CANADA ECONOMICS

NAFTA

Global Affairs Canada. September 5, 2017. Trilateral Statement on the Conclusion of the Second Round of NAFTA negotiations

Ottawa, Ontario - Building on the progress made in the First Round of the renegotiation and modernization of the North American Free Trade Agreement (NAFTA), Canadian Foreign Affairs Minister, Chrystia Freeland, United States Trade Representative, Robert Lighthizer, and Mexican Secretary of the Economy, Ildefonso Guajardo, today successfully concluded the Second Round of negotiations, which took place in Mexico City from September 1 – 5.

Over the past five days, more than two dozen working groups comprised of trade experts and technical officials, worked diligently to advance the discussions and exchanged information and proposals. In several groups, this engagement resulted in the consolidation of proposals into a single text upon which the teams will continue to work throughout the following negotiation rounds.

Important progress was achieved in many disciplines and the Parties expect more in the coming weeks. The three countries will continue their respective processes of internal consultation in preparation for the Third Round of negotiations, which will take place in Ottawa, Canada, from September 23 – 27.

The Ministers from Mexico, the United States and Canada reaffirm their commitment to an accelerated and comprehensive negotiation, with the shared goal of concluding the process towards the end of this year.

The successful conclusion of these negotiations will update NAFTA through new rules that will generate important economic opportunities for all three countries, fostering further growth in the region for the benefit of the three NAFTA partners.

The Globe and Mail. 6 Sep 2017. Mexican minister vows results as NAFTA talks move to Canada

ADRIAN MORROW

Canadian Foreign Minister Chrystia Freeland shakes hands with U.S. Trade Representative Robert Lighthizer as Mexico’s Economy Minister Ildefonso Guajardo looks on in Mexico City on Tuesday.

Mexico’s Economy Minister is vowing that the renegotiation of the North American free-trade agreement will start to show results when talks move to Ottawa at the end of this month, as the three countries work to knock off the easiest items on the agenda.

But Canada, the United States and Mexico remain at loggerheads on a series of issues – from dispute settlement to labour – and U.S. negotiators have yet to even table details on some of the Trump administration’s toughest proposals.

At a joint event in the offices of the Mexican economy ministry on Tuesday at the end of the second round of talks, Economy Minister Ildefonso Guajardo said the three governments are working to find the areas of greatest agreement in hopes of putting them to rest in the next round.

“We have instructed our chief negotiators to commit to defining what we call the closest chapters, to begin to see the first results in the third round,” said Mr. Guajardo, flanked by Canadian Foreign Minister Chrystia Freeland and U.S. Trade Representative Robert Lighthizer. “We will be in close contact with the ministers to continue pushing our teams to present the first results in Canada.”

The three countries broadly agree on energy, which involves bringing Mexico’s rapidly opened oil and gas market into the deal, modernizing the agreement to cover the digital economy and cutting red tape for exporters and importers.

The third round is scheduled for Sept. 23 to 27. Two sources said it will most likely be held at Ottawa’s old city hall building at 111 Sussex Dr.

The 23-year-old pact is being renegotiated at the behest of U.S. President Donald Trump, who blames the deal for moving factory jobs out of his country. Mr. Trump, who has repeatedly threatened to pull out of the deal, wants talks done by the end of the year to fulfill a key campaign pledge. Mexico wants to avoid discussions running into its presidential election next year. By comparison, most trade agreements take three to five years to negotiate.

The three countries have tabled two dozen texts that are now being merged into a single master document from which negotiators will identify the areas of agreement and points of friction.

“This is Day 20 of an extremely accelerated and extremely comprehensive negotiation,” Ms. Freeland said. “We are running fast for the end of the year.”

Mr. Lighthizer said negotiators are working at “warp speed” to get a deal.

But for all the talk of progress on Tuesday, the countries are separated by vast gulfs on the most contentious files.

The United States has signalled it will demand an American-content requirement in autos manufactured in the NAFTA zone; demanded that Canada’s protectionist system of supply management for milk, eggs and poultry be loosened; and pushed for the gutting of the Chapter 19 disputeresolution system that Canada and Mexico insist on, sources with knowledge said of the closed-door talks.

The round ended without the United States providing specific numbers on the American-content requirement, detailing exactly how it wanted supply management loosened or proposing an exemption for “Buy American” laws from government contracting rules, the sources said.

Canada, for its part, is pushing for the United States to ban “right-to-work” laws blamed for impoverishing unions in some states and pushed for climate change to be included in the pact.

The talks unfolded in an atmosphere of escalating tension.

Mr. Trump repeatedly threatened to pull out of the deal in the days leading up to the talks. He also took renewed aim at Mexico, blaming the country for “tremendous drugs” pouring over the border. On Tuesday, his administration announced it would do away with Deferred Action for Childhood Arrivals, a program that allowed undocumented immigrants brought to the United States as children to live and work legally in the country.

Mexico condemned the move, which would largely affect Mexican nationals.

CANADA - ASEAN

Global Affairs Canada. September 6, 2017. Parliament Secretary Goldsmith-Jones to visit Philippines for 6th ASEAN economic ministers’ meeting with Canada

Ottawa - Canada is committed to strengthening its engagement with ASEAN and its member states through ongoing collaboration.

On behalf of the Honourable François-Philippe Champagne, Minister of International Trade, Parliament Secretary Pamela Goldsmith-Jones will travel to Manila, Philippines, to attend the 6th Association of Southeast Asian Nations (ASEAN) Economic Ministers-Canada Consultation on September 8, 2017.

ASEAN is one of the world’s fastest growing economic regions. The Parliamentary Secretary will meet with ASEAN economic ministers to discuss progress and opportunities to further deepen the Canada-ASEAN trade and investment relationship. 2017 also marks Canada’s 40th anniversary of Dialogue Partner relations with ASEAN and is a good opportunity to further strengthen our partnership.

Canada’s commitment to engaging with ASEAN is demonstrated by the country’s diplomatic presence in all 10 ASEAN member states and by the initiatives Canada has undertaken to bolster its presence in the region.

Quotes

“Strengthening commercial ties with ASEAN is part of the Government of Canada’s plan to create jobs, growth and long-term prosperity for the middle class. As a group, ASEAN represents Canada’s sixth-largest trading partner and we have significantly developed our relationship in recent years’’.

- François-Philippe Champagne, Minister of International Trade

“Canada is a Pacific nation and for 40 years ASEAN has been our partner in Southeast Asia. Our close relationship is built on strong people-to-people ties and ever growing commercial success. This meeting provides Canada and ASEAN with an opportunity to highlight our mutual successes and to broaden our economic connections.”

- Pamela Goldsmith-Jones, Parliamentary Secretary to the Minister of International Trade

Quick facts

- In 2016, Canada-ASEAN merchandise trade reached a value of $21.6 billion.

- ASEAN is one of the world’s fastest-growing economic regions, with a GDP estimated at over $3.1 trillion in 2015.

- The Philippines is the chair of ASEAN in 2017 and is responsible for coordinating ASEAN’s overall relationship with external partners, including Canada.

- This year marks the 40th anniversary of Canada’s status as a Dialogue Partner of ASEAN. Canada is one of only 10 countries with this important level of partnership.

INTERNATIONAL TRADE

StatCan. 2017-09-06. Canadian international merchandise trade, July 2017

Imports

$47.2 billion, July 2017

-6.0% decrease (monthly change)

Exports

$44.1 billion, July 2017

-4.9% decrease (monthly change)

Trade balance

-$3.0 billion, July 2017

Source(s): CANSIM table 228-0069.

Canada's merchandise trade deficit totalled $3.0 billion in July, narrowing from a $3.8 billion deficit in June. Imports fell 6.0% and exports decreased 4.9%, both due mainly to the effect of widespread price decreases, while the Canadian dollar appreciated sharply relative to the American dollar in July.

Chart 1 Chart 1: Merchandise exports and imports

Merchandise exports and imports

Widespread declines in imports in July

Total imports fell 6.0% in July to $47.2 billion, following seven consecutive monthly increases, with declines observed in all commodity sections. Prices were largely responsible for this decrease, falling 3.8%. This occurred as the Canadian dollar gained 3.6 cents US relative to the American dollar from June to July.

The decrease in import values was partially attributable to aircraft and other transportation equipment and parts, as well as motor vehicles and parts. Year over year, imports rose 4.0%.

Following a record observed in June, imports of aircraft and other transportation equipment and parts fell 35.2% to $1.6 billion in July. Aircraft imports led this decrease, with a slowdown in imports of airliners in July after two months of strong growth.

Imports of motor vehicles and parts also contributed to the decline, down 4.4% to $9.1 billion. Imports of motor vehicle engines and motor vehicle parts (-13.0%) were responsible for the decrease in July, as planned closures in the automotive manufacturing industry were longer this year. Overall, prices in the section declined 2.6% and volumes decreased 1.8%.

Lower export values mainly due to prices

After posting a 5.0% decline in June, total exports fell 4.9% in July to $44.1 billion, with decreases observed in 9 of 11 sections. Prices decreased 3.9%, while volumes were down 1.1%. Motor vehicles and parts, as well as aircraft and other transportation equipment and parts contributed the most to the decline. In July, exports excluding energy products were down 5.2%. Year over year, total exports were up 2.2%.

Exports of motor vehicles and parts fell 9.6% to $7.4 billion in July, the strongest decrease since August 2014. Exports of passenger cars and light trucks (-12.6%) were mostly responsible for the decline. As was the case with imports of motor vehicle engines and motor vehicle parts, longer planned closures in the automotive manufacturing industry in July were behind the decrease. Overall, prices were down 4.5% and volumes decreased by 5.4%.

Exports of aircraft and other transportation equipment and parts were down 18.3% in July to $1.8 billion, following four consecutive monthly increases. Exports of aircraft led the decline, falling 23.9% due to lower exports to the United States.

Decline in imports from the United States

Imports from the United States decreased 6.7% to $30.4 billion in July, led by lower aircraft imports. Exports to the United States were down 3.2% to $33.3 billion, mainly on lower exports of passenger cars and light trucks. As a result, Canada's trade surplus with the United States widened from $1.8 billion in June to $2.9 billion in July.

Exports to countries other than the United States declined 10.0% in July to $10.8 billion, with the United Kingdom (unwrought gold), Japan (copper, canola and seafood) and Saudi Arabia (personal transportation equipment) posting the largest decreases. Imports from countries other than the United States were down 4.7% to $16.8 billion in July, with Brazil (bauxite) and Mexico (motor vehicle parts) contributing the most to this decrease. Consequently, Canada's trade deficit with countries other than the United States rose from $5.6 billion in June to $5.9 billion in July.

Real trade deficit narrows in July

In real (or volume) terms, imports decreased 2.3% and exports were down 1.1% in July. Consequently, Canada's trade deficit in real terms narrowed from $891 million in June to $338 million in July.

Chart 2 Chart 2: International merchandise trade balance

International merchandise trade balance

Revisions to exports and imports

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, as well as amendments made for late documentation of high-value transactions. Exports in June, originally reported as $46.5 billion in last month's release, were revised to $46.4 billion in the current month's release. However, exports in May, originally reported as $48.6 billion in June's release, were revised to $48.9 billion on revisions applied to energy prices. June imports, originally reported as $50.1 billion in last month's release, were revised to $50.2 billion.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170906/dq170906a-eng.pdf

The Globe and Mail. REUTERS. SEPTEMBER 6, 2017. U.S. services sector growth accelerates, trade deficit edges up

LUCIA MUTIKANI, WASHINGTON

U.S. services sector activity accelerated in August amid strong gains in new orders and employment, suggesting that a slowdown in job growth last month was probably temporary.

The economic outlook received a further boost from other data on Wednesday showing only a modest rise in the trade deficit in July. The reports were the latest signs that the economy had gathered momentum early in the third quarter.

Economists, however, cautioned that Hurricane Harvey, which devastated parts of Texas, could sap some of the strength.

"The U.S. economy carried a little more momentum than originally thought," said Jennifer Lee, a senior economist at BMO Capital Markets in Toronto. "However, some of that momentum will be blunted by, for starters, Hurricane Harvey."

The Institute for Supply Management (ISM) said its non-manufacturing activity index increased 1.4 points to 55.3 in August, rebounding from an 11-month low in the prior month. A reading above 50 indicates expansion in the sector, which accounts for more than two-thirds of U.S. economic activity.

Last month's increase in services industry activity also reflected a jump of 1.6 points in the production subindex.

Even more encouraging, a measure of services sector employment jumped 2.6 points. The government reported last week that the economy created 156,000 jobs in August, with the private services sector hiring the smallest number of workers in five months.

Economists largely shrugged off the slowdown in job growth, blaming it on a seasonal quirk. Over the past several years, the initial August job count has tended to exhibit a weak bias, with revisions subsequently showing strength.

Last month, services industries also reported an increase in new orders as well as prices. The ISM said the "majority of respondents are optimistic about business conditions going forward."

The dollar was trading marginally lower against a basket of currencies as traders digested news that Federal Reserve Vice Chair Stanley Fischer would step down next month.

Prices for longer-dated U.S. Treasuries rose, while stocks on Wall Street were trading mostly higher.

CHINA TRADE GAP WIDENS

Reports on consumer and business spending have suggested the economy gathered more strength early in the third quarter after gross domestic product increased at a 3.0 per cent annualized rate in the April-June period.

In a separate report on Wednesday, the Commerce Department said the trade deficit rose 0.3 per cent to $43.7-billion in July. When adjusted for inflation, the trade deficit widened to $61.6-billion from $60.8-billion in June.

The so-called real goods deficit in July was below the second-quarter average of $62.4-billion.

While that suggests trade could add to gross domestic product in the third quarter, economists at Wrightson ICAP cautioned that Hurricane Harvey could significantly impact commodity prices and trade volumes, and push up the trade deficit in September.

Trade added two-tenths of a percentage point to GDP in the second quarter.

The politically sensitive U.S.-China trade deficit increased to an 11-month high in July. That ongoing deficit has grabbed the attention of President Donald Trump, who has blamed it for helping to decimate U.S. factory jobs as well as stunting U.S. economic growth.

Trump, who argues that the United States has been disadvantaged in its dealings with trade partners, has ordered the renegotiation of the North American Free Trade Agreement (NAFTA), which was signed in 1994 by the United States, Canada and Mexico.

On Saturday, Trump threatened to withdraw from a free trade deal with South Korea.

"When you negotiate with countries keep in mind you are really going up against some of the biggest corporations in America who moved their operations overseas years ago," said Chris Rupkey, chief economist at MUFG in New York.

"This deficit concern is somewhat misguided as it is largely a trade war with ourselves. These jobs are not coming back to America's heartland."

In July, real goods exports slipped despite petroleum exports hitting a record high. Exports of goods and services fell 0.3 per cent to $194.4-billion in July. Exports of motor vehicles and parts fell, but shipments of capital goods rose.

Exports to China increased 3.5 per cent, while those to the European Union tumbled 9.8 per cent.

Imports of goods and services slipped 0.2 per cent to $238.1-billion in July. There were declines in imports of motor vehicles and parts as well as crude oil.

Imports of goods from China increased 3.1 per cent. The U.S.-China trade deficit rose 3.0 per cent to $33.6-billion in July, the highest level since August 2016.

The United States saw a 3.7 per cent drop in goods and services imported from the EU in July, which left the trade deficit with the economic bloc 7.9 per cent higher at an eight-month high of $13.5-billion.

REUTERS. SEPTEMBER 6, 2017. Canada trade deficit shrinks as strong Canadian dollar hits imports, exports

David Ljunggren

OTTAWA (Reuters) - Canada’s trade deficit in July shrank to C$3.04 billion, thanks largely to a strong Canadian dollar that cut the value of imports and also helped depress exports, Statistic Canada said on Wednesday.

Analysts in a Reuters poll had predicted a shortfall of C$3.1 billion. Statscan revised June’s deficit to C$3.76 billion in June from an initial C$3.60 billion.

In volume terms, imports fell by 2.3 percent while exports dropped by 1.1 percent.

The data came too late to influence the Bank of Canada, which was due to make an interest rate announcement at 10 am ET (1400 GMT) on Wednesday. Analysts are split over whether it will hike rates for the second time this year as the economy strengthens.

The central bank has long fretted over what it sees as the relative underperformance of Canada’s non-energy export sector.

“Prices did play a significant role but weaker volumes also contributed and point to a slowdown in growth in the third quarter,” said Royce Mendes of CIBC Economics.

The value of imports fell by 6.0 percent from June, with lower prices accounting for most of the decline. The Canadian dollar gained 3.6 U.S. cents against the greenback in July.

The robust domestic currency also depressed the value of exports, which dropped by 4.9 percent after falling by 5.0 percent in June. Many major exporters price their goods in U.S. dollars, which means they receive fewer Canadian dollars as the currency strengthens.

Export Development Canada Chief Economist Peter Hall said the slipping exports could be explained in part by longer than usual shutdowns in the auto sector.

“Two months of declining exports bears watching ... This is not great news but the fundamentals suggest this is not going to last,” he said in a phone interview.

Exports to the United States, which accounted for 75.5 percent of Canadian goods exports in July, fell by 3.2 percent while imports plunged by 6.7 percent. As a result, the trade surplus with the United States grew to C$2.90 billion from C$1.80 billion in June.

Paul Ferley, assistant chief economist at Royal Bank of Canada, said although the trade balance had improved, “unfortunately it is not coming from the source you want to see, strength in exports”.

Separately, Statscan said the labor productivity of businesses dipped by 0.1 percent in the second quarter as the number of hours worked grew faster than business output.

Reporting by David Ljunggren; Editing by Frances Kerry

BLOOMBERG. 6 September 2017. Canada Trade Deficit Exceeds C$3 Billion for 2nd-Straight Month

By Greg Quinn

Canada’s merchandise trade deficit exceeded C$3 billion ($2.5 billion) for a second month in July as exports slumped.

The shortfall of C$3.04 billion followed a revised C$3.76 billion reading for June, Statistics Canada reported Wednesday from Ottawa. Economists predicted a C$3.3 billion deficit according to the median in a Bloomberg survey.

Exports fell by 4.9 percent in July, and are down almost 10 percent over two months, adding to concerns Canada’s recovery may be more fragile than it appears. Imports, meanwhile, declined by 6 percent. Statistics Canada attributed the declines to price swings as the country’s currency surged against the U.S. dollar.

— With assistance by Erik Hertzberg

INTERNATIONAL RESERVE

Department of Finance Canada. September 6, 2017. Official International Reserves

Ottawa - The Department of Finance Canada announced today that Canada's official international reserves increased by an amount equivalent to US$155 million during August to US$85,103 million.

Details on the level and composition of Canada's reserves as of August 31, 2017, as well as the major factors underlying the change in reserves, are provided below. All figures are in millions of US dollars unless otherwise noted.

| Millions of US dollars | |

|---|---|

| Securities | 65,516 |

| Deposits | 9,509 |

| Total securities and deposits (liquid reserves): | 75,025 |

| Gold | 0 |

| Special drawing rights (SDRs) | 7,901 |

| Reserve position in the IMF | 2,177 |

| Total: | |

| August 31, 2017 | 85,103 |

| July 31, 2017 | 84,948 |

| Net change: | 155 |

INTEREST RATE

BANK OF CANADA. 6 September 2017. Bank of Canada increases overnight rate target to 1 per cent

Ottawa, Ontario - The Bank of Canada is raising its target for the overnight rate to 1 per cent. The Bank Rate is correspondingly 1 1/4 per cent and the deposit rate is 3/4 per cent.

Recent economic data have been stronger than expected, supporting the Bank’s view that growth in Canada is becoming more broadly-based and self-sustaining. Consumer spending remains robust, underpinned by continued solid employment and income growth. There has also been more widespread strength in business investment and in exports. Meanwhile, the housing sector appears to be cooling in some markets in response to recent changes in tax and housing finance policies. The Bank continues to expect a moderation in the pace of economic growth in the second half of 2017, for the reasons described in the July Monetary Policy Report (MPR), but the level of GDP is now higher than the Bank had expected.

The global economic expansion is becoming more synchronous, as anticipated in July, with stronger-than-expected indicators of growth, including higher industrial commodity prices. However, significant geopolitical risks and uncertainties around international trade and fiscal policies remain, leading to a weaker US dollar against many major currencies. In this context, the Canadian dollar has appreciated, also reflecting the relative strength of Canada’s economy.

While inflation remains below the 2 per cent target, it has evolved largely as expected in July. There has been a slight increase in both total CPI and the Bank’s core measures of inflation, consistent with the dissipating negative impact of temporary price shocks and the absorption of economic slack. Nonetheless, there remains some excess capacity in Canada’s labour market, and wage and price pressures are still more subdued than historical relationships would suggest, as observed in some other advanced economies.

Given the stronger-than-expected economic performance, Governing Council judges that today’s removal of some of the considerable monetary policy stimulus in place is warranted. Future monetary policy decisions are not predetermined and will be guided by incoming economic data and financial market developments as they inform the outlook for inflation. Particular focus will be given to the evolution of the economy’s potential, and to labour market conditions. Furthermore, given elevated household indebtedness, close attention will be paid to the sensitivity of the economy to higher interest rates.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/09/fad-press-release-2017-09-06.pdf

The Globe and Mail. SEPTEMBER 6, 2017. Canadian banks hike prime rates by quarter percentage point

DAVID BERMAN

Canada's biggest banks have responded to the Bank of Canada's interest rate increase on Wednesday morning, raising their prime rates in lockstep with the central bank's move.

Royal Bank of Canada was the first bank to respond, raising its prime rate by a quarter of a percentage point, to 3.2 per cent. Toronto-Dominion Bank, Bank of Montreal, Canadian Imperial Bank of Commerce and Bank of Nova Scotia followed soon after with the same increase.

The big banks tend to move together when they adjust their prime rates, which affect variable rates on loans and mortgages.

However, they don't always adjust their prime rates exactly in line with the Bank of Canada's moves. When the Bank of Canada last cut its key interest rate, by a total of half a percentage point, the banks lowered their prime rates by just half that amount.

But following the central bank's last two rate increases, including Wednesday's quarter point increase that raise the overnight rate to 1 per cent, the banks appear to be raising their prime rates by the same amount.

For the banks, higher prime rates should translate into fatter margins on loans. At a financials conference on Wednesday, RBC's chief executive officer, Dave McKay, estimated that the Bank of Canada's rate hike will add $100-million of revenue to RBC's retail operations, according to Bloomberg.

For consumers, higher prime rates will mean homeowners with variable rate mortgages will see rates rise when the new prime rates kick in on Thursday.

"Anyone who currently has a variable rate mortgage should consider if now is a good time to lock into a fixed rate mortgage," James Laird, co-founder of Ratehub.ca and president of CanWise Financial mortgage brokerage, said in a statement.

The moves in both the Bank of Canada's overnight rate and the big banks' prime rates follow some uncertainty in certain areas within Canada's housing market. The Toronto Real Estate Board reported on Wednesday that Toronto home prices in August fell 20.5 per cent from their peak in April, while the number of home sales fell 34.8 per cent from last year.

BANK OF CANADA. REUTERS. SEPTEMBER 6, 2017. Bank of Canada surprises with second rate hike, eyes future moves

Andrea Hopkins, Leah Schnurr

OTTAWA (Reuters) - The Bank of Canada raised interest rates on Wednesday, surprising many, and left the door open to more rate hikes in 2017 even as it pledged to pay attention to how higher borrowing costs would hit Canada’s indebted households.

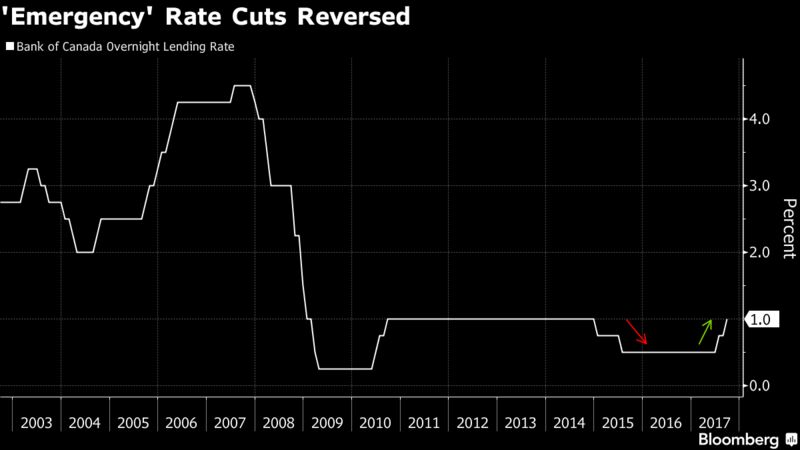

The 25-basis-point increase to 1 percent followed a hike in July and puts Canada ahead of the curve in returning borrowing costs to more normal levels after they were slashed due to the 2007-2009 financial crisis. While the U.S. Federal Reserve has begun tightening, its pace has been slower.

The Bank of Canada said the hike was warranted given unexpectedly strong economic growth in the second quarter, but said future moves are not predetermined and would be guided by data and market developments.

“I guess they felt the economy was too strong for their comfort and raises inflation risks,” said Sal Guatieri, senior economist at BMO Capital Markets.

While a significant minority in the market had bet on a move on Wednesday, most analysts had expected the bank would wait until its October meeting to hike, and the back-to-back increases rocked financial markets.

The Canadian dollar surged more than 2 percent after the announcement to its strongest since June 2015 at C$1.2140, while the 2-year yield jumped as much as 10 basis points to its highest since April 2012 at 1.450 percent.

The tone of the statement that accompanied the rate decision had not moderated at all since July, when the bank raised rates for the first time in nearly seven years, said Eric Theoret, currency strategist at Scotiabank.

“There is no sense that the Bank of Canada looks to be moderating the tighter path from here. For them, it’s still a very data-dependent outlook,” Theoret said.

The market had widely expected the Bank to reverse the two rate cuts it made in 2015 amid a decline in oil prices that sideswiped Canada’s energy-dependent economy.

Now that the so-called insurance has been removed, the next step is less certain, particularly given the vulnerability of Canada’s indebted consumers and housing market to higher interest rates.

Canadian household debt is near record levels and housing prices in Toronto, Canada’s biggest city, have already fallen more than 20 percent from their April peak.

While some analysts fear higher rates will hurt consumers and spur a broader housing market correction, Dominion Lending Centers Chief Economist Sherry Cooper said the bank’s policymakers are likely happy with the slowdown.

“This is a change welcomed by the Bank and government authorities concerned about the continued rise in household debt,” Cooper said in a note to clients.

Guatieri said if the economy remains exceptionally strong, the bank could hike again in October, but the sensitivity of indebted households and the housing market to higher interest rates “probably warrants some caution on their part.”

Markets will now be watching both economic data and a speech by Bank of Canada Governor Stephen Poloz scheduled for Sept. 27 in which he is expected to provide an economic update.

Additional reporting by Fergal Smith and Solarina Ho in Toronto; Editing by Meredith Mazzilli

BLOOMBERG. 6 September 2017. Bank of Canada Raises Benchmark Rate to 1%

By Theophilos Argitis

- Central bank cites concern about continued excess capacity

- Future rate increases are “not predetermined,” BOC says

The Bank of Canada forged ahead with another interest rate hike in a nod to the country’s surging economy, while signaling its appetite for further tightening may be curbed by a rising currency and sluggish price pressures.

Policy makers raised their benchmark rate 25 basis points to 1 percent, the second increase since July. At the same time, they cited risks including continued excess capacity, subdued wage and price pressures, geopolitics and the higher Canadian dollar, along with concern about the impact of rising interest rates on indebted households.

“Future monetary policy decisions are not predetermined and will be guided by incoming economic data and financial market developments as they inform the outlook for inflation,” the Bank of Canada said Wednesday in a statement from Ottawa.

Governor Stephen Poloz is trying to strike a balance between bringing interest rates back to more normal levels amid the strongest growth spurt in more than a decade, without harming an economy that is only now beginning to fully recover from an almost decade-long downturn. Markets, shrugging off some of the more dovish language, sent the Canadian dollar to the highest level in more than two years as it interpreted the statement as confirmation the central bank is firmly on a rate hike path.

“What they are saying to me is they are leaving the door open to future hikes,” said Derek Holt, head of capital markets economics at Bank of Nova Scotia in Toronto. He changed his forecast last week to correctly predict the rate increase.

Erik Hertzberg/Bloomberg

Investors are anticipating as many as two hikes from the Bank of Canada over the next year, including one by the end of 2017, according to swaps trading, on the expectation the central bank is worried quickly vanishing economic slack will soon fuel inflation.

Canada’s currency climbed as much as 1.8 percent after the decision, reaching C$1.2146 against its U.S. counterpart, the highest intraday level since June 2015, and extending the gain this year to 10 percent. Bonds yields surged, with the two-year note jumping seven basis points to 1.42 percent, the highest in more than five years.

Only six of 26 economists surveyed by Bloomberg News expected the central bank to hike its benchmark rate. Traders had assigned about a 40 percent chance of an increase.

Adding to the market reaction was the fact the bank didn’t repeat language from previous statements about the current degree of stimulus being “appropriate,” which suggests it will stay on its tightening path.

‘Fairly Hawkish’

“It didn’t say that the current level of stimulus is now ‘appropriate,’ which has been a phrase used in the past and would have been a way of signaling a pause in hikes from here,” Andrew Grantham, an economist with Canadian Imperial Bank of Commerce, said in a note to investors. “It was a fairly hawkish move and statement today.”

Few developed economies are growing as quickly as Canada. The economy accelerated at a 4.5 percent pace in the second quarter -- tops among Group of Seven countries -- led by the biggest binge in household spending since before the 2008-2009 global recession.

Quarterly growth has averaged 3.7 percent over the past four quarters, compared to 2.2 percent in the U.S. Economists are now projecting growth of above 3 percent in Canada for all of 2017, a full percentage point above the U.S. The surge may have already brought the country to full capacity more quickly than the central bank estimated only two months ago. That would typically be a strong signal to policy makers that interest rates need to rise.

Considerable Stimulus

The bank cited Canada’s stronger-than-expected economic performance for the hike, warranting a removal of some of the “considerable” stimulus in place. In effect, the bank fully removed the two rate cuts from 2015, which were meant to counter the negative impact of falling commodity prices.

Recent better-than-expected data supports the view that growth is more “broadly-based and self-sustaining,” the bank said, citing more “widespread strength” in business investment and exports, and “stronger-than-expected indicators of growth” globally.

Yet, there was an introduction of cautionary language, and new worries about financial market developments, that weren’t in the last rate decision and suggests the central bank isn’t quite ready to declare victory on the economy totally eliminating its slack.

“There remains some excess capacity in Canada’s labor market, and wage and price pressures are still more subdued than historical relationship would suggest,” according to the statement.

Poloz may also be attempting to restrain market expectations it will get too far ahead of the Federal Reserve, citing worries about recent “financial market developments.”

The bank said there remains “significant geopolitical risks and uncertainties” around international trade and fiscal policies that have weakened the U.S. dollar. The suggestion is the Canadian dollar gains aren’t totally reflective of Canadian growth and it was the first reference to the Canadian dollar in a rate statement since March.

The bank also said it will pay close attention to the “sensitivity” of the economy to higher interest rates given “elevated” household indebtedness, and added it will pay “particular focus” to the evolution of the economy’s potential growth rate, possibly a suggestion that the economy can run at a faster pace than the bank originally thought without triggering inflation.

— With assistance by Greg Quinn, and Erik Hertzberg

AVIATION

The Globe and Mail. 6 Sep 2017. Ottawa looks for second-hand jets amid Boeing dispute. The Canadian government is looking into buying second-hand fighter jets in Australia – instead of a new fleet of 18 Super Hornets – as it tries to force Boeing Co. to drop its trade dispute against Bombardier Inc., sources said.

DANIEL LEBLANC With a report from Nicolas Van Praet

Boeing International president Marc Allen, seen in Ottawa on Sept. 1, urged the Canadian government to stop making the link between their case against Bombardier and the Super Hornet contract, saying he ‘wouldn’t want the U.S. government trading national security for trade.’

Federal officials said the government is refusing to sign a planned multibillion-dollar contract for Super Hornets as long as Boeing pursues its complaint against Bombardier at the International Trade Commission in the United States.

A final decision to pull the plug on the Super Hornet contract has not been made, but tensions with Boeing are quickly escalating and the government is looking at all options to increase the pressure on the firm, the officials said.

A Canadian delegation travelled to Australia last month to see whether second-hand F/A-18 fighter jets, which are being placed on the market by the country’s military, could fit Canada’s needs for an “interim” fleet.

In addition, Prime Minister Justin Trudeau called Eric Greitens, the Governor of Missouri, where Boeing’s Super Hornets are assembled, to highlight the billions of dollars and thousands of jobs that are now in play.

“Canada is reviewing current military procurement that relates to Boeing, as Boeing is pursuing unfair and aggressive trade action against the Canadian aerospace sector. Meanwhile, Boeing receives billions in support from U.S. federal, state and municipal governments,” the Prime Minister’s Office said on Tuesday.

Federal officials said that Boeing recently walked away from discussions with the federal government to find a way to settle the Bombardier dispute. Last week, a senior executive from the firm told Canadian media that Boeing would not back down in its fight against unfair subsidies, alleging Bombardier received billions in illegal assistance from the Canadian and Quebec governments.

“We recognize the Canadian government might be upset with us. We don’t intend to upset anybody, but we plainly have to do what we believe is right,” Boeing International president Marc Allen told The Globe and Mail.

Boeing complained in April to the U.S. Department of Commerce that Bombardier’s C Series planes were unfairly subsidized by the Canadian and Quebec governments. Last year, Bombardier sold 75 109-seat CS100 planes to Delta Air Lines at a cut-rate cost, which led to Boeing’s accusation of predatory pricing.

Bombardier has denied any wrongdoing and is currently defending itself in front of the International Trade Commission.

“The bottom line is that Boeing’s petition is meritless and based on false assumptions citing a campaign in which they didn’t even compete,” Bombardier Commercial Aircraft spokesman Bryan Tucker said. “Boeing’s petition is a direct attack on innovation, competition, development and jobs on both sides of the border.”

However, Mr. Allen urged the federal government to stop making a link between Boeing’s case against Bombardier and the Super Hornet contract, which Ottawa announced last year to fill a “capability gap” until a new fleet of fighter jets is acquired in the next decade.

“We are not here to tell the sovereign state what to do, that’s not our role and we would never pretend to that. Do we think the two should be tied together? No, we don’t think they should be,” Mr. Allen said. “If you ask me my opinion, I wouldn’t want the U.S. government trading national security for trade.”

Mr. Allen said the federal government should not forget that Boeing does $4-billion a year of business in Canada, with 560 suppliers and an overall impact of 17,000 jobs.

“If Canada kicks Boeing out, I think that will be deeply unfortunate for us both. It would be a deeply unfortunate outcome,” he said. “It has to be a two-way street, there has to be this mutually beneficial relationship for it to be one that grows, one that both sides are happy and excited about.”

However, Mr. Trudeau pointed out on Tuesday to Mr. Greitens that Canada is Missouri’s biggest trading partner.

“Canada-Missouri bilateral trade was valued at US$8.2-billion in 2016, and 163,800 jobs in Missouri depend on trade and investment with Canada,” the Prime Minister’s Office said in its statement.

The Globe and Mail. Reuters. 6 Sep 2017. United Tech defends Rockwell deal. Acquisition would create a major supplier to Boeing, Airbus and Bombardier at a time when plane makers are pressing for price cuts

ALWYN SCOTT

Aerospace and industrial company United Technologies Corp. defended its $23-billion (U.S.) acquisition of avionics maker Rockwell Collins Inc. on Tuesday, as Boeing Co. said it was skeptical the deal would benefit airlines.

United Tech shares fell 5 per cent as some analysts downgraded the company, citing its decision to halt share buybacks for three to four years and dilution from the cash-and-stock deal.

Boeing said it would take a hard look at the combination, the largest in aerospace history, and use the power granted by its contracts with the companies, and its sway with regulators, “to protect our interests.”

United Tech chief executive Greg Hayes earlier on Tuesday said he had assured Airbus SE CEO Tom Enders that the Pratt & Whitney engine division will stay focused on delivering between 350 and 400 jetliner engines this year.

Airbus raised concern about the Rockwell acquisition last week, and Boeing has been known to oppose deals if suppliers gain too much power or risk losing focus.

“Pratt has nothing to do with this deal,” Mr. Hayes told Reuters. “They won’t be part of the integration efforts” combining United Tech’s separate aerospace unit with Rockwell Collins to create Collins Aerospace.

Mr. Hayes also knocked down speculation that the purchase would prompt United Tech to spin off its Carrier air-conditioner or Otis elevator units, saying the company needs their cash flow to help pay down debt from the deal.

But Mr. Hayes did not rule out such sales in the longer term.

“After the deal is done, and after we pay down some debt, we’re going to go back and look,” he said.

If the company’s share price does not reflect its value, he said, “we’ll need to do something.”

United Tech could sell “noncore pieces” such as home security in the meantime, Mr. Hayes said. But given taxes and lost earnings, “it’s hard to make financial sense out of those transactions” unless they fetch a high price, he said.

Rockwell’s shares rose 0.5 per cent to $131.26 in midday trading. United Tech shares, part of the Dow Jones industrial average, fell 4.9 per cent to $112.18.

“We see limited upside near term as share repurchase is withdrawn and deal timing becomes an investor focus,” analyst Jeff Sprague at Vertical Research Partners said in a note.

United Tech had planned $2-billion in buybacks in the second half of 2017, he said.

The acquisition, announced on Monday, would create a major supplier to Boeing, Airbus and Bombardier at a time when the plane makers are pressing for price cuts and trying to compete against suppliers on services and spare parts.

It also marks the rise of a second engines-to-seating supplier, after jet-engine maker Safran SA’s pending $7.7-billion deal to buy seat maker Zodiac Aerospace. Safran said on Tuesday it would look at assets that might come up for sale after the United Tech-Rockwell deal.

United Tech’s engines and systems portfolio has little overlap with the avionics, seats and interiors businesses of Rockwell, which Mr. Hayes said should mean little trouble during the necessary regulatory review.

United Tech expects to borrow $15-billion and will assume $7-billion in Rockwell debt to fund the deal, which is expected to close by the third quarter of 2018.

United Tech said the acquisition would add to earnings in its first full year and yield at least $500-million in cost savings by the fourth year of operation.

BOEING. REUTERS. SEPTEMBER 6, 2017. United orders more Airbus A350s but drops largest model

Tim Hepher

PARIS (Reuters) - United Airlines has ordered 10 extra Airbus (AIR.PA) A350 jetliners, while ditching the largest model, the A350-1000, in favor of the smaller and more popular A350-900 and delaying deliveries to save cash, the companies said on Wednesday.

United Airlines will now take 45 A350-900 aircraft instead of 35 of the upcoming A350-1000, which is undergoing flight trials before the first delivery later this year.

The move is a mixed result for Airbus, sacrificing what had been seen as a key endorsement for its A350-1000 but preserving a place in the wide-body fleet at United after a review that had raised doubts over the A350’s entire future at the airline.

United Airline’s finance chief Andrew Levy told a Cowen and Co conference that the 325-seat A350-900 was a “better fit” for United’s network.

The aircraft will be used to replace United’s Boeing 777-200ER jets, which start to reach 25 years of age in 2022.

Industry sources said United could still opt for the A350-1000 or other types if its fleet needs evolve.

“We have many more options that we can exercise at similar attractive economics,” Levy said.

The A350 order was held over from United Airlines’ fleet plans before it merged in 2010 with Continental Airlines, which had previously had an exclusive relationship with Boeing.

Industry analysts said the A350-1000 risked being crowded out of the world’s largest airline, which had also placed significant orders for the competing Boeing 777-300ER.

However, the airline also wanted to delay taking delivery of A350s, a decision that can trigger price escalation clauses and give planemakers some extra bargaining power in negotiations.

Parent company United Continental Holdings (UAL.N) said it had deferred A350 deliveries to late 2022 through 2027, lowering near-term spending by $1 billion.

The revised deal is worth another $1.5 billion for Airbus at list prices. The 366-seat A350-1000 has a catalogue price of $359.3 million, compared with $311.2 million for the A350-900.

Aircraft are typically sold at discounts.

Keeping the A350 at United had been seen as a key priority for Airbus executive vice-president Kiran Rao, recently named as successor for Airbus’s soon-to-retire sales chief John Leahy.

Airbus declined comment.

The A350-1000 was launched to compete with the older Boeing 777-300ER, whose production is slowing. But Airbus has struggled to preserve momentum at the top of its twin-engined range after Boeing fought back with the larger 777X.

Orders for the A350-1000 peaked in July at 212 units, when they represented a quarter of all orders for the A350 family. The latest reshuffle reduces that percentage to a five-year low of 20.6 percent, a Reuters analysis shows.

Additional reporting by Alana Wise; Editing by Brian Love and Elaine Hardcastle

________________

LGCJ.: