CANADA ECONOMICS

VENEZUELA

Global Affairs Canada. September 15, 2017. Canada welcomes panel to investigate possible crimes against humanity in Venezuela

Ottawa, Ontario - Canada is deeply concerned by the grave violations of human rights in Venezuela and is actively working with international partners to restore democracy and protect human rights.

The Honourable Chrystia Freeland, Minister of Foreign Affairs, today welcomed the appointment of Professor Irwin Cotler to the Organization of American States (OAS) Panel of Independent International Experts that will examine evidence collected on possible crimes against humanity committed in Venezuela.

The panel of international human rights experts is being assembled to support the former chief prosecutor of the International Criminal Court (ICC), Luis Moreno Ocampo, who has been appointed as special adviser on crimes against humanity by OAS Secretary General Luis Almagro. This process responds to ongoing reports of human rights abuses, including those detailed in a report issued by the Office of the United Nations High Commissioner for Human Rights on August 30.

The report determined that “extensive human rights violations and abuses have been committed in the context of anti-government protests in Venezuela and point to the existence of a policy to repress political dissent and instill fear in the population to curb demonstrations.” The panel will compile and evaluate information, and, if warranted, will submit its findings to the ICC.

Quotes

“I am so pleased to support the appointment of my friend and former colleague Professor Cotler to this investigative panel and welcome his global experience with regard to human rights and the rule of law, which will be invaluable to the credibility and quality of this investigative process. This initiative represents a critical contribution by the OAS to uphold justice and human rights for the people of Venezuela.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

- According to the report issued by the Office of the United Nations High Commissioner for Human Rights, as of July 31, the Attorney General’s Office has investigated 124 deaths linked to the protests. The security forces and pro-government armed groups are reportedly responsible for 73 of those deaths; however, the cause of the remaining 51 deaths has yet to be determined.

- The report also states that from April 1 to July 31, investigations into at least 1,958 cases of reported injuries were opened in the context of demonstrations. In addition, 5,051 people have been detained since April 1, including 410 children, with 1,381 reportedly still in custody as of July 31. At least 609 civilians arrested in the context of the protests have been presented before military tribunals.

- On July 30, Canada denounced the Maduro regime’s action to create an undemocratic constitutional assembly and called on the Government of Venezuela to uphold the rights enshrined in the UN Charter and in human rights treaties to which the country is a signatory.

- Irwin Cotler is an emeritus professor of law at McGill University, chair of the Raoul Wallenberg Centre for Human Rights, former minister of justice and attorney general of Canada, and an international human rights lawyer.

See also:

- Canada denounces Venezuelan government’s action to create constituent assembly: https://www.canada.ca/en/global-affairs/news/2017/07/canada_denouncesvenezuelangovernmentsactiontocreateconstituentas.html

- Canada and the Venezuela crisis: http://www.international.gc.ca/americas-ameriques/venezuela_crisis-crise_au_venezuela.aspx?lang=eng

- Canada and the OAS: http://www.international.gc.ca/oas-oea/index.aspx?lang=eng

- Secretary General of the OAS announces the appointment of Independent Panel of International Experts: http://www.oas.org/en/media_center/press_release.asp?sCodigo=E-069/17

- OAS Secretary General designates Luis Moreno Ocampo as special adviser on crimes against humanity: http://www.oas.org/en/media_center/press_release.asp?sCodigo=E-057/17

- UN Human Rights Office report on human rights violations in Venezuela: http://www.ohchr.org/EN/NewsEvents/Pages/DisplayNews.aspx?NewsID=22007&LangID=E

NAFTA

The Globe and Mail. 15 Sep 2017. Canada, Mexico reject ‘sunset clause’ in NAFTA

ADRIAN MORROW

The Trump administration is pushing for a “sunset clause” in the North American free-trade agreement that would automatically kill the deal after five years unless all three sides agreed to keep it in place.

Canada and Mexico immediately rejected the idea, arguing that it would create unnecessary uncertainty for businesses, which would not want to make investments without reassurance that market access between the three countries is here to stay.

Such a provision, if inserted into NAFTA, would all but guarantee that the current traderelated drama would play out in the United States again in five years’ time.

The three countries are in the midst of renegotiating NAFTA at the behest of U.S. President Donald Trump, who blames the accord for moving jobs out of the United States and has repeatedly threatened to “terminate” it if it’s not rewritten to his satisfaction.

U.S. Commerce Secretary Wilbur Ross confirmed the sunset proposal on Thursday, saying both he and U.S. Trade Representative Robert Lighthizer, who is overseeing the NAFTA renegotiations, are in favour of the idea.

“The five-year thing is a real thing, would force a systematic re-examination,” Mr. Ross told a Washington conference organized by news website Politico.

Politico had reported earlier in the day that the administration was mulling such a clause. The plan, Politico said, was to put it on the table at the third round of NAFTA talks, scheduled for Sept. 23 to 27 in Ottawa.

The three countries are trying to finish the deal by the end of the year to allow Mr. Trump to fulfill a key campaign pledge and ensure talks don’t run into the campaign period for Mexico’s presidential election next year. Such a schedule is tight: Most trade negotiations last three to five years.

Writing in a sunset provision would allow the United States to take another crack at the deal in a few years.

“The forecasts that had been made at the initiation of NAFTA and of the other trade agreements mostly had been wildly optimistic as to the results, and the results have been quite different,” Mr. Ross said. “If there was systematic re-examination after a little experience period, you’d have a forum for trying to fix things that didn’t work out.”

Mr. Ross said pulling the United States out of NAFTA, as Mr. Trump has talked about, is “not the preferred option” but remains on the table if a deal can’t be reached.

Canadian Ambassador to the United States David MacNaughton dismissed the five-year proposal in a panel discussion at the Politico conference with his Mexican counterpart, Geronimo Gutierrez.

“Not to try to make light of it, but if every marriage had a fiveyear sunset clause on it, I think our divorce rate would be a heck of a lot higher than it is right now,” Mr. MacNaughton said. “The best thing you can do in these things is to try to have goodwill and try to work through tough times rather than set an arbitrary date.”

Mr. MacNaughton, who said members of the Trump administration had floated the sunsetclause idea to him months ago, argued that Mr. Ross would face a fight with American industry over the idea.

“I think he may get some pushback from U.S. businesses who are saying, ‘My goodness, how do we make a 20-, 25-, 30-year investment when it could be overturned in five years?’ ” he said.

Mr. Gutierrez said a sunset clause would not be a good way to create a favourable investment climate.

“It would probably have very detrimental consequences to the business sector of the United States, Mexico and Canada,” he said. “Let’s look at what they are thinking in more detail, but ‘certainty’ is the key word here.”

Speaking with reporters afterward, Mr. MacNaughton said it would make sense to put provisions in NAFTA to allow the deal to be amended down the road if all three countries agree. But he said a sunset clause was pointless because the deal already has a provision that allows any country to pull out with six months’ notice to the other two. “I don’t understand what the benefit is, frankly,” he said.

The three countries have held two rounds of renegotiation talks so far, and are aiming to do seven before the end of the year.

They are far apart on numerous major provisions in the deal: The United States, for instance, wants to abolish a process for resolving trade disputes between countries using binational panels, and has floated a U.S. content requirement for cars and trucks made in the NAFTA zone – both proposals Canada and Mexico oppose.

On Thursday, Mr. MacNaughton mocked the Trump administration’s obsession with the balance of trade, the core thinking that underpins its international economic agenda.

Mr. Trump, Mr. Ross and Mr. Lighthizer contend that the United States’ trade deficit is a problem that must be solved by cutting back on imports. Many economists, however, argue overall economic growth is the only thing that matters and it is of little consequence whether trade is in balance.

“I’d just like to remind the Americans that they have a $34billion surplus in manufactured goods with Canada, and I’d be interested to know what it is that the United States is proposing to do to reduce that surplus,” Mr. MacNaughton deadpanned. “I’m assuming when they come to Ottawa, there will be some of those ideas … I’ll be looking for it.”

Department of Finance Canada. September 14, 2017. Canada and Mexico, Partners for Prosperity

Mexico City, Mexico – Canada and Mexico enjoy one of the most productive relationships in the world, underpinned by strong people-to-people ties and a mutually beneficial trading relationship under the North American Free Trade Agreement (NAFTA), which has helped to strengthen the middle class. Sharing more than a continent, the two partners share a common commitment to creating prosperity and making life better for their citizens.

Canada's Finance Minister, Bill Morneau, joined Mexico's Secretary of Finance, José Antonio Meade, in Mexico City today for discussions about shared priorities that will create jobs and deepen the relationship between our two countries. Part of these discussions involved strengthening NAFTA, which is being modernized by Canada, Mexico and the United States.

In his address to the Canada-Mexico Chamber of Commerce, Minister Morneau spoke about the benefits NAFTA has brought to people throughout North America, as well as the long history of cooperation between Canada and Mexico when it comes to trade, labour mobility, tourism and travel, education and cultural exchange, as well as empowering women and Indigenous Peoples.

Minister Morneau also met with representatives from government, business and the financial sector to strengthen relationships and discuss new opportunities for Canadians and exporters.

Minister Morneau highlighted the importance of fair, free and open trade, and Canada's plan to strengthen the global economy so that the benefits of growth are widely shared by the world's middle class and those working hard to join it.

Quote

"Canada and Mexico understand how important it is to have a productive and respectful relationship—one that allows for greater trade and mobility of people in support of stronger, more inclusive and more innovation-driven growth. As Canada continues down its path toward long-term growth for the middle class, investment, innovation and increasing global ties, we will hold our strong bilateral relationship with Mexico as an example of the shared prosperity we can achieve by working together for the benefit of our people."

- Bill Morneau, Minister of Finance

Quick Facts

- For more than 70 years, Canada and Mexico have shared a vibrant relationship characterized by deep people-to-people ties, rich cultural connections and growing trade and investment. Our two countries work closely together in areas such as trade and investment, security, competitiveness and the environment to create a more integrated, sustainable and globally competitive North American economy:

- As a result of NAFTA, Canada's commercial relationship with Mexico is strong and growing. Just last year, we reached a milestone with bilateral merchandise trade totalling C$40.8 billion.

- Through the annual Canada-Mexico Partnership, we are encouraging even more collaboration between our public and private sectors in areas such as: energy; agri-business; labour mobility; human capital; trade, investment and innovation; environment; mining; and forestry.

- These efforts have resulted in Canadian direct investment in Mexico totalling roughly $17 billion (stock) in 2016, while Mexican direct investment in Canada is nearly $2 billion (stock).

NATIONAL ACCOUNTS - FINANCIAL FLOWS

StatCan. 2017-09-15. National balance sheet and financial flow accounts, second quarter 2017

National wealth: $10.3 trillion, Second quarter 2017

0.1% increase (quarterly change)

National net worth: $10.6 trillion, Second quarter 2017

0.4% increase (quarterly change)

Source(s): CANSIM table 378-0121.

National wealth edges up

National wealth, the value of non-financial assets in the Canadian economy, edged up 0.1% to $10,279.1 billion at the end of the second quarter. Household residential real estate grew by $4.5 billion, the smallest increase since the first quarter of 2009, due to lower real estate prices and less activity in the resale market. In April, policy changes were implemented by the Government of Ontario to dampen growth in the real estate market.

The value of Canada's international financial assets continued to exceed liabilities in the second quarter. The country's net foreign asset position rose by $25.7 billion in the second quarter to $271.5 billion, a fourth consecutive quarterly advance. The increase in the net asset position mainly reflected the stronger performance of foreign stock markets relative to the Canadian stock market. Over the quarter, the US stock market rose by 2.6% while the Canadian stock market declined by 2.4%.

National net worth, the sum of national wealth and Canada's net foreign asset position, increased by $39.2 billion to $10,550.6 billion. On a per capita basis, national net worth was $287,200 at the end of the second quarter.

Chart 1 Chart 1: National wealth components

National wealth components

Household net worth stable as households continue to borrow

Household sector net worth was relatively flat at $10,500.8 billion in the second quarter. Non-financial assets grew at a faster pace (+0.3%) than financial assets in the second quarter (+0.1%). Meanwhile, total financial liabilities increased 1.9% in the second quarter. On a per capita basis, household net worth decreased by $1,300 to $285,900.

Total household credit market debt (consumer credit, mortgage and non-mortgage loans) reached $2,077.2 billion in the second quarter. Mortgage debt increased 1.6% to $1,361.0 billion, while consumer credit was up 2.4% to $609.6 billion as households continued to increase spending on consumer durables. The share of mortgage liabilities to total credit market debt edged down from 65.7% at the end of the first quarter to 65.5%.

Household credit market debt as a proportion of household disposable income (adjusted to exclude pension entitlements) increased from 166.6% in the first quarter to 167.8%, as household income (+1.2%) rose at a slower pace than household credit market debt (+1.9%). In other words, there was $1.68 in credit market debt for every dollar of household disposable income. Leverage, measured by the ratio of household total debt to total assets, edged up 0.3% to 16.7% at the end of the second quarter, as debt grew at a faster pace (+1.9%) than the value of total assets (+0.2%) by the end of the second quarter.

Chart 2 Chart 2: Household sector leverage: Debt to assets

Household sector leverage: Debt to assets

Household debt service ratio is flat

On a seasonally adjusted basis, households borrowed $28.9 billion of credit market debt in the second quarter, up from $25.4 billion in the previous quarter.

Mortgage borrowing decreased $2.6 billion from the first quarter to $16.5 billion, while borrowing in the form of consumer credit and non-mortgage loans increased by $6.1 billion to $12.3 billion.

The household debt service ratio, measured as total obligated payments of principal and interest as a proportion of household disposable income, was flat at 14.2% in the second quarter. The non-mortgage debt service ratio increased 0.5% while the mortgage debt service ratio decreased 0.7%.

The interest-only debt service ratio, defined as household mortgage and non-mortgage interest as a proportion of adjusted household disposable income, stood at 6.0% in the second quarter, down slightly from the previous quarter. At the end of the second quarter, households' mortgage principal payments continued to exceed mortgage interest payments.

Chart 3 Chart 3: Household mortgage interest and obligated principal payments

Household mortgage interest and obligated principal payments

Increase in borrowing for all levels of government

The federal government demand for funds rose by $20.7 billion in the second quarter, the largest net borrowing since 2010. The increase involved $14.0 billion of net issuances of short-term paper, accompanied by $7.1 billion in net issuances of Canadian bonds. Likewise, the demand for funds by all other levels of governments increased by $25.0 billion. The bulk of this borrowing was composed of $20.3 billion in net issuances of Canadian bonds and debentures.

The ratio of federal government net debt (book value) to GDP edged down from 30.8% at the end of the first quarter to 30.6% at the end of the second quarter. Similarly, the ratio of other government net debt (book value) to GDP edged down from 28.8% to 28.6% as GDP continued to post positive gains.

Demand for equity declines as debt increases

Non-financial private corporations' demand for funds fell from $61.9 billion in the first quarter to $29.9 billion in the second quarter. New issues of equity were the main contributor, decreasing from $38.7 billion to $2.6 billion, as merger and acquisition activity returned to more normal levels.

On a book value basis, the credit market debt-to-equity ratio of non-financial private corporations increased from 68.3% in the first quarter to 70.0% at the end of the second quarter. This represented 70 cents of credit market debt for every dollar of equity, compared with 68 cents at the end of the previous quarter. The increase was attributable to lower equity issuance relative to higher debt levels.

Chart 4 Chart 4: Borrowing by private non-financial corporations

Borrowing by private non-financial corporations

Financial corporations' increase provision of funds to the Canadian economy

The financial sector provided $90.5 billion of funds to the economy through financial market instruments in the second quarter, up from $55.5 billion in the first quarter. Lending activity increased for mortgages (up $24.7 billion), non-mortgage loans (up $24.1 billion), short-term paper (up $17.0 billion) and consumer credit (up $14.4 billion), all of which more than offset a divestment of listed shares (down $18.3 billion).

The increase in supply of funds was negated by downward revaluations, causing the value of financial assets of financial corporations to increase 0.5% (up $61.5 billion) to $13,501.0 billion at the end of the second quarter, the slowest growth since the first quarter of 2016. The increases in loans, deposits, short-term paper and foreign equity were offset by declines in domestic corporate bonds and equity investments. Foreign equities increased due to strong foreign markets, while domestic investors were affected by weakening markets.

Chart 5 Chart 5: Pension solvency ratio

Pension solvency ratio

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170915/dq170915a-eng.pdf

ENERGY

StatCan. 2017-09-15. Supply and disposition of refined petroleum products, June 2017

Refinery receipts of crude oil: 8.5 million cubic metres

June 2017, 17.6% increase (12-month change)

Refinery production: 9.8 million cubic metres

June 2017, 11.1% increase (12-month change)

Refinery domestic sales: 9.3 million cubic metres

June 2017, 3.9% increase (12-month change)

Source(s): CANSIM table 134-0004.

Refinery receipts of crude oil (+17.6%), production of refined petroleum products (+11.1%) and domestic sales (+3.9%) were all up in June compared with the same month in 2016. The Fort McMurray wildfire in 2016 led to the lowest June receipts since 1994 and the lowest June production levels since 2011.

Refinery receipts up

Canadian refineries received 8.5 million cubic metres of crude oil in June, up 17.6% from the same month a year earlier. In 2016, the wildfire in northern Alberta led to the lowest June level of crude oil receipts since 1994.

Chart 1 Chart 1: Refinery receipts of crude oil and equivalent products

Refinery receipts of crude oil and equivalent products

Domestic crude oil receipts were up 18.7% from June 2016 to 5.1 million cubic metres.

Crude oil imports increased 15.9% from June 2016 to 3.4 million cubic metres. Imports represented 39.5% of total crude oil received at refineries in Canada.

Crude oil inventories held at refineries totalled 3.8 million cubic metres in June, up 1.3% from the same month in 2016.

Refinery production and sales rise

Refinery production increased 11.1% from June 2016 to 9.8 million cubic metres in June. Refinery slowdowns in the spring of 2016 due to the Fort McMurray wildfire led to the lowest June production level since 2011.

Domestic sales of refined petroleum products rose 3.9% to 9.3 million cubic metres. Sales of diesel fuel oil (+11.8%) and motor gasoline (+1.5%) were both up in June compared with the same month in 2016.

Chart 2 Chart 2: Domestic sales of refined petroleum products, by product

Domestic sales of refined petroleum products, by product

Imports down while exports increase

Canada imported 1.3 million cubic metres of refined petroleum products in June, down 39.1% from the same month in 2016. Meanwhile, exports of refined petroleum products increased 6.2% to 2.3 million cubic metres.

Inventories rise

Closing inventories of refined petroleum products held at refineries increased 7.3% year over year to 7.5 million cubic metres in June.

Second quarter review for 2017

Canadian refineries received 24.8 million cubic metres of crude oil in the second quarter, up 15.2% from the same quarter in 2016.

Over the same period, refinery production rose 9.5% to 28.7 million cubic metres and domestic sales increased 1.5% to 26.5 million cubic metres.

Petroleum product imports decreased 17.5% to 4.1 million cubic metres while exports increased 13.8% to 7.2 million cubic metres.

The 2016 Fort McMurray wildfire affected refinery levels in the second quarter, resulting in large year-over-year changes for the second-quarter of 2017.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170915/dq170915d-eng.pdf

StatCan. 2017-09-15. Crude oil and natural gas: Supply and disposition, June 2017

Production of crude oil and equivalent products: 19.1 million cubic metres

June 2017, +21.9% increase (12-month change)

Exports of crude oil and equivalent products: 15.7 million cubic metres

June 2017, +17.8% increase (12-month change)

Source(s): CANSIM table 126-0003.

Canada produced 19.1 million cubic metres (120.3 million barrels) of crude oil and equivalent products in June, up 21.9% compared with the same month in 2016.

Chart 1 Chart 1: Production of crude oil and equivalent products

Production of crude oil and equivalent products

Crude oil production

In June 2016, production fell in the wake of the Fort McMurray wildfire. As a result, the production of synthetic crude oil was up 64.8% to 4.6 million cubic metres in June 2017, while non-upgraded bitumen production rose 14.2% to 7.3 million cubic metres. Additionally, the production of light and medium crude oil increased 16.2% to 3.9 million cubic metres, while heavy crude oil decreased 0.3% to 1.9 million cubic metres.

Provincial production

Alberta produced 15.3 million cubic metres of crude oil and equivalent products, up 23.8% from June 2016 and accounted for 79.7% of total Canadian production. Saskatchewan (12.0%) and Newfoundland and Labrador (6.0%) were also key contributors.

Refinery use of crude oil

Input of crude oil to Canadian refineries totalled 8.6 million cubic metres in June, up 15.2% from the same month a year earlier. Conventional crude oil accounted for 68.1% of the total, while non-conventional represented the remaining 31.9%. Light and medium crude oil (4.9 million cubic metres) and synthetic crude oil (2.2 million cubic metres) were the main types of crude oil used by Canadian refineries.

Exports and imports

Exports of crude oil and equivalent products were up 17.8% from June 2016 to 15.7 million cubic metres in June. Imports to Canadian refineries rose 15.9% to 3.4 million cubic metres.

Closing inventories

Closing inventories of crude oil and equivalent products were down 1.2% to 17.7 million cubic metres in June compared with the same month in 2016. The total was comprised of transporters (-0.6% to 11.3 million cubic metres), refineries (+1.3% to 3.8 million cubic metres) and fields and plants (-6.8% to 2.6 million cubic metres).

Quarterly changes in crude oil

Crude oil and equivalents production rose 18.2% to 56.4 million cubic metres in the second quarter from the same quarter of 2016. The sharp increase in quarterly production in 2017 was attributable to the Fort McMurray wildfire in 2016 and its impact on the energy sector. Over the same period, exports rose 17.8% to 48.8 million cubic metres, while imports increased by 4.4% to 9.7 million cubic metres.

Natural gas production

Marketable natural gas production in Canada totalled 12.9 billion cubic metres in June, up 0.4% from the same month in 2016. Alberta (76.2%) and British Columbia (21.2%) accounted for most of Canadian production.

Additional information on natural gas is available in "Natural gas transmission, storage and distribution," published in The Daily on August 23, 2017.

Quarterly changes in natural gas

Production of natural gas rose by 4.9% from the second quarter of 2016 to 40.4 billion cubic metres in the second quarter.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170915/dq170915e-eng.pdf

HOUSING

The Globe and Mail. 15 Sep 2017. Foreign buyers buy fewer homes over summer. Toronto feels effect of foreign-buyers tax. Whether it’s the levy itself or psychology at play, housing sales to non-citizens and non-permanent residents are down from peak

JUSTIN GIOVANNETTI

JILL MAHONEY, TORONTO

Purchases of Toronto homes by foreign buyers dropped over the summer after a new tax in Ontario began targeting international property investment, falling from 7.2 per cent of sales in May to 5.6 per cent of homes sold over the three months ending in August.

Newly released data show purchases of Toronto homes by foreign buyers dropped over the summer after a new tax in Ontario began targeting foreign property investment. Purchases of Toronto homes by foreign buyers dropped over the summer after a new tax in Ontario began targeting international property investment, falling from 7.2 per cent of sales in May to 5.6 per cent of homes sold over the three months ending in August.

York Region was the area with the highest percentage of sales to foreign buyers in the Greater Golden Horseshoe during the three months ending in August, at 6.9 per cent of homes – down from 9.1 per cent between April and May.

Toronto’s real estate market has been in a slump for months as prices have fallen and the number of homes with for-sale signs has risen. The new data from the provincial government will feed a debate about whether Ontario’s new 15-per-cent foreign-buyers tax is itself responsible for the slide or if the psychological effects of the tax shook the market.

Foreign investment began to fall in a vast area around Toronto known as the Greater Golden Horseshoe soon after the tax was introduced in April, according to the data from Ontario’s Finance Ministry. At the time the tax was introduced, the region’s housing market looked to be overheating as average home prices soared to nearly $1-million.

Since then, sales to foreign buyers in the wider region dropped from 4.7 per cent of homes in the month before May 26 to 3.2 per cent of sales between May 27 and Aug. 18. The Bank of Canada also hiked interest rates during that period, increasing the cost of a mortgage.

Premier Kathleen Wynne’s government has celebrated falling sales to non-residents as a sign of the tax’s success. “The measures that we introduced as a part of the Fair Housing Plan are working,” Finance Minister Charles Sousa said in a statement. “We are seeing increased housing supply and evidence that more people are finding affordable homes.”

The drop in home purchases by foreign buyers did not come as a surprise, said Josh Gordon, a professor at Simon Fraser University in B.C. who researches Toronto’s housing market.

“When you put a tax on something, the frequency of that activity declines. That happened in Vancouver as well and so that was to be expected,” he said.

The Ontario government’s introduction of a foreign-buyers tax created a “powerful psychological impact on the market” that affected not just international buyers but also domestic consumers, Prof. Gordon said. Instead of the previous widespread belief that Toronto housing prices would continue to rise on strong international demand, people began to worry the market had peaked and prices were inflated.

The largest amount of purchases by foreign buyers during the period was recorded in Toronto at 857 properties. York Region, which includes the hot-spot communities of Markham and Richmond Hill, was the area with the highest percentage of sales to foreign buyers at 6.9 per cent of homes – down from 9.1 per cent between April and May.

Foreign buyers in the two areas had divergent tastes in properties, according to the new data, with nearly 70 per cent of purchases in Toronto recorded as condominiums. However, most foreign buyers in Ontario had their eyes on detached houses, with more than half of sales recorded in that category.

Richard Silver, a Toronto real estate agent who works with foreign buyers, said the new tax “shocked the marketplace” and gave international buyers reason to pause.

“Whenever a tax like that is implemented, people sort of pull back and they wonder what’s going to happen and also what it means in terms of are they welcome to invest in Canada and I think that’s sort of taking people aback,” said Mr. Silver, a past president of the Toronto Real Estate Board.

Despite the tax, however, he said foreign home buyers are still eyeing the Greater Toronto Area (GTA) housing market and he noted that prices are affordable for people whose funds are in U.S. dollars, given the exchange rate.

The average home price in the GTA was $732,292 in August, down almost 21 per cent from April, when the average reached $920,791.

Catherine To, a real estate agent specializing in the suburbs of Markham and Richmond Hill, where sales have plummeted since the tax was implemented, said the levy took away home buyers’ confidence in the market, causing many to retreat because they expected future bargains.

“This is purely psychological,” said Ms. To, who called the government’s decision to introduce the tax “irresponsible.”

Ms. To said some of her Chinese clients are still interested in buying GTA real estate because they want to move their assets or for their children to study abroad. The new tax is just part of the price of doing business, she said.

The government also released data from outside the Greater Golden Horseshoe for the first time, recording that 2.6 per cent of all transactions across Ontario in the spring were made by foreign buyers. In Ottawa, 2.1 per cent of homes were purchased by foreign buyers.

Ontario’s tax applies to people who aren’t citizens or permanent residents of Canada. According to the government, the tax was designed to discourage speculation in the province’s housing market by non-residents, not to make it harder for them to move there.

The tax was introduced nearly a year after British Columbia implemented a 15-per-cent levy in the Vancouver region. Statistics collected by the B.C. government showed foreign buyers accounted for 13 per cent of purchases in Metro Vancouver before the tax took effect on Aug. 2, 2016. That has fallen to between 3 per cent and 4 per cent in the year since.

REUTERS. SEPTEMBER 15, 2017. Canadian home resales rose in August after 4 declines: CREA

Andrea Hopkins

OTTAWA (Reuters) - Resales of Canadian homes bounced back in August after four straight monthly declines, the Canadian Real Estate Association said on Friday, but it lowered its forecasts for sales and prices in 2017 and 2018.

Sales of existing homes edged up 1.3 percent in August from July nationwide and rose 14.3 percent in Toronto, Canada’s largest market. The industry group said, though, that only time would tell if August’s bounce is the start of a rebound after tax and rule changes announced in April doused demand.

Sales were down 9.9 percent from August 2016, while home prices were up 11.2 percent from a year earlier, according to CREA’s home price index.

Dramatically cooler demand in recent months has sparked fears that Canada could fall victim to a housing crash, and the association slashed forecasts for sales and prices for both 2017 and 2018 due to a swoon in Toronto earlier this year.

“Activity has begun to show tentative signs of stabilizing among markets in the region, but is down sharply since March amid a rapid shift in housing market balance and increased cautiousness among homebuyers,” the group said.

Sales activity is now forecast to drop 5.3 percent in 2017, a downward revision from a 1.5 percent decline forecast three months ago, and to fall another 2.3 percent in 2018, the association said.

The national average price is forecast to rise by 3.4 percent to C$506,700 ($416,352) in 2017 before falling 0.6 percent in 2018 as the impact of the Toronto correction is felt. In June, the group had expected increases of 7.4 percent in 2017 and 1.8 percent in 2018.

Besides a foreign buyers tax imposed in Vancouver in 2016 and Toronto in 2017, rising interest rates are expected dampen housing demand in the months ahead.

“Tightened mortgage rules, higher mortgage default insurance premiums, changes to Ontario housing policies and higher interest rates are factors that will continue to lean against housing market activity over the rest of the year and into 2018,” the association said.

Reporting by Andrea Hopkins; Editing by Chizu Nomiyama and Lisa Von Ahn

REUTERS. SEPTEMBER 15, 2017. Toronto condos buck Canada housing crunch, but prices seen cooling

Andrea Hopkins

OTTAWA (Reuters) - Canada’s condo boom continues to surprise, with groundbreaking in Toronto still going strong even as prices of detached homes in Canada’s largest city slump, but recent rate hikes and rent controls are likely to cool condo prices by 2018.

While many predicted the brisk construction of high rise homes in Toronto would cause a glut and eventual crash, the condo market has emerged as the stalwart survivor as a long-awaited broad housing market correction grips the city.

Developers and economists alike say condo prices, up 21 percent in a year according to the Toronto Real Estate Board, cannot keep rising at such a pace, in part because it was their relative affordability compared to single-family homes that fueled the boom in the first place.

“We’ve seen significant appreciation over the last 12 months and it not going to continue to grow at that aggressive rate,” said Christopher Wein, president of Great Gulf Residential, a developer with projects in Canada and the United States.

While prices may cool, the scarcity of land on which to build detached houses will continue to fuel the condo building boom, said Peter Norman, chief economist at real estate consulting firm Altus Group.

The health of the condo market is critical for Toronto. So-called multiple unit buildings account for about 40 percent of housing starts in Canada as a whole and about 53 percent in Toronto. By 2018, more than 62 percent of Toronto groundbreaking will be multiples, Norman believes - nearly all of them to be snapped up by investors, not residents.

“The vast majority of multiples are being sold to investors, that’s just the way market works,” he said, pointing out that few owner-occupiers have the patience to buy from a floor plan and wait years for the unit to be ready to move in.

Those who buy condos for a guaranteed monthly income may find the market less attractive with two Bank of Canada rate hikes in the last three months boosting borrowing costs, and provincial rent controls unveiled in April limiting income potential.

“If the math doesn’t work because of higher mortgage rates, they will simply stop doing it and demand for condos will go down,” said Benjamin Tal, senior economist at CIBC Capital Markets in Toronto.

Developers are divided over the impact of risk of rent control and Jim Ritchie, senior vice president of sales and marketing for condo developer Tridel, said new condos will become more attractive than resales because rent controls do not limit initial rents, only subsequent increases.

What makes Toronto’s condos an attractive long-term bet is the city’s low vacancy rate, which has fueled bidding wars among renters and driven monthly condo rents to an average of C$2,074 ($1,703) in the second quarter, up 7.2 percent from C$1,935 a year ago, according to market research firm Urbanation.

Another factor is affordability. With detached homes having doubled in price to about C$1 million - twice the price of the average condo - during the recent boom, Ritchie is confident condos will sell even as detached homes sit unsold and prices fall.

“The naysayers have been consistent and we’ve consistently moved along,” said Ritchie. “As far as we are concerned, we continue to believe in this marketplace ... and we are moving ahead as in the past.”

Reporting by Andrea Hopkins; Editing by Tomasz Janowski

BLOOMBERG. 15 September 2017. Canada Home-Sales Rebound as Lower Toronto Prices Entice Buyers

By Greg Quinn and Erik Hertzberg

Canadian home sales had their first increase in five months as tumbling prices in Toronto coaxed buyers back following government moves to cool the market in the nation’s largest city.

Toronto sales jumped 14.3 percent in August from July, leading a nationwide sales gain of 1.3 percent. Toronto activity remains 36 percent below a peak set in March, the month before the Ontario government brought in measures such as a foreign buyers tax, the Canadian Real Estate Association said Friday from Ottawa.

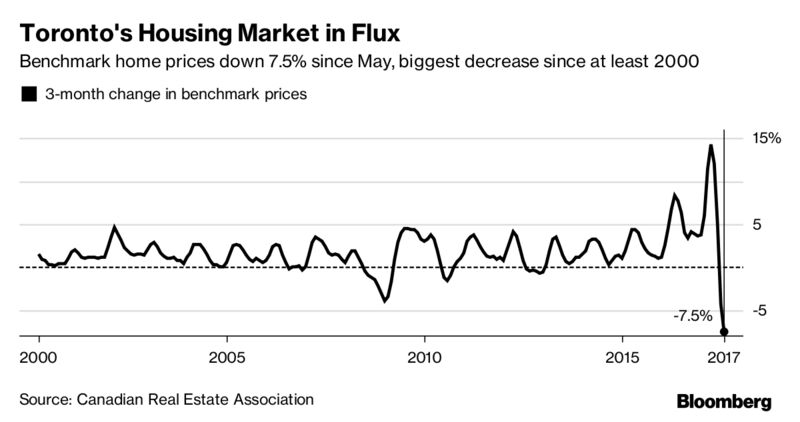

Toronto’s rebound comes as benchmark prices fell 2.3 percent on the month, CREA said, and 7.5 percent over three months, the biggest such decline in records back to 2000. In a city where many young buyers looked at smaller properties they could still afford, prices for all dwellings from condos to single detached units fell over the past two months, the first time that’s happened since the 2009 recession.

The housing gains may be short lived. The realtor group cut its sales forecast through next year, citing the tougher Ontario rules and the prospect of higher mortgage rates. CREA projects transactions will drop 5.3 percent this year, compared with a forecast in June for a 1.5 percent decline, and the number will fall another 2.3 percent in 2018.

“Changes to Ontario housing policies and higher interest rates are factors that will continue to lean against housing market activity over the rest of the year and into 2018,” the realtor group said Friday in an updated forecast it released along with the monthly sales figures.

COMPANIES

AMAZON. The Globe and Mail. 15 Sep 2017. Forget it Canada, we’re not winning the Amazon lottery

GARY MASON

Mayor John Tory thinks Toronto would be the perfect place for it. Not so fast, says Vancouver Mayor Gregor Robertson, his city has it all over any competitor in the country. But then, Mayor Naheed Nenshi feels the same way about Calgary, and Mayor Don Iveson, about his kingdom in Edmonton.

What is it they all covet so badly? The winning lottery ticket of urban investment: Amazon’s proposed second headquarters.

You may have heard that the world’s largest Internet retailer has plans to build a “full second” head office somewhere in North America. The company is talking about a $5-billion (U.S.) investment and 50,000 jobs that will pay an average of $100,000. It will require more than eight-million square feet of office space.

You don’t need to be Einstein to see how transformational a project of this magnitude could be for a metropolitan area. Amazon’s operation in Seattle is so big it consumes nearly an entire neighbourhood; one with a vibrant ecosystem of services and amenities aimed at Amazon employees. The company has become such a behemoth, it has been blamed for driving up the cost of housing in Seattle.

You can see why many cities, especially ones that are economically stagnant, are drooling at the prospect of having Amazon owner Jeff Bezos come to town to cut the ribbon on such phantasmagorical enterprise.

The problem is most of the cities dreaming about sharing its cafés with Amazon’s techies are, for the most part, doing just that: dreaming. That would include most, if not all, of the Canadian cities who plan to file a bid.

Jeff Bezos isn’t stupid. He likely already has two or three cities in mind for the venture. The cities that would meet important prerequisites the company is insisting on – proximity to a major transportation hub that includes an airport with direct flights to Seattle; an educated work force to draw upon; a metropolitan population of one-million plus – are already known to Amazon’s head honchos. One intangible will ultimately swing the deal: incentives.

There are lots of North American cities with a major airport and direct flights to Seattle. But there aren’t as many willing to fork over hundreds of millions, possibly billions in inducements. That’s what Mr. Bezos wants. And that’s what at least a few jurisdictions are likely willing to put up to land what civic leaders regard as a goose that will lay golden eggs for years to come.

When it comes to subsidies, Canadian cities are usually no match for their U.S. counterparts. Wisconsin just offered Chinese manufacturer Foxconn $3-billion in enticements to set up a crystal-display factory there. Washington State has given Boeing billions in contentious tax breaks to build its planes in Seattle. Texas is renowned for breaks to lure big business. And on it goes.

Some will argue the Canadian dollar serves as an incentive. Maybe at the moment. Still, cities such as Toronto and Vancouver are among the most expensive in the world in which to live. Also, Amazon is insisting that any site be serviced by public transit. What if it’s not? Are people living in a major Canadian city going to be happy to see their tax dollars used to build public infrastructure to meet the needs of a single company? Not a chance.

Mr. Bezos, who owns The Washington Post, is also in the crosshairs of U.S. President Donald Trump. Mr. Trump has called the Post, which has been highly critical of him, a “lobbyist weapon” for Amazon. I can picture the nationalistic rage the President would stir up if Mr. Bezos took 50,000 jobs to another country. I can’t imagine Amazon risking the backlash.

No, I don’t see the company building its HQ2 in Canada, and maybe that’s not a bad thing. It seems some people in the South Lake Union district of Seattle, where Amazon has established its sprawling campus, have had it with the insufferable attitudes possessed by many of the young whiz kids toiling for the company.

Someone recently went to the trouble of distributing a flyer around the Amazon neighbourhood that attempted to deflate some egos. Among the questions it asked Mr. Bezos’s employees: “Do you not realize that you are working for an updated version of Sears and Roebuck …?”

If Mr. Bezos really wants to make his mark, he’ll locate his headquarters somewhere it could have an extraordinary impact, some place that desperately needs a break – a city such as Detroit.

It may not have Seattle’s coffee shops but the pizza is way better.

AMAZON. The Globe and Mail. Bloomberg. 15 Sep 2017. Bigger cities aren’t necessarily better in Amazon’s contest

NOAH SMITH, Bloomberg View columnist and former assistant professor of finance at Stony Brook University

In a 2004 essay, [Pike] Powers listed what he saw as the factors behind Austin’s success. Corporate incentives were important, but he argues that creating capacity was even more crucial. This entailed ensuring sufficient land and water resources, encouraging university-business co-operation, building high-quality infrastructure and creating a livable environment.

Construction of three domes, part of an expansion of the Amazon.com campus in Seattle, is seen on April 27. Amazon has the power to create a new U.S. tech hub with its planned second headquarters.

The competition to host HQ2, as Amazon.com Inc.’s planned second headquarters is being called, has captivated a country. The lucky city can expect an economic bonanza: 50,000 jobs, plus the tech ecosystem the online retail giant’s presence will inevitably attract.

But the winner doesn’t have to be a big metropolis. On the contrary, Amazon has the power to create an entirely new U.S. technology hub.

In a recent piece, my colleague Conor Sen discusses some of the factors that will (or should) influence Amazon’s decision. These include an educated work force, an airport, tax incentives and – perhaps most importantly – a tolerant local culture. But Mr. Sen makes one assumption I’m not sure holds true: that the winner of HQ2 is going to have to be a large city.

Mr. Sen writes, “Amazon says it’s considering metro areas of a million or more, but realistically to provide 50,000 employees a metro area is going to need to be significantly larger than that. … Is Amazon, a company that thinks of growth in terms of decades, going to locate a headquarters in a place where it might have to hire over 4 per cent of the metro area’s labour force[?]”

But HQ2 would not do all of its hiring locally, any more than Amazon’s current headquarters hires exclusively from Seattle. Its mere presence would increase any city’s educated work force – indeed, boosting the tax base is one reason cities want it in the first place. The number of tech workers in the area would also rise when a bunch of other tech companies moved into town to be close to Amazon. This would, in turn, increase the skilled-labour pool that Amazon could draw on – an effect economists call “thick markets.”

Economists have long debated whether jobs tend to go where the workers are or vice versa. The most likely answer is “both.” Amazon certainly could decide to feed off an existing tech hub such as Boston or a huge metropolis such as Philadelphia. But it could also choose to create its own.

There’s actually an important precedent: Austin, Tex. In the early 1990s, a group of U.S. technology companies and universities, along with the U.S. Department of Defence, decided to band together to combat Japanese dominance in the semiconductor industry. The resulting consortium, called Sematech, held a highly publicized competition to decide where to locate its operations. Contenders included Silicon Valley and Boston, but in the end, the prize went to an up-andcoming college town: Austin.

Austin’s surprise victory was no random event. The area was already home to reputable tech companies such as Dell, Texas Instruments and Motorola. And it had the University of Texas, an unusually large and highquality school. But the city also had an unusual group of visionary leaders determined to transform the sleepy college town into one of the United States’ premier tech hubs. These included George Kozmetsky, a former technology entrepreneur who had been a professor at UT for 16 years, and Pike Powers, a consultant with a passion for regional development.

In a 2004 essay, Mr. Powers listed what he saw as the factors behind Austin’s success. Corporate incentives were important, but he argues that creating capacity was even more crucial. This entailed ensuring sufficient land and water resources, encouraging university-business co-operation, building high-quality infrastructure and creating a livable environment. Austin had it all – a tolerant, diverse culture, plenty of open space, good restaurants and bars, sports facilities and a legendary live-music scene.

Sematech is long gone, but Austin’s reputation remains. It’s known as one of the United States’ premier tech hubs, probably second only to Silicon Valley. Although it’s undoubtedly in the running for HQ2, Amazon could also choose to create the next Austin – a place that’s more like Austin was back in 1991.

Which up-and-coming tech cities might fit the bill? Raleigh, N.C., would be one. The population of the metro area barely exceeds Amazon’s threshold of one million, but the city is growing at a startling pace, with tech industries at the forefront. With its close proximity to Research Triangle Park and to three good schools – Duke, the University of North Carolina at Chapel Hill and North Carolina State University – the area looks as if it could be the top contender.

Other possibilities include Nashville and Minneapolis, Minn. Both have the requisite population size and international airports. Both have large universities nearby, plenty of cheap land and reputations as rising startup hubs. And both, like Raleigh, are located far from Amazon’s current headquarters on the West Coast.

So while a big city would be fine, Amazon clearly has another option. It could use its HQ2 to create the country’s next great Technopolis.

SOFTWOOD LUMBER

The Globe and Mail. 15 Sep 2017. Storms drive push to ease softwood tariffs. Pressure from industry mounts as affected states look to begin rebuilding. U.S. industry is struggling to meet current demand. The U.S. government is facing increasing pressure to reach a deal with Canada on softwood lumber, as demand for construction materials is expected to spike higher in Texas and Florida in the wake of hurricanes Harvey and Irma.

SHAWN McCARTHY

ADRIAN MORROW

Devastation wrought by hurricanes Harvey and Irma on communities across Texas and Florida, respectively, add a new dimension to continuing softwood-lumber negotiations between Canada and the United States.

While the U.S. lumber industry is dug in on its demand for tariffs, its customers argue that domestic supplies cannot meet their needs, which will drive up the cost of reconstruction in the states that sustained many billions of dollars in storm damage in recent weeks.

The Canadian government is hoping the added domestic pressure resulting from the hurricanes will help pave the way for a deal, Natural Resources Minister Jim Carr said on Thursday.

“We know that [the looming reconstruction] has an influence on markets and on demand,” Mr. Carr said after speaking at the Council of Forestry Ministers meeting in Ottawa.

“And we also know that Canadian producers offer a very good supply of softwood lumber in the United States. That’s an economic reality. Market forces are important, so we think that will almost certainly have some impact on thinking.”

However, during a visit to Washington on Thursday, Ontario Premier Kathleen Wynne said that a resolution to the softwood standoff currently looks unlikely.

Ms. Wynne met with U.S. Commerce Secretary Wilbur Ross at his office in Washington.

“He didn’t hold out, I would say, a clear hope that there is an easy resolution on the horizon,” the Premier said in an interview at the Canadian embassy.

The two sides were close to a deal over the summer, in which Canada would have agreed to a cap on the amount of softwood it would export to the United States. That quota, one source said at the time, would have been a little more than 30 per cent of U.S. market share to start, falling to slightly less than 30 per cent over five years, then holding steady for another five.

But talks deadlocked over whether Canada would able to exceed its cap in the event that U.S. industry couldn’t produce enough to meet the rest of the demand.

Canadian Ambassador to the United States David MacNaughton said this is still the sticking point in a deal. He pointed out that, as it stands, the United States is importing more lumber from Germany and Russia because it cannot produce enough to fill the market gap left by its punitive duties on Canadian wood.

HOUSEHOLD DEBIT

REUTERS. SEPTEMBER 15, 2017. Canada debt-to-income hits record as consumers face higher rates

Leah Schnurr

OTTAWA (Reuters) - Canadian household debt as a share of income hit a record in the second quarter as consumers spent more on durable goods, pointing to the challenges that could lie ahead for the economy as interest rates rise.

The ratio of debt to disposable income rose to 167.8 percent from a downwardly revised 166.6 percent in the first quarter, Statistics Canada said on Friday, meaning Canadians had C$1.68 of debt for every dollar of income.

While the report did not capture the effects of interest rate increases by the Bank of Canada in July and September, economists and policymakers are watching closely to see if heavily indebted consumers will be able to sustain higher interest payments.

“Certainly it’s confirming that debt levels remain high and (are) creeping up a little bit higher. That’s been an ongoing vulnerability for the Canadian economy,” said Paul Ferley, assistant chief economist at Royal Bank of Canada.

While higher interest rates are likely to dampen current strong consumer spending and could trip up some borrowers, most households should be able to cope, Ferley said.

Others fear a more dire situation if borrowing continues to outpace wage growth.

“Canadians continue to ‘tread water’ and are at risk of reaching their tipping point where they can no longer manage their debt payments,” says Scott Hannah, president of the Credit Counselling Society.

On a seasonally adjusted basis, households borrowed C$28.9 billion ($23.8 billion) in the second quarter, up from C$25.4 billion in the preceding quarter.

While mortgages made up more than half of this, the amount of borrowing to buy a home declined to C$16.5 billion from C$19.2 billion, the first decrease since the third quarter of 2016.

The pullback could help address some of the affordability issues in markets where prices have surged, said Ferley.

Separate data showed Canadian home resales bounced back in August after four straight monthly declines, suggesting the cooling market may be stabilizing, but forecasts for sales and prices for this year and next were lowered.

Consumer credit and other non-mortgage loans jumped to C$12.3 billion from C$6.2 billion as Canadians increased their spending on durable items.

Auto sales have been on a hot streak this year, putting Canada on track to hit a record this year.

The debt service ratio, which measures debt principal and interest payments as a proportion of income, was flat at 14.2 percent.

Additional reporting by Andrea Hopkins; Editing by Jeffrey Benkoe

________________

LGCJ.: