the wider economy," he said.

"But we think this shock would be small, partly because we would also expect some depreciation of the Canadian dollar against the U.S. dollar. This would certainly be the case if, as we would anticipate, the Bank of Canada were to soften its aggressive stance on the interest rate outlook."

CIBC World Markets chief economist Avery Shenfeld agreed that the levies themselves wouldn't be that onerous under the WTO.

"Looking at the weighted average tariff that would be applicable on Canada's U.S.-bound exports, we estimate that a mere 5-per-cent Canadian dollar depreciation would reduce the costs of the domestic content in our exports enough to offset the tariff," Mr. Shenfeld said, adding that Canadian exports to Mexico aren't a big issue because they're so small.

"Proposed U.S. corporate tax cuts, which would see the U.S. dollar bid up by capital inflows, could fuel some of that exchange-rate adjustment. Keeping Canadian interest rates a bit below those stateside would do the rest."

There are other issues to consider, of course.

A cheaper loonie would raise the cost of imports to Canada, which would hurt demand, though that would be "mitigated by the availability of cheaper domestically produced goods and services," Mr. Madani said.

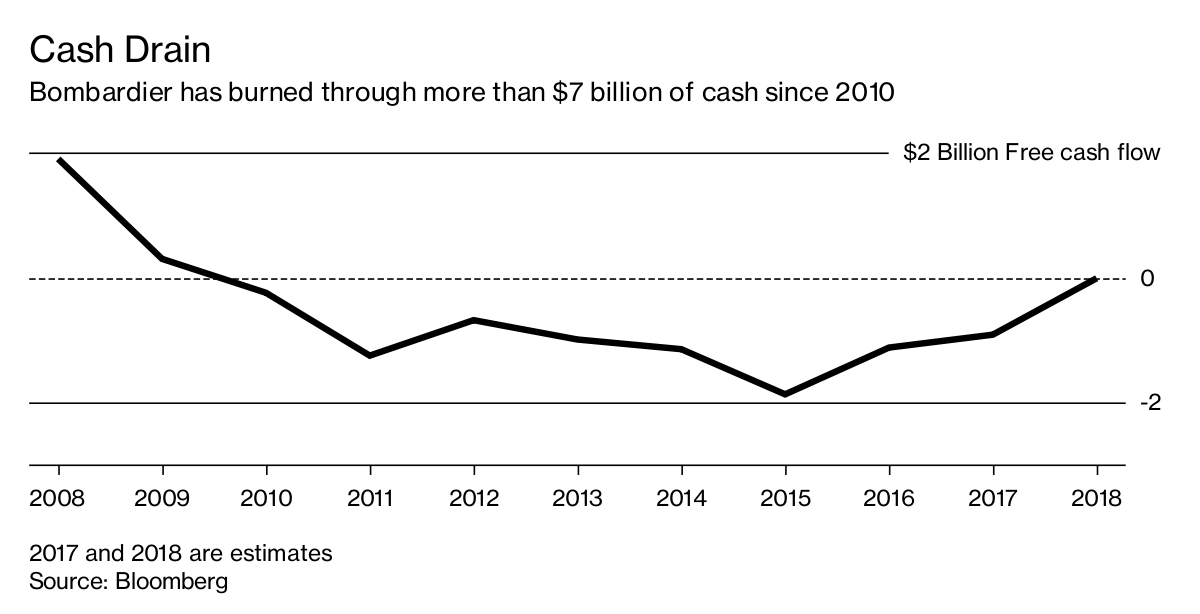

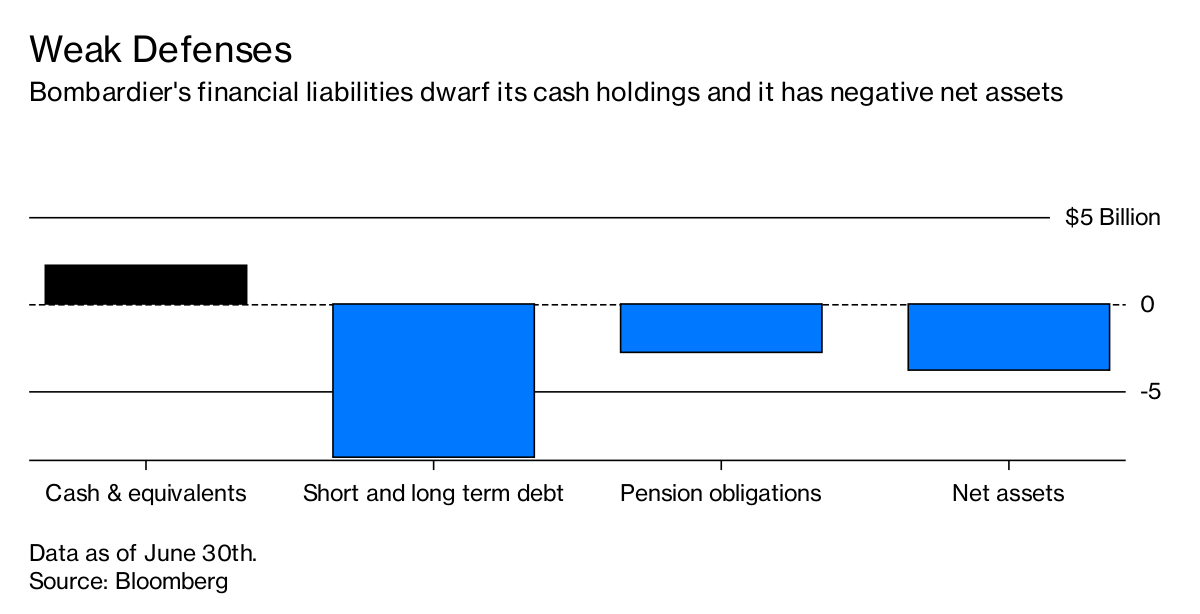

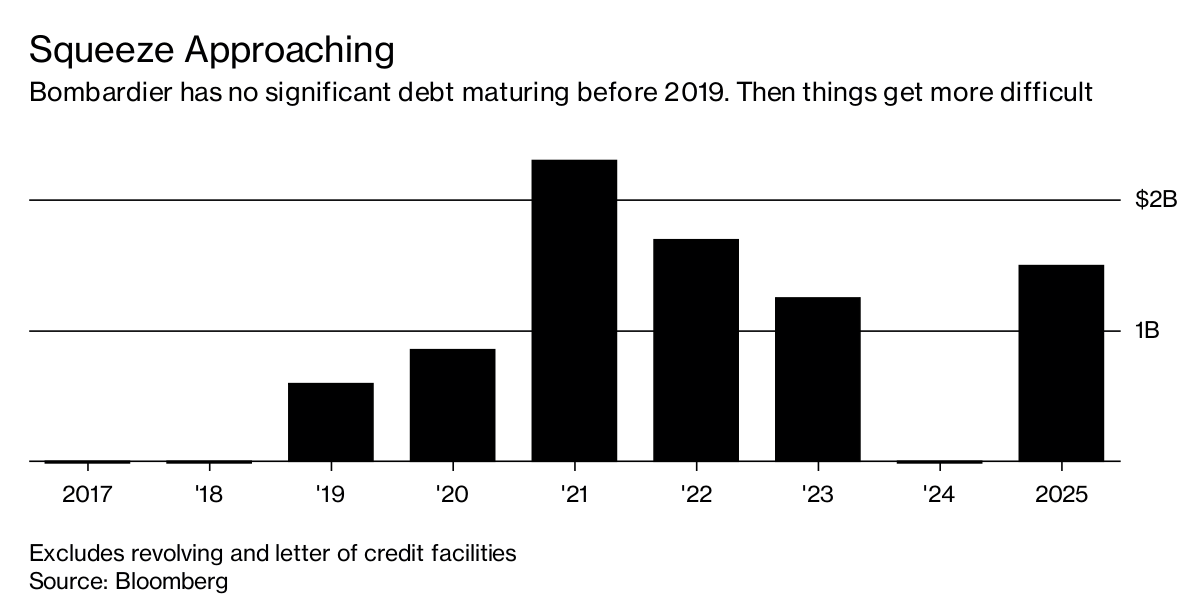

Of greater concern are the non-tariff issues. Just ask Canada's Bombardier Inc. and the softwood lumber industry, both of which have been hit by the Trump administration.

"Tensions between Canada and the U.S. over softwood lumber, dairy supply management and aerospace industry subsides are the main areas of concern," Mr. Madani said.

"The U.S, has also targeted steel and aluminium in the past, so we can't rule out additional trade disputes potentially upsetting the economy," he added.

"Despite the WTO, it's no secret that, since the global financial crisis, trade disputes over non–tariff barriers have increased substantially. For Canada, this added uncertainty could obviously discourage domestic business investment."

CIBC's Mr. Shenfeld cited similar concerns.

"As we've seen of late, the U.S. Commerce Department can impose massive anti-dumping and countervailing duties in a capricious manner, and the WTO isn't able to review or reverse these in a reasonable timeframe," he said.

"That's why we sought a free-trade agreement in the first place. It's the dispute-resolution process, not low tariffs, that is the jewel in the NAFTA crown."

But such things aren't working out so well for Bombardier and the lumber industry, right?

And you've got to question how much better it could get given that the Trump administration has declared war on foreign exporters with few rules of engagement.

The bluster from the administration is one thing, no doubt part negotiating tactic and part Trump doing what he does.

The shocking duties are another, and something NAFTA appears incapable of dealing with, anyway.

For the record, Citigroup analysts say the market is pricing a 30-per-cent chance of the death of the trade pact, while Citi itself sees a 10-per-cent probability.

"The base case from our economists is that while the negotiations are expected to be tough, the eventual resolution will be a preservation of NAFTA with some potential modifications," said Citi's Jabaz Mathai.

"If this was purely a negotiating strategy on the part of the U.S. administration (and there is broad consensus that it is ultimately a negotiating strategy), then the end objective for all parties is still a free-trade treaty with some potential modifications," he added in his report.

"However, the probability of a pullout by the U.S. is higher now than in the past, given the need for the administration to showcase the achievement of some campaign promises. NAFTA in other words could be a political decoy in case tax reform doesn't go through."

THE GLOBE AND MAIL. OCTOBER 16, 2017. OPINION. The sisterhood that could save NAFTA

MARYSCOTT GREENWOOD

Maryscott Greenwood is the CEO of the Canadian American Business Council and a principal in Dentons U.S. LLP where she co-leads the federal government relations practice group. She was previously a U.S. diplomat who served in Ottawa.

Conventional wisdom emerging from the fourth round of the current NAFTA negotiations is that the trade agreement is nearly dead, awaiting the digestion of a poison pill to end it completely. Pundits fear a unilateral U.S. withdrawal, or a frustrated partner deciding to flip the table to end the talks. From my vantage point, I see it a little differently. We are just beginning the hard part of the process, and I have faith in a certain sisterhood that just might be able to save the deal.

The composition of the sisterhood is as follows: the Prime Minister Whisperer, the Technocrat, the Secret Weapon, the Scribes and the New Powerhouse. To be clear, these are not the only characters in the cast of NAFTA. The front line of the negotiations is populated with an accomplished cadre including Canadian Foreign Affairs Minister Chrystia Freeland.

But the group I am about to describe is an entirely new phenomenon to emerge in modern trade negotiations.

Let me introduce you to the dream team, or as I call them, the Sisterhood that Could Save NAFTA.

First we have the Prime Minister Whisperer – Mr. Trudeau's chief of staff Katie Telford. Outside power circles in Ottawa/Washington/Mexico City, people may not realize the extent of Ms. Telford's impact or the power of her strategic thinking. A trusted member of the Trudeau inner circle and a lighthouse of ideas, Ms. Telford's ability to find outside-the-box solutions to tough political questions could be a key ingredient to NAFTA's ultimate success.

The Technocrats are Canada's new Deputy Chief of Mission in Washington, Kirsten Hillman and Ana Luisa Fajer Flores, Mexican Embassy DC Chief of Staff. A seasoned negotiator and expert in dispute resolution, Ms. Hillman led Canada's team in the complex multiparty Trans-Pacific Partnership negotiations. Smart and fearless, she is now the top career official at 501 Pennsylvania Avenue, strategically positioned between the U.S. Capitol and the White House with an eye toward influencing both.

For her part, everything in her professional experience to date has prepared Ms. Flores for this moment. Formerly consul in St. Paul, Minn., and adviser to the President of the Committee of Foreign Affairs of the Senate in Mexico, among other portfolios, Ms. Flores has deep insights into the governmental and political factors on both sides of the border that weigh on the current trade negotiations.

The Secret Weapon is Andrea van Vugt. She is the vice-president for North American policy of the Business Council of Canada, and a voice of reason in an otherwise frantic world of doomsday scenarios of the end of NAFTA. As the youngest member of almost every high-profile panel on which she serves, Ms. van Vugt patiently explains the interconnectedness of the North American economy and the role it plays in global prosperity. In addition, Ms. van Vugt provides the secretariat for the Canada/U.S. women's CEO council launched at the White House earlier this year. It is one of the few outside advisory councils still intact after business leaders sought to distance themselves from the White House in the wake of various controversies.

The Scribes are Rossella Brevetti and Megan Cassella. Ms. Brevetti writes on trade policy for Bloomberg BNA and Ms. Cassella covers trade for Politico. Ms. Brevetti tirelessly works her sources gathering tips and context for the latest developments in an otherwise opaque and archaic process of trade negotiations. Ms. Cassella's morning newsletter is essential education for everyone following the negotiations. Somehow the mini but mighty Politico Pro Trade team has figured out how to be everywhere in D.C. at one time, explaining each morning what happened the previous day and what to expect in the hours ahead.

The New Powerhouse is the incoming U.S. ambassador to Canada, Kelly Craft. Named in March of this year and confirmed Aug. 3, she will present credentials in Canada on Oct. 23 and immediately assume her official duties. The first woman to serve as U.S. ambassador to Canada, Ms. Craft is already proving to be a powerful asset in the Sisterhood to save NAFTA. She is a consummate relationship builder, who has not only the confidence of the White House, but also of House and Senate leadership and a number of key Governors.

Unlike the USTR negotiators and other members of the U.S. cabinet who have competing priorities to manage, Ms. Craft wakes up every morning with one laser-like focus – how to enhance the Canada/U.S. relationship. No one will work harder or longer to develop channels of communication that in the end can save NAFTA. Ms. Craft and her counterpart, ambassador David MacNaughton, have already developed a close rapport, and the moving trucks have not yet even departed Lexington for Ottawa.

So let others draft an obituary for NAFTA. I have confidence in the power of the sisterhood to save it.

THE GLOBE AND MAIL. AP. OCTOBER 15, 2017. TRADE. U.S. pushes for sweeping protectionism at fourth-round NAFTA talks

ADRIAN MORROW

ARLINGTON, VIRGINIA - The Trump administration has thrown down all of its major demands in the renegotiation of the North American free-trade agreement, pushing for sweeping protectionist changes that would decisively tilt the playing field in favour of the United States at the expense of Canada and Mexico.