CANADA ECONOMICS

INTERNATIONAL TRADE

StatCan. 2017-07-12Value added in exports, 2013

Value added in exports accounted for 21.7% of gross domestic product (GDP) and more than three million jobs in 2013. The United States dominated the export market, accounting for 15.3% of Canadian GDP and more than two million jobs.

The contribution to GDP of value added in exports in 2013 was unchanged from 2012. However, its contribution to jobs edged up, from 16.8% to 16.9%.

Value-added represents the contribution of labour and capital to the production process. Its components are labour income, gross operating surplus (or profits and depreciation) and taxes net of subsidies on production. The sum of value-added by all industries plus taxes net of subsidies on products is equal to GDP.

Saskatchewan's GDP is the most reliant on exports

Among the provinces and territories, Saskatchewan (35.1%), Newfoundland and Labrador (33.9%) and Alberta (28.9%) had the highest dependence of GDP on exports. A key factor in their high exposure was the export of crude oil and natural gas to the US, which accounted for 16.9% of Alberta's GDP, 12.8% of Saskatchewan's and 11.7% of Newfoundland and Labrador's.

Nova Scotia (11.2%), Prince Edward Island (13.3%), Yukon (13.8%) and Nunavut (15.4%) were the least dependent on exports. Domestic final consumption expenditures played a more important role in these four economies than in those of the other provinces and territories.

Chart 1 Chart 1: Contribution of exports to gross domestic product (GDP) and jobs, 2013

Contribution of exports to gross domestic product (GDP) and jobs, 2013

Ontario jobs most reliant on exports

Exposure of the provincial and territorial job markets to foreign demand differed slightly from that of GDP. Ontario (18.7%) ranked first in terms of the reliance of its jobs on foreign demand even though it ranked fifth in terms of GDP reliance on exports. Saskatchewan (17.0%) ranked second, followed by Alberta (16.7%). The least dependent job markets were Nunavut (8.4%), Yukon (10.4%) and Newfoundland and Labrador (10.6%).

Many jobs indirectly depend on exports

While exports directly generated 1,556,000 jobs, almost as many jobs (1,493,000) were also indirectly created by exporters through their purchases of goods and services from other domestic suppliers. Most spillover effects remained within the same province or territory. Purchases by exporters generated 1,051,000 jobs within the exporting provinces or territories and 442,000 jobs in other Canadian jurisdictions. Most of the spillover out-of-province jobs resulted from exports by Ontario (129,000 jobs), Alberta (106,000), Quebec (69,000) and British Columbia (47,000).

Exports contribute more to gross domestic product than to jobs

In almost all provinces and territories, exports made a larger contribution to GDP than to jobs. The only exceptions were Nova Scotia and Prince Edward Island, where the two proportions were almost equal. This difference between GDP and jobs was due mainly to the mining and oil and gas extraction sectors, where the value added per job, at $507,000, was 5.4 times the national business sector average.

An examination of the provincial and territorial economies, excluding mining and oil and gas extraction, shows a much closer alignment of GDP and jobs in terms of reliance on foreign markets. It also shows generally higher exposure for the larger economies (Ontario, Quebec and the western provinces), below-average exposure for the relatively smaller Atlantic provinces, and the least exposure for the territories, which are the smallest economies.

Chart 2 Chart 2: Contribution of exports to gross domestic product (GDP) and jobs, excluding mining and oil and gas extraction, 2013

Contribution of exports to gross domestic product (GDP) and jobs, excluding mining and oil and gas extraction, 2013

Global supply chains

The economies of Canada and the US are highly integrated. Of the exports originating in domestic Canadian production in 2013, $378.5 billion were destined for the US market. In turn, production of these exports required $65 billion of imports from the US, accounting for 17.3% of the Canadian export value. An additional $20 billion of US imports was also embedded in Canadian exports to markets outside the US.

Manufacturing dominated these integrated supply chains. The $200 billion in exports of manufactured products to the US embedded 26.0% of import content from that country, while the $67.1 billion of exports to non-US markets had 18.8% US import content.

Ontario's manufacturing exports ($143.6 billion) were the largest contributors to these cross-border activities. Its $112.5 billion of manufacturing exports to the US embedded 31.5% of import content from that country, while the remaining $31 billion, consisting of exports to other markets, embedded 21.8% of US import content.

Other provinces that showed a high US import content in their exports were New Brunswick (61.1%), Nova Scotia (31.9%), Newfoundland and Labrador (29.2%) and Quebec (28.0%). However, these provinces were generally not as reliant on US imports as Ontario. Across the provinces just mentioned (excluding Ontario), petroleum refineries contributed to the high import proportions. However, other manufacturing industries also played a substantial role in Nova Scotia and especially in Quebec. In Nova Scotia, rubber product manufacturing contributed to the high import content. In Quebec, the contributions were spread among large exporters, notably in industries such as heavy duty trucks (61.4%), non-ferrous metals (42.3%), and aerospace products (34.6%).

The lowest import content of exports was in Saskatchewan (10.1%), Yukon (10.6%), and Alberta (12.4%). All three are economies whose exports are dominated by extraction industries, which have very high ratios of value added to output, such as mining and crude oil and gas extraction.

Products

The value-added exports database provides data on the exports and imports of industries, as well as on the direct and indirect impact of each industry's production for exports on industry and on total gross domestic product and jobs. Industry impacts can be viewed from the perspective of their incidence on other industries or from the perspective of an industry's dependence on other industries. Data cover the period from 2007 to 2013 and rely on the supply-and-use tables, which provide the basis for the calculations.

Beginning with reference year 2013, a provincial and territorial dimension has been added to the measures. Imports embodied in exports have also been expanded to show their US and non-US origins.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170712/dq170712a-eng.pdf

ENERGY

StatCan. 2017-07-12. Crude oil and natural gas: Supply and disposition, April 2017

Production of crude oil and equivalent products

18.0 million cubic metres, April 2017

+4.4% increase (12-month change)

Exports of crude oil and equivalent products

16.2 million cubic metres, April 2017

+15.1% increase (12-month change)

Source(s): CANSIM table 126-0003.

Canada produced 18.0 million cubic metres (113.2 million barrels) of crude oil and equivalent products in April, up 4.4% compared with the same month in 2016.

Chart 1 Chart 1: Production of crude oil and equivalent products

Production of crude oil and equivalent products

Crude oil production

The increase in production of crude oil and equivalent products was driven primarily by synthetic crude (up 20.0% to 3.5 million cubic metres), heavy crude oil (up 3.2% to 1.9 million cubic metres) and light and medium crude production (up 0.6% to 3.8 million cubic metres). Despite the increase in April, production was the lowest since June 2016. This was attributable to a fire and explosion that occurred in March at an oil upgrader facility in northern Alberta.

Meanwhile, non-upgraded crude bitumen production declined 0.5% to 7.4 million cubic metres.

April's non-upgraded crude bitumen production consisted of mined crude bitumen (up 10.3% to 4.6 million cubic metres), plus in situ crude bitumen (up 3.4% to 6.8 million cubic metres), minus crude bitumen sent for further processing (up 20.9% to 4.0 million cubic metres).

Chart 2 Chart 2: Production of crude oil and equivalent products by type of product

Production of crude oil and equivalent products by type of product

Provincial production

Alberta produced 14.2 million cubic metres of crude oil and equivalent products, up 4.6% from April 2016 and accounting for 78.7% of Canada's total production. Saskatchewan and Newfoundland and Labrador were also key producing provinces.

Refinery use of crude oil

In April, input of crude oil to Canadian refineries totalled 8.0 million cubic metres, up 1.5% compared with the same month in 2016. Conventional crude oil represented 65.7% of the total, while non-conventional crude oil accounted for the remaining 34.3%.

Exports and imports

Exports of crude oil and equivalent products rose 15.1% in April compared with the same month in 2016, to 16.2 million cubic metres. The vast majority of exports (89.1%) were transported via pipelines, while other means (including rail, truck and marine) accounted for the remaining 10.9%.

Over the same period, imports to Canadian refineries declined 3.4% to 2.9 million cubic metres.

Chart 3 Chart 3: Exports and imports of crude oil and equivalent products

Exports and imports of crude oil and equivalent products

Inventories

Closing inventories of crude oil and equivalent products were down 2.8% to 17.8 million cubic metres in April compared with the same month in 2016.

Marketable natural gas

Canada produced 13.7 billion cubic metres of marketable natural gas in April, up 7.3% compared with the same month in 2016. Alberta (72.7%) and British Columbia (24.5%) accounted for almost all of Canadian production.

Additional information on natural gas is available in "Natural gas transmission, storage and distribution," published in The Daily on June 23, 2017.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170712/dq170712e-eng.pdf

MONETARY POLICY

Bank of Canada. 12 July 2017. Monetary Policy Report - July 2017

Growth in the Canadian economy is projected to reach 2.8 per cent this year before slowing to 2.0 per cent next year and 1.6 per cent in 2019.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/07/mpr-2017-07-12.pdf

Bank of Canada. 12 July 2017. Monetary Policy Report Press Conference Opening Statement. Stephen S. Poloz - Governor

Carolyn A. Wilkins - Senior Deputy Governor

Ottawa, Ontario - Good morning. Senior Deputy Governor Wilkins and I are pleased to be here to answer your questions about today’s interest rate announcement and our Monetary Policy Report (MPR).

Today, we raised our key policy rate by 25 basis points, in the context of an economy that is approaching full capacity and with inflation expected to reach the 2 per cent target within the next year.

Before we turn to your questions, let me offer some insights into the deliberations of Governing Council.

Economic data have been encouraging over the past few months, globally and especially for Canada. We acknowledged this positive trend in our April MPR and in our May 24 press release, while noting concern about the sustainability of growth because of its composition, as well as US-based policy uncertainties. While uncertainties remain, delays in decision making in the United States seem to have moved some of those concerns more into the background. The Bank’s latest Business Outlook Survey, for example, finds very strong business sentiment, particularly for investment and hiring intentions, despite a lack of clarity about future US policies.

Since April, we have also seen further evidence of a broadening of growth in Canada. Along with stronger-than-expected growth, this has bolstered Governing Council’s confidence in the outlook for the economy and inflation. The economy is absorbing excess capacity more rapidly than we projected in April, and it now appears that the output gap will close around the end of this year.

That will nevertheless leave some slack in the labour market. As output growth continues to exceed potential, we expect companies to invest in additional capacity and draw from this slack in the labour market, thereby expanding potential output further. This process is difficult to forecast but is likely to become increasingly evident as we approach full potential. This is an important reason why monetary policy is not on a predetermined path. It will remain highly data-dependent as we move forward. One key indicator of progress will continue to be wage inflation, which has shown signs of a pickup in recent months but remains restrained by the lingering effects of the adjustment to low oil prices.

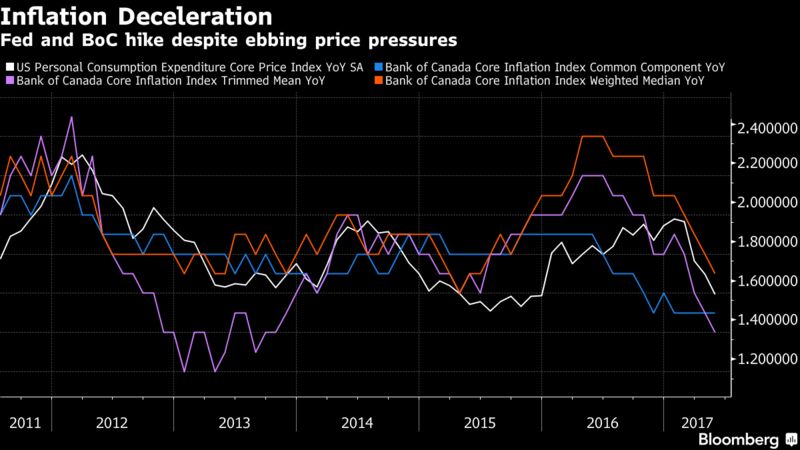

Meanwhile, inflation has continued to fluctuate in the bottom half of our target range. This has prompted a lively debate, not just in Canada but in many other countries, about the appropriate interest rate setting when economic growth is rapid but inflation is low. Governing Council examined this issue closely from two perspectives.

The first asks whether there are special factors that are temporarily pushing inflation lower, and we discuss this issue in a technical box in the MPR. Generally speaking, central banks prefer to look through temporary factors. Of course, our new core measures of inflation were developed to help us see through the noise in inflation data, but even these are not immune to temporary fluctuations.

After careful assessment of the evidence, Governing Council agreed that a significant portion of the recent softness in our measures of inflation should prove to be temporary. Nevertheless, even a one-time price change affects inflation for a year, simply because we gauge inflation on a year-over-year basis. Some temporary factors are themselves gradual rather than one-off, such as increased competition in retail food stores. This all serves to underscore the data-dependent nature of monetary policy.

All things considered, Governing Council judges that in the absence of temporary factors, inflation would be running at around 1.8 per cent, as excess capacity in Canada is estimated to account for an inflation shortfall of about 0.2 per cent. Accordingly, as the gap closes in the months ahead, we expect inflation to head toward 2 per cent, with the rate of convergence determined by how quickly these various temporary factors unwind.

Our projection shows a modest overshoot of the 2 per cent inflation target in 2019. This is a product of the dynamics of our model, but it is an important reminder that, while our target is 2 per cent, our control range is a symmetric 1 to 3 per cent. Having a target range acknowledges the uncertainty inherent in economic forecasting and inflation control. The chances of an overshoot will depend on how investment and potential output respond to tighter capacity constraints, a process that the Bank will monitor closely.

The second perspective on the low-inflation issue concerns the lags between monetary policy actions and their ultimate effects on inflation. It is worth remembering that it can take 18 to 24 months for a monetary policy action to have its full effect on inflation. This means that central banks must target future inflation by anticipating future deviations from target. And because inflation is measured with a lag, reacting only to the latest inflation data would be akin to driving while looking in the rear view mirror. In contrast, imagine a world where the Bank was able to anticipate all future movements in inflation, and adjust interest rates in advance to offset them and keep inflation exactly at 2 per cent. In such a case, it might appear to the casual observer that interest rates were being adjusted up or down for no reason.

Taking together the approaching closing of the output gap and our understanding of recent soft inflation readings, today’s increase in interest rates is clearly warranted. That being said, we will of course monitor the details of inflation carefully to determine the extent to which it remains appropriate to look through fluctuations in inflation.

Interest rates were lowered in 2015 in order to help the economy adjust to lower oil prices, and much of that adjustment is now behind us. While lower rates contributed to greater household financial vulnerabilities, enhanced macroprudential policies helped to mitigate these and will continue to do so. As the economy approaches full capacity, a higher policy rate in pursuit of our inflation target also serves to reinforce efforts to mitigate financial system vulnerabilities.

Governing Council acknowledges that the economy may be more sensitive to higher interest rates than in the past, given the accumulation of household debt. We will need to gauge carefully the effects of higher interest rates on the economy.

Future adjustments to the target for the overnight rate will be guided by incoming data as they inform the Bank’s inflation outlook, keeping in mind continued uncertainty and financial system vulnerabilities.

With that, Senior Deputy Governor Wilkins and I will be happy to take your questions.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/07/opening-statement-120717.pdf

Bank of Canada. 12 July 2017. Bank of Canada increases overnight rate target to 3/4 per cent

Ottawa, Ontario - The Bank of Canada is raising its target for the overnight rate to 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent. Recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy. The Bank acknowledges recent softness in inflation but judges this to be temporary. Recognizing the lag between monetary policy actions and future inflation, Governing Council considers it appropriate to raise its overnight rate target at this time.

The global economy continues to strengthen and growth is broadening across countries and regions. The US economy was tepid in the first quarter of 2017 but is now growing at a solid pace, underpinned by a robust labour market and stronger investment. Above-potential growth is becoming more widespread in the euro area. However, elevated geopolitical uncertainty still clouds the global outlook, particularly for trade and investment. Meanwhile, world oil prices have softened as markets work toward a new supply/demand balance.

Canada’s economy has been robust, fuelled by household spending. As a result, a significant amount of economic slack has been absorbed. The very strong growth of the first quarter is expected to moderate over the balance of the year, but remain above potential. Growth is broadening across industries and regions and therefore becoming more sustainable. As the adjustment to lower oil prices is largely complete, both the goods and services sectors are expanding. Household spending will likely remain solid in the months ahead, supported by rising employment and wages, but its pace is expected to slow over the projection horizon. At the same time, exports should make an increasing contribution to GDP growth. Business investment should also add to growth, a view supported by the most recent Business Outlook Survey.

The Bank estimates real GDP growth will moderate further over the projection horizon, from 2.8 per cent in 2017 to 2.0 per cent in 2018 and 1.6 per cent in 2019. The output gap is now projected to close around the end of 2017, earlier than the Bank anticipated in its April Monetary Policy Report (MPR).

CPI inflation has eased in recent months and the Bank’s three measures of core inflation all remain below 2 per cent. The factors behind soft inflation appear to be mostly temporary, including heightened food price competition, electricity rebates in Ontario, and changes in automobile pricing. As the effects of these relative price movements fade and excess capacity is absorbed, the Bank expects inflation to return to close to 2 per cent by the middle of 2018. The Bank will continue to analyze short-term inflation fluctuations to determine the extent to which it remains appropriate to look through them.

Governing Council judges that the current outlook warrants today’s withdrawal of some of the monetary policy stimulus in the economy. Future adjustments to the target for the overnight rate will be guided by incoming data as they inform the Bank’s inflation outlook, keeping in mind continued uncertainty and financial system vulnerabilities.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/07/fad-press-release-2017-07-12.pdf

The Globe and Mail. Jul. 12, 2017. Bank of Canada raises interest rates for first time in 7 years

BARRIE MCKENNA

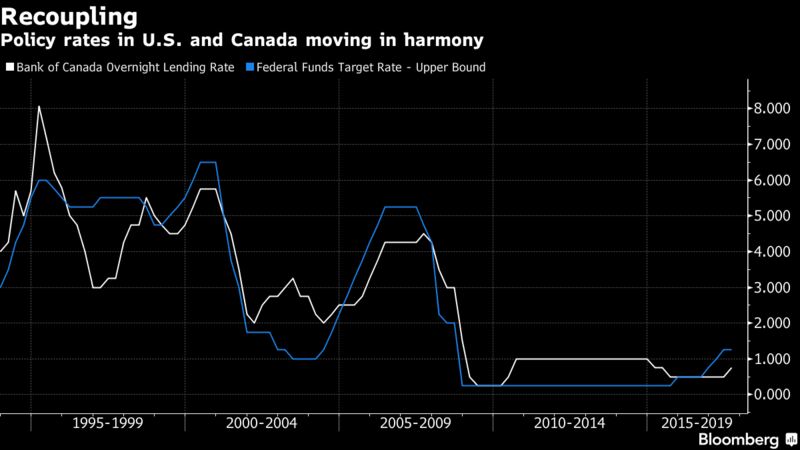

OTTAWA — The Bank of Canada is hiking its key interest rate for the first time in seven years, joining the U.S. Federal Reserve in starting the process of undoing nearly a decade of easy money.

The bank raised its overnight lending rate to 0.75 per cent from 0.5 per cent Wednesday, citing “bolstered” confidence that the Canadian economy has finally turned the corner after years of sputtering growth.

“Growth is broadening across industries and regions and therefore becoming more sustainable,” the bank said in a statement.

“The current outlook warrants [Wednesday’s] withdrawal of some of the monetary stimulus in the economy.”

Meanwhile, the bank dismissed the recent fall in inflation as mainly temporary, dragged down by lower gasoline prices, electricity rebates in Ontario, intense food price competition and unexpectedly weak car prices.

Bank of Canada Governor Stephen Poloz and his central bank colleagues aren’t yet ready to pull the trigger on a second rate hike this year. The bank insisted that any future rate hikes would be guided by the effect of “incoming data” on inflation, according to the statement.

“Monetary policy is not on a predetermined path,” Mr. Poloz told reporters in Ottawa after the rate announcement.

Many economists are expecting at least one more rate hike this year, most likely in October, when the bank releases its next quarterly forecast.

Bank of Montreal chief economist Douglas Porter said Wednesday’s hike begins a process that could see the Bank of Canada’s key rate bumped up to 1.5 per cent by mid-2018.

“And so the tide begins to turn,” Mr. Porter said in a research note. “We would expect the next rate hike in October . . . and then a brief pause before some modest follow-up moves in 2018.”

The bank said that the 3.5-per-cent annual pace of GDP growth in the first quarter will “moderate” over the rest of the year, but remain “above potential.” Among other things, the bank expects consumer spending, exports and business investment to drive growth in the months ahead.

But Wednesday’s quarter percentage-point rate increase could cool one of the key sectors that has been driving the economy – housing. Lenders have already started pushing some mortgage rates higher, which will discourage home buying.

The bank pointed out that housing activity has already abated, particularly in the Toronto area, where homes sales have fallen sharply.

The central bank also noted that while the global economy is getting stronger and spreading to new regions, “elevated geopolitical uncertainty still clouds the global outlook.” For example, the bank has removed from its forecast an expected bump to the U.S. economic growth from future personal and corporate tax cuts, which now appear less likely.

Today’s ultra-low interest rates have encouraged many Canadians to load up on mortgage debt, driving home prices and home construction, particularly in and around Toronto and Vancouver. But they have also penalized savers and made it tough for pension funds to generate healthy returns.

Inflation remains one of the puzzles facing central banks – not just in Canada, but globally. Canada’s Consumer Price Index (CPI) currently sits well below the bank’s 2 per cent target and continues to drift lower.

Economists will no doubt raise questions about why the central bank is raising rates while inflation is still falling.

But the Bank of Canada is apparently looking ahead to conditions that will likely prevail a year or two from now. Inflation may weaken further in the months ahead before getting back to the two per cent target by the middle of next year as excess capacity in the economy fades, according to the bank’s Monetary Policy Report, released Wednesday.

“Reacting only to the latest inflation data would be akin to driving while looking in the rear-view mirror,” Mr. Poloz told reporters.

The bank now estimates that the so-called output gap – a measure of excess labour, factory capacity and the like – will close “around the end of 2017.” That’s significantly sooner than its assessment in April that the gap would disappear in the first half of next year.

The Bank of Canada cut rates twice in 2015, taking out what Mr. Poloz called “insurance” against the fallout from the collapse in the price of oil and other commodities.

Recently, Mr. Poloz has said that those cuts “have largely done their work” as the effects of the oil shock receded in Canada’s oil patch.

“Higher interest rates are what is needed to reduce the vulnerability of high household indebtedness and real estate price imbalances in parts of the country,” Conference Board of Canada chief economist Craig Alexander said. “[Wednesday’s] decision to raise rates is a positive development.”

Overall, the bank’s latest projection of where the economy is headed is little changed from its April forecast. It now expects the economy to grow 2.7 per cent this year, compared to its earlier estimate of 2.5 per cent. But its forecast for GDP growth in 2018 and 2019 remains virtually unchanged.

The bank did, however, significantly underestimate the strength of consumption this year – most notably the hot housing markets in Ontario and B.C.

Likewise on inflation, the bank said CPI inflation will average just 1.6 per cent this year, versus its April estimate of 2.1 per cent. But its forecasts for 2018 and 2019 (2 per cent and 2.1 per cent) remain roughly in line with earlier projections.

The central bank warned of a series of risks that could derail its latest forecast. These include rising trade protectionism, a house price correction in Toronto and Vancouver and weaker than expected exports and business investment. The bank likewise cited a number of factors that could cause the economy to grow faster than expected, including stronger U.S. growth and more debt-fueled consumption in Canada.

THE GLOBE AND MAIL. BANK OF CANADA. JUL. 12, 2017. How the rate hike affects homeowners and buyers

ROB CARRICK, JEREMY AGIUS AND MATT LUNDY

The Bank of Canada has increased its benchmark interest rate for the first time since 2010, a sign that the economy is improving enough to allow borrowing costs to rise from historic lows reached in the aftermath of the global financial crisis.

The overnight lending rate was raised to 0.75 per cent from 0.5 per cent, where it had been locked for two years as the country adjusted to the challenge that low oil prices posed for an already sluggish economy. Many economists expect the central bank to hike again this year.

Bank of Canada overnight lending rate

5.0%

4.5

4.0

3.5

3.0

2.5

25-basis-

point rate

hike

2.0

1.5

1.0

0.5

0.0

2003

2006

2009

2012

2015

THE GLOBE AND MAIL, SOURCE: BLOOMBERG

Homeowners with fixed-rate mortgages

There is no immediate impact on payments for existing mortgages. Only when the mortgage comes up for renewal would higher rates affect payments.

The interest rate on fixed-rate mortgages is influenced by the interest rates on bonds issued by the federal government, not the Bank of Canada’s overnight rate.

But if the central bank is confident enough about the economy to start pushing the overnight rate higher, expect interest rates in the bond market to rise as well. This explains how an increase in the overnight rate can indirectly affect fixed-rate mortgages.

How will your mortgage payments change?

For those with a fixed-rate mortgage that will come up for renewal, we’ve created the following tool to see how your monthly payments could change.

First, figure out the mortgage amount remaining at the start of your next term, and the remaining amortization. (Talk to your mortgage lender to find out, or use a calculator like this one to get a rough idea.) If you wish to compare mortgage payments, check your mortgage statement to find your current monthly payment. Finally, test out some higher interest rates than you’re now paying.

Current monthly payment ($)(add this if you want to calculate the difference)

Mortgage amount at renewal ($)

Amortization period at renewal (years)

Interest Rate (%)

Monthly cost would be:

$447

*Notes: Calculation assumes biannual compounding. Results are for illustrative purposes only. Contact your mortgage broker for an official figure.

Homeowners with variable-rate mortgages

The interest cost on variable-rate mortgages is pegged to your lender’s prime rate, minus whatever discount you negotiated. The prime rate is in turn guided by the Bank of Canada’s benchmark overnight rate. Payments on most variable-rate mortgages will be adjusted higher in a matter of days or weeks to reflect an increase in the overnight and prime rates. (Royal Bank of Canada raised its prime rate after the Bank of Canada’s move.)

With some variable-rate mortgages, payments remain the same for the duration of the term. But there are adjustments going on in the background. As rates rise, more of your payment goes toward paying interest and less goes toward the principal. This will increase the amount of time it takes to pay off your mortgage unless you increase payments on renewal.

Borrowers tend to use the term “variable-rate mortgage” to describe all mortgages where rates can fluctuate during the term of the loan. However, lenders use the term “adjustable-rate mortgage” to describe mortgages where payments are reset according to changes in the lender’s prime rate. Variable-rate mortgages technically apply to those where the mix of principal and interest changes, but not the amount of the payment.

One final note: Toronto-Dominion Bank is an example of a lender that has a “mortgage prime rate,” a unique in-house rate used for pricing variable-rate mortgages. TD’s mortgage prime has been higher than its conventional prime rate.

Prospective buyers

It could become tougher to qualify for home ownership.

Federal rules unveiled last fall require home buyers with a down payment of less than 20 per cent to “stress test” their ability to carry mortgage payments at whichever is greater: the negotiated rate in their mortgage contract or the Bank of Canada’s conventional five-year fixed posted rate.

The central bank’s rate is based on posted five-year fixed mortgage rates at Canada’s largest banks, and was most recently set at 4.64 per cent. That’s roughly two percentage points higher than many discount rates on the market.

When the Bank of Canada’s posted rate starts climbing, some home buyers will be “stress tested” at a higher rate. Joining the homeowner’s club will have a higher barrier of entry.

Even before the rate hike, the mortgage market was changing. In early July, RBC raised rates by 0.2 of a percentage point for some of its fixed-rate mortgages as bond yields moved higher. Other major banks followed with their own rate increases.

Still thinking of getting into the market? Here’s a tool to show how your monthly mortgage payments would differ at various interest rates.

Just fill out the mortgage amount (the home’s purchase price minus your down payment) and the amortization period.

Mortgage amount ($)

Amortization period (years)

Monthly cost for a 25-year mortgage at various interest rates

*Note: Mortgage default insurance costs not included here. Calculation assumes biannual compounding.

For some context, mortgage broker David Larock says discounted five-year fixed rates for his clients ranged between 2.39 per cent and 2.59 per cent in the first half of 2017, while variable-rate mortgages were in the range of 2 to 2.25 per cent.

Mortgage market breakdown

The latest survey data on mortgage borrowing suggest about eight in 10 borrowers who bought a home last year have a fixed-rate mortgage, 17 per cent have a variable rate and 3 per cent have a mortgage that combines a fixed rate and variable portion.

The outlook

Financial markets at mid-year expected the Bank of Canada to increase the overnight rate by a total 0.5 of a percentage point in 2017, which suggests one more increase of 0.25 of a point before year’s end. This would hypothetically take the prime rate at major lenders to 3.2 per cent from 2.7 per cent before the latest rate hike. Increases in the cost of fixed-rate mortgages will depend on how high rates for federal government bonds climb.

The Globe and Mail. Jul. 12, 2017. Five harsh realities of rising rates for savers and borrowers

ROB CARRICK

Everyone has something to complain about as interest rates rise. There are no true winners – borrowers pay more, while returns for savers and cautious investors improve to pretty bad levels from the punitively awful. Here are five harsh realities of rising rates for both savers and borrowers:

No exit from saver’s hell

It’s a borrower’s world. Savers just live in it. You can see this in the way banks promptly announce how they’re adjusting the cost of mortgages when interest rates rise. Comparable bulletins about higher rates for guaranteed investment certificates and savings accounts are rare to non-existent.

GICs and savings rates will drift higher, but not in the same regimented way as mortgage, loan and line of credit rates. And when GIC rates do move higher, they’ll still lag well behind the inflation rate in many cases.

If you’re parking more than $100 in a big bank savings account, move along. As of Wednesday, you could get savings rates of 1.65 per cent or more with the protection of Canada Deposit Insurance Corp. from Alterna Bank, EQ Bank, Oaken Financial and Zag Bank. Big banks pay 0.5 per cent if you’re lucky.

Prepare for mortgage renewal shock

The impact of rising mortgage rates is arguably worse for existing home owners than it is for first-time buyers. As you own a home, you accumulate financial obligations like car loans, day care, and home maintenance/upkeep. Mortgages have in recent years been a bit of a relief valve on these costs. If you bought a home in 2009-2011, you’ve been able to renew a five-year mortgage at a lower rate and thus reduce your monthly expenses.

Your next renewal will probably involve a higher mortgage payment. [for online: We’ve developed a tool to help you map out how much more you might have to pay.] Resist the easy solution of lengthening your amortization to ease the load of higher rates. Your payments will fall, but you’ll be mortgage-free at a later date than before. You want to be mortgage-free as soon as possible so you can start power-saving for retirement.

Forget housing as an investment

The real estate sector likes to say the huge house price gains of the past few years in some cities are justified by underlying factors like strong immigration, a limited supply of newly constructed homes and our world-class cities. But the real force in housing was low interest rates. Every step higher for rates weakens housing in the expensive markets in and around the cities of Vancouver and Toronto.

There are plenty of markets in Canada that are affordable now and will remain so as mortgage rates rise. But a continued increase in rates will take the froth out of housing everywhere. Houses as an investment? Maybe if you buy in after a market correction.

You’re getting the worst of two worlds

Interest rates typically rise when the economy is generating enough heat to send wages and salaries noticeably higher. But that’s not the case today. Hourly wages in the latest tally by Statistics Canada moved up by a weak 1.3 per cent on a year-over-year basis, the same rate as the most recent inflation rate. The net result here is that you’re facing higher household costs through higher interest rates, while your income stagnates on an after-inflation basis.

Until wages start moving, higher interest rates are like a pay cut or a tax increase. You will need to trim your household spending to keep your balance. Don’t take the easy way out by lowering the amount you save for retirement or your children’s post-secondary education.

Your line of credit could be a problem

The federal Finance Consumers Agency of Canada says there are about 3 million home equity line of credit accounts in Canada, with an average outstanding balance of $70,000. HELOCs are considered to be persistent debt – people often don’t pay them off until they sell their house.

Rising rates will make HELOCs even harder to conquer. You can generally keep onside with a HELOC by paying interest owning every month and not touching the principal. As interest rates rise, it costs more to just maintain a HELOC. That means there’s less chance households will have money to reduce their balance owing. Fighting hard to pay down your mortgage? Your line of credit comes first.

REUTERS. JULY 12, 2017. Confident Bank of Canada hikes rates for first time since 2010

By Andrea Hopkins and Leah Schnurr

OTTAWA (Reuters) - The Bank of Canada raised interest rates for the first time in nearly seven years on Wednesday, saying the economy no longer needed as much stimulus and sending the Canadian dollar to a near 11-month high on expectations of more rate hikes to come.

The widely expected rate increase makes Canada the first major central bank to follow the Federal Reserve in removing some of the monetary stimulus poured into the global economy after the 2007-2009 financial crisis.

Economists said the central bank's statement suggested at least one more quarter-percentage point rate increase is in store for 2017, with more likely to follow gradually if growth continues to meet expectations.

The central bank cited a need to look through soft inflation as it hiked rates for the first time since September 2010 but said it will wait for more economic data before committing to its next move.

"There is an upward revision to our outlook of course because of the data ... but more importantly it's our confidence that has increased through those months compared to where we were at the beginning of the year," Bank of Canada Governor Stephen Poloz said at a news conference.

"It's that confidence in the outlook that makes us more confident today, to make the change we've made."

The increase, which pushed the official interest rate up to a still-low 0.75 percent, boosted the Canadian dollar to a near 11-month high and sent yields on Canada's two-year bonds to their highest since September 2014.

A Reuters poll of economists on Tuesday showed a sharp shift in sentiment in the week leading up to the rate decision, with many bringing their rate hike expectations forward based on hawkish comments from policymakers.

"I thought the Bank of Canada did a masterful job today," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

"They raised rates and they stopped short of promising another rate hike this year but they were broadly bullish on the economy which bodes well for another rate increase this year."

Years of ultra-low interest rates since the financial crisis spurred a borrowing binge and helped drive Canadian household debt to record levels in recent years, fueling a housing boom that has recently began to falter.

The bank said in its accompanying monetary policy report that activity in the housing sector has abated, largely due to sharp declines in resales in Toronto and surrounding areas.

The central bank has repeatedly warned about the vulnerabilities posed by the massive consumer debt but was forced to cut interest rates twice in 2015 as oil prices dropped, sideswiping Canada's energy-dependent economy.

In a decision that emphasized the lag between a rate hike and future inflation, the bank signaled it did not want to commit to a predetermined path of more hikes.

Acknowledging the contradiction in raising rates when inflation is low, the bank said it will analyze short-term price fluctuations "to determine the extent to which it remains appropriate to look through them," and noted temporary factors like electricity rebates have kept a lid on prices.

Additional reporting by Solarina Ho, Fergal Smith in Toronto, Dion Rabouin and Jennifer Ablan in New York; Editing by Meredith Mazzilli

BLOOMBERG. 12 July 2017. The Bank of Canada Shows It's the Federal Reserve of the North

By Luke Kawa

- Poloz follows Yellen template for first rate hike since 2010

- Tightening comes even as measures of core inflation soften

A North American central bank hiking rates in the face of strong job growth and deteriorating core inflation rates, citing temporary factors for the drop-off in price pressures.

No, it’s not Janet Yellen’s Federal Reserve -- it’s Stephen Poloz’s Bank of Canada.

On Wednesday, the Bank of Canada delivered its first interest-rate hike in almost seven years, becoming the first Group of Seven central bank to join the Fed in policy normalization, the first concrete step toward global monetary policy convergence. And it followed the Fed in more ways than one.

The Bank of Canada now sees inflation averaging 1.6 percent, down three tenths of a percentage point from its April Monetary Policy Report. At the same time, the bank estimates economic slack will be eliminated by the end of 2017, sooner than it had anticipated three months ago. That’s an echo of the Fed’s move in June, which saw officials mark down their forecast for the unemployment rate forecasts and core PCE inflation, its preferred gauge of price pressures.

For Janet Yellen, Verizon has been the big headache in suppressing inflation. Stephen Poloz and Canadian policymakers attributed the shortfall to sluggish food inflation, measures by the Ontario government to reduce the cost of electricity and a significant slowdown in auto price gains.

Core Measures

The bank’s three core measures of inflation were designed by officials in part to filter out exactly these sector-specific shocks. However, they’ve proven are unable to fully do so, contributing to a downward trend in all three metrics since early 2016.

The bank’s Monetary Policy Report even alluded to an Amazon effect potentially contributing to subdued inflation globally, just as Chicago Fed President Charles Evans did in late June.

“The rise of e-commerce may also have heightened retail competition, by enabling retailers to compete across national borders, thus changing pricing behavior and making prices more sensitive to new information and global market conditions,” the bank’s Governing Council wrote in its opening statement before Wednesday’s press conference.

Steeled Resolve

Canada’s best quarter for employment gains since 2010 and broadening economic growth bolstered the central bank’s confidence in the outlook and steeled its resolve to increase interest rates. As such, the Fed and Bank of Canada are expected to lead the charge away from the zero lower bound. That’s after an onslaught of hawkish rhetoric from top Canadian monetary policymakers over the past month.

Historically, the two central banks’ policy rates have moved in sync. However, a Canadian credit cycle that’s completely divorced from that of its largest trading partner in the wake of the financial crisis, a weakened link between U.S. demand and Canadian exports, and the plummet in oil prices starting in mid-2014 has prompted policy to decouple this decade.

The Bank of Canada and Fed have different government-appointed directives: the U.S. central bank has a dual mandate for full employment and stable inflation; its Canadian counterpart targets only the latter. At this juncture, both are fundamentally relying heavily on unobservable constructs to justify the removal of monetary stimulus in the face of subdued price pressures.

Yellen still puts faith in the Phillips Curve, which suggests that an unemployment rate that sinks beyond a sustainable level will foster higher wages and price pressures broadly.

Poloz’s basis for tightening rests upon his outlook for the output gap -- the cumulative difference between the central bank’s estimate of how fast the economy can grow and how fast it has -- buttressed by the notion that central bank policy changes influence economic activity with a lag. A zero output gap is consistent with an economy that’s operating at full capacity with stable inflationary pressures.

“It is the output gap which guides the pressures on inflation through time,” the governor said in the press conference following his first rate decision in 2013.

While using slightly different compasses, Poloz and Yellen have the same rationale in mind: easing up on monetary accommodation now -- despite the current lack of success on their government-appointed inflation mandates -- will help avoid a situation in which they fall behind the curve and need to tighten policy swiftly to tamp down on inflation, sending their respective economies into recession.

BLOOMBERG. 12 July 2017. Bank of Canada Raises Rates for First Time in 7 Years

By Theophilos Argitis

- Recent inflation softness mainly due to temporary factors: BoC

- Future rate adjustments will be guided by data, bank says

Canada became the first Group of Seven country to join the U.S. in raising interest rates on Wednesday, fueling speculation the world’s central bankers are heading into a tightening cycle.

The central bank’s benchmark rate was raised to 0.75 percent, from 0.5 percent. It said future rate moves will be “guided” by the data, while downplaying recent sluggishness in inflation.

Investors are looking at the decision as a possible harbinger of things to come globally and are monitoring it for clues on the central bank’s resolve for withdrawing stimulus, with the prospect of central bank tightening has triggered a selloff in government bond markets over the last two weeks. Canadian government bonds yields and the country’s currency rose after the hike, on expectations the Bank of Canada will follow with a second rate hike this year.

“Governing Council judges that the current outlook warrants today’s withdrawal of some of the monetary policy stimulus in the economy. Future adjustments to the target for the overnight rate will be guided by incoming data as they inform the Bank’s inflation outlook, keeping in mind continued uncertainty and financial system vulnerabilities,” it said in the statement.

Growth Spurt

Canada is in the midst of one of its strongest growth spurts since the 2008-2009 recession, with the expansion accelerating to an above-3 percent pace over the past four quarters. That’s the fastest among Group of Seven countries and double what the central bank considers Canada’s capacity to grow without fueling inflation.

The Bank of Canada said the acceleration in growth, and its broadening to more sectors and regions, has increased its “confidence” the economy will continue to grow above potential, meaning excess capacity is being absorbed.

There wasn’t much indication on the future path to rates, outside the nod to data. One of the big questions investors had ahead of the rate decision was whether the central bank’s focus was the 50 basis points of cuts implemented in 2015. Just last month, Governor Stephen Poloz said that what the recovery “suggests to us is that the interest rate cuts that we put in place in 2015 have largely done their work.” While the statement did say the adjustment to lower oil prices is largely complete, there was no reference to the 2015 rate cuts.

The statement had “no detailed hints on when the next hike is coming other than boilerplate language that it will depend on the data, but October (the next MPR) is our favored pick, since by skipping September the Bank can signal that this will be a gradual process,” Avery Shenfeld, chief economist at Canadian Imperial Bank of Commerce, said in a note to investors.

Poloz holds a press conference to discuss the rate decision at 11:15 a.m. Ottawa time.

Full Capacity

The central bank estimates the economy will return to full capacity by the end of 2017. In April, it had predicted the closing of the output gap in the first half of 2018. The bank estimates the degree of excess capacity in the second quarter of this year is between zero and 1 percent of GDP.

“The initial indications are that the Bank fully expects to follow-through with another rate hike,” Doug Porter, chief economist at Bank of Montreal, said in a client note.

The central bank downplayed recent weakness in inflation, judging the sluggishness as “mostly temporary.” Not only has inflation been sluggish, it’s also been weakening with consumer prices in May up 1.3 percent on an annual basis -- the slowest pace this year.

The central bank predicted inflation will return “close to” its target of 2 percent by the middle of 2018 -- which is later than it had predicted in April. The slowdown can be “explained mainly by easing consumer energy and automobile price inflation,” it said.

Other Details

- The central bank cites broadening of Canadian growth across industries and regions as one reason for its confidence in sustainability of expansion

- The Bank of Canada cites broadening growth across countries as well

- The central bank estimates GDP growth of 2.8 percent in 2017, versus an April forecast of 2.6 percent. Growth in 2018 is estimated at 2 percent, and 1.6 percent in 2019

- The better than expected growth in 2017 is largely being driven by household spending, which is contributing 1.9 percentage points to the growth rate. Outside of stronger household spending in 2017, the outlook for everything else over the next three years is little changed from April forecasts

- The rate statement makes no mention of Canada housing market

- Bank of Canada removes its expectations for a stimulus boost from the U.S. fiscal measures of half a percent point to the level of U.S. GDP by mid-2019

- Slumping core inflation globally requires further analysis, but may include structural changes related to technology and falling inflation expectations

- Labor market indicators suggest slack in the labor market is being absorbed, albeit with a lag, the central bank said in its monetary policy report

- Housing activity expected to ease

BLOOMBERG. OPINION. 11 July 2017. Canada Sure Seems to Be Betting on a Global Recovery. The central bank is expected to tighten credit, a vote of confidence in the U.S. economic expansion and the world's.

By Daniel Moss

The world's fastest-growing major developed economy is expected to get an interest-rate increase as soon as this week.

The Bank of Canada is likely to pull the trigger and increase its benchmark rate, the first such move in seven years. Economists have penciled in a further step by year-end.

While it would mean higher borrowing costs for a housing industry showing signs of strain, that's a good problem to have. A rising rate in Canada is a vote of confidence in U.S. expansion and, by extension, the newfound optimism that the world economy is poised for an upswing.

Canadian customers are the biggest buyers of American exports. The bulk of Canada's oil exports go to the U.S. No other major industrialized economy is as reliant on the U.S. economy, accounting for about three-quarters of what Canada sells abroad.

Bank of Canada Governor Stephen Poloz is well aware of his country's links to the broader world through the U.S. Prior to leading the central bank, he ran Export Development Canada, the business-development agency equivalent to the Export-Import Bank in the U.S. He has co-written academic papers on global supply chains.

Poloz took great heart from the International Monetary Fund's last update on the global economic outlook. After years of downgrades to its forecast, the IMF raised its growth projection to 3.5 percent this year and 3.6 percent in 2018. Modest increases for sure, but it's the direction that's important.

And things are humming at home. Gross domestic product grew 3.3 percent in April from a year earlier. The central bank's latest quarterly Business Outlook Survey found executives expect growth will be sustained. The Business Outlook Survey also included the highest-ever score for intentions to hire.

So confident are traders that Poloz will deliver a rate increase -- market estimates put the chances at 90 percent -- that the only thing up for grabs is whether this is the start of a cycle of rate increases, or just a one-off, or perhaps the first in a two-off.

The Bank of Canada cut rates twice in 2015 in an effort to contain the damage from a slump in energy investment. So is this likely step just an effort to eradicate 2015 from the slate or something more? In addition to Wednesday's statement, Poloz will hold a press conference to explain the bank's thinking.

The Bank of Canada's action certainly says something about the domestic scene, but just as importantly it's a vote of confidence in the world beyond Canada's borders.

G-20

The Globe and Mail. 12 Jul 2017. Trade pacts need an overhaul – why not start with EU-Japan deal? Ahead of the G20 summit tomorrow, I believe Japan and the EU are demonstrating our strong political will to fly the flag for free trade against a shift toward protectionism. Shinzo Abe Prime Minister of Japan

ERIC REGULY, EUROPEAN BUREAU CHIEF

Japanese Prime Minister Shinzo Abe and U.S. President Donald Trump hold a meeting on the sidelines of the G20 summit in Hamburg, Germany, on Saturday. Japan and the European Union recently rolled out a new free-trade agreement, in part as a symbol of their united front against protectionism.

On the eve of the Group of 20 summit in Hamburg, the European Union and Japan, figuratively speaking, raised their right arms and extended their middle fingers in the general direction of Donald Trump.

The message to the U.S. President was: Retreat all you want from global trade, we’re not joining you and we don’t need you, so there.

As proof, they rolled out the EU-Japan free-trade deal and duly gloated. “Ahead of the G20 summit tomorrow, I believe Japan and the EU are demonstrating our strong political will to fly the flag for free trade against a shift toward protectionism,” Japanese Prime Minister Shinzo Abe said in a news conference with Donald Tusk, President of the European Council, and Jean-Claude Juncker, President of the European Commission.

If Mr. Trump was annoyed by the smirking show of bravado, he didn’t show it, and why would he? The EU-Japan deal (formally known as the Japan-EU Economic Partnership Agreement, or JEEPA), is not a done deal by any stretch of the imagination. It is a low-profile negotiation that was suddenly thrust onto the front lines for no other reason than to needle Mr. Trump and isolate him.

Mr. Trump could get the last laugh. The EU-Japan agreement, whose negotiations started in 2013, is a work in progress and won’t come into force until 2019, at the earliest, and probably later. The simpler Canada-Europe trade deal, known as CETA, took seven years to negotiate and could yet fail because it awaits approval in national and regional parliaments across the EU, a few of which have serious reservations about its implementation.

Koji Tsuruoka, Japan’s ambassador to Britain, told the British Broadcasting Corp. it was wildly

premature to declare consensus on the EU-Japan trade talks. “It took four years and three months to lay down the structure of the deal, and you can guess how many more years we may need to finalize this,” he told the BBC.

The EU-Japan deal has had little media attention in recent years, even though it’s ambitious. Two-way trade between the two economic heavyweights amounts to some €125-billion ($185-billion) a year. The Japanese want open EU access for their cars and machinery; the EU wants to boost its food and booze exports to Japan, from fresh Italian mozzarella to French wines. Some negotiators have dubbed the talks a “cars for cheese deal,” although the description vastly underplays its complexity.

The deals that dominated the trade agenda instead were CETA, the Trans-Pacific Partnership (TPP) and the EU-U.S. Transatlantic Trade and Investment Partnership (TTIP). Mr. Trump pulled out of the TPP, which would have struck a deal among the United States, Japan and 10 other Pacific countries, and halted negotiations on the TTIP. His “America First” agenda also saw him reopen the North American free-trade agreement after having threatened to scrap the whole thing.

With trade negotiations dying everywhere, the Europeans are trying hard to take over the trade leadership role from the Americans. Their pro-trade agenda has been buoyed by the election of French President Emmanuel Macron, whose pro-EU and proglobalization agenda runs counter to Mr. Trump’s view. With the TTIP gone and CETA still a possible failure, the EU is desperate for the EU-Japan deal to succeed and will no doubt intensify the negotiating efforts.

But pushing hard and fast risks a shoddy deal. Mr. Trump isn’t alone in his doubts about the value of free trade; the riots by the anti-globalization mob at the G20 told you as much.

Free trade has been a godsend for large companies, who can plunk their operations in countries with the lowest tax rates and labour costs. It works for some consumers, who can buy everyday items on the cheap. But the gains made by the big companies have translated into pain for many workers. In Europe and in North America, there was scant attention paid to workers who lost their jobs when the borders were flung open to all comers. Many workers can be forgiven for thinking that free trade creates as many losers as winners.

The EU-Japan trade deal should be pursued, but not at any cost. It should serve as a model for future trade deals by reinforcing environmental protection among the signatories (in this area, the EU-Japan talks are off to a good start because the deal would incorporate the Paris climatechange commitments).

It should recognize that investor-dispute tribunals that override national sovereignty and legal systems in favour of foreign companies is anti-democratic and risks stoking anti-globalization sentiment. The deal should set the highest standards for data and privacy protection. It should recognize that free trade is not necessarily fair trade and put in place a strategy for those workers who will lose their jobs as tariff and non-tariff barriers melt away.

Speed should not be of the essence just because the EU and Japan want to upstage Mr. Trump and reinforce his image as a deluded isolationist. Announcing that the deal was close to completion ahead of the G20 summit was a cynical move that was quickly exposed as something close to fake news. The EU-Japan deal is still a long way off, as it should be. Trade deals need an overhaul and there is no better place to start than the EU-Japan deal. If it takes another five years to get right, so what? A bad deal is worse than no deal.

INNOVATION

Innovation, Science and Economic Development Canada. July 12, 2017. Government of Canada launches Strategic Innovation Fund. $1.26-billion fund will attract high-quality business investments leading to more jobs, skills and opportunities for Quebecers

Montréal, Quebec – Quebecers will benefit from new jobs, skills and business opportunities as a result of a $1.26-billion investment by the Government of Canada.

Today, David Lametti, Parliamentary Secretary to the Minister of Innovation, Science and Economic Development, highlighted the launch of the Strategic Innovation Fund. The fund is a new program to attract and support high-quality business investments across all sectors of the economy.

This fund is open to all industries and will support four types of innovation activities:

- research, development and commercialization of new products and services

- growth and scale-up of high-potential firms

- attraction of new investments to Canada, which will expand business opportunities and create jobs for Canadians

- public-private collaborations in developing and demonstrating new technologies

This fund is part of the Government’s Innovation and Skills Plan, a multi-year strategy to create well-paying jobs for the middle class and those working hard to join it.

Quotes

“Quebec is home to many hotbeds of innovation that drive the province’s economy. Our government is making smart and responsible investments in sectors where Quebec has globally competitive advantages that will create jobs and business opportunities that will benefit all Quebecers. The Strategic Innovation Fund reflects the diversity of innovative sectors that exist in Canada and encourages cross-sector partnerships. This fund is an investment in jobs and skills training for Canadians. Putting Canada at the forefront of innovation will equip Canadians with the in-demand skills they need for well-paying middle-class jobs now and into the future.”

– David Lametti, Parliamentary Secretary to the Minister of Innovation, Science and Economic Development

Quick Facts

- The Strategic Innovation Fund is a flexible program that reflects the diversity of innovation in all sectors of the economy.

- The fund has a common set of terms and conditions that apply to all sectors, making it easier for companies to access.

HOUSING BUBBLE

The Globe and Mail. 12 Jul 2017. Foreign buyers bought 9.1% of homes in Toronto-area market. Non-resident buyers had bigger impact in some suburbs in the spring than broader data reveal

JILL MAHONEY

JUSTIN GIOVANNETTI

New data shows foreign investment in the Toronto region’s overheated real estate market over one month this spring was most significant in affluent suburbs north of the city, where one in 11 homes were purchased by non-residents.

In York Region, which includes the hotspot communities of Markham and Richmond Hill, 9.1 per cent of residential properties that changed hands between April 24 and May 26 were bought by international investors, according to provincial figures that provide the first geographic breakdown of the scope of foreign buyers’ influence on the Greater Toronto Area’s housing market.

In the city of Toronto, 7.2 per cent, or 1 in 14 sales, were by foreign buyers, according to the analysis obtained by The Globe and Mail.

The pocket of foreign investment is much higher than the region-wide figure the provincial government released one week ago, when it said 4.7 per cent of homes sold in a large area around Toronto known as the Greater Golden Horseshoe Region were purchased by international buyers in the same time frame. The Ontario government introduced a 15-per-cent foreign-buyers tax in April as part of a suite of changes to cool the region’s housing market.

Benjamin Tal, the deputy chief economist at CIBC, said the regional numbers confirm observers’ belief that certain communities in the GTA were attracting higher rates of offshore interest.

“Foreign investors are looking for the centre,” he said.

“We knew that the overall 4.7 per cent number previously released by the government was masking totally different regional trajectories.” »

Mr. Tal argued the regional data might dispel the view held by some that the increase in housing prices in the GTA was largely driven by international buyers. “I think that shows that while foreign investment isn’t insignificant, it’s not the game changer here, it’s not the only reason prices are rising,” he said.

The government has not released the value of transactions involving foreign buyers.

Some observers criticized the government’s previous release of data as distorting the true extent of foreign ownership because of the sprawling area comprising the Greater Golden Horseshoe Region, which spans more than 300 kilometres from Niagara Region in the west to the County of Peterborough in the east.

Markham City Councillor Karen Rea, who began pushing for a foreign-buyers tax months ago in response to complaints about vacant homes in her community, called on the government to release further localized data so that cities and towns within, for example, York Region, can better understand sales activity and plan for future services.

“They should be accountable and transparent,” said Ms. Rea, a licensed realtor.

“Why put everybody in together? What happens in Markham is not the same as what happens in East Gwillimbury. Markham is not the same as Stouffville. We’re all different. Every municipality is unique. So why wouldn’t they want to release the information to all the municipalities individually?”

While York Region had the highest level of foreign investment, one realtor said interest in the area feels even more intense.

“I really am surprised, I would have expected it to be much higher,” said Jenny Jones, who is based in Markham. “I’m increasingly selling outside of Markham now because my clients can’t afford homes over $1-million. Unless they have access to the bank of mom and dad, it’s become impossible for them to buy.”

After facing mounting calls to act on fears that international speculators were inflating the Greater Toronto Area’s overheated real estate market, making prices increasingly unaffordable, Premier Kathleen Wynne’s government announced a 15-percent foreign-buyers tax on April 20 as part of a package of changes. The levy, known as the non-resident speculation tax, applies to residential properties bought by people who are not Canadian citizens or permanent residents. However, most of the transactions included in the province’s first wave of data were not subject to the tax because the sales contracts were signed before it came into effect.

In addition, a new provincial form requiring home buyers to declare their citizenship did not become mandatory until May 6, meaning the government’s figures may understate the extent of international investors’ purchases.

Since the foreign-buyers tax was introduced, property values and sales in the GTA have fallen. The average price of homes decreased 13.8 per cent in June from April’s high and the number of homes sold fell 37.3 per cent from one year earlier, according to figures released last week by the Toronto Real Estate Board.

For his part, Ontario Finance Minister Charles Sousa said the tax was working. “We brought in the [tax] as part of our Fair Housing Plan because we recognized that housing affordability was a real and growing concern for many people. The goal of the plan was to make buying and renting a home more affordable and recent data shows that our plan is having its desired effect,” he said in a written statement.

Ontario’s foreign-buyers tax came eight months after the British Columbia government imposed a similar tax on international purchasers in the Vancouver region.

Since implementing its tax, the British Columbia government has released new figures on its impact at least every two months. The B.C. data provide province-wide statistics on the number and value of transactions by foreign buyers as well as more specific data focused on a number of cities in Metro Vancouver, as well as Victoria and Kelowna. While the Ontario government has outsourced the collection of data to a private business that manages its land registry, the B.C. government does the collection itself.

The Globe and Mail. 12 Jul 2017. Builders unfazed by housing downturn. Housing: Toronto homes priced above $1.5-million see greatest decline in sales

JANET McFARLAND

The recent downturn in the resale housing market in the Toronto region has not deterred builders, who have continued to break ground on home construction at a strong pace.

Data released on Tuesday by Canada Mortgage and Housing Corp. show housing starts climbed 60 per cent in Toronto in June over May based on seasonally adjusted data at annualized rates. The increase included a 54-per-cent climb in starts of single-family detached homes and a 63-per-cent increase in starts of other types of housing, such as semi-detached homes or condominiums.

The numbers suggest many builders are proceeding with planned projects despite a significant recent drop in home sales in the Toronto region. The number of homes sold in the Greater Toronto Area fell 37 per cent in June compared with the same month last year, and prices were down almost 14 per cent from their peak in April.

Bank of Montreal economist Robert Kavcic said it is too early to conclude that builders are shrugging off the sales trend, however, because construction starts tend to lag sales data. He said projects will often proceed when they are in the advanced stages of planning, so it could take six months or more before new construction tapers.

However, Mr. Kavcic said many builders may not ultimately be deterred. The decline in sales in the Toronto region is greatest for detached homes priced above $1.5-million, he said, and most new construction is not in that price range, so there could be less of an impact.

“A lot of the new supply is in the middle range of the multiunit market, so I don’t think you’re going to see as big an impact on supply as you are seeing on prices in the resale market,” he said.

Much of Toronto’s 60-per-cent increase in starts in June over May also comes from a particularly low base in May, when housing starts dipped sharply after climbing by 46 per cent in April.

National Bank of Canada economist Marc Pinsonneault said June reflected “a more normal level of starts” for Ontario – especially in Toronto, Oshawa, London and Kingston – after a weak showing in May.

On a national basis, CMHC said its six-month moving average of monthly housing starts – a measure designed to smooth the choppiness of monthly data – has reached its highest level in almost five years, suggesting the new housing sector continued to grow steadily in the first half of 2017.

“So far this year, all regions are on pace to surpass construction levels from 2016 except for British Columbia, where starts have declined year-to-date after reaching near-record levels last summer,” CMHC chief economist Bob Dugan said in a statement.

Vancouver has seen a particularly sharp drop in condominium starts, with 880 units launched in the first half of 2017 compared with 3,290 in the first half of 2016, CMHC said. However, the agency said there had been a record number of new units already under construction, so “it is not surprising to see starts trend downward according to industry capacity.”

In the Toronto region, CMHC said starts of ground-level houses – including detached homes, semis and townhouses – have gained momentum in the first half of 2017 with housing starts reaching a five-year high for the six-month period.

Toronto-Dominion Bank economist Dina Ignjatovic said the improvement in housing starts in Toronto in June compared with May could be a sign that new home construction may not be significantly impacted by new measures introduced in April by the Ontario government to cool the overheated housing market.

“While the province’s housing starts are unlikely to return to the highs seen early this year, we expect them to hold near current levels going forward,” Ms. Ignjatovic said in a research report.

Ms. Ignjatovic also said an interest-rate increase from the Bank of Canada on Wednesday would mean the housing sector is likely to be “slightly weaker” than TD currently expects, with the impact of a rate hike anticipated to be most pronounced in Vancouver and Toronto, where home prices are highest.

REUTERS. JULY 12, 2017. Canadian home prices rise in June as Toronto keeps climbing: Teranet

OTTAWA (Reuters) - Canadian home prices rose in June as the cities of Toronto and Hamilton led the way with record increases despite provincial government efforts to rein in demand in the hot markets, data showed on Wednesday.

The Teranet-National Bank Composite House Price Index, which measures changes for repeat sales of single-family homes, showed prices rose 2.6 percent from May. It was the largest increase for the month of June in the 19-year history of the index, and took it to a record for the seventeenth month in a row.

Prices rose in 10 out of the 11 markets covered by the index, with Toronto up 3.7 percent and nearby Hamilton rising 4.1 percent. Hamilton has seen prices surge as homebuyers have been priced out of Toronto, Canada's largest city.

The housing data comes ahead of a Bank of Canada interest rate decision in which the central bank is expected to raise rates for the first time in nearly seven years. Some have blamed years of cheap borrowing costs for fueling Canada's long housing boom.

In April, the Ontario government put a number of measures in place to cool the housing market in Toronto and the surrounding region, including a foreign buyers tax.

While other data has shown sales have tumbled since then, the Teranet report pointed to ongoing price acceleration.

Toronto prices were up 29.3 percent from a year ago, while Hamilton was up 25.6 percent.

In the once-hot market of Vancouver, where provincial authorities imposed their own foreign buyers tax last year, prices rose 2.5 percent on the month to hit a record after cooling through late 2016.

Reporting by Leah Schnurr; Editing by Chris Reese

CIB

The Globe and Mail. 12 Jul 2017. UBS chair champions infrastructure bank. Infrastructure: New bank continues to tap experienced leadership. There’s some idiosyncrasy around the Canadian project, but there’s some stuff that would really fly globally.

Axel Weber, UBS AG chairman

The chairman of Swiss banking giant UBS AG is throwing his support behind Canada’s plans to create a federal infrastructure bank, saying aspects of the plan could provide a “blue-print” for financing global investments.

Axel Weber, a former central banker in Germany, said Canada has a promising constellation of factors converging to create the Canada Infrastructure Bank, a $35-billion initiative to attract private investment into new infrastructure projects.

He pointed to the country’s robust capital markets and large institutional investors, as well as strong promise in high-tech and clean-energy sectors.

Although Mr. Weber appears confident Canada can sidestep the mistakes that have plagued past infrastructure investment plans, not everyone in Canada is convinced that the federal proposal strikes the right balance between public good and private support.

Axel Weber, chairman of UBS AG, expressed confidence in the nascent Canada Infrastructure Bank project in a recent interview, suggesting the initiative could serve as a ‘global blueprint.’

Details are still scarce and there are lingering questions about the Infrastructure Bank’s independence, as well as concerns about whether the most influential investors will see the appeal of tying their big bets to the public purse.

None of that seems to faze Mr. Weber, however. An economist by training, he was president of Germany’s central bank, the Bundesbank, through the global financial crisis before joining UBS’s board in 2012. And after encounters with Finance Minister Bill Morneau over the past two years, Mr. Weber is bullish on Canada’s initiative, and suggests other jurisdictions would be wise to take notes.

“It probably could serve as a blueprint for how other countries could look into financing sustainable investment,” he said in an interview at The Globe and Mail’s Toronto offices this week.

“There’s some idiosyncrasy around the Canadian project, but there’s some stuff that would really fly globally,” he added. “Probably, Canada is ahead of the U.S. in that sense.”

UBS takes a keen interest in infrastructure investment, managing more than $16.5-billion (U.S.) in infrastructure and private equity asset classes, and has highlighted North American infrastructure needs in recent research. But the bank hasn’t yet committed to taking part in Canada’s plans.

Ottawa plans to spend more than $187-billion (Canadian) on infrastructure over a dozen years, and Prime Minister Justin Trudeau has been encouraging banks, pension funds, insurers and private wealth funds to take equity stakes in Canadian projects.

In the process, his government has sought to reassure detractors who worry the proposed partnerships may surrender too much control of public infrastructure to public interests, or could cost taxpayers more in the long run. Some are concerned

the Infrastructure Bank could be vulnerable to political interference, as cabinet can fire its executives at any time.

Governments around the world are evaluating the best models for funding infrastructure projects, and Canada faces competition in trying to attract interest in these types of projects from investors with large pools of private capital. At the same time, U.S. President Donald Trump has promised to invest $1-trillion (U.S.) in infrastructure projects, leaning heavily on private-sector funds.

Canada, in turn, took inspiration from Infrastructure Australia, a government agency that has had success, but also backed some controversial projects. Canada’s Infrastructure Minister, Amarjeet Sohi, has said Canada’s approach has key differences, and “is a very innovative undertaking that no other country has done to the extent that we have.”

The new bank should be able to tap a deep well of experienced leadership: Last week, former Royal Bank of Canada chief financial officer Janice Fukakusa was named the first chair of the Infrastructure Bank’s board after former Ontario Teachers’ Pension Plan chief executive Jim Leech came aboard as a senior adviser earlier this year.