CANADA ECONOMICS

GOVERNMENT

Global Affairs Canada. May 24, 2017. Minister of Foreign Affairs to attend G7 Leaders’ Summit

Ottawa, Ontario - The Honourable Chrystia Freeland, Minister of Foreign Affairs, today announced she will join the Prime Minister in Taormina, Italy, on May 26 and 27, 2017, for the 43rd G7 Leaders’ Summit.

The Minister will support the Prime Minister in advancing Canada’s progressive international agenda and expanding opportunities for Canadians. Leaders will also discuss pressing global issues, including international peace and security, climate change and migration.

In 2018, Canada will hold the G7 presidency, providing an opportunity to showcase the country’s contributions, including support for a strong middle class and gender equality, as well as respect for diversity and inclusion.

Quotes

“The G7 Leaders’ Summit offers Canada a distinct opportunity to advance its international agenda with key partners and expand opportunities for our middle class. As Canada prepares to take over the G7 presidency, we will continue to ensure Canadian diplomacy and leadership shape important global issues.

- Hon. Chrystia Freeland, P.C., M.P., Minister of Foreign Affairs

Quick facts

- The leaders of the G7, united by common values of respect for freedom and democracy, human rights and the rule of law, come together each year to discuss issues of domestic and global concern. The G7 comprises Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. Representatives of the European Union also attend meetings.

- The G7 dates back to the mid-1970s, and the G7 presidency, which rotates annually among member countries, sets the agenda for the year in consultation with G7 partners. Italy holds the presidency in 2017.

- G7 ministerial-level meetings are also held each year to build on the leaders’ agenda. Italy has convened a total of 12 such meetings in 2017. The Minister of Foreign Affairs met with her G7 counterparts in Lucca, Italy, on April 10 and 11, 2017.

Innovation, Science and Economic Development Canada. May 23, 2017. Minister Chagger concludes successful visit to the United States. Visit reinforced the strength of the Canada–U.S. economic partnership

Chicago, Illinois – Canada and the United States enjoy the longest and most peaceful and mutually beneficial relationship of any two countries on the planet. Our integrated economies support good, middle-class jobs on both sides of the border. This was the message delivered by the Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism, as she concluded a two-day visit to Toledo, Ohio, and Chicago, Illinois.

Minister Chagger began in Toledo, where she participated at a roundtable discussion on Canada–Ohio trade at the Port of Toledo. She later delivered remarks on the importance of the Canada–U.S. trade relationship and participated in a panel discussion organized by the Toledo Metropolitan Area Council of Governments and the Toledo Regional Growth Partnership.

Minister Chagger also met with Toledo Mayor Paula Hicks-Hudson and Congresswoman Marcy Kaptur. During these meetings, the Minister emphasized the strength of the trade relationship between Ohio and Canada. The Minister concluded her visit to Toledo with a tour of NatureFresh Farms, a Canadian company based in Leamington, Ontario, that is currently building a 175-acre greenhouse complex in Ohio.

Minister Chagger then travelled to Chicago, Illinois, where she met with state and local officials as well as with Canadian and U.S. innovators.

Minister Chagger met with Illinois Deputy Governor Leslie Munger, Chicago Mayor Rahm Emanuel, and senior staff of U.S. Senator for Illinois Dick Durbin.

She also toured and participated in a roundtable at MATTER Chicago—a not-for-profit healthcare incubator—where she spoke about small businesses as the drivers of innovation and was joined by Alberta Minister of Economic Development and Trade Deron Bilous.

While in Chicago, the Minister also participated in interviews on “Worldview,” a radio show on WBEZ, the local National Public Radio affiliate, and on the “Roe Conn Show,” a talk show on WGN Radio Chicago.

Quotes

“It has been a pleasure visiting Toledo and Chicago and meeting with local partners about the importance of the Canada–U.S. relationship. Trade between our two countries is balanced, fair and mutually beneficial. These strong ties are reflected in how closely our economies work together to better compete with the rest of the world. We look forward to working closely with our American friends to find solutions that create jobs and growth in both countries—providing more opportunities for our middle class and those working hard to join it.”

– The Honourable Bardish Chagger, Leader of the Government in the House of Commons and Minister of Small Business and Tourism

Quick Facts

- Canada buys more from the U.S. than any other country. Nearly 9 million jobs in the United States directly depend on trade and investment between our two countries.

- 13 U.S. states border Canada, and seven Canadian provinces and one territory border the U.S. We share the world’s longest international border.

- The North American free trade zone is the biggest economic region in the world, comprising a US$19-trillion regional market of some 470 million consumers and a combined economic output accounting for more than a quarter of the world’s GDP.

- The United States is the most important export destination for Canadian small and medium-sized enterprises (SME); of the 11.8% of Canadian SMEs that engage in export, approximately 90% export to the U.S.

- In 2015, approximately US$2 billion in goods and services crossed our shared border each day.

- For every dollar’s worth of goods that the United States imports from Canada, approximately 25 cents comprises U.S. inputs. When Americans buy Canadian products, they’re buying American.

________________

INTEREST RATE

BANK OF CANADA. 24 May 2017. Bank of Canada maintains overnight rate target at 1/2 per cent

Ottawa, Ontario - The Bank of Canada is maintaining its target for the overnight rate at 1/2 per cent. The Bank Rate is correspondingly 3/4 per cent and the deposit rate is 1/4 per cent.

Inflation is broadly in line with the Bank’s projection in its April Monetary Policy Report (MPR). Food prices continue to decline, mainly because of intense retail competition, pushing inflation temporarily lower. The Bank’s three measures of core inflation remain below two per cent and wage growth is still subdued, consistent with ongoing excess capacity in the economy.

The global economy continues to gain traction and recent developments reinforce the Bank’s view that growth will gradually strengthen and broaden over the projection horizon. As anticipated, growth in the United States during the first quarter was weak, reflecting mostly temporary factors. Recent data point to a rebound in the second quarter. The uncertainties outlined in the April MPR continue to cloud the global and Canadian outlooks.

The Canadian economy’s adjustment to lower oil prices is largely complete and recent economic data have been encouraging, including indicators of business investment. Consumer spending and the housing sector continue to be robust on the back of an improving labour market, and these are becoming more broadly based across regions. Macroprudential and other policy measures, while contributing to more sustainable debt profiles, have yet to have a substantial cooling effect on housing markets. Meanwhile, export growth remains subdued, as anticipated in the April MPR, in the face of ongoing competitiveness challenges. The Bank’s monitoring of the economic data suggests that very strong growth in the first quarter will be followed by some moderation in the second quarter.

All things considered, Governing Council judges that the current degree of monetary stimulus is appropriate at present, and maintains the target for the overnight rate at 1/2 per cent.

FULL DOCUMENT: http://www.bankofcanada.ca/wp-content/uploads/2017/05/fad-press-release-2017-05-24.pdf

The Globe and Mail. May 24, 2017. Bank of Canada sees conflicting economic forces; holds rates

BARRIE MCKENNA

OTTAWA — The Bank of Canada is keeping its key interest rate unchanged at 0.5 per cent as it weighs the clashing forces of falling inflation and a surprising burst of economic growth.

But the central bank warned Wednesday that both factors may be temporary.

The torrid growth in the first quarter – now on a pace to hit 4.7 per cent annual rate – will be followed by “some moderation” in the April-to-June quarter, the bank said in a statement. In April, the bank had forecast 3.8 per cent GDP growth in the first quarter.

Likewise, some of the recent inflation weakness may not last. The bank pointed out that inflation is being pushed lower by “intense retail competition,” which has led to falling food prices.

All three of the bank’s core inflation measures remain below the bank’s two per cent target – reflecting “ongoing excess capacity in the economy,” according to the statement.

Wednesday’s decision marked the 15th consecutive time since July 2015 that the central bank has left its key rate unchanged. Most economists don’t expect the bank to begin raising rates until at least early 2018.

The five-paragraph statement was generally upbeat about prospects for the economy. The bank said the global economy is gaining traction and there are encouraging signs that business investment will pick up now that the economy has largely adjusted to lower oil prices. It also highlighted the “improving” labour market, which is driving consumer spending and housing.

“Growth will gradually strengthen and broaden over the projection horizon,” the bank said.

The bank also acknowledged the hot Ontario and B.C. housing markets, noting that recent government efforts to stop speculation and risky borrowing “have yet to have a substantial cooling effect.” But it said these measures are “contributing to more sustainable debt profiles” of borrowers.

The bank’s generally optimistic tone is tempered a bit by the uncertainties still clouding the economic outlook. The bank is still concerned about policy changes in the U.S., including rising protectionism, renegotiation of the North American free trade agreement and deep tax cuts that could make Canada less competitive.

The statement also noted that export growth remains “subdued” as exporters continue to face “competitiveness challenges.”

REUTERS. May 24, 2017. Bank of Canada holds rates, sees no cooling in housing yet

OTTAWA May 24 (Reuters) - The Bank of Canada held interest rates steady on Wednesday, as expected, saying that while economic growth is likely to moderate in the second quarter, government measures to rein in the housing market have not yet had a substantial cooling effect.

Reiterating its position that excess capacity remains in the economy and wage growth is subdued, the central bank nevertheless noted strong spending by Canadians along with a housing boom and job growth.

"Consumer spending and the housing sector continue to be robust on the back of an improving labor market, and these are becoming more broadly based across regions," the bank said in a statement accompanying the interest rate decision.

The bank kept the benchmark interest rate at 0.50 percent, as widely expected, saying its monitoring of data suggests that very strong growth in the first quarter of the year will be followed by "some moderation" in the second quarter.

It said that inflation is broadly in line with the bank's projection in April despite temporary downward pressure from lower food prices. While noting the country's exporters continue to face "ongoing competitiveness challenges," it said recent indicators of business investment are encouraging.

While recent macroprudential measures aimed at cooling the housing market have contributed to more sustainable debt profiles, they "have yet to have a substantial cooling effect on housing markets," the bank said. Governments have tightened mortgage lending rules and imposed a foreign buyers tax in Vancouver and Toronto amid fears of a housing bubble.

(Reporting by Andrea Hopkins and Leah Schnurr)

BLOOMBERG. 2017 M05 24. Poloz Gives Nod to Recovery While Holding Rates Steady

by Theophilos Argitis

- Bank of Canada changes its language in stand-pat rate decision

- Recent data ‘encouraging’ after adjustment to low oil prices

The Bank of Canada kept its benchmark interest rate unchanged at 0.5 percent in a rate decision Wednesday in Ottawa.

Policy makers led by Governor Stephen Poloz gave a nod to improving economic data and added new language stating “the current degree of monetary stimulus is appropriate at present.”

The Canadian dollar jumped on the report, gaining 0.3 percent to C$1.3466 per U.S. dollar at 10:08 a.m. in Toronto.

Key Points

- The Bank of Canada reiterated its assessment that subdued inflation and wage growth is consistent with “ongoing excess capacity in the economy.”

- At the same time, it said the economy’s adjustment to the oil price decline is “largely complete” and that “recent economic data have been encouraging” -- with a “robust” labor market driving consumer spending and housing

- Critically, it changed its policy language to add a time element and the word “stimulus.”

- In the April 12 statement, that language had been that “Governing Council judges that the current stance of monetary policy is still appropriate.”

- The last time it used the “current degree” of stimulus language was in the May 2015 statement, which immediately preceded a July 2015 rate move -- which was a cut at the time.

Big Picture

Up until now, Poloz has been downplaying the recent run of strong data --, pointing instead to persistent slack in the economy, especially relative to the U.S., as well as emerging geopolitical risks. That dovishness has helped to keep the Canadian dollar in check and exporters more competitive. He even in talked openly in January about the possibility of cutting interest rates if needed. Yet, it’s become more difficult to be play down the outlook as economic numbers show a robust rebound. At a press conference after the April statement, he said he had become “decidedly neutral.”

Key Quote

“All things considered, Governing Council judges that the current degree of monetary stimulus is appropriate at present,” the Bank of Canada says.

Other Details

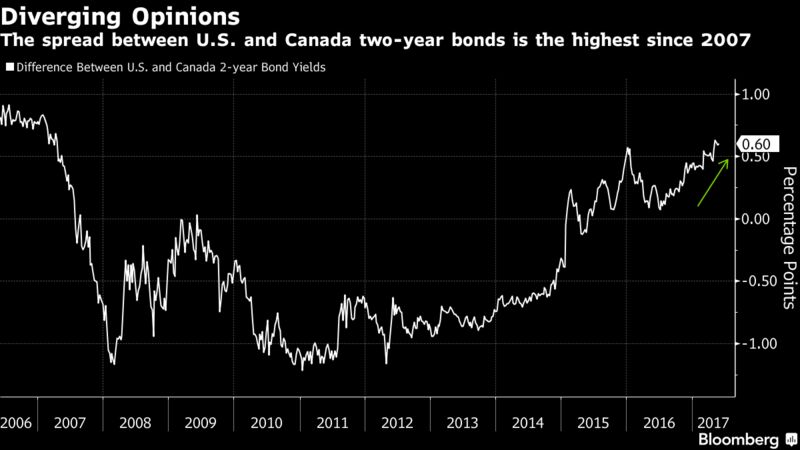

- No indication of how U.S. economy is diverging from Canada’s economy, which has been something highlighted in the recent past.

- The bank calls inflation consistent with April projections, with decline in food prices temporary because of intense retail competition.

- Global economy gaining traction, with growth strengthening and broadening, the bank says.

- Policy makers see the first-quarter slump in U.S. growth as temporary.

- Canadian export growth remains subdued, as anticipated.

- Strong Canada growth in the first quarter will be “followed by some moderation.”

FULL DOCUMENT: https://www.td.com/document/PDF/economics/comment/BOCInterestRate_May2017.pdf

________________

HOUSING BUBBLE

The Globe and Mail. ANALYSIS. May 24, 2017. Mr. Poloz, Toronto’s housing bubble ‘is not your problem’

MICHAEL BABAD, Columnist on Economics

Briefing highlights

- What to expect from Poloz this morning

- BMO raises dividend as profit jumps

- Markets at a glance

- Quebec building sector hit by walkout

‘Not your problem’

Some observers have suggested Bank of Canada Governor Stephen Poloz raise interest rates to deflate Toronto’s housing bubble.

But, Mr. Poloz, Deutsche Bank says “Toronto is not your problem.”

As The Globe and Mail’s Barrie McKenna reports, Mr. Poloz and his central bank colleagues held their benchmark overnight rate steady at 0.5 per cent, saying recent indicators have been “encouraging.”

For his part, Mr. Poloz has left the inflated Vancouver and Toronto housing markets to government policy measures, both at the provincial and federal levels.

And at any rate, it’s a local, rather than national, problem, though one with Canada-wide implications.

British Columbia’s move to tax foreign buyers in the Vancouver area has sparked a sales slump, while a similar move by Ontario to cool down the markets in and around Toronto is too recent to gauge.

Regardless, say Deutsche Bank macro strategist Sebastien Galy and senior economist Brett Ryan, there’s nothing in the Toronto and Vancouver that should knock the central bank off its course.

“A detailed look at the Greater Toronto Area housing market price dynamics does not suggest the Bank of Canada would revise substantially lower its growth and [inflation] forecasts,” Mr. Galy and Mr. Ryan said before the rate decision in a report titled “Toronto is not your problem.”

Indeed, the central bank said little today other than that things are looking up, though housing markets are still a big question mark.

“The Canadian economy’s adjustment to lower oil prices is largely complete and recent economic data have been encouraging, including indicators of business investment,” the Bank of Canada said.

“Consumer spending and the housing sector continue to be robust on the back of an improving labour market, and these are becoming more broadly based across regions,” it added.

“Macroprudential and other policy measures, while contributing to more sustainable debt profiles, have yet to have a substantial effect on housing markets.”

On other fronts, it noted that growth in exports “remains subdued” given competitive challenges.

“The bank’s monitoring of the economic data suggests that very strong growth in the first quarter will be followed by some moderation in the second quarter,” it added.

The Deutsche Bank observers said, by the way, that they expect the Toronto impact to be “roughly double” that of Vancouver.

The Globe and Mail. May 23, 2017. HOUSING BUBBLE. Home Capital raises rates to draw funds

CLARE O’HARA AND CHRISTINA PELLEGRINI

Home Capital Group Inc. is hiking rates on its guaranteed investment certificates in a bid to attract depositors and replenish its cash base, weeks after the troubled lender was rattled by a surge of withdrawals.

The Toronto-based company says it had a total of $12.33-billion in GIC deposits as of Monday – an amount that has remained relatively stable in recent weeks. But that stability is threatened by a coming wave of maturities. Home Capital reported with is first-quarter results that $7.05-billion of fixed-term deposits, including GICs and institutional deposit notes, were set to mature in the 12 months following March 31. About $4.3-billion is set to mature from July to next March.

With renewal dates looming, the company is hitting the street with attractive interest rates that may be piquing the interest of new and current investors. Last Friday, Home Capital raised interest rates for all terms of its Home Trust GICs. A one-year Home Trust GIC now offers 2.2 per cent, up from 1.6 per cent earlier this month, according to a financial adviser.

Investigation: Mayday at Home Capital

Oaken Financial posted a rate increase Tuesday morning, offering 2.6 per cent for a one-year GIC, up from 2 per cent at the beginning of May.

“We have raised interest rates recently on GICs offered by both Oaken and Home Trust. We regularly update our rates to reflect the market for deposits and our place in it, and we understand that we need to pay a rate premium right now to attract deposit flows,” said Benjy Katchen, Home Capital’s executive vice-president, deposits and consumer lending.

“… In addition, consumers can benefit from up to $100,000 in CDIC-insured deposits per named account at each of Home Bank and Home Trust, which are both members of [Canada Deposit Insurance Corp.]” (Home Trust offers deposits through financial advisers while Oaken Financial sells directly to consumers.)

In comparison, rival alternative mortgage lender Equitable Bank’s one-year rate is 1.75 per cent while the Bank of Montreal is offering 0.85 per cent for the same term.

For Home Capital, the question is whether it can attract enough new deposits to offset the maturing ones and maintain enough liquidity to run a healthy business.

Earlier this year, Home Capital was seen as an attractive mortgage lender that was able to offer better-than-average interest rates for both high-interest savings accounts (HISAs) and GICs. But after regulatory concerns surfaced within their mortgage business, brokers at other financial institutions grew wary and a flood of investment dollars was immediately pulled from the company’s HISAs.

Over the past two months, balances in those accounts dropped to $115-million as of Monday from $1.9-billion.

Now, as GICs mature, wealth managers and their clients have been hesitant to reinvest funds back into Home Capital product. Several investment firms have capped the amount of Home Capital deposits a financial adviser can sell to $100,000 or less (the same amount insured under the CDIC program).

“Cash is first and foremost, and will always be, about liquidity,” said James Price, director of investment and advice at Richardson GMP Ltd. “Any time you are stretching for a return with your cash, all of a sudden you are not making a cash decision. It doesn’t mean the return that you could get with HISAs or GICs should be ignored completely, but it should always be a consideration that liquidity problems may arise in certain situations.”

The Globe and Mail. May 23, 2017. HOUSING BUBBLE. OPINION. Are we pushing millennials into a financial abyss of home ownership?

ROB CARRICK

Realtors, lenders and everyone else living off hot housing, thank a parent today for helping to keep prices on the rise in cities across the country.

Manulife Bank issued survey results on Tuesday that suggest 45 per cent of millennial home buyers received a gift of money or a loan from family. That compares with 37 per cent for Gen Xers and 31 per cent of baby boomers. One-third of the people receiving financial help recently got more than $25,000.

Parents are simply doing what parents do – helping their kids out and perhaps making sacrifices to do so. But there are signs parents may not grasp the full extent of the affordability challenges of not only buying a house, but also owning one. Ask this if you’re a parent helping your millennial kids buy a home: What am I getting them into?

Rob Carrick: Five financial realities that millennials have never seen (but be prepared)

Family help has been a constant in home buying for generations. But now, it’s subsidizing close to half of house purchases by young first-time buyers. There couldn’t be a clearer illustration of how surging house prices are reducing affordability for young adults.

As a society, our response to this phenomenon is that everyone has to try harder to get young people into houses. Parents have to help their millennial children and those kids have to stop wasting money on anything but house down payments. This is the conclusion to be drawn from the meme of avocado toast, which is basically mashed avocados on toasted bread. Apparently, millennials like avocado toast and pay good money for it when dining out. A narrative, which began on social media, is emerging that spending on luxuries such as this is preventing millennials from being able to afford homes.

I highlighted one instance of this in the Carrick on Money e-mail newsletter last fall (subscribe here). Last week, avocado toast was cited again. A millionaire Australian real estate mogul named Tim Gurner said that when he was trying to buy his first home, he wasn’t spending money on fancy restaurant food and coffee. Media everywhere picked up on the story.

Some will see avocado toast as a metaphor for millennial self-indulgence. But the fascination with this storyline says a lot more about society’s trivial understanding of millennials than it does about these young adults themselves.

Avocado toast is not the problem in today’s housing market. The average Toronto-area house price jumped $181,709 over the 12 months to April 30. That’s 12,114 orders of avocado toast at $15 a crack, or 33.2 orders a day over a year. This brings us back to parental financial help for millennial home buyers. The need is obviously there, but so is the danger of getting millennials into a situation they can’t handle in a financial sense.

As the Manulife survey notes, the increase in parental support for millennials compared with previous generations comes despite a long-term trend toward two-income families. Over the past 40 years, the number of families with two employed parents has doubled. Families often need two incomes to afford a house today.

There’s also a high incidence of precarious work in the millennial generation, which means a lot of people are working contract or temporary jobs. This leads to inconsistent or variable incomes, a problem documented in a recently issued survey that was sponsored by Toronto-Dominion Bank.

Almost 40 per cent of participants said they have experienced moderate to high levels of income volatility in the past year, and two in 10 put themselves in the high or very high category. TD’s summary of the results said people who experienced high or very high levels of income variability are more likely to see themselves as falling behind financially and more likely to report feeling stress about money.

Manulife’s survey reinforces the idea of millennial homeowners being financially vulnerable. Almost one-third of millennials found themselves without enough money in their bank account to cover expenses at least once over the past 12 months, compared with 28 per cent of Gen Xers and 17 per cent of boomers. Millennials were also more likely to say they’d run into trouble making a mortgage payment if the prime earner in their household became unemployed.

Unless your adult children are well positioned, helping them into the housing market could be toxic to their finances. You may be better off encouraging them to rent and giving them money to put into the investment portfolio they’ll use to generate an amount of wealth similar to homeowners’.

BLOOMBERG. 2017 M05 24. Bidding Wars Turn to Homebuyers’ Remorse in Toronto

by Kim Chipman

- Home Capital woes combined with new tax measures cool market

- Listings soar in first half of May as sellers rush in

- BMO Optimistic on Measures to Cool Toronto Housing Market

Toronto’s hot housing market has entered a new phase: jittery.

After a double whammy of government intervention and the near-collapse of Home Capital Group Inc., sellers are rushing to list their homes to avoid missing out on the recent price gains. The new dynamic has buyers rethinking purchases and sellers asking why they aren’t attracting the bidding wars their neighbors saw just a few weeks ago in Canada’s largest city.

“We are seeing people who paid those crazy prices over the last few months walking away from their deposits,” said Carissa Turnbull, a Royal LePage broker in the Toronto suburb of Oakville, who didn’t get a single visitor to an open house on the weekend. “They don’t want to close anymore.”

Home Capital may be achieving what so many policy measures failed to do: cool down a housing market that soared as much as 33 percent in March from a year earlier. The run on deposits at the Toronto-based mortgage lender has sparked concerns about contagion, and comes on top of a new Ontario tax on foreign buyers and federal government moves last year that make it harder to get a mortgage.

“Definitely a perception change occurred from Home Capital,” said Shubha Dasgupta, owner of Toronto-based mortgage brokerage Capital Lending Centre. “It’s had a certain impact, but how to quantify that impact is yet to be determined.”

Read more: Canadian Real Estate Sentiment Slips

Early data from the Toronto Real Estate Board confirms the shift in sentiment. Listings soared 47 percent in the first two weeks of the month from the same period a year earlier, while unit sales dropped 16 percent. Full-month data will be released in early June.

Prices Moderate

The average selling price was C$890,284 ($658,000) through May 14, up 17 percent from a year earlier, yet down 3.3 percent from the full month of April. The annual price gain is down from 25 percent in April and 33 percent in March. Toronto has seen yearly price growth every month since May 2009. The last time the city saw gains of less than 10 percent was in December 2015.

Brokers say some owners are taking their homes off the market because they were seeking the same high offers that were spreading across the region as recently as six weeks ago.

“In less than one week we went from having 40 or 50 people coming to an open house to now, when you are lucky to get five people,” said Case Feenstra, an agent at Royal LePage Real Estate Services Loretta Phinney in Mississauga, Ontario. “Everyone went into hibernation.”

Toronto real estate lawyer Mark Weisleder said some clients want out of transactions.

“I’ve had situations where buyers are trying to try to find another buyer to take over their deal,” he said. “They are nervous whether they bought right at the top and prices may come down.”

Confidence Wanes

Brokers say the 15 percent foreign buyers’ tax announced by Ontario on April 20 and the ongoing struggles at Home Capital are sapping confidence. That’s more than offset concerns about tighter rent controls that developers have said will limit housing supply and keep prices high.

Weekly polling data show real estate price expectations have come down, in a sign that Canadians are anticipating housing markets in Toronto and Vancouver will finally cool. The share of people saying home prices will rise in the next six months fell for a second week to 46 percent, according to data compiled by Nanos Research Group for Bloomberg News. That’s down from a record 50.1 percent two weeks ago.

The fate of Home Capital, known as a “b-lender” because it caters to new immigrants and other homebuyers who can’t get a traditional bank loan, remains in question. A run on deposits and stock plunge began late last month after regulators accused the company of misleading investors about potentially fraudulent mortgage applications.

“Home Capital is affecting things because people who can’t get mortgages from the banks rely on them and other b-lenders,” said Lorand Sebestyen, an agent with iPro Realty Ltd. in Toronto. “If you can’t get the mortgage then you obviously can’t buy anything and it’s going to affect the market, especially for the higher-priced properties.”

Market Fear

The firm went into survival mode as concern about Toronto’s housing market was escalating, with Bank of Canada Governor Stephen Poloz warning the gains were unsustainable. Worries about a market bubble morphed into nervousness about whether Canada might be on the brink of a financial meltdown. Rising household debt and runaway housing prices led to credit rating downgrades for the country’s six biggest banks this month by Moody’s Investors Service.

“It’s fear,” Century 21 Millennium Inc. brokerage owner Joanne Evans, who focuses on Toronto suburbs such as Brampton, said about the potential Home Capital effect on housing. “It’s another contributing factor to the fear of ‘what’s going to happen?”’

Home Capital’s competitors have seen a surge in demand as more brokers steer clients away from the struggling lender, Dasgupta said. Those lenders in turn are experiencing slower response times due to a backlog of borrowers.

“Home Capital is a bigger deal than the government announcement,” Weisleder said. “It’s had a bigger impact on the market.”

Rental Time

Still, not all sellers are feeling pinched.

Michael Hartmann put his north Toronto home up for sale on May 17, and it sold on May 22, the first day he began taking offers. The 53-year-old professor at McMaster University’s DeGroote School of Business in Hamilton, Ontario, decided not to take his agent’s advice to price the house on the low side in an attempt to stir up a bidding war.

He nudged the price up to be more in line with other homes in the neighborhood and sold it for C$1.65 million, C$10,000 above asking price. Hartmann said he and his wife will take their time before choosing their next move.

“We are in the fortunate position as empty-nesters that we don’t have to rush back into the market,” he said. “We have the advantage of seeing whether we go back in and buy in Toronto or somewhere else in Canada or go abroad.”

In the meantime, they plan to rent.

________________

INNOVATION SUPPORT

The Globe and Mail. May 23, 2017. Ottawa to kick off $950-million innovation ‘supercluster’ competition

SEAN SILCOFF

OTTAWA — The federal government will kick off the centrepiece of its innovation agenda Wednesday by officially launching a program that will disburse $950-million to as many as five “supercluster” initiatives geared toward creating high-paying jobs in fast-growing sectors.

Initial applications for the funds will be due July 21 from industry-led consortiums in eight high-potential sectors: advanced manufacturing, agri-food, clean technology, digital technology, health-bioscience, clean resources, infrastructure and transportation. Shortlisted applicants will have until Oct. 20 to submit detailed proposals, and the government plans to select the winners by year’s end.

“This initiative is about government partnering with industry, academia and communities to build on our strengths to develop the economy and the jobs of the future,” Innovation, Science and Economic Development Minister Navdeep Bains said in an interview.

“We’re looking for bold and ambitious proposals that can generate large-scale transformative results, not incremental change,” Mr. Bains said.

“People say to me: ‘What does success look like?’ I’ve got three words: jobs, jobs jobs.”

The Globe and Mail has learned that winning consortiums must include two industry-leading “anchor” companies, six small and medium-sized enterprises and one postsecondary institution. The proposals must lay out how each group would create globally competitive sectors with high-paying, “resilient” jobs, boost economic growth and translate into commercial success for Canadian companies.

To qualify, supercluster participants must commit to creating and governing a not-for-profit organization, which would receive and disburse the money. Anchors can be Canadian-based subsidiaries of foreign corporations.

“I suspect part of those proposals will be tapping into the global market and global supply chains,” Mr. Bains said.

Winning bidders must put skin in the game: For every dollar requested, each consortium will commit a dollar of cash or in-kind contributions of their own. Industry sectors such as artificial intelligence and clean tech that received commitments in the March budget may bid for additional supercluster cash.

Mr. Bains insisted the program was not an instance of government attempting to pick winners, saying the process would be competitive and transparent, with outside experts helping public servants evaluate bids. “We’re not prescribing the outcomes. It’s really going to be based on merit and, if and when we need, we will definitely engage with [outside] subject matter experts.”

The bids must also include an intellectual property (IP) strategy to ensure that breakthrough technologies developed by the consortiums benefit Canada, addressing criticism that patented technology developed here often ends up in foreign hands and commercialized elsewhere.

“This is one of the big concerns I have about clusters,” said Jim Hinton, an IP lawyer in Waterloo, Ont. who acts for Canadian innovators. “We have to make sure we’re not just subsidizing foreign tech firms’ research and development. This is what we’ve conventionally done. … We need to make sure the IP stays in Canada and the cluster members benefit.”

He warned Ottawa shouldn’t offload the IP strategy to the clusters; the government ought to ensure “the taxpayer gets the innovation benefits as well.”

Ottawa has pledged to develop a national IP strategy as part of its innovation agenda, which also includes commitments to buy more goods and services from Canadian startups and to invest in the country’s venture capital sector.

Innovation is one of the few areas to benefit in the recent budget, as the government attempts to make targeted investments in higher-potential areas of the economy to foster growth.

“Canada’s high-growth tech sector wants this cluster strategy to double-down on our domestic strengths and support scaling tech firms across the country,” said Benjamin Bergen, executive director of Council of Canadian Innovators. “Only by supporting high-growth tech companies – the ones most equipped to turn the $950-million investment into $9.5-billion – will we see this investment in innovation grow Canada’s bottom line.”

Several groups are ready to apply for supercluster funding. Industry collectives have been mobilizing since the government announced in the March, 2016, budget that it would commit $800-million to fund clusters, before raising that to $950-million two months ago.

Alan Bernstein, CEO of the Canadian Institute for Advanced Research, which is overseeing the disbursement of Ottawa’s recently announced $125-million artificial intelligence funding strategy, said key AI industry players are working on a bid.

Winnipeg-based non-profit Enterprise Machine Intelligence and Learning Initiative (EMILI) – backed in part by the Richardson family, owner of the eponymous agribusiness giant, and led by local business people and academics – has been lobbying Ottawa for innovation funding to bring powerful AI technology to the agri-food business.

“We are going to be putting together an application,” said Ray Bouchard, chairman of EMILI and CEO of Enns Brothers, a large Manitoba John Deere dealerships.

Sources said groups in medical technology and regenerative medicine are also readying bids.

________________

ENERGY

The Globe and Mail. Reuters. May 24, 2017. Loonie holds on to recent gains ahead of Bank of Canada, OPEC decisions

FERGAL SMITH

TORONTO — The Canadian dollar was little changed against its U.S. counterpart on Wednesday, holding onto recent gains ahead of an interest rate decision by the Bank of Canada and a possible extension of oil production cuts by major producers.

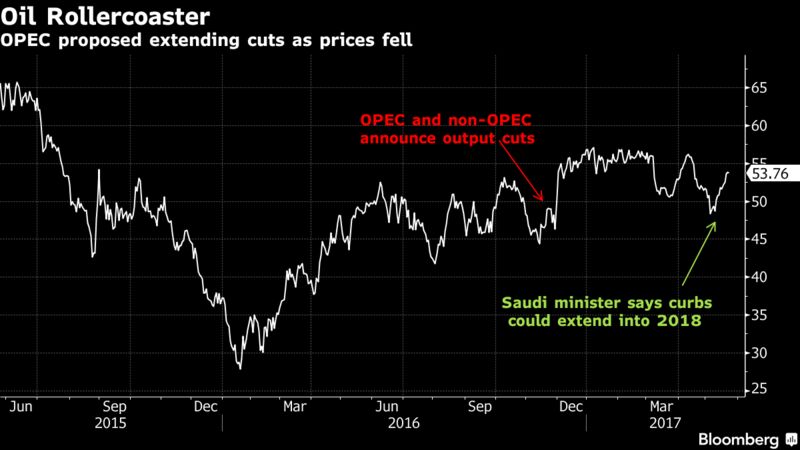

U.S. crude’s price dipped 0.19 per cent to $51.37 a barrel as investors waited for news from Vienna, where ministers from the Organization of the Petroleum Exporting Countries and other nations were discussing whether to extend production cuts into the first quarter of 2018.

Oil is one of Canada’s major exports.

The Bank of Canada is widely expected to hold interest rates at 0.50 per cent. They have stood at that level since July 2015, when the central bank cut them for the second time that year to offset the impact of plunging oil prices.

Economists say Canada’s economy could grow as much as 4 per cent in the first quarter after a solid expansion in the second half of 2016. But the central bank has downplayed the sustainability of recent stronger-than-expected growth while its measures of core inflation have remained muted.

The market has largely given up on prospects for a rate hike this year. Reuters data showed the chances of that have sunk to 12 per cent from around one-in-three at the last Bank of Canada rate announcement in April.

Investors also awaited the minutes from the U.S. Federal Reserve’s last policy meeting, while world stocks inched lower after China’s sovereign credit rating was downgraded.

At 9:13 a.m. ET, the Canadian dollar was unchanged at $1.3512 to the greenback, or 74.01 U.S. cents, according to Reuters data.

The currency traded in a range of $1.3492 to $1.3540.

It has recovered from a 14-month low of $1.3793 set earlier this month, helped by a rally in oil prices and broader losses for the U.S. dollar amid diminishing expectations of a promised fiscal boost to the U.S. economy from President Donald Trump.

Last Thursday, the loonie touched its strongest in nearly one month at $1.3457.

Canadian government bond prices were higher across the yield curve in sympathy with U.S. Treasuries. The two-year rose 1 cent to yield 0.698 per cent, and the 10-year climbed 18 Canadian cents to yield 1.494 per cent.

REUTERS. May 24, 2017. Kuwait says OPEC, non-OPEC could deepen oil cuts

By Ahmad Ghaddar, Alex Lawler and Vladimir Soldatkin

VIENNA (Reuters) - OPEC and non-member oil producers could deepen output cuts or extend them for a year when they meet in Vienna this week as they seek to clear a global stocks overhang and prop up the price of crude, Kuwait said on Wednesday.

The top oil producer in OPEC, Saudi Arabia, favors extending the output curbs by nine months rather than the initially planned six months, to speed up market rebalancing and prevent crude prices from sliding back below $50 per barrel.

OPEC members Iraq and Algeria as well as top non-OPEC producer Russia also said they support a nine-month extension.

As ministers gathered in Vienna for informal consultations, Saudi OPEC ally Kuwait said discussions included the possibility of deepening the cuts or prolonging them by 12 months.

"All options are on the table," Kuwaiti oil minister Essam al-Marzouq told reporters.

The Organization of the Petroleum Exporting Countries meets formally in Vienna on Thursday to consider whether to prolong the deal reached in December in which OPEC and 11 non-members agreed to cut output by about 1.8 million barrels per day in the first half of 2017.

On Wednesday, a ministerial monitoring committee consisting of OPEC members Kuwait, Venezuela, Algeria and non-OPEC Russia and Oman meets in the Austrian capital to discuss the progress of cuts and their impact on global oil supply. Saudi Arabia, which holds the current OPEC presidency, will also attend.

Several delegates and ministers including Algeria said they did not believe cuts could be extended to a full year.

DEEPER CUTS

Possible surprises could include a deepening of the cuts, but this would likely be minor because the non-OPEC producers that are expected to join the accord for the first time on Thursday, such as Turkmenistan and Egypt, are fairly small.

A more substantial cut was unlikely, one OPEC delegate said, "unless Saudi Arabia initiates it with the biggest contribution and is supported by other Gulf members".

OPEC's cuts have helped push oil back above $50 a barrel this year, giving a fiscal boost to producers. By 1029 GMT (6:29 a.m. ET) on Wednesday, Brent crude was up around 0.2 percent at $54.37 a barrel. [O/R]

But the price rise has spurred growth in the U.S. shale industry, which is not participating in the output deal, thus slowing the market's rebalancing with global stocks still near record highs.

"This (stocks decline) is a bit tricky as production cuts cause higher prices which will incentivize more production for the U.S. shale oil and reduce the impact of the production cuts. So it's a bit cyclical," said Sushant Gupta, research director for consultancy Wood Mackenzie.

Algeria's energy minister said he believed stocks remained stubbornly large in the first half of 2017 because of high exports from the Middle East to the United States.

"Thankfully, things are improving and we started seeing a draw in inventories in the United States," Noureddine Boutarfa told Reuters.

One industry source close to OPEC said the group could also send a message about tighter exports but it was unclear how that could be presented on Thursday.

Boutarfa said extending output cuts by nine months would help to ease a global glut by the end of 2017, when inventories should decline to their five-year average: "Before the end of the year, prices may go above $55 a barrel".

(Additional reporting by Ernest Scheyder, Rania El Gamal; Writing by Dmitry Zhdannikov; Editing by Dale Hudson)

REUTERS. May 24, 2017. Oil prices steady as market awaits extended output cut

By Christopher Johnson

LONDON (Reuters) - Oil prices steadied on Wednesday as investors waited for news from Vienna where ministers from OPEC and other exporting countries were discussing whether to extend production cuts into the first quarter of next year.

Benchmark Brent crude oil LCOc1 was up 10 cents a barrel at $54.25 by 1210 GMT (8:10 a.m. ET). U.S. light crude oil CLc1 was unchanged at $51.47.

Both crude benchmarks have gained more than 10 percent from their May lows below $50 a barrel, rebounding on a consensus that the Organization of the Petroleum Exporting Countries and other producers will maintain strict limits on oil production in an attempt to drain a global oversupply.

OPEC has promised to cut supplies by 1.8 million barrels per day (bpd) until June and is expected on Thursday to decide to prolong that cut by up to nine months.

"It could be three, six or nine months," the Iranian Students' News Agency quoted Iran's oil minister, Bijan Zanganeh, as saying.

Most investors expect an extension of nine months.

Sushant Gupta, research director at Wood Mackenzie, told Reuters Global Markets Forum that output cuts were likely to be extended until the first quarter of 2018, and that adherence by OPEC members to the output cuts would probably remain high.

Harry Tchilinguirian, strategist at BNP Paribas, agreed:

"With oil stocks nowhere near OPEC’s self-assigned objective of the recent five-year average level, an extension of cuts seems all but a forgone conclusion," he said.

BMI Research said the OPEC-led cuts would only result in a balanced market this year, but that from 2018 onward markets would return to oversupply, albeit at a lower level than 2013-2016.

"Over a five-plus-year horizon, oil price growth is in a structural slowdown, pressured by persistent supply gains," BMI Research said.

One reason why markets have not tightened more has been U.S. oil production, which has soared by 10 percent since mid-2016 to 9.3 million bpd. C-OUT-T-EIA

Benefiting from a market known as contango, in which future oil prices are higher than those for immediate delivery, U.S. drillers have sold future production in order to finance expanding output.

To stop this, analysts at Goldman Sachs have suggested the oil futures price curve should be pushed into backwardation, where forward prices are below current ones.

But while backwardation might be able to reduce inventories, it is less clear how OPEC could alter the forward price curve, or if that would stop production rising.

(Additional reporting by Henning Gloystein in Singapore; editing by Susan Thomas and Jason Neely)

BLOOMBERG. 2017 M05 24. OPEC Committee Recommends Nine-Month Oil Cuts Extension

by Wael Mahdi , Angelina Rascouet , and Elena Mazneva

- Panel of six OPEC, non-OPEC nations supports longer curbs

- Crude market is rebalancing in earnest, says PIRA’s Gary Ross

- BofA's Blanch Says OPEC Can No Longer Control Oil Prices

OPEC and its allies came one step closer to agreeing to extend their oil supply deal after a ministerial committee recommended another nine months of cuts.

The Joint Ministerial Monitoring Committee -- composed of six OPEC and non-OPEC nations -- agreed in Vienna on Wednesday to support an extension through March 2018, according to a statement on the producer group’s website. That added to the backing for another nine months of cuts from the most influential participants in the deal, including Russia, Saudi Arabia and Iraq.

The Organization of Petroleum Exporting Countries and 11 non-members agreed last year to cut output by as much as 1.8 million barrels a day. The supply reductions were initially intended to last six months from January, but the slower-than-expected decline in surplus fuel inventories prompted the group to consider an extension. U.S. crude futures have rebounded by about 13 percent from a five-month low since Saudi Arabia first proposed maintaining the curbs into 2018.

“A nine-month extension is effectively a done deal, but because Russia and Saudi Arabia announced their support for it earlier in the month, the market may be disappointed if Thursday’s meeting ends with ‘just’ a nine-month extension, and prices may sell off,” Amrita Sen, chief oil market analyst at Energy Aspects Ltd., said in Vienna.

Brent crude oil for July settlement rose 0.4 percent to $54.35 a barrel at 3:26 p.m. on the London-based ICE Futures Europe exchange.

The JMMC discussed several scenarios for the cuts before settling on nine months, delegates said. Prior to the meeting, ministers had also mentioned the possibility of an additional six months, 12 months or even curbs extending through the whole of 2018. The committee didn’t discuss deeper cuts and will continue to monitor the market regularly, delegates said.

Oil officials from the 24 nations participating in the deal meet in the Austrian capital Thursday to finalize their agreement. Ministers will discuss the committee’s recommendation then, United Arab Emirates Oil Minister Suhail Mohammed Al Mazrouei said in an interview with Bloomberg television.

Kazakhstan presents one potential complication to those talks. The third-largest non-OPEC participant in the agreement pumped 1.76 million barrels a day in April, overshooting its target of 1.68 million, OPEC estimates show. The country’s Energy Minister Kanat Bozumbayev said he will seek to renegotiate the cap on its output before agreeing to an extended deal.

OPEC and its allies will probably agree to prolong their agreement until the end of the first quarter of 2018, Gary Ross, global head of oil at PIRA Energy Group, part of S&P Global Inc., said in an interview in Vienna on Wednesday.

The crude market is now starting to rebalance in earnest, but it will take time and the bulk of stockpile draws will come between June and September, Ross said. OPEC will achieve its stated aim of bringing fuel inventories back in line with the five-year average by the end of this year, said Venezuelan Oil Minister Nelson Martinez.

________________

LGCJ.: