CANADA ECONOMICS

VENEZUELA AND TRADE

Global Affairs Canada. 2017-05-28. Canada to call for action at Organization of American States meeting on Venezuela

Canada is deeply concerned by the rapidly deteriorating political and economic crisis in Venezuela and reaffirms its commitment to the promotion and protection of democracy and human rights.

As part of Canada’s continued action, the Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced that she will participate in an Organization of American States (OAS) ministerial meeting to address the concerning situation in Venezuela. The meeting will be held in Washington, D.C., on May 31, 2017.

Foreign ministers of OAS member states will explore options in support of the Venezuelan people and will seek to find solutions to the crisis in Venezuela.

Canada, along with OAS member states, has repeatedly called on Venezuela’s government to end the violence, release all political prisoners, restore constitutional order and return to democracy, including by setting an electoral calendar. We further call on the government of Venezuela to engage with the international community, particularly specialized agencies of the United Nations, to conduct an assessment of the humanitarian situation in Venezuela.

Canada has been instrumental in the passing of several statements and resolutions at the OAS supporting the people of Venezuela in their efforts to achieve political and economic reforms.

While at the OAS, the Minister will take the opportunity to meet with Luis Almagro, OAS Secretary General, who has played a key role ensuring the crisis in Venezuela remains an international priority.

Quotes

“Freedom, democracy, human rights and the rule of law must be protected for the people of Venezuela. As demonstrations continue across the country and tensions escalate in Venezuela, it is time for the regional community to come together and advance a strong plan to help support a return to democracy in Venezuela. Canada can and will continue to play an active role in this critical effort.”

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Global Affairs Canada. May 26, 2017. Minister Champagne concludes successful trade mission to Asia

Ottawa, Ontario - Growing Canada’s trade and investment relationship with partners in Asia is a top priority for the Government of Canada and will help create more long-term growth, good jobs and an economy that benefits the middle class. The fast-growing markets in Asia represent significant potential as trading partners and for bilateral investment to stimulate further economic growth for Canadians.

The Honourable François-Philippe Champagne, Minister of International Trade, today concluded a week-long trip to East and Southeast Asia to boost trade and investment relationships, make the case for Canada’s progressive trade agenda, and identify more opportunities and export markets for Canada’s world-class forest products. He travelled to Hanoi, Vietnam; Singapore; Seoul, South Korea; and Tokyo, Japan, where he engaged with senior government officials, his international counterparts, media, and local entrepreneurs—notably key wood and wood-product importers and architects, woman entrepreneurs, youth, and innovation and innovative companies.

Highlights of the visit included participating in the Asia-Pacific Economic Cooperation (APEC) Ministers Responsible for Trade Meeting, productive meetings with companies using Canadian wood products and companies interested in potentially growing imports, discussing ways to advance women’s economic empowerment with woman executives and entrepreneurs, and participating in a videoconference between students at Waseda University in Tokyo and Carleton University in Ottawa.

Quote

“During my official visits to Asia, I have seen first-hand the rapid growth taking place across the region. Asia represents massive opportunities for Canadian businesses that will translate into more innovation, and commercial connections that will help create more jobs and growth at home for Canada’s middle class.”

- François-Philippe Champagne, Minister of International Trade

Quick facts

- The APEC Ministers Responsible for Trade Meeting is held in preparation for the APEC Economic Leaders’ Meeting in November 2017.

- In July 2017, Canada will host an APEC Business Advisory Council meeting in Toronto, which will bring together business and political leaders from the Asia-Pacific region who are focused on increasing trade and economic cooperation.

- Collectively, the members of the Association of Southeast Asian Nations (ASEAN) rank as Canada’s sixth-largest merchandise trading partner. In 2016, bilateral merchandise trade was $21.6 billion.

- Japan is Canada’s second-largest trading partner in Asia. Canada’s merchandise exports to Japan in 2016 were worth $10.7 billion, up 9.7 percent since 2015, with the top exports being agri-food products; forest products; and metallurgical, coal and copper ores.

- In Hanoi, Minister Champagne participated in the APEC trade ministers meeting, met with the President of Vietnam and his Vietnamese counterpart, and engaged with business leaders to promote Canadian wood products.

- In Singapore, Minister Champagne met with Ministers and representatives of the Singaporean government, delivered a speech to the local Canadian Chamber of Commerce and the Canada-ASEAN Business Council, promoted Canadian wood products to construction industry representatives, and spoke at CommunicAsia 2017 to showcase Canadian technology companies.

- In Seoul, the Minister met with Korean government ministers and members of the Korean business community, witnessed a commercial signing between a Canadian and a Korean technology company, and hosted round table discussions with students from Sookmyung Women’s University, and a second with key forestry product importers and architects to promote Canadian wood in the Korean market.

- In Tokyo, Minister Champagne met with Japanese ministers, potential investors, and top importers and buyers of Canadian wood products. He also spoke at the AGSUM Agritech Summit, met with women executives and entrepreneurs and participated in a video teleconference between students at Waseda University in Tokyo and Carleton University in Ottawa.

________________

HOUSING BUBBLE

The Globe and Mail. May 29, 2017.The real housing boom: The suburbs are where we want to be

KONRAD YAKABUSKI, Columnist

The transformation of once-decrepit downtown neighbourhoods such as Vancouver’s Yaletown, Toronto’s Liberty Village and Montreal’s Griffintown into bustling modern burgs of condo-dwelling millennials only looks like the defining urbanization trend of the past decade.

While condo cranes dotting city skylines get all the attention, the real story in most Canadian cities remains the unabated growth of the suburbs. The ’burbs continue to draw tens of thousands of new residents every year compared to the few thousand or so who move downtown.

Smart-growth gurus, most of whom seem to live downtown, don’t like to talk much about suburbia’s enduring lure because it sounds like we’re stuck in the 1950s. The irony is that the suburbs are thriving, in part, because of the smart-growth policies that have made a house in the city out of reach for most. Most people, though, still move to the ’burbs by choice.

Unless you pass a law or something, you cannot stop Canadians from aspiring to own a house, preferably a detached one, with a yard, a deck and a two-car driveway. No group of Canadians consider this a rite of citizenship more than those who come here from countries where such a lifestyle is reserved only for the rich. For most immigrants, the Canadian Dream inevitably involves all of the above, with publicly funded education and health care as an added bonus.

With immigration accounting for two-thirds (and rising) of Canada’s population growth, it’s no coincidence the suburbs are booming. New immigrants may initially settle downtown or in the inner suburbs, such as North York in Toronto or Montreal’s Cartierville. But they will scrimp and save, and soon move to the outer suburbs to places such as Milton, Ont., or Laval, Que.

There, they can still own a little piece of paradise to raise kids, send them to good schools, let them wander on their bikes and have the relatives over for a backyard barbecue. It may or may not mean a longer commute – many already work in the ’burbs. But if so, it’s worth it.

Between 2011 and 2016, according to an Environics Analytics analysis of census data, the population of Toronto’s suburbs grew by 7.7 per cent while the city proper grew by 4.5 per cent. In Vancouver, suburban growth outpaced the increase in the city 7.1 per cent to 4.6 per cent. In Montreal, the suburbs grew 5.3 per cent; the city, 2.9 per cent.

The gap between suburban and city growth was even wider in all three metropolitan areas during the previous 2006-2011 census period. Toronto’s suburbs grew by 12.7 per cent during that period, or at 2.8 times the rate of the city itself.

The raw numbers are even more revealing. More than two-thirds of Canadians already live in some form of suburb, according to research by Queen’s University’s David Gordon, who divides Canada’s urban population between those who live in the “active core” of cities, in “transit suburbs” with ready access to public transport, and in the “auto suburbs” where the car rules.

Between 2006 and 2011, the active cores added 89,000 souls; the transit suburbs grew by 70,000. The auto suburbs added 1.3 million people, with 380,000 more in suburban Toronto alone. “We’re a suburban nation,” says Prof. Gordon. “That trend is not soon going to change.”

Luckily, Canada has not seen the kind of “sorting” of its population that has made the political divide between U.S. suburbs (largely white, middle-class and Republican) and inner cities (ethnically and socio-economically diverse and overwhelmingly Democratic) so unbridgeable. In Canada, it’s in the suburbs where elections are the most competitive.

The reason, Prof. Gordon notes, is that our suburbs are far more diverse.

Though we have “ethnic enclaves” such as Brampton, Ont., and Surrey, B.C., they are neither exclusive nor cut off from the surrounding community or society. This helps explains why suburban politics is so fluid here.

“There’s hope in Canada; we’re not as dug in as the Americans on the blue-red thing,” Prof. Gordon says. “It’s possible for any centrist politician to craft a platform to win in the suburbs.”

We still need to make suburbs more environmentally sustainable – Prof. Gordon favours toll roads and an end to free parking. But smart-growth policy-makers who think they can nudge people back to the city will be disappointed. Never try to get between a family and its barbecue.

THE GLOBE AND MAIL. MAY 29, 2017. Face it, Canada—you’re a real estate addict, and no one wants a cure. Canada’s housing mania is a collective lunacy fuelled by debt and irrational hope

IAN MCGUGAN

Why, Canada! It’s great to see you, old friend. Here, take the comfortable seat by the window. You’re probably wondering why I’m here in your living room, so let me blurt it out. This is an intervention. And, yes, it’s about this housing habit of yours.

I know what you’re going to say: What’s so bad about a little mortgage debt? What’s wrong with just one more bidding war? Sure, sure. You’ve been playing this real estate game for a long time and it hasn’t killed you yet.

But that’s what every addict says. And you, my friend, are an addict: A middle-class junkie, to be sure, but still a fiend on fire for the buzz of cheap mortgages and the rush of rising home prices.

Canada, just look at yourself. Your home prices have surged to unprecedented heights and your debt levels have ballooned. The International Monetary Fund and others have warned of the dangerous rise in borrowing.

And here’s your dirty little secret: You’re enjoying the whole sick, crazy ride, aren’t you?

This is the scandal no one talks about. Officially, everyone is fretting that we may have a housing bubble. Politicians, bankers and regulators go all preacher-faced and proclaim their deep, deep concern.

But let’s be honest: No one really gives a damn, do they? And why should they? Now that a record 70% of Canadian families are homeowners, the vast majority of households crave even more insane prices. A politician who credibly promised to jolt the housing market back to reality and reduce prices by 20% would be slashed to shreds by mobs of hedge-clipper-wielding homeowners.

Our elected officials aren’t fools. While they devise half-hearted, largely cosmetic measures that might cool the madness by half a degree, the system goes on adding fuel to the frenzy.How, you ask? Tax laws shelter profits on the sales of principal residences. CMHC insures mortgages with meagre down payments. RRSP rules allow first-time homebuyers to tap their retirement savings, while governments proffer various other incentives to nudge newbies into the market.

Any nation serious about getting off its real estate high would demand an immediate end to this nonsense. It could start by introducing—perhaps in increments—a tax on the profits from a principal residence. It could demand far higher down payments, restrict people’s ability to pour savings into housing, and discourage first-timers from entering an already crazy market. In addition, it could encourage the building of high-quality rental accommodations.

But, Canada, you either don’t do these things or do them only in the most grudging, timid fashion. Fundamentally, that’s because you don’t want to take action. Let’s face the truth. You’re just a doper jonesing for your next hit of magically mushrooming real estate prices.

Instead of confronting the ad-diction, you try to pin the blame on foreigners. Really? It’s not foreigners who are propelling the lunacy in rust-belt towns like Windsor, Ontario, where prices soared 20% over the past year. It’s not foreigners who nearly doubled the debt load of Canadian households over the past generation, from 87% of our disposable income in 1990 to 167% now.

Oh, I know what you say, Canada. You always claim it’s just low interest rates, that’s all. You insist that with debt so cheap, it makes sense to borrow, especially for mortgages.

So let me be blunt: That’s junk math. This is not the 1980s any more. Rates are low today precisely because inflation has faded and economic growth is so lacklustre. In a low-growth environment like this, the real burden of debt tends to stick around because you can’t count on galloping inflation or bountiful pay increases to help ease the load. Paying down a mortgage is a long, painful process if you’re paying 3% but your salary is only inching ahead by 1% a year.

Piling on mortgage debt in today’s climate only makes sense if you believe someone will be willing to buy your property for an even greater price in the future. But how sure a bet is that? Despite what your real estate agent says, there’s scant evidence of any housing shortage. Canada’s population is growing a mere 1% a year, way below the levels of a few decades ago. Our working-age population is barely expanding at all. Rents have gone up nowhere near as much as home prices, a sign there is actually a fair amount of accommodation out there, even in supposedly packed cities.

Fundamentally, Canada’s real estate mania is a financial phenomenon. It’s a collective lunacy fuelled by households taking on more and more debt to bet on what they hope will be a profitable investment.

We’ve seen this story before—in Japan in the early 1990s, in the United States, Ireland and Spain several years later—and it doesn’t end well. In each case, big run-ups in real estate prices and mortgage debt gave way to devastating recessions, followed by painfully slow recoveries.

Even if you think Canada can escape that fate, there’s still the issue of fairness. Soaring real estate prices are really a transfer of wealth between generations. In many cities, boomers who paid three times their annual incomes for homes a generation ago are now selling them to millennials who are paying six times their incomes. The weight of that debt is going to suffocate young families for decades to come and drag on economic growth.

There’s no easy way out, my friend. But there are things we could do. As with any detox program, we have to start by admitting that we have a problem. Then we have to admit we have all the tools to solve the problem if only we choose to do so. Yes, I know, it’s going to hurt a little, but here’s one final truth: It will only get worse if we wait.

The Globe and Mail. Bloomberg News. May 29, 2017. How much gold would buy you a home in Toronto?

JEANETTE RODRIGUES

Toronto homes aren’t that expensive, if you pay in gold.

Douglas Porter, chief economist at the Bank of Montreal, mined data showing that when expressed in terms of gold, house prices in Canada’s red-hot real estate market are far from record highs. An average home in Toronto today costs just over 540 ounces of gold, well below the record 655 ounces in 2005, Porter found.

“The slightly more serious point is that gold is again close to a record high in Canadian dollar terms – and no one is calling the gold market a bubble,” Porter wrote in a May 26 note.

To be sure, sanity seems to be returning to Toronto’s property market. After a double whammy of government intervention and the near-collapse of mortgage lender Home Capital Group Inc., sellers are rushing to list their homes to avoid missing out on recent price gains.

Even so, strong population growth in Canada’s financial hub will probably support elevated home prices, Porter wrote. “As will low-low interest rates – while the Bank of Canada indicated this week it was now more inclined to hike than cut, the hikes still look very far down the road,” he said.

Not to mention that Rumpelstiltskin – the fairy tale figure who spun straw into gold – could still easily afford to buy into the market.

The Globe and Mail. Special. May 29, 2017. Toronto real estate prices entrepreneurs out of the market

JESSICA LEEDER

Given the choice between living in a tiny Toronto shoebox in the sky or a sprawling space in a small riverside town, Natasa and Cory de Villiers chose the option that made the most sense.

They moved into a 3,000-square-foot commercial building in Hespeler, a Southwestern Ontario town that is part of Cambridge.

“When we first moved here we had no idea where we were moving. We literally saw this really affordable building in a small town that was off the 401,” Ms. de Villiers said. “It was far cheaper than anything we could even think about moving into in Toronto. It just made more financial sense.”

The same kind of math led to Cassie McDaniel and Mark Staplehurst leaving Toronto for Paris, Ont. Although neither had ties to the town, as new parents who could work remotely, they felt its lure. “We came out here a few times and it just clicked. It’s beautiful. There’s no traffic. You don’t have to fight for a spot when you sit down for coffee,” Ms. McDaniel said. “… It just made sense for us and the kind of lifestyle we want.”

That lifestyle now includes booming businesses that neither had intentions of starting when they moved; people like them are transforming small-town business in a broad swath of towns that dot the Greater Golden Horseshoe – a stretch of Southwestern Ontario counties ringing the outer GTA from Niagara in the west to Northumberland in the east.

“There’s a whole cadre of people coming in. … They’re offering goods, services and opportunities that are unique for the area but may not be in downtown Toronto,” said Paul Emerson, chief administrative officer for the County of Brant, which includes Paris. “They can really capture a market here without the same type of competition that they would see in downtown Toronto.”

Paris has a population of about 12,000 people but is poised for fast growth: More than 3,000 new housing units are being built, Mr. Emerson said.. While real estate is still cheaper than in Toronto, the average price of homes sold in April reported by the Brantford Regional Real Estate Association, which includes Paris, was $418,636, up 25.9 per cent on a year-over-year basis. “It’s not the same small town now,” Mr. Emerson said. “People who may have located in bigger cities 10 years ago to start their business … are seeing the opportunities available in this area.”

When Ms. McDaniel, an Orlando native, and Mr. Staplehurst, raised in Luxembourg, moved to Paris, they both worked in Web design; Ms. McDaniel intended to telecommute to a city-based job. But one thing led to another and the couple’s own digital agency, Jane and Jury, was born. “We are just entrepreneurial and like having our own products,” Ms. McDaniel explained. Their clients are located all over the world, Paris, Ont., included.

“We draw from our experience in the city and the contacts we made there, but we have made a name for ourselves locally,” Ms. McDaniel said. “There’s no one else out here that really has the same skill set. That’s definitely a bonus. There’s enough competition to feel inspired, but not so much that it’s overwhelming or intimidating.”

In Galt, another town that is part of Cambridge, Graham and Monica Braun had a similar experience when moving from Montreal with their young family. Mr. Braun, an IT consultant, and Ms. Braun, who worked in the pharmaceutical industry, decided to see if they could transform Mr. Braun’s hobby of roasting coffee beans into a wholesale business aimed at retail coffee shops. When they opened Monigram in 2013, they had a small retail space so people could taste what they were buying. Then demand exploded.

“We were run off our feet on the retail side,” Mr. Braun said. “People were coming in and drinking cup after cup.” The couple reversed the course of their business and decided to focus on their coffee shop; the wholesale arm took another year to grab their focus.

“You just chase whatever is working,” Mr. Braun said. Four years later, the shop is still going strong. Had the couple settled in Toronto, though, it would never have been. “I’m not sure if we would have become entrepreneurs there,” Mr. Braun said. “We just feel plugged into the community here in a way that I don’t think we would in Toronto.”

Ms. de Villiers, a former college instructor who runs O & V Tasting Room, an olive oil tasting room and specialty food store in Hespeler, has the same sense. “The costs would be so high in Toronto that it wouldn’t be worth it,” she said. “Here, you make more of an impact. You open a business and your presence is felt – it’s a big change to a small community.”

The Globe and Mail. Special. May 29, 2017. Smaller banks worth a look after Home Capital woes sideswipe shares

DAVID BERMAN

The crisis at Home Capital Group Inc. has affected other Canadian lenders in at least one way: Some smaller banks are offering higher rates on deposits, which could weigh on the banks’ profits as they prepare to report their second-quarter results this week.

For investors who thrive on uncertainty, though, this Home Capital spectre offers a good reason to give some of the less obvious names in the financial sector a closer look than they might usually demand.

Laurentian Bank of Canada will report its results on Tuesday, followed by Canadian Western Bank on Thursday.

Both lenders have seen their share prices decline by double-digits since the end of April. Laurentian’s share price is down about 13 per cent, and Canadian Western’s is down nearly 15 per cent – making these two bank stocks stand out as relatively cheap next to the heftier valuations of the bigger financial institutions.

Blame Home Capital for the discounts.

The lender, which specializes in alternative mortgages to home buyers who don’t qualify for loans from major lenders, announced last month that it required a financial lifeline to offset fleeing deposits. Its share price plummeted 65 per cent on April 26, reflecting a crisis of confidence.

Concerns about Home Capital’s future have reverberated throughout Canada’s financial sector, weighing on the share price of any lender with a stake in the country’s housing market.

But the smaller, regional banks have been hit harder than the more diversified bigger banks, and any discussion about their second-quarter results this week should explain why: Home Capital’s liquidity crisis has raised questions about the funding costs for a number of other lenders, CWB in particular.

BLOOMBERG. 2017 M05 26. Ex-Home Capital Brokers Penalized in First Disclosed Crackdown

by Katia Dmitrieva

- Brokers part of review into 45 former Home Capital dealers

- Duggal, Mohammad are first broker names disclosed in probe

A Canadian regulator said it disciplined two mortgage brokers who funneled business to Home Capital Group Inc., marking the first disclosure of action taken against dealers who submitted fraudulent loan applications to the embattled mortgage lender.

The Financial Services Commission of Ontario conducted its own review into Home Capital in relation to the company severing ties in 2015 with 45 brokers who used falsified client income on applications. The agency found that broker Gagandeep Duggal and agent Zaheer Mohammad weren’t complying with the rules, according to a spokesman. Home Capital and the regulator hadn’t disclosed the names of any dealers sanctioned until now.

“FSCO takes allegations of fraud very seriously, and is committed to protecting consumers in the mortgage brokering sector,” spokesman Malon Edwards said in an email Thursday. He said that most of the brokers and agents that were part of its Home Capital review continue to be licensed. The level of proof is higher for a regulator to discipline a broker than for a company to cut ties with mortgage dealers, he said.

A Home Capital spokesman declined to comment. Duggal didn’t respond to messages left with his firm, Mortgage Alliance, or to a voicemail message left on a phone number associated with his name. John Gabriel, director of compliance at the brokerage, said he “had no knowledge" of Duggal being sanctioned by FSCO and that Duggal, who still works at the brokerage, was hired on Feb. 22, after the investigation took place. FSCO doesn’t provide the industry with historical employment of brokers, he said.

Broker Terminated

Mohammad was terminated from brokerage Mortgage Architects after FSCO released its findings last year, according to president Dong Lee. Management didn’t provide his contact details and he didn’t respond to a Linkedin message.

“We take fraud very seriously,” Lee said in an email. “At the conclusion of the investigation, FSCO found no fault of Mortgage Architects."

Home Capital’s stock has plunged by almost 60 percent and it lost more than C$3.5 billion ($2.6 billion) in deposits after the Ontario Securities Commission last month accused the bank of misleading investors about its probe of the 45 outside brokers. The cash crunch has forced the company to take out an emergency credit line with a pension fund, and concerns about contagion from the lender have contributed to a slowdown in Toronto’s housing market.

The shares jumped 2.9 percent to C$9.27 at 2:56 p.m. in Toronto.

The enforcement underscores the difficulty regulators face in keeping fraud out of the mortgage market, and prosecuting individuals who break regulations. Despite having one of the world’s hottest housing markets and C$1.45 trillion in mortgage debt, the system of rooting out industry fraud isn’t keeping up, experts say. Principal brokers -- those who’ve hired individuals to work at their brokerage -- have a responsibility to monitor broker and agent compliance, according to FSCO.

The Toronto-based regulator accused Mohammad of providing false employment and income documents to Home Capital six times between June and August 2014 for loans that the lender approved. He didn’t respond to FSCO’s allegations or report to court, and had his license revoked in May of last year. FSCO accused Duggal in November 2016 of providing false and deceptive information and fined him C$5,000, bypassing a court hearing. He remains on FSCO’s online mortgage database.

In Canada, the mortgage industry is overseen by each province, with the ministry of finance creating the regulation that FSCO enforces in Ontario. Companies have their own risk measures, maintaining an internal list of brokers who have submitted fudged applications, referring to them as “unlucky." According to Equifax, mortgage fraud jumped 52 percent last year from 2011, showing the issue may only be growing.

________________

INTEREST RATES

The Globe and Mail. May 28, 2017. Why the Bank of Canada needs to prepare Canadians for rate hikes

STEVE AMBLER AND JEREMY KRONICK, Columnists

We have been stuck in a low-interest period for almost a decade now, and with that apparent inertia comes the challenge of knowing when to start reversing course. Last Wednesday’s interest rate announcement and press release by the Bank of Canada were slightly more hawkish (or slightly less dovish) in tone than its previous announcement, but it gave no explicit hints that rate increases are on the immediate horizon. However, stronger economic data that support the bank’s own internal forecasts suggest they should be. At a minimum, communication with the public should start to prepare the market for such increases.

To understand why, let’s review the concept of the neutral rate of interest. In the world of central banking, the neutral rate of interest represents the policy rate consistent with output at its potential level and inflation equal to target. The Bank of Canada sets its interest rate to achieve such a well-functioning economy within a six-to-eight quarter horizon. Therefore, the current policy rate of 50 basis points represents the stimulus required to get us to potential, with inflation at target, over this time period. In last April’s Monetary Policy Report, the bank projected that output will return to potential by the first half of 2018, with headline inflation sustainably returning to its 2 per cent target.

So what’s the problem? The issue is the Bank of Canada’s estimate for the neutral rate of interest, which it believes sits between 2.5 and 3.5 per cent. If the bank expects output to hit potential and inflation to be at target some time in the first half of 2018, the policy rate would have to increase by some 200 basis points (from 50 to 250) in one year. In a world where 25-basis-point changes are the norm, that would require an increase at every Bank of Canada interest rate announcement between now and the middle of next year.

The private sector appears to give the neutral rate little concern. A recent Bloomberg News survey found that none of the 23 economists surveyed thought the bank would increase rates at Wednesday’s announcement. Furthermore, economists didn’t expect the next rate hike to occur until the second quarter of 2018, the same time frame the economy will supposedly return to potential.

What can the bank do? While it is not realistic to get to its estimate of the neutral rate over the next 12 months, the bank can start preparing the market for rate hikes in much the same way the Fed has done in the United States. Forward guidance has proven to be a useful tool for central banks around the world coming out of the financial crisis. The tool allows markets to adjust in advance of expected rate changes, creating a more stable environment for consumers and businesses.

Of course, all of this depends on a strong Canadian, and global, economy. So far in 2017 this has been the case, after a strong finish to 2016. The global economy appears in good shape, an improved labour market has stimulated consumer spending, business investment has gone up, and oil prices have rebounded – and although they have not returned to their previous highs, the economy has adjusted. Risks remain, including household debt levels, and inflation that has stayed stubbornly below 2 per cent – even if only mildly. But on balance, the strengths appear to outweigh the weaknesses.

If the bank believes its forecast of potential output and inflation, and believes its estimate of the neutral rate to be accurate, the time to prepare for rate hikes is now. If the bank foresees headwinds or risks that justify a policy rate substantially below the neutral rate, it would be best to continue highlighting what these are.

Steve Ambler is the David Dodge Chair in Monetary Policy, and Jeremy Kronick is a Senior Policy Analyst at the C.D. Howe Institute.

________________

ENERGY

Reuters. May 29, 2017. Oil flat in subdued trade, focus remains on supply surplus

LIBBY GEORGE

LONDON — Oil prices were flat on Monday but remained on an unstable footing as increases in U.S. drilling activity undercut an OPEC-led push to tighten supply.

Trading was subdued due to public holidays in China, the United States and Britain, but the market remains unsettled because of uncertainty over whether the impact of OPEC’s latest action to curb oversupply would be enough to support prices.

Brent crude futures were trading 5 cents higher at $52.20 per barrel at 1311 GMT. The contract ended the previous week down nearly 3 per cent.

U.S. West Texas Intermediate (WTI) crude futures were 4 cents higher at $49.84 per barrel.

The Organization of the Petroleum Exporting Countries and some non-OPEC producers pledged last week to extend production cuts of around 1.8 million barrels per day (bpd) until March 2018.

An initial agreement, in place since January, would have expired in June this year.

Commerzbank analyst Carsten Fritsch called Monday’s price moves little more than “intraday noise” but said hints of deeper cuts or a longer extension from OPEC left the market deflated after the final decision.

“They increased expectations to such an extent that nine months was a disappointment,” Fritsch said.

High compliance with the cuts so far was unlikely to last, he said, adding to worries about whether the pledge would dent physical oil stockpiles that remain near record levels.

“The pain for OPEC will increase to such a point that 100 per cent compliance is unrealistic,” Fritsch said.

Despite ongoing cuts, oil prices have not risen much beyond $50 per barrel.

OPEC’s success in drawing down inventories may hinge on output in the United States, which is not participating in the cuts. U.S. production has soared 10 per cent since mid-2016 to more than 9.3 million bpd, close to levels in major producers Russia and Saudi Arabia.

U.S. drillers have added rigs for 19 straight weeks, bringing the total 722, the highest number since April 2015 and the longest run of additions on record, according to energy services firm Baker Hughes Inc.

Almost all of the recent U.S. output increases have been onshore, from so-called shale oil fields.

Even if the rig count did not rise further, Goldman Sachs said it estimated U.S. output would increase by 785,000 bpd between the fourth quarter of 2016 and the fourth quarter of 2017 across the Permian, Eagle Ford, Bakken and Niobrara shale plays.

Analysts say that reducing bloated global stocks will be key to reining in oversupply.

“It’s going to be all about inventories and whether they fall as much as OPEC thinks,” said Greg McKenna, chief market strategist at futures brokerage AxiTrader.

The Globe and Mail. May 29, 2017. Trans Mountain pipeline faces fresh landowner complaints

JEFF LEWIS

CALGARY — A West Coast property developer says it will ruin plans for a new subdivision of million-dollar homes. The owner of a family ranching business in British Columbia’s Interior fears for his pure-bred cows. The operator of a luxury heli-ski lodge says construction will spoil a pristine wilderness.

These are among hundreds of fresh complaints facing Kinder Morgan Inc. as the Houston-based company plots a route for its $7.4-billion Trans Mountain pipeline expansion from Alberta to the Pacific coast.

The disputes, detailed in filings before the National Energy Board, add to a growing list of risks facing the project as the company prepares to launch a $1.75-billion share sale to help fund the massive expansion, which would nearly triple the system’s capacity to the tune of 890,000 barrels a day.

They show that apart from headline issues, such as global warming, marine safety and aboriginal treaty rights, the project has stoked numerous complaints tied to highly local concerns.

Prime Minister Justin Trudeau approved the contentious expansion last year, but the company is only now beginning to fine tune the pipeline route. It also faces renewed opposition in Victoria, where the anti-pipeline Green Party now holds the balance of power in a Liberal minority government.

“I don’t want to come across as saying I’m against the pipeline. I’m just against it going through the middle of our property and destroying our project,” said Dennis Wiemken, senior vice-president at Vesta Properties Ltd. in Langley, B.C.

A year ago, the developer paid roughly $16.5-million for a parcel of land in the Surrey, hoping to develop 41 single-family lots atop a plateau overlooking the Fraser River.

Mr. Wiemken estimates the lots’ worth is somewhere in the neighbourhood of $1-million apiece before improvements. But Kinder Morgan aims to build its pipeline directly through the planned subdivision, rather than a nearby highway corridor.

The company has requested a 2.64-acre right-of-way for the pipeline, plus 7.29 acres of workspace on Vesta lands, according to the developer.

That will make it impossible to build on 34 of the proposed lots, necessitating a redesign that “is likely to produce a drastically lower lot yield than the current proposal plus drastically reduces the market value and desirability of homes near the pipeline,” the company said in a complaint to the regulator.

The NEB has so far received 420 such statements of opposition, with more coming in daily. A portion of those will trigger hearings, scheduled for later this year.

Construction can only proceed on board-approved segments of the route, after either a settlement between the landowner and company or through a board decision after a hearing.

If no such agreement is reached, the regulator can ultimately issue a so-called “right-of-entry” order enabling the company to proceed.

A spokeswoman for the Trans Mountain project said the company would prefer to reach negotiated settlements with any holdouts. “But if there’s one or two, or a handful of them, there are mechanisms and they’ll be sorted out through the processes,” Ali Hounsell said by phone.

She could not say what portion of the pipeline is covered by landowner agreements, but noted that the company would proceed with the expansion at its terminal sites and on uncontested portions of the route as early as September.

It appears to have already made concessions. Near Valemount, B.C., Trans Mountain has discussed limiting construction to summer months, in part because heavy snowfall through the winter makes building untenable.

That followed a formal complaint from luxury ski-resort operator Intrawest ULC Inc., which had argued the work would “unreasonably interfere” with visitors at its nearby lodge, where a maximum of ten guests pay up to $260,000 for seven days of heli-skiing.

Elsewhere, opposition lingers. In B.C.’s verdant Interior, the pipeline expansion is poised to cut a four-kilometre path through 300 acres of irrigated pastureland that Kym Jim’s family has worked since 1919.

Mr. Jim, principal operator of Little Fort Herefords, said the route as proposed could disrupt an operation that breeds 180 cows every spring. Kinder Morgan, through its land agent, has agreed to mitigation measures, including providing alternative pasture and paying for feed.

But Mr. Jim frets about compensation and logistics. For one, he says good pastureland is difficult to find, and he worries about cattle wandering through open fences. Because it’s a pure-bred operation, the bulls must be kept separate from the rest of the herd.

“For them it’s no big deal if the cows get out one day. But it’s a pretty big deal for us to make that work,” he said. “So really their plans lack certainty on the details, and that’s a big concern that we have.”

BLOOMBERG. 2017 M05 29. OPEC Wins Hedge Funds Back With Jump in Oil Bets Before Deal

by Catherine Traywick

- Net-long position on WTI rose by most this year: CFTC

- U.S. supply drop will be key to sustaining the enthusiasm

- Hedge funds are giving OPEC some credit again.

Following four weeks of growing pessimism, bets on rising West Texas Intermediate prices jumped the most this year just as Saudi Arabia and Russia were mustering support for the deal they struck in Vienna last week, U.S. Commodity Futures Trading Commission data show.

What happens to U.S. stockpiles will be key to sustaining the enthusiasm, and the Saudis know that. In addition to prolonging a historical deal with allies, the kingdom plans to reduce exports to the world’s biggest consumer.

“With OPEC now consciously trying to reduce flows into North America, it’s suggesting a faster than expected inventory unwind,” Bart Melek, a commodity strategist at Toronto Dominion Bank, said by phone. “There may be a bigger upside as we go into summer driving season.”

U.S. inventories, one of the most watched indicators of the global supply glut, have remained above the five-year average that OPEC has sought to break as production from shale plays keeps rising. But they have fallen for seven straight weeks, and the decline is likely to continue as Americans take to the roads, boosting demand for fuel.

Markets were initially unimpressed by the May 25 deal between the Organization of Petroleum Exporting Countries and other top exporters to extend reduced output levels through March, without deeper cuts or any signals as to what happens later in 2018. Futures slumped 4.8 percent in New York before rebounding 2.1 percent Friday. WTI on Monday lost 0.3 percent to $49.65 a barrel as of 12:06 p.m. in Singapore.

"Ahead of the OPEC meeting there was a lot of optimism they would get a deal done, and potentially even a bigger cut," said Phil Flynn, senior market analyst at Chicago-based Price Futures Group.

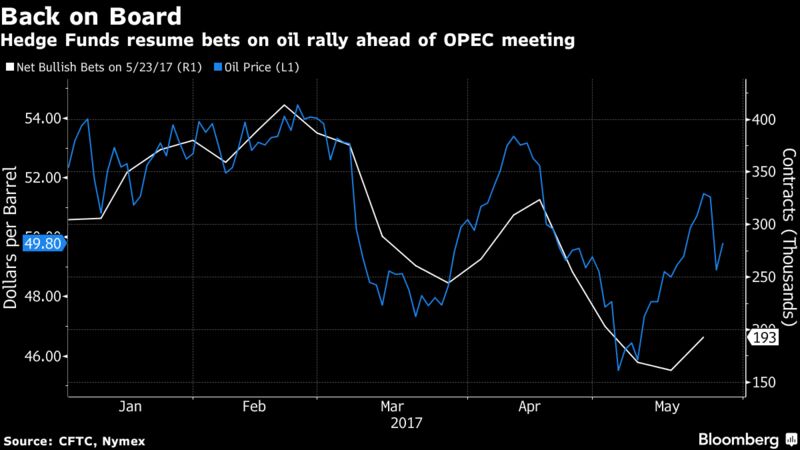

Hedge funds’ WTI net-long position -- the difference between bets on a price rise and wagers on a drop -- rose 20 percent in the week ended May 23, reaching 193,143 futures and options, according to the CFTC. The number had plunged 50 percent in the previous four weeks.

As for fuels, pessimism over gasoline prices eased for a second week, with the net-short position on the New York-traded benchmark shrinking 79 percent, following a 38 percent contraction a week earlier, the CFTC data showed. Diesel bets moved to a net-long position of 10,846 contracts, from 4,053 net shorts.

When the Energy Information Administration reports on June 1 if U.S. stockpiles shrank for another week, oil investors will have a chance to reassess if their frustration following the OPEC meeting was exaggerated.

“I still think this was a knee-jerk sell-off,” Melek said of the plunge in oil futures after the meeting. “In fact, things are better fundamentally than they were. Guess what? For the next three quarters we are going to get pretty robust deficits.”

________________

NAFTA AND SOFTWOOD LUMBER

The Globe and Mail. Special. May 26, 2017. Softwood lumber: The never-ending battle

GORDON RITCHIE

Gordon Ritchie is a former free-trade negotiator, special envoy for softwood lumber, and author of Wrestling with the Elephant: the Inside Story of the Canada-US Trade Wars.

In the iconic film, Groundhog Day, the hero is obliged to relive the day’s events over and over again. That also describes the softwood-lumber dispute between Canada and the United States.

The two most important points to understand about the latest round in this never-ending dispute are these. First, it was not triggered by U.S. President Donald Trump’s aggressive “America First” agenda. The dispute, in its current form, dates back to the early 1980s (some would say 1880s) and is now in its fifth iteration. Groundhog Day, indeed. Second, it truly has little to do with Canadian resource-management practices, although these have long been used as the pretext by U.S. industry protectionists and their agents in successive administrations and U.S. Congresses. Imports from Canada reduce lumber prices in the United States, to the benefit of American home buyers and builders, but at the expense of producers. It is worth billions of dollars to these producers to be able to raise prices without fear of being undercut by more efficient producers from the north. And a small fraction of those billions is enough to buy the highest-priced lawyers, lobbyists and legislators.

My first encounter with this file was almost by accident. In the early days of the Canada-U.S. free-trade negotiations, my colleague, Simon Reisman, and I were summoned to meet with Commerce Secretary Mac Baldridge, highly regarded for his integrity. Mr. Baldridge was fully aware the U.S. industry had claimed it was being injured by subsidized imports from Canada (Lumber I) and that his department, in 1983, had thrown out the case as unfounded. This was obviously not the politically correct answer. Mr. Baldridge asked us to take home the message that, irrespective of the facts, he had no choice but to rule against the Canadian imports to avoid a vicious backlash from a Congress that might impose its own restrictions and, in the process, blow up the trade negotiations.

Rightly or wrongly, Ottawa, over the bitter opposition of its own industry, felt it had no choice but to agree to impose a 15-per-cent export duty on lumber shipments to the United States, thereby keeping the funds in Canada. This was nicknamed Lumber II.

To further accommodate the Americans, the biggest producer, British Columbia, proceeded to raise the timber price it charged to its producers to the point where the United States determined there was no subsidy remaining and exempted those shipments from the export tax. Nonetheless, it insisted on retaining the right to advance approval or veto of any further policy changes by the provincial government, an intrusion on sovereignty that infuriated British Columbians. The province and the B.C. industry led the charge, soon joined by the other major producers, to terminate the agreement on the grounds there was no longer, if there ever was, any basis for these onerous restrictions. When the agreement ended, the groundhog reared its head yet again (Lumber III). The same Commerce Department that had just found there was no subsidy now found that Canadian lumber was subsidized to the tune of 14.5 per cent. The Canadian industry engaged me to advise it in handling this case.

The Canadians used the newly established machinery of the free-trade agreement to arbitrate the dispute, and the panel ruled in Canada’s favour and tossed out the case. After further machinations, the Americans agreed to drop the pretexts and settled for an arrangement to limit imports from Canada to just less than 35 million cubic metres per annum – enough, they believed, to keep U.S. prices up. When that deal expired in 2001, it proved impossible to agree on a replacement. The groundhog soon re-emerged, as Commerce quickly translated the U.S. industry’s claims into new penalty duties, doubling up to just less than 30 per cent. Again, various dispute-settlement panels were convened and ruled yet again that U.S. actions were unfounded. This time, in a new twist, the United States simply refused to comply and announced it was keeping the $5.3-billion (U.S.) it had illegally collected.

At that point, Ottawa asked former top public servant Paul Tellier and me to see what we could do to work something out. Focusing on the real U.S. demands to limit Canada’s share of the U.S. lumber market, we were able to establish the basis of a deal but, in the crunch, the Paul Martin government was not prepared to swallow such a one-sided agreement. Subsequently, Stephen Harper took power and, in 2006, implemented a similar arrangement. It gave the Canadians back most of the duties illegally collected but left the Americans with more than $1-billion in ill-gotten gains. It then imposed a sliding scale of duties rising toward 15 per cent as prices fell in the United States.

In economic terms, this agreement (Lumber IV) was an abomination, rewarding U.S. producers with a licence to gouge home buyers and builders. But from the Canadian perspective, it kept lumber producers in business and provided economic and political stability for 10 profitable years. When the agreement expired in 2015, the U.S. industry balked at its renewal. Following a pre-agreed one-year moratorium on trade actions, they took their case back to their friends at Commerce. It fell to the new Commerce Secretary, Wilbur Ross, to announce the imposition of roughly 20-per-cent duties on most imports from Canada.

When an irate B.C. Premier Christy Clark threatened to retaliate, Mr. Ross complained that this would be inappropriate. He had simply been applying U.S. trade laws. That is, according to the battle-hardened staff at the Commerce Department as repudiated by every independent panel of arbitration over the past 20 years.

BLOOMBERG. 2017 M05 29. Trudeau Tiptoes Toward Trump Trade Talks as Nafta Clock Ticks

by Josh Wingrove

- Leaders discuss steel, aluminum, lumber, aerospace at G-7

- Canadian prime minister says he won’t ‘lecture’ Trump on trade

Justin Trudeau really didn’t want to talk about Donald Trump. After three days together at a pair of meetings in Europe, Trudeau spent a press conference bobbing, weaving and ducking questions from reporters about his U.S. counterpart.

The barrage of media queries came as the 43rd Group of Seven summit in Sicily ended with the U.S. president as an outlier. The final meeting communique had all leaders except Trump back the Paris climate accord and added new caveats aimed at appeasing the U.S. -- thanks in part to diplomacy and deft editing by Canada.

But while Germany’s Angela Merkel and Emmanuel Macron of France showed signs of frustration with the U.S. and Trump, Trudeau put on a happy face. He’s intent on playing peacemaker while confronting a growing list of disputes with his top trade partner in areas such as lumber, dairy and aerospace. And, given the dependence that Canada has on trade with its southern neighbor, he has a lot to lose.

“I’m not going to lecture another country on what they should do, nor will I have my position determined by anyone outside of Canada,” Trudeau said when asked about Trump at a press conference Saturday in the seaside town of Taormina, Italy. “We share a very similar approach on a broad range of issues.”

Trump officially set the table for new talks on the North American Free Trade Agreement when he notified Congress on May 18 that he intends to start renegotiating the 23-year-old deal binding the U.S., Canada and Mexico in 90 days. Foreign Affairs Minister Chrystia Freeland joined Trudeau at the G-7 and said Canada would be focused on finding “common ground” with the U.S. on trade.

Lumber Dispute

In a 30-minute bilateral meeting on Saturday, Trump and Trudeau discussed trade but not Nafta specifically, said a Canadian government official speaking on the condition of anonymity to discuss private deliberations. The Congressional notice period prevents Trump from discussing Nafta with Canadian and Mexico officials.

Instead, the pair talked about softwood lumber, steel, aluminum and aerospace. In the latter case, Trudeau’s government is threatening to back out of a planned purchase of Boeing Co. fighter jets because of a trade case pending against Canada’s Bombardier Inc.

Trump said in a Twitter post on Saturday, not long after meeting with Trudeau, that he’d “take major action if necessary” as his Commerce Department reviews whether steel and aluminum imports threaten national security.

Through it all, Trudeau espoused a positive view of Trump.

“We know that creating growth through trade in ways that benefits all our citizens is a priority we share,” Trudeau told reporters. “The approach that we need to strike fair, free, open, balanced trade is something we all share around the table.”

‘Fight Protectionism’

While the summit face-time yielded little on Nafta, it underscored Trump’s position -- and hinted at a change. The U.S. initially bristled at the inclusion of a pledge to oppose protectionism in the G-7’s joint release. Ultimately, though, the communique had leaders committing to “keep our markets open and to fight protectionism, while standing firm against all unfair trade practices.”

Reflecting Trump’s view of the U.S. as the loser in many trade deals, it also noted that “trade has not always worked to the benefit of everyone.”

The path forward for Trudeau is risky because no G-20 country does a larger share of its trade with the U.S. than Canada. Trudeau is weighing restrictions on shipments of American coal through Canadian ports in response to U.S. tariffs placed on its lumber. Canada has also pledged to fight the lumber duties -- imposed as part of a long-running dispute -- in court.

The lumber spat is shaping up to take years, and Nafta talks could stretch into 2018, when they could be snagged by U.S. midterm elections and Mexico’s presidential vote. With Europe frustrated by Trump and lengthy battles shaping up, Trudeau is sticking with a pair of mantras: Freeland’s hunt for “common ground,” which was also the title of Trudeau’s 2015 autobiography, and “sunny ways,” the 45-year-old leader’s quasi-slogan of optimism from his winning campaign that year.

“There’s always opportunities to do more on trade, always opportunities to improve trade deals,” Trudeau said on Saturday. “And that’s very much what we’re focused on.”

________________

LGCJ.: