CANADA ECONOMICS

Global Affairs Canada. May 3, 2017. Parliamentary Secretary Leslie promotes trade and cooperation in Washington, D.C.

Ottawa, Ontario - Canadians and Americans share a unique friendship strengthened by common values and close economic ties.

Lieutenant-General (Retired) Andrew Leslie, Parliamentary Secretary to the Minister of Foreign Affairs (Canada-U.S. Relations), yesterday undertook a visit to Washington, D.C., where he delivered the Thomas O. Enders Memorial Lecture on U.S.-Canadian Relations at the Johns Hopkins University School of Advanced International Studies (SAIS). In his remarks, Parliamentary Secretary Leslie underscored the importance of the bilateral relationship and the need for the two nations to continue to work together to advance North American prosperity and opportunities for the middle class.

In addition, Parliamentary Secretary Leslie met with representatives from the Heritage Foundation, where discussions centred on the first 100 days of the U.S. administration and its priorities going forward.

Quotes

“We continue to work with the U.S. administration, the 115th U.S. Congress and officials at the state and local levels to advance our growing economy, expand middle-class job opportunities and address global challenges. Maintaining strong economic ties is vital to our mutual success.”

- Lieutenant-General (Retired) Andrew Leslie, Parliamentary Secretary to the Minister of Foreign Affairs (Canada-U.S. Relations)

Quick facts

- In recognition and commemoration of the influence Thomas O. Enders had on Canada-U.S. relations, the Center for Canadian Studies at Johns Hopkins SAIS hosts an annual lecture series in Washington, D.C., on U.S.-Canadian relations.

- The Heritage Foundation is a conservative American think tank based in Washington, D.C. The foundation has a significant influence in U.S. public policy making, and is considered to be one of the most influential conservative research organizations in the United States.

- Canada and the United States benefit from robust trade and investment ties and integrated economies that support millions of Canadian and U.S. jobs. Nine million American jobs depend on trade and investment with Canada.

Ottawa, Ontario - Celina Caesar-Chavannes, Parliamentary Secretary to the Minister of International Development and La Francophonie, will travel to Yokohama, Japan, from May 4 to 7, 2017, to participate in the 50th Annual Meeting of the Asian Development Bank, and to Tokyo, from May 8 to 9, for bilateral meetings.

As part of this visit, the Parliamentary Secretary will reaffirm Canada’s commitment to the empowerment of women and girls, bring attention to the importance of tackling extreme poverty and growing inequality, and explore shared opportunities for climate change action with the Asian Development Bank.

Canada has a long-standing commitment to working with key multilateral partners to foster green and inclusive growth throughout the Asia-Pacific region. Through these initiatives, Canada is helping to create jobs and grow the economy within developing countries in the region.

Quotes

“A focus on green economic growth, innovation and new partnerships will be essential in tackling extreme poverty and inequality in developing countries. Empowering women and girls to be leaders of growth enables them to become a part of the solution to future challenges facing their communities.”

Celina Caesar-Chavannes, Parliamentary Secretary to the Minister of International Development and La Francophonie

Quick Facts

- Established in 1966, the Asian Development Bank is a multilateral development bank dedicated to reducing poverty in Asia and the Pacific through inclusive economic growth, environmentally sustainable growth and regional integration.

- Canada is the Asian Development Bank’s seventh-largest (fourth non-regional) shareholder, as well as one of its largest donor countries.

________________

REAL STATE - HOUSING BUBBLE

The Globe and Mail. REAL ESTATE. May 03, 2017. Torrid Toronto housing market finally takes a breather

JANET MCFARLAND - REAL ESTATE REPORTER

Toronto’s housing market showed signs of cooling in April as prices for low-rise homes dropped slightly compared to March and a surge of new listings increased the available supply of resale homes.

Prices continued their torrid gains compared to a year earlier, climbing another 25 per cent in April for all types of homes compared to April, 2016, according to sales data from the Toronto Real Estate Board.

TREB said the average selling price for all homes types hit a new record level of $920,791 in the Greater Toronto Area in April, up 24.5 per cent over April last year.

But there were signs the Toronto region’s market may be poised for more balanced growth.

The average sale price for all homes in April was almost flat – up just 0.5 per cent – compared to March, when prices averaged $916,567.

Prices for detached homes dipped slightly to an average of $1,205,262 in April from $1,214,422 in March, while semi-detached and townhouse prices also fell slightly compared to a month earlier. Condominium prices rose 4.3 per cent, however, to an average of $541,392 in April from $518,879 in March.

The data also show 21,630 homes were listed for sale in April, a substantial 33.6-per-cent increase over the same month last year.

There were double-digit increases in new listings across all of the particularly tight categories of low-rise homes, including detached and semi-detached houses, as well as townhouses, TREB said. Condominium listings were flat.

TREB president Larry Cerqua said it is too soon to know whether the strong growth in listings in April is a sign of sellers reacting to recent price growth, or whether the Ontario government’s new housing measures are playing a role in the market.

The sales data comes less than two weeks after the Ontario government announced a new 15-per-cent tax on foreign buyers on April 20, and said it would give the City of Toronto powers to impose a new tax on vacant homes.

Jason Mercer, TREB’s director of market analysis, said he still anticipates the annual rate of price growth to remain well above the rate of inflation through the spring and summer months, arguing it will take “a number of months to unwind the substantial pent-up demand” that has built over the past two years.

“It was encouraging to see a very strong year-over-year increase in new listings,” Mr. Mercer said in a statement. “If new listings growth continues to outpace sales growth moving forward, we will start to see more balanced market conditions.”

The total number of homes sold fell 3.2 per cent in April compared to a year ago, but TREB said the Easter long weekend was in April this year, but in March last year, which meant there were fewer working days in April to conclude sales compared to last April.

TREB also released a new analysis Wednesday of the impact of foreign buyers in the Toronto region’s housing market, saying it believes foreign buyers and other speculators are not playing a major role in current market conditions.

The association analyzed annual property sales data from 2008 to April, 2017, provided by the Municipal Property Assessment Corp. and by Teranet Inc. for the broad region surrounding Toronto known as the Greater Golden Horseshoe.

The data showed that foreign buyers in the region accounted for 2.3 per cent of sales between 2008 and April, 2017, including 2.2 per cent of sales in 2016 and 2.6 per cent from January to April this year.

Between 87 per cent and 90 per cent of buyers bought their homes as a place to live, TREB said, including 88 per cent of those buying so far this year. Fewer than 1 per cent of buyers had a mailing address outside of Canada, and most of those were U.S. addresses.

“The trend from 2008 to April, 2017, suggests that the share of foreign home buyers has remained low,” TREB concluded.

The association also looked at data on speculation in the market, saying homes sold within a year of purchase by domestic or foreign buyers accounted for less than 5 per cent of sales in 2016 and about 7 per cent in the first four months this year. TREB said 6.2 per cent of property owners in the region owned more than one property as of April.

The Globe and Mail. May 03, 2017. Home Capital delays results amid bid to restore confidence

ANDREW WILLIS, JACQUELINE NELSON AND JANET MCFARLAND

Mortgage lender Home Capital Group Inc. delayed the release of financial results on Tuesday as the company recruits new board members in a bid to restore its credibility, stem the bleeding of deposits and find a potential buyer or investor.

Home Capital is expected to announce as early as this week that it will add members to its board who have experience in restructuring financial companies. The company is the country’s largest lender to home owners who typically do not qualify for mortgages from the big banks.

Home Capital’s short-term plan is to appoint experienced leaders who help can slow client withdrawals, then quickly decide if the company can survive as an independent business or be sold.

Searches for a permanent chief executive officer and a new chief financial officer are already under way. Sources familiar with the company say a sale is the most likely outcome.

“Everyone recognizes getting this stabilized is important to the financial system and important to the real estate market,” said one investment banker working for Home Capital.

Toronto-based Home Capital was scheduled to report quarterly results on Wednesday.

It postponed the release until May 11 to provide an update “for events that have occurred since the close of the first quarter.”

Over the past five weeks, more than $1.6-billion of deposits have been withdrawn from high-interest savings accounts with Home Capital, money used to fund the mortgage business. On April 19, the Ontario Securities Commission revealed allegations that the company improperly disclosed financial information. To shore up the business, the company secured a $2-billion life line from a major pension fund last week, but it came with onerous terms, including an interest rate of 10 per cent.

The company dismissed its CEO this spring and announced that founder and director Gerald Soloway will retire.

Home Capital’s interim management team and board say they are “reviewing strategic alternatives” that could include the sale of the company.

Two regional banks – Edmonton-based Canadian Western Bank and Montreal-based Laurentian Bank of Canada – are significant players in the alternative mortgage business and sources said both are interested in acquiring part of Home Capital, but not the whole company. Canadian Western CEO Chris Fowler told the Bloomberg news service on Tuesday the bank will consider “selectively” acquiring loan portfolios, and a Laurentian spokeswoman said the bank would look at acquisitions that are a strategic fit. None of Canada’s six big banks are expected to bid.

A number of U.S. private equity funds and large Canadian financial institutions are also kicking the tires at Home Capital. One interested party is private equity fund J.C. Flowers & Co., which also recently bought Citigroup Inc.’s Canadian subprime lender, now called Fairstone Financial Inc., which has $2.5-billion (Canadian) in assets.

But one source working for a potential bidder said the key issue for any buyer of Home Capital is ensuring sources of funds, such as savings accounts and GICs, to backstop the mortgage portfolio.

A spokesman for Home Capital declined to comment on the company’s plans.

Other sources said the company does not necessarily need to be sold. A new CEO, an improved board and a lower-cost financing deal similar to the $2-billion line of credit mortgage lender Equitable Group Inc. firmed up with a syndicate of five major banks this week might be enough to right Home Capital’s ship.

When Home Capital does report financial results, it will need to show that homeowners are making the payments on the underlying $18-billion worth of mortgages it holds. Last year, defaults were at historic lows, owing in part to surging residential real estate markets. Any buyer or investor will want to see evidence that this has continued. The company’s plans to originate new mortgages will also be in question, as its cost of capital – the amount it will cost the company to extend new loans – has skyrocketed thanks to its financing deal with the Healthcare of Ontario Pension Plan.

Mortgage brokers said Home Capital does not appear to have taken any significant steps to reduce the number of mortgages it is granting.

One broker, who did not want to be identified, said Home Capital appears to be focusing on new mortgages for home purchases, rather than refinancing existing ones. Refinancing is generally considered riskier because many people do it to remove equity from their homes to use for other purposes, including consolidating other debts.

However, while the firm remains open for business, some mortgage brokers said they are leery about a mortgage from Home Capital’s Home Trust unit.

“There are a large number of brokers who will not refer to Home Trust right now, and that type of confidence is going to take a long time to get back,” the mortgage broker said.

However, John Bargis, vice-president of Mortgage Edge, said he is still sending business to Home Trust and believes the company’s core mortgage business is sound.

“My agents have inquired about whether or not they should continue sending business to Home Trust, both purchases and refinances, and the answer is yes,” Mr. Bargis said.

The Globe and Mail. May 02, 2017. Greater Vancouver condo prices surge, but sales slow down

BRENT JANG

VANCOUVER — Condos are leading a revival of prices in the Vancouver region’s housing market, but sales activity remains below the torrid pace of a year earlier.

The Real Estate Board of Greater Vancouver said Tuesday that the benchmark price for condos sold last month in its territory reached $554,100, up 8.2 per cent over the past three months and 16.6 per cent from April, 2016. Benchmark prices are the industry’s representation of typical homes sold.

In the townhouse segment in April, the benchmark price hit $701,800, up 5.3 per cent over the past three months and 15.3 per cent from April, 2016.

After setting record highs for sales early last year, the number of properties changing hands began falling in April, 2016, and continued sliding for several months after the B.C. government imposed a 15-per-cent tax on foreign buyers in the Vancouver region in August.

The tax hit detached houses the hardest. Last month’s benchmark price of $1.52-million for detached houses in Greater Vancouver fell 3.9 per cent compared with August, but is still up 8.1 per cent over the past year.

For all housing types, there were 3,553 transactions of existing properties on the Multiple Listing Service last month, down 25.7 per cent from a year earlier, though the sales volume rang in 4.8 per cent more than the 10-year average for April. The benchmark price for all housing types increased 11.4 per cent year over year to $941,100.

“Until more entry-level – or ‘missing middle’ – homes are available for sale in our market, we’ll likely continue to see prices increase,” real estate board president Jill Oudil said in a statement Tuesday. She noted that 68.5 per cent of sales in the first four months of this year have been for condos and townhouses, compared with 58.2 per cent during the same period in 2016.

Fewer luxury mansions are selling, dragging down the average price for detached houses to $1.77-million in Greater Vancouver last month, a 2.7-per-cent decrease from April, 2016. The average price for resale condos, by contrast, has surged 20.1 per cent over the past year to $634,723, while the average price for townhouses increased 8 per cent to $833,223.

Industry experts say the B.C. government’s subsidy program for first-time home buyers, introduced in mid-January, has contributed to the run-up in entry-level property prices over the past three months.

Housing affordability has been a major issue during the provincial election campaign for both the BC Liberals and the BC NDP.

The benchmark price of a detached house in the Fraser Valley Real Estate Board’s territory reached $888,900 in April, a 14.5-per-cent increase from the same month in 2016. The Fraser Valley board’s sales volume last month dropped 24.9 per cent from a year earlier.

Many residents have cashed out of Greater Vancouver and the Fraser Valley to move to Victoria on Vancouver Island. There, the benchmark price for detached houses in the provincial capital’s core has climbed 17.6 per cent over the past year to $805,100. The core encompasses Victoria and suburbs such as Oak Bay, Esquimalt and View Royal, as well as parts of Saanich.

In the broader area called Greater Victoria, the benchmark price for detached properties last month hit $663,500, up 16.8 per cent from a year earlier.

Ara Balabanian, president of the Victoria Real Estate Board, said Victoria City Council wisely reversed course last week by scrapping plans to ask the provincial government to slap a tax on foreign buyers in the capital.

“The issues that Vancouver and Toronto may have with regards to foreign buyers and speculators are much different than what we have in Victoria,” Mr. Balabanian said in an interview. “I don’t see any real reason to rush into a tax in our area.”

Between June 10 and Feb. 28, foreign purchasers accounted for 4.5 per cent of residential transactions in the Capital Regional District, which includes Victoria and suburbs such as Oak Bay and Saanich. By comparison, foreign buyers accounted for more than 11 per cent of residential deals over the same period in the Vancouver suburbs of Richmond and Burnaby, according to data compiled by the B.C. government.

BLOOMBERG. 2017 M05 3. Toronto Home Price Growth Slows as New Listings Soar

by Kim Chipman and Erik Hertzberg

- Average price rises 25% to C$920,791 after 33% jump in March

- New listings jump 34% as Ontario imposes foreign buyer tax

- Ontario Tries to Temper Rising Toronto Home Prices

Toronto home price gains slowed in April and new listings soared the most in seven years, signaling the red-hot market may be cooling after the Ontario government imposed new measures to curb runaway gains in Canada’s biggest city.

Housing prices jumped 25 percent last month from a year earlier, down from the 33 percent annual increase in March. The average price of C$920,791 ($671,000) in April was just 0.5 percent higher than in March, according to figures from the Toronto Real Estate Board.

In further signs of a slowdown, sales fell 3.2 percent to 11,630 units, the first year over year decline since 2014. The number of new homes on the market jumped 34 percent to 21,630, the biggest increases since 2010, the figures released Wednesday show.

“If new listings growth continues to outpace sales growth moving forward, we will start to see more balanced market conditions,” Jason Mercer, head of market analysis at the real estate board, said in a statement. “It will likely take a number of months to unwind the substantial pent-up demand that has built over the past two years.”

Mercer predicted that annual home price growth on a monthly basis will remain

“well-above the rate of inflation as we move through the spring and summer

months.”

The sales slowdown and jump in listings suggest the Ontario government’s moves to curb price gains may be having an effect. The government announced a 16-point housing plan on April 20, including a 15 percent tax on foreign home buyers and expanded rent controls. A similar tax in British Columbia slowed home price growth in Vancouver last year, although prices there rebounded 11 percent in April from a year earlier.

For a Quick Take on the Housing Measures

“It is too early to tell whether the increase in new listings was simply due to households reacting to the strong double-digit price growth reported over the past year or if some of the increase was also a reaction to the Ontario government’s recently announced” housing measures, said board President Larry Cerqua.

The month of May is typically one of the busiest of the year and should provide a better indicator of market direction following the Ontario moves, Mercer said.

The April housing numbers also cover about 10 days of the crisis at embattled mortgage lender Home Capital Group Inc. The Toronto-based company has seen its stock plunge and customers withdraw deposits after it was accused by Ontario’s securities regulator of misleading investors about fraudulent loans. Some economists have said the turmoil may cool the market if it spreads to other mortgage lenders, making it harder for some home buyers to borrow.

Home Capital’s funding woes aren’t “the beginning of the end,” of the housing boom nor does this represent the “ultimate test” for the market, said Benjamin Tal, deputy chief economist at Canadian Imperial Bank of Commerce.

“The ultimate test will be high interest rates,” he said at a real estate conference in Toronto Wednesday. “The ultimate test will be a recession, and that will come eventually. Home Capital is not the ultimate test.”

Home Capital represents a small segment of the so-called subprime market of borrowers who can’t get a mortgage at a traditional bank yet are still good credits, he added.

“Many of those sub primers, so-called sub-primers, they are a better risk than me because they are self-employed new immigrants with a lot of money that simply don’t fit into the regulation framework so they go elsewhere and are actually doing fine.”

The Toronto Real Estate Board weighed in Wednesday on the ongoing debate over the role non-Canadian investors are playing in the housing boom, as well as on the prevalence of speculation by foreign and domestic homebuyers and multiple home ownership in Toronto and broader Ontario.

The number on all counts “remains low,” the board said in a separate statement. Foreigners have accounted for about 2.3 percent of purchases in the Toronto and Niagara region over the past decade, the board said.

The board noted the Easter holiday may have affected the most recent sales data as it fell in April this year and in March in 2016.

REUTERS. May 3, 2017. Toronto house prices, listings surge in April but sales dip

OTTAWA (Reuters) - Toronto home prices and new listings surged in April from a year earlier while sales fell, the Toronto Real Estate Board said on Wednesday, suggesting the market may be starting to rebalance after new housing rules were put it place amid fears of a bubble in Canada's largest city.

The industry group said the average home price rose 31.7 percent in April from a year earlier, while new listings rose 33.6 percent and sales dipped 3.2 percent.

Toronto is the capital of the province of Ontario, which introduced a 15 percent tax on property purchases by foreign buyers as part of 16 measures designed to cool Toronto's red-hot housing market.

While the real estate group said it was too early to say whether the surge in new listings was in response to the new rules or simply sellers responding to the recent surge in prices, the market will rebalance if the trend continues.

"It was encouraging to see a very strong year-over-year increase in new listings. If new listings growth continues to outpace sales growth moving forward, we will start to see more balanced market conditions," said Jason Mercer, TREB's director of market analysis.

"It will likely take a number of months to unwind the substantial pent-up demand that has built over the past two years. Expect annual rates of price growth to remain well above the rate of inflation as we move through the spring and summer months," he added.

Economists have said the foreign buyers tax should cool demand, even though there is little data showing that foreign buyers are a large part of the market, because it shows the government is determined to slow the market.

The Toronto Real Estate Board said its data showed foreign buyers were not a major factor in the "Greater Golden Horseshoe" area surrounding Toronto.

It said 2.3 percent of buyers between 2008 and 2017 had a mailing address outside of Canada. The share was 2.2 percent in 2016 and 2.6 percent for the January through April period in 2017. A survey of its members in the fall of 2016 showed 4.9 percent of deals between the fall of 2015 and the fall of 2016 were done by foreign buyers, the group said.

(Reporting by Andrea Hopkins; Editing by W Simon and Chizu Nomiyama)

The Globe and Mail. ANALYSIS. GLOBE EDITORIAL. Apr. 07, 2017. Globe editorial: How to pop Toronto’s housing bubble, without blowing up the economy

The price of the average detached house in the Greater Toronto Area has shot up by 33 per cent over the last 12 months, hitting $1,214,422 in March. The average semi-detached home price has risen 34 per cent. Townhouses are up 33 per cent; so are condos. No wonder federal Finance Minister Bill Morneau this week sent a letter to Toronto Mayor John Tory and Ontario Finance Minister Charles Sousa, wanting to get together to talk about what to do. The GTA hasn’t seen price increases like this since 1989 – just before the last Toronto housing-market crash.

So, as Mr. Morneau and his colleagues ponder their next moves, here’s our advice.

Stop waiting, start acting: Governments have spent the last few years hoping that they could sit back and let Canada’s hottest real-estate markets – Vancouver and Toronto – self-correct. The good news is that markets always do, eventually. The bad news is that a late-arriving correction can carry catastrophe in its wake. Exhibit A is the U.S. housing bust of a decade ago, leading to the worst economic downturn since the Great Depression.

It’s not the economy, stupid: Canada’s economy is hardly racing ahead at an overheated clip. And there’s almost no inflation. Toronto housing prices shooting up 33 per cent in a year is not the result of an economic boom.

Don’t blame a lack of housing supply: Despite the claims of many in Toronto’s real estate and development industries, there’s limited evidence of a housing shortage. Yes, the GTA has grown by nearly 400,000 people in the past five years. Yes, Metro Vancouver has added 150,000 people. Yes, all of those people need somewhere to live.

But there’s been lots of new construction. Enough has been built over the last few years that the number of housing units per person in Toronto has been rising, not falling. In a recent study, Simon Fraser University professor Josh Gordon concluded that “there is little indication of ‘not building enough.’”

It’s psychology: With apologies to Shakespeare, the fault for the housing bubble, dear Canadians, is not in our stars, but in ourselves. Bubbles, from the tulip mania of the 17th century to the stock market’s dot.com boom, are products of the fertile human imagination. Market psychology? It’s all in our heads.

You’ve heard of the phrase folie à deux; a housing bubble is a folie à millions. It involves millions of people believing something that, in hindsight, may be very foolish. In the case of Toronto’s housing bubble, it’s believing that prices are forever guaranteed to go higher – so buyers must buy now, or miss out, and sellers must not sell now, or end up missing even bigger profits.

The rush to buy, and reluctance to sell, have created what feels like a housing shortage. The number of homes for sale in Toronto, relative to the number of people looking to buy, is far below the norm. Active listings have fallen from more than 12,000 a year ago to fewer than 8,000; the average home takes just 10 days to sell.

People have started to believe that supply and demand are permanently unbalanced. Government policy has to challenge that mindset, and nudge it in a different direction.

Foreign money may be part of the problem: There’s never been entirely accurate information on the scale of offshore investors in Vancouver’s housing market. But when British Columbia brought in a foreign buyers’ tax last year, the impact was large and immediate. Vancouver housing prices, by far the country’s most out-of-whack, stopped rising and actually reversed course.

It’s far from certain exactly how much the tax contributed to this, or entirely why. It may have discouraged some non-resident speculators. It definitely challenged market psychology, convincing buyers and sellers that the market might not go up forever, because government might not let it.

That’s why, regardless of the precise level of purchases by non-residents, a foreign buyers’ tax, modelled on B.C.’s, is worth putting on Toronto’s menu of options. It can always be adjusted or eliminated in response to market conditions in the years to come.

What government shouldn’t do: The federal government, Ontario and Toronto can all take lessons from B.C. The province came up with a measure that helped cool the Vancouver market – and almost immediately set about undermining it.

As soon as B.C.’s foreign buyers’ tax started working, its terms were watered down. And in response to a bubble making homes less affordable, B.C. introduced taxpayer-financed subsidies for first-time home buyers. That only encourages people to spend more on a home, pushing up prices. It’s designed to fuel housing-price inflation. Crazy.

Another bad idea Ontario is considering: Expanding rent control. It can make housing, or at least rental housing, more affordable – in the short term.

But in the long run, a rule that forces landlords to set rental rates below market prices is going to discourage new rental construction, which is exactly what happened when Ontario introduced rent control in the 1970s. For decades after, very little new rental housing was built in Toronto.

In fact, much of the new “rental” housing in the city is individual condo units. If Ontario puts them under strong rent control, it risks simultaneously limiting rental housing supply, and discouraging condo construction – both of which would push up housing prices and exacerbate the bubble.

Ottawa, Ontario and Toronto have to act boldly but thoughtfully. Pop the bubble, gently, before it blows up the Canadian economy.

The Globe and Mail. ANALYSIS. May 03, 2017. The one thing standing in the way of Home Capital’s stock going to zero

DAVID BERMAN

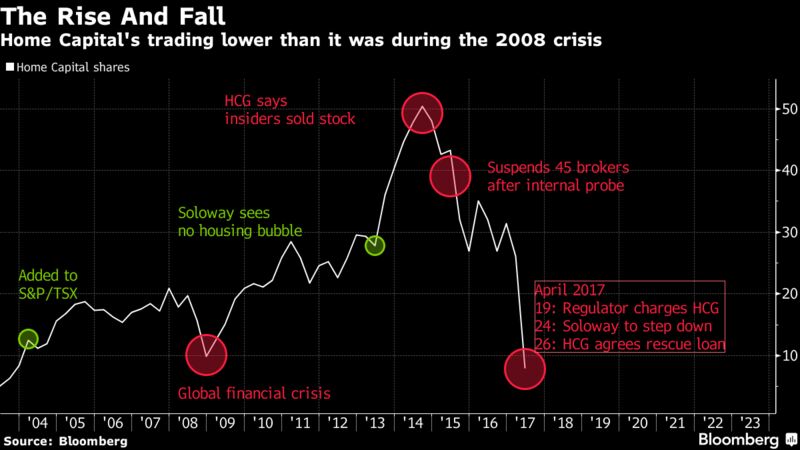

Investors who have been betting against Home Capital Group Inc. are buoyed by the bad news that has pummelled the alternative mortgage lender’s share price by more than 70 per cent this month.

Bad brokers? Regulatory investigation? Executive departures? Run on the bank? Desperate terms for a financial lifeline? Home Capital has it all.

But the one element that would complete their investment thesis is still missing: Ontario’s housing market is red hot, which provides some confidence in Home Capital’s mortgage book.

And that has short-sellers, who profit when share prices fall, busily offering up views that the market is prone to a crash. They believe that a busted bubble will eviscerate the quality of Home Capital’s loan book and perhaps deflate a few other financial firms as well.

Could a big bank get caught in a housing market downturn? Well, an ambitious short-seller can certainly dream big.

The argument for buying Home Capital shares, or acquiring the company outright, rests to a large extent on the quality of the company’s loan book. If the loan book is solid – the mortgages were underwritten properly and customers will continue to make their regular payments – then the company should be worth something.

According to Bloomberg, the book value per share is north of $25. At least one investor, David Taylor of Taylor Asset Management, believes the mortgage book could be valued as high as $28 a share, or about three times the stock’s current price of $7.72.

He may be onto something. A number of industry observers have argued that Home Capital’s loan book is probably in fine shape. They point to recent financial statements: In the fourth quarter, non-performing loans accounted for just 0.3 per cent of gross loans. Provisions for credit losses were a minuscule 0.04 per cent.

No problems there. It seems that Canadian non-prime borrowers, many of whom are self-employed workers who have been rejected for loans by more risk-averse major banks, are very good customers.

But could problems arise? Again, industry observers say that is unlikely. Their optimism rests on the recent performance of the Ontario housing market, which is the centre of Home Capital’s residential lending activity.

According to the Teranet-National Bank National Composite House Price Index, Toronto’s year-over-year housing prices in March rose 24.8 per cent and prices have risen nearly 50 per cent over the past three years.

The sharp gains raise concerns about affordability. But they also imply that anyone with a mortgage is unlikely to default on it, given that the price increases provide a greater incentive for homeowners to make their monthly payments.

These non-prime customers bought their homes with initial down payments of 20 per cent or more, adding additional comfort as prices rise.

“The delinquency rate on Home Capital’s mortgages remains unusually low, which is not a surprise since house prices are still rising rapidly in Ontario,” David Madani, an economist at Capital Economics, said in a note.

Not everyone has this confidence in Home Capital’s loan book, though. Short-sellers and former investors are calling into question the company’s underwriting standards, after it suspended 45 mortgage brokers for submitting fake or altered verification documents in 2015.

But what short-sellers really need is a sharp downturn in the housing market, which could raise default levels at Home Capital and call into question the health of the loan books of many other lenders.

Marc Cohodes, Home Capital’s most vocal short-seller, declared on Twitter last week: “$HCG is the Canary(Vulture) in the Canadian Housing Coal Mine.”

As Canada’s largest alternative lender, Home Capital has long fascinated short-sellers because they believe the company is particularly vulnerable to a popped housing bubble. When the market turns, they believe, problems will show up here first.

They’ve done well over the past week, but committed short-sellers still need to hear that popping sound.

Home Capital’s share price rose more than 11 per cent on Tuesday, and is up about 35 per cent from its intraday low last week. This rebound suggests that something is standing in the way of the stock going to zero.

BLOOMBERG . 2016 M10 3. ANALYSIS. Canada Broadens Fight to Cool Surging Home Prices: QuickTake Q&A

by Katia Dmitrieva and Kim Chipman

Canada’s most crowded province, Ontario -- home to Toronto and its hot real-estate market -- has followed Vancouver and the federal government in trying to tame booming house prices in hopes of preventing a crash. The template is the one used elsewhere across the country: Tax foreign buyers, expand rent control and put levies on vacant properties.

1. What’s Ontario’s game plan?

On April 20, provincial Finance Minister Charles Sousa unveiled a 16-point plan that called for a 15 percent tax on foreign "speculators" in the Toronto region and expanded rent control for buildings constructed after 1991. He also proposed a five-year, C$125-million ($93 million) program to encourage the construction of new rental units by refunding a portion of the fees collected from builders. This followed moves by the province of British Columbia, which enacted a 15 percent tax on foreign home buyers in Vancouver in 2016.

2. Did it work in Vancouver?

The tax did push down home sales to the lowest in almost two years. But the market’s showing signs of heating up again.

3. What are federal officials doing?

In October 2016, Finance Minister Bill Morneau closed a tax loophole used by overseas purchasers: They’re no longer be able to claim a capital gains tax exemption on the sale of their principal home. There are also limits on capital gains tax breaks for resident home buyers and tightened requirements on mortgage insurance. In December 2015, the government raised down payment requirements on homes over C$500,000. The government may ask banks to hold more money backing property loans in case of default.

4. Why is Canada’s housing market so hot?

Rich foreigners -- particularly from China -- have been blamed by government and locals for soaking up the limited supply of houses and condos. House prices in Toronto shot up more than 30 percent in March 2017, surpassing gains in Vancouver, and have outpaced San Francisco and New York in recent years. Priced-out residents are driving up sales and prices in sleepy nearby towns.

5. How did we get here?

Blame a perfect storm of depressed interest rates, limited housing supply and city planning policies. Armed with cheap debt, buyers are overextending themselves: An overnight lending rate near a record low means some mortgage rates are as low as 2.28 percent. Vancouver’s sprawl is hemmed in by the Pacific Ocean on one side and mountains on the other, Toronto is limited by an ecological reserved territory, the Green Belt. And since the 1980s, the Canadian government has been encouraging offshore investment, at one point even establishing a national investor program to fast-track citizenship applications.

6. Where else have steps like this been tried?

In Australia, foreigners generally now need to seek approval before buying residential real estate and are required to pay extra fees. Switzerland doesn’t allow any purchase of residential real estate by non-residents, though investors can get around the rule by applying for a Swiss residence permit. Hong Kong taxes non-resident home buyers an additional 15 percent. On Canada’s east coast, Prince Edward Island limits purchases by non-residents -- even Canadians from other provinces -- to five acres.

7. So will this work?

Probably not. While economists at Toronto-Dominion Bank say the non-resident tax and rent control expansion combined will “take some steam” out of Toronto sales and prices in the near term, several others say the measures may deter investment and curb future supply of homes. Expectations that real estate prices will continue rising are the highest since at least 2008, according to the weekly Bloomberg Nanos Canadian Confidence Index released on April 24.

8. What’s proving so difficult?

The tricky part is that rich investors from abroad find ways around crackdowns. To skirt tighter bank rules, buyers can go to non-bank lenders, a k a the shadow market. In Australia, even as the nation implemented offshore buyer rules, home prices continued rising and investment increased.

BLOOMBERG. 2017 M05 1. ANALYSIS. Why Everyone Is Talking About the Troubles at a Tiny Canadian Lender

by David Scanlan , Doug Alexander , and Jeanette Rodrigues

- Home Capital Sale May Be Next After Pension Fund Loan

The world is suddenly paying attention to Home Capital Group Inc., the tiny Canadian mortgage lender that’s on the ropes. The stock is plunging, it faces a run on deposits and regulators are probing management’s disclosure of fraudulent mortgages. Its troubles are raising questions: Is this an isolated case of a struggling mortgage company, or early signs of cracks forming in Canada’s red-hot housing market?

1. How did Home Capital get into trouble?

It started in 2014 when the company, formed 31 years ago by Gerald Soloway, failed to screen a pile of questionable mortgages brought in by outside brokers. Some 45 brokers falsified income information on borrowers, prompting Home Capital to cut ties with them, leading to a drop in new business. This eventually led to an investigation by the Ontario Securities Commission, which said on April 19 that Home Capital had misled investors by not disclosing the fraud until five months after they became aware of the problem.

2. Will Home Capital fail?

There are plenty of signs of stress. The stock has plunged almost 75 percent this year, cutting its market value to about C$515 million, from C$3.5 billion in 2014. Most pressing is the run on deposits. Customers pulled C$1.5 billion from high-interest savings accounts in four weeks, cutting the balances to C$500 million. The company has another C$13 billion in GICS. As these 30- and 60-day deposits come due, more withdrawals may follow. Without a deposit base, Home Capital can’t fund new mortgages. Home Capital hired investment bankers for a possible sale, though there is likely as much interest in the loan book as the company itself. Commercial banks may be interested, precluding any need for a government bailout. Financial regulators say they are watching closely.

3. Will this fallout spread to other lenders?

Possibly. Home Capital competes with other companies in the so-called alternative mortgage space. They cater to small-business owners, new immigrants and other people who can’t get mortgages from the big commercial banks. It’s a niche segment but growing, accounting for almost 13 percent of the market. Unlike in the U.S. housing crash when loan defaults soared, there is little evidence of faulty loans so far. Home Capital’s delinquency rate, for example, was just 0.20 percent as of February. Still, shares of rivals First National Financial Corp. and Equitable Group Inc. have been dragged lower by the Home Capital woes as investors fear contagion.

4. And what’s a ‘frothy’ housing market?

The housing markets in Toronto and Vancouver are on a tear, raising the prospect of a bubble bursting. Prices in Toronto soared 33 percent in March from a year earlier, lifting the average price of a detached home to almost C$1.6 million. Vancouver prices are even higher. That’s sparked several moves by the federal and some provincial governments to try to cool the market, including new taxes on foreign buyers and higher loan standards. The moves haven’t had much impact.

5. So will Home Capital burst the bubble?

Not on its own. Home Capital accounts for just 1 percent of the Canadian mortgage market. Yet if other alternative lenders see a similar deposit run and they retreat from the market, and if home buyers and sellers get spooked enough to stop bidding up home prices, it may take the steam out of the market in a way that policy measures couldn’t.

________________

ANALYSIS

SCOTIABANK. ECONOMIS. May 3, 2017. GLOBAL ECONOMICS - Scotiabank's Forecast Tables

(Obs.: include Brazil GDP and Consumer Prices Index forecasts)

DOCUMENTO: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/forecast.pdf

SCOTIABANK. ECONOMIS. May 3, 2017. Executive Briefing Colombia

DOCUMENTO: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/colombia-execbriefing.pdf

SCOTIABANK. ECONOMIS. May 3, 2017. Auto News Flash. Canadian and US Vehicle Sales — April 2017

DOCUMENTO: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/autoflash.pdf

TD Bank. TD Economics. Analysis of economic performance and the implications for investors. May 2, 2017. U.S. Vehicle Sales

DOCUMENT: https://www.td.com/document/PDF/economics/comment/USVehicle_Apr2017.pdf

TD Bank. TD Economics. Analysis of economic performance and the implications for investors. May 3, 2017. U.S. ISM Non-Manufacturing Index

DOCUMENT: https://www.td.com/document/PDF/economics/comment/USISMNonMfg_Apr2017.pdf

TD Bank. TD Economics. Analysis of economic performance and the implications for investors. May 3, 2017. Q1 and Done? Assessing Canadian Growth Sturdiness

DOCUMENT: https://www.td.com/document/PDF/economics/special/SourcesOfGrowth2017.pdf

RBC. Daily Economic Update. May 1, 2017. US consumer spending volumes higher in March

DOCUMENT: http://www.rbc.com/economics/daily-economic-update/US%20PCE_Mar2017.pdf

________________

LGCJ.: