CANADA ECONOMICS

STATISTICS

StatCan. 2017-05-30. Canada's balance of international payments, first quarter 2017

Current account balance

-$14.1 billion, First quarter 2017

Source(s): CANSIM table 376-0105.

Canada's current account deficit (on a seasonally adjusted basis) widened by $2.3 billion in the first quarter to $14.1 billion, as the goods balance moved from a surplus to a deficit.

In the financial account (unadjusted for seasonal variation), large foreign investment in Canadian corporate securities led the net inflow of funds into the economy.

Current account

The goods balance posts a deficit following a modest surplus

The balance on international trade in goods posted a $1.8 billion deficit in the first quarter, following a $0.1 billion surplus in the previous quarter.

Chart 1 Chart 1: Current account balances

Current account balances

On a geographical basis, the goods deficit with non-US countries was up $2.3 billion, mainly reflecting higher deficits with Brazil, Netherlands, Germany and Hong Kong. Meanwhile, the surplus with the United States, led by stronger exports of energy products, increased $0.5 billion in the first quarter.

Total exports of goods rose $2.2 billion to $138.5 billion in the first quarter. Energy products, led by crude petroleum, were the major contributor, with exports up $2.5 billion as prices reached their highest level since the end of 2014.

Total imports of goods were up $4.0 billion to $140.3 billion in the first quarter, as both energy products and motor vehicles and parts had increases of over $1 billion.

Chart 2 Chart 2: Goods balances by geographic area

Goods balances by geographic area

Trade in services deficit grows

The overall deficit on international trade in services rose $0.3 billion in the first quarter to $5.7 billion as the commercial services surplus went down.

In the first quarter, imports of commercial services edged up $0.2 billion while exports were unchanged. The deficit on transport services increased slightly, reflecting higher payments of water transport. Travel deficit also marginally increased to reach $3.7 billion, as higher receipts from US travellers were more than offset by larger payments by Canadian travellers visiting the United States.

Deficit on investment income up slightly

The investment income deficit, the difference between incomes generated on Canada's international assets and liabilities, edged up $0.2 billion to $5.4 billion in the first quarter.

Higher interest paid on foreign currency deposits held by non-residents in Canada contributed to the increase in the investment income deficit for the quarter.

Profits earned by Canadian direct investors on their assets abroad were up $0.3 billion despite lower dividend receipts. This increase was moderated by lower interest receipts on inter-company debt claims. On the payment side, profits earned by foreign direct investors on their Canadian assets were unchanged.

Financial account

Foreign investment in Canadian securities reaches a record high

Foreign investors increased their holdings of Canadian securities through a record high investment of $60.7 billion in the first quarter, following acquisitions of $33.5 billion in the previous quarter. The investment activity was largely in Canadian corporate securities, as foreign investors reduced their exposure to government securities in the quarter.

Chart 3 Chart 3: Foreign investment in Canadian securities

Foreign investment in Canadian securities

Foreign acquisitions of Canadian equities reached $38.2 billion in the first quarter, the largest investment ever recorded. Issuances of new Canadian shares to non-resident portfolio investors resulting from cross-border mergers and acquisitions led the investment activity.

Foreign investment in Canadian bonds amounted to $26.4 billion, led by acquisitions of corporate bonds. The largest foreign divestment in federal government bonds in more than 13 years moderated the overall inflows in the quarter. At the same time, non-resident investors withdrew $3.9 billion of funds from the Canadian money market. The decline was mainly in provincial government paper and, to a lesser extent, federal government paper. Canadian long-term interest rates were down by 14 basis points in the quarter after a large increase in the fourth quarter.

Canadian investment in foreign securities increases significantly

Canadian investors acquired $31.9 billion of foreign securities in the first quarter, up significantly from a $0.7 billion investment in the previous quarter. The activity in the quarter was led by large purchases of US instruments, moderated by sales of non-US foreign securities.

Canadian investors increased their holdings of foreign shares by a record $26.2 billion. This activity reflected acquisitions of $28.8 billion of US shares in the quarter, mainly in March. Investors also added foreign debt securities to their portfolios, largely in the form of US government instruments.

Chart 4 Chart 4: Canadian investment in foreign securities

Canadian investment in foreign securities

Direct investment abroad hits a record

Direct investment abroad totalled $49.3 billion in the first quarter, the highest value on record. The investment was entirely in the form of equity instruments, with over three-quarters resulting from merger and acquisition activities in the United States. On a sector basis, the bulk of the investment in the quarter was in the trade and transportation industry.

Direct investment in Canada slowed to $8.7 billion in the first quarter, continuing low levels of investment recorded since the fourth quarter of 2015. Equity investment made by foreign parents in Canadian affiliates accounted for all of the investment, as there was a reduction in debt liabilities of Canadian affiliates to their foreign parents. More than half the direct investment in Canada was in the form of reinvested earnings.

Chart 5 Chart 5: Foreign direct investment

Foreign direct investment

Other investment generates a net inflow of funds

The other investment category of the financial account generated a net inflow of $26.4 billion in the first quarter. A reduction in currency and deposits held abroad by Canadians led the activity.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170530/dq170530a-eng.pdf

StatCan. 2017-05-30. Industrial product and raw materials price indexes, April 2017

Industrial Product Price Index

April 2017, 0.6% increase

(monthly change)

Industrial Product Price Index, excluding energy and petroleum products

April 2017, 0.3% increase

(monthly change)

Raw Materials Price Index

April 2017, 1.6% increase

(monthly change)

Raw Materials Price Index, excluding crude energy products

April 2017, -0.1% decrease

(monthly change)

Source(s): CANSIM table 330-0008.

The Industrial Product Price Index (IPPI) rose 0.6% in April, mainly due to higher prices for energy and petroleum products. The Raw Materials Price Index (RMPI) increased 1.6%, mainly as a result of higher prices for crude energy products.

Chart 1 Chart 1: Prices for industrial goods increase

Prices for industrial goods increase

Industrial Product Price Index, monthly change

The IPPI rose for the eighth consecutive month, up 0.6% in April following a 0.8% increase in March. Of the 21 major commodity groups, 14 were up, 3 were down and 4 were unchanged.

The growth in the IPPI was mostly attributable to higher prices for energy and petroleum products (+2.9%). The gain in this commodity group was mainly due to higher prices for motor gasoline (+5.8%), which posted its largest increase since December 2016. Higher prices for light fuel oil (+2.4%), lubricants and other petroleum refinery products (+1.9%), and asphalt (except natural) and asphalt products (+2.3%) also contributed to the increase, but to a lesser extent. The IPPI excluding energy and petroleum products rose 0.3%.

Primary non-ferrous metal products (+1.6%) also contributed to the increase in the IPPI. Higher prices for unwrought precious metals and precious metal alloys (+2.9%), specifically unwrought gold and gold alloys (+3.8%) and unwrought silver and silver alloys (+4.1%), drove the increase in this commodity group. Higher prices for other unwrought non-ferrous metals and non-ferrous metal alloys (+1.4%), basic and semi-finished products of aluminum and aluminum alloys (+2.5%), and unwrought aluminum and aluminum alloys (+0.9%) also contributed to the increase in primary non-ferrous metal products.

Prices for motorized and recreational vehicles (+0.2%) rose for a second consecutive month, mainly due to higher prices for passenger cars and light trucks (+0.3%), motor vehicle engines and motor vehicle parts (+0.3%) and aircraft (+0.4%). Higher prices for motorized and recreational vehicles were closely linked to the depreciation of the Canadian dollar relative to the US dollar.

Pulp and paper products rose for a fourth consecutive month, up 0.9% in April mainly due to higher prices for wood pulp (+1.8%).

The increase in the IPPI was primarily moderated by lower prices for chemicals and chemical products (-0.3%), which posted their first monthly decrease since August 2016. Lower prices for petrochemicals (-1.5%) and other basic inorganic chemicals (-1.0%) were the main contributors to the decline.

Some IPPI prices are reported in US dollars and converted to Canadian dollars using the average monthly exchange rate. Consequently, any change in the value of the Canadian dollar relative to the US dollar will affect the level of the index. From March to April, the Canadian dollar fell 0.4% relative to the US dollar. If the exchange rate had remained constant, the IPPI would have increased 0.5% rather than rising 0.6%.

Industrial Product Price Index, 12-month change

The IPPI rose 6.3% over the 12-month period ending in April, after increasing 5.1% in March. This was the largest year-over-year increase since October 2011.

Compared with April 2016, the increase in the IPPI was largely due to higher prices for energy and petroleum products (+20.8%), which posted a fifth consecutive year-over-year increase. The increase in this commodity group was mainly attributable to higher prices for motor gasoline (+15.5%), light fuel oil (+31.6%), diesel fuel (+24.5%) and, to a lesser extent, heavy fuel oil (+45.5%).

Primary non-ferrous metal products (+15.9%) also contributed significantly to the year-over-year increase in the IPPI. Prices for other unwrought non-ferrous metal and non-ferrous metal alloys (+39.3%), unwrought precious metals and precious metal alloys (+9.3%), unwrought aluminum and aluminum alloys (+24.0%) and unwrought copper and copper alloys (+23.9%) were the main contributors to the year-over-year increase in the primary non-ferrous metal products group.

Higher prices for motorized and recreational vehicles (+3.3%) and chemicals and chemical products (+7.5%) also contributed to the year-over-year increase in the IPPI. The increase in motorized and recreational vehicles was mainly due to higher prices for passenger cars and light trucks (+3.4%), motor vehicle engines and motor vehicle parts (+3.2%) and aircraft (+5.8%).

Prices for petrochemicals (+30.8%) and, to a lesser extent, plastic resins (+5.8%), ammonia and chemical fertilizers (+7.9%) and chemical products, not elsewhere classified (+6.0%) were largely responsible for the gain in the chemicals and chemical products group.

Telling Canada's story in numbers; #ByTheNumbers

After the introduction of the ISPI in 1956, prices received by Canadian manufacturers remained relatively stable for more than a decade. However, the growth rate of prices increased in 1972, led by gold and gold alloys for resale. From January 1972 to October 1980, while prices received by Canadian manufacturers increased 150%, the price of gold increased 1,486% to reach a record high. After the United States broke the link between the US dollar and gold in 1971, investors drove up the price of gold to a historic high of $850/ounce in 1980 during a period of high inflation, high oil prices and geopolitical instability.

Chart 2 Chart 2: Industry selling price indexes

Industry selling price indexes

Raw Materials Price Index, monthly change

The RMPI rose 1.6% in April following a 1.7% decline the previous month. Of the six major commodity groups, three were up and three were down.

Chart 3 Chart 3: Prices for raw materials increase

Prices for raw materials increase

The increase in the RMPI was primarily due to higher prices for crude energy products (+3.9%), particularly conventional crude oil (+4.2%). The RMPI excluding crude energy products edged down 0.1%.

To a lesser extent, prices for metal ores, concentrates and scrap (+1.3%), up for a fourth consecutive month, also contributed to the increase in the RMPI in April.

The growth in the RMPI was primarily moderated by lower prices for animals and animal products (-1.5%), specifically hogs (-11.3%).

Prices for the logs, pulpwood, natural rubber and other forestry products group (-2.0%), particularly natural rubber (-10.4%), also decreased compared with March.

Raw Materials Price Index, 12-month change

The RMPI rose 17.7% in the 12-month period ending in April, following a 16.7% increase in March.

Compared with April 2016, the increase in the RMPI was largely due to higher prices for crude energy products (+34.2%), mainly conventional crude oil (+36.0%). The RMPI excluding crude energy products rose 7.6%.

Prices for metal ores, concentrates and scrap (+17.8%) were also up compared with April 2016, following a 15.0% increase in March. This was the largest year-over-year increase for this group since July 2011.

To a lesser extent, animals and animal products (+3.0%) also contributed to the gain in the RMPI, mainly due to higher prices for fish, crustaceans, shellfish and other fishery products (+19.3%), cattle and calves (+3.5%) and unprocessed fluid milk (+2.8%).

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170530/dq170530b-eng.pdf

REUTERS. May 30, 2017. Canada producer prices up for eighth consecutive month in April

OTTAWA (Reuters) - Canadian producer prices rose for the eighth month in a row in April due to higher costs for energy and petroleum products, data from Statistics Canada showed on Tuesday.

Prices were up 0.6 percent, with prices higher in 14 out of the 21 major commodity groups. Compared to a year ago, prices were up 6.3 percent, the largest annual increase since October 2011.

Prices for energy and petroleum products rose 2.9 percent in April on a monthly basis, led by a 5.8 percent jump in gasoline, the highest increase in four months.

Raw materials prices rose 1.6 percent, reversing the previous month's decline as crude energy products rose, particularly conventional crude oil.

(Reporting by Leah Schnurr; Editing by Nick Zieminski)

StatCan. 2017-05-30. Poultry and egg statistics, March 2017 and annual 2016

Egg production rose 3.1% from March 2016 to 63.6 million dozen in March 2017.

In April 2017, placements of hatchery chicks on farms increased 1.2% compared with April 2016, to 64.1 million birds.

Stocks of frozen poultry meat in cold storage decreased 11.3% from May 1, 2016 to 78 244 tonnes on May 1, 2017.

Annual

Egg production totalled 747.7 million dozen in 2016, up 7.2% from 2015. The value of egg sales increased 7.1% to $1.3 billion.

Canadian farmers produced 1.4 million tonnes of poultry meat in 2016. Chicken, including stewing hens, accounted for 86.5% of all poultry meat produced. Turkey production was 183 370 tonnes in 2016, up 6.8% from the previous year. Sales of poultry meat, including turkey, increased 2.7% to $2.9 billion.

FULL DOCUMENT: http://www.statcan.gc.ca/daily-quotidien/170530/dq170530d-eng.pdf

Global Affairs Canada. Speech. Assolombarda Headquarters. May 29, 2017 - Milan, Italy. Address by Minister Champagne at a Plenary Session on the Comprehensive Economic and Trade Agreement (CETA) Between Canada and the European Union

Thank you for those kind words of introduction.

Good morning, friends and colleagues, ladies and gentlemen.

I’d like to begin by acknowledging the presence of fellow parliamentarians, la Délégation du Québec en Italie, as well as representatives of the three Italian Chambers of Commerce in Canada, located in Vancouver, Toronto and Montréal.

Let me also welcome and extend my sincere appreciation to all my fellow Canadians and our Italian friends who are attending today’s plenary session.

I want to take this opportunity to thank Gianfelice and his team at Assolombarda for welcoming us and bringing everyone together here today.

I’m delighted to be part of this historic Team Canada trade mission to Italy with some of our country’s leading companies in the aerospace and defence, agriculture and agri-food, and information and communications technology sectors.

My visit here this week feels a lot like coming home.

As some of you may know, I lived and worked in Genoa for four years before entering politics in Canada.

So this country and its people will always hold a special place in my heart.

Now, I’m thrilled to return to Italy in a new capacity as Canada’s Minister of International Trade.

Milan is Italy’s business capital and one of the world’s major financial centres.

So it’s fitting that we are kicking off our trade mission here.

Tomorrow, the Canadian business delegation and I will be fortunate to join Prime Minister Justin Trudeau in Rome.

I look forward to attending our Prime Minister’s historic speech at the Italian Parliament tomorrow morning – a true honour for Canada that speaks to the enduring strength of our close ties.

Canada and Italy have a lot in common.

The people-to-people ties between Canada and Italy are some of the strongest in the world, with nearly 1.5 million people of an Italian heritage now living in Canada – more than 300,000 of them in my home province of Quebec.

Many Canadians also call Italy home.

These are the ties on which a remarkable partnership started and remains the principal reason for its continued success.

Both of our countries are trading nations, and our prosperity depends on our ability to trade with the world.

More trade and more investments mean more growth for our companies, our economies and the well-paying jobs we are determined to generate for our people.

That’s why Canada is so committed to pursuing free, open and progressive trade.

And it’s why we are so proud of the gold-standard trade agreement we so carefully crafted with our European partners.

By starting our trade negotiations for CETA where our relationship started, our people, governments created a new and progressive agreement that puts them first.

CETA is about making people’s lives better.

CETA is a comprehensive blueprint for responsible economic cooperation between countries and will ensure the future prosperity of Italians and Canadians alike.

We may not have realized when we started but its culmination and application (very soon!) now comes at a time of growing recognition around the world that when it comes to international trade, business as usual is no longer an option.

This is the right deal at the right time.

Many people, especially those working hard to join the middle class, feel that trade and globalization have not worked for them.

They feel that their interests have been ignored by corporations and politicians.

Some political leaders have chosen to respond to public anxiety by pursuing protectionist policies.

This has never been the right solution, and today is no exception.

The status quo is also not option.

We need to think differently about how we pursue trade.

CETA is a manifestation of a new approach – one that not only benefits all segments of society, but secures their support for the trade deals we need and addresses the genuine anxiety people feel by putting people first.

Those are the guiding principles behind Canada’s progressive trade agenda.

Canada’s commercial relations with Italy are already strong, with two-way merchandise trade reaching almost $10 billion (€6.7 billion) last year.

Foreign direct investment between Canada and Italy, meanwhile, was valued at $2.8 billion (almost €2 billion) at the end of 2016.

With the application of CETA fast approaching, our commercial ties are poised to grow even stronger.

This mission is about capitalizing on the enormous and remarkable opportunity that CETA brings for our producers, workers and their families on both sides of the Atlantic.

CETA will guarantee duty-free access for almost all originating goods traded between Canada and the EU.

Tariffs will be eliminated on almost everything that Italy exports to Canada.

Currently, Canadian tariffs on motor vehicle and parts, machinery and engineering equipment, furniture and clothing and footwear – to name a few – range from eight to 18 percent.

CETA will drop those tariffs down to zero. A NIENTE!

The same is true for thousands of other popular Italian imports in Canada.

The elimination of tariffs will benefit exporters, importers, and, ultimately, consumers in both our countries, who will enjoy more choice and lower costs for a variety of products.

CETA will also make it possible for 41 Italian products – including Prosciutto di Parma and San Daniele – to be marketed in Canada with their proper trade names.

That’s a first, and it’s largely thanks to the comprehensive nature of CETA.

CETA will also open up significant opportunities in the Canadian government procurement market, which is estimated to be worth up to €119 billion.

When CETA is provisionally applied, EU suppliers will be able to compete for government contracts and provide goods and services at all levels of government in Canada: federal, provincial and municipal.

Canadian companies will likewise benefit from new opportunities to win government contracts in the EU procurement market – one of the largest in the world.

The recently signed memorandum of understanding between Consip and its Canadian partner is a great example of cooperation on government procurement made possible by CETA.

As a modern and ambitious agreement, CETA also clearly recognizes the increasingly important role that services play in our economies.

The services sector is responsible for the majority of economic activity in both Canada and the EU – over 70 percent in both cases.

With CETA, service suppliers will enjoy vastly improved access to each other’s markets.

Crucially for the Italian economy, many of those who will reap the rewards will be smaller Italian businesses providing services in engineering, architecture, and machinery and equipment repair.

CETA will also make it easier for company staff and other professionals to work on both sides of the Atlantic, and for firms to move staff temporarily between Italy and Canada.

By putting predictable investment rules in place and guaranteeing access to the Canadian market, CETA will also help enhance two-way investment flows.

While other nations are choosing to close their borders and look inward, Canada stands out as a beacon of stability, predictability, inclusiveness and diversity.

And that’s a big part of what makes Canada such an attractive place to invest.

We’re also proud of the numbers: our business taxes and overall business costs are the lowest in the G7. Our banking system is second-to-none, the best availability of skilled labour in the G20 and we offer unparalleled access to global markets.

In fact, businesses operating in Canada already benefit from preferential access to a North American market of more than 480 million consumers.

In total, once CETA is added to the mix, Canada will have free trade access to more than 40 countries with nearly 1.2 billion of the world’s wealthiest consumers.

This will put Canada right at the centre of a network of free trade agreements connecting the Americas, Asia and Europe – making Canada truly the Atlantic and Pacific trading nation we have always been.

Today’s event is a great opportunity for our Italian friends to find out what Canada brings to the table and explore potential new business partnerships thanks to CETA.

So I encourage you to make the most of the valuable networking opportunities available to you today.

Reach out to our Trade Commissioner Service if you need any advice on investing in Canada or opportunities in the Italian market.

Canada’s Chief Trade Commissioner, Ailish Campbell, and our Senior Trade Commissioner in Italy are both with us here today.

Canada is grateful to Italy, and to its business leaders, for being such strong supporters of CETA from the very beginning.

I look forward to your continued support and advocacy of CETA for early ratification in the Italian Parliament.

As a progressive agreement, CETA shows the world that with great ambition and the will to get things done, progressive trade deals are possible.

That’s something we can all be proud of.

CETA is poised to do great things for our countries and our people. Now, let’s get to work! Andiamo al Lavoro!

Thank you. Merci. Grazie.

FULL DOCUMENT: https://www.canada.ca/en/global-affairs/news/2017/05/address_by_ministerchampagneataplenarysessiononthecomprehensivee.html

BLOOMBERG. 2017 M05 30. Canada-EU Trade Deal Is a Model in Automation Era, Trudeau Says

by Josh Wingrove

- Trudeau says leaders who seek to hide from changes ‘are wrong’

- Canada trade minister says CETA impact needs to be tangible

- Trudeau Treads Carefully With Trump as Nafta Clock Ticks

The Canada-EU trade agreement is "a blueprint for future ambitious trade deals’’ in an age of automation where job security is threatened, Prime Minister Justin Trudeau says.

Trudeau, in a speech to lawmakers and business figures in Rome, lauded the pact as a model in an era of protectionism. The speech comes as Trudeau faces a lengthy trade battle with Donald Trump over lumber, airplanes, steel, aluminum and the North American Free Trade Agreement.

"Leaders who think we can hide from these changes or turn back the clock are wrong," he said Tuesday in the ornate Sala della Regina room at the Chamber of Deputies in Rome. "The pace of change has never been so fast, and yet it’ll never be this slow again."

The trade deal, known as CETA, has what Trudeau called "unprecedented” provisions on labor protection, responsible investment, food and consumer safety, management of natural resources and environmental stewardship.

Trudeau was joined at the speech by his trade minister as Canada pushes European Union member states to ratify the trade deal as quickly as possible.

“We need to make CETA real for people,” Canada Trade Minister Francois-Philippe Champagne told reporters after the Trudeau speech. “The best way to convince those who may not be convinced is to show them the benefits” such as 9,000 tariff lines set to drop to zero when the deal is provisionally enacted, expected early this summer.

’Twin Forces’

The deal comes as automation makes traditional stable jobs more difficult to find as the "twin forces" of technology and globalization remake the world, Trudeau said. "There are those in Canada and here in Italy who feel uncertain and anxious about what the world holds," he said.

CETA will soon be considered by the Italian senate, Italian Senate President Pietro Grasso said in introducing Trudeau.

Trudeau lauded Italy for recognizing same-sex civil unions and pushed for greater numbers of women to be elected as lawmakers or appointed to corporate boards, calling Canada’s current ratio of female Members of Parliament "not acceptable."

________________

HOUSING BUBBLE

The Globe and Mail. May 30, 2017. Housing bubble, mortgage trouble: Chill, Canada isn't 2006 America

MICHAEL BABAD

Briefing highlights

- Canada not 2006 America: National Bank

- Scotiabank boosts profit, announces buyback

- Amazon stock tops $1,000

- Current account deficit swells

- Markets at a glance

- Trans Mountain to proceed, Trudeau says

- Kinder Morgan Canadian unit opens below IPO price

‘A far cry’

Yes, debt among Canadian households is at record levels. Yes, Vancouver home prices are inflated, while Toronto is in bubble territory. Yes, there’s trouble at Home Capital Group Inc. And, yes, Moody’s has downgraded Canada’s banks.

But relax, says National Bank of Canada, we’re still a “far cry” from where the U. S. was in the runup to the financial crisis.

“Underwriting standards for mortgage debt in Canada have become an issue for many investors following the troubles of an alternative-mortgage lender at a time when home price inflation in Ontario is ahead of fundamentals,” said Stéfane Marion, though he didn’t name Home Capital.

“Fortunately, the Ontario government has recently stepped in with a number of measures to cool its housing market,” Mr. Marion added, referring to a recent tax on speculative foreign buyers and an expansion of rent controls, among other things.

British Columbia has also put a levy on foreign buyers of Vancouver area homes, while the federal government has introduced its own tax and mortgage measures.

“In the meantime, we take solace from the fact that lending standards for first-time homeowners in Canada have remained strict in recent years,” said Mr Marion.

His point, as this chart shows, is that “the share of first-time home buyers with a low credit score on this side of the border recently fell to a multiyear low of 4 per cent.”

“That is a far cry from the peak of 28 per cent observed in the U.S. at the height of its housing bubble,” Mr. Marion added.

Some of the “froth” is already coming off the Toronto market, said David Rosenberg, chief economist at Gluskin Sheff + Associates, citing a Globe and Mail report.

“Rare is the day that housing bubbles get resolved smoothly but then again, what typically bursts them are central bank rate hikes,” Mr. Rosenberg said.

“And while the Bank of Canada sounded less dovish last week, it seems unlikely that a tightening in monetary conditions is coming any time soon,” he added.

“So maybe it will be left up to shifting tax and regulatory policy to do the job of letting helium out of the balloon.”

As for Canada’s big banks and their downgrade, Mr. Rosenberg noted that four of them have already “smashed through” profit targets in their latest quarterly reports. Not all had reported by the time Mr. Rosenberg released his note to clients.

“Lost in the debate as to their exposure to the local mortgage market is that these institutions are extremely well diversified and their capital markets and wealth management lines of business are doing just fine even as consumer credit growth and housing-related activity softens,” he said.

“Not just that, but lower credit losses were a key factor behind the solid [second-quarter] performance.”

________________

ENERGY

The Globe and Mail. May 30, 2017. Trudeau stands by Trans Mountain pipeline despite B.C. shakeup

ROBERT FIFE AND SHAWN MCCARTHY

ROME and OTTAWA — Prime Minister Justin Trudeau took a hard line Tuesday, saying the controversial Trans Mountain pipeline expansion should proceed despite political threats in British Columbia to kill the massive project.

Mr. Trudeau said the $7.4-billion expansion project benefits the entire country, which is why the federal cabinet gave its approval.

“The decision we took on the Trans Mountain pipeline was based on facts, evidence on what is in the best interest of Canadians, and indeed all of Canada,” Mr. Trudeau said during a joint news conference with Italian Prime Minister Paolo Gentiloni in Rome.

Mr. Trudeau said the pipeline should not be held hostage by a possible change in the B.C. government after the NDP and anti-pipeline Green Party announced a deal to oust the minority Liberals, casting the project’s future in doubt.

“Regardless of a change in government in B.C. or anywhere, the facts and evidence do not change,” Mr. Trudeau said. “We understand that growing strong economies for the future requires taking leadership on the environment and we have to do those two things together. That is what drives us and the choices we make and we stand by those choices.”

The Prime Minister did not say what Ottawa would do if the NDP and Green Party form a government and attempt to stop the pipeline expansion.

The Trudeau cabinet approved the expansion last November, subject to Kinder Morgan satisfying mostly technical conditions imposed by the National Energy Board.

The recent B.C. election has raised the stakes as the Green Party and NDP vow to block it, even as Alberta Premier Rachel Notley argues the province has no right to do so.

Combined, the provincial NDP’s 41 seats and the Greens’ three seats outnumber the Liberals’ 43 seats. An NDP government formed with the support of the Greens – the Greens have explicitly rejected a coalition government – would give the parties a single-seat majority.

In a statement Tuesday, Ms. Notley said she would work with a government led by NDP Leader John Horgan. But she reiterated Alberta’s position that the federal government has ultimate authority over projects such as Trans Mountain. “It’s important to note that provinces do not have the right to unilaterally stop projects such as Trans Mountain that have earned the federal government’s approval,” she said. “This is a foundational principle that binds our country together. There are no legal tools available to provinces to stand in the way of infrastructure projects that benefit all Canadians.”

Last week, Houston-based Kinder Morgan vowed to move forward with the Trans Mountain expansion pending a successful completion of an initial public offering.

Shares in the company’s Canadian unit started trading Tuesday on the Toronto Stock Exchange. However, the company and its bankers were forced to temper expectations, pricing the shares on offer at $17 apiece, down from a previous range of $19 to $22. Proceeds are still expected to be $1.75-billion, with the company offering more shares to make up for the lower price. But the stock could come under pressure as it begins trading.

Indeed, the lower issue price reflects uncertainty that Trans Mountain will actually be built on time and on budget, said Laura Lau, a senior portfolio manager at Brompton Funds in Toronto.

Investors are buying exposure to Kinder Morgan’s existing Canadian assets as well as a targeted annual dividend of 65 cents per restricted voting share. The pipeline expansion is effectively “gravy,” she said. “I think that’s how they tried to sell it.”

The company said it expects to start construction in September.

“It’s nearly June,” Ms. Lau said. “So we’ll see. Even if you start it in September, building through the mountains is not easy, and if you’re delayed a season, then it’s another year.”

The political threat to the pipeline comes as First Nations in B.C. mount a renewed campaign against the project. They have warned that investors could be at risk as a result of Indigenous legal challenges to the mammoth project that would triple the existing line’s capacity to 890,000 barrels a day.

There are 19 separate lawsuits, including 12 from First Nations communities, challenging the NEB’s review process, the federal government’s consultations and the extent of provincial reviews. Some First Nations communities have court-recognized fishing rights in the coastal waters, while others are asserting title to land through which the pipeline crosses.

“I want to put a face and a name to the legal risk,” Tsleil-Waututh councillor Charlene Aleck said in a telephone interview Monday. “Through our aboriginal law, we’ve upheld and maintained the stewardship of our land and that’s got to be respected. And if we can’t do that through letting them know we’re opposed, we’ll use all legal means.”

Kinder Morgan acknowledged in its prospectus that the claims, if successful, “could result in the total stoppage of the Trans Mountain expansion project, which stoppage would have a material adverse effect on the business.”

More than 400 statements of opposition have been filed with the National Energy Board, raising the prospect of further delays should the company fail to reach an agreement with affected landowners.

With files from Jeff Lewis in Calgary

What Kinder Morgan’s Trans Mountain pipeline will mean for B.C.: https://www.theglobeandmail.com/news/british-columbia/kinder-morgan-trans-mountain-pipeline-bc-coast/article35043172/

REUTERS. May 30, 2017. Oil slips on oversupply worries despite OPEC deal

By Christopher Johnson

LONDON (Reuters) - Oil prices fell on Tuesday on concerns that output cuts by the world's big exporters may not be enough to drain a global glut that has depressed the market for almost three years.

Benchmark Brent crude LCOc1 dropped $1.10 a barrel, or more than 2 percent, to a low of $51.19 before recovering some ground to trade around $51.30 by 1345 GMT (9:45 a.m. ET). U.S. light crude CLc1 was 65 cents lower at $49.15.

"The oil market remains on the back foot," said Stephen Brennock, analyst at London brokerage PVM Oil Associates.

"Last week’s decision by OPEC to extend its output pact (has failed) to alleviate lingering fears of a global oil glut."

The Organization of the Petroleum Exporting Countries and other oil producers, including Russia, agreed last week to keep a tight rein on supply until the end of the first quarter of 2018, nine months longer than originally planned.

Collective output by OPEC and other producers will be held around 1.8 million barrels per day (bpd) below its level at the end of last year.

But the cutbacks have yet to drain inventories significantly and prices fell sharply after the OPEC deal was announced.

Part of the problem for OPEC is oil supply in the United States, where shale production is booming.

U.S. drillers have added rigs for 19 straight weeks to reach 722, the highest since April 2015, according to services firm Baker Hughes (BHI.N: Quote).

Goldman Sachs analysts have reduced their forecasts for oil prices, saying falling U.S. production costs will keep supply rising for years to come.

The bank said that once OPEC's production growth resumes after its self-imposed cuts, U.S. and OPEC output would rise by 1 million to 1.3 million bpd between 2018 and 2020.

"While we are bullish on near-term prices as inventories normalize ... 2018-19 futures need to be in the $45-$50 range," Goldman said.

The American summer driving season, which by tradition started on the Memorial Day holiday on Monday, may offer some support for prices, analysts said.

Demand in the United States for transport fuels tends to rise as families visit friends and relatives or go on vacation during the Northern Hemisphere summer.

The American Automobile Association said ahead of Memorial Day that it expects 39.3 million Americans each to travel 50 miles (80 km) or more away from their homes over the Memorial Day weekend, the highest Memorial Day mileage since 2005.

(Additional reporting by Henning Gloystein in Singapore; Editing by David Evans and Edmund Blair)

BLOOMBERG. 2017 M05 30. Canada to Open Its First Refinery in Decades Amid a Fuel Glut

by Robert Tuttle

- Alberta’s Sturgeon refinery to begin producing by end of year

- Fuel premium down by half in three years amid economic slump

- North West Refining’s Sturgeon plant in 2016

It seemed like a good idea at the time.

When Canada’s government decided to fund the nation’s first new refinery in three decades in 2012, a diesel shortage had just caused some truckers to be turned away from filling stations, and demand was climbing. Oil-sands producers were ramping up output and crude prices topped $100 a barrel.

Fast forward to 2017, and North West Refining’s Sturgeon plant in Alberta is poised to add 40,000 barrels a day of diesel to an already-glutted market. Crude is hovering around $50 amid surging North American output, oil-sands producers have shelved expansions and Alberta has just emerged from a two-year recession. Diesel demand is lower than it was two years ago, and truck-fuel prices relative to crude oil are half their level from three years ago.

“Diesel demand is dropping in Alberta,” John Auers, executive vice president at energy consultant Turner Mason & Co., said by phone. “Any time you are adding more supply, you are going to impact the price negatively.”

The Sturgeon plant, Canada’s first new refinery since 1984, will begin turning oil-sands bitumen into diesel by the end of the year, according to Ian MacGregor, chairman of Northwest Redwater Partnership, which owns half the project in partnership with Canadian Natural Resource Ltd. Bitumen is a molasses-like substance extracted from oil sand that is so thick, it has to be blended with condensate or upgraded into synthetic oil to be processed.

Near Supply

Located southwest of Alberta’s oil sands, home to the world’s third-largest crude reserves, Sturgeon is about 90 percent built, with bitumen scheduled to be injected into the plant by the end of summer, MacGregor said. It will process 80,000 barrels a day of diluted bitumen at the end of its first phase, scheduled for completion this year.

Canadian Drillers Brave Deep Freeze as Oil Patch Revives

The Alberta Petroleum Marketing Commission, an agent of the provincial government, will provide 75 percent of the feedstock used by the C$8.5 billion ($6.32 billion) refinery, or about 37,500 barrels a day, along with loans, equity and fees, according to government documents published last year, which estimated the total package at about C$25 billion over 30 years.

That much bitumen alone is worth about C$20 billion at the current market price of about C$48 a barrel, according to Bloomberg calculations. Oil-sands producers supply the bitumen as a royalty payment to the province.

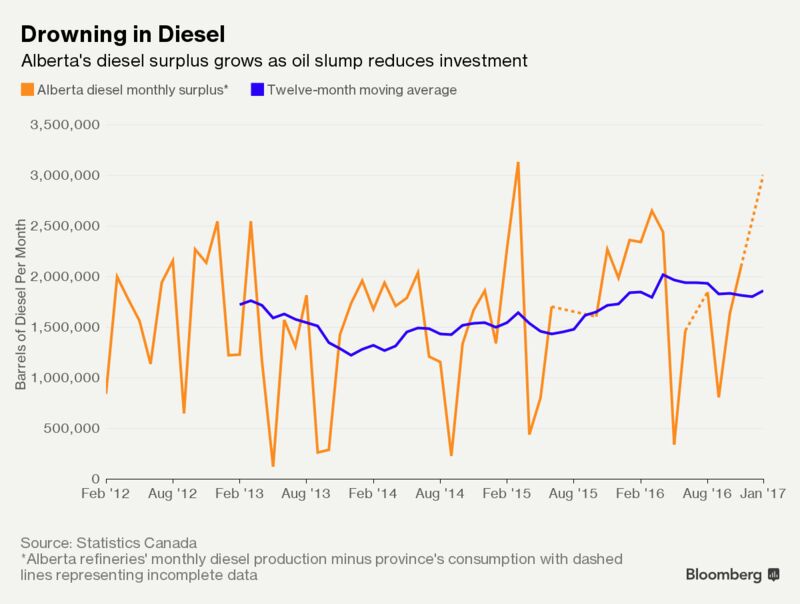

Changing Market

The diesel market that the refinery will supply has also changed radically in the years since the project got off the drawing board, with swelling quantities of the trucking fuel. The surplus of diesel produced by Alberta refineries in the 12 months through January was 45 percent bigger than in the same period three years before, the latest government figures show.

Diesel at a fuel rack in Edmonton, Alberta, has traded at a 32-cent premium to New York futures over the past three months, almost half its price three years earlier, data compiled by Bloomberg show.

But demand may rise longer term. The country’s National Energy Board projects that vehicles that move freight, such as diesel-burning trucks, will use 5 percent more energy in 2020 from 2016. Energy demand for freight vehicles will rise 1.6 percent this year alone.

“If you look at any long-term forecast, its showing that Alberta will be diesel short, so there will be economic sense for the refinery,” Dinara Millington, vice president of research at the Canadian Energy Research Institute. “If that doesn’t transpire, we could potentially export diesel.”

Export Options

Canada is a net exporter of diesel to the U.S. The country sent 71,000 barrels a day across the border in 2016, down from 118,000 barrels a day the year before, U.S. Energy Information Administration data show. Most of that goes to the U.S. East Coast, which has access to production from Eastern Canadian refineries. Western Canada’s biggest export market for diesel is the U.S. West Coast, which is connected to Alberta via the Trans Mountain Pipeline.

By 2020, the diesel will find ready buyers on the Pacific coast as new low-sulfur bunker-fuel rules go into effect worldwide, Turner Mason’s Auers said. World distillate demand will rise as much as 1.5 million barrels a day, creating a “slug” of demand that refiners may struggle to fulfill.

That said, the refinery probably isn’t worth the money, Auers said.

“They are paying $9 billion to build that plant and its only processing 50,000 barrels a day of bitumen,” he said. “It was not good investment by the crown.”

________________

VENEZUELA

REUTERS. May 30, 2017. Goldman confirms buying Venezuela bonds after opposition cries foul

CARACAS (Reuters) - Goldman Sachs Group Inc (GS.N: Quote) has confirmed it bought Venezuelan bonds after being excoriated by the country's opposition for financing the embattled government of President Nicolas Maduro, who is facing sustained protests.

The president of the opposition-led Congress accused the bank of financing "dictatorship" after the Wall Street Journal reported Goldman had bought $2.8 billion in bonds issued by state oil company PDVSA at a steep discount.

"We bought these bonds, which were issued in 2014, on the secondary market from a broker and did not interact with the Venezuelan government," Goldman wrote in a statement late on Monday.

"We recognize that the situation is complex and evolving and that Venezuela is in crisis. We agree that life there has to get better, and we made the investment in part because we believe it will."

The statement did not include the price of the bonds or the amount purchased.

With Venezuela's inefficient state-led economic model struggling under lower oil prices, Maduro's unpopular government has become ever more dependent on financial deals or asset sales to bring in coveted foreign exchange.

Many economists say the only way to improve the country's situation is to scrap price and currency control systems that have hobbled the private sector.

Maduro's critics have for two months been staging street protests, which have left nearly 60 people dead, to demand that he hold early elections. Maduro says the protests are a violent effort to overthrow his government, and insists the country is victim of an "economic war" supported by Washington.

(Reporting by Brian Ellsworth; Editing by Nick Zieminski)

________________

BOMBARDIER

BOMBARDIER. May 26, 2017. Bombardier Delivers the First CS300 Aircraft to C Series launch Operator SWISS

- SWISS becomes the first airline to integrate both C Series aircraft models to its fleet

- CS300 aircraft to be operated from Geneva, Switzerland

Montréal - Bombardier Commercial Aircraft announced today that Swiss International Air Lines (SWISS) took delivery of its first CS300 aircraft at Bombardier’s facility in Mirabel, Canada, where the C Series aircraft are manufactured. When the aircraft enters commercial service in a few days, SWISS will become the first airline to operate both C Series aircraft models. SWISS will dedicate this new aircraft to the French-speaking part of Western Switzerland as the airline will operate this CS300 aircraft from Geneva.

“We are very proud to deliver SWISS’s first CS300 aircraft today. SWISS is known for its leading-edge technical and operational excellence and has been a wonderful partner for the C Series aircraft program. The SWISS family has been part of the C Series journey from the beginning and we thank the airline for its continuous support,” said Fred Cromer, President of Bombardier Commercial Aircraft. “This new delivery is a demonstration of Bombardier’s commitment to deliver revolutionary and high-performing aircraft and help connecting communities with the best flying experience in the world!”

“The C Series aircraft program continues getting strong momentum with its successful entry into service with SWISS and today, the launch airline becomes the first one to take delivery of both the CS100 and the CS300 models,” said Rob Dewar, Vice President, C Series Aircraft Program, Bombardier Commercial Aircraft. “The C Series airliners demonstrate robust in-service performance to date and we are confident that SWISS will also benefit from a smooth entry-into-service with the CS300 aircraft.”

“We are delighted that, having successfully integrated the first Bombardier CS100s into our fleet from mid-2016 onwards, we can now welcome our first CS300,” says Thomas Klühr, SWISS’s Chief Executive Officer. “With its 20 additional seats, this second model in the C Series family ideally complements our current aircraft fleet, and gives us an optimal equipment mix for our European short- and medium-haul services. Our first CS300 will be initially stationed in Geneva, where its superior comfort credentials will be excellently suited to this premium travel market,” Klühr continues. “In fact, our entire Geneva-based fleet will soon consist solely of Bombardier C Series aircraft.”

SWISS’ first CS300 aircraft is scheduled to enter service on June 1st, 2017 with its maiden commercial flight taking passengers from Geneva to Heathrow. SWISS will take delivery of a total of 30 CS100 and CS300 aircraft.

Twelve C Series aircraft have been delivered by Bombardier so far, nine of which have been delivered to SWISS. Three CS300 aircraft are currently in operations with airBaltic.

The C Series aircraft is manufactured by the C Series Aircraft Limited Partnership, an affiliate of the Bombardier Commercial Aircraft segment of Bombardier Inc.

BOMBARDIER. REUTERS. May 30, 2017. Bombardier delivers first CS300 passenger jet to Swiss International (This May 26 story corrects headline to add "to Swiss International")

(Reuters) - Bombardier Inc said on Friday it delivered its first CS300 aircraft to customer Swiss International Air Lines AG, marking a significant milestone for the Canadian planemaker's CSeries passenger jet family.

Although it has won accolades for fuel savings, the CSeries has not received a substantial order since the sale of 75 CS100 jets to Delta Air Lines nearly a year ago.

The CS300's delivery also comes as planemakers are bracing for another bout of softer sales this year after a prolonged order boom peaked in 2014.

The 130-seat CS300 is larger than Bombardier's 110-seat CS100 plane.

Its maiden commercial flight will be from Geneva to London, when it enters service on June 1, Bombardier said.

Swiss International is expected to take delivery of 30 CS300 and CS100 aircraft.

Bombardier has so far delivered 12 CSeries aircraft, nine of which were to Swiss International, the planemaker said.

(Reporting by Yashaswini Swamynathan in Bengaluru; Editing by Sai Sachin Ravikumar)

________________

LGCJ.: