CANADA ECONOMICS

Global Affairs Canada. May 15, 2017. Minister Champagne to travel to Asia to advance Canada’s progressive trade agenda and to conduct a forest products trade mission

Ottawa, ON - Now more than ever, Canada is focused on stimulating economic growth at home by increasing trade with partners in Asia. Fast-growing markets in the region offer enormous potential for Canadian businesses and opportunities to create good-paying jobs for Canada’s middle class.

Speaking to an audience of Canadian business executives in Ottawa, the Honourable François-Philippe Champagne, Minister of International Trade, today reiterated the importance of relations between Canada and the Association of Southeast Asian Nations (ASEAN), as Canada celebrates 40 years of engagement in the region. The Minister also took the opportunity to announce his upcoming travel to East and Southeast Asia from May 20 to 26, 2017.

On May 20 and 21, Minister Champagne will take part in the Asia-Pacific Economic Cooperation (APEC) Ministers Responsible for Trade Meeting in Hanoi, Vietnam, to promote Canada’s progressive trade approach and advance engagement with Asia Pacific.

While in Vietnam, Minister Champagne will meet with senior government and business leaders to discuss ways to expand Canada’s trade, including in Canadian forest products, with Vietnam.

On May 22 in Singapore, the Minister will meet with representatives of key ministries, to advance trade and investment relations. He will meet with leaders of Singapore’s construction industry to promote innovative Canadian building systems and wood exports. He will speak at Canada’s B2B Networking Marketplace @ CommunicAsia/BroadcastAsia 2017, an event hosted by Canada’s High Commission in Singapore to showcase Canadian information and communication technology companies, and he will meet with members of the Canada-ASEAN Business Council and the Canadian Chamber of Commerce in Singapore.

The Minister will be in Seoul, South Korea, on May 24, to advance trade and investment relations and promote Canada’s wood and wood products. He will meet with government officials as well as representatives of businesses operating in South Korea. He will also join a round table to discuss education and business with participants from Sookmyung Women’s University.

Minister Champagne will also visit Tokyo, Japan, where, on May 25 and 26, he will be joined by Canadian associations to promote Canada’s wood and forest sectors and seek new growth opportunities for Canadian businesses in the Japanese market, Canada’s second-largest export market in Asia for forestry products. Minister Champagne’s itinerary will include remarks at the AG/Sum Agritech summit and meetings with business leaders, including businesswomen. He will also meet with senior Japanese officials, including the Minister of Economy, Trade and Industry and the Minister of Foreign Affairs.

Quotes

“Canada is a trading nation, and growing our trade relations with Asia is a top priority. Asia represents significant opportunities for trade and investment with Canada that will create long-term growth, good jobs and an economy that works for the middle class. I am proud to be in Asia for the second time in a month promoting our world-class forest products.”

- François-Philippe Champagne, Minister of International Trade

Quick facts

- APEC’s aim is to facilitate economic growth and prosperity in the Asia-Pacific region. APEC members include economies critical to Canada’s future economic prosperity and security interests.

- The APEC Ministers Responsible for Trade Meeting is held in preparation for the APEC Economic Leaders’ Meeting in November.

- In August of 2016, Minister Freeland and economic ministers of the 10 ASEAN member states tasked officials with preparing terms of reference for a feasibility study on the merits of a free trade agreement between Canada and the fast-growing ASEAN region.

- In 2016, the Canadian Trade Commissioner Service served over 1,650 Canadian firms looking for opportunities in the ASEAN market, and companies from the region invested more than $1 billion in Canada.

- Vietnam has been Canada’s largest ASEAN trading partner since 2015. Two-way merchandise trade totalled nearly $5.5 billion in 2016, up from $4.7 billion in 2015.

- The Canada-Korea Free Trade Agreement, Canada’s first free trade agreement in the Asia-Pacific region, entered into force on January 1, 2015. South Korea was Canada’s sixth-largest export market in 2016.

- Two-way merchandise trade between Canada and Japan totalled more than $26 billion in 2016, making Japan Canada’s fourth-largest trading partner.

US STATE DEPARTMENT. May 16, 2017. Secretary Tillerson and Secretary Mattis' Meeting With Canada's Foreign Minister Freeland and Defense Minister Sajjan

Washington, DC, Spokesperson Heather Nauert - U.S. Secretary of State Rex Tillerson and U.S. Secretary of Defense James Mattis hosted Canadian Minister of Foreign Affairs Chrystia Freeland and Canadian Minister of Defense Harjit Sajjan for policy discussions over dinner yesterday evening at the Department of State in Washington, D.C. Their conversations focused on joint security initiatives in the United States, Canada, and throughout the world. Among other topics, the Secretaries and Ministers discussed the North American Aerospace Defense Command (NORAD), NATO, Ukraine, Venezuela, Iraq, Syria, and continuing counterterrorism cooperation to defeat ISIS.

________________

REAL STATE - HOUSING BURBLE

BLOOMBERG. 2017 M05 15. Home Capital Is Talking to Banks to Replace Its Costly Lifeline

by Doug Alexander

- Firm seeks debt-like financing with those supporting deposits

- Policy makers say Home Capital’s woes are specific to company

- After Home Capital, Canada's Economy Suddenly Looks Frail

Home Capital Group Inc. is in talks to replace its costly rescue loan from Healthcare of Ontario Pension Plan as policy makers sought to reassure investors there is little sign of contagion in Canada’s financial system.

“I’m talking to all sorts of entities -- banks and others on this," said Alan Hibben, a former investment banker who took founder Gerald Soloway’s place on the mortgage lender’s board. “The replacement on the HOOPP deal is really a debt-like financing, so we’re looking at people who can actually provide deposit note-type support to this thing."

Home Capital’s woes intensified last month, when Ontario’s securities regulator accused the company of misleading investors on the firm’s probe into falsified mortgage applications some two years earlier. A resulting run on deposits and plunging shares forced it to take the C$2 billion ($1.5 billion) loan from HOOPP at terms that analysts have called "exorbitant."

As concern about contagion unfurled, policy makers have stepped out several times over the past weeks to assure investors about the soundness of Canada’s financial system. Bank of Canada Governor Stephen Poloz and Finance Minister Bill Morneau said Home Capital’s troubles are unique to the company and there’s no evidence they’re spreading.

"They are obviously trying to work through to find a market-based solution to their funding challenges. We support them taking that market-based approach," Morneau told reporters in Ottawa on Monday. "In the interim, we will stay very focused on monitoring the situation to make sure we protect anyone involved either as a depositor or a mortgage holder at that institution. We see the Canadian banks as strong and resilient."

Buying Time

Home Capital pays an effective rate of 22.5 percent on the first C$1 billion of the one-year HOOPP loan, which is secured with a C$5.4 billion portfolio of mortgages. The terms also prevent it from taking on more debt or pursue asset sales, mergers or a wind-up without permission from HOOPP.

“We’ve bought ourselves enough time to run a couple of months, but that’s obviously not our time frame on this," Hibben said in a phone interview Monday. “I am hoping that I can have some degree of stability within the deposit base, because it’s just easier to talk to people about a deal with better term and better terms, if we have some element of stability underlying the company."

Home Capital’s high interest savings deposit balances stood at about C$125 million as of May 12 -- roughly the same as the day earlier but down from C$2 billion March 28. Available liquidity and credit capacity totaled about C$1.51 billion, including an undrawn C$600 million under the HOOPP facility, the firm said in a Monday statement.

Cancel the Facility

“Investors may be concerned that the over-collateralization is higher than what they may have initially believed,” RBC Capital Markets analyst Geoffrey Kwan wrote in a May 12 note. “Given there is no penalty to cancel the facility, we think it makes it that much more important” for Home Capital to secure funds -- such as an alternative funding facility with better terms, or asset sales -- to cancel the facility, he said.

Other deals have already been put in place to help stabilize Home Capital. Mortgage financing firm MCAP Corp. said last week it reached a deal to service C$1.5 billion of Home Capital’s mortgages and renewals. Hibben said there’s the potential to bring in other partners or upsize the deal -- without naming MCAP as the third-party -- though he said private equity players are unlikely.

“There are other players in the marketplace that we are talking to about that," he said. "We’ve had some very early indications of interest in upsizing that, but nothing has been done."

Asset sales are also an option in case things get worse than expected, though Hibben said it’s not a priority. Calls to the office of HOOPP President Jim Keohane were unanswered. Home Capital rose 1.9 percent to C$9.17 at 4 p.m. in Toronto, paring its decline over the past month to 58 percent.

‘Nowhere Near Last Resort’

One option that doesn’t seem to be on the table is seeking support from the Bank of Canada. Home Capital is “nowhere near last resort time" at this stage, Hibben said. “A market-driven solution is our first, second and third choice."

Poloz described Home Capital’s troubles as "idiosyncratic" and unique to the mortgage lender in a weekend interview with the Globe and Mail, adding that there’s no evidence they’re spreading to other parts of the nation’s financial system.

Hibben meanwhile is doing his best to contain any fallout by outlining his plan to get Home Capital back on its feet. First comes governance, with the addition of new directors. The HOOPP loan replacement and other possible financing deals come next, which will help repair Home Capital’s reputation with its depositors and broker network. Then management, which includes the search for a new chief executive officer, though this could mean "45 to 60 days, if we’re really lucky."

Hibben -- who was named to the board May 5 to help restore confidence -- has the skill to do that. He’s a retired RBC Capital Markets investment banker who was once a managing director for mergers and acquisitions. His career highlights include helping advise Ontario’s government on the sale of Hydro One Ltd. in 2015, overseeing strategy at Royal Bank of Canada, and leading North American Trust Co. through a restructuring and eventual sale in the early 1990s after its previous management were relieved.

"I’m not looking at a partial solution to the HOOPP facility," Hibben said when asked about the difficulty of overcoming restrictions in the terms of the loan. "I’m looking for a total solution."

BLOOMBERG. 2017 M05 15. Buy Canadian Banks on Home Capital’s ‘Bearish Narrative,’ TD Says

by Kristine Owram

- Home Capital risks will weigh on bank stocks in short term

- No ‘rotting carcass’ of bad loans in the Canadian market

The troubles at Home Capital Group Inc. have created a "powerful bearish narrative" that will weigh on Canadian bank stocks yet creates a compelling buying opportunity for the long term, says the head of TD Asset Management’s core Canadian equity team.

"In the very short term it wouldn’t shock me if we get a bit of a pause here," said Mike O’Brien, whose firm manages C$345 billion ($253 billion) in assets. "There’s a very powerful bearish narrative that has the floor right now and that will hurt sentiment for a period of time."

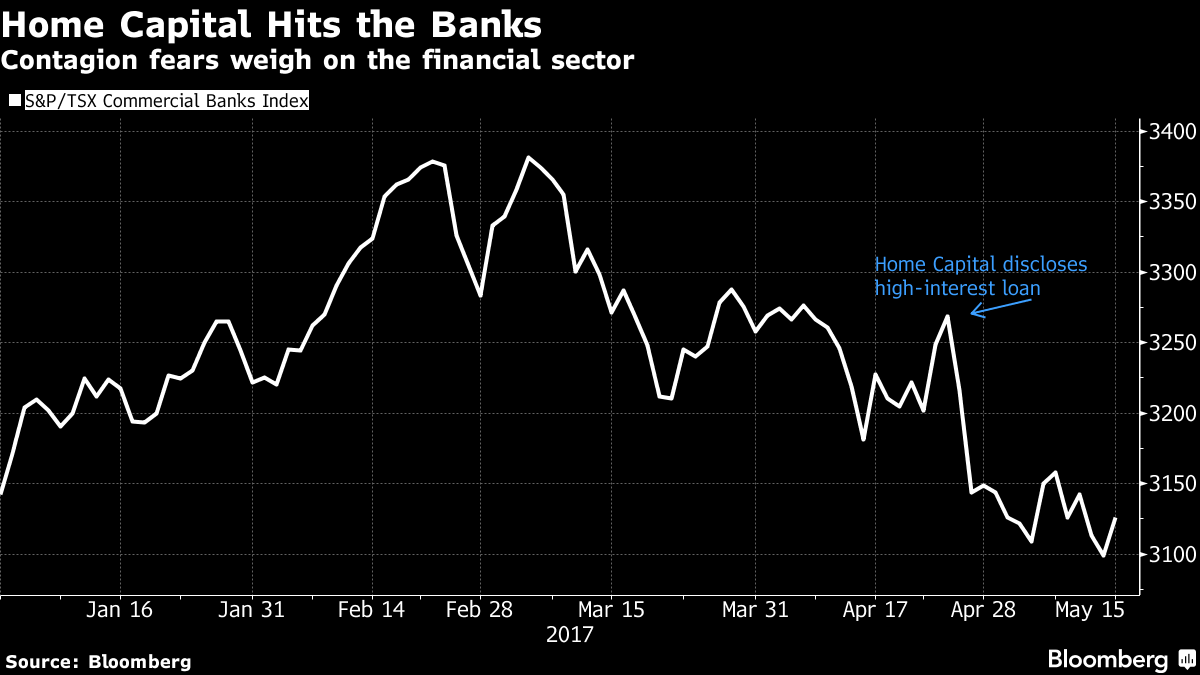

The S&P/TSX commercial banks index, which includes the Big Five banks, has lost 4.4 percent since April 25, the day before Home Capital disclosed a high-interest loan to cover a run on deposits, instigating fears of contagion in the Canadian financial sector. Home Capital’s shares have tumbled 46 percent in the same period.

Finance Minister Bill Morneau and Bank of Canada Governor Stephen Poloz have both said Home Capital’s problems are unique to the company and aren’t expected to spread to the broader financial system. O’Brien agreed with their assessment that the alternative mortgage lender isn’t going to kick-start a 2008-style meltdown, when the U.S. housing crash sparked a global financial crisis.

"The difference between this situation and what we saw in 2008 is there isn’t a rotting carcass of bad loans or poor-quality credit underneath all that," he said.

Any tightening of the credit available to non-prime borrowers -- the type of home buyers that Home Capital and its competitors service -- could soften the housing sector in the short term but the economy is strong enough to avoid a full-scale housing crash, O’Brien said.

"I don’t think what we’re seeing today is going to have a dramatic impact on (banks’) earnings or earnings estimates," he said. "At the end of the day we’ll look back and say this was a good time to be buying the banks."

O’Brien said he’d recommend buying banks and insurers rather than yield-heavy defensive stocks like utilities, telecoms and REITs. He also likes defensive staples like Loblaw Cos. Ltd. and Alimentation Couche-Tard Inc., as well as late-cycle sectors like the railways.

RBC. ECONOMICS. ANALYSIS. May 16, 2017. US housing starts unexpectedly declined in April following a strong Q1

FULL DOCUMENT: http://www.rbc.com/economics/daily-economic-update/US%20Housing%20Starts_Apr17.pdf

TD BANK. TD Economics. Analysis of economic performance and the implications for investors. The analysis covers the globe, with emphasis on Canada, the United States, Europe and Asia. May 16, 2017. U.S. Housing Starts and Permits

FULL DOCUMENT: https://www.td.com/document/PDF/economics/comment/USHousingStarts_Apr2017.pdf

SCOTIA BANK. ECONOMICS PUBLICATIONS. ANALYSIS. May 16, 2017. Scotia Flash: US Housing Is Working Against Hope For A Q2 GDP Rebound

FULL DOCUMENT: http://www.gbm.scotiabank.com/scpt/gbm/scotiaeconomics63/scotiaflash20170516.pdf

Bank of Montreal. econoFACTS. ANALYSIS. May 16, 2017. U.S. Housing Starts Stumble… Again

FULL DOCUMENT: https://economics.bmocapitalmarkets.com/economics/econofacts/20170516a/econofacts.pdf

________________

REUTERS. May 16, 2017. Resolute Forest says U.S. tariffs behind move to lay off workers

(Reuters) - Canadian lumber company Resolute Forest Products Inc RFP.N said its move to temporarily lay off 1,282 employees was related to the United States' decision last month to impose preliminary anti-subsidy duties on imports of Canadian softwood lumber.

The company said, starting Monday, it would cut shifts at three sawmills in Quebec for a six-week period, and also halt some activities at another sawmill in Quebec for two weeks, among other actions.

"Real people are now being impacted by the baseless actions of the U.S. Department of Commerce. They not only hurt Canadians, as demonstrated clearly with these actions, but American Consumers are also hit hard by market volatility," Resolute Forest's spokesman Seth Kursman told Reuters on Monday.

The U.S. tariffs, which affect nearly $5.66 billion worth of imports of construction material, were imposed at a time when the two countries and Mexico are preparing to renegotiate the 23-year-old North American Free Trade Agreement.

Canadian firms affected by the tariff include West Fraser Timber Co Ltd WFT.TO, Canfor Corp CFP.TO, Conifex Timber Inc CFF.TO, Western Forest Products Inc WEF.TO and Interfor Corp IFP.TO, apart from Resolute Forest Products.

(Reporting by John Benny in Bengaluru; Editing by Martina D'Couto)

The Globe and Mail. REUTERS. May 16, 2017. Oil rises on expectations of extended supply curbs

By Christopher Johnson

LONDON (Reuters) - Oil prices extended gains on Tuesday after top producers Saudi Arabia, Russia and Kuwait supported prolonging supply cuts until the end of March 2018 in an effort to drain a global glut.

Brent crude oil was up 30 cents at $52.12 a barrel by 1215 GMT (8.15 a.m. ET). U.S. light crude was also 30 cents higher at $49.15 a barrel. Both benchmarks have risen more than $5 since hitting five-month lows 10 days ago.

Saudi Arabia and Russia said on Monday they agreed on the need for a 1.8 million barrels per day (bpd) crude supply cut to be extended by nine months, until the end of March next year.

Kuwait's oil minister, Essam al-Marzouq, on Tuesday backed the Saudi/Russian initiative. Other OPEC states are expected to support the move at a meeting on May 25.

"Rebalancing is essentially here and, in the short term at least, is accelerating," the International Energy Agency said in its monthly report on Tuesday.

Russian Energy Minister Alexander Novak said on Tuesday the main aim of the proposed extension of oil output cuts was to bring the world's commercial oil inventories down to the five-year average and to stabilize the market.

"Our goal is to balance the market and to remove the surplus (from stocks)," Novak told reporters in St Petersburg.

U.S. bank Goldman Sachs said the deal would likely extend the oil price rebound "although the rally so far ... has remained modest compared to the move that occurred last year when the OPEC cuts were first announced".

James Woods, investment analyst at Rivkin Securities, said world oil supplies would likely remain plentiful, even if OPEC extended the production cut as expected.

"As we have seen over the past six months, rising U.S. production and record inventories have kept upside limited and a nine-month extension at this stage is unlikely to break that."

Goldman Sachs said output would increase from OPEC members that were exempt from the cuts. Libya and Nigeria, which have faced disruptions to production, were excluded from limits on their output.

In addition, U.S. oil production is rising quickly and now up more than 10 percent since mid-2016 at 9.3 million bpd.

"These combined volumes could largely offset the benefit of the extended cuts," Goldman Sachs said, keeping its average Brent price forecast for the third quarter of 2017 at $57 per barrel.

(Additional reporting by Henning Gloystein in Singapore; editing by Edmund Blair and Jason Neely)

BLOOMBERG. OPEC Prolonging Cut Would Achieve Mission to Clear Oil Glut

by Grant Smith

- Inventories may drop below 5-year average in March, data shows

- Producers get a helping hand as stockpile averages rise

The world’s two biggest oil exporters seem to have finally figured out how to eliminate a global surplus that’s kept crude prices in check for almost three years.

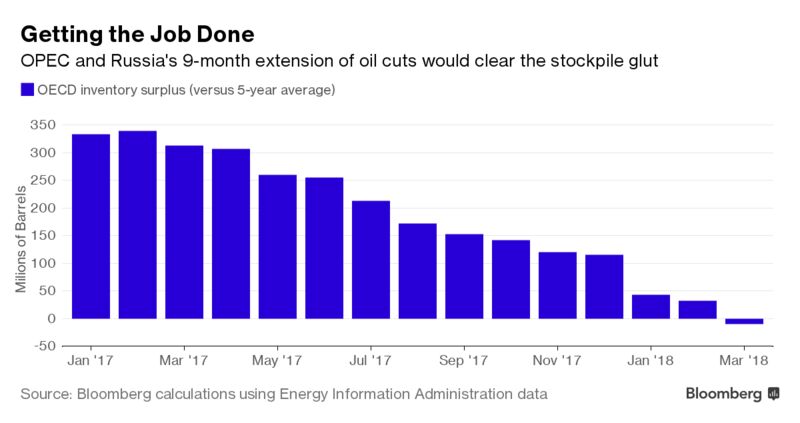

Saudi Arabia and Russia said in Beijing on Monday they favor prolonging this year’s oil curbs to the first quarter of 2018. If they convince fellow producers to adopt the strategy when OPEC and its partners meet next week, it will pare near-record inventories in developed nations by 8 percent and erase the glut weighing on the market, according to Bloomberg calculations using U.S. government data.

“They have a very clear goal,” said Mike Wittner, head of oil market research at Societe Generale SA in New York. “They remain focused on having stocks get down to the five-year average. They really want to see it work.”

While news of the Saudi-Russia proposal helped send prices to a two-week high on Monday, crude remains stuck near $50 a barrel, less than half the level traded in 2014. That’s because output cuts by OPEC and its allies have failed to drain bloated stockpiles as production rises in places like the U.S. and as demand growth slowed. Brent crude was 0.4 percent higher at $52.04 a barrel as of 11:53 a.m. in London.

Inventories in the 35 of the world’s most industrialized nations -- the Organization for Economic Cooperation and Development -- were just above 3 billion barrels in April, or about 307 million above their five-year average, data from the U.S. Energy Information Administration shows.

If OPEC and Russia complete the nine-month extension, stocks will fall to about 10 million barrels below that average next March, according to Bloomberg calculations using the EIA’s numbers.

The calculations assume OPEC keeps its output at April levels of 31.7 million barrels a day, and that Russia keeps supply steady at 11.15 million a day from May. Those levels represent the full cuts they’d agreed to undertake in a deal reached last year.

OPEC’s own data suggest it could take even longer to eliminate the surplus, while figures from the International Energy Agency indicate it could happen sooner.

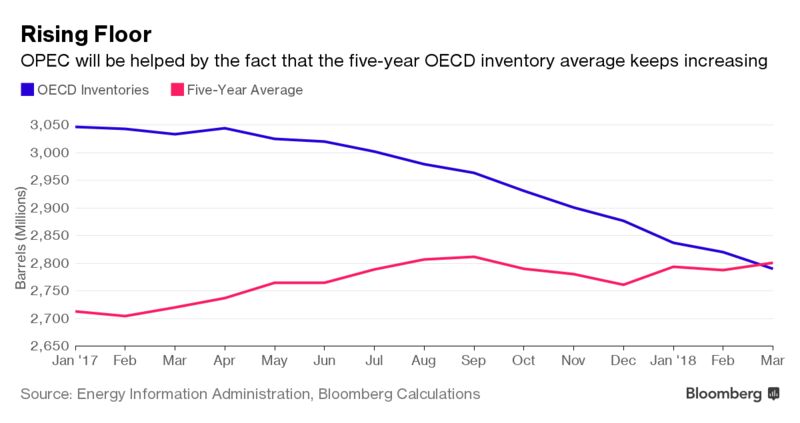

While supply cuts by OPEC and its partners would certainly play a significant part in reaching the five-year average, the producers are also set to receive a helping hand: oil markets have been oversupplied so long that their historical average is getting higher.

The five-year average for OECD stocks was at 2.71 billion barrels in January, according to the EIA. Yet, as years of elevated inventories push the average higher, by next January it will jump to 2.79 billion -- making the task of hitting that target a little bit easier.

That still doesn’t mean success is straightforward. Fulfilling the plan, which started in January, would require OPEC to comply with output targets for 15 months, longer than the group has typically managed in the past.

Although a longer extension may achieve OPEC’s objective, it risks backfiring by giving extra support to rivals in the U.S. shale industry, according to Natixis SA. American oil explorers are using double the number of rigs they deployed a year ago, and the nation’s production is rebounding. OPEC last week raised its outlook for U.S. output growth this year by 285,000 barrels a day to 820,000 a day.

“It depends on how much the U.S. adds,” said Abhishek Deshpande, chief energy analyst at Natixis in London. “The problem is, will OPEC extend it further if oil gets supported and U.S. producers hedge more and increase oil production more?”

The Globe and Mail. May 16, 2017. Not even the crisis or oil shock ‘spooked’ loonie investors like this

MICHAEL BABAD, Columnist. Michael Babad is a Report on Business editor and co-author of three business books. He has been with Report on Business for several years, and has also been a reporter and editor at The Toronto Star, The Financial Post and United Press International. His articles have appeared in major newspapers around the world.

Briefing highlights

- Why loonie investors are spooked

- Currency seen sliding

- Bell apologizes after data breach

- Ford to cut jobs in North America, Asia

- Absolutely loonie

Canada now faces the 2017 version of the “Diefenbuck” or the “Hudson Bay peso.”

Granted, the loonie is almost 20 cents shy of the former and a dime or so ahead of the latter, but you get the idea.

“To put this into perspective – not even the global financial crisis or the commodity shock a few years ago had investors this concerned on the CAD,” said Bipan Rai, executive director of macro strategy at CIBC World Markets, referring to the Canadian dollar by its symbol.

Mr. Rai was referring to the latest numbers from the U.S. Commodity Futures Trading Commission, which showed speculators shorting the loonie at exceptional levels.

Indeed, the report put the net short position against the currency at almost $6.3-billion (U.S.) as of a week ago. In contract terms, the net short surged to about 86,200, breaking a previous record high of 85,0000 in 2007.

“Despite what looks to be a very solid quarter of growth in the Canadian economy, the market is clearly spooked by risks to the housing sector and the degree of leveraging,” Mr. Rai said.

“We can also include broader macro and political risks in here, as well.”

Markets have been concerned about the troubles at Home Capital Inc., and what that means for mortgage financing in Canada, compounded by angst over the housing market in general, given the bubble in and around Toronto, and recent government measures to deflate it.

“We do think the market is getting a bit ahead of itself at this point,” Mr. Rai said. “Banks are well capitalized and housing risks are contained for now.

Also playing into the mood are concerns over the Trump administration’s trade agenda and policy differences between the Federal Reserve and the Bank of Canada.

The loonie did manage to perk up slightly Monday after oil bounced on Saudi Arabia and Russia calling for an extension of an OPEC production cap agreement meant to buoy prices.

But only slightly. And, for that matter, oil may well not have any lasting impact.

“The oil story is a short-term positive, but will do little to address one of the critical reasons why oil prices remain capped,” Mr. Rai said. “That being the increased supply from U.S. shale.”

Toronto-Dominion Bank strategists have an interesting take on it, looking, as they do, through a longer-term lens.

“We run the data through (what we call) sentiment indicators,” said Mark McCormick, North American head of foreign exchange strategy at TD Securities.

“It scales the data over the past year on the max/min of that range,” he added.

“The important for CAD is that it now sits at zero, indicating record shorts versus the last year. It also has the lowest score of the currencies we track, suggesting that it is the more oversold major currency.”

On that basis, there’s potential for a rebound, Mr. McCormick said, but a “macro trigger” is needed to turn sentiment around.

“Given the focus on housing, we probably need a mix of better data, a pickup in Canadian bank stocks and confirmation from the BoC (June 8 stability review) that the market is exaggerating this narrative.”

Where the loonie goes from here, of course, depends on several things. Notably market sentiment,” Mr. Rai said.

He suggests watching the charts. Should the currency rise to close above 73.66 cents (U.S.), that “would imply that this CAD rally has more room to run, and without that nothing changes.”

For speculators, it could mean they have to cover their butts.

“On the one hand, investors clearly have a pretty dim view of the CAD’s outlook,” said Mr. Osborne and Mr. Theoret.

“But on the other, the sudden surge, to a record, in bets on the CAD declining represents a classic contrarian signal, with positioning possibly saturated.”

They believe the loonie could “technically” regain some ground in the next one or two weeks, say to about 74 cents or better, but may well dip below 71.5 cents through the middle of the year.

“The focus on Home Capital’s problems certainly seems to have galvanized CAD short sellers but given the relatively narrow range that the CAD traded in in the week through May 9, the shorts got no immediate gratification and are now flat (at best) and likely underwater to some extent on the bear trades put on through the week,” the Scotiabank strategists said.

“The 'pain trade’ for the market is now a strengthening in the CAD that will force the bears to cover, driving the CAD even higher,” they added.

(For loonie buffs, the “Diefenbuck” was a phrase coined by the Liberals in the early 1960s to slam a devalued 92.5-cent currency. Little did they know what was in store, like the plunge that brought references to the “Hudson Bay peso,” when the dollar sunk as far as the low-60s early in the 2000s.)

CIBC. Economics Research. ANALYSIS. May 16, 2017. Canada Economic Update

FULL DOCUMENT: https://economics.cibccm.com/economicsweb/cds?ID=3083&TYPE=EC_PDF

________________

LGCJ.: