BOEING - BOMBARDIER. US - CANADA. COUNTERVAILING DUTIE

DoC. 09/26/2017. U.S. Department of Commerce Issues Affirmative Preliminary Countervailing Duty Determination on Imports of 100- to 150-Seat Large Civil Aircraft From Canada

Today, U.S. Secretary of Commerce Wilbur Ross announced the affirmative preliminary determination in the countervailing duty (CVD) investigation of 100- to 150-seat large civil aircraft from Canada, finding that exporters of this merchandise received countervailable subsidies of 219.63 percent.

The Commerce Department will instruct U.S. Customs and Border Protection to collect cash deposits from importers of 100- to 150-seat large civil aircraft based on these preliminary rates.

“The U.S. values its relationships with Canada, but even our closest allies must play by the rules,” said Secretary Ross. “The subsidization of goods by foreign governments is something that the Trump Administration takes very seriously, and we will continue to evaluate and verify the accuracy of this preliminary determination.”

Although Canadian civil aircraft subject to this investigation have not yet been imported, an April 2016 press release announcing the sale of Canadian civil aircraft to a U.S. airline valued the order to be in excess of $5 billion.

The petitioner is The Boeing Company (IL).

Enforcement of U.S. trade law is a prime focus of the Trump administration. From January 20 through September 20, 2017, the Commerce Department has initiated 65 Antidumping (AD) and CVD investigations – a 48 percent increase from the previous year. For the same time period in 2016, The Commerce Department had initiated 44 antidumping and countervailing duty investigations.

The Commerce Department currently maintains 411 AD and CVD duty orders which provide relief to American companies and industries impacted by unfair trade. CVD laws provide U.S. businesses and workers with an internationally accepted mechanism to seek relief from the harmful effects of unfair subsidization of imports into the United States.

Unless the final determination is aligned with the concurrent antidumping duty investigation, Commerce is currently scheduled to announce its final CVD determination in this investigation on December 12, 2017.

If the Commerce Department makes an affirmative final determination of subsidization and the U.S. International Trade Commission (ITC) makes an affirmative final injury determination, Commerce will issue a CVD order. If the Commerce Department makes a negative final determination of subsidization or the ITC makes a negative final determination of injury, the investigation will be terminated and no order will be issued.

The U.S. Department of Commerce’s Enforcement and Compliance unit within the International Trade Administration is responsible for vigorously enforcing U.S. trade laws and does so through an impartial, transparent process that abides by international rules and is based solely on factual evidence.

Imports from companies that receive unfair subsidies from their governments in the form of grants, loans, equity infusions, tax breaks and production inputs are subject to “countervailing duties” aimed at directly countering those subsidies.

In fiscal year 2016, the United States collected $1.5 billion in duties on $14 billion of imported goods found to be underpriced, or subsidized by foreign governments.

Fact sheet: http://enforcement.trade.gov/download/factsheets/factsheet-canada-large-civil-aircraft-cvd-prelim-092617.pdf

Global Affairs Canada. September 26, 2017. Statement by Minister of Foreign Affairs on U.S. Department of Commerce preliminary subsidy determination on large civil aircraft from Canada

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today issued the following statement:

“The aerospace industries of Canada and the United States are highly integrated and support well-paying, middle-class jobs on both sides of the border.

“The U.S. Department of Commerce’s preliminary determinations almost always rule in favour of the U.S. complainant.

“While this is only a preliminary stage in the investigation, and no duties can be imposed until the final investigations are completed, Canada strongly disagrees with the anti-dumping and countervailing duty investigations into imports of Canadian large civil aircraft. This is clearly aimed at eliminating Bombardier’s C Series aircraft from the U.S. market.

“Components of the Bombardier C Series are supplied by American companies, directly supporting almost 23,000 well-paying jobs in many U.S. states, including Connecticut, Florida, New Jersey, Washington, New York, Ohio, Kansas, Pennsylvania and Colorado. Boeing’s petition is threatening these U.S. jobs.

“Our government has repeatedly raised this issue with key members of the U.S. administration, with American elected officials and with Boeing. We will continue to raise this at the highest levels.

“We will always defend Canadian companies and Canadian workers against unfair and costly protectionism.”

BOMBARDIER. September 26, 2017. Commercial Aircraft. Statement on Commerce Department Countervailing Duties Preliminary Decision

Montréal - “We strongly disagree with the Commerce Department’s preliminary decision. The magnitude of the proposed duty is absurd and divorced from the reality about the financing of multibillion-dollar aircraft programs. This result underscores what we have been saying for months: the U.S. trade laws were never intended to be used in this manner, and Boeing is seeking to use a skewed process to stifle competition and prevent U.S. airlines and their passengers from benefiting from the C Series.

The simple truth is that Bombardier created a superior aircraft that is more efficient, more comfortable, and quieter. The C Series serves a market segment not supported by any U.S. manufacturer. Delta wants to bring this remarkable new aircraft to the U.S. flying public. Boeing wants to prevent U.S. passengers from realizing these benefits, irrespective of the harm that it would cause to the U.S. aerospace industry and the cost to airlines and consumers.

Looking beyond today’s and next month’s preliminary decisions, the International Trade Commission will determine next year whether Boeing suffered any injury from the C Series. Because Boeing did not compete at Delta and because Boeing years ago abandoned the market the C Series serves, there is no harm.

There is wide consensus within the industry on this point, as well as a growing chorus of voices, including airlines, consumer groups, trade experts, and many others who have come forward to express grave concerns with Boeing’s attempt to force U.S. airlines to buy less efficient planes with configurations they do not want and economics that do not deliver value.

The U.S. government should reject Boeing’s attempt to unfairly tilt the playing field in its favor and to impose an indirect tax on the flying public through unjustified import tariffs.”

________________

The Globe and Mail. 27 Sep 2017. U.S. slaps Bombardier with hefty duties in Boeing trade dispute

NICOLAS VAN PRAET

Levy of nearly 220% throws into doubt company’s ability to secure orders for its C Series flagship aircraft The U.S. government has imposed duties of nearly 220 per cent on imports of Bombardier’s C Series planes into the United States, a move that threatens to exacerbate trade tensions between the two countries and undermine sales prospects for the Canadian company’s most important aircraft.

In a preliminary decision issued Tuesday, the U.S. Department of Commerce ruled to put in place the countervailing duties on C Series airliners, siding with Chicago-based Boeing Co. in its complaint against Montreal-based Bombardier Inc. Duties would be payable when Bombardier begins its first C Series deliveries to the United States.

“The U.S. values its relationship with Canada but even our closest allies must play by the rules,” Commerce Secretary Wilbur Ross said in a statement.

“The subsidization of goods by foreign governments is something that the Trump administration takes very seriously and we will continue to evaluate and verify the accuracy of this preliminary determination,” Mr. Ross said.

The development was one of two on Tuesday that increased pressure on Bombardier’s turnaround effort.

In the other, German train maker Siemens AG announced plans to merge with France’s Alstom SA to create a pan-European rail juggernaut, setting aside a separate merger proposal from Bombardier. » In Ottawa, Foreign Affairs Minister Chrystia Freeland said the U.S. duties are “clearly aimed at eliminating Bombardier’s C Series aircraft from the U.S. market.” She said the C Series directly supports 23,000 U.S. jobs and that the federal government would continue to raise the issue “at the highest levels” in the United States. “We will always defend Canadian companies and Canadian workers against unfair and costly protectionism,” Ms. Freeland said.

Bombardier said it disagreed with the ruling. The duties imposed are even higher than those Boeing demanded. Boeing had initially demanded 80 per cent.

“The magnitude of the proposed duty is absurd and divorced from the reality about the financing of multibilliondollar aircraft programs,” Bombardier said. “This result underscores what we have been saying for months: The U.S. trade laws were never intended to be used in this manner and Boeing is seeking to use a skewed process to stifle competition and prevent U.S. airlines and their passengers from benefiting from the C Series.”

Commerce’s decision immediately throws into question whether Delta will move forward with its deal to buy 75 C Series planes. The Atlanta-based airline’s order, which would have the first of those C Series planes delivered next spring, was a key sale to a marquee customer that cemented the airliner’s viability internationally. Delta said late Tuesday it was confident that Boeing’s complaint will be rejected at a later stage.

The ruling could also hurt Bombardier in its ability to secure further orders for the C Series, not only in the United States but elsewhere. The flagship aircraft is the company’s big bet to drive future revenue in its commercial aerospace business and getting it to market at a cost of $6-billion (U.S.) nearly bankrupted it. Although the plane is widely considered a technical achievement and has earned praise from early operators, winning new C Series sales has been difficult for Bombardier as rivals move aggressively to stop the 100– to 150-seat airliner before it grabs a solid toehold.

“The really critical issue here is what pricing and profitability are they going to be able to achieve on [the C Series] program” if rivals are using whatever tools they can to prevent Bombardier from making major sales, said David Tyerman, an analyst at Cormark Securities.

The C Series is essentially sold out through 2020 based on orders received so far from carriers including Swiss and Korean Air. Bombardier is in talks with China’s three biggest airlines and leasing businesses on buying the C Series and aims to close deals ahead of a trip to China next month by Prime Minister Justin Trudeau, a company official told Reuters.

U.S. airlines may be unwilling to strike a deal for C Series planes as long as the threat of duties looms, analysts say. NonU.S. carriers may stall for the same reason or try to squeeze Bombardier for steeper pricing discounts if they sense the plane maker is more desperate for orders given the impediments selling into the United States. Bombardier hasn’t booked a major order for the C Series since the Delta deal in April, 2016.

“You take the U.S. market out of the demand side because of expensive duties and it becomes hard to get the right price elsewhere,” said Fadi Chamoun, an analyst with Bank of Montreal. For the C Series business case to work, Bombardier needs to supply 100 planes a year, he said. Analysts have estimated the United States would account for about 35 per cent of that demand.

Commerce’s decision stems from a petition filed earlier this year by Boeing. In it, the U.S. plane maker alleges that the Canadian company sold the 75 C Series planes to Delta at “absurdly low prices” while benefiting from unfair subsidies from the Canadian, Quebec and British governments. It asked the U.S. government to impose countervailing and anti-dumping duties on C Series planes imported into the United States.

Ottawa earlier this year pledged $372.5-million in “repayable contributions” to Bombardier to help finance two aerospace development programs, including the C Series. Quebec separately invested $1-billion (U.S.) for a 49.5-percent equity stake in the C Series program.

Bombardier denies it did anything wrong, saying the financing it received adheres to global trade rules. It argues Boeing wasn’t even in the running on the Delta sales competition, doesn’t make a plane of that size and is now is trying to stifle the technological innovation the C Series brings to the industry.

The Trudeau government has threatened to cancel a $6.4-billion contract to buy 18 Boeingbuilt Super Hornet jets in an attempt to force Boeing to back off. The British and Quebec governments are flexing their political muscle to try to win a settlement with the American plane maker to protect thousands of Bombardier jobs in their jurisdictions. Some U.S. lawmakers have also joined the fray, noting that about half the parts content of the C Series jet is produced in the United States.

Tuesday’s decision is just one step in a lengthy process. After this preliminary ruling on countervailing duties, a separate Commerce decision is expected around Oct. 4 on anti-dumping duties. Final determinations by the U.S. International Trade Commission and the issuance of orders to impose the duties are not expected to be concluded until next year.

To win its case, Boeing will have to prove that it suffered “material injury” from Delta’s decision to pick C Series planes. That might be a tough sell given Boeing enjoys an enviable backlog of 4,400 737s and is set to hike production to meet soaring demand. It chose deliberately to abandon the market for the smaller planes Delta wanted to focus on larger jets.

The Globe and Mail. 27 Sep 2017. How NAFTA could save the C Series Trade deal’s Chapter 19 might be Bombardier’s last hope of coming out on top in a dispute with Boeing

BARRIE McKENNA

Bombardier has lost another round in its fight against Boeing and the U.S. government.

And it will almost certainly lose every future round until the case reaches its inevitable conclusion with a final ruling next year – with hefty duties confirmed on every Bombardier C Series aircraft sold in the United States.

That’s just the way it is with anti-dumping and subsidy cases. The deck is heavily stacked against a foreign company such as Bombardier when it’s going up against a politically powerful domestic industry.

And few can rival Boeing’s clout and influence, particularly in the current protectionist trade climate in Washington.

It’s worth remembering that Donald Trump’s first visit to a factory as U.S. President was to the Boeing’s Dreamliner assembly plant in Charleston, S.C., where he proclaimed: “We are going to fight for every last American job.”

Tuesday’s preliminary duties ruling by the U.S. Commerce Department is a vivid reminder that NAFTA’s Chapter 19 is worth fighting for. That’s the section of the North American free-trade agreement that allows Canada, the United States and Mexico to challenge subsidy or dumping decisions before a binding panel if they aren’t convinced another country has fairly applied their own trade laws.

And on its current course, a Chapter 19 challenge might be Bombardier’s only hope of coming out on top in the dispute.

Boeing alleges that the Canadian company sold 75 C Series planes to U.S.-based Delta Air Lines at “absurdly low prices,” while benefiting from unfair subsidies from the Canadian, Quebec and British governments.

Bombardier sees something more sinister – an effort to kill an aircraft that challenges Boeing’s core market of narrow-body transcontinental planes, such as the 737 Max. The trade case has already cast a cloud on sales of the C Series, and raised doubts about Bombardier’s future in the commercial aircraft business, where subsidies and other forms of government support are the norm.

The intent of trade remedies is not to put a rival out of business. But that is what is at stake. Bombardier’s predicament demonstrates why Chapter 19 matters, explained Toronto trade lawyer Lawrence Herman.

“It illustrates why Canada fought so hard for this system in the 1980s to have a neutral body that ensures that the laws have been correctly applied and the facts reasonably support the conclusions reached,” he said.

Chapter 19 was the proverbial line-in-the-sand for Canada in the original 1988 Canada-U.S. free-trade deal – an insurance policy against unbridled protectionism by Washington. And Ottawa fought hard for its continuation in the 1994 North American free-trade agreement.

The Trump administration has targeted Chapter 19 in the ongoing renegotiation of NAFTA. So far, however, the United States has not put a specific proposal on the table, as the third round of talks continues in Ottawa this week.

U.S. players in industries such as steel and lumber have long been suspicious of binational panels, which they regard as an infringement on the sovereignty of U.S. courts. Some have even threatened to mount a Supreme Court challenge to have Chapter 19 declared unconstitutional.

Part of the power of Chapter 19 is that panel rulings are enforceable in U.S. courts. That isn’t the case for rulings by the World Trade Organization.

And it offers relatively speedy justice – a final ruling is due 315 days after a country requests a panel review. That’s significantly faster than pursuing a case in the courts or at the WTO.

Chapter 19 has fallen into disuse in recent years. Canada has filed just three cases in the past decade. The United States hasn’t used it against Canada since 2005.

But Mr. Trump’s aggressive trade agenda could change that. Beyond Bombardier, Canada is a target of several ongoing cases involving steel, aluminum, solar panels and, of course, softwood lumber.

Canada has successfully used Chapter 19 in the past to get duties on lumber removed.

Canada is facing an administration that is bent on repatriating U.S. jobs and cutting its trade deficit by tilting the playing field in its favour and more aggressively pursuing litigation.

Now is not the time to negotiate away a valuable insurance policy.

REUTERS. SEPTEMBER 26, 2017. Bombardier would not pick up tab for duties on CSeries jet: sources

Tim Hepher, Allison Lampert

LONDON/MONTREAL (Reuters) - Canada’s Bombardier Inc (BBDb.TO) is unwilling to swallow the extra cost for airlines if the United States slaps duties on its CSeries jet and is keen to press ahead with the deal that provoked a North American trade spat, people familiar with the matter told Reuters.

The stance gathered momentum as the United States prepared to issue a preliminary ruling on whether Bombardier used subsidies to bankroll a sale of 75 new jets to Delta Air Lines (DAL.N), which U.S. rival Boeing Co (BA.N) claims took place at unrealistically low prices.

Tuesday’s expected ruling is one step in a process that could lead to U.S. import duties being levied on the CSeries, forcing Delta and other potential U.S. customers to pay millions more for each jet, on top of the agreed purchase price.

That has prompted some aerospace analysts to speculate the deal could fall through unless Bombardier agrees to soften the blow for Delta, whose support for the CSeries rescued a programme beset by delays and cost overruns.

Although Bombardier cannot legally skirt the measure by agreeing to pay any duty directly on Delta’s behalf, trade lawyers say it could technically import the jets itself through a local subsidiary in a way that would be neutral for Delta.

But doing so could significantly depress the net amount Bombardier receives and could be seen as legitimising Boeing’s complaint on prices, which Bombardier has rejected.

“The economics won’t make sense,” a person familiar with the company’s thinking said this week.

Secondly, Bombardier would not readily allow Delta to walk away from the deal because it might risk other buyers asking for an “out” which could prompt an unravelling of its commercial recovery plan.

“Delta may ask to cancel; Bombardier will say no,” another person familiar with the case predicted. None of the sources agreed to be named because of the matter’s sensitivity.

LEGAL FIGHT

Bombardier’s decision to tough it out seems designed to encourage Delta to take up cudgels against Boeing and the U.S. government. It could have ramifications for the large jet market where the same airline is expected to choose between Airbus SE (AIR.PA) and Boeing for a big single-aisle jet order in the coming year.

“I think they (Delta) will send a signal and look closely at Airbus,” said Teal Group aerospace analyst Richard Aboulafia.

Delta has said it wants the CSeries soon, but has not said how it will respond if forced to pay potentially large duties.

A Delta spokesman said it was too early to comment.

People close to the case said it could lead to months if not years of contractual and legal wrangling, with Bombardier likely to appeal any negative finding and Canada ready to take the case to the World Trade Organisation in the absence of a settlement.

“I think it will go to legal territory whatever the number (in import duties) because Canada wants to make it a point of principle,” one of the people familiar with Bombardier’s thinking said.

But many of the legal options are covered in dust. Industry veterans say it is the first time in memory duties have been considered on aircraft, following a 1980 agreement to free aircraft trade among 32 of the world’s leading trading powers.

How this plays out could depend on the size of any import duty. A small duty might allow all sides to declare victory and let Bombardier and Delta negotiate a smooth delivery of the planes, but many analysts say a hefty import fee is more likely.

Seattle-based trade lawyer Bill Perry said Bombardier could appeal, but only after a final decision is made by the U.S. International Trade Commission next February.

Delta or any nominated importer would still have to pay duties as cash deposits during that process, he said.

Reporting by Tim Hepher; Editing by Matthew Lewis

REUTERS. SEPTEMBER 26, 2017. U.S. slaps steep duties on Bombardier jets after Boeing complaint

Allison Lampert, Alwyn Scott

MONTREAL/NEW YORK (Reuters) - The U.S. Commerce Department on Tuesday slapped preliminary anti-subsidy duties on Bombardier Inc’s CSeries jets after rival Boeing Co accused Canada of unfairly subsidizing the aircraft, a move likely to strain trade relations between the neighbors.

The department said it imposed a steep 219.63 percent countervailing duty on Bombardier’s new commercial jets after it made a preliminary finding of subsidization. Boeing has complained the 110-to-130 seat aircraft were dumped below cost in the U.S. market last year while benefiting from unfair subsidies.

An April 2016 order for 75 CSeries jets from Delta Air Lines stemmed from the same harmful sales practices European rival Airbus SE employed to win business in the 1990s, according to Boeing.

The Commerce Department’s penalty against Bombardier will only take effect if the U.S. International Trade Commission (ITC) rules in Boeing’s favor in a final decision expected in 2018.

“We strongly disagree with the Commerce Department’s preliminary decision,” Bombardier said in a statement, calling the magnitude of the proposed U.S. duty “absurd.”

Commerce’s announcement and accompanying fact sheet on the preliminary duty order did not provide any rationale or methodology for how it calculated the 220 percent duty.

The CSeries starts at $79.5 million, according to list prices, but carriers usually receive discounts of about 50 percent.

If imposed, the duties would more than triple the cost of a CSeries aircraft sold in the U.S. to about $61 million per plane, based on Boeing’s assertion that Delta received the planes for $19 million each. Bombardier has disputed the $19 million sales figure.

There are not that many Commerce countervailing orders that are this high, but it is lower than the 256 percent final duties slapped on Chinese cold-rolled steel last year.

The timing is awkward because Canada and the United States are in a three-way negotiation involving Mexico to modernize the North American Free Trade Agreement..

A source familiar with the Canadian government’s thinking said the Boeing trade dispute was “separate” from the NAFTA talks.

“This in no way is part of our conversation” the source said. “People should not read too much into this piece today.”

The spat between Boeing and Bombardier has snowballed into a bigger fight this month when British Prime Minister Theresa May asked President Donald Trump to intervene in the dispute to help protect jobs in Northern Ireland, where Bombardier is the largest manufacturing employer..

The United States has also faced opposition from a handful of American carriers and elected officials over potential U.S. job losses.

Canada’s foreign affairs minister Chrystia Freeland said Bombardier CSeries components are supplied by American companies that support almost 23,000 jobs in U.S. states, including Connecticut, Florida and New Jersey.

“This is clearly aimed at eliminating Bombardier’s C Series aircraft from the U.S. market,” Freeland said. She added that Canada strongly disagrees with the anti-dumping and countervailing duty investigations.

Boeing said in a statement that the dispute “has everything to do with maintaining a level playing field and ensuring that aerospace companies abide by trade agreements.”

Bombardier’s was unwilling to swallow the extra cost for airlines if the United States slaps duties on its CSeries jet, Reuters reported on Tuesday, citing people familiar with the matter.

“We are confident...no U.S. manufacturer is at risk because neither Boeing nor any other U.S. manufacturer makes any 100-110 seat aircraft that competes with the CS100,” Delta said in a statement.

Duties could chill U.S. sales of the fuel-efficient CSeries, raising concerns over future orders and jobs in Canada and the United Kingdom.

Canadian Prime Minister Justin Trudeau had put his government’s planned purchase of Boeing Super Hornet fighter jets on hold because of the trade dispute, saying it could not “do business with a company that’s busy trying to sue us and put our aerospace workers out of business.”

‘NOT A SLAM DUNK’

Boeing has argued that the military sale to the Canadian government and its petition against Bombardier are not linked. But the U.S. jetmaker has said the CSeries would not exist without hundreds of millions of dollars in launch aid from the governments of Canada and Britain, or a $2.5 billion equity infusion from the province of Quebec and its largest pension fund in 2015.

To win its case before the ITC, Boeing must prove it was harmed by Bombardier’s sales practices, despite not using one of its own jets to compete for the Delta order, Dan Pearson, a senior fellow at the libertarian Cato Institute think tank in Washington, said before Tuesday’s announcement.

“This (ITC case) cannot be a slam dunk,” said Pearson, a former ITC chairman. “I‘m having a hard time figuring out how Boeing was harmed by this.”

Canada has pushed to settle the dispute. But one industry source said Boeing, which could gain some leverage with the Commerce Department’s initial decision in its favor, sees the possible CSeries dumping as a long-term threat to its civilian airliner business.

Bombardier stock has fallen about 15 percent over the past month on uncertainty around the duties and a rail venture. On Tuesday, Bombardier missed out an opportunity to strike a rail deal with Siemens, when the German company decided to combine its rail operations with French group Alstom.

Reporting by Allison Lampert in Montreal and Alwyn Scott in New York; Additional reporting by Alana Wise in New York and Tim Hepher in London; Writing by Denny Thomas; Editing by Peter Cooney and Grant McCool

REUTERS. SEPTEMBER 27, 2017. Dismayed Britain chides Boeing over Bombardier ruling

Estelle Shirbon, Guy Faulconbridge

LONDON (Reuters) - Britain is bitterly disappointed by a U.S. decision to slap duties on a Boeing competitor’s jets, Prime Minister Theresa May said on Wednesday, promising to fight for thousands of jobs in Northern Ireland that the ruling puts at risk.

The consequence of a dispute between the U.S. planemaker (BA.N) and its smaller Canadian rival Bombardier (BBDb.TO), the ruling is a political headache for May, whose minority Conservative government relies on support from a Northern Irish party to stay in power.

The dispute also undermines the British government’s assurances that free trade and London’s close ties with Washington will be pillars of Britain’s prosperity and global influence after it leaves the European Union in 2019.

“Bitterly disappointed by initial Bombardier ruling,” May said on Twitter. “The government will continue to work with the company to protect vital jobs for Northern Ireland.”

The penalty, which threatens 4,200 jobs at a Bombardier plant in the UK province that makes parts for its new CSeries 110-to-130 seat jets, will only take effect if the U.S. International Trade Commission (ITC) rules in Boeing’s favor.

That final decision is expected early in 2018.

Boeing accuses Canada of unfairly subsidizing Bombardier, which Ottawa and Bombardier deny.

May had personally asked U.S. President Donald Trump to help find a solution to the dispute, but the U.S. Commerce Department on Tuesday imposed a 219.63-percent duty on the CSeries jets.

Bombardier is the largest manufacturing employer in Northern Ireland, which is the poorest of the United Kingdom’s four parts and is mired in political difficulties after emerging from decades of armed sectarian conflict.

Given the importance of the province’s Democratic Unionist Party (DUP) to May’s own position as prime minister, mass job losses at the Belfast factory would be particularly sensitive.

The setback has come at a bad time for May, who was severely weakened by her party’s poor showing in an election in June and who has been struggling to contain infighting within her top team over Brexit.

The British government said Boeing’s stance was unjustified and not the sort of position it would expect of a long-term partner.

“SABRE-RATTLING”

Arlene Foster, the DUP leader, quickly signaled she would put pressure on May to act.

“Everyone realizes how important Bombardier is to Northern Ireland and we will use our influence with our government to make sure that continues,” she said on Sky News.

“What we must do now is to continue to work with our own government, with the American government, with the Canadian government, in trying to get Boeing to see sense.”

However, London’s options in fighting Bombardier’s corner may be limited.

Boeing says it employs 2,200 people in the United Kingdom, its third largest supply base after the United States and Japan.

Britain recently ordered the Boeing P-8 maritime surveillance plane and a new fleet of Apache attack helicopters made by the U.S. giant. Its armed forces have deployed Chinook helicopters, the C-17 transport plane and the E-3 Sentry airborne early warning and command post.

British defense analyst Howard Wheeldon said it was unlikely that Britain would pursue any reprisals against Boeing.

“I think there is a lot of saber-rattling, but in practical terms it is not on,” he said when asked whether Britain could cancel or reduce Boeing defense orders.

“They can play politics, but can’t actually walk away from what they need and have committed to buying from Boeing.”

The row comes weeks after Boeing began construction of its first European parts manufacturing site in Sheffield, northern England.

Additional reporting by Kate Holton, Michael Holden and Tim Hepher; editing by John Stonestreet

BLOOMBERG. September 27, 2017. Bombardier Takes Twin Hits in U.S. Jet Levy, Rival Rail Deal

By Frederic Tomesco and Andrew Mayeda

- Boeing-led effort slaps C Series with 220 percent tariffs

- Siemens-Alstom rail deal sidelines Bombardier’s trains

Prospects for the C Series, which cost at least $6 billion to develop, were hobbled by the U.S. Commerce Department’s preliminary decision to levy import duties of 220 percent over claims of improper subsidies. The plane has already struggled to compete with Boeing Co.’s 737, and the move threatens to upend deliveries due next year to Delta Air Lines Inc., which ordered at least 75 jets with a list value of more than $5 billion.

On the rail side, Bombardier was left out in the cold as hours before the Commerce Department’s announcement, Germany’s Siemens AG and France’s Alstom SA agreed to merge their rail businesses in a deal that gives rise to a European transportation giant better able to counter competition from China.

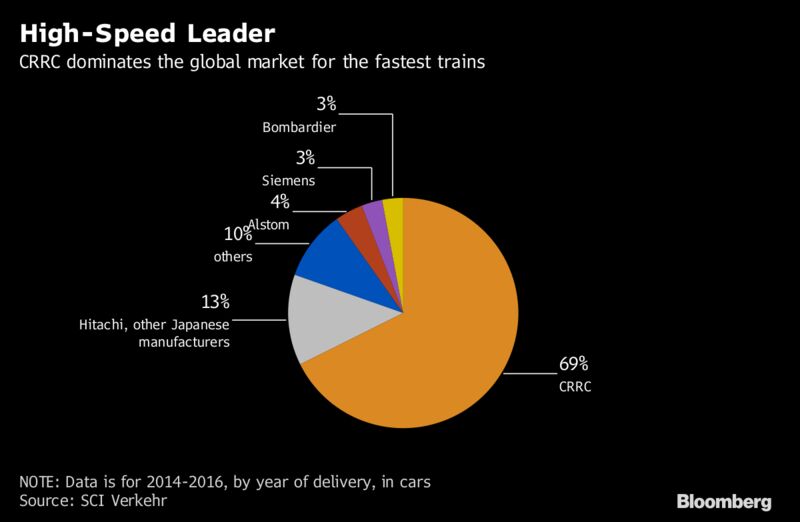

As it vies with Asian giants including Beijing-based CRRC Corp. and Hitachi Ltd. of Japan, Bombardier’s biggest business will now need to battle with a French-German competitor with 15 billion euros ($18 billion) in combined sales. Bombardier had become the largest western trainmaker following the 2001 purchase of Daimler AG’s Germany-based Adtranz arm.

Bombardier’s widely traded Class B shares dropped 11 percent to C$2.02 in 7:35 a.m. premarket trading in Toronto. The company’s euro-denominated bonds maturing in 2021 declined the most in more than two years.

With rail operations now undersized and Boeing prompting the U.S. jet penalties, Bombardier Chief Executive Officer Alain Bellemare has new hurdles as he tries to turn around the company and end reliance on financial support from Quebec and Prime Minister Justin Trudeau’s federal government.

The C Series came in more than two years late and about $2 billion over budget. With the exception of a two-aircraft order from Air Tanzania in December, Bombardier hasn’t booked a major sale of the model since the Delta deal in April 2016. The U.S. move sours prospects further in the world’s largest aviation market.

“We believe the key area of concern will be what Delta does with its order,” Walter Spracklin, an analyst at RBC Capital Markets, said in a note to clients. “Moreover, the impact on other U.S.-based airlines will also be in question under such a ruling.”

Trade Tensions

The Bombardier-Boeing spat is roiling trade relations just as the U.S. tries to renegotiate the North American Free Trade Agreement with Canada and Mexico. “Even our closest allies must play by the rules,” U.S. Commerce Secretary Wilbur Ross said in announcing the decision on Canadian jets with 100 to 150 seats.

Canada “strongly disagrees” with the U.S. probes into its aerospace industry, Foreign Affairs Minister Chrystia Freeland said in a statement. “This is clearly aimed at eliminating Bombardier’s C Series aircraft from the U.S. market,” said Freeland. She was scheduled to dine with U.S. Trade Representative Robert Lighthizer in Ottawa on Tuesday during the third round of Nafta talks.

The import duties could be reversed by the U.S. International Trade Commission if the trade tribunal determines that Boeing wasn’t injured by Bombardier’s jet program. That decision is expected to be made next year. Trudeau has said the Canadian government won’t buy Boeing military jets unless the company drops its case against Bombardier.

‘Absurd’ Magnitude

The Montreal-based manufacturer said Boeing was “seeking to use a skewed process to stifle competition and prevent U.S. airlines and their passengers from benefiting from the C Series.” The aircraft entered commercial service last year in Europe.

“The magnitude of the proposed duty is absurd and divorced from the reality about the financing of multibillion-dollar aircraft programs,” Bombardier said in a statement.

Boeing has accused Bombardier of selling its biggest jet in the U.S. at less than fair value, while benefiting from unfair government subsidies in Canada. The U.S. planemaker has argued that the C Series wouldn’t exist without the assistance, noting that Bombardier received money from the Canadian and Quebec governments to develop the aircraft and further aid from both in recent years to shore up the company’s finances.

“The U.S. Department of Commerce today affirmed that Bombardier has taken massive illegal subsidies in violation of existing trade law,” Boeing said in an emailed statement. The process is part of “the longstanding, transparent course for examining and addressing situations where products are ‘dumped’ into the United States at below-cost prices for the purposes of gaining market share.”

The Commerce Department is expected to decide by Oct. 4 whether to also impose anti-dumping duties on the C Series. On that matter, Boeing is seeking duties of about 80 percent.

Delta Preparations

Delta noted the decision is “preliminary” and said the real ruling will come early next year, when the International Trade Commission makes a final determination of whether any U.S. manufacturer will be harmed by imports of the plane. In June, the ITC made a preliminary ruling that Boeing, maker of the 737 narrow-body, may have been harmed by Bombardier.

“We are confident the USITC will conclude that no U.S. manufacturer is at risk because neither Boeing nor any other U.S. manufacturer makes any 100-110 seat aircraft that competes with the CS100,” Delta said in a statement.

The Atlanta-based airline agreed to buy at least 75 of the CS100 planes, the smaller C Series variant. Delta has been preparing to take delivery of the jets in the spring, and was expected to allow pilots to bid on flying assignments in the coming months. Those and other preparations will continue, Delta spokesman Morgan Durrant said.

But other potential U.S. buyers of the C Series are likely to think twice before placing any orders in the immediate future.

“This is just a preliminary decision, so this will be a risk overhang on the program for some time,” said Chris Higgins, an analyst at Morningstar. “That might impede sales efforts, which are already pretty slow.”

— With assistance by Michael Sasso

The Globe and Mail. 27 Sep 2017. European rail deal presses Bombardier

ERIC REGULY, ROME

NICOLAS VAN PRAET, MONTREAL

Merger of Siemens, Alstom train units narrows strategic options of Canadian aerospace firm’s transportation wing.

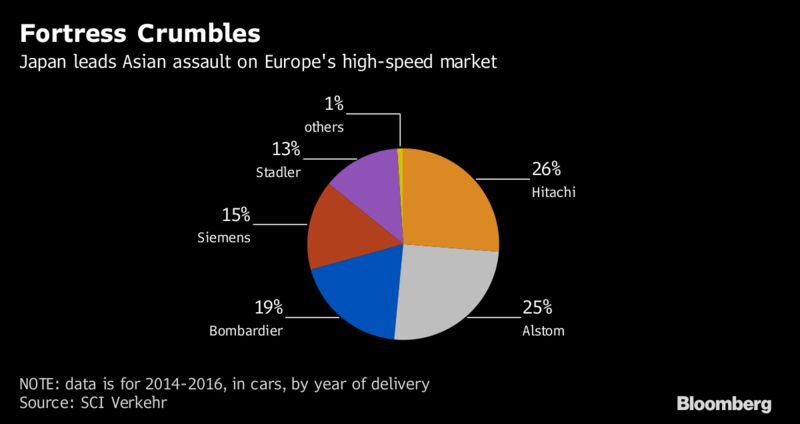

A rail version of Europe’s Airbus has been born and will put enormous pressure on Bombardier Inc.’s train division. Directors at Siemens AG of Germany signed off on a deal Tuesday to merge its train unit with that of France’s Alstom SA, creating what will be Europe’s dominant rail business, with combined annual sales of about €15.3-billion ($22.3-billion).

Chances remained slim until late in the day that Canada’s Bombardier could still play spoiler with its own proposal with Siemens, which was also considered by the German company’s board. But the politics of a Franco-German industrial champion proved too difficult to overcome, as the French government, which controls 19.9 per cent of Alstom, threw its weight behind the merger.

The new company, to be called Siemens Alstom, would be the world’s second-largest train company after China’s CRRC Corp.

The merger significantly narrows the strategic options of Bombardier Transportation (BT), as Bombardier’s rail division is called, as it faces a corruption probe related to a $340-million (U.S.) contract in Azerbaijan.

BT has other potential merger partners, including Stadler Rail of Switzerland and Spain’s Grupo CAF, but they are not as big and could require more legwork. Joining forces with a Japanese manufacturer is also possible.

“They do look like they would be the guy without a dance partner, and that would be difficult,” Cormark Securities analyst David Tyerman said of Bombardier Transportation.

The launch of Siemens Alstom will be the equivalent of a land-bound Airbus, the European passenger-jet maker that is Boeing’s main global rival.

The merger hits Bombardier with a hefty dose of bad news in the same week that its Montrealbased aerospace business faces a blow from the U.S. Commerce Department. On Tuesday the department was expected to issue a preliminary ruling on whether the Canadian company benefited from unfair subsidies on the sale of its C Series jet in the U.S. market. Boeing contends that Bombardier sold the C Series to Delta Air Lines at “absurdly low prices” while taking unfair government aid.

Both Bombardier and BT, whose headquarters are in Berlin, declined to comment Tuesday about the Siemens-Alstom deal and how it would affect the Canadian train maker. BT is 70-percent owned by Bombardier and 30 per cent by pension fund Caisse de dépôt et placement du Québec, which invested $1.5-billion (U.S.) into BT in 2015 as Bombardier was struggling to raise money to finance the C Series.

All three European train makers have been circling one another for years as the Chinese threat intensified. BT insiders have said that competition from the new breed of Chinese train giants, which intend to become strong competitors in the European and North American markets, would force industry-wide consolidation among the French, German, Italian and Japanese train companies, a process that has already started. In 2015, Hitachi of Japan bought Italy’s AnsaldoBreda, the maker of Italy’s new generation of Bombardier-engineered highspeed trains.

Although there are other issues that could have swayed the Siemens board, politics is believed to be the strongest. As leaders in France and Germany articulated an ambition behind the scenes to create a truly European champion, pressure against a Siemens-Bombardier deal intensified in recent weeks, high-level sources confirmed.

Siemens and BT also have greater overlap, raising the likelihood of asset sales and job cuts that would not have pleased the French government or unions. A former BT senior manager who did not want to be identified said massive overlap in Germany between Siemens and BT was also a deal buster. “Everyone agrees that the European rail business needs restructuring, but forcing the German factories [of Siemens and BT] to bear the brunt of this restructuring would not be politically acceptable,” he said.

Siemens will transfer its train and rail equipment business to Alstom in return for a 50-per-cent stake in the enlarged company, the manufacturers said in a joint statement. Alstom boss Henri Poupart-Lafarge will be the chief executive of the new company, which will be based and listed in Paris. Siemens will name the chairman. A break fee of €140million is in place. The companies still have to win anti-trust approval for the deal. It wasn’t immediately clear how they would deal with current contracts they’re working on with Bombardier, including the modernization of Montreal’s metro system.

Siemens is best known as the maker of Germany’s ICE highspeed inter-city trains, while Alstom makes the high-speed TGV trains that are a source of French pride. Siemens is also a strong player in signalling systems. Bombardier also makes high-speed trains but is better known for its commuter and light-rail trains.

BLOOMBERG. September 27, 2017. Alstom, Siemens Forget High-Speed-Rail Feud Amid Asian Onslaught

By Christopher Jasper

- European rivals unite as CRRC threatens to corner train market

- Past tensions culminated in public spat over Eurostar contract

Alstom SA’s merger with the train-making arm of Siemens AG will mark the end of a bitter rivalry as the European rail industry’s biggest adversaries unite in an effort to fend off the challenge from China and Japan.

The ill-tempered contest between Alstom and Siemens has been a feature of the sector for decades and reached boiling point in 2011, when the pair engaged in a public spat over the safety of competing high-speed models they were pitching to Channel Tunnel express operator Eurostar International Ltd.

Now the French and German companies are set to join forces in a business with 15 billion euros ($18 billion) in combined sales as they seek to halt the advance of Asian giants including Beijing-based CRRC Corp. and Hitachi Ltd. of Japan. That seemed a very distant prospect at the height of the confrontation over the 600 million-euro Channel Tunnel tender.

As the supplier of Eurostar’s original fleet, Alstom had seemed to be in prime position to win the order with a modified version of its iconic TGV. Instead, the deal went to the Siemens Velaro e320, prompting the French company to suggest that the multiple engines powering the German train would pose a serious fire risk in the confines of the 30-mile undersea tunnel.

Siemens emerged victorious after France accepted a ruling from the European Union’s rail-safety body saying the Velaro presented no more of a danger than the TGV. The defeat in its home nation came as a body blow to Alstom, which had been regarded as rail royalty since the original Train à Grande Vitesse snatched the world speed record from the Japanese Shinkansen in the 1980s.

GE Deal

While the TGV was still the fastest railed vehicle after a 357.2 mile per hour run in 2007, the loss confirmed the pressure facing Alstom not just in the shape of Siemens but also from increasingly export-oriented Asian manufacturers and Canada’s Bombardier Inc., which had become the largest western train-maker following the 2001 purchase of Daimler AG’s Germany-based Adtranz arm.

The critical move in propelling Alstom toward a tie-up with Siemens came with the sale of the French group’s power-generation business to General Electric Co. in 2015, according to Maria Leenen, chief executive officer of German rail consultancy SCI Verkehr. While the French company gained GE’s signalling unit, giving it critical mass in one of the most profitable areas of rail technology, the transaction ultimately left it without the heft to fund expensive new train and engineering projects, Leenan told Bloomberg.

Though Alstom is of a similar size to the rail division of Munich-based Siemens, with annual sales of more than 7 billion euros, the German business is part of a group that ranks as Europe’s largest manufacturer with almost 80 billion euros in revenue and a product range spanning power grids and building controls to medical scanners, washing machines and wind turbines.

Yet Siemens, too, had seen the writing on the wall as overcapacity in Europe ate into rail margins, accentuated by the entry of Shinkansen partner Hitachi, which established its global headquarters and a major factory in the U.K. after winning a 5.7 billion-pound ($7.7 billion) express-train contract there. The Tokyo-based group followed up by purchasing the signalling business of Italy’s Finmeccanica SpA in its largest-ever overseas deal.

All the while, European train-makers were facing growing competition from China, where train output began to eclipse Bombardier, Alstom and Siemens from 2011. The threat was ratcheted up in 2015 when a government-led merger of China CNR Corp. and CSR Corp. -- formerly competing groups based in the north and south of the country -- created a new global No. 1 in CRRC.

The Chinese giant has yet to penetrate the most lucrative Western markets, but already dominates sales to cost-sensitive economies in Africa, Eastern Europe, Latin America and Southeast Asia. CRRC can build a high-speed train for about 20 million euros, half the price of a European model.

Siemens had sought to head off the GE-Alstom deal in 2014 with a proposal that would have handed its rail operations to the French company in exchange for the power business.

The failed intervention created resentment between Siemens CEO Joe Kaeser and his then opposite number Patrick Kron, with the German company turning to Bombardier in its bid to stem the Asian tide through proposed joint ventures in train manufacturing and signaling. While that plan, which until this month seemed set to go ahead, would have helped to restructure rail capacity in Germany, it would have fallen short of creating a European champion capable of assuming a “quality-leadership role” in the global market, Leenen said.

The surprise Alstom transaction will do just that, though a test will come when the new company has to rationalize its lineup and production base for the next generation of rolling stock, she said. For now the overlapping ranges of subway trains, trams and commuter and express models is likely to survive, with the TGV and Velaro making the unlikeliest of stablemates.

— With assistance by Richard Weiss

BLOOMBERG. September 27, 2017. Bombardier News Hits ‘Bitterly Disappointed’ May in Lots of Ways

By Robert Hutton

- Ruling may damage key employer in politically sensitive region

- U.K. prime minister had lobbied Trump personally on issue

It’s no wonder Theresa May says she’s “bitterly disappointed” by the U.S. Commerce Department’s decision to impose punitive import duties on Bombardier Inc.’s new jetliner. It hurts the U.K. prime minister in several ways at once.

First, it’s a blow to a big employer: More than 4,000 work for the company in Belfast, Northern Ireland, where the plane’s wings are built.

Second, Northern Ireland is a sensitive area for British politics: It is only because May’s Conservatives have the support of 10 lawmakers from the region that she’s able to govern.

Third, it’s a personal embarrassment: After spending political capital at home to try to build a close relationship with Donald Trump, she raised the issue with him both by phone and in person, with no obvious result.

The opposition Labour Party, while offering support to the government’s position that the U.S. ruling is wrong, was quick to point out that the news doesn’t bode well for the proposed free-trade deal with the U.S. that Trump and May have both made much of.

“Try telling Bombardier workers this morning that post Brexit we’ll be striking ‘easy’ free-trade agreements with the U.S.” the party’s Northern Ireland spokesman, Owen Smith, said on Twitter.

REUTERS. SEPTEMBER 26, 2017. Bombardier shares leap 14 percent ahead of U.S. trade court ruling

TORONTO (Reuters) - Shares of Bombardier Inc (BBDb.TO) rose as much as 13.6 percent on Tuesday ahead of a U.S. trade court’s preliminary ruling on Boeing Co’s (BA.N) CSeries aircraft dumping complaint.

The jump in Bombardier’s shares also comes after Reuters reported on Tuesday that the planemaker aims to close deals with Chinese airlines in coming months and is in talks with the country’s three biggest airlines.

Bombardier’s shares, which have clawed back steep falls over the past two sessions, were last up 11.7 percent at C$2.39. It is the biggest one-day gain for the stock since February 2016.

Reporting by Fergal Smith; editing by Susan Thomas

BLOOMBERG. September 27, 2017. Bombardier Bonds Tumble as U.S. Slaps Import Duties on C-Series

By Marianna Duarte De Aragao

Bombardier Inc.’s euro-denominated bonds maturing in 2021 have declined the most in more than two years after the U.S. imposed import duties of 220 percent on the company’s C-series plane, threatening to upend deliveries of more than $5 billion to Delta Air Lines Inc. next year.

The Canadian aircraft and train manufacturer’s senior unsecured notes are currently down by more than seven price points at 99.963, according to Bloomberg prices at 10am London time. The notes had already fallen 2.2 points on Tuesday -- the same day that competitors Siemens AG and Alstrom SA agreed to join their rail businesses.

The penalties create a new hurdle for Bombardier’s Chief Executive Officer Alain Bellemare, who is trying to turn the company around after the C-Series came in more than two years late and $2 billion over budget.

U.K. Prime Minister Theresa May earlier said, “I am bitterly disappointed by the initial Bombardier ruling. The government will continue to work with the company to protect vital jobs for Northern Ireland.” Bombardier is the largest manufacturing company in Northern Ireland; its rail division employs ~3,500 in the U.K., according to the company’s website.

________________

REUTERS. 26 DE SETEMBRO DE 2017. EUA impõem tarifas a aviões da Bombardier após queixa da Boeing por subsídios

Por Allison Lampert e Alwyn Scott

(Reuters) - O Departamento de Comércio dos Estados Unidos impôs nesta terça-feira tarifas contra os subsídios aos jatos CSeries da Bombardier, depois que a rival Boeing Co acusou o Canadá de subsidiar injustamente a aeronave, numa decisão que provavelmente prejudicará as relações comerciais entre os vizinhos.

O departamento disse ter aplicado uma tarifa compensatória de 219,63 por cento nas importações dos novos jatos comerciais da Bombardier após concluir preliminarmente sobre a prática de subsídio. A Boeing queixou-se de que os aviões de 110 a 130 assentos foram vendidos abaixo do custo no mercado norte-americano no ano passado, com a empresa canadense se beneficiando de subsídios injustos.

Um pedido 75 jatos CSeries feito pela Delta Air Lines, em abril de 2016, decorreu das mesmas práticas prejudiciais de vendas que a rival Airbus empregou para ganhar negócios na década de 1990, de acordo com a Boeing.

A penalidade do Departamento de Comércio contra a Bombardier só entrará em vigor se a Comissão de Comércio Internacional dos Estados Unidos (ITC) decidir em favor da Boeing em uma decisão final prevista para 2018.

“Estamos totalmente em desacordo com a decisão preliminar do Departamento de Comércio”, disse a Bombardier em um comunicado, chamando a magnitude das tarifas propostas de “absurda”.

Já a Boeing disse em comunicado que “esta disputa não tem relação com limitar a inovação ou a concorrência, o que consideramos positivo. Está relacionado a ter um quadro de igualdade e garantir que as empresas aeroespaciais respeitem os acordos comerciais”.

A Embraer disse em uma declaração por email que a decisão dos EUA reforça o argumento do Brasil perante a Organização Mundial do Comércio (OMC) de que os subsídios à Bombardier violam as obrigações comerciais do Canadá.

REUTERS. 26 DE SETEMBRO DE 2017. Embraer comemora decisão dos EUA contra Bombardier por subsídios

SÃO PAULO (Reuters) - A brasileira Embraer (EMBR3.SA) celebrou a decisão do Departamento de Comércio dos Estados Unidos na terça-feira de impor tarifas compensatórias preliminares antisubsídios de 220 por cento nos jatos CSeries produzidos pela Bombardier (BBDb.TO).

A decisão veio depois que a Boeing (BA.N) afirmou que os jatos CSeries são injustamente subsidiados pelo governo do Canadá.

Embraer disse em uma declaração por email que a decisão dos EUA reforça o argumento do Brasil perante a Organização Mundial do Comércio (OMC) de que os subsídios à Bombardier violam as obrigações comerciais do Canadá.

No entanto, uma fonte da indústria aeronáutica disse que a decisão dos EUA tem resultado misto para a Embraer, uma vez que pode levar companhias aéreas a desistirem de comprar os jatos brasileiros por medo de atraírem represália comercial similar.

Por Brad Haynes

REUTERS. 27 DE SETEMBRO DE 2017. Reino Unido alerta Boeing de que pode perder negócios devido a disputa com Bombardier

BELFAST/LONDRES (Reuters) - O Reino Unido disse na quarta-feira que a norte-americana Boeing pode perder os contratos de defesa britânicos por causa da disputa com a rival canadense Bombardier, que colocou 4200 empregos em risco na Irlanda do Norte.

O Departamento de Comércio dos Estados Unidos impôs na terça-feira uma tarifa compensatória de 220 por cento nos aviões CSeries, da Bombardier, cujas asas são produzidas em uma fábrica em Belfast, após uma queixa da Boeing, que acusa o Canadá de subsidiar injustamente a Bombardier.

A decisão é uma dor de cabeça política para o governo conservador minoritário da Grã-Bretanha, que depende do apoio de um partido do norte da Irlanda para permanecer no poder.

Também mina as garantias do governo aos britânicos de que o livre comércio e os laços estreitos de Londres com Washington serão pilares da prosperidade do Reino Unido e da influência global depois que o país deixar a União Europeia em 2019.

“Este não é o comportamento que esperamos da Boeing e isso pode, de fato, comprometer nosso relacionamento futuro com eles”, disse o secretário de Defesa britânico, Michael Fallon, a jornalistas em Belfast.

“A Boeing tem contratos de defesa significativos conosco e ainda espera conquistar novos contratos. A Boeing quer e nós queremos uma parceria de longo prazo, mas isso tem que ser uma via de mão dupla.”

Por Amanda Ferguson e Estelle Shirbon; reportagem adicional por Tim Hepher, Conor Humphries, Guy Faulconbridge, Kate Holton e Michael Holden

REUTERS. 27 DE SETEMBRO DE 2017. Boeing diz que está comprometida com Reino Unido e ouviu preocupações sobre empregos na Irlanda do Norte

BELFAST (Reuters) - A norte-americana Boeing informou na quarta-feira que tinha ouvido as preocupações do Reino Unido sobre empregos na Irlanda do Norte depois que ganhou a primeira rodada de uma batalha comercial com a canadense Bombardier, a maior fabricante da região.

Um porta-voz disse que a gigante aeroespacial norte-americana continua comprometida com o Reino Unido depois que o secretário de Defesa britânico, Michael Fallon, alertou que a Boeing poderia perder os contratos de defesa do país por causa de sua disputa com sua rival canadense.

O Departamento de Comércio dos Estados Unidos aprovou na terça-feira multas preliminares contra os subsídios nos jatos CSeries da Bombardier, depois que a Boeing acusou o Canadá de subsidiar injustamente o modelo.

“Nós ouvimos e entendemos as preocupações do primeiro ministro e do governo sobre os trabalhadores da Bombardier na Irlanda do Norte. A Boeing está comprometida com o Reino Unido e valoriza a parceria, que se estende por quase 80 anos”, disse o porta-voz da Boeing no Reino Unido por e-mail.

“Qualquer alegação de ameaça econômica à Bombardier é devido à fraqueza de seu produto no mercado”, acrescentou.

Por Tim Hepher

________________

REUTERS. 26 DE SETEMBRO DE 2017. Bombardier negocia modelo C-Series com chinesas

Redação Reuters

XANGAI (Reuters) - A Bombardier quer fechar acordos com aéreas chinesas nos próximos meses e negocia com as três maiores do setor no país, disse um executivo da Bombardier nesta terça-feira.

Marc Meloche, chefe de finanças da Bombardier Comercial Aircraft, disse que a fabricante de aeronaves também discute com empresas de leasing sobre a venda de C-Series. Ele falou à Reuters enquanto estava na China.

O executivo disse que o interesse da China é alto. “A Bombardier está conversando com as três principais aéreas chinesas, bem como muitas organizações regionais e startups. Todos estão muito interessados no Bombardier C-Series”.

O modelo tem de 110 a 130 assentos, acima do limite chinês de 100 lugares para jatos regionais, mas Meloche disse que a empresa pode fazer ajustes para se adequar aos critérios legais.

O C-Series compete com a brasileira Embraer, bem como aviões menores da Boeing e da Airbus.

Por Brenda Goh

REUTERS. SEPTEMBER 26, 2017. Bombardier in talks for C-Series deals with Chinese carriers: executive

Brenda Goh

SHANGHAI (Reuters) - Planemaker Bombardier Inc aims to close deals with Chinese airlines in upcoming months and is in talks with the country’s three biggest airlines, a senior Bombardier executive said on Tuesday.

Marc Meloche, Bombardier Commercial Aircraft’s head of structured finance, said in an interview the planemaker was also in discussions with leasing businesses on purchasing its C-Series plane. He spoke to Reuters while in China.

Meloche said he hoped the deals could be announced during a visit by Canadian Prime Minister Justin Trudeau to China next month.

“Prime Minister Trudeau is coming to China next month so there is optimism that Bombardier will be among those able to announce deals on that trip,” he said.

In Ottawa, a Canadian government official said Trudeau would not be going to China in October.

Lu Shaye, China’s ambassador to Canada, told an Ottawa reception on Tuesday evening that Trudeau would visit China “in the near future”, according to a speech posted on China’s Canadian embassy website on Wednesday. Officials familiar with the visit said it was likely to take place in December.

Canadian government officials have previously said Trudeau is expected to attend the Asia Pacific Economic Cooperation meeting in Vietnam on Nov. 11-12.

Asked about the comment by the Canadian government official on Trudeau’s travel, a Bombardier spokesman in Montreal did not offer an immediate comment.

Meloche added that China’s interest is high. “Bombardier is talking to all three big Chinese airlines, as well as many regional (players) and startups. All are very interested in the Bombardier C-Series,” he said.

Bombardier is pushing hard for orders in China, the world’s fastest-growing aviation market, at a time when it faces threats to U.S. sales of the C-Series single-aisle jet because of a trade dispute with U.S. rival Boeing Co.

The U.S. government on Tuesday slapped steep preliminary anti-subsidy duties on sales of C-Series jets over that dispute.

The C-Series competes with some aircraft made by Brazil’s Embraer SA, as well as the smallest planes made by Boeing and Airbus.

Meloche also said that several Chinese lessors, many of which were looking at sale-and-leaseback opportunities, had issued term sheets in support of C-Series deliveries.

New rules requiring Chinese airline startups to operate at least 25 smaller-city hopper jets before graduating to bigger aircraft have also fueled hopes of Chinese demand for C-Series jets.

While current C-Series models accommodate 110 to 130 seats, above China’s 100-seat limit for regional jets, Meloche said Bombardier can make adjustments to meet the requirements.

He also said Bombardier could expand its activities at China’s Shenyang Aircraft Corporation, which already makes part of the fuselage for its C-series and Q-series aircraft.

But unlike Boeing and Airbus, which are expanding production facilities in China, he said Bombardier had not discussed the possibility of a separate aircraft plant in the country.

Additional Reporting by Allison Lampert in Montreal and David Ljunggren in Ottawa; Editing by David Goodman, Matthew Lewis and Muralikumar Anantharaman

REUTERS. SEPTEMBER 26, 2017. Boeing to invest $33 million in JV with COMAC for China plant: China Daily

SHANGHAI (Reuters) - Boeing Co will invest $33 million for a majority stake in a joint venture with Commercial Aircraft Corp of China (COMAC) that will oversee the U.S. planemaker’s new 737 completion plant in China, the China Daily reported.

The firms had signed an agreement to set up the joint venture with registered capital of $55 million, the state-run newspaper said on Wednesday. Boeing would take a 60 percent share, while COMAC would invest $22 million for the remainder.

Construction of the factory in the eastern city of Zhoushan began in May. It would install interiors and paint liveries.

Boeing had not previously disclosed how much it would invest in its first overseas completion and delivery center outside the United States. It aims to deliver 100 planes a year.

The China Daily, citing COMAC, added that the Chinese planemaker would participate in the completion tasks with Boeing employees, but how the two sides would share the work was still unknown. The delivery center would be owned by Boeing.

Boeing and its European rival Airbus are expanding their footprint in China as they vie for orders in the world’s fastest growing aviation market. Airbus last week opened its Chinese completion plant for A330 jets in the eastern city of Tianjin.

Reporting by Brenda Goh; Editing by Stephen Coates

_________________

LGCJ.: