CANADA ECONOMICS

INTERNATIONAL RESERVES

Department of Finance Canada. June 5, 2017. Official International Reserves. All 2017 Official International Reserves

Ottawa - The Department of Finance Canada announced today that Canada's official international reserves increased by an amount equivalent to US$879 million during May to US$85,589 million.

Details on the level and composition of Canada's reserves as of May 31, 2017, as well as the major factors underlying the change in reserves, are provided below. All figures are in millions of US dollars unless otherwise noted.

| Millions of US dollars | |

|---|---|

| Securities | 66,445 |

| Deposits | 9,131 |

| Total securities and deposits (liquid reserves): | 75,576 |

| Gold | 0 |

| Special drawing rights (SDRs) | 7,801 |

| Reserve position in the IMF | 2,212 |

| Total: | |

| May 31, 2017 | 85,589 |

| April 28, 2017 | 84,710 |

| Net change: | 879 |

| Millions of US dollars | |

|---|---|

| Other central banks/Bank for International Settlements | 9,131 |

| Banks headquartered in Canada | 0 |

| Of which: located abroad | 0 |

| Banks headquartered abroad | 0 |

| Of which: located in Canada | 0 |

| Total: | 9,131 |

| Millions of US dollars | |

|---|---|

| Reserves management operations1 | 207 |

| Gains and losses on gold sales | 0 |

| Net investment gains and losses: | |

| Return on investments2 | 267 |

| Foreign currency debt charges | -95 |

| Revaluation effects3 | 504 |

| Net government operations4 | -4 |

| Official intervention | 0 |

| Other transactions | 0 |

| Net change: | 879 |

| Millions of US dollars | |

|---|---|

| US dollars | 50,478 |

| Euro | 16,202 |

| Pound sterling | 7,886 |

| Yen | 1,010 |

| Total: | 75,576 |

| Millions of US dollars | ||||

|---|---|---|---|---|

| 0-1 month | 1-3 months | 3-12 months | Total | |

| Foreign currency securities5: | ||||

| Principal | -2,349 | -1,861 | -7,288 | -11,499 |

| Interest | -88 | -192 | -872 | -1,152 |

| Aggregate short forward positions in foreign currencies vis-à-vis Canadian dollar | -505 | 0 | 0 | -505 |

| Aggregate long forward positions in foreign currencies vis-à-vis Canadian dollar | 0 | 0 | 0 | 0 |

| Total net drains: | -2,943 | -2,054 | -8,160 | -13,157 |

| Millions of US dollars | |

|---|---|

| Undrawn, unconditional credit lines with banks headquartered outside Canada | 0 |

| Securities lent under repurchase agreements6 | 0 |

| Securities held under repurchase agreements7 | 8,648 |

| Financial derivatives assets (net, marked to market): | |

| Forwards | -36 |

| Swaps | -6,522 |

NOTES:

- Net change in securities and deposits resulting from foreign currency funding activities of the Government. (Issuance of foreign currency liabilities used to acquire assets increases reserves, while maturities decrease reserves). During May, Canada bills increased by US$462.4 million to a level of outstanding bills of US$2,942.1 million. An equivalent of US$494.4 million in cross-currency swaps was raised while US$750 million in cross-currency swaps matured during the month.

- "Return on investments" comprises US$90 million of interest earned on investments and a US$177 million increase in the market value of securities.

- "Revaluation effects" reflect changes in the market value of reserve assets resulting from movements in exchange rates. In May, the revaluation effect was mainly due to the appreciation of the euro.

- "Net government operations" are the net purchases of foreign currency for government foreign exchange requirements and for additions to reserves.

- "Foreign currency securities" include maturities of foreign currency debt, cross-currency swap payments and an estimate of interest payments on foreign currency liabilities.

- "Securities lent under repurchase agreements" are included in total reserves. Collateral provided in securities lending transactions is not included in total reserves.

- Cash invested under repurchase agreements is included in total reserves. Collateral provided in securities lending transactions is not included in total reserves.

| Millions of US dollars | ||||||

|---|---|---|---|---|---|---|

| Date | US dollars | Other currencies | Gold | SDRs | IMF position | Total |

| May 31, 2017 | 50,478 | 25,098 | 0 | 7,801 | 2,212 | 85,589 |

ENERGY

National Energy Board. June 5, 2017. Four Board Members to carry out expanded indigenous and public engagement

Calgary, Alberta – The National Energy Board (NEB) has launched an initiative to gather input from Indigenous peoples and the public to help shape the hearing process and other engagement activities for the Energy East and Eastern Mainline projects. The comment period ends on 15 July 2017.

These activities will be led by a team of four Board Members who are independent from the Hearing Panel: Alain Jolicoeur, Wilma Jacknife, Damien Côté and Ronald Durelle. They will be gathering comments by meeting with Indigenous peoples and through a new online engagement platform.

The four Board Members hope to engage with many of the more than 200 groups of indigenous peoples who may be impacted by the projects. One of the key aspects of these discussions will be to identify the best ways to collect oral traditional evidence.

Relevant findings from these engagement efforts will be filed on the official record for the Hearing Panel to consider as they design the Energy East and Eastern Mainline hearing process.

The expanded engagement activities announced are in keeping with the Government of Canada’s Interim Measures for Pipeline Reviews.

The National Energy Board is an independent federal regulator of several parts of Canada’s energy industry. It regulates pipelines, energy development and trade in the public interest with safety as its primary concern.

Quick Facts

- The NEB is committed to hearing from indigenous peoples in a way that respects their values and traditions. Indigenous peoples have an oral tradition for sharing lessons and knowledge from generation to generation. Since this information cannot always be shared adequately or appropriately in writing, the NEB is inviting Indigenous peoples to provide oral traditional evidence as has been done in previous hearings.

- On 31 May 2017, a comment period on documents to establish the scope of the assessment for the Energy East and Eastern Mainline projects ended.

- Energy East is a proposed 4,500-kilometre pipeline that would carry 1.1 million barrels of crude oil per day from Alberta and Saskatchewan to refineries in Eastern Canada and a marine terminal in New Brunswick.

- The Eastern Mainline Pipeline is a proposal to build approximately 279 kilometres of new gas pipeline and related components, beginning near Markham, Ontario and finishing near Brouseville, Ontario.

Natural Resources Canada. June 5, 2017. 40-Year Export Licence Issued to Woodfibre LNG

Ottawa - Liquefied natural gas (LNG) is greener than any other fossil fuel and more affordable than many renewables, which means it will play a significant role as we transition to a clean energy future. Canada is the world’s fifth-largest producer of natural gas, and creating the conditions to open access to global markets will help to create good, middle-class jobs for Canadians.

Today, while speaking at the Canadian Embassy in China, the Honourable Jim Carr, Canada’s Minister of Natural Resources, announced that the Government of Canada has approved a 40-year natural gas export licence to Woodfibre LNG Limited for its proposed facility in Squamish, British Columbia.

The Government’s approval of this licence will help Canada achieve international market access for its natural gas by providing certainty to investors on their long-term access to natural gas while strengthening investment and planning decisions in the industry.

The National Energy Board (NEB), which regulates the import and export of natural gas, approved Woodfibre’s application on April 6, 2017. The Government reviewed and supported the NEB’s recommendations.

Quotes

“We know there is tremendous demand for natural gas, especially in the fast-growing countries of Asia. The approval of Woodfibre LNG’s 40-year export licence provides certainty for investors while creating jobs for Canadians as the world moves toward a low-carbon future. This project also underscores the significance of working together with First Nations communities, as it will lead to environmental protection and economic benefits for the Province of British Columbia and the Squamish Region.”

Jim Carr

Canada’s Minister of Natural Resources

Quick Facts

- Canada has about 300 years’ worth of marketable natural gas reserves, estimated at 1,566 trillion cubic feet, or 44 trillion cubic metres, which puts it in the top tier globally.

- To date, the Government of Canada has issued LNG export licences to 24 projects.

- In October 2015, the Squamish Nation Council voted to approve an Environmental Assessment Agreement for the Woodfibre LNG project and issued an Environmental Certificate to the company.

- The Woodfibre LNG project will create about 100 full-time jobs at the facility during operation and about 650 jobs each year during an estimated two-year construction period.

The Globe and Mail. Reuters. Jun. 05, 2017. Oil falls on fears Qatar rift could harm OPEC cuts

DEVIKA KRISHNA KUMAR

NEW YORK — Oil prices fell about 1 per cent on Monday on concerns that the cutting of ties with Qatar by top crude exporter Saudi Arabia and other Arab states could hamper a global deal to reduce oil production.

Saudi Arabia, the United Arab Emirates, Egypt and Bahrain closed transport links with top liquefied natural gas (LNG) and condensate shipper Qatar, accusing it of supporting extremism and undermining regional stability.

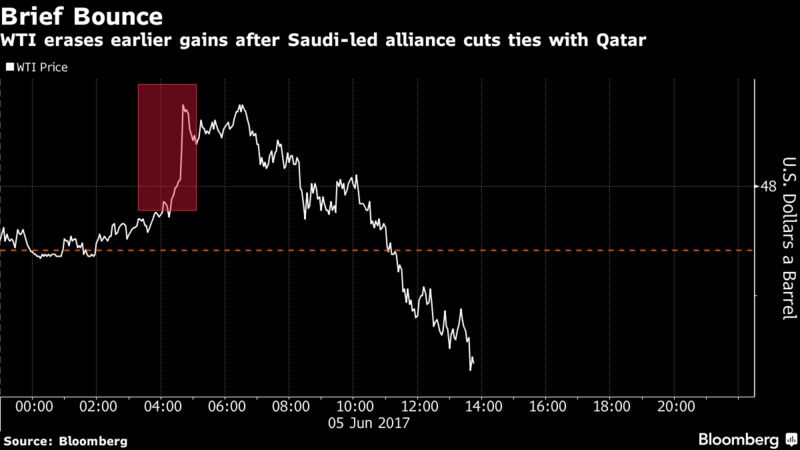

The news initially pushed Brent crude prices up as much as 1 per cent as geopolitical fears rippled through the market. But Brent later reversed gains, trading down 58 cents, or 1.12 per cent at $49.37 a barrel by 10:42 a.m. EDT.

U.S. West Texas Intermediate futures were at $47.15 a barrel, down 51 cents, or 1.1 per cent.

With production capacity of about 600,000 barrels per day (bpd), Qatar’s crude output ranks as one of OPEC’s smallest, but tension within the Organization of the Petroleum Exporting Countries could weaken the supply deal, aimed at supporting prices.

“While we would not want to read too much into this in terms of looming trouble for OPEC, the fact that Qatar’s stance towards Iran is a key element in this issue does make for a potentially more complicated setup at future meetings should the issue not have been resolved in due time,” JBC Energy analysts said in a note.

There are already doubts that the effort to curb production by almost 1.8 million bpd is seriously denting crude exports.

While there was a dip in OPEC supplies between February and April, a report on Monday by Thomson Reuters Oil Research said OPEC shipments likely jumped to 25.18 million bpd in May, up over 1 million bpd from April.

Brent futures have fallen more than 8 per cent from their open on May 25, when OPEC opted to extend production cuts into 2018.

Outside of OPEC, South Sudan will drill 30 new wells this year and significantly boost oil output as it chases a peak 350,000 bpd target by mid-2018, the petroleum minister said on Monday.

Crude output in the United States, which is not participating in the supply cuts, has jumped more than 10 per cent since mid-2016 to 9.34 million bpd, close to levels of top producers Saudi Arabia and Russia.

The rise in U.S. production has been driven by a record 20th straight weekly climb in oil drilling, with the rig count climbing by 11 in the week to June 2, to 733, the most since April 2015.

U.S. crude stockpiles, however, have consistently fallen for eight straight weeks, which had prompted some to suggest that the long-awaited effects from OPEC efforts to reduce world supply were materializing. “We believe that U.S. inventories will continue falling this summer, allowing OPEC to point to lower stocks as a positive measure of success,” Sandy Fielden, director of oil and products research at Morningstar said in a note.

“But if, as we have already seen, higher refinery runs and/or crude exports are the causes of these inventory drawdowns, then the impact on OPEC’s balancing act is actually negative.”

BLOOMBERG. 2017 M06 4. Oil Slips as Gulf Diplomatic Clash Seen to Have Limited Impact

by Jessica Summers and Grant Smith

- Saudi Arabia, U.A.E., Egypt and Bahrain cut ties with Qatar

- Diplomatic spat hasn’t affected oil and gas shipments

- Here's What's Behind the Qatar Diplomatic Split

Oil traded near $47 a barrel as a diplomatic clash involving OPEC members Saudi Arabia and Qatar was seen as having limited impact on supply.

Futures dropped 0.8 percent in New York, after earlier rising as much as 1.6 percent. Saudi Arabia, Bahrain, the United Arab Emirates and Egypt said they will suspend air, sea and land travel to and from Qatar, escalating a crisis that started from a dispute over relations with Iran. Saudi Arabia immediately banned Qatari planes from landing in the kingdom and said it will prohibit them from using Saudi air space as of Tuesday. Qatar still has access to shipping routes to deliver oil and gas to buyers around the world.

Crude has traded below $50 a barrel in New York amid concern that an extension of OPEC’s cuts won’t be enough to shrink global inventories as U.S. output expands. While the diplomatic spat hasn’t affected shipments, any further escalation could raise the prospect of supply disruptions from the Middle East, including Organization of Petroleum Exporting Countries members Saudi Arabia, Iran and Qatar. The nations all use the Strait of Hormuz, through which the U.S. Department of Energy estimates about 30 percent of seaborne oil trade passes.

“The gas continues to flow. There is no disruption in the cargo schedule. At the end of the day, it sends the signal that there’s not this unified OPEC-type situation that is advertised,” Bob Yawger, director of the futures division at Mizuho Securities USA Inc. in New York, said by telephone. “The rig count in the United States is up 20 weeks in a row. We’re not going to burn off the storage overhang here in the U.S. any time soon.”

West Texas Intermediate for July delivery slipped 40 cents to $47.26 a barrel at 10:10 a.m. on the New York Mercantile Exchange. Total volume traded was about 33 percent above the 100-day average. WTI dropped 4.3 percent last week, the largest weekly drop since early May.

Brent for August settlement fell 43 cents to $49.52 a barrel on the London-based ICE Futures Europe exchange. The global benchmark crude traded at a premium of $2.07 to August WTI.

While OPEC members have had political disputes and even fought wars through the organization’s 57-year history, their shared economic interests have meant agreements on oil production have still been implemented. The same will probably happen during the current dispute, said Abdulsamad Al-Awadhi, a London-based analyst who was one of Kuwait’s representatives to the group between 1980 and 2001.

Oil-market news:

- Libya’s oil output dropped to 807,000 barrels a day on power cuts from Agoco fields. Production dropped from 824,000 barrels a day on Friday due to outages at Messla and Sarir fields operated by Arabian Gulf Oil Co., according to Jadalla Alaokali, a board member at National Oil Corp.

- Drillers targeting crude in the U.S. added rigs for the 20th straight week to the highest level since April 2015, according to data Friday from Baker Hughes Inc.

- Saudi Arabia raised pricing for July sales of all crude grades to Asia, the U.S. and Northwest Europe as it seeks to take advantage of increased demand after suppliers extended output cuts.

- Hedge funds trimmed bets on rising WTI prices to the lowest level since November.

BLOOMBERG. 2017 M06 4. Oil Bears Can't Look to Libya as Expat Exodus Slows Recovery

by Sam Wilkin and Salma El Wardany

- Output won’t rise much above 1 million barrels a day: WoodMac

- OMV says security must improve before it can send expats back

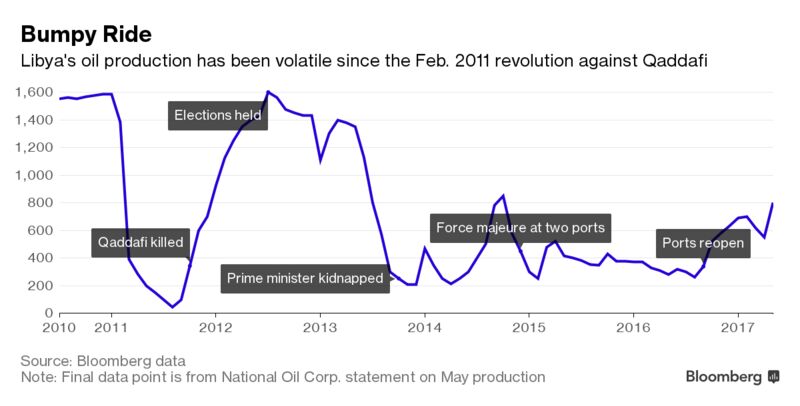

The rapid increase in Libya’s oil production is heading toward a hard ceiling.

Crude output in the politically fragmented country has more than doubled in the past year to exceed 800,000 barrels a day, according to the state-run National Oil Corp., as fighting and labor unrest at ports and fields have subsided. But with foreign staff of international companies staying away, analysts from Energy Aspects Ltd. to Wood Mackenzie Ltd. say Libya’s ability to pump more oil will soon reach a limit -- and won’t be enough to upset an oversupplied market.

“You’ve got a cumulative buildup of technical issues, shortages of equipment, and increasingly reports of damage to facilities,” Richard Mallinson of London-based Energy Aspects said by phone. The North African country will struggle to push production above 900,000 barrels a day in the coming months, he said. “Without bringing in the expertise to carry out deeper maintenance, there’s only so much local teams are able to do.”

Libya was exempted from output cuts that the Organization of Petroleum Exporting Countries and allied producers agreed to in an effort to curb a global glut and support prices. The nation has announced plans to boost production to 1.3 million barrels a day by the end of the year. Output and exports collapsed after the 2011 revolt against former leader Moammar Al Qaddafi, when the country with Africa’s largest crude reserves pumped about 1.6 million barrels a day.

Oil Price

Crude prices rebounded early on Monday after a Saudi-led coalition cut diplomatic ties with Qatar, escalating a crisis that started over the Persian Gulf emirate’s relationship with Iran. Benchmark Brent crude gained as much as 1.6 percent, reversing a slump last week amid concern that rising U.S. output would undercut supply curbs by OPEC and its partners. Brent later surrendered gains, falling 66 cents to $49.29 a barrel at 2:48 p.m. in London.

While Libyan workers have been able on their own to boost oil production since 2011, the nation also requires foreign contractors and service providers, NOC Chairman Mustafa Sanalla said by phone on June 1. The departure of most of these contractors due to concerns for their safety “had some effect on maintaining and increasing our production,” he said.

The recent increase in Libyan supply has offset some of OPEC’s cuts, though the country is unlikely to pump more than 1 million barrels a day without new investment, Sanford C. Bernstein & Co. analysts including Neil Beveridge said in a June 2 emailed note. “With decaying infrastructure and a fragile peace, there are clear downside risks to Libyan production,” they said.

Output fell to 807,000 barrels day, a decrease of 17,000, due to power outages at the Messla and Sarir fields operated by Arabian Gulf Oil Co., Jadalla Alaokali, an NOC board member, said Monday by phone. Arabian Gulf Oil is an NOC unit.

Libya’s output capacity has atrophied after six years of intermittent fighting that led most foreign oil workers to stay clear of the place. While local employees have continued to pump crude when security allows, they’ve been unable to keep up with maintenance or repair facilities damaged by looting or attacks, due to a shortage of equipment and training, Mallinson of Energy Aspects said.

“We can’t send any expats into Libya right now -- the security situation doesn’t allow it,” OMV AG Chief Executive Officer Rainer Seele said in a May 11 Bloomberg television interview. The Vienna-based company, which has stakes in several fields in Libya, can pump at about half of its capacity using only local employees, he said. “If we would like to increase to the maximum capacity, of course we need to have the security situation to bring back our expats.”

The amount of oil that can be produced without expatriate staff “varies significantly from project to project,” said Martijn Murphy, an analyst at Edinburgh-based consultant Wood Mackenzie. For the country as a whole, it would be a “considerable achievement” to push output above 1 million barrels a day on a sustainable basis, he said.

Foreign workers in the country have been targets in the past for extremists and kidnappers. Islamic State militants raided an oil field in March 2015, killing eight Libyan guards and kidnapping nine foreigners. Unidentified gunmen kidnapped three foreign oil workers last September, holding them for two months before releasing them.

Local employees too run severe risks as they continue to produce and export crude. A worker at the Mediterranean port of Ras Lanuf recalled that his team had to suspend loading the first oil tanker to call at the terminal in almost two years, when fighting between rival militias engulfed the port on Sept. 18.

The tanker Seadelta moved offshore, and the employee, who asked not to be identified out of concern for his safety, said he spent the night hiding in a warehouse with his co-workers. He and his team returned to work the next day and soon had the vessel on its way to Italy carrying 781,000 barrels of crude.

“The security and political situation still hangs on a knife edge,” said Murphy of Wood Mackenzie.

BLOOMBERG. 2017 M06 5. Why Tiny Qatar Angers Saudi Arabia and Its Allies: QuickTake Q&A

by Grant Clark and Mohammed Sergie

- Here's What's Behind the Qatar Diplomatic Split

Saudi Arabia and three of its Arab allies cut diplomatic ties with Qatar on Monday, furious with what they see as the tiny emirate’s tolerant attitude toward Iran and Islamist groups such as the Muslim Brotherhood. The moves by the Saudis, Bahrain, the U.A.E. and Egypt came soon after U.S. President Donald Trump visited the region and joined Saudi Arabia in lambasting Iran for sponsoring terrorism from Syria to Yemen.

1. What’s caused the diplomatic rift?

It’s mostly, but not all, about Iran. The spark for this flare-up was a report by the state-run Qatar News Agency that carried comments by Qatar ruler Sheikh Tamim bin Hamad Al Thani criticizing mounting anti-Iran sentiment. Qatari officials quickly deleted the comments, blamed them on hackers and appealed for calm. Criticism by Saudi and U.A.E. media outlets escalated after Sheikh Tamim phoned Iranian President Hassan Rouhani over the weekend in apparent defiance of Saudi criticism.

2. So this is a Sunni vs Shiite tension?

Partly. The Shiite-led Islamic Republic of Iran is Sunni-led Saudi Arabia’s main regional rival. The two major oil exporters are on opposite sides of conflicts from Syria to Iraq. In taking diplomatic action, the Saudis accused Qatar of supporting “Iranian-backed terrorist groups” operating in the kingdom’s eastern province as well as Bahrain. But they also

cited Qatar’s support of “terrorist groups aiming to destabilize the region,” including the Muslim Brotherhood, Islamic State and al-Qaeda.

3. Why is the spat taking place now?

The temperature noticeably rose following Trump’s visit. Days after Trump and Saudi King Salman bin Abdulaziz singled out Iran as the world’s main sponsor of terrorism, Saudi Arabia and the U.A.E. accused Qatar of trying to undermine efforts to isolate the Islamic Republic. Newspapers, clerics and even celebrities attacked Qatar’s Sheikh Tamim; the Riyadh-based Al-Jazirah daily declared that he stabbed his neighbors with Iran’s dagger.

4. What do analysts say?

Emboldened by closer U.S. ties under Trump, the Saudis and the U.A.E. are seeking to crush any opposition that could weaken a united front against Iranian influence in the Middle East. The two countries are also putting pressure on Qatar to end its support for Islamist movements such as the Muslim Brotherhood and the Palestinian Hamas group that rules the Gaza Strip.

5. What does Iran say?

Before the latest confrontation, Rouhani, a moderate cleric who was re-elected to a second, four-year term last month, said his country is ready for talks to end the feuding. At the same time, though, Iran’s Supreme Leader Ayatollah Ali Khamenei, who wields more power than Rouhani, has said the Saudi regime faces certain demise for its policies in Yemen. In 2015, Saudi Arabia assembled a coalition of Sunni-led countries to fight Yemeni Shiite rebels loyal to Iran after they toppled a Gulf-backed government. The war there continues.

6. Where else are Saudi and Iran facing off?

They are locked in proxy wars on opposite sides of conflicts across the region from Syria to Yemen. Suspicions that cyberattacks on government agencies in Saudi Arabia emanated from Iran threatened to elevate tensions between the two powers in late 2016. Earlier that year, after Saudi Arabia executed a prominent Shiite cleric, Iranian protesters set the Saudi embassy in Tehran on fire, and Saudi Arabia severed diplomatic relations with Iran.

7. Are disagreements with Qatar anything new?

In 2014, Saudi Arabia, the U.A.E. and Bahrain temporarily withdrew their ambassadors from Qatar. That dispute centered on Egypt, where Qatar had supported a Muslim Brotherhood government while the Saudis and U.A.E. bankrolled its army-led overthrow. Qatar also hosts Hamas’s exiled leadership as well as Taliban officials. Analysts say Saudi and its allies want to show Qatar, a country of 2.6 million residents, that it is punching above its strategic weight.

8. Isn’t that what Qatar tries to do?

Less so now than in the past. During the Arab Spring uprisings Qatar, uniquely among Middle Eastern governments, broadly supported groups agitating for change — as long as it was outside the Persian Gulf. Muslim Brotherhood groups have mostly foundered since, and Qatar reeled back its support for them in 2014 when faced with diplomatic threats from its Gulf neighbors. Qatar also aspires to be the region’s indispensable mediator. Its leaders have connections with a wide range of parties, such as warring tribes in Libya as well as both the U.S. and the Taliban. On the other hand, by choosing sides during the Arab Spring revolts, it weakened its standing as a neutral party.

9. What else is Qatar known for?

It’s the world’s biggest exporter of liquefied natural gas, has the world’s highest per-capita income ($129,700 a year), will hold the 2022 FIFA World Cup and hosts the Al Jazeera television channel. When Saudi Arabia ejected the U.S. air operations center for the region in 2003, Qatar took it on. Today the emirate hosts 10,000 U.S. troops and is home to the forward headquarters of CENTCOM, the U.S. military’s central command in the Middle East.

The nation’s $335 billion sovereign wealth fund holds stakes in companies from Barclays Plc and Credit Suisse Group.

10. What are the repercussions for markets?

Any dispute in the region will make oil markets nervous. Internal disputes among the Gulf countries could limit their appeal to foreign investors. Even before Trump’s visit, Citigroup said rising tensions between the U.S. and Iran could also have “significant”’ implications for oil and financial markets. Qatar stocks plunged 7.3 percent by the market close on Monday and dollar bonds tumbled, with yields on bonds due in 2026 increasing 23 basis points.

Oil erased earlier gains, however, because the diplomatic clash was seen as having limited impact on OPEC policy.

11. Why might this dispute be different?

“Internal differences and disagreements are nothing new, but what is interesting is the timing and the somewhat unprecedented level of pressure,” says Mehran Kamrava, director of the Center for International and Regional Studies at Georgetown University in Qatar, referring to the recent Trump visit. That suggests that “Saudi Arabia and the U.A.E. want nothing but complete submission from Qatar.’’ If Qatar resists, that will further destabilize an already volatile region. For one, the faceoff also encumbers U.S. efforts to fight Islamic State: Qatar is home to bases central to the U.S.-led air offensive.

BLOOMBERG .March 30, 2017. Qatar’s Bets.

By Mohammed Sergie

The Persian Gulf emirate of Qatar is tiny, but it’s made a name for itself by placing big bets. Thanks to vast reserves of natural gas, its 2.6 million residents enjoy the world’s highest per-capita income: $129,700 a year. Qatar has acquired more than $335 billion worth of assets around the globe, buying up trophies such as London’s Shard, the tallest building in Europe. The emirate has also drawn attention as an outsized power-broker in a volatile region, and it will be center stage globally in 2022 as the host of the World Cup. Those gambles haven’t always worked out as planned. Qatar’s support for opposition groups challenging other Arab governments has enraged its neighbors, and so far its soccer preparations have attracted mostly bad press.

The Situation

After huge investments made Qatar the world’s largest exporter of liquefied natural gas, a global production glut has cut prices and driven a downturn in the country’s fortunes. Emir Sheikh Tamim Bin Hamad Al Thani, who assumed the throne in 2013, has focused more on domestic affairs than foreign adventures. Qatar’s first budget deficit in 15 years has prompted the government to restrain spending. The state-backed global TV station Al Jazeera has shed employees and shuttered its U.S. operations. After a probe by soccer’s governing body, Qatar was cleared of charges that it secured the World Cup through bribery. Still, the preparations have been clouded by reports of abuse of migrant workers building the facilities. The country’s sovereign wealth fund hasn’t lost its appetite for high-profile deals: In the last few months, Qatar pumped money into Turkey’s biggest poultry producer and Russian oil giant Rosneft. It’s the third-biggest shareholder in Germany’s Volkswagen and remains one of the largest investors in Barclays, after it helped rescue the U.K. bank during the 2008 financial crisis. Qatar also owns the Paris Saint-Germain Football Club.

The Background

A peninsula off Saudi Arabia’s eastern coast, Qatar emerged from the shadow of its powerful neighbor in 1995 when Emir Tamim’s father, Hamad Bin Khalifa Al Thani, overthrew his father in a bloodless coup and put Qatar on an ambitious course. Al Jazeera launched the next year, breaking regional tradition by including news that embarrassed Arab leaders. When Saudi Arabia ejected the U.S. air operations center for the region in 2003, Qatar took it on; today the emirate hosts 10,000 U.S. troops. In the Arab Spring uprisings that began in 2010, Qatar, uniquely among Middle Eastern governments, broadly supported groups agitating for change — as long as it was outside the Persian Gulf. The emirate’s leaders backed Muslim Brotherhood groups challenging authorities in Libya, Syria, Tunisia and Egypt, calculating that they would prevail and confident that Qatar’s own prosperous population would not rebel. Since then, Brotherhood groups have mostly foundered, and Qatar reeled back its support for them in 2014 when faced with diplomatic threats from its Gulf neighbors. In Qatar itself, political parties are prohibited and freedom of expression is severely limited. Just 300,000 of Qatar’s residents are citizens; the rest are foreign workers with few rights.

The Argument

Qatar aspires to be the region’s indispensable mediator. Its leaders have connections with a wide range of parties, such as warring tribes in Libya as well as both the U.S. and the Taliban. On the other hand, by choosing sides during the Arab Spring revolts, it weakened its standing as a neutral party. Relations with Saudi Arabia remain cool, and its ties with Iran, once cordial, are tense. The capacity of Qatar’s leaders to focus on foreign affairs is being squeezed by the pressure of domestic concerns. Like other petro-states, Qatar is determined to diversify its economy to reduce dependence on finite fossil fuels, though some analysts question the value of spending on infrastructure projects for the World Cup. Still, Qatar’s gas reserves aren’t apt to run out soon: by one estimate, they’ll last another 135 years. The government continues to face very little open opposition, but it does have critics. And a planned reduction in public sinecures invites more citizens to question their riches-for-silence contract with the monarchy.

BLOOMBERG. 2017 M06 5. For OPEC, Saudi-Qatar Crisis Is Just the Latest Family Squabble

by Grant Smith and Wael Mahdi

- OPEC deals have survived many political clashes: Al-Awadhi

- Group continued to function through past wars, invasions

The diplomatic clash between Qatar and three Arab allies flared regional tensions and caused oil prices to jump. For OPEC, it’s likely to remain business as usual.

Saudi Arabia and three other Arab countries severed most diplomatic and economic ties to Qatar to punish the nation for its links with Iran and Islamist groups. Although most of the countries involved are members of the Organization of Petroleum Exporting Countries, the stand-off is seen posing little threat to the group’s initiative to re-balance world oil markets by cutting production.

"It is not the first time for OPEC to see a political rift between its member countries, and it’s not going to be the last," said Abdulsamad Al-Awadhi, a London-based analyst who was one of Kuwait’s representatives to the group between 1980 and 2001. "OPEC has gone through many political and military conflicts among its members and this has never had an impact on the flow of work of the organization or its binding agreements."

While OPEC members have fought political disputes and even wars through the organization’s 57-year history, their shared economic interests have meant policies on oil production have still been implemented. The group withstood a bitter conflict between Iran and Iraq in the 1980s and Saddam Hussein’s 1990 invasion of Kuwait. Renewed hostility between Saudi Arabia and Iran didn’t prevent last year’s historic agreement to curb production.

After initially jumping as much as 1.6 percent on the diplomatic spat, Brent crude erased its gains to trade 0.8 percent lower at $49.55 a barrel as of 12:44 p.m. in London.

Shared Interests

Russia, which is cooperating with OPEC on supply cuts, doesn’t see tensions in the Gulf having any impact on the deal, the nation’s Vienna-based envoy to international organizations, Vladimir Voronkov, told RIA Novosti.

“There are no signs of any disruption to the OPEC and non-OPEC deal,” said John Sfakianakis, a Riyadh-based director of research at Gulf Research Center. “It is not only in the GCC’s national energy interest but also it is in Russia’s national interest to see the OPEC deal sustained as everyone needs higher oil prices and a stable market.”

Here are some examples of OPEC’s ability to keep working despite conflict:

- 1980s -- Iran and Iraq waged an eight-year war that disrupted production in both members, yet OPEC still managed to set its first-ever output quotas in 1983.

- 1990 -- After Iraq invaded Kuwait on Aug. 2, the combined production of both countries -- 4.3 million barrels a day -- was halted, according to the Energy Information Administration. OPEC continued to meet through the conflict.

- 2011 -- Syria’s civil war intensified tensions between Saudi Arabia and Iran, with Iran supporting the regime of Bashar Al-Assad while Saudi and other Sunni-led members backed rebels seeking to topple him. OPEC agreed a new collective production ceiling in December of that year.

- 2015 -- Yemen’s civil war deepens the divide, with Saudi Arabia accusing Iran of backing rebel factions. Despite the friction, the group settled on its first production cut in eight years in November 2016.

BLOOMBERG. 2017 M06 4. Saudis Lead Push to Isolate Qatar, a Fellow U.S. Ally

by Glen Carey and Zainab Fattah

- Saudi leads alliance to cut off Qatar over Islamist support

- Countries suspend air, sea travel; Saudis shut land border

- Arab World Faces Dramatic Split

The fallout from Monday’s shock move by four U.S. Arab allies to isolate Qatar over its ties to Iran was felt across the region on Monday, as flights were canceled and Qatari stocks plunged the most since 2009.

Saudi Arabia banned all Qatari planes from landing in the kingdom and will bar them from its airspace as of Tuesday, the official Saudi Press Agency reported. Abu Dhabi’s state-owned carrier Etihad Airways and Dubai’s Emirates said they would suspend all flights to and from Qatar’s capital, Doha, from Tuesday, with the U.A.E.’s low-cost carriers Air Arabia and Flydubai also following suit.

The decision by Saudi Arabia, Bahrain, the United Arab Emirates and Egypt to punish the Gulf Cooperation Council member over its support for Islamist groups -- as well as their key rival, Iran -- pits some of the world’s richest nations in a struggle for regional dominance. Qatar’s population is smaller than Houston’s, but it has a sovereign wealth fund with stakes in global companies from Barclays Plc to Credit Suisse Group. It’s also a home to the forward headquarters of the U.S. military’s central command in the region.

While the escalation is unlikely to affect energy exports from the Gulf, it threatens to have far-reaching effects on Qatar and raises the political risk for the Middle East, a region grappling with wars from Syria to Yemen. Secretary of State Rex Tillerson said the U.S. stands ready to help defuse the tension.

“It’s not in the U.S.’s interest to see the GCC sort of unravel,” Allison Wood, an analyst with Control Risks in Dubai, said. “That would be very destabilizing in a region that’s already very unstable. There are limits to the U.S. giving tacit approval to the kind of pressures that are being applied.”

Defiance

Qatar’s first response struck a defiant tone. The Foreign Ministry called the accusations “baseless” and said they were part of a plan to “impose guardianship on the state, which in itself is a violation of sovereignty.”

Qatar’s QE Index for stocks tumbled 7.3 percent at the close in Doha, the most since 2009. Qatar’s credit risk, measured by credit default swaps, climbed the most globally. Saudi Arabia, Egypt and Dubai were also among the worst six performers on the day, according to data compiled by Bloomberg.

“There are going to be implications for people, for travelers, for business people. More than that, it brings the geopolitical risks into perspective,” Tarek Fadlallah, the chief executive officer of Nomura Asset Management Middle East, said in an interview to Bloomberg Television. “Since this is an unprecedented move, it is very difficult to see how it plays out.”

The Saudis also accused Qatar of supporting “Iranian-backed terrorist groups” operating in the kingdom’s eastern province as well as Bahrain.

While Qatar maintains diplomatic and economic ties with Iran, it’s not clear how close the two countries are, and none of the statements issued on Monday offered evidence of deep cooperation. Saudi Arabia also accused Qatar of supporting “terrorist groups aiming to destabilize the region,” including the Muslim Brotherhood, Islamic State and al-Qaeda.

Iran’s Comment

Iranian Foreign Minister Mohammad Javad Zarif stepped into the fray, saying on Twitter that “coercion” would not lead to a solution.

“Neighbors are permanent, geography can’t be changed,” he said.

The five key countries involved in the dispute are U.S. allies, and Qatar has committed $35 billion to invest in American assets. The Qatar Investment Authority, the country’s sovereign wealth fund, plans to open an office in Silicon Valley.

Read More: Why Tiny Qatar Angers Saudi Arabia and Its Allies: QuickTake Q&A

Tillerson, speaking at a news conference in Sydney, said it was important that the Gulf states remain unified and he encouraged the parties to address their differences. He said the crisis won’t undermine the fight on terrorism.

“What we’re seeing is a growing list of some irritants in the region that have been there for some time,” Tillerson said. “Obviously they’ve now bubbled up to a level that countries decided they needed to take action in an effort to have those differences addressed.”

Monday’s actions escalate a crisis that started shortly after President Donald Trump’s trip last month to Saudi Arabia, where he and King Salman singled out Iran as the world’s main sponsor of terrorism.

Verbal War

Three days after Trump left Riyadh, the state-run Qatar News Agency carried comments by Qatari ruler Sheikh Tamim bin Hamad Al Thani criticizing mounting anti-Iran sentiment. Officials quickly deleted the comments, blamed them on hackers and appealed for calm.

Saudi and U.A.E. media outlets then launched verbal assaults against Qatar, which intensified after Sheikh Tamim’s phone call with Iranian President Hassan Rouhani over the weekend in apparent defiance of Saudi criticism.

Past Crisis

Disagreements among the six GCC members have flared in the past, and tensions with Qatar could be traced to the mid-1990s when Al Jazeera television was launched from Doha, providing a platform for Arab dissidents to criticize autocratic governments in the region --except Qatar’s.

GCC members Kuwait and Oman have so far maintained their diplomatic and commercial ties with Qatar.

Qatar also played a key role in supporting anti-regime movements during the Arab Spring, and acted against Saudi and U.A.E. interests by bankrolling the Muslim Brotherhood’s government in Egypt. Qatar also hosts members of the exiled leadership of the Iranian-backed Hamas militant group that rules the Gaza Strip.

In 2014, Saudi Arabia, the U.A.E. and Bahrain temporarily withdrew their ambassadors from Qatar. That dispute centered on Egypt following the army-led ouster of Islamist President Mohamed Mursi, a Muslim Brotherhood leader.

This time, Saudi Arabia, along with Bahrain and the U.A.E., gave Qatari diplomats 48 hours to leave.

The crisis comes shortly after Moody’s Investor Service cut Qatar’s credit rating by one level to Aa3, the fourth-highest investment grade, citing uncertainty over its economic growth model.

Read More: Qatar Wealth Fund’s Expansion Undeterred by Brexit, Trump

“Qatar is economically and socially most vulnerable from food and other non-energy imports,” said Paul Sullivan, a Middle East expert at Georgetown University. “If there is a true blockade, this could be a big problem for them. Rules stopping citizens of the U.A.E., Saudi Arabia and Bahrain from even transiting via Qatar could cause significant disruptions.”

NAFTA

Global Affairs Canada. June 3, 2017. Government welcomes Canadians’ views on NAFTA

Ottawa, Ontario - Canada is committed to a progressive trade agenda that creates jobs and opportunities for the middle class and those working hard to join it.

The input of Canadians is essential when considering trade agreements, and the Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced expanded, online consultations with Canadians on the renegotiation of the North American Free Trade Agreement (NAFTA).

The consultations are an important next step toward the renegotiation process. The views gathered from Canadians will inform the federal government’s approach as we engage with the United States and Mexico.

In recent months, the Minister and her colleagues have been listening to Canadians from across the country and from all sectors and backgrounds.

The government is steadfastly committed to free trade in the North American region and ensuring that the benefits of trade are enjoyed by all Canadians.

We want to hear from Canadians, and we invite them to share their ideas, experiences and priorities on the modernization of NAFTA by visiting: www.international.gc.ca/nafta

Quotes

“I invite all Canadians to provide their views on how we can maximize the benefits of a modernized NAFTA. We are committed to hearing directly from Canadians on their priorities, and we will ensure that Canadians continue to have the opportunity to provide their input as we engage with our NAFTA partners.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick facts

- NAFTA, which includes Canada, the United States and Mexico, came into effect on January 1, 1994.

- On May 18, 2017, the United States formally indicated its intent to renegotiate NAFTA.

- NAFTA created what is today a US$20.7-trillion regional market with 478 million consumers.

- Trilateral trade has increased more than threefold since NAFTA came into force.

- NAFTA has been updated 11 times by Canada, the United States and Mexico.

The Globe and Mail. Jun. 05, 2017. Special. When Canada confronts a bully, tit-for-tat is best

TOM KOCH. Tom Koch is a medical geographer and ethicist at the University of British Columbia and the director of Information Outreach, Ltd. in Toronto. He is the author of 15 books, including Thieves of Virtue

How do you negotiate with a bully? Can you reason with an egotist who will not listen to another point of view? The answer for game theorists and strategists has been clear for almost 40 years: tit-for-tat. The basic rule is be nice – and respond in kind.

It seems to be the idea behind Canada’s increasingly strong reaction to U.S. tariffs and “Buy American” policies. In the past, Canada has been content to play the long game of adjudication rather than rapid response. But in aerospace and lumber disputes, tit-for-tat is the new Canadian order of the day.

In 1979, University of Michigan political-science professor Robert Axelrod sponsored a competition for the best strategy to encourage co-operation in competitive situations. The winner was a very short, two-step program scripted by a University of Toronto psychologist and philosopher, Anatol Rapoport. He called it Tit-for-Tat, and there were just two rules: Co-operate on the first move, then respond in kind to whatever the other person does in each future meeting.

Explainer: The countdown to NAFTA talks has begun. What’s going on? A guide

Mr. Rapoport’s program won again in a later competition with a much larger field of competitors – some submitting lengthy and detailed strategies. And perhaps best, in reiterative games where the cycle of negotiation goes on and on, Tit-for-Tat was still the hands-down winner. It triumphed not by “beating” the other player into exhaustion but by eliciting behaviours that maximized the potential for both players to do well enough.

It makes intuitive sense. If a co-operator never responds in kind to aggression, there is no reason for the aggressor to be anything but forceful. But if force is met in kind, aggression becomes exhausting. With the rule “respond only in kind,” tit-for-tat assures that when co-operation is offered, it is accepted. I’ll fight, it says, but I’d rather not.

I learned this in the schoolyard long ago. If you slap me and I do nothing, then I’m a wimp and fair game for a beating. But if I slap you back, well, the confrontation becomes painful no matter who “wins.” If you stop fighting, however, so will I, and that’s the end of it.

Tit-for-tat doesn’t end in continued escalation and ongoing strife because at the first sign of accommodation one responds in kind.

This has never been Canada’s policy of international engagement. In successive battles over softwood lumber, for example, Canadian politicians have preferred the long game of adjudication rather than a short-term, comparable response to unilateral, punitive U.S. tariffs. Time and again, World Trade Organization adjudicators have exonerated Canadian policies, but each time the process took years and cost millions.

But times are changing. Ottawa’s threat last week to reconsider the purchase of new military jets from Boeing after it called for a trade review of Bombardier was a classic tit-for-tat move. So, too, is British Columbia Premier Christy Clark’s suggestion to Ottawa to bar coal exports from B.C. in retaliation for the current softwood-lumber battle.

Note that bluster and shaming are not part of the program. Threats score no points. There is no advantage to calls upon a prior history of shared hardships or proclamations of long-term friendship. Those things are irrelevant, and the rules are simple: proportional response and, when the opportunity arises, co-operation.

Tit-for-tat is not a zero-sum game. Beginning with co-operation, it assumes the best outcome will probably be less than everything. Nobody gets everything, but all get enough to maintain a peaceful equilibrium.

It may be a game strategy, but as we’re discovering, it’s one with real-world applications. In the current climate of escalating political conflicts – from U.S. trade to North Korea to the Middle East – it’s certainly worth trying. Politeness is too often mistaken for weakness by the bullies of the world. With tit-for-tat, nice guys don’t need to finish last.

The Globe and Mail. Jun. 04, 2017. Is Ottawa ready for a New Economy version of NAFTA?

BARRIE MCKENNA

OTTAWA — Most of the talk so far in Canada about renegotiating NAFTA has been about lumber, dairy, cars and other traditional goods.

That’s unfortunate. The economy has undergone a radical transformation in the nearly 25 years since the North American free-trade agreement was signed. It’s gone digital.

So much of the economic action these days is in the knowledge economy, rather than in products that move across the border in tractor-trailers.

The majority of the value of the Standard and Poor’s 500 is now tied up in intangible things – intellectual property, data, brands and the like. Many of the largest and fastest-growing companies – public and private – are in areas such as social media (Facebook, Twitter and Snap), cloud computing (Amazon and Microsoft), online streaming and content (Netflix, Google, Apple and Spotify), e-commerce (Amazon and eBay), ride sharing (Uber) and online payments (PayPal).

There is a common denominator here. They’re all U.S. companies. Donald Trump often laments that the United States doesn’t make anything any more. But guess what? The country sure produces – and exports – a whole lot of digital stuff.

And you can bet U.S. negotiators will take care of their own in the looming NAFTA negotiations. When U.S. Trade Representative Robert Lighthizer talks about a “modernization” of the trade agreement, he clearly has digital trade on his mind.

It’s not clear if the Trudeau government and its negotiators are ready to do battle on this turf. The risk is that we get distracted by the Old Economy, while the United States quietly rewrites the rules of the game for the knowledge economy, to suit their own interests.

For example, the United States will want to weaken any rules that limit the ability of U.S. companies to store Canadian data on their own U.S.-based servers, creating potential privacy concerns. The Americans will also seek to expand protections for intellectual property, patents and copyright – as they did in the now-stalled Trans Pacific Partnership trade agreement. And they may not look favourably on protections of Canada’s cultural industries.

Ottawa must be mindful of the “winner-take-all” dynamic that exists in the digital world, according to a new report by the Conference Board of Canada on the NAFTA renegotiation. Most of the big players have dominant market positions in their patch of the digital economy.

“Canada should aim to maintain a certain level of flexibility with regard to future digital policies at home should Canadian firms and industries need some support to stay competitive in markets dominated by a few digital players,” says the report, titled NAFTA 2.0 and Canada.

The Conference Board also warns that Canada’s cultural policies could be at risk unless Ottawa pushes to keep the broad cultural exemption that currently exists in NAFTA, rather than the TPP’s weaker protections.

“In a digital world characterized by winner-takes-all dynamics, having the freedom to develop our own cultural policies will be essential to our ability to create and distribute a wide variety of Canadian content,” the report says.

Cross-border flows of goods, and even services, have slowed in recent years. But data-based trade is exploding. Cross-border data flows already contribute more to the global economy than trade in goods, according to a recent McKinsey Global Institute study, cited in the Conference Board report.

One of Mr. Trump’s first acts as U.S. President was to walk away from the TPP deal. But in the months since, Commerce Secretary Wilbur Ross has acknowledged that the TPP will be a “starting point” for NAFTA 2.0.

Some experts worry that the U.S. will seek to replicate much of the gains it made in the TPP in areas such as digital trade and intellectual property. The United States will seek to “back-door” the TPP’s governance rules for the knowledge economy in the NAFTA negotiations, with the aim of giving U.S. companies maximum “freedom to operate,” argues economist Dan Ciuriak, a former deputy chief economist at the Department of Foreign Affairs.

And this, he suggests, will lock in a “home-ice advantage” for the big U.S. players, who already dominate digital trade.

Canada never wanted to reopen NAFTA. Indeed, it initially wanted no part of the 1988 agreement.

The danger now for Ottawa in reopening NAFTA is that it becomes too preoccupied with saving Old Economy jobs in industries such as dairy and lumber. If that happens, Canadians could wake up one day and find themselves boxed out of emerging opportunities in the New Economy.

The Globe and Mail. Jun. 04, 2017. Canadian auto sector divided on approach to NAFTA

GREG KEENAN - AUTO INDUSTRY REPORTER

As the federal government seeks advice from Canadians on the country’s approach to renegotiating the North American free-trade agreement, players in the auto sector disagree on how a key feature of automotive trade should be treated.

Ottawa has issued a notice in the Canada Gazette saying it’s seeking views on all aspects of NAFTA with comments due by July 18.

The notice comes after the U.S. government exercised a clause in the deal last month that opens it up to renegotiation after a 90-day notice. Talks are expected to begin in August.

“The government will proceed in a manner that supports jobs and growth for Canadians – and prosperity in North America as a whole,” the Canada Gazette notice said.

That goal is likely to run up against a tough negotiating stand from U.S. officials, who will be seeking changes that will make the agreement more favourable to the United States than the current deal, which came into force in 1994.

The Americans have already signalled that they want changes to NAFTA’s dispute-resolution mechanism and have taken aim at Canada’s supply-management system for dairy products and renewed the decades-long assault on Canadian softwood-lumber exports south of the border.

Those issues are expected to be front and centre in the talks, as are government procurement and rules of origin for goods manufactured in North America (such as auto parts), trade lawyer Riyaz Dattu said.

The difference of opinion in the auto sector over the issue of tracing the origin of automotive components indicates the difficulty the federal government will have in balancing the multitude of interests that various groups have in the outcome of the talks.

Auto-parts makers and auto manufacturers are required to trace the origin of parts and systems to make sure they meet the NAFTA regulation that vehicles and parts contain 62.5-per-cent North American content in order to move duty between Canada, the United States and Mexico.

“We would prefer to see tracing eliminated,” David Paterson, vice-president of corporate affairs at General Motors of Canada Co., told the House international trade committee last month.

“Under the category of do no harm, we must set out to reduce, not add, red tape,” Mr. Paterson told the committee. “A lot of bureaucracy is still required in tracing auto parts as they move across borders in NAFTA.”

That view runs counter to what the Automotive Parts Manufacturers’ Association of Canada is pursuing in a new deal, which is that tracing be extended.

“Tracing needs to be improved to include supply categories that didn’t exist when they were negotiating NAFTA in the early 1990s,” APMA president Flavio Volpe said. Those categories include much of the electronics and the software present in today’s vehicles.

Tracing the origin of parts is a way of making sure the 62.5-per-cent content requirement in vehicles is met, Mr. Volpe said.

The Japan Automobile Manufacturers Association of Canada, which represents Honda Canada Inc. and Toyota Motor Manufacturing Canada Inc. also has a difference of opinion with GM Canada.

JAMA supports retaining the current 62.5-per-cent rule of origin for vehicles and parts as well as the related provisions of that rule, which include tracing.

Mr. Paterson said GM Canada also supports maintaining the 62.5-per-cent threshold.

On the issue of a border-adjustment tax, which is being raised as a possibility in the United States as part of the trade debate, there is generally strong and united opposition in the auto sector.

A border adjustment tax of, say, 20 per cent “would be a very severe constraint to the ability to win new investment for anything in Canada that depends on the U.S. market,” Mr. Paterson said.

HOUSING BUBBLE

The Globe and Mail. Jun. 05, 2017. REAL ESTATE. Toronto’s housing market feels chill from provincial measures

JANET MCFARLAND - REAL ESTATE REPORTER

Toronto’s overheated housing market has cooled rapidly since the Ontario government announced a suite of new housing measures in April, with average prices dropping 6 per cent in May while the number of homes sold fell by 12 per cent during the month.

The average sale price for all home types in the Greater Toronto Area was $863,910 in May, a drop of 6.2 per cent from $920,791 in April, according to sales data from the Toronto Real Estate Board. The price was still up 15 per cent compared to May, 2016, however, because of large price gains earlier this year.

The month-over-month price decline came as 19.4 per cent more homes were listed for sale in May, with new listings rising to 25,837 from 21,630 in April. New listings were up 49 per cent from 17,356 in May last year.

TREB said 10,196 homes were sold in May, a 12-per-cent drop from 11,630 homes sold in April and a decline of 20.3 per cent from May last year, when 12,790 homes were sold.

Jason Mercer, TREB director of market analysis, said the leap in new listings coming onto the market in May was the result of many homeowners reacting to the strong price gains earlier this year, putting their homes up for sale “to take advantage of these equity gains.”

Mr. Mercer said the Toronto market hasn’t had time to absorb the impact of the Ontario government’s new housing measures, so hasn’t seen the “normalized” impact of the reforms, which included a new 15-per-cent tax on foreign buyers.

“In the past, some housing policy changes have initially led to an overreaction on the part of homeowners and buyers, which has later balanced out,” he said in a statement.

The number of active listings of homes available for sale at the end of May was up 43 per cent to 18,477 listings compared to 12,931 listings at the end of May, 2016, which was a 15-year-low at that time, TREB said.

However, TREB president Larry Cerqua said inventory levels are still low, despite the increase in listings.

“At the end of May, we had less than two months of inventory,” he said. “This is why we continued to see very strong annual rates of price growth, albeit lower than the peak growth rates earlier this year.”

The Ontario government introduced the new foreign buyer’s tax on April 20 and announced it would give Toronto powers to tax vacant properties as part of a suite of measures aimed at cooling the region’s soaring housing prices. The measures came after average house prices climbed 33 per cent in March compared to a year earlier.

Whether due to the new reforms or to buyer fatigue with sky-high housing prices, the market has cooled considerably this spring, especially for low-rise homes.

Detached house prices dropped 5.3 per cent to an average of $1,141,041 in May compared to $1,205,262 in April.

The number of detached homes sold in May fell 17 per cent to 4,757 compared to 5,715 in April, while sales were down 26 per cent compared to May last year.

Prices for semi-detached homes fell 2.4 per cent in May to an average of $824,667 compared to April, and townhouse prices fell 6.4 per cent to an average of $656,392.

Condominium sales held up somewhat better, with prices dropping 1.8 per cent to average $531,659 in May compared to April while the number of units sold fell 5.3 per cent.

The Globe and Mail. Jun. 04, 2017. The Home Capital effect: Mortgage rates spike for riskier borrowers

ROBERT MCLISTER. Mortgage planner at intelliMortgage and founder of RateSpy.com.

It was just six weeks ago that investors feared Home Capital Group Inc. – Canada’s biggest non-prime mortgage lender – was going out of business. That turned the alternative-lending market on its head, and one of the consequences is now being seen: Mortgages have become more expensive for the many Canadians who can least afford it.

The situation at Home Capital has stabilized somewhat thanks to the company securing short-term financing. This lifeline gives Home Capital more time to find a permanent way to bankroll its mortgages.

But the meltdown in investor confidence means the company is still facing severe funding constraints. That’s a problem because Home Capital closed more than $5-billion worth of riskier residential mortgages last year.

No one else funds that much non-prime business in Canada.

With the company now unable to meet borrower demand and would-be customers worrying their mortgages won’t close in time, mortgage brokers are sending untold millions in business to Home Capital’s competitors, including lenders such as Equitable Trust, B2B Bank, Optimum Mortgage and credit unions.

Some smaller alternative lenders are seeing application volumes up more than 100 per cent. And when any opportunistic lender gets a flood of business, what does it do?

Two things.

For one, it raises prices. That’s exactly what’s happening right now in Canada’s non-prime mortgage market. Lenders are jacking up the price of money by demanding higher interest rates.

Since Home Capital’s funding woes started, “rates on [non-prime] mortgages have increased between 50 and 125 basis points, based on whether it’s a purchase or refinance,” said Ron Butler, a broker at Butler Mortgage. (One basis point equals 1/100th of a percentage point.)

That’s almost $1,000 to $2,500 more interest over 12 months on the average $201,000 Canadian mortgage. And believe me, many of the people getting subprime loans aren’t rich enough to shrug off that cost.

Rate hikes and application backlogs at larger lenders have even small mortgage-investment companies (MICs) getting more of the action. MICs, which specialize in higher risk loans, “are really stepping up, albeit with much higher rates, 6.9 to 7.9 per cent,” Mr. Butler says. MICs can fund mortgages much quicker than bigger lenders, with fewer questions and at more flexible terms.

The second thing lenders do when they have too much business is get a lot pickier, and slower to approve people. That means some home buyers who would have been approved a few months ago are getting declined today, or are being offered less favourable terms. Folks with weak credit and/or less provable income – particularly self-employed borrowers – are feeling the brunt of the impact, especially if they’re trying to refinance. Refinances are generally riskier in a lender’s eyes than purchases.

If Home Capital doesn’t partner with or get bought out by a more stable entity – and there’s a good chance it will – the company could leave a void in our mortgage market for quite some time.

Can other lenders make up for its lost capacity? “It is really hard to say,” Mr. Butler says. “There is a dampening in the market right now and these small players are booming. The only dead certainty is: the consumer pays more.”

BLOOMBERG. 2017 M06 5. Toronto May Home Price Gains Slow as New Listings Surge 49%

by Greg Quinn and Erik Hertzberg

- Average price rises 15% from year earlier to C$863,910

- May slowdown reflects first month of new foreign buyer tax

- How Much Gold Would Buy You a Home in Toronto?

Toronto’s housing fever is showing signs of cooling as price gains slowed and new listings surged in May, the first full month reflecting a new tax on foreign buyers and a crisis at mortgage lender Home Capital Group Inc.

The number of new listings soared 49 percent last month from a year earlier to 25,837, the biggest increase since 2010, according to Toronto Real Estate Board figures published Monday. The average price rose 15 percent to C$863,910 ($640,076), compared with annual gains of 25 percent in April and 33 percent in March. The benchmark price index, which measures more typical mid-priced homes, rose 29 percent, also down from a 32 percent gain in April.

Sellers may be moving to lock in price gains after the Ontario government’s April announcement of a 15 percent foreign buyer tax on the Greater Toronto Area to clamp down on speculation. Home Capital needed to refinance after a regulator accused the Toronto-based company of misleading investors about potential fraud by some brokers.

“The increase in active listings suggests that homeowners, after a protracted delay, are starting to react to the strong price growth we’ve experienced over the past year by listing their home for sale to take advantage of these equity gains,” Jason Mercer, the board’s director of market analysis, said in the report. He also said it’s unclear what the long-term effect of the new tax will be.

In Vancouver, prices have already returned to record highs after the British Columbia government announced a foreign buyers tax in July, and the federal government targeted Vancouver and Toronto with tougher mortgage rules last year. Average prices for single detached homes in the west coast city hit C$1.83 million in May, the most ever, a report on Friday showed.

Toronto’s market needed a break from the rapid price gains earlier this year, even if the impact of the buyer tax may be short lived as in Vancouver, according to Benjamin Tal, deputy chief economist at Canadian Imperial Bank of Commerce in Toronto.

“The acceleration in activity and prices in 2016 and early 2017 did not pass the logic test,” Tal wrote in a research note. “We believe that this adjustment will be relatively short-lived, not unlike the situation in Vancouver where activity is already rebounding.”

Sales Drop

Toronto buyers took a step back in May as the number of sales dropped 20 percent to 10,196 units from a year earlier, the sharpest decline in four years. Prices fell by 6.2 percent in May from April on a raw basis without any adjustment for seasonal patterns.

May figures suggested a shift in demand to smaller and less expensive types of housing. Detached home sales dropped 26 percent, while for condominiums they were down just 6.4 percent. Condo prices also rose 28 percent from a year earlier, faster than the 16 percent gain for detached properties.

While the housing boom in Canada’s biggest city has been supported by job growth and rising population, the International Monetary Fund warned last week that further measures may be needed to curb the dangers from surging prices and record consumer debts. Bank of Canada Governor Stephen Poloz will probably repeat similar concerns on June 8 when he holds a press conference on his semi-annual Financial System Review. He has identified housing and consumer debt as a key vulnerability in the domestic economy.

Toronto has seen yearly price growth every month since May 2009. The last time the city saw gains of less than 10 percent was in December 2015.

The May slowdown still does little to make housing affordable for many buyers. The average year-over-year price gain amounts to an extra C$111,810 to borrow or save for a home.

The risks of such a boom were underlined by a run on Home Capital’s deposits and a plunge in its stock. Moody’s Investors Service downgraded the credit ratings of Canada’s biggest banks, citing rising household debt and runaway home prices.

Market Strength

Toronto’s market may still have some strength in coming months. The realtor group suggested that even with the surge in listings, the market may still favor sellers over buyers.

“At the end of May, we had less than two months of inventory,” Toronto board President Larry Cerqua said in the report. “This is why we continued to see very strong annual rates of price growth, albeit lower than the peak growth rates earlier this year.”

Houses are still selling faster than they were a year ago. The average house was on the market for 11 days in May, down from 15 days in the same month in 2016.

CANADA - US

Department of Finance Canada. June 2, 2017. Finance Minister Bill Morneau to Welcome U.S. Treasury Secretary Steven Mnuchin

Ottawa, Ontario - Canada and the United States have one of the strongest partnerships between any two nations—one that is built on common geography, history and culture and mutual respect. The Canada-U.S. relationship is a model for the world: it is balanced and fair, and it supports growth, innovation, and well-paying jobs for the middle class in both countries.

Finance Minister Bill Morneau today announced that he will welcome his counterpart, U.S. Treasury Secretary Steven Mnuchin, on his first visit to Canada in Ottawa on June 9, 2017.

Quote

“I look forward to welcoming Secretary Mnuchin to Canada, and to another productive day with my U.S. counterpart. As we discuss the importance of our economic and business relationships, our shared interests keep our Canada-U.S. relationship strong.”

- Bill Morneau, Minister of Finance

Quick Facts

- Canada and the United States share a longstanding relationship, through people-to-people ties and a strong trading and investment relationship:

- Nearly 9 million American jobs are dependent on trade and investment with Canada.

- Canada and the U.S. have the largest, two-way, balanced trading relationship in the world, reaching nearly $882 billion in 2016.

- Every day, more than $2.4 billion worth of goods and services and 400,000 people cross the Canada-U.S. border.

- Canada is the number one market for most U.S. states, and is among the top three customers for 48 of them.

- Canada and the U.S. benefit from a highly integrated manufacturing sector, with products crossing the border several times before final assembly and sale in both countries.

- Capital flows are balanced, with the U.S. stock of direct investment totalling half of all foreign direct investment (FDI) in Canada and Canadian direct investment one of the main sources of FDI into the United States. In 2016, Canadian stock investment in the U.S. was over $474 billion, accounting for 45% of Canadian investment abroad.

REUTERS. Jun 5, 2017. Canada beats U.S. in pork sales to China - feet, elbows and all

By Rod Nickel, Michael Hirtzer and Dominique Patton

WINNIPEG/CHICAGO/BEIJING (Reuters) - Canada has overtaken the United States as the top North American supplier of pork to China as farmers and meat packers in both nations battle for lucrative shares of the biggest global market.

Canada's pork sales to China, after a sharp rise last year, exceeded those of the United States in the first quarter of 2017. That's only happened a handful of times in two decades, according to U.S. and Canadian government data.

Rising affluence is driving China's voracious appetite for pork, including parts of the pig - feet, elbows, innards - which command little value in most countries. At the same time, tightened environmental standards in China have forced farm closures and boosted demand for cheaper imports.

That's a bonanza for Canadian farmers, who have almost completely removed the growth drug ractopamine from their pigs' diet - largely because it is banned in China, which consumes half the world's pork.

U.S. exports to China, by contrast, are limited because only about half of the nation's herd has been weaned off the drug, according to U.S. hog producers, meat packers and animal feed dealers.

But major U.S.-based firms are now moving to produce more ractopamine-free hogs - including the three biggest pork producers, Smithfield Foods [SFII.UL]; Seaboard Foods, a division of Seaboard Corp (SEB.A: Quote); and Triumph Foods, a hog farmer cooperative.

The ascension of Canada's pork exports underscores the power of the gargantuan Chinese market to influence agricultural practices and profits in supplier countries worldwide.

As recently as 2013, annual U.S. pork sales to China, some 333,000 tonnes, more than doubled Canada's shipments of 161,000 tonnes.

That's the same year Canada's hog industry started to remove ractopamine, best known as Eli Lilly & Co (LLY.N: Quote) product Paylean.

In the first quarter of this year, Canada shipped nearly 93,000 tonnes of pork to China, on pace to hit 372,000 tonnes annually. That eclipsed the 87,500 tonnes that the United States shipped, according to data from both governments.

For a graphic on United States and Canada pork sales to China, see: tmsnrt.rs/2r80PeW

The European Union, which has long banned ractopamine, is China's top foreign pork supplier, sending 393,365 tonnes there in the first quarter.

Chinese authorities banned the use of ractopamine in livestock in 2002. They say meat raised with the drug can cause nausea and diarrhea in people and be life-threatening to sufferers of heart disease.

The U.S. Food and Drug Administration, however, did not see the same dangers when it approved ractopamine in 1999, concluding that it would "not have a significant impact on the human environment."

The FDA's stance has drawn some criticism, including a 2014 lawsuit by environmental groups alleging the agency has not fully examined the drug's impact. The suit was later dismissed on technical grounds but is being appealed.

Hog farmer and rancher groups defend ractopamine use, saying it allows them to grow livestock more efficiently, with less feed, said Dave Warner, spokesman for National Pork Producers Council. Canadian health authorities also allow consumption of pork from hogs raised with the drug.

SELLING ELBOWS ONLINE

The China market is so lucrative that Canada's HyLife started selling pork online directly to Chinese consumers last year.

The small Manitoba processor hawks pig feet and elbows on e-commerce site JD.com Inc (JD.O: Quote), a competitor of Alibaba Group Holding Ltd (BABA.N: Quote).

"They're big online buyers," said Claude Vielfaure, HyLife's chief operating officer. "You try to move your pork all kinds of ways."

Rising Chinese pork demand has driven up prices for by-products including pigs' feet, kidneys and livers.

Pigs feet sell for more than C$2.50 ($1.85) per kilogram - about double their value two years ago, said Richard Davies, executive vice-president of sales and marketing at Olymel, one of Canada's biggest pork packers.

Selling by-products can squeeze another $10 per pig from a carcass that otherwise earns packers about $180, said Ray Price, president of Alberta-based processor Sunterra Meats.

China is the biggest byproduct market, followed by Taiwan and Philippines.

Stewed pigs feet with white beans is a famous dish from Sichuan province, one of China’s culinary capitals, while blood sausage, made from intestines and cooked with pickled vegetables, is a traditional winter dish in the northeast.

Chinese consumers enjoy the strong flavor of offal - internal organs and entrails. In Beijing, stir-fried pig’s liver with vegetables is common on dinner tables and known for its nutritional value.

In all, China consumed 55 million tonnes of pork last year. Although that is the lowest total in four years, imports are rising fast because millions of China’s small-scale farmers have left the pork business in recent years because of falling prices and rising environmental standards.

The government forced thousands of farms to close because of severe water pollution.

China became Quebec-based Olymel's biggest export market last year, vaulting over the United States and Japan. It plans to open a sales office there as early as next year.

"Just a tweak in that market can change the game for anyone in the world," Davies said.

GETTING PIGS OFF DRUGS

U.S. pork producers have moved more slowly than their Canadian competitors to raise ractopamine-free pigs, primarily because the United States is the world's third-biggest domestic market for pork.

Tyson Foods Inc (TSN.N: Quote) and Hormel Foods Corp (HRL.N: Quote) continue to process hogs that were fed ractopamine in part because they do not raise their own pigs.

Hormel's hog supply "comes from more than 500 family farms," a Hormel spokesman said, many of which use the growth drug.

U.S. firms can also send pork from ractopamine-fed hogs to Mexico and Japan, the top U.S. pork export markets.

But many U.S.-based suppliers are nonetheless scrambling to take advantage of Chinese demand for ractopamine-free pork.

Smithfield - the world's biggest pork producer and a subsidiary of Hong Kong-listed WH Group (0288.HK: Quote) - has raised most of its hogs without the drug for more than two years, a spokeswoman said. As the top exporter of pork to China, Smithfield firm shipped 300,000 tonnes there from the United States and Europe last year.